Interest Group

Interest group allows you to maintain differentiated Interest groups for the different kinds of Interests on a Card Account Product. This (along with the Charge Group) will enable you to offer different pricing schemes for different groups of customers / card accounts.

During creation of a Card Account Product, a Default Interest Group for the Product is automatically created by Aura, using the interest schemes that were assigned for the various types of interest. You cannot edit any values for this Default Interest Group.

You can create other Interest Groups for a Card Account Product using this option and use the Default Group or any of these additional groups during the Card Account creation.

Following are the sub-tabs:

Adding Interest group

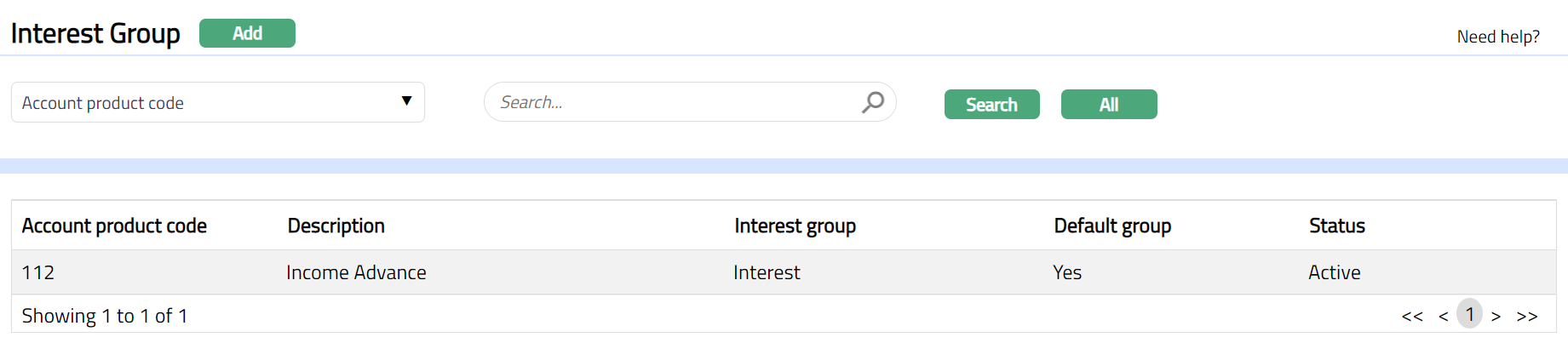

From Card menu, click Settings, and then Interest Group. Interest Group Search page appears. All existing interest groups appear on the page.

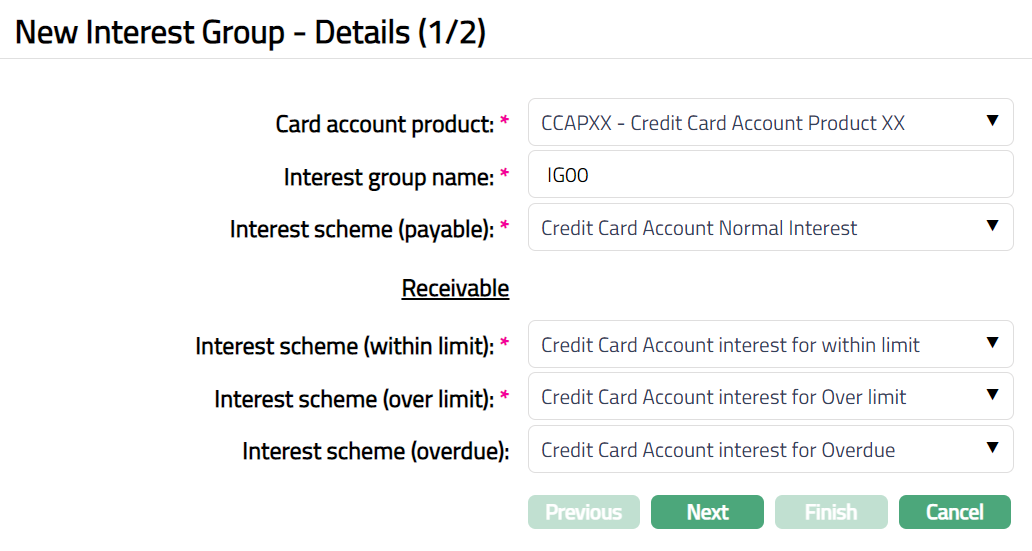

Click Add. New Interest Group -- Details (1/2) page appears.

Select Card account product for the new interest group from the drop-down list. The list will display all the active Card Account Products maintained at Card > Settings > Card Account Product.

Enter name for Interest group.

Select Interest scheme (payable) for the new interest group from the drop-down list of all the active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

Select Interest scheme (within limit) for interest receivable on the Default Debit Balance Class from the drop-down list of all active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

Select Interest scheme (over limit) for receivable from the drop-down list of all active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

Select Interest scheme (overdue) for receivable from the drop-down list of all active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme

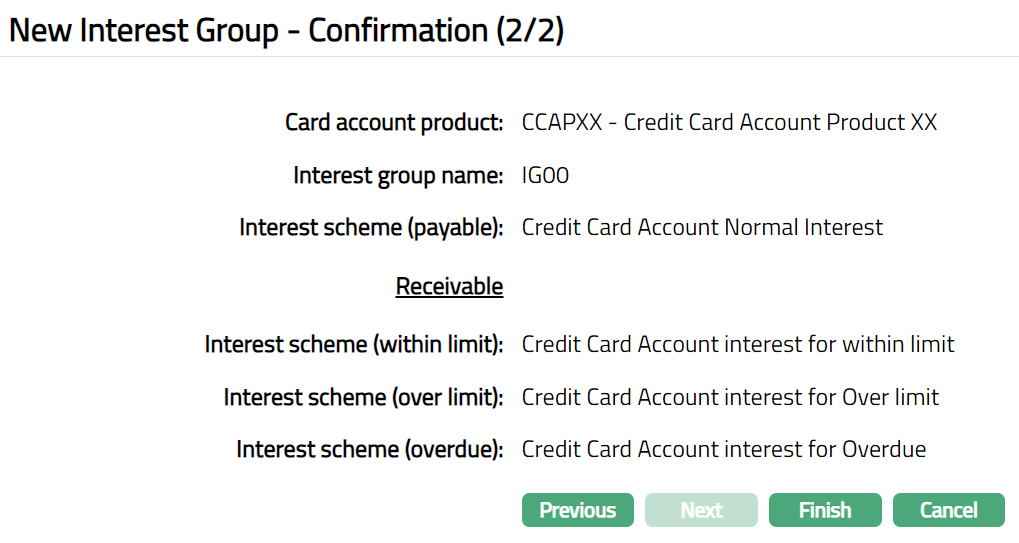

Click Next. New Interest Group -- Confirmation (2/2) page appears.

- Click Finish. Interest Group page appears with the added details.

Functions: Add, Search, Suspend, Delete

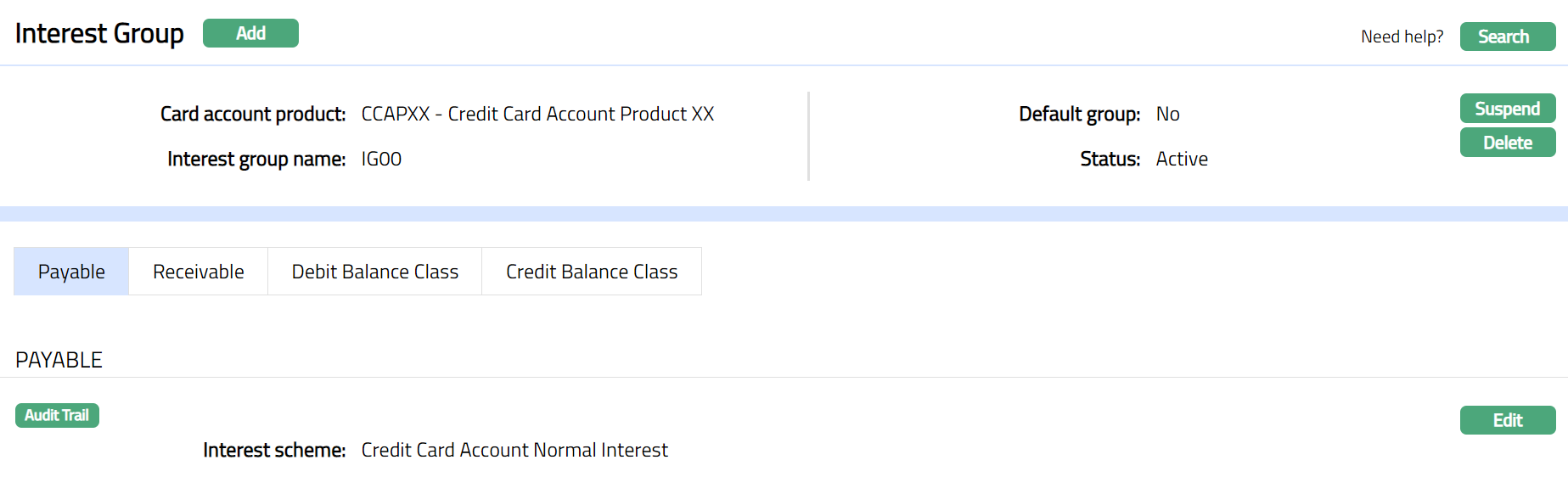

Note: Edit, Delete and Suspend buttons will be disabled for the Default Group but will be allowed for non-default groups.

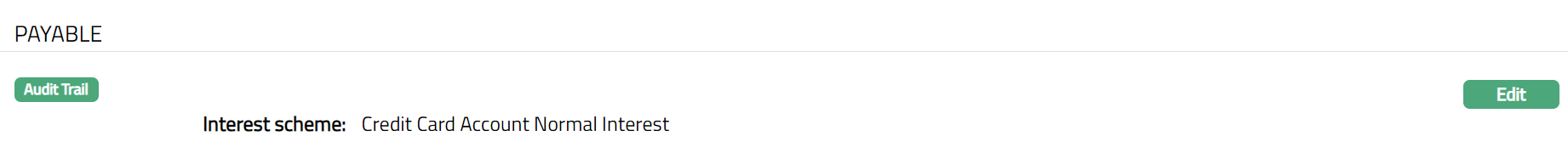

Payable

This tab will allow you to view and edit the Interest schemes for the Interest Payable.

To view / edit Interest Payable

- Access Interest Group page and click Payable. Interest scheme that you chose for the Interest Payable during New Interest Group -- Details (1/2) will be displayed.

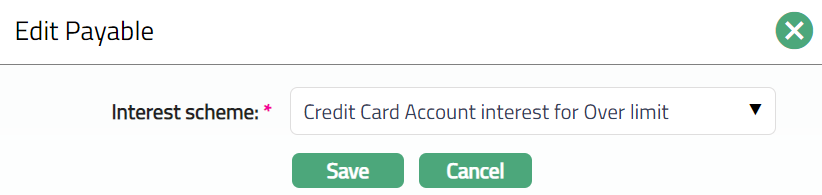

- Click Edit. Edit Payable page appears.

Select Interest scheme for Interest payable from the drop-down list of all the active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

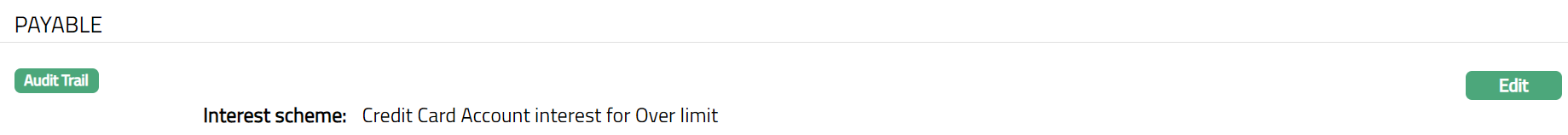

Click Save. Payable page appears with the edited details.

Functions: Edit

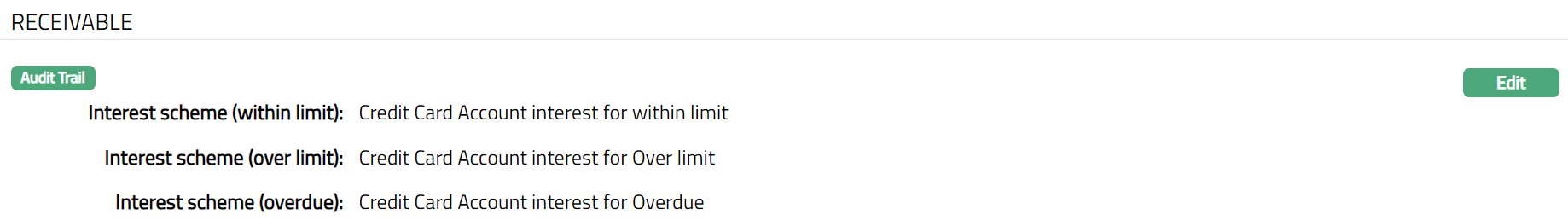

Receivable

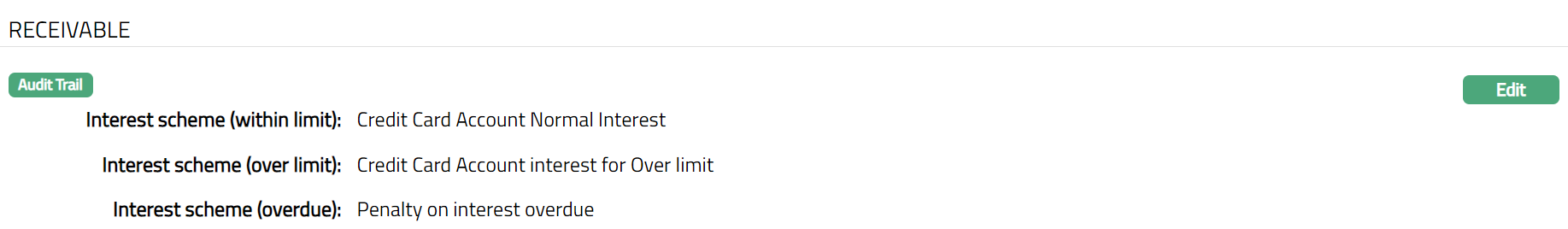

This tab will allow you view and edit the Interest schemes for the Interest Receivable.

- Access Interest Group page and click Receivable. Interest scheme that you choose for the Interest Receivable during New Interest Group -- Details (1/2) will be displayed.

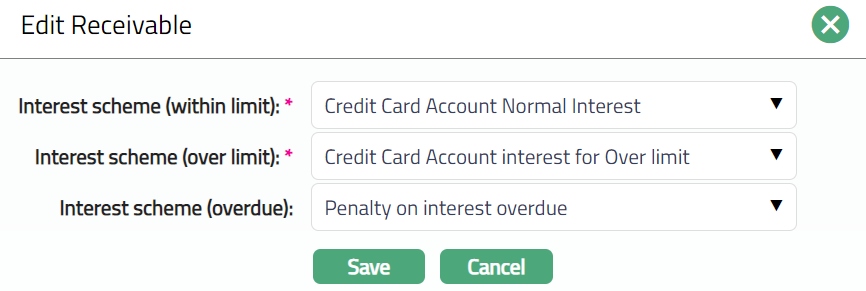

- Click Edit. Edit Receivable page appears.

Note: All fields are editable.

- Click Save. Receivable page appears with the edited details.

Functions: Edit

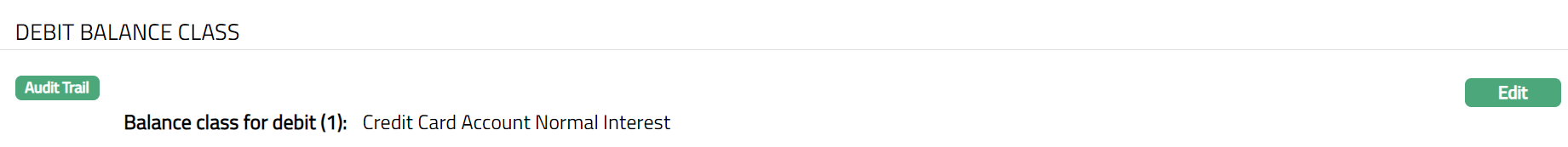

Debit Balance Class

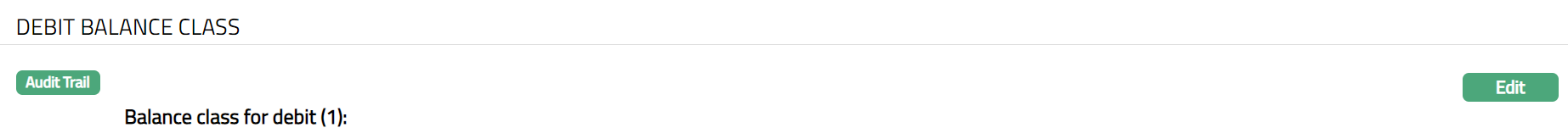

This tab will allow you to view and maintain the Interest scheme for all the latest defined Debit balance classes for the chosen Product.

- Access Interest Group page and click Debit Balance Class. This will display the Interest schemes maintained for the various debit balance classes in the Interest Group. On creation of the new Interest Group, this will be blank.

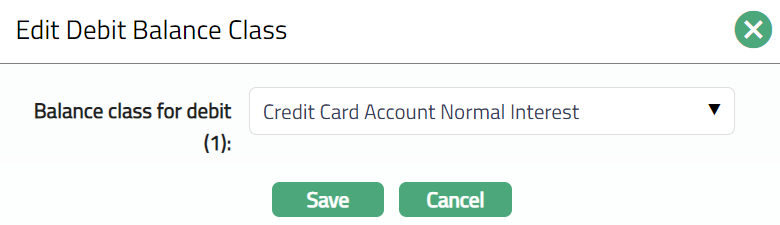

To edit interest schemes for the Debit Balance Classes,

- Click Edit. Edit Debit Balance Class page appears.

Select Interest scheme for the Balance Class from the drop-down list of all the active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

Click Save. Debit Balance Class page appears with the edited details.

Functions: Edit

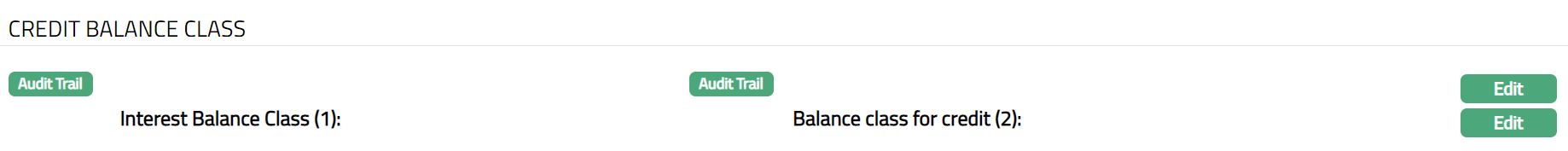

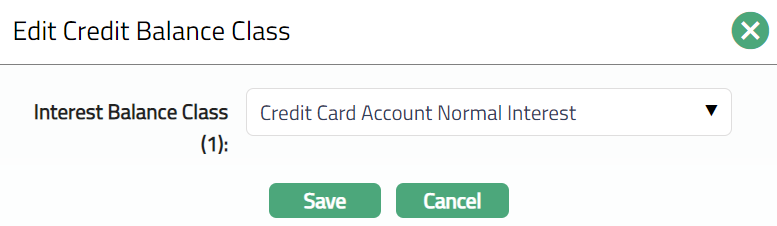

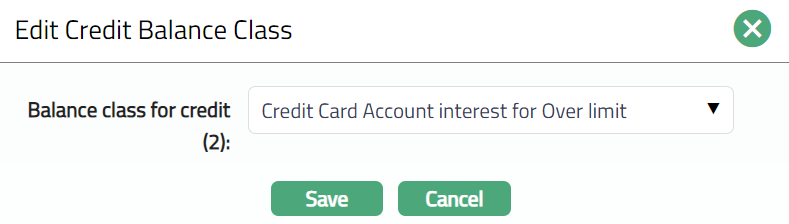

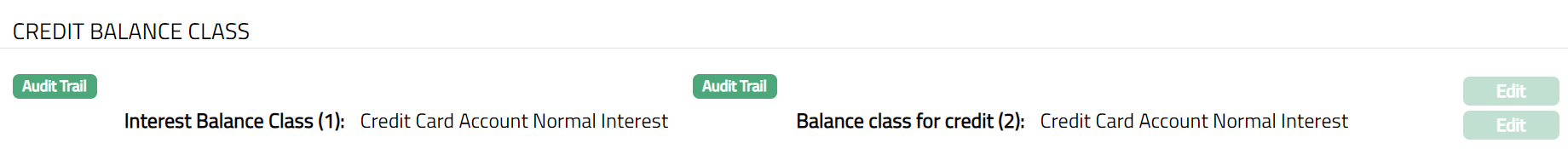

Credit Balance Class

This tab will allow you to view and maintain the Interest scheme for all the latest defined Credit balance classes for the chosen Product.

- Access Interest Group page and click Credit Balance Class. This will display the Interest schemes maintained for the various Credit balance classes in the Interest Group. On creation of the new Interest Group, this will be blank.

To edit interest schemes for the Credit Balance Classes,

- Click Edit. Edit Credit Balance Class page appears.

Select Interest scheme for the Balance Class from the drop-down list of all the active interest schemes maintained under Admin > System Codes > Pricing > Interest > Interest Scheme.

Click Save. Credit Balance Class page appears with the edited details.

Functions: Edit