Manual Reconciliation

Manual Reconciliation is used to manually reconcile those records which do not get reconciled in the auto-reconciliation process. Aura will display all internal and external account transactions that are not reconciled. For manual reconciliation, you need to select the required entries from transactions of both external and internal accounts.

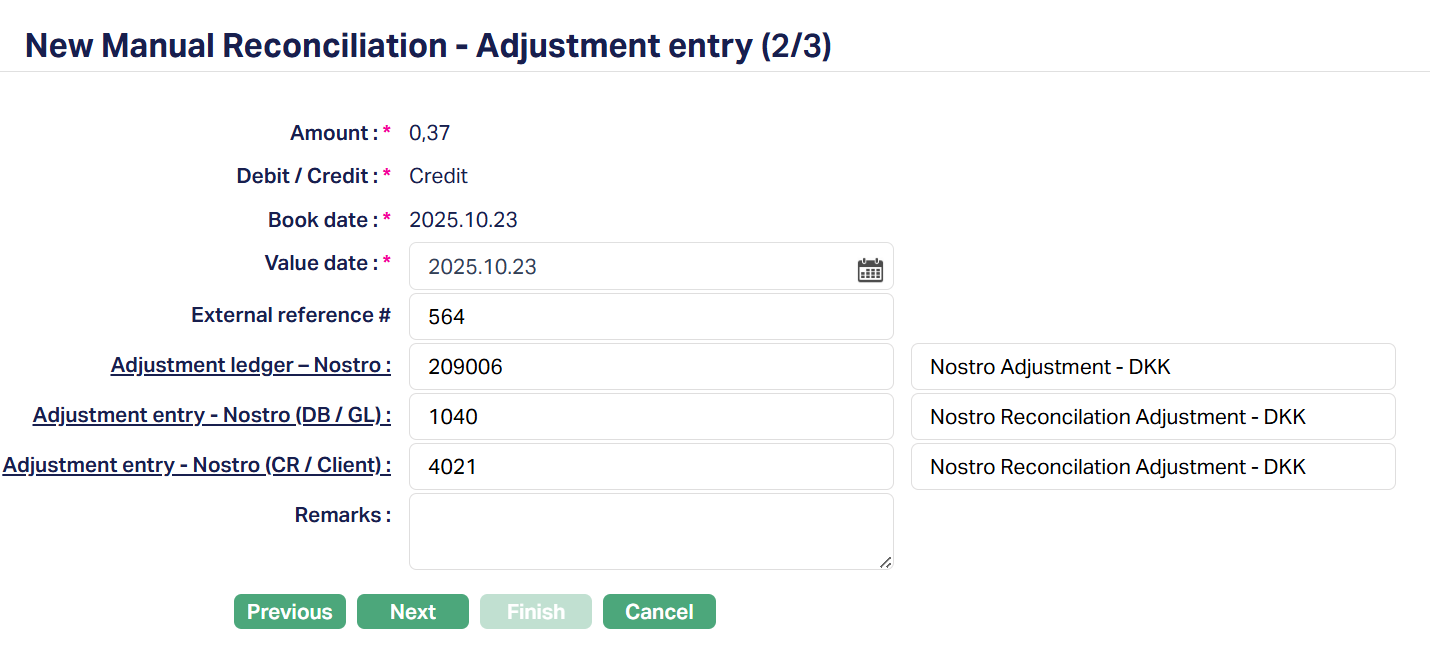

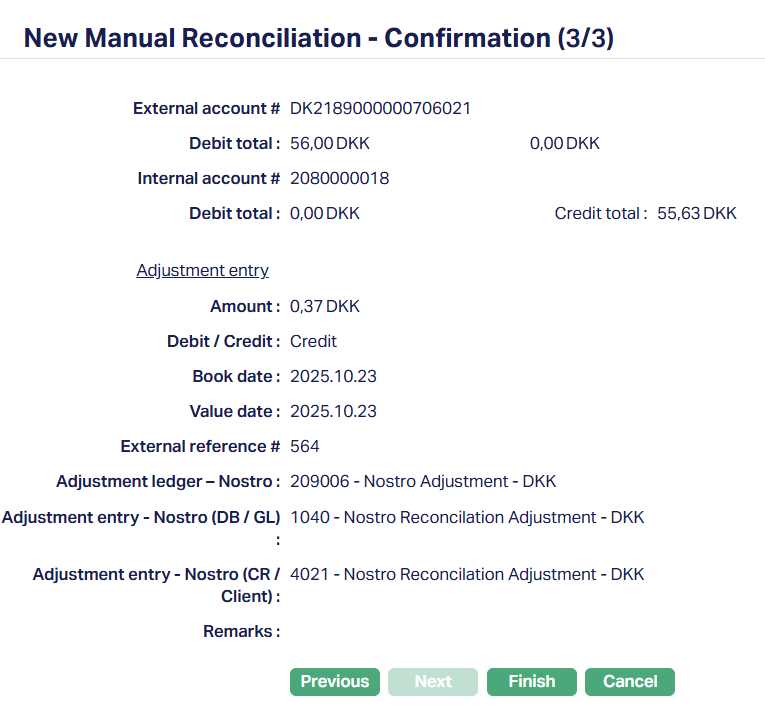

During the matching process of manual reconciliation, if there is any variance in the amounts between the internal and external account transactions, then Aura will display the adjustment entry screen, where you can input all adjustment entry details. If there is no amount difference during the matching process, then the screen will automatically go to the confirmation screen.

To Manually Reconcile a record

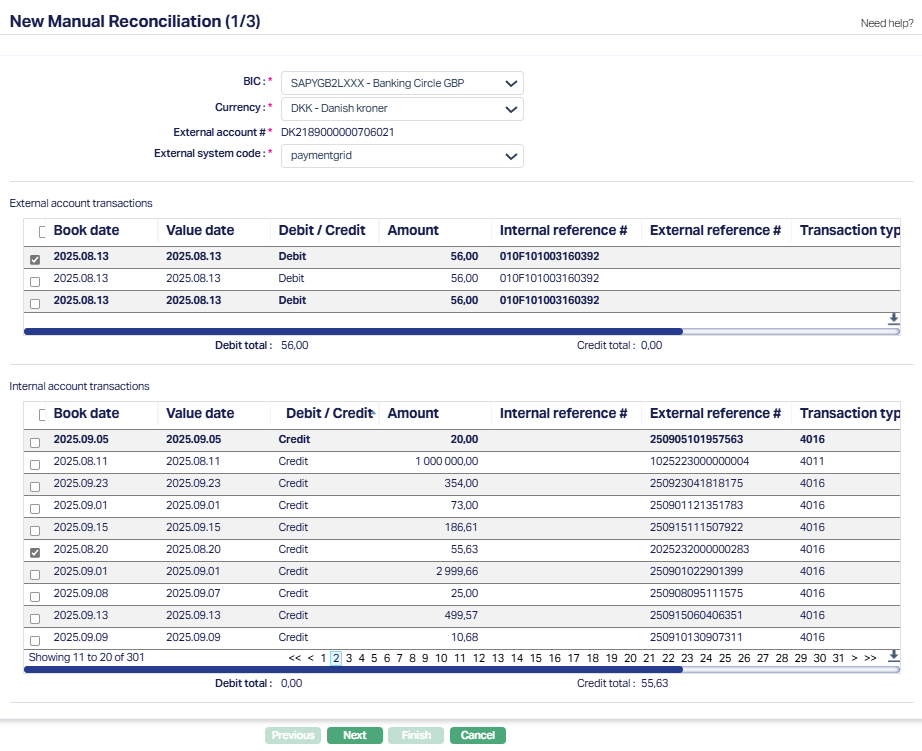

1. From the Payment Grid menu, click Nostro reconciliation and then click Manual reconciliation. The New Manual Reconciliation (1/3) page appears.

2. Select the BIC (Business Identifier Code) from the drop down list of active BIC’s auto-populated from Account Mapping and Preferences.

3. The Currency will be enabled only on selection of BIC. Select the Currency from the drop down list of active currencies which gets auto-populated from the Account Mapping and Preferences based on selection of BIC.

4. External account # gets auto-populated from Account Mapping and Preferences based on selection of BIC and Currency combination.

5. Select the External system code from the drop-down list which gets auto-populated from Account Mapping and Preferences based on selection of BIC and Currency combination.

6. All the unreconciled external account transactions are shown at the top and all the unreconciled internal account transactions are shown at the bottom. The details of the Internal/External account transactions are displayed under the following fields:

- Book date: It specifies the date the external bank initiates the transaction in its ledger (often shown as entry date on SWIFT statements). This is a bookkeeping timestamp; it is not always the same as the date when funds are settled.

- Value date: It specifies the date on which the transaction affects the available/settled balance (that is, when funds are considered effective). Value date is not always equal to booking date in many cases; both are recorded for reconciliation.

- Debit / Credit: This field, sometimes abbreviated as Dr / Cr, specifies a directional indicator showing whether the statement line is a debit (amount leaving the Nostro account) or credit (amount entering the Nostro account).

- Amount: It specifies the monetary value of the statement line in the statement currency (the exact numeric amount recorded on the external statement).

- Internal reference #: It specifies the unique identifier created by your internal system (the mirror or internal transaction ID). It is used to link or correlate an external statement line to an internal posting for audit and matching.

- External reference #: It specifies the identifier supplied by the correspondent/external system (the external bank’s transaction or message reference). This is the field you typically match against your internal reference during automated or manual reconciliation.

- Transaction type code: It specifies the classification or code describing the nature of the entry. Many reconciliation UIs show a transaction type code which helps filtering and applying match rules.

- Transaction description: This field provides a short description of the unreconciled Internal/External account transactions.

- Debit Total – It is the sum of all debits (amount leaving the Nostro account) of the Internal/External account transactions.

- Credit Total – It is the sum of all credits (amount entering the Nostro account) of the Internal/External account transactions.

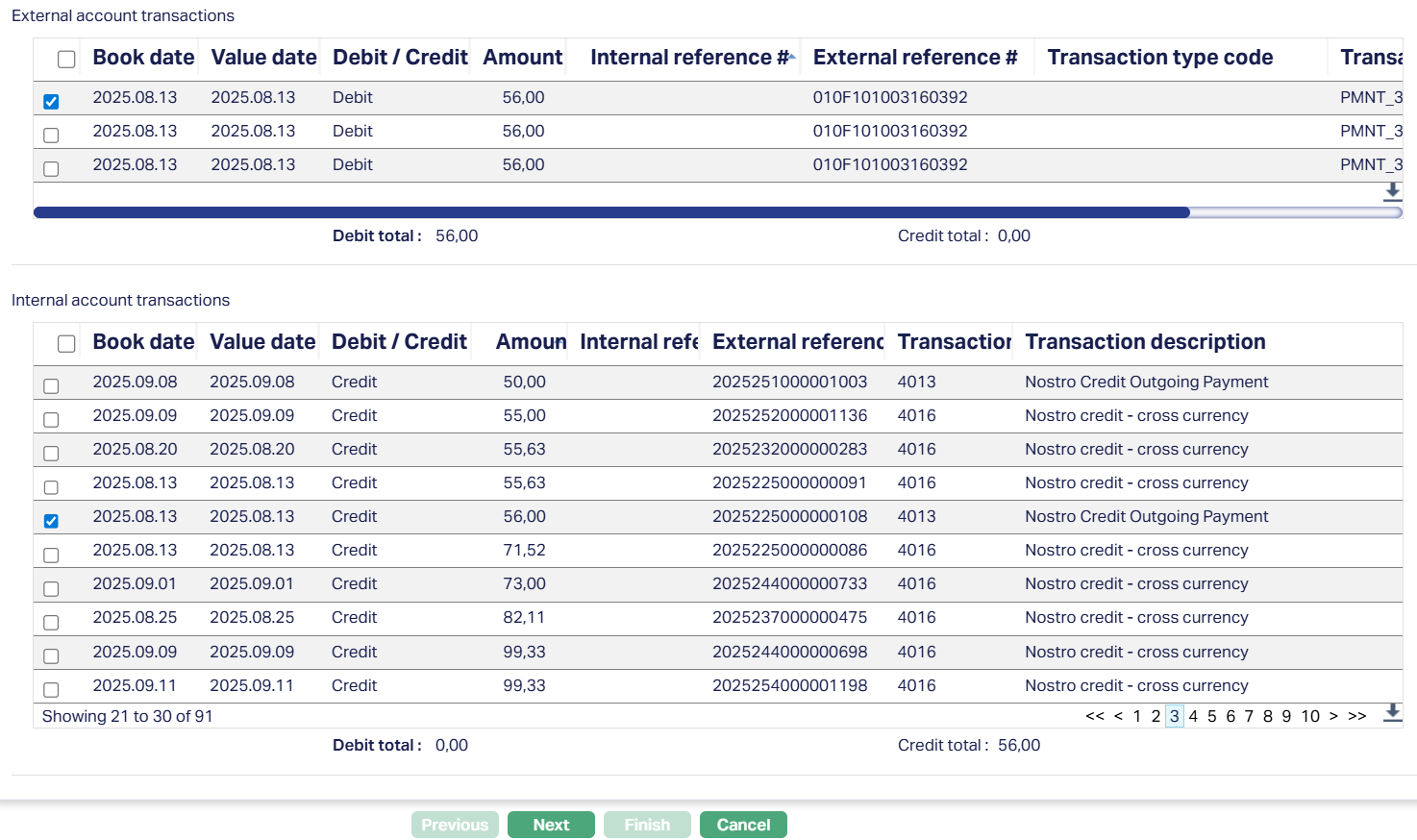

7. To select the transactions that are to be marked for reconciliation, click on the checkbox against the respective External/Internal account transaction. Based on the chosen external and internal account transactions, the Debit Total/Credit Total under each pane will be updated. A sample screen is given below.

Conditions for matching transactions:

- Minimum two transactions are required for matching (at least one each from External and Internal transactions)

- Only Internal and External account transactions will get matched.

- Only the amount will get matched during Internal and External account matching.

- Adjustment entry is not possible for only internal or only external matching respectively.

- Aura will not allow posting of adjustment entries, if the amount is not within the adjustment posting limit maintained for manual reconciliation under Account mapping and preferences.

- Aura will auto update the authorization if the amount has reached the Manual reconciliation limit as maintained under Account mapping and preferences.

Matching can be done only between a credit and a debit transaction, as shown above.

8. Click Next. Aura will verify whether the amount for the selected external & internal transactions are balanced; if there is any variance in amounts, Aura will display the New Manual Reconciliation – Adjustment entry (2/3) page.

9. The following fields are displayed and not editable:

- Amount

- Debit/Credit

- Book date

- Value date

- External reference #

10. The table below gives the fields, the use for, the conditions and the remarks for each of these Transaction Codes/General Ledger. You can either directly input the Transaction Code #/GL or click on the hyperlink to see the list of Transaction codes/GL satisfying these conditions and select the required Transaction code #/GL.

| Fields | Used for | List of accounts/transaction codes based on | Remarks |

|---|---|---|---|

| Adjustment Ledger – Nostro | Specifying which Ledger number is to be used as the Adjustment Ledger for the Nostro reconciliation. | Ledger type Asset, Liability , Income and Expense maintained under Payment Grid > Settings > General Ledger | Adjustment ledger maintained for auto reconciliation gets auto populated from Account mapping and preferences |

| Adjustment entry - Nostro (DB/Client). | Specifying which transaction code is to be used for debiting the Client account during the Nostro Reconciliation. | Active transaction codes with the transaction type Client and Debit/Credit as Debit maintained under Settings > Transaction code. | By default, the Adjustment entry - Nostro (DB/Client) maintained for auto reconciliation gets auto populated from Account mapping and preferences. The field will be enabled only if the amount difference for the adjustment entry is a Debit. |

| Adjustment entry- Nostro (DB/GL) | Specifying which transaction code is to be used for debiting the General Ledger account during the Nostro Reconciliation. | Transaction codes with the transaction type GL and Debit/Credit as Debit maintained under Settings > Transaction code | By default, the Adjustment entry - Nostro (DB/GL) maintained for auto reconciliation gets auto populated from Account mapping and preferences. The field will be enabled only if the amount difference for the adjustment entry is a Credit. |

| Adjustment entry - Nostro (CR/Client) | Specifying which transaction code is to be used for crediting the client account during the Nostro Reconciliation. | Active transaction codes with the transaction type Client and Debit/Credit as Credit maintained under Settings > Transaction code | By default, the Adjustment entry - Nostro (CR/Client) maintained for auto reconciliation gets auto populated from Account mapping and preferences. The field will be enabled only if the amount difference for the adjustment entry is a Credit. |

| Adjustment entry-Nostro (CR/GL) | Specifying which transaction code is to be used for crediting the General Ledger account during the Nostro Reconciliation | Active transaction codes with the transaction type GL and Debit/Credit as Credit maintained under Settings > Transaction code. | By default, the Adjustment entry - Nostro (CR/Client) maintained for auto reconciliation gets auto populated from Account mapping and preferences. The field will be enabled only if the amount difference for the adjustment entry is a Debit. |

11. Enter the Remarks for the adjustment entry. A maximum of 500 characters are allowed.

12. Click Next. The New Manual Reconciliation – Confirmation (3/3) page appears.

13. Click Finish. The record gets reconciled and is displayed under Reconciliation Details. Reconciliation reference # gets generated and Reconciliation status is displayed as Reconciled.

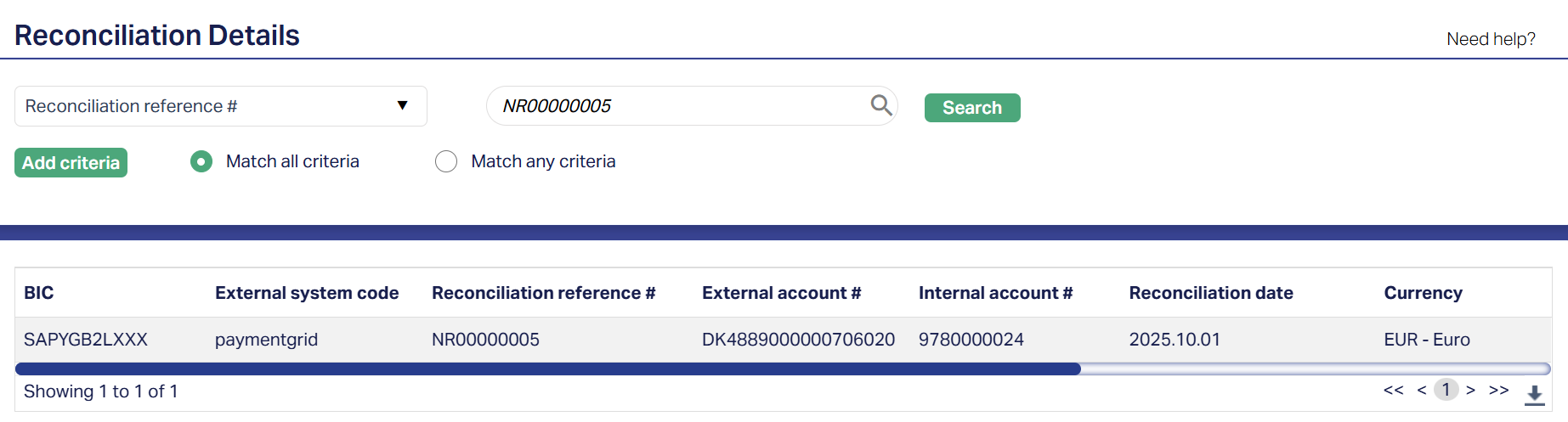

You can access the reconciled records in Payment Grid > Nostro Reconciliation > Reconciliation details. For example, you can search for a particular reconciled record using the generated Reconciliation Reference # in the Reconciliation Details search page. A sample screenshot is shown below.