Close of Business

The Close of Business (COB) processes are used to update the previous, current, and next booking days. During this process, the Next Day becomes the Current Day and the Current Day becomes the Previous Day. Aura executes several batches in a logical and predefined sequence to complete functions like interest accrual, invoice generation, dormancy checks, etc.

The COB process in Aura has been orchestrated in such a way that there is no need for a system down time and that normal processing activities can go on uninterrupted 24/7. At the start of the COB process, the system date (booking date) changes and any subsequent transactions posted will be considered as the next day's transactions.

Process

The series of activities that occur when Close of Business (COB) process is triggered are given below, taking 11-Dec-2013 as an example:

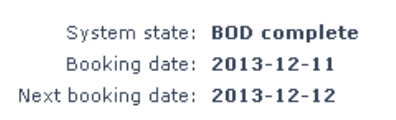

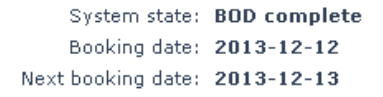

1. System state -- BOD Complete

During the day on 11-Dec-2013, System state will be BOD Complete indicating that the Beginning of Day processes have been completed for 11-Dec-2013. The Booking Date will be 11-Dec-2013 and the Next Booking date will default to the Next calendar day, i.e., 12-Dec-2013. You can view this on Branches > Maintain > EOC Dates tab.

At the time specified in Admin > Branches > EOC Dates -- Next execution, COB is triggered in the system and below are the series of activities which take place during the EOC run.

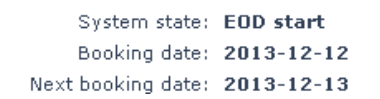

2. System state -- EOD start

This system state indicates that the EOC process has been initiated.

3. Date Change

The first step in the COB process is change of Book Date. The date is changed from the current Booking Date to the Next Booking Date.

At this state, the system will start the End of Day processing. The System State and Booking Dates will be as follows:

4. EOD processes

During this, all batches that are scheduled to be executed as End-Of-Day batches are executed. Aura processes all the data considering the last booking date as the triggering date. The sequence in which the batches are processed depends on the business needs and functionality.

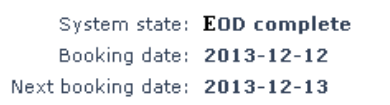

5. System state -- EOD Complete

This system state indicates that the EOD processes have been completed. The System State and Booking Dates will be as follows:

6. Notification

Aura initiates a Notification to the external system (DataMatrice) about the EOD process having been completed.

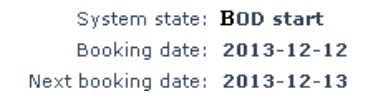

7. System state -- BOD start

This system state indicates that the BOD process has been initiated. The System State and Booking Dates will be as follows:

8. BOD processes

During this, all batches that are scheduled to be executed as Beginning-Of-Day batches are executed. Aura processes all the data considering the current booking date as the triggering date. The sequence in which the batches are processed depends on the business needs and functionality.

9. System state -- BOD complete

This system state indicates that the BOD process has been completed. The System State and Booking Dates will be as follows:

Note:

Each installation can have multiple Entities (many banks); and each Entity may have multiple Branches. It is possible to set a business date for every branch of an Entity in the system. The business date is taken into consideration for COB processing.

The same installation can have multiple entities & branches each with their own branch business dates and hence can run COB independently.

List of Processes

| S. No. | MODULE | EVENT | DESCRIPTION | EOD / BOD |

|---|---|---|---|---|

| 1 | AC | ACACST | Current Account Status Movement | EOD |

| 2 | AC | ACDORM | Account Dormancy | EOD |

| 3 | AC | ACPAST | Payment status fee | EOD |

| 4 | PP | ACTFEE | Placement Instruction Activation Charge | EOD |

| 5 | AC | ADDFEE | Additional Charge | EOD |

| 6 | CC | ADDFEE | Additional charge fee | EOD |

| 7 | LN | ADDFEE | Additional charge | EOD |

| 8 | PP | ADDFEE | Additional charge | EOD |

| 9 | AC | ADHFEE | Adhoc charge fee | EOD |

| 10 | CC | ADHFEE | Adhoc charge fee | EOD |

| 11 | LN | ADHFEE | Adhoc charge fee | EOD |

| 12 | PP | AINVFE | Placement Instruction Auto-investment Charge | EOD |

| 13 | PP | AITBFE | PI Tenor Based Auto-investment Charge | EOD |

| 14 | AC | ALLFEE | Allocation fee | EOD |

| 15 | AC | AVGFEE | Average balance non-maintenance fee | EOD |

| 16 | AC | AWRTOF | Write off processing for CASA | EOD |

| 17 | LN | AWRTOF | Write off processing for loans | EOD |

| 18 | AC | BALFEE | Breach of minimum balance fee | EOD |

| 19 | CC | BALUPD | Card balance update | EOD |

| 20 | AC | BNCFEE | Breach of withdrawal conditions fee non cash | EOD |

| 21 | AC | BRCFEE | Breach of withdrawal conditions fee cash | EOD |

| 22 | GL | BUDUPD | Budget update | EOD |

| 23 | CC | CAACST | Account status fee | EOD |

| 24 | CC | CAACTV | Account activation | EOD |

| 25 | CC | CACLOS | Account closure | EOD |

| 26 | CC | CACOMM | Card Account Opening Commission | EOD |

| 27 | CC | CADORM | Account dormancy | EOD |

| 28 | CC | CAEOGD | End of grace day | EOD |

| 29 | CC | CAINPR | Insurance premium | EOD |

| 30 | LN | CAINPR | Insurance premium | EOD |

| 31 | CC | CAOPEN | Account opening | EOD |

| 32 | CC | CAPAST | Payment status fee | EOD |

| 33 | CC | CAREIN | Transaction account reinstate | EOD |

| 34 | CD | CDEXPY | Card expiry | EOD |

| 35 | LN | CHGAMR | Charge Amortization | EOD |

| 36 | CB | CHGBUN | Charge recovery for charge bundle process | EOD |

| 37 | CC | CHGCOL | Charge collection | EOD |

| 38 | AC | CHGWAV | Waive charge | EOD |

| 39 | CC | CHGWAV | Waive charge | EOD |

| 40 | GL | CLPROV | Collective impairment booking | EOD |

| 41 | GL | CLREBL | Collective impairment rebalancing | EOD |

| 42 | AC | DBTPRO | Debit processing | EOD |

| 43 | CC | DBTPRO | Debit processing | EOD |

| 44 | TD | DBTPRO | Debit processing | EOD |

| 45 | AC | DOUREC | Doubtful receivable processing for CASA | EOD |

| 46 | LN | DOUREC | Doubtful receivable processing for loans | EOD |

| 47 | CC | EARACT | Earmark activation | EOD |

| 48 | AC | EVNPOP | Event Population | EOD |

| 49 | CC | EVNPOP | Event Population | EOD |

| 50 | LN | EVNPOP | Event Population | EOD |

| 51 | TD | EVNPOP | Event Population | EOD |

| 52 | FX | FXACTV | FX Contract Activate | EOD |

| 53 | FX | FXAMND | FX Contract Amendment | EOD |

| 54 | FX | FXBOOK | FX Contract Book | EOD |

| 55 | FX | FXCANC | FX Contract Cancel | EOD |

| 56 | FX | FXREVB | FX Contract reverse - Buy Leg | EOD |

| 57 | FX | FXREVS | FX Contract reverse - Sell Leg | EOD |

| 58 | FX | FXRRVB | FX Contract Reverse Revaluation - Buy Leg | EOD |

| 59 | FX | FXRRVS | FX Contract Reverse Revaluation - Sell Leg | EOD |

| 60 | FX | FXRVLB | FX Contract Revaluation - Buy Leg | EOD |

| 61 | FX | FXRVLS | FX Contract Revaluation - Sell Leg | EOD |

| 62 | GL | GLREVL | GL Revaluation | EOD |

| 63 | GL | GLSUSP | Balance movement to suspense GL | EOD |

| 64 | AC | INACRP | Interest Accrual for payable | EOD |

| 65 | CC | INACRP | Interest accrual payable | EOD |

| 66 | TD | INACRP | Interest Accrual | EOD |

| 67 | AC | INACRR | Interest Accrual for Receivable | EOD |

| 68 | CC | INACRR | Interest accrual receivable | EOD |

| 69 | CC | INACTV | Insurance re-activation | EOD |

| 70 | LN | INACTV | Insurance re-activation | EOD |

| 71 | AC | INADJP | Interest adjustment for Payable | EOD |

| 72 | AC | INADJR | Interest Adjustment for Receivable | EOD |

| 73 | AC | INCAPP | Accrued interest capitalized for payable | EOD |

| 74 | CC | INCAPP | Accrued Interest Capitalized | EOD |

| 75 | AC | INCAPR | Accrued interest capitalized for receivable | EOD |

| 76 | CC | INCAPR | Accrued Interest Capitalized | EOD |

| 77 | CC | INEXPY | Insurance plan expiry | EOD |

| 78 | LN | INEXPY | Insurance plan expiry | EOD |

| 79 | PP | INGFEE | Interest Guarantee Fee | EOD |

| 80 | AC | INLIQP | Interest Liquidation for Payable | EOD |

| 81 | CC | INLIQP | Interest liquidation payable | EOD |

| 82 | TD | INLIQP | Interest Liquidation | EOD |

| 83 | AC | INLIQR | Interest Liquidation for Receivable | EOD |

| 84 | CC | INLIQR | Interest liquidation receivable | EOD |

| 85 | TD | INRVLQ | Interest liquidation reversal | EOD |

| 86 | TD | INRVPY | Interest Payable reversal | EOD |

| 87 | CC | INSUSP | Insurance suspension | EOD |

| 88 | LN | INSUSP | Insurance suspension | EOD |

| 89 | PP | INTBFE | PI Tenor Based Investment Charge | EOD |

| 90 | CC | INVFEE | Invoice fee | EOD |

| 91 | CC | INVGEN | Invoice Generation | EOD |

| 92 | PP | INVSFE | Placement Instruction Investment Charge | EOD |

| 93 | AC | INWAVP | Accrued interest waived for payable | EOD |

| 94 | CC | INWAVP | Accrued Interest Waived for Payable | EOD |

| 95 | AC | INWAVR | Accrued interest waived for receivable | EOD |

| 96 | CC | INWAVR | Accrued Interest Waived for Receivable | EOD |

| 97 | LM | LMAMND | Limit Amendment | EOD |

| 98 | LM | LMCACR | Limit Accrual | EOD |

| 99 | LM | LMCLIQ | Limit Liquidation | EOD |

| 100 | LM | LMCONT | Limit Contingent Entry | EOD |

| 101 | LM | LMDLNK | Limit DeLink | EOD |

| 102 | LM | LMEXPY | Limit Expiry | EOD |

| 103 | LM | LMLINK | Limit Link | EOD |

| 104 | LN | LNACCR | Loan Account Accrual (Interest/Penal) | EOD |

| 105 | LN | LNAMRT | Loan account advance interest accrual | EOD |

| 106 | LN | LNCLOS | Loan Account closure | EOD |

| 107 | LN | LNEOGD | Loan account end of grace day | EOD |

| 108 | LN | LNLIQD | Loan Account Liquidation | EOD |

| 109 | LN | LNPAYP | Loan Account Prepayment | EOD |

| 110 | LN | LNPAYS | Loan Account Schedule Repayment | EOD |

| 111 | LN | LNPYST | Loan Account Payment Status | EOD |

| 112 | LN | LNRATE | Interest Rate Revision | EOD |

| 113 | LN | LNRVDB | Loan Account Disbursement Reverse | EOD |

| 114 | LN | LNRVPP | Loan Account Prepayment Reverse | EOD |

| 115 | LN | LNRVPY | Loan Account Payment Reverse | EOD |

| 116 | LN | LNSCHG | Loan Account Schedule Generation | EOD |

| 117 | AC | MINBAL | Minimum balance | EOD |

| 118 | CC | NODORM | Reversing of dormancy | EOD |

| 119 | AC | NOPFEE | Non Operation Fee | EOD |

| 120 | CC | NOPFEE | Non operating fee | EOD |

| 121 | CC | NPDUPD | Next Payment date update | EOD |

| 122 | CC | OLMFEE | Over limit fee | EOD |

| 123 | AC | OPEFEE | Locker operation fee | EOD |

| 124 | CC | OVDFEE | Over Due Fee | EOD |

| 125 | AC | OVDLMT | Overdraft exceeds | EOD |

| 126 | PA | PAYMIN | Payment Initiation for Internal Transfers | EOD |

| 127 | CC | PDDUPD | Payment date update | EOD |

| 128 | PP | PIABLK | Placement Instruction Amount Block | EOD |

| 129 | PP | PIABUP | Placement Instruction Auto-Bid Update | EOD |

| 130 | PP | PIACTV | Placement Instruction Activation | EOD |

| 131 | PP | PIAICH | Placement Instruction Auto-Invest Charge | EOD |

| 132 | PP | PIDISB | Placement Instruction Disbursement | EOD |

| 133 | PP | PILINT | Placement Instruction Interest credit | EOD |

| 134 | PP | PIOPEN | Placement Instruction Opening | EOD |

| 135 | PP | PIPAYS | Placement Instruction Repayment | EOD |

| 136 | PP | PIPINT | Placement Instruction Interest debit portal account | EOD |

| 137 | PP | PIRDAC | Additional charges | EOD |

| 138 | PP | PIRDAD | Additional disbursement charge | EOD |

| 139 | PP | PIRDAH | Adhoc Charge | EOD |

| 140 | PP | PIRDAP | Appraisal charge | EOD |

| 141 | PP | PIRDBF | Broker fee | EOD |

| 142 | PP | PIRDCR | Credit report charge | EOD |

| 143 | PP | PIRDDC | Documentation charge | EOD |

| 144 | PP | PIRDIN | Installment fee | EOD |

| 145 | PP | PIRDLF | Lender fee | EOD |

| 146 | PP | PIRDLG | Legal Charge | EOD |

| 147 | PP | PIRDLI | Lender inspection charge | EOD |

| 148 | PP | PIRDLM | Loan management charge | EOD |

| 149 | PP | PIRDLT | Late payment fee | EOD |

| 150 | PP | PIRDNT | Notary charge | EOD |

| 151 | PP | PIRDPC | Processing fee | EOD |

| 152 | PP | PIRDPI | Penalty on Interest | EOD |

| 153 | PP | PIRDPP | Penalty on Principal | EOD |

| 154 | PP | PIRDPR | Prepayment charge | EOD |

| 155 | PP | PIRDSC | Service Charge | EOD |

| 156 | PP | PIRDST | Stamp charge | EOD |

| 157 | CC | PLNEXP | Payment plan expiry | EOD |

| 158 | CC | PLNFEE | Payment plan maintainence fee | EOD |

| 159 | GL | PNLTRF | GL YearEndProfitLoss Transfer | EOD |

| 160 | PP | PPCHAR | Peer to Peer Loan request charge | EOD |

| 161 | PP | PPCLOS | Peer to Peer Loan Request Closed | EOD |

| 162 | PP | PPCOMM | Peer to Peer Loan Request Committed | EOD |

| 163 | PP | PPEXPY | Peer to Peer Loan Request Expired | EOD |

| 164 | PP | PRGFEE | Principal Guarantee Fee | EOD |

| 165 | AC | PROCHG | pro rata charge | EOD |

| 166 | CC | PROCHG | pro rata charge | EOD |

| 167 | AC | PROVIS | Provision processing for CASA | EOD |

| 168 | LN | PROVIS | Provision processing for loans | EOD |

| 169 | CC | REMGEN | Reminder generation fee | EOD |

| 170 | LN | REMGEN | Loan Reminder Generation | EOD |

| 171 | AC | RNTFEE | Locker rent fee | EOD |

| 172 | CC | ROLFEE | Rollover fee | EOD |

| 173 | AC | SERFEE | Service Charge | EOD |

| 174 | CC | SERFEE | Service charge fee | EOD |

| 175 | PP | SERFEE | Service charge | EOD |

| 176 | AC | SERFEP | Service Charge Percentage | EOD |

| 177 | SI | SISWEP | Standing Instruction Sweep Out | EOD |

| 178 | AC | STAGEN | Statement Generation | EOD |

| 179 | CC | STAGEN | Statement generation fee | EOD |

| 180 | LN | STAGEN | Statement generation | EOD |

| 181 | TD | STAGEN | Statement Generation | EOD |

| 182 | AC | STPFEE | Stop payment cheque fee | EOD |

| 183 | SI | SWEPIN | Standing Instruction Sweep In | EOD |

| 184 | TD | TDRATE | TD Interest Rate Revision | EOD |

| 185 | TD | TDRVAC | Term deposit activation reversal | EOD |

| 186 | TD | TDRVCL | Term deposit closer reversal | EOD |

| 187 | TD | TDRVLQ | Term deposit premature withdrawal reversal | EOD |

| 188 | TD | TDRVMT | Term deposit maturity reversal | EOD |

| 189 | TD | TDRVRL | Term deposit roll over reversal | EOD |

| 190 | AC | TODEXP | Overdraft limit expiry | EOD |

| 191 | CC | TODEXP | Temporary overdraft expiry | EOD |

| 192 | AC | UODFEE | Unauthorized overdraft fee | EOD |

| 193 | CC | UODFEE | Unauthorized overdraft fee | EOD |

| 194 | AC | WOEXPY | Withdrawal order expiry | EOD |

| 195 | AC | WRITOF | Write off | EOD |

| 196 | CC | WRITOF | Write off | EOD |

| 197 | AC | AMTBLK | Creation of amount block | BOD |

| 198 | CC | AMTBLK | Creation of amount block | BOD |

| 199 | TD | AMTBLK | Creation of amount block | BOD |

| 200 | AC | AUTBON | Automatic reward redemption | BOD |

| 201 | CC | AUTBON | Automatic bonus redemption | BOD |

| 202 | AC | BLKREL | Release of amount block | BOD |

| 203 | CC | BLKREL | Release of amount block | BOD |

| 204 | TD | BLKREL | Release of amount block | BOD |

| 205 | CC | BONCOM | Bonus commission | BOD |

| 206 | CD | CDACTV | Card activation | BOD |

| 207 | CD | CDRISS | Card re-issued | BOD |

| 208 | CC | CHGGRP | Charge group application | BOD |

| 209 | PA | CHQCON | Contingent cheque entries | BOD |

| 210 | CC | EAREXP | Earmark expiry | BOD |

| 211 | FX | FXSETB | FX Contract Buy Settle | BOD |

| 212 | FX | FXSETS | FX Contract Sell Settle | BOD |

| 213 | CC | ININIT | Insurance initiation | BOD |

| 214 | LN | ININIT | Insurance initiation | BOD |

| 215 | CC | INTGRP | Interest group application | BOD |

| 216 | AC | INTPAY | Interest Payout | BOD |

| 217 | CC | INTPAY | Interest Payout | BOD |

| 218 | TD | INTPAY | Interest Payout | BOD |

| 219 | LM | LMACTV | Limit Activation | BOD |

| 220 | LM | LMCHRG | Limit Periodic Charge | BOD |

| 221 | LN | LNACST | Loan account status | BOD |

| 222 | LN | LNDISB | Loan Account Disbursement (Auto/Manual) | BOD |

| 223 | AC | LOYCOM | Account opening commission | BOD |

| 224 | CC | PLNACT | Payment plan activation | BOD |

| 225 | TD | REMGEN | TD Reminder generation | BOD |

| 226 | SI | SIACTV | Standing Instruction Activation | BOD |

| 227 | SI | SIEXEC | Standing Instruction Execution | BOD |

| 228 | SI | SISUSP | Standing Instruction Suspend | BOD |

| 229 | TD | TDACTV | Term Deposit Account Activation | BOD |

| 230 | TD | TDMATY | Term Deposit Maturity | BOD |

| 231 | TD | TDMPAY | Maturity payout | BOD |

| 232 | TD | TDROLL | Roll over | BOD |

| 233 | AC | WOACTV | Withdrawal order activation | BOD |

Legend for Module Code:

AC Current Account

CB Charge Bundling

CC Credit Cards

CD Cards

FX Forex

GL General Ledger

LM Limits

LN Loans

PA Payments

PP Peer-to-Peer

SI Standing Instruction

TD Term Deposit