Maintain Card Account

Card Account option allows you to maintain all the details of the card account. For any Card Account created under a Card Account Product, certain values from the Card Account Product will be defaulted, with an option to change some details at the account level. However, such changes at the Account will be subject to Restrictions that have been set at the Product.

When creating a card account, you can create as one of two types: Billing account or Transaction account. Billing Account determines which account interest and charges are debited from. It is also the account into which clients will make their payments.

An account can have only one Billing Account, whereas one account can be the Billing Account for more than one Transaction Account. The Billing Account itself may or may not be a Transaction Account. Once a Billing Account is set up for a certain Transaction Account, the same cannot be changed or edited. The currency of the Transaction Account and the Billing Account must be the same

When a Billing Account is chosen for a Transaction Account certain account parameter of the Transaction Account, like Interest receivable and Payable, are not applicable; and the Billing Account parameters will be applicable.

The tabs in the Card Account page is displayed in two sets: The first set of Profile, Overview, Status and Account Activity appear on the first row with an additional link More information. All the other tabs will be visible in the next rows only on click on More Information.

The following are the various tabs that appear on the Card Account page for a Card account.

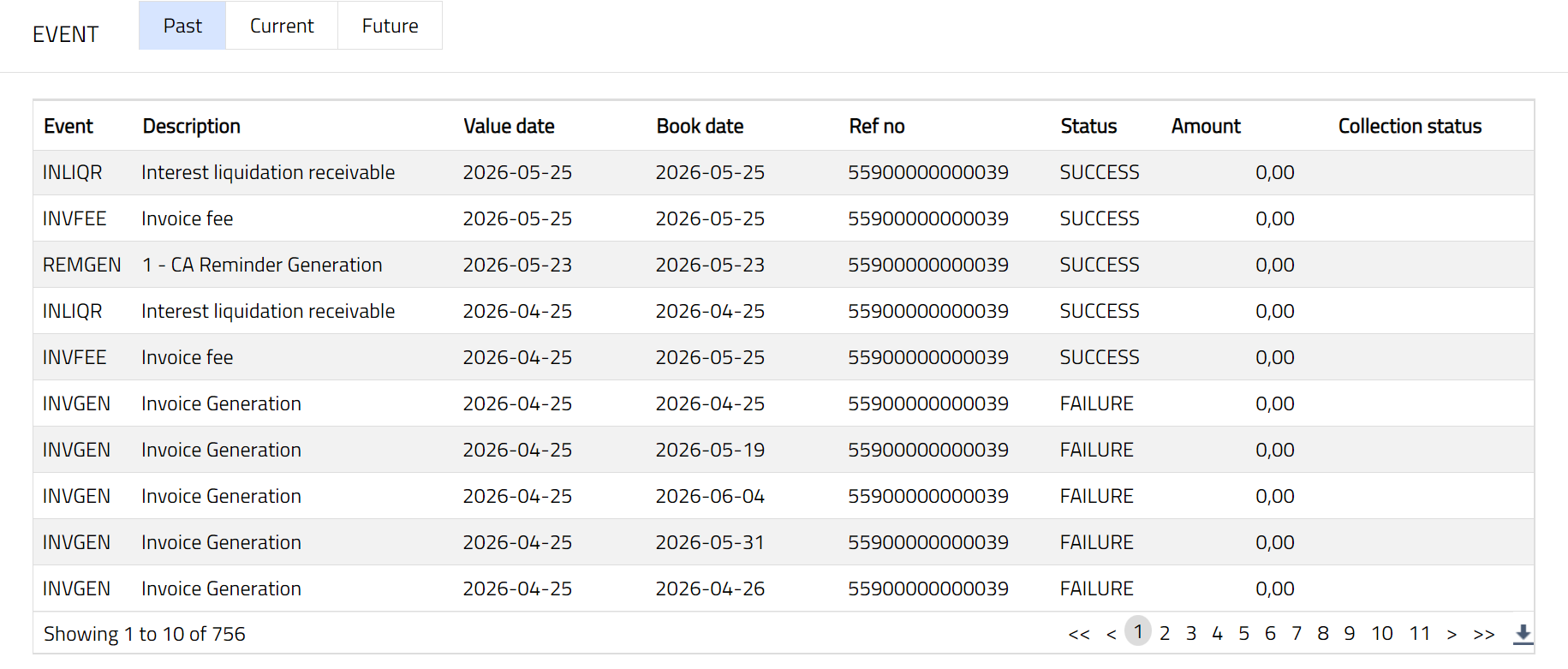

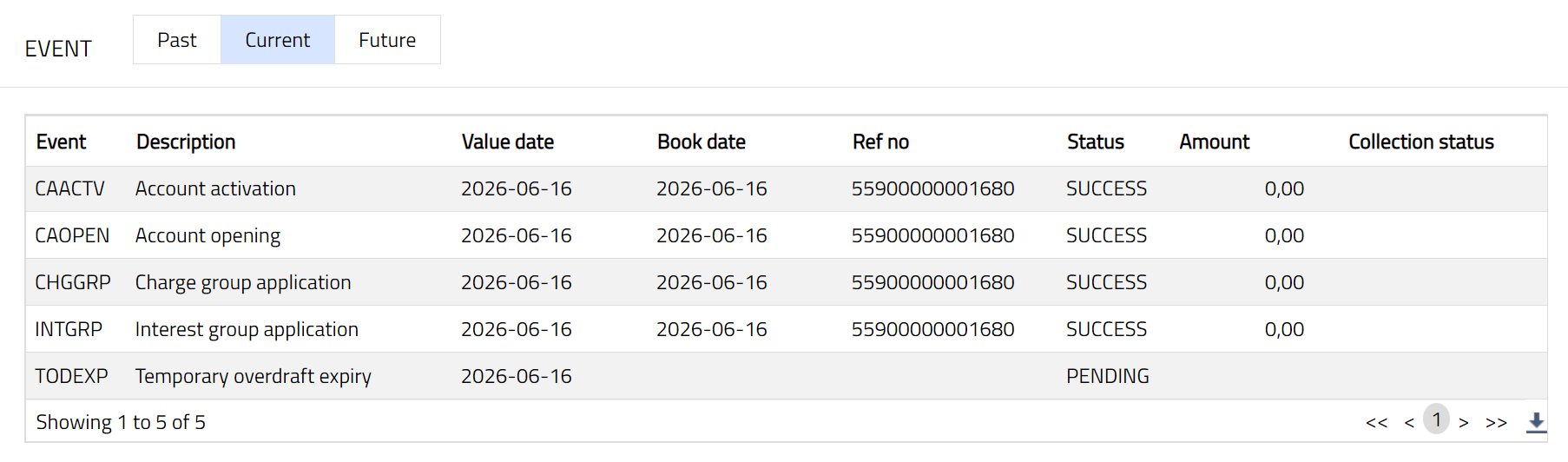

Past

Current

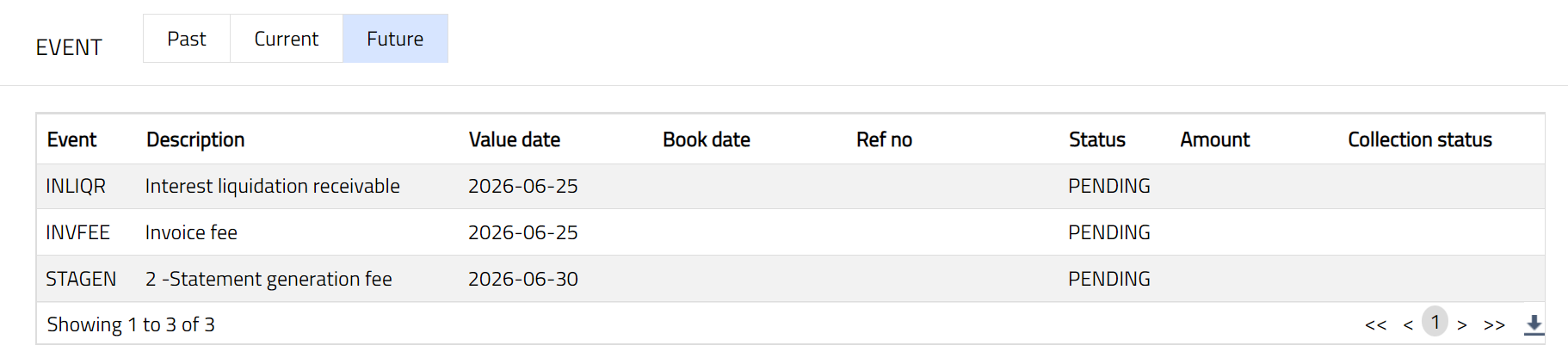

Future

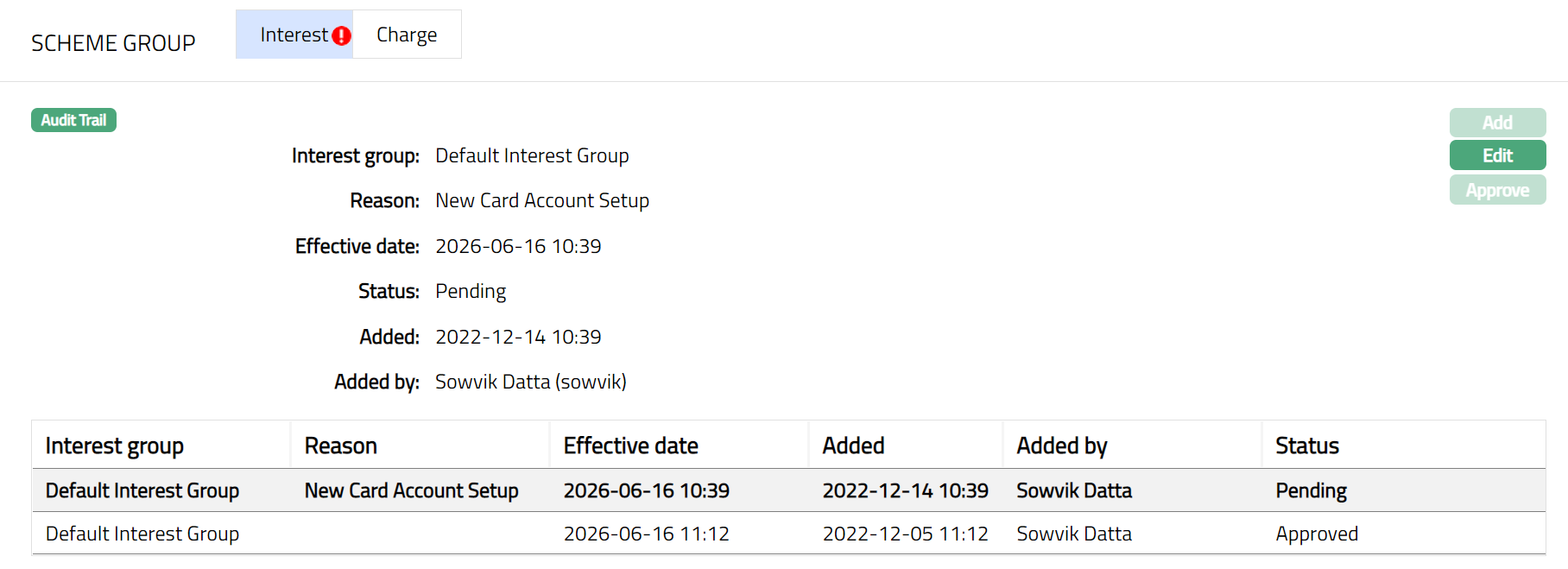

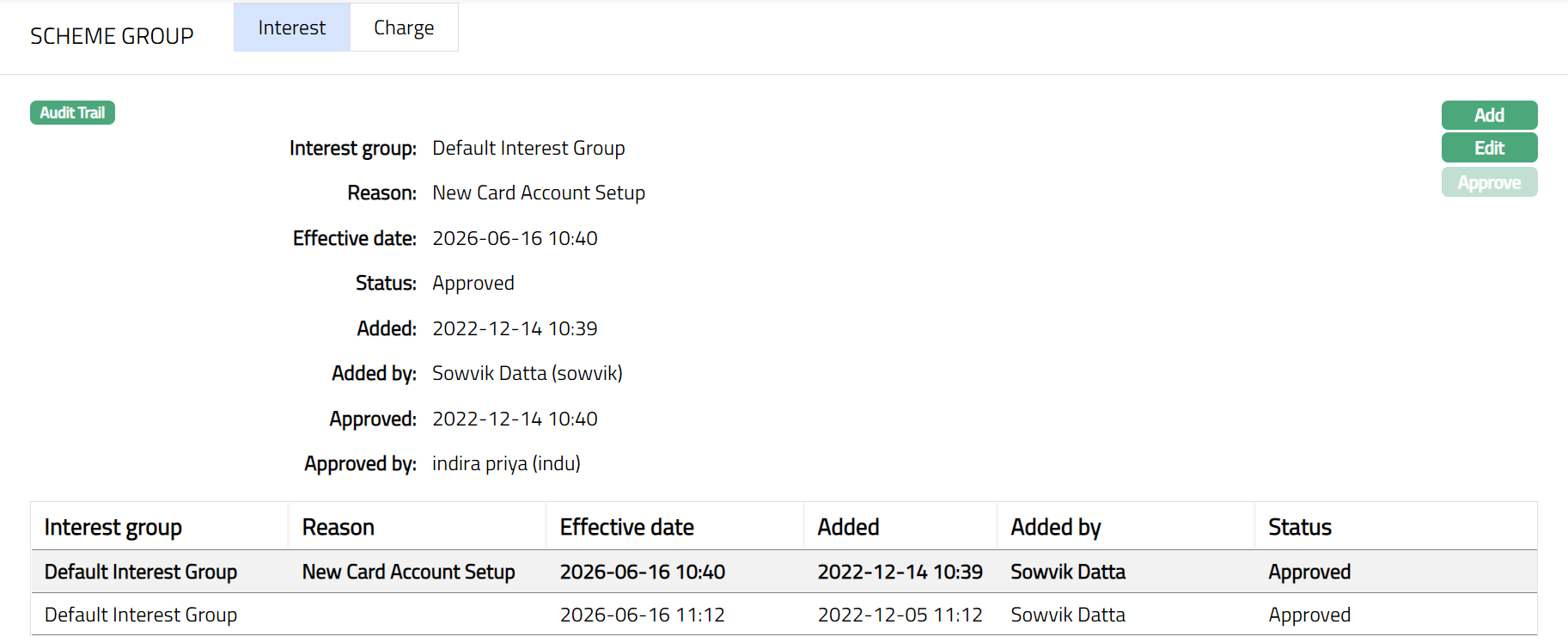

Interest

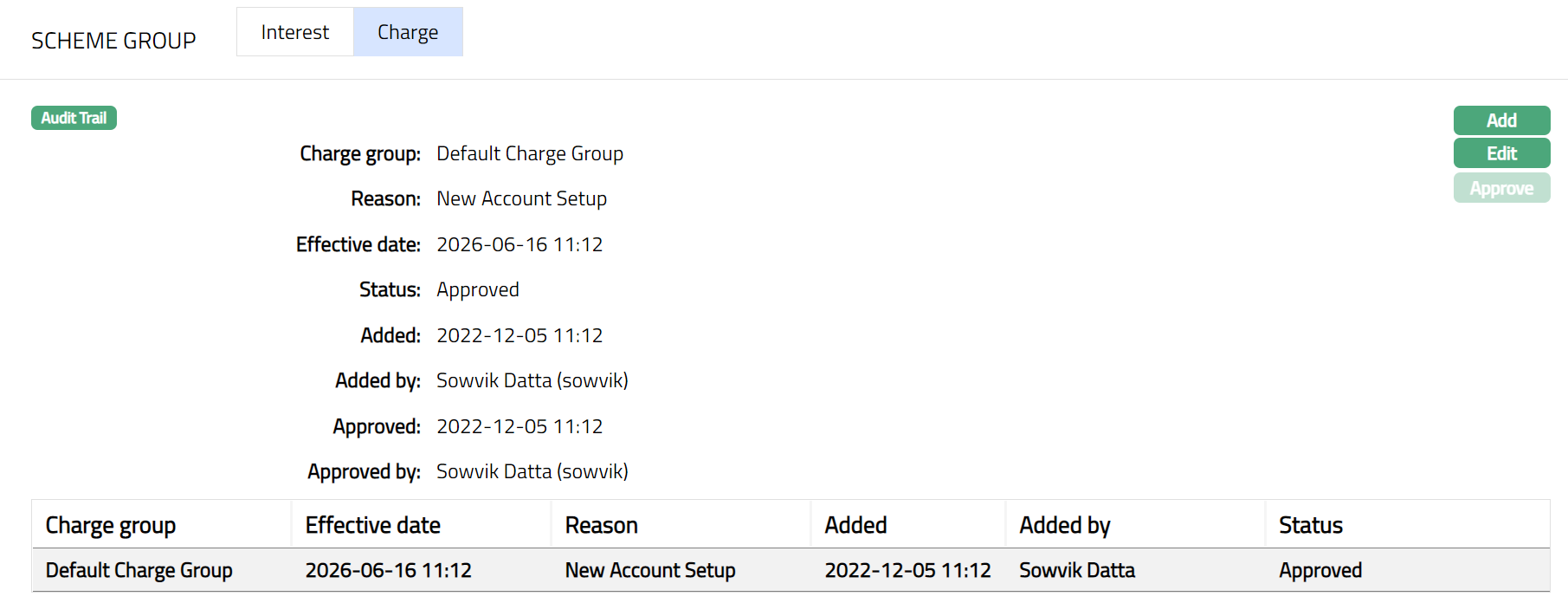

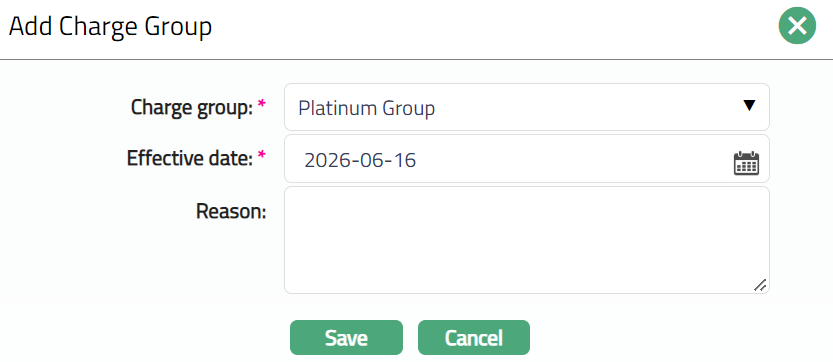

Charge

To add a card account,

- From Card menu, click Cards, and then Maintain card account. Card Account Search page appears.

- Click Add. New Card Account -- Details (1/5) page appears.

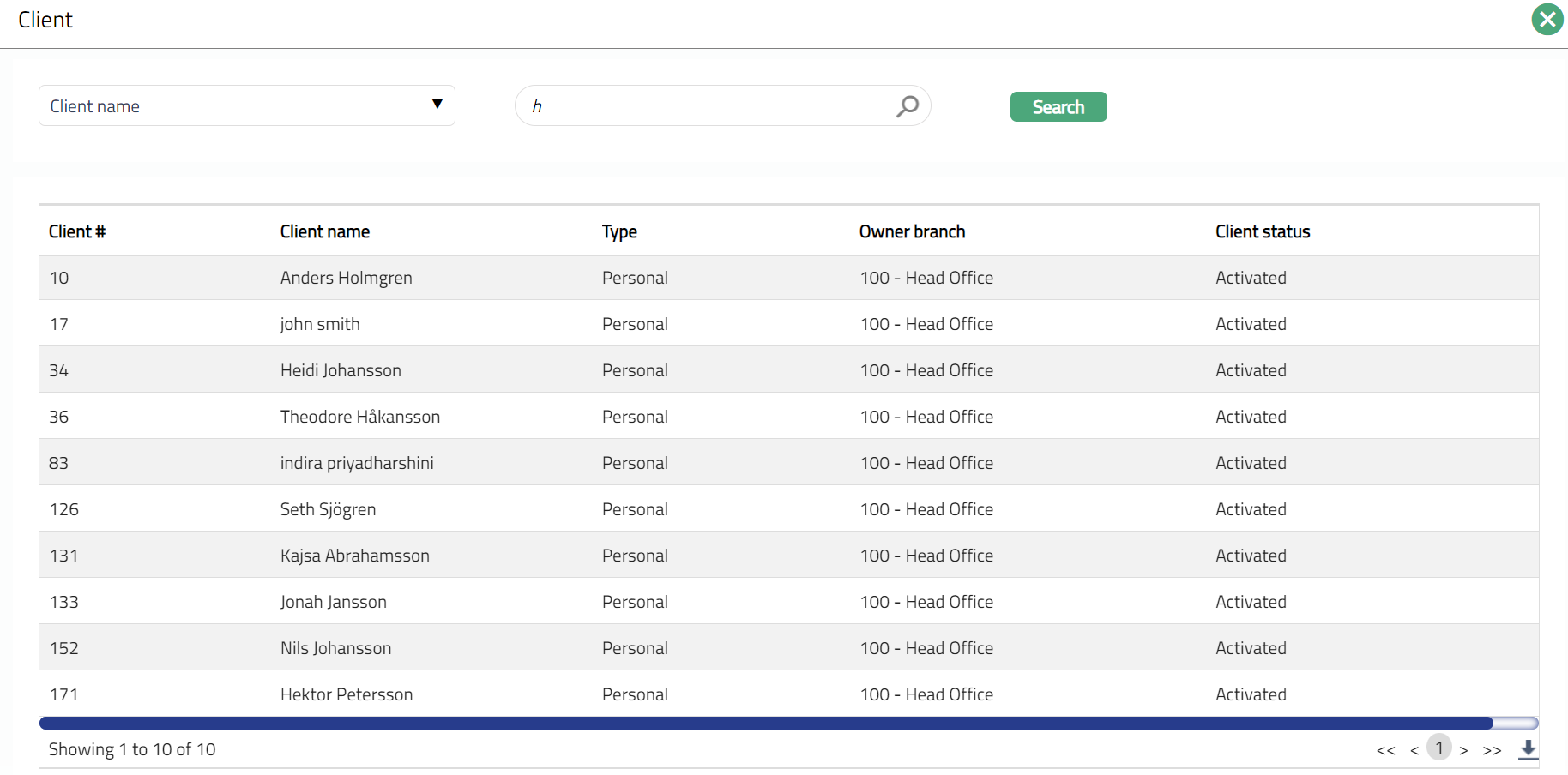

Select Client by clicking on client hyperlink. The Client search page appears with the list of Clients maintained under CRM > Clients > Maintain. You can search for a client with relevant criteria and select the required client. You can also input the client's name and select the required client from the list displayed by Aura.

Select Product from the drop-down list of active Products belonging to Type Card Account Product, where the client type defined for the Product matches the selected client. For example, if a selected client belongs to Client type Personal, then all the Products which are marked for Personal will be displayed.

Input if this new account will be its own billing account or if there will be a different Card Account that is to be treated as the Billing account for this new account. In the case of the former, input Billing account option as Same account, so that a Billing account is created; and in case of the latter, input the Billing account option as Different account so that a Transaction account is created. By default, Same account will be selected. If Same account is selected, then the Billing account field will be disabled and the Currency, Charge group and Interest group fields will be enabled. If Different account is selected, then the Billing account field will be enabled, and Currency and Interest group fields will be disabled.

Click the Billing Account hyperlink to select that Card account which will be the Billing account for this new account. This field will be enabled only in case of Transaction Accounts i.e., if you select Different account in the Billing account option field. In case of a Billing account, i.e., if you select Same account in the Billing account option, this field will be disabled and defaulted with the same account number on creation of the account. Select the required Billing account using the search criteria in the Card Account Search screen.

Select Currency for the card account from the drop-down list of the currencies maintained for the selected Product. Since only in case of a Billing account you can select the currency, this field will be enabled only if Same account is selected; in case of a Transaction Account, the currency will be the same as that of the billing account and hence this field will be disabled

Select Account branch from the drop-down list of all the branches which are allowed for the Product. By default, the user's logged in branch is selected. You can change as required. This is the branch in which the account is maintained.

Select Service delivery channel from the drop-down list. The Service delivery channels should have been maintained under Admin > System codes > Categories > Service delivery channel.

Select Charge group from the drop-down list of all the charge groups maintained for the selected Product.

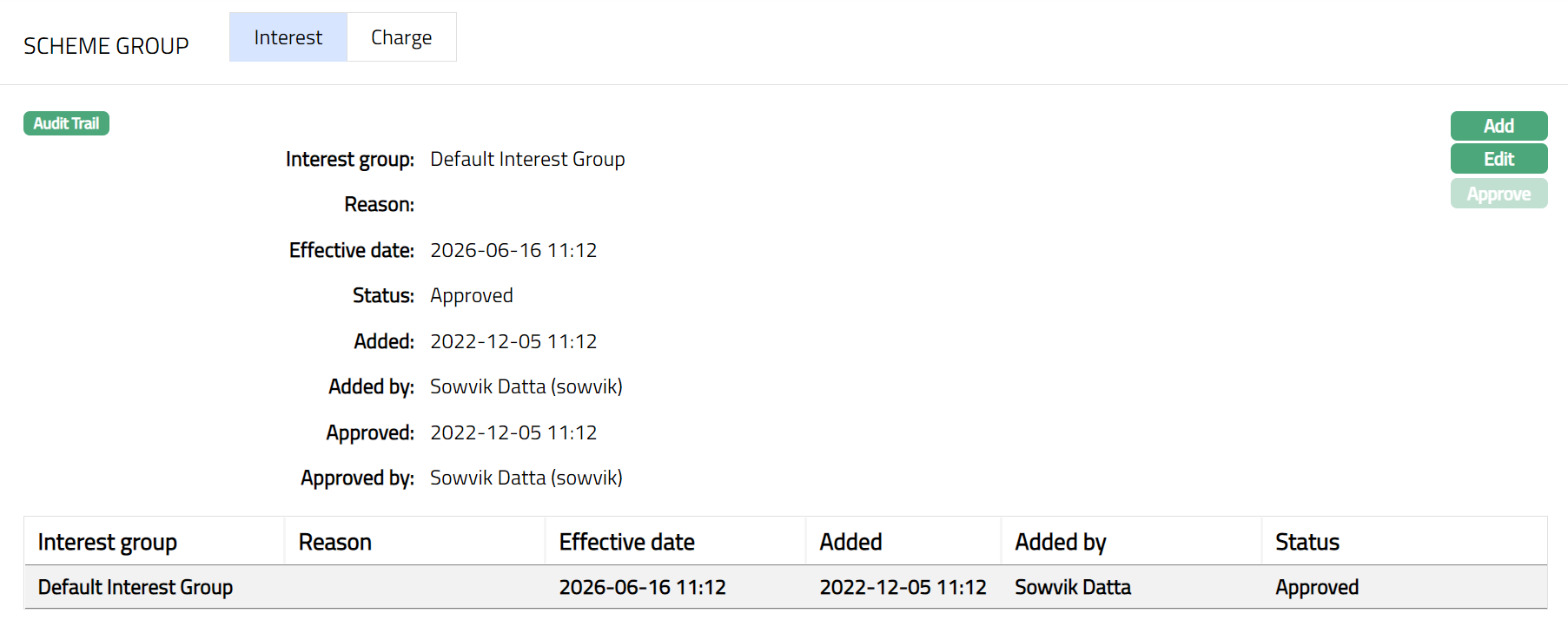

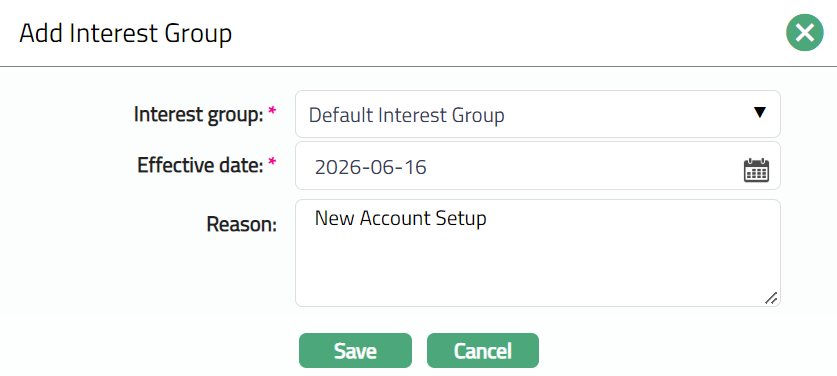

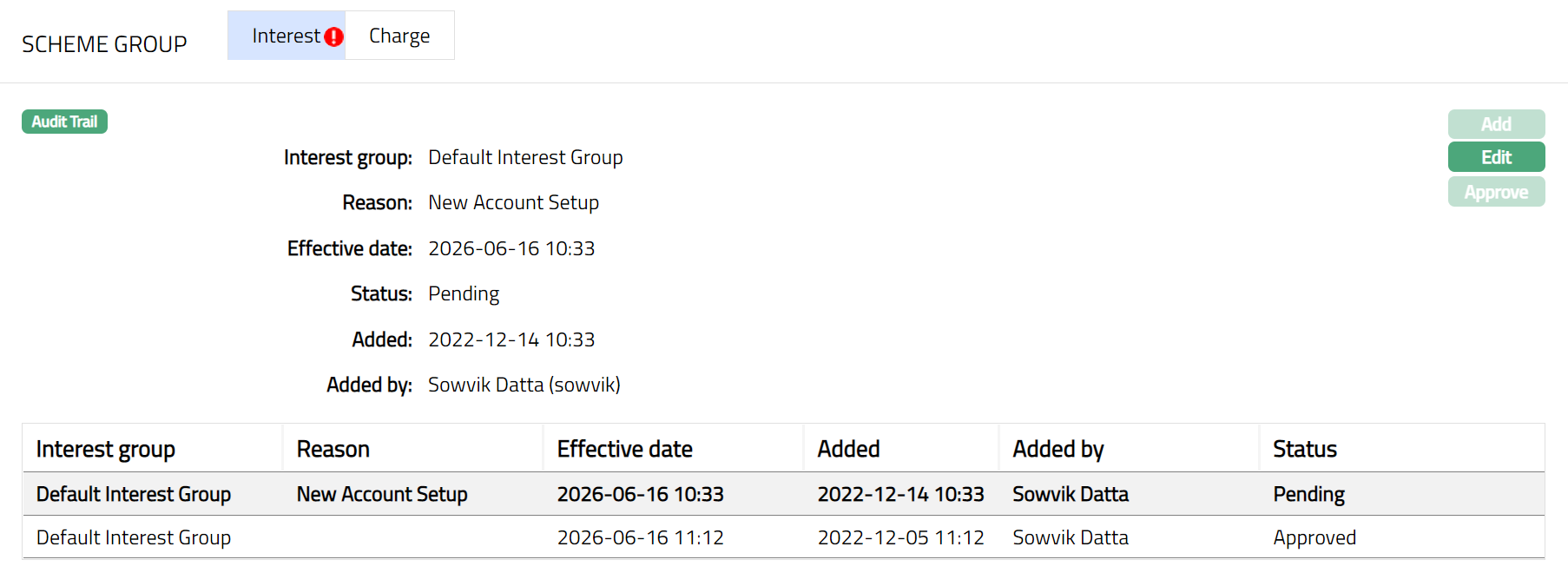

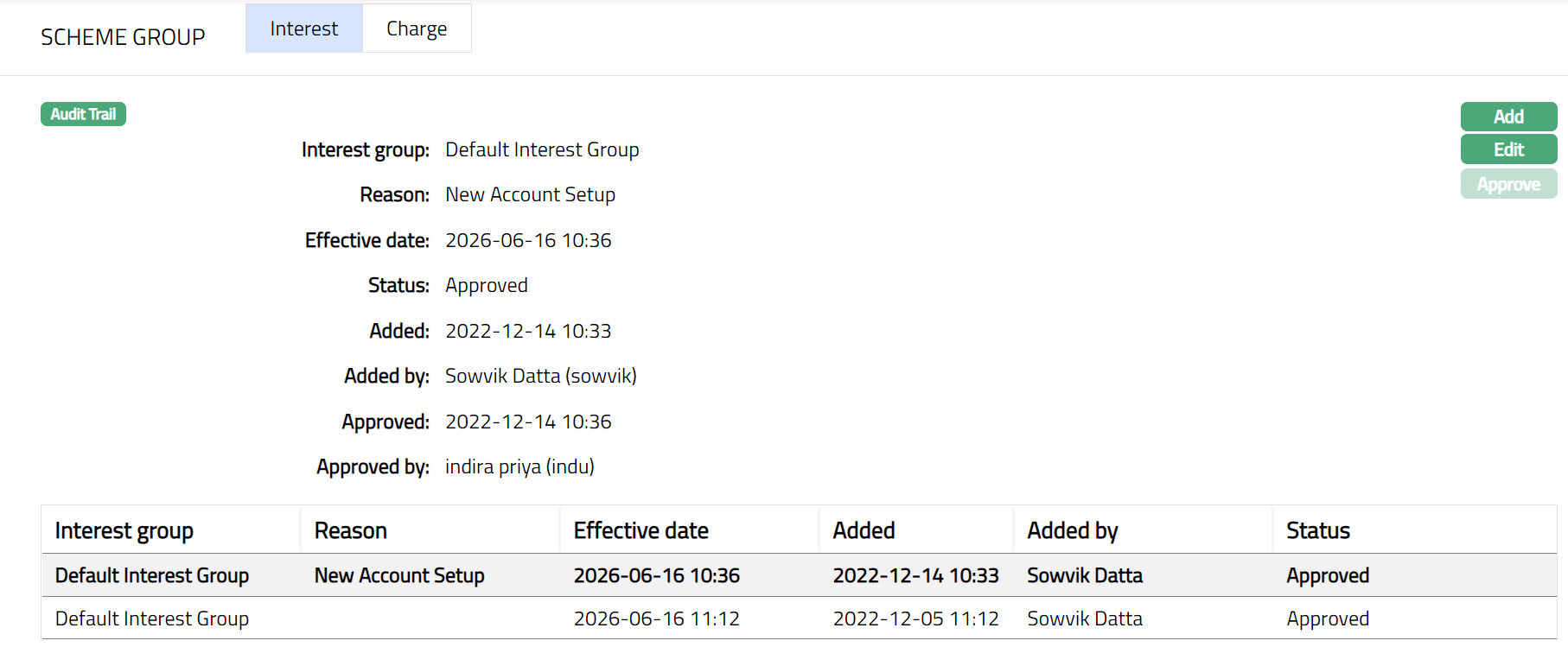

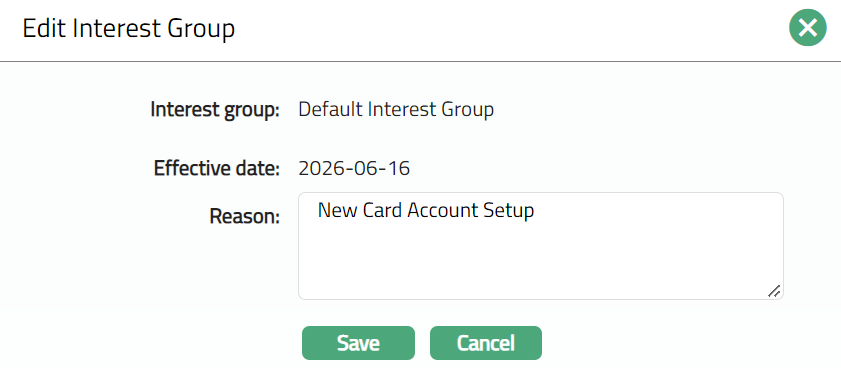

Select Interest group from the drop-down list of all the interest groups maintained for the selected Product. This field will be enabled only in the case of a Billing Account; and in case of a Transaction Account the Interest Group is inherited from the associated Billing account.

Select Cycle group from the drop-down list of all the Cycle Groups maintained for the selected Product at Cards > Settings > Cycle group. This field will be enabled only in the case of a Billing Account; and in case of a Transaction Account the Cycle Group is inherited from the associated Billing account.

Input how the account number has to be generated in Generate account number. If you want to auto-generate the account number, choose Next in sequence. If you want to give a specific account number for this account, choose pre-assigned number. In case of the former, Aura will generate account number internally using the account number mask maintained at the Entity level. The account number is unique across the Entity.

Account # will be enabled only on selecting pre-assigned number for Generate account number. Enter the required Account #. Aura will validate the Pre - assigned number against the account number mask maintained at the Entity level and also check if it is unique.

Enter Account name. This name will be used for the account.

Enter Account usage, i.e., the purpose of the account.

Select mode by which the client wants to settle the dues in the account in the Settle By field. The following are the available options:

Own account transfer: If the client wants to settle using his own card account or current account, choose this option. You need to enter the relevant account number (next field).

Direct Debit: If the client wants to settle the dues by way of a direct debit on an external account, choose this option. You need to enter the relevant Agreement reference number (next field).

Payment by invoice: If the client wants to settle the dues by any other mode based on the invoice that is sent, choose this option. You need to enter the relevant agreement reference number (next field).

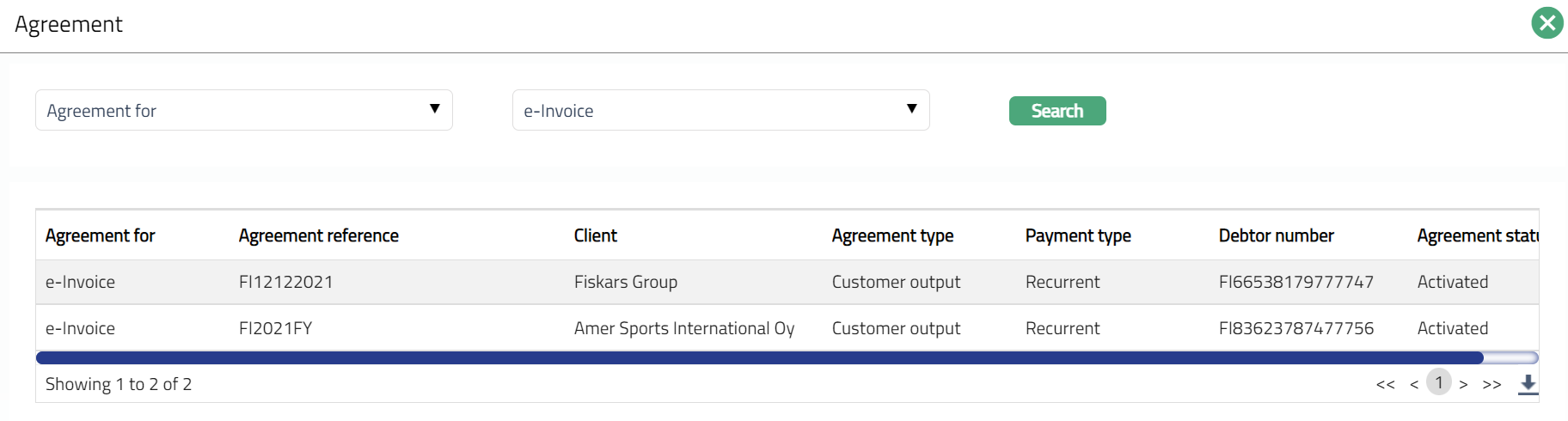

If Direct Debit or Payment by invoice option is selected in Settle by field, then the hyperlinked Agreement reference number will be enabled. If you click on the hyperlink, then the Agreement search page will appear with the list of all active Agreements. If Settle By is Direct Debit all agreements of the client where Agreement Type is Direct Debit will be shown. Similarly, if Settle By is Payment by invoice, all agreements of the client, where Agreement Type is Others and Agreement For is Invoice will be shown. Select the required agreement for the client.

If Own account transfer is selected in Settle By field, then the hyperlinked Own Account # will be enabled. If you click on the hyperlink, the Core Bank Account Search page appears with the list of all active accounts. Select the account from which you want the funds to be transferred to settle the card account dues.

If Auto-Create Reward Account is marked as Yes in the Product Settings, the relevant Reward account Product will be displayed. Else, this field is not displayed. Based on the Reward Account Product and the Reward Account Currency (next field), a Reward Account will also automatically be created, on creation of the Card Account.

If Auto-Create Reward Account is marked as Yes in the Product Settings, the relevant Reward account currency will be displayed. Else, this field is not displayed.

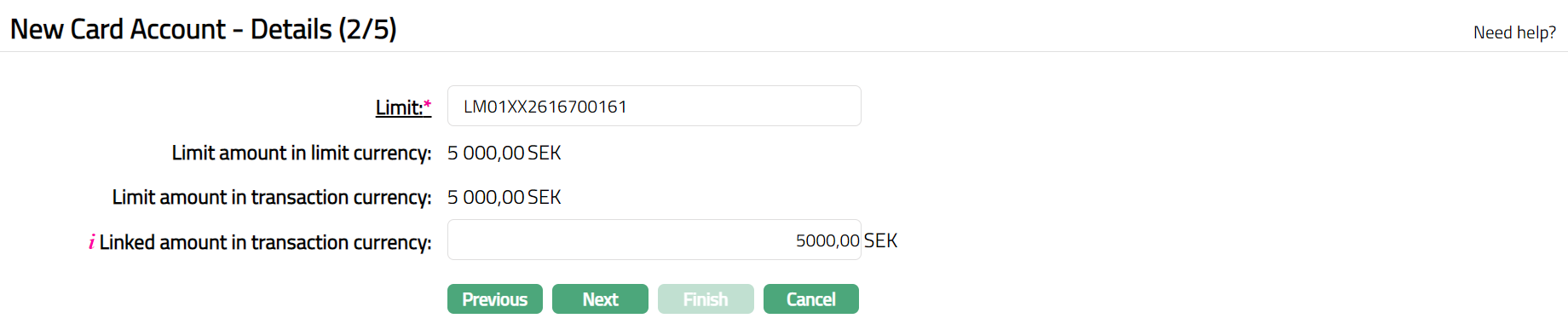

Click Next. New Card Account -- Details (2/5) page appears.

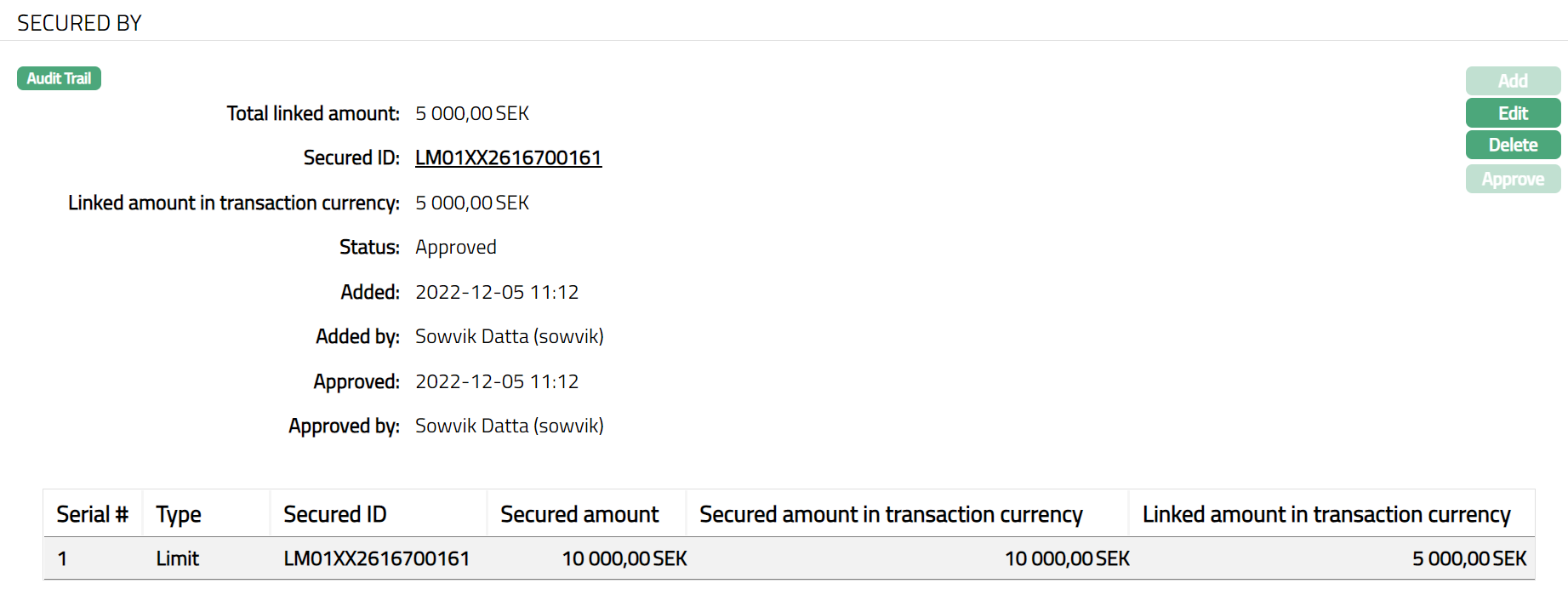

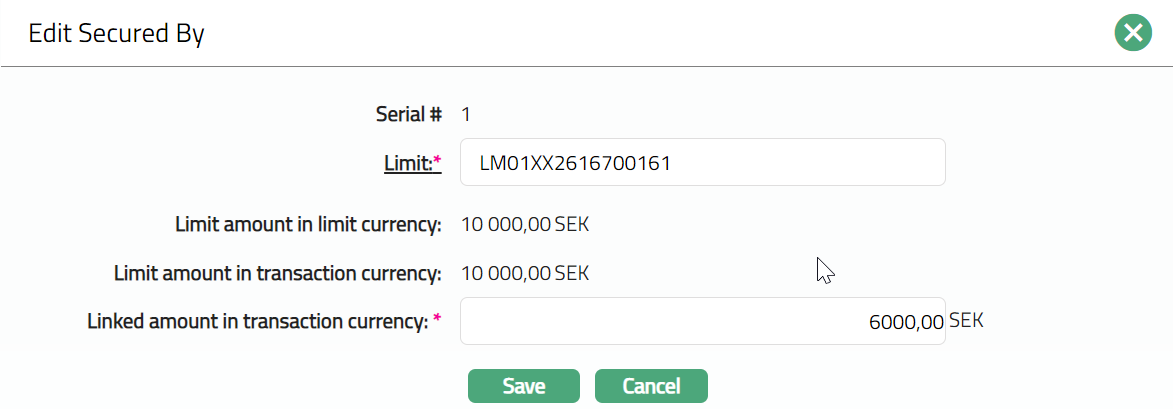

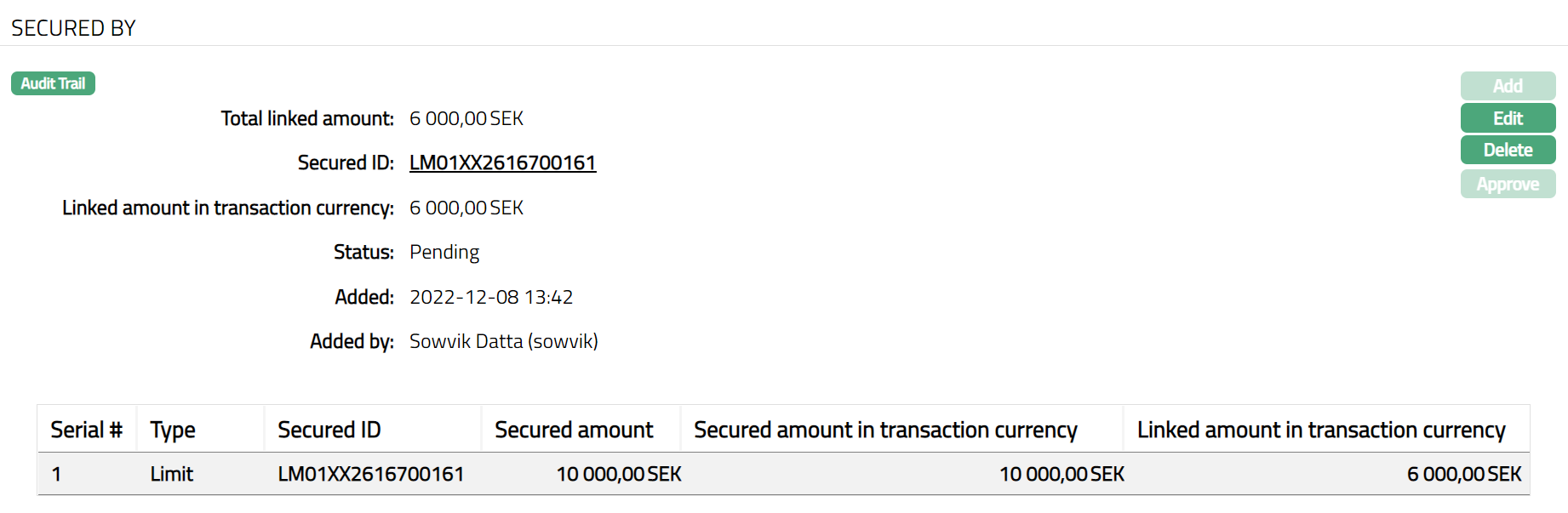

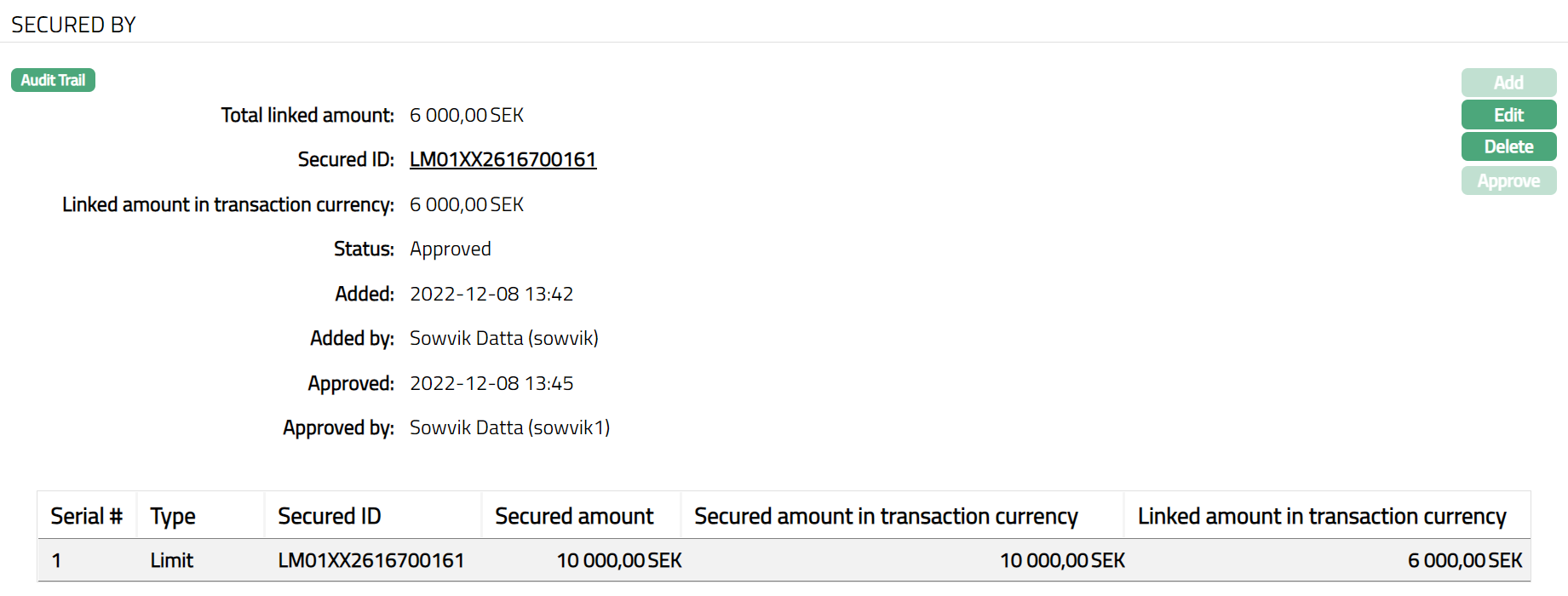

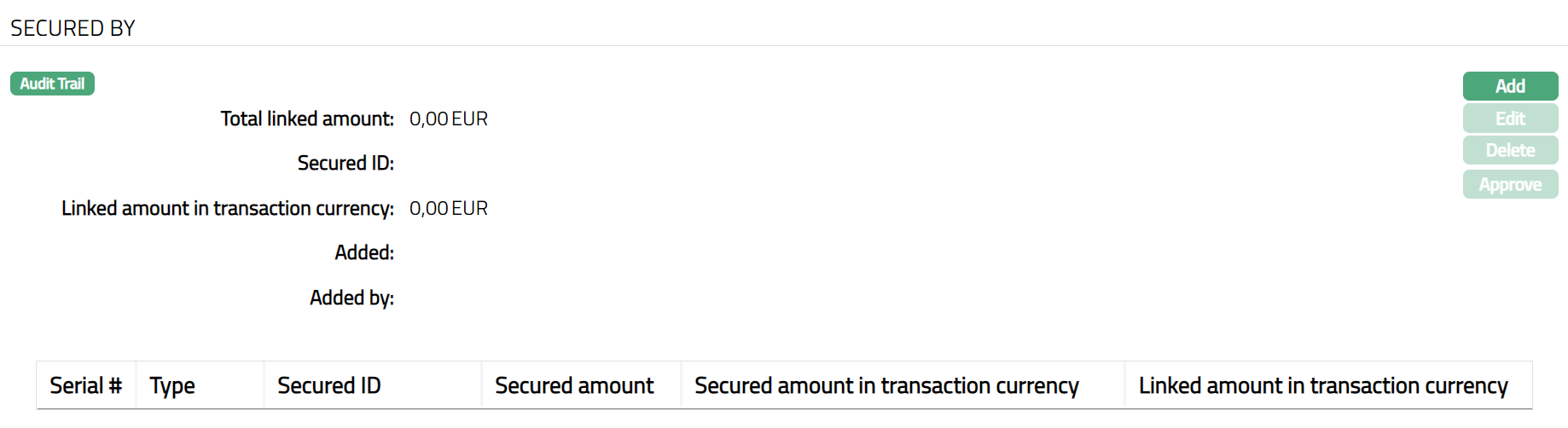

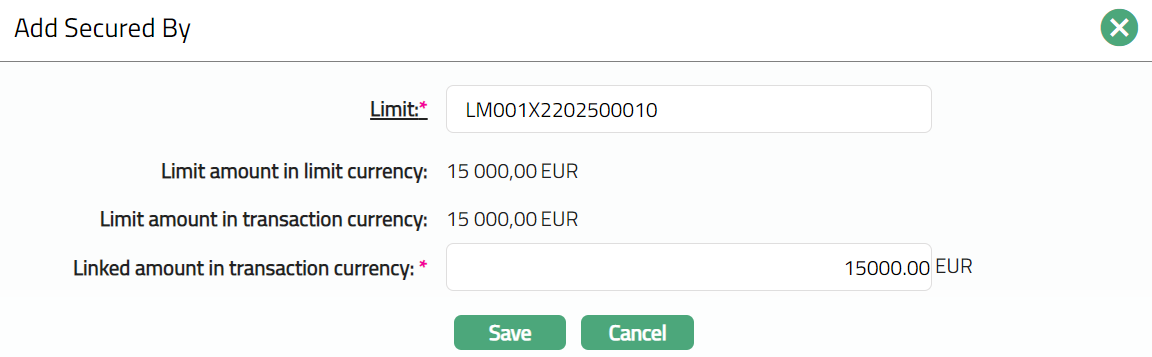

If you click on Limit hyperlink, then the Limit Search page appears with the list of all active revolving limits made available for the Client under CRM > Collaterals & Limits > Limits. Select the required limit for the client.

Limit amount in limit currency will display the unutilized amount of the selected limit id in limit currency by default. Aura will calculate the Limit amount as (Limit amount -- Utilized limit).

Limit amount in transaction currency will display by default the limit amount converted into the account currency. If Limit currency and card account currency are different, then the limit amount in limit currency will be converted into limit amount in transaction currency using the mid-rate of the rate type defined at the entity level.

The Linked amount in transaction currency will by default display the Limit amount in transaction currency. You can enter the actual limit amount that is to be available for this account here, subject to the maximum of the Limit amount in transaction currency shown above.

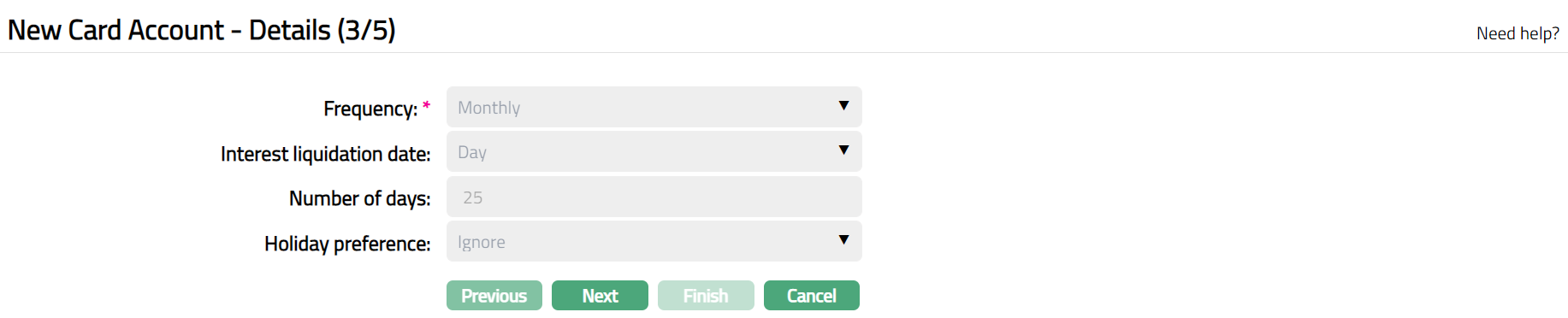

Click Next. Depending on whether it is a Billing Account or a Transaction Account, the next screen will change. In case of Transaction account, The New Card Account - Confirmation (3/3) appears. (Refer to Confirmation screen at the end of the section). In the case of Billing account, The New Card Account -- Details (3/5) page appears as shown below.

Note: All the values are defaulted from the Cycle Group chosen in The New Card Account -- Details (1/5) page and are disabled:

Frequency.

Interest liquidation date.

Number of days

Holiday Preference.

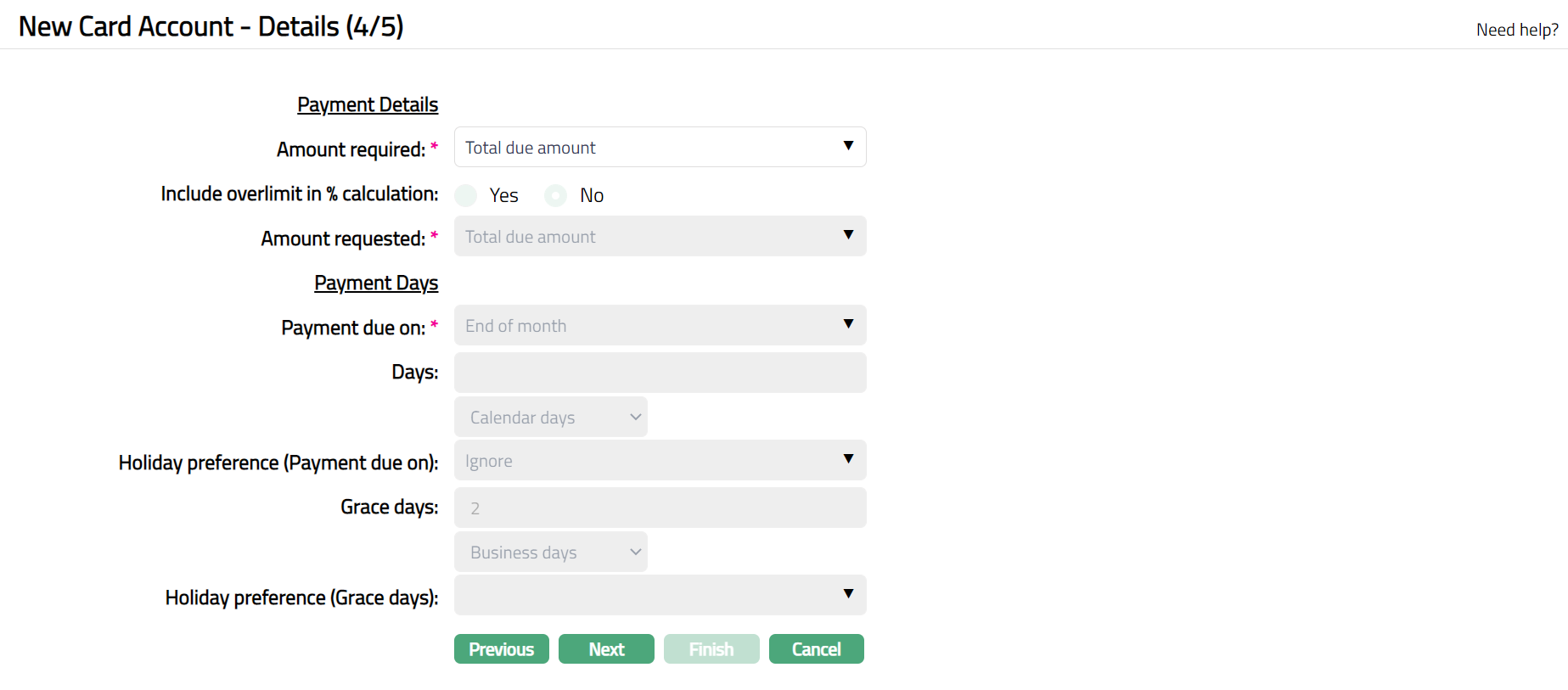

- Click Next. The New Card Account -- Details (4/5) page appears. This page will not be displayed for a Transaction Account.

The Payment Details are defaulted from Product and can be changed at the account level, subject to Restrictions that have been set up for the Product.

The Amount required is the minimum amount that the customer has to pay to avoid overdue interest or any overdue-related charges / status changes. The value for the amount required is defaulted from the Product. You can change the amount required by changing the option.

The available options are:

- Partial Amount: If you want the customer to pay only a part amount of the total outstanding amount due for payment, choose this option. If you choose partial amount here, then Aura will ask to enter the percentage of the outstanding amount.

- Total Due Amount: If you want the customer to pay the total outstanding amount due for payment, choose this option.

If Partial amount is selected in the Amount required field above, % of total outstanding will be enabled. The value for the % of total outstanding is defaulted from the Product. If you want to change the % of the total outstanding, then enter the % of total outstanding amount that needs to be paid on the payment due date.

If Partial amount is selected in the Amount required field above, Rounding rule will be enabled. This rule is used to round the Amount required. The value for the Rounding rule is defaulted from the Product. The following options are available:

Up: This option rounds the Amount required up to a higher amount.

Down: This option rounds the amount required down to a lower amount.

None: This option does not round the amount required and gives the exact calculated figure.

- If Partial amount is selected in the Amount required field above, Rounding Unit is enabled. The value for the Rounding unit is defaulted from the Product. You can specify how much the rounding rule should be applied. The available options are:

1

5

10

50

100

Example:

If total balance is (-) 3427.60 and % of total outstanding is 5% and

Round up is marked as 1, then amount required will be calculated as 172

Round up is marked as 10, then amount required will be calculated as 180

Round up is marked as 100, then amount required will be calculated as 200

Note: The Amount required cannot be greater than the total balance outstanding in the account. If it is so during invoice generation, then the total balance outstanding becomes the Amount required.

- The value for the Minimum amount is defaulted from the Product. If the amount calculated using the % is less than the Minimum amount specified here, then, the Minimum amount specified here becomes the Amount required.

Examples:

a. The amount required is 5 % of balance, minimum 10. Total card usage and hence, outstanding = 150. Amount required = 5% of 150 = 7.5, subject to minimum of 10, and hence, 10

b. The amount required is 5% of balance, minimum 10. Total card usage and hence outstanding = 300. Amount required = 5% of 300 = 15, subject to minimum of 10 and hence, 15.

Include Over limit in % calculation enables you to specify how the amount required is to be calculated when the account balance is over limit. By default, it will be No which means the over limit amount will be added in full; if checked, the over limit will be included in the % calculation and the amount required will be a % of the current due amount (including over limit).

The value for the Amount requested is defaulted from Product. If you want to change the Amount requested, then select the Amount requested from the available options. If Total due amount is selected in the Amount required field, then Amount Requested will be defaulted to Total due amount and disabled. If you choose Partial amount in the Amount required field, then Amount Requested can be either Total due amount or Partial Amount.

The Payment Days values are defaulted from the Cycle Group chosen in The New Card Account -- Details (1/5) page and cannot be edited.

Payment due on

Days.

Holiday Preference

Grace days

Holiday Preference (Grace days)

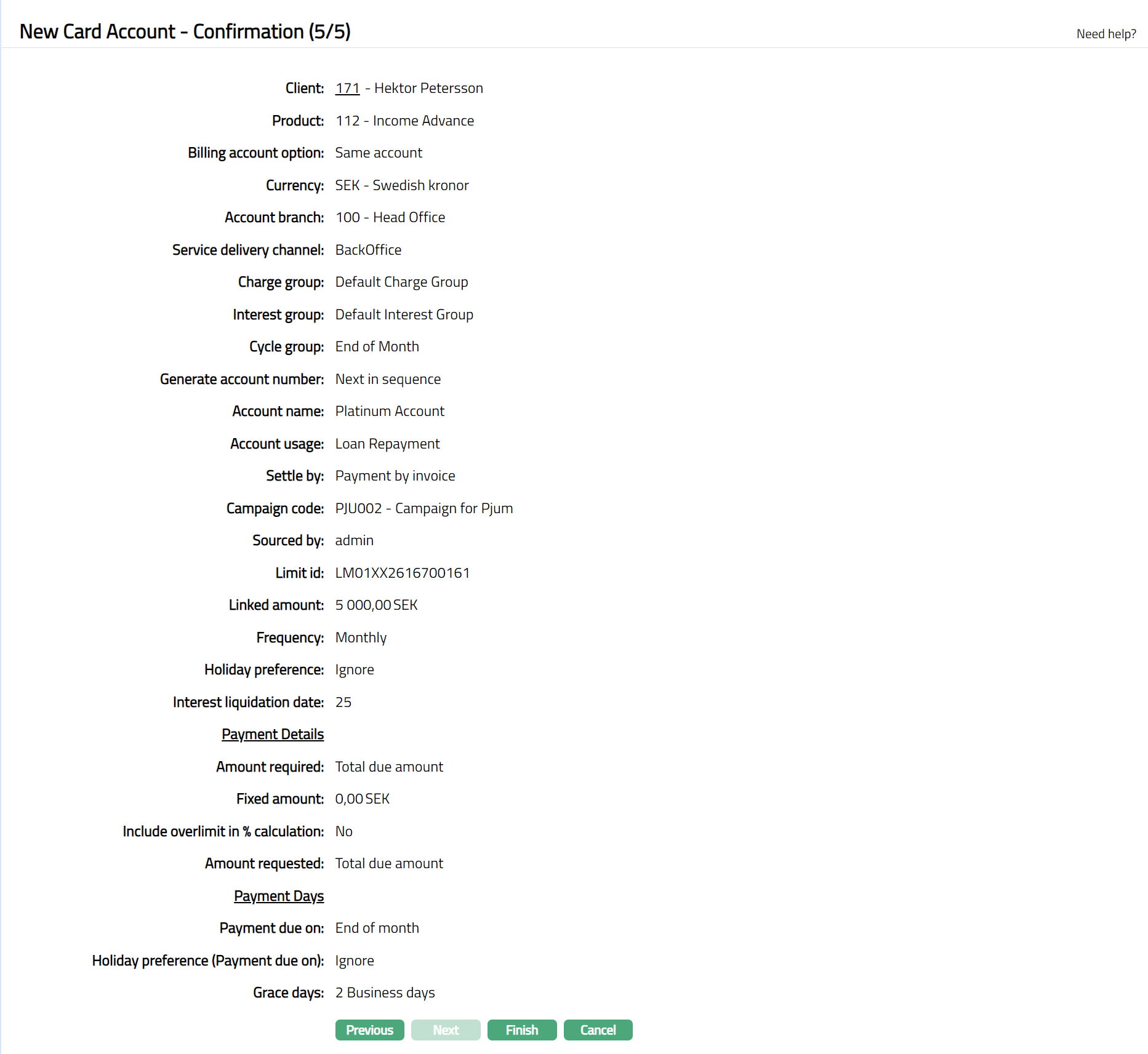

- Click Next. The New Card Account - Confirmation (5/5) page appears.

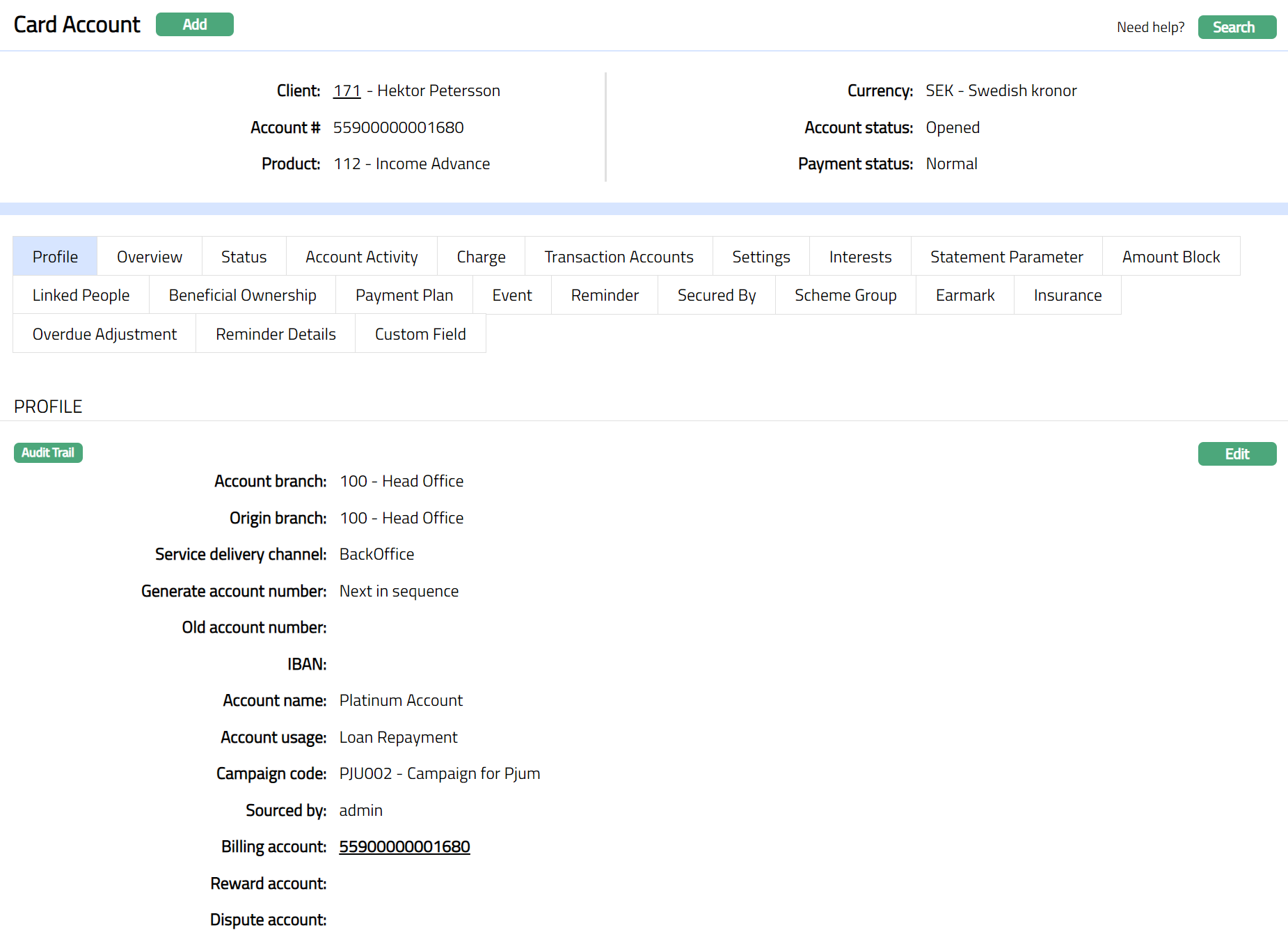

- Click Finish. Card Account page appears displaying the Profile tab of the Account you added.

Functions: Add, Search

Note: On creation of the account, the Account Status by default will be Opened. Only when the account status is Activated and record status is Approved, the account becomes effective, and transactions can be posted in the account.

To activate the account,

- Add Activated Account status using Account Status tab. This will make the Account Status Activated, but the record status is Pending.

- Another user should approve the Activated Account status, so that the record status becomes Approved.

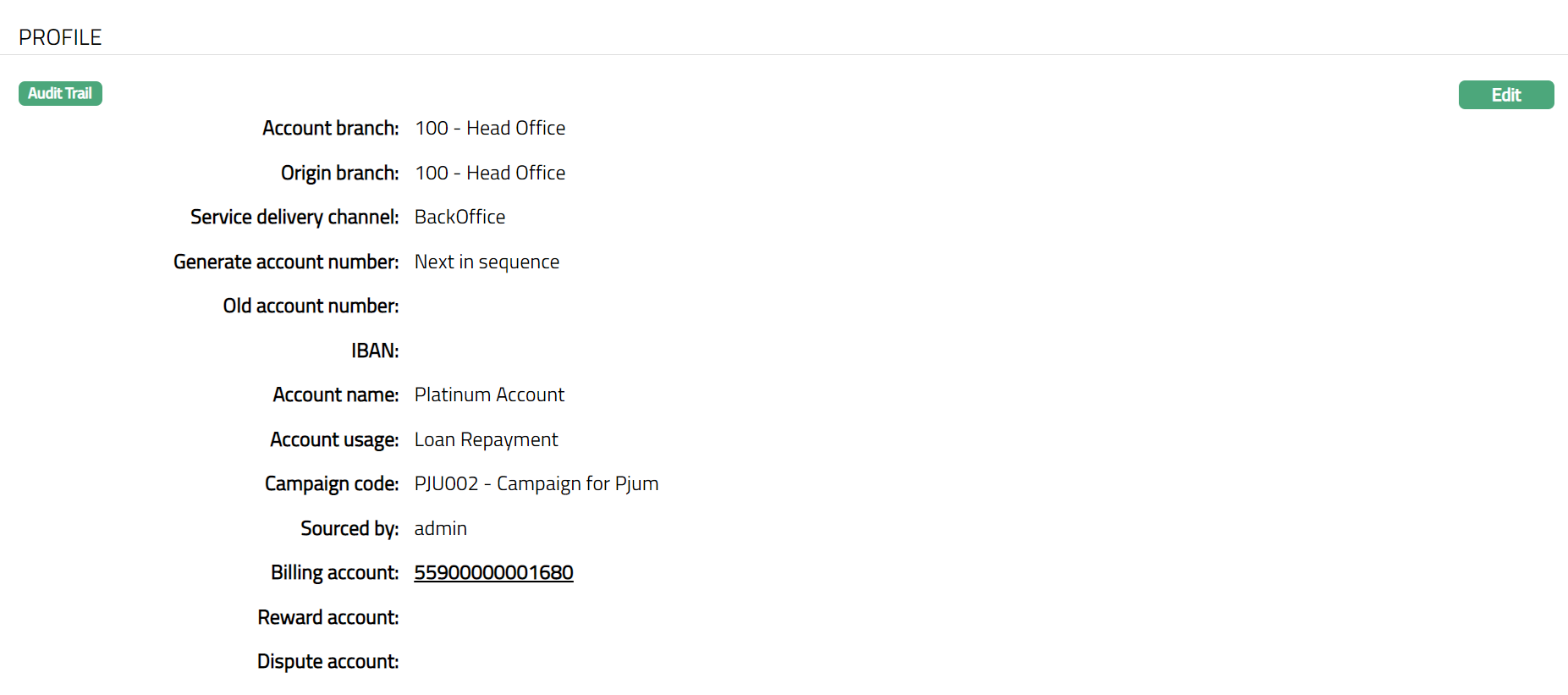

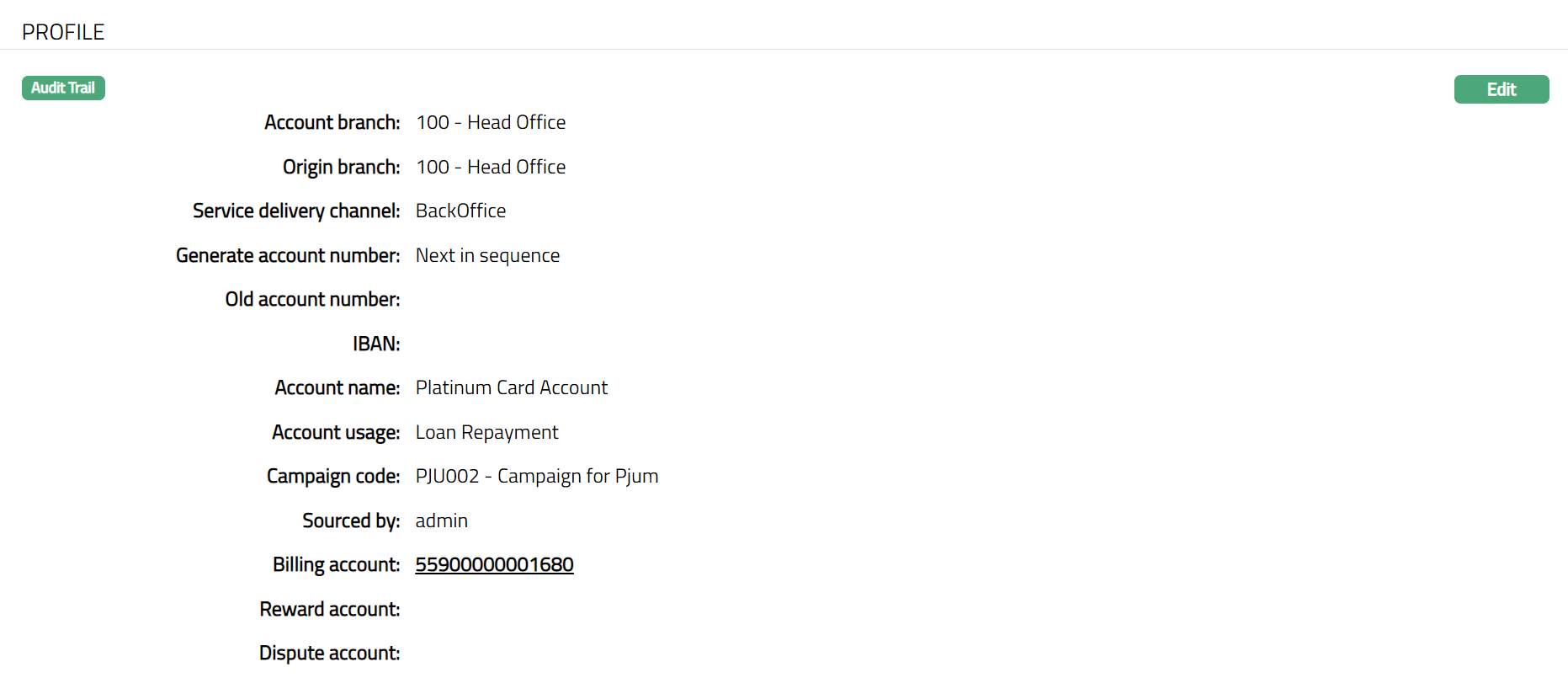

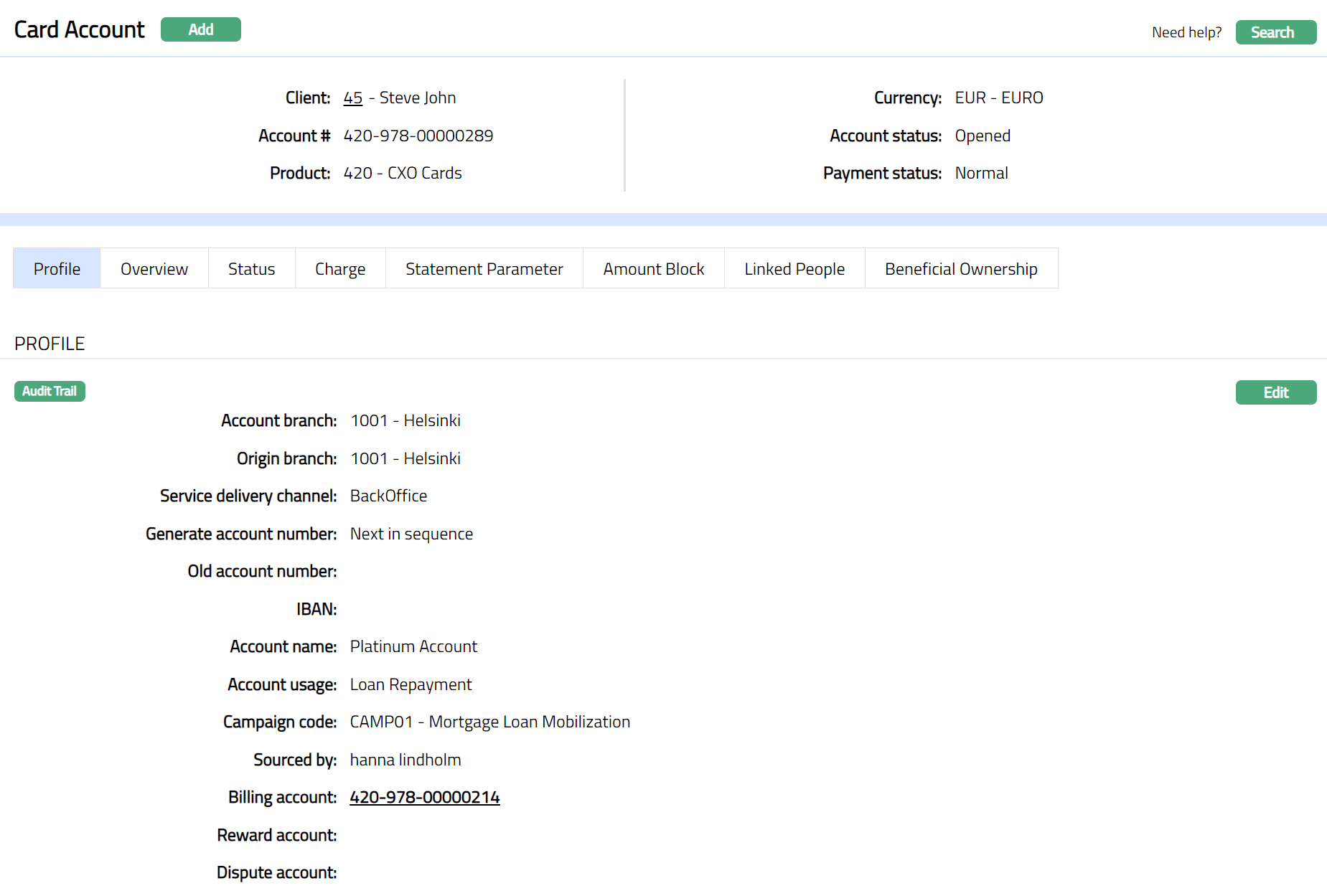

Profile

Profile tab, which is the default tab in the Card Account screen, shows the basic details of the Card Account of the client.

- Access Card Account page and click Profile tab to view the details as per sample below. The details are defaulted from the entries that you made during New Card Account creation. For details refer to New Card Account -- Details (1/2).

The additional fields that you can view in the Profile tab are explained below:

Origin branch denotes the branch name where the Account was created. This field is non-editable.

Old Account number can be used to record the earlier account number, say, from a legacy system, for purposes of reference. You can enter the same during Edit.

Aura displays the IBAN for the Account. IBAN is generated only if you have selected IBAN generation required at Product level. This field is non editable.

Billing Account displays the account number under which billing will be done. It is a non-editable field. In case of Billing accounts, this will show the same account number; while in case of Transaction accounts, this will show a different account number.

Bonus Account is the account where the bonus points get accumulated. It is non-editable field. It will be displayed only in case a Bonus account is mapped to the card account.

Dispute account displays the account number which contains the disputed balance. It is non-editable field. It will be displayed only in case a Dispute account is mapped to the card account.

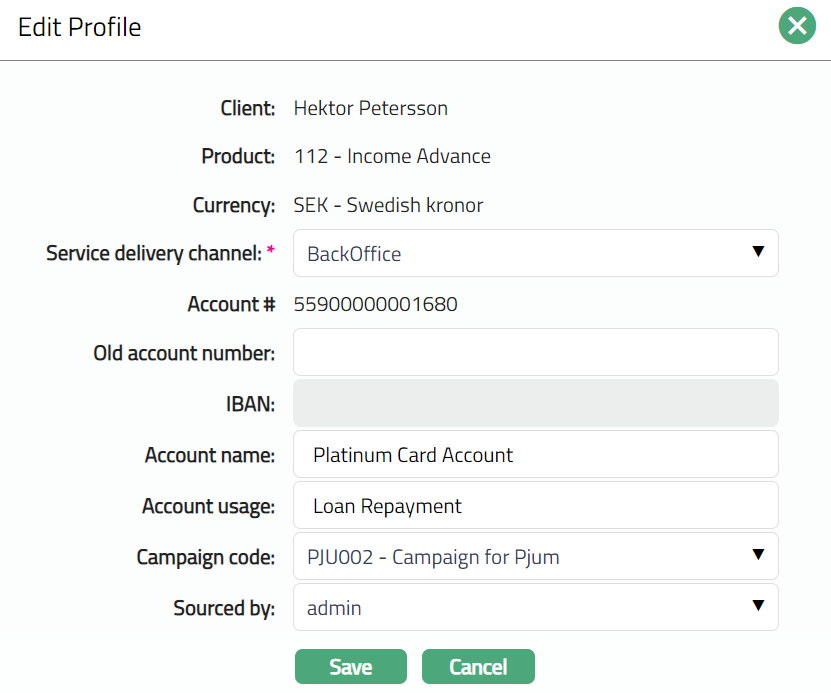

To edit Profile:

- Access Card Account page. The Profile tab is displayed by default.

- Click Edit. Edit Profile page appears.

Note: The editable fields are as follows:

Service delivery channel

Old account number

Account name

Account usage

Campaign code

Sourced by

- Click Save. Profile page appears with the edited details.

Functions: Edit

Functions: Edit

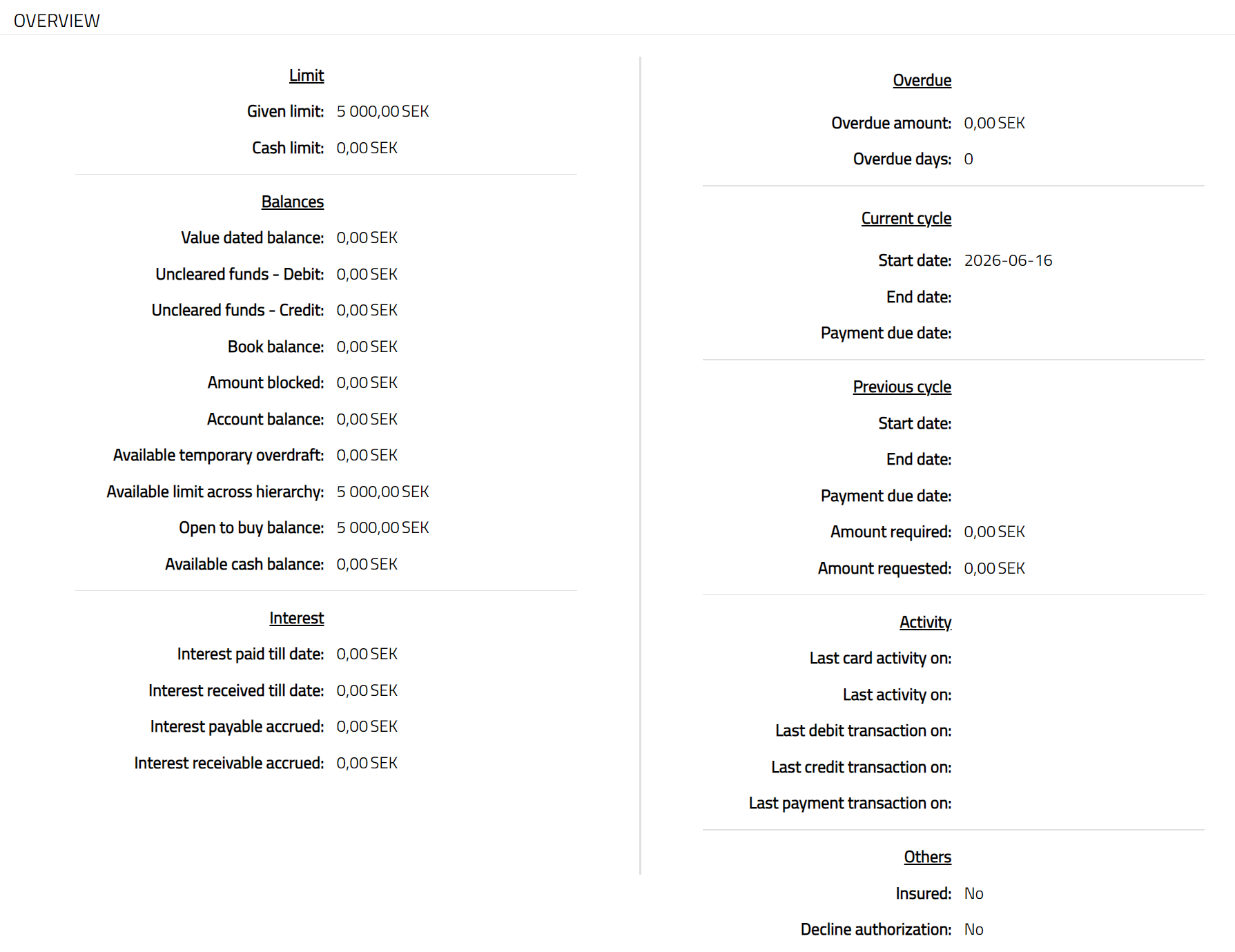

Overview

The Overview tab allows you to see various details of an account to get an immediate overview of the account in terms of the various balances in the account and details of the current cycle, past cycle and overdue. It also shows information on the interest and general activities in the account. The fields that you see would depend on whether it is a Billing account or a Transaction Account.

To view the account details

- Access Card Account page and click Overview tab to view the details.

Given limit is the total limit amount attached to the Card account while creating an account. The value is derived from the Secured By tab. This is a static amount.

Cash Limit is the Approved cash limit amount. This is that part of the Credit Limit that will be available as the Cash Limit for the account. This will be calculated using the Approved Cash Limit% and the Secured Limit. The value is derived from the Settings tab.

Value dated Balance will display the current value dated balance in the account. This will be shown as a negative amount in the case of Debit balance and as a positive amount in case of Credit balance.

Uncleared funds -- Debit denotes the total amount of future value dated debits for the account. In case of negative debits (say, for a reversal) with a future value date, it will be shown under Uncleared funds -- Credit.

Uncleared funds -- Credit denotes the total amount of future value dated credits for the account. In the case of negative credits, (say, for a reversal) with future value date, it will be shown under Uncleared funds -- Debit.

Book balance will display the current book dated balance. The Book balance will be calculated as Value dated balance -- Uncleared Funds Debit + Uncleared Funds Credit. This will be shown as a negative amount in the case of Debit balance and as a positive amount in case of Credit balance.

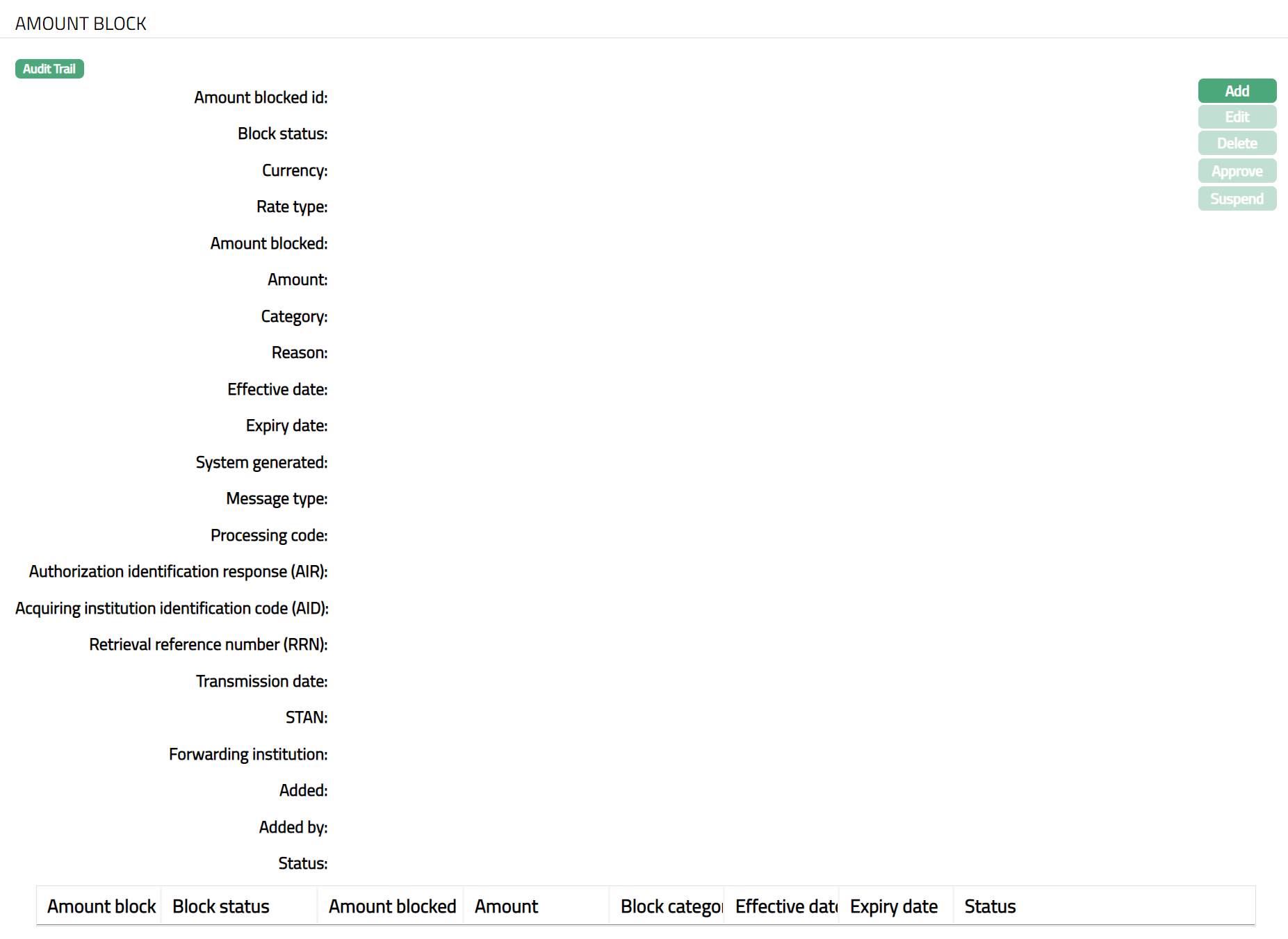

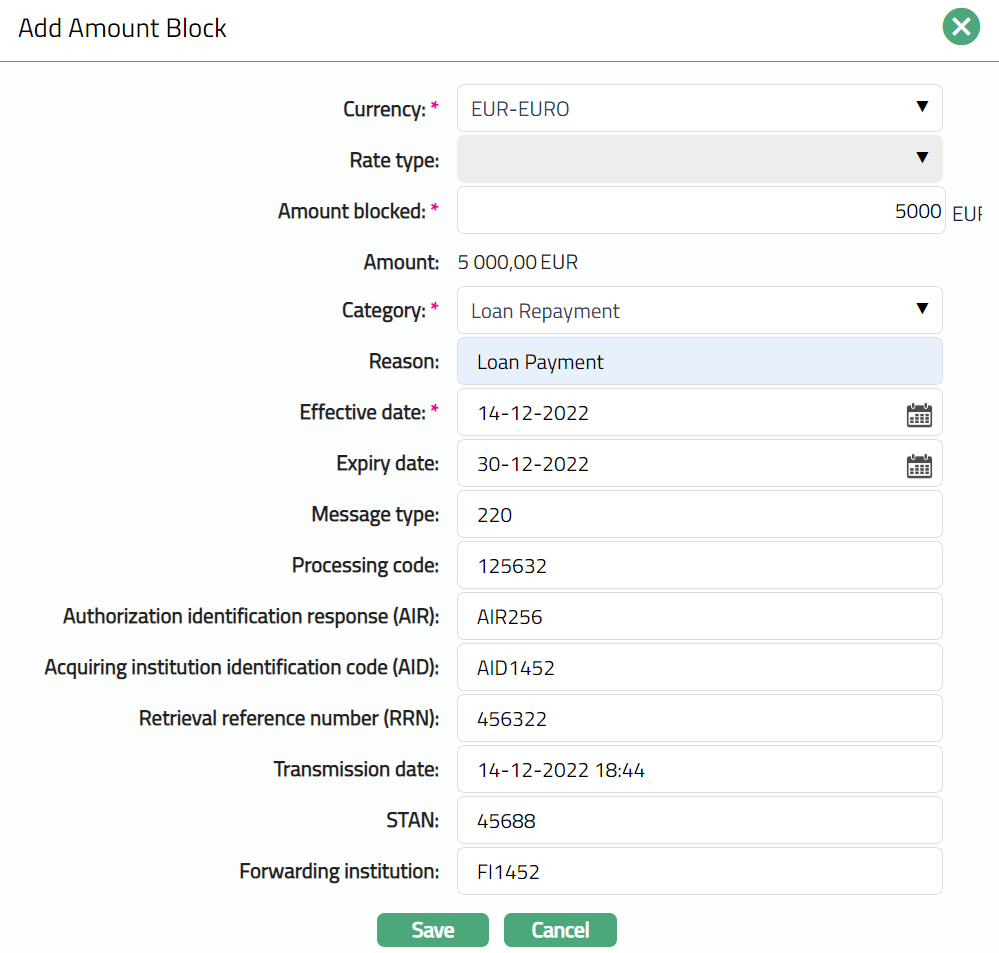

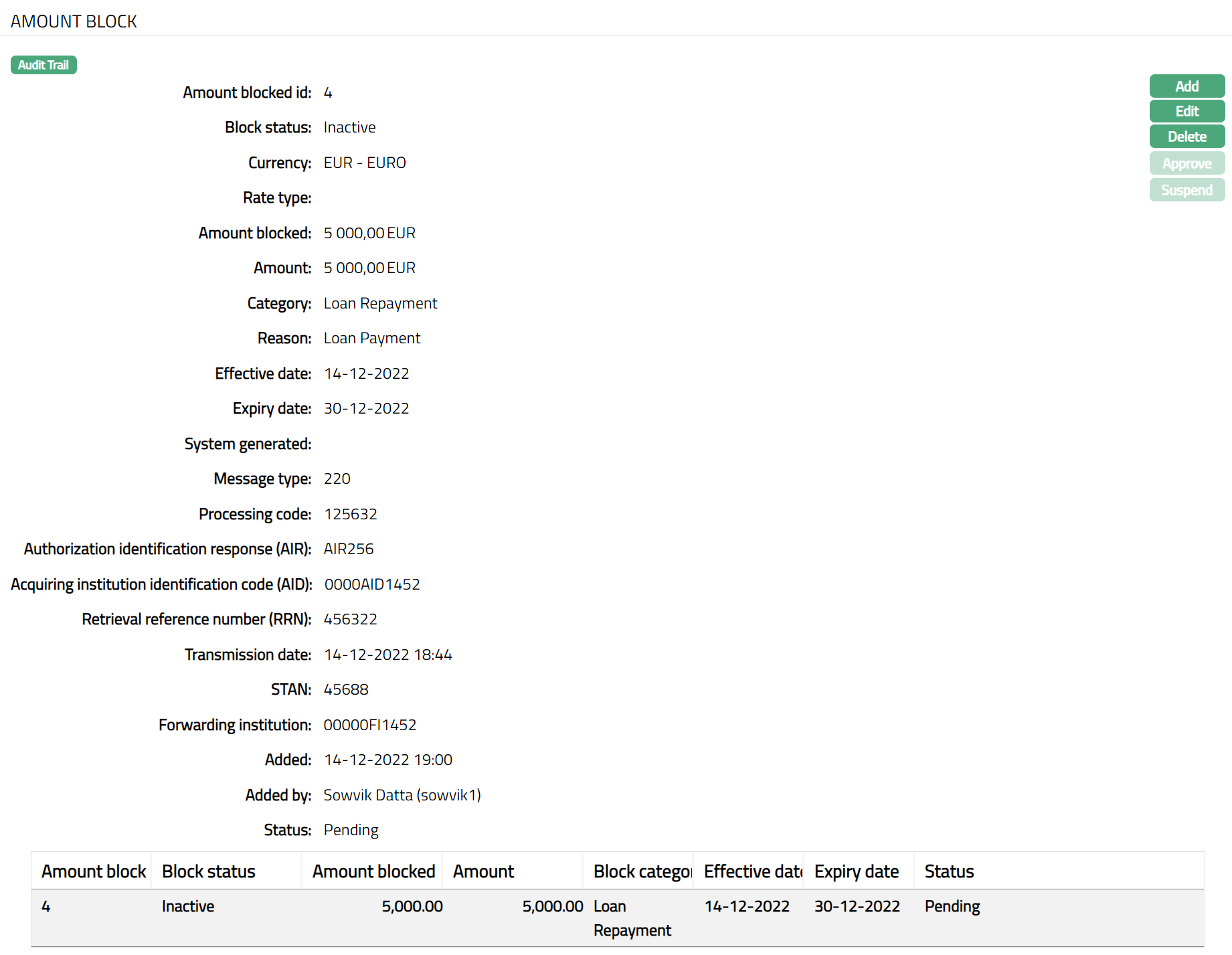

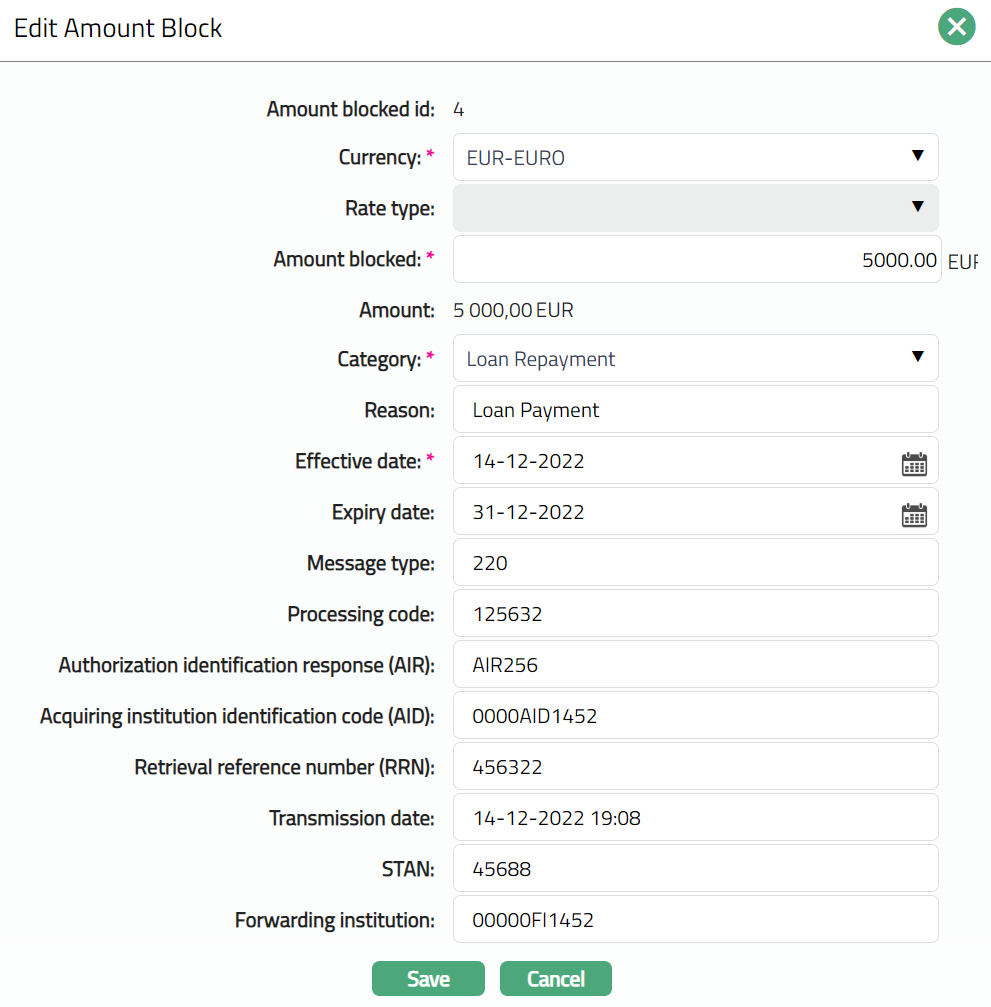

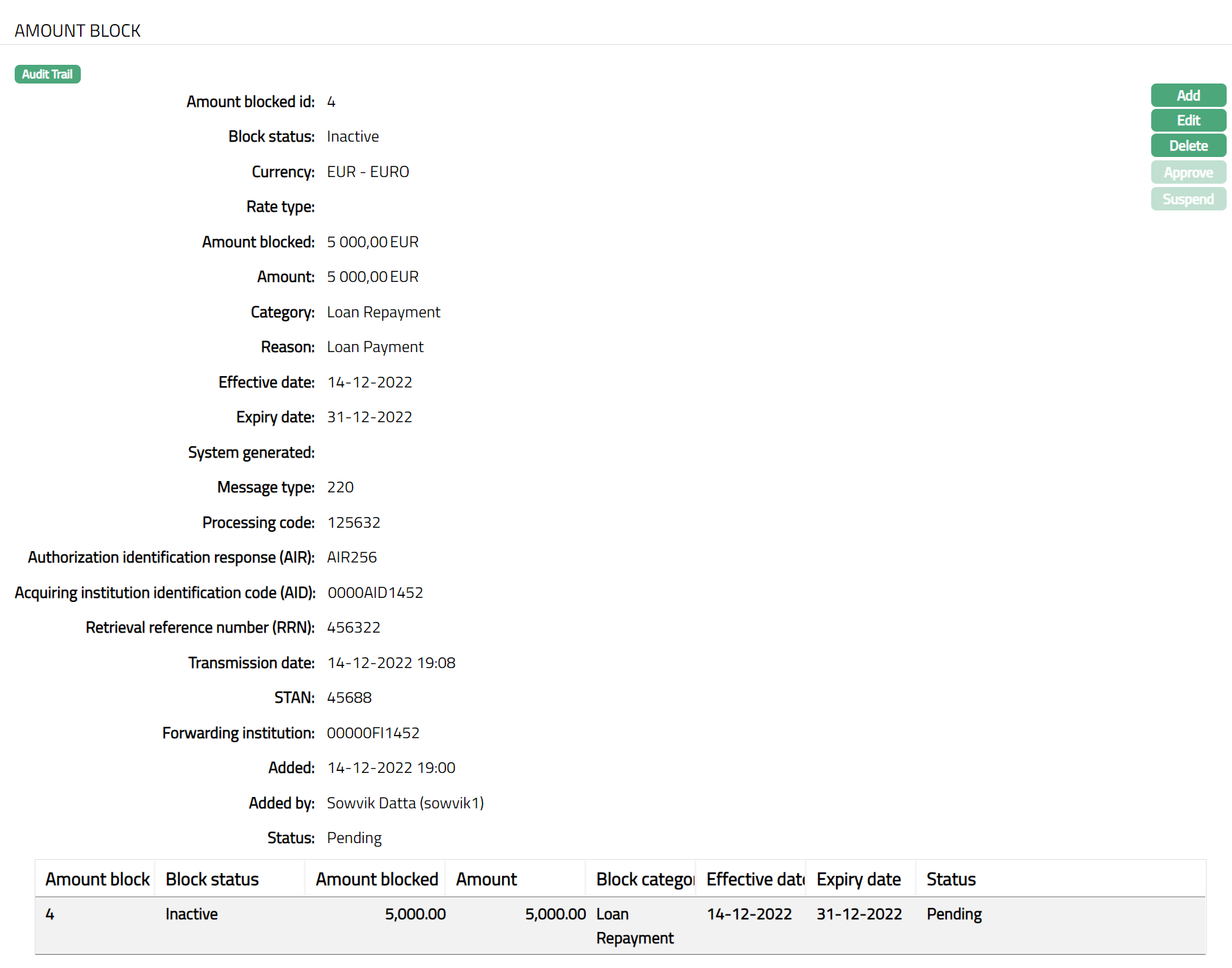

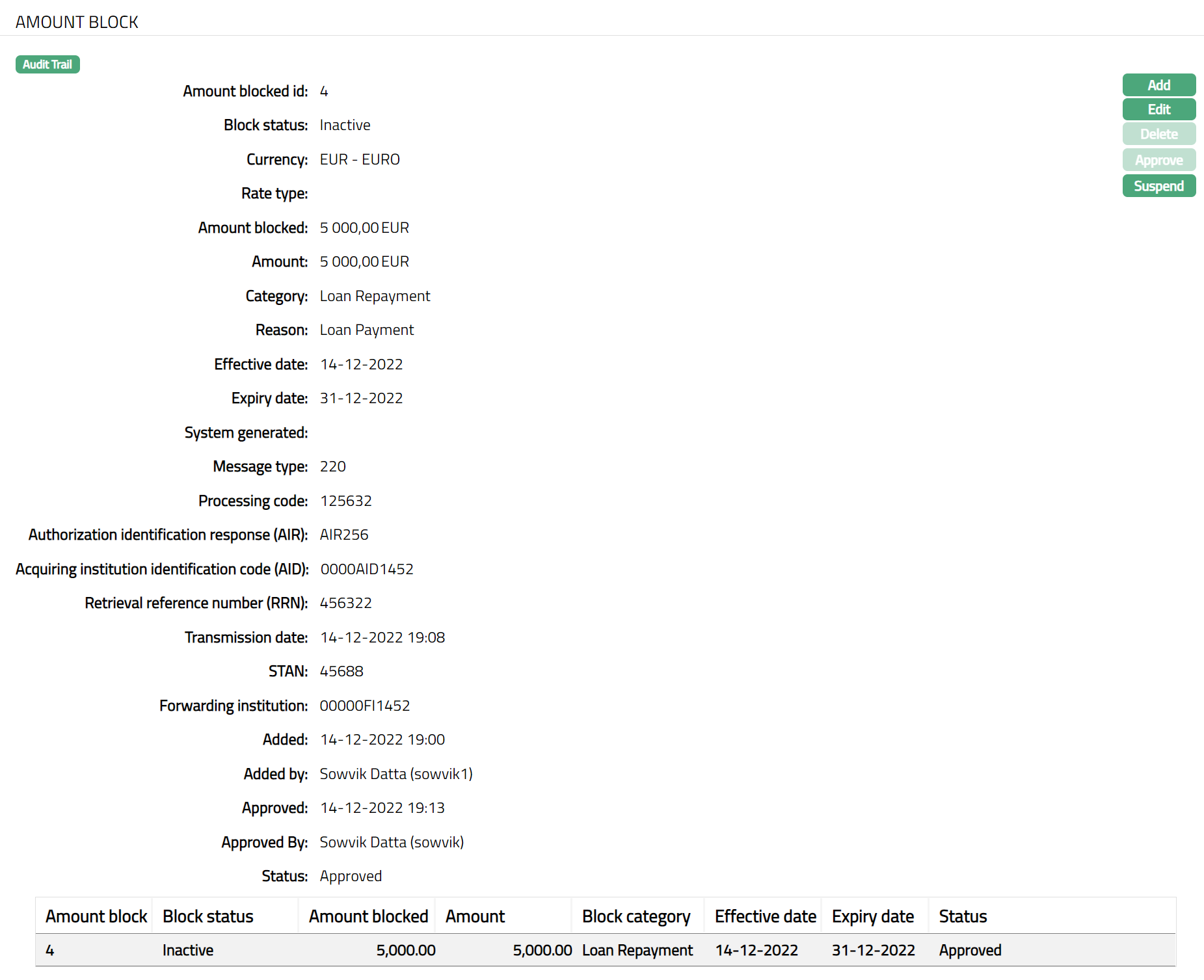

Amount blocked is the sum of authorizations that are pending on the account. The value is derived from the sum of all active amount blocks in the Amount block tab. This is generally shown as a negative amount.

Account balance denotes the available balance in the account and is calculated as Book Balance + Amount Blocked. This will be shown as a negative amount in the case of Debit balance and as a positive amount in case of Credit balance.

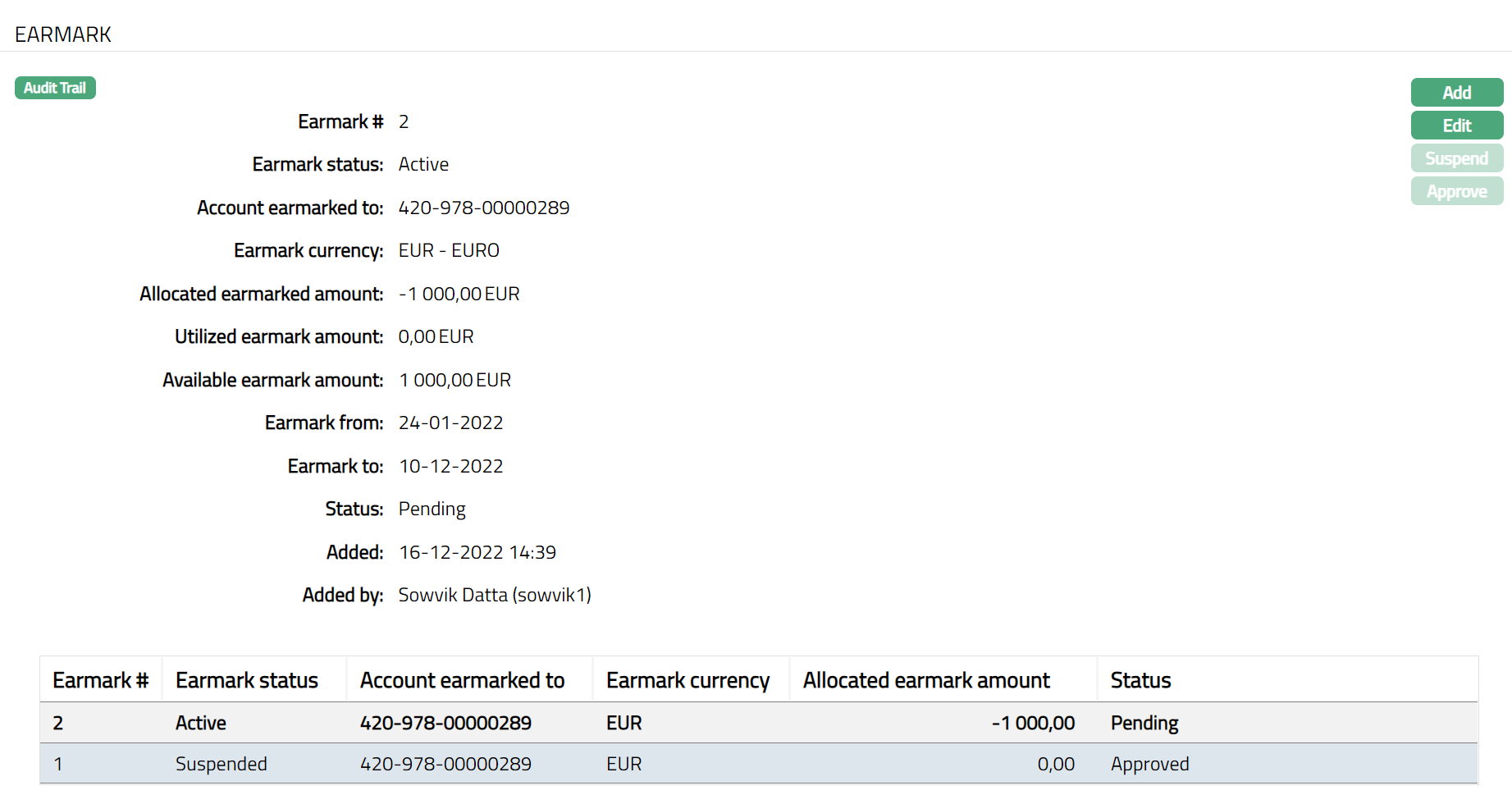

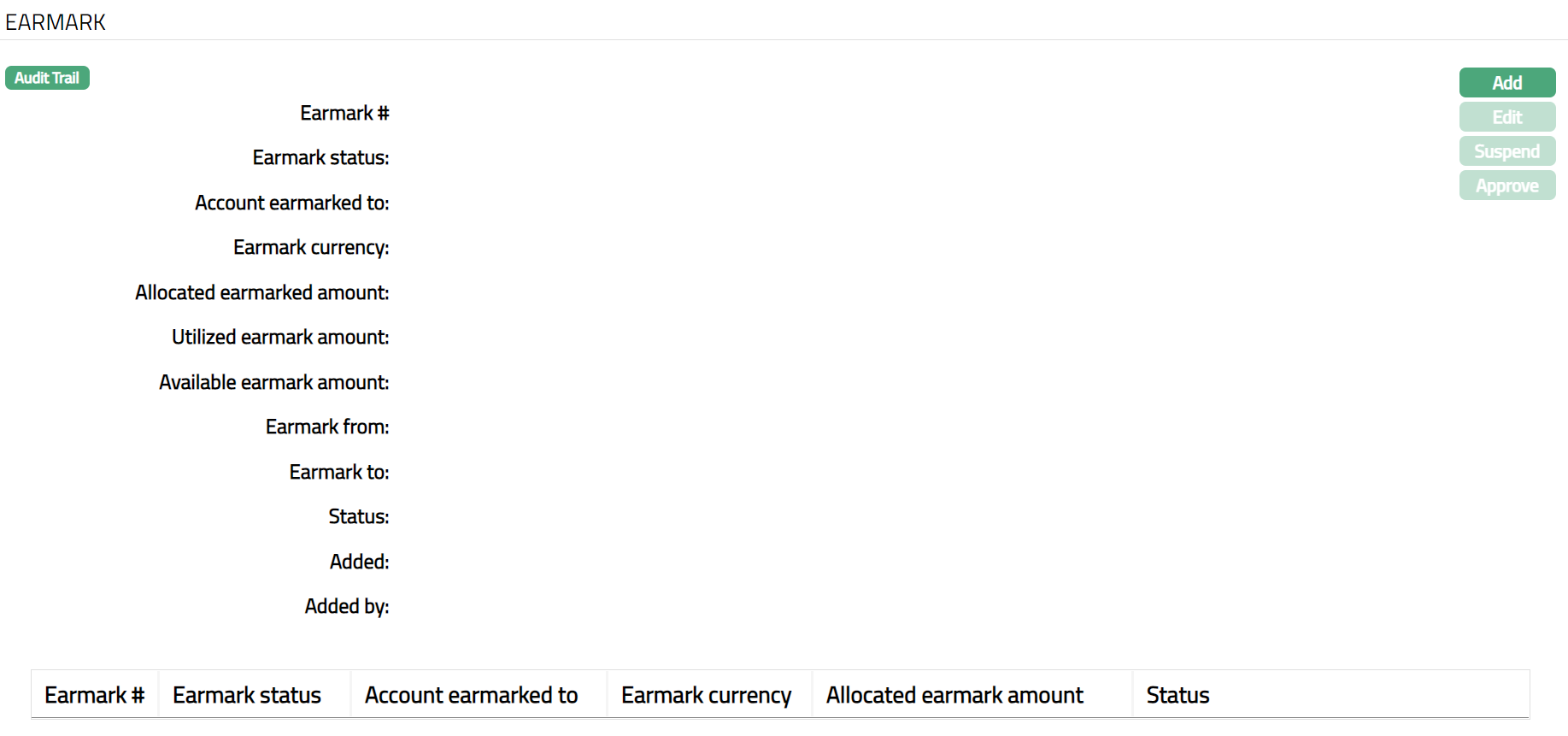

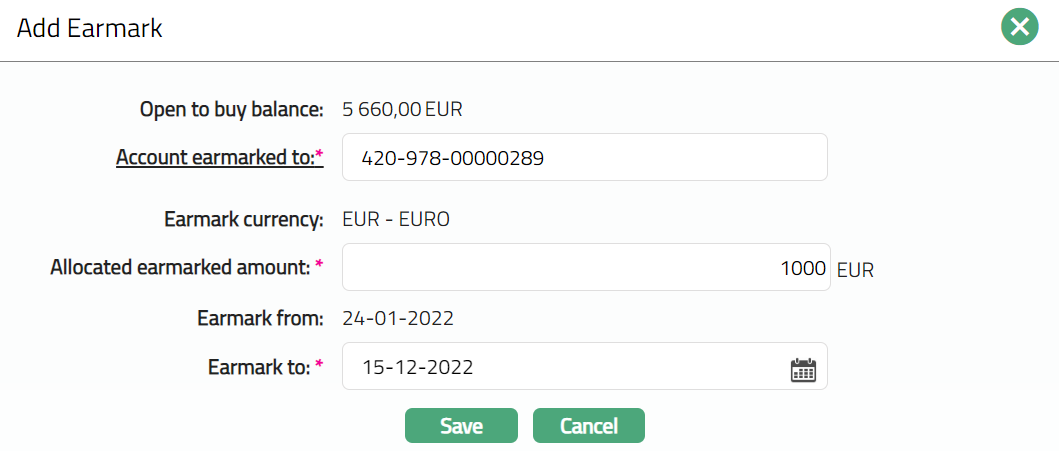

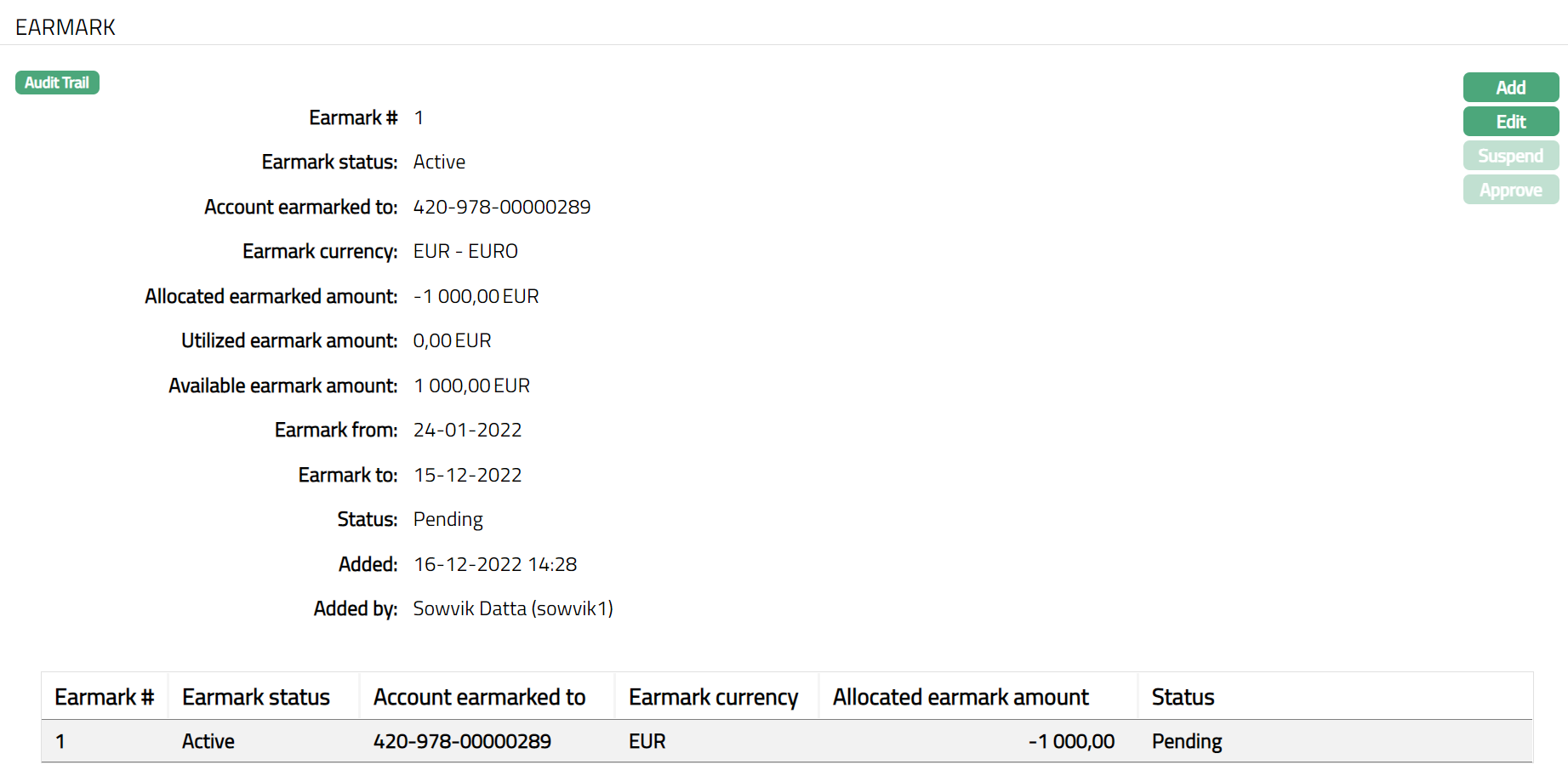

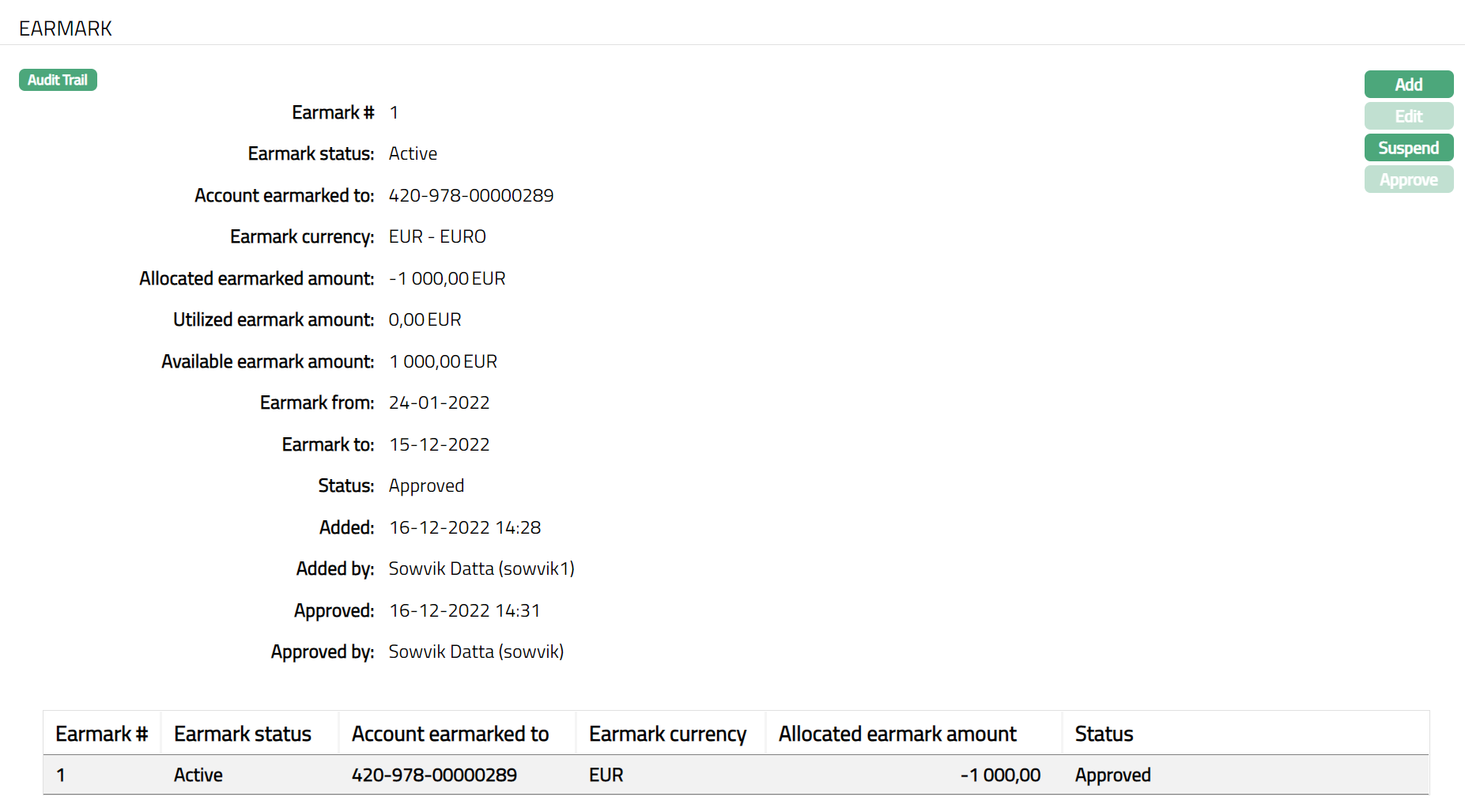

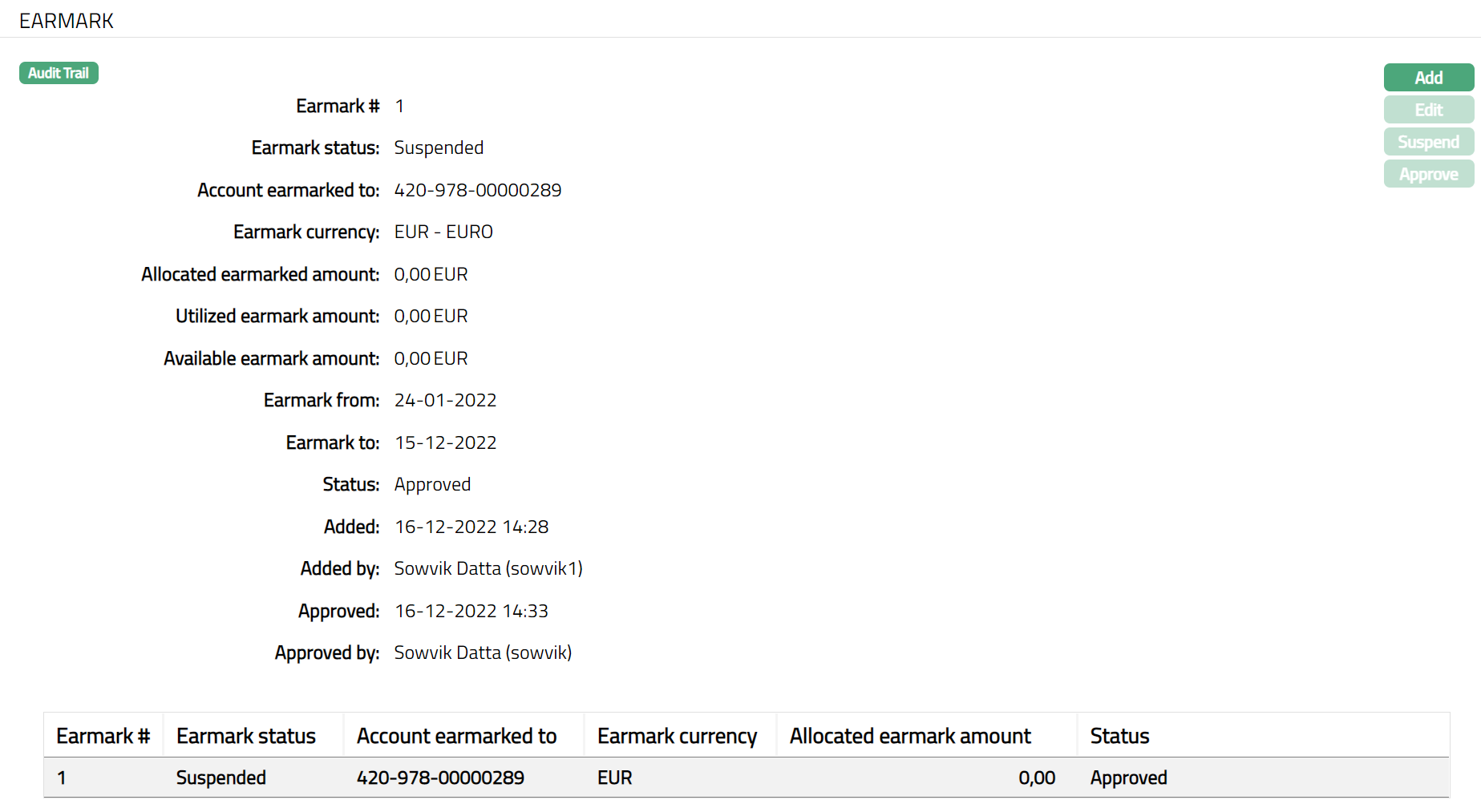

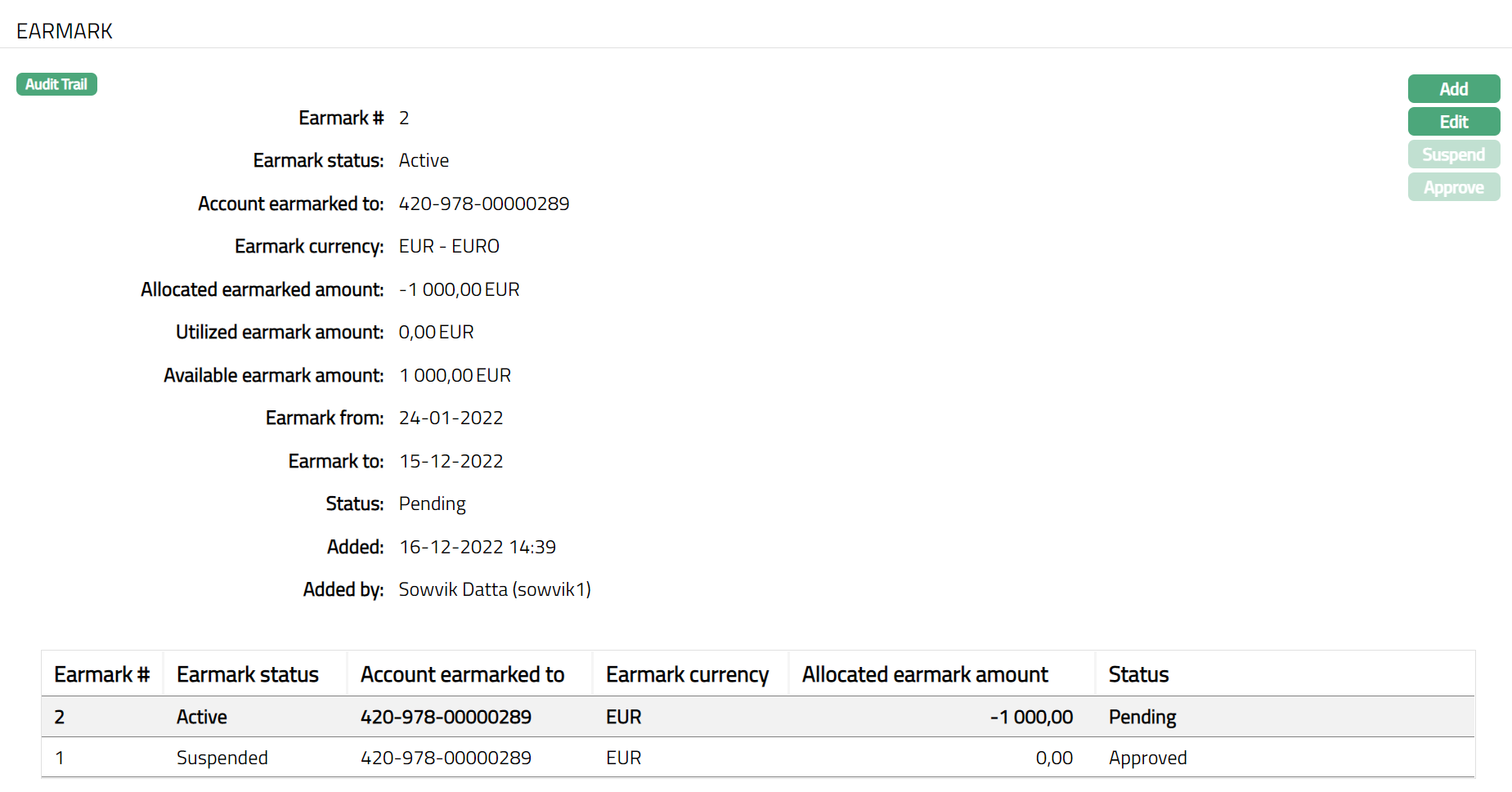

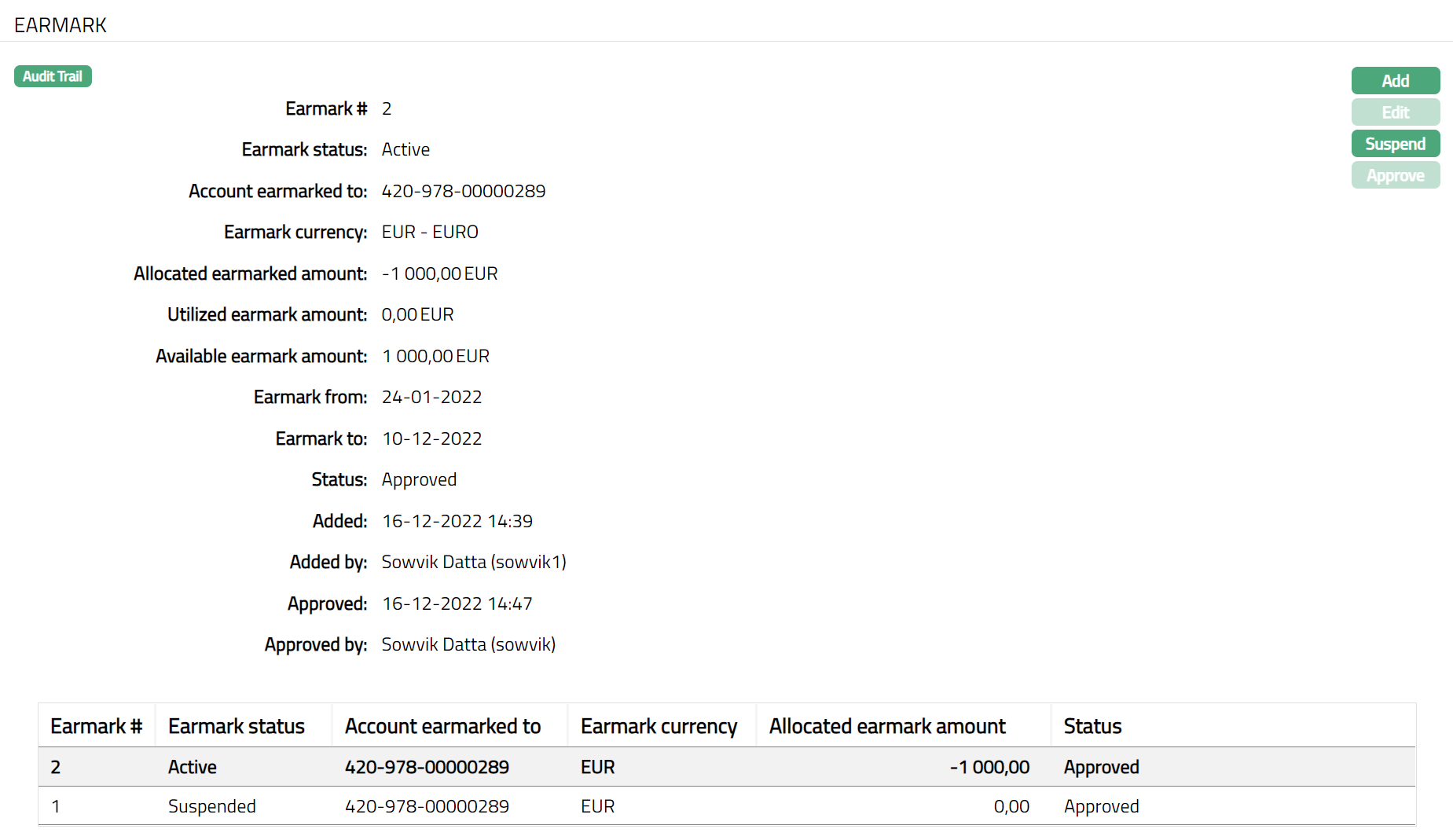

Available earmark denotes the earmarked amount available to the account.

For Billing account, Aura will display the sum of all active Allocated earmark amounts. The balance will be displayed with --ve sign.

For Transaction account, Aura will display the sum of all active Available earmark amounts. The balance will be displayed with the +ve sign.

The value for the Allocated earmarked amount is derived from the Earmark tab. By default, the value is 0.

Available temporary overdraft is a temporary additional amount that is granted by the bank. This will be derived from the Settings tab. This is generally shown as a positive amount.

Available limit across hierarchy is the minimum available limit across the limit hierarchy above. If the limit has been over-utilized, this field will be 0.

Open to buy balance displays the available limit balance for both billing and transaction account. By default, it will be 0.

If Account balance is a Debit balance

OTB (open to buy balance) = Available earmark + Available temporary overdraft + Available limit across hierarchy

If Account Balance is a Credit balance

OTB (open to buy balance) = Account balance + Available earmark + Available temporary overdraft + Available limit across hierarchy.

Available cash balance is the cash balance available in the Card account. Available cash balance will be the minimum of [Cash limit minus (sum of all balances under Balance classes where "qualify for cash limit" is YES) minus (Sum of all active Amount Blocks where the Block Category is checked for cash limit balance) and Open to buy balance]. By default, the value will be 0. For Transaction account, Cash limit of the Billing account will be considered.

Interest paid till date denotes the amount of interest paid out till date (credited) to the card account. This field will be displayed only for Billing accounts and not for Transaction account.

Interest received till date denotes the amount of interest received till date (debited) on the account. This field will be displayed only for Billing accounts and not for Transaction account.

Interest payable accrued denotes the amount of interest payable accrued (but not yet credited to the card account) as of the previous day, since interest payable accrual happens at the end of day. This field will be displayed only for Billing accounts and not for Transaction account.

Interest receivable accrued denotes the amount of interest receivable accrued (but not yet debited from the card account) as of the previous day, since interest receivable accrual happens at the end of day. This field will be displayed only for Billing accounts and not for Transaction account.

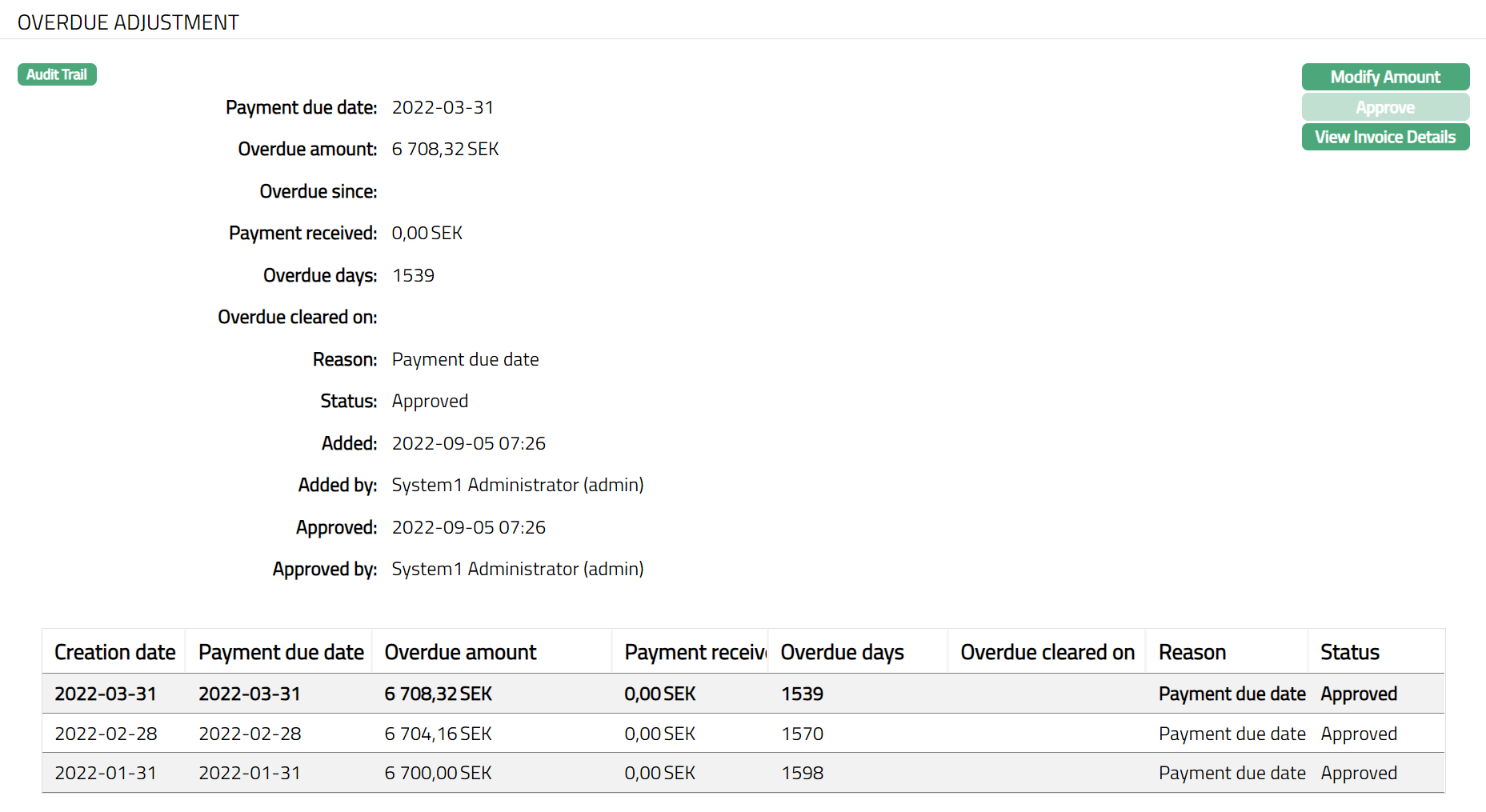

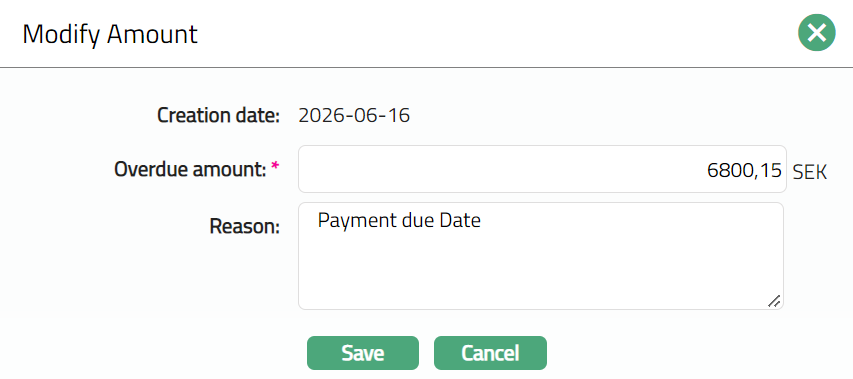

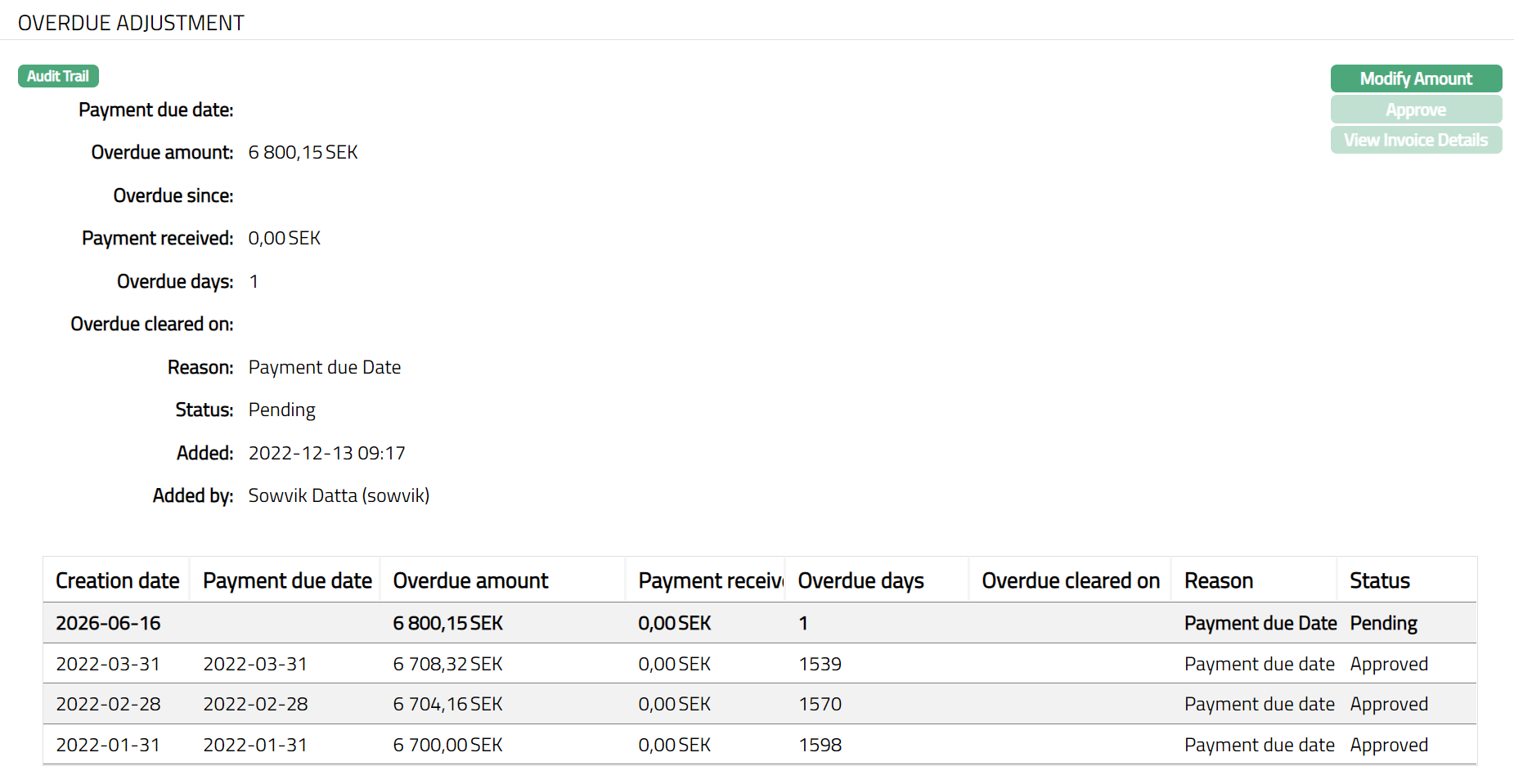

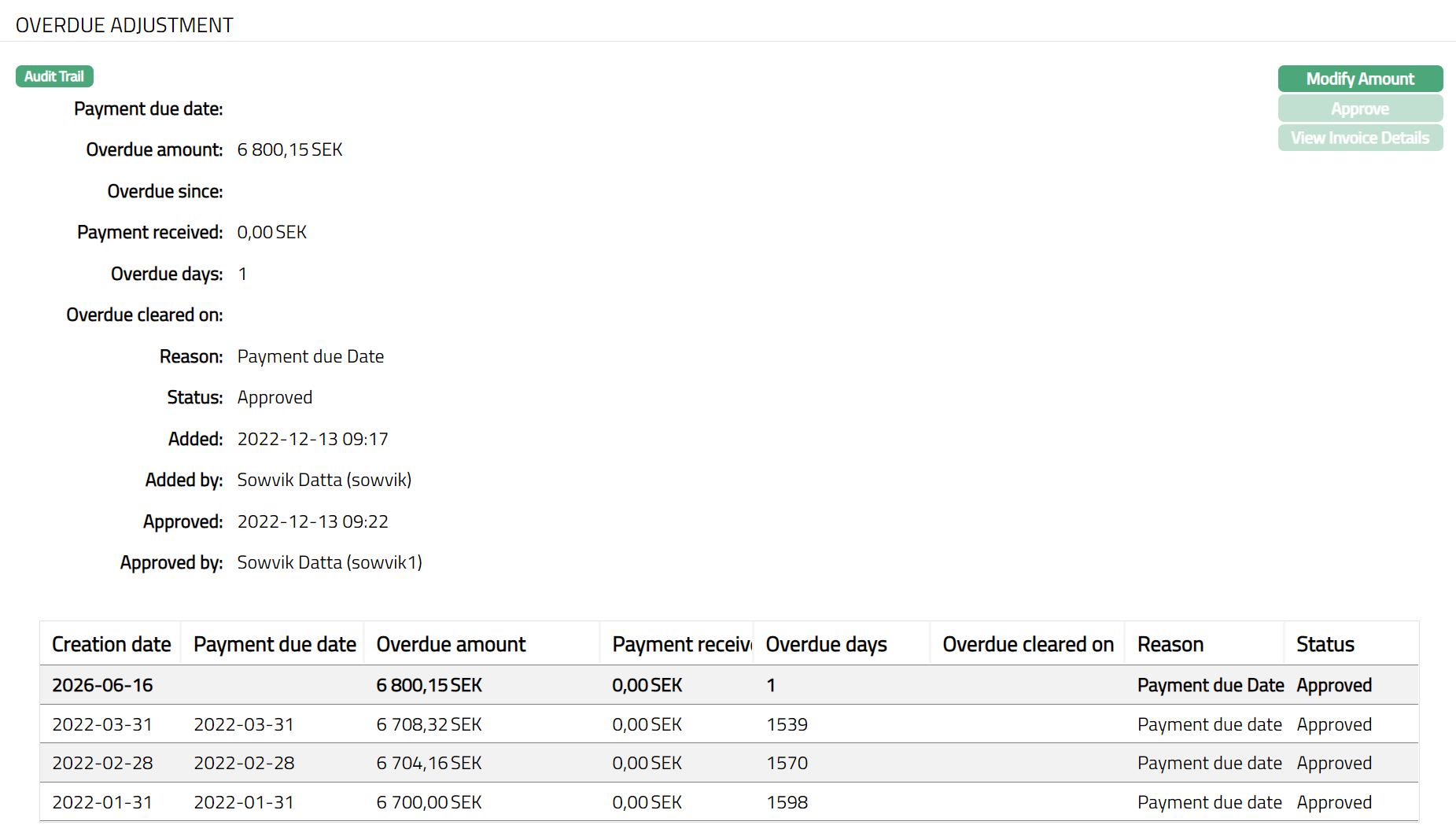

Overdue amount displays the overdue amount -- i.e., the excess of Amount required over the Payment received. The value is derived from the Overdue adjustment tab.

Overdue days denote overdue days as on date. The value is derived from the Overdue adjustment tab.

Start date (Current Cycle) will display the start date for the current cycle. For the first cycle, the Start date will be the account activation date.

For example, Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, Start date for current cycle will be 26^th^ Feb.

- End date (Current Cycle) will display the end date for the current cycle.

For example: Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, End of cycle date will be 25^th^ Mar.

- Payment due date (Current Cycle) will display the payment due date for the current cycle.

For example: Current Cycle: 26th Jan to 25th Feb. From 26th Jan to 25th Feb, Payment due date -- 10th Mar.

- Start date (Previous cycle) will display the start date of the previous cycle. For the first cycle, it will be blank.

For example: Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, Start date of previous cycle will be 26^th^ Jan.

- End date (Previous cycle) will display the end date of the previous cycle for which invoice has been generated last.

For example: Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, End date of previous cycle will be 25^th^ Feb.

- Payment due date (Previous cycle) will display the payment due date for the previous cycle.

For example: Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, Payment due date of last cycle will be 10^th^ Mar.

- Amount Required (Previous cycle): Amount required is the minimum amount that the customer has to pay to avoid overdue interest and / or any overdue-related charges / status changes. The amount required value depends on the option chosen at product level and any changes that have been made at the account level (example: payment plan, negotiated payment, etc.). It will display the amount required for the previous cycle as generated in the invoice.

For example**😗* Invoice generated for Cycle: 26^th^ Jan to 25^th^ Feb; Payment due date -- 10^th^ Mar. From 26^th^ Feb to 25^th^ Mar, the Amount required will show the figure from the above invoice.

- Amount Requested (Previous cycle): Amount Requested denotes the amount requested for payment for the last invoice. The requested amount depends on the option chosen at product level and any changes that have been made at the account level (example: Full payment request).

For example: Invoice generated for Cycle: 26th Jan to 25th Feb; Payment due date -- 10th Mar. From 26th Feb to 25th Mar, Amount requested will show the figure from the above invoice.

Last card activity on displays the date on which the last card activity (debit / credit) was recorded on the account. The transaction code used should have Card Activity as Yes.

Last activity on displays the date on which the last activity (debit / credit) was recorded on the account.

Last debit transaction on displays the date on which the last debit transaction was recorded.

Last credit transaction on displays the date on which the last credit transaction was recorded.

Last payment transaction on displays the date on which the last payment transaction on the account is recorded. The transaction can be a credit transaction code of a balance class where Treat as payment is Yes or a Debit transaction reversal for which Treat reversal as payment is marked.

Insured: If even one Insurance Plan for the account is active, the Insured field will show Yes; else, it will show No.

Decline authorization displays Yes if Decline authorization field is marked as Yes in the Account Status tab or Payment Status tab of the account. Else it shows No.

Status

The Status tab allows you to view / set the Account status and Payment Status as well as define the Preferences for the current status of the account. The Preferences will allow you to enable / disable certain functions on the card account like Interest Accrual, Waiver, Liquidation, Disallow Debit, Disallow credit, Stop invoice etc.

There are two sub-tabs

Account Status

The Account Status of an account can be automatically moved based on the Rules that have been defined for the Product; or it can be manually set.

This tab will allow you to set and view the history of the Account Status of the Card Account. The list of Account Statuses and the corresponding Preference details for each status would be defaulted from the Status Maintenance (Admin > System Codes > Generic Definitions > Status). You can edit the defaulted preferences before approval.

The following Account Statuses will be pre-shipped:

Opened: This is the initial account status as soon as it is created. If the Account Status is Opened, then Preferences will not be displayed.

Activated: This is the status in which transactions are allowed on the account. The account creator and the approver should be two different users. If the Account status is Activated, then the Preferences will be displayed and by default the preferences will be No.

Marked for Closure: This is the status to which an account can be moved manually. During the End-Of-Day processing, any account that is in this status will be Closed. Preferences are enabled and pre-defined.

Closed: This account status will be automatically updated when an account closure is processed. If the Account status is Closed, the preferences will not be displayed.

Re-opened: You can open an account that has a Closed account status, if needed. This account status is equivalent to Open account status in all other respects but gives you an indication that the account was once Closed. If the Account status is Reopened, the preferences will not be displayed.

You would be able to set a new status for an account subject to the following:

a. An Account can move between the pre-shipped statuses as follows:

From Opened to Activated

From Activated to Marked for Closure

From Marked for Closure to Activated

From Closed to Reopened

From Reopened to Activated

b. An account can move to any of the user defined account statuses.

c. When the Account Status is changed manually, the Allow Auto movement flag as maintained in Status Maintenance will be inherited for the new Status; however, you can change the same. When the account is in this status, and the flag is No, rule-based status changes will not apply.

Notes related to Transaction Accounts

The Account Status for a Transaction Account will change, whenever the Billing Account's Account status changes. This is however subject to the flag -- Allow Auto Movement. If this flag is Yes at the Transaction Account, the Account Status of the Transaction Account will automatically move as per the Billing Account. If this flag is No at the Transaction Account, the Account Status of the Transaction Account will not be governed by the Billing Account's Account Status. Thus, if Allow auto movement is Yes in the Transaction Account it will automatically take the account status from the Billing Account; else it will remain the same as was before the rule was applied.

For a Transaction Account, the Preferences related to Invoice and Interest are not relevant. These preferences for the corresponding Billing account will prevail.

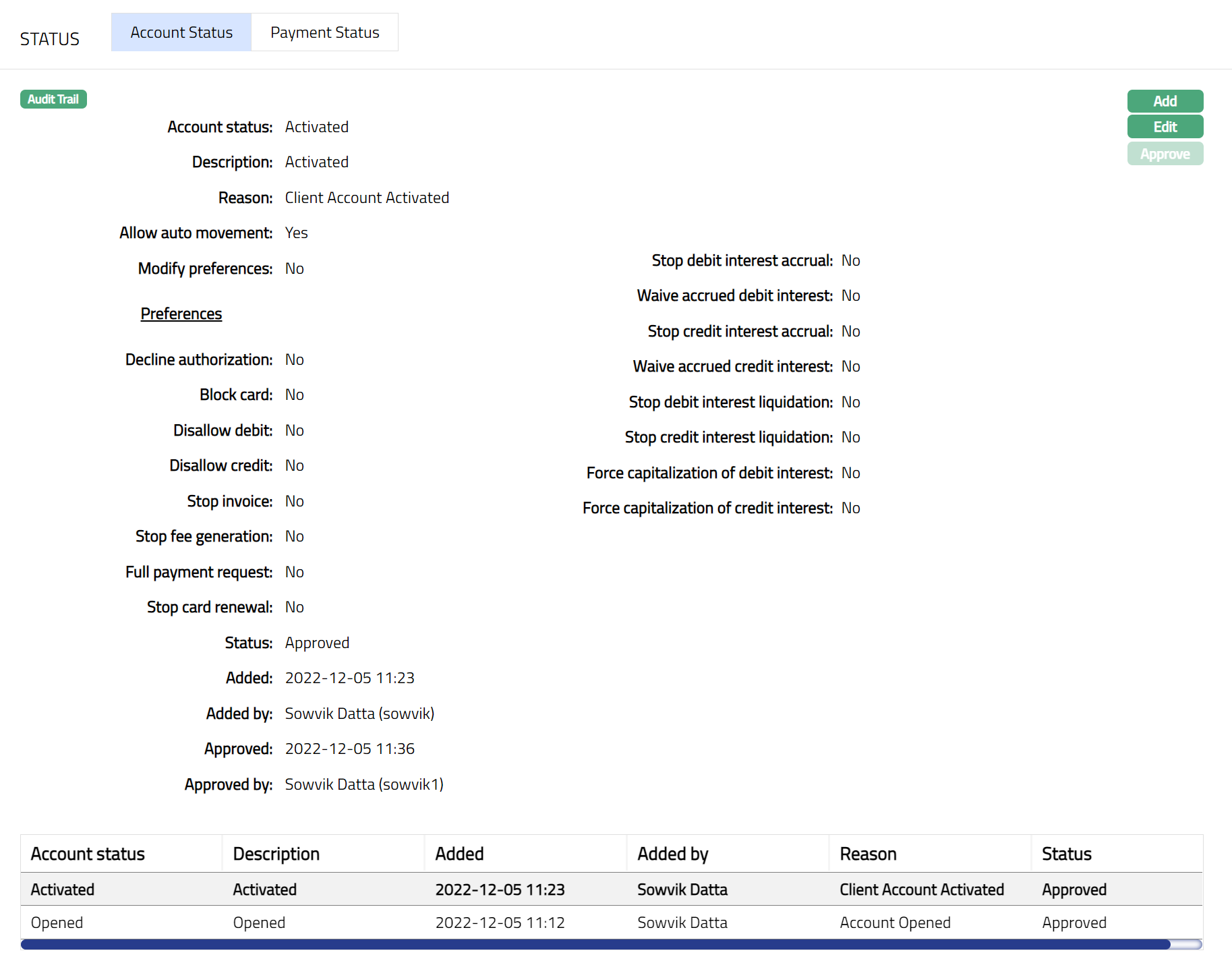

To view the Account Status

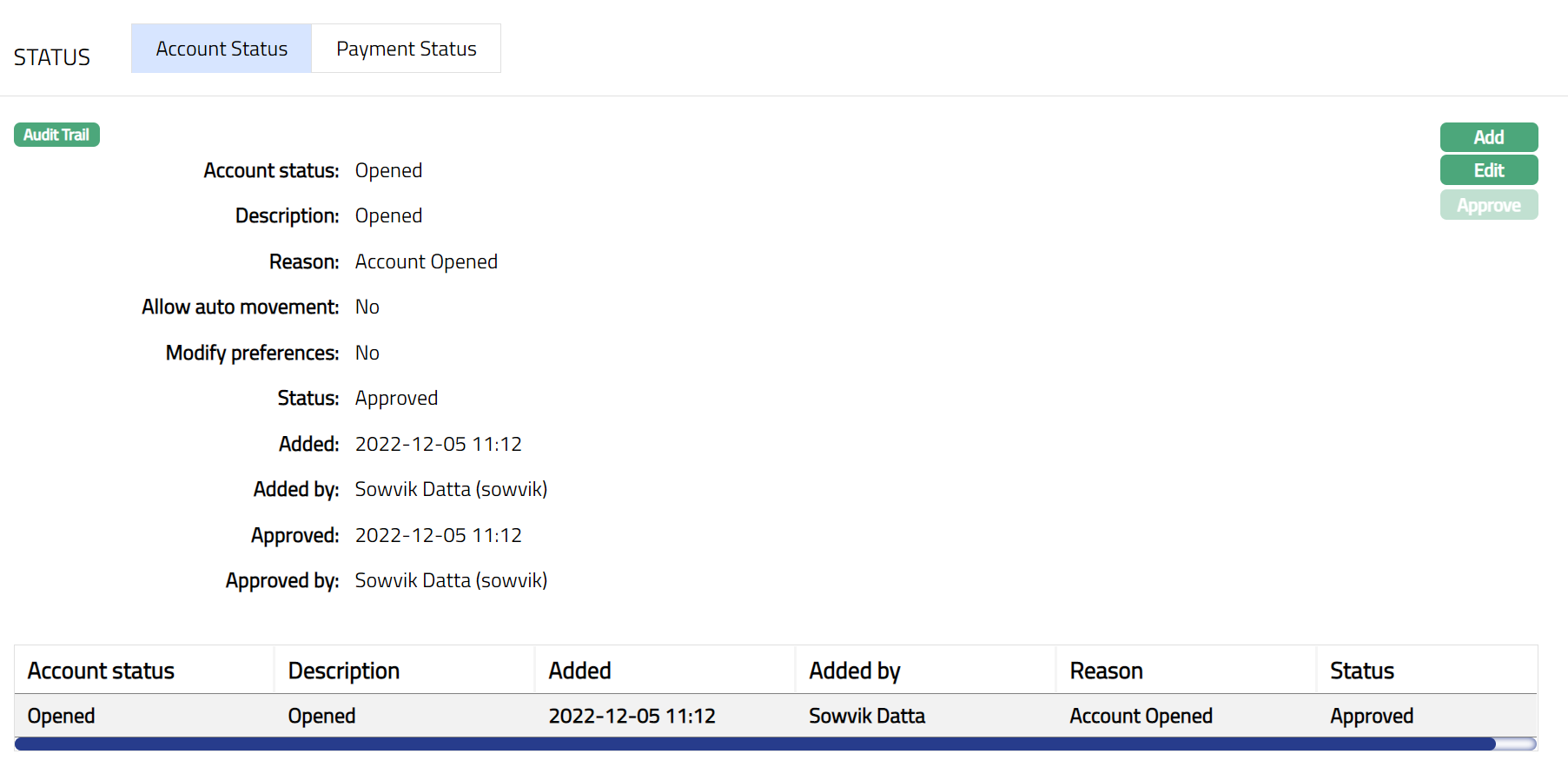

- Access Card Account page and click Status tab and then Account Status tab. On creation of the Card Account, the Account Status is Opened, Record Status is Approved and there are no Preferences as shown below:

Account Status displays the status of the account. On account creation, the Account Status is Opened.

Description is defaulted from the Account Status in case of user defined Account Statuses; and in case of pre-shipped Account Statuses, Description is the same as the Account Status. On account creation, Description is Opened.

Reason displays the reason for the status selected for the account. In case of automatic status movements, the reasons are predefined; while in case of manual status updates, this will display the reason input during the manual status change.

Allow auto-movement is defaulted from Account status in case of user defined Account Statuses; and in case of pre-shipped Account Statuses, this is predefined. When status is Opened, the Allow auto movement flag is defaulted to No, and is not editable.

Modify Preferences is defaulted from Account status in case of user defined Account Statuses; and in case of pre-shipped Account Statuses, this is predefined. When status is Opened, the Modify Preferences flag is defaulted to No, and is not editable.

Status field denotes the status of the record. In case of automatic status movements, the Status is automatically set to Approved; while in case of manual status updates, this will be Pending. Once another user manually approves the record, this will be set to Approved.

The following fields are shown only in the View screen and are not editable:

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records

Note: On account creation, the Account status of the account is opened, and no activities are possible on the account till it is Activated. You need to set the status manually to Activated status so that there can be activities in the account.

To manually add Account Status / Preferences for an Account Status

- Access Card Account page and click Status tab and then Account Status tab.

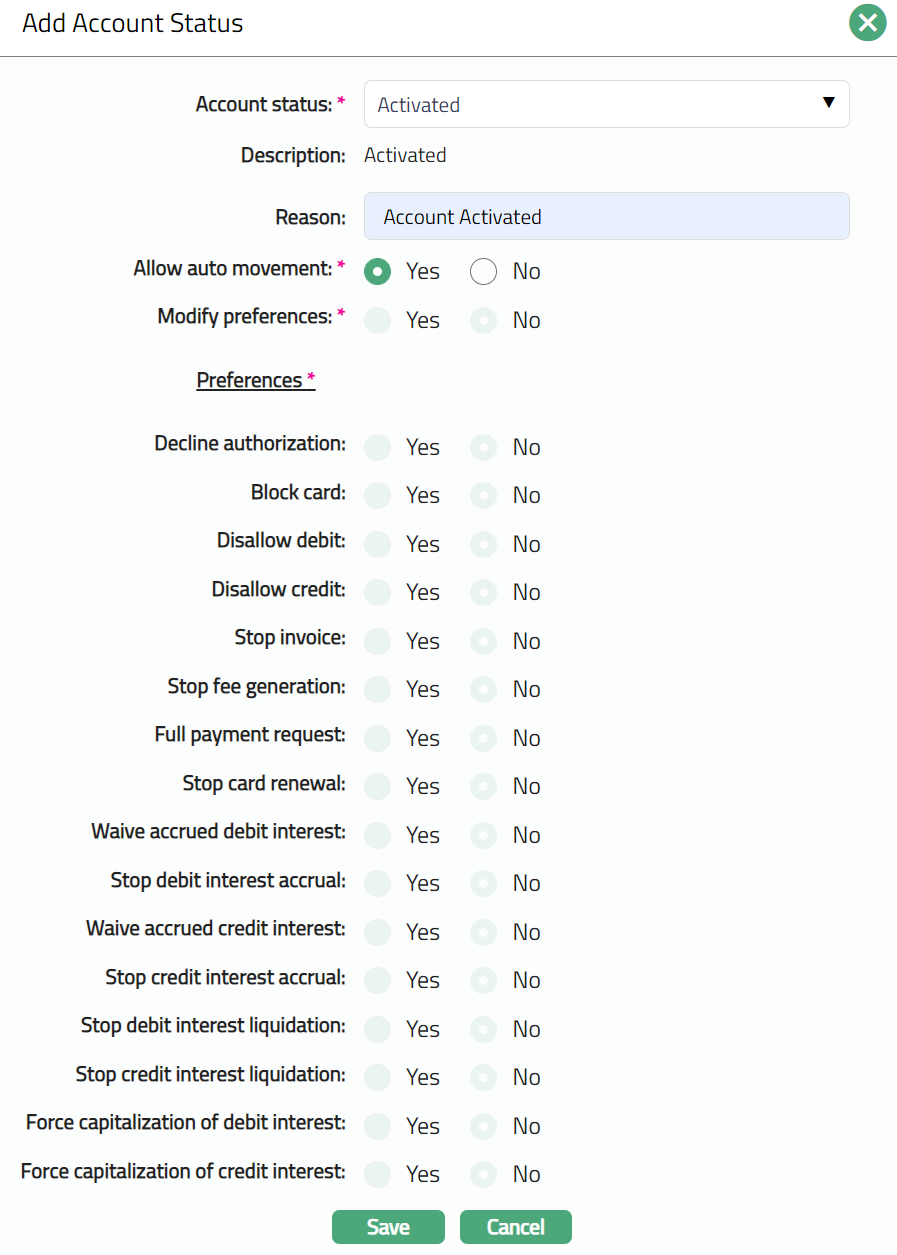

- Click Add. Add Account status screen appears.

- Select Account status to which you want to move the Account. Depending on the current status of the account, the list of Account Statuses shown here will change as described below:

| Current status | List of Account Statuses |

|---|---|

| Opened | Activated |

| Activated | User defined Account Statuses or Marked for Closure |

| User defined statuses | Activated or any other User defined Account Status or Marked for Closure |

| Closed | Reopened |

| Reopened | Activated |

Description displays the description of the status selected above and is displayed by default.

Enter Reason for the status movement.

If Allow auto movement is Yes, rule-based status changes will automatically be applied to the account; however, if No is selected, then the rule-based status changes will not apply. By default, this will be as explained in the following table:

| Current status | Allow auto movement flag |

|---|---|

| Opened | Defaulted to No and disabled and the Preferences will not be displayed. |

| Activated | Defaulted to Yes and enabled and all the preferences will be displayed. |

| Marked for Closure | Defaulted to No and disabled |

| Closed | Default to No and disabled |

| Reopened | Default to No and disabled |

| User Defined Status | As in Status Maintenance |

- When the Modify Preferences is marked as Yes, then the Preferences will be enabled, and you can modify them as required. When the flag is marked as No, then all Preferences from the Status Maintenance will be defaulted and disabled. By default, this will be as explained in the following table:

| Current status | Modify preferences flag |

|---|---|

| Opened | Defaulted to No and disabled. |

| Activated | Default to Yes and enabled |

| Marked for Closure | Defaulted to Yes and enabled |

| Closed | Default to No and disabled |

| Reopened | Default to No and disabled |

| User Defined Status | As in Status Maintenance |

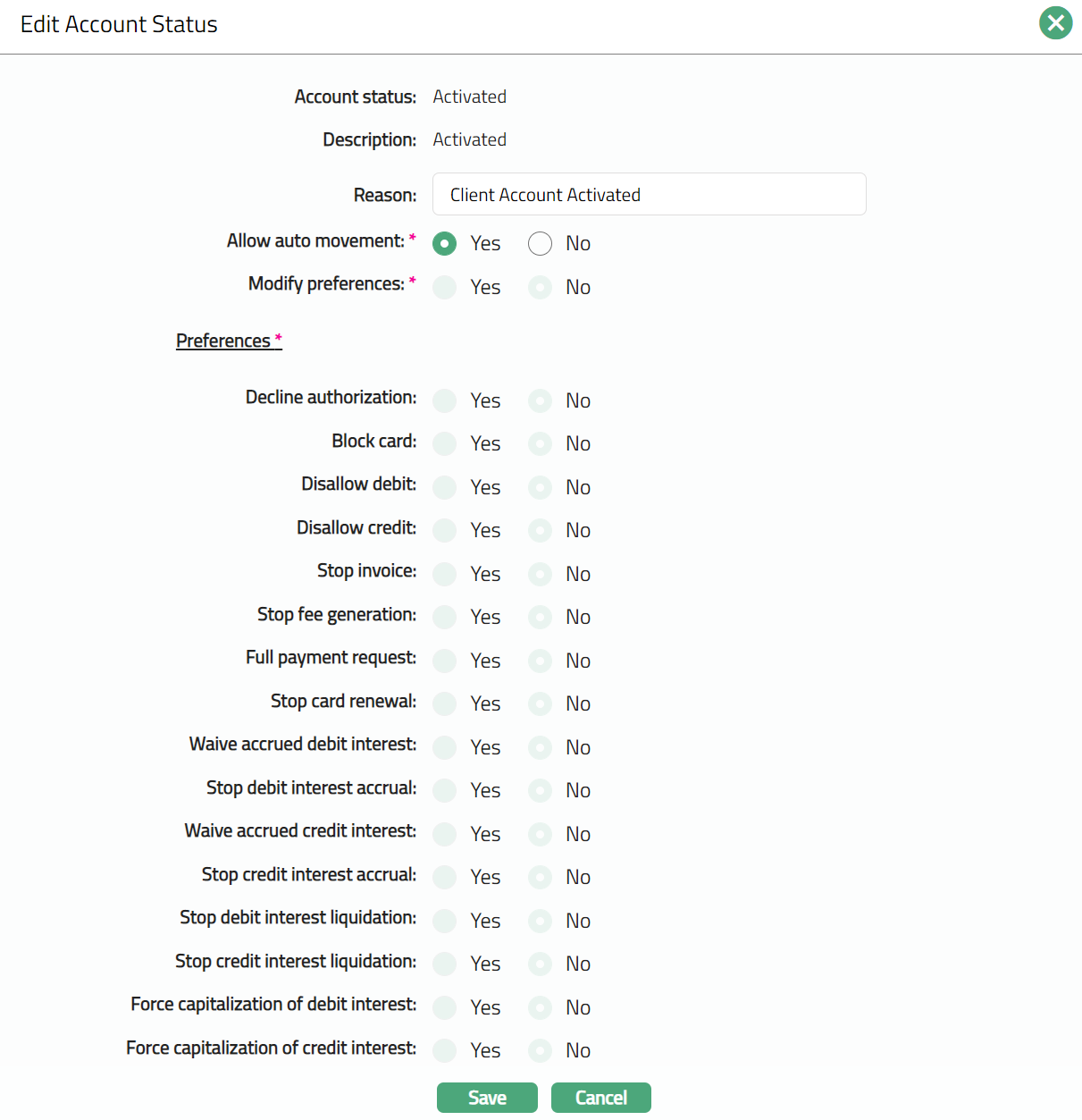

Decline Authorization: When the flag is marked as Yes, Aura will decline all authorizations irrespective of the balance available in the account. It will be defaulted from the account status maintenance after selection of account status.

Block card: When the flag is marked as Yes then the card will be blocked. It will be defaulted from the account status maintenance after selection of account status.

Disallow Debit: When the flag is marked as Yes, Aura will not allow you to debit from that account. However, based on Allow Forced Debit flag in the Transaction code, debits may still be done. It will be defaulted from the account status maintenance after selection of account status.

Disallow Credit: When the flag is marked as Yes, Aura will not allow you to credit to this account. However, based on Allow Forced Credit flag in the Transaction code, credits may still be done. It will be defaulted from the account status maintenance after selection of account status.

Stop Invoice: When the flag is marked as Yes, no invoice will be generated for this account. This does not stop debit interest liquidation. Only invoice generation is stopped. If debit interest has to be stopped then the relevant flag (Stop Debit interest accrual) has to be marked. It will be defaulted from the account status maintenance after selection of account status.

Stop fee generation: When the flag is marked as Yes, Aura will not process any periodical fee for the account. However, the transaction charges that are generated by the Transaction file upload will continue to apply. It will be defaulted from the account status maintenance after selection of account status.

Full payment request: When the flag is marked as Yes, then Aura will override the payment amount options to always require for full outstanding balance. Amount required and Amount requested will always be full outstanding balance. It will be defaulted from the account status maintenance after selection of account status.

Stop card renewal: When the flag is marked as Yes, then it indicates stoppage of card renewal. It will be defaulted from the account status maintenance after selection of account status.

Stop debit interest accrual: When the flag is marked as Yes, Aura will stop any interest accrual on the debit balances for this account. When the flag is unchecked, Aura will continue to accrue interest from that date. There will not be any accrual for the interim period when this flag is Yes. It will be defaulted from the account status maintenance after selection of account status.

Waive accrued debit interest: This field is enabled only if Stop debit interest accrual is marked as Yes. You can choose to waive the interest that has accrued till that point by marking this Yes. If this is marked as No, then the interest that had accrued till then will not be waived and will remain as an accrual. It will be defaulted from the account status maintenance after selection of account status.

Stop Credit interest accrual: When the flag is marked as Yes, Aura will stop any interest accrual on the credit balances for this account. When the flag is unchecked, Aura will continue to accrue interest from that date. There will not be any accrual for the interim period when this flag is Yes. It will be defaulted from the account status maintenance after selection of account status.

Waive accrued Credit interest: This field is enabled only if Stop credit interest accrual is marked Yes. You can choose to waive the interest that has accrued till that point by marking this Yes. If this is marked as No, then the interest that had accrued till then will not be waived and will remain as an accrual. It will be defaulted from the account status maintenance after selection of account status.

Stop debit interest liquidation: When the flag is marked as Yes, Aura will not liquidate any debit interest even though the liquidation day according to the frequency is reached. The accrual of debit interest continues and thus this flag will only stop the liquidation of interest as long as this option is checked. When the flag is unchecked all the accrued debit interest will be liquidated in the next cycle. It will be defaulted from the account status maintenance after selection of account status.

Stop credit interest liquidation: When the flag is marked as Yes, Aura will not liquidate any credit interest even though the liquidation day according to the frequency is reached. The accrual of credit interest continues and thus this flag will only stop the liquidation of interest as long as this option is checked. When the flag is unchecked all the accrued credit interest will be liquidated in the next cycle. It will be defaulted from the account status maintenance after selection of account status.

Force capitalization of debit interest: When the flag is marked as Yes, Aura will liquidate the accrued debit interest in the account, when the account moves to this payment status. If this is Yes, Stop Debit Interest Accrual will be Yes and disabled. It will be defaulted from the account status maintenance after selection of account status.

Force capitalization of credit interest: When the flag is marked as Yes, Aura will liquidate the accrued credit interest in the account, when the account moves to this payment status. Withholding Tax will be debited. If this is Yes, Stop Credit Interest Accrual will be Yes and disabled. It will be defaulted from the account status maintenance after selection of account status.

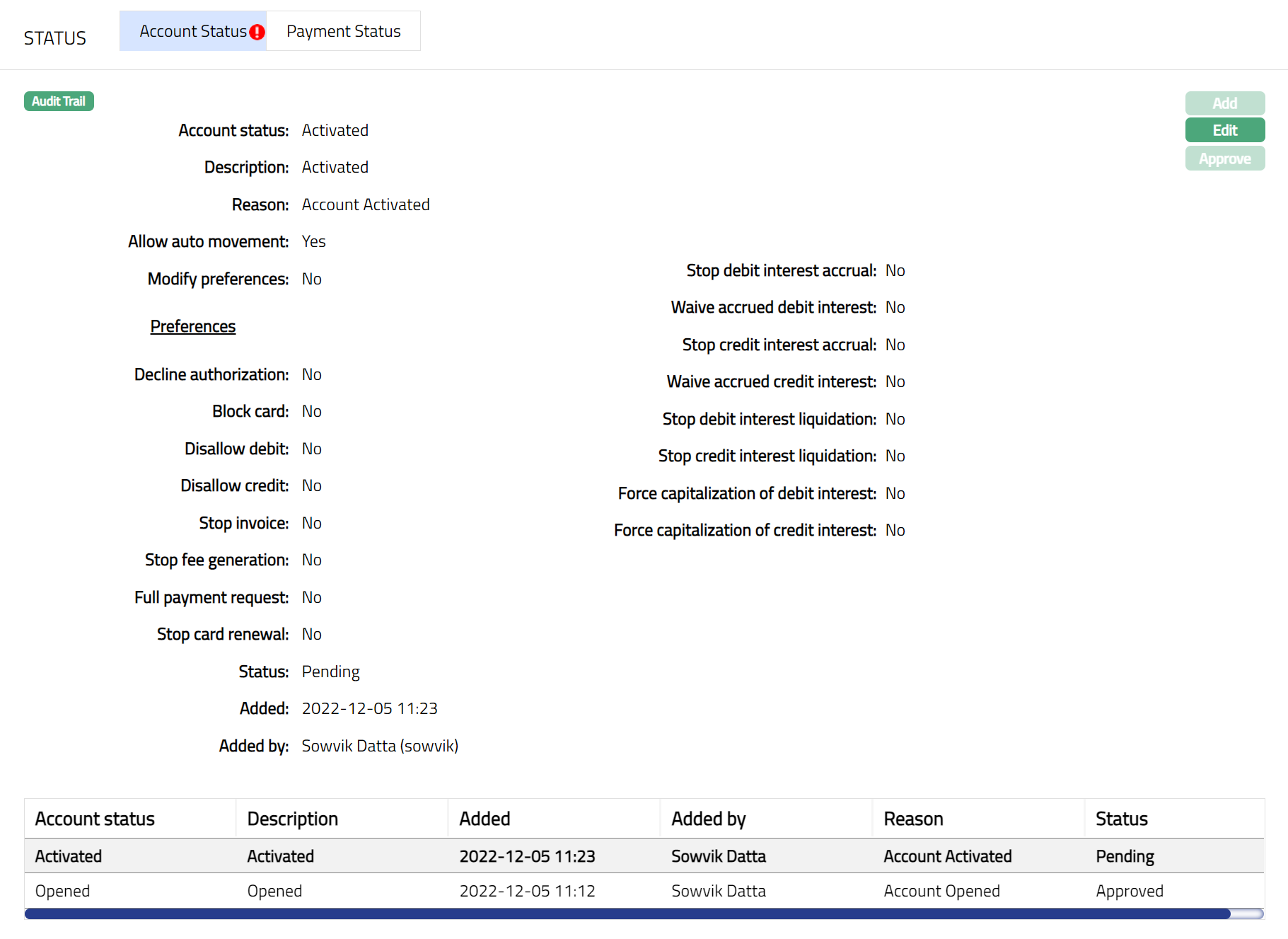

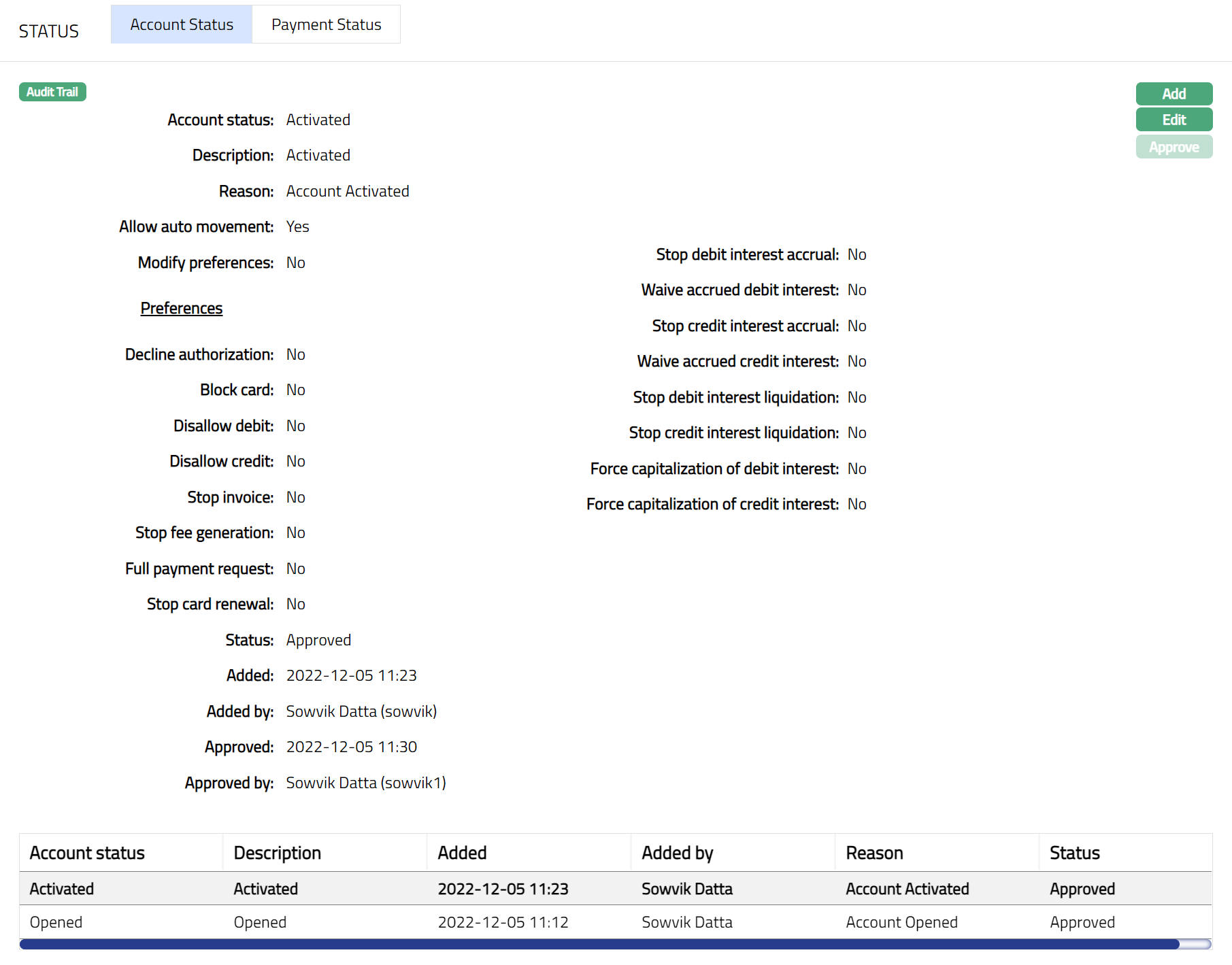

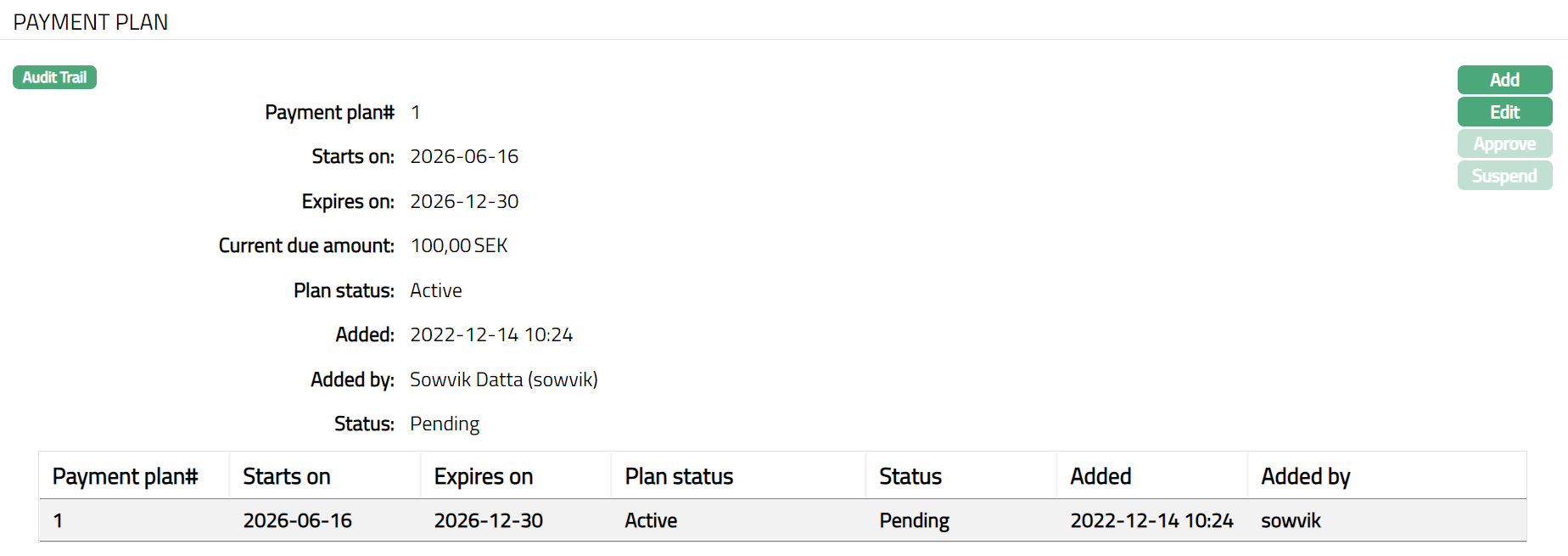

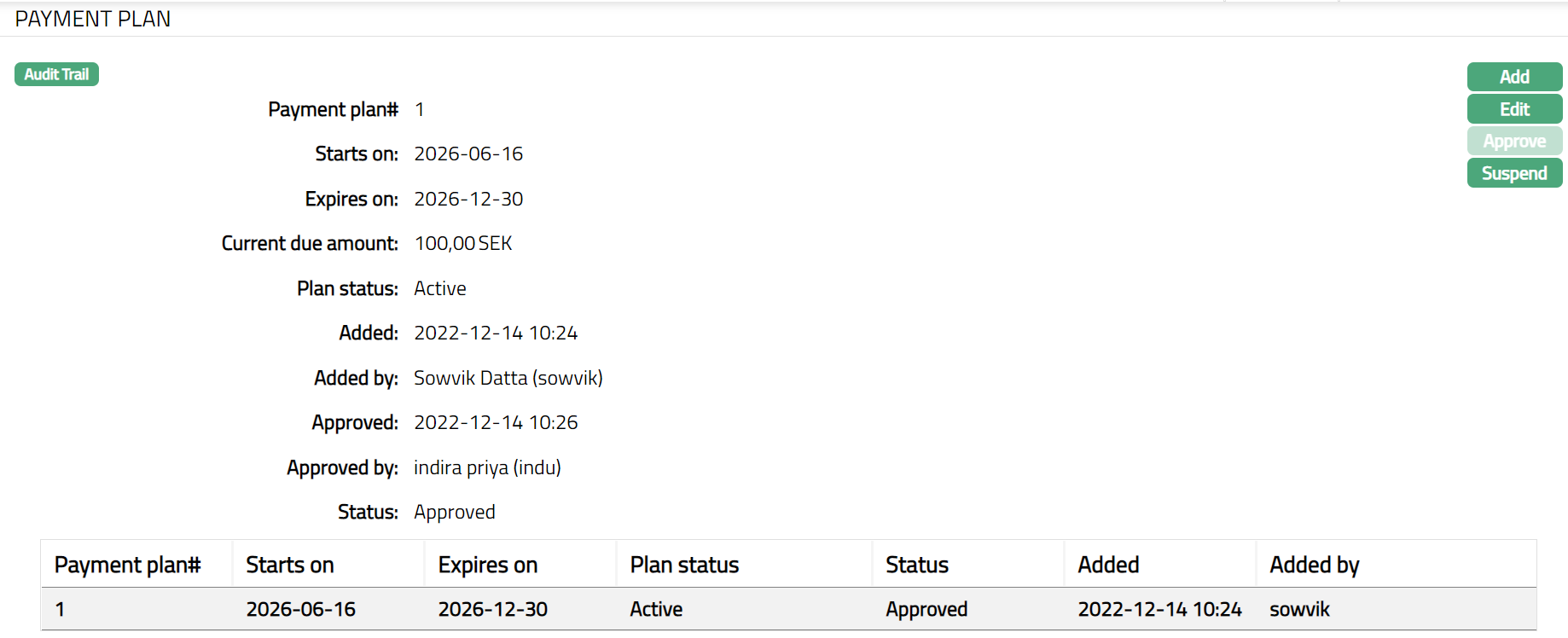

Click Save. The Account Status sub tab under Status tab appears with the added details and the Status will be Pending.

Functions: Add, Edit, Approve

Note: Any changes made in this Account status tab, will display the Status as Pending. On Approval by another user who has not created the account, the Status will change to Approve.

The additional fields that you can view in the tab are explained below:

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the person who created the record.

Approved field denotes date on which the record was approved.

Approved by field denotes name of the person who approved the record.

You can edit a record for Account Status for both Billing and Transaction Accounts. To edit,

- Click Edit. Edit Account Status page appears.

Except Account Status and Description, all other fields are editable**,** subject to certain conditions as described earlier.

The Preferences can be edited, only if the Modify preference is Yes. By default, it will display all the last maintained values for the Account status.

Click Save. Account Status sub tab appears with the edited details.

Functions: Add, Edit, Approve

Note: Edit and Approve buttons will be enabled only when you add a new Account Status, and the status of the record is Pending. Any change in the tab will set the tab status to Pending till it is approved by another user. On approval, the record status is set to Approved and the Add button gets enabled.

Payment status

The Payment Status of an account can be moved only based on the Rules that have been defined for the Product. There will not be any user-input Payment Status at Account level.

This tab will allow you to view the current Payment status and the history of the payment status movements. You will be able to edit the Preferences for Payment Status only at the Billing Account. The same will be cascaded to the underlying Transaction Accounts. When an account is moved into a particular Payment status all the underlying accounts having this account as the billing account will also be changed. Payment statuses are handled only at the billing account level, so if an account has another account as the billing accounts it will derive the payment status from the billing account.

The following Payment Status will be pre-shipped: Normal

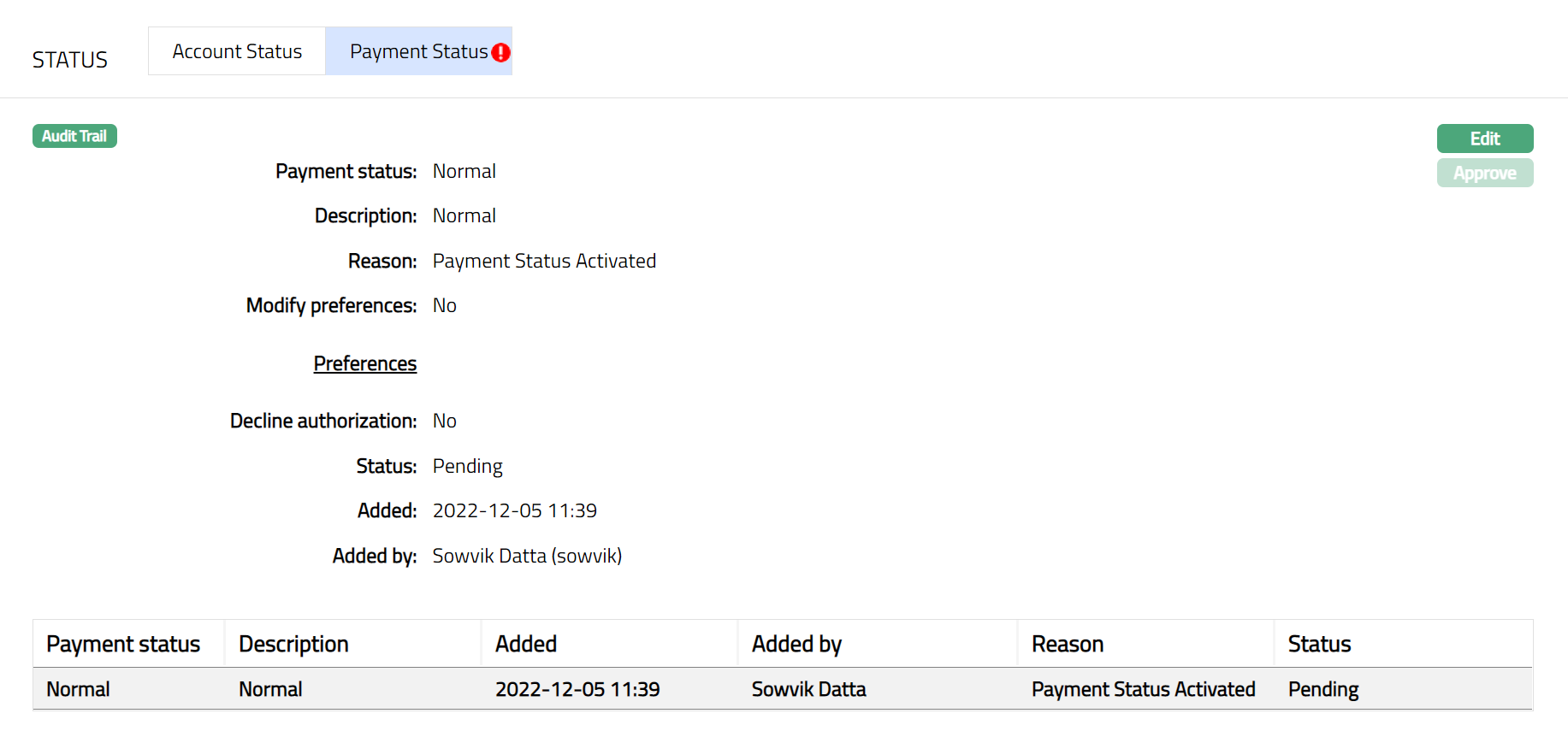

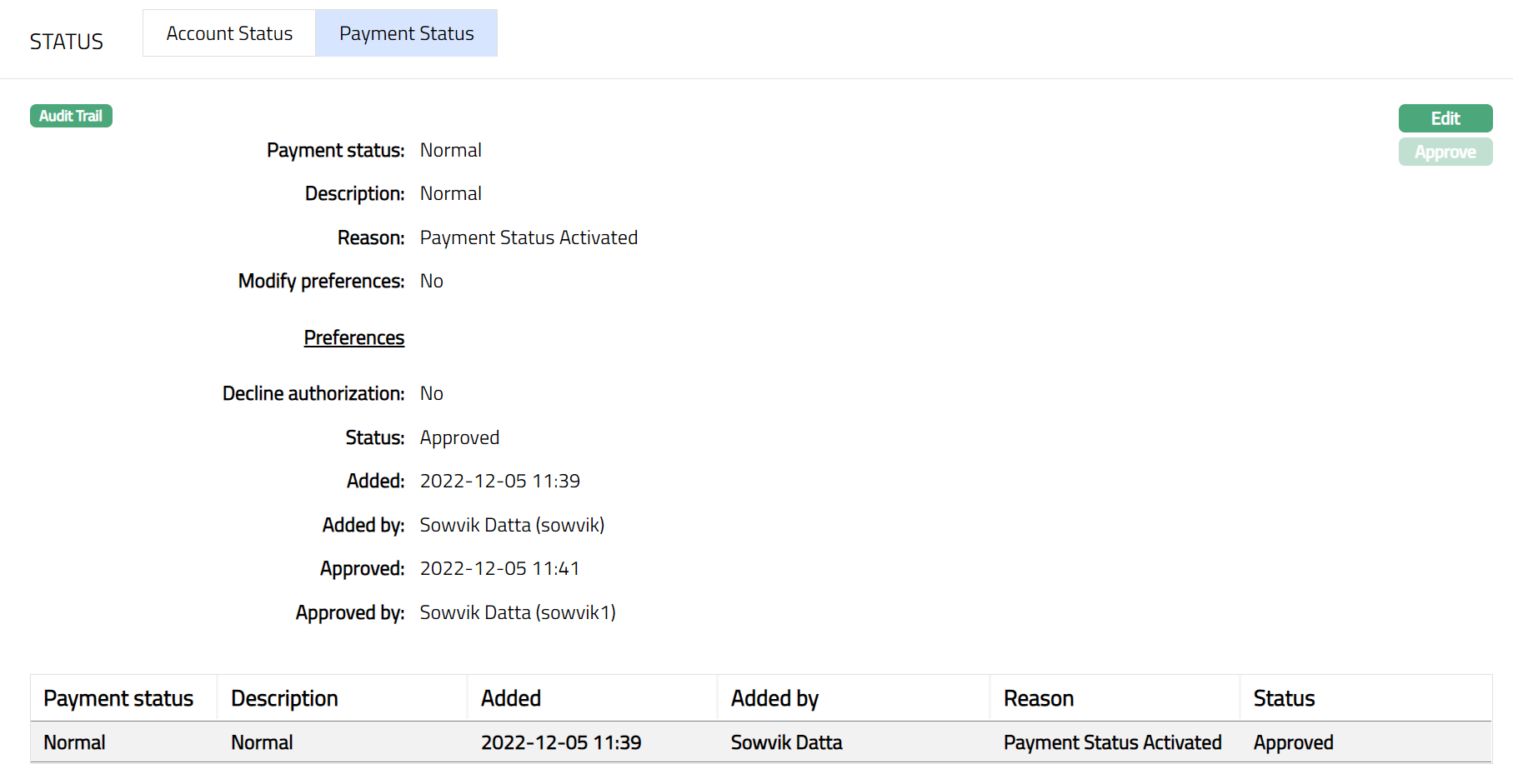

To view the Payment Status

- Access Card Account page and click Status and then Payment status tab. On account creation, the Payment Status is Normal as shown below:

Payment status displays the Payment status for the account.

The Description will be defaulted from the Payment Status Maintenance in case of user defined Payment Statuses; and in case of pre-shipped Payment Statuses, Description is the same as the Payment Status. On account creation, Description is Normal.

.

Reason displays the reason for the status selected for the account. In case of automatic status movements, the reasons are predefined; while in case of manual Preferences updates, this will display the reason input during the change.

Modify Preferences is defaulted from Payment status maintenance in case of user defined Payment Statuses; and in case of pre-shipped Payment Statuses, this is predefined. When Payment status is Normal, the Modify Preferences flag is defaulted to No, and is disabled. By default, this will be as explained in the following table:

| Current status | Modify preferences flag | Preferences |

|---|---|---|

| Normal | Defaulted to Yes and enabled. | By default, the Preference will be displayed and will be No. |

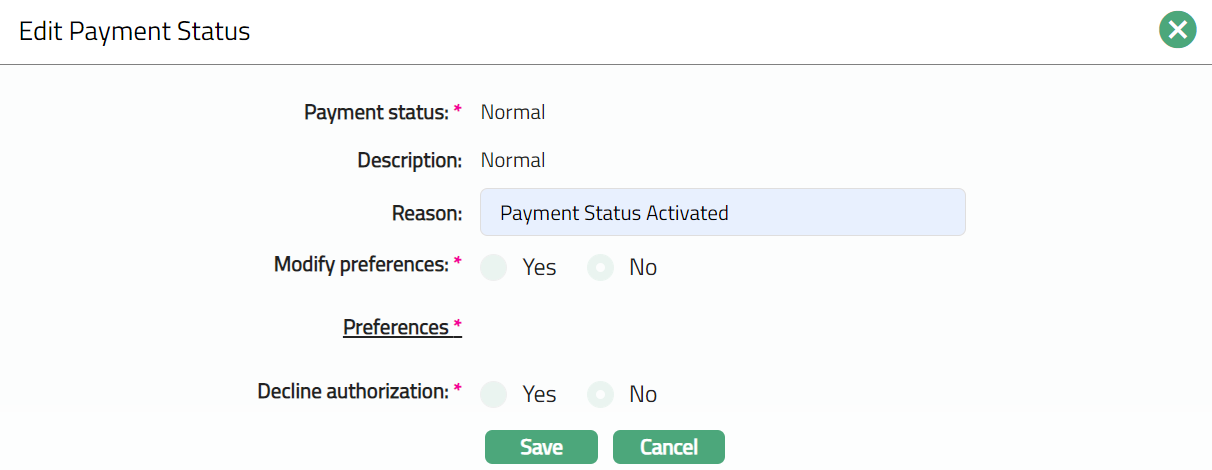

- Decline Authorization: When the flag is marked as Yes, Aura will decline all authorizations irrespective of the balance available in the account. It will be defaulted from the payment status maintenance after selection of payment status.

The following fields are shown only in the View screen and are not editable:

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

Note: On account creation, the Payment status of the account is Normal.

To manually set the Preferences for a Payment Status for a Billing Account

- Click Edit. Edit Payment Status page appears.

Only Reason field is editable.

The Preferences can be edited, only if Modify preference is Yes. By default, it will display all the last maintained values for the Account status.

Note:

You can edit a record for Payment Status only for Billing Accounts. The edited values will be cascaded to the underlying Transaction Accounts also.

When an account is moved into a particular Payment status all the transaction accounts -- that is accounts that have this account as the billing account -- will also be changed.

When the Decline Authorization flag is not under Account Status Preference or under Payment Status Preference, the Authorization request will be rejected.

- Click Save. Payment Status sub tab appears with the edited details.

Functions: Edit, Approve

Note: Any change in the tab will set the record status to Pending till it is approved by another user. On approval, the record status is set to Approved.

Functions: Edit, Approved.

The additional fields in the View screen are:

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

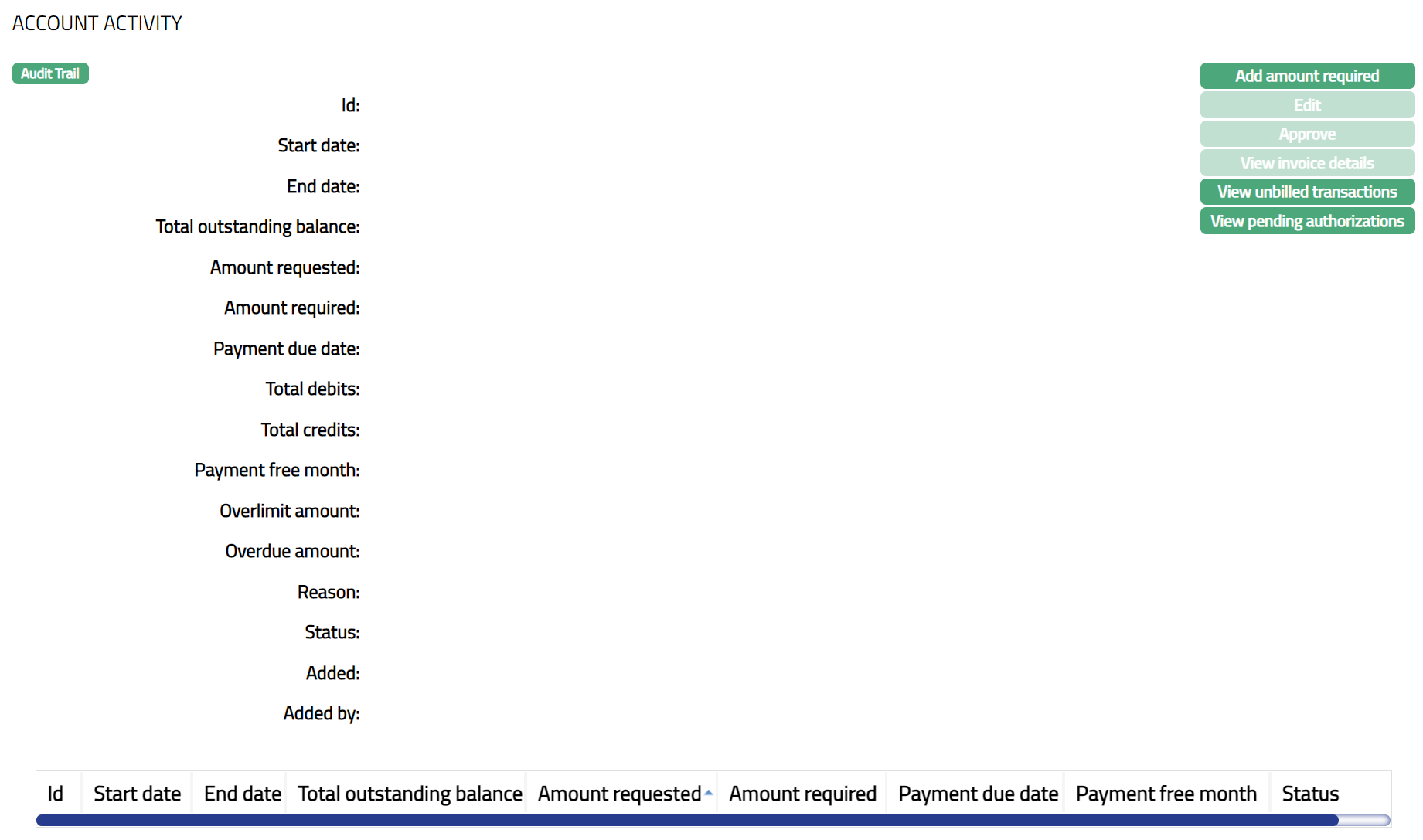

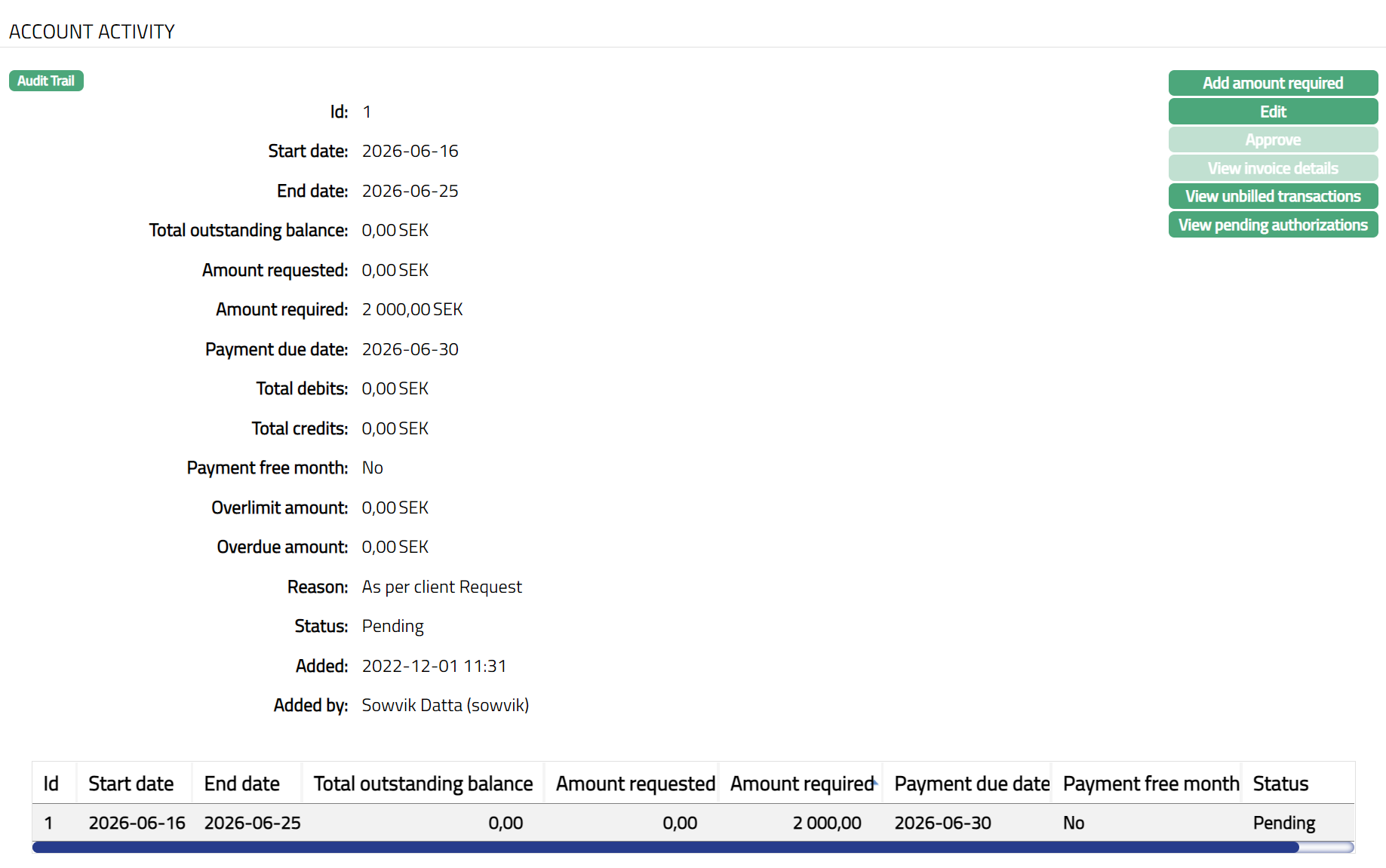

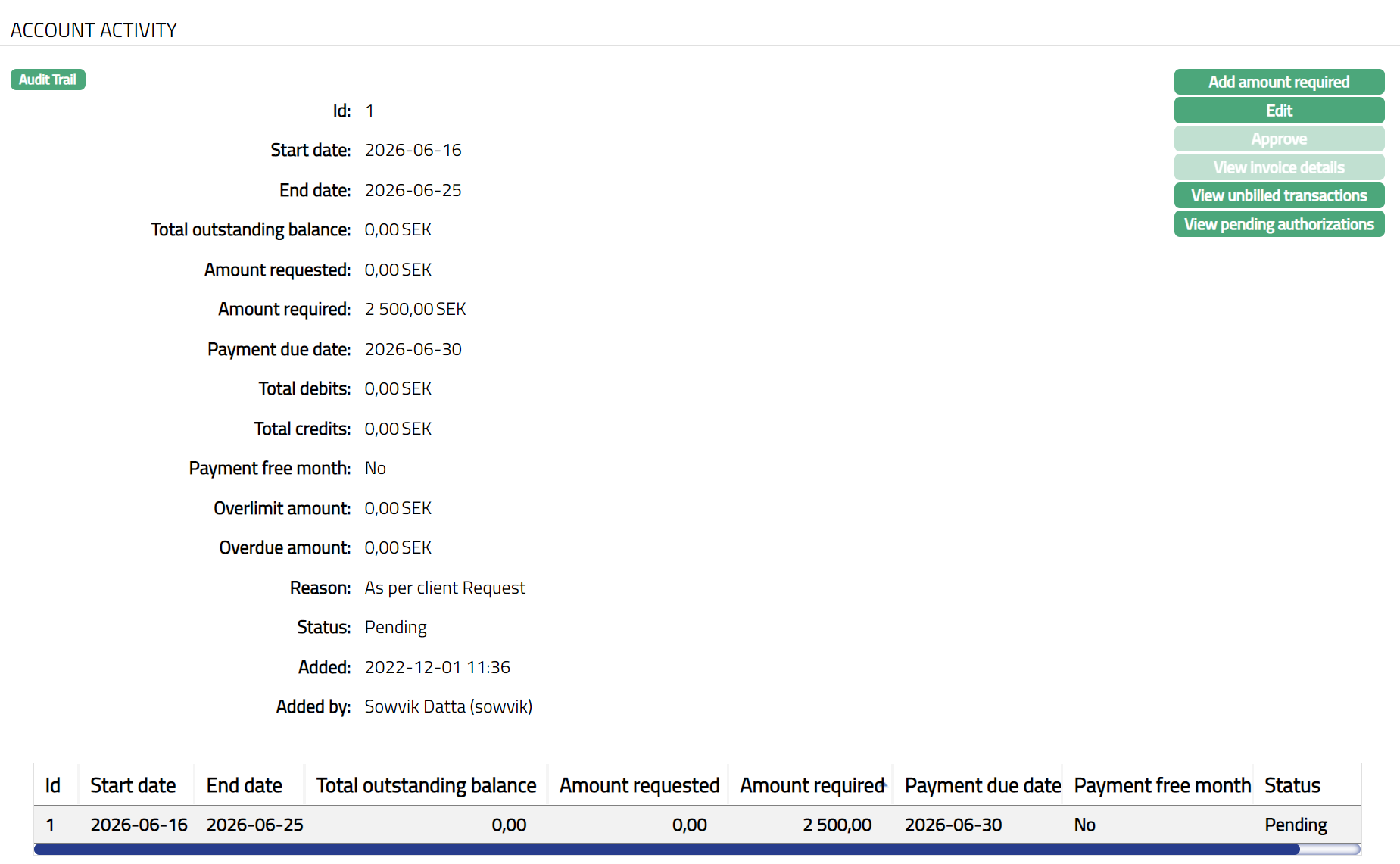

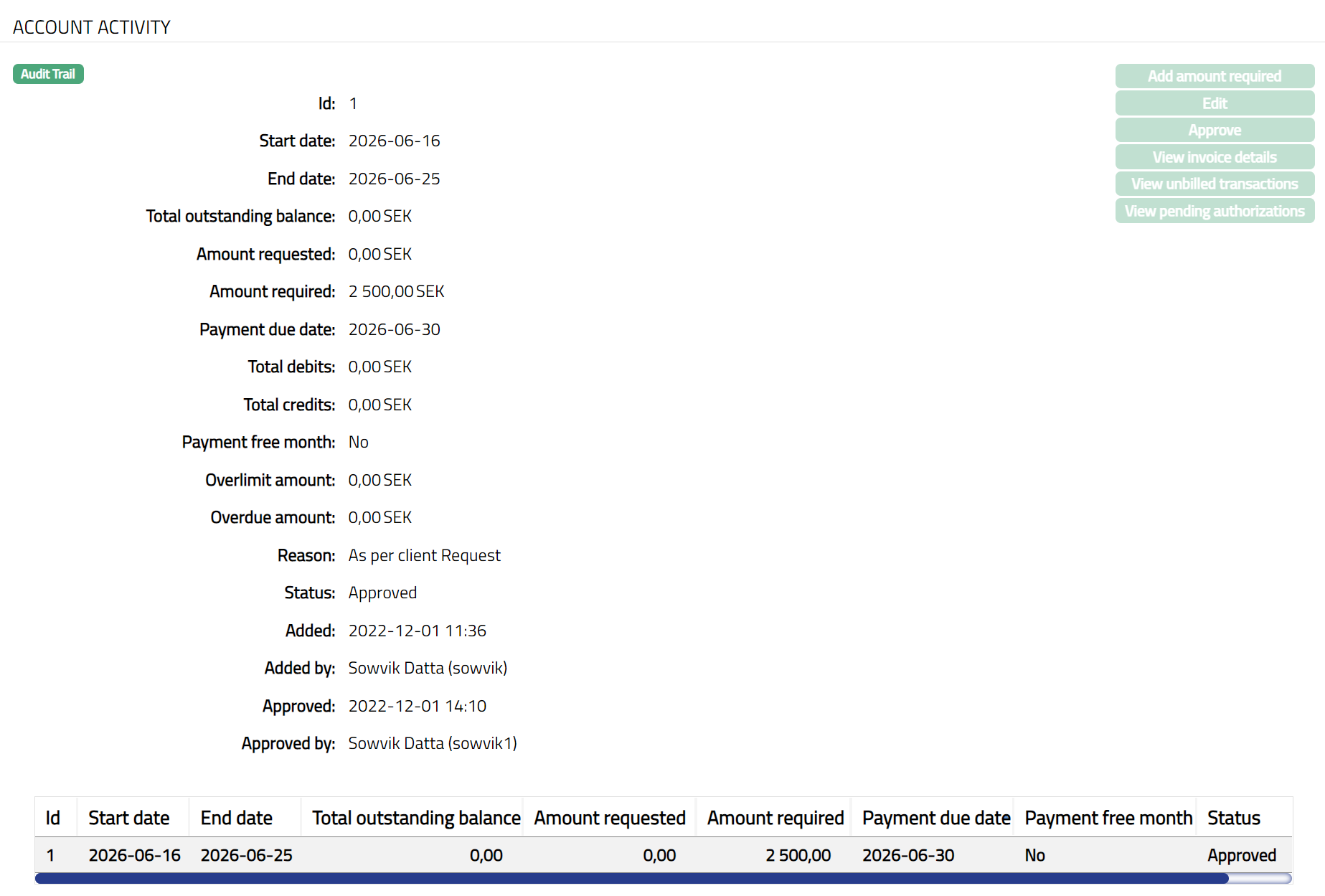

Account Activity

This tab enables the user to view the summary of invoice details, bonus points, balance class with accrued interest, unbilled transactions and pending authorizations (active amount blocks) for a Billing account and its related transaction accounts. This tab also allows the user to edit the Amount required when the invoice is generated till payment due date and also add the Amount required for the next invoice. You can perform the following actions under this tab.

- Access Card Account page and click Account activity tab to view the details as per sample below.

The fields that you can view are explained below:

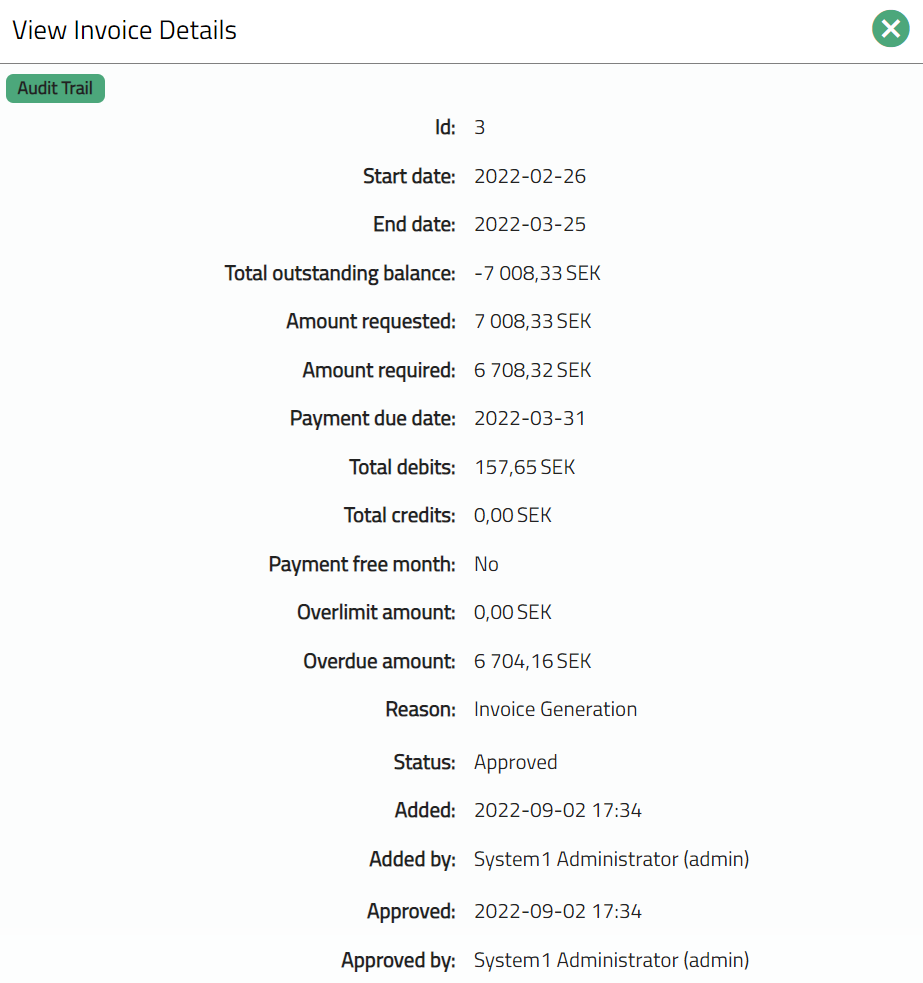

Id denotes the unique identifier for the selected Invoice.

Start date denotes the cycle start date of the selected invoice.

End date denotes the cycle end date of the selected invoice.

Total outstanding balance is the total outstanding balance in the selected invoice.

Amount requested denotes the amount requested in the selected invoice.

Amount required is the minimum amount that the client is required to pay for the selected invoice.

Payment due date is the date by which the client has to make the payment for the selected invoice.

Total debits is the total of debit transactions in the billing cycle for the selected invoice.

Total credits denote the total of credit transactions in the billing cycle for the selected invoice

Payment free month displays Yes if that month is a Payment Free Month and there are no payments required from the client; else displays No.

Overlimit amount is the amount that was above the given limit as at the end of the billing cycle for the selected invoice.

Overdue amount denotes the amount overdue (amount required minus payments received) as at the end of the billing cycle for the selected invoice.

Reason denotes the reason for the record. For invoice records created by Aura, this is by default "invoice generation". In case of user created records, this displays the reason input by the user during creation of the record

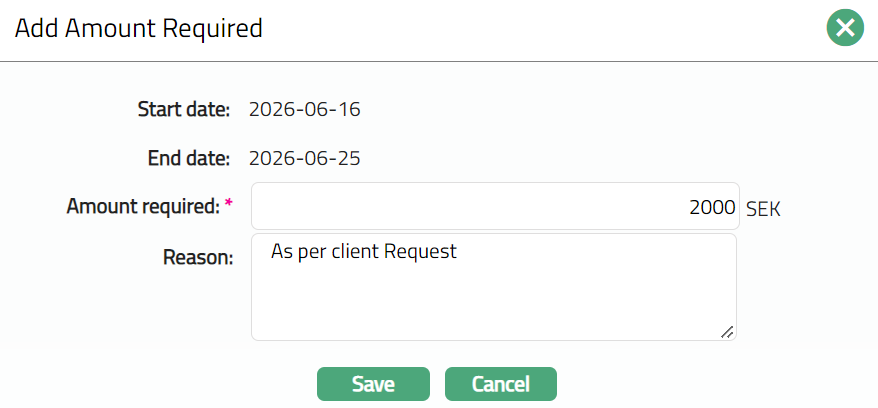

Add Amount Required

To Add amount required that has to be included in the next invoice,

- Click Add amount required button. The Add amount required page is displayed.

Aura automatically populates the current cycle Start date and End date for which the invoice is not yet generated.

Enter Amount required to be claimed in the next invoice. If the Product, Treat Overdue as Balance is set to Yes, this cannot be less than the overdue amount (Overdue Balance + Overdue Interest).

Enter Reason.

Click Save. The Account Activity page appears with the added details.

Functions: Add amount required, Edit, Approve, View invoice details, View unbilled transactions, view pending authorization

Functions: Add amount required, Edit, Approve, View invoice details, View unbilled transactions, view pending authorization

On saving, the amount required is maintained as a new record with a new Invoice Id and all the amounts apart from the Amount required are defaulted to zero. The record will be in Pending status.

Note: Any user other than the one who added the Amount required has to approve this record.

Edit

You will be able to edit an invoice record to give the revised Amount required only when the current date is between invoice generation date and payment due date. Similarly, you can edit a user-created record (which was created using Add Amount Required described above) only till the Invoice is generated.

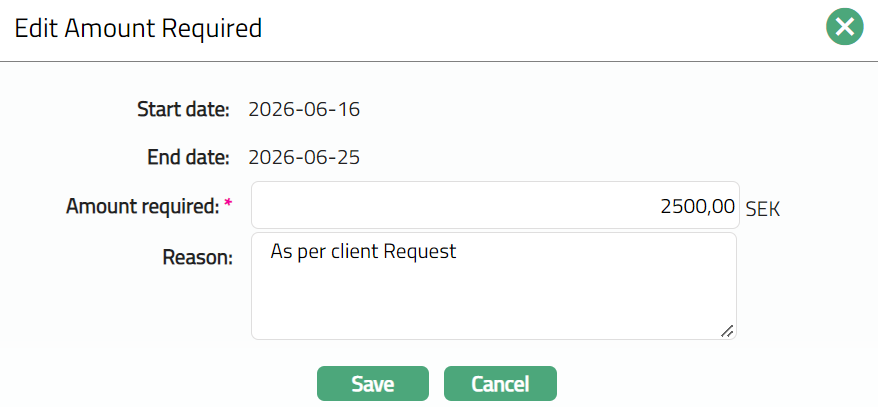

To Edit Amount Activity,

- click Edit button. Edit Amount Required page will be displayed.

Note: The Amount required, and Reason fields are editable.

- Click Save. Account Activity page appears with the edited details.

Note:

On edit, the record status will be updated to Pending. Any user other than the one who edited the Amount required has to approve the record to make the record status Approved. Only if the record is Approved, the edited values will be applicable.

Functions: Add amount required, Edit, Approve, View invoice details, View unbilled transactions, view pending authorization

Functions: Add amount required, Edit, Approve, View invoice details, View unbilled transactions, view pending authorization

The Additional Fields are as follows

Status denotes status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

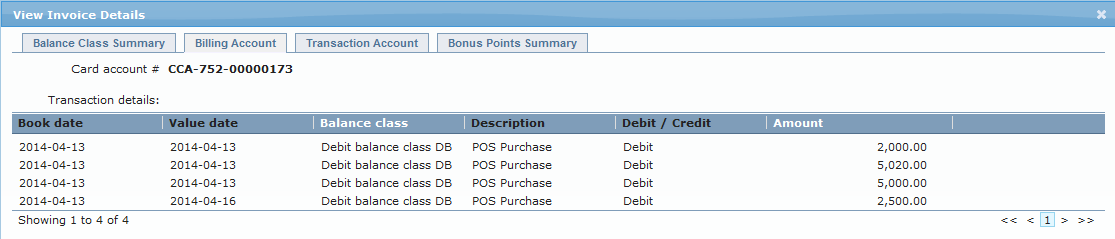

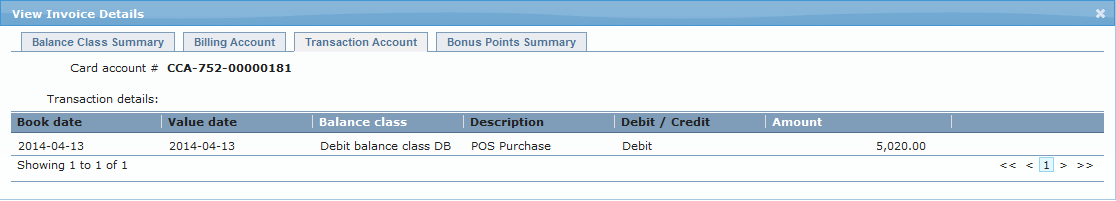

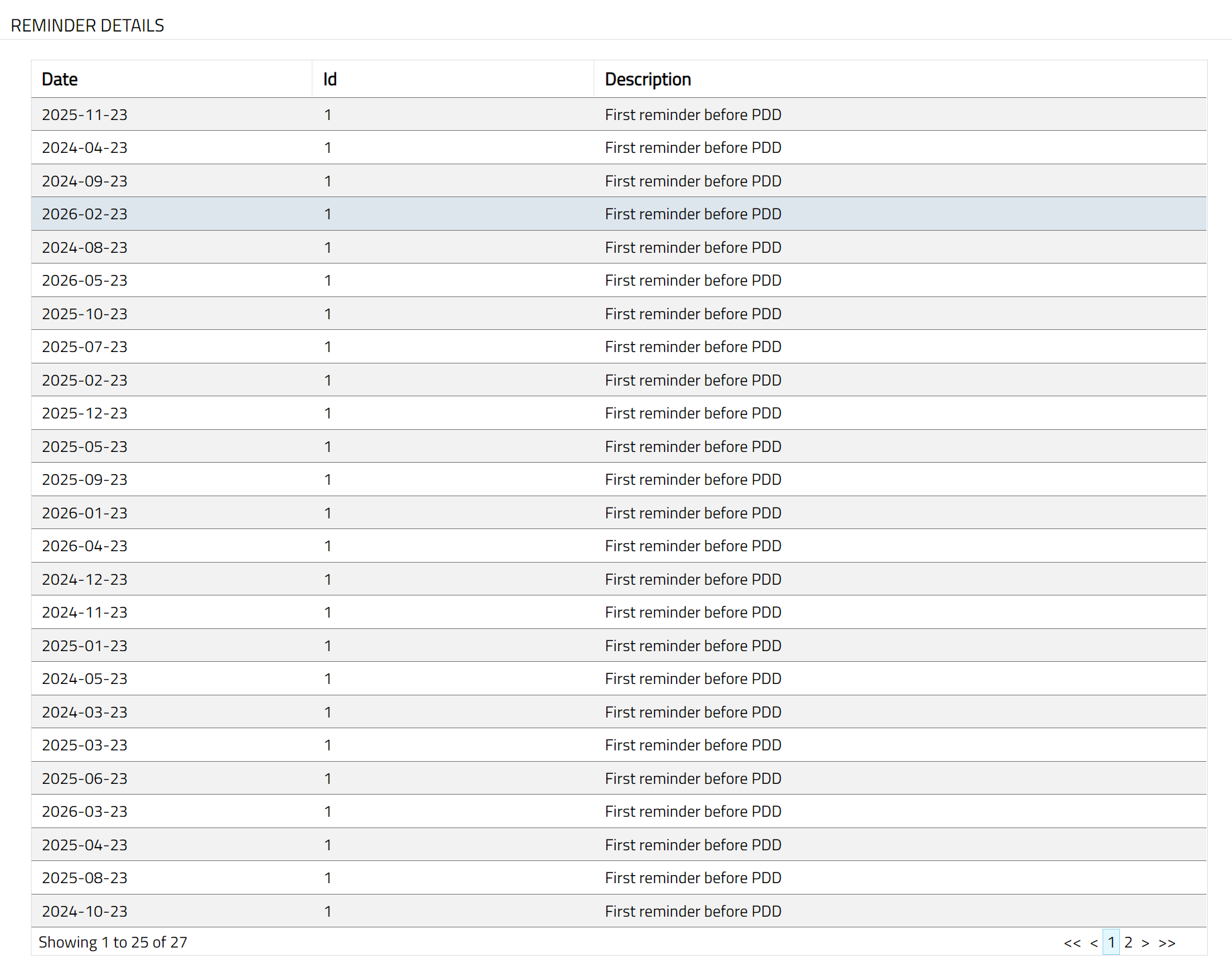

View Invoice Details

You can view the details of any invoice record using the View Invoice Details button.

To View invoice details,

Click View invoice details. The View Invoice details page opens and shows by default, the Balance Class Summary tab

Click Billing Account tab to view the billing account details. All the transaction details of the Billing account in the selected invoice are displayed.

Click Transaction Account tab to view the transaction account details. All the transaction details of the transaction account in the selected invoice are displayed.

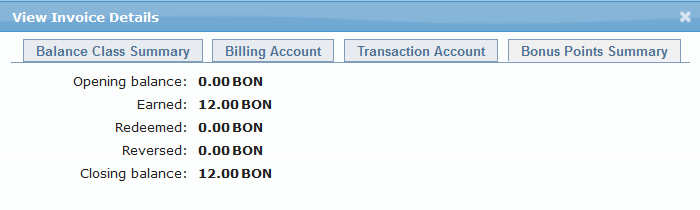

Click ~Bonus~ Points Summary tab to view the details of bonus points in the account.

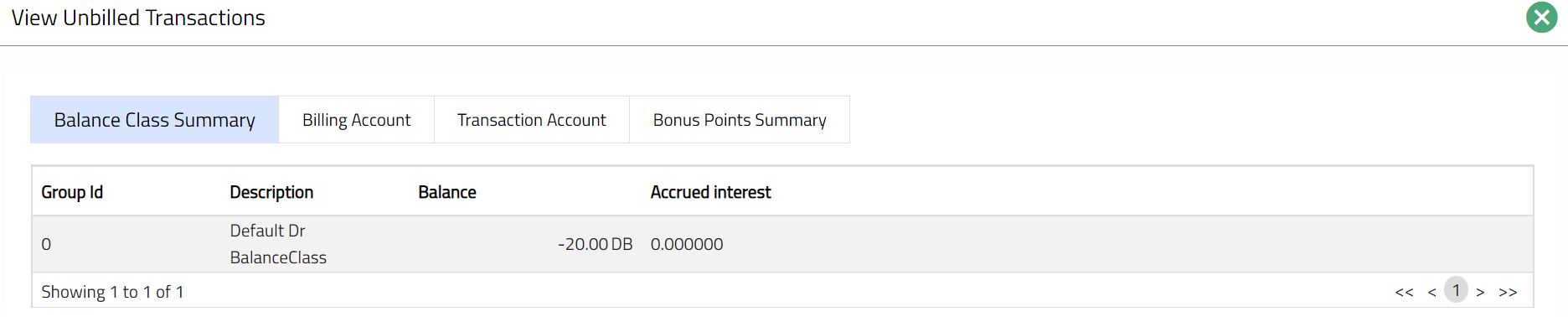

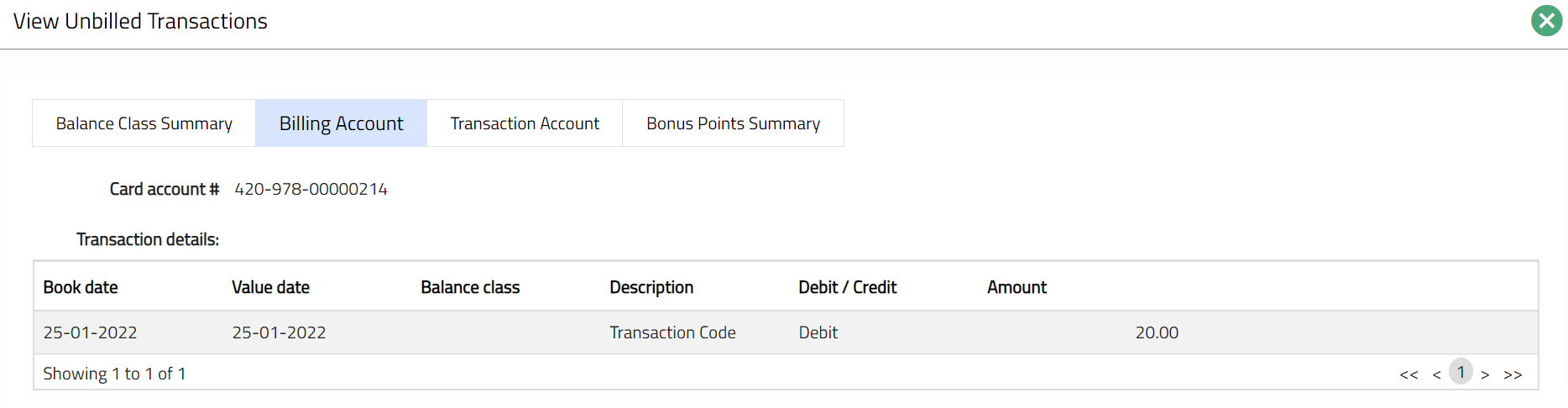

View Unbilled Transactions

Using this button, you will be able to view the unbilled transactions, as well as the current balances and accrued interest in the balance classes in the Billing Account and the associated Transaction Accounts.

To view unbilled transactions,

- Click View unbilled transactions button. The View Unbilled Transactions page is displayed. By default, Balance Class Summary tab is opened, showing the current balances in the various balance classes and the accrued interest on each of these.

- Click Billing Account tab to view the unbilled transaction details in the billing account. The tab displays all unbilled transactions from the oldest transaction to the latest transaction.

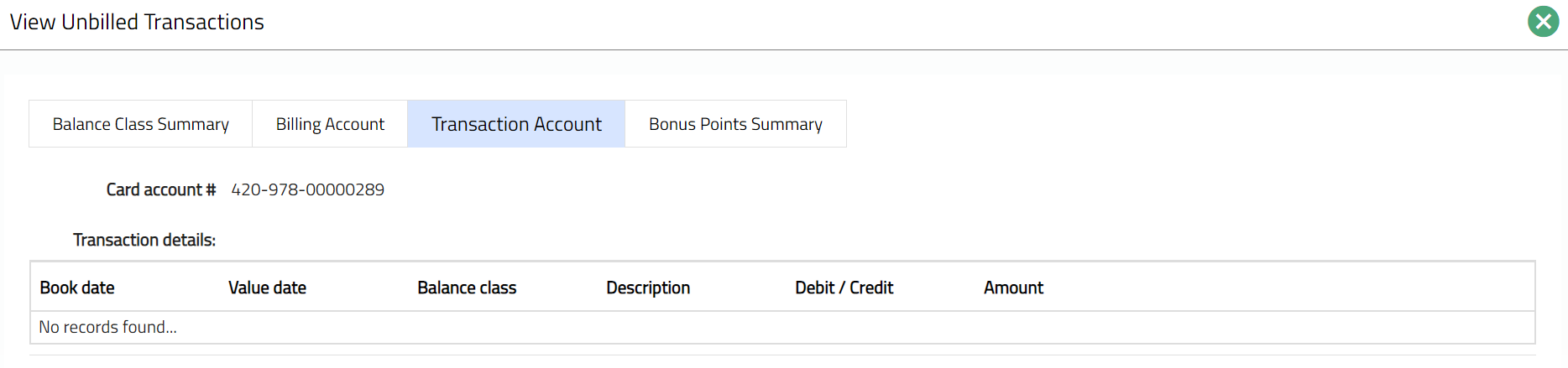

- Click Transaction Account tab to view the unbilled transaction details of the associated Transaction accounts. The tab displays all unbilled transactions for each Transaction Account from the oldest transaction to the latest transaction.

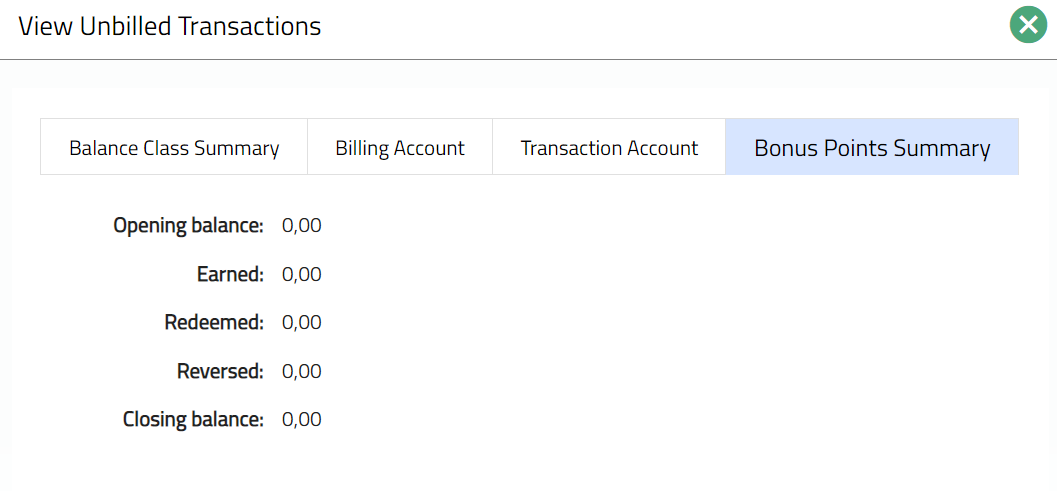

- Click Bonus Points Summary tab to view the details of the bonus points in the account.

View Pending Authorizations

You will be able to view all the Pending Authorizations i.e., active amount blocks, in the Billing account and associated Transaction accounts.

To view Pending Authorizations,

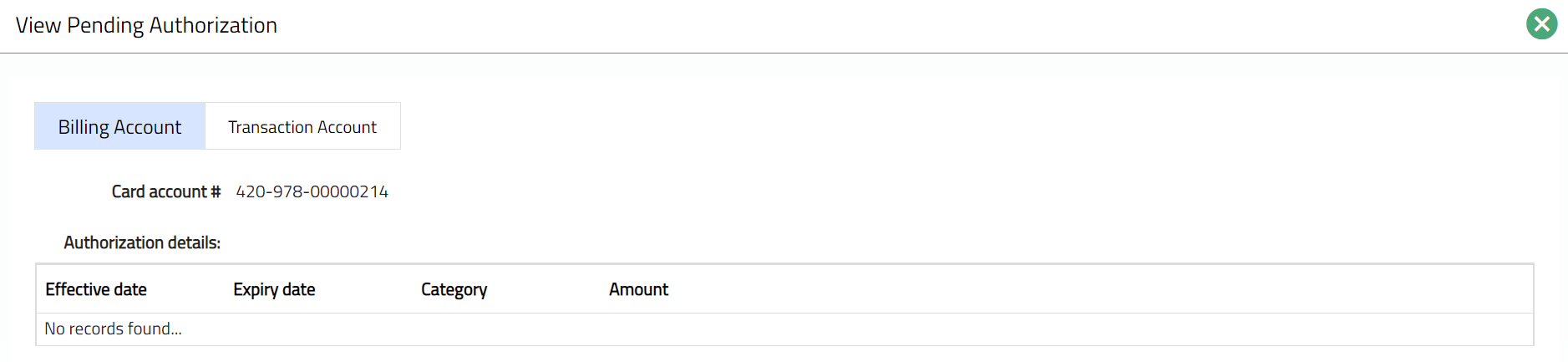

- Click View pending authorization button. The View Pending authorization page is displayed. By default, the Billing Account tab is opened. All active amount blocks in the billing account, from the earliest Effective date to the latest, are displayed.

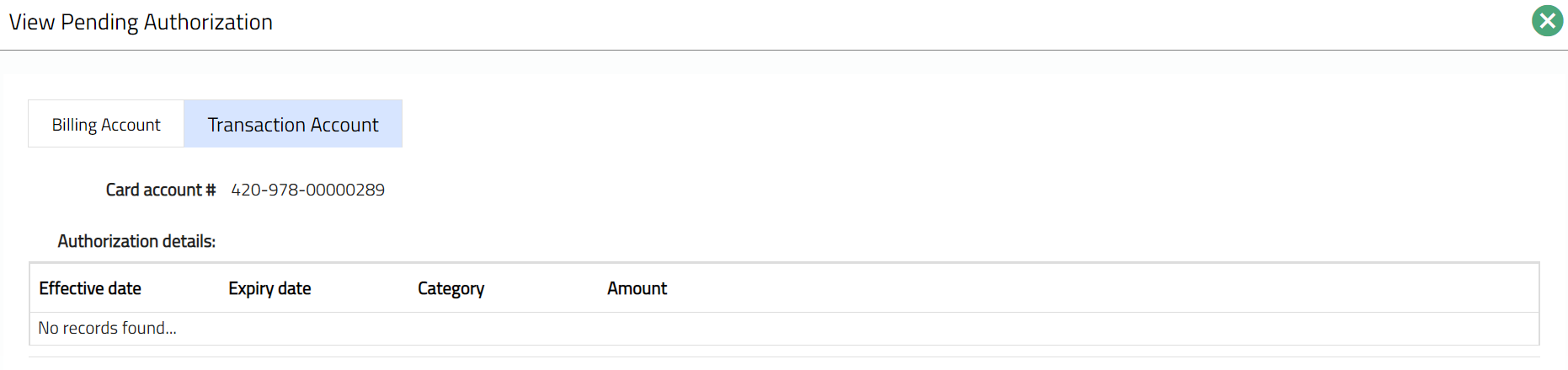

- Click Transaction account tab, all active amount blocks in the transaction account, from the earliest Effective date to the latest are displayed.

Categorisation

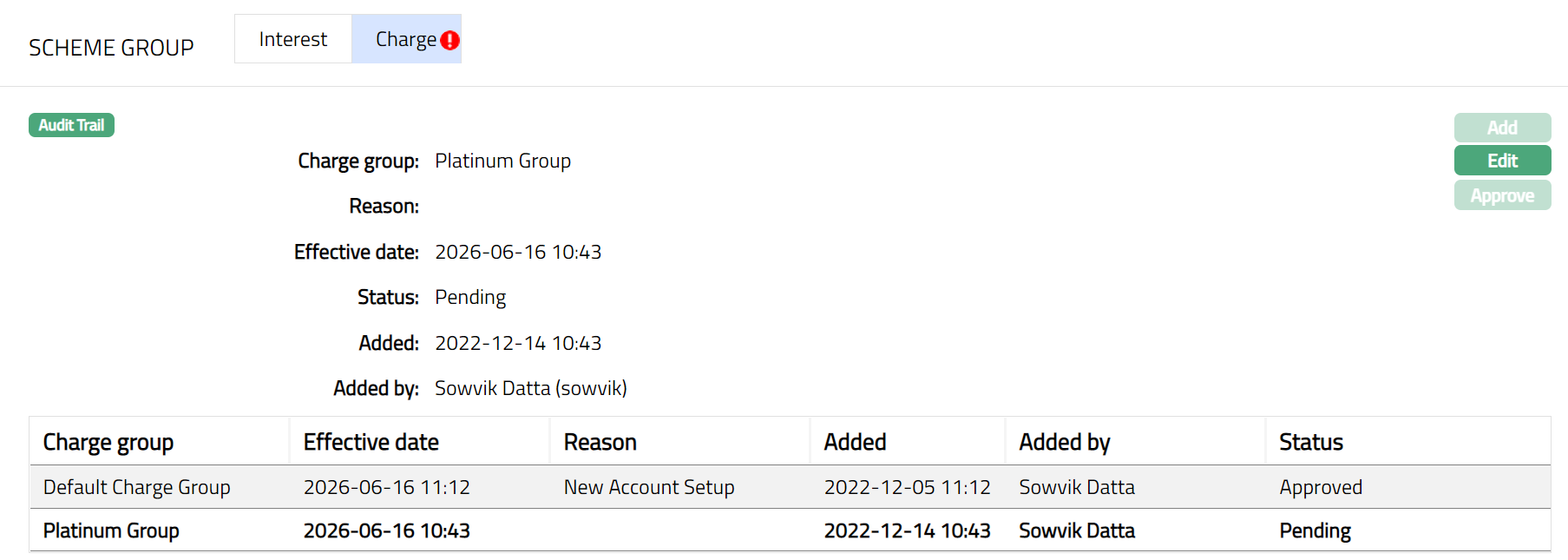

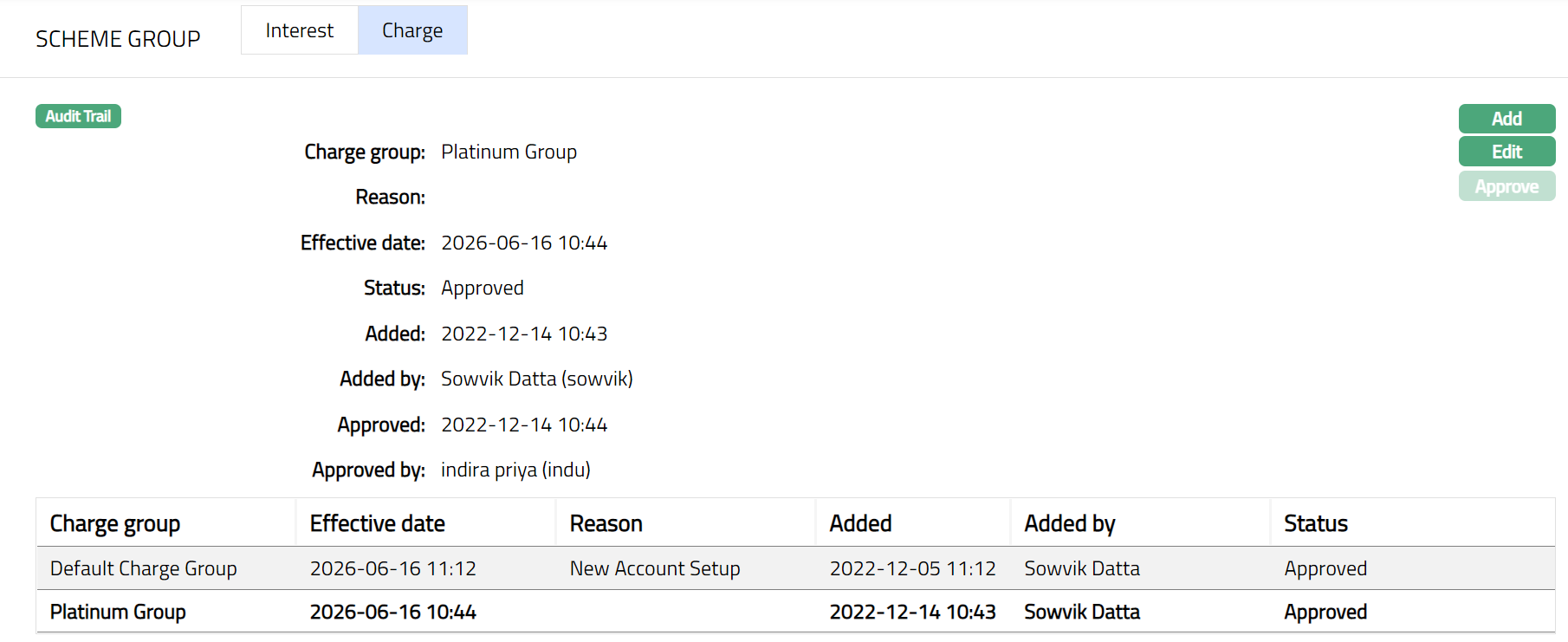

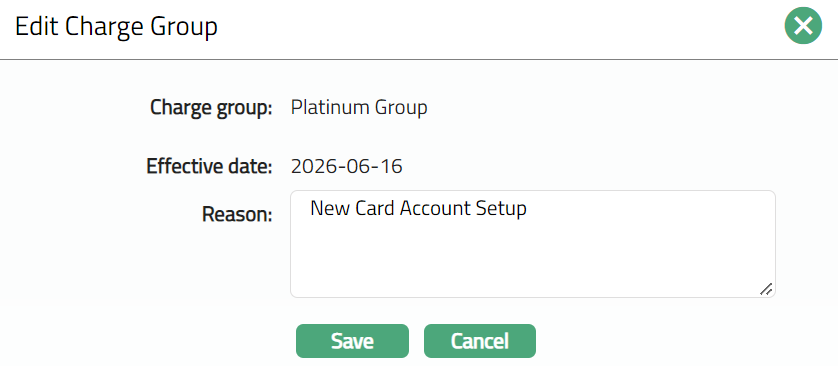

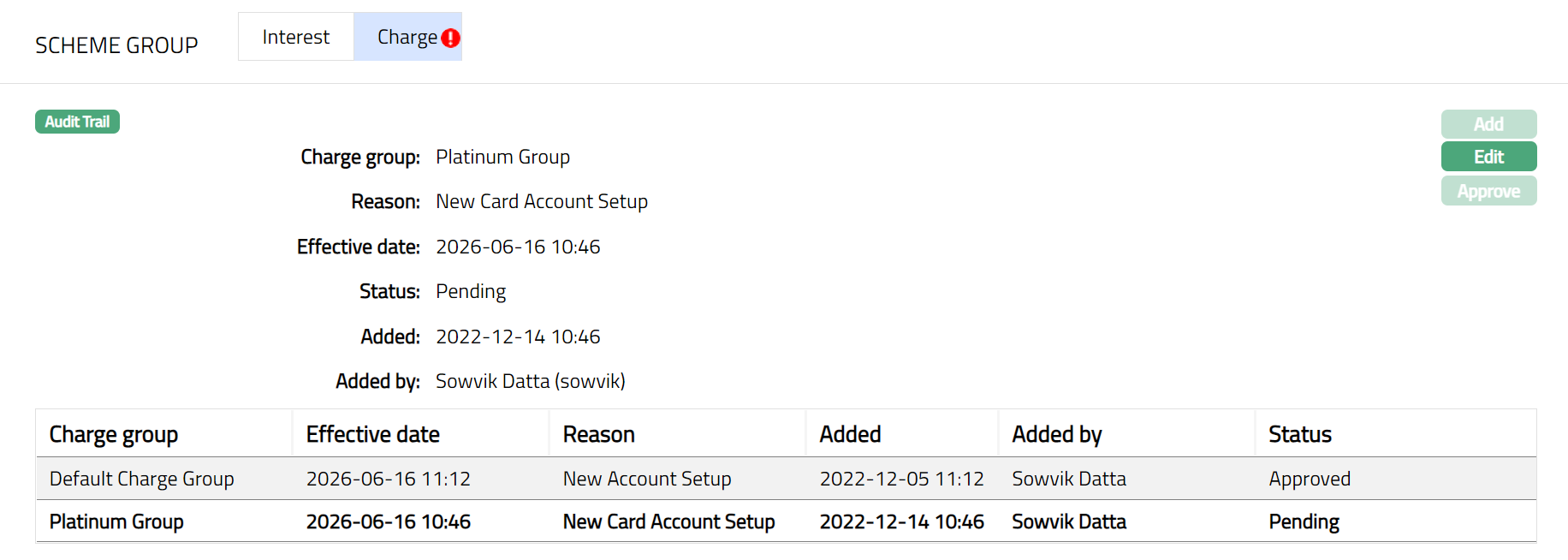

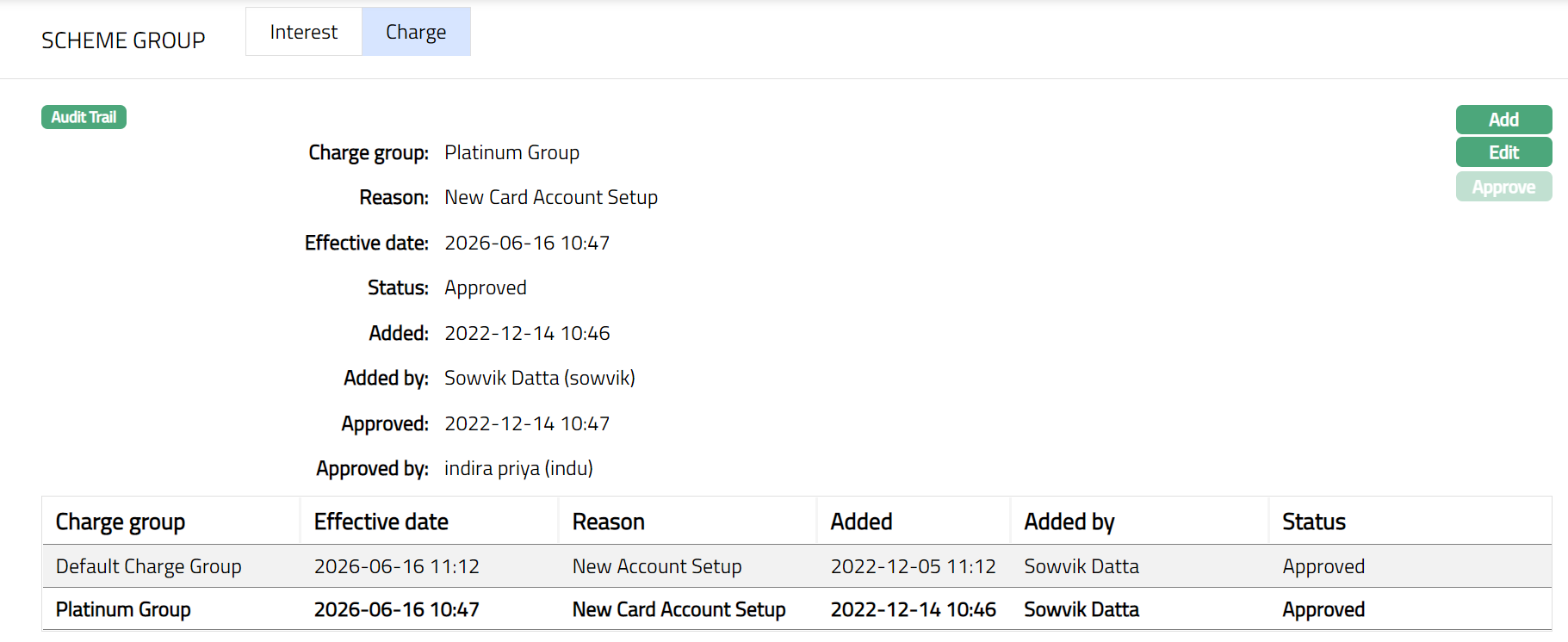

Charge

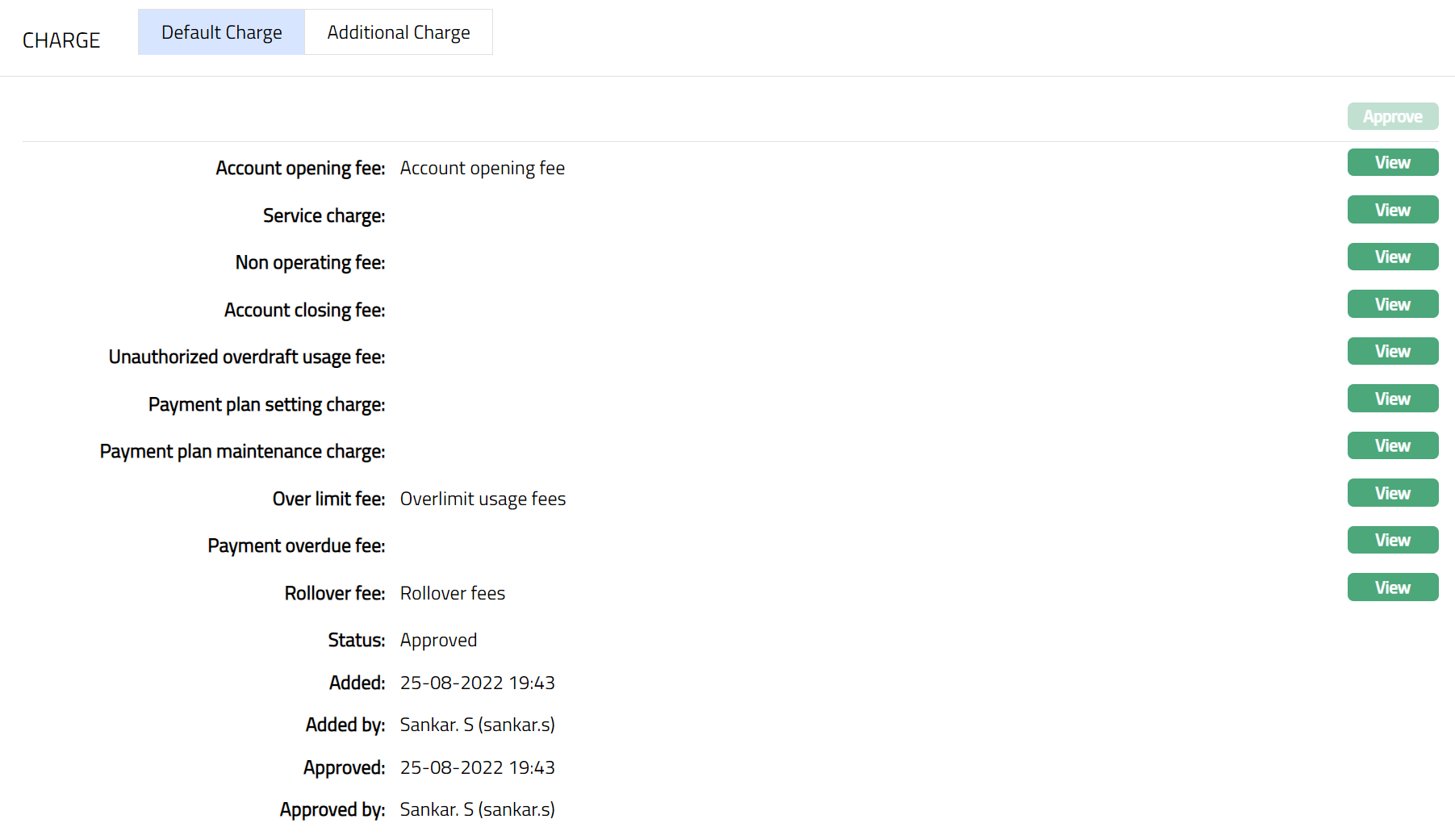

This tab allows you to view and edit the default charges and additional charges of the Card account subject to Restrictions that have been set at the Product. The charges displayed in the Card account are defaulted from the Charge Group chosen for the account during creation. It has two sub-tabs, one for each of these.

The Charge tab is displayed for both Billing accounts and Transaction accounts.

Default Charge

The Default Charges tab allows you to view and maintain the details of a set of pre-defined charges applicable for the Card account. The charge scheme and applicable parameters can be updated for each default charge, allowing you to customize the pricing for each Card account.

To view the Default Charges

- Access Card Account page. Click Charge tab to view the Default Charges. On creation of the Account, the charges are defaulted from the Charge group chosen during the account creation. A sample of the screen is shown below:

2. Account Opening Fee is the charge for opening the account and is selected from the list of the Event based Flat Charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

3. Service Charge is the charge for the service provided and is selected from the list of Periodic, Flat or Banded Charges. If Banded, the card account outstanding balance will be the basis for the charge. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge

4. Non-operating fee is charged for an account that remains un-operated and is selected from the list of Periodic, Flat Charges. If there were no transactions which affect the Dormancy calculation during the charge period, the charge will be applied at the end of the period. It will be only arrear charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

5. Account Closing charges is used for closure of the account and is selected from the list of Event based Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

6. Unauthorized overdraft usage fee charge is levied every time the account goes beyond its authorized limit and is selected from the list of Event based Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

7. Payment plan setting charge will be applied when a payment plan for an account is initiated. Select the charge from the list of Event based Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

The Payment plan maintenance charge will be applied whenever the Amount required for the Invoice is derived from an active Payment plan. Select the charge from the list of Periodic, Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

The Over limit fee will be applied if the account goes beyond limit for even one day during the cycle. Select the charge from the list of Periodic, Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

Payment overdue fee will be levied if the customer miss's payment of amount required and if the payment status is Normal. Select the charge from the list of Event based Flat charges. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

Rollover fee will be levied when the account balance is rolled over to the next cycle by not paying the amount due for the last cycle. Select the charge from the list of Event based Flat or Banded charges. If Banded, the rolled over amount will be the basis for the charge. The charge scheme is defaulted from the Charge Group chosen during account creation. It is an editable field and if edited, it shows the charge scheme combination that was chosen last for this charge.

The additional fields that you can view in the tab are explained below:

Status field denotes the status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes the name of the user who approved the record and is displayed only for approved records.

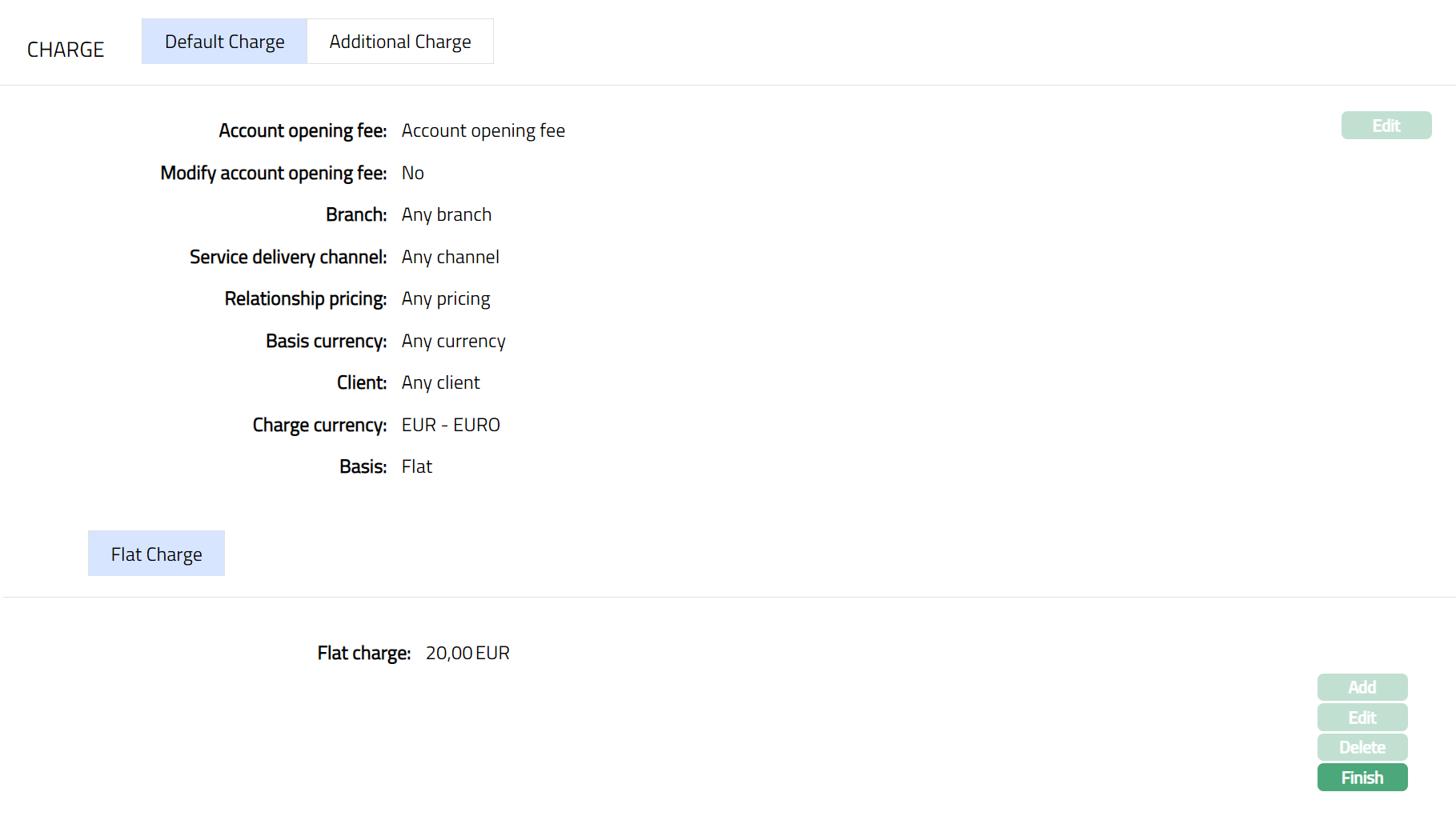

To view / edit the parameters for any default Charge

- Click View against the specific Charge to see the charge scheme, charge combination details and other parameters for the charge.

On creation of the account, the Charge Combination values are picked up based on the most suitable combination applicable to the account. The order in which the combination is chosen is shown below:

| Order | Effective Date | Pricing | Client | Service Delivery Channel | Currency | Branch |

|---|---|---|---|---|---|---|

| 1 | Current Date | Specific | Specific | Specific | Specific | Specific |

| 2 | Current Date | Specific | Specific | Specific | Specific | Any |

| 3 | Current Date | Specific | Specific | Specific | Any | Any |

| 4 | Current Date | Specific | Specific | Any | Any | Any |

| 5 | Current Date | Specific | Any | Any | Any | Any |

| 6 | Current Date | Specific | Specific | Specific | Any | Specific |

| 7 | Current Date | Specific | Specific | Any | Any | Specific |

| 8 | Current Date | Specific | Any | Any | Any | Specific |

| 9 | Current Date | Any | Any | Any | Any | Specific |

| 10 | Current Date | Specific | Specific | Any | Specific | Specific |

| 11 | Current Date | Specific | Any | Any | Specific | Specific |

| 12 | Current Date | Any | Any | Any | Specific | Specific |

| 13 | Current Date | Any | Any | Any | Specific | Any |

| 14 | Current Date | Specific | Any | Specific | Specific | Specific |

| 15 | Current Date | Any | Any | Specific | Specific | Specific |

| 16 | Current Date | Any | Any | Specific | Specific | Any |

| 17 | Current Date | Any | Any | Specific | Any | Any |

| 18 | Current Date | Any | Specific | Specific | Specific | Specific |

| 19 | Current Date | Any | Specific | Specific | Specific | Any |

| 20 | Current Date | Any | Specific | Specific | Any | Any |

| 21 | Current Date | Any | Specific | Any | Any | Any |

| 22 | Current Date | Any | Any | Any | Any | Any |

| 23 | Future Dated | Specific | Specific | Specific | Specific | Specific |

Depending on whether the charge Basis is Flat or Banded, you will see the below screen:

Flat Charge view

1. Name of Charge: For example: Account Opening Fee / Service Charge: It is the name of the Default Charge and shows the Charge scheme that is derived from the Charge Group chosen during creation of the account. This is an editable field.

2. Modify charge allows you to modify the charge parameters applicable to this account that are defaulted from the Charge scheme attached to the default charge. By default, it will be No, but is an editable field. Only if this is set to Yes, you will be allowed to change the charge parameters.

The values for Branch, Service delivery channel, Relationship pricing, Basis currency, Client, Chargecurrency, Basis are defaulted from the most suitable charge combination for the account as explained earlier. These fields are non-editable.

The Flat charge value is derived from the flat charge maintained for the Charge scheme attached to the default charge. The Flat charge is displayed only when the Charge Basis is Flat.

In case the charge Basis is Banded, the following fields are displayed:

5. Range Low, i.e., the lower limit, is defaulted to Zero for the first band. For the succeeding bands, it is automatically set as Range high of the previous band + least decimal of Basis currency. In case of Any Currency, the number of decimals is taken as 2. The value is derived from the Band details maintained for the Charge scheme attached to the default charge. See Note below.

6. Range high. i.e., the upper limit for the Band is derived from the Band details maintained for the Charge scheme attached to the default charge. This is an editable field.

Note: The Range Low and High should be entered as negative numbers if the charge basis is the debit balance of an account. For example, in case of Card Accounts, if you want to charge a fee based on the balance in the card account, maintain the Band in negative numbers, so that charge would be calculated only if there is a debit balance in the card account.

If the charge basis amount lies outside the Range, the charge will be calculated as 0. Hence, you should maintain the Range values such that it would cover any amount.

Specify if you want the charge for the Band to be a fixed amount or a percentage using the Amount or percentage field. Accordingly, the charge amount will be taken as the fixed amount for the band or calculated using the percentage and the basis amount. The Amount or Percentage selected while maintaining the Band details for the charge scheme is displayed here. This is an editable field.

On the basis of the Amount or Percentage selected in the above field, the Value will display the input percentage or the input amount to be charged.

9. Add Base enables you to add a fixed amount apart from a percentage-based charge. This field is enabled only if Percentage is selected. It provides you with the ability to define the percentage to calculate the charge and add a fixed amount to get the final amount to be charged.

10. Minimum charge amount field will be enabled only if percentage is selected above. Aura will check if the calculated charge amount < Minimum amount, if Yes then the final charge amount will be the Minimum amount.

11. Maximum charge amount field will be enabled only if percentage is selected above. Aura will again check whether the calculated charge amount > Maximum amount, if Yes then the final charge amount will be the Maximum amount.

For example:

Band Range is between - 10000.00 to 0.00. Percentage is 8%. Add Base = 10.00

EUR, Minimum amount = 20.00 EUR, Maximum Amount = 100.00 EUR.

Case 1:

If The Account balance = - 1000.00

Percentage Charge = 80 (1000 * 8%).

Add base = 10,

Calculated Charge amount = 80+10= 90.

Case 2:

Account balance = - 100.00

Percentage charge = 8 (100 * 8%)

Add base = 10

Calculated Charge amount = 8 + 10 = 18, which is < Minimum amount of 20.00

Hence, the charge amount that will be booked = 20.00

Case 3:

Account balance = - 10000.00

Percentage charge = 800 (10000 * 8%)

Add base = 10

Calculated Charge amount = 800 + 10 = 810, which is > Maximum amount of 100.00

Hence, the charge amount that will be booked = 100.00

- Click Edit to change the Charge Scheme and modify the parameters attached to the charge scheme. The Edit Schema page appears.

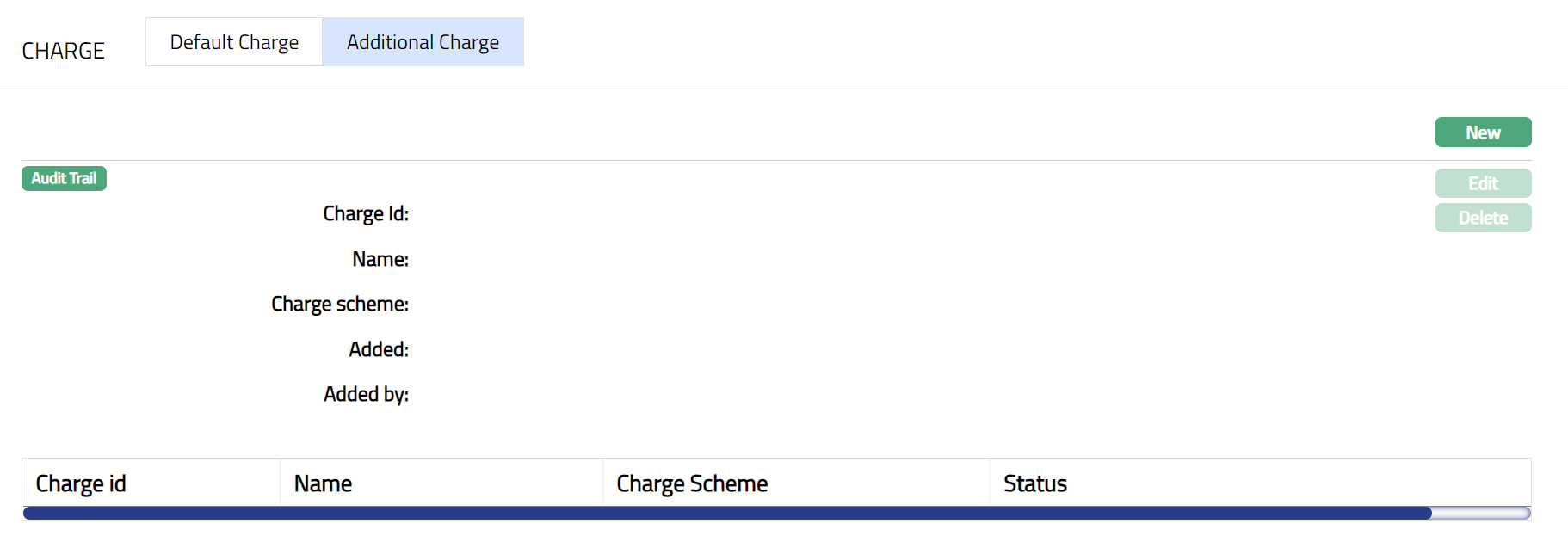

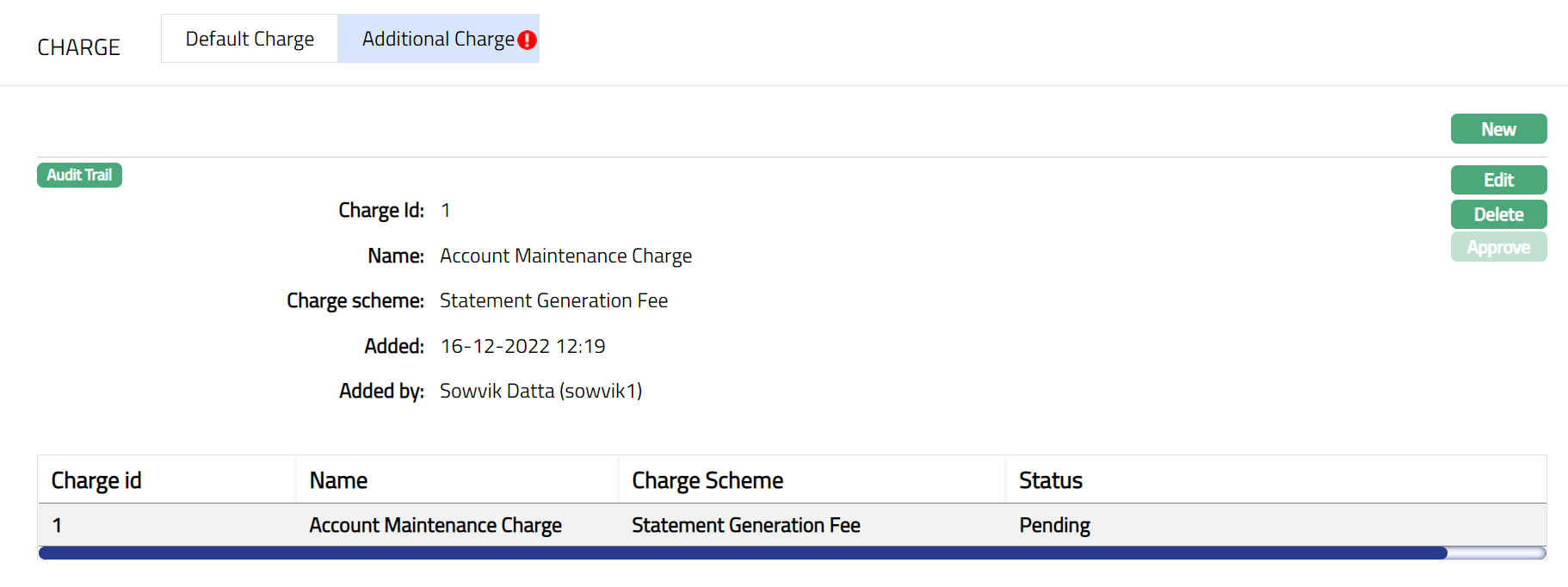

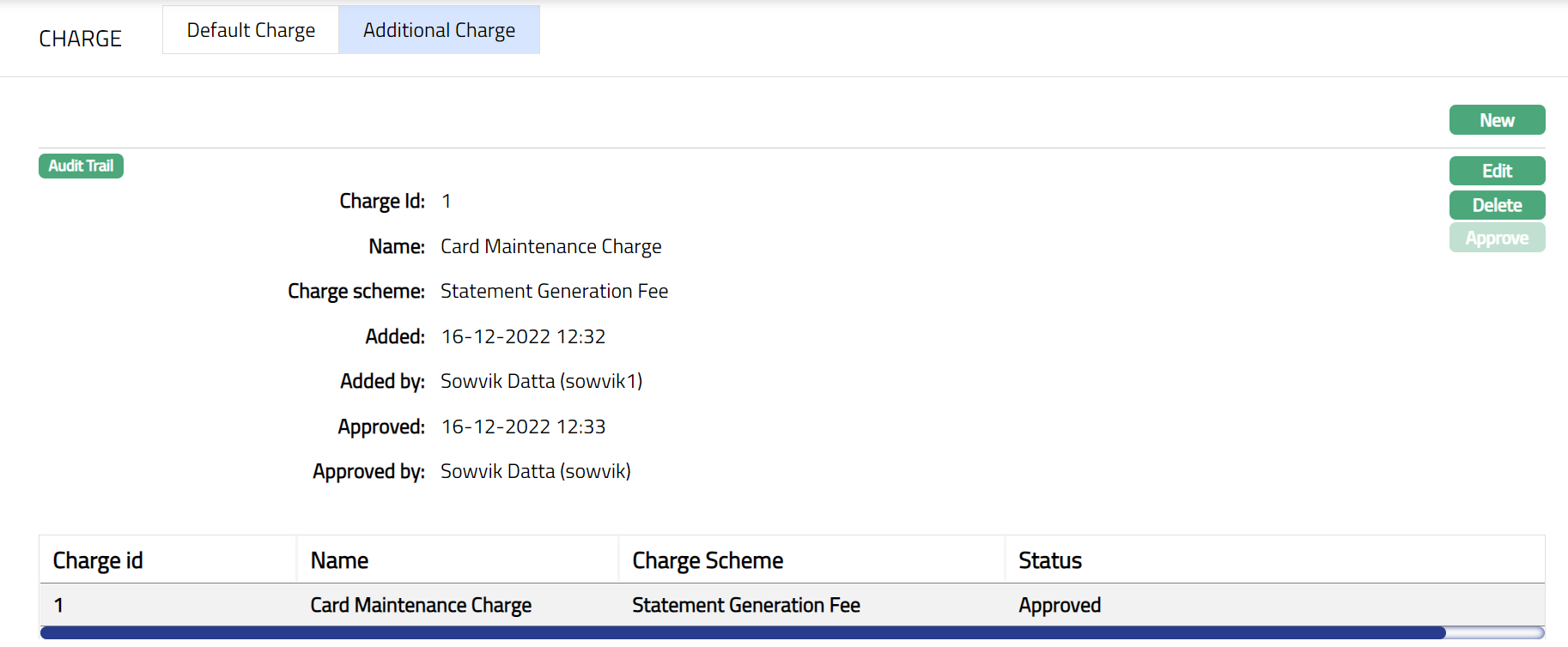

Additional Charge

The Additional Charge tab allows you to add, view and maintain additional charges for the card account

To Add a charge

- Access Card Account page. Click Charge tab and then Additional charge tab to view the details as per sample below. On creation of Account, if there are any additional charge maintained at the product level - the details are defaulted from Product > Additional Charge based on the Product that you chose for the account during creation.

The following fields are shown only in the View screen and are not editable:

Charge Id field denotes the unique sequential charge id generated at the Account level for the additional charges.

Name field denotes the name of the additional charge.

Charge Scheme field denotes the name of the charge scheme attached to the additional charge.

Status field denotes the status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

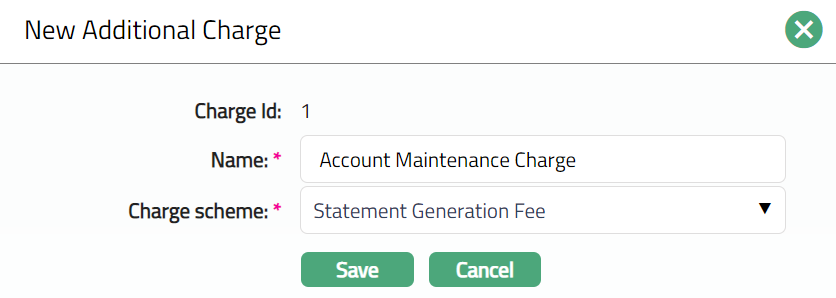

- Click New. The New Additional Charge page appears.

Enter charge Name.

Select Charge scheme from the drop-down list of Periodic flat or banded charges maintained at Admin > Pricing > Charges > Charge Schemes If the Charge is Banded, the charge amount will be calculated on the basis of the amount sanctioned.

Click Save. The Additional charge page appears with the new added details and the details are displayed on the summary pane.

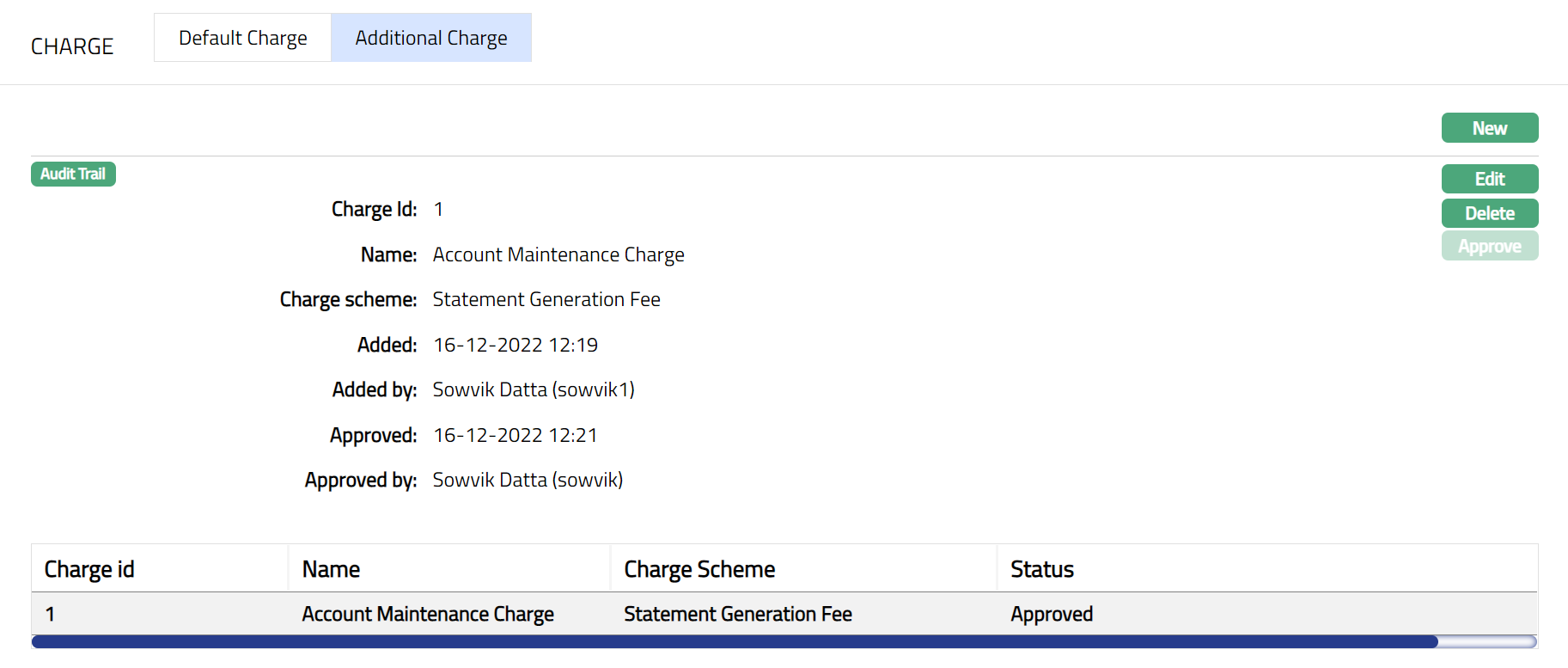

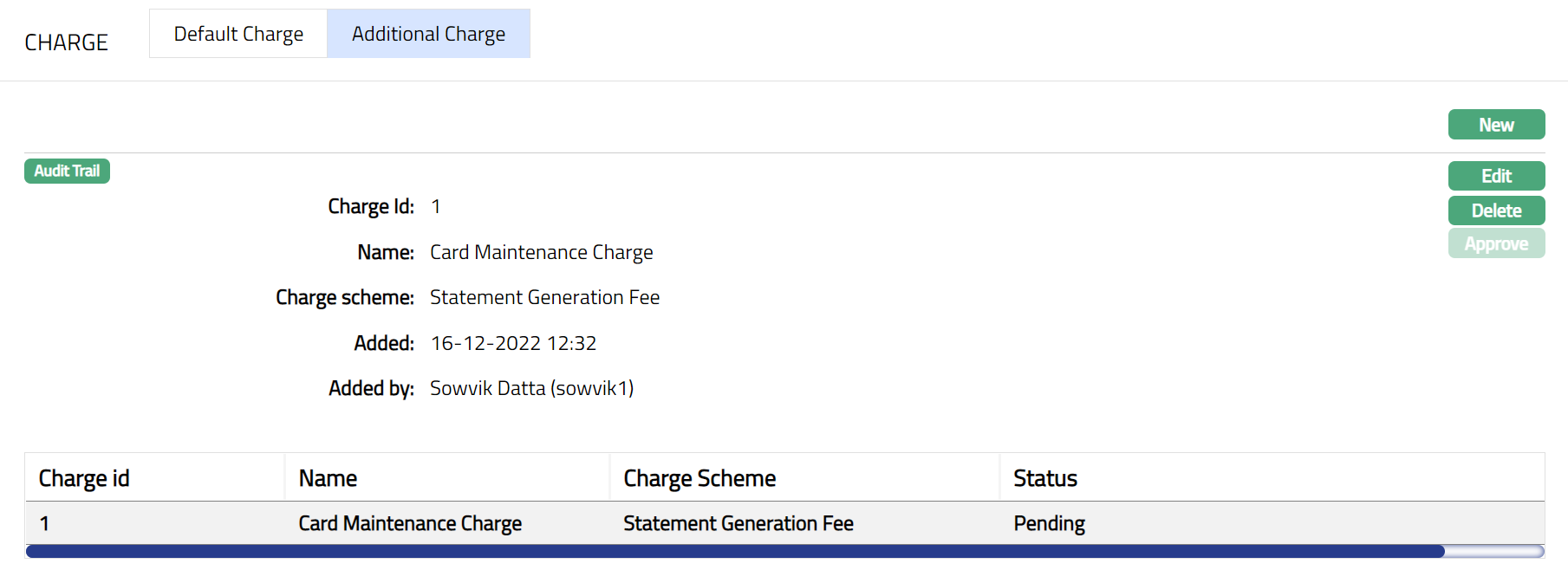

Note: once added/edited the status will reflect as pending unless approved by another person who has not created the records. Once approved the status will reflect as approved.

Functions: New, Edit, Delete, Approve

The following fields are shown only in the View screen and are not editable:

Status field denotes the status of the record.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes the name of the user who approved the record and is displayed only for approved records.

Approve: Any new additional charge attached or edited at the account level has to be Approved. You can approve the additional charge by clicking on Approve button. Aura will ask for confirmation. On confirming, the charge status will be Approved.

Delete: You can delete an Additional charge at the account level at any time irrespective of the charge is attached at the Product level or not. To delete the Additional charge click Delete. Aura will ask for confirmation. On confirming, the additional charge will be deleted. Alt the future dated pending events related to this charge for this account will be deleted.

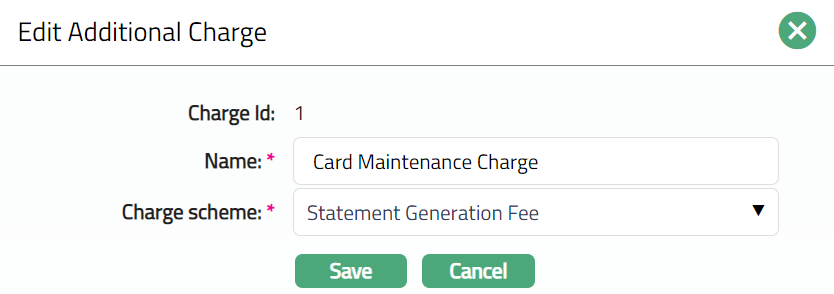

To edit Additional Charge

- Click Edit. The Edit Additional Charge page appears.

The Charge Id field is not editable.

- Click Save. The Additional Charge page appears with the edited details.

Any change in the tab will set the tab status to Pending till it is approved by another user. On approval, the tab status is set to Approved.

Functions: New, Edit, Delete, Approve

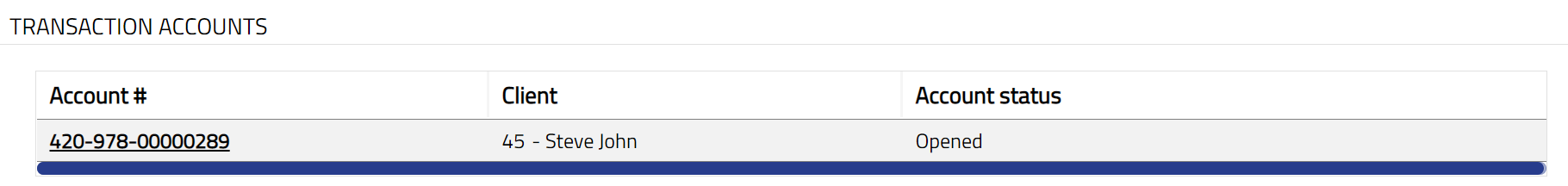

Transaction Accounts

This tab allows you to view the list of transaction accounts associated with a billing account. This tab is displayed only in case of a Billing account.

To view the Transaction Accounts for a Billing Account

Access Card Account page.

Click Transaction Accounts tab. The transaction accounts associated with the current billing account are listed under this tab.

- To view and access the transaction account details, click the required transaction account number hyperlink listed under this tab. The transaction account details will be displayed in a new tab.

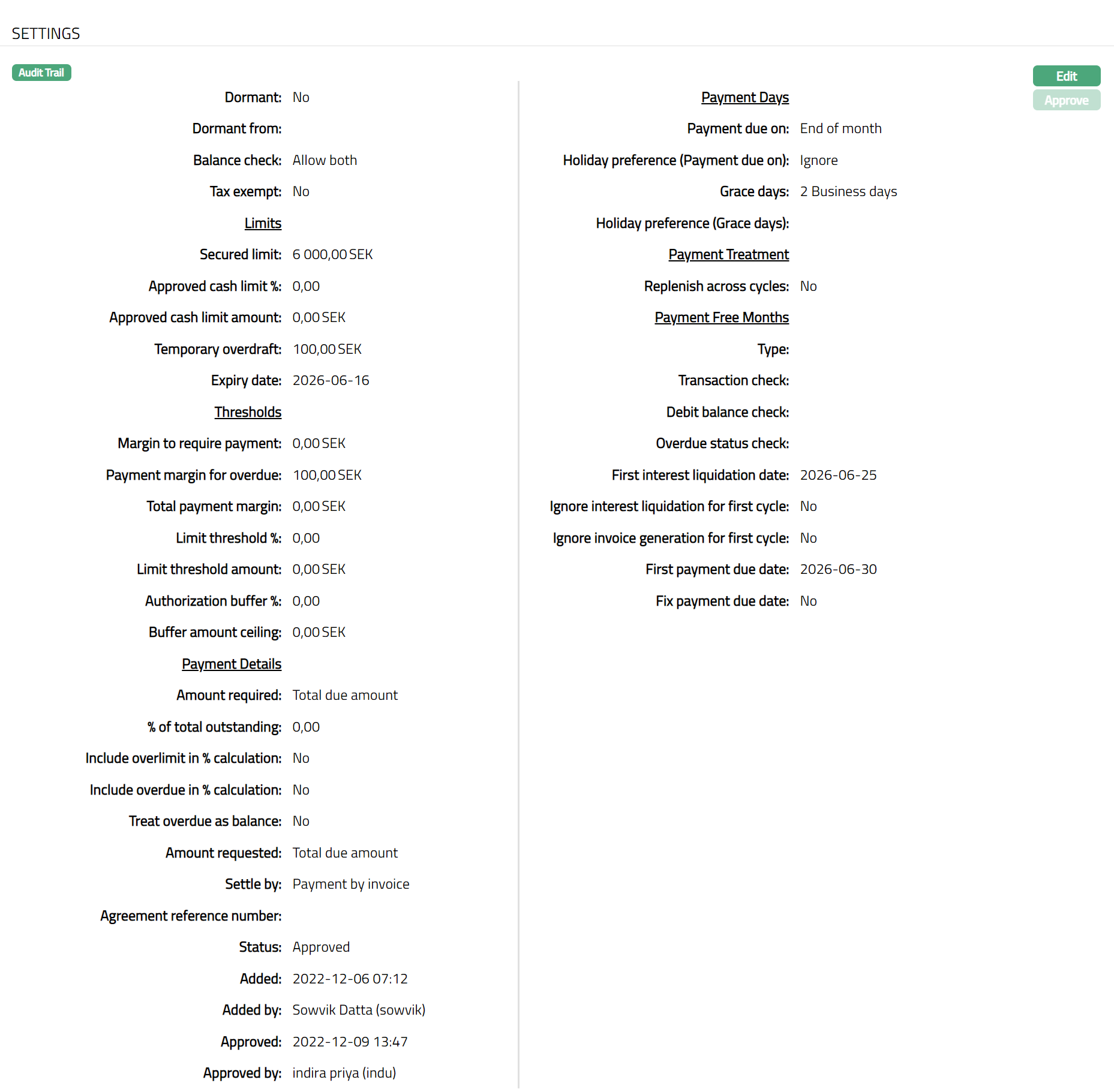

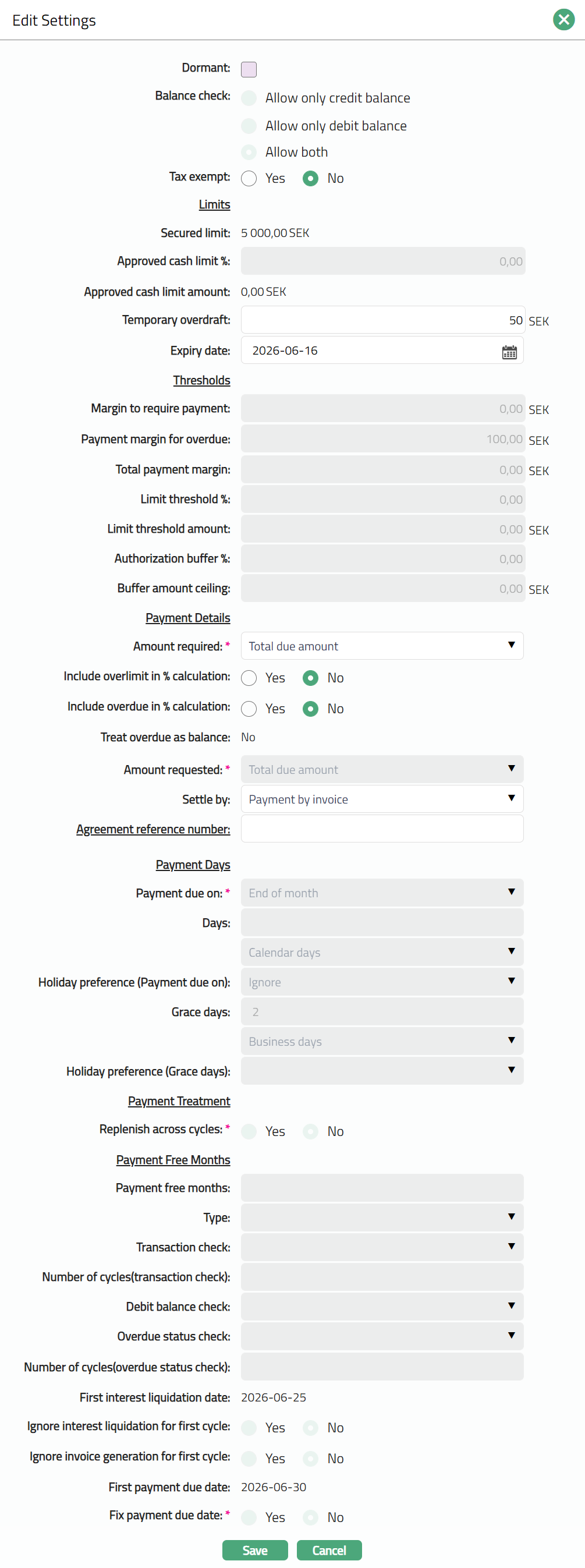

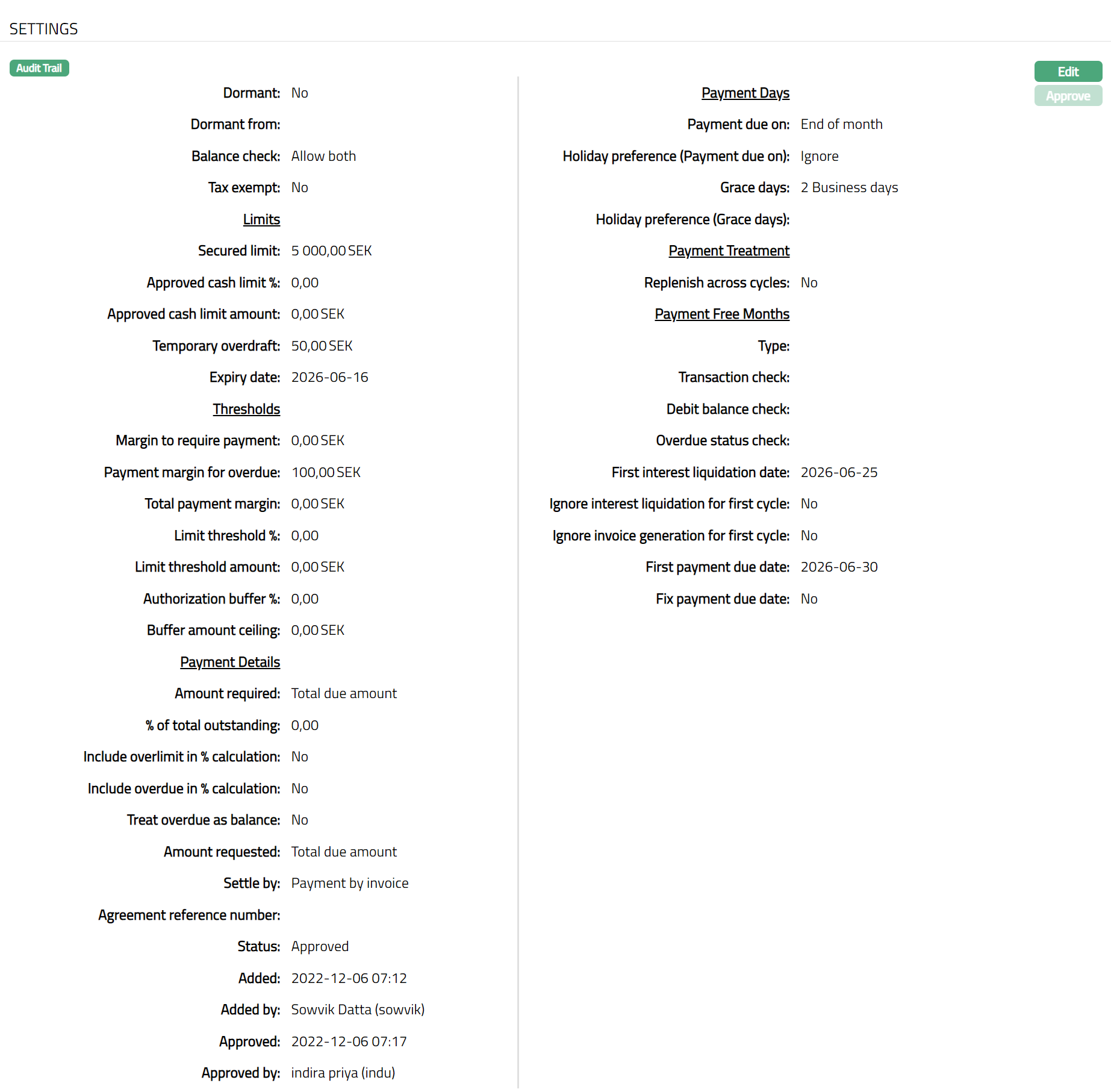

Settings

This tab allows you to view and maintain certain account settings. The values from the Card Account Product / Cycle Group are defaulted to the Card Account and you can edit the settings according to the requirement, subject to Restrictions that have been set up for the Product.

To view / edit settings

- Access Card Account page and click Settings tab to view the details as per samples below.

- When an account shows no activity for some specified period, then the account is considered as Dormant. The Dormancy calculation depends on the Dormancy days set in the Product and the Transaction Code settings for the entries posted to the account. By default, the Dormant checkbox is unchecked and the value displayed is No. If Account Dormancy days is defined in the Product, and if the Dormancy days for the account becomes 0, then Aura will automatically check the Dormancy checkbox. The Dormant value will be displayed as Yes and Aura will display the Dormant From date by default. If you want the account to be no longer treated as Dormant, click Edit and then uncheck the Dormant checkbox.

For Example:

An Account is opened and activated on 01-Jan-2012 and the Dormancy Day for the product is 45 days.

| Date | Transactions | Dormancy Days Calculation |

|---|---|---|

| 01-Jan-2012 | No transaction done | 45 - 30 = 15 |

| to | ||

| 30-Jan-2012 | ||

| 31-Jan-2012 | a) Transaction done using transaction | a) 15 - 1 = 14 |

| code where "Affect dormancy | ||

| calculation" is selected as No. | b) 45 | |

| b) If transaction is done using a | ||

| transaction code where "Affect | ||

| dormancy calculation" is selected | ||

| as Yes. | ||

| 01-Feb-2012 | a) No transaction done | a) 14 - 14 = 0 -- |

| to | The account will be marked as Dormant on | |

| 14-Feb-2012 | b) No transaction done | 15-Feb-2012 |

| b) 45 - 14 = 31 |

If the account becomes dormant, Aura will automatically display the date from when the account is Dormant. The Dormant from date will be displayed based on the Dormancy days. In the above example, the Dormant from in case a) would be 15-Feb-2012. This is a non-editable field.

Balance Check specifies the type of balance -- whether credit, debit or both -- to be allowed in the account. The value will be defaulted from the Product selected for this account and is editable. The options for Balance check are as follows:

- Allow only credit balance -- If you select Allow only credit balance, then Aura will allow only credit balance for that account. If a transaction would result in a debit balance, and if this account allows only credit balance, the transaction will fail.

Allow only debit balance -- If you select Allow only debit balance, then Aura will allow only debit balance for that account. If a transaction would result in a credit balance, and if this account allows only debit balance, the transaction will fail.

Allow both -- If you select Allow both, then Aura will allow both credit and debit balances for that account.

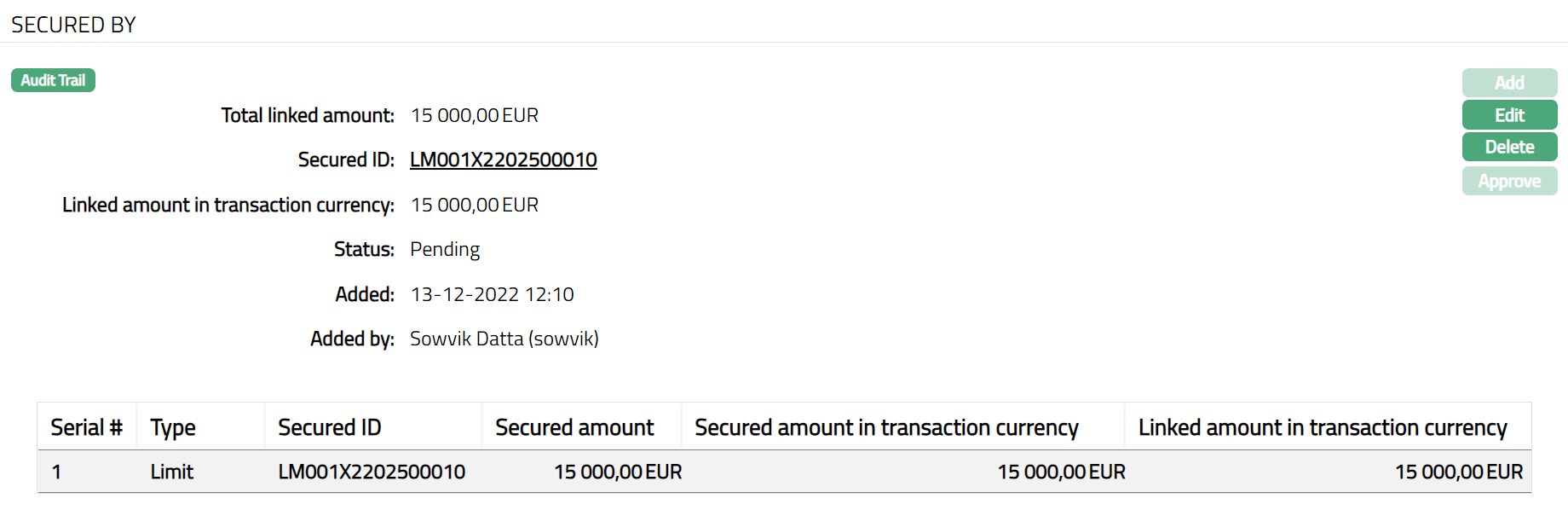

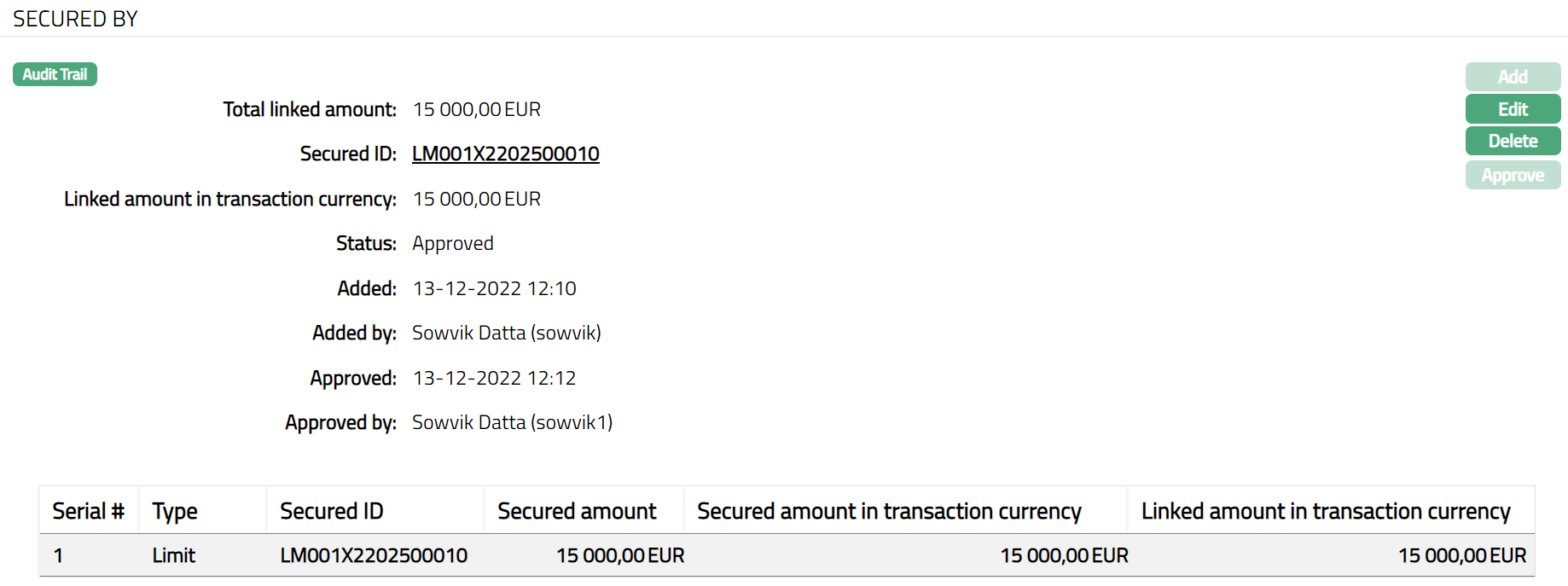

Secured Limit is the credit limit for the card account. Once the limit is attached to the account under the Secured By tab and approved, the linked amount in transaction currency under the Secured By tab will be displayed here. This is a non-editable field.

Approved Cash Limit % is the percentage of the Credit (Secured) Limit that will be available as the Cash Limit for the account. The Cash Limit% should be between 0 and 100. By default, the value from the Product will get displayed and you can edit it as required. This is an editable field.

Approved Cash Limit Amount is the amount that will be available as the Cash Limit for the account. This will be calculated using the Approved Cash Limit% and the Secured Limit. For example, if Secured Limit is 1000 EUR and Approved Cash Limit % is 25%, the Approved Cash Limit Amount is calculated as 25/100 * 1000 = 250 EUR. This is a non- editable field.

Temporary overdraft is a temporary arrangement. It is an additional amount for a temporary period that is granted by the bank, which will have an expiry date and increases the Account Balance for the account. Soon after the expiry date, the arrangement will become unavailable, and the Account Balance will be reduced to that extent. It is an editable field.

Expiry date is the date when the temporary overdraft will get expired. It is an editable field.

Aura will generate Amount required only if the balance in the account is more than the Margin to require payment. If the balance is less than this amount, then no payment due is requested; but the statement will still be generated. By default, the value will be 0 and is an editable field.

For Example: Margin to require payment is 100 EUR and Total outstanding is 90 EUR. In this case, no payment due is requested but a statement will be generated.

Note: If edited, the updated amount will be applicable for the next invoice generation.

- Payment margin for overdue is the margin allowed for designating an account as overdue. If the Payment margin for overdue is 5 EUR, Amount required is 100 EUR and Payment received is 95 EUR, Aura will check whether the payment amount is less than the amount required + payment margin for overdue i.e., 95 EUR + 5 EUR. If the condition is satisfied, then no overdue interest or charges will be applied. If the condition is not satisfied, then overdue interest and charges will be applied. By default, the value will be 0 and is an editable field.

Note**😗* If edited, the updated amount will be applicable for the next Payment Due Date / End of Grace Days.

- Total payment margin amount is taken into consideration if the payment falls short by this amount to qualify the payment as Total payment amount. The account will get all the benefits as though the Total payment amount is received. By default, the value will be 0 and is an editable field.

Note**😗* If edited, the updated amount will be applicable for the next Payment Due Date / End of Grace Days.

Limit threshold % ensures that over limit charges and interest are not marked if the limit is breached by an amount set within the threshold. Limit threshold % will be calculated on the limit amount. By default, the value will be 0 and is an editable field.

Limit threshold amount is similar to Limit threshold % but is entered as an amount. Aura will charge over limit charge and interest only if the account balance goes beyond the (limit + limit threshold amount). By default, the value will be 0 and is an editable field.

Note: If both Limit threshold % and Limit threshold amount are entered, Aura will consider the lesser of the two as the actual threshold.

- Authorization buffer % ensures that the authorization is not rejected for small amounts. It is a % of the overall limit. The authorization buffer applies only when the account is within the limit at the start of the transaction. If the account is already above the limit at the start of the transaction, then the buffer does not apply, and the authorization is declined with appropriate codes. Therefore, the buffer can only be applicable for one transaction at any given point of time. By default, the value will be 0 and is an editable field.

For example, the limit is 10,000 EUR. The Authorization buffer is set to 1.5% of the limit. With a limit of 10,000 EUR this means that a maximum of 150 EUR is allowed as the authorization buffer. The available balance is 100 EUR. An authorization with the amount of 120 EUR is received. It will be approved since it is (120-100=20 EUR) within the authorization buffer. If the available balance had been 0 the authorization would have been rejected because the available balance at the start of the transaction was 0 even though the threshold was 150 EUR.

- Buffer amount ceiling is the maximum authorization buffer amount. By default, the value will be 0 and is an editable field.

For Example: If the account has a limit of 10,000 EUR and if the authorization buffer is maintained as 3% subject to maximum threshold amount of 200 EUR, then the authorization buffer is 200 EUR. If the limit is changed from 10,000 EUR to 5000 EUR, then the buffer becomes 150 EUR.

Note: If both Authorization buffer % and Buffer amount ceiling are entered, Aura will consider the lesser of the two as the actual buffer.

- Amount required is the minimum amount that the customer has to pay to avoid overdue interest or any overdue-related charges / status changes. The following options are available:

Partial Amount: If you want the customer to pay only a part amount of the total outstanding amount due for payment, you can choose this option. If you choose partial amount here, then Aura will ask to enter the percentage of the outstanding amount.

Total Due Amount: If you want the customer to pay the total outstanding amount due for payment, choose this option.

Fixed Amount: If you want the customer to pay a fixed amount irrespective of the total outstanding amount due for payment, choose this option.

By default, the value will be derived from the product and is editable.

Note: If edited, the updated option will be applicable for the next invoice generation.

Note: The Amount required cannot be greater than the total balance outstanding in the account. If it is so during invoice generation, then the total balance outstanding becomes the Amount required.

Example

Amount required: 5% of total outstanding, minimum amount: 100, rounding up to 0.

Account Limit: 10 000If total outstanding is 95

Amount required = 5% of 95 = 4.75, subject to minimum amount of 100. However, since the total outstanding is only 95, the amount required will be 95.

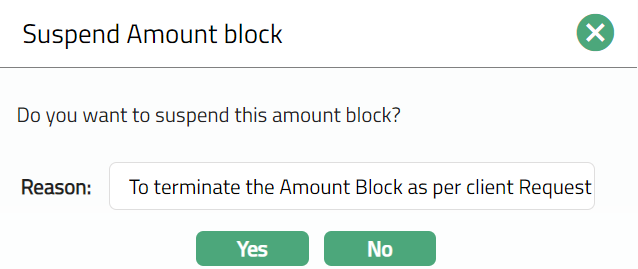

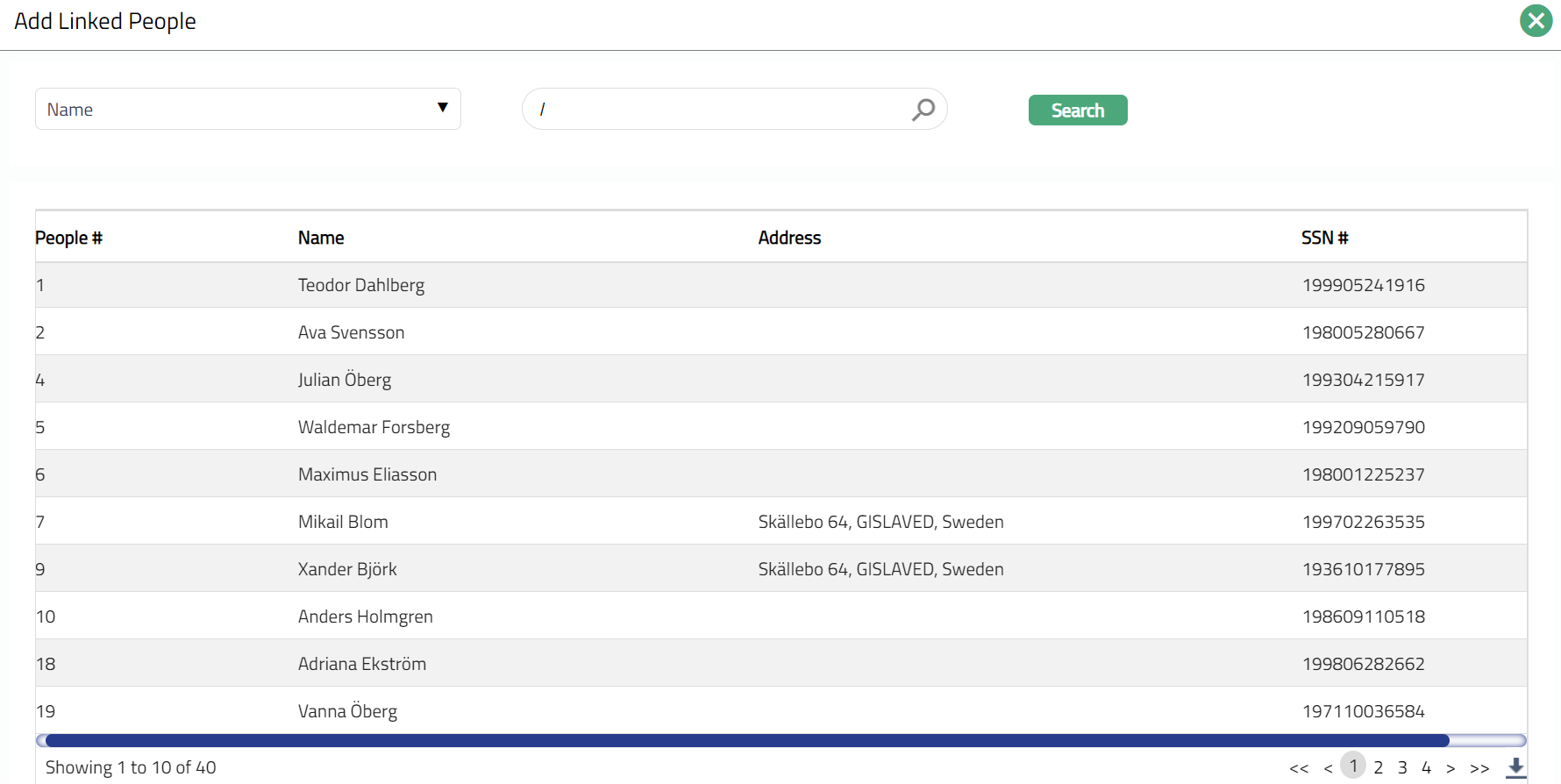

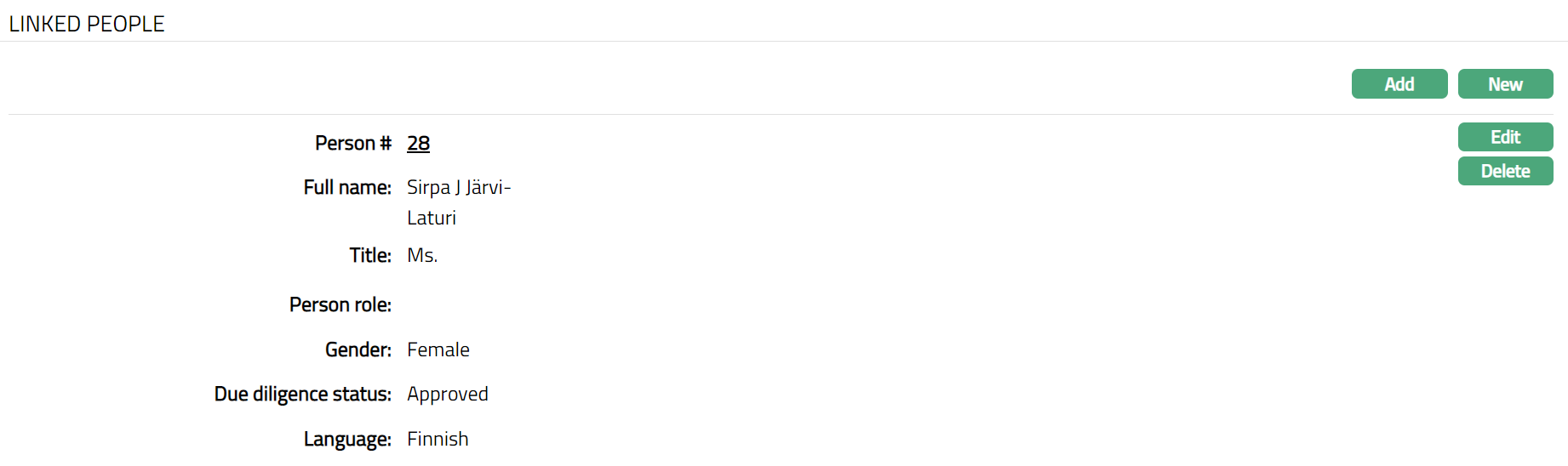

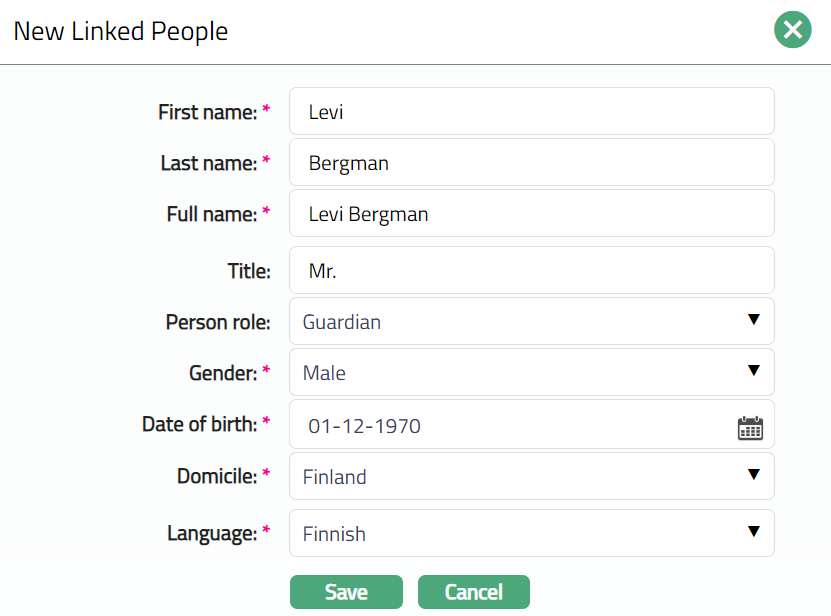

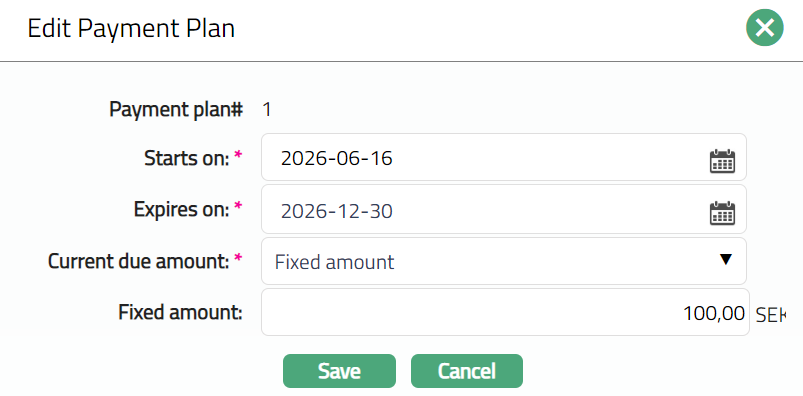

If Fixed amount is selected in the Amount required field above, Fixed amount field will be displayed. Enter the fixed amount that the customer has to pay.