Nostro Configuration

Nostro Configuration allows you to add any rule / trigger in the Nostro Configuration screen. Based on the rule configured here, the relevant Nostro account is derived for SWIFT/TARGET2 Outgoing Payments. If the rule is satisfied, Nostro Rule Processor picks up the Nostro account for credit processing. Thus, if Nostro Configuration is not maintained or if Nostro rules are not satisfied, credit processing will fail.

In the following cases, the rules defined using Nostro Configuration will not be considered:

If Nostro BIC Mapping is configured and is successfully picked, then outgoing payments will not consider the rules defined under Nostro configuration for credit processing.

If the Outgoing payment is of type Bank, then Nostro Route definition is used and Nostro configuration will not be considered.

There are two sub-tabs in Nostro Configuration record:

To add a rule for Nostro Configuration

- From PaymentGrid menu, click Settings and then Nostro configuration. Nostro Configuration Search page appears.

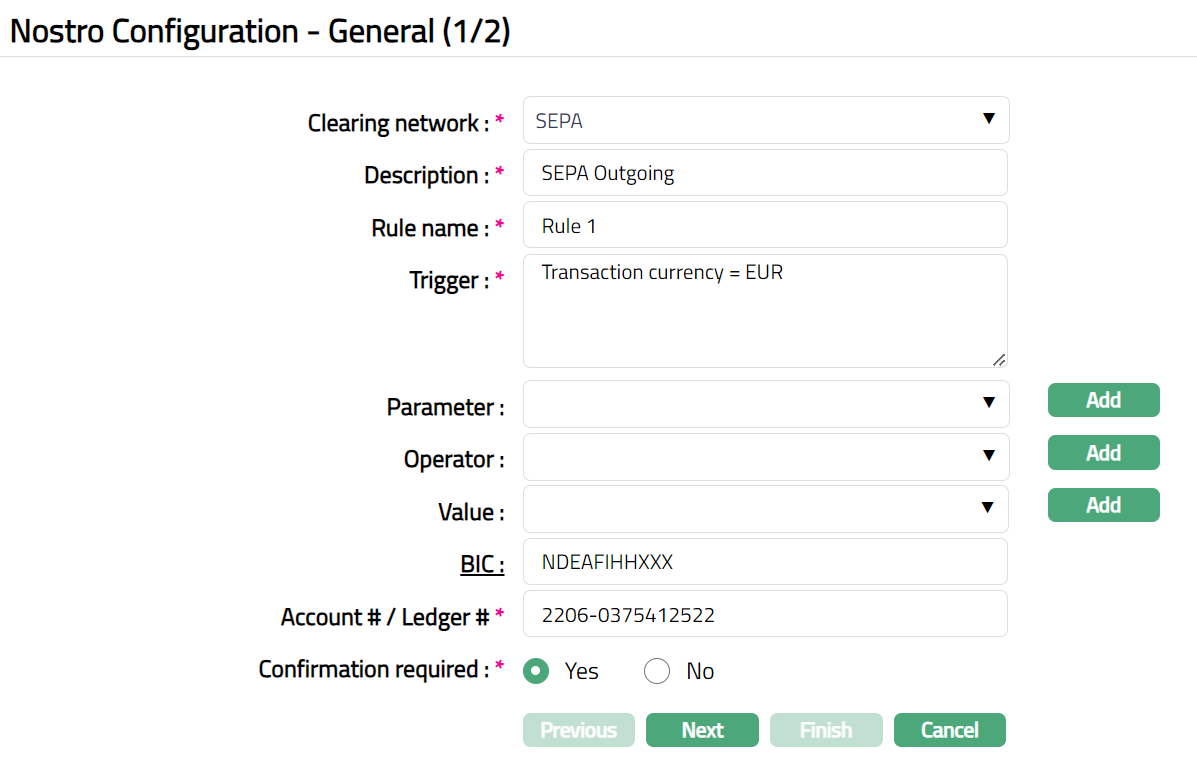

- Click Add. New Nostro Configuration -- General (1/2) page appears.

Select Clearing Network from the drop-down list. The pre-shipped options are SWIFT and TARGET2.

Enter Description for Nostro configuration.

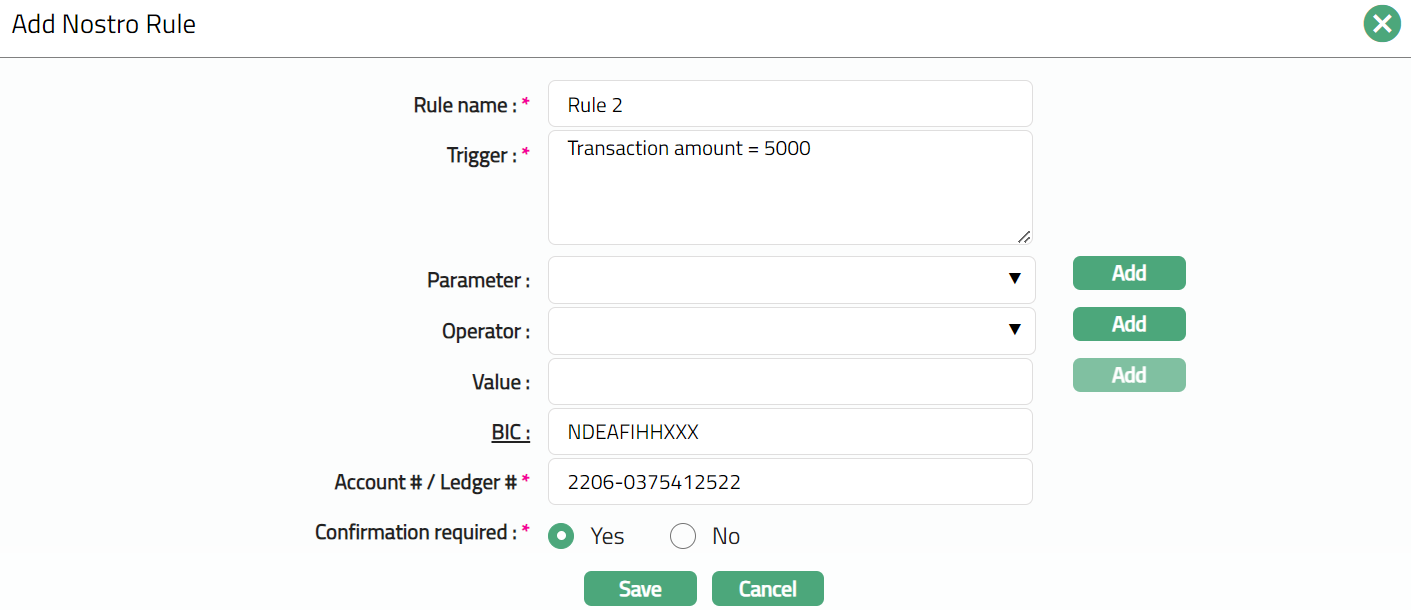

Enter Rule name. It is the name of the rule for the Nostro Configuration.

Enter Trigger details. Each trigger will constitute a collection of individual conditions joined by an Operator. The Trigger details can be built using the Parameter, Operator and Value.

Select Parameter from the pre-shipped list and click Add. CC-PG will push the selected value of Parameter into the Trigger text area above. Based on the Parameter selected, the Operator and Values will change. See detailed explanation below.

Select Operator from the pre-shipped list and click Add. CC-PG will push the selected value of Operator into the Trigger text area above. See detailed explanation below.

Enter required Value for the Parameter and click Add. CC-PG will push the selected value into Trigger text area above. See detailed explanation below.

Details of the Parameter, Operator and Values

Account with institution: It specifies the financial institution which provides services for the beneficiary client's account. If this parameter is chosen, Value field becomes a text box where you can enter the required BIC code.

Bank Operation Code: If this parameter is chosen, Value field becomes a text box where you can enter the Bank operation Code. For example: 23B: SPAY is the tag for the Bank Operation Code and SPAY is the code. You can give a trigger as Bank Operation Code = SPAY.

Beneficiary Client: If this parameter is chosen, Value field becomes a text box where you can enter client's name.

Beneficiary Country: If this parameter is chosen, Value field becomes a drop down where you can select the country from the available dropdown list of countries maintained under Admin > System codes > Generic definition > Countries.

Beneficiary institution: If this parameter is chosen, Value field becomes a text box where you can enter the Beneficiary institution BIC.

Charge account: If this parameter is chosen, the Value field becomes a text box where you can enter the account number.

Charge bearer: If this parameter is chosen, Value field becomes a textbox. You can enter the codes in the value field based on the clearing network, as per examples given below:

| Clearing Network | Values |

|---|---|

| SWIFT/TARGET2 | SHA/BEN/OUR |

| SEPA | DEBT/CRED/SHAR/SLEV |

Clearing network: If this parameter is chosen, then select the option for Clearing network from the drop-down list in the Value field. The available options are RTGS, SEPA, TARGET2, BANKGIRO, SWIFT, and PLUSGIRO.

Clearing number: If this parameter is chosen, Value field becomes a text box where you can enter the clearing number. For example, Autogiro network, the standard number is 9900. Each bank will have their respective clearing number.

Credit account: If this parameter is chosen, Value field becomes a text box where you can enter the credit account number of the client.

Creditor BIC: If this parameter is chosen, Value field becomes a text box where you can enter the Creditors BIC number.

Creditor Giro number: If you choose this parameter, Value field becomes a text box where you can enter the Creditor Giro number.

Creditor reference: If you choose this parameter, Value field becomes a text box where you can enter the reference number of the creditor.

Debit account: If this parameter is chosen, Value field becomes a text box where you can then enter the Debit account number.

Debtor BIC: If this parameter is chosen, Value field becomes a text box where you can enter the Debtor's BIC number.

Debtor Giro number: If you choose this parameter, Value field becomes a text box where you can enter the Debtor Giro number.

External source: If you choose this parameter, Value field becomes a text box where you can specify the external source system.

Instructed amount: This amount is provided for instruction purpose. If you choose this parameter, Value field becomes a text box where you can enter the instructed amount.

Instructed currency: It is the currency of the Instructed amount. If you choose this parameter, Value field becomes a drop down where you can then select the currency from the available drop-down list of active currencies maintained under Admin > System codes > Currencies > Currencies.

Intermediary institution: It is the financial institution through which the transaction passes to reach the Account with Institution. If you choose this parameter, Value field becomes a text box where you can enter the BIC code of the Intermediary institution.

Message Priority: If you choose this parameter, Value field becomes a drop down where you can select the option for the Message Priority from the drop-down list. The available options are System, Normal, and Urgent.

Ordering customer: It is the customer who orders the transaction. If this parameter is chosen, Value field becomes a text box where you can enter the ordering customer's name.

Ordering institution: It is the financial institution of the ordering customer. If this parameter is chosen, Value field becomes a text box where you can enter the BIC code of the Ordering Institution.

Pay by cash: If a customer, who does not have an account with the bank, walks in for a transaction, you can apply a charge on that transaction by using this option. If this option is chosen as a parameter, Value field becomes a drop down where you can select Yes or No option from the drop-down list.

Receiver charges amount: It is the amount of transaction charges payable by the receiver. If this option is chosen as a parameter, Value field becomes a text box where you can enter the amount.

Receiver charges currency: It is the currency of transaction charges amount payable by the receiver. If you choose this parameter, Value field becomes a drop down where you can then select the currency from the available drop-down list of active currencies maintained under Admin > System codes > Currencies > Currencies.

Receivers' correspondent: It is the branch of the receiver or another financial institution at which the funds will be made available to the receiver. If this option is chosen as a parameter, Value field becomes a text box where you can enter the BIC code of the Receiver correspondent in the Value field.

Remittance information: It specifies the details of the individual transaction or a reference to another message containing the details which are to be transmitted to the beneficiary customer. If this option is chosen as a parameter, Value field becomes a text box where you can enter the code (like INV, IPI, RFB).

Sender to receiver info: It specifies additional information for the Receiver or other party specified. If this option is chosen as a parameter, Value field becomes a text box where you can enter the code (like ACC, INS, INT).

Sender's charges amount: It specifies the amount of the transaction charges deducted by the Sender and by previous banks in the transaction chain. If this option is chosen as a parameter, Value field becomes a text box where you can enter the Senders charge amount.

Sender's charges currency: It is the currency of transaction charges deducted by the Sender and by previous banks in the transaction chain. If you choose this parameter, Value field becomes a drop down where you can select the currency from the available drop-down list of active currencies maintained under Admin > System codes > Currencies > Currencies.

Sender's correspondent: When two financial institutions do not have direct relationship and communicate via correspondent, then the financial institution associated with sender is the Sender's Correspondent. If this option is chosen as a parameter, Value field becomes a text box where you can enter the BIC code of the Senders correspondent.

Sender's reference: It specifies the reference assigned by the Sender to unambiguously identify the message. If this option is chosen as a parameter, Value field becomes a text box where you can enter the reference number.

Sending institution: It identifies the Sender of the message. If this option is chosen as a parameter, Value field becomes a text box where you can enter the Sending institution BIC code.

Service identifier: It specifies the character values of SWIFT/TARGET2 network. If this option is chosen as a parameter, Value field becomes a text box where you can enter the code for the service identifier. For example: 01, 03, 021 (as mentioned in Block 1).

Service delivery channel: It is the mode/medium through which the customers interact with the financial institutions and by which the financial institution delivers its products and services to the customers. If you choose this parameter, Value field becomes a drop down where you can select the Service delivery channel from the available drop-down list maintained under Admin > System codes > Categories > Service delivery channel.

TAG 119: If this parameter is chosen, Value field becomes a text box. If the condition satisfies, then product attached to the TAG 119, will be picked and Charge is applicable. For example:

If TAG 119 = COV, then it is a Cover message

If TAG 119 = TGT, then it is a TARGET2 message.

Third reimbursement institution: It specifies the Receiver's branch, when the funds are made available to this branch through a financial institution other than that indicated in field 53a. If this option is chosen as a parameter, Value field becomes a text box where you can enter the BIC code of the institution.

Transaction amount: It specifies the amount of the subsequent transfer to be executed by the receiver. If this option is chosen as a parameter, Value field becomes a text box where you can enter the amount.

Transaction code: It specifies the nature of, purpose of, and/or reason for the individual transaction. For example, salaries, pensions, dividends. If this option is chosen as a parameter, Value field becomes a text box where you can enter the code. For example: 26T:K90.

Transaction currency: It specifies the currency of the Transaction Amount. If you choose this parameter, Value field becomes a drop down where you can select the currency from the available drop-down list of active currencies maintained under Admin > System codes > Currencies > Currencies.

Transaction date: It specifies the date of the transaction. If this parameter is chosen, Value field becomes a text box where you can enter the date in the Value field.

Transaction reference: It specifies the reference number that is generated by CC-PG for the individual transaction. If this option is chosen as a parameter, Value field becomes a text box where you can enter the reference number in the Value field.

Transfer type: It specifies the type of transfer, whether the transfer is made to the bank or to the customer. If this parameter is chosen, Value field becomes a drop down where you can select the Transfer type from the drop-down list. The pre-shipped options are Customer and Bank.

Value date: It specifies the value date of the transaction. If this parameter is chosen, Value field becomes a text box where you can enter the value date from the date picker.

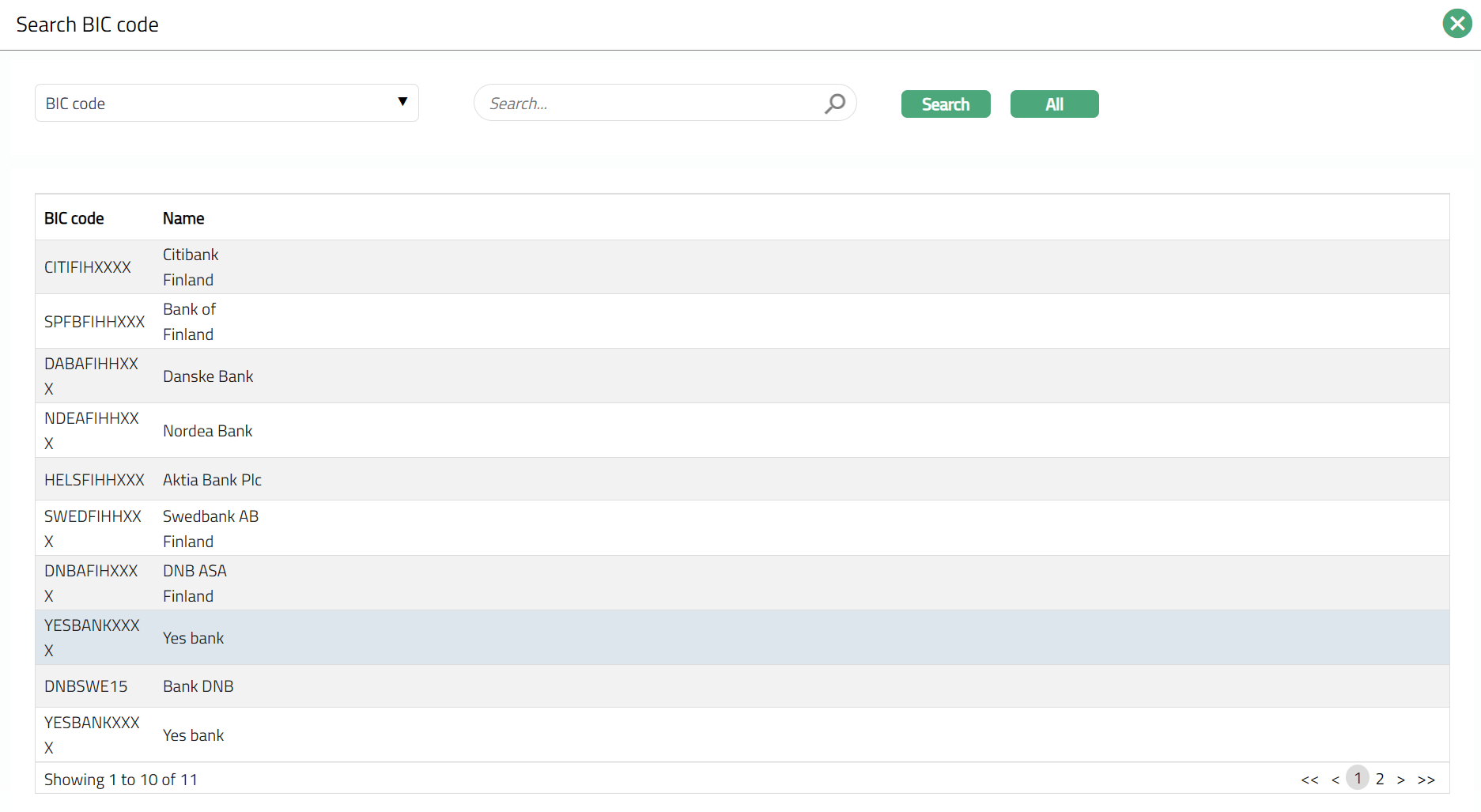

- Select BIC (Business Identifier Code) for the nostro account by clicking on BIC hyperlink. The Search BIC code page appears with the list of active BIC's maintained under Admin > Management > Settlement Directory. You can search for a BIC code with relevant criteria and select the required BIC code. You can also input the name of the bank and select the required BIC code from the list displayed by Aura.

Enter Nostro Account # maintained in the external system.

Select Yes or No for Confirmation Required. If Yes is chosen, Nostro account will be credited and Nostro approval is required. If No is selected then Nostro account will be credited, but Nostro approval is not required.

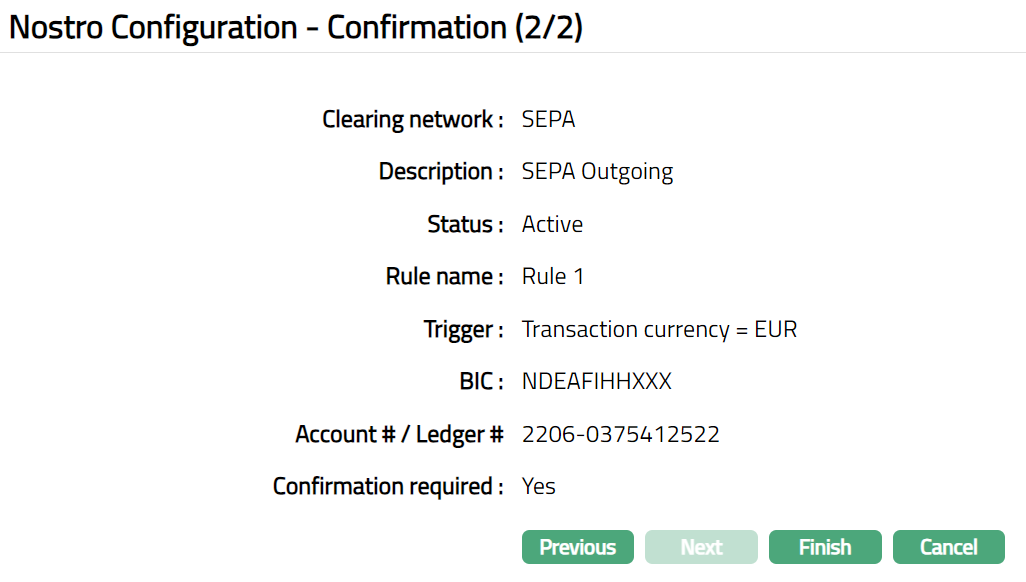

Click Next. Nostro Configuration -- Confirmation (2/2) page appears.

- Click Finish. Nostro Configuration page appears. A new rule is created for Nostro Configuration, and you can see the Rules tab by default.

Functions: Add, Search, Edit, Delete,Approve, Suspend, Activate

Functions: Add, Search, Edit, Delete,Approve, Suspend, Activate

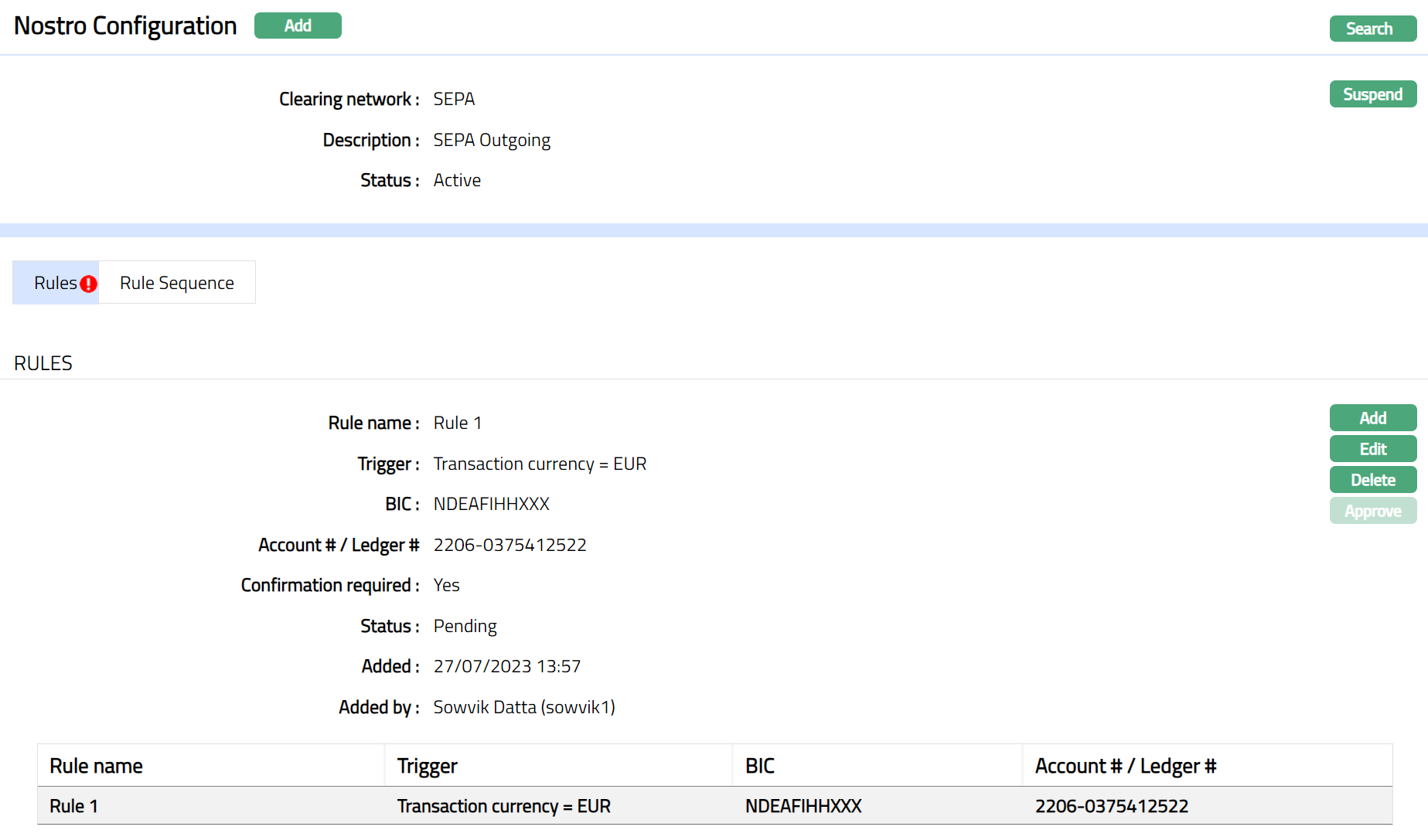

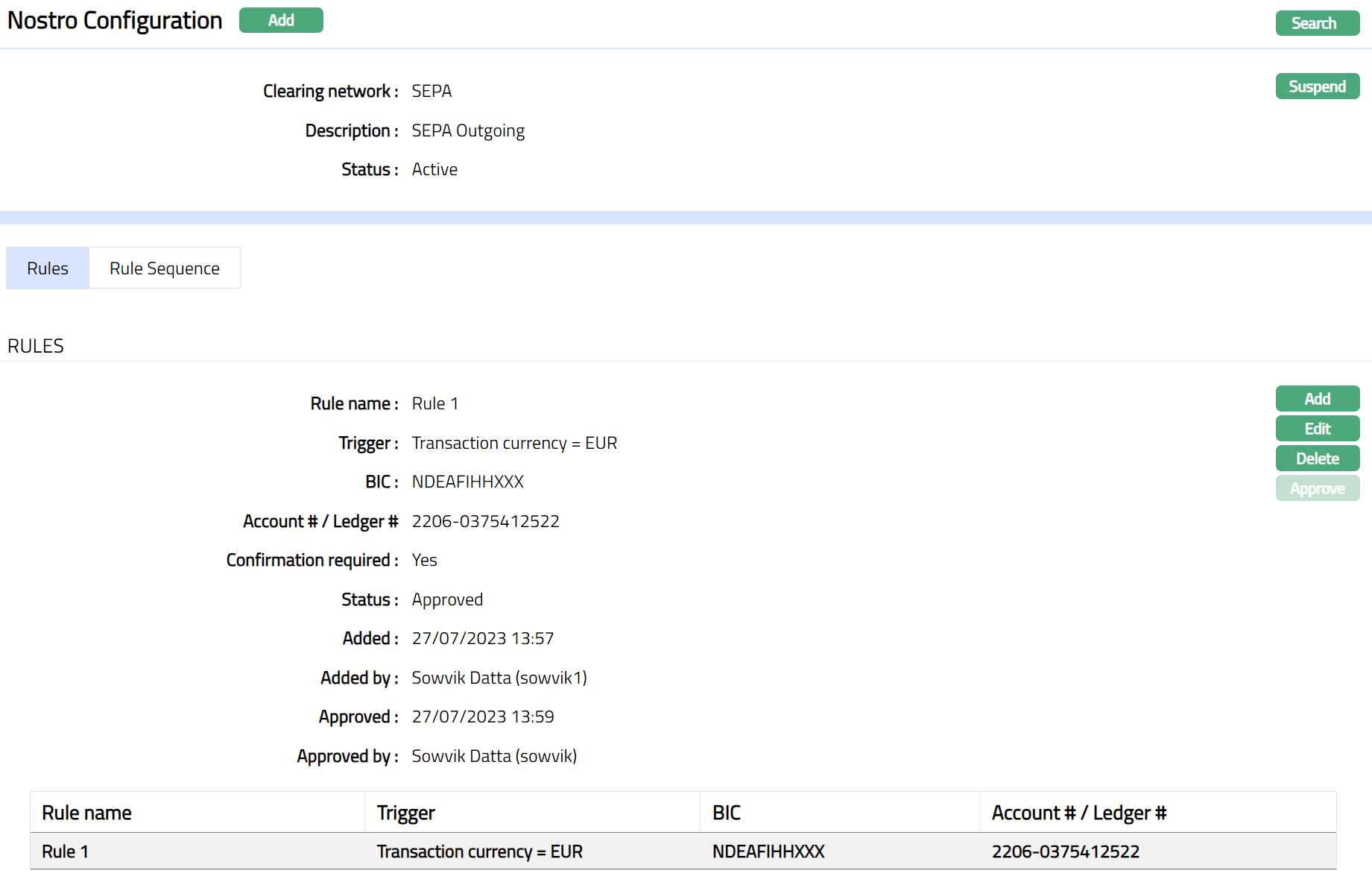

Note: On creation of a new Nostro Configuration, the Status by default will be Active, the record status will be Pending, and a red bubble appears on the Rules tab. Only on Approval, the record Status gets changed to Approved and the red bubble disappears.

Functions: Add, Search, Edit, Delete, Approve, Suspend, Activate

Functions: Add, Search, Edit, Delete, Approve, Suspend, Activate

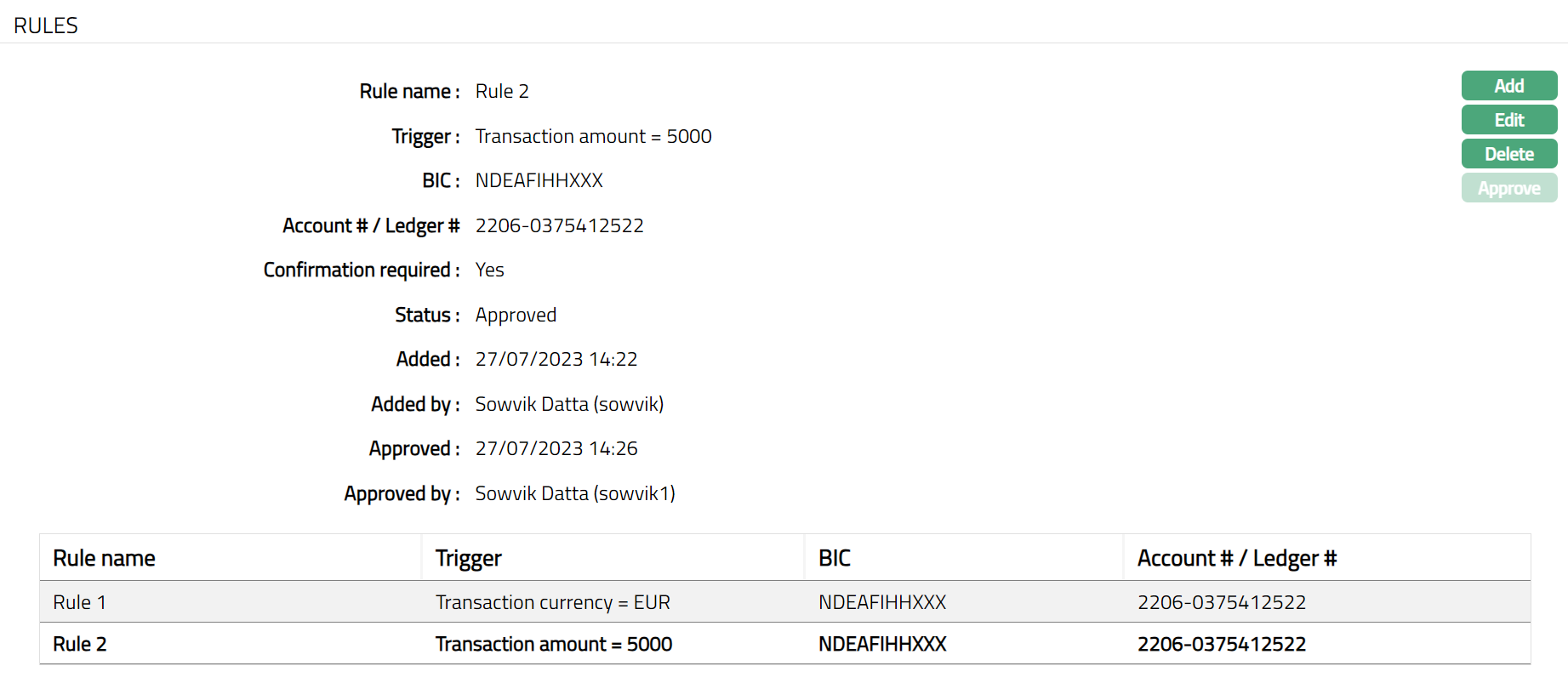

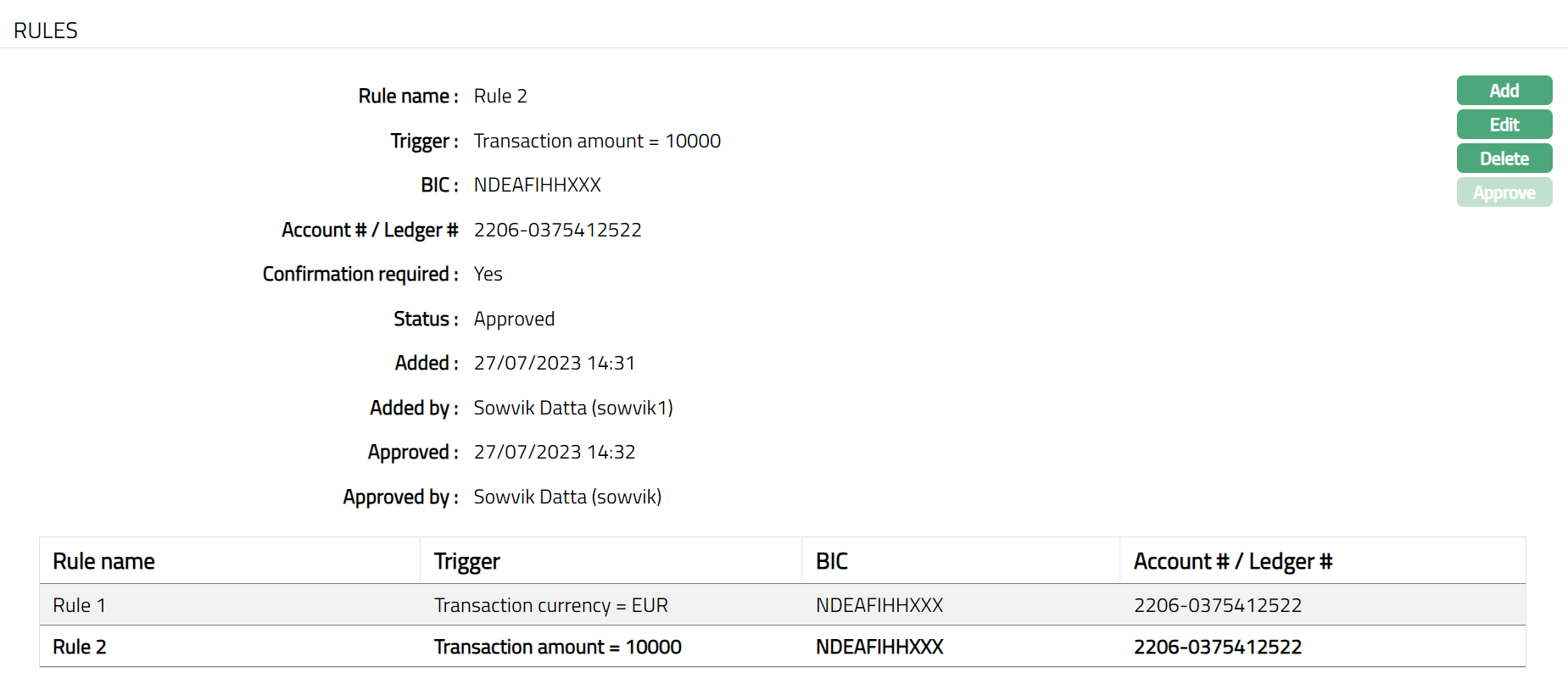

The additional fields that you can view in the Rules tab are as follows:

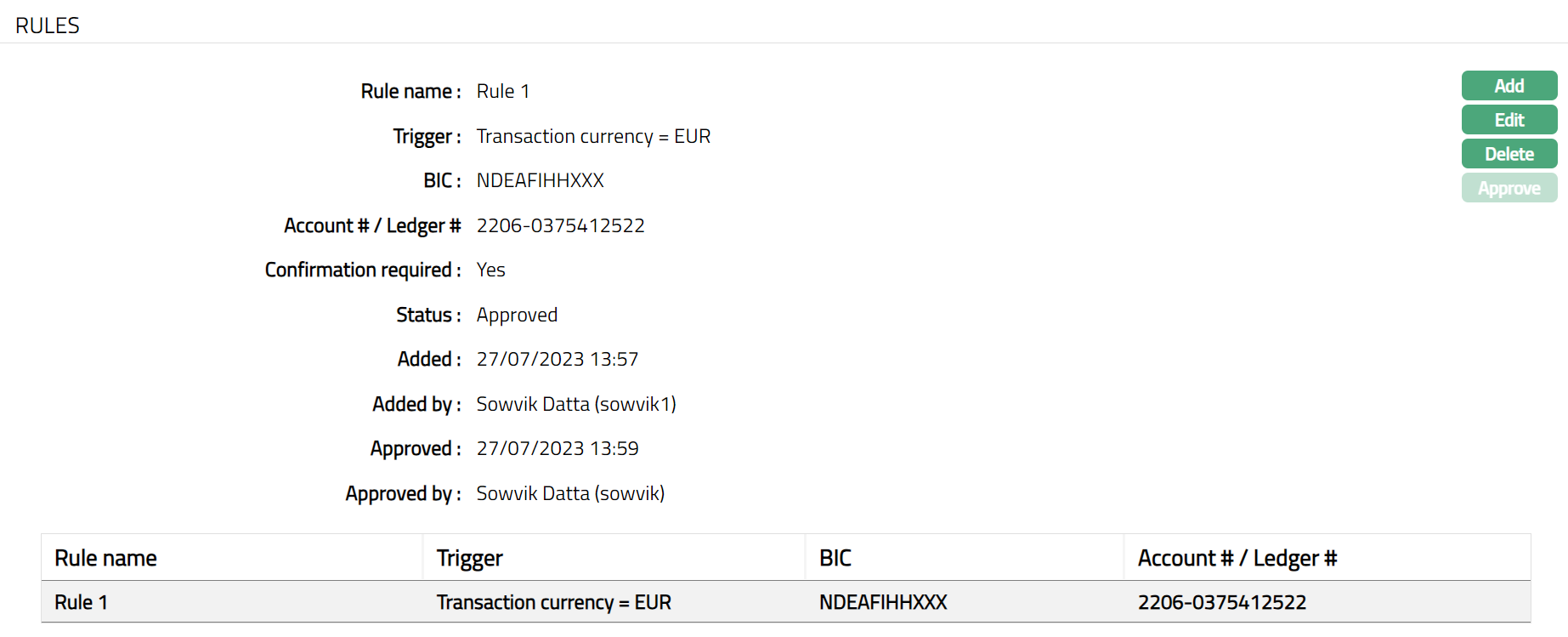

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

Delete: You can delete a Nostro configuration rule by clicking on Delete button. When you click on Delete button, CC-PG will ask for confirmation, on confirmation selected record will be deleted.

Approve: If you want to approve a rule, then retrieve the record and click on Approve. CC-PG will ask for confirmation. Once the rule is approved, status gets changed from Pending to Approved.

Suspend: You can suspend a rule by clicking on Suspend button. When you click on Suspend button, CC-PG will ask for confirmation. On confirmation CC-PG will suspend the rule and Activate button will appear in place of the Suspend button.

Activate: If you want to activate a suspended rule then click on Activate button. CC-PG will ask for confirmation. On confirmation CC-PG will Activate the rule, and Suspend button will appear in place of Activate button.

Rules

- Access Nostro Configuration page and click Rules tab to view the details as per sample below. The details are defaulted from the entries that you made during New Nostro Configuration setup. For details refer to New Nostro Configuration -- General (1/2) page.

- Click Add. Add Nostro Rule page appears.

Note: Please refer to the above section for the details regarding the fields.

- Click Save. Rule tab appears with the added details. Status of the tab will be Pending, and a red bubble appears on the Rules tab. Only on Approval, the Status gets changed to Approved and the red bubble disappears.

Functions: Add, Edit, Delete, Approve.

Functions: Add, Edit, Delete, Approve.

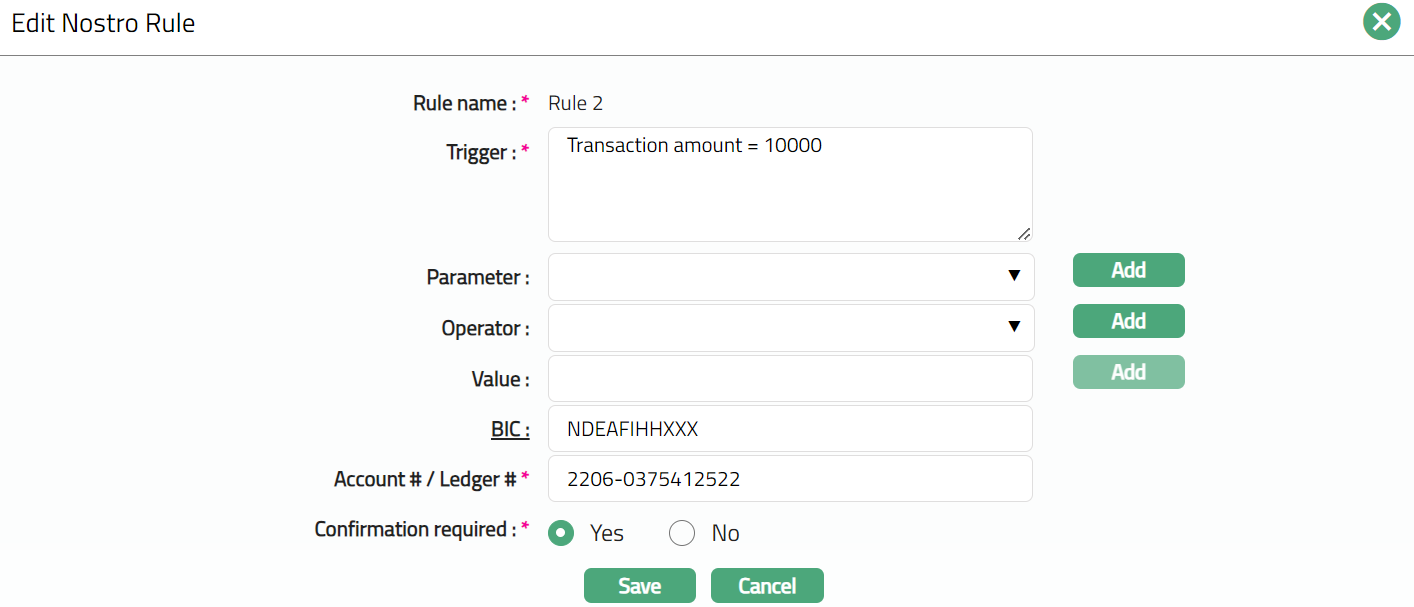

To edit Rule

Select the required Rule record you wish to Edit.

Click Edit. Edit Nostro Rule page appears.

Note: Except Rule name field, rest all other fields are editable.

- Click Save. Nostro Configuration Maintenance page appears with the edited details. Note: Status of the tab will be Pending, and a blue bubble appears on the Rules tab. Only on Approval, the Status gets changed to Approved and the blue bubble disappears.

Functions: Add, Edit, Delete, Approve.

Functions: Add, Edit, Delete, Approve.

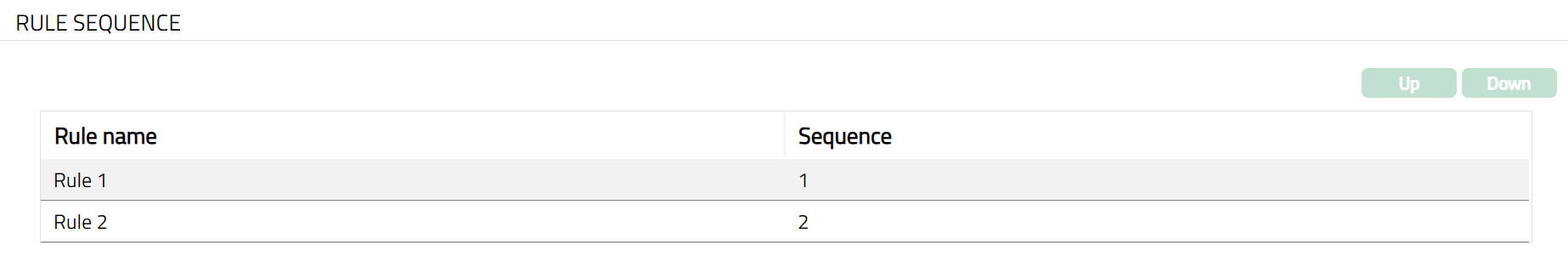

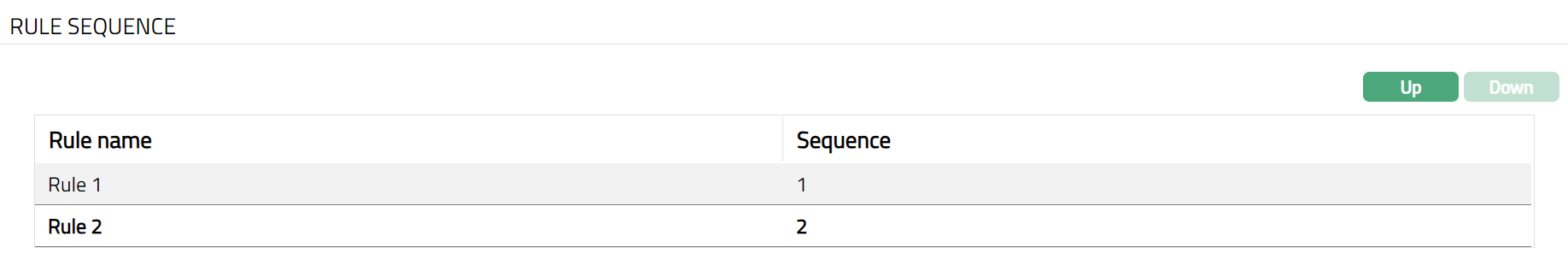

Rule Sequence

You can define the order in which the Nostro rules have to be executed using the Rule Sequence tab. By default, it will contain all the maintained Rule names. It will be displayed in ascending order and will have the provision to manipulate the sequence, as you require.

To define the Rule Sequence,

- Access Nostro Configuration page and click Rule Sequence tab.

- All available Rules are displayed. Select any Rule Name and click Up or Down button, as required.

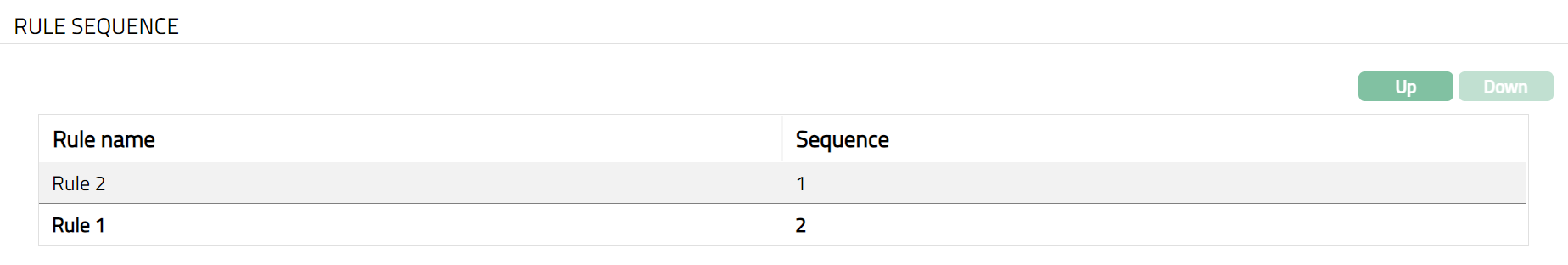

Up

After Changing Sequence

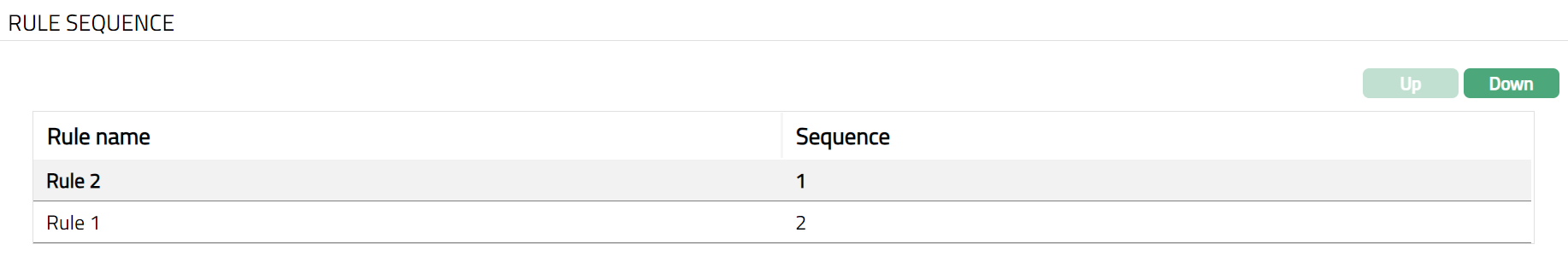

Down

After Changing Sequence

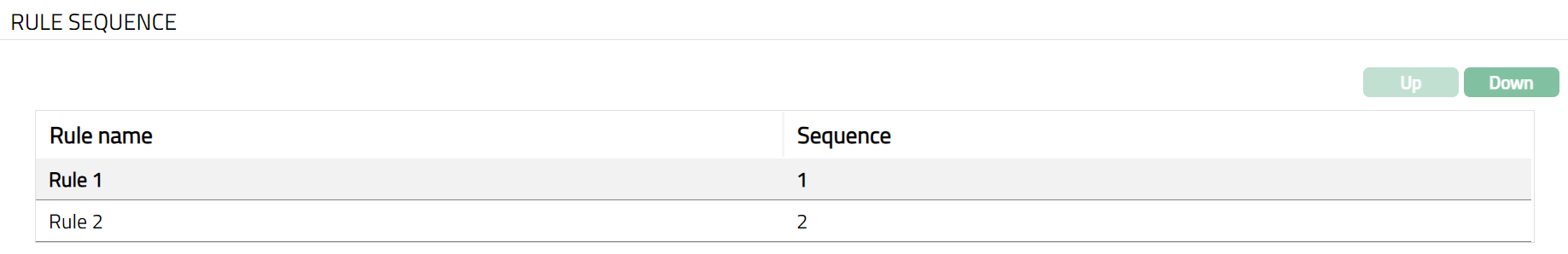

Functions: Up, Down.

Up: If you click on Up button, then CC-PG will move the selected Rule Name to the next higher order of preference and interchange the position between the source and destination. For the topmost Rule Name, the Up button will be disabled.

Down: If you click on Down button, then CC-PG will move the selected Rule Name to the next lower order of preference and interchange the position between the source and destination. For the bottom most Rule Name the Down button will be disabled.