Cycle Group

Cycle Group will provide you an option to maintain different Interest receivable due dates and Payment due date which can then be used for any billing account.

During creation of a Card Account Product, a Default Cycle group for the Product is automatically created by Aura, using the Liquidation Date and Payment Days options that were chosen. You cannot edit any values for this Default Cycle Group.

You can create other Cycle Groups for a Card Account Product using this option and use the Default Group or any of these additional groups during the Billing Account creation.

The only tab is

Adding Cycle group

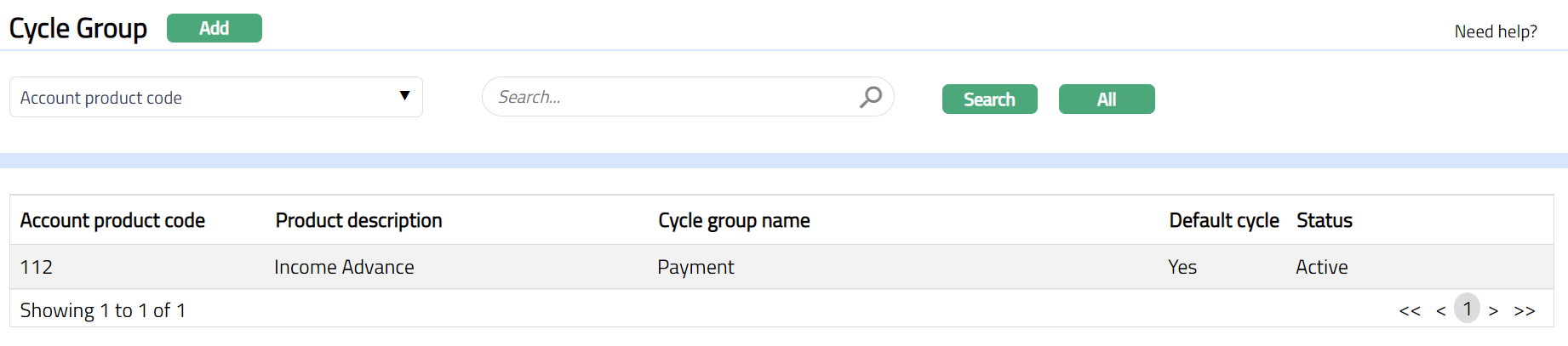

From Card menu, click Settings, and then Cycle Group. Cycle Group Search page appears. All existing Cycle Groups will appear on the page.

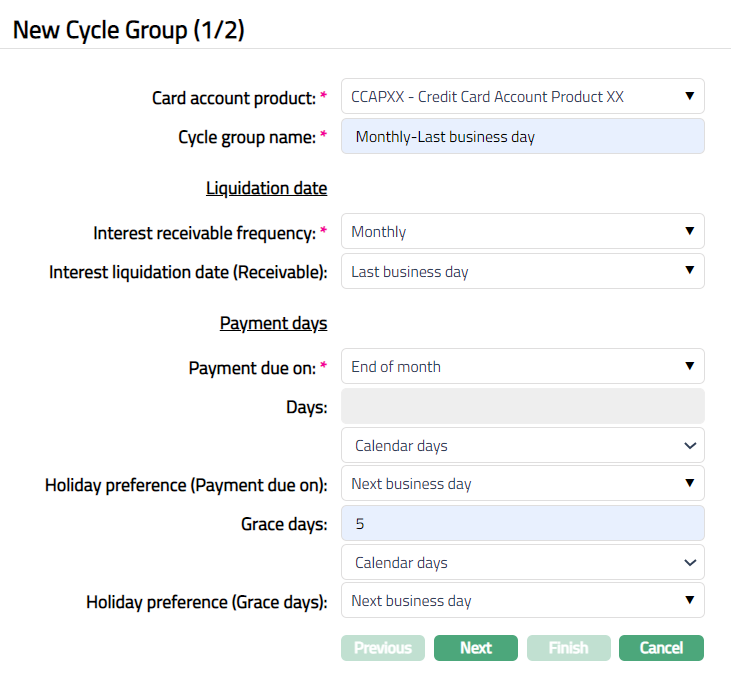

Click Add. New Cycle Group - (1/2) page appears.

Select Card account product for the new cycle group from the drop-down list. The list will display all the active Card Account Products maintained at Card > Settings > Card Account Product.

Enter name for Cycle group.

Select Interest receivable frequency for the Interest Receivable accrual from the drop-down list. Available options are: Monthly, Quarterly, Semi-annual and Annual.

Specify when the Interest receivable has to be liquidated (capitalized) in the Interest Liquidation date (Receivable). It is the date on which the interest will be posted to the accounts under this product. Available options are as follows:

Day: If you want the interest to be liquidated on a specific date of the calendar month, choose this option. You need to then specify the day in the Day field.

Last Calendar Day: If you want the interest to be liquidated on the last calendar day of the selected frequency instead of the specified date, choose this option.

Last Business Day: If you want the interest to be liquidated on the last business day, then choose this option.

X days before last calendar day: If you want the interest to be liquidated x days before the last calendar day, then choose this option.

X days before last business day: If you want the interest to be liquidated x days before the last business day, then choose the option.

Note:

If frequency is Monthly

If 31 is chosen and if the month has 30 days interest will be liquidated on 30th of the month

If 30 is chosen and if the month has 31 days interest will be liquidated on 30th of the month

If frequency is quarterly, semi-annual or annual, the 'Day' parameter is interpreted in the same way as month; however, the month will be

March, June, September and December -- if it is quarterly,

June and December -- if it is semi-annual

December -- if it is annual

If Interest liquidation date is selected as X days before last calendar day or X days before last business day, you need to then specify the value for the X in the Number of days field and also indicate if these days are calendar days or business days. The number of days field is available twice so that you can specify the interest liquidation date as: 5 business days before 2 calendar days before last calendar day

If interest liquidation date so arrived at is a holiday, specify how it should be treated using the Holiday preference. The options are:

Ignore: If this option is chosen, then the holiday will be ignored, and interest will be liquidated on same day. This is the default option selected.

Next business day: If this option is chosen, then interest will be liquidated on the next business day.

Previous business day: If this option is chosen, then interest will be liquidated on previous business day

- Select option for when the Payment is due using the Payment due on.

The following table shows how the Payment due on is arrived at for each of the options. In this table, the Start date and End date for the cycle is taken as 26-Apr-2013 and 25-May-2013 respectively and X days is taken as 5 days.

Payment Due Dates

| Sl | Option Chosen | Payment due on |

|---|---|---|

| 1 | End of cycle | 25-May-2013 |

| 2 | End of month | 31-May-2013 |

| 3 | Last business day of month | 31-May-2013 |

| 4 | Next end of cycle | 25-Jun-2013 |

| 5 | Next end of month | 30-Jun-2013 -- but, since this is beyond Next End of Cycle (i.e. 25-Jun-2013), Payment due on will be 25-Jun-2013 |

| 6 | Last business day of next month | 28-Jun-2013 -- but, since this is beyond Next End of Cycle (i.e. 25-Jun-2013), Payment due on will be 25-Jun-2013 |

| 7 | X days after End of Cycle | 30-May-2013 |

| 8 | X days after End of Month | 5-Jun-2013 |

| 9 | X days before next End of Cycle | 20-Jun-2013 |

| 10 | X days before next End of Month | 25-Jun-2013 |

| 11 | X days after next End of Month | 5-Jul-2013 -- but, since this is beyond Next End of Cycle (i.e. 25-Jun-2013), Payment due on will be 25-Jun-2013 |

If option 11 is chosen above, Interest receivable Liquidation frequency options Daily and Monthly will be disabled.

Note: During every Invoice generation, if Payment due date is greater than next EOC, Payment due date will be taken as the next EOC. Similarly, if during invoice generation, if Payment due date falls within the same cycle, Payment due date will be taken as the current EOC date. This will be the case even if the Fix Payment Date at account level is marked Yes.

Also, the actual Payment Due Date will be in conjunction with the Invoice generation date (i.e., the Debit Interest liquidation date). For example, if the Frequency is quarterly and the Payment due on is Last business day of month, the payment due date for the invoice generated during March 2013 will be 29th Mar 2013, assuming 30th and 31st Mar are holidays.

If you have selected options 7 to 11 above, you need to specify the number of Days to be taken for the Payment due date calculation and also indicate if the number days should be taken as calendar days or business days.

- Indicate Holiday Preference (Payment due on) for the Payment due date calculated using the above values.

Following options are available:

Ignore: If the Payment due date falls on a holiday, and you still want to retain that date as the payment due date, choose Ignore. For Example, if the Payment due date is 25^th^ Dec which is a holiday and you have chosen Ignore, the payment due date will still remain 25^th^ Dec.

Next Business Day: If the Payment due date falls on a holiday, and you want to move it to the next business day, choose this option. In our above example, if this option is chosen, the Payment due date would be 26^th^ Dec.

Previous Business Day: If the Payment due date falls on a holiday, and you want to move it to the previous business day, choose this option. In our above example, if this option is chosen, the Payment due date would be 24^th^ Dec.

- Grace days enables you to provide a few additional days for the customer to make his payment; and if the customer makes the payment by the end of the Grace days period, the payment is considered as having been received by the Payment due date. Enter the required number of Grace days and indicate if these days should be calendar days / business days.

Note: If payment is made within the grace days, even if it is after the payment due date, the payment is not treated as overdue and associated charges / interest is not applied. If payment is not received within the payment date + grace days, then overdue interest accrual starts from the payment due date onwards.

Indicate Holiday preference (Grace days) for end of grace days calculated using the above values. If Grace days is business days, then this field will be disabled. In case of calendar days, indicate if the end of grace days arrived at is a holiday, whether it should not be moved / moved to next / previous working day.

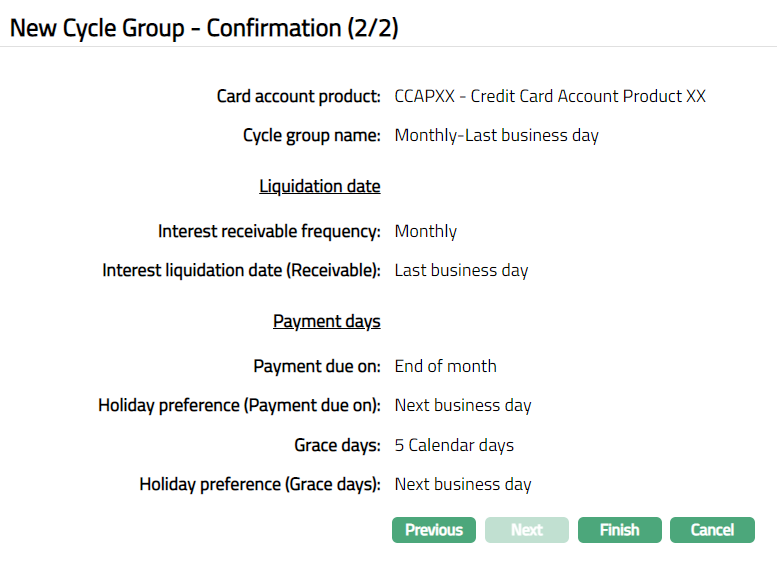

Click Next. New Cycle Group -- Confirmation (2/2) page appears.

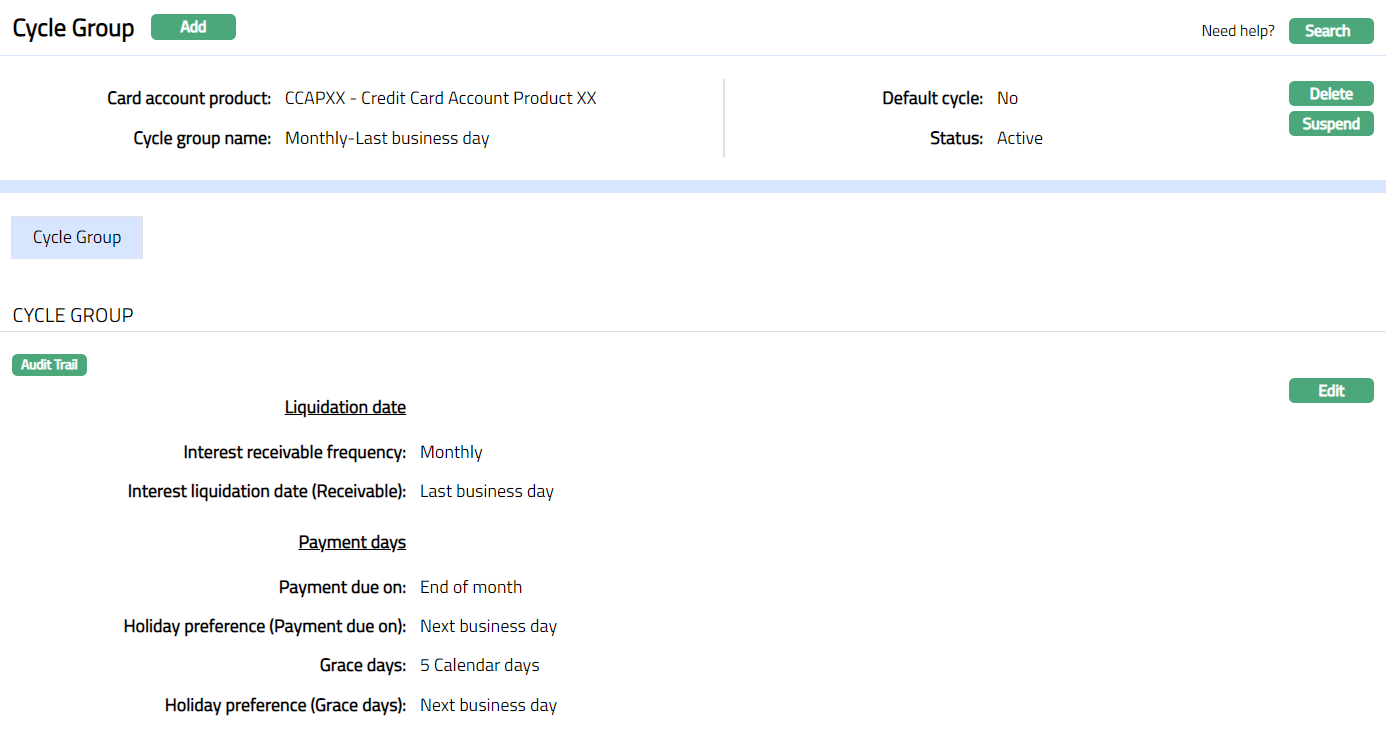

Click Finish. Cycle Group page appears with the added details.

Functions: Add, Search, Delete, Suspend, Activate

The additional fields available are:

If the Cycle group is Default cycle for any product, then Yes will be displayed for this field else No will be displayed.

Note: Edit, Delete and Suspend buttons will be disabled for the Default Cycle Group but will be allowed for non-default Cycle Groups.

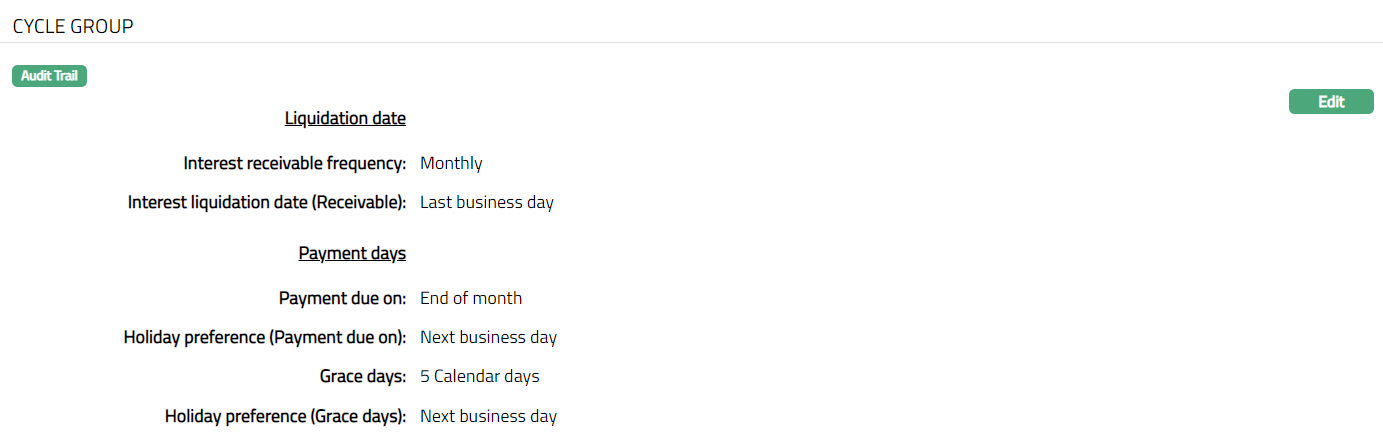

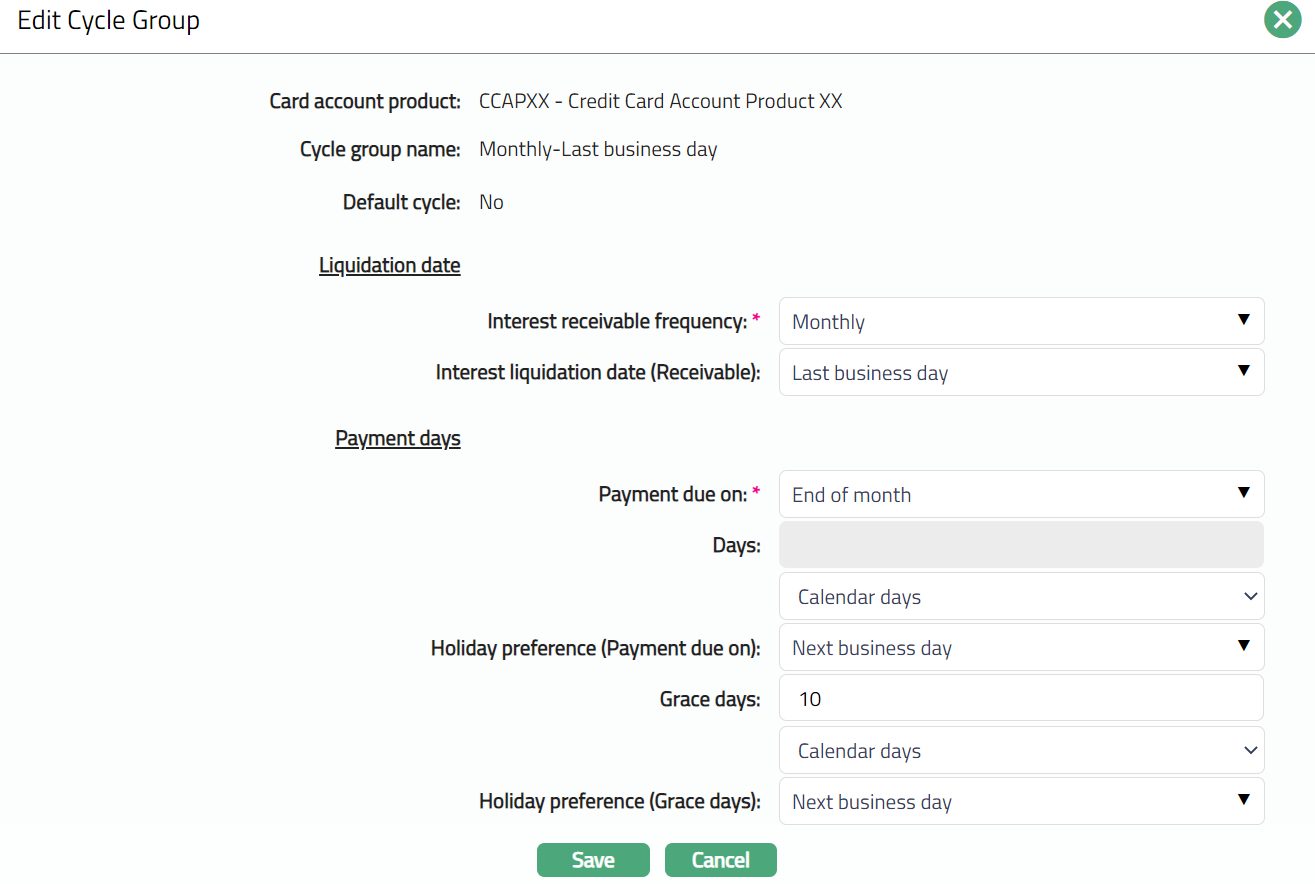

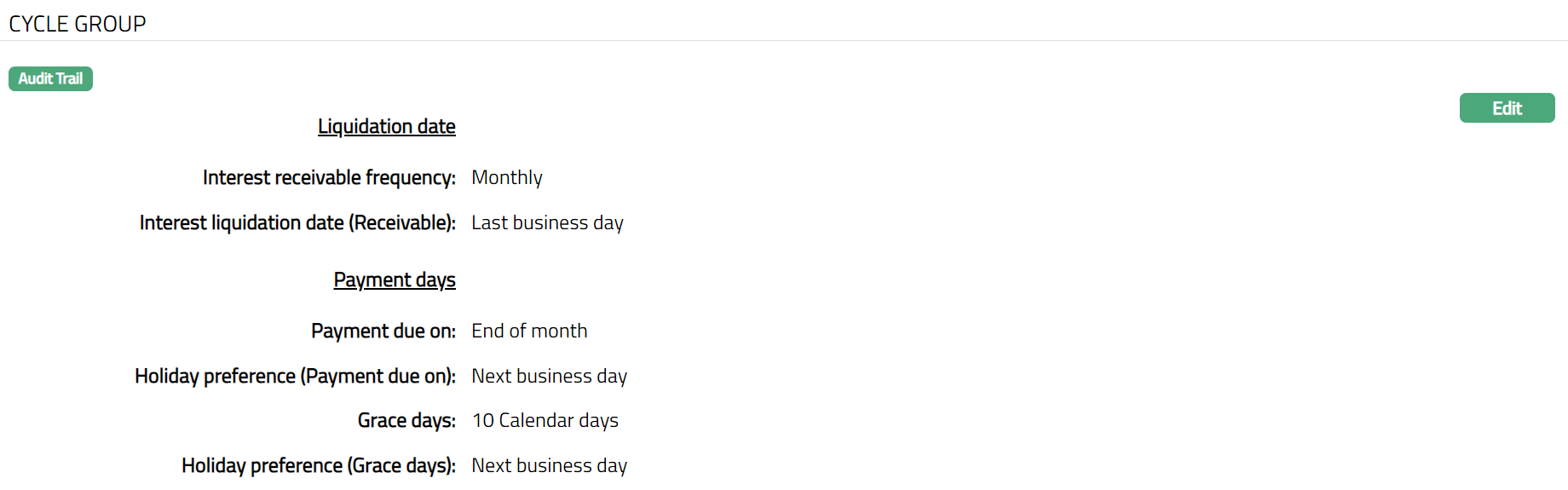

Cycle Group

This tab will allow you view and edit the Cycle group. Default Cycle group cannot be edited under this tab.

To edit Cycle Group

Access Cycle Group page.

- Click Edit. Edit Cycle Group page appears.

Note: Except Card account product, Cycle group name and Default cycle fields rest all other fields are editable.

- Click Save. Cycle Group Page appears with the edited details.

Function: Edit