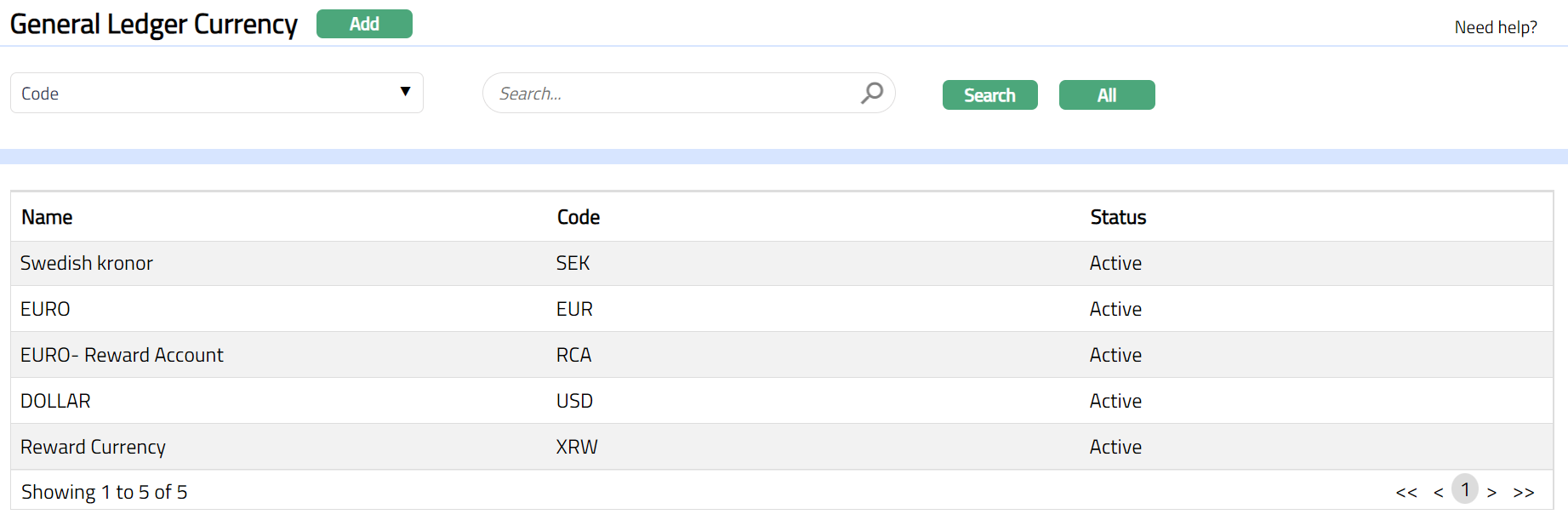

General Ledger Currency

This Menu option is used to define currency attributes to facilitate General Ledger (GL) accounting.

The following are the tabs in the General Ledger Currency screen:

Adding new GL Currency

- Access General Ledger menu, click Settings and then Currencies. The General Ledger Currency Search page appears. All Currencies maintained for the Entity for which these attributes are yet to be defined appear on the page.

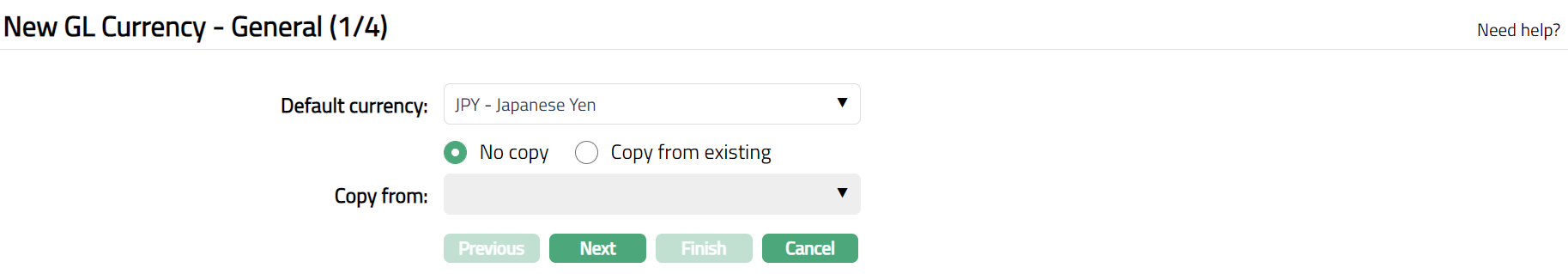

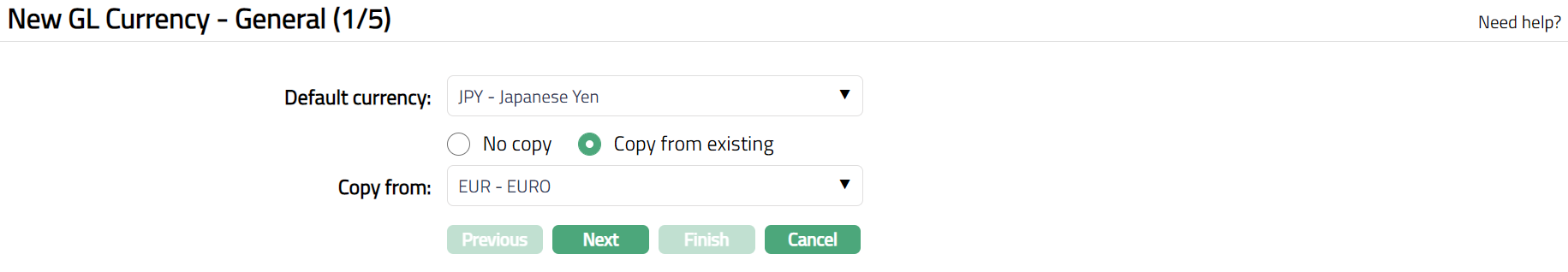

- Click Add. New GL Currency -- General (1/4) page appears

Select Default currency from the available drop-down list of Active currencies maintained under Admin > System codes > Currencies > Currency, that are not yet added to the GL currency.

While adding a GL Currency there are two options No Copy and Copy from existing

a. No copy -- Choose this when you want to create the attributes for the Currency afresh.

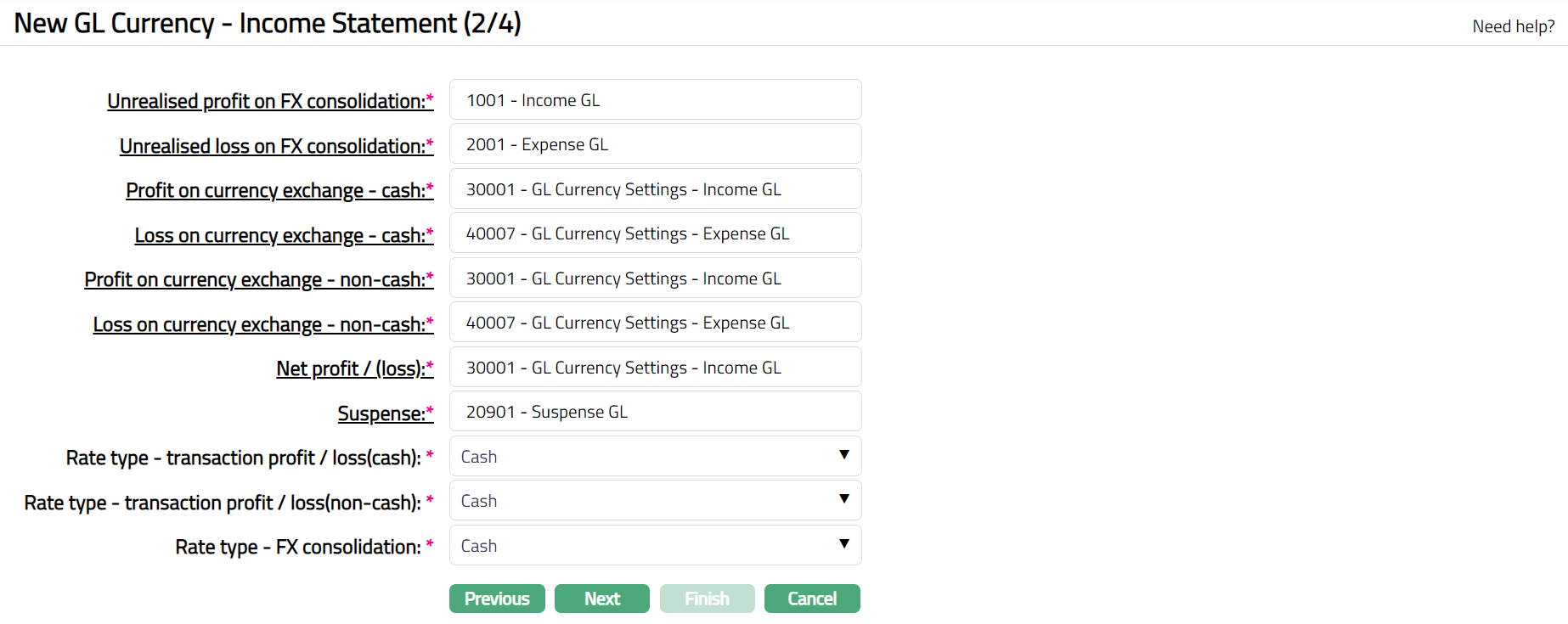

Click Next. New GL Currency -- Income Statement (2/4) will appear

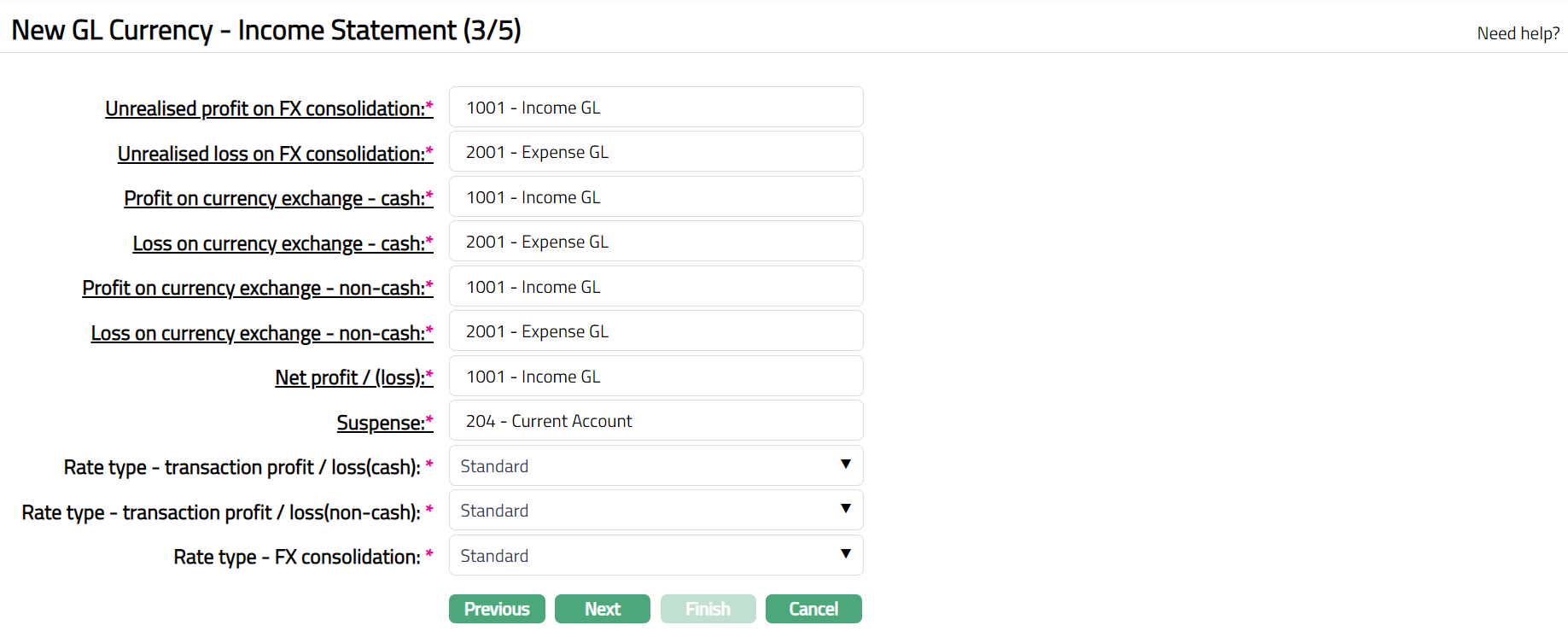

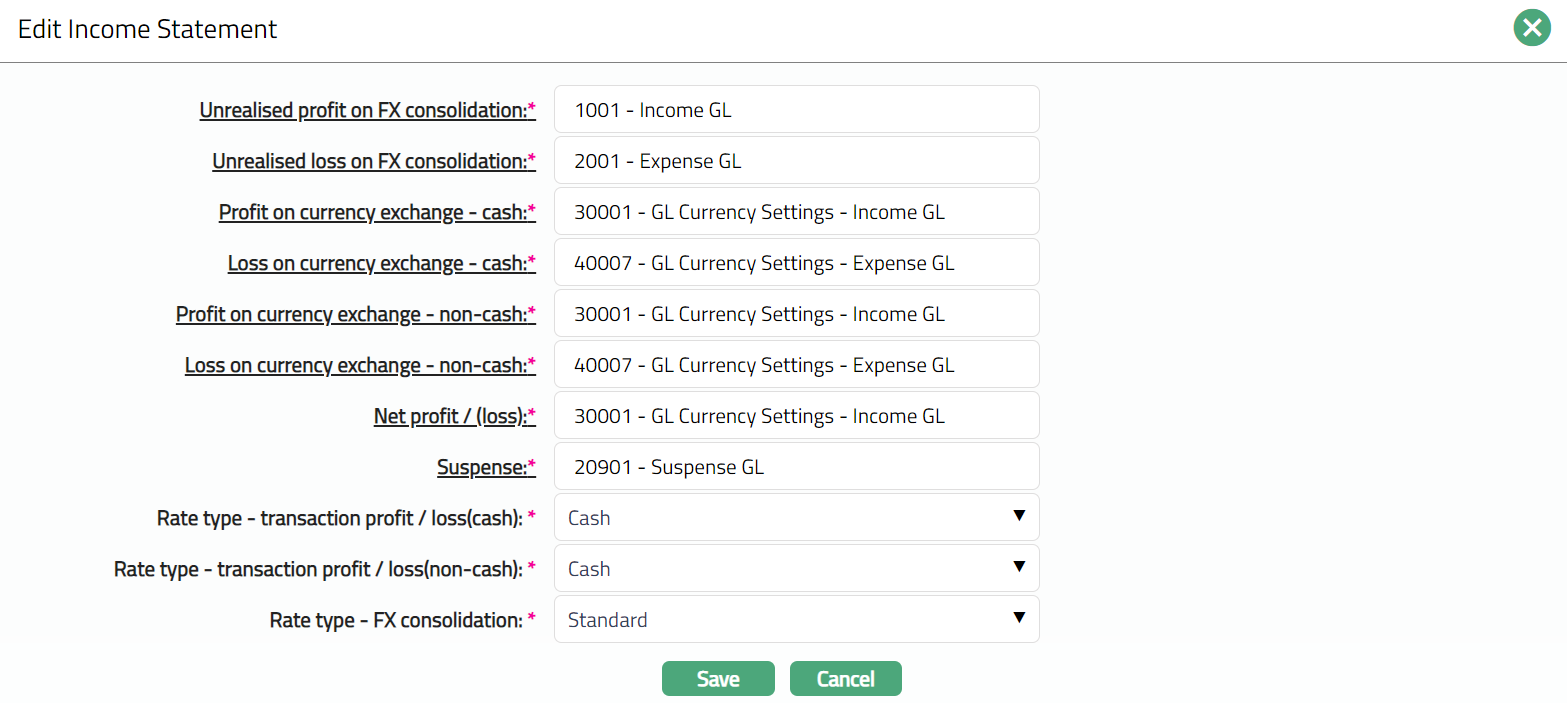

Choose specific Income / Expense GL that you want to use for recording unrealized profit caused by exchange rate movements in the Unrealised profit on FX Consolidation.

Choose specific Income / Expense GL that you want to use for recording unrealized loss caused by exchange rate movements in the Unrealised loss on FX Consolidation

Choose specific Income / Expense GL that you want to use for recording the profit on foreign currency cash transactions in the Profit on currency exchange -- Cash.

Choose specific Income / Expense GL that you want to use for recording the loss on foreign currency cash transactions in the Loss on currency exchange -- Cash.

Choose specific Income / Expense GL that you want to use for recording the profit on foreign currency non-cash transactions in the Profit on currency exchange -- non-cash.

Choose specific Income / Expense GL that you want to use for recording the loss on foreign currency non-cash transactions in the Loss on currency exchange -- non-cash.

Choose specific Income / Expense GL that you want to use for reporting the year end profit / loss from the Income statement in the Net profit / (loss).

Choose GL account in which you want to temporarily record unidentifiable transactions in the Suspense field.

Choose Rate type -- transaction profit / loss(cash) which will be used in currency conversion calculations for cash transactions

Choose Rate type -- transaction profit / loss (non-cash) which will be used in currency conversion calculations for non-cash transactions.

Choose Rate type -- FX consolidation which will be used in currency conversion calculations for revaluation

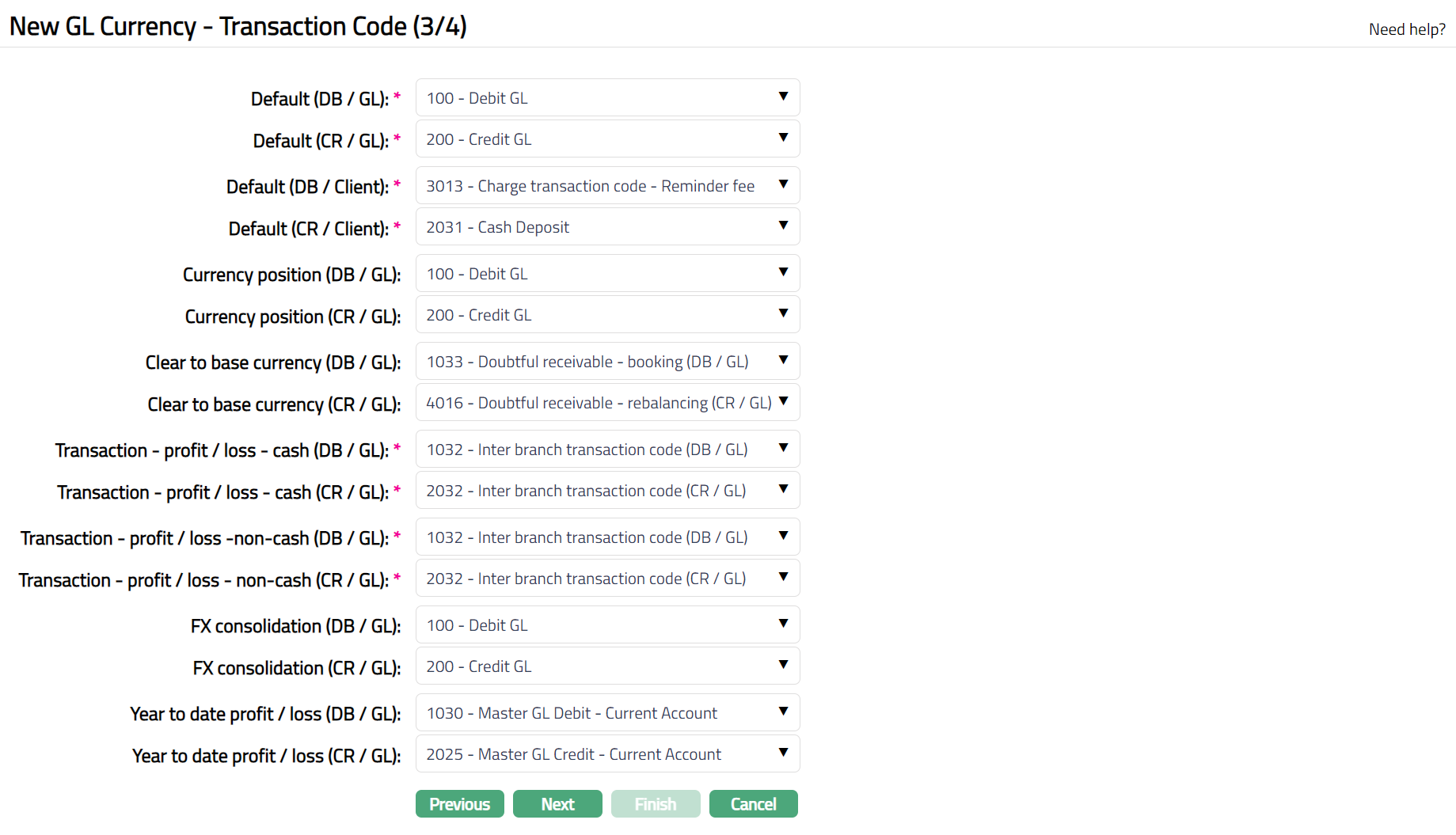

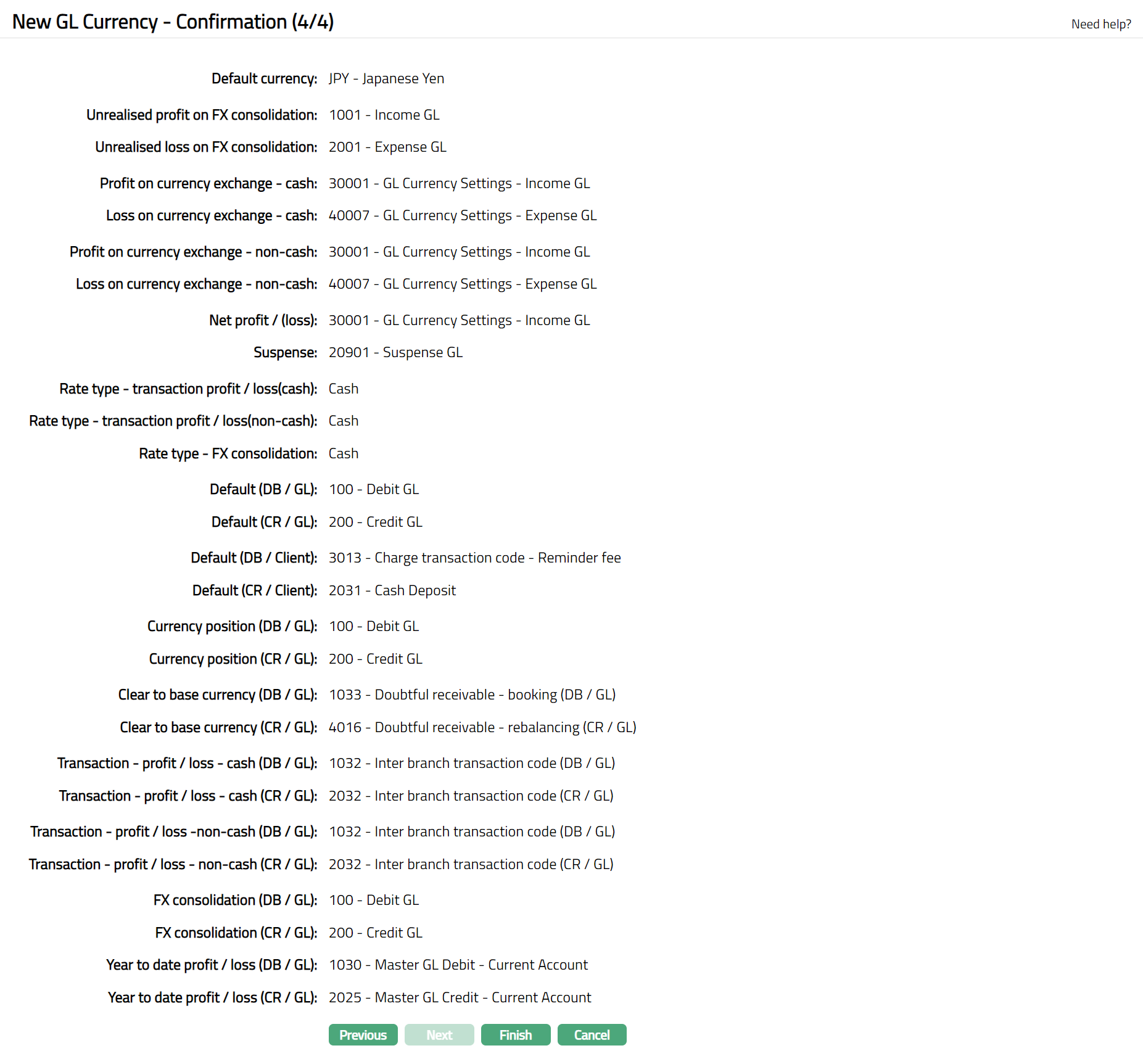

Click Next. The following screen New GL Currency -- Transaction code (3/4) will appear

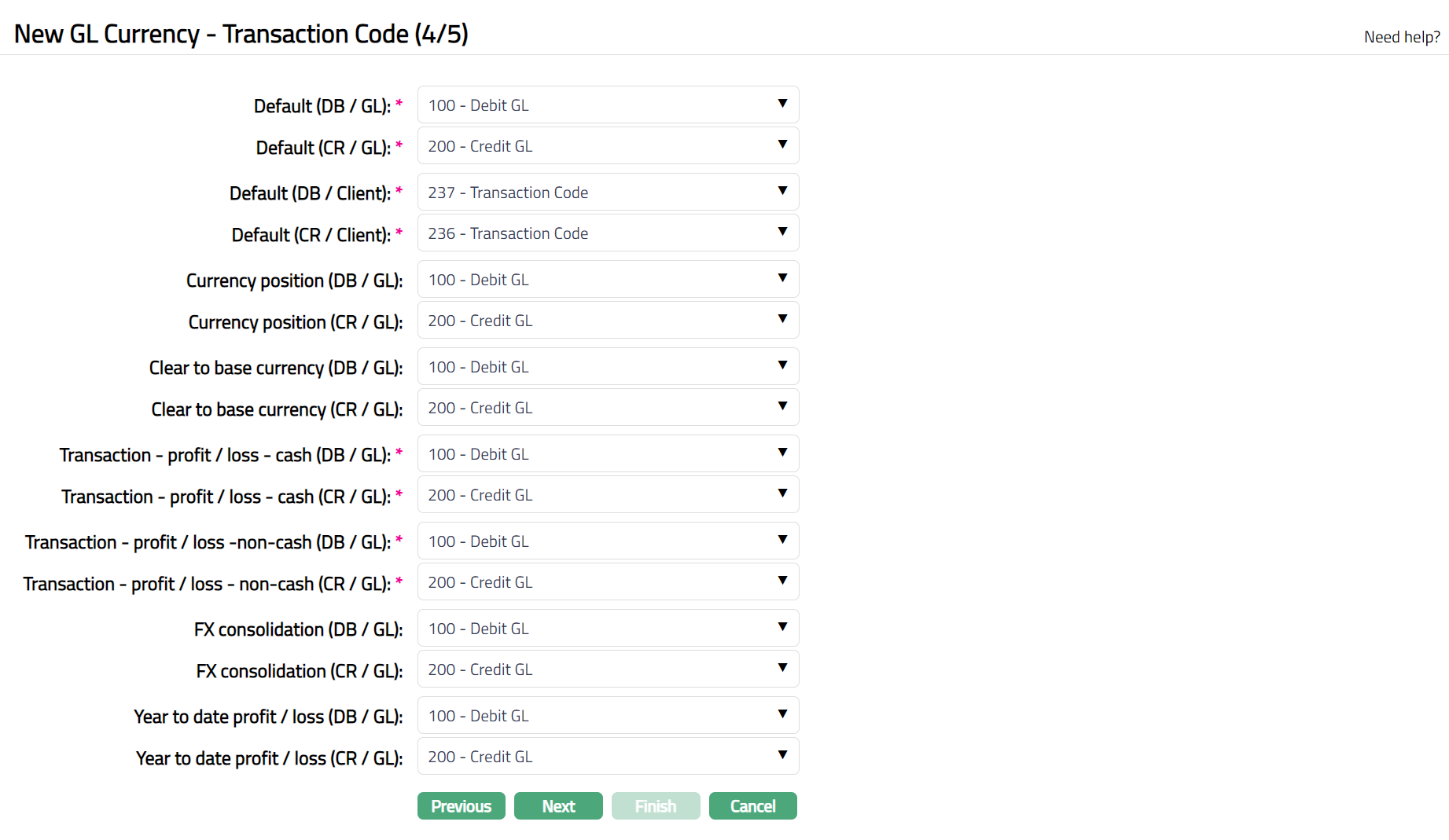

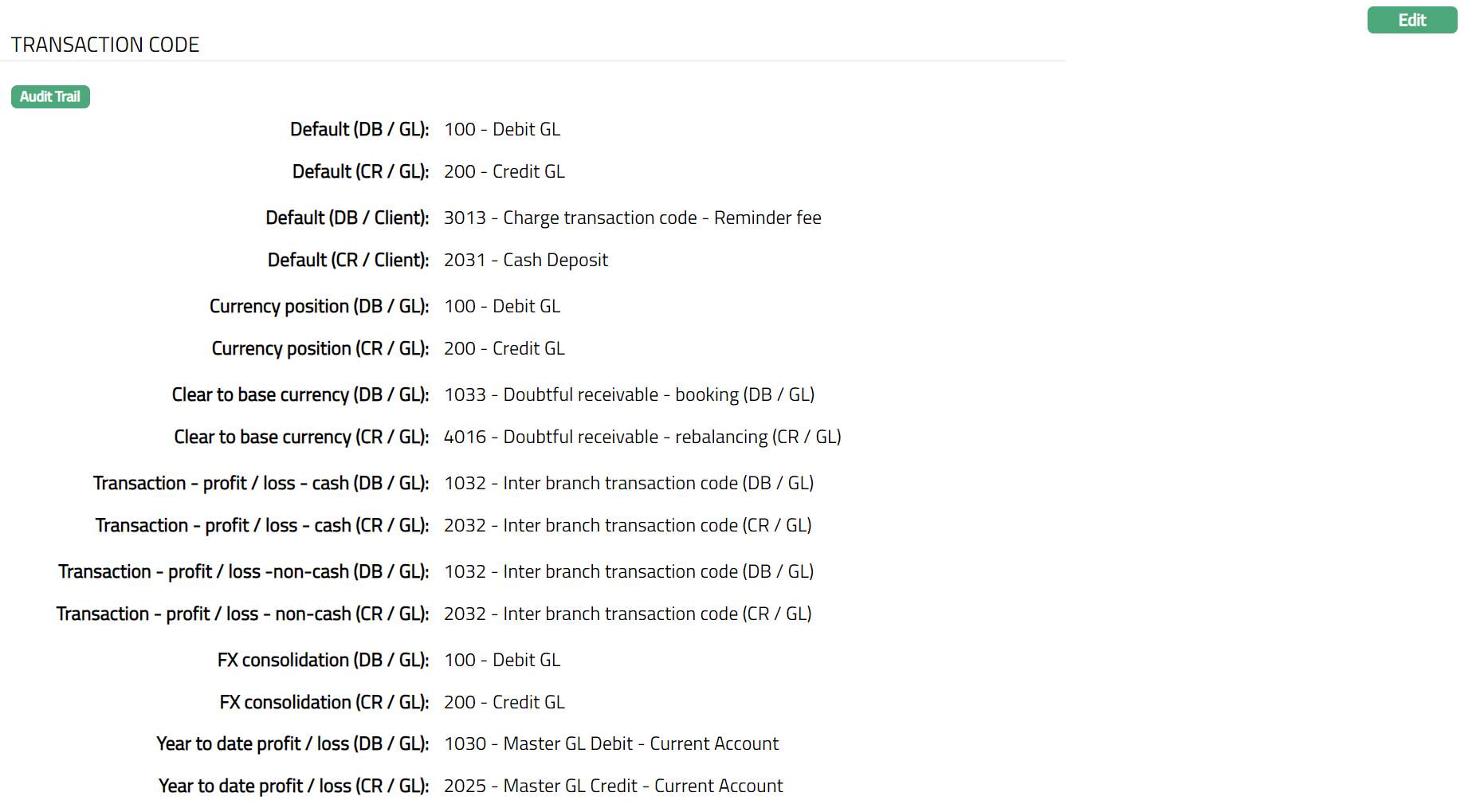

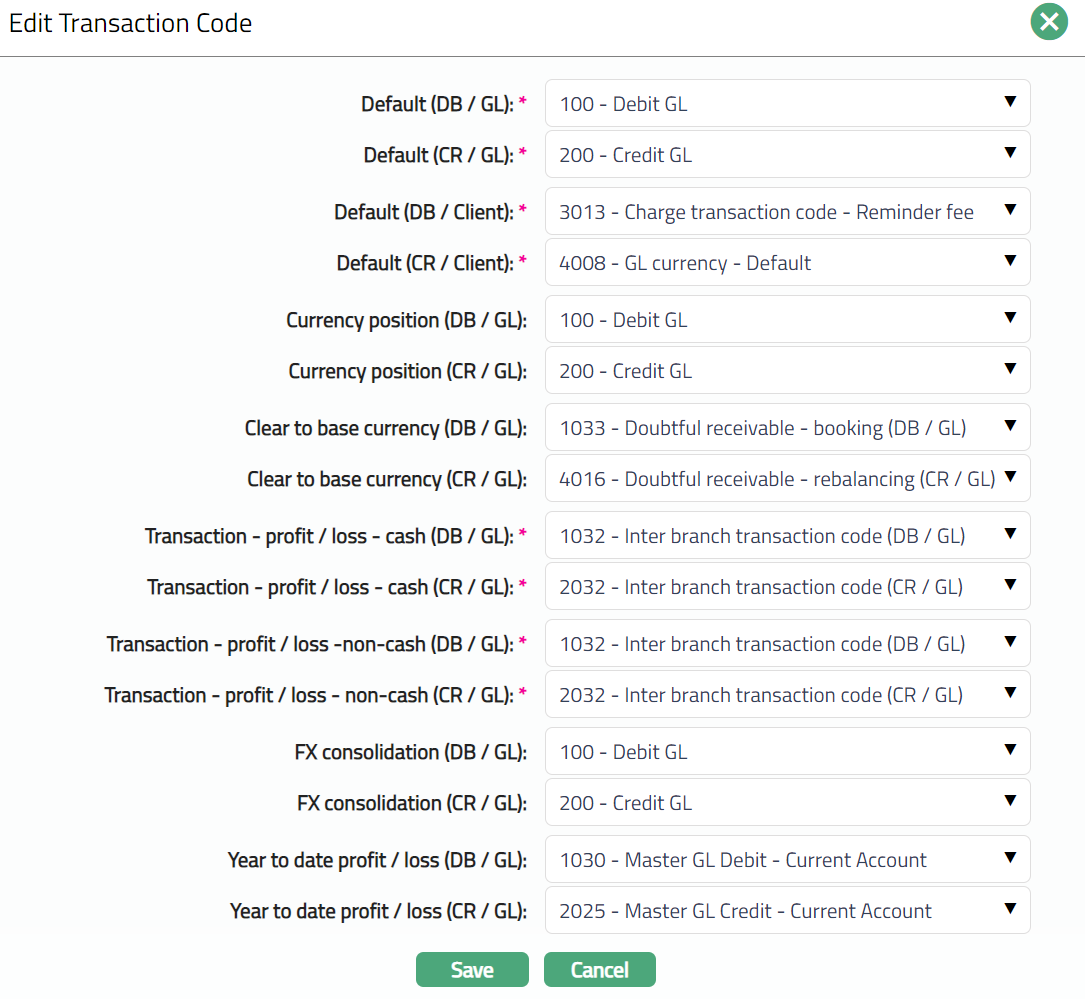

In Default (GL/DB), choose a transaction code for GL debit

In Default (GL/CR), choose a transaction code for GL credit

In Default (Client/DB), choose a transaction code for Client debit

Default (Client/CR), choose a transaction code for Client credit

In Currency position (GL/DB), choose a transaction code for currency position debit

In Currency position (GL/CR), choose a transaction code for currency position credit

In Clear to base currency (GL/DB), choose a transaction code for clear to base currency (GL/DB).

In Clear to base currency (GL/CR), choose a transaction code for clear to base currency (GL/CR).

In Transaction -- profit / loss -- cash (GL/DB), choose a transaction code for profit and loss GL debit for cash transactions

In Transaction -- profit / loss -- cash (GL/CR), choose a transaction code for profit and loss GL credit for cash transactions

In Transaction -- profit / loss -- non-cash (GL/DB), choose a transaction code for profit and loss GL debit for noncash transactions

In Transaction -- profit / loss -- non-cash (GL/CR), choose a transaction code for profit and loss GL credit for noncash transactions.

In FX consolidation (GL/DB), choose a transaction code for currency consolidations GL debit

In FX consolidation (GL/CR), choose a transaction code for currency consolidations GL credit

In Year-to-date profit / loss (DB/GL), choose a transaction code to be used for the profit / loss in current accounting year till date.

In Year-to-date profit / loss (CR/GL), choose a transaction code to be used for the profit / loss in current accounting year till date.

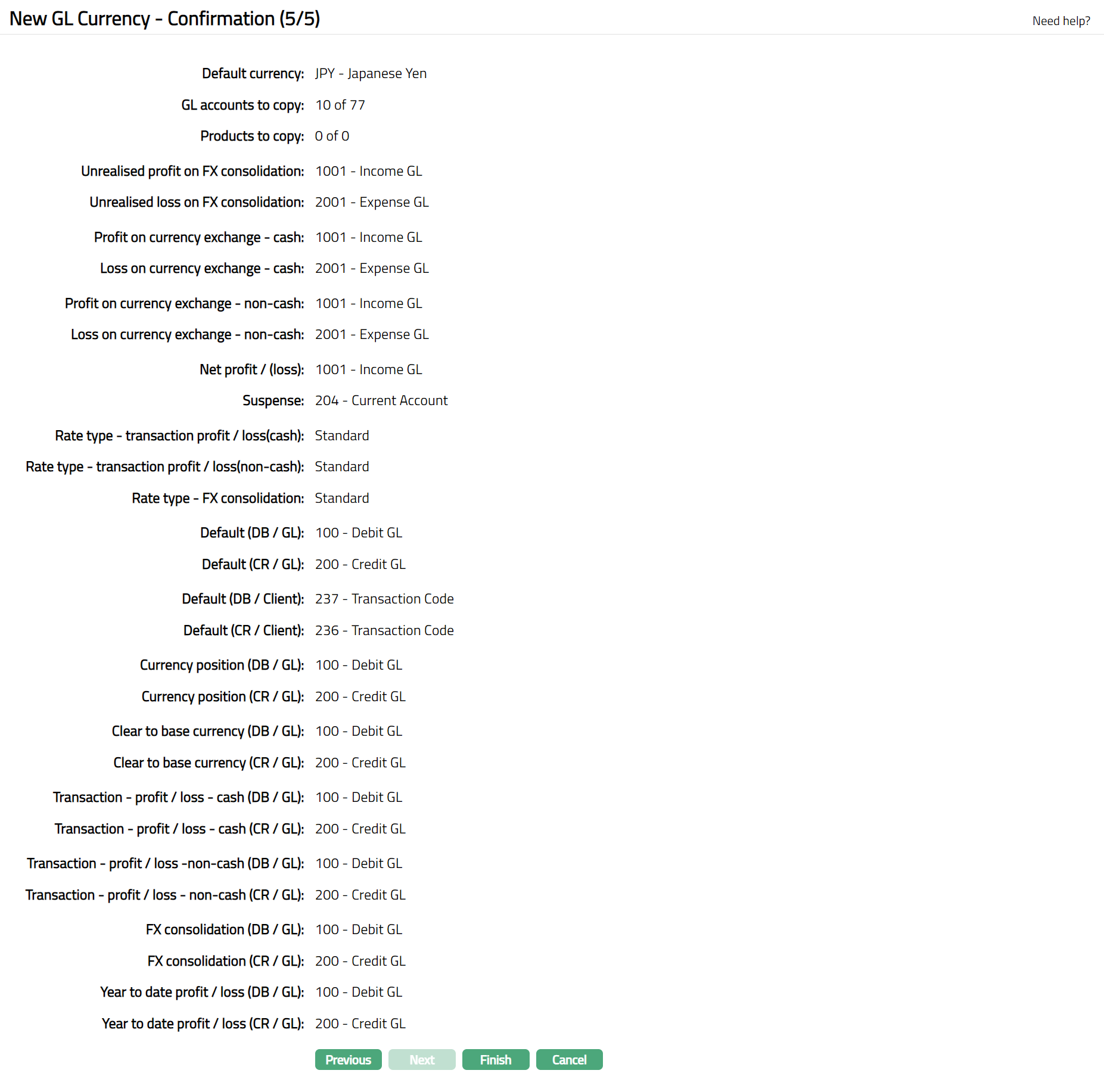

Click Next. New GL Currency -- Confirmation (4/4) will appear

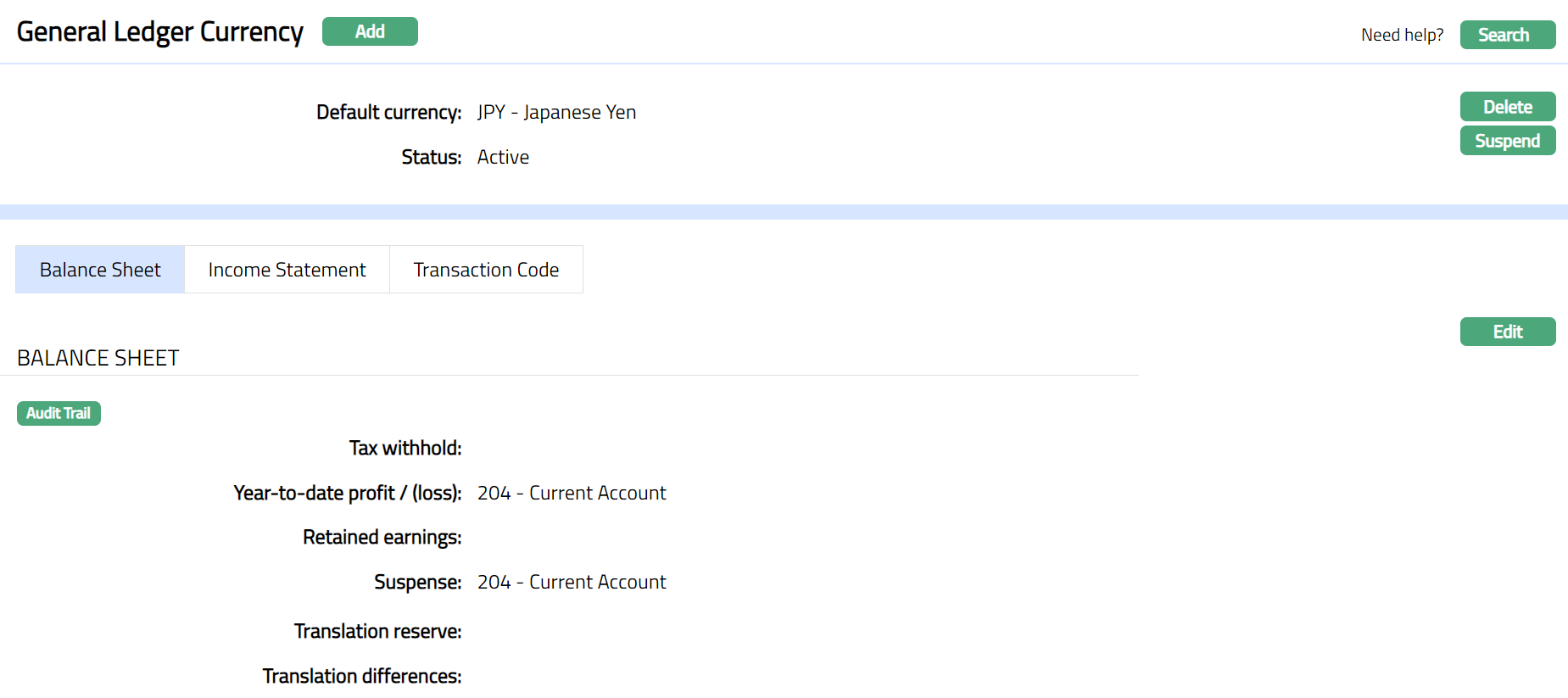

- Click Finish. General Ledger Currency page will appear

Copy from existing -- Choose this option when you want the attributes of an already defined currency to be used for the selected currency.

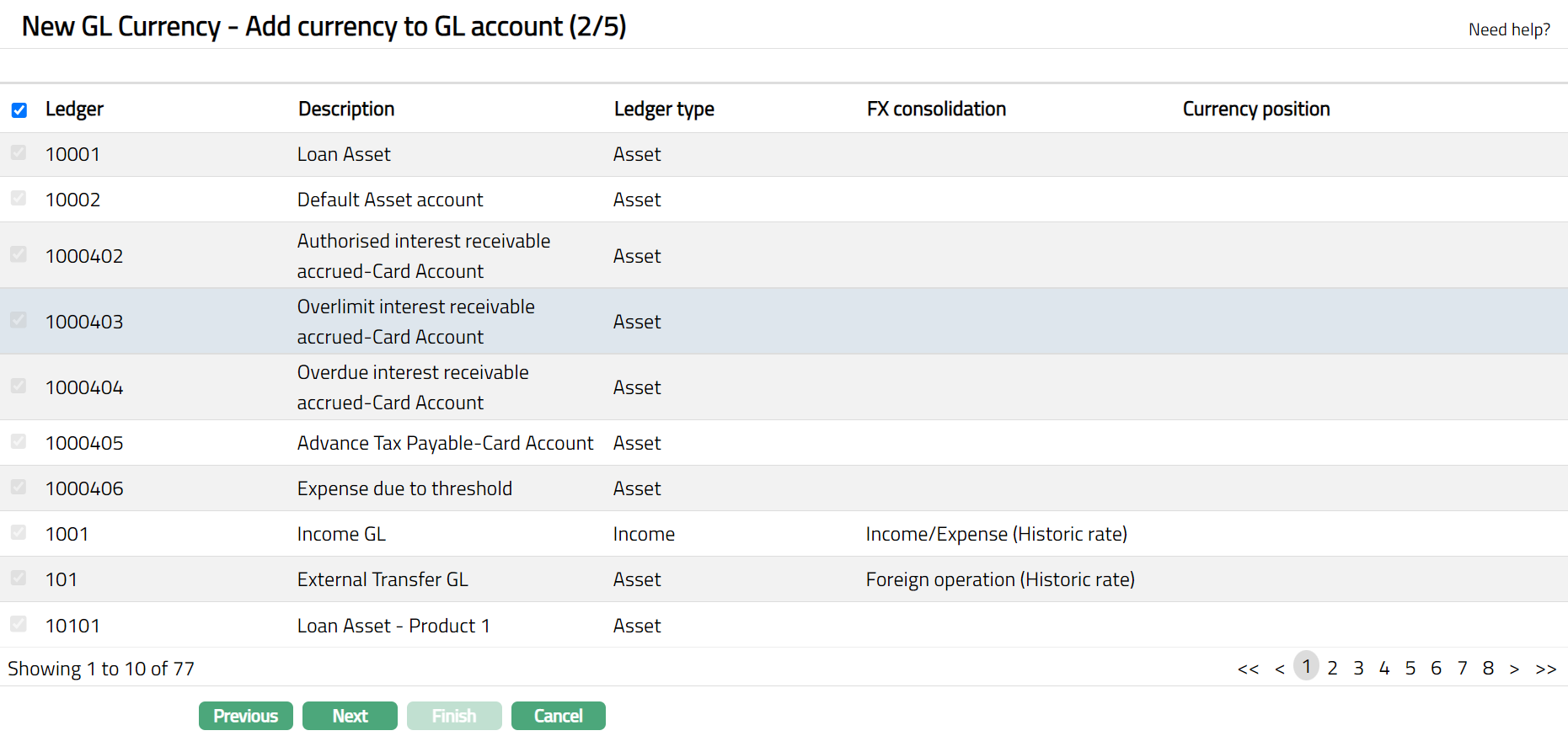

- Copy from will display the list of currencies already maintained in GL currencies. Select the required currency and click Next, New GL Currency -- Copy GL Accounts (2/5) appears

Select the GL Accounts to which these attributes have to be copied. Aura automatically updates these as selected when you have defined that all currencies will be allowed under a GL account (see GL Account -- Ledger Details). Only where the GL Account has been defined to be applicable for select currencies, you will have the option to choose here.

Click Next. New GL Currency Income Statement (3/5) will appear

Note: Refer to New GL Currency Income Statement (2/4) above for details.

- Click Next. New GL currency -- Transaction code (4/5) appears.

Note: Refer to New GL Currency Transaction code (4/5) above for details.

- Click Next. New GL Currency- Confirmation (5/5) appears

- Click Finish. General Ledger Currency page appears

Functions: Add, Search, Delete, Suspend, Edit.

Note: Once all the currencies maintained at the Entity level have been added under GL Currency Maintenance, the Add button will be disabled.

Delete: You can delete a GL Currency by clicking on Delete button. When you click Delete button, Aura displays an alert message. On confirmation, Aura will delete the GL Currency. Aura will also delete any GL Currency until it is used for creation of any Product in Aura.

Suspend: You can suspend the GL Currency by clicking on Suspend button. When you click on Suspend button, Aura displays an alert message. On confirmation Aura will suspend the GL Currency. Once the GL Currency is suspended, the becomes unavailable in the drop-down list in other modules in Aura. Activate button will be displayed. Suspension of the GL Currency will not have any impact on the existing accounts where the suspended currency is used.

Activate: If you want to activate a suspended GL Currency then click on Activate button. Aura displays an alert message. On confirmation Aura will Activate the GL Currency and Suspend button will appear in place of Activate button.

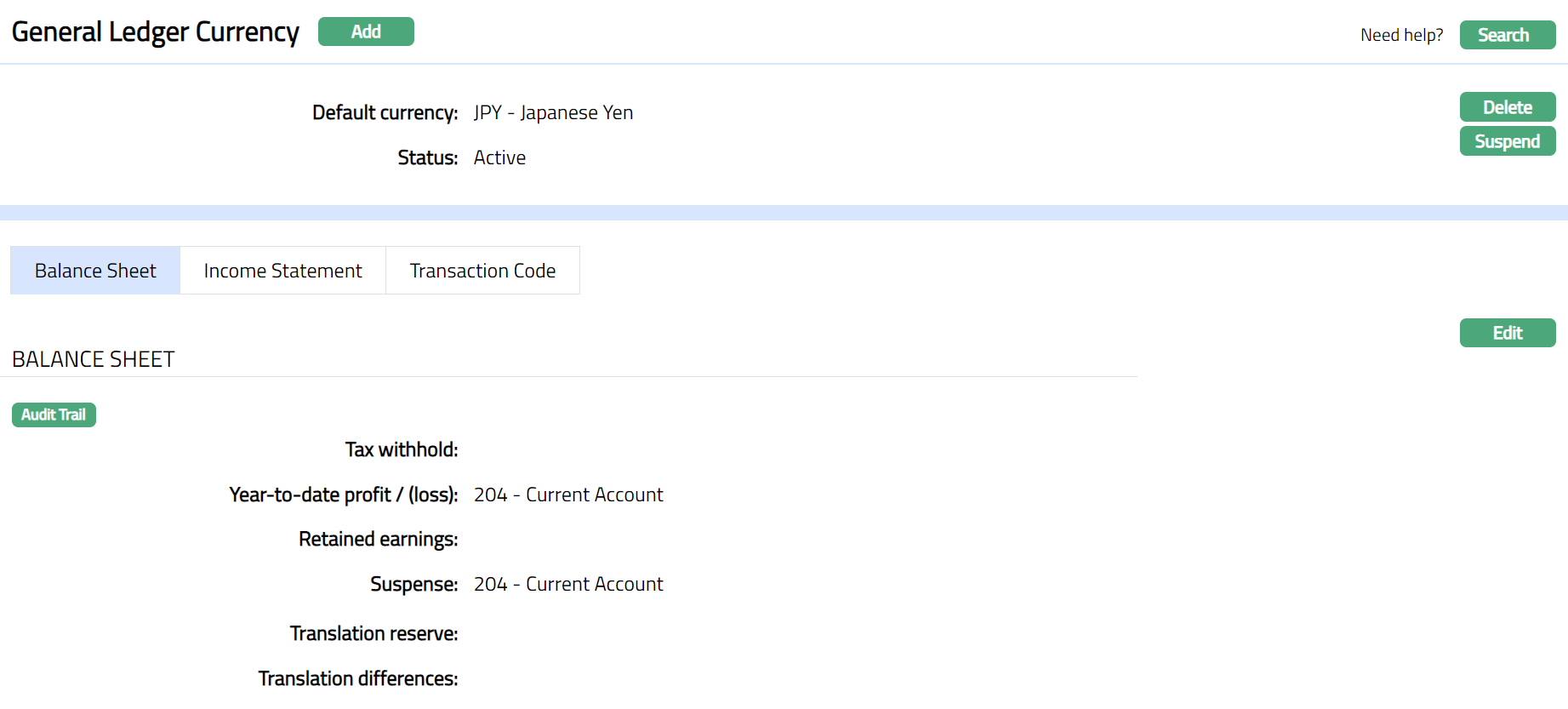

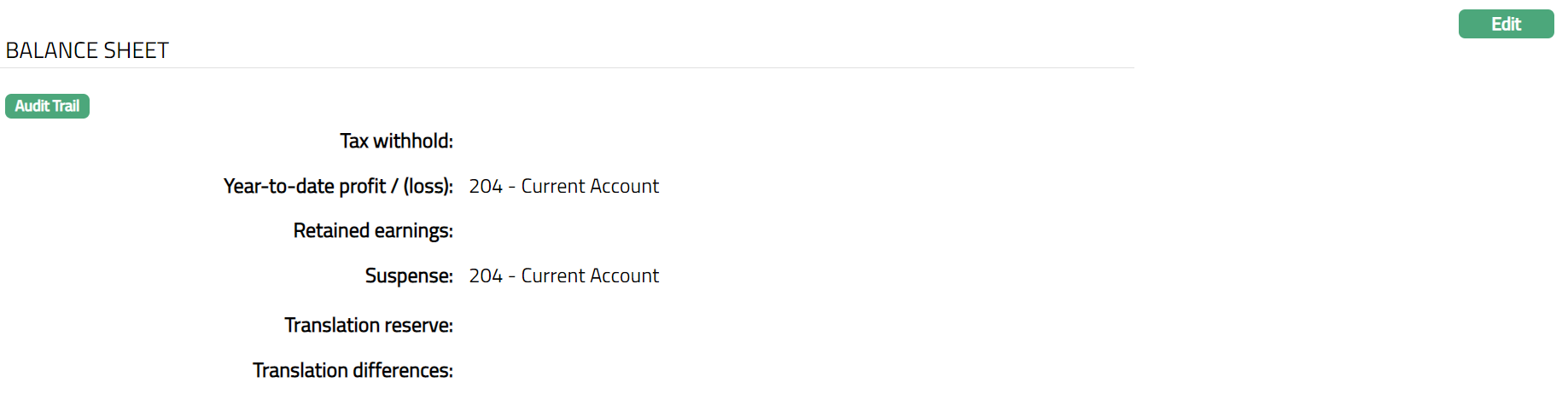

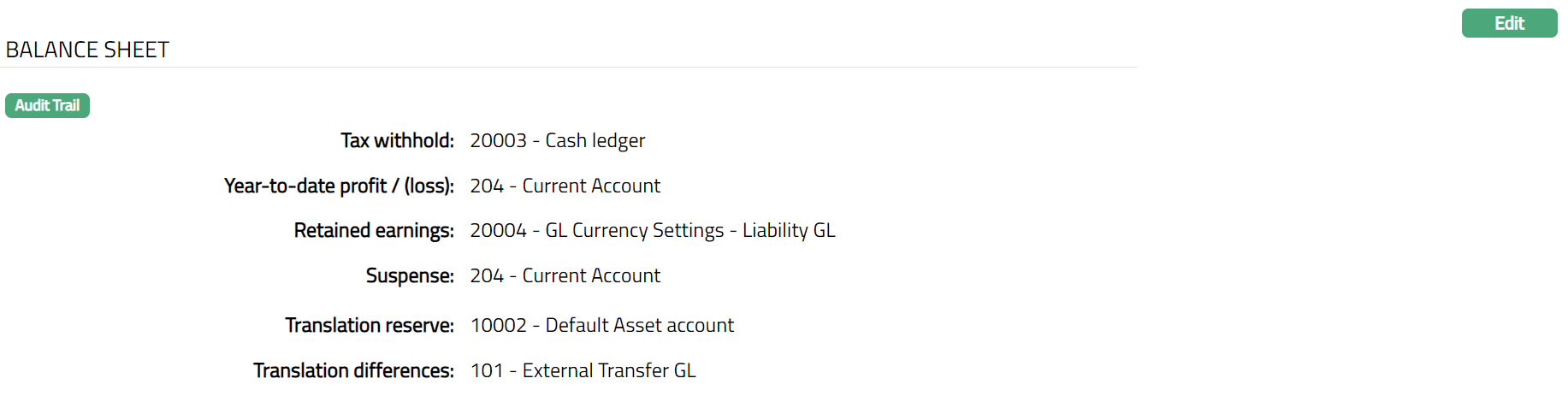

Balance Sheet

This is the default tab in the General Ledger Currency screen, and it allows you to link accounting functions within the Balance sheet. Using Edit option, the parameters for the Balance sheet can be modified.

- Access General Ledger Currency screen, click Balance Sheet tab. On creation of the record there will be no data available in this tab.

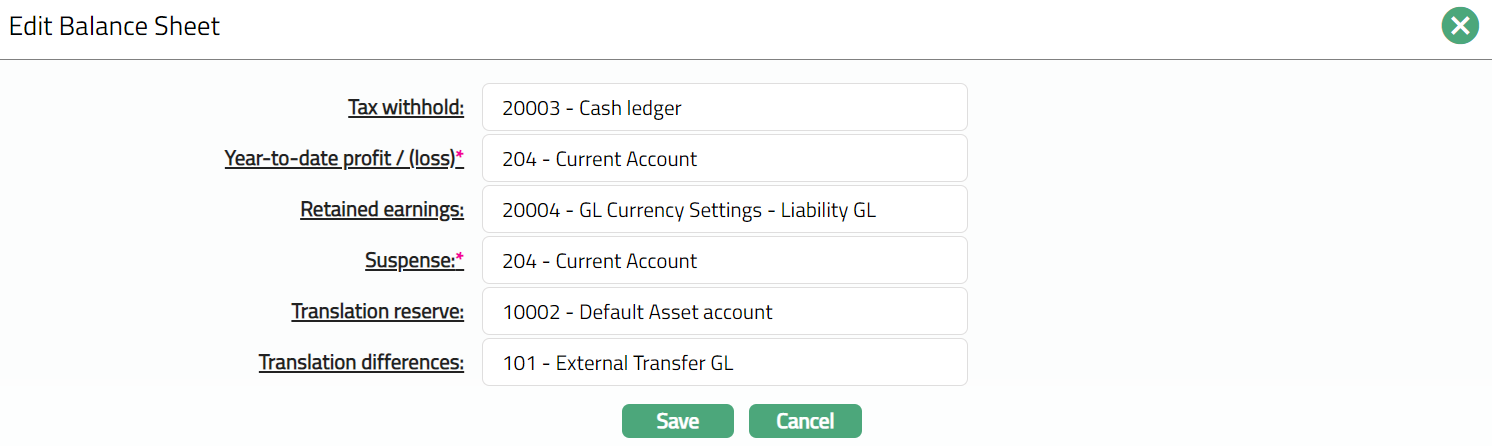

- Click Edit. Edit Balance Sheet page appears

In Tax withhold, select the GL Account to which the taxes withheld should be accumulated.

In Year-to-date profit/(loss), select the GL Account under which the year-to-date profit will be reported

In Retained earnings, select the GL Account to which the accumulated profit / loss should be reported

In Suspense, choose the account into which all the unidentified transactions will be recorded for adjustments

In Translation Reserve choose the account into which translation reserves are recorded

In Translation differences, choose the account into which translation differences should be reported when producing a consolidated balance sheet.

Click Save. Balance Sheet page appears with the edited details.

Functions: Edit.

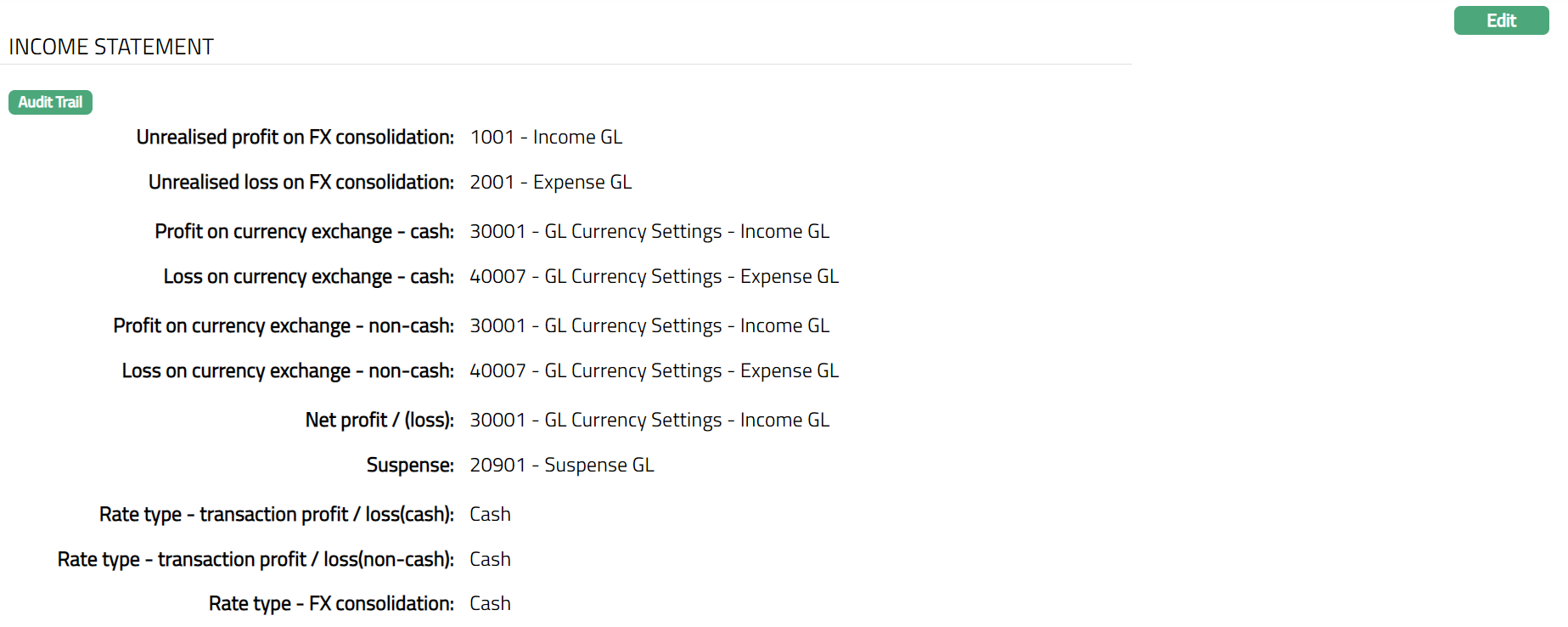

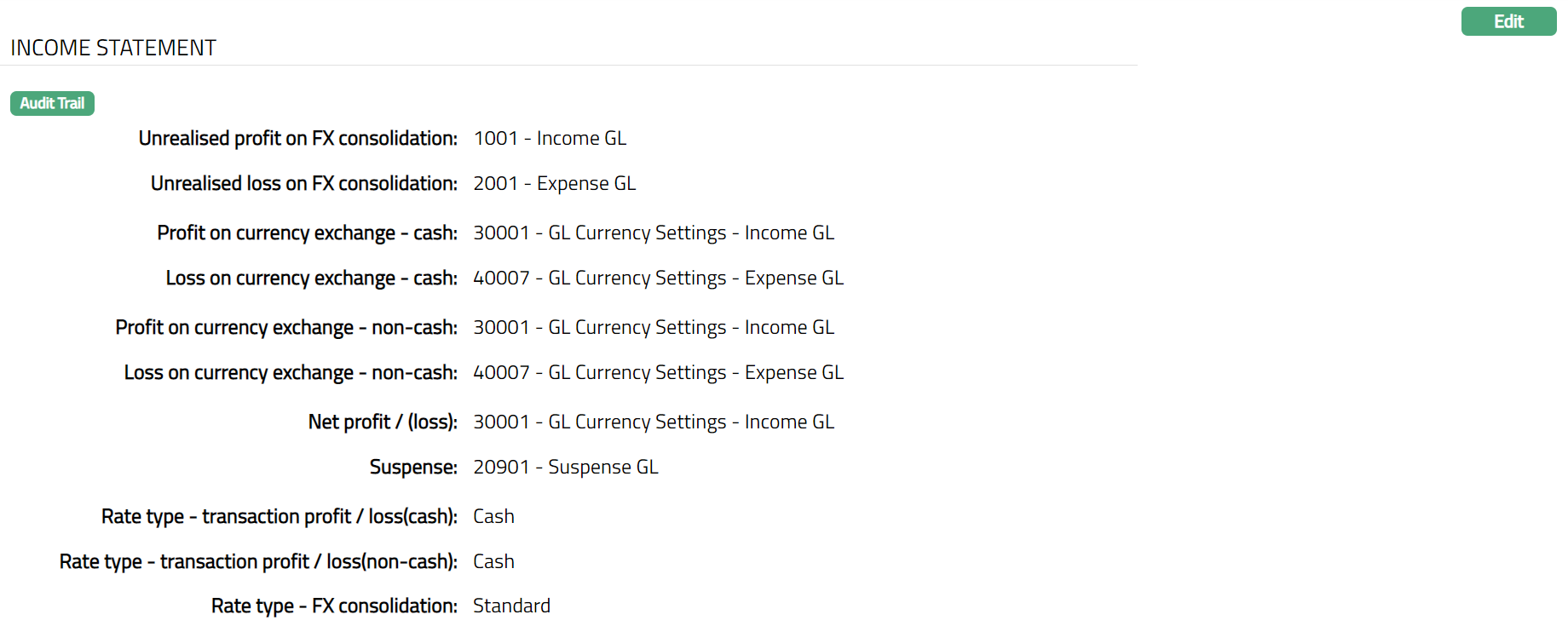

Income Statement

This tab allows you to link the accounting functions within the Income Statement. The purpose of this tab is to post various transactions to General ledger account relating to currencies. Using Edit option, the parameters for the Income Statement can be modified.

- Access General Ledger Currency, click Income Statement. The details are defaulted from the entries that you made during creation of a new record. For details refer to New GL Currency Income Statement (2/4) or New GL Currency Income Statement (3/5).

- Click Edit. Edit Income Statement page appears.

Note: All fields are editable.

- Click Save. Income Statement page appears with the edited details.

Functions: Edit.

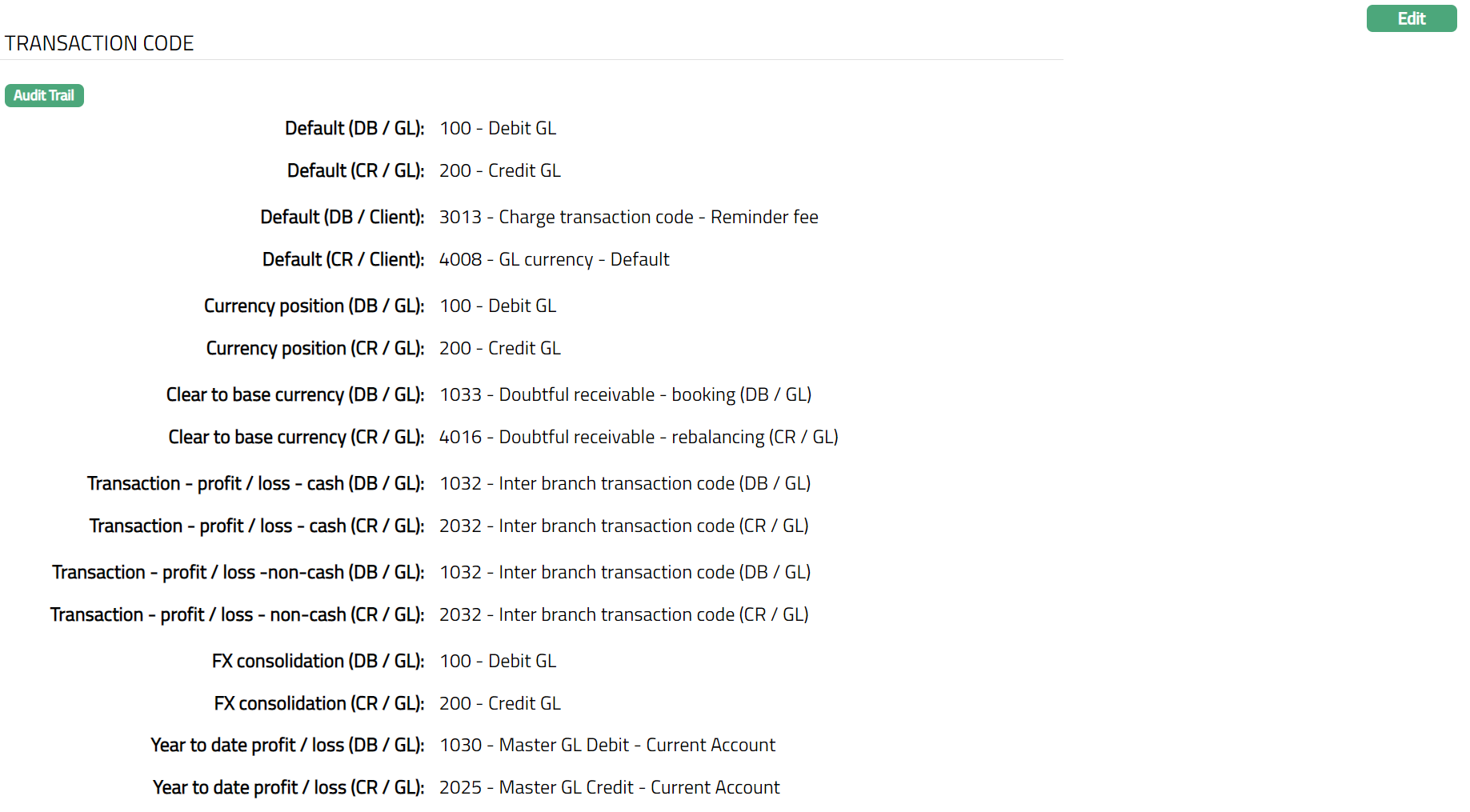

Transaction Code

This tab contains the various transaction code linked to GL Currencies. The purpose of this tab is to define transaction code for posting transactions to general ledger accounts. Using Edit option for the parameters can be modified.

- Access General Ledger Currency screen, click Transaction code tab. The details are defaulted from the entries that you made during creation of a new record. For details refer to New GL currency -- Transaction code (4/5) or New GL Currency Transaction code (4/5).

- Click Edit. Edit Transaction code page appears.

Note: All fields are editable.

- Click Save. Transaction code page appears with the edited details.

Functions: Edit.