Reward Group

A Reward Group lets you define a set of generic rewards that apply to Mortgage and Loan accounts created under a specific loan product. You can create Reward Groups in CRM and then map them to mortgage and loan products.

Once a Reward Group is mapped to a product, all loan accounts created under that product automatically inherit the rewards defined in the group. These rewards are referred to as Generic Rewards and are common for all loans created under the same product.

Reward Groups help you manage rewards centrally. Instead of defining the same rewards at each loan account, you define them once in a Reward Group and reuse them across multiple loan accounts through product mapping.

The following tabs are available in a Reward Group functionality -

To add/maintain a Reward Group

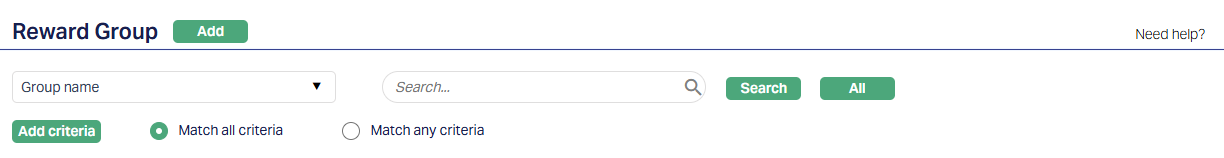

1. From the CRM menu, click Loyalty Program, then Settings and then Reward Group. The Reward Group Search page appears.

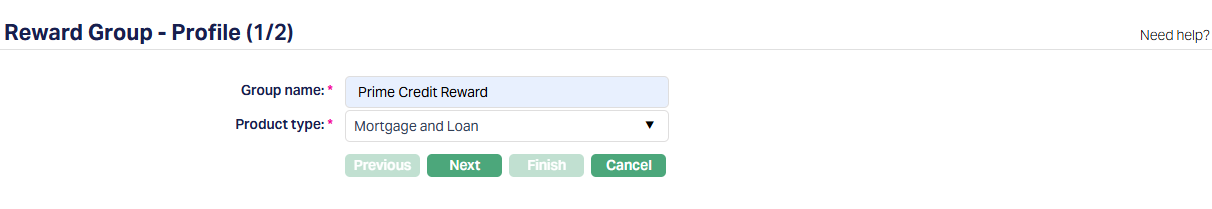

2. Click Add. The Reward Group → Profile (1/2) page appears.

3. Enter the Group Name - this identifies the set of rewards maintained under this group. This name is used when the Reward Group is mapped to loan products and loan accounts.

4. Select the Product Type from the drop-down list. Currently, Reward Groups can be created only for Mortgage and Loans. This allows the Reward Group to be used for mortgage and loan products in Aura.

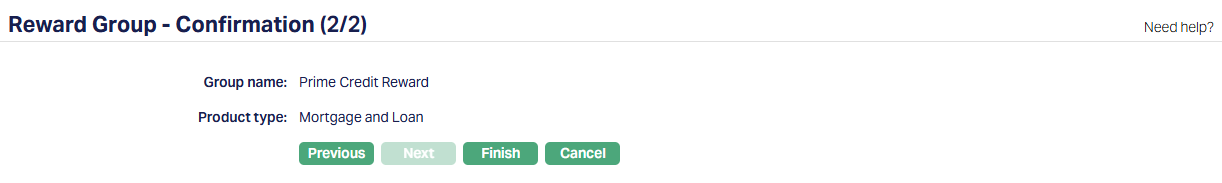

5. Click Next. The Reward Group → Confirmation (2/2) page appears.

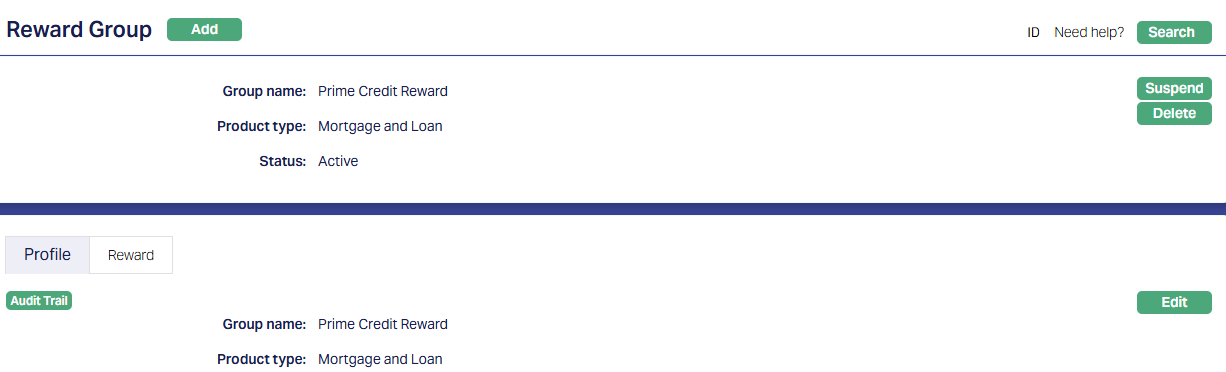

6. Click Finish. Reward Group page appears with the added details with Profile tab displayed by default with Status displays as Active.

Functions: Add, Search, Suspend, Delete.

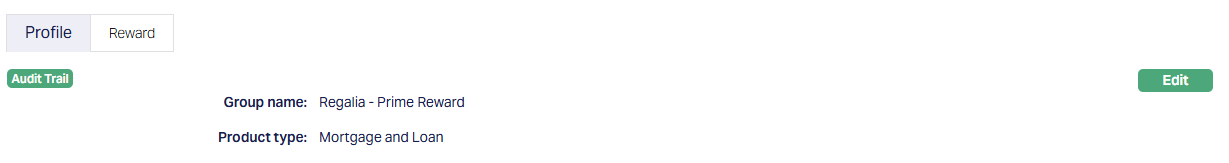

Profile

The Profile tab, which is the default tab in the Reward Group screen, shows the basic details of the Reward Group.

To edit the Profile

1. Access Reward Group page. Click the Profile tab to view the details. The details are defaulted from the entries that you made during Reward Group creation. For details refer to Rewards Group → Profile (1/2).

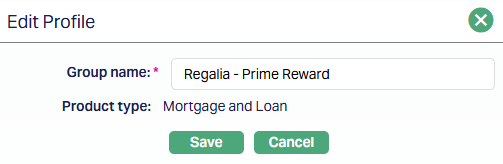

2. Click Edit. Edit Profile page appears.

Note: Only Group name field is editable under Edit Profile page.

3. Click Save. Profile page appears with the edited details.

Function: Edit

Reward

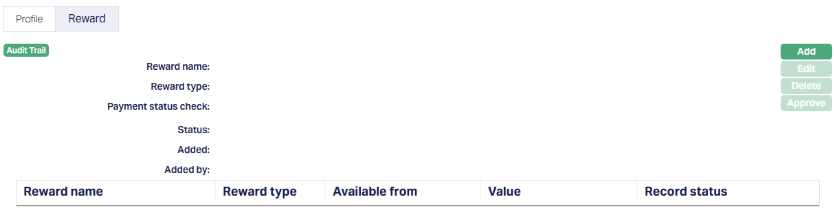

The Reward tab lets you define and manage the individual rewards that belong to a Reward Group. You can add multiple rewards to Reward Group to support different reward types, eligibility conditions, and availability periods across the loan lifecycle.

When a Reward Group is created, the Reward tab is initially empty. You must add and approve rewards before they can be applied to loan accounts created under products mapped to this Reward Group.

To add a reward

1. Go to the Reward tab and click Add. The Add Reward page appears.

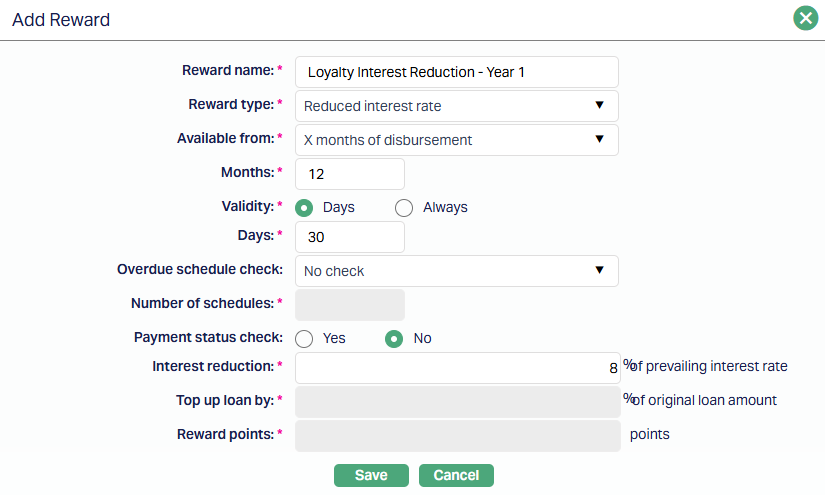

2. Reward Name - Enter a name to describe the reward. This helps you differentiate rewards that apply at different stages of the loan lifecycle. The reward name may also be displayed to customers in the Customer Portal, so it should clearly indicate the nature of the benefit.

3. Reward Type - Select the type of reward you want to offer. Aura supports four reward types: Reduced Interest Rate, Payment Free Month, Top Up Loan and Reward Points.

The reward type you select determines which additional fields are enabled and mandatory in this screen.

4. Available From - Specify when the reward becomes available for a loan account. This information is used to derive the Valid From date in the Reward Schedule.

You can choose one of the following options:

X months of First Due Date - where the reward becomes available after a specified number of months from the first payment due date.

X months of Disbursement - where the reward becomes available after a specified number of months from the loan disbursement date.

Date - where the reward becomes available from a fixed date.

5. Months - Enter the number of months after which the reward becomes available. This field is mandatory when Available From is set to X months of First Due Date or X months of Disbursement.

6. Date - Enter the date from which the reward becomes available. This field is mandatory when Available From is set to Date.

This option is typically used for campaign-based rewards, where all loan accounts under a product are eligible from a specific date.

7. Validity - Define how long the reward remains available to the customer after it becomes active. You can choose Days, where the reward is available for a fixed number of days, or Always, where the reward remains available until the Loan maturity date.

This information is used to derive the Valid To date in the Reward Schedule.

8. Days - Enter the number of days for which the reward remains available. This field is mandatory when Validity is set to Days. If the reward is not accepted within this period, it expires.

9. Overdue Schedule Check - Define an eligibility condition based on overdue history. If you select Overdue Check for X schedules, the loan account must not have been overdue in the specified number of past schedules to qualify for the reward. Eligibility is evaluated during EOD processing on Valid From minus one day.

10. Number of Schedules - Enter the number of past schedules during which the loan account must not have been overdue. This field is mandatory when Overdue Schedule Check is set to Overdue check for X schedules.

11. Payment Status check - Specify whether eligibility should be evaluated based on the loan account's payment status. By default, this option is set to No. If you select Yes, you must specify the allowed payment statuses.

Eligibility is evaluated as of Valid From minus one day.

12. Payment Status - Select one of more payment statuses that qualify the loan account for the reward. This field is mandatory when Payment Status Check is set to Yes.

As of the Valid From date, the loan account must be in one of the selected payment statuses to be eligible for the reward.

13. Interest Reduction - Enter the percentage by which the prevailing interest rate will be reduced. This field is enabled and mandatory only when Reward Type is set to Reduced Interest Rate.

The reduction is applied as a percentage of the prevailing interest rate, not as a direct rate subtraction.

14. Top Up Loan By - Enter the percentage of the original loan amount that can be availed as a top-up. This field is enabled and mandatory only when Reward Type is set to Top Up Loan.

Aura validates the top-up amount to ensure that the total loan amount does not exceed the maximum loan amount defined for the product.

15. Reward Points - Enter the number of reward points that will be credited to the linked Reward Account when the customer accepts the reward.

This field is enabled and mandatory only when Reward Type is set to Reward Points.

Note: For Payment Free Month rewards, Aura always applies one payment-free month. The specific month is selected later during reward acceptance at the loan account.

16. Click Save. The Reward tab appears with the details you have entered.

Notes:

Rewards defined here are used to derive Reward Schedule at loan accounts.

Actual application happens at Loan Account > Reward tab.

Functions: Add, Edit, Delete, Approve.

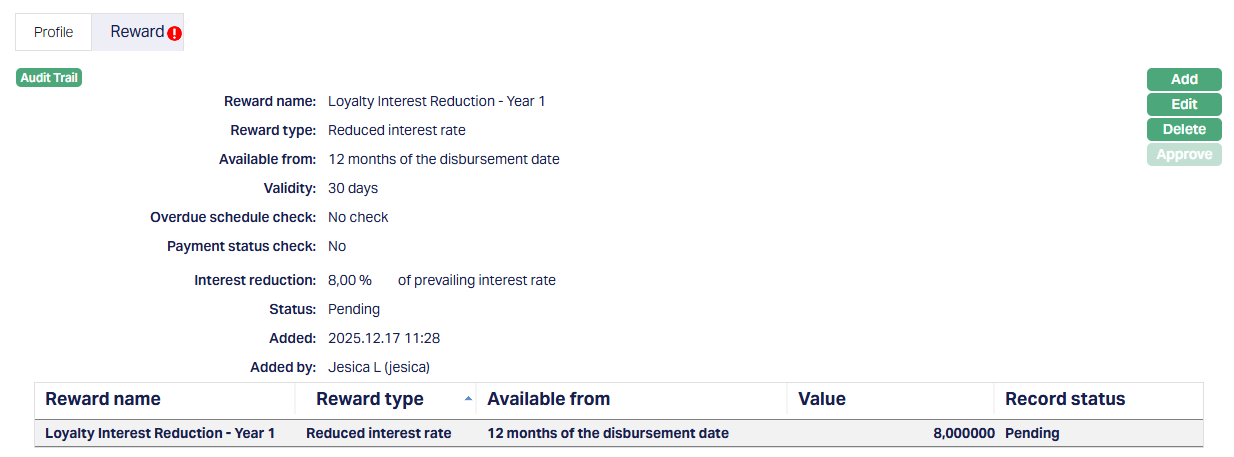

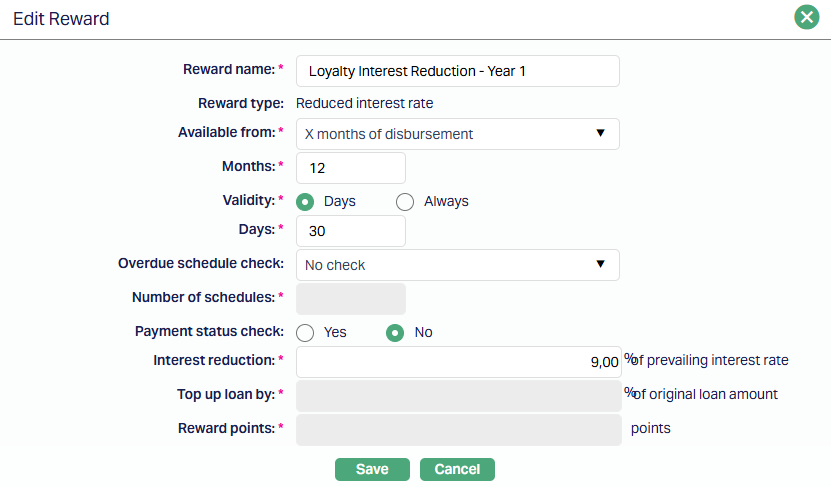

To edit Reward,

1. Go to the Reward tab and click Edit. Edit Reward page appears.

Note: All fields are editable except Reward Type.

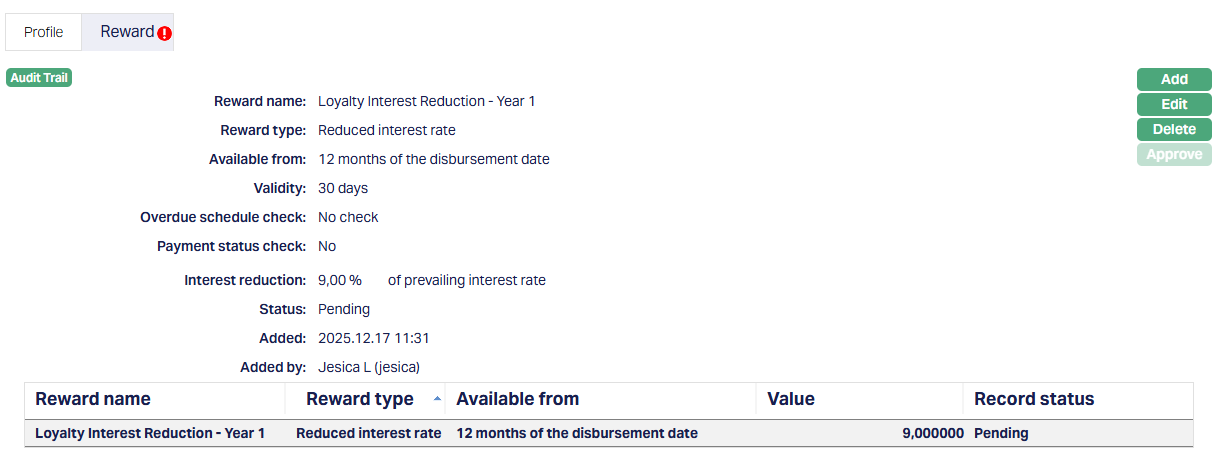

3. Click Save. The Reward tab appears with the edited details.

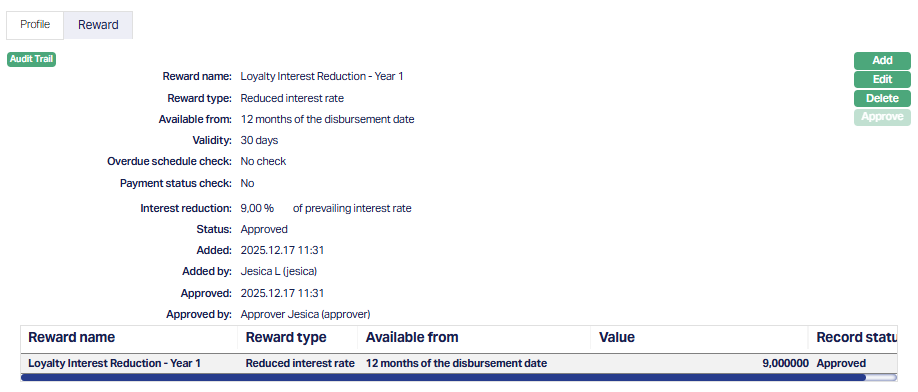

Status of the record is Pending till it is approved by another user. On approval, the tab status is set to Approved and the red bubble disappears.

Functions: Add, Edit, Delete, Approve.

Edit: You can edit a reward at any time. Once the changes are approved, they apply only to loan accounts disbursed after the approval.

Delete: You can delete a reward only when its status is Pending. When you click Delete, Aura displays a confirmation message. If you confirm, the reward is deleted and is no longer available for loan accounts disbursed after the deletion.

Suspend: You can suspend a Reward Group by clicking on the Suspend button. When you click on the Suspend button, Aura will ask for confirmation. On confirmation Aura will suspend the Reward Group and Activate button will appear in place of the Suspend button. The status of the Reward Group is set to Suspended.

Activate: If you want to activate a suspended Reward Group then click on the Activate button. Aura will ask for confirmation. On confirmation Aura will activate the Reward Group and Suspend button will appear in place of the Activate button. The status of the Reward Group is set to Active.

The additional fields that are shown are:

Status indicates the current state of the record. It will be either: Pending - If the record is waiting for approval or Approved - If the record has been reviewed and finalized.

Added shows the date and timestamp when the record was created and Added by displays the user ID and full name of the person who created the record.

Approved shows the date and time when the record was approved and Approved by displays the user ID and full name of the person who approved the record.