Replenishment

A replenishment function will allocate any credit (debit) balance towards debit (credit) balance classes. This function will be invoked for each transaction provided the nature of the transaction is against the nature of the current balance of the account. If the transaction is a debit while the current balance is credit, the replenishment function will be triggered. Similarly, if the transaction is a credit while the current balance is debit, the replenishment function will be triggered.

Credits to the account replenish the existing debit balances based on the replenishment priority defined for the Debit Balance Classes; similarly, debits to the account replenish the existing credit balances based on the replenishment priority defined for the Credit Balance Classes.

If the current balance in the account is zero, there will not be any replenishment; the respective balance classes will just be incremented based on the nature of the transaction. Thus, if current balance is zero, and there is a debit transaction, the debit balance class will be incremented; similarly, if there is a credit transaction, the credit balance class will be incremented.

Replenishment of Debit Balance Classes can happen across the cycle per balance class or one cycle across all balance classes based on the settings for the 'Replenish across cycle'.

Updates of Balances as per Balance class, Buckets and replenishment functions are explained below using an example.

Note:

End of Cycle (EOC) Date = End of Month

Payment Due Date (PDD) = 10 days after EOC

Grace Days = 5 days

End of Grace Days (EOGD) = 5 days after EOC

Amount Required = 10% of Total outstanding

All amounts are in EUR.

Debit Balance Class Data Set up (Replenishment Priority)

| Balance Class (Debit) | Priority # |

|---|---|

| Cash | 1 |

| Purchase | 2 |

| Default | 3 |

Credit balance class Data Set up (Replenishment Priority)

| Balance Class (Credit) | Priority # |

|---|---|

| Payment | 1 |

| Default | 2 |

CYCLE 1

Cycle Details

| Cycle No | Start date | End date | PDD | EOGD |

|---|---|---|---|---|

| 1 | 1-Jan-13 | 31-Jan-13 | 10-Feb-13 | 15-Feb-13 |

- Total debit balances, and across buckets, at the Beginning of the Cycle 1 on 01-Jan-13.

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 0 | 0 | 0 |

| Purchase | 0 | 0 | 0 | 0 | 0 |

| Default | 0 | 0 | 0 | 0 | 0 |

| Total Debit balance | 0 | 0 | 0 | 0 | 0 |

- Total credit balances at the beginning of the Cycle 1 on 01-Jan-13.

| Balance Class (Credit) | Total |

|---|---|

| Payment | 0 |

| Default | 0 |

| Total Credit balance | 0 |

- Transactions on 15-Jan-13:

| Balance Class (Debit) | Balance (DB) |

|---|---|

| Cash | 800 |

| Purchase | 112.5 |

| Default | 150 |

| Total Debits | 1062.5 |

- Since the current balance is zero, Replenishment is not triggered. As the transactions are debit transactions, the debit balances are incremented. The total debit balances, and across buckets, after the above transactions are posted on 15-Jan-13.

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 0 | 800 | 800 |

| Purchase | 0 | 0 | 0 | 112.5 | 112.5 |

| Default | 0 | 0 | 0 | 150 | 150 |

| Total Debit balance | 0 | 0 | 0 | 1062.5 | 1062.5 |

- Total debit balances, and across buckets, at the End of the Cycle 1 on 31-Jan-13. Amount required = 10% of 1062.50 = 106.25.

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 800 | 0 | 800 |

| Purchase | 0 | 0 | 112.5 | 0 | 112.5 |

| Default | 0 | 0 | 150 | 0 | 150 |

| Total Debit balance | 0 | 0 | 1062.5 | 0 | 1062.5 |

- Total credit balances at the End of the Cycle on 31-Jan-13.

| Balance Class (Credit) | Total |

|---|---|

| Payment | 0 |

| Default | 0 |

| Total Credit balance | 0 |

CYCLE 2

Cycle Details

| Cycle No | Start date | End date | PDD | EOGD |

|---|---|---|---|---|

| 2 | 1-Feb-13 | 28-Feb-13 | 10-Mar-13 | 15-Mar-13 |

- Total debit balances, and across buckets, at the Beginning of the Cycle 2 on 01-Feb-13.

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 800 | 0 | 800 |

| Purchase | 0 | 0 | 112.5 | 0 | 112.5 |

| Default | 0 | 0 | 150 | 0 | 150 |

| Total Debit balance | 0 | 0 | 1062.5 | 0 | 1062.5 |

- Total credit balances at the Beginning of the Cycle 2 on 01-Feb-13.

| Balance Class (Credit) | Total |

|---|---|

| Payment | 0 |

| Default | 0 |

| Total Credit balance | 0 |

- Transactions on 08-Feb-13:

| Balance Class (Debit) | Balance (DB) |

|---|---|

| Cash | 200 |

| Purchase | 117.5 |

| Default | 250 |

| Total Debits | 567.5 |

- Since the current balance is debit and the transactions are debits, replenishment is not triggered and the debit balances are incremented. Total debit balances, and across buckets after the above transactions are posted on 08-Feb-13

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 800 | 200 | 1000 |

| Purchase | 0 | 0 | 112.5 | 117.5 | 230 |

| Default | 0 | 0 | 150 | 250 | 400 |

| Total Debits | 0 | 0 | 1062.5 | 567.5 | 1630 |

- Total debit balances, and across buckets, on PDD (for Cycle 1) on 10-Feb-13. Since Amount required is not paid up, it becomes overdue. If Overdue is treated as Balance, the balances will be as follows:

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 106.25 | 693.75 | 0 | 200 | 1000 |

| Purchase | 0 | 112.5 | 0 | 117.5 | 230 |

| Default | 0 | 150 | 0 | 250 | 400 |

| Total Debits | 106.25 | 956.25 | 0 | 567.5 | 1630 |

Note: If Treat Overdue as Balance is No, the entire amount from Past bucket will move into the Rolled over bucket.

- Total debit balances, and across buckets, at the End of the Cycle 2 on 28-Feb-13. Amount Required = 10% of Outstanding = 10% of (1630-106.25) + 106.25 = 258.63

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 106.25 | 693.75 | 200 | 0 | 1000 |

| Purchase | 0 | 112.5 | 117.5 | 0 | 230 |

| Default | 0 | 150 | 250 | 0 | 400 |

| Total Debit balance | 106.25 | 956.25 | 567.5 | 0 | 1630 |

- Total credit balances at the End of the Cycle 2 on 28-Feb-13.

| Balance Class (Credit) | Total |

|---|---|

| Payment | 0 |

| Default | 0 |

| Total Credit balance | 0 |

CYCLE 3

Cycle Details

| Cycle No | Start date | End date | PDD | EOGD |

|---|---|---|---|---|

| 3 | 1-Mar-13 | 31-Mar-13 | 10-Apr-13 | 15-Apr-13 |

- Total debit balances, and across buckets, at the Beginning of the Cycle 3 on 01-Mar-13.

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 106.25 | 693.75 | 200 | 0 | 1000 |

| Purchase | 0 | 112.5 | 117.5 | 0 | 230 |

| Default | 0 | 150 | 250 | 0 | 400 |

| Total Debit balance | 106.25 | 956.25 | 567.5 | 0 | 1630 |

- Total credit balances at the Beginning of the Cycle 3 on 01-Mar-13.

| Balance Class (Credit) | Total |

|---|---|

| Payment | 0 |

| Default | 0 |

| Total Credit balance | 0 |

- Debit Transactions on 07-Mar-13:

| Balance Class (Debit) | Balance (DB) |

|---|---|

| Cash | 100 |

| Purchase | 0 |

| Default | 0 |

| Total Debits | 100 |

- Total debit balances, and across buckets after the above transactions are posted on 07-Mar-13

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 106.25 | 693.75 | 200 | 100 | 1100 |

| Purchase | 0 | 112.5 | 117.5 | 0 | 230 |

| Default | 0 | 150 | 250 | 0 | 400 |

| Total Debits | 106.25 | 956.25 | 567.5 | 100 | 1730 |

- Credit Transactions -- Payment on 08-Mar-13:

| Balance Class (Credit) | Balance (CR) |

|---|---|

| Payment | 1530 |

| Default | 0 |

| Total Credits | 1530 |

Since the current balance is Debit and there is a Credit transaction,Replenishment is triggered. The replenishment behaviour depends on the value for Replenish across cycles.

If Replenish across cycles is No, the balance replenishment will be as follows, till the credit amount is exhausted:

Overdue bucket (If Treat Overdue as Balance = Yes) will first get replenished for each balance class as per the replenishment priority

Rolled Over bucket will then get replenished for each balance class as per the replenishment priority

Next, Past bucket will get replenished for each balance class, again, as per the replenishment priority

Lastly, Current bucket will get replenished for each balance class, again, as per the replenishment priority.

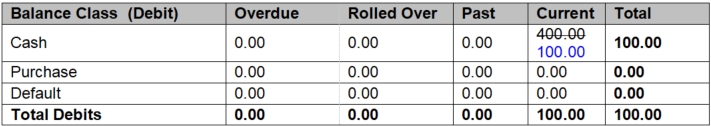

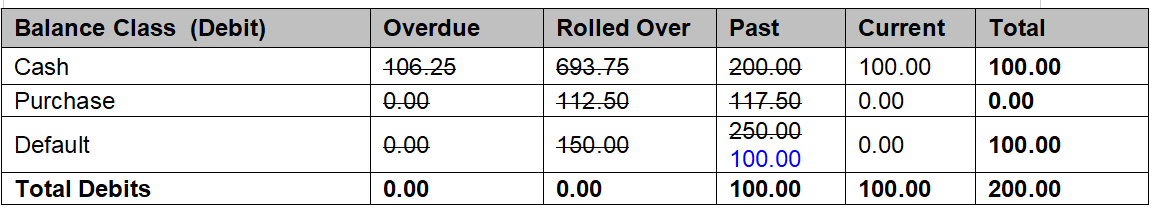

In our example, the replenishment will be as depicted below, where the strike-through indicates the amount that is replenished and the amount in Blue is the new balance.

If Replenish across cycle is Yes, the balance replenishment will be as follows, till the credit amount is exhausted:

All the buckets -- Overdue (if Treat Overdue as Balance = Yes), Rolled Over, Past and Current, in that order, for the Balance Class with the highest priority will be replenished first

Similarly, all the buckets for the Balance Class with the next highest priority will be replenished.

In our example, the replenishment will be as depicted below, where the strike-through indicates the amount that is replenished and the amount in Blue is the new balance.

- Total debit balances, and across buckets, on PDD (for Cycle 2) on 10-Mar-13

If Replenish across cycle = No

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 100 | 0 | 100 |

| Purchase | 0 | 0 | 0 | 0 | 0 |

| Default | 0 | 100 | 0 | 0 | 100 |

| Total Debits | 0 | 100 | 100 | 0 | 200 |

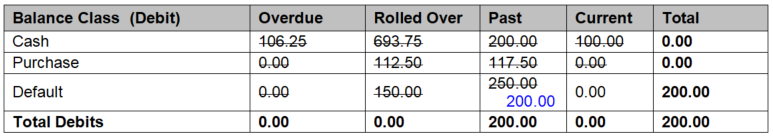

If Replenish across cycle = Yes

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 0 | 0 | 0 |

| Purchase | 0 | 0 | 0 | 0 | 0 |

| Default | 0 | 200 | 0 | 0 | 200 |

| Total Debits | 0 | 200 | 0 | 0 | 200 |

- Credit Transactions -- Payment on 20-Mar-13:

| Balance Class Description | Balance (CR) |

|---|---|

| Payment | 500 |

| Default | 0 |

| Total Credits | 500 |

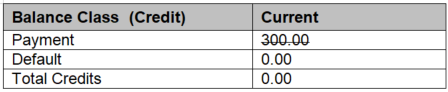

- Replenishment is triggered as the current balance is a Debit, and the transaction is a Credit. The 200.00 from debit balance class is completely replenished and the balance of 300.00 is retained in the Credit balance class as depicted below

| Balance Class (Debit) | Overdue | Rolled Over | Past | Current | Total |

|---|---|---|---|---|---|

| Cash | 0 | 0 | 0 | 0 | 0 |

| Purchase | 0 | 0 | 0 | 0 | 0 |

| Default | 0 | 0 | 0 | 0 | |

| Total Debits | 0 | 0 | 0 | 0 | 0 |

| Balance Class (Credit) | Balance (CR) |

|---|---|

| Payment | 300 |

| Default | 0 |

| Total Credits | 300 |

- Debit Transactions on 25-Mar-13

| Balance Class (Debit) | Balance (DB) |

|---|---|

| Cash | 0 |

| Purchase | 400 |

| Default | 0 |

| Total Debits | 400 |

- Replenishment is triggered as the current balance is a Credit, and the transaction is a Debit. The credit balance of 300.00 will be replenished completely and the balance of 100.00 is retained in the Debit balance class under current bucket as depicted below.