Interest bases

This option is used to create multiple interest bases like LIBOR, EURIBOR, Fed Funds Rate and Prime rate. Interest rates created under these Interest bases can then be used as the basis for variable (floating) rates of interests. The following tabs are available on the Interest Base Maintenance page:

To add a new Interest base

- From Admin menu, click Pricing, Interest, and then Interest bases. The Interest Bases Search page appears. All Interest Bases available in Aura appear on the page.

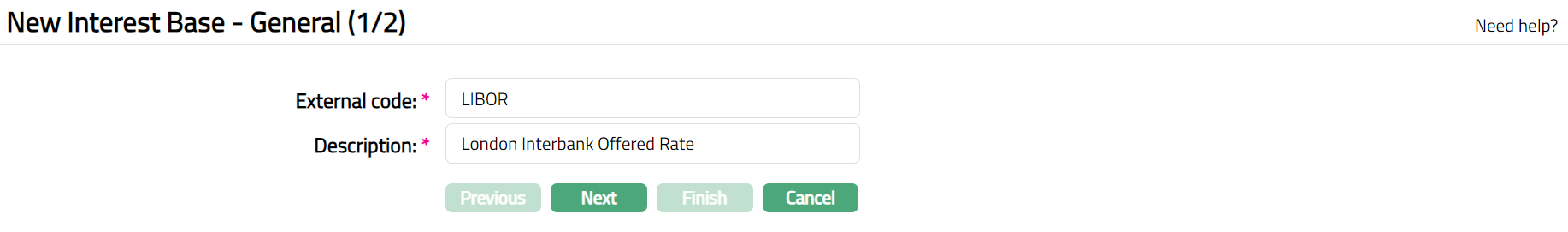

- Click Add. New Interest Base -- General (1/2) page appears.

Enter External code for the Interest Base.

Enter Description for the Interest Base.

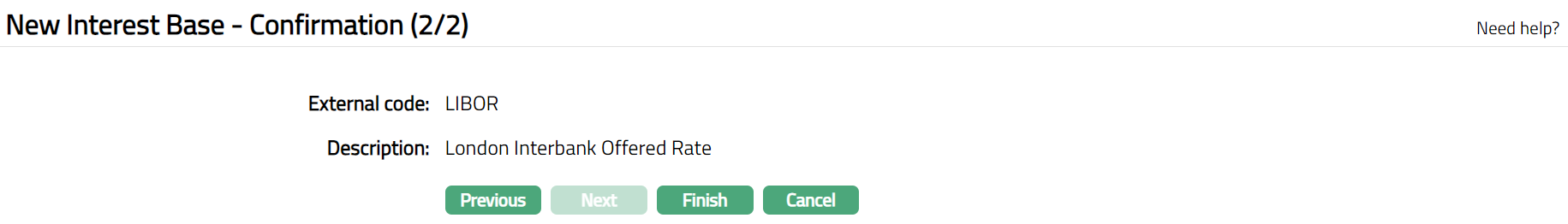

Click Next. Interest Base -- Confirmation (2/2) page appears.

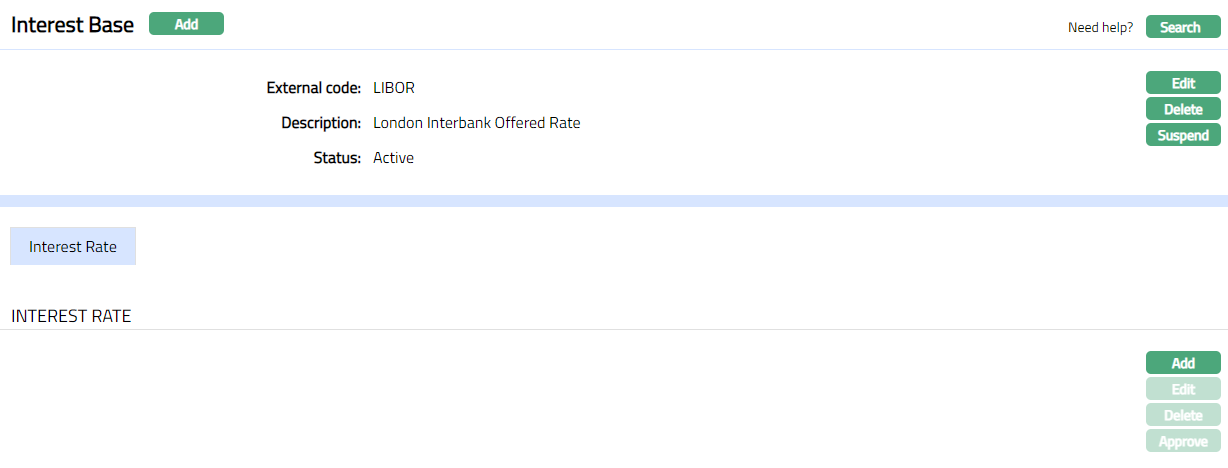

- Click Finish. Interest Base page appears displaying the details of the Interest Base you added.

Functions: Add, Search, Edit, Delete, Suspend, Activate

Functions: Add, Search, Edit, Delete, Suspend, Activate

Interest Rate

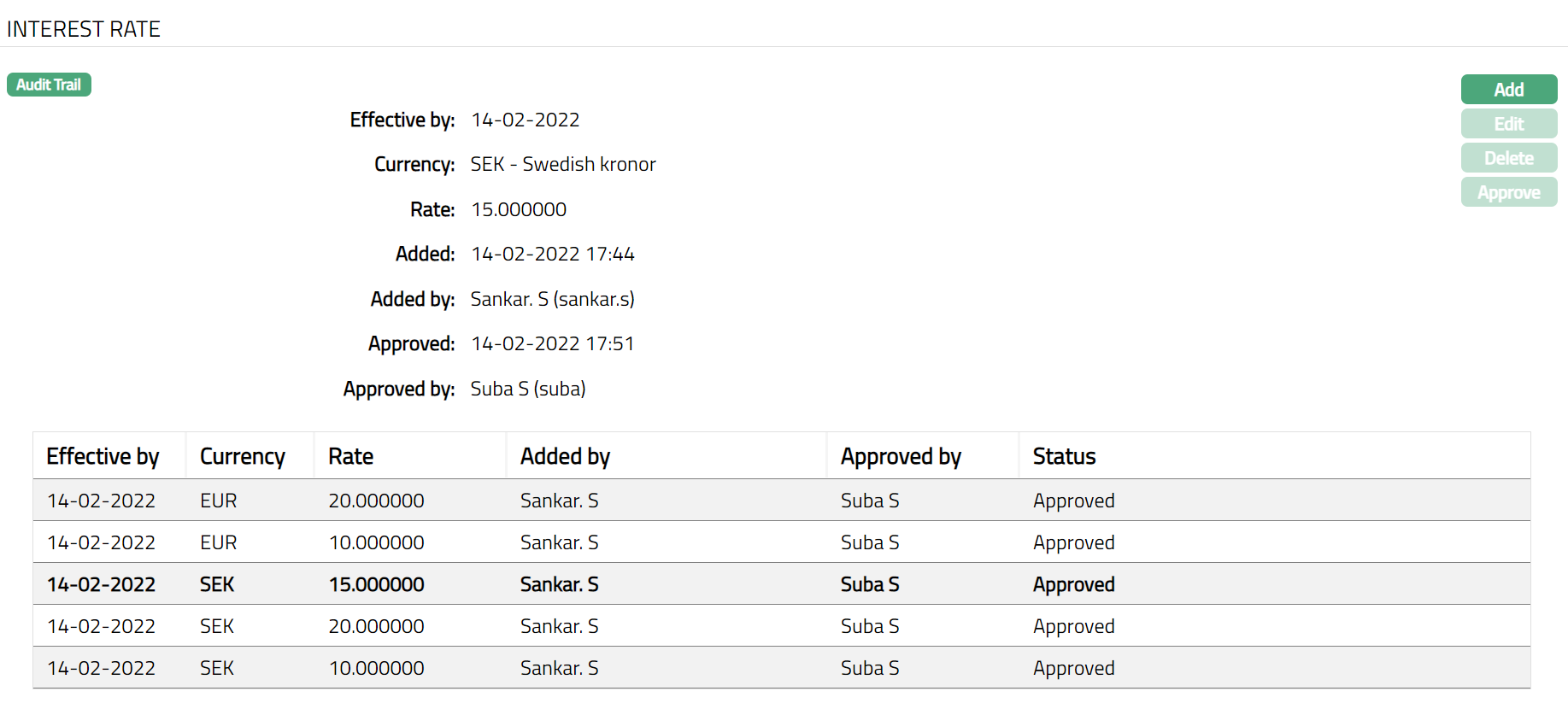

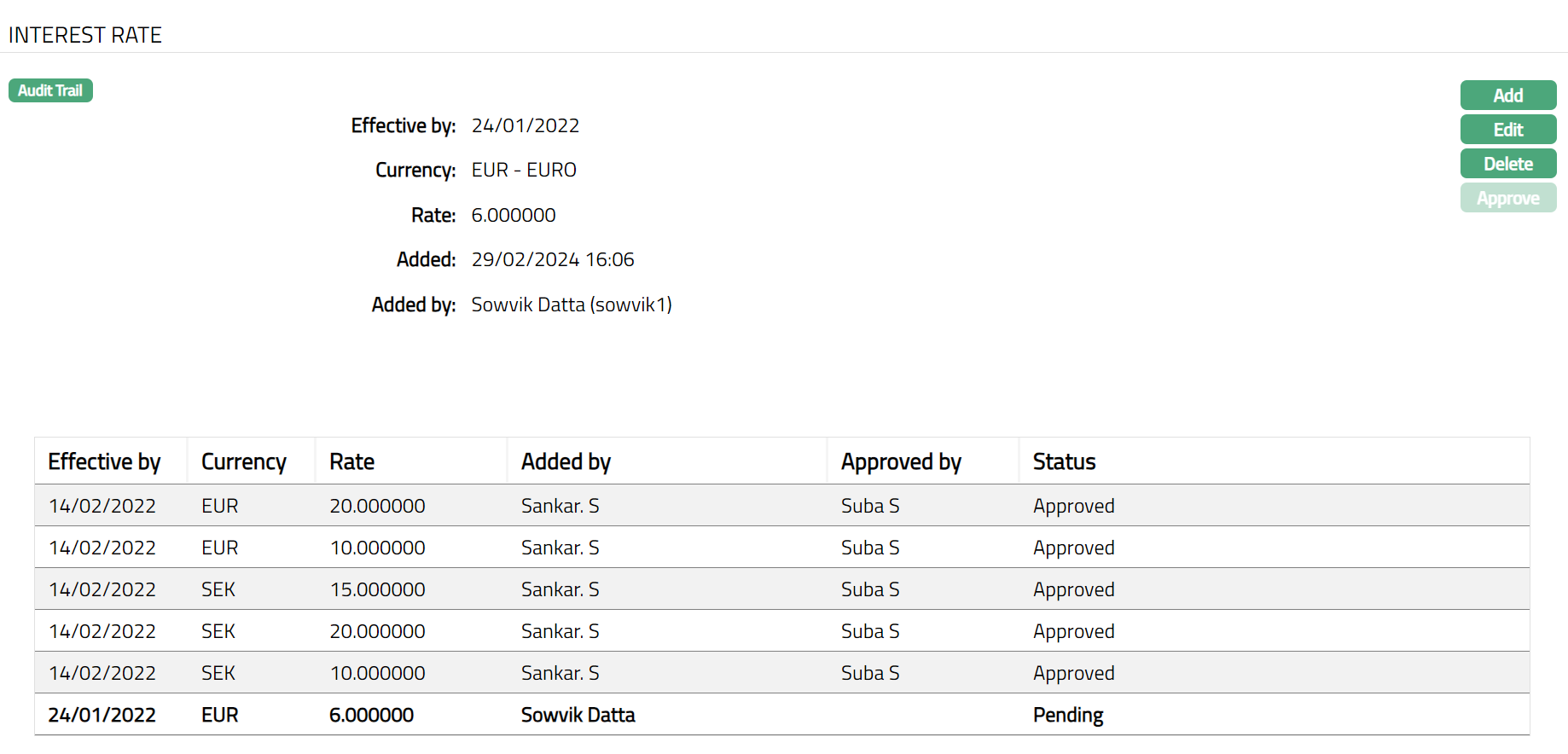

The Interest Rate tab shows the basic details of the Interest rate records created under the Interest Base.

Adding Interest Rate

- Access the Interest Base page to see the details of the interest base rates already added.

The additional fields that you can see are as follows:

Status field denotes the status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

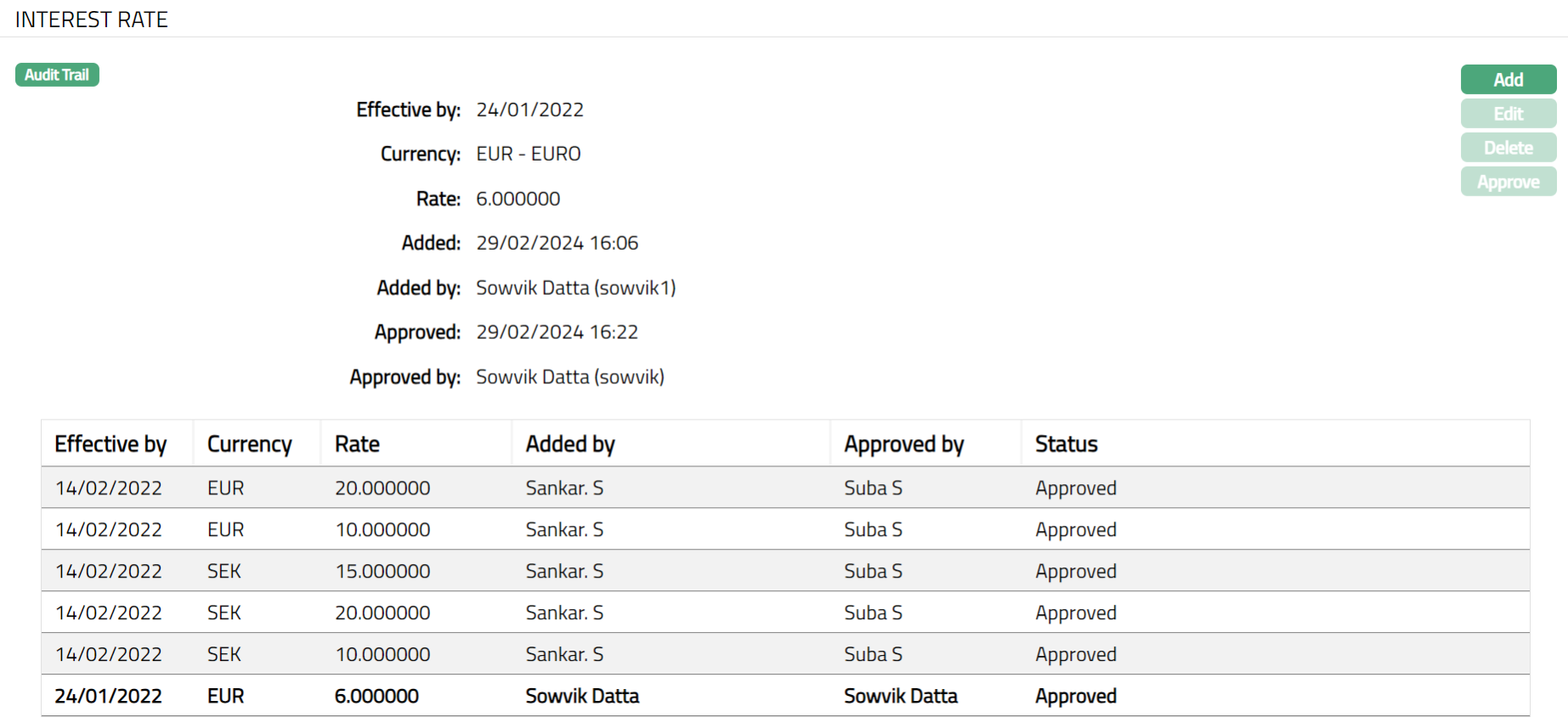

Approved field denotes date on which the record was approved and is displayed only on approval.

Approved by field denotes name of the user who approved the record and is displayed only on approval.

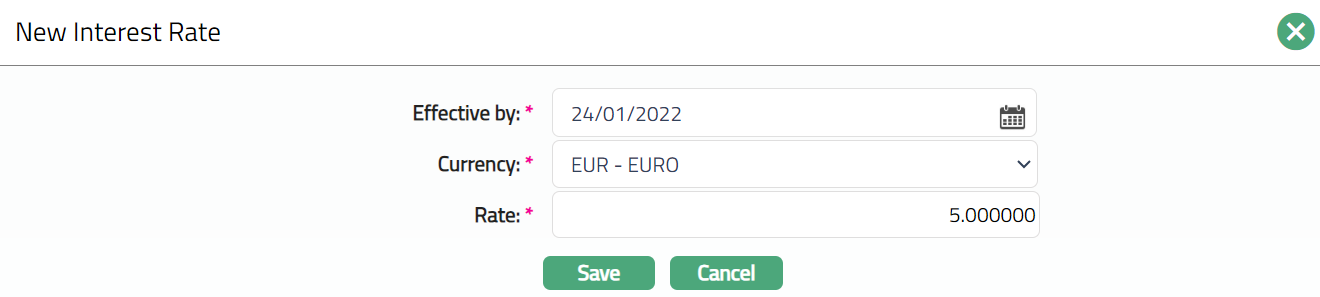

Click Add under Interest Rate tab.

New Interest Rate page appears.

Enter Effective by date or use the date picker.

Select Currency for the Interest Rate from the available list.

Enter Rate.

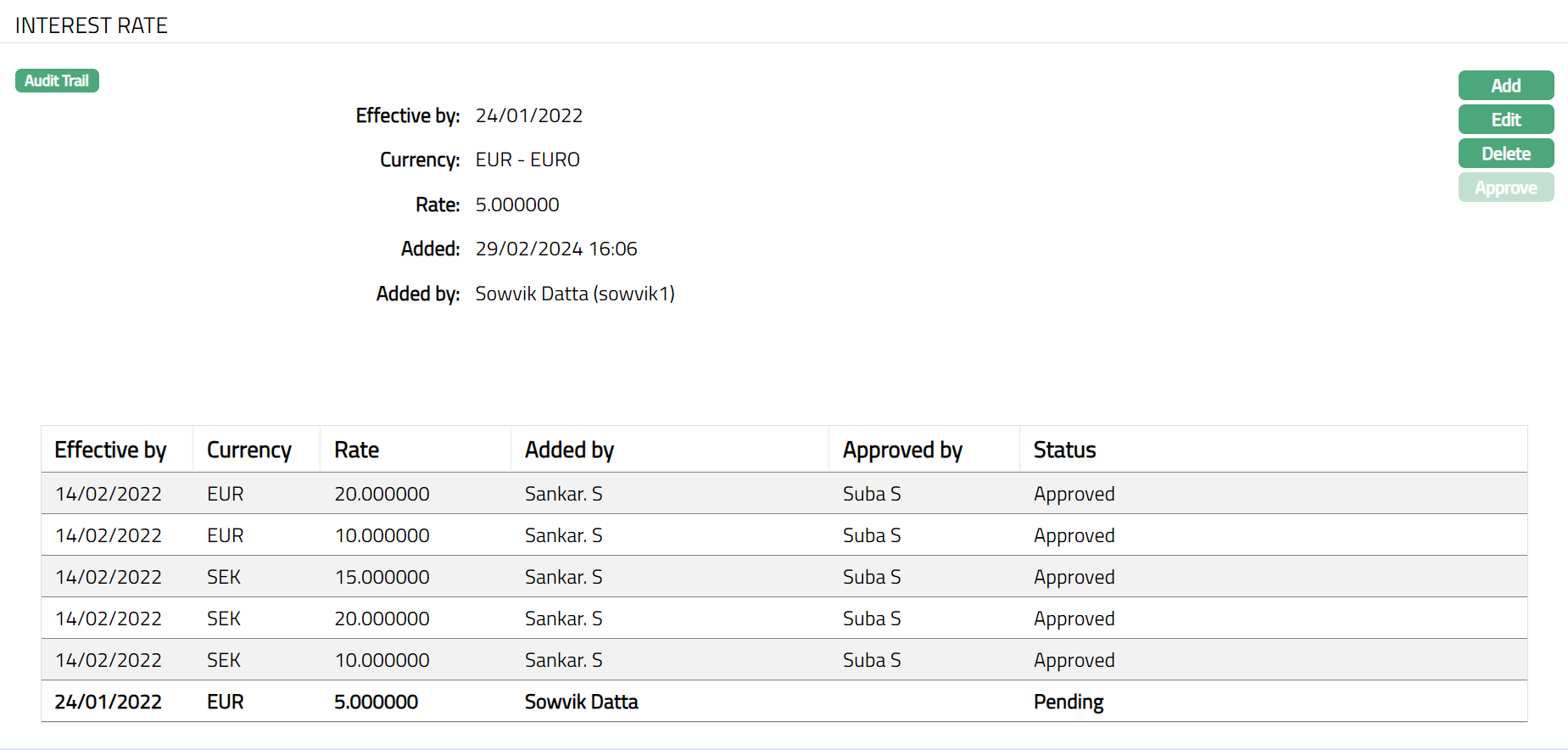

Click Save. Interest Rate page appears with the newly added details.

Functions: Add, Edit, Delete, Approve

Delete: You can delete an Interest Rate by clicking Delete button. When you click on Delete button, Aura displays an alert message. On confirmation, Aura will delete the Interest Rate. An Interest Rate can be deleted until it is approved.

Approve: The status of the interest rate that you added will be Pending till it is Approved. On Approval, the Approver's username along with the Approval date and time are added to the record. Only when it is Approved, the rate will be actually applied to the relevant transactions / contracts. Approval can be done only by a user who is different from the one who created the record.

If you want to Approve Interest Rate tab, then retrieve the record and Click Approve. Aura will ask for confirmation. Once the tab is approved, status gets changed from pending to Approved.

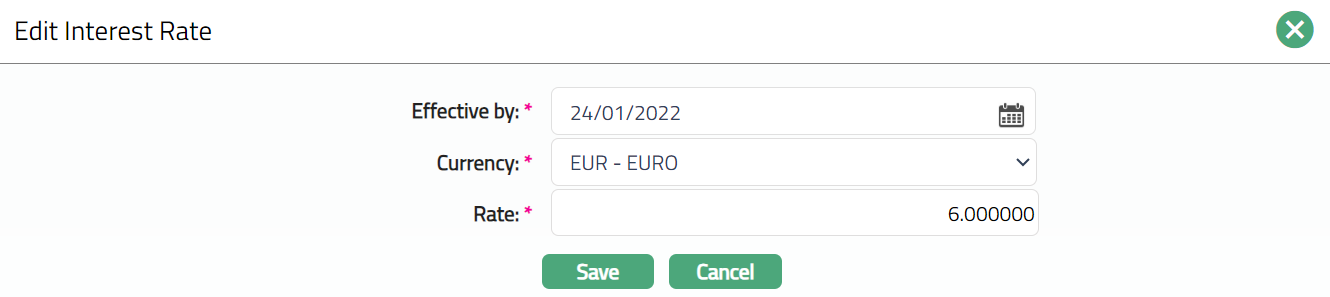

To Edit Interest Rate

- Click Edit. Edit Interest Rate page appears.

- Make required changes and click Save. Interest Rate page appears with the edited details.

Note: Interest Rates can be edited / deleted only when the status is Pending. Once Approved, edit or delete of the Interest rate is not allowed.

Functions: Add, Edit, Delete, Approve