Premature Withdrawal

Premature Withdrawal wizard facilitates partial or full redemption of term deposit account before its maturity.

To initiate Premature Withdrawal

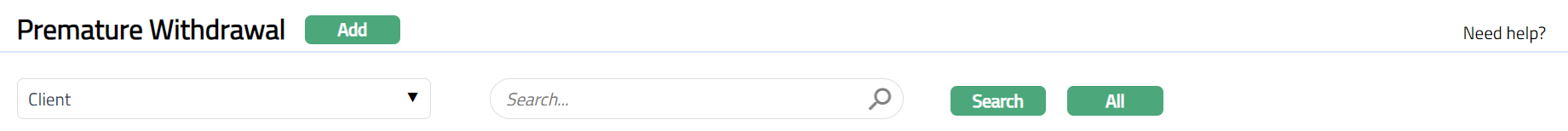

- From Retail menu, click Accounts, click Term Deposit, and then click Premature Withdrawal. The Premature Withdrawal Search screen appears. All premature withdrawal records available in Aura appears on the page.

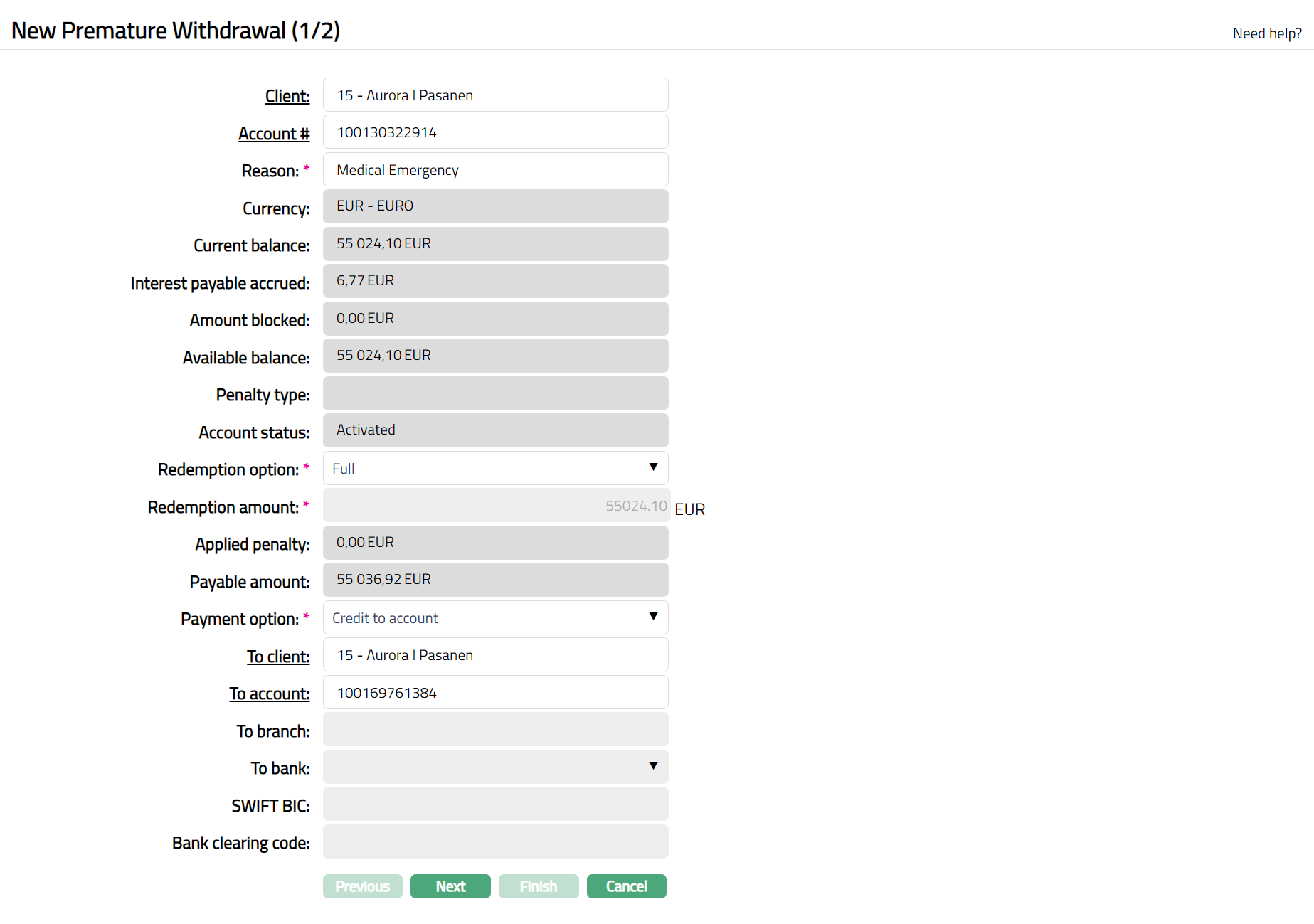

- Click Add. New Premature Withdrawal (1/2)

Click Client hyperlink. Client Search page appears where you can search for a client with relevant criteria and select the required client.

Click Account hyperlink. Term Deposit Search page appears showing the term deposit accounts of the selected client. Select the required Account #.

Based on the selected account number, the following fields are displayed along with the defaulted details while creating the account:

Currency denotes the account currency. This is defaulted from the Retail > Accounts > Term deposit

Current balance denotes the balance of the term deposit as on date i.e. the original Principal less premature withdrawals if any and it includes the interests credited to the Term Deposit account in case of Compound Interest till last liquidation date.

Interest payable accrued denotes the amount of interest accrued that is payable under the account as of the previous day EOD.

Amount blocked denotes the total of all the amount blocks that are valid as at this time.

Available balance denotes the available balance in the term deposit account. it is the difference between the Current balance and amount blocked.

Penalty type denotes the type of penalty applicable for the account. This is defaulted from the Penalty type if maintained at the account level. System displays four types of Penalty and how system calculates penalty based on selected penalty type has been mentioned below.

Fixed amount: If user selects this option as Penalty type, then this option enables user to define a Fixed amount as Penalty.

To calculate the Penalty amount:

Add interest accrued on the withdrawal amount (Amount Payable)

Reduce the penalty amount from the above amount (Penalty)

This is the Net Amount Payable

On Elapsed period: If user selects this option as Penalty type, then

On the basis of the withdrawal amount and the period for which the deposit has run, Aura will find out the applicable interest rate.

Reduce the penalty % from this interest rate.

Compare this with the contracted interest rate.

Whichever is lower, is taken as the Penalty Interest rate

Using this, the interest payable is calculated and added to withdrawal amount.

Recalculate interest and if excess amount has been liquidated, recover from the above amount.

This is Net Amount Payable.

On Remaining period: If user selects this option as Penalty type, then

On the basis of the withdrawal amount, and the period for which the deposit has run, find out total accrued interest based on contracted interest rate

Add withdrawal amount and accrued interest.

This is the Amount 1(Amount Payable).

For the withdrawn amt, and the period for which deposit is NOT kept, the interest rate applicable is found.

Add Penalty % to this.

Compare this total to the contracted interest rate.

Whichever is higher is the penalty interest. Calculate penalty interest on this basis.

This is Amount 2 (Penalty Amount).

Net Amount Payable = Amount 1 minus Amount 2

Revised Interest: If user selects this option as Penalty type, then

On premature withdrawal of any TD account, TD account interest rate is revised as per setup.

Penalty Type will be defaulted from term deposit account level (Retail>Accounts>Term Deposit>Premature Withdrawal)

At the time of premature withdrawal of any TD account - based on the selected interest scheme at the account level, Aura recalculates TD Interest for the period till which TD amount will be with the bank.

Penalty% denotes the percentage of the penalty applied on the account which is to be charged on premature withdrawal. This is defaulted from the account. This field is displayed only if the Penalty Type is selected as On elapsed period or On remaining period

Penalty amount denotes the penalty amount to be charged on premature withdrawal. This is defaulted from the account level if maintained. This field is displayed only the Penalty type is Fixed amount.

Account status denotes the status of the account chosen for premature withdrawal

Select Redemption option -- whether Partial or Full -- from the drop-down list. This field will be enabled only when the account status is Activated.

Redemption amount is enabled only on selecting the redemption option as partial. You can enter any amount less than available balance. In case of Full redemption, the available balance is automatically displayed here, and it cannot be edited.

Based on the Penalty% or fixed Penalty Amount, Aura will calculate the Applied penalty amount to be charged on the term deposit account on premature withdrawal

Payable amount denotes the net payable amount; it is the Redemption amount minus Penalty amount.

Select Payment option from the drop-down. The available options are Credit to account and Transfer to another bank.

In case Payment option Credit to Account is chosen:

a) To client will by default show the client chosen above. However, you can choose a different client using the To client hyperlink. On clicking the hyperlink, the Client search page appears with the list of active clients where you can search for a client with relevant criteria and select the required client.

b) Click To account hyperlink to see the Client Account Search screen. You will see the selected Client's current accounts whose status is Activated and where the account currency matches with the term deposit account currency and where the Disallow credit has not been checked. Select the required account

In case Payment option Transfer to another bank is chosen:

a) Aura will display the Deposit matured payable GL as per the product settings. This cannot be edited.

b) Enter the account number to which the payment has to be transferred in the To Account box.

c) Enter branch of the external bank to which the payment has to be transferred in the To branch.

d) Select To bank from the dropdown list of banks. maintained under Admin > Management > Settlement directory. You can choose Others, if the Bank has not been so maintained.

e) Aura will automatically display the SWIFT BIC code of the above bank from under Admin > Management > Settlement directory. If the Payout bank is Others, then you can input the BIC code.

f) Aura will automatically display the Bank clearing code of the above bank from under Admin > Management > Settlement directory. If the Payout bank is Others, then you can input the Bank clearing code.

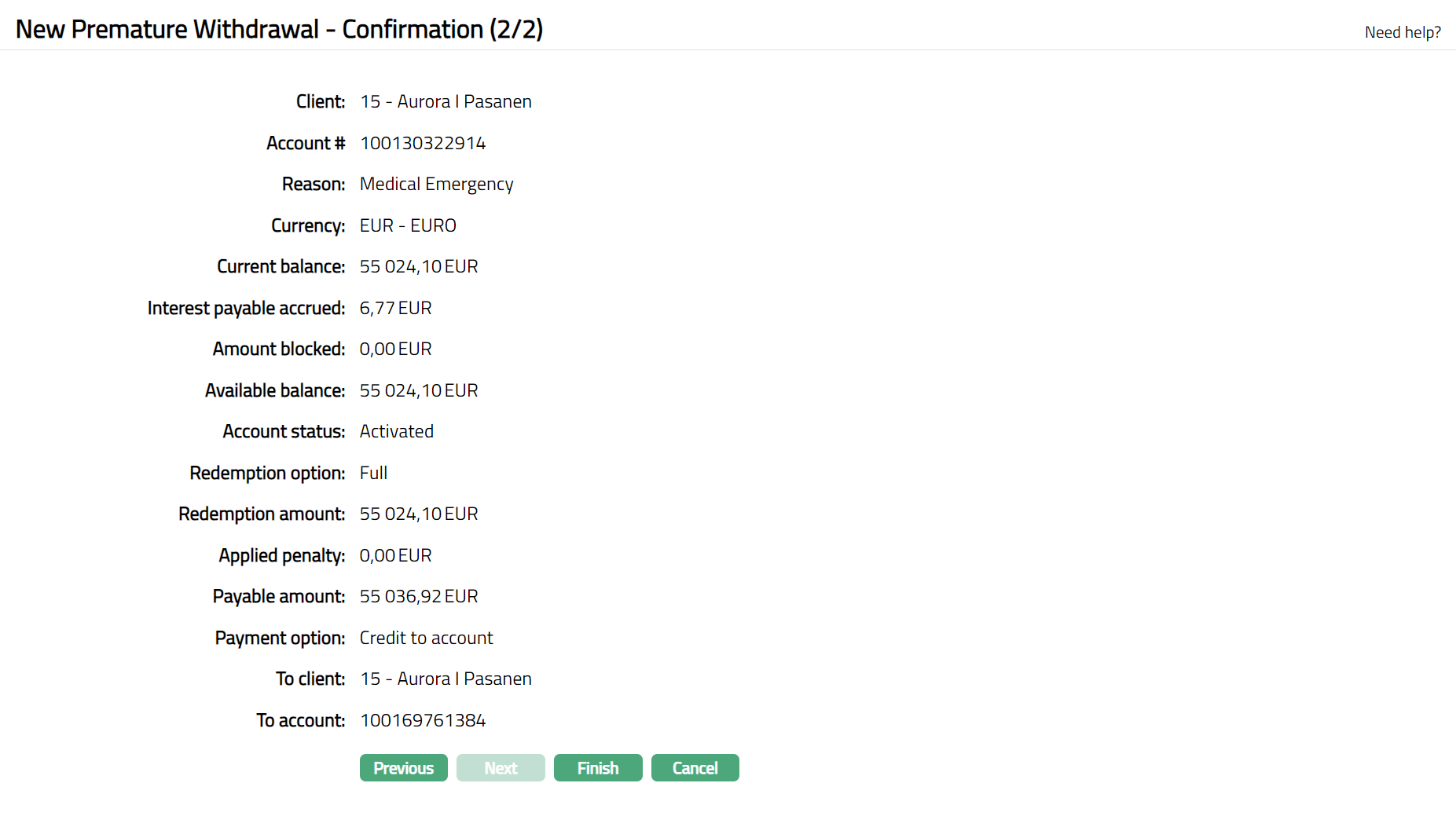

Click Next. New Premature Withdrawal -- Confirmation (2/2) page appears displaying the details of the New Premature withdrawal that you added.

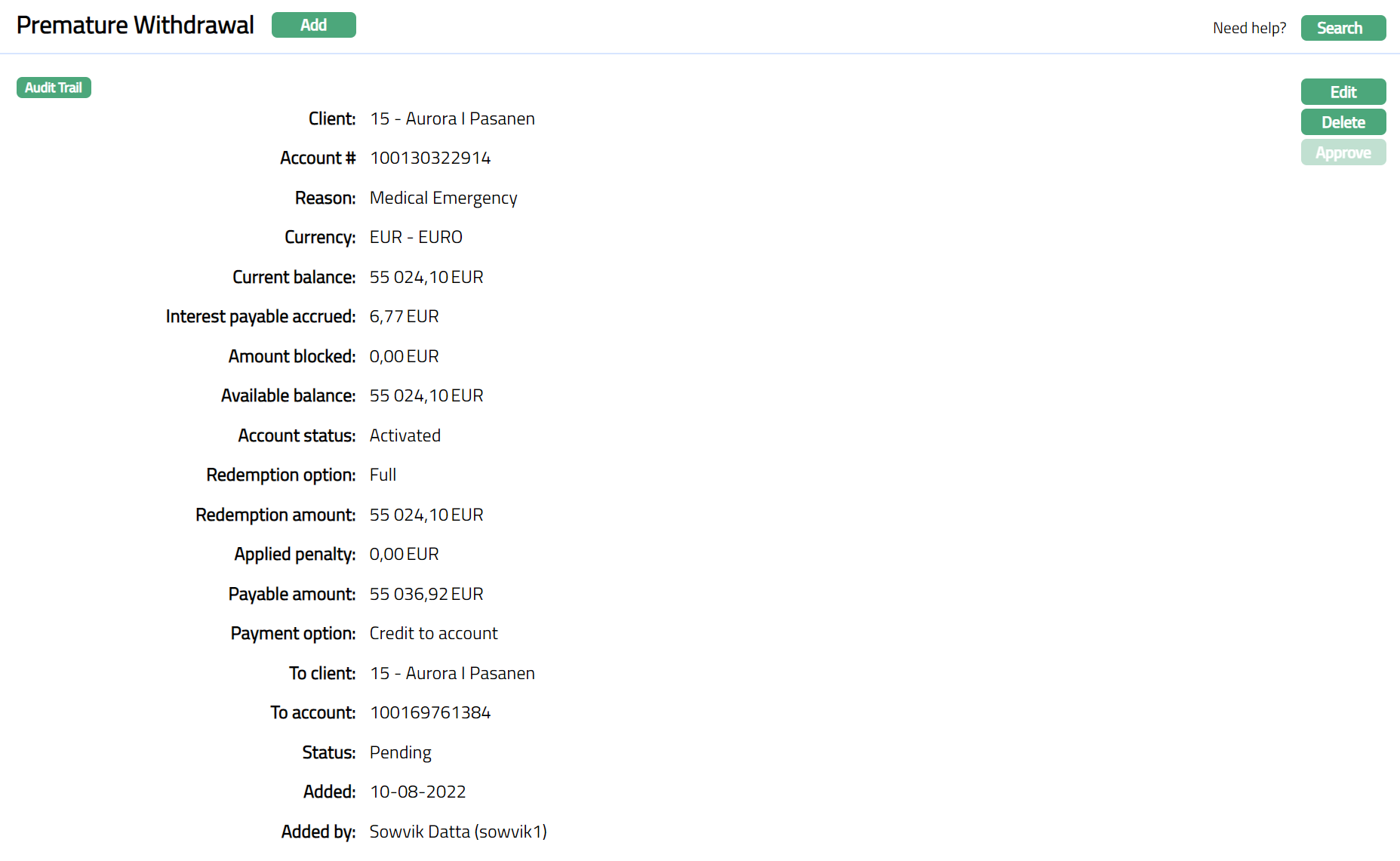

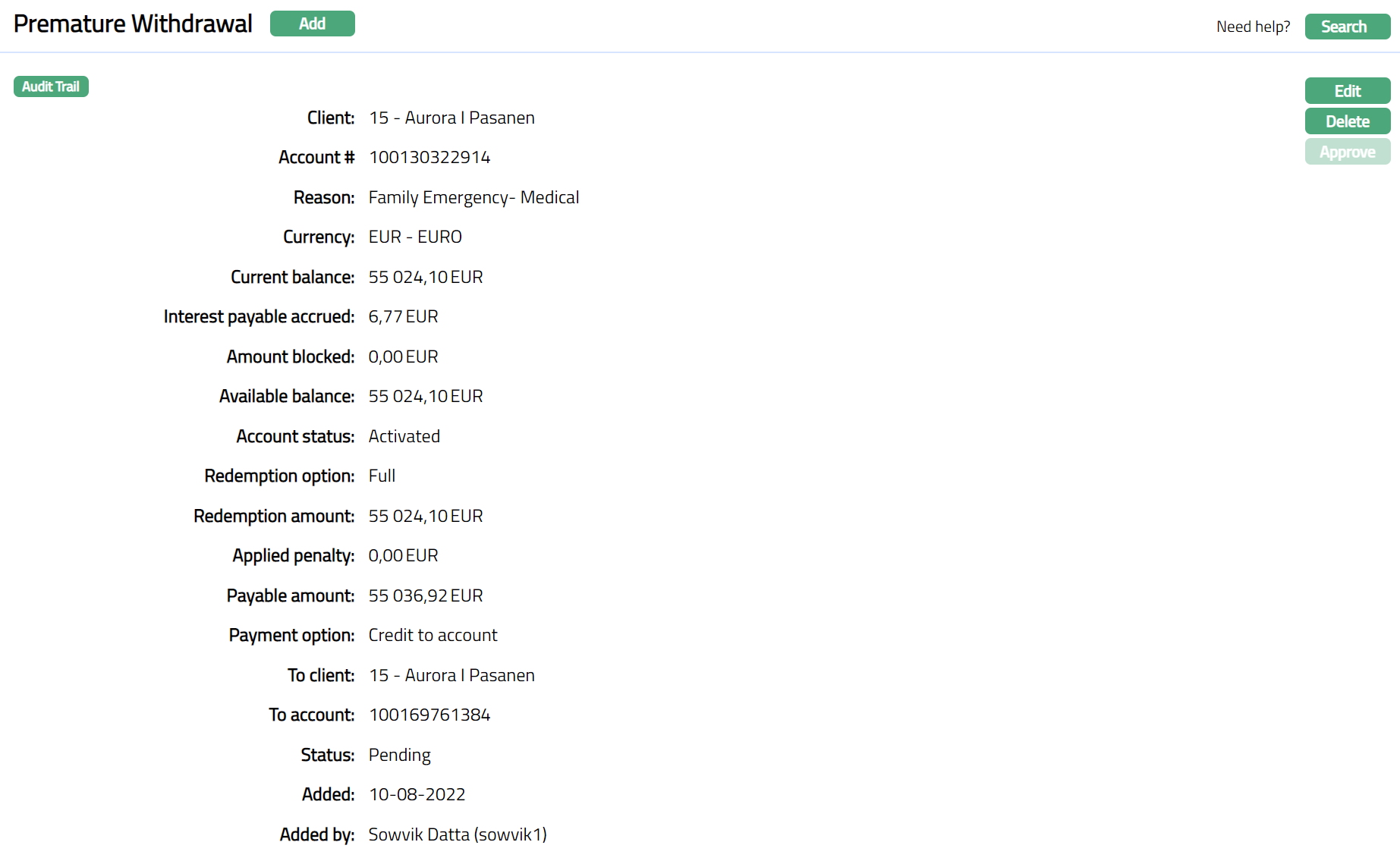

- Click Finish. Premature Withdrawal page appears with the added details.

Functions: Add, Search, Edit, Delete, Approve

Status of the premature withdrawal is Pending till it is approved by another user. The user who created the record can edit it any number of times, till it is approved. In this status, Aura disables all the buttons of all the tabs for that particular TD account and only view is enabled.

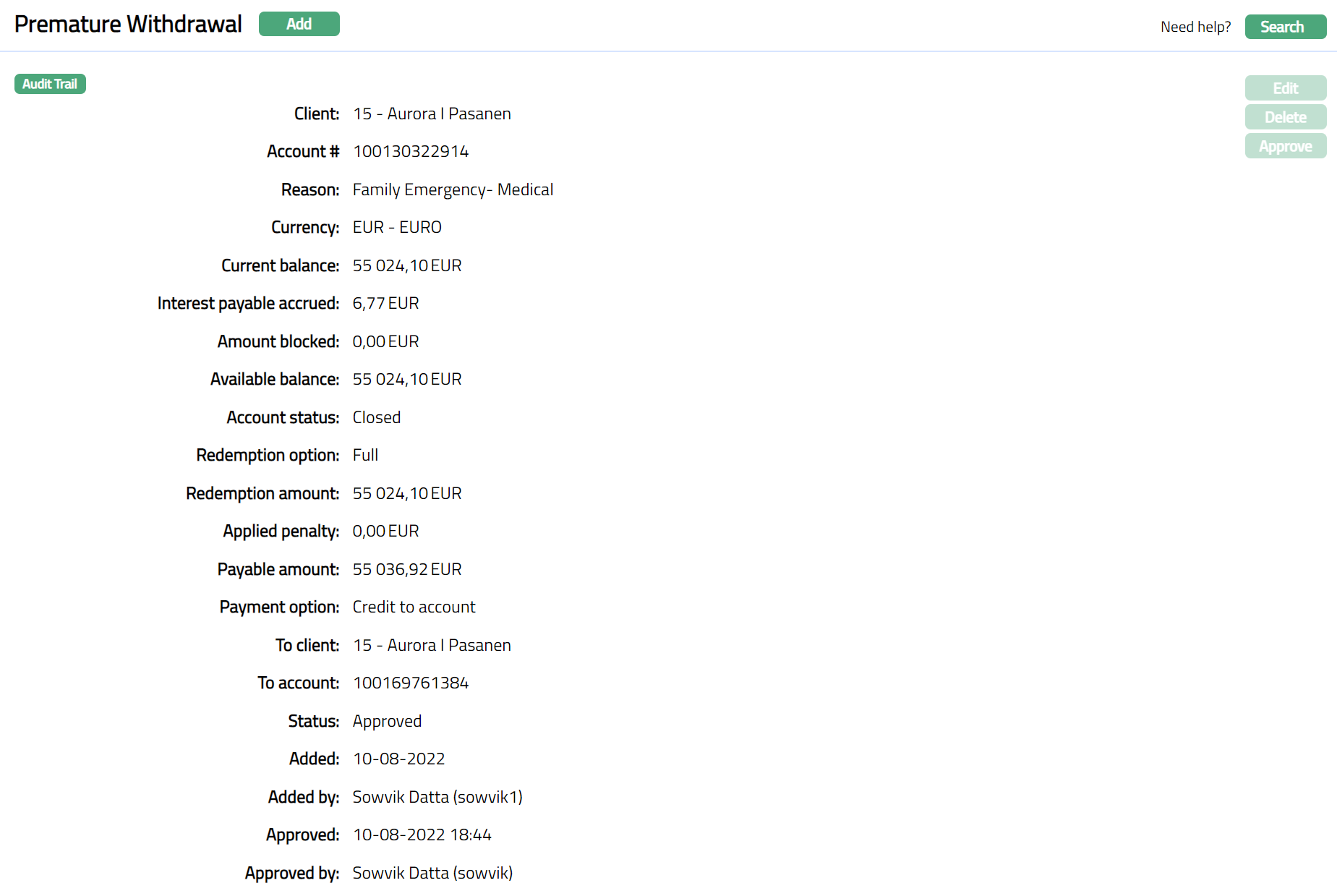

To approve a premature withdrawal, access the premature withdrawal screen and click Approve

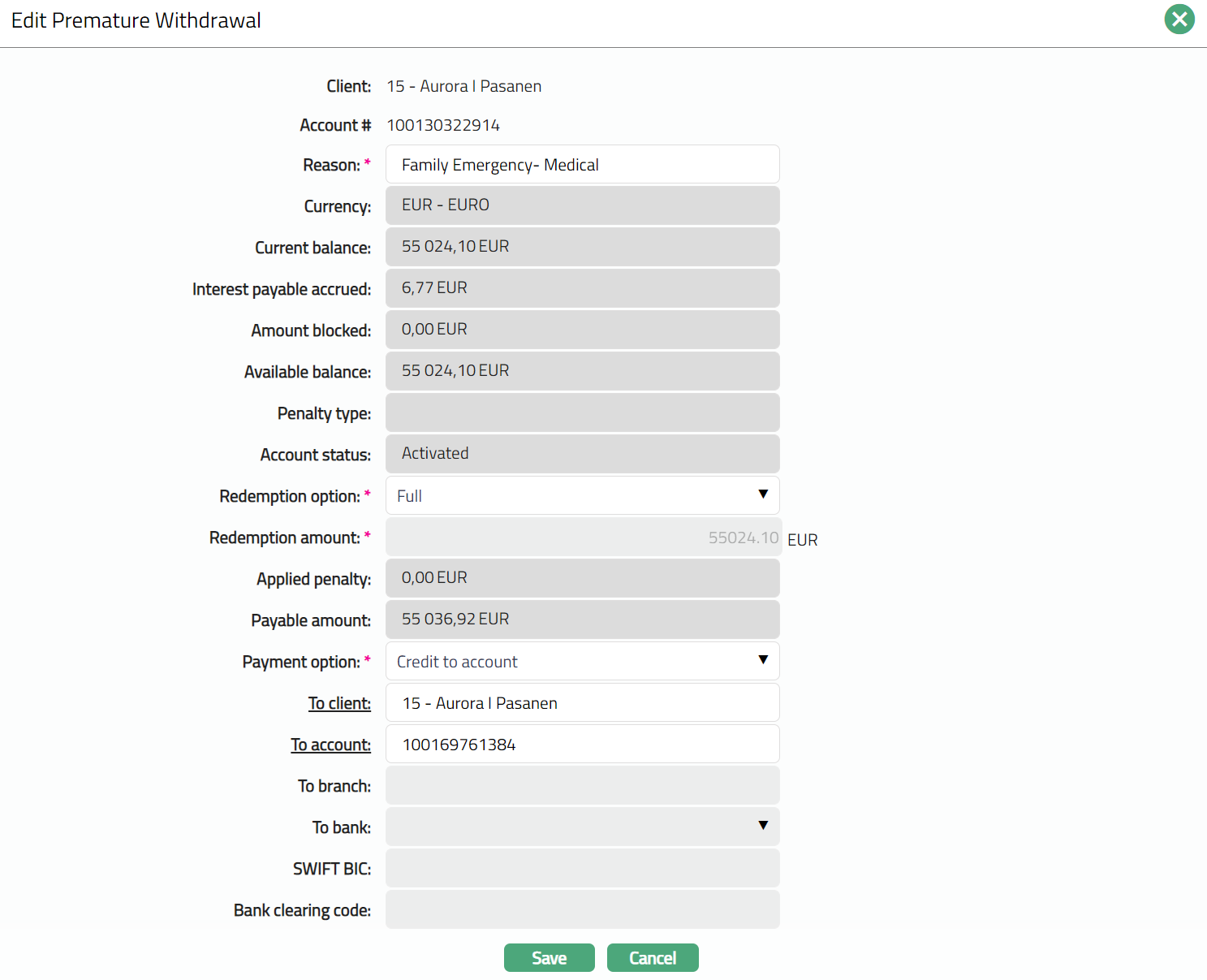

To Edit premature withdrawal record

Access Premature Withdrawal record in the search page which you have created and click Edit.

Edit Premature Withdrawal screen appears.

Note: Only the following fields are editable in the Edit Premature Withdrawal screen.

Reason

Redemption Option

Payment option

To client

To Account

- Click Save. Premature Withdrawal screen appears with the edited details.

Function: Edit, Delete

Once edited the status of the premature withdrawal is Pending till it is approved by another user. The user who created the record can edit it any number of times, till it is approved. In this status, Aura disables all the buttons of all the tabs for that particular TD account and only view is enabled.

To approve premature withdrawal, access the premature withdrawal screen and click Approve. Once Approved the status changes to approved.

Functions: Add, Search, Edit, Delete, Approve.

Functions: Add, Search, Edit, Delete, Approve.

Once Premature withdrawal is approved, the following sequence of activities occurs:

The interest payable accrued is liquidated only on selecting the redemption option as Full while creating a new premature withdrawal. Penalty will be levied for both full and partial premature withdrawal if selected.

The payable amount is transferred based on the selected payment option. If Credit to account is selected, then the payable amount is transferred to the provided account using the transaction code maintained at the product level. If Transfer to other bank is the payment option, then the payable amount is transferred to Deposit matured payable GL defined at product level.

In case of transfer to other bank a separate payment instruction has to be initiated for transferring the amount

Delete: You can delete Premature Withdrawal record by a click on Delete button. When you click on Delete button, Aura displays an alert message. On confirmation Aura will delete the Premature Withdrawal record.