Balance movement

Balance movement provides an option to move the Balances from one Billing account to another. You will be able to move the whole or part of the balances from any Balance Class (es) of the source account to any Balance Class (es) in the destination account.

The balances will be moved as per the value date that you input. However, if the transaction code mapped for balance movement at the Product level has different value date settings, the same will be applied, taking the value date input in the Balance Movement as the default value date.

Balance movement updates will be done as if it is a reversal transaction in the From Account and an Onward Transaction in the To Account.

To move balances from one account to another,

From Cards menu, click Operations and then Balance Movement. Balance Movement Search page will appear.

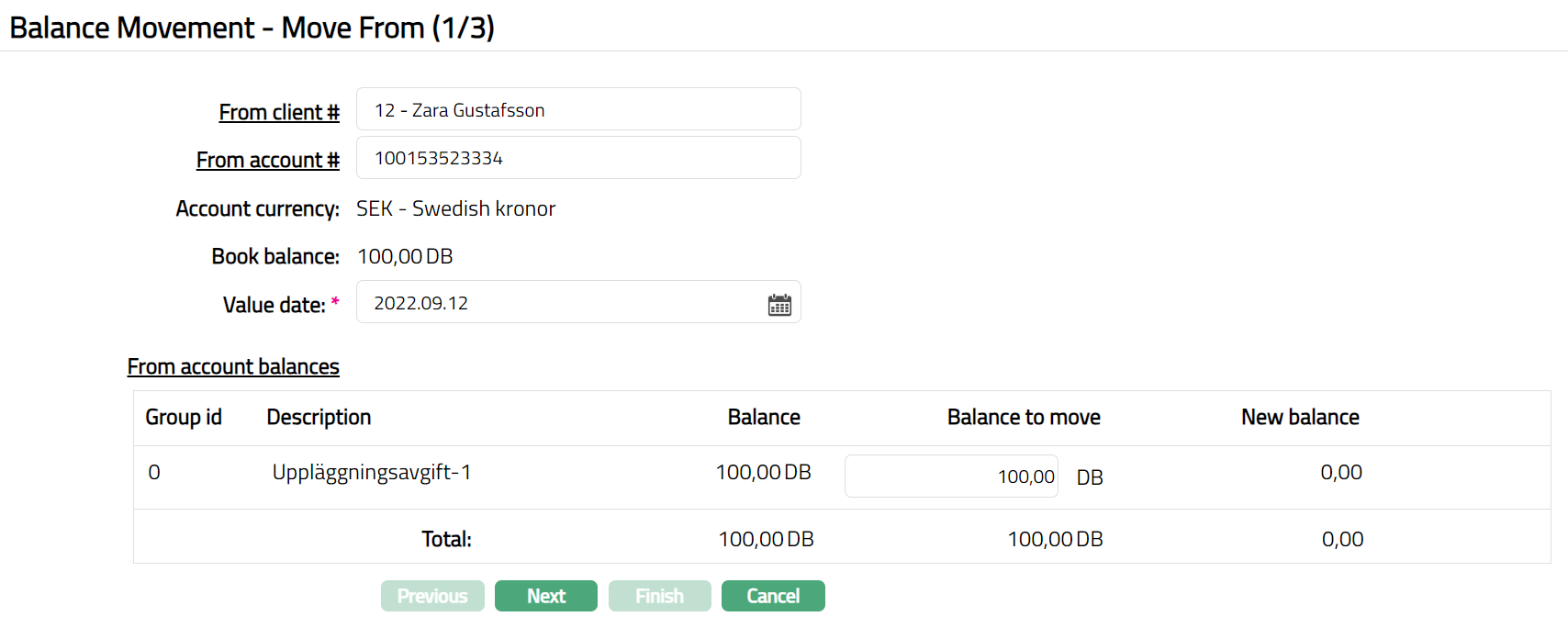

Click Add. Balance Movement -- Move From (1/3) page appears.

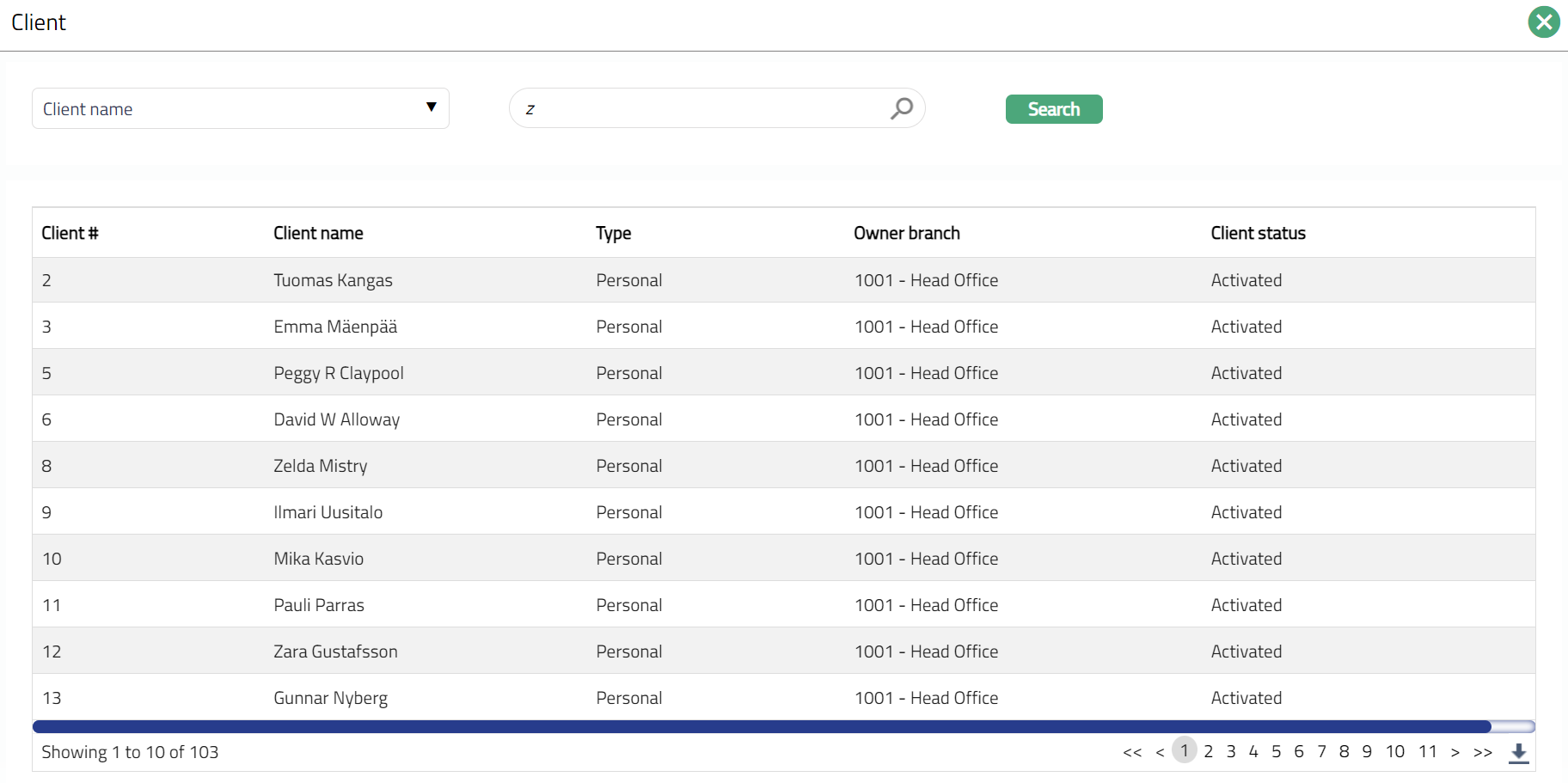

Click From client# hyperlink to select the client from whose account the balance has to be moved, Aura will display the list of all Active clients maintained under CRM > Clients > Maintain.

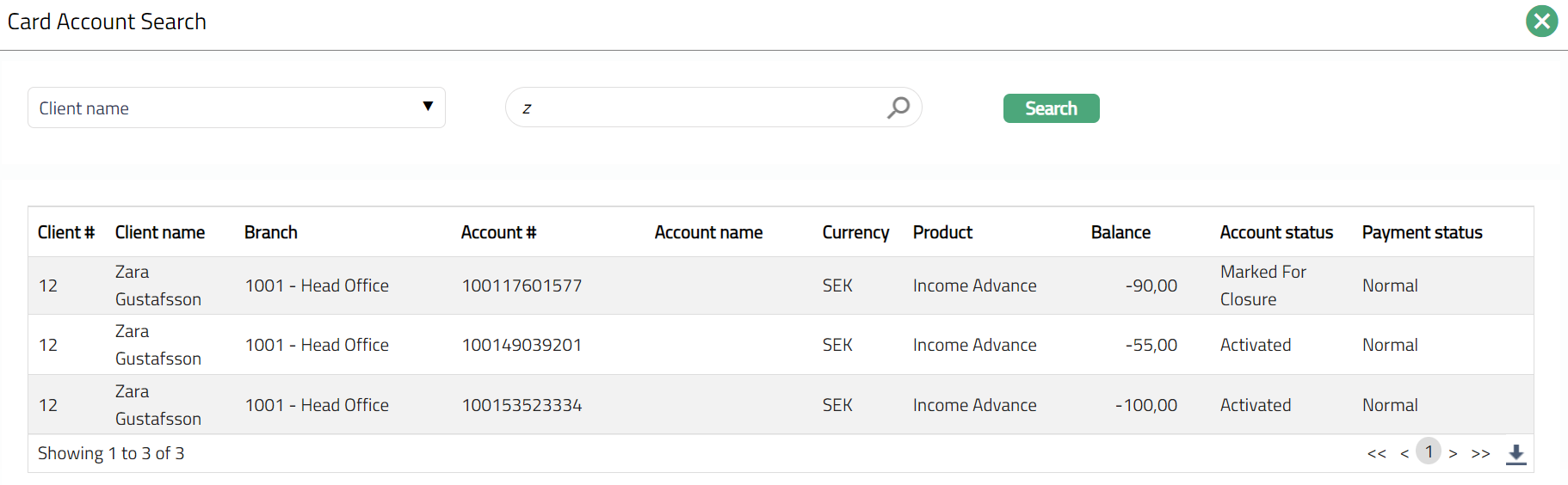

Click From account # hyperlink to select the Billing Accounts held by the selected client. The selected account is the source account from which the balance has to be moved to the destination account.

By default, Account currency and Book balance are auto populated from the account chosen above. The value for the Account currency is defaulted from, From Account#. The Book dated balance is the current balance in the From Account#.

By default, Aura will display the current date as the Value date for the Balance Movement. You can change it to any future date.

From account balances displays the following details:

- Group ID: It denotes the Ids of the balance classes that have balance, in the order of Group Id of the balance class as maintained at the Card Account Product to which the From Account# belongs.

Note: If the Book balance is Debit, then Aura will display only the Debit balance classes. If the Book balance is Credit, then Aura will display only the Credit balance classes.

Description: This denotes description of the balance class.

Balance: This denotes the current (book) balance of the balance class.

Balance to move: By default, the current balance is displayed. You can edit the amount in this field.

New balance: This denotes the new balance i.e. the balance after the balance movement (Balance minus Balance to move).

The figures in the last line, Total, show the total of each column, viz., Balance, Balance to move and New balance (Total Current balance minus Total Balance to move) of the various balance classes of the account.

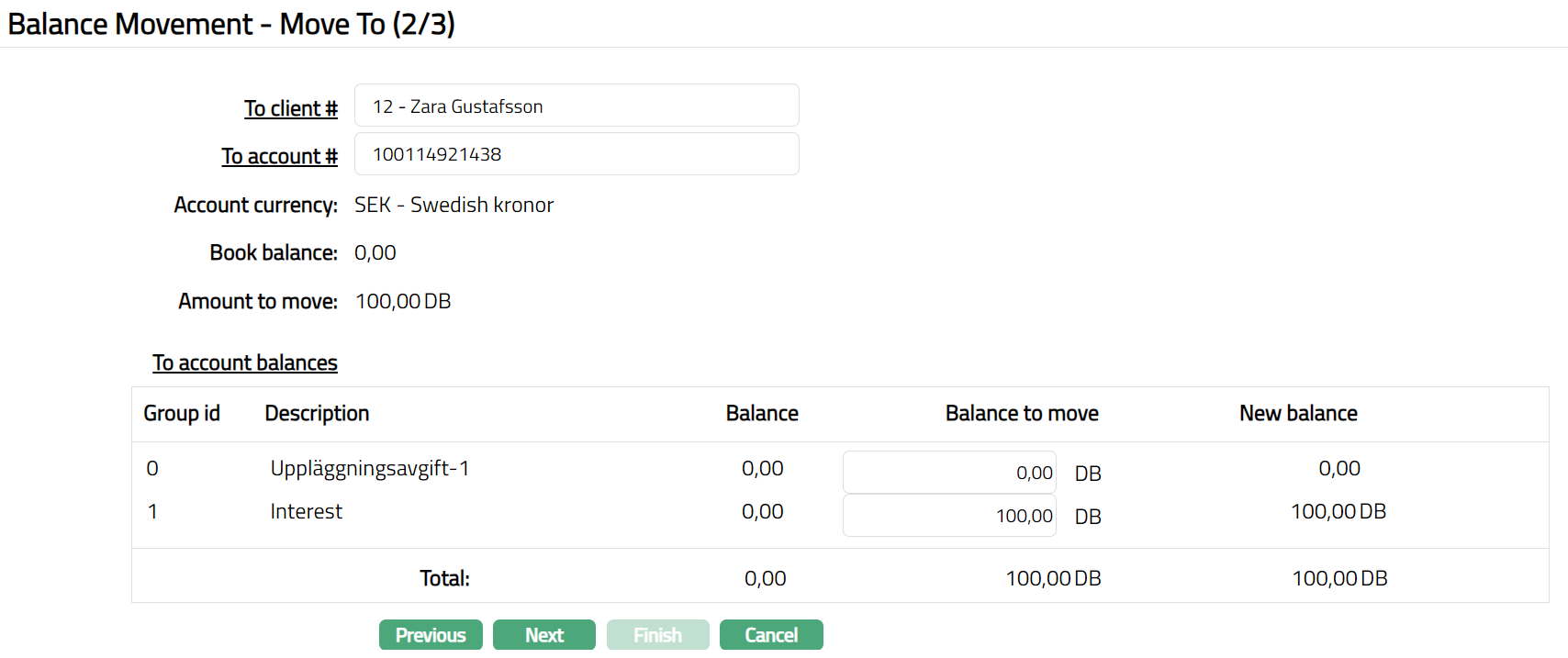

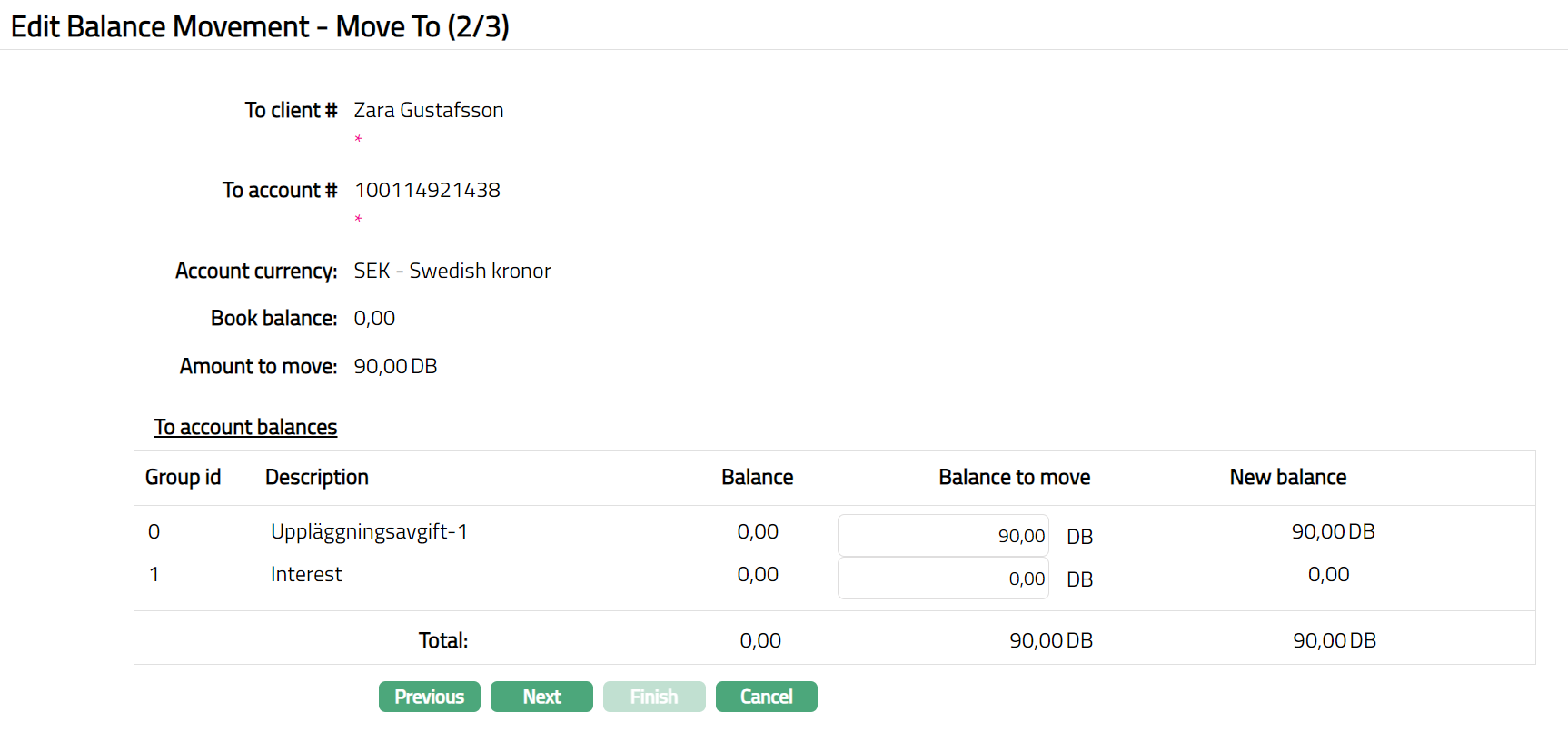

Once you enter the balance to be moved in the Balance to move field click Next. Balance Movement -- Move To (2/3) page appears.

Click To client # hyperlink to select the client to whose account the balance has to be moved. Aura will display the list of all Active clients maintained under CRM > Clients > Maintain.

Click To account # hyperlink to select the Billing Account held by the above client, where the Account currency matches the From Account's account currency. The selected account is the destination account to which the balance is to be moved from the Source account.

Account currency shows the Account currency of the To account# chosen above.

Book balance shows the current balance in the To Account#.

Amount to move displays the amount to be moved to the destination account and is defaulted from the total of the Balance to move that you input in the previous step.

To account balances displays the following details:

- Group ID: It denotes the Ids of the balance classes in the order of Group Id of the balance class as maintained at the Card Account Product to which the To Account# belongs.

Note: If it is a Debit balance that is to be moved from the From Account#, then Aura will display only the Debit balance classes from the To Account's Product. If it is a Credit balance that is to be moved from the From Account#, then Aura will display only the Credit balance classes from the To Account's Product.

Description: This denotes description of the balance class.

Balance: This denotes the current (book) balance of the balance class.

Balance to move: By default, the value will be 0. You can edit the amount in this field.

New balance: This denotes the new balance i.e. the balance after the balance movement (Balance plus Balance to move).

The figures in the last line, Total, show the total of each column, viz., Balance, Balance to move and New balance (Total Balance plus Total Balance to move) of the various balance classes of the account.

Note: The total of the Balance to move in Step 1/3 should be equal to the total of the Balance to move in Step 2/3.

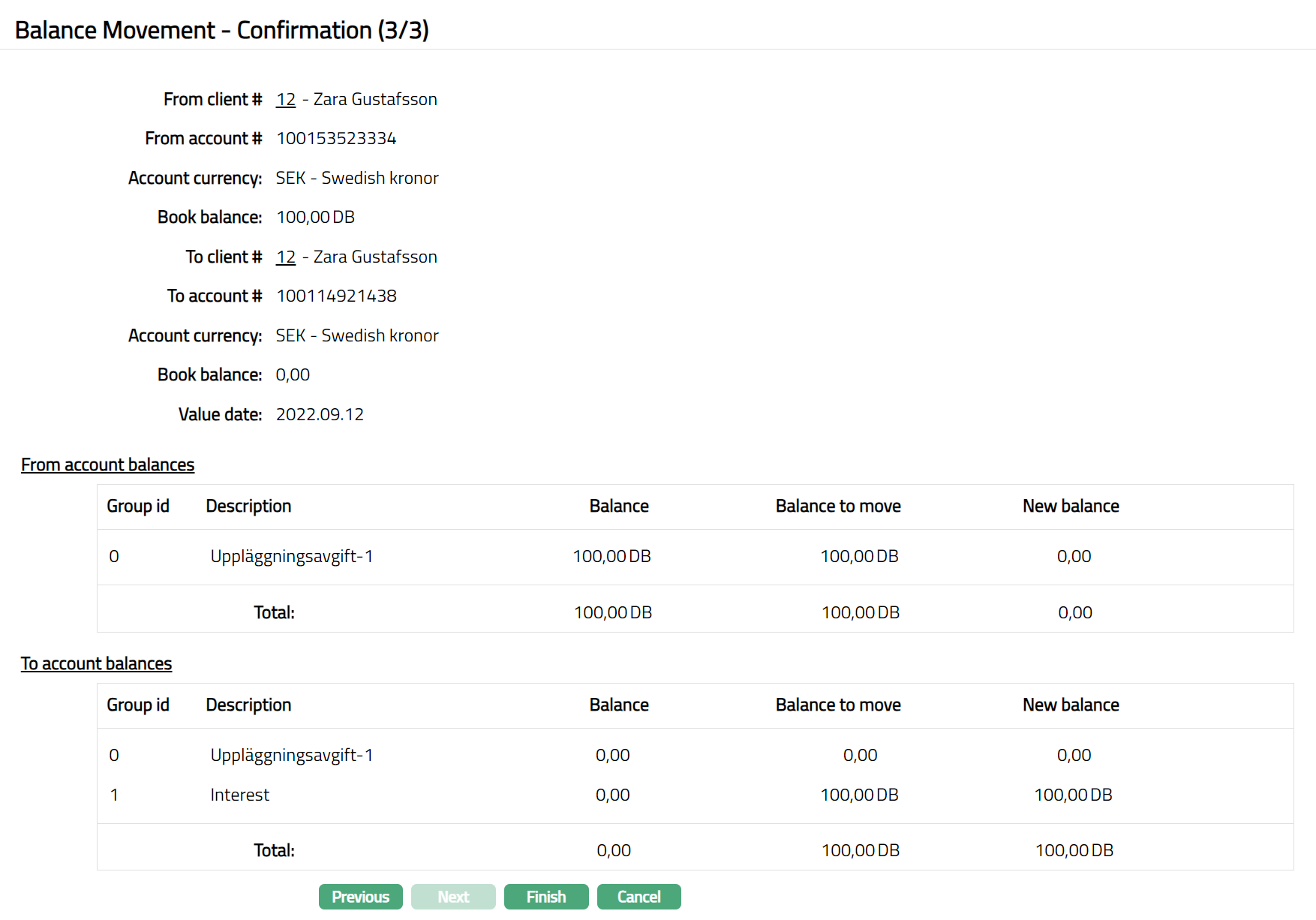

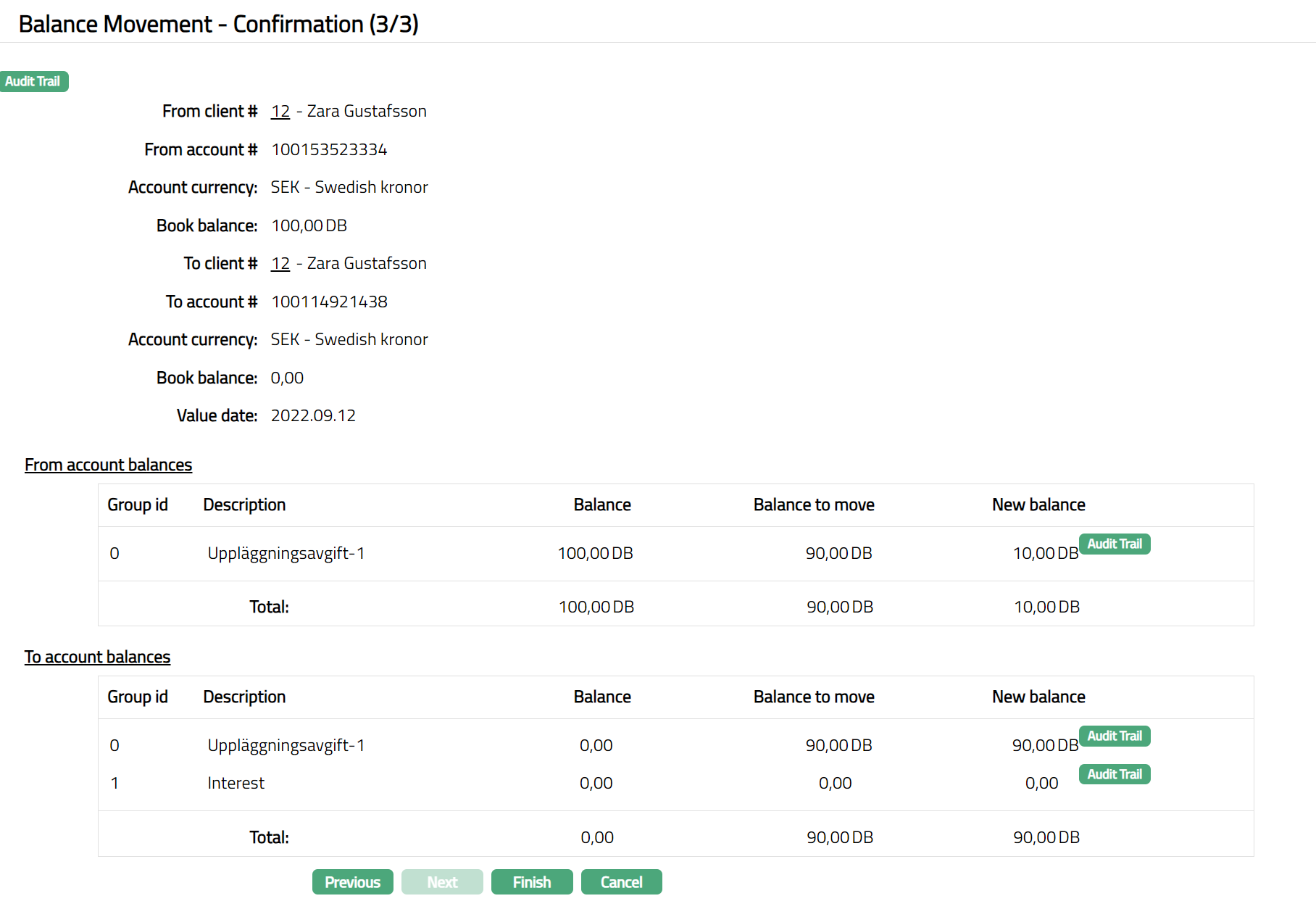

Once you enter the balance to be moved in the Balance to move field, click Next. Balance Movement -- Confirmation (3/3) page appears.

Click Finish. Balance Movement page appears with the edited details.

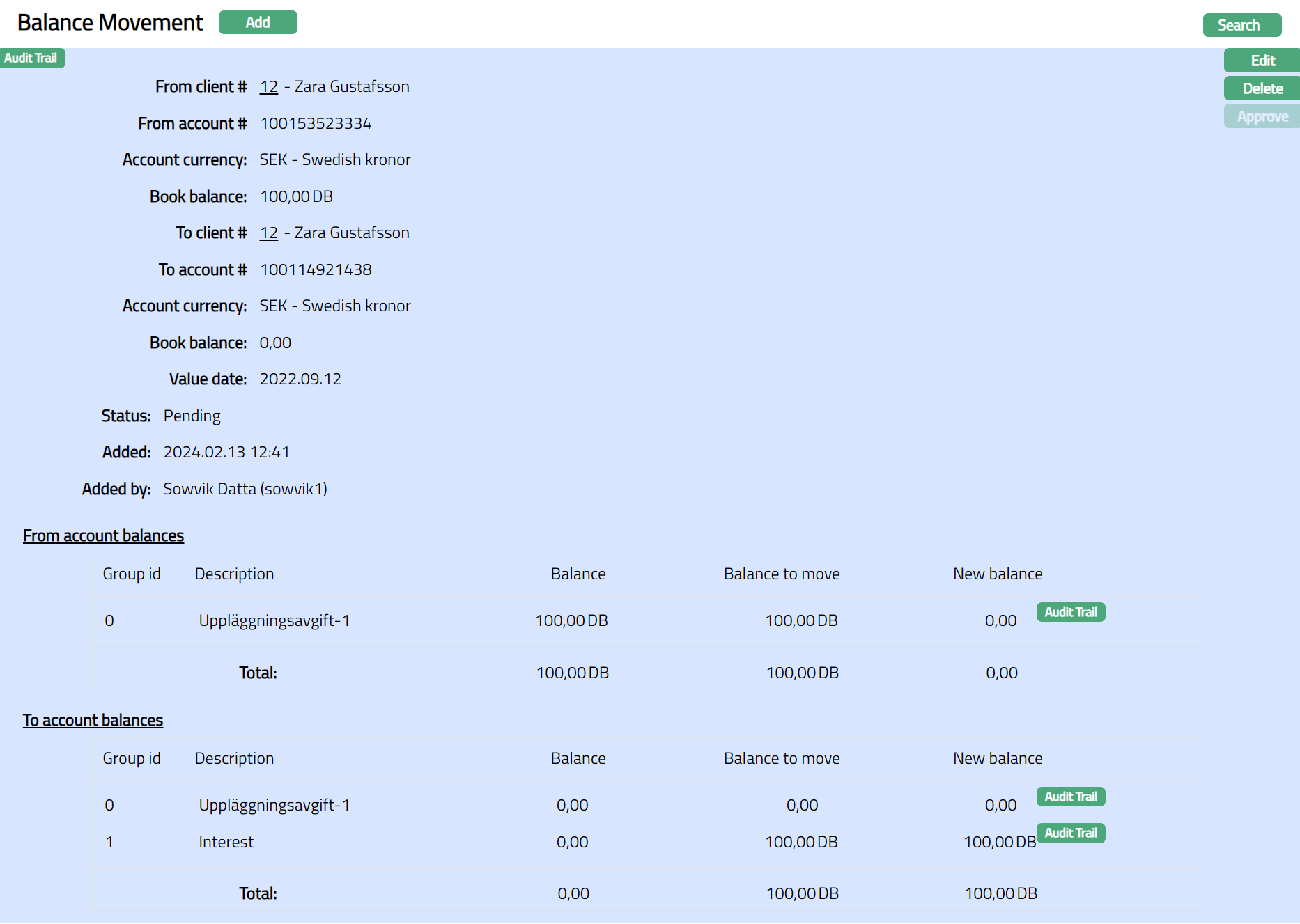

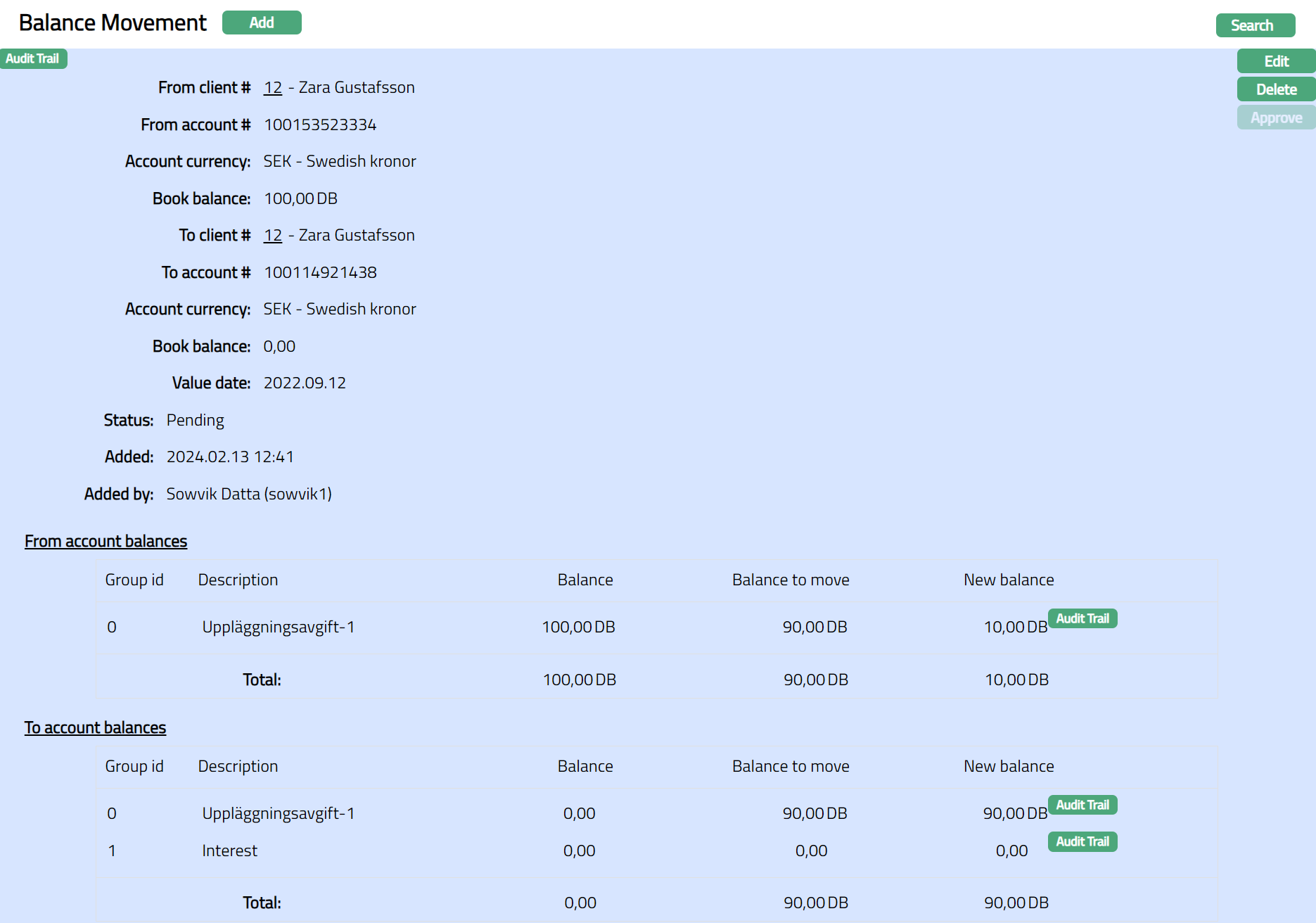

Functions: Edit, Delete and Approve.

Functions: Edit, Delete and Approve.

Note: On creation of the Balance movement record, the record status will be Pending. Any user other than the one who created the Balance Movement can approve the record.

Note: The record will not be approved if,

There is any difference between the balance amounts when the record was created and the balance amounts at the time of approval.

Each of the relevant balance classes in the From and To Accounts do not have a Transaction Code For Balance Movement defined in the Card Account Product > Balance Classification Tab.

Delete: Only the user who created the record can delete the record by clicking on Delete button. When you click on Delete button, Aura will ask for confirmation, on approval of which the record will get deleted.

Edit

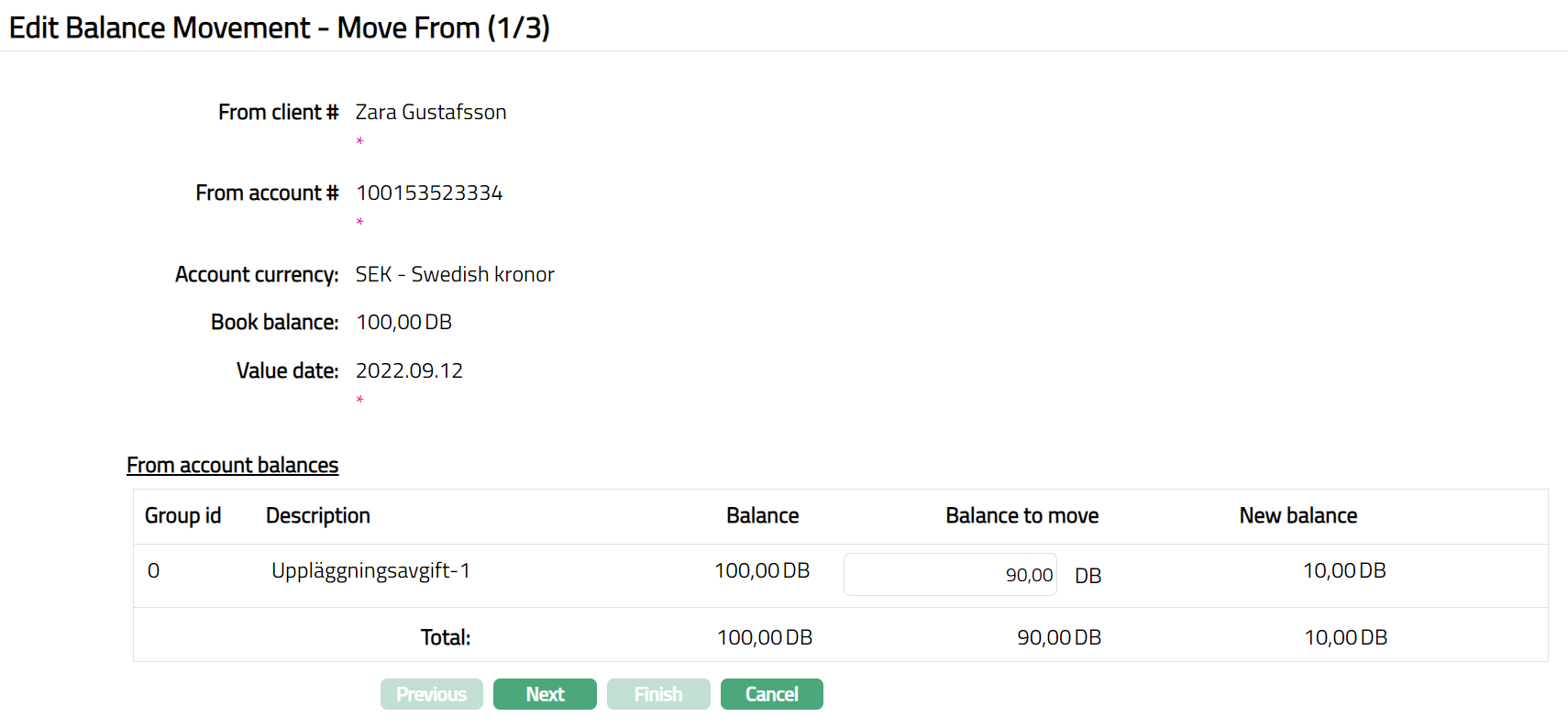

Edit button is enabled only if the record is in Pending status; and only for the user who created the record.

To view / edit balance movement record,

Click Edit button. Edit Balance Movement -- Move From (1/3) page appears.

Note: Only Balance to move field is editable.

Make required changes and click Next. Edit Balance Movement -- Move To (2/3) page appears.

Note: Only Balance to move field is editable.

Note: The total Balance to move in Step 1/3 should be equal to the total of the Balance to move in Step 2/3.

Make required changes and click Next. Balance Movement -- Confirmation (3/3) page appears.

Click Finish. Balance Movement page appears with the edited details.

Functions: Edit, Delete and Approve.

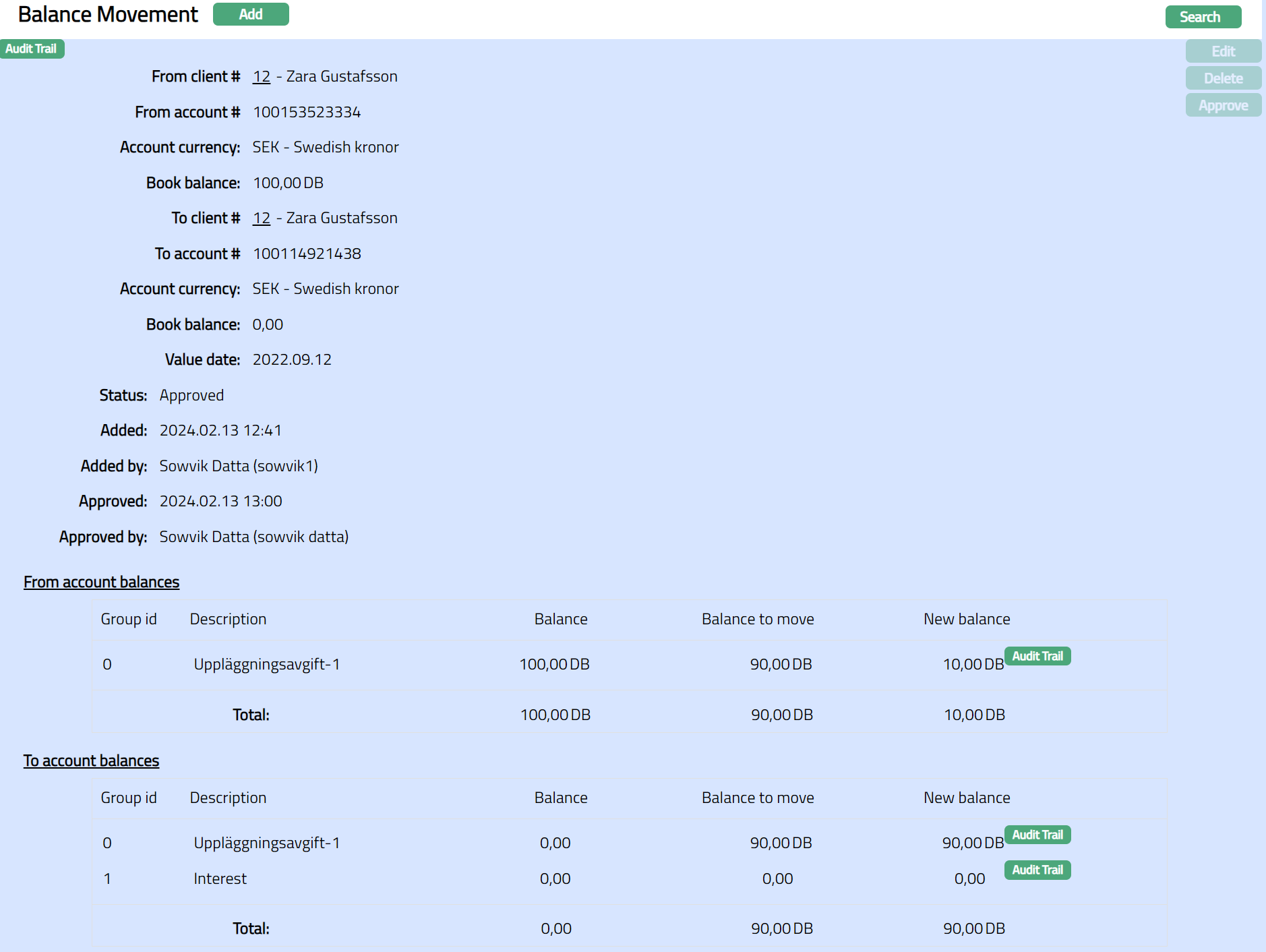

Approve: Any user other than the one who created the Balance movement record can approve the record. You can click on the Approve button to approve the Balance movement record. On approval, the balances will be moved from source account to destination account as per the value date of the Transaction Code for the balance movement. (Note: The transaction code for Balance Movement is defined in the Card Account Product > Balance Classification tab.) Note: Once approved the Status of the record changed to Approved.

Functions: Edit, Delete and Approve

The additional fields that you can see are as follows:

Status field denotes the status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only on approval.

Approved by field denotes name of the user who approved the record and is displayed only on approval.