Mortgage and Loan Account

Mortgage and Loan Account option allows you to create and maintain Mortgage and Loan Accounts. These accounts can be created under various Mortgage and Loan Products that you have maintained. Based on the Product defined, the account level details are defaulted, with options to modify these for specific accounts. Thus, it combines ease of maintenance with flexibility to suit the specific needs of each account.

The following are the various tabs that appear on the Loan Account page:

Creating a Mortgage and Loan Account

To Create a Mortgage and Loan Account,

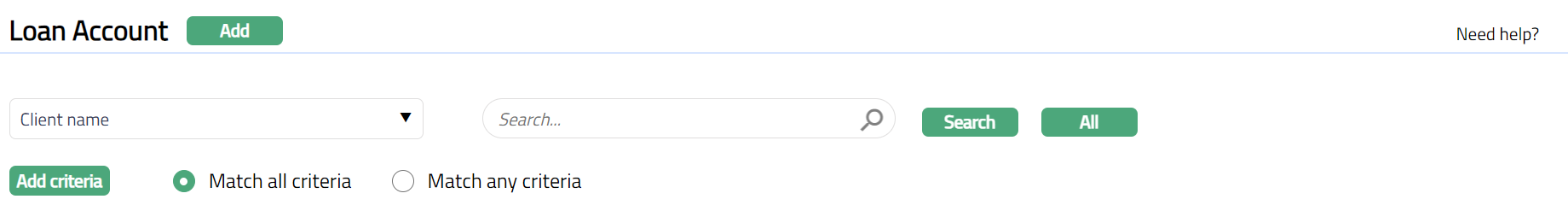

1. From the Retail menu, click Loans, and then click on Maintain. The Loan Search page appears.

2. Click Add. The New Loan → Profile (1/6) page appears

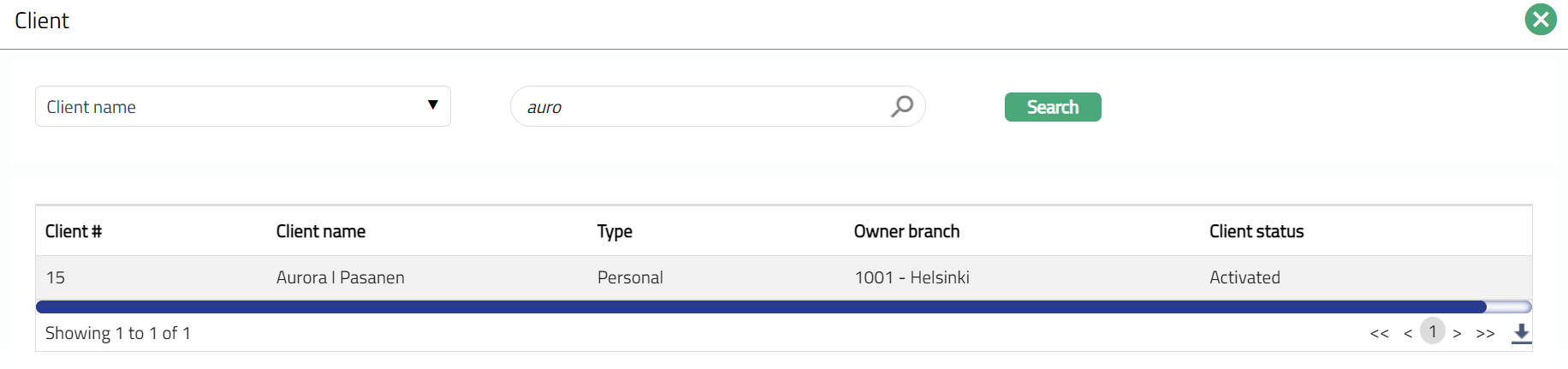

3. Click on Client hyperlink. The Client Search page appears where you can search for a Client with relevant criteria and select the required Client. Alternatively, you can start typing in the name of the Client in the text box and choose the required Client from the list suggested by Aura.

4. The Origin branch will be automatically populated as the Branch into which you have logged in and it cannot be edited. This indicates the Branch in which the Loan Account record is being created.

5. Select the Owner branch from the drop-down list of active Branches to indicate the Branch in which the Loan Account will be maintained.

6. Select the Service delivery channel for the account. The service delivery channels should have been maintained under Admin > System codes > Categories > Service delivery channel.

7. Select the loan Currency from the drop-down list of currencies that have been maintained under General ledger > Settings > Currency.

8. Enter the loan Amount sanctioned for the account.

9. Select Tenor or Maturity Date radio button to Choose loan term by. If you want to indicate the loan's term by way of a specific duration / period, choose Tenor. If you want to indicate the loan's term by way of a specific Maturity Date, choose Maturity Date.

10. The Days / Months / Years depends on what was selected for Choose Loan Term By.

If you had selected Tenor, this field will be enabled, and you can select the appropriate radio button to specify the loan term in Days / Months / Years

If you had selected Maturity Date, this field is disabled and is automatically defaulted to Days.

11. Tenor denotes the period / duration of the Loan Account and depends on what was selected for Choose Loan Term By.

If you had selected Tenor, this field is enabled, and you can input the number of days / months / years for which the loan is sanctioned

If you had selected Maturity Date, this field is disabled and is automatically calculated as Maturity Date minus Value Date.

Example: If Value Date = 27-Feb-23 and Maturity Date = 31-Dec-24, the Tenor would be calculated as the difference between the two dates = 673 Days

12. Value Date denotes the date on which the loan is to be disbursed. By default, Aura will display the current system date, and if required, you can change it to a future date.

13. Maturity date denotes the date when the Loan Account will mature and depends on what was selected for Choose Loan Term By.

If you had selected Maturity Date, this field is enabled and is mandatory. You need to input a date greater than the Value Date.

If you had selected Tenor, this field is not editable. Aura automatically calculates it as Tenor plus Value Date. See examples below:

| Days / Months / Years | Tenor | Value Date | Maturity Date Derived |

|---|---|---|---|

| Days | 30 | 27-Feb-24 | 28-Mar-24 |

| Days | 30 | 28-Feb-24 | 29-Mar-24 |

| Days | 30 | 29-Feb-24 | 30-Mar-24 |

| Months | 1 | 27-Feb-24 | 27-Mar-24 |

| Months | 1 | 28-Feb-24 | 28-Mar-24 |

| Months | 1 | 28-Feb-25 | 31-Mar-25 |

| Months | 1 | 29-Feb-24 | 31-Mar-24 |

| Months | 1 | 29-Apr-24 | 29-May-24 |

| Months | 1 | 30-Apr-24 | 31-May-24 |

| Months | 1 | 30-May-24 | 30-Jun-24 |

| Months | 1 | 31-May-24 | 30-Jun-24 |

| Months | 2 | 31-May-24 | 31-Jul-24 |

| Years | 1 | 27-Feb-24 | 27-Feb-25 |

| Years | 1 | 28-Feb-23 | 29-Feb-24 |

| Years | 1 | 28-Feb-24 | 28-Feb-25 |

| Years | 1 | 29-Feb-24 | 28-Feb-25 |

| Years | 1 | 29-Apr-24 | 29-Apr-25 |

| Years | 1 | 30-Apr-24 | 30-Apr-25 |

| Years | 1 | 30-May-24 | 30-May-25 |

| Years | 1 | 31-May-24 | 31-May-25 |

14. If you want to specify the date on which the loan has to be transferred to the card account, you can input the same in Billing Value Date. This date should be greater than or equal to Maturity Date. On Maturity Date of the loan, the amount will be transferred to the Card Account with the specified Value Date. If no specific date is input here, the date is derived based on the Transaction Code settings for Value Date movement.

15. Based on the combination of Client, Owner Branch, Currency, Amount Sanctioned, Tenor, Aura will display a list of active Mortgage and Loan Products that are maintained subject to the Availability for these parameters. Select the required Product from the list.

16. Interest calculation method is defaulted from the Product that you chose above. However, you can change the same from the dropdown list. The options available are Annuity and Amortized.

Amortized: Under this, the Loan Principal is spread out into a series of fixed payment amounts that you can specify. You have the ability to set different frequencies for Interest and Principal payment. The interest calculation will be based on the outstanding principal at the beginning of the period and is calculated based on the amount and length of time period.

Annuity: Annuity is a payment option where the repayment interval and the amount of repayment are fixed. Aura will automatically split the required repayment amount between Principal and Interest and you cannot change the same.

17. Input how the account number has to be generated in Generate account number. If you want to auto-generate the account number, choose Next in sequence. If you want to give a specific account number for this account, choose pre-assigned number. In case of the former, Aura will generate account number internally using the Client Account Mask maintained at the Entity level. In case of the latter, you need to input the account number in the next field. The account number is unique across the Entity.

18. If you select pre-assigned number in the above field, the next field Account Number will be enabled where you can enter an Account number. Aura will validate the entered account number against the Client Account Mask format defined at the Entity level as well as check whether it is unique across the Entity. However, if you select Next in Sequence, this field is disabled as Aura will generate the Account number internally based on the Client Account Mask format defined at the Entity level..

19. Enter Loan application # if applicable.

20. Select the Purpose of loan from the available drop-down list of values as maintained under Admin > System Codes > Generic Definitions > Purpose of Loan.

21. Enter Account name. This name will be used for the account.

22. Enter Account usage, i.e. how the account will be used.

23. Select Campaign Code if applicable for this account, from the available drop-down list as maintained under CRM > Sales > Campaign.

24. Enter Sourced by from the list of active Bank Users and Agent Users as maintained under Admin > Users > Maintain and under CRM > Sales > Agent user respectively

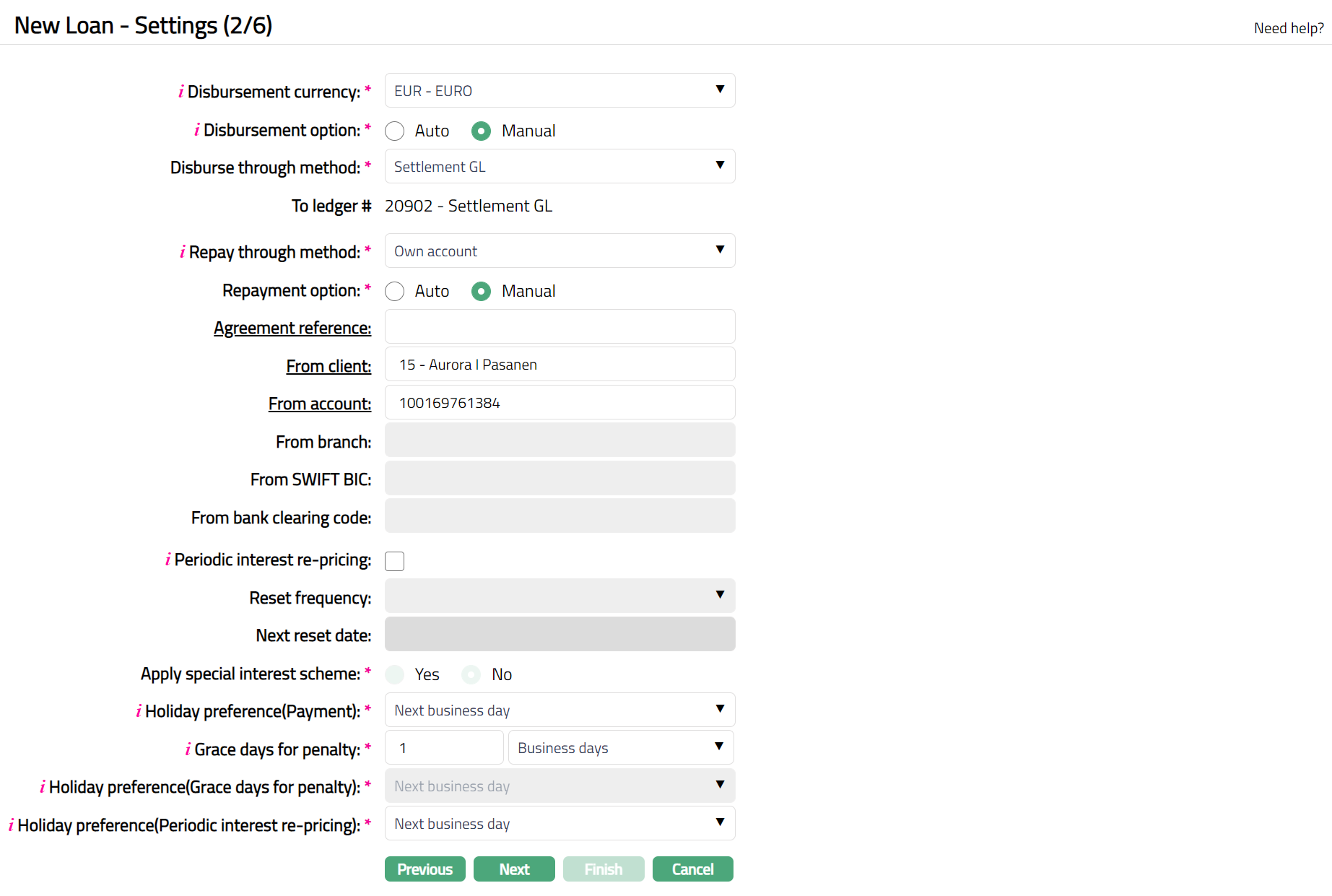

25. Click Next. The New Loan → Settings (2/6) page appears.

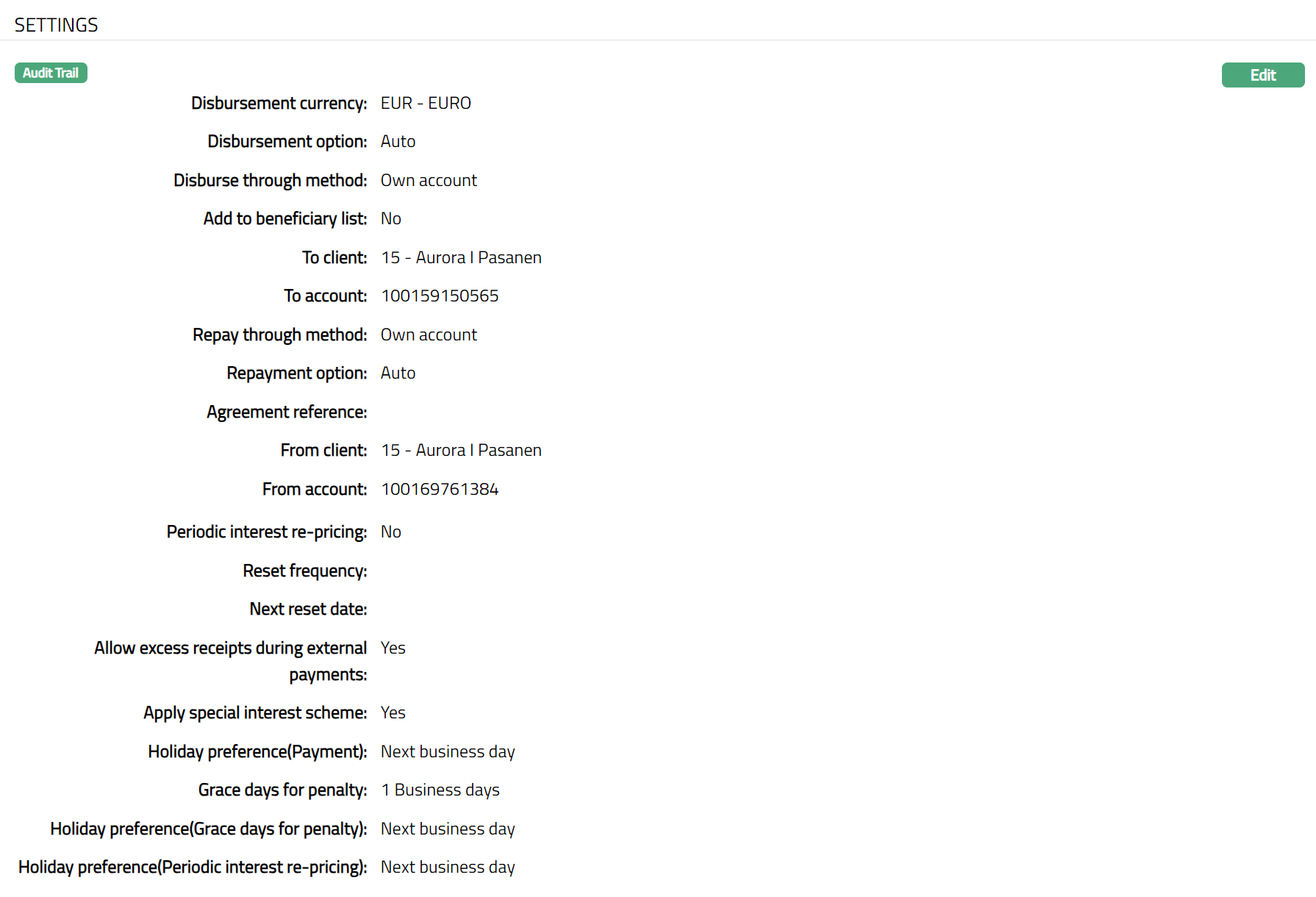

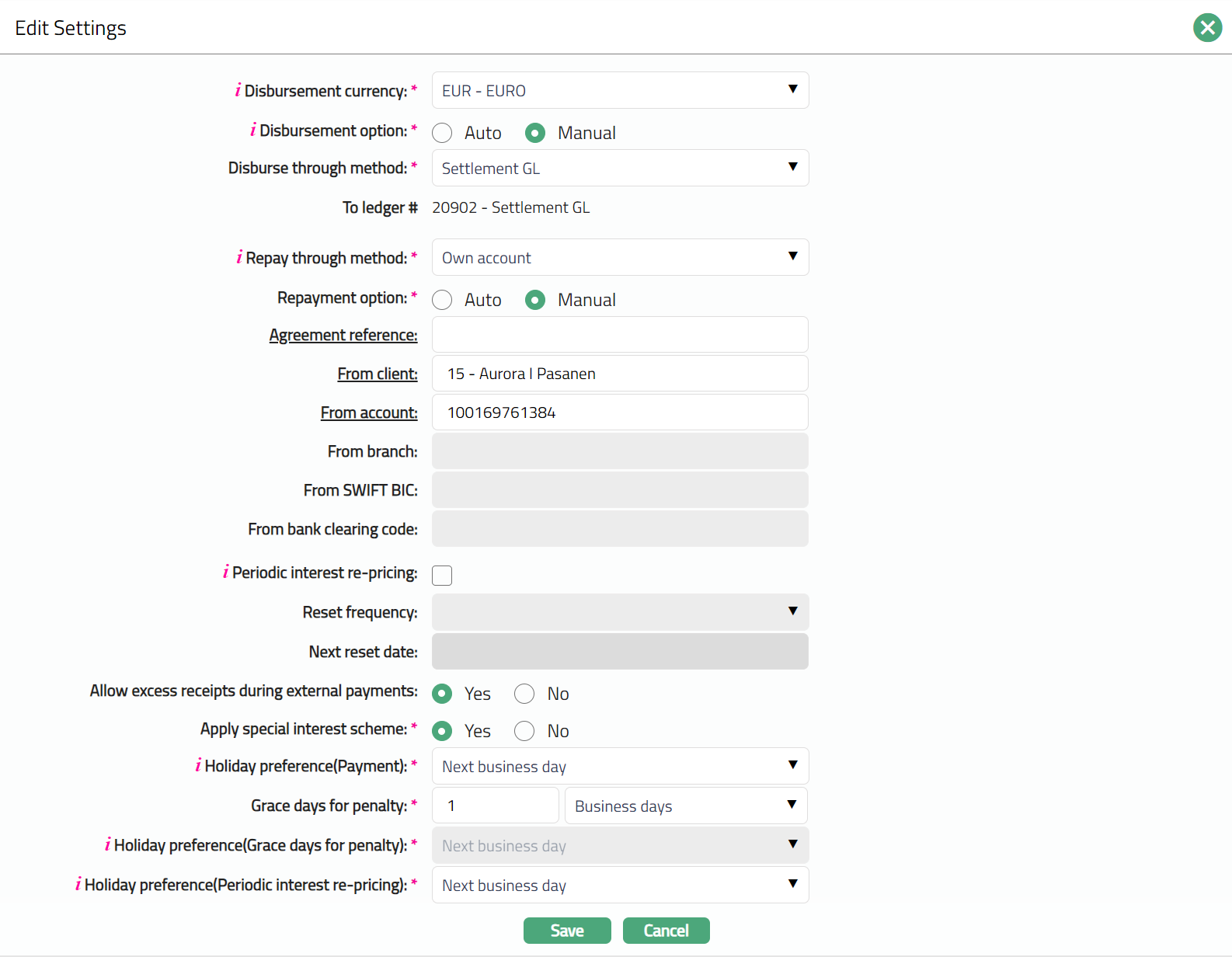

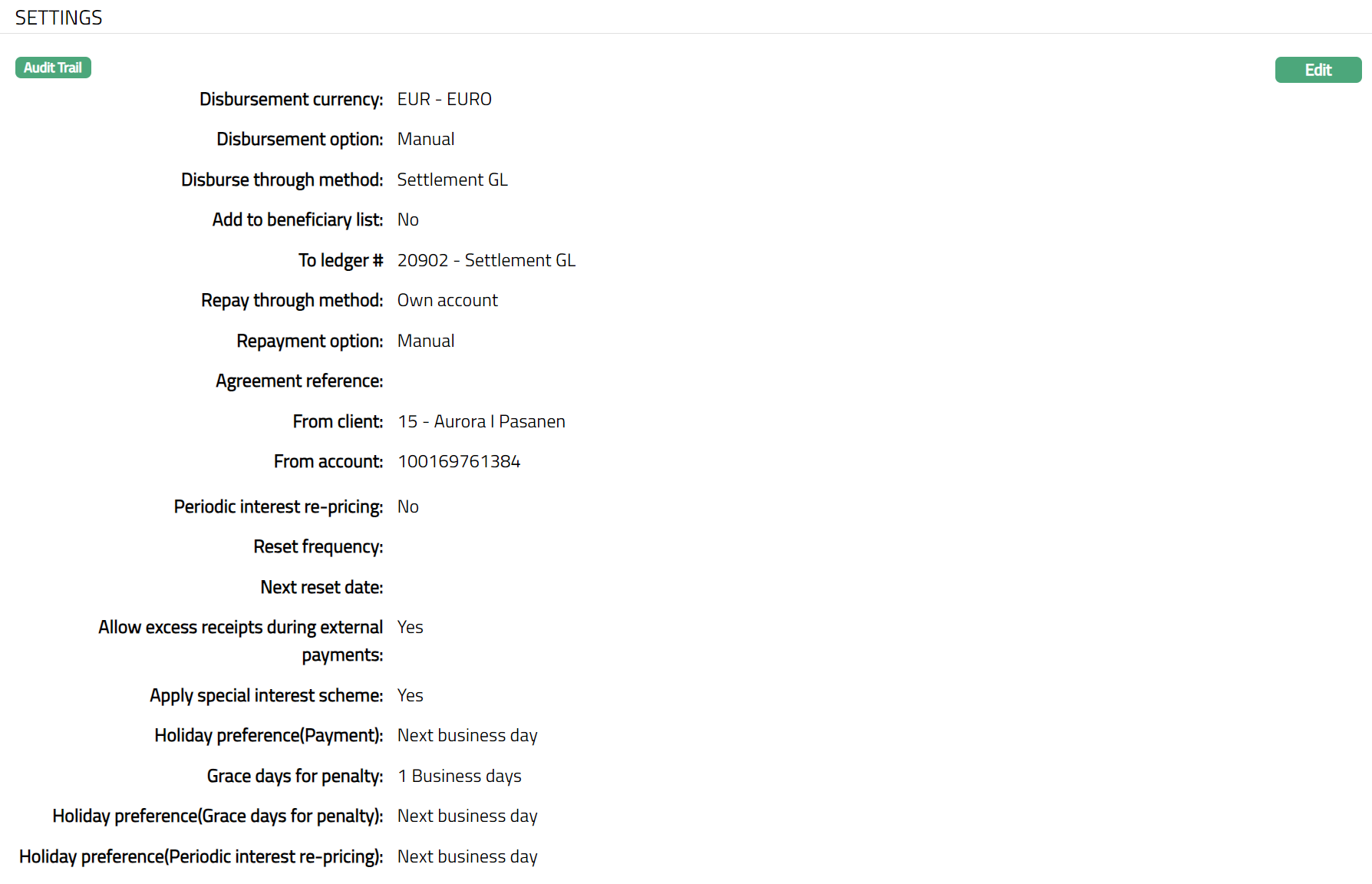

26. The Disbursement currency will be defaulted to the currency selected in Step 1. If required, you can change the Disbursement Currency from the drop-down list of GL currencies maintained under General Ledger > Settings > Currency.

27. Choose the Disbursement option - whether Automatic or Manual by choosing the appropriate radio button.

If you select the option as Auto, then the disbursement happens automatically on Value Date

If you select the option as Manual, then the disbursement has to be done manually by a user on or after the Value Date.

28. Select the Disburse through method from the drop down. This denotes the method in which the loan amount is to be disbursed and depends on what you selected as the Disbursement Option above. The following are the options available in Aura:

Settlement GL - This option appears only if you had selected the Disbursement Option as Manual. If this option is selected, then disbursement of the amount will happen to a General Ledger.

If you select Settlement GL as the Disburse Through Method:

- To ledger # field will be displayed. The Settlement GL specified at the Product will be defaulted and it cannot be edited. All other fields related to Disbursement will be disabled

Own Account - This option appears for both Auto and Manual Disbursement Options. If this option is selected, then Sanctioned Loan Amount will be disbursed to the Client's account in the same bank.

If you select Own Account as your Disburse Through Method:

- To Client field is enabled. By default, the Client you chose in Step 1 is displayed. If required, you can change to a different Client. To change the Client, click on Client hyperlink to see the Client Search page. Search for the required Client using appropriate inputs and select the required Client. Alternatively, you can start typing in the name of the Client in the text box and choose the required Client from the list suggested by Aura.

- Click on To account hyperlink to select the Client's active Client Accounts maintained under Retail > Accounts > Client Account > Maintain from which the repayment should be made.

External Account - This option appears for both Auto and Manual Disbursement Options. If this option is selected, then disbursement will be made to the specified external account.

If you select External Account as your Disburse Through Method:

- Client is displayed. By default, the Client you chose in Step 1 is displayed. If required, you can change to a different Client. To change the Client, click on Client hyperlink to see the Client Search page. Search for the required Client using appropriate inputs and select the required Client. Alternatively, you can start typing in the name of the Client in the text box and choose the required Client from the list suggested by Aura.

- Specify if the details of the Disbursement beneficiary are to be taken afresh or from records already maintained at the Client by choosing New or Existing. By default, the option New is selected so that you can input all the details of the external bank account to which the disbursement amount has to be credited. If required, you can change the option to Existing so that you can select a Beneficiary record that has already been maintained under CRM > Client > Maintain. In this case, all the details of the external bank Account as well as the Bank are defaulted from the Beneficiary record and the fields are disabled for any input.

- Choose the Clearing network through which the disbursement will be done. The drop-down list will display Clearing Networks that support payment in the Disbursement Currency chosen above. Based on the Clearing Network chosen, the subsequent fields related to Bank Account details will change. See the table below for more details.

- Specify if the details of the Bank of the Disbursement Beneficiary are to be taken afresh or from records already maintained by choosing New or Existing. By default, the option New is selected so that you can input all the details of the external bank in which the Disbursement Beneficiary Account is held. If required, you can change the option to Existing so that you can select a record that has already been maintained under Admin > Correspondent Bank Management > Maintain. In this case, all the details of the external bank are defaulted from the chosen record and the fields are disabled for any input. See the table below for more details.

- By checking the Add to Beneficiary List checkbox, you can indicate if you would like the New Beneficiary Account and Bank Details to be added to the Client's Beneficiary List under CRM > Client > Maintain. By default, this is unchecked and hence, the beneficiary details are not added to the Client record.

Note: If you had selected the Disbursement Beneficiary Option as Existing, Bank option will be automatically defaulted to Existing and disabled.

If you had selected Clearing Network = GIRO, Bank option will be disabled.

| External Account Details | Description | GIRO | TARGET2 | SEPA | SWIFT | Banking Circle | SEPA-INST | DCL - Bank Account |

|---|---|---|---|---|---|---|---|---|

| Sub-network | The sub-network to be used for the disbursement. Options are Bankgiro & Plusgiro | Enabled | Not displayed | Not displayed | Not displayed | Not displayed | Not displayed | Not displayed |

| Bankgiro# / Plusgiro# | The Bankgiro / Plusgiro number to indicate the bank account into which the disbursement has to be made | Enabled | Not displayed | Not displayed | Not displayed | Not displayed | Not displayed | Not displayed |

| Account number | The Account Number in the External Bank into which the Disbursement has to be made. | Disabled. If Clearing Network = GIRO and the Bankgiro / Plusgiro Directory is available, this will be displayed based on the Bankgiro# / Plusgiro# input | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory. Displayed as two separate text boxes to input Clearing # & Account # |

| Account holder | The name of the Account Holder in the External Bank Account to which the disbursement has to be made | Enabled - optional | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - optional |

| Address1 | Address1 of the Disbursement Beneficiary | Not displayed | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Not displayed |

| Address2 | Address2 of the Disbursement Beneficiary | Not displayed | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Not displayed |

| City/State | City / State of the Disbursement Beneficiary | Not displayed | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Not displayed |

| Post code | Post code of the Disbursement Beneficiary | Not displayed | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Not displayed |

| Country | Country of the Disbursement Beneficiary. List of countries as maintained under Admin > System Codes > Generic Definitions > Countries | Not displayed | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Not displayed |

| External Bank Details | Description | GIRO | TARGET2 | SEPA | SWIFT | Banking Circle | SEPA-INST | DCL - Bank Account |

|---|---|---|---|---|---|---|---|---|

| Bank Name | Name of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory |

| Address1 | Address1 of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional |

| Address2 | Address2 of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional |

| City/State | City / State of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional |

| Post code | Post code of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional | Enabled - optional |

| Country | Country of the Bank in which the Beneficiary Account is maintained. List of countries as maintained under Admin > System Codes > Generic Definitions > Countries | Disabled | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory |

| SWIFTBIC | The Bank Identifier Code (BIC) of the Bank in which the Beneficiary Account is maintained | Disabled | Enabled - mandatory | Enabled - optional | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory | Enabled - mandatory |

29. Use the Repay through method to indicate the method in which the amounts due on the loan is to be repaid. The available options are:

Direct Debit: If this option is selected, then repayment happens through an external account based on the Direct Debit instructions recorded.

By default, Repayment option will be Auto and disabled as Direct Debit instructions will be automatically handeld and you do not have to initiate any other manual action.

You have to mandatorily select the direct debit Agreement reference number that is to be used for this loan. Click on the hyperlink to select the required Activated Direct Debit Agreements where the Client is the Debtor Agreement Party as maintained under CRM > Client > Agreement. Alternatively, you can type the Agreement Reference as maintained in the Agreement Record to get a list of Agreements for the Client and select the required one.

The following fields will be auto-populated from the Agreement and disabled:

- Repayment account detail

- From account

- Repayment account holder

- From bank

- From branch

- From SWIFT BIC

- From bank clearing code

Own account: If this option is selected, then repayment happens through Client's account in the same bank

Repayment option can be Auto or Manual.

- If you select the option as Auto, then the Repayment happens automatically on Repayment date

- If you select the option as Manual, then you have to manually initiate the Repayment on the Repayment date.

Agreement reference can be used optionally to link the agreement under which the Client Account has to be debited for the Loan repayments. Click on the hyperlink to select the required Activated Direct Debit Agreements for the Client as maintained under CRM > Client > Agreement. Alternatively, you can type the Agreement Reference as maintained in the Agreement Record to get a list of matching agreements for the client and select the required one.

From Client identifies the Client whose Client Account should be debited for the loan payments. By default, the Client you chose in Step 1 is displayed. If required, you can change to a different Client. To change the Client, click on Client hyperlink to see the Client Search page. Search for the required Client using appropriate inputs and select the required Client. Alternatively, you can start typing in the name of the Client in the text box and choose the required Client from the list suggested by Aura.

Click on From account hyperlink to select the Client Accounts of the selected Client where the Loan Account Currency matches the Client Account Currency.

The following fields will be auto-populated from the Agreement and disabled:

- From Branch

- From SWIFT BIC

- From bank clearing code

Payment by invoice: If this option is selected, then the payment will be made against the invoice generated using an external account in a different bank.

Repayment option can be Auto or Manual.

- If you select the option as Auto, then the Repayment happens automatically on Repayment date

- If you select the option as Manual, then you have to manually initiate the Repayment on the Repayment date.

Agreement reference can be used optionally to link the agreement for the Loan repayments. Click on the hyperlink to select the required Activated Invoice Agreements for the Client as maintained under CRM > Client > Agreement. Alternatively, you can type the Agreement Reference as maintained in the Agreement Record to get a list of matching agreements for the Client and select the required one.

Optionally, you can specify if the Repayment account details are to be taken afresh or from records already maintained at the Client by choosing New or Existing. By default, the option New is selected so that you can input all the details of the external bank account from which the repayment will be made. If required, you can change the option to Existing so that you can select a Beneficiary record that has already been maintained under CRM > Client > Maintain. In this case, all the details of the external bank Account as well as the Bank are defaulted from the Beneficiary record and the subsequent repayment related fields are disabled for any input.

- In the From account field enter the account number from which the repayment is supposed to happen.

- Enter the account holder's name in the Repayment account holder field.

- Enter the name of the Bank in which the above account is maintained. Alternatively, you can click on the From Bank hyperlink to select a record that has already been maintained under Admin > Correspondent Bank Management > Maintain. In this case, all the details of the external bank are defaulted from the chosen record and the following fields are disabled for any input.

- From SWIFT BIC

- From bank clearing code

- In the From Branch field enter the name of the Branch of the bank which holds the account through which repayment is supposed to be done.

Settlement GL: If this option is selected, then repayment happens in the form of cash through the Client.

- Repayment option is defaulted to Manual and is disabled.

- Click on the Agreement reference hyperlink to select the agreement. Aura will display the list of agreements maintained under CRM > Client > Agreement.

- From ledger# field will be displayed. The Settlement GL specified at the Product will be defaulted and it cannot be edited.

- The following fields will be disabled:

- From Branch

- From SWIFT BIC

- From bank clearing code.

Postdated cheques: If this option is selected, then repayment happens through post-dated cheques

Note: Invoice can be generated for any of the Repay through method option. Even in case of Repay Through Own Account, Invoice can be generated and sent to the Client.

30. If you want to be able to reset the interest rate at a specified frequency, check Periodic interest rate re-pricing checkbox. This enables the next two fields Reset Frequency and Next Reset Date.

31. Select the Reset frequency from the dropdown list. The following are the available options: Monthly, Quarterly, Semi Annual and Annual.

32. Select the Next reset date. This date should be greater than the Value Date specified in Step 1.

Note on Re-pricing:

If the Interest Band applicable to the Account is Variable, and Periodic Interest Re-pricing check box = No, it means that the interest rate is truly variable for that account; and the interest will change as and when the interest base rate is changed. If Periodic Interest Re-pricing is Yes, it means that the interest rate will change only on the specified reset date, though there may be changes in the base interest rate. If the interest band applicable to the Account is Fixed, then, there is no change in the interest rate at any time.

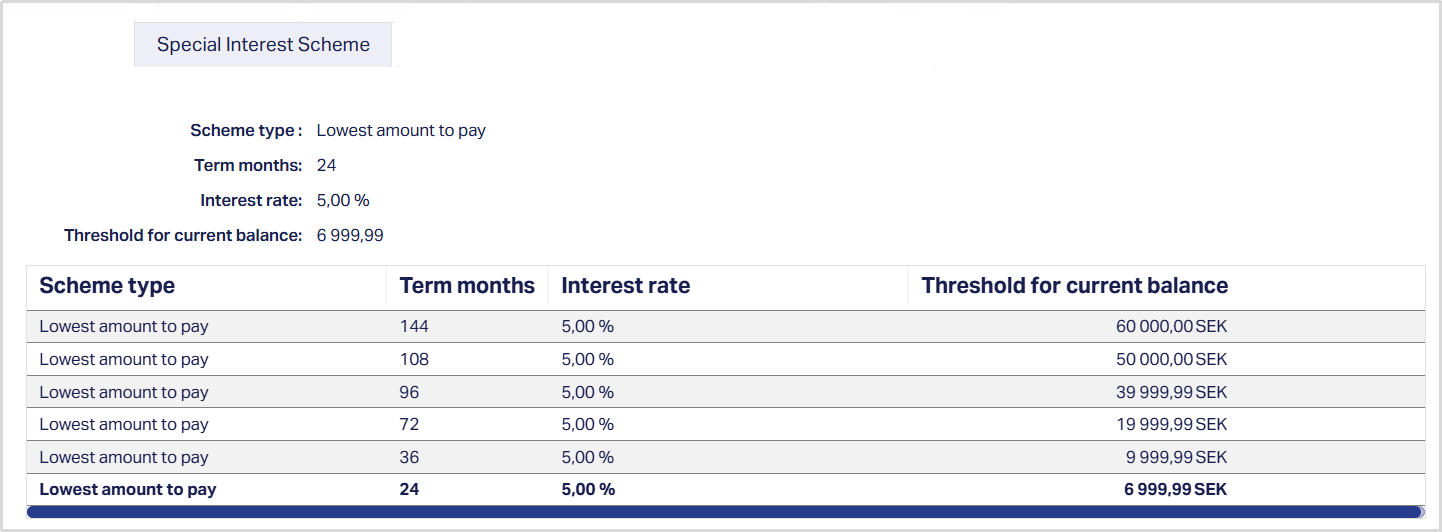

33. Apply special interest scheme will automatically be defaulted from the Product. If it is defaulted as No, you cannot change it to Yes. However, if it is defaulted as Yes, you can change it to No. When it is Yes, it indicates that the loan will be subject to concessional rates of interest till there isn't any payment default; and on payment default, the loan will move to normal interest rates as specified in the Special Interest Scheme defined in the Product.

34. Select the holiday preference for loan payment from the Holiday preference (payments) to determine when the payment is actually due on the account if the scheduled due date is a holiday. This is defaulted from the Product but can be changed during loan creation. The options available are:

Ignore: When this preference is selected No holiday preference will be applicable for the payment date on the Loan Account and payment is due on the same date as per the Schedule Due Date.

Next business day: When this preference is applied to the loan account, Aura will check if the payment schedule due date is a holiday. If yes, then the Payment Due On for the schedule is updated with next business date.

Previous day: When this preference is applied to the loan account, Aura will check if the payment schedule due date is a holiday. If yes, then the Payment Due On for the schedule is updated with previous business date

Note: You can see the Payment Due Date and the Payment Due On Date in the Payment Schedule tab.

35. Grace days for Penalty determines when the Penalty on Principal / Interest Overdue and Late Payment fees are applicable on the loan account. Thus, even if the payment is received after the Due Date, but within the Grace Days specified, penalties / late payment fee will not be applicable. The values are defaulted from the Product, but you can change during loan creation. You can also specify if the Grace Days are to be counted in terms of Calendar Days or Business Days.

36. Enter the holiday preference for grace days for penalty from the Holiday preference (grace days for penalty) dropdown list. If the End of Grace Days is a holiday, this value indicates how the revised End of Grace Days should be arrived at so that Penalty and Late Payment Fees, if any, can be applied on the revised End of Grace Days. If the full payment is not received by such date, penalty interest will be calculated with effect from the Due Date on the Overdue amount. The values are defaulted from the Product, but you can change during loan creation. The options available are:

Ignore: When this preference is selected, No holiday preference will be applicable for the end of Grace Days and grace days will end on the same date as per the payment schedule.

Next business day: When this preference is applied to the loan account, Aura will check if the day on which the Grace Days end is a holiday. If yes, then the End of Grace Days is updated with next business date.

Previous day: When this preference is applied to the loan account, Aura will check if the day on which the Grace Days end is a holiday. If yes, then the End of Grace Days is updated with previous business date.

Note: If Grace Days for Penalty is defined as Business Days, then the field Holiday Preference(Grace Days for Penalty) will not be applicable as the Grace Days will never end on a Holiday; and hence, will be disabled..

Example:

Holidays: 25-Dec-2025, 26-Dec-2025, 27-Dec-2025, 28-Dec-2025

Schedule's Payment Due Date: 26-Dec-2025

Grace Days: 2 calendar days End of Grace Days will be as follows for the different Holiday Preferences:

| Preference | End of Grace Days |

|---|---|

| Ignore | 28-Dec-2025 |

| Next business day | 29-Dec-2025 |

| Previous business day | 24-Dec-2025 |

37. Select the holiday preference for periodic interest re-pricing from the Holiday preference (periodic interest re-pricing) dropdown list. If the Periodic Interest Re-pricing Reset Date is a holiday, this field indicates when the interest re-pricing should apply. The options available are:

Ignore: When this preference is selected No holiday preference will be applicable for the periodic interest re-pricing and rate reset will happen on the same date as per the payment schedule.

Next business day: When this preference is applied to the loan account, Aura will check if the Next Reset Date is a holiday. If yes, then the Next Reset Date is updated with next business date.

Previous day: When this preference is applied to the loan account, Aura will check if the Next Reset Date is a holiday. If yes, then the Next Reset Date is updated with previous business date.

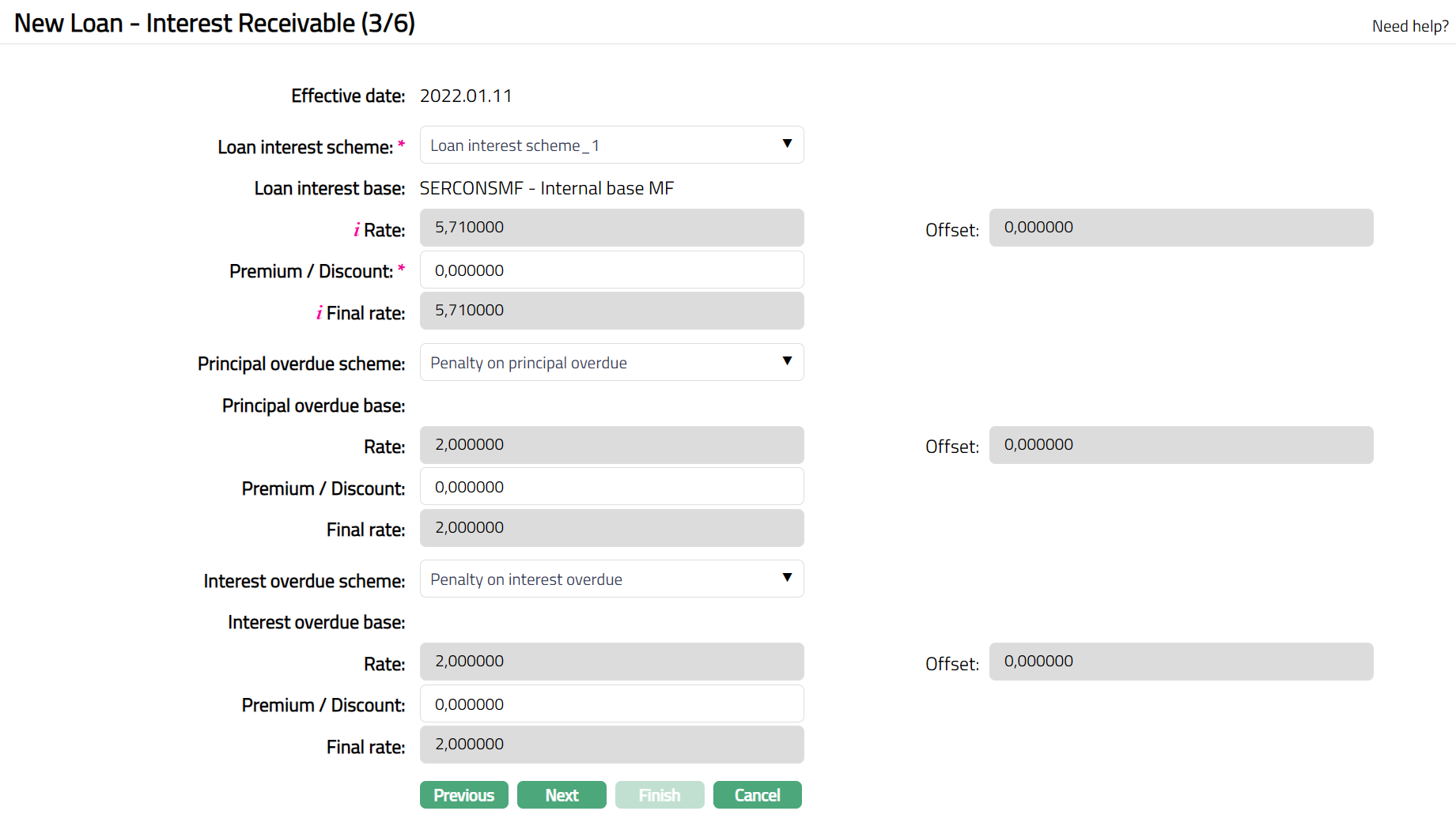

38. Click Next. The New Loan → Interest Receivable (3/6) page appears.

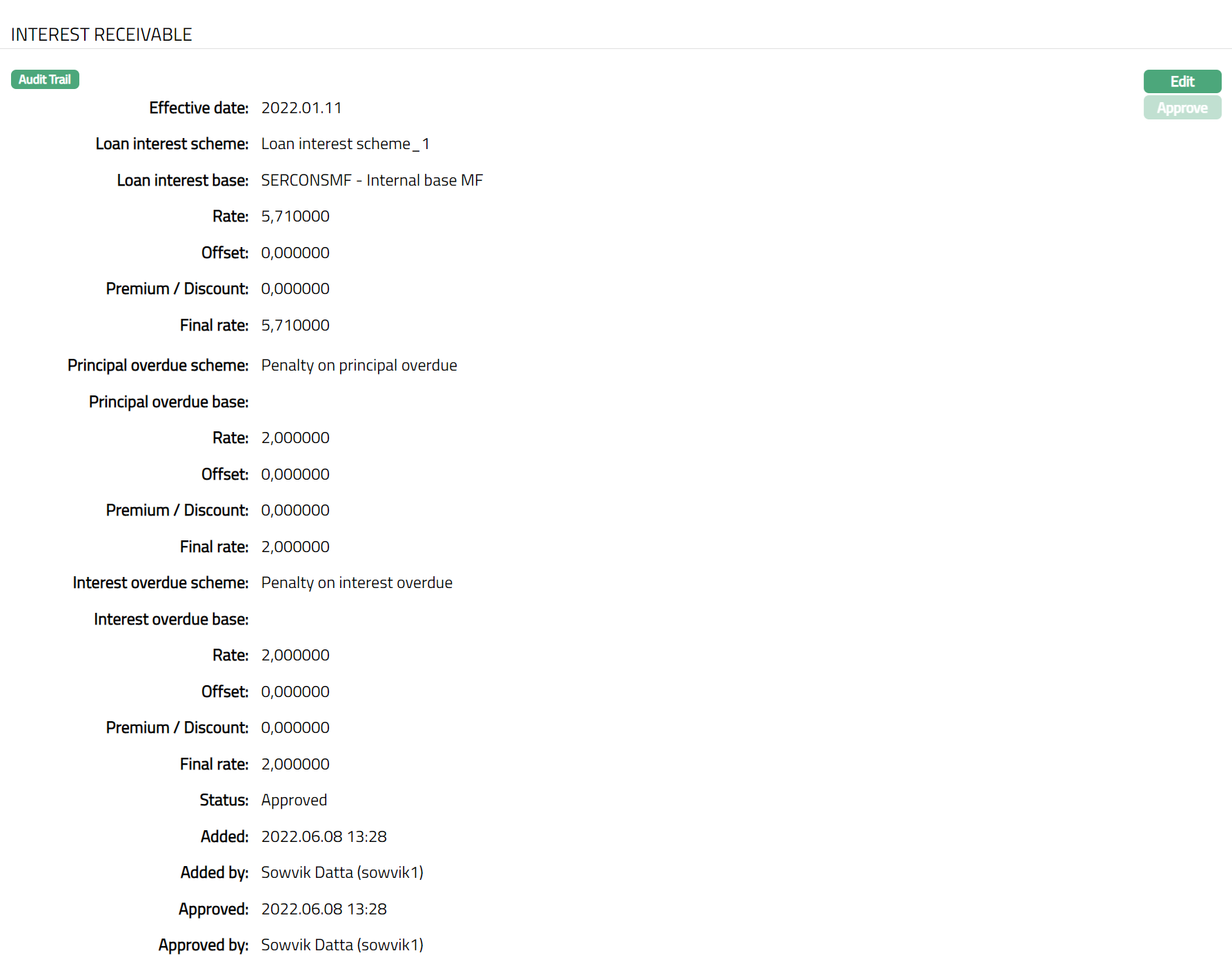

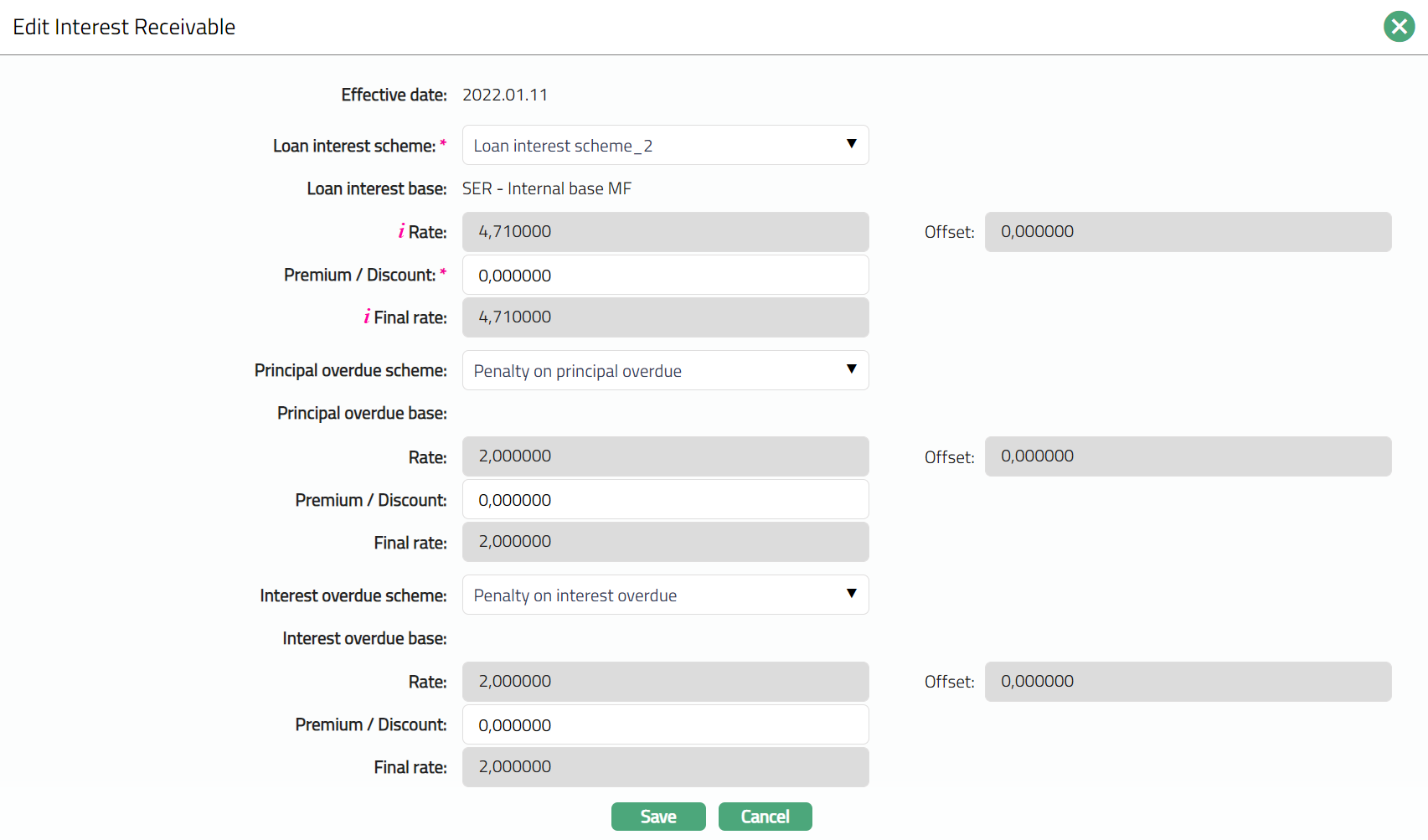

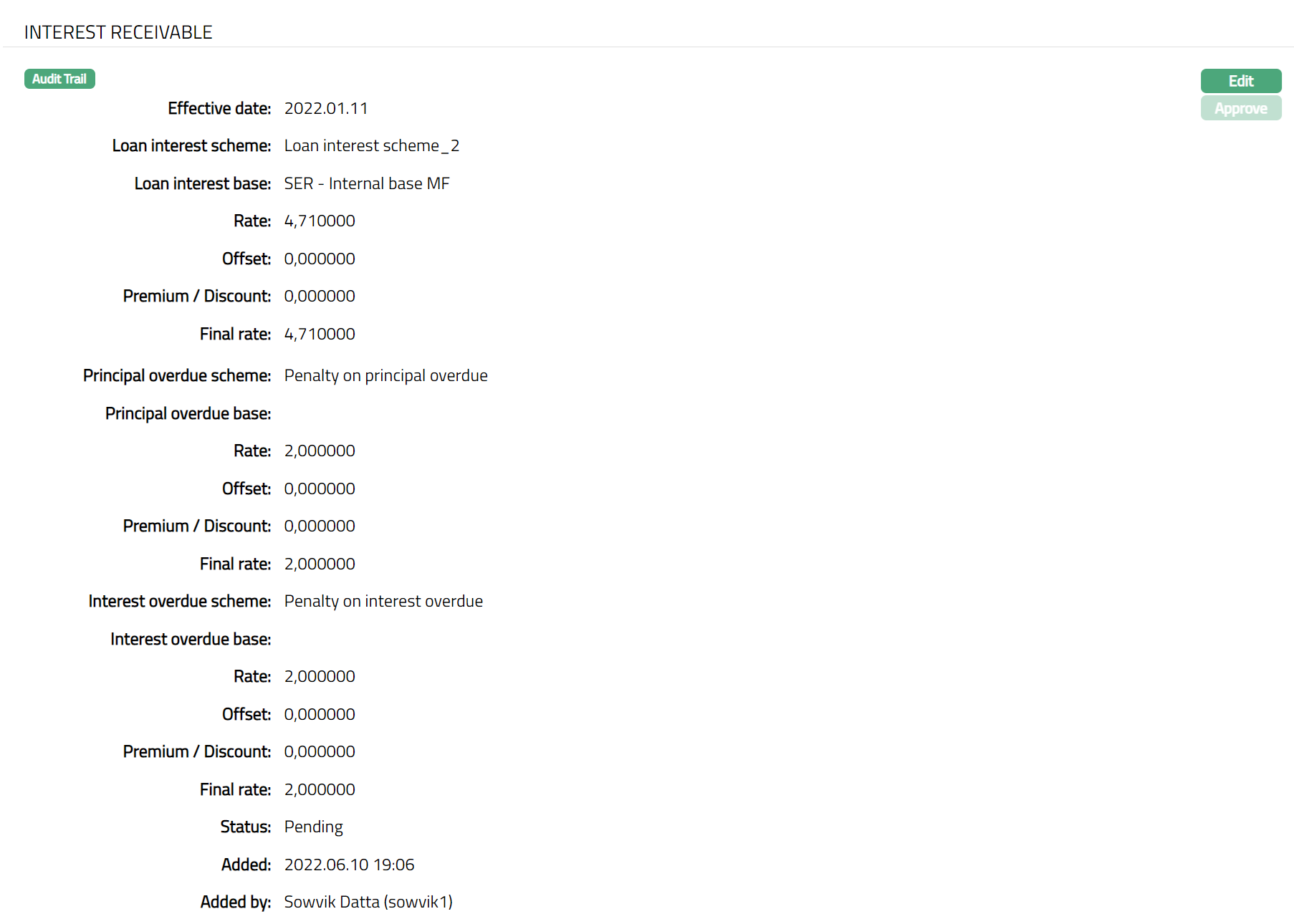

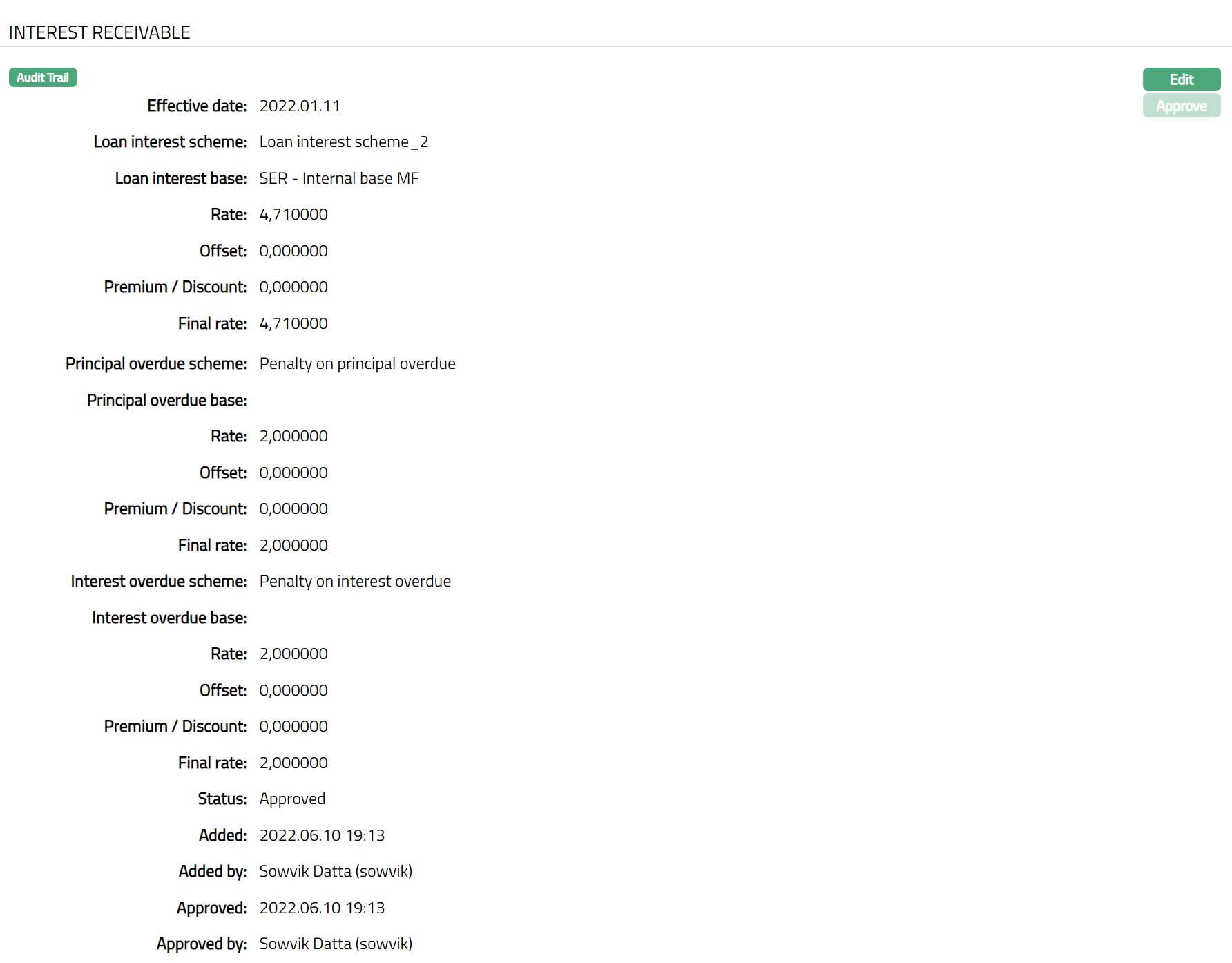

39. By default, current system date is populated as Effective date; and you cannot change this.

40. The Loan interest scheme field is defaulted from the Product and denotes the interest scheme for the main interest on the loan principal amount. This field is editable while creating the loan. Before activating the Loan Account, you can change it using Settings Tab > Edit. After activation of the Loan Account, you have to use Change of Terms > Interest parameters for any changes.

41. Based on the Loan Account Currency, Client, the Client's current Relationship Pricing and Risk Category, Aura determines the Interest Combination that is the most appropriate for the Loan from the Combinations maintained for the above Interest Scheme; and derives the Band that is applicable for the Loan Amount Sanctioned.

- If the Band's Interest Method is Variable, Loan interest base that is mapped to that Band will be displayed.

- If the Band's Interest Method is Fixed, Loan interest base will be blank.

42. Rate is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Rate = latest approved Rate from the Interest Base where currency matches the Loan Account Currency and Effective By in the Interest Base <= Effective Date displayed above.

- If the Band's Interest Method is Fixed, Rate = Rate from Band in the Interest Scheme.

Note: If the Interest Method is Variable, Aura will apply the changes to existing Loans only when the Rate is changed at Interest Base level. If the Offset is changed at the Interest Scheme level, it will be applied only to new loans and not to existing loans.

43. Offset field is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Offset = Rate from Band in the Interest Scheme.

- If the Band's Interest Method is Fixed, Offset will be blank.

44. Enter the Premium / Discount that is to be applied on the above Rate. By default it will be zero. Both positive and negative values are allowed. A positive value is considered as a Premium and negative value is considered a Discount.

45. Final rate is calculated as Rate + Offset + Premium / Discount. This field is non-editable.

Examples:

| Rate | Off-set | Premium / Discount | Final Rate |

|---|---|---|---|

| 7.25 | 2.00 | 1.00 | 10.25 |

| 7.25 | 2.00 | -1.00 | 8.25 |

46. The Principal overdue scheme field is defaulted from the Product and denotes the interest scheme for the principal overdue on the loan. This field is editable while creating the loan. Before activating the Loan Account, you can change it using Settings Tab > Edit. After activation of the Loan Account, you have to use Change of Terms > Interest parameters for any changes.

47. Based on the Loan Account Currency, Client, the Client's current Relationship Pricing and Risk Category, Aura determines the Interest Combination that is the most appropriate for the Loan from the Combinations maintained for the above Interest Scheme; and derives the Band that is applicable for the Loan Amount Sanctioned.

- If the Band's Interest Method is Variable, Principal overdue base that is mapped to that Band will be displayed.

- If the Band's Interest Method is Fixed, Principal overdue base will be blank.

48. Rate is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Rate = latest approved Rate from the Interest Base where currency matches the Loan Account Currency and Effective By in the Interest Base <= Effective Date displayed above.

- If the Band's Interest Method is Fixed, Rate = Rate from Band in the Interest Scheme.

Note: If the Interest Method is Variable, Aura will apply the changes to existing Loans only when the Rate is changed at Interest Base level. If the Offset is changed at the Interest Scheme level, it will be applied only to new loans and not to existing loans.

49. Offset field is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Offset = Rate from Band in the Interest Scheme.

- If the Band's Interest Method is Fixed, Offset will be blank.

50. Enter the Premium / Discount that is to be applied on the above Rate. By default it will be zero. Both positive and negative values are allowed. A positive value is considered as a Premium and negative value is considered a Discount.

51. Final rate is calculated as Rate + Offset + Premium / Discount. This field is non-editable.

Examples:

| Rate | Off-set | Premium / Discount | Final Rate |

|---|---|---|---|

| 18.00 | 2.00 | 1.00 | 21.00 |

| 18.00 | 2.00 | -1.00 | 19.00 |

52. The Interest overdue scheme field is defaulted from the Product and denotes the interest scheme for the interest overdue on the loan. This field is editable while creating the loan. Before activating the Loan Account, you can change it using Settings Tab > Edit. After activation of the Loan Account, you have to use Change of Terms > Interest parameters for any changes.

53. Based on the Loan Account Currency, Client, the Client's current Relationship Pricing and Risk Category, Aura determines the Interest Combination that is the most appropriate for the Loan from the Combinations maintained for the above Interest Scheme; and derives the Band that is applicable for the Loan Amount Sanctioned.

- If the Band's Interest Method is Variable, Interest overdue base that is mapped to that Band will be displayed.

- If the Band's Interest Method is Fixed, Interest overdue base will be blank.

54. Rate is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Rate = latest approved Rate from the Interest Base where currency matches the Loan Account Currency and Effective By in the Interest Base <= Effective Date displayed above.

- If the Band's Interest Method is Fixed, Rate = Rate from Band in the Interest Scheme.

Note: If the Interest Method is Variable, Aura will apply the changes to existing Loans only when the Rate is changed at Interest Base level. If the Offset is changed at the Interest Scheme level, it will be applied only to new loans and not to existing loans.

55. Offset field is defaulted from the Band as derived above and is non-editable.

- If the Band's Interest Method is Variable, Offset = Rate from Band in the Interest Scheme.

- If the Band's Interest Method is Fixed, Offset will be blank.

56. Enter the Premium / Discount that is to be applied on the above Rate. By default it will be zero. Both positive and negative values are allowed. A positive value is considered as a Premium and negative value is considered a Discount.

57. Final rate is calculated as Rate + Offset + Premium / Discount. This field is non-editable.

Examples:

| Rate | Off-set | Premium / Discount | Final Rate |

|---|---|---|---|

| 18.00 | 2.00 | 1.00 | 21.00 |

| 18.00 | 2.00 | -1.00 | 19.00 |

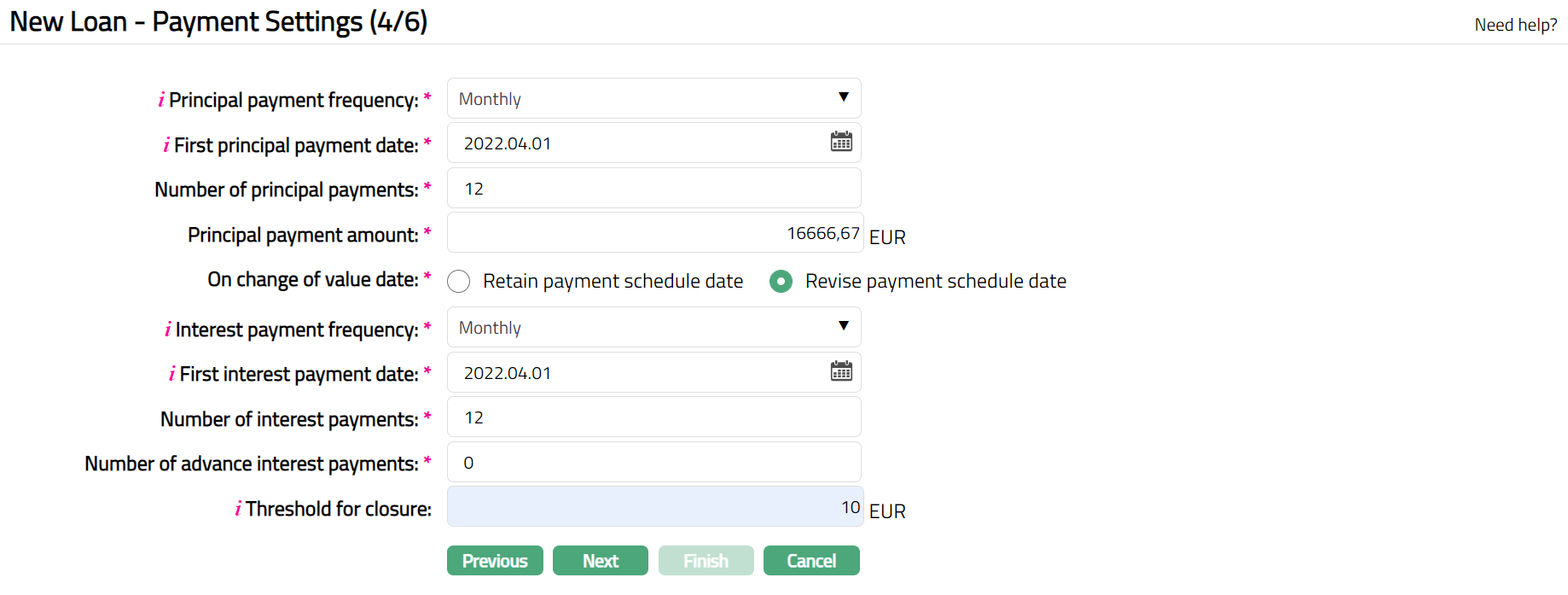

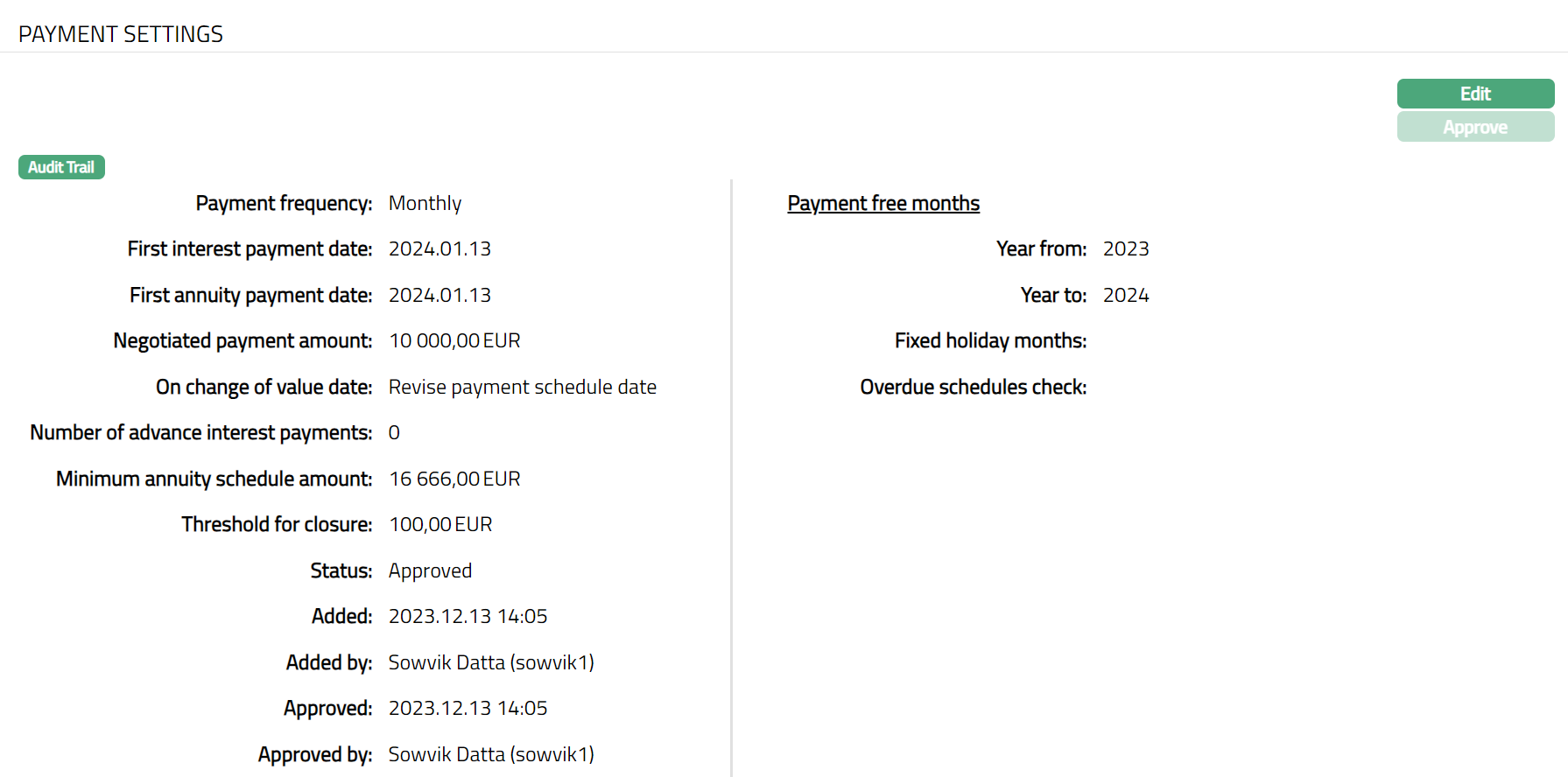

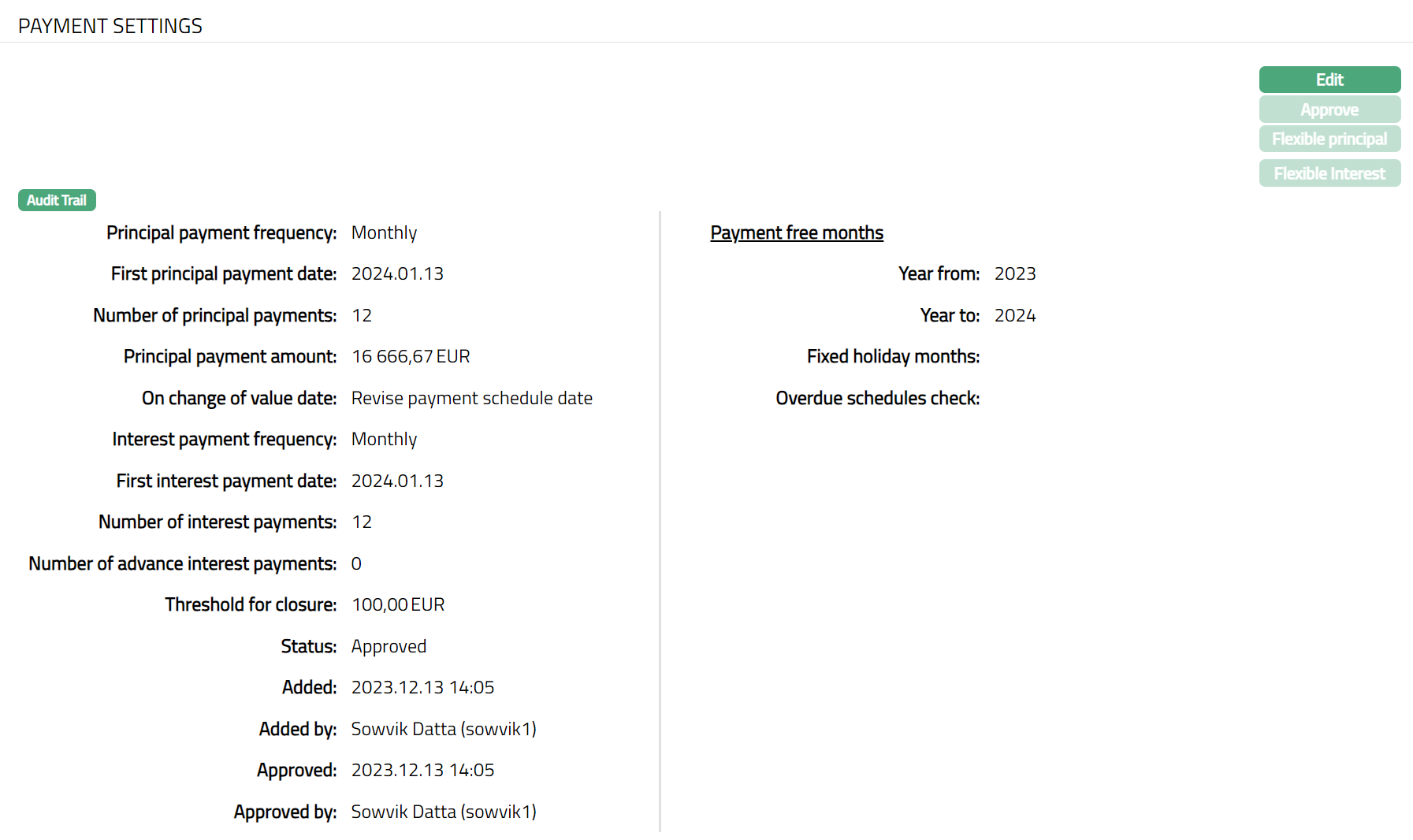

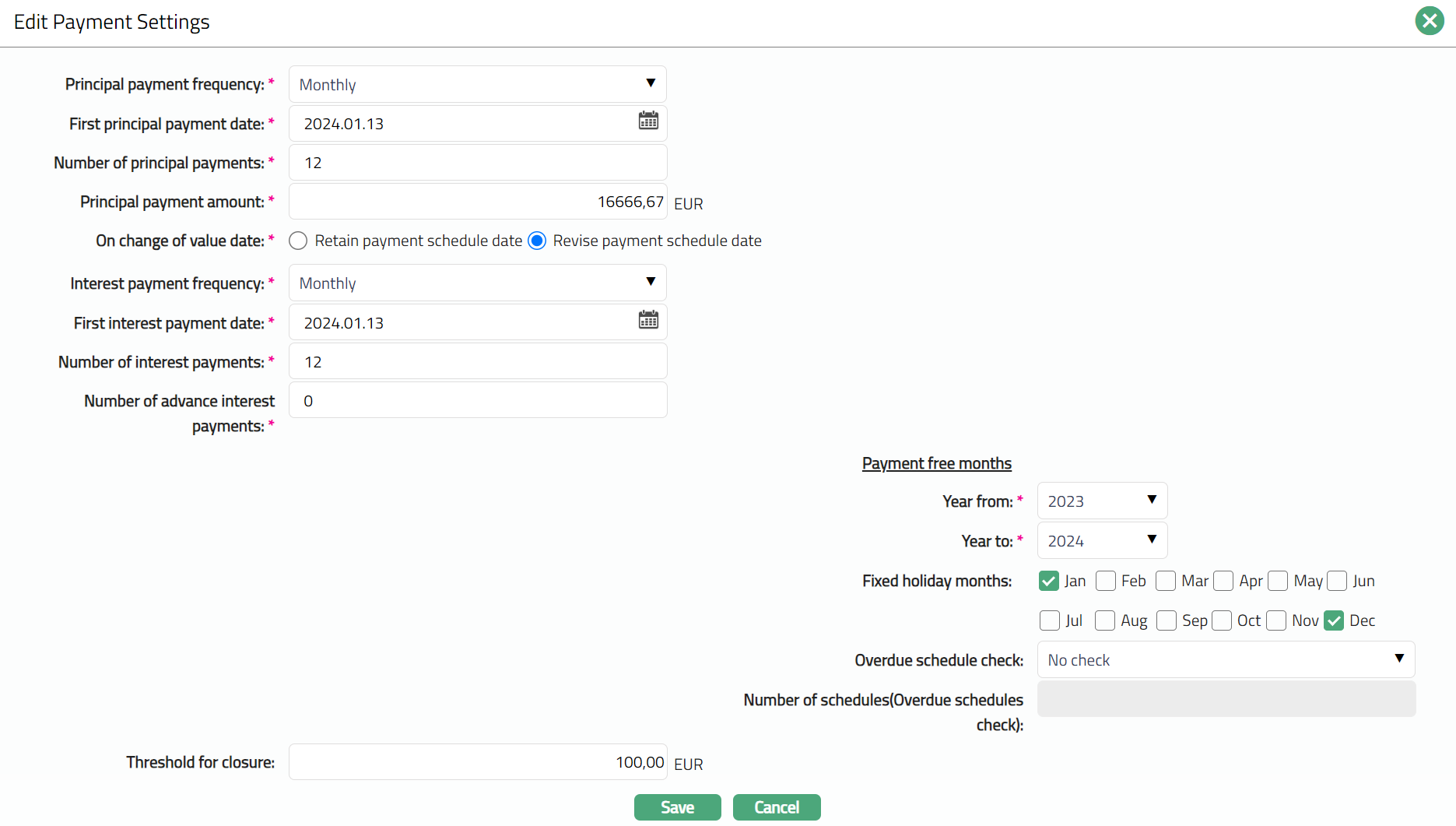

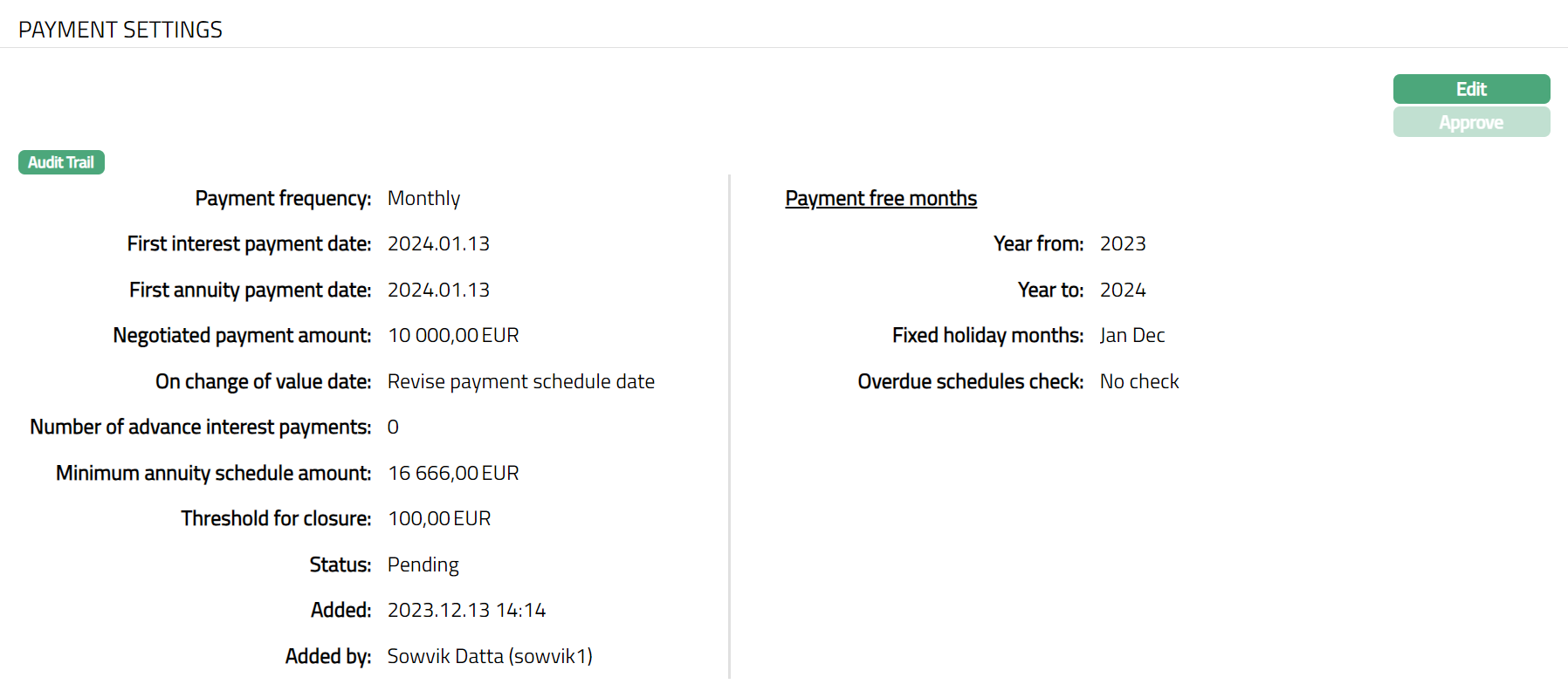

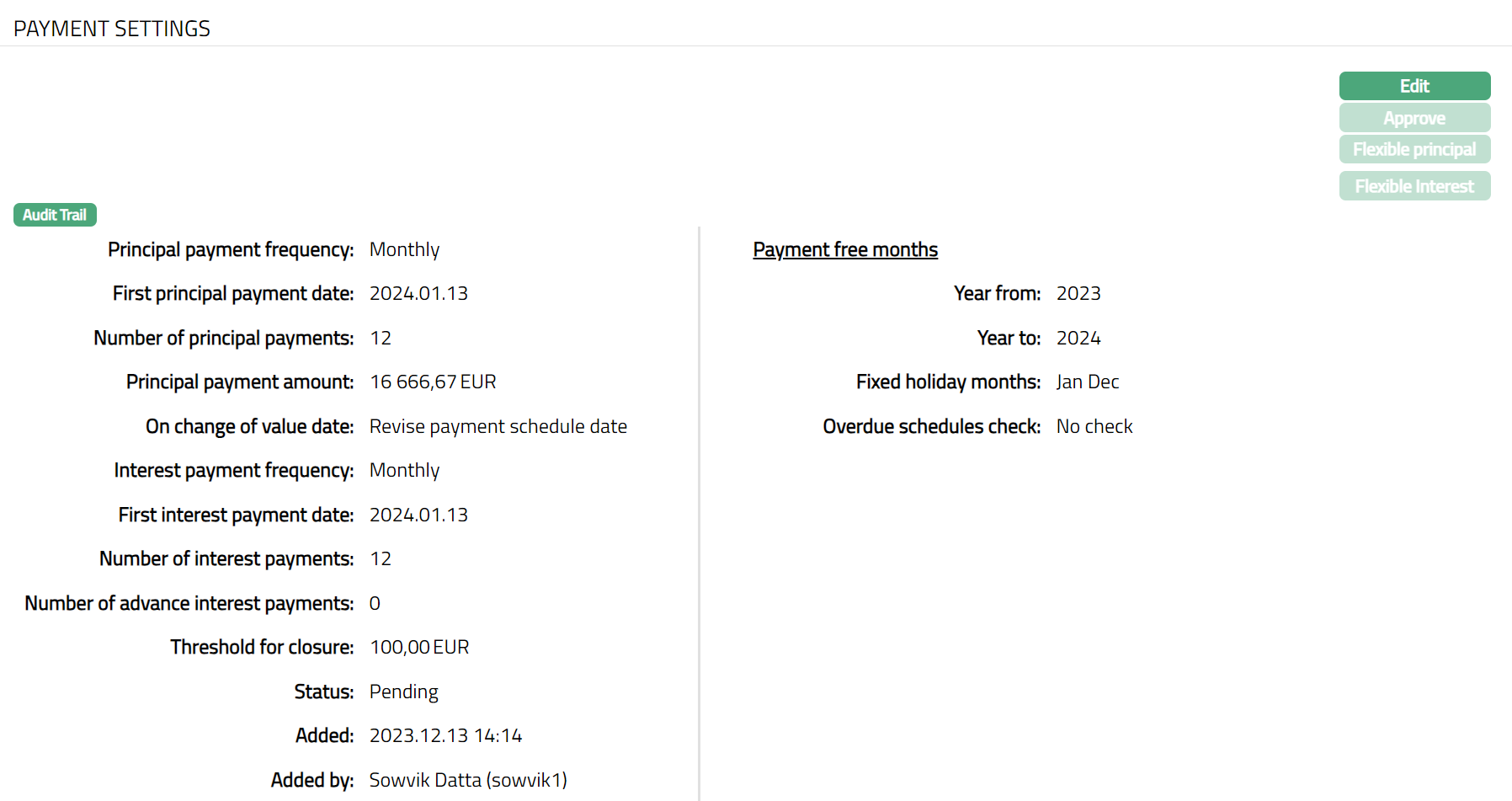

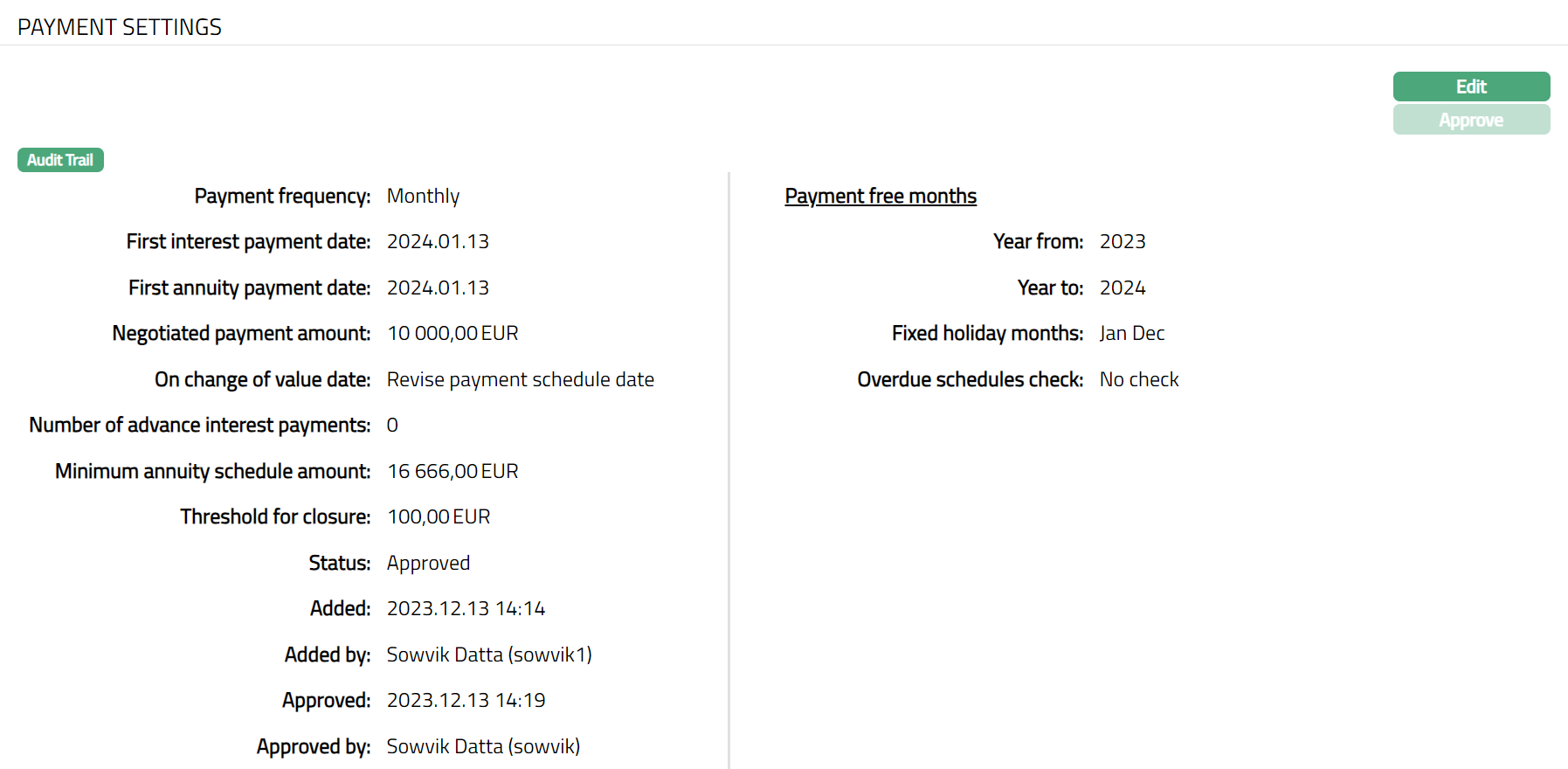

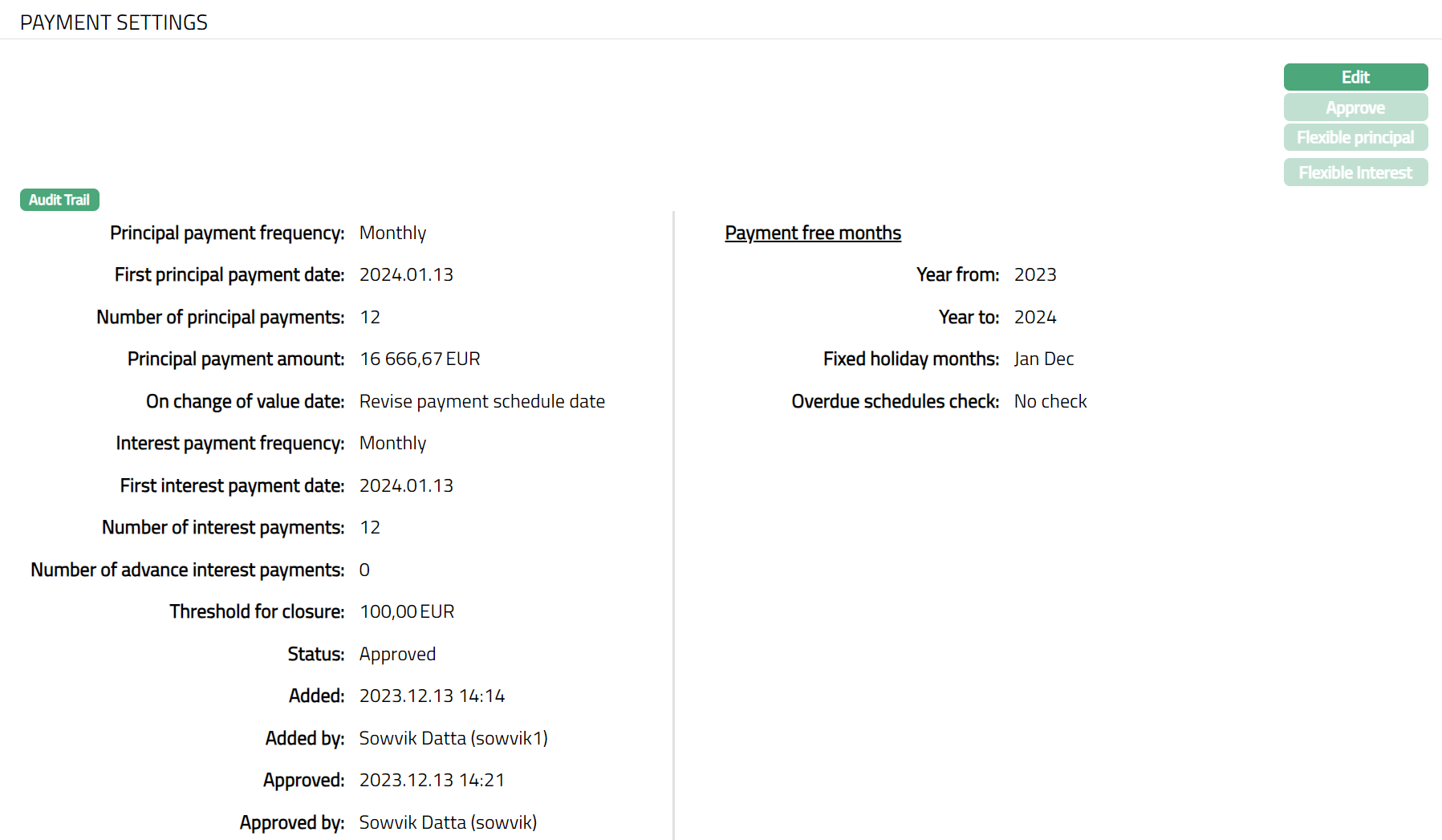

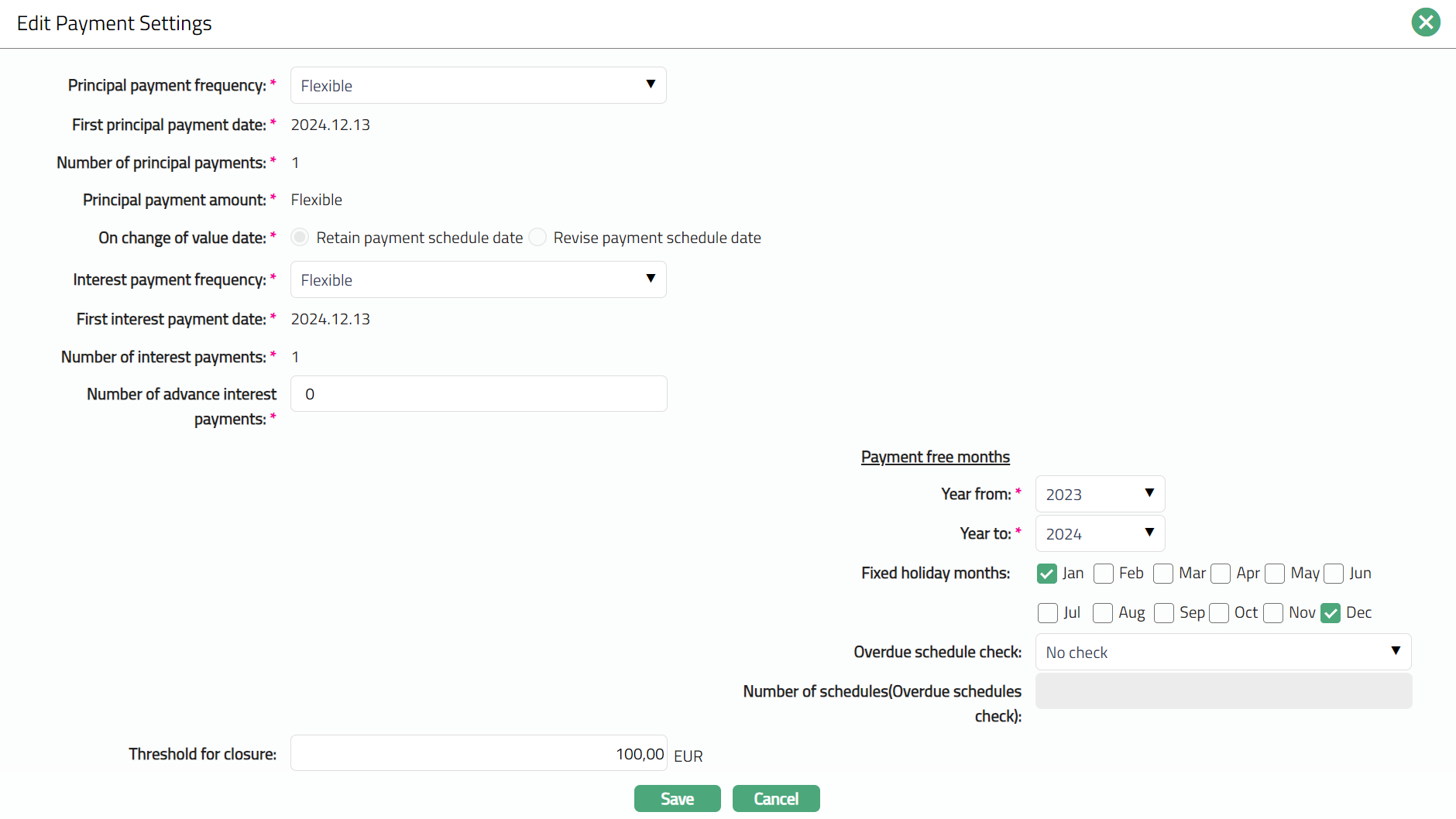

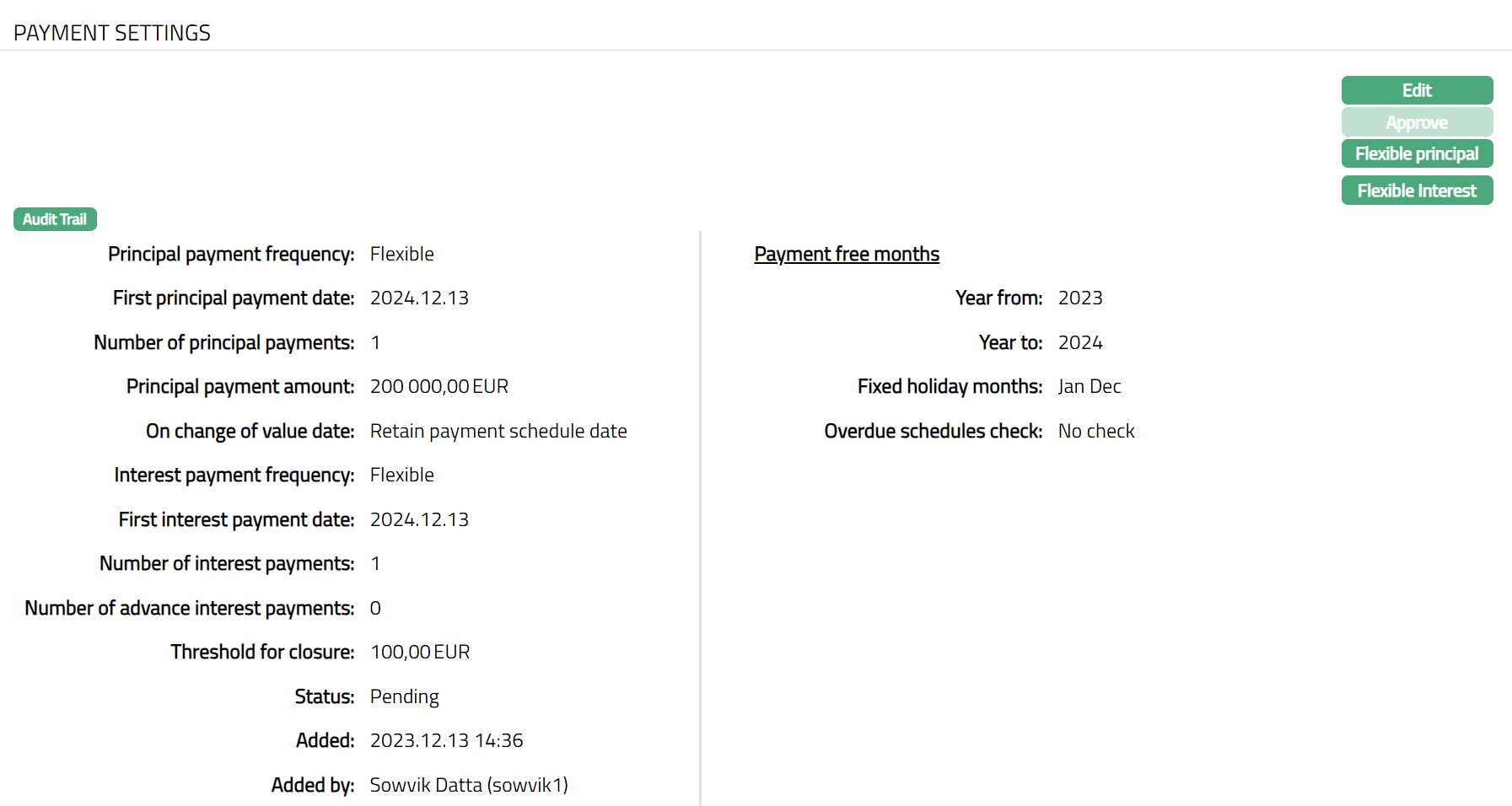

58. Click Next. The New Loan → Payment Settings (4/6) page appears

59. There are two different Payment Settings screens based on whether Interest Calculation Method that you chose for the loan is defined as Amortized or Annuity.

If the Interest Calculation Method for the loan is Amortized, then you will get the following screen:

Select the Principal payment frequency from the drop-down. The available options are:

- Weekly: Principal should be paid every week

- Semi-Monthly: Principal should be paid twice a month

- Monthly: Principal should be paid every month

- Quarterly: Principal should be paid every quarter

- Semi-annual: Principal should be paid twice a year

- Annual: Principal should be paid every year

- On maturity: Principal should be paid only on the Maturity Date of the loan

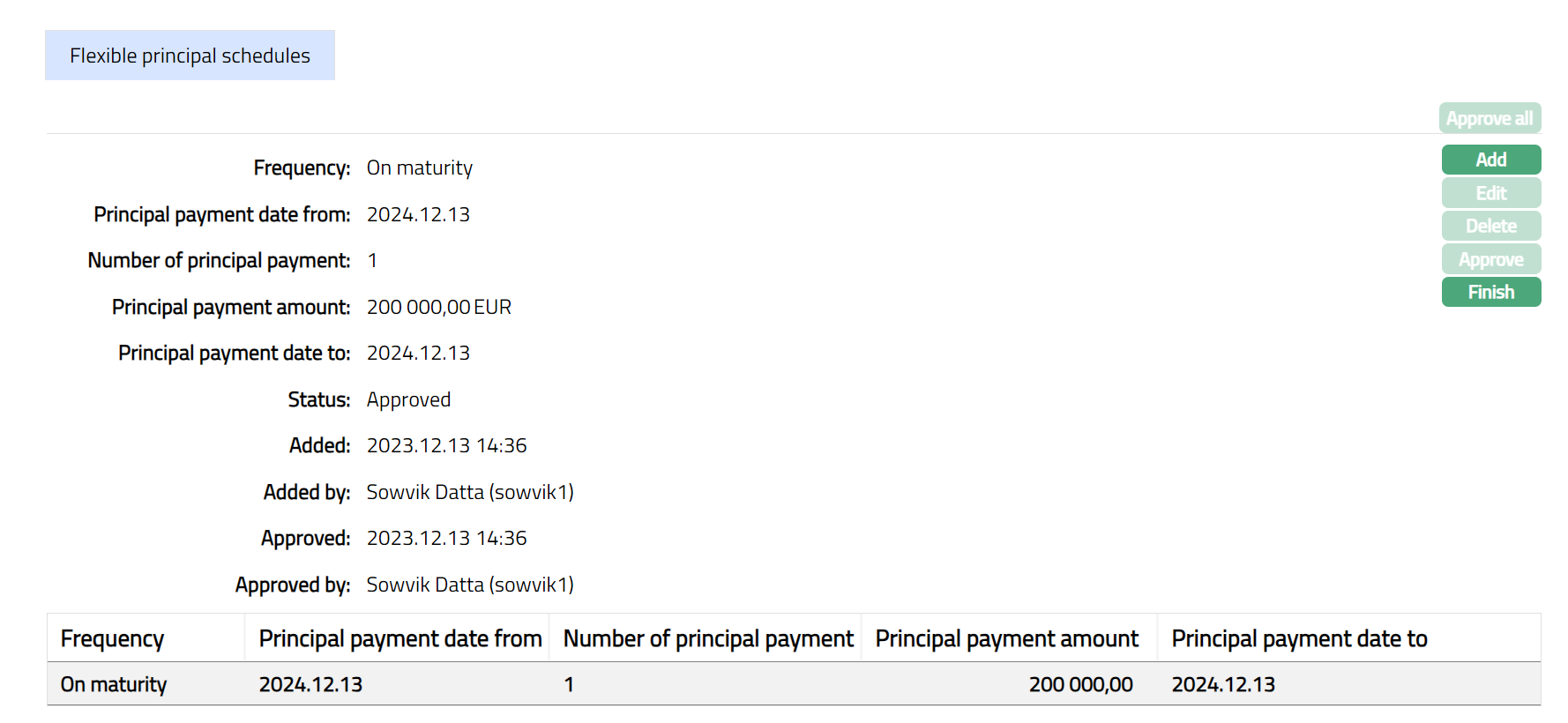

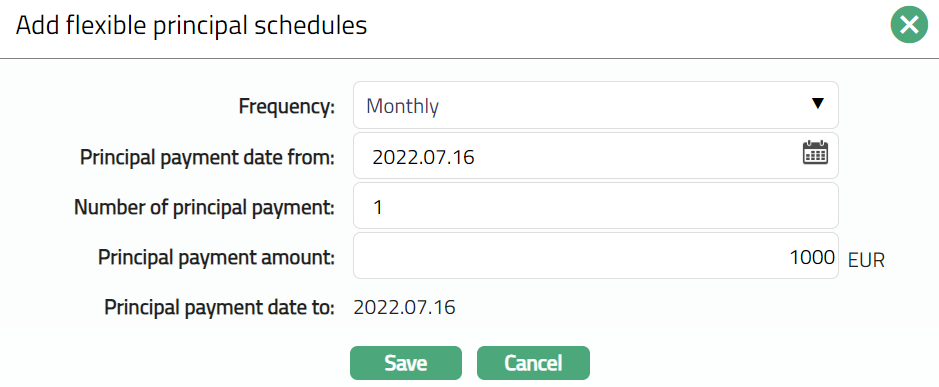

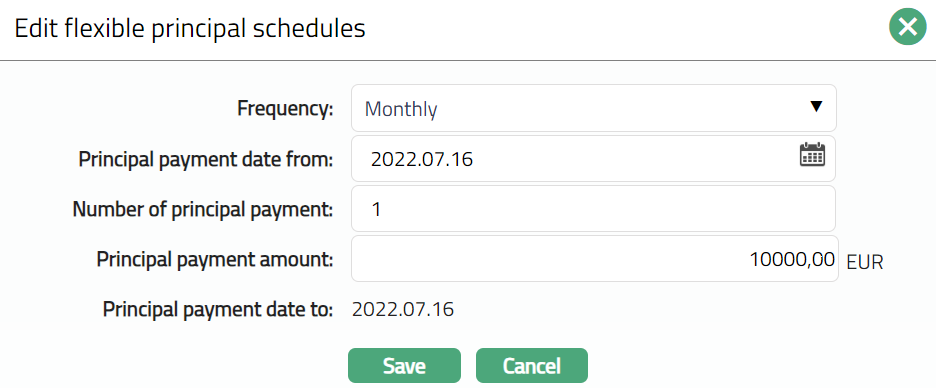

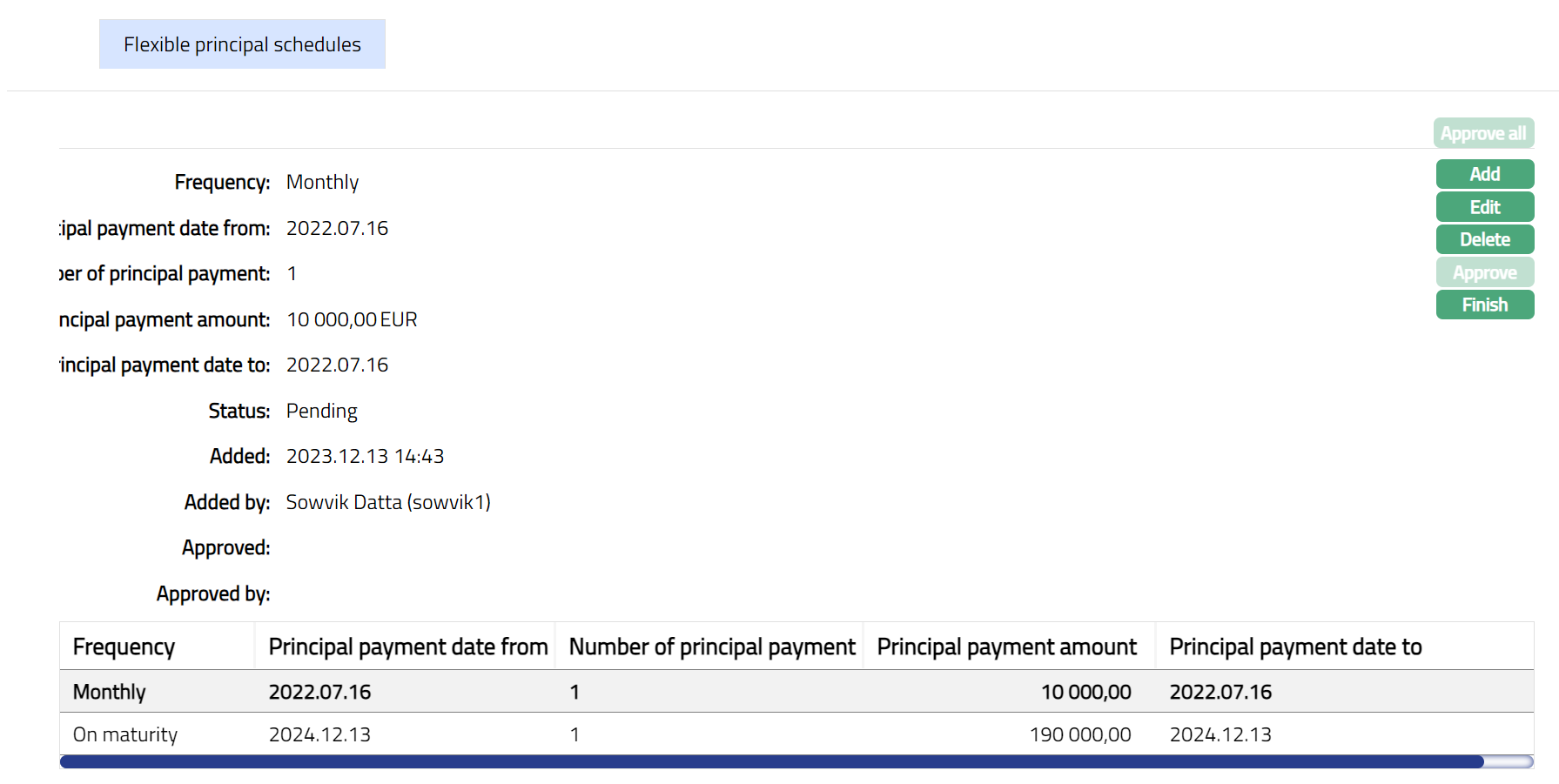

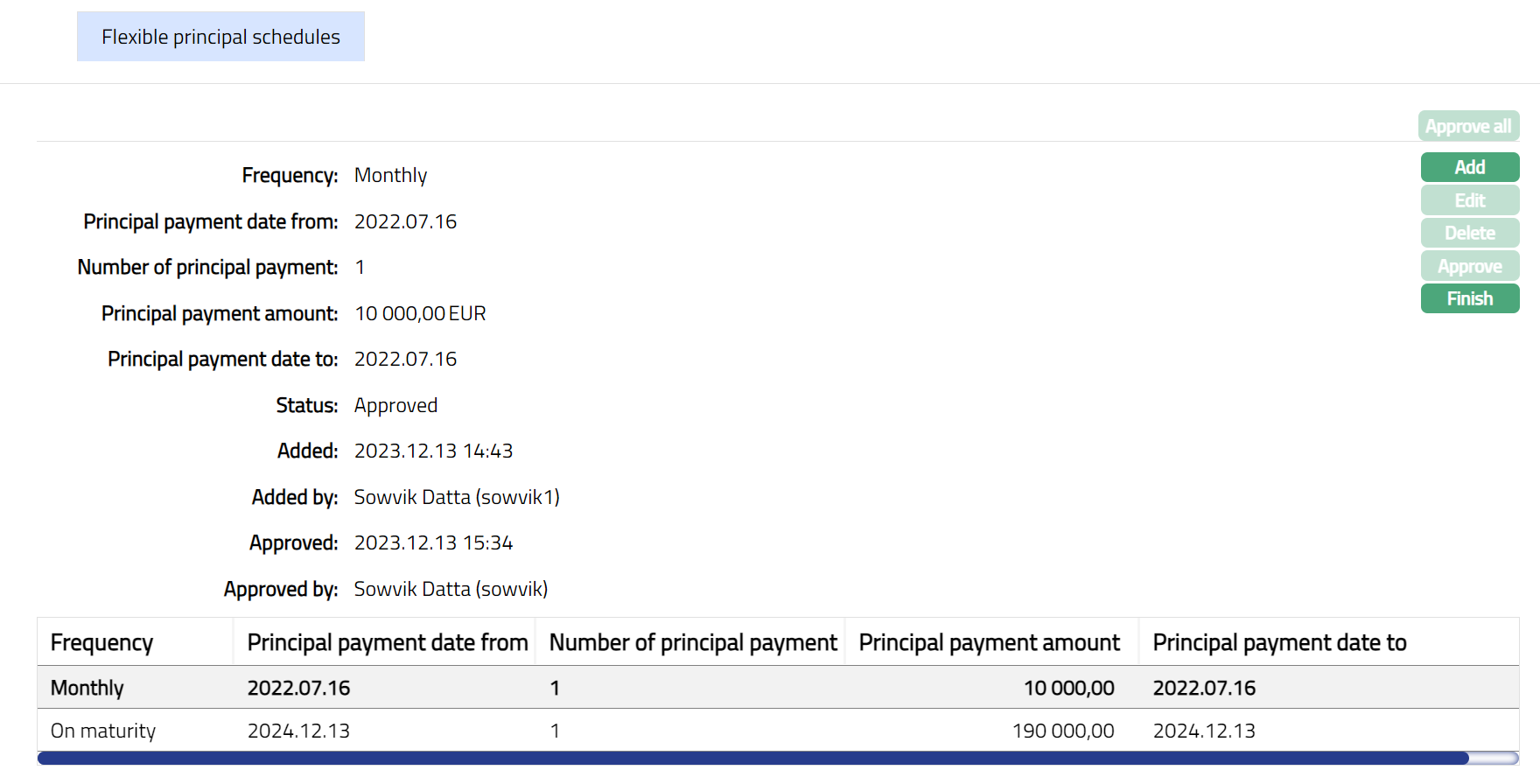

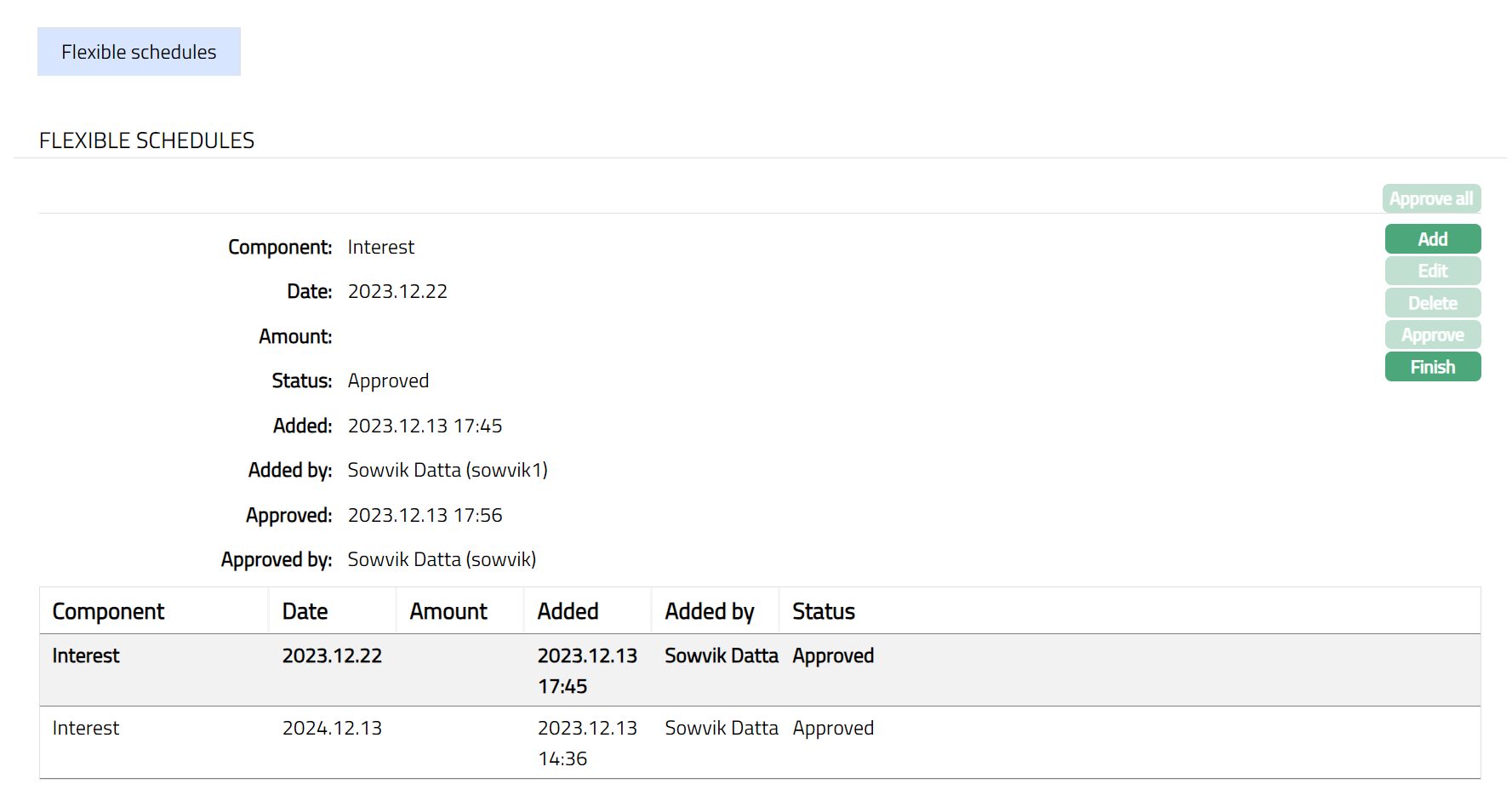

- Flexible: You can define the specific dates on which Principal should be paid using the Payment Settings Tab - Edit

By default, the First principal payment date will be Value Date + Principal Payment Frequency. If required, you can change the date to any date greater than Value Date and less than or equal to Maturity Date. If Principal Payment Frequency is On Maturity or Flexible, then this field is defaulted to Maturity Date and cannot be changed.

Aura derives the Number of principal payments based on First Principal Payment Date, Maturity Date and Principal Payment Frequency. If required, you can change the same, but it has to be less than the number calculated by Aura. If Principal Payment Frequency is On Maturity or Flexible, then this field is defaulted to 1 and is non-editable. This field will not be displayed for Annuity Loans.

The Principal payment amount is defaulted by Aura based on the following formula: Loan Amount Sanctioned / Number of Principal Payments. If required, you can change the same, but it has to be less than the number calculated by Aura. If Principal Payment Frequency is On Maturity or Flexible, then this field is defaulted to the Amount Sanctioned and is non-editable. This field will not be displayed for Annuity Loans.

On change of value date defines how Aura handles the payment schedule Due Dates when the Value Date of the loan during Disbursement is different from the Value Date in the Loan Account. It enables you to retain dates that you input for Flexible Schedules based on your negotiations with the borrower. Also, you can sync up the payment dates for consumer loans based on when you want all loan payments to be received. You can select the following options from the radio-button:

- Retain Payment Schedule Date: Aura retains the existing payment schedule Due Dates even if the Value Date changes.

- Revise Payment Schedule Date: Aura recalculates the payment schedule Due Dates based on the new Value Date and the defined Tenor.

During Loan Creation:

- If Choose Loan Term By = Maturity Date and Interest Calculation Method = Amortized, this field is displayed with the default value Retain Payment Schedule and is disabled for all principal payment frequencies.

- If Choose Loan Term By = Tenor and Interest Calculation Method = Amortized, the field behaves as follows:

- When Principal Payment Frequency = Flexible, the field defaults to Retain Payment Schedule and is disabled.

- When Principal Payment Frequency = On Maturity, the field defaults to Retain Payment Schedule and is disabled.

- When Principal Payment Frequency = Any other, the field defaults to Retain Payment Schedule and is enabled, allowing you to change it to Revise Payment Schedule, if required.

During first disbursement:

- If the selected value is Revise Payment Schedule, Aura regenerates the simulated schedule using the new Value Date and Tenor.

- If the selected value is Retain Payment Schedule, Aura does not regenerate the schedule but retains the existing one. Note: Once the Loan Account is Activated Approved, there is no way to change this field.

Select the Interest payment frequency from the drop-down. The available options are:

- Weekly: Interest should be paid every week

- Semi-Monthly: Interest should be paid twice a month

- Monthly: Interest should be paid every month

- Quarterly: Interest should be paid every quarter

- Semi-annual: Interest should be paid twice a year

- Annual: Interest should be paid every year

- On maturity: Interest should be paid only on the Maturity Date of the loan

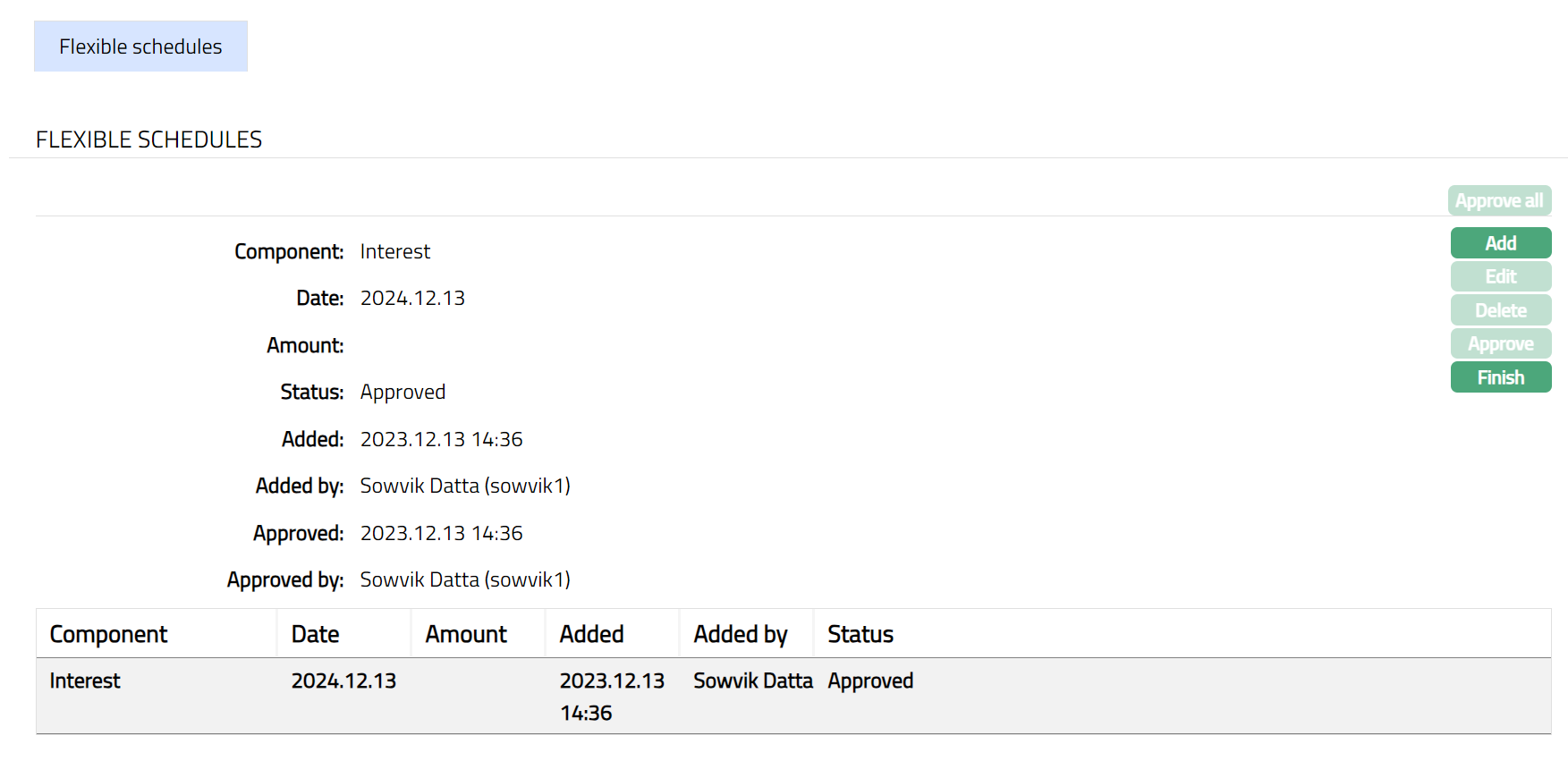

- Flexible: You can define the specific dates on which Interest should be paid using the Payment Settings Tab - Edit

By default, the First interest payment date will be Value Date + Interest Payment Frequency. If required, you can change the date to any date greater than Value Date and less than or equal to Maturity Date. If Interest Payment Frequency is On Maturity or Flexible, then this field is defaulted to Maturity Date and cannot be changed.

Aura derives the Number of interest payments based on First Interest Payment Date, Maturity Date and Interest Payment Frequency. If required, you can change the same, but it has to be less than the number calculated by Aura. If Interest Payment Frequency is On Maturity or Flexible, then this field is defaulted to 1 and cannot be changed. This field will not be displayed for Annuity Loans.

In the Number of advance interest payments field, enter the number of interests you would want the customer to pay in advance. The interest amount for that many instalments will be netted off during first disbursement.

Threshold for closure is defaulted from the Product. During the end-of-day run, if it is found that the remaining unpaid amount is less than the threshold amount for closure, then Aura will pass threshold entries for the account and will close the Loan Account. If required, you can change it.

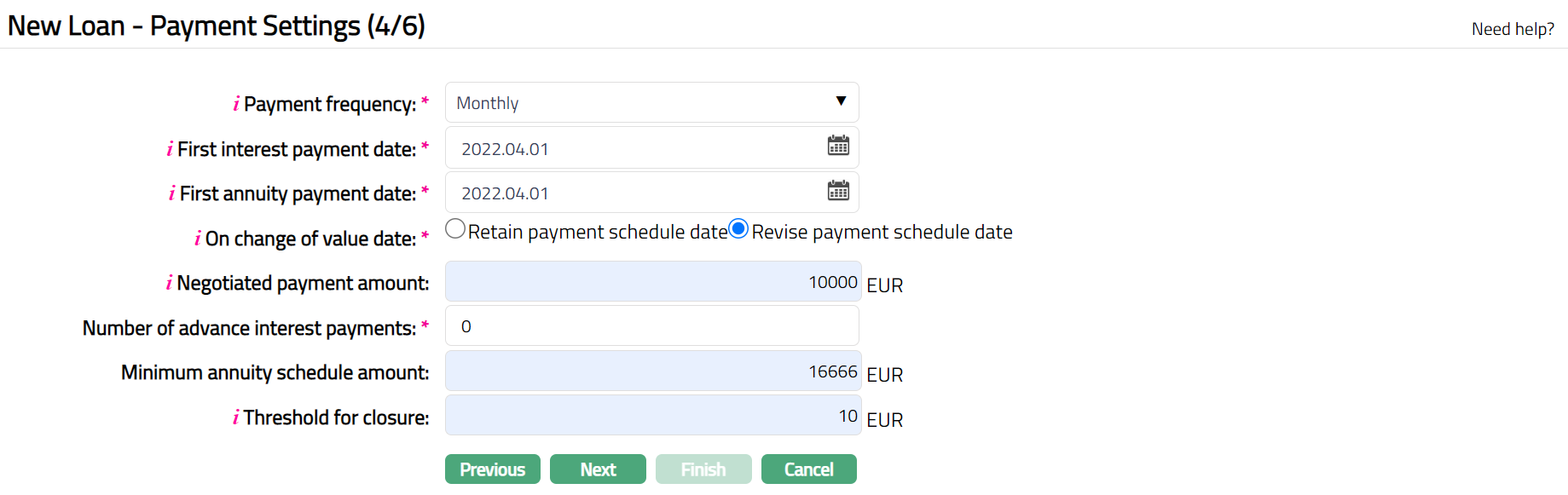

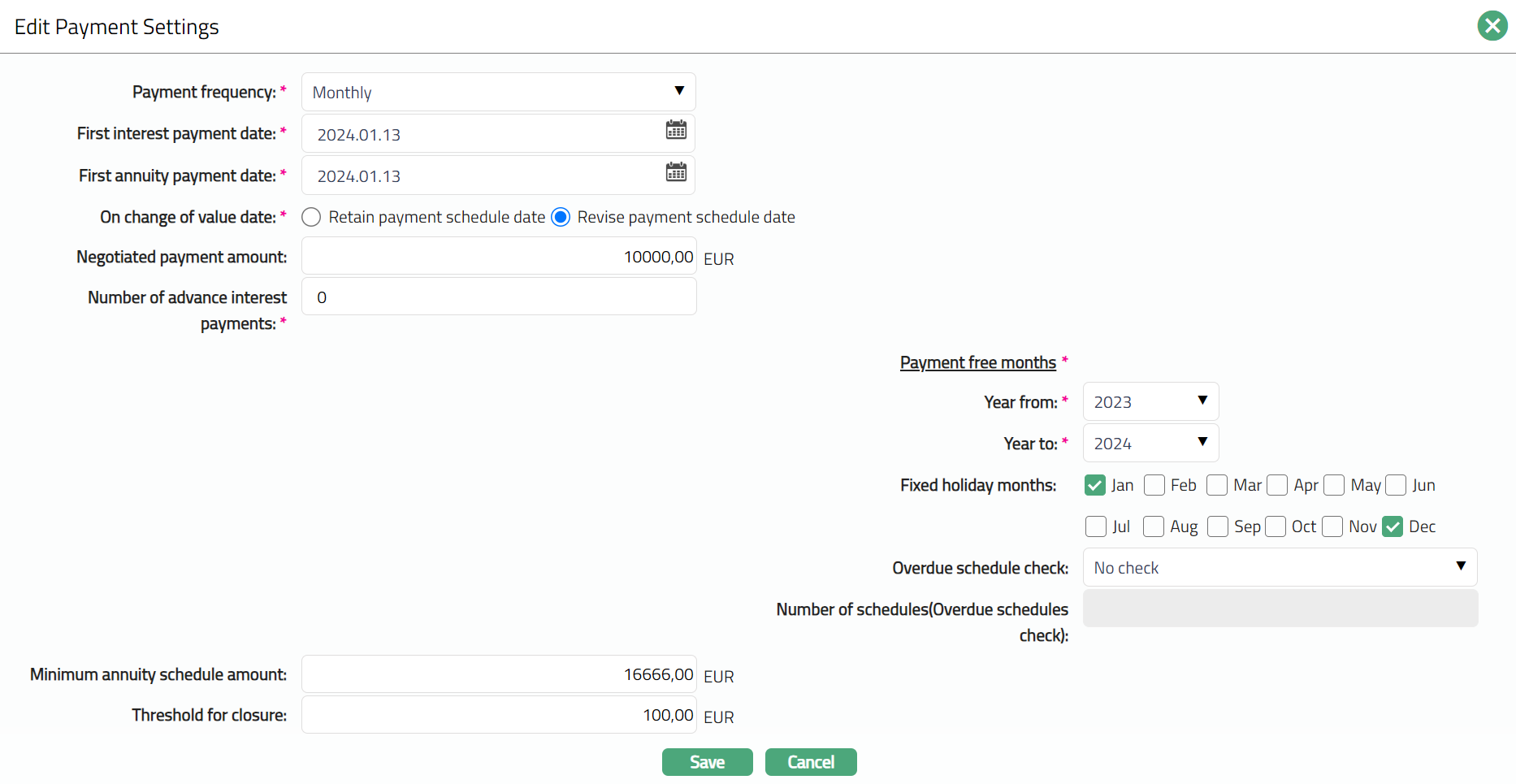

If you have selected the interest calculation method as Annuity, then you will get the following screen.

- Select the Payment frequency from the drop down. The available options are:

- Weekly: Interest should be paid every week

- Semi-Monthly: Interest should be paid twice a month

- Monthly: Interest should be paid every month

- Quarterly: Interest should be paid every quarter

- Semi-annual: Interest should be paid twice a year

- Annual: Interest should be paid every year

- By default, First interest payment date will be Value Date + Frequency. You can change the date to any date greater than Value Date and less than / equal to Maturity Date, if required.

- By default, the First annuity payment date will be Value Date + Frequency. You can change the date to any date greater than Value Date and less than / equal To Maturity Date, if required. First Annuity Payment Date cannot be less than the First Interest Payment Date. If First Annuity Payment Date is greater than First Interest Payment Date then Aura will calculate simple interest between Value Date and First Annuity Payment Date based on the Frequency specified and there will not be any Principal repayment required till the First Annuity Payment Date.

- Select the Payment frequency from the drop down. The available options are:

⚠ Note of Caution - Automatic Update of First Payment Dates

When you update the Next Payment Date in COT - Payment Terms, Aura automatically updates the First Annuity Payment Date and First Interest Payment Date in the Loan Account’s Payment Settings tab.

System Behaviour and Impact -

- System Behaviour: Once the COT record is saved, Aura synchronises the Next Payment Date with the First Annuity Payment Date and First Interest Payment Date.

- Impact: Any previous values are overwritten.

Example-

- During COT - Payment Terms, you update Next Payment = 10 November 2025.

- Aura automatically updates:

- First Annuity Payment Date = 10 November 2025

- First Interest Payment Date = 10 November 2025

- If the loan had special terms (grace period, irregular installments), this automatic update may shift dates unexpectedly. Always double-check the Payment Settings to confirm accuracy.

Quick Summary -

| Do’s | Don’ts |

|---|---|

| Review the First Annuity Payment Date and First Interest Payment Date in the Loan Account > Payment Settings tab after performing COT - Payment Terms. | Assume the original first payment dates remain unchanged - they will be overwritten with the Next Payment Date from COT. |

| Ensure the updated dates align with your intended repayment schedule. | |

| Double-check loans with special terms (grace periods, irregular installments) to avoid unexpected shifts. |

Additional Note for Amortized Loans: For amortized loans, the same behaviour applies when defining the First Principal Payment Date in COT. Aura uses this date as the starting point to generate the amortization schedule.

On Change of Value Date: By default, Retain Payment Schedule Date will be selected. If required, you can change it to Revise Payment Schedule Date. This indicates what should happen to the payment schedule Due Dates if the Value Date during full Disbursement is different from the Value Date in the Loan. If the option chosen here is Retain Payment Schedule Date, even if the Disbursement Value Date is different from the Loan Value Date, the Payment Schedule dates will remain the same i.e., as it was during loan creation. If the option chosen here is Revise Payment Schedule Date, if the Disbursement Value Date is different from the Loan Value Date, the entire Payment Schedule Due Dates will be changed with reference to the Disbursement Value Date.

Enter Negotiated payment amount. Negotiated payment amount enables you to input an EMI (Equated Monthly Instalment) amount that is different from the one computed by Aura. However, the amount cannot be greater than the loan sanctioned amount. Also the amount cannot be lesser than the interest that is payable for each instalment.

Note:

If Negotiated payment amount is greater than the computed EMI (Equated Monthly Instalment) amount, then Aura will consider the Negotiated Payment Amount as the EMI (Equated Monthly Instalment) amount and schedules will be generated based on this. In this case the payment schedule will get over before Maturity Date; however, Maturity Date will not change.

If Negotiated payment amount is lesser than the computed EMI (Equated Monthly Instalment) amount, then too Aura will consider the Negotiated Payment Amount as the EMI (Equated Monthly Instalment) amount and schedules will be generated based on this. In this case the payment schedule will be displayed until Maturity Date and the last instalment will adjust the balance amount with no change in Maturity Date.

In the Number of advance interest payments field, enter the number of interests you would want the customer to pay in advance. The interest amount for that many instalments will be netted off during first disbursement.

Enter the Minimum annuity schedule amount. By default, the value is defaulted from the Product, and if required, you can change it. This field is displayed only if the Interest Calculation Method is selected as Annuity. When a value is input here and during schedule generation, if the Total Outstanding Amount in the last schedule is less than the Minimum Annuity Schedule Amount then Aura adds minimum annuity schedule amount in previous schedule.

Threshold amount for closure is defaulted from the Product. During the end-of-day run, if it is found that the remaining unpaid amount is less than the threshold amount for closure, then Aura will pass threshold entries for the account and will close the Loan Account. If required, you can change it

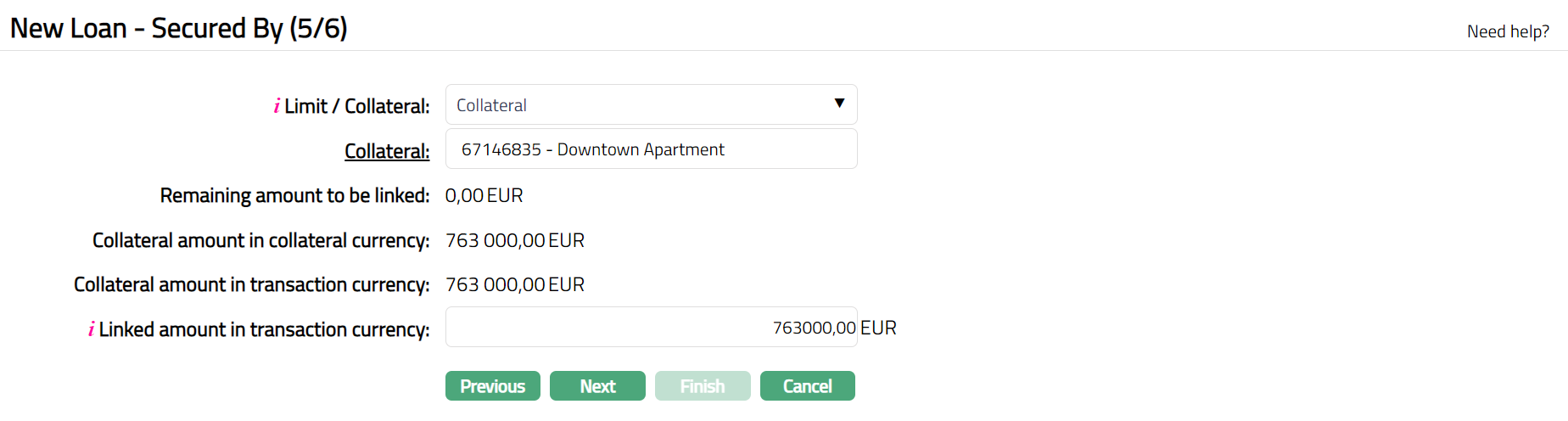

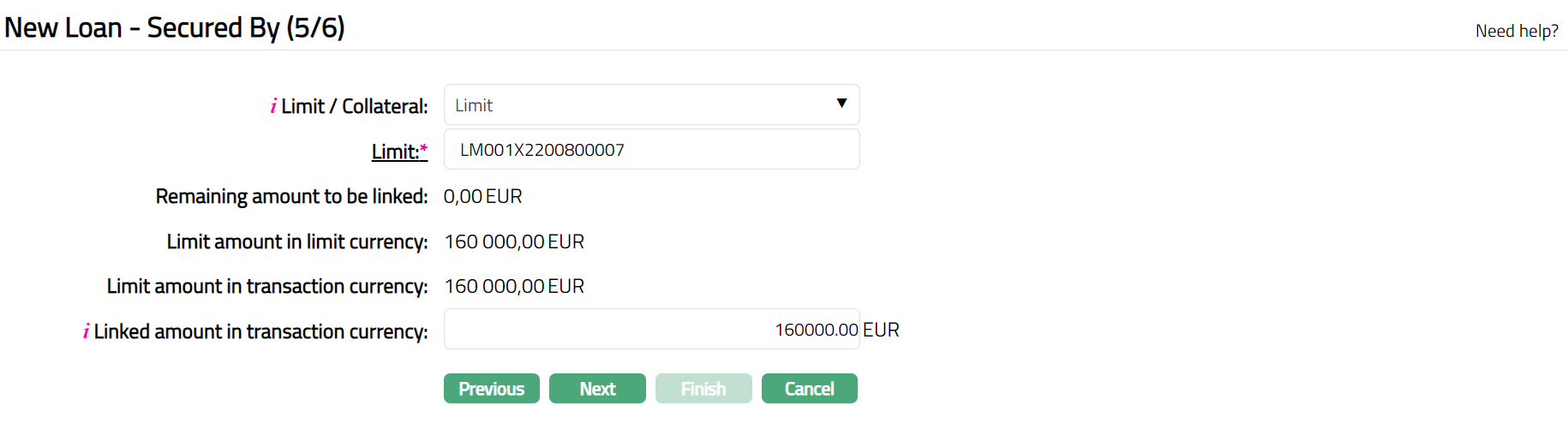

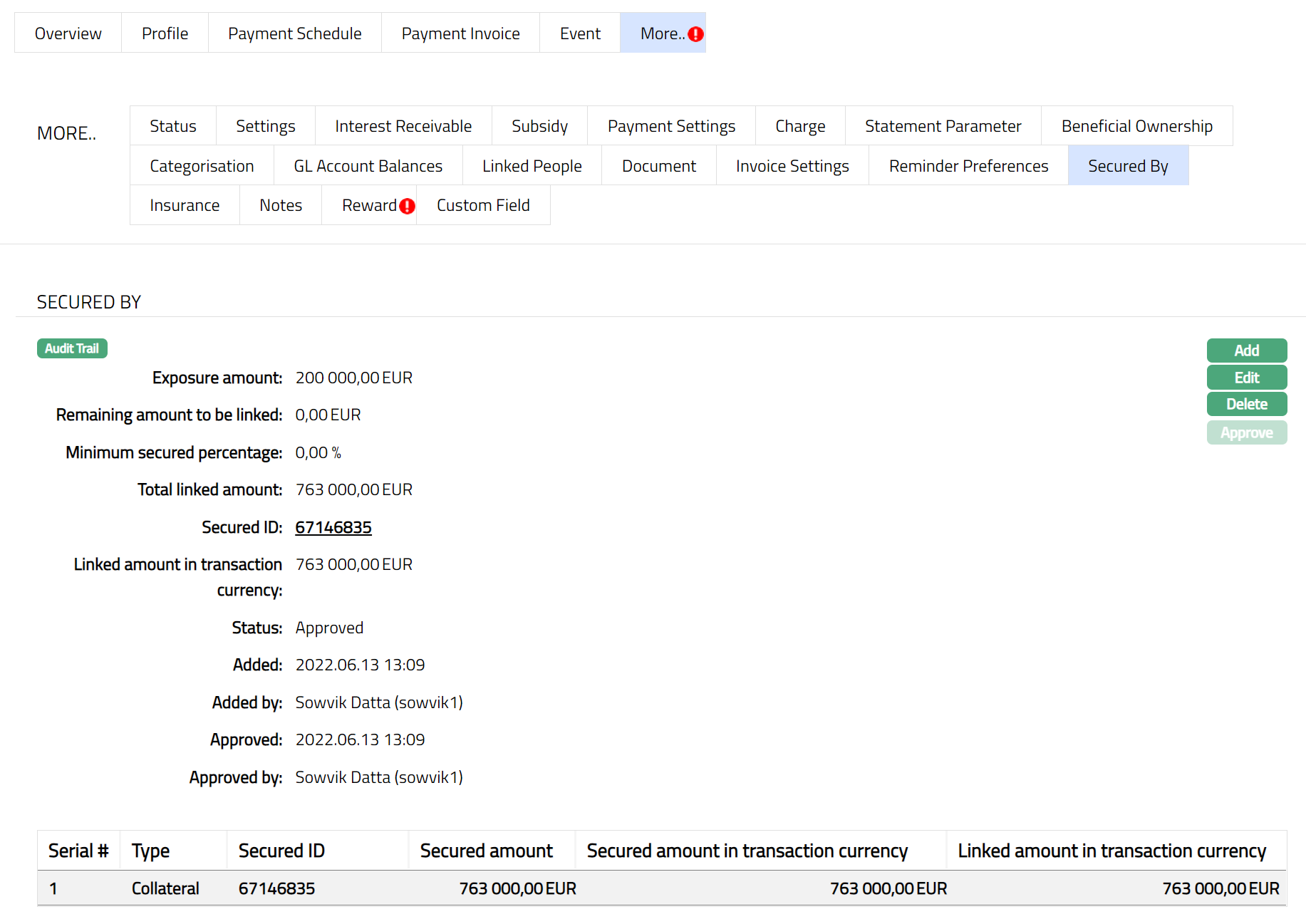

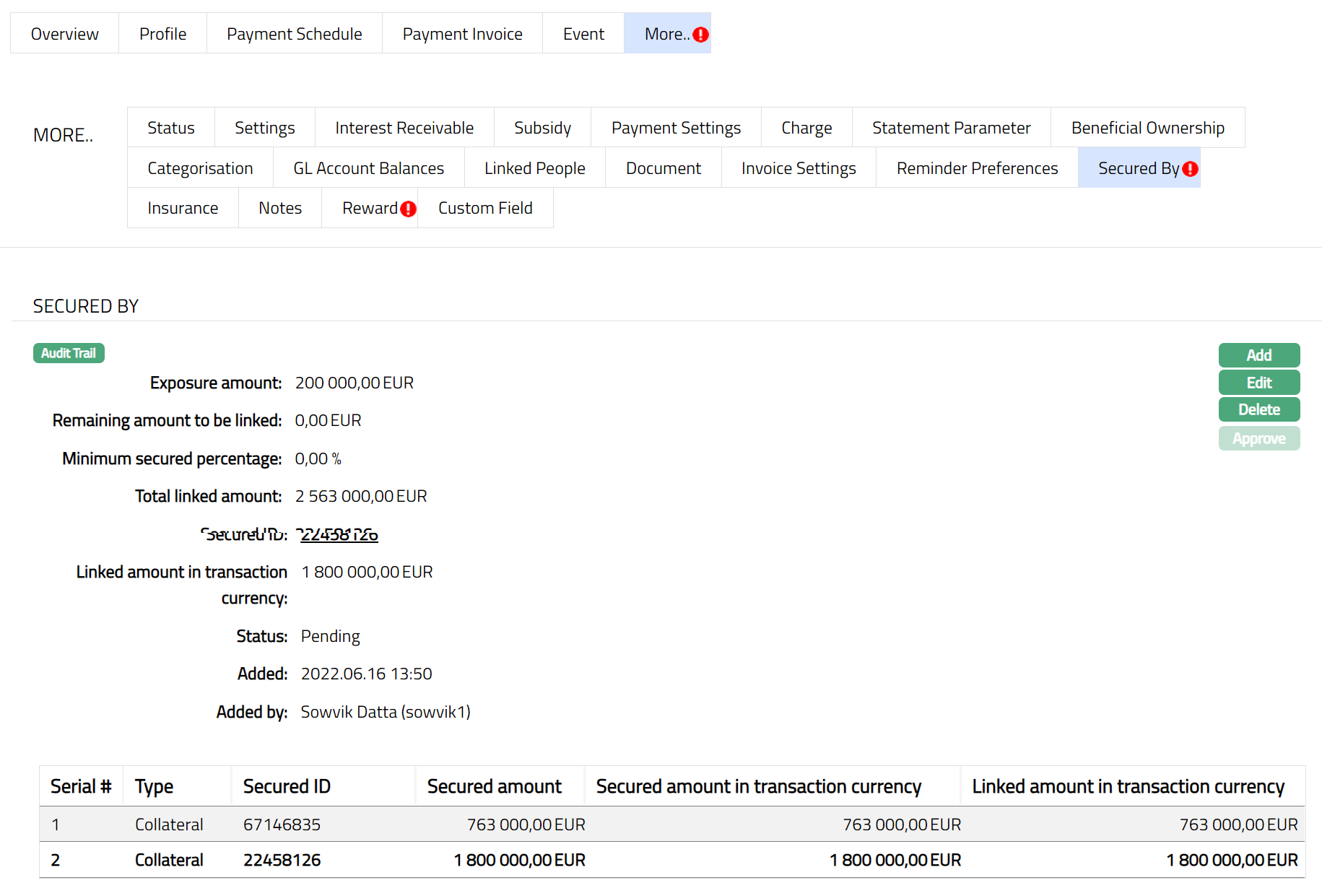

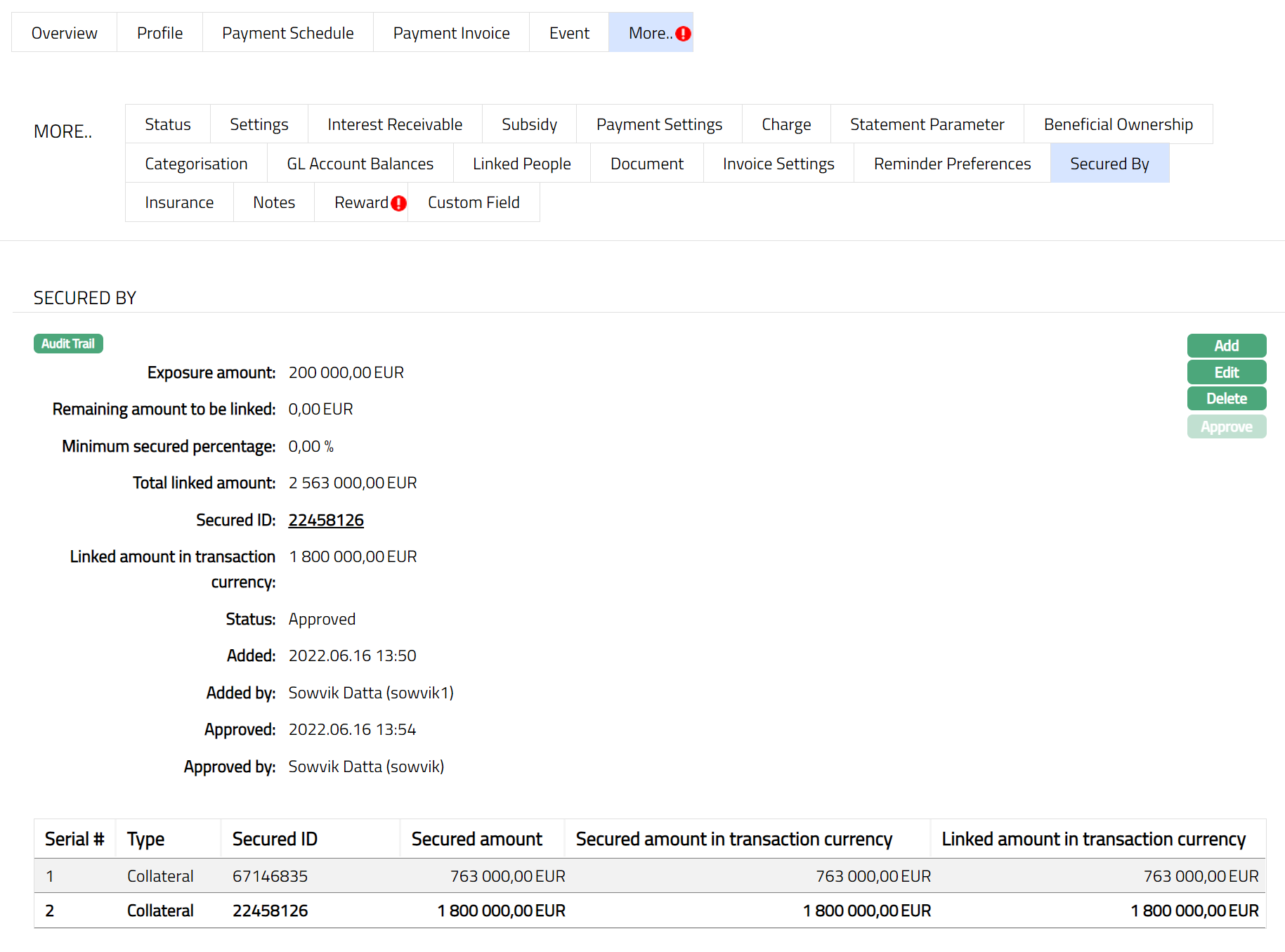

60. Click Next. The New Loan → Secured By (5/6) page appears. If Secured By is marked as Yes at the Product level, then it is mandatory to attach a Security by way of a Limit or Collateral to the Loan Account.

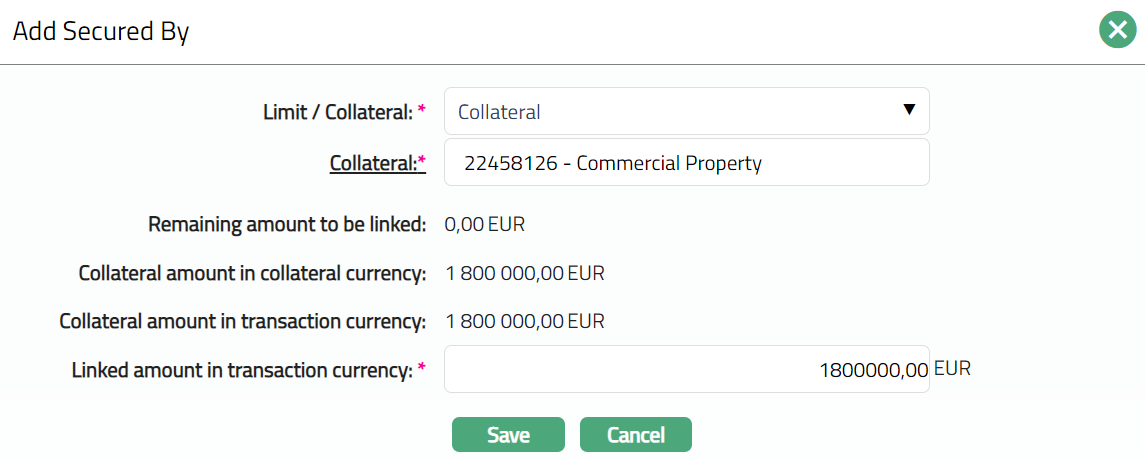

- If Collateral is chosen, you will see the following screen:

- If Limit is chosen, you will see the following screen:

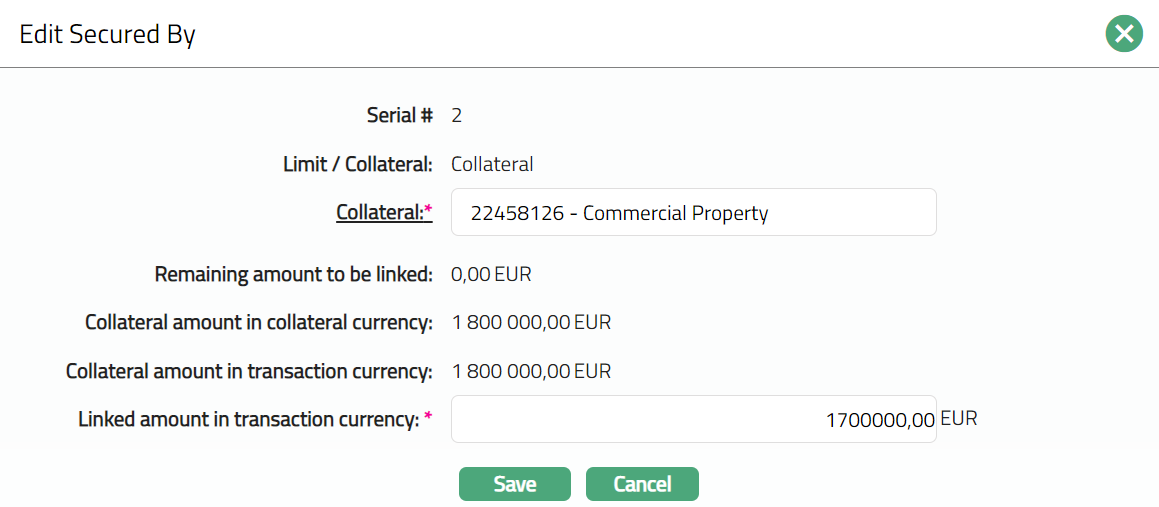

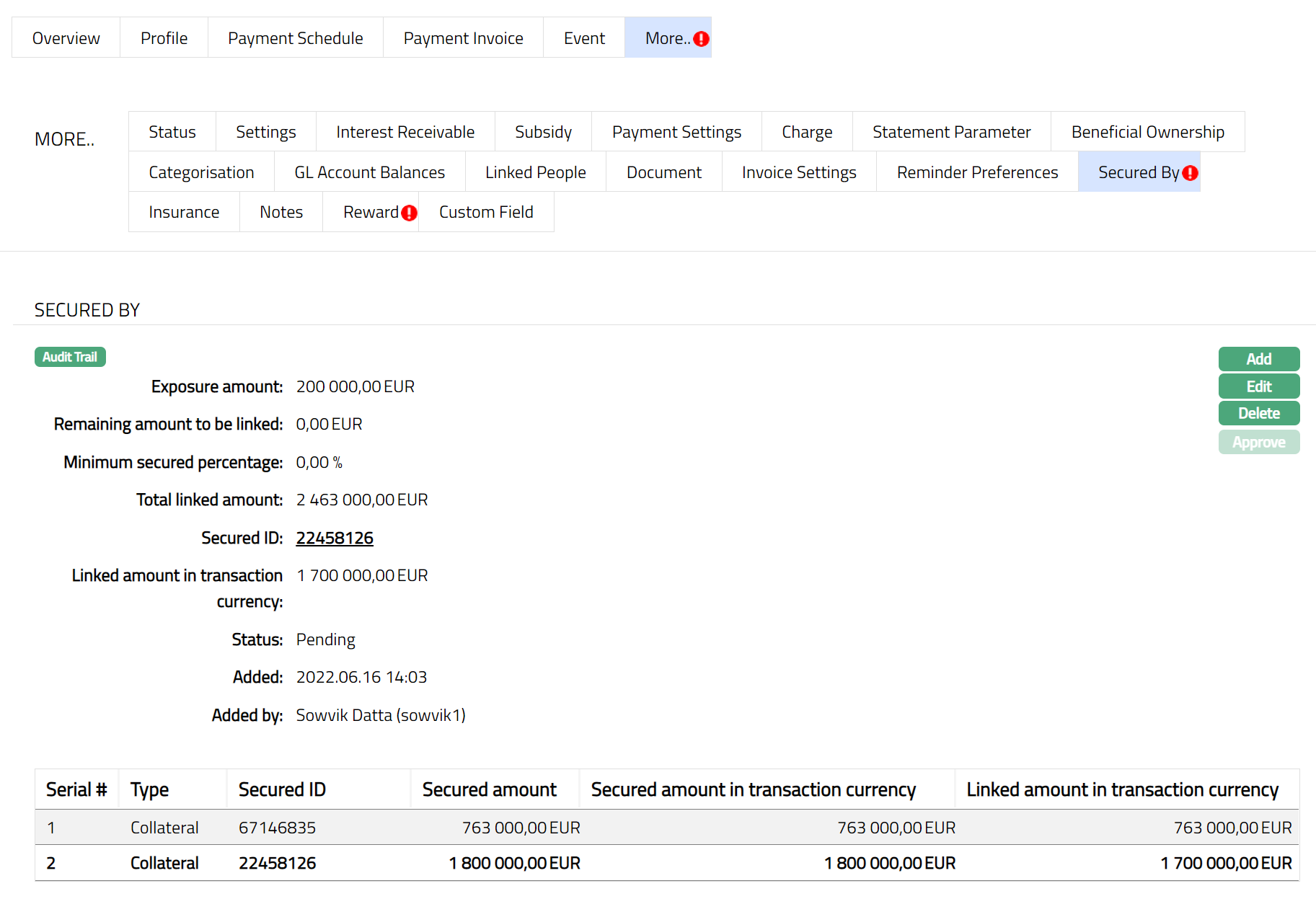

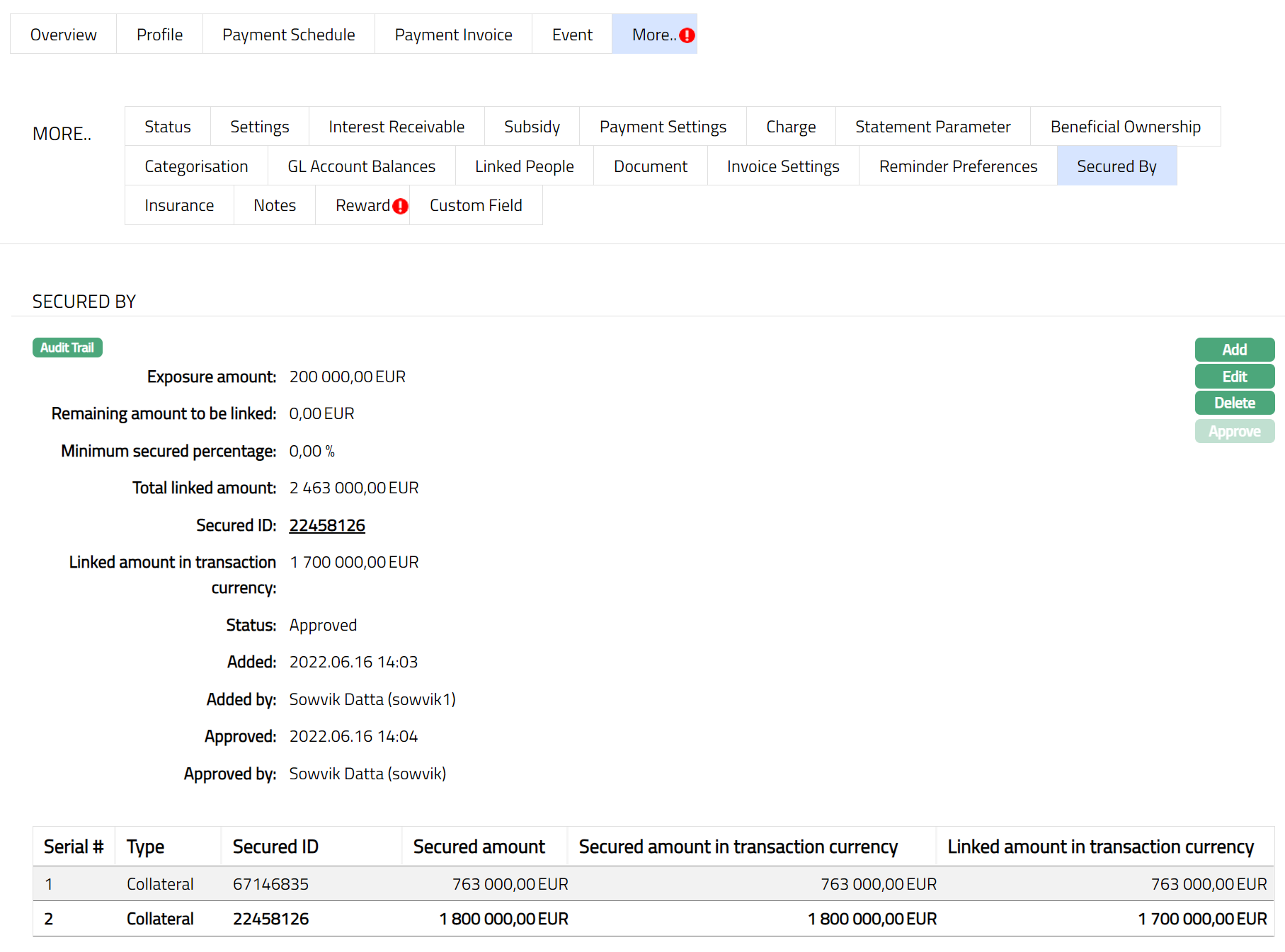

61. Specify whether the Loan Account is to be secured by a Limit or Collateral using the Limit / Collateral drop-down. It is mandatory only if Secured By is Yes at the Product level.

62. Based on the selection above, enter the details of the specific Limit or Collateral as described below:

If you select Limit, Limit hyperlink will be displayed. On click of the hyperlink, Aura displays the Limit Search screen and the list of Active Limits that are available for the Client chosen in Step 1 as maintained under CRM > Collaterals & Limits > Limits having Available Limit Amount > 0.

If you select Collateral Collateral hyperlink will be displayed. On click of the hyperlink, Aura displays the Collateral Search screen and the list of Active collaterals that are available for the Client chosen in Step 1 as maintained under CRM > Collaterals & Limits > Collaterals, having Available Collateral Amount > 0.

63. Remaining amount to be linked denotes the pending amount to be linked to the Loan Account when the limit amount is less than the amount calculated based on Minimum secured percentage and loan amount sanctioned. If the Secured by flag is marked as No and still a Limit or Collateral is attached, then Remaining Amount To Be linked is Calculated as 0.

64. Based on the selection of Limit/Collateral, Limit amount in limit currency field or Collateral amount in collateral currency field is displayed. The value for the displayed fields is derived from the limit id or collateral id maintained under CRM > Collaterals & Limits.

65. Based on the selection of Limit/Collateral, Limit Amount in Transaction Currency or Collateral Amount in Transaction Currency is displayed.

For Limit amount in transaction currency, the value is derived from selected limit id. If the limit currency is different from the transaction (account) currency, then Aura will apply the mid-rate for these two currencies from the default rate type maintained in the Entity level and display the values after respective conversion. If Account currency is the same as the Limit Currency, Aura will display the same amount as in Limit Amount In Limit Currency.

For Collateral amount in transaction currency, the value is derived from selected Collateral ID. If the collateral currency is different from the transaction (account) currency, then Aura will apply the mid-rate for these two currencies from the default rate type maintained in the Entity level and display the values after respective conversion. If Account currency is the same as the Collateral Currency, Aura will display the same amount as in Collateral Amount In Limit Currency.

66. Based on the selection of Limit/Collateral, Linked amount in transaction currency is defaulted from Limit (or Collateral) Amount In Transaction Currency. You can modify this, but, this amount cannot be greater than Limit (Collateral) Amount In Transaction Currency.

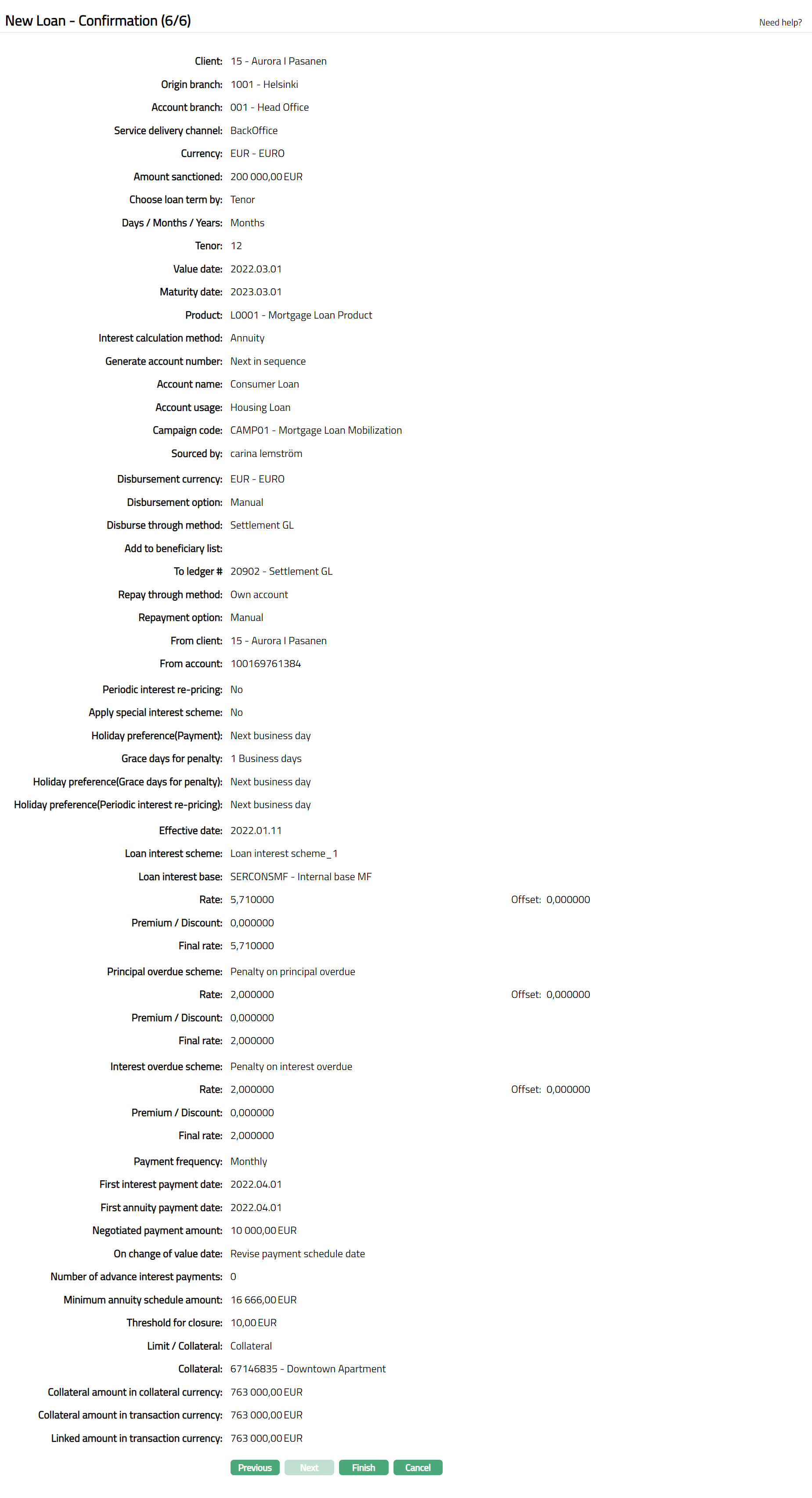

67. Click Next. The New Loan → Confirmation (6/6) page will appear.

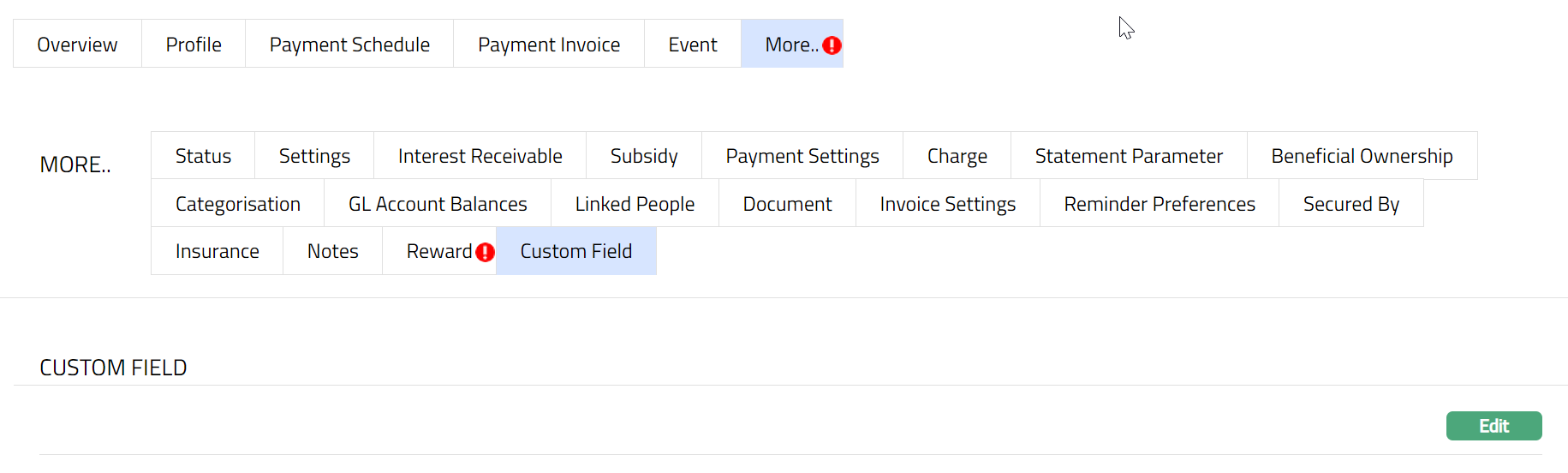

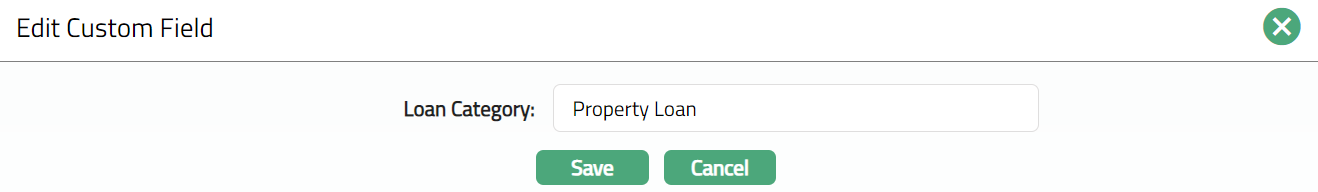

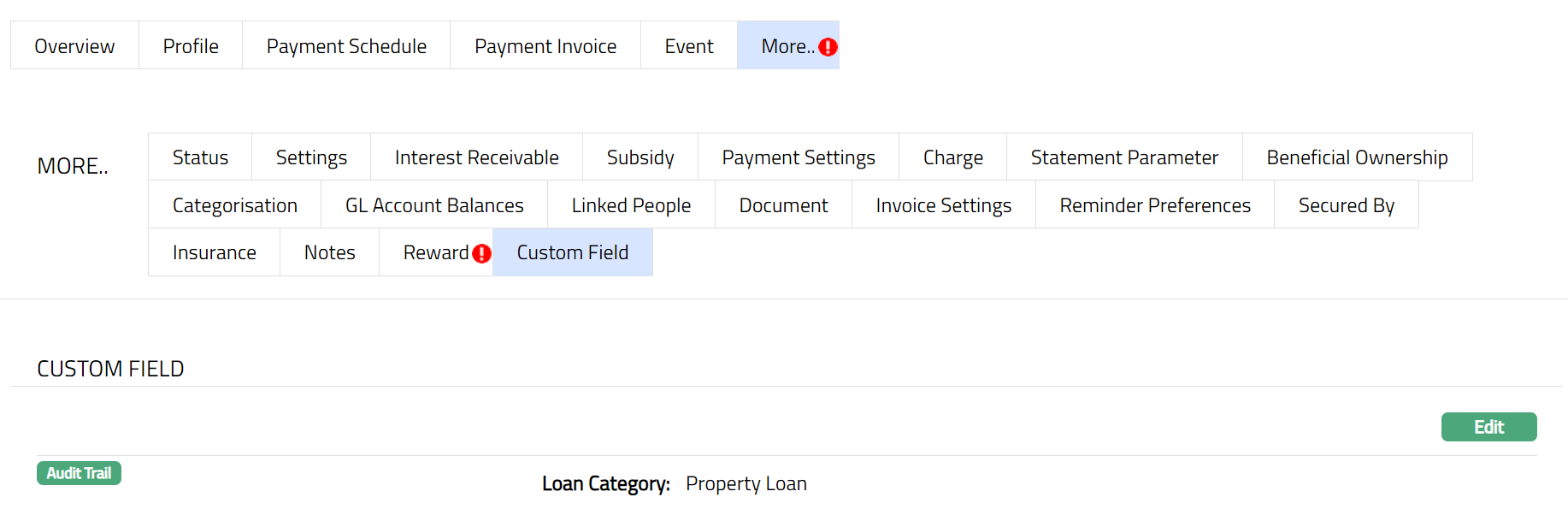

Note: If any Custom Field is mapped to Loan account at Admin > System Codes > Custom fields > Field mapping, then an additional screen will appear before the Confirmation screen. The Custom Fields will be mandatory or non-mandatory based on the rules set at the Field Mapping. For more details on Custom Field functionality, please refer Admin> System codes > Custom fields > Field mappings manual

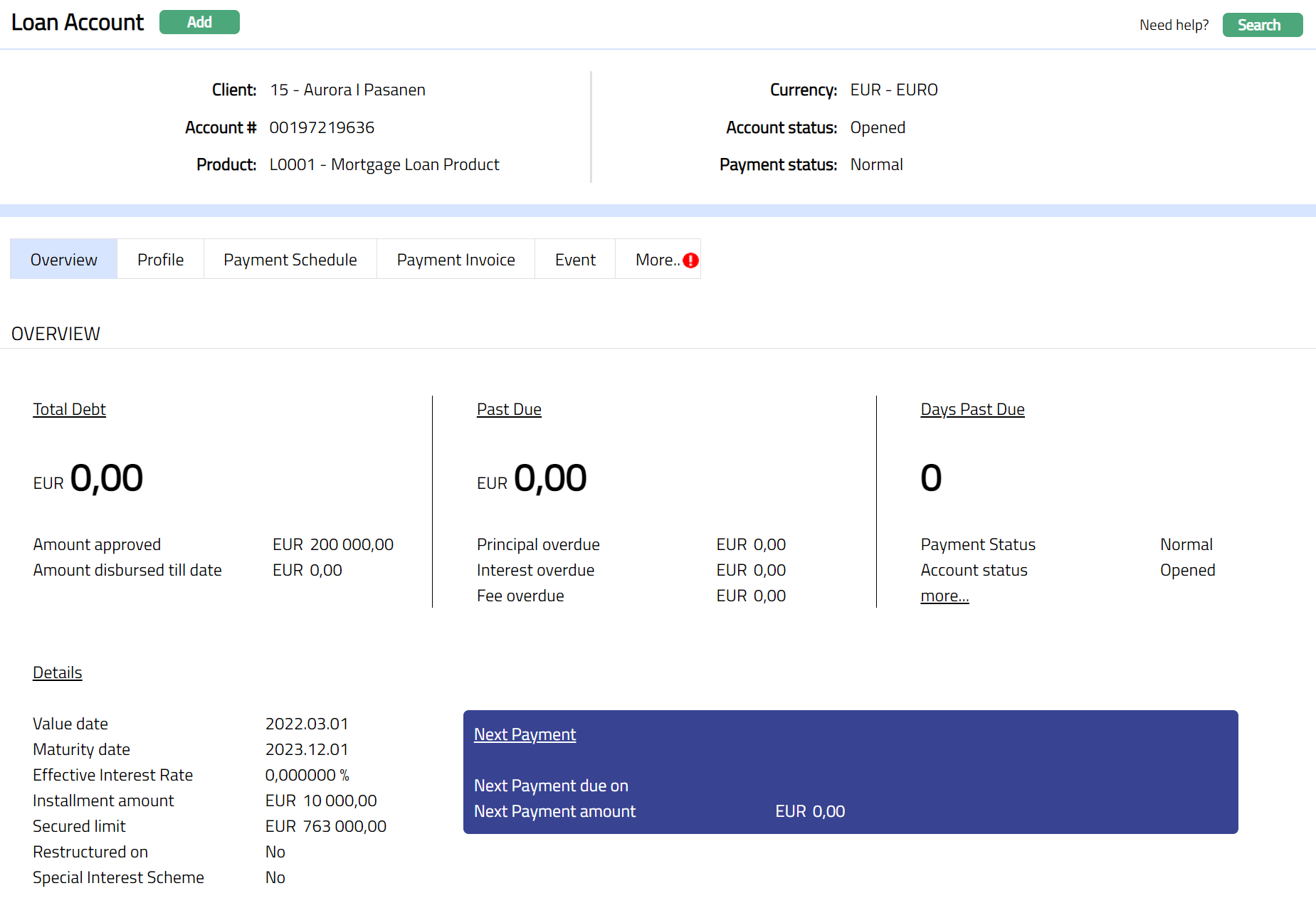

68. Click Finish. The Mortgage and Loan Account is created with a unique Account # and the Loan Account page appears displaying the Overview tab of the account that you created.

Functions: Add, Search, Edit

Notes:

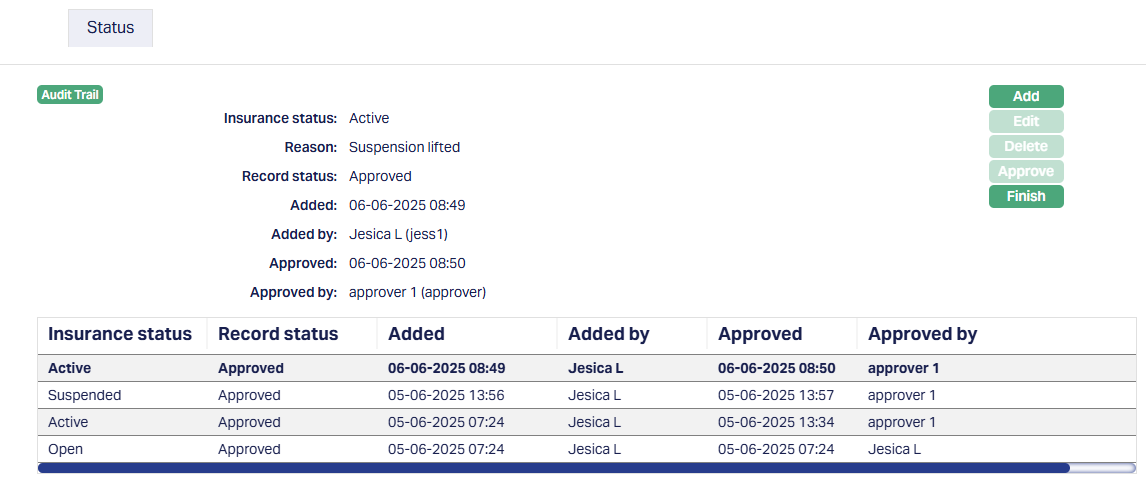

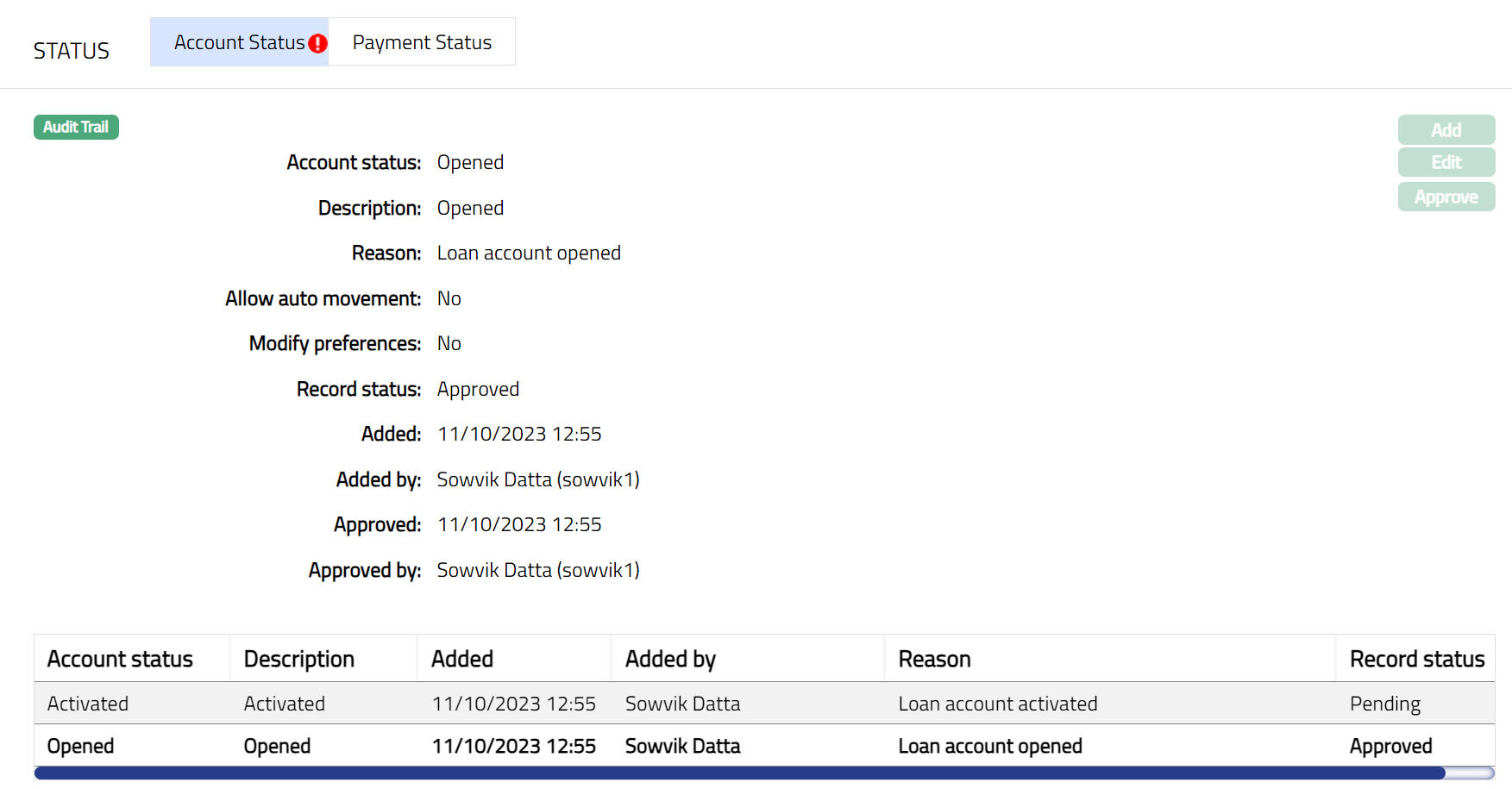

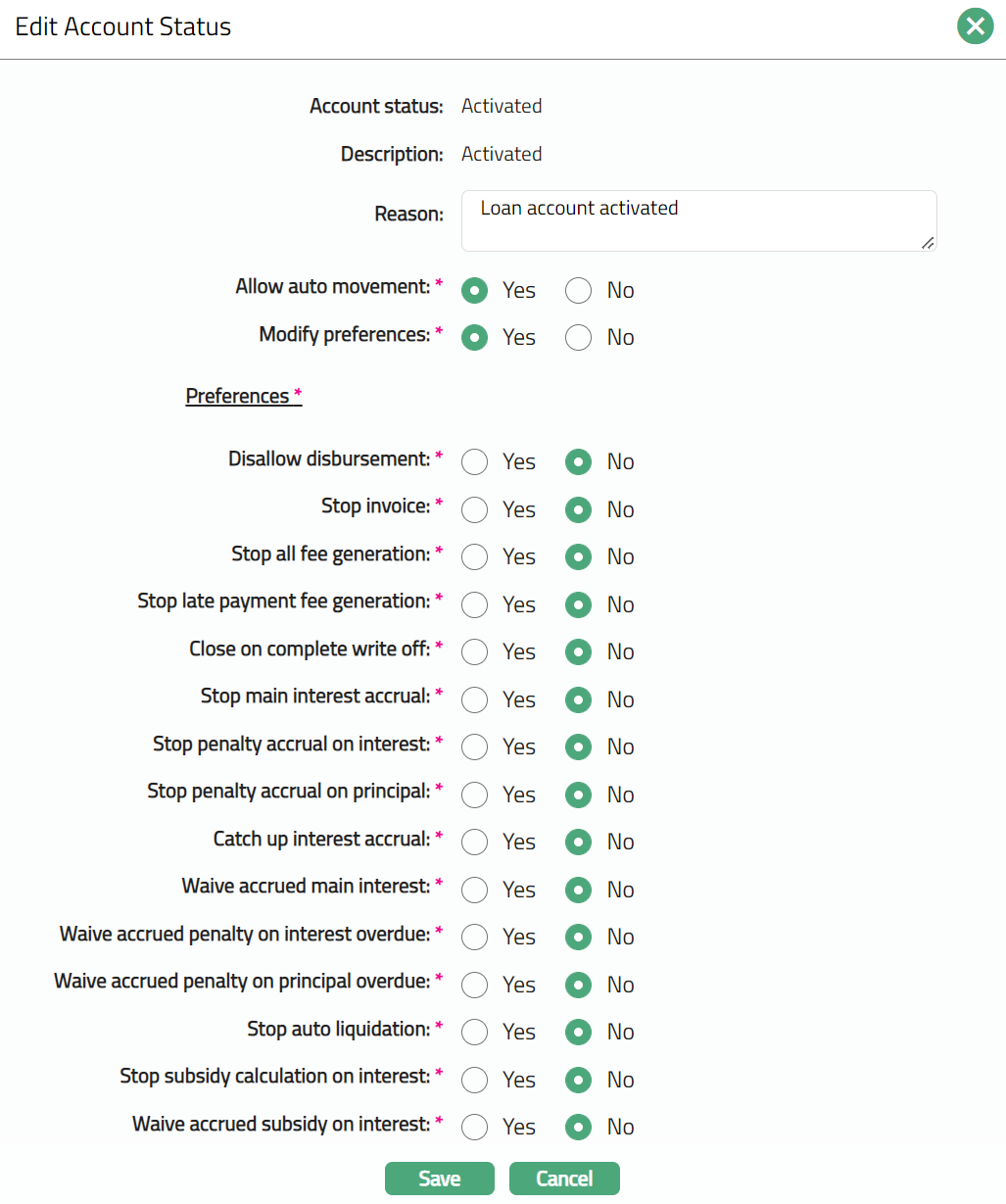

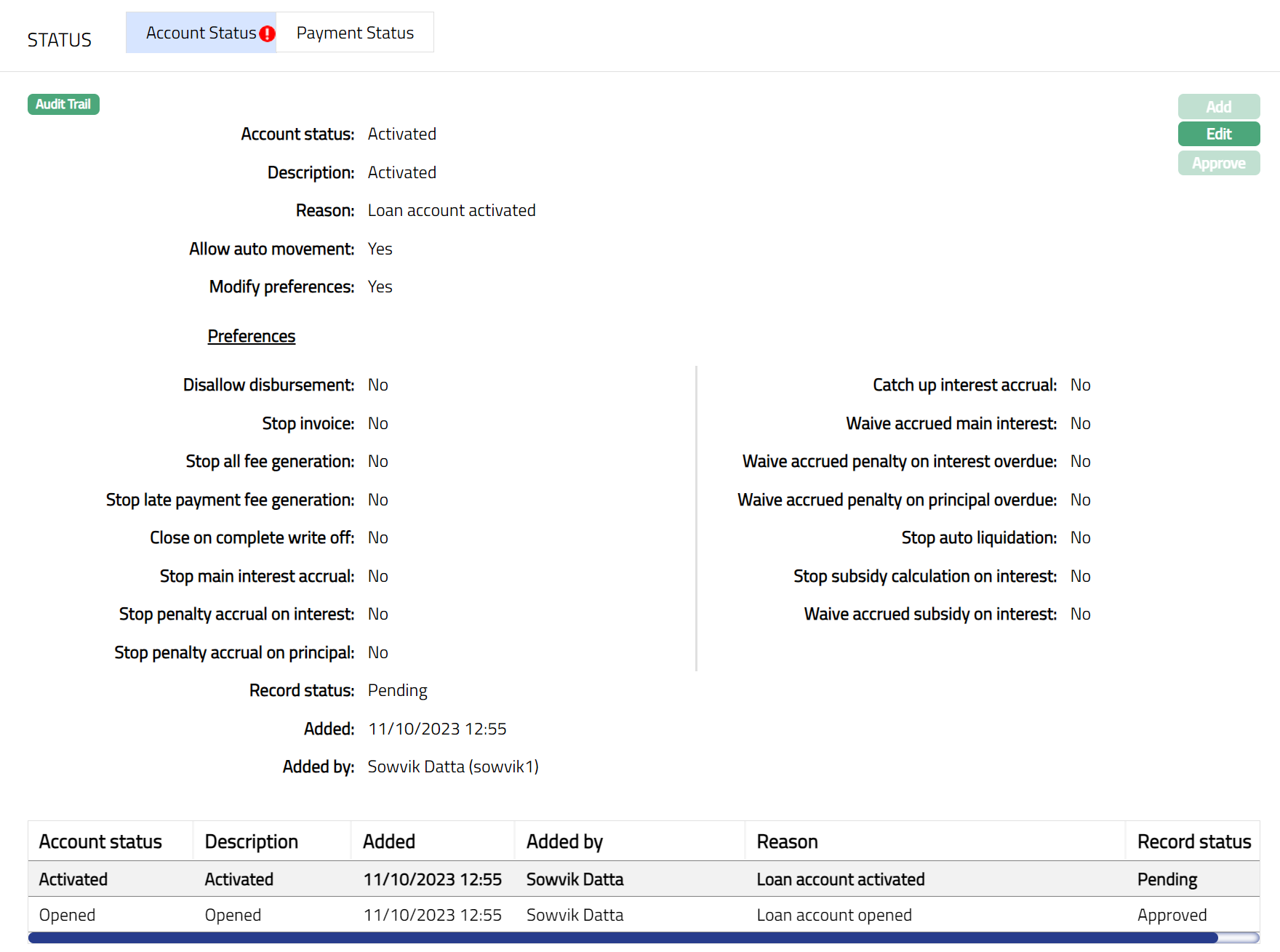

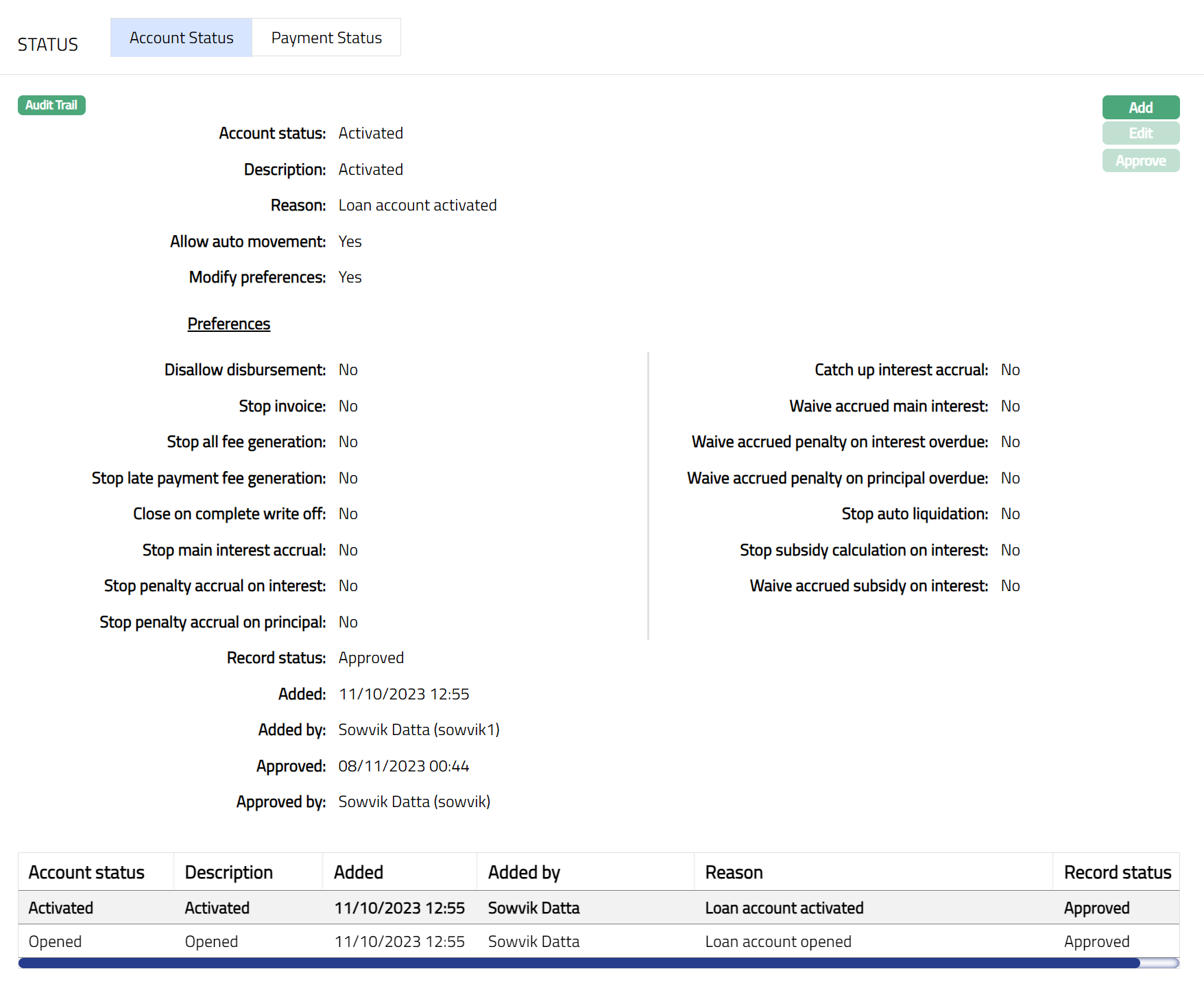

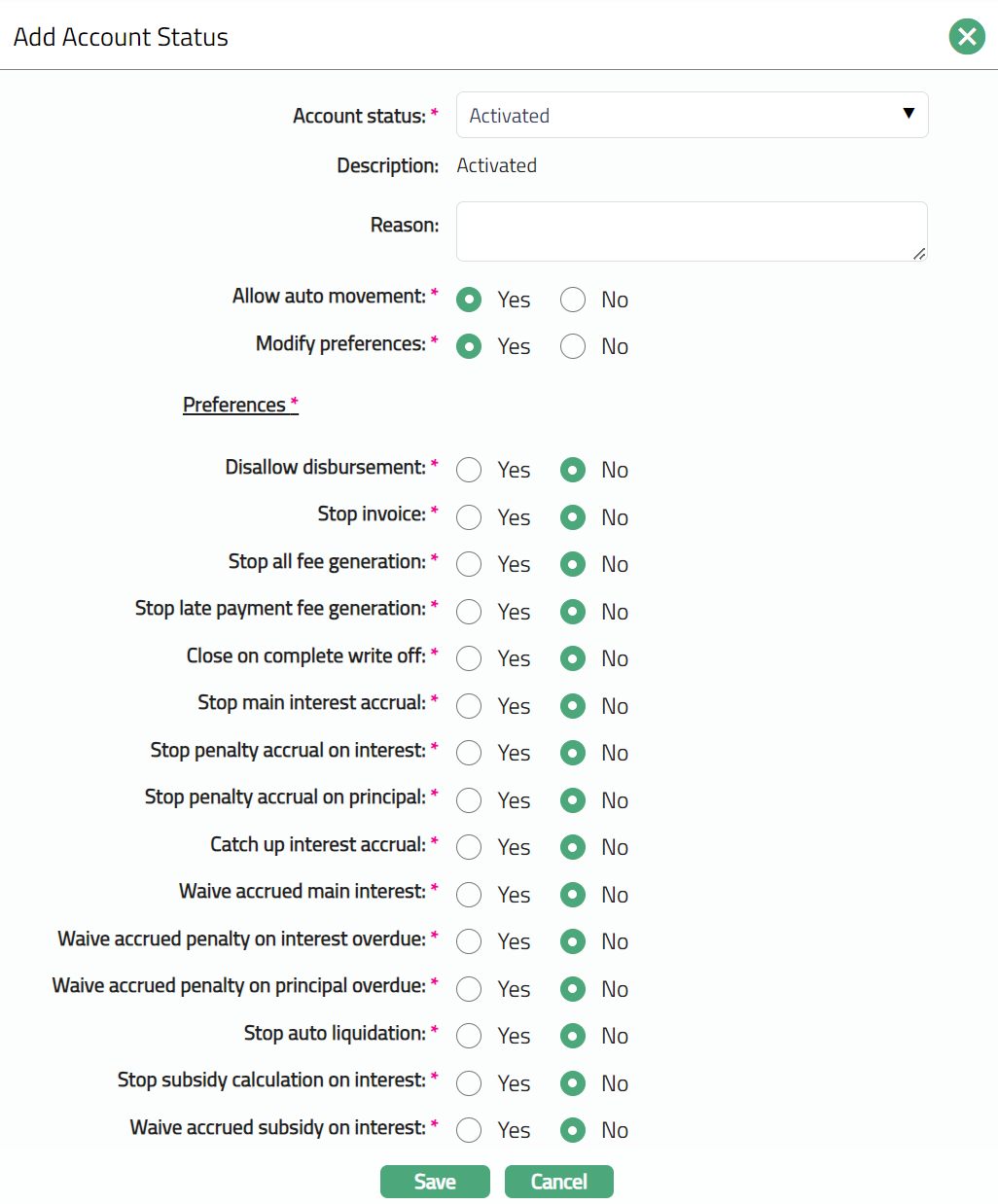

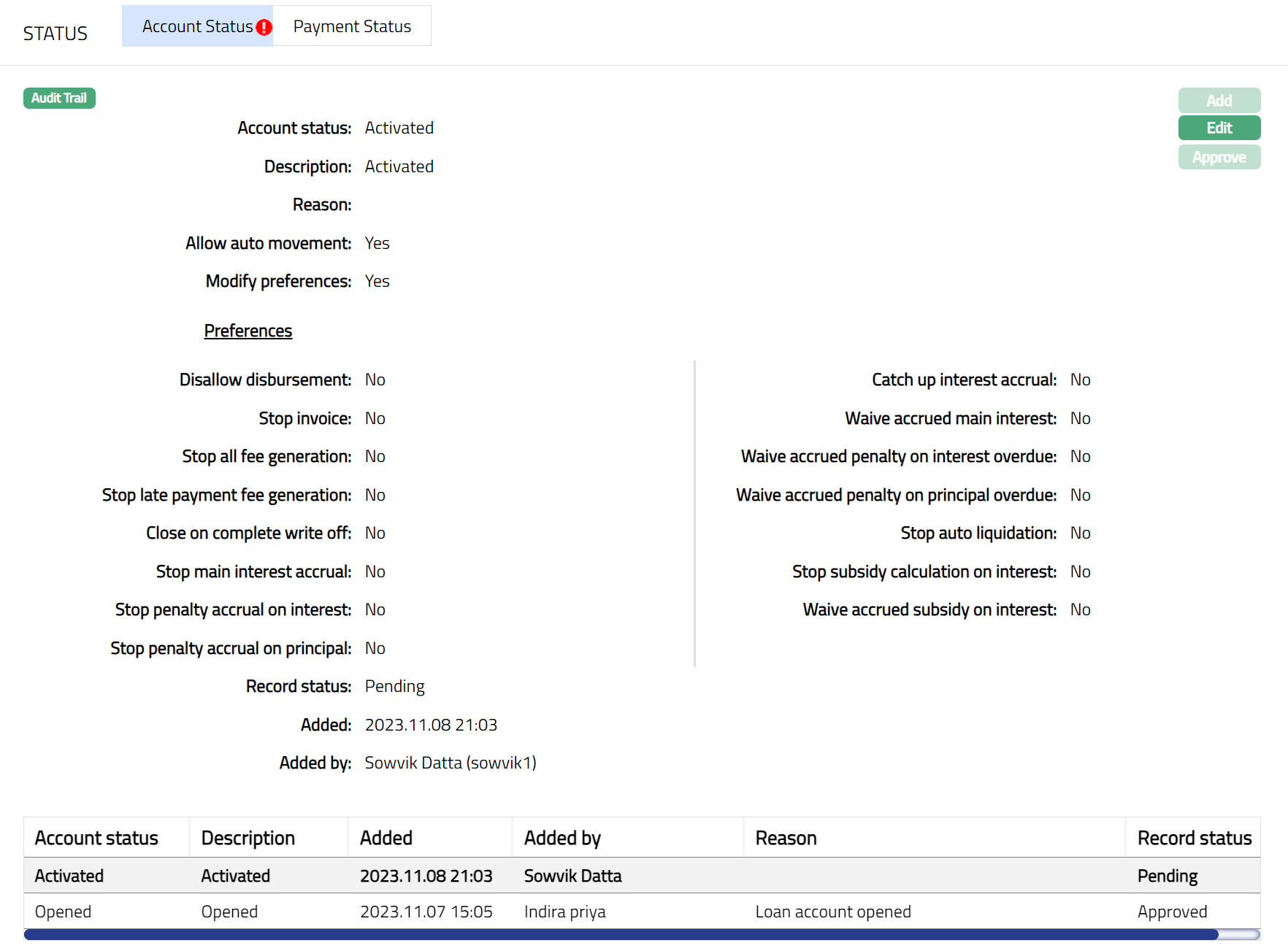

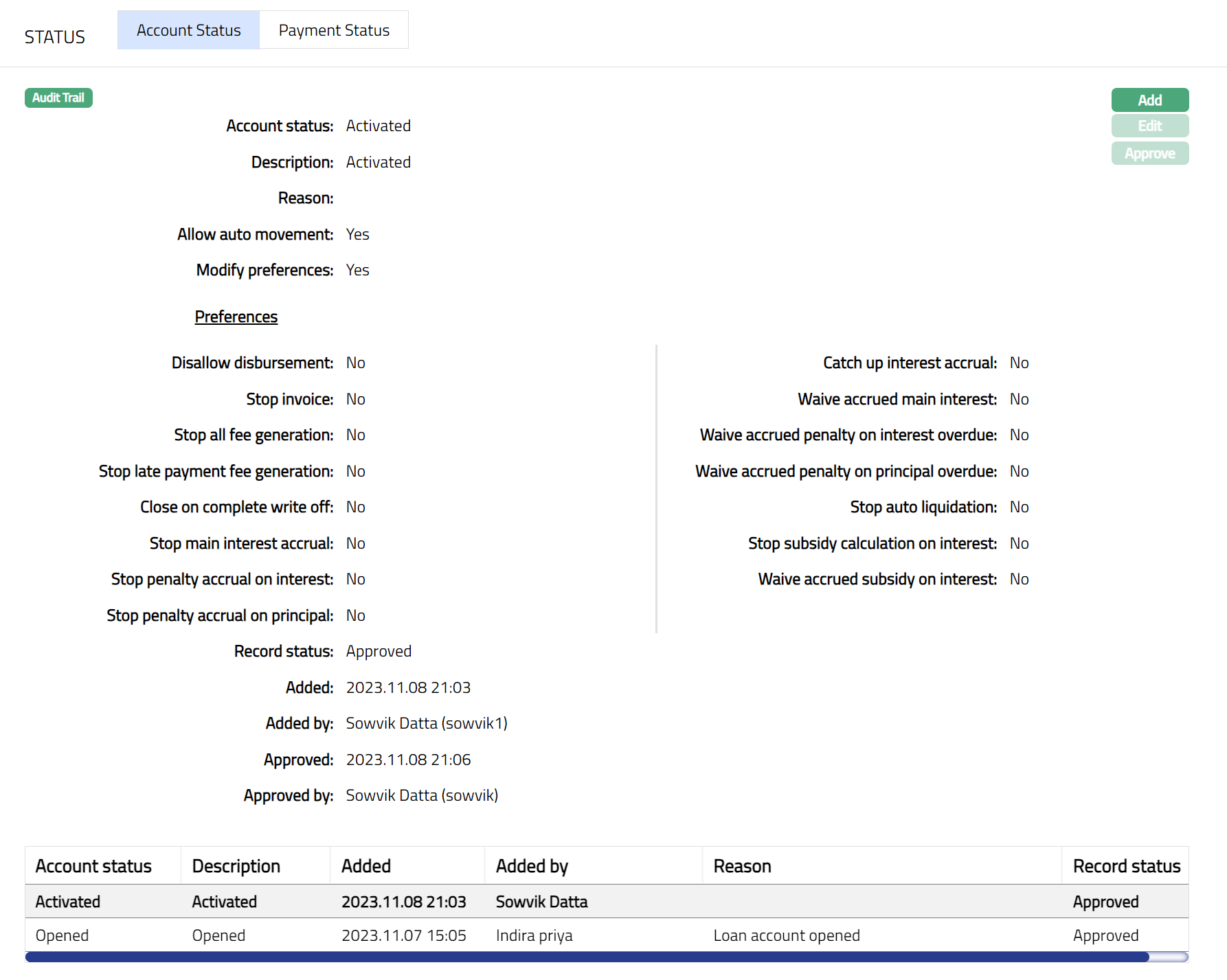

Loan Status: On click of Finish,

The Loan Account Status will be as follows:

If KYC of the customer is not approved:

- The Account Status is Opened, and the record status is Approved.

- Add the Activated Account Status using Account Status tab. The record status will be Pending.

- Another user should approve the Account Status, so that the record status becomes Approved and Account Status becomes Activated

If KYC is approved

- The Account Status is Opened, Approved and Activated Pending.

- Another user should approve the Account Status, so that the record status becomes Approved and Account Status becomes Activated.

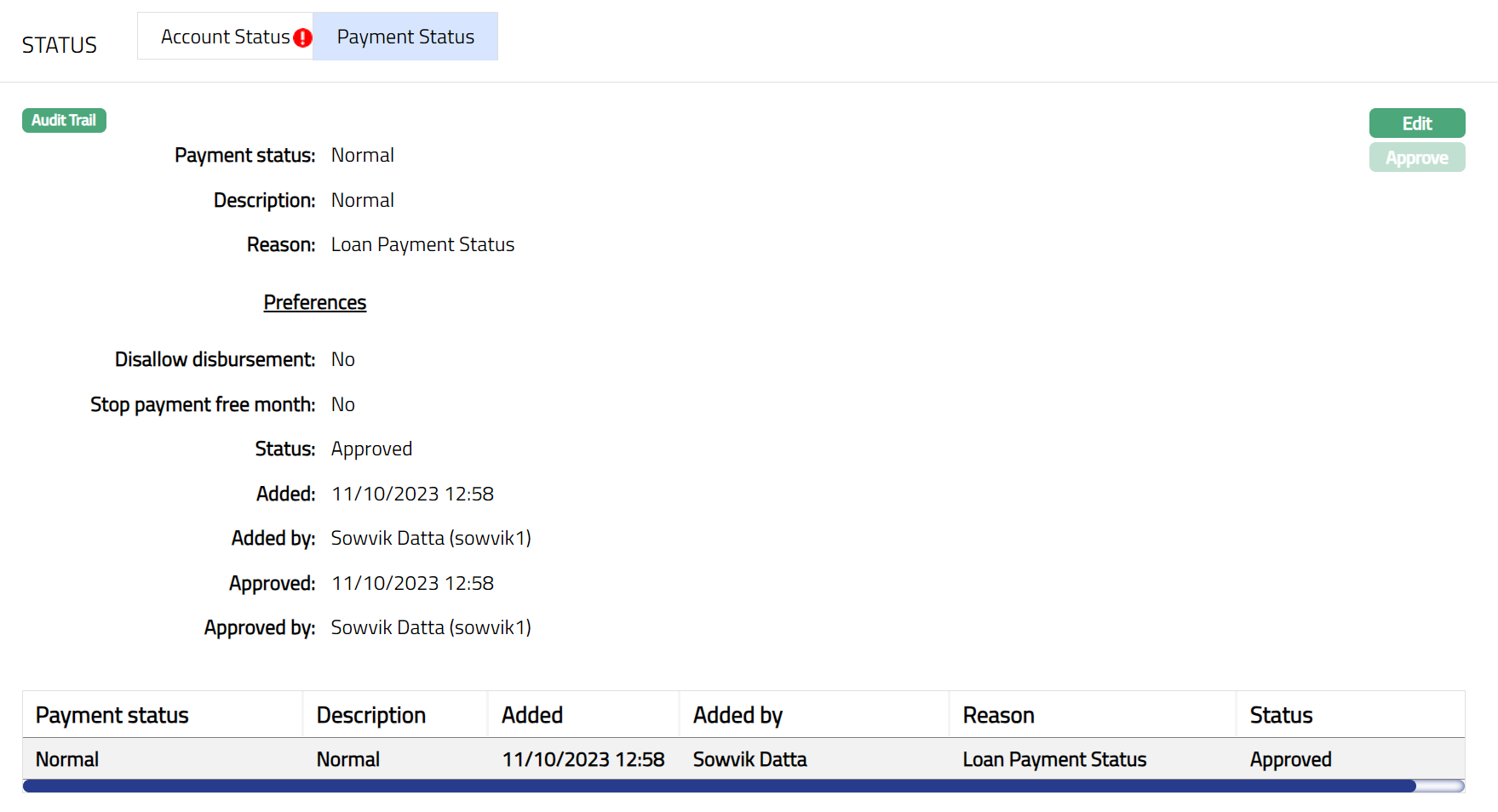

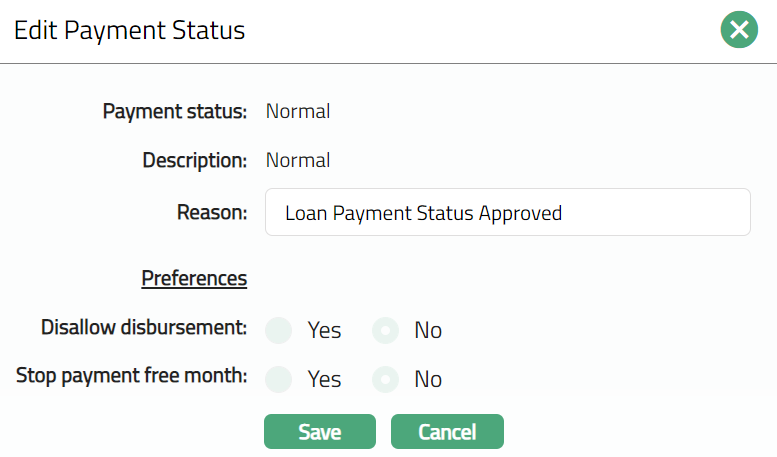

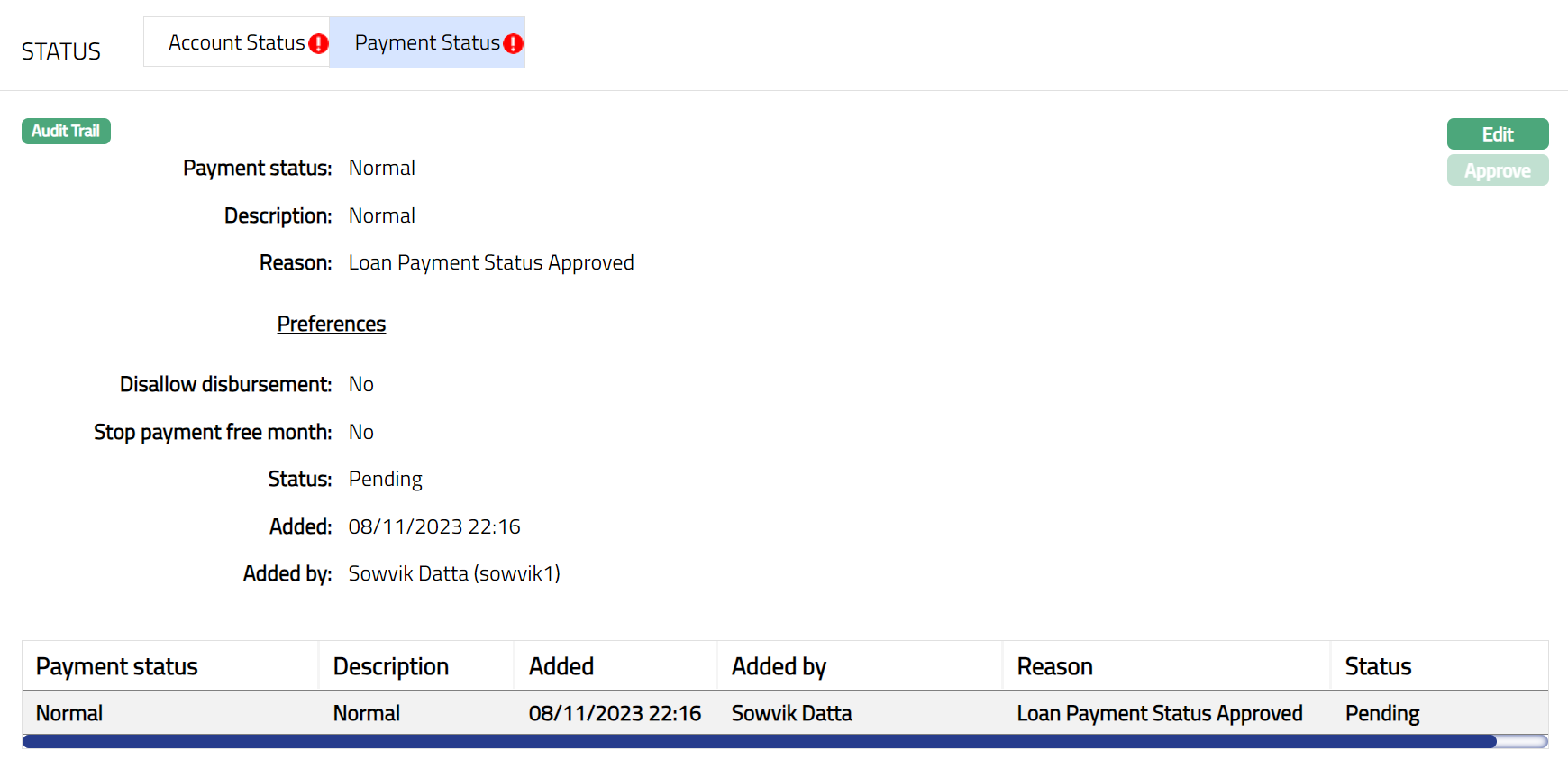

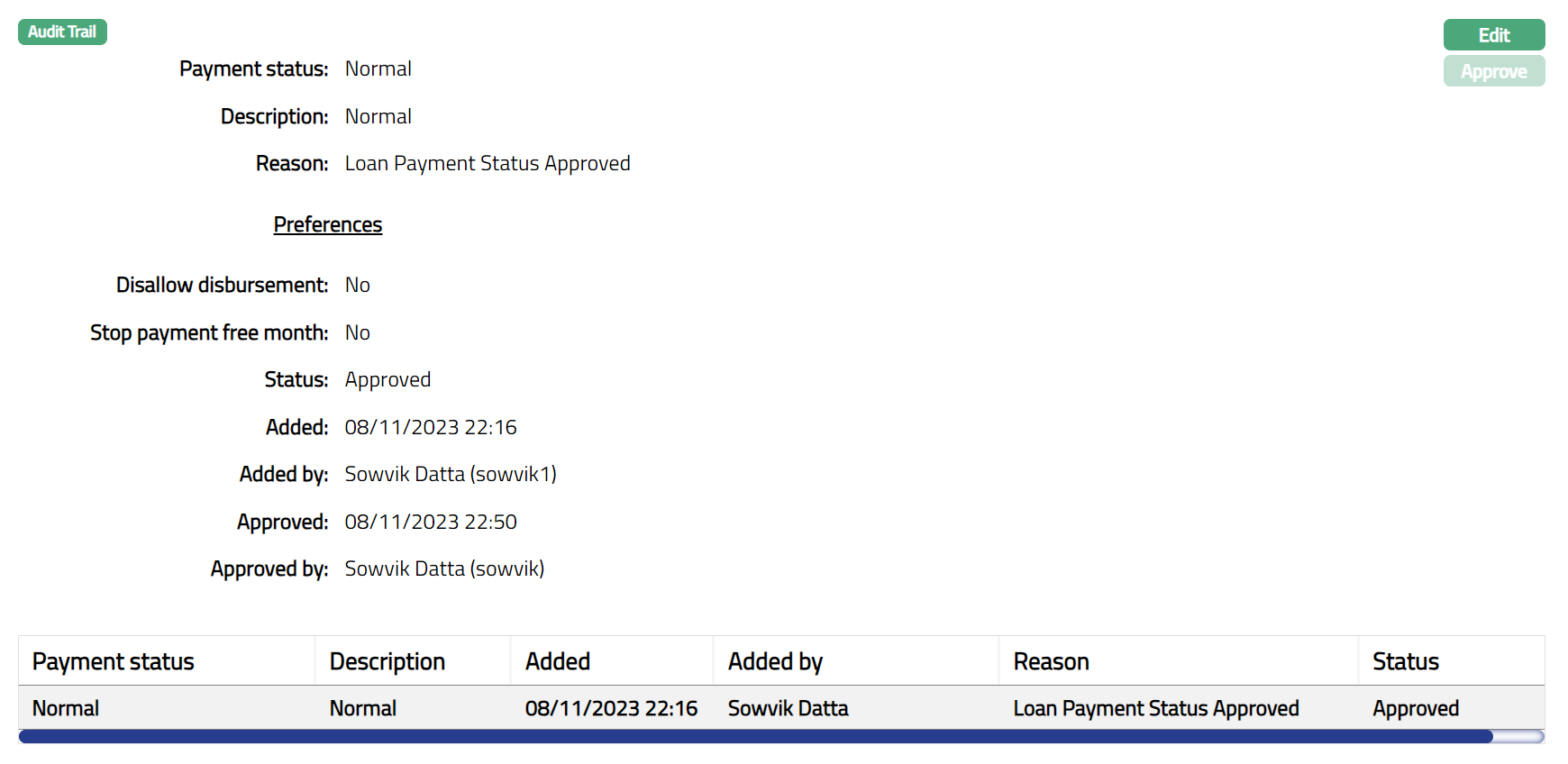

The Loan Payment Status will be Normal, Approved.

Refer to the Account Status section for a detailed explanation

Edit: Once Loan is activated, Edit is allowed only for specific tabs. To make changes to the interest / Payment parameters / certain Settings, after activation of Loan Account, you can use Retail > Loan > Change of terms .

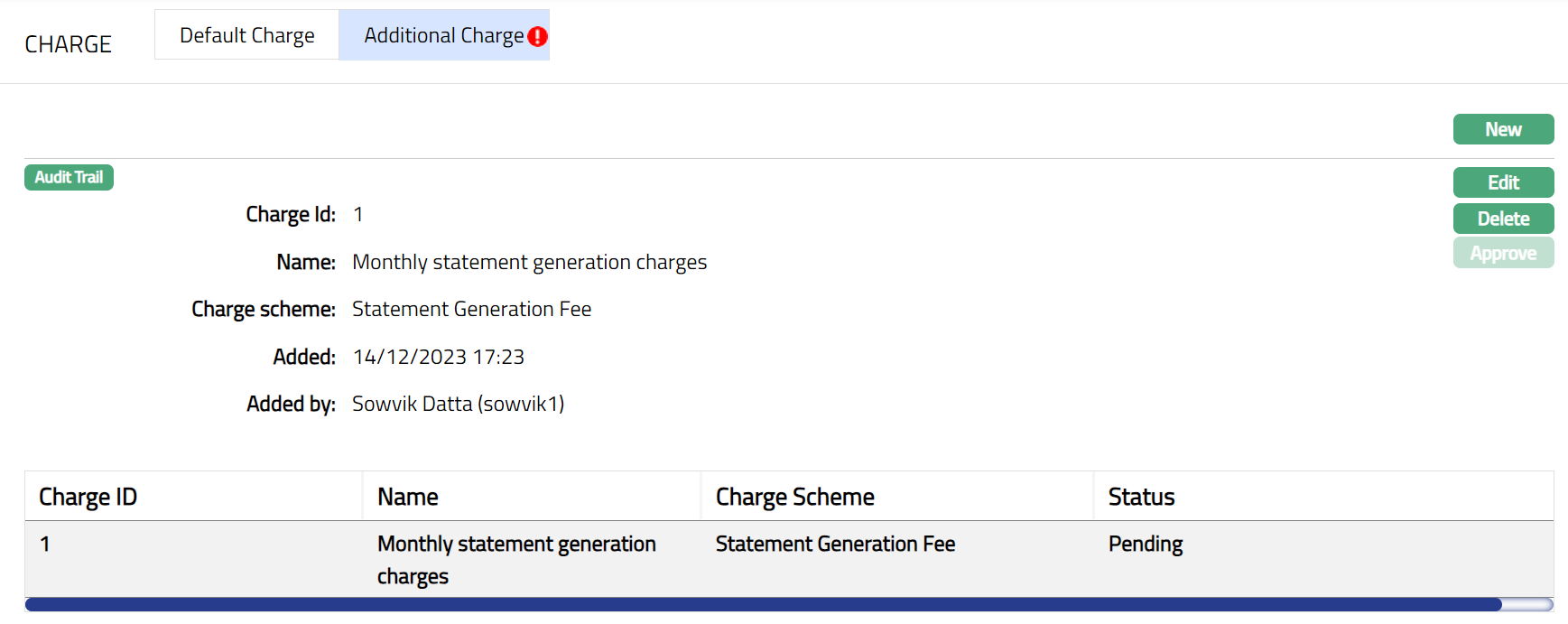

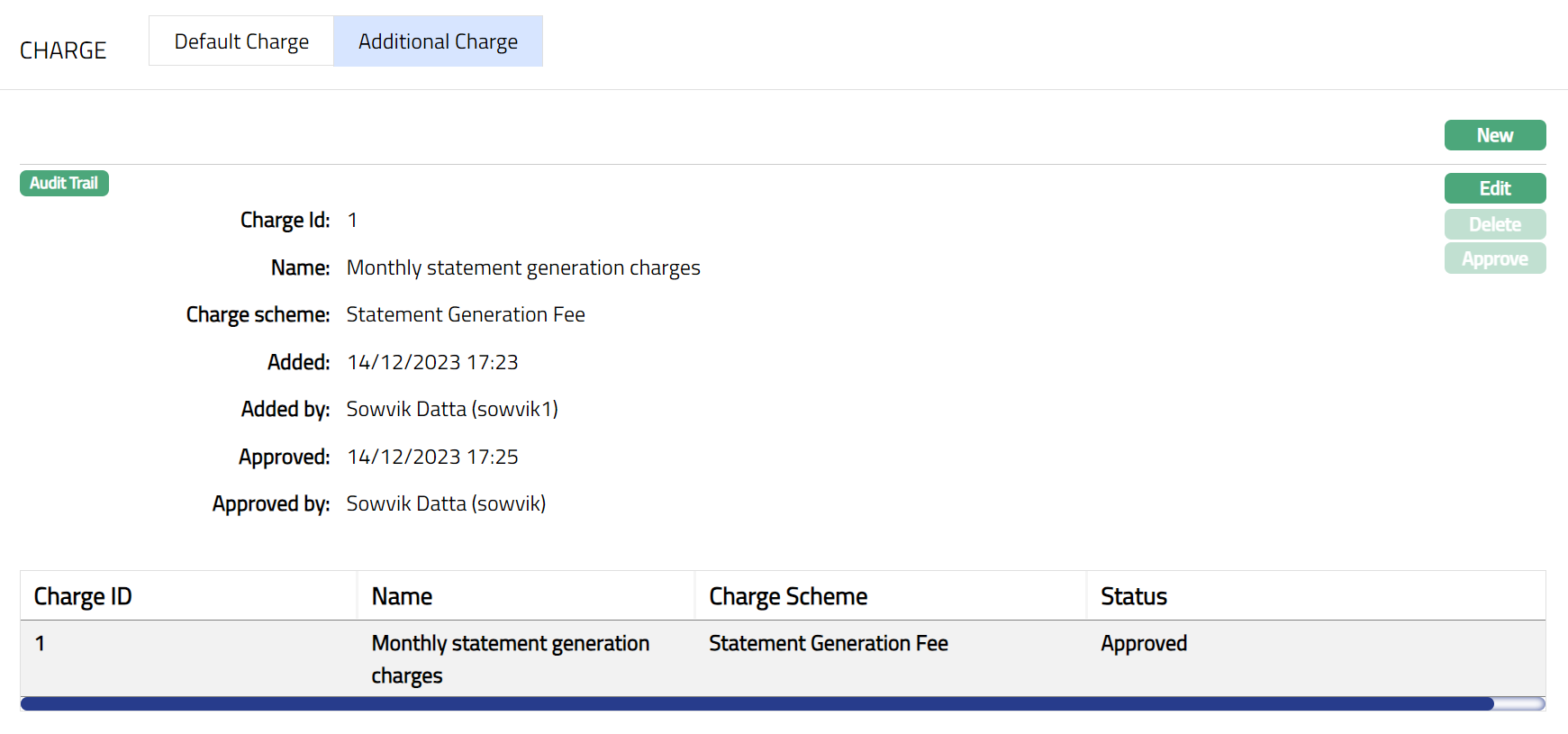

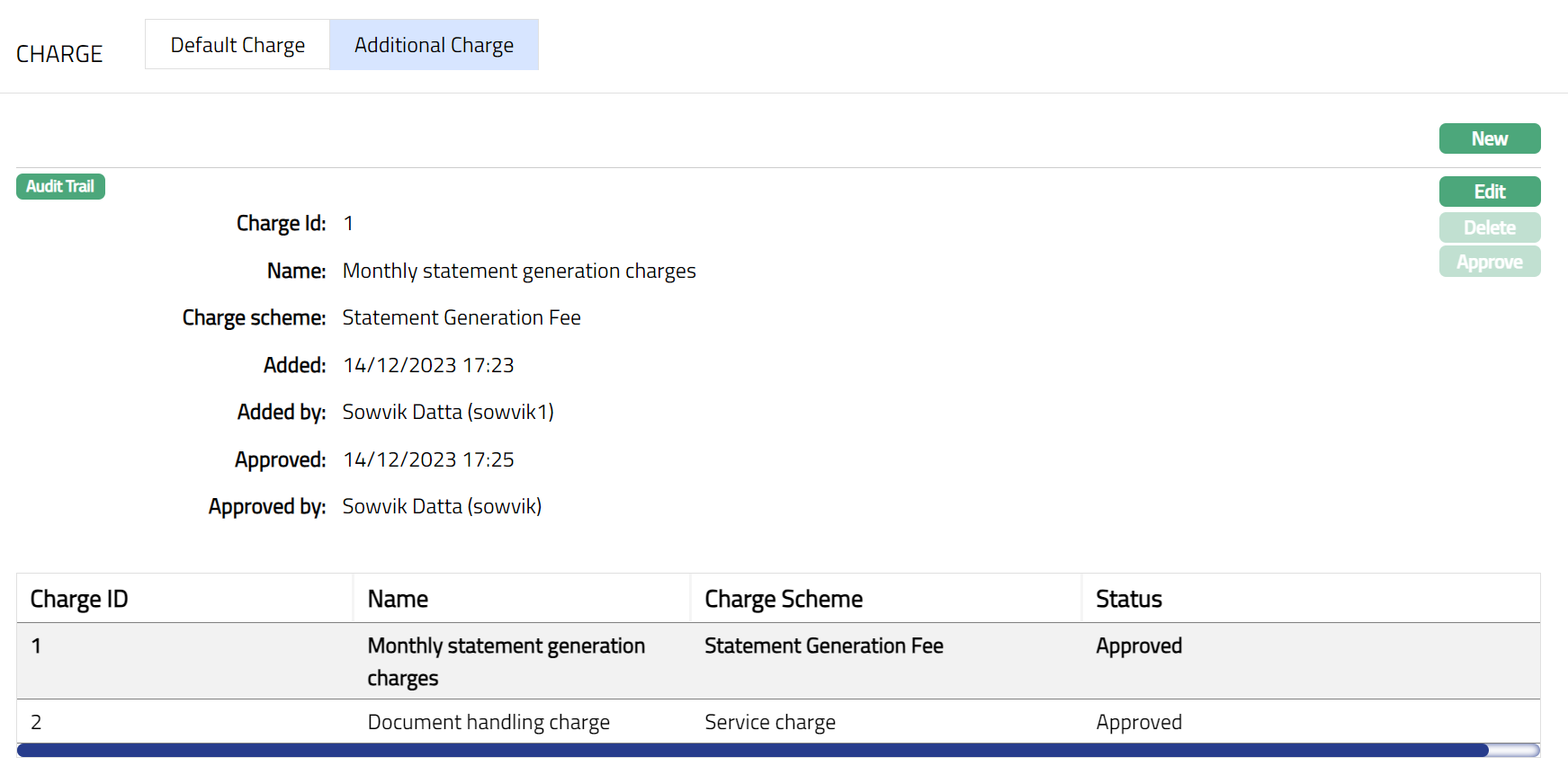

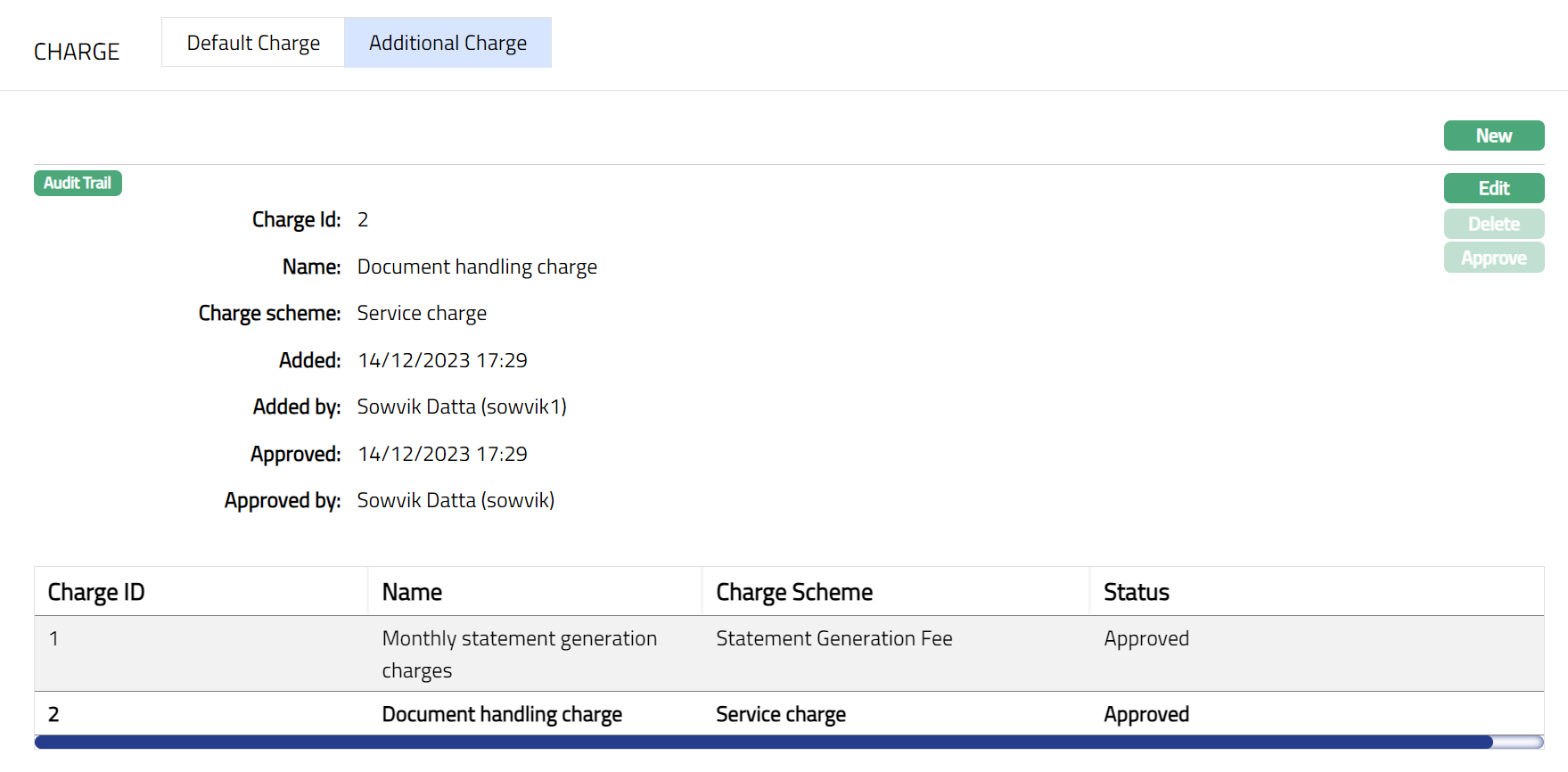

Any changes to the Interest Receivable, Payment Settings, Charge and Account Status tabs will render the status of these tabs to Pending. Only when it is Approved by another user, the changes will be effective.

For activating a Loan Account, the value of the Limit / Collateral attached under the Secured By Tab should be >= Sanctioned Amount * Minimum Secured Percentage. Unless the loan has enough coverage based on this formula, the activation approval will fail.

Only when the Account status is Activated and Record status is Approved, the account becomes effective and further actions like Disbursements, Repayment, Change Of Terms, etc., can happen in the account.

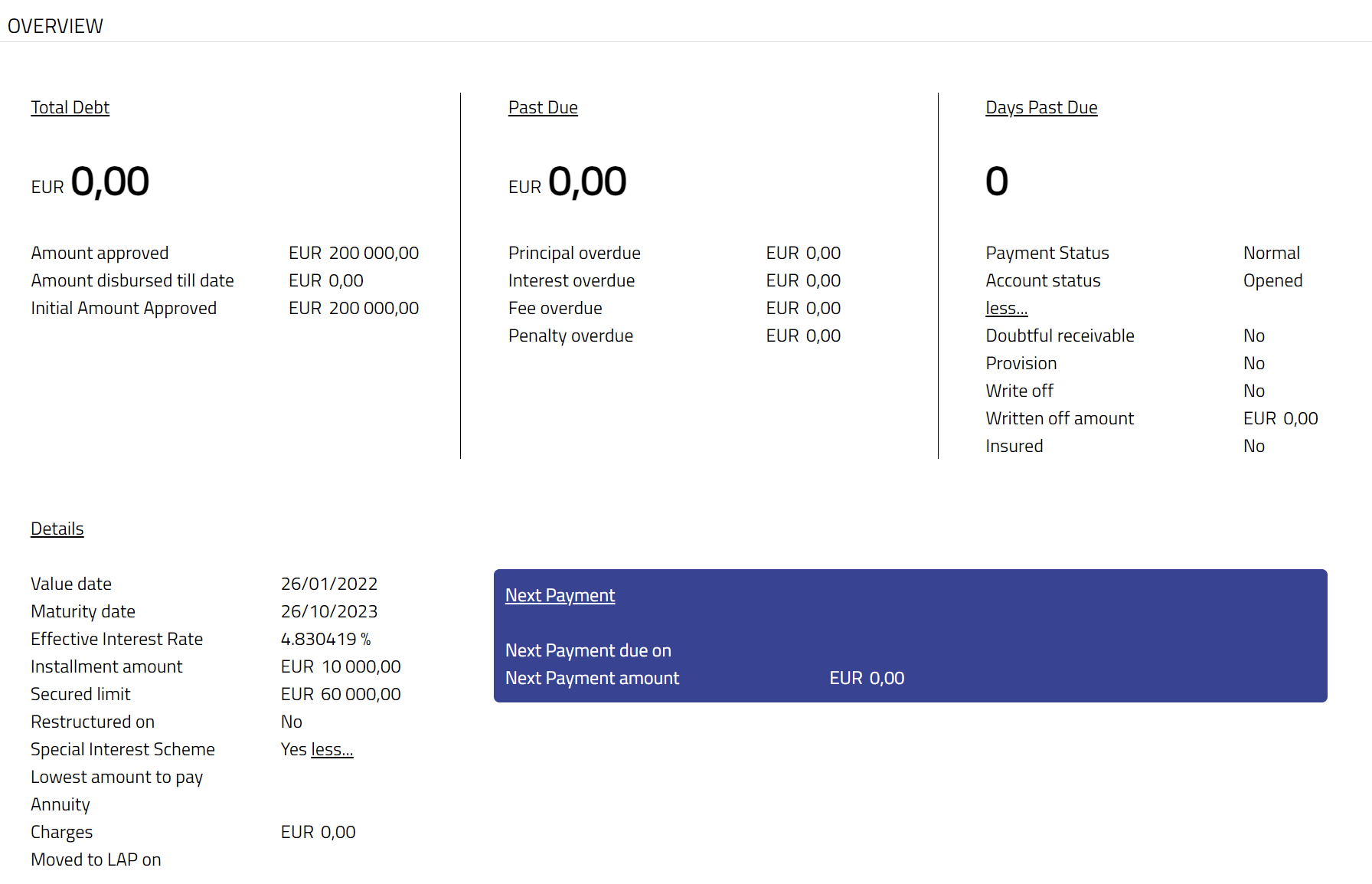

Overview

The Overview tab, which is the default tab in the Loan Account, allows you to see various details of a Loan Account to get an immediate overview of the account in terms of the various balances in the account, amounts that are past due, overdue days, significant dates related to the account and such other details.

To view the Overview details

- Access Loan Account page using Retail > Accounts > Loans > Maintain > Search. The Overview tab will be displayed by default.

The following are displayed under the head Total Debt: 2. Amount approved: It denotes the amount that is approved for the Loan Account - i.e., Loan's Sanctioned Amount as input at the time of loan activation or subsequently topped-up using Change of Terms.

Amount disbursed till date denotes the amount which has been disbursed for the Loan Account till that point of time.

Initial Amount Approved denotes the amount which was approved initially - i.e., Loan's Sanctioned Amount as input at the time of loan activation.

The following are displayed under the head Details: 5. Value Date denotes the date from which the loan starts - i.e., from when the interest would be applicable.

Maturity Date denotes the day when the loan matures or ends.

Effective interest rate (EIR) denotes the interest rate after adjusting for the frequency of compounding during the year. It is based on the projected cash flows for the loan. Aura calculates the EIR when

- the loan is created

- the loan is approved

- the loan is disbursed

- there is any change in the loan's interest parameters or payment terms

- there is any schedule regeneration, say, due to Prepayment or any other change

Installment amount is the EMI (Equated monthly instalments) amount calculated by Aura if the Loan type is Annuity. This field is not visible if the Type is Amortized.

Secured Limit denotes the total of the linked collaterals / limits that have been mapped to the Loan as Security for the Loan.

Restructured on denotes the day when the Loan Account was Restructured. If there has not been any restructuring for the Loan Account, this will display No

Special Interest Scheme (SIS) indicates whether or not a Special Interest Scheme is applicable for this loan. If this is Yes, you can click on the More button to see the expanded details as follows:

Lowest Amount to Pay is the minimum amount which needs to be paid as calculated at the time of creation / activation of the loan.

Principal: If SIS = Yes and Interest Calculation Method = Amortized, it is the Principal part of the amount calculated as the lowest amount to pay. This will be displayed only for Amortized Loans.

Interest: If SIS = Yes and Interest Calculation Method = Amortized, it is the Interest part of the amount calculated as the lowest amount to pay. This will be displayed only for Amortized Loans.

Annuity: If SIS = Yes and Interest Calculation Method = Annuity, it is the annuity amount calculated as the lowest amount to pay. This will be displayed only for Annuity Loans.

Charges: If SIS = Yes, this denotes the regular charges that are part of the Payment Schedule (like Instalment Fees / Loan Management Fees). If there are no such charges, this will display 0.00

Moved to LAP on: If Special Interest Scheme = Yes, this indicates the date on which the loan moved to the Lowest Amount to Pay slab. If loan has not yet moved to the Lowest Amount to Pay slab & is continuing in the Chosen Amount to Pay slab, this will be blank.

Payment plan active: Indicates if a Payment Plan is active (on-going) on the Loan Account.

Past Due section displays the amounts that have not been paid by the due date.

Principal overdue denotes the principal amount which was due before the current booking date but has not been received from the Client.

Interest overdue denotes the interest amount which was due before the current booking date but has not been received from the Client. This would include amounts for all Interest related components viz., Interest, Interest Intermediate and Interest Difference.

Fee overdue denotes the sum of charges that was due before the current booking date but has not been received from the Client.

Penalty overdue denotes if there are any penalties (Penalty on Principal Overdue + Penalty on Interest Overdue) that were applied on the loan but has not yet been received from the Client.

Days Past Due indicates the number of days by which the loan account is overdue. It is calculated as the difference between the current booking date and the earliest Due Date of the schedule that remains unpaid. If there are no such unpaid amounts past the due date, this will show 0.

Payment status denotes the current Payment Status of the loan to indicate the payment behaviour of the loan account.

Account status denotes the current Account Status of the loan.

Payment received in excess displays the amount of funds received in excess of the due amounts for that loan as at that point of time.

Click on More hyperlink under Payment Received in Excess to see the following details: 22. Doubtful receivable will be Yes if Doubtful Receivable Impairment treatment is currently booked for the account.

Provision will be Yes if Provision Impairment treatment is currently booked for the account.

Write off will be Yes if Write-off Impairment treatment is currently booked for the account.

Written off Amount denotes the total amount which is written off as on date for this Loan Account under the impairment.

Insured field denotes if the active insurance plan is attached to the Loan Account.

Next Payment Due On: The date on which the next instalment is payable.

Next Payment Amount: The amount of payment that is due on the above date.

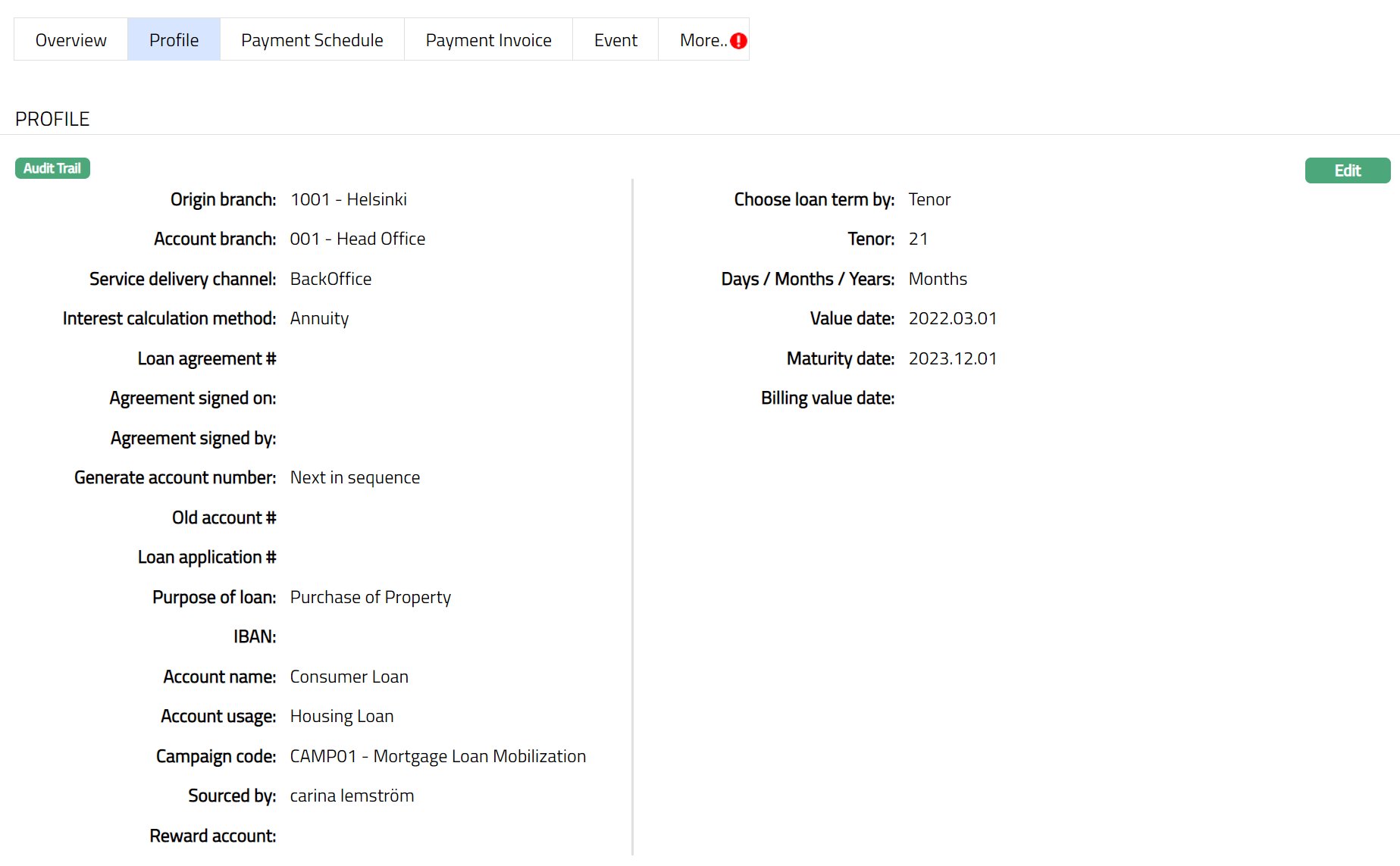

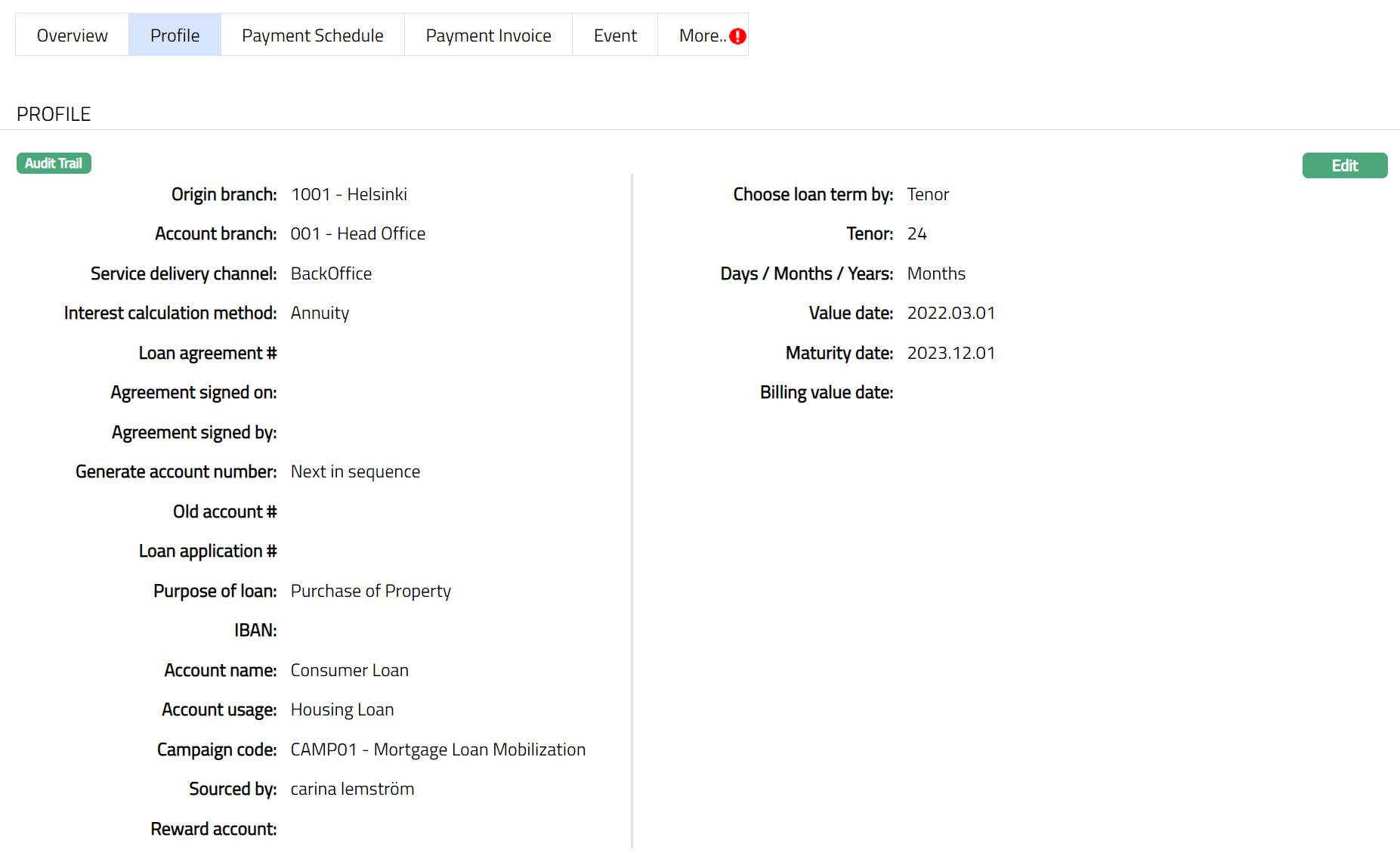

Profile

Profile tab shows the basic details of the Loan Account. For details refer to New Loan → Profile (1/6).

To view/edit Profile.

Access Loan Account page. Then click Profile tab.

The additional fields that you can view in the Profile tab are explained below:

Loan agreement # denotes the agreement number attached to the Loan Account. You can enter the same during Edit.

Agreement signed on date denotes the date when the Agreement was signed. You can enter the same during Edit.

Agreement signed by denotes the name of the person who signed the agreement. You can enter the same during Edit.

Old account # can be used to record the earlier account number, say, from a legacy system, for purposes of reference. You can enter the same during Edit.

IBAN is the International Bank Account Number that is generated by Aura, if applicable, as per the Product used for creating the Loan Account.

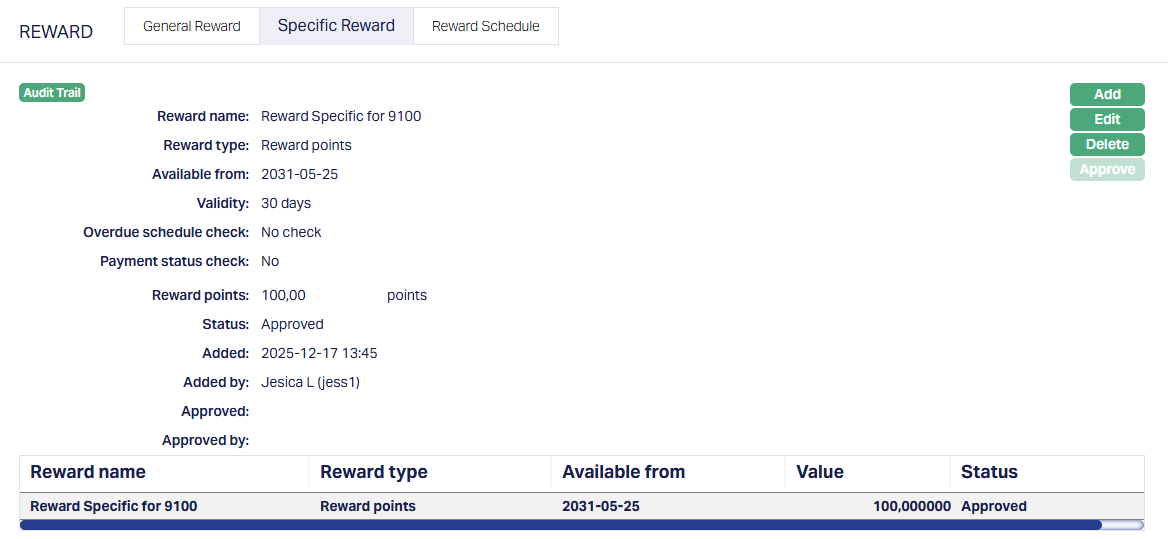

Reward account denotes the reward account created for this loan account, if applicable, as per the Product used for creating the Loan Account.

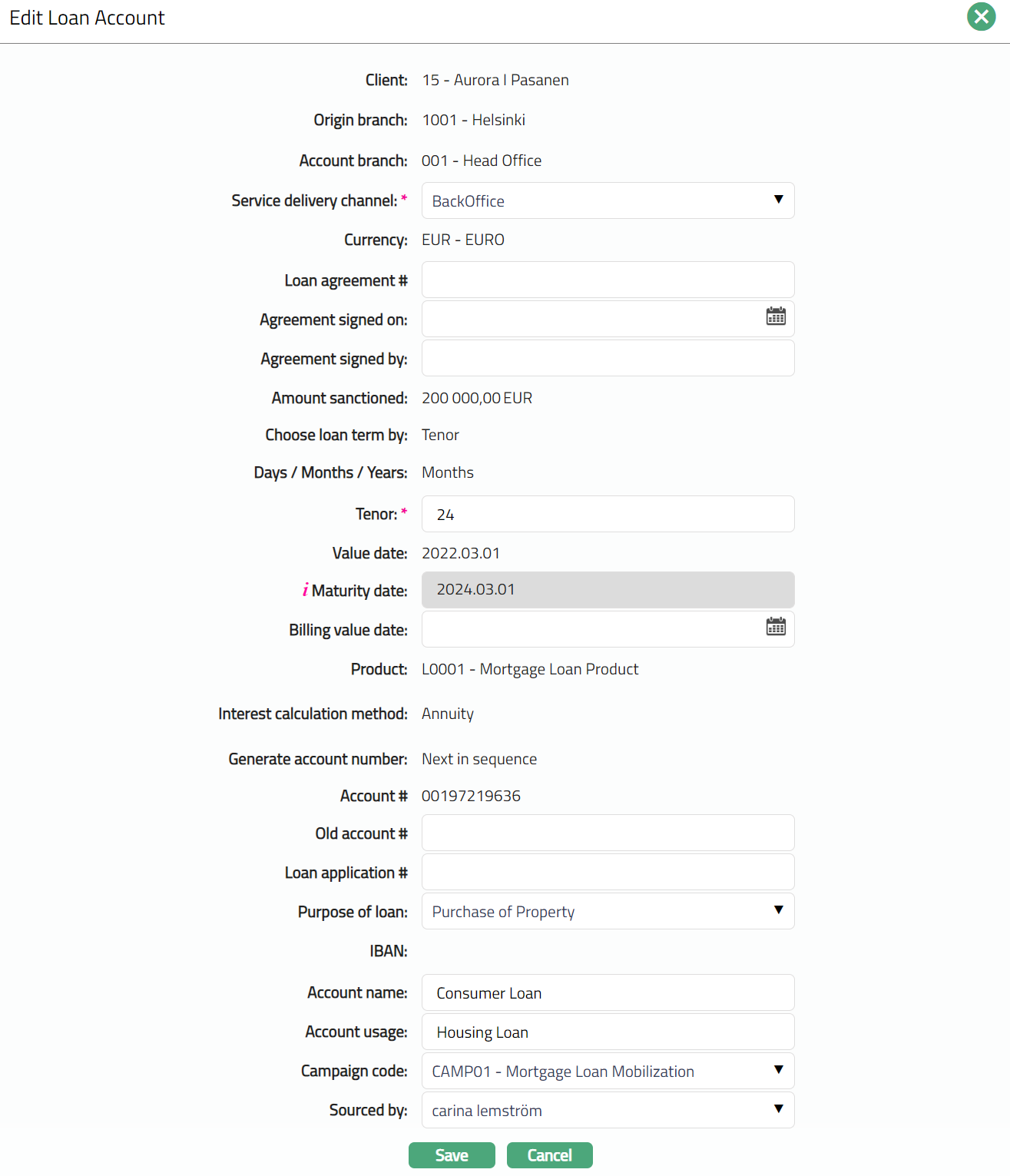

To edit Profile,

- Click Edit. The Edit Loan Account page appears.

Note: After Loan Account is Activated, Profile tab is not editable.

The editable fields are:

Service delivery channel

Loan agreement #

Loan agreement signed on.

Loan agreement signed by

Tenor (If user has opted for Choose by Tenor)

Maturity Date (If user has opted for Choose by Maturity Date)

Billing Value Date

Old account #

Loan application #

Purpose of loan

Account name

Account usage

Campaign code

Sourced by

Note:

If you select Choose Loan Term by as Tenor, then Tenor will be available for edit; else Maturity Date will be available as per the selection.

If Tenor or Maturity Date is changed, Aura will validate the Tenor with Maximum term days and Minimum term days specified at the Product level.

If you change Tenor, Maturity Date will be changed.

If you change Maturity Date, Tenor will be changed.

- Click Save. Profile page appears with the edited details.

Function: Edit

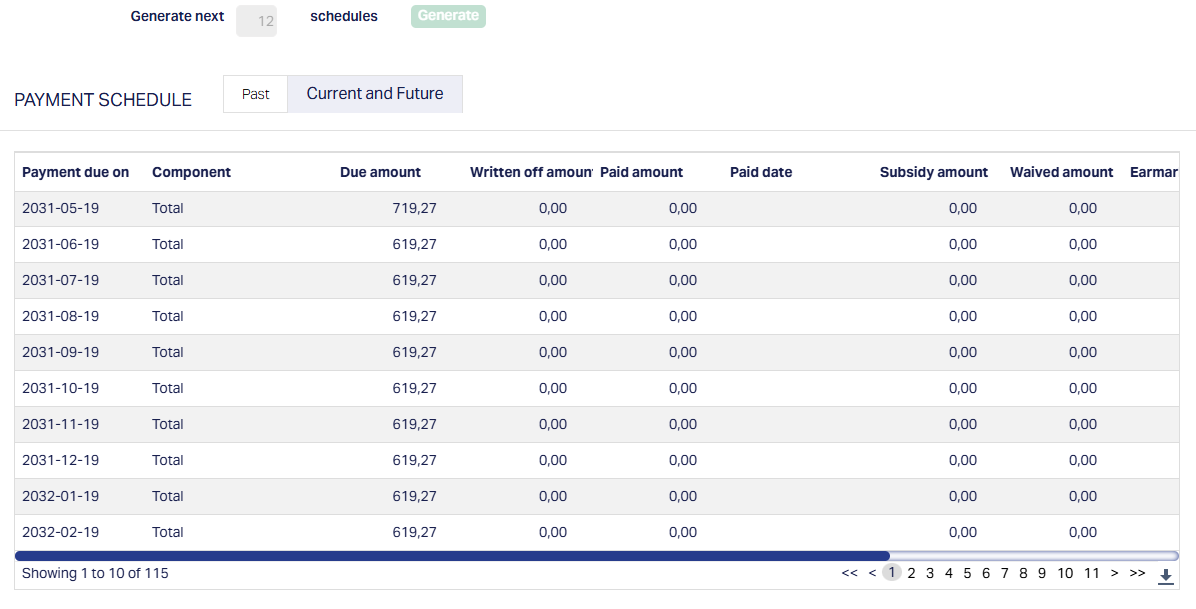

Payment Schedule

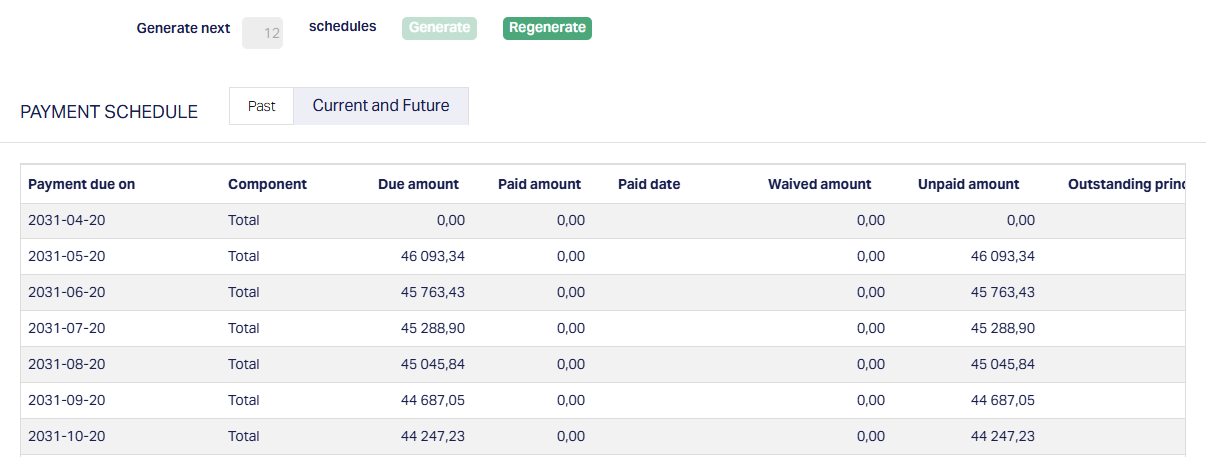

Payment Schedule tab allows you to view / generate / regenerate the Payment Schedule details.

By default, Current and Future tab is displayed. All the current and future payment schedules for each Payment Due On date are shown with the total amounts. The details of all the Components due on that date will be displayed when you click on any specific row. To view the past schedules, click on Past tab. Both the tabs are identical and display schedules as the tab names indicate.

- Access Loan Account page. Click Payment Schedule tab to view the details as per sample below.

The columns available here are:

Payment due on denotes the date on which the payment is to be made. This date is generated based on the holiday preferences applicable on the account or on the number of advance interest payments done. Once the disbursement is done, this column will be visible in the payment schedule.

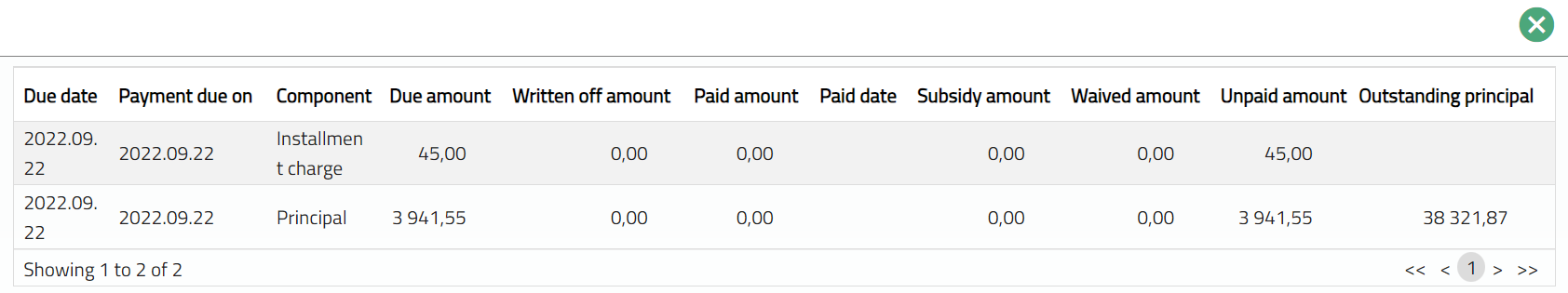

Component denotes the loan components i.e., the different heads under which the due amounts are to be paid. The details of the break-down of the amount for each loan component will be displayed in a pop-up when you click on a specific row. Sample screenshot shown below.

The list of components and a brief description of each is given below:

| Component Name | Description |

|---|---|

| Principal | Principal amount of the loan |

| Principal Intermediate | Principal added or reduced when there is any additional disbursement or pre-payment |

| Interest | Main interest on the loan |

| Interest Difference | Difference in Interest component for change of interest during a period after invoice has been generated for the period |

| Interest Intermediate | Interest calculated on a fraction for a split period before invoice is generated for that period |

| Penalty On Interest Overdue | Penalty interest on un-paid interest |

| Penalty On Principal Overdue | Penalty interest on un-paid Principal |

| Additional Charge | Additional period fee charged during life cycle of a loan |

| Additional Disbursement Charge | Disbursement fee for a loan in case of additional disbursement |

| Adhoc Charge | Adhoc fee charged on a loan |

| Appraisal Charge | Appraisal fee for a loan collateral. For example, appraisal of land |

| Credit Report Charge | Fee for credit report for a credit check |

| Documentation Charge | Documentation fee for a loan |

| Installment Charge | Fee on loan installment |

| Insurance Charge | Fee for Insurance set up |

| Invoice Charge | Fee on loan invoice |

| Late Payment Charge | Fee on late payment of a loan |

| Legal Charge | Legal fee for a loan |

| Lender Inspection Charge | Inspection fee for a loan collateral |

| Loan Management Charge | Fee for loan management |

| Notary Charge | Fee for Notary |

| Premium Charge | Fee for insurance premium |

| Prepayment Charge | Fee on pre-payment for a loan |

| Charge Processing Charge | Processing fee for a loan |

| Charge Reminder Charge | Fee for Payment Reminder |

| Charge Service Charge | Service fee for a loan |

| Stamp Charge | Stamp fee for a collateral or an agreement register |

| Statement Charge | Fee for statement of account |

| Status Charge | Fee charged on status movement |

| Contractual Savings | Savings that are contractual when providing a loan |

| Voluntary Savings | Savings that are voluntary when providing a loan |

| Total | Total of the amounts for that schedule |

Due Date: The date on which the payment is due

Written off amount denotes that amount that has been written off on this Loan Account based on the impairment settings at the Product.

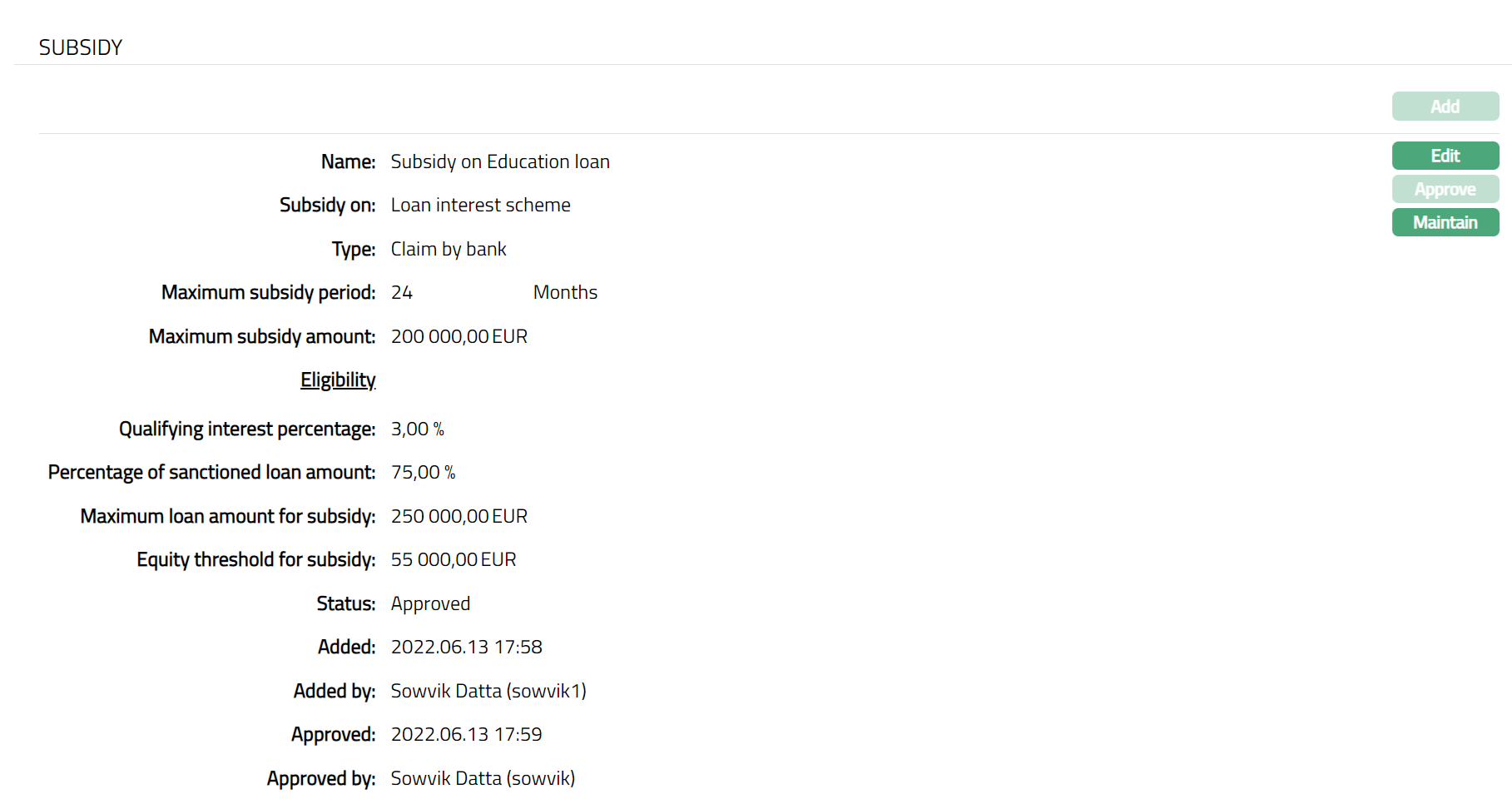

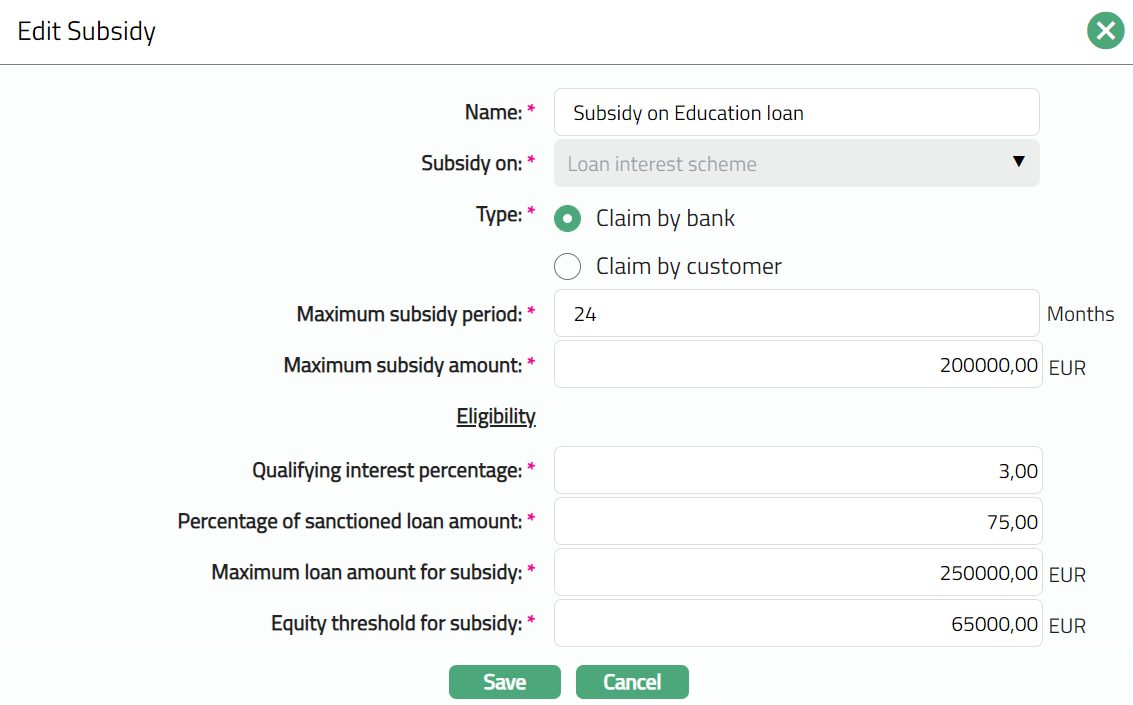

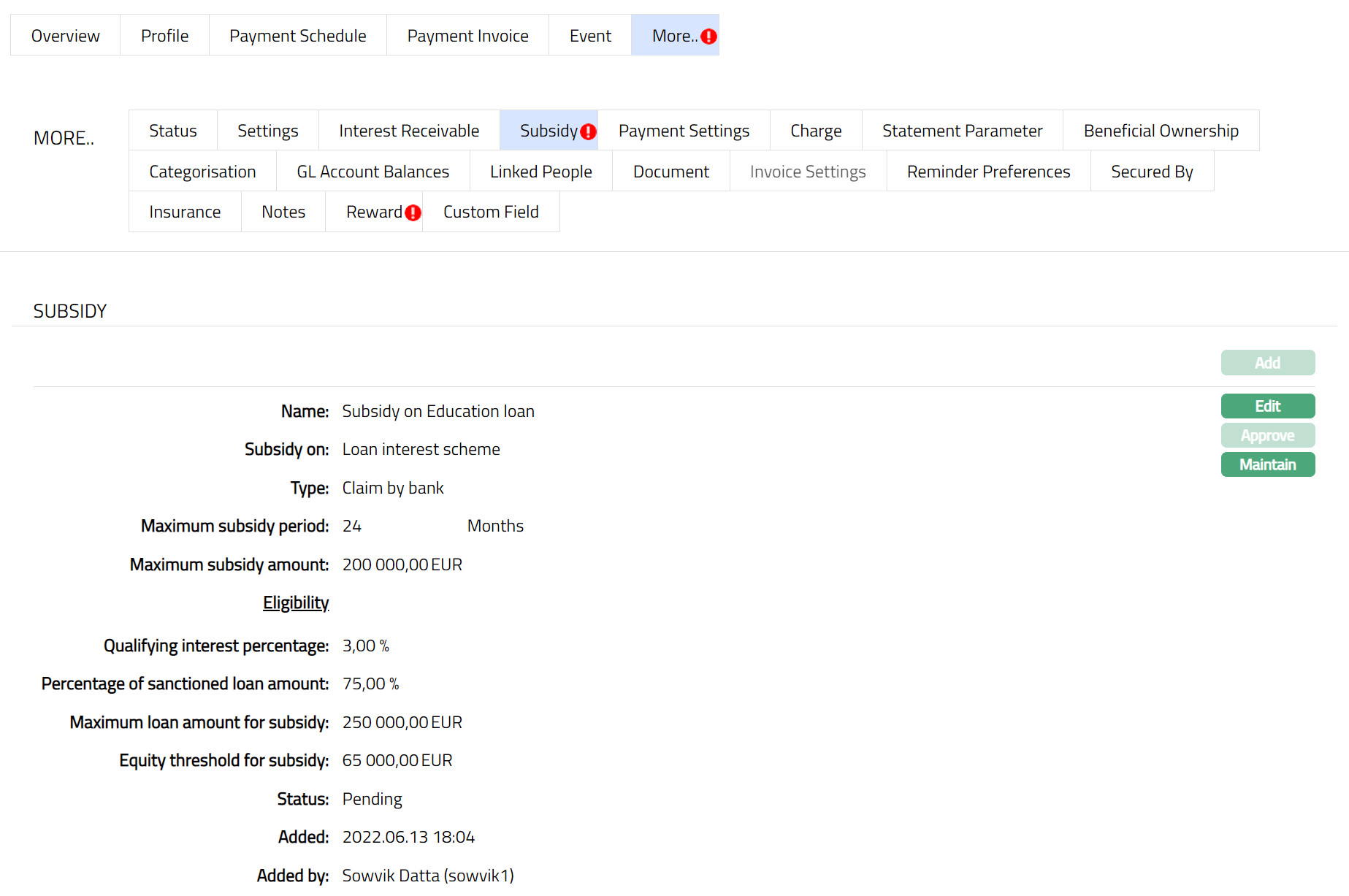

Subsidy amount denotes the amount of interest subsidy applicable on this account.

Due amount denotes the amount that is due for payment

Paid amount denotes the amount that is paid.

Paid date denotes the date on which the last payment is made.

Waived amount denotes the amount that is waived / written off as per the impairment setting maintained at the Product level for that account.

Unpaid amount denotes the amount that is unpaid for schedule. If the amount is written off as per the impairment setting maintained at the Product level, then Unpaid amount = Due amount + written off amount - paid amount - waived amount.

Outstanding principal denotes the Total principal amount that remains to be paid as on the Due Date and will be displayed only when the Component is related to Principal. If the amount is written off as per the impairment setting maintained at the Product level, then New outstanding principal = original outstanding principal - written off amount

Notes:

As soon as the loan account is created, the Account Status is Opened and a Simulated Payment Schedule is generated giving the details of the amounts due on the different due dates. You can make required changes in certain parameters of the loan using the Edit button in the various tabs.

To ensure that the changed values are considered in the Simulated Schedules, it is recommended that you Regenerate the Payment Schedule. To do so, click on the Regenerate button that is displayed when the Account Status is Opened (see sample screenshot below).

Once the Account Status is Activated, you can change the parameters by using Retail > Loans > Change of Terms; and on approval of such records, the schedules will be regenerated. Such regeneration will happen whether or not the loan has been disbursed.

On disbursement (whether automatic or manual), schedules will be regenerated and the Due Dates will be retained or revised based on the parameter On Change of Value Date. Schedules generated on and after disbursement are the Actual Schedules.

You can use the Generate button to generate the next 12 schedules, if applicable. The button will be enabled in case schedules for the full tenor have not yet been generated based on the flag at the Product.

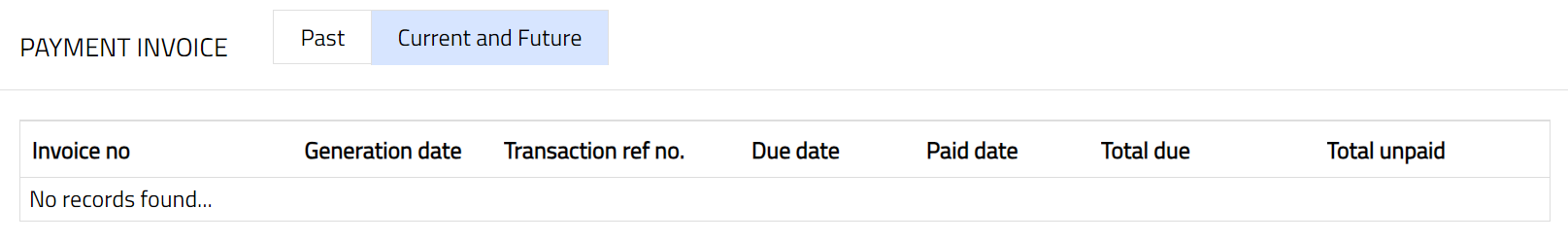

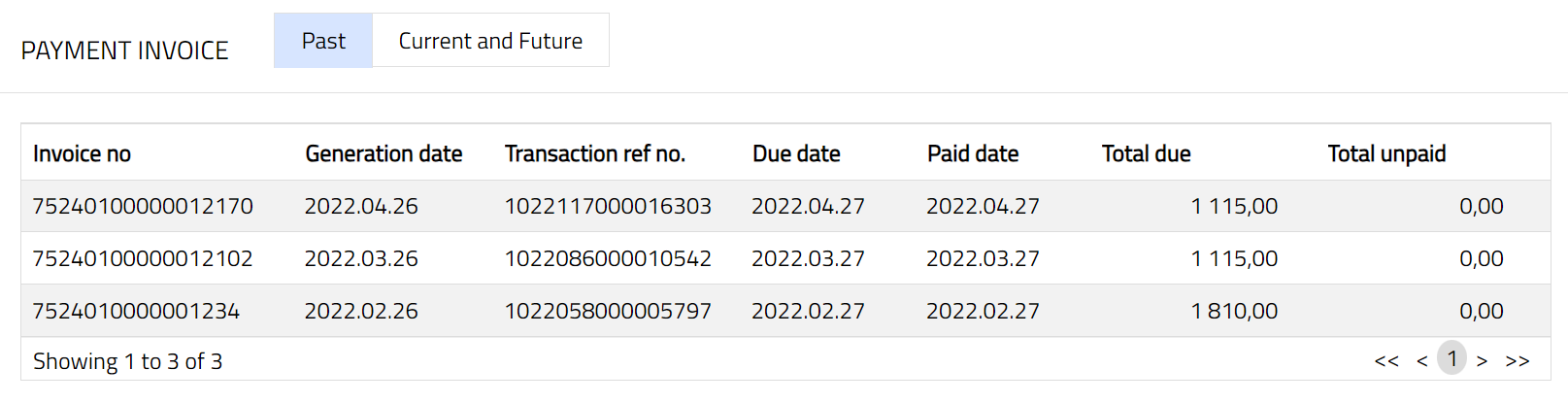

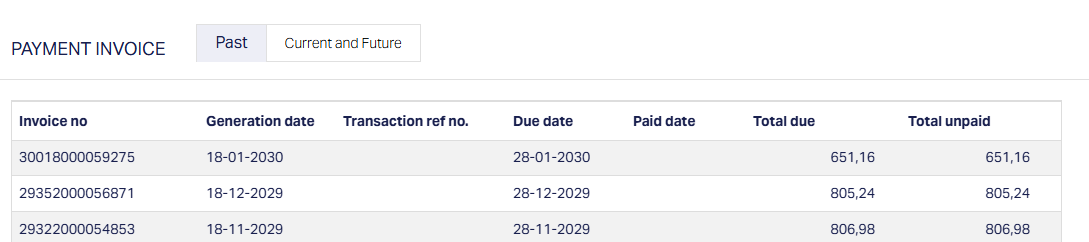

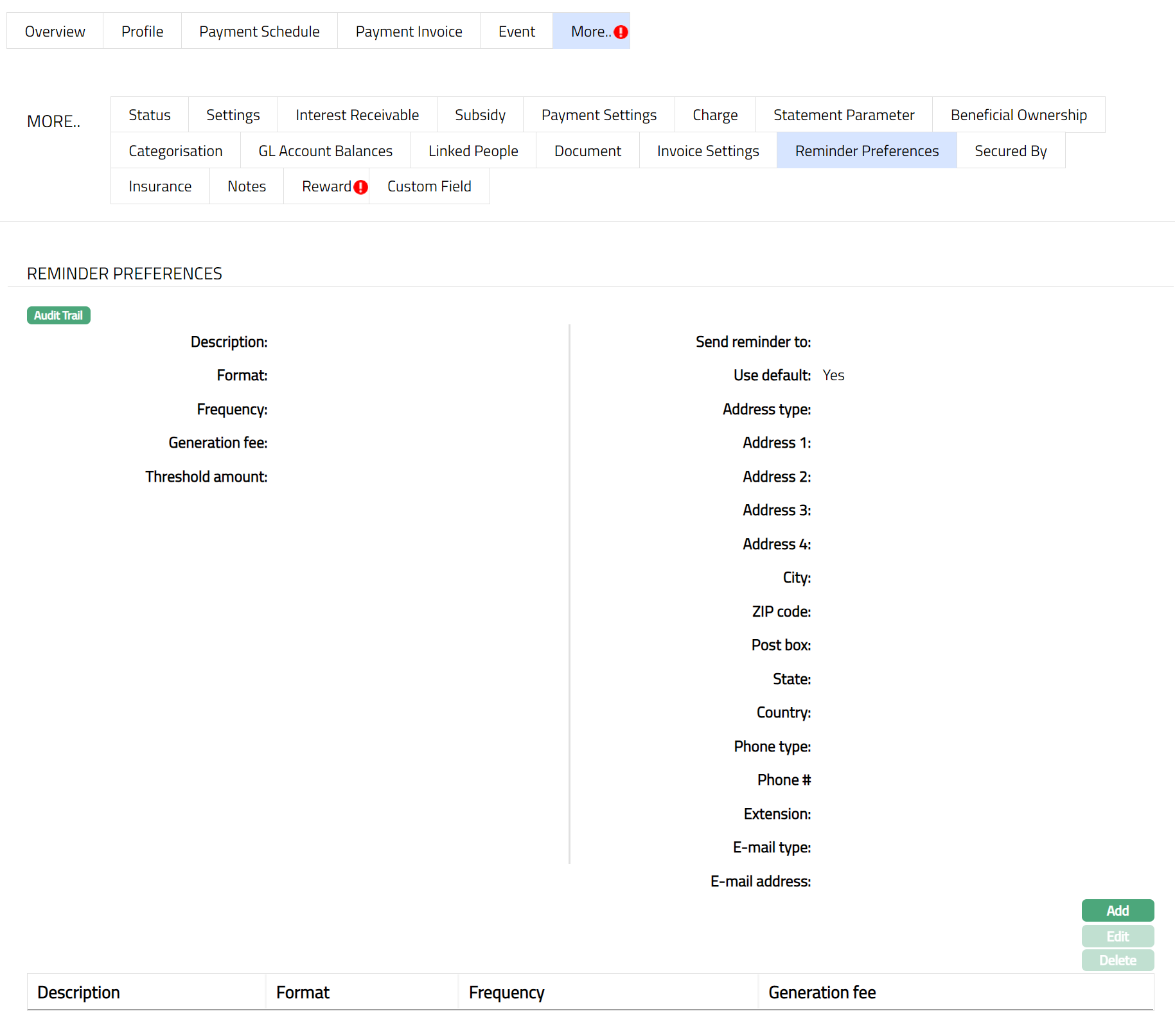

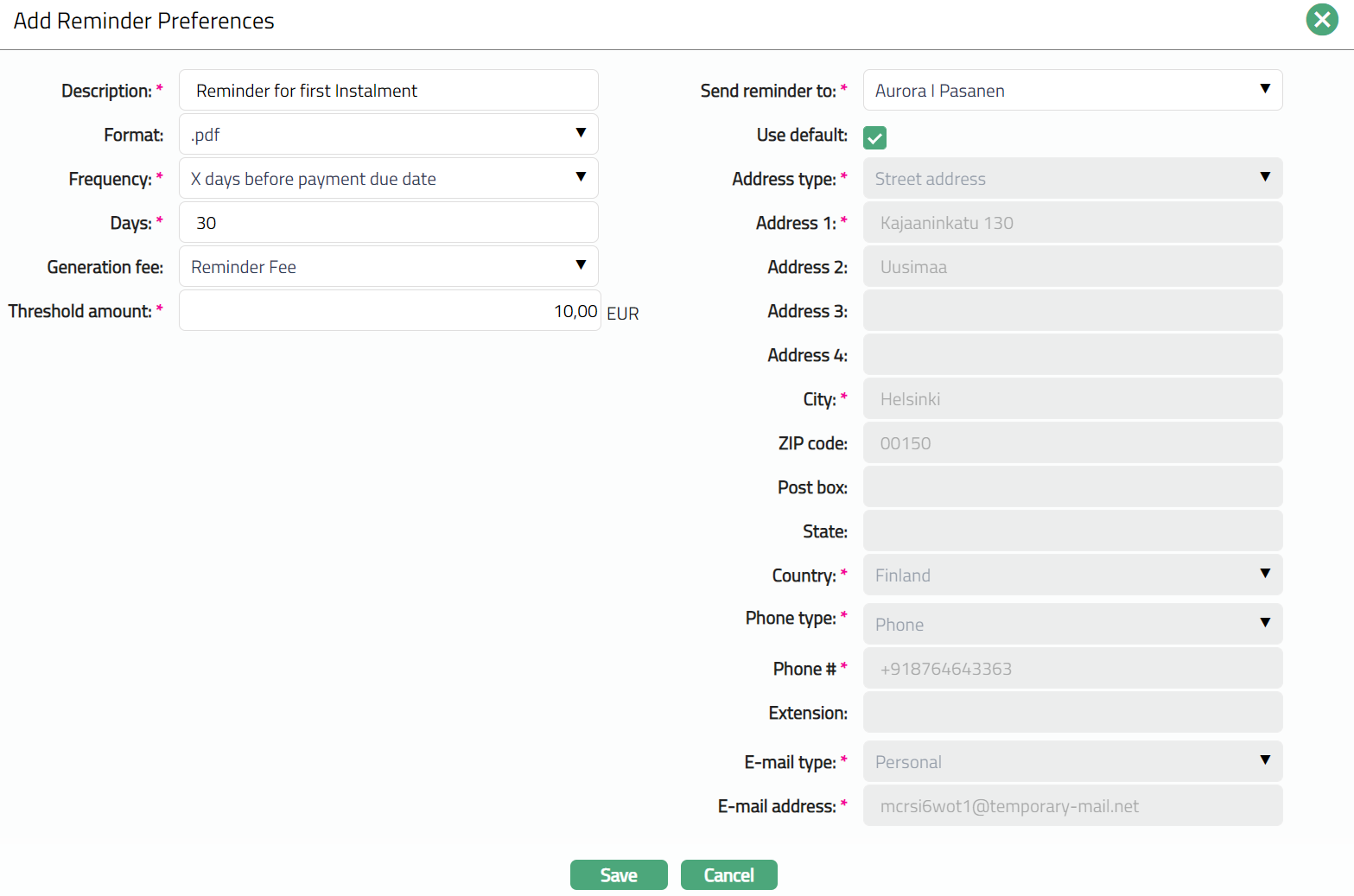

Payment Invoice

Payment Invoice tab allows you to view the details of invoices generated for this Loan Account. By default, Current and future payment invoice details are displayed. If the Product under which the loan is created has Invoice Generation Required = No, then, this tab will not be displayed at all.

Note: Depending on the Due Date of the invoice, it will be shown either under Current and Future sub-tab or under Past sub-tab. If there are no records to be displayed, the tab will be blank. For example, if invoices have not yet been generated, then both the sub-tabs will display blank as per the sample screen shot shown below.

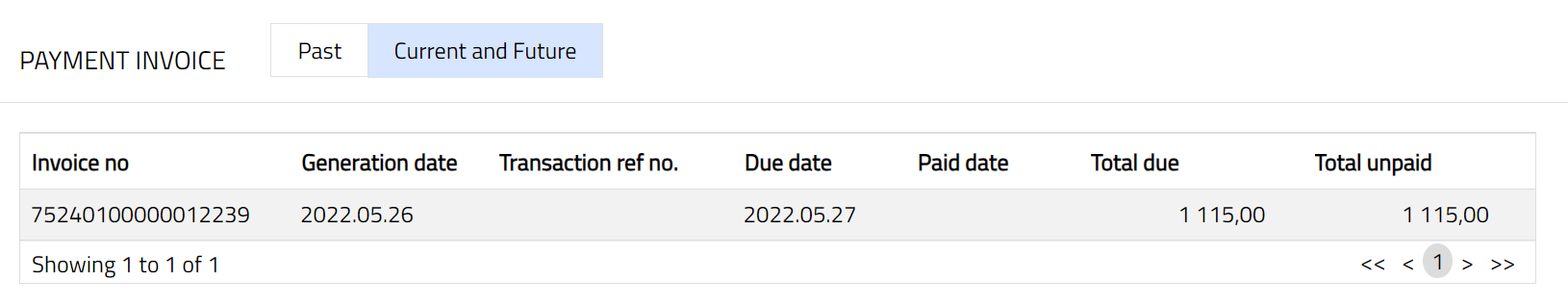

To view the invoices

- Access Loan Account page. Click Payment Invoice tab to view the details of the Current and Future Invoices as per sample below.

The available fields are:

Invoice no denotes the invoice number generated by Aura.

Generation date denotes the date on which the invoice is generated.

Transaction ref no denotes the transaction reference number generated by Aura on the last repayment of the due amount for the invoice.

Due date denotes the date for which the payment is due.

Paid date denotes the date on which the last repayment was made on that invoice.

Total due denotes the due amount in that invoice.

Total unpaid denotes the amount that is unpaid for that invoice.

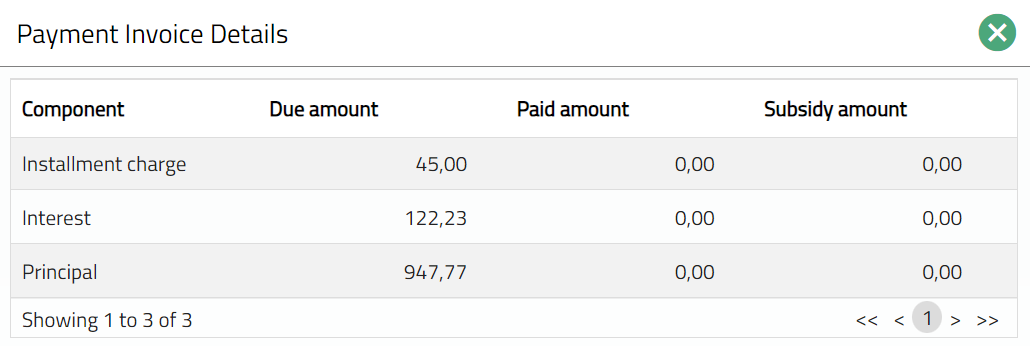

- Click the required record. Payment Invoice Details pop-up screen will appear displaying all the details related to that invoice. Sample screen shot shown below.

The available fields are:

Component denotes the loan components that are to be paid.

Due amount denotes the amount that is due for payment under that invoice.

Paid amount denotes the amount that is paid against that component under that invoice.

Subsidy amount denotes the amount that is subsidised for the schedule.

- Click Past tab to view the old invoices generated.

Event

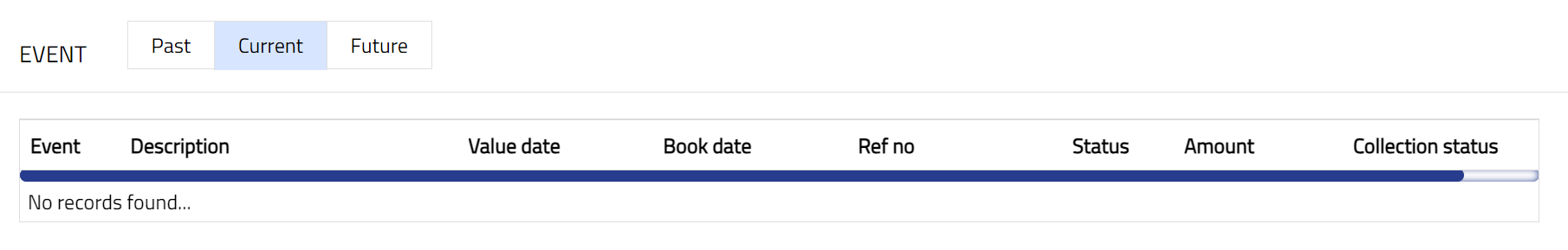

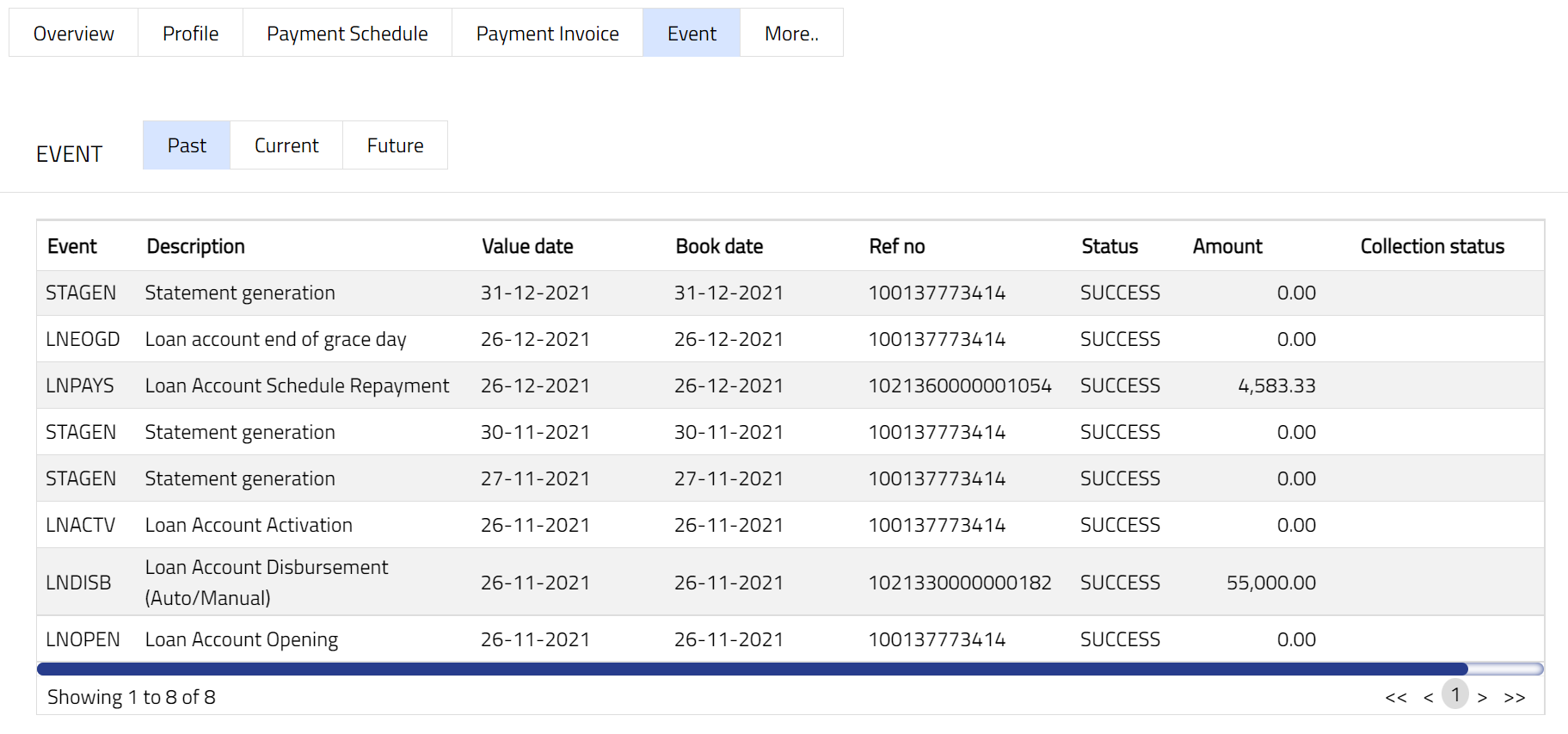

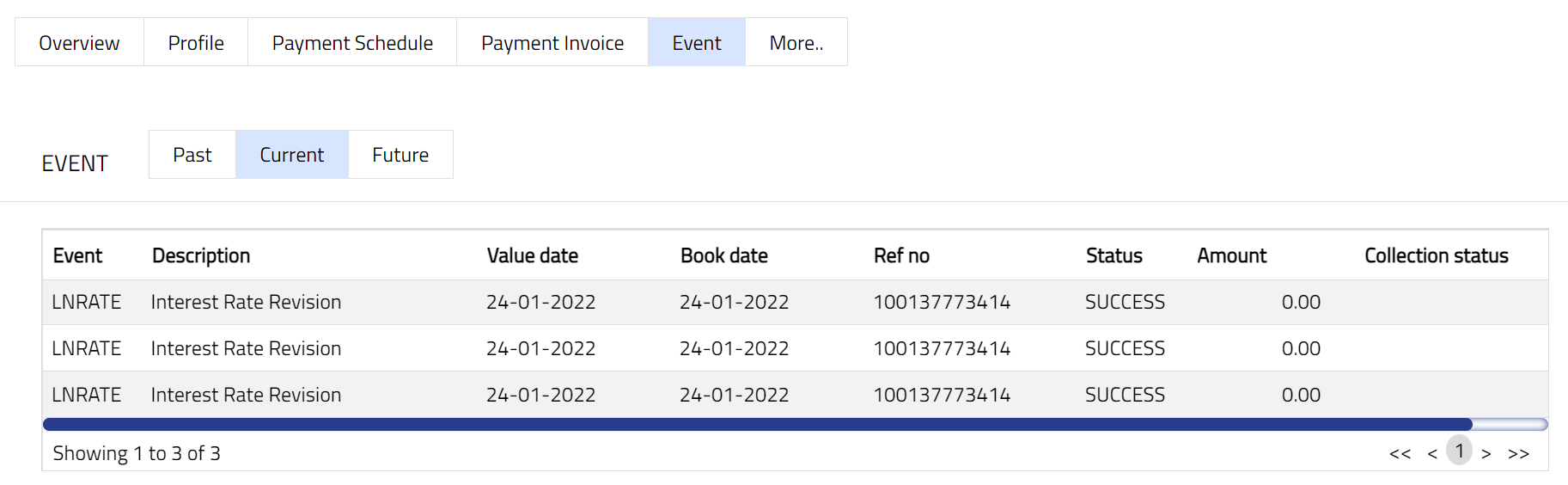

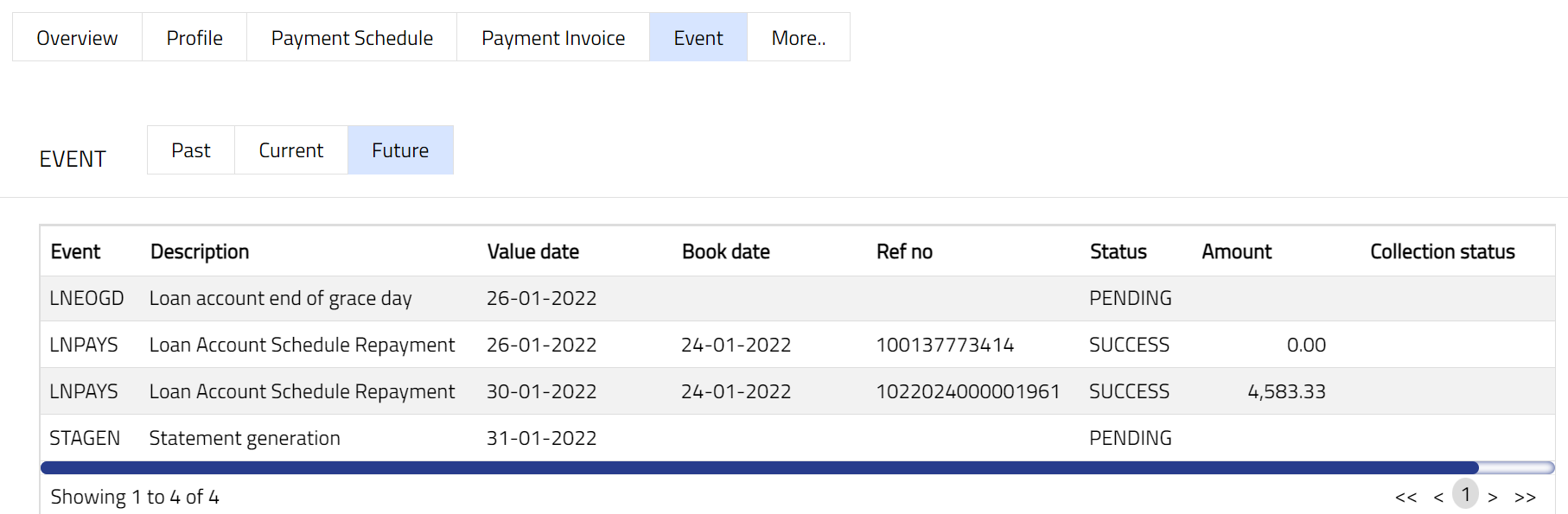

Event tab allows you to view the past, current and future events. This tab is non-editable.

To view the Events

- Access Loan Account screen. Click Event tab. There are three sub-tabs within it -- Past, Current and Future. By default, the Current tab is displayed. It shows the details of the Events that have Value Date as current business date. The Past tab and Future tab show details of events that have Value Date earlier than / later than the current business date respectively.

Note: If there are no event then the sub-tab will display blank as per the sample screen shot shown below.

A sample of the Past tab is shown below:

A sample of the Current tab is shown below:

A sample of the Future tab is shown below:

All the tabs show the following data:

Event: It displays the code for the event.

Description: It displays the description of the event.

Value Date: It indicates the date on which any event pertaining to the account gets applied. It can be back date, future date or current date.

Book Date: The date of entry / input of the event.

Ref No: The transaction reference number, if applicable, under which the event is processed.

Status: It displays the status of the event. The status can be of the following:

Pending: Where the event is not yet processed.

Success: Where the event has been processed successfully.

Failure: Where the event has failed during process.

Retry: Indicates a failed event where the system retries to process the event on subsequent business days.

Amount: It indicates the amount processed by the event. Example: Interest liquidation event will have the amount of interes liquidated.

Collection Status: If the Collection status is Pending, it indicates that the deferred charges has not been collected and if the Collection Status is Success, it indicates that the deferred charges has been collected.

The following shows the list of events for a Loan Account:

| Sl no | Event Code | Description | Condition |

|---|---|---|---|

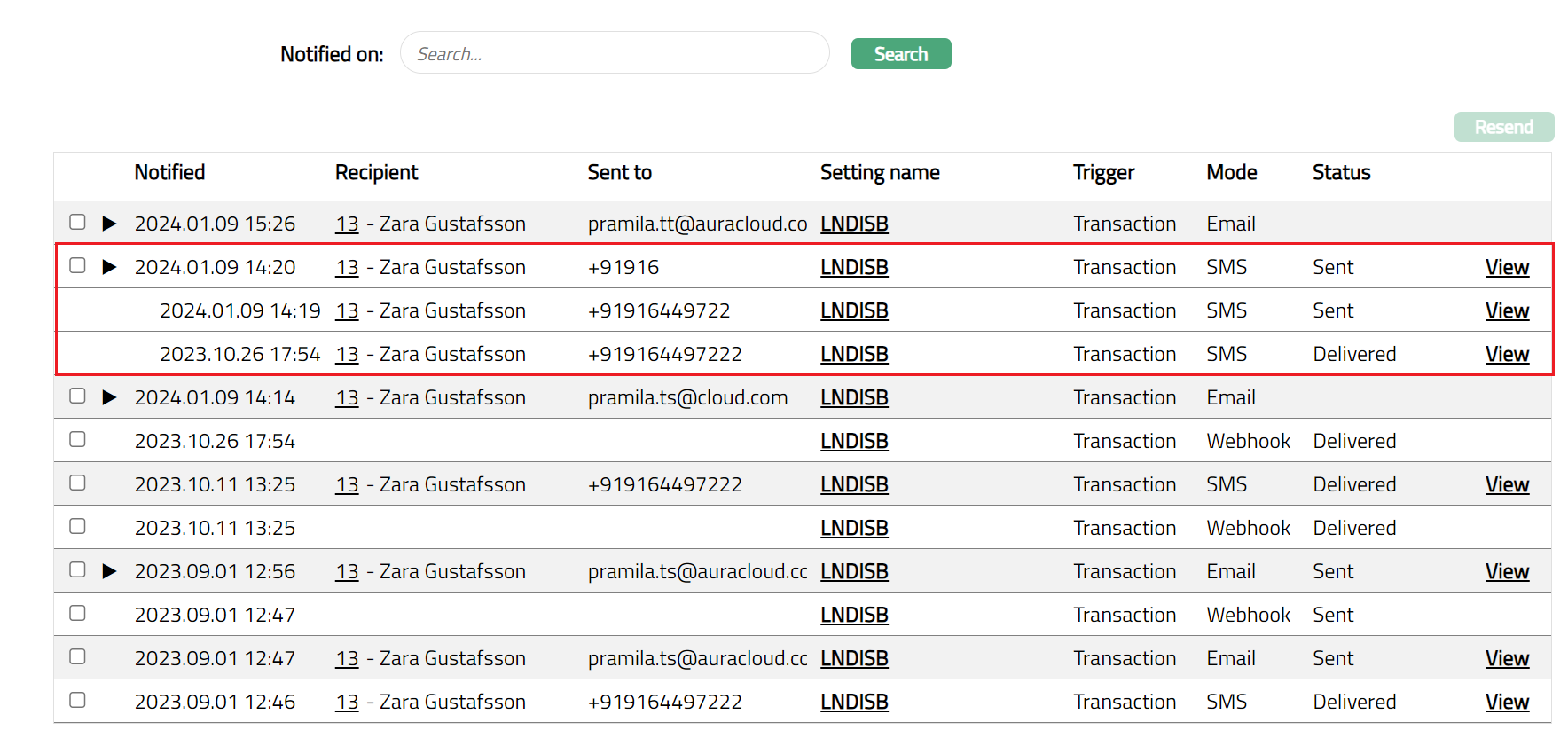

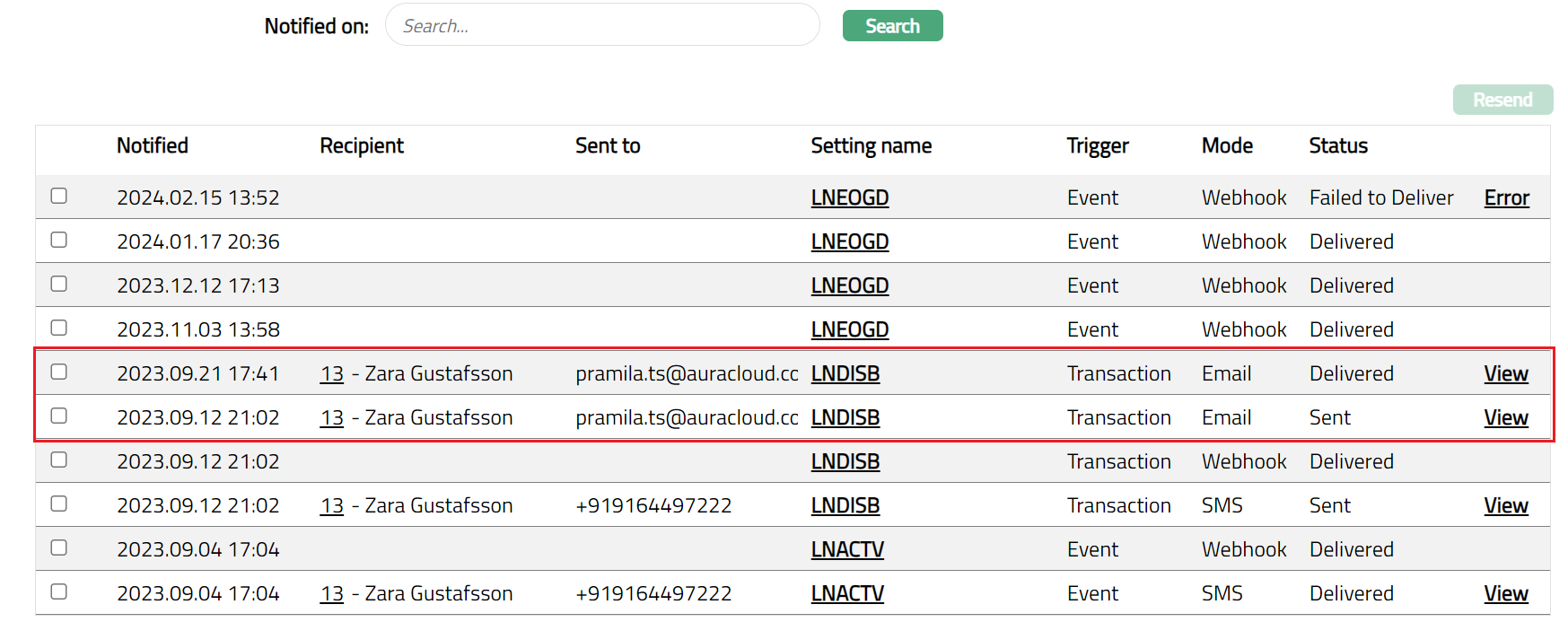

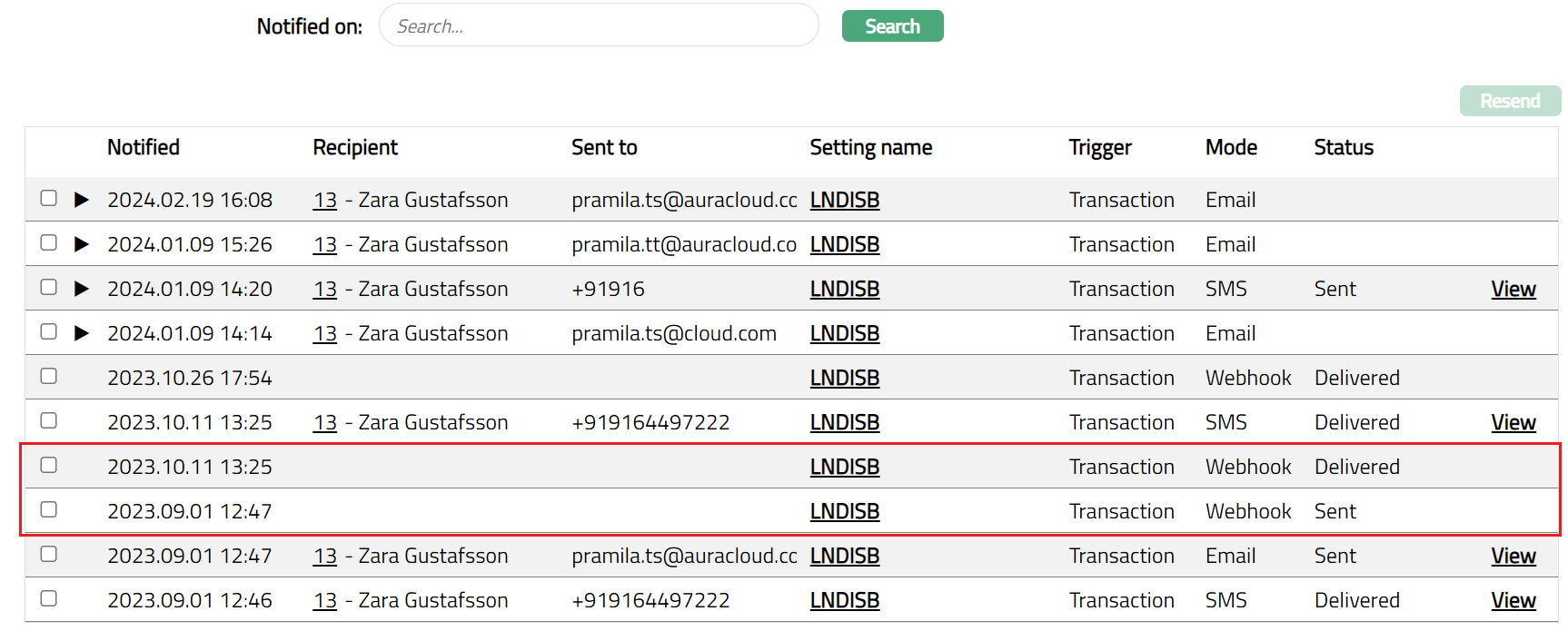

| 1 | LNDISB | Loan Disbursement | This event occurs when the loan amount is disbursed to the Loan Account |

| 2 | LNPAYS | Loan Account schedule payment | This event occurs when the payment is made based on the Payment frequency maintained under the Payment Settings tab. Payment made can be Auto or Manual |

| 3 | LNPAYP | Loan Account Prepayment | This event occurs when there is a manual prepayment of the loan |

| 4 | LNOPEN | Loan account opening | This event occurs when the account is opened, and it occurs only once, i.e., at the time of account opening |

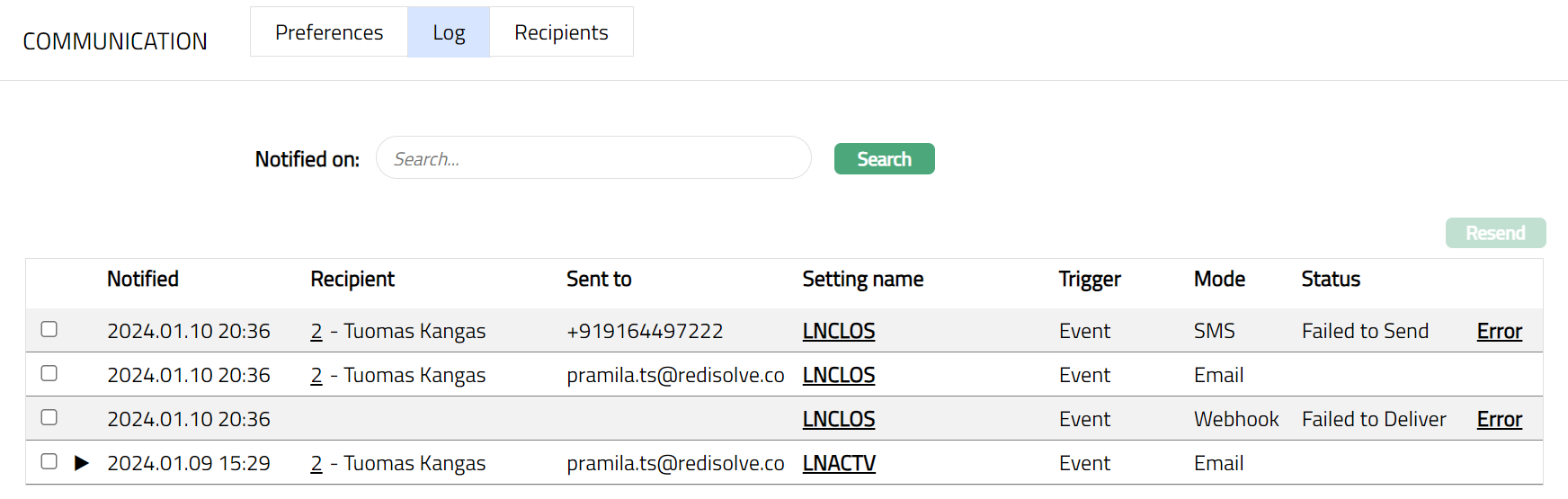

| 5 | LNACTV | Loan account activation | This event occurs when the account is in opened status and the user changes manually the status of the account from Opened to Activated |

| 6 | LNCLOS | Loan Closure | This event occurs when the Loan Account is closed, and it occurs only once. It can happen on maturity when there is a full payment of the loan or in case of pre-closure when the user does a full prepayment |

| 7 | LNRATE | Interest rate revision | This event occurs on approval of the latest interest record in Interest Base. On rate revision, the new rate is brought into effect by assigning the new rate to existing accounts |

| 8 | LNSCHG | Loan account schedule generation | This event triggers the next LNPAYS |

| 9 | STAGEN | Statement generation fee | This event occurs when a statement is generated in the Loan Account based on the frequency. If a statement fee is attached, it will also be displayed |

| 10 | REMGEN | Reminder generation | This event occurs when a reminder is attached to the Loan Account and, based on the frequency, the reminder is generated. If a reminder fee is attached, it will also be displayed |

| 11 | LNACCR | Loan interest accrual | This event occurs every day for loan interest accrual |

| 12 | EVNPOP | Event population | This event triggers other events |

| 13 | LNRVPP | Reversal prepayment | This event is manually triggered for reversal of Loan Account Prepayment |

| 14 | LNRVPY | Reversal payment | This event is manually triggered for reversal of Loan Account Payment |

| 15 | LNACST | Loan account status | If Move Account Status To is maintained as a rule at the Product level with an associated fee, and if the rule satisfies, then this event is triggered, and an Account Status fee is charged at the account level |

| 16 | RBIMPR | Re-book/re-calculate impairment on cash flow | This event triggers when re-booking is done for already booked impairment in case of cash flow, and in case of account, the status remains the same as the booked impairment status |

| 17 | RIMPAR | Impairment re-balancing for loans | This event triggers when booked impairment is reversed as per previous status, i.e., if statuses (account & payment) change happen |

| 18 | IMPAIR | Impairment booking for loans | The account status maintained in Impairment settings for the loan Product, which is attached to the Loan Account; and when the Loan account moves into the status as per the rules maintained in Impairment settings for the loan Product, then the IMPAIR event triggers, and impairment is booked |

| 19 | DOUREC | Doubtful receivable processing for loans | The account status maintained in Impairment settings for the loan Product, which is attached to the Loan Account; when the Loan account moves into the status as per the rules maintained in Impairment settings for the loan Product, and if the treatment is Doubtful receivable, then DOUREC event triggers |

| 20 | AWRTOF | Write off processing for loans | The account status maintained in Impairment settings for the loan Product, which is attached to the Loan Account. When the Loan account moves into the status as per the rules maintained in Impairment settings for the loan Product, and if the treatment is Write off, then AWRTOF event triggers. When the AWRTOF event triggers, if a write-off amount is maintained at the Loan Product, the amount specified will be written off from the loan current balance. If the booking amount is maintained as the Principal amount, then the principal amount is reduced from the loan current balance |

| 21 | PROVIS | Provision processing for loans | The account status maintained in Impairment settings for the loan Product, which is attached to the Loan Account. When the Loan account moves into the status as per the rules maintained in Impairment settings for the loan Product, and if the treatment is Provision, then PROVIS event triggers and impairment amount is booked |

| 22 | INSUSP | Insurance Suspension | This event is triggered when an insurance plan is suspended |

| 23 | INACTV | Insurance Re-activation | This event is triggered when an insurance plan is reactivated |

| 24 | INEXPY | Insurance expiry | This event is triggered when an insurance plan is expired. This event will trigger only on the effective date |

| 25 | ININIT | Insurance plan initiation | This event is triggered when an insurance plan is initiated |

| 26 | LNLIQD | Loan Account Liquidation | This event occurs only when a Loan has been liquidated or paid back |

| 27 | CAINPR | Insurance premium | This event is triggered when an insurance premium is paid. This event will trigger only on the date when the premium is paid |

| 28 | ADDFEE | Additional charge | This event occurs based on the periodicity of the charges linked to the account as Additional charges |

| 29 | ADHFEE | Adhoc charge fee | This event occurs when an account is charged for an adhoc charge fee |

| 30 | CHGAMR | Charge Amortization | |

| 31 | LNPYST | Loan Account Payment Status | This event occurs when the status of the Loan Account changes automatically after the payment is made |

| 32 | LNAMRT | Loan account advance interest accrual | This event occurs when interest that has been accumulated on a Loan Account is paid in advance |

| 33 | CONSAV | Contractual savings due | This event occurs when Contractual savings (Savings which are made on a regular basis) become due |

| 34 | VOLSAV | Voluntary savings amount | This event occurs when a user (individuals or organizations) voluntarily deposits |

| 35 | LNRVDB | Loan Account Disbursement Reverse | This event occurs when any Loan Account disbursement is reversed |

| 36 | LNEOGD | Loan account end of grace day | This event occurs only when the grace day for the Loan Account ends |

| 37 | INVCNC | Invoice Cancellation | This event occurs when you cancel any invoice |

| 38 | LNPSIM | Loan Payment Simulation | |

| 39 | LNPPSU | Payment plan suspend | This event occurs when an active payment plan linked to the Loan Account is suspended before completion. |

| 40 | LNPPEX | Payment plan expiry | This event occurs when the payment plan linked to the Loan Account reaches its configured end date and expires. |

| 41 | LNPRNO | Loan account product novation | This event occurs when the product associated with a Loan Account is changed through a product novation process. |

| 42 | LNCURC | Loan Curing Capitalization | This event occurs when curing capitalization is applied to the Loan Account as part of the loan curing process. |

| 43 | LNINPR | Insurance premium | This event occurs when an insurance premium linked to the Loan Account is paid. |

| 44 | LNINSP | Insurance suspension | This event occurs when an insurance plan linked to the Loan Account is suspended. |

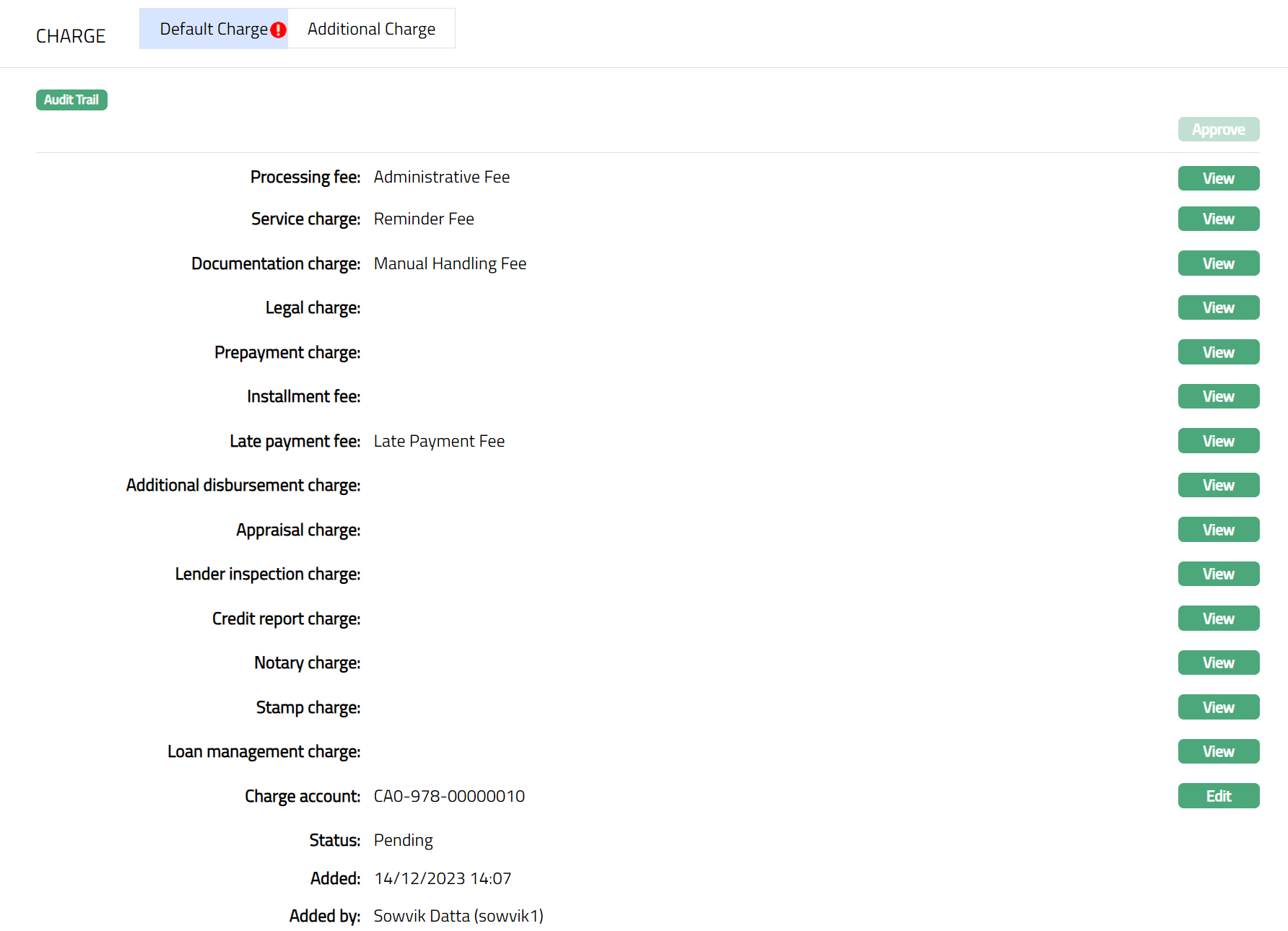

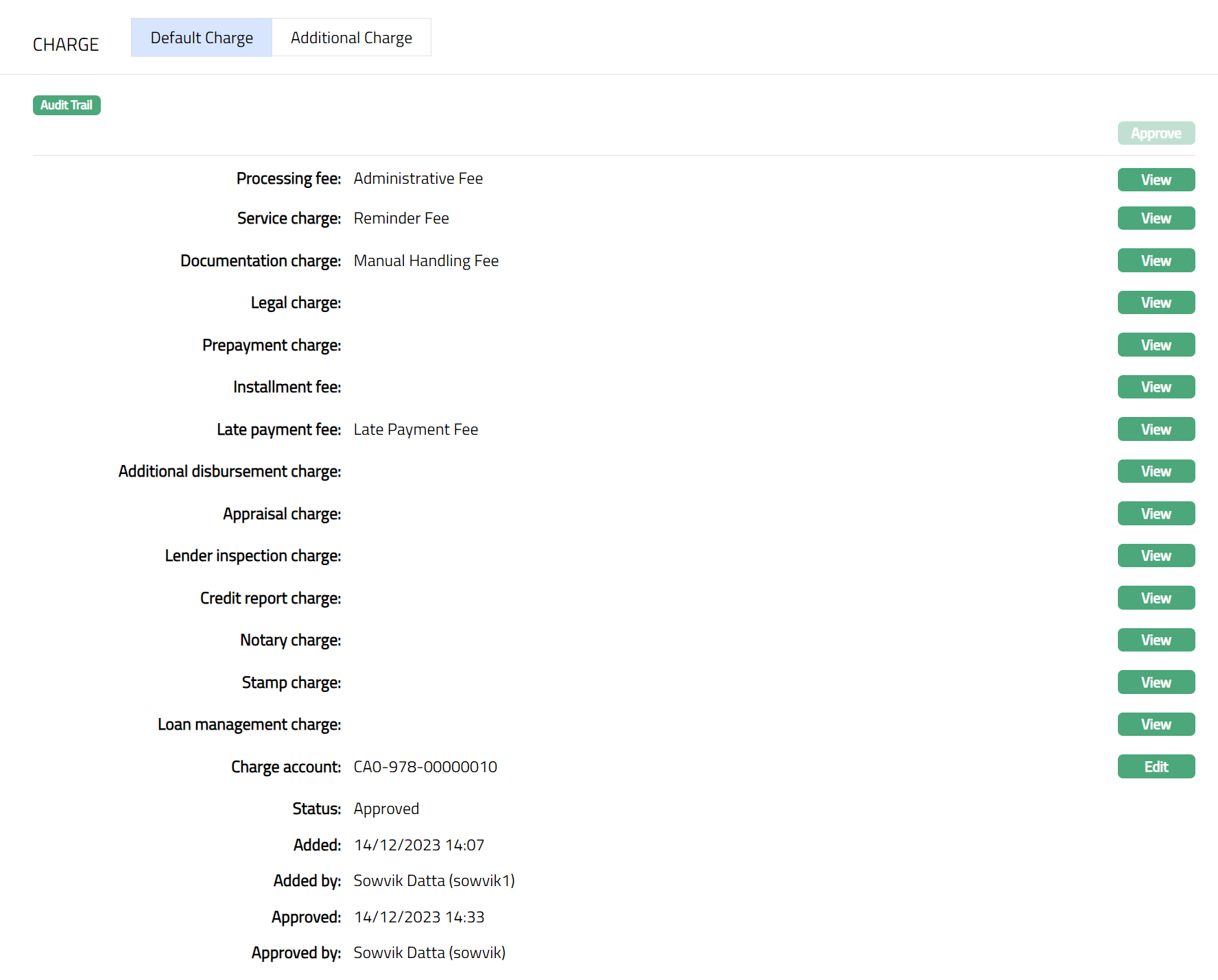

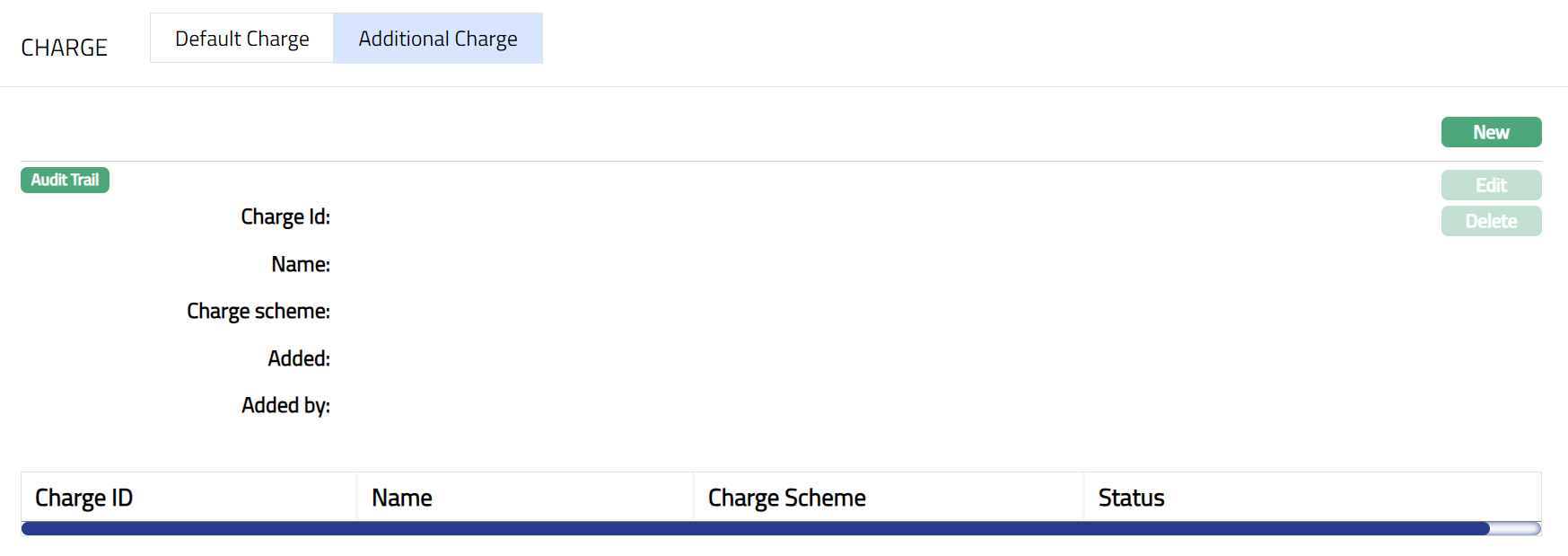

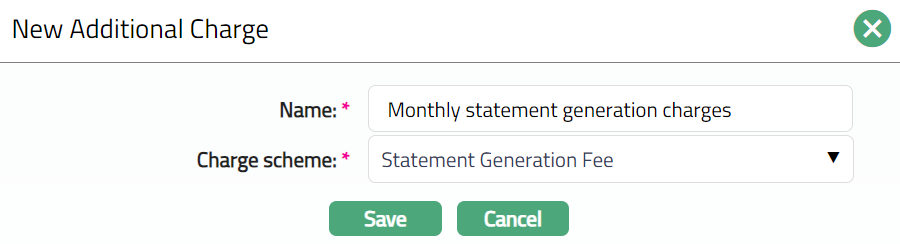

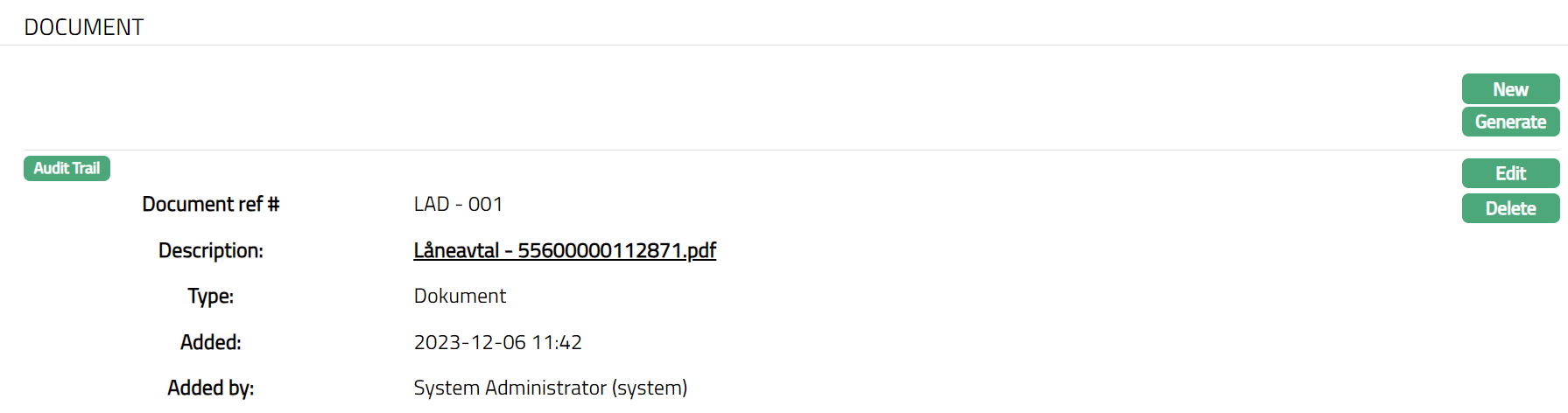

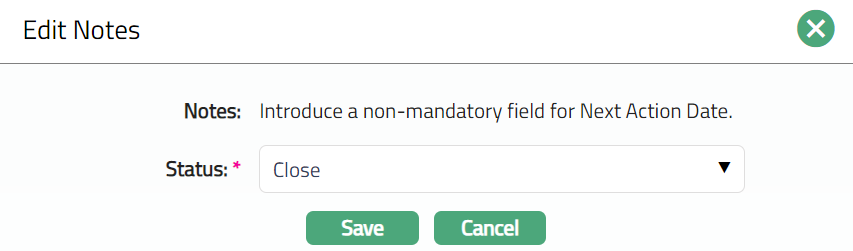

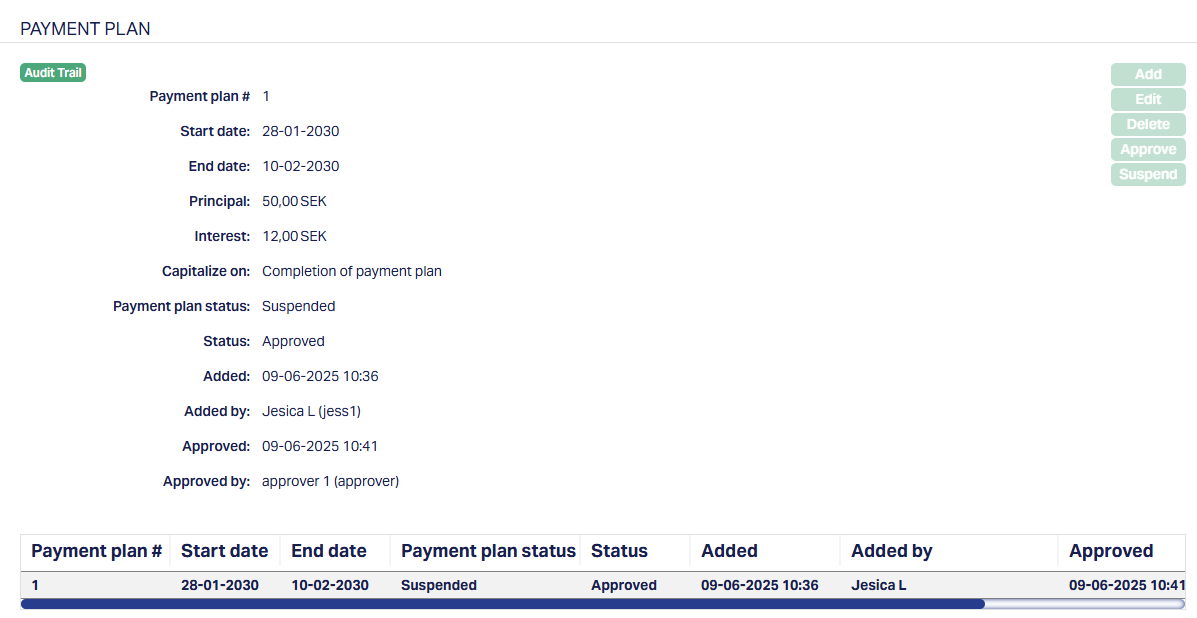

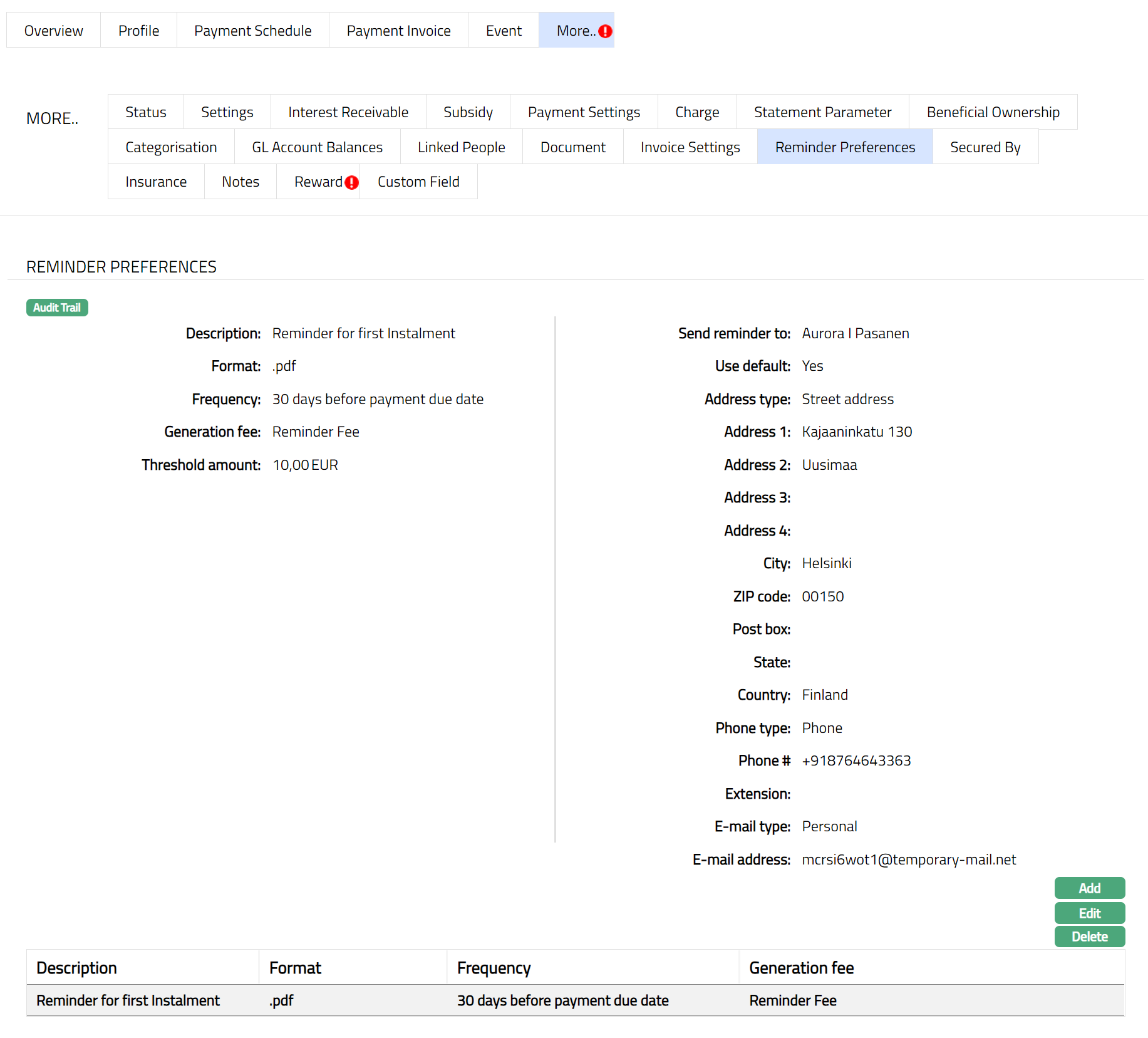

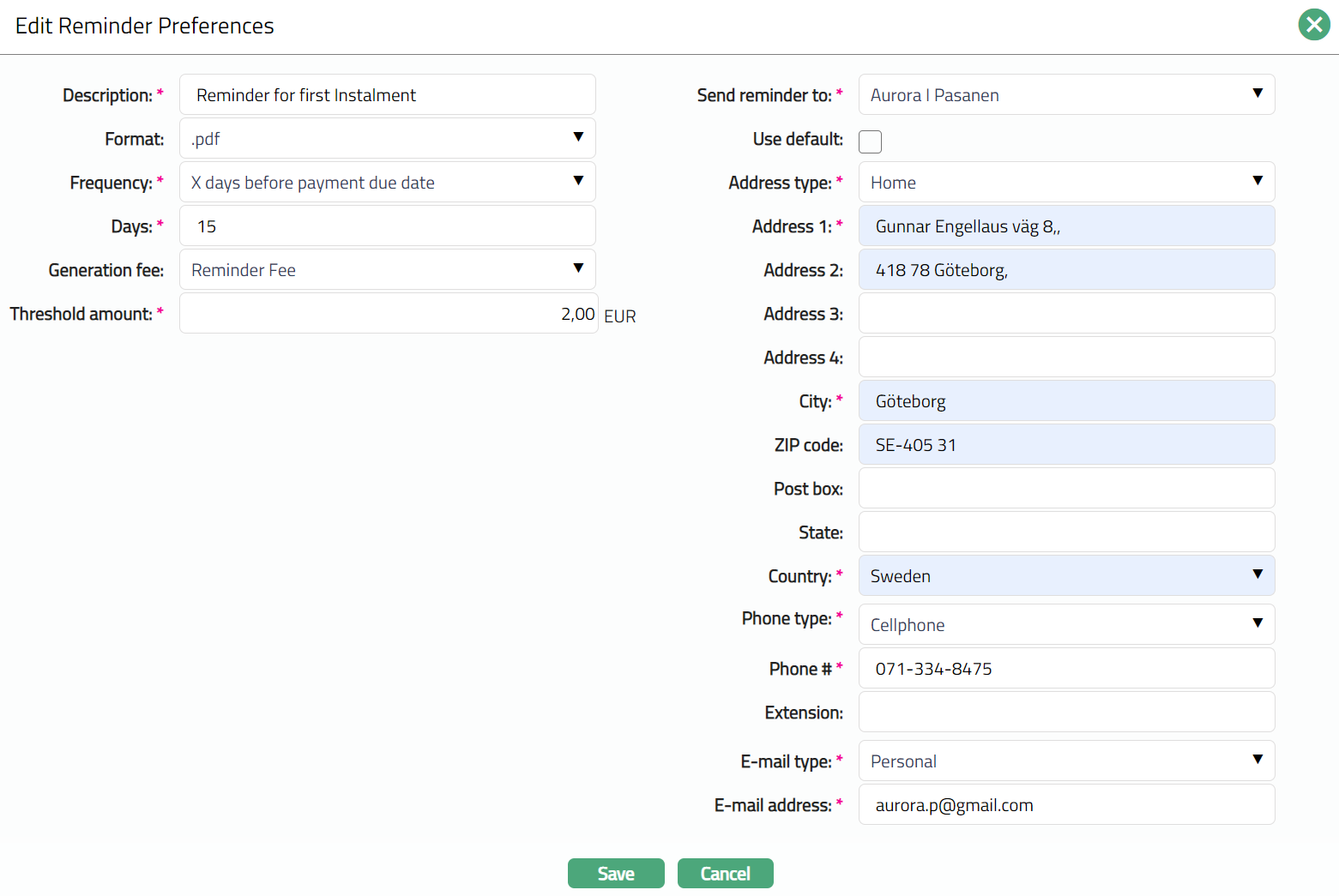

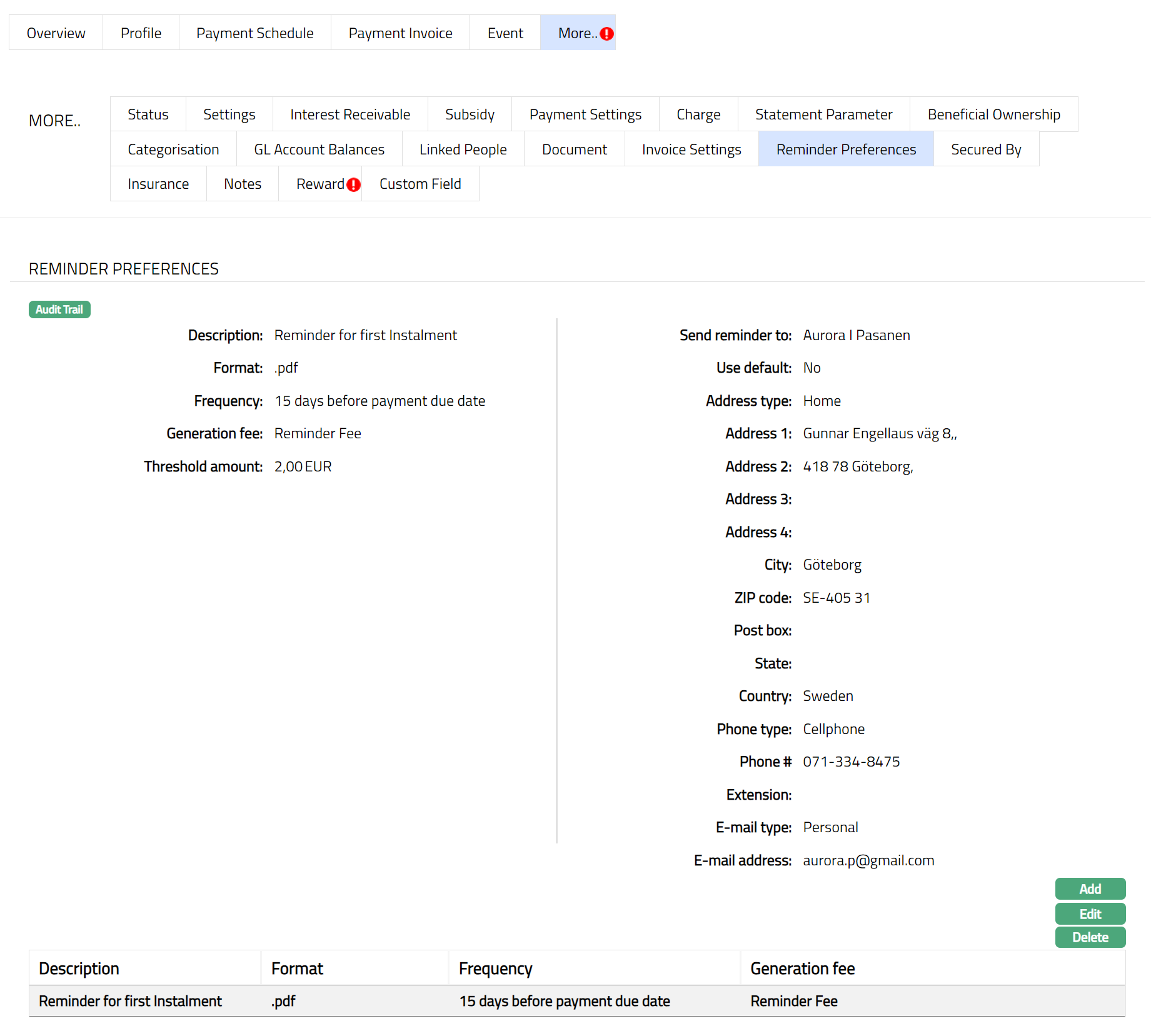

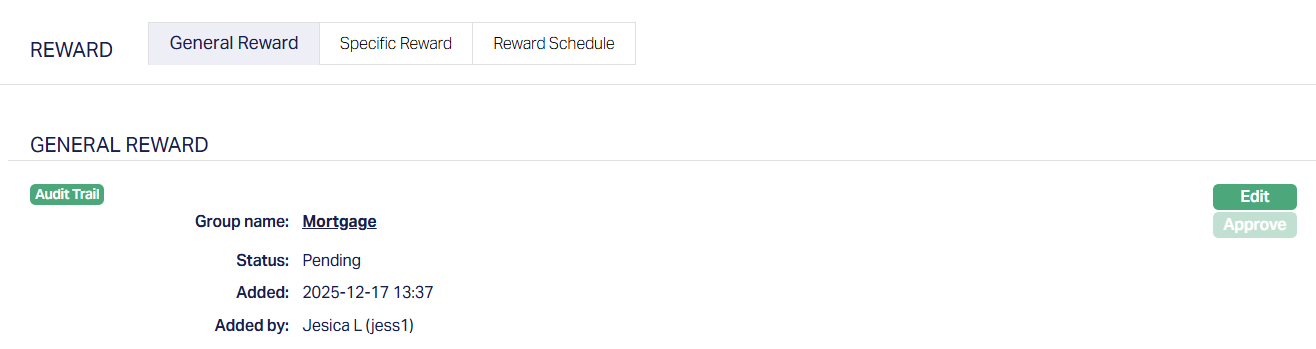

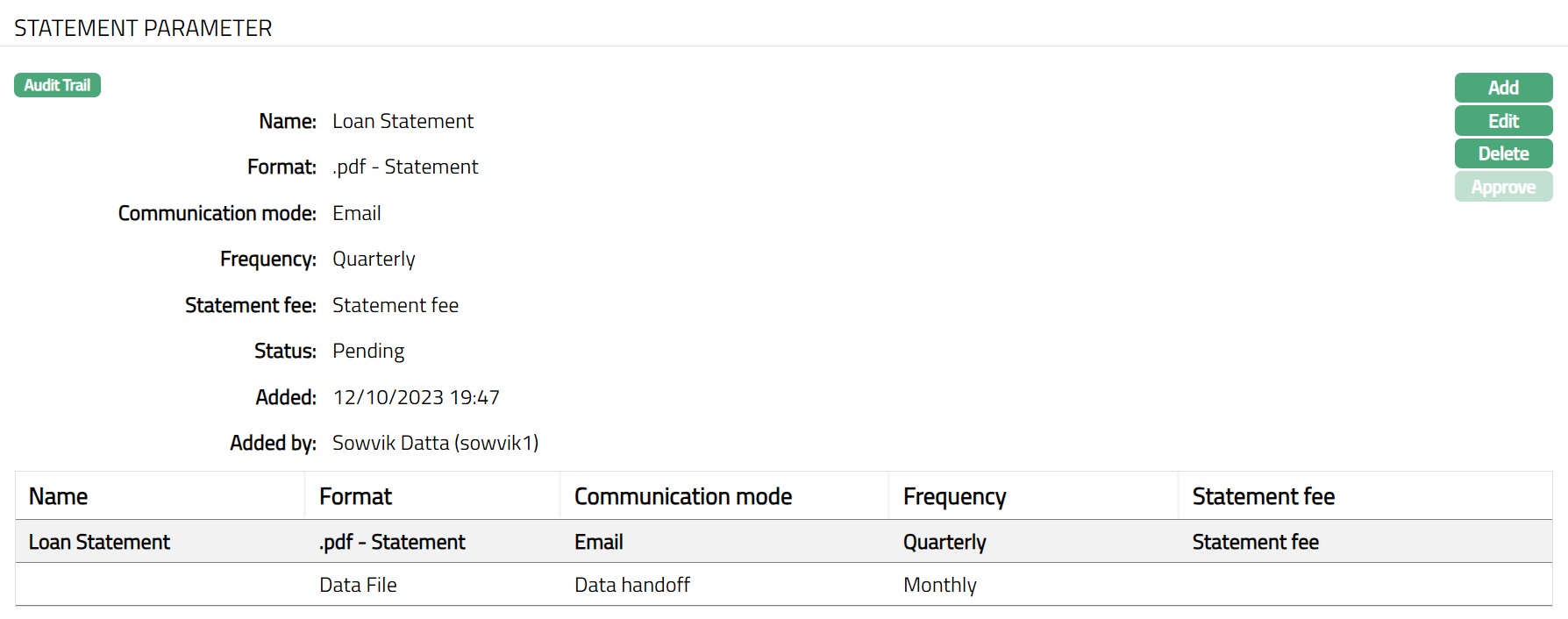

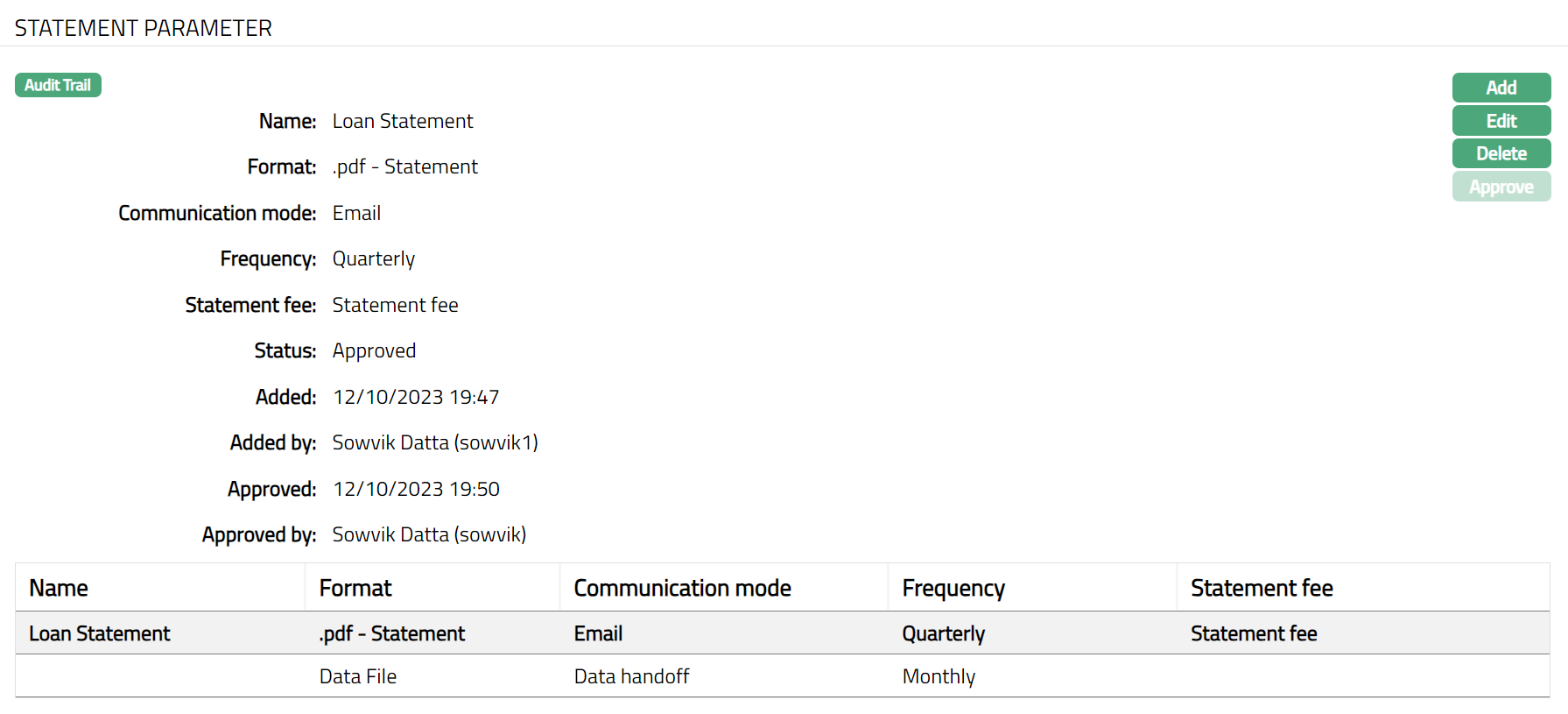

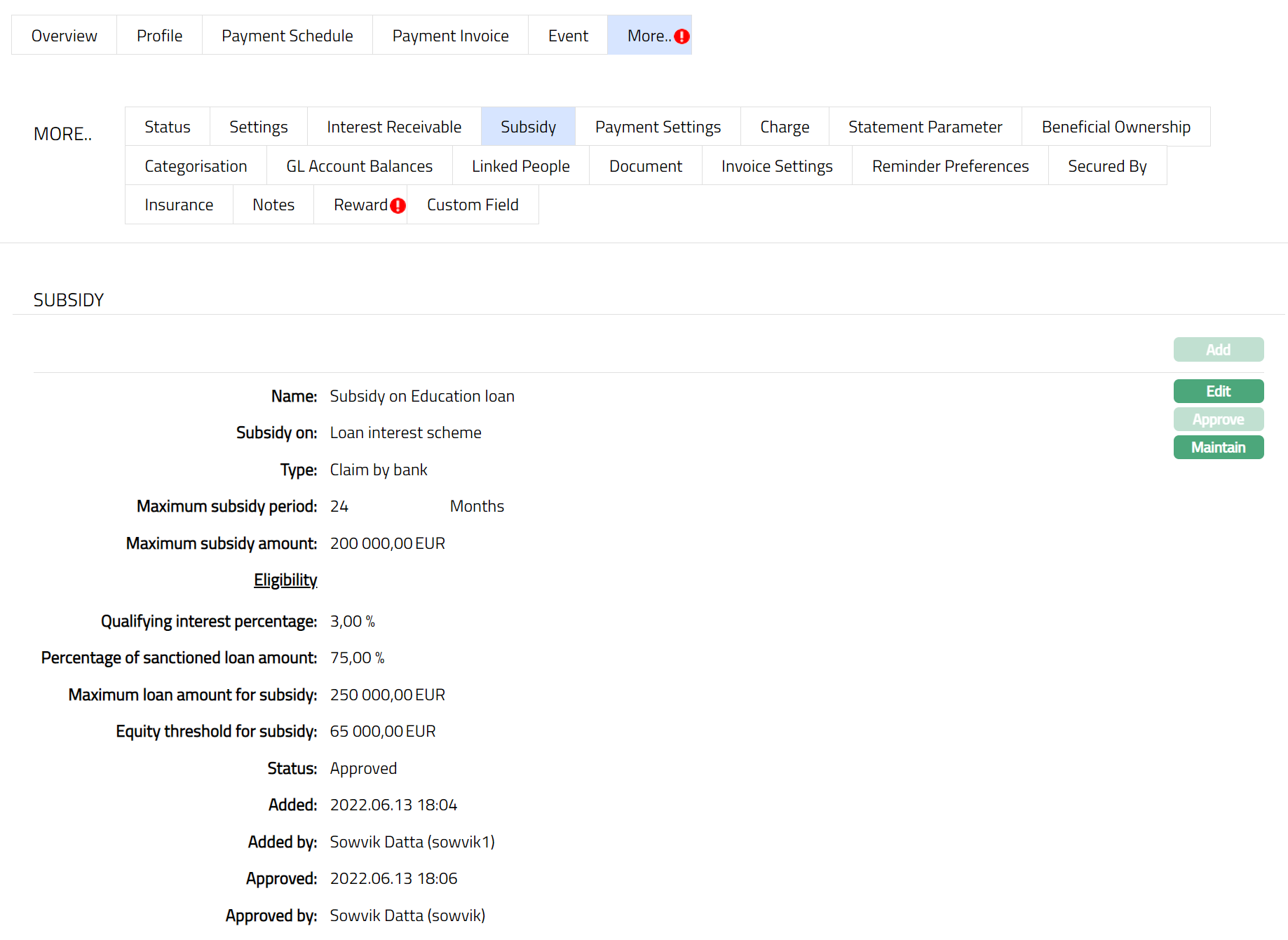

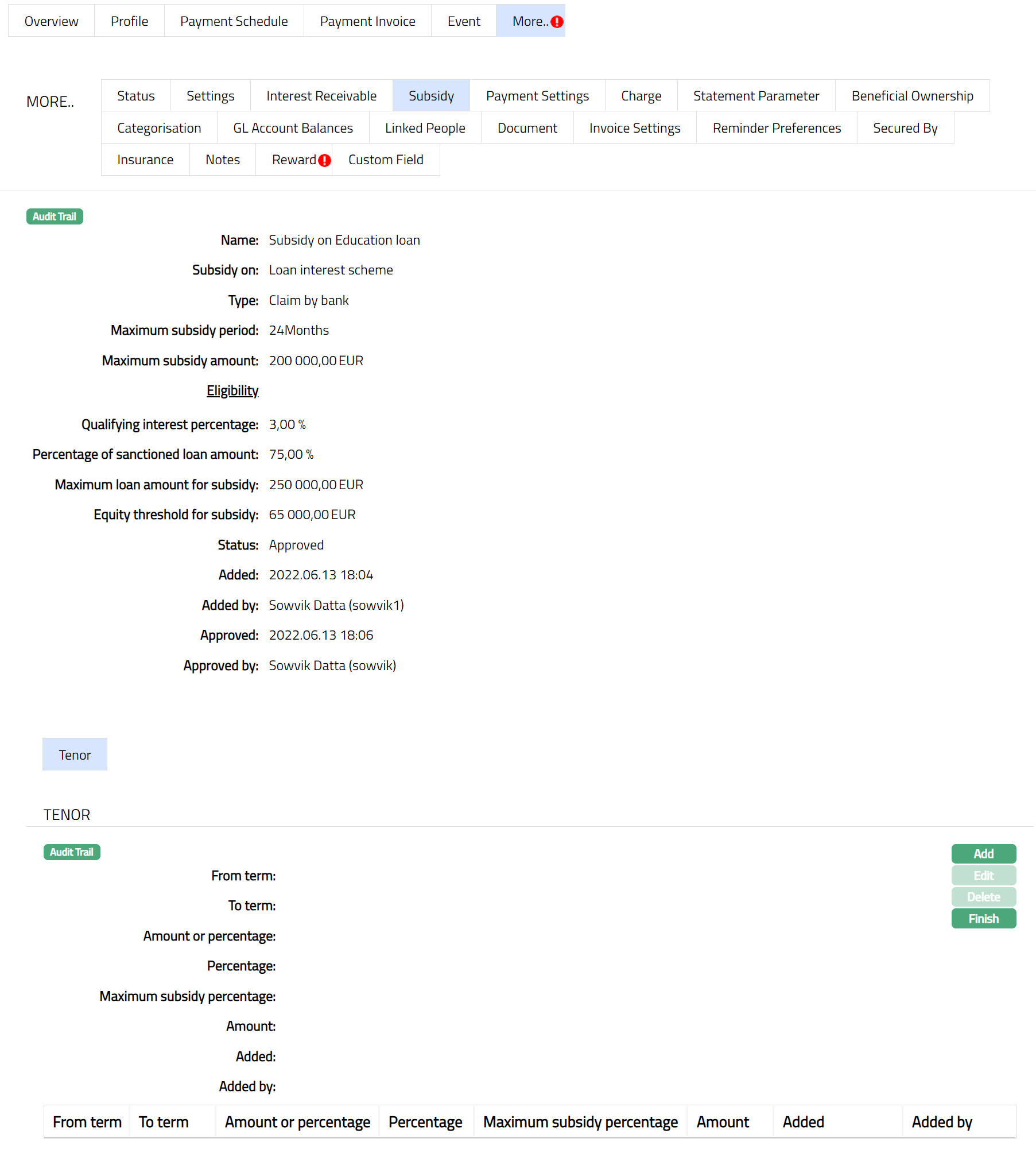

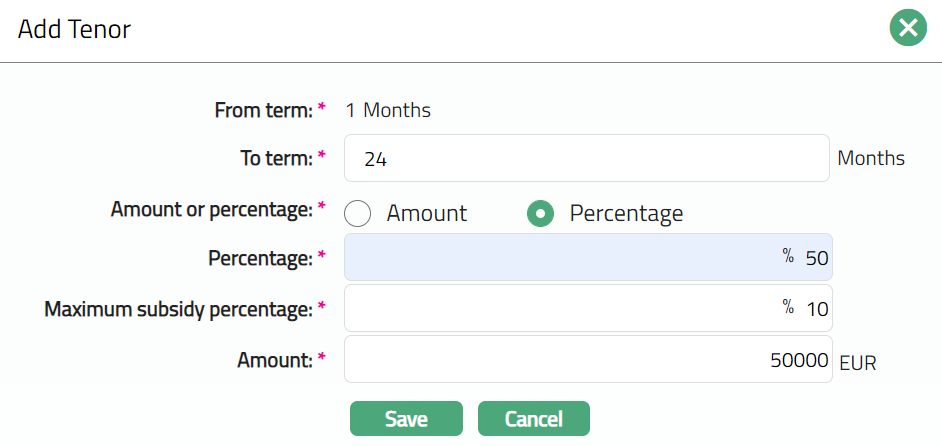

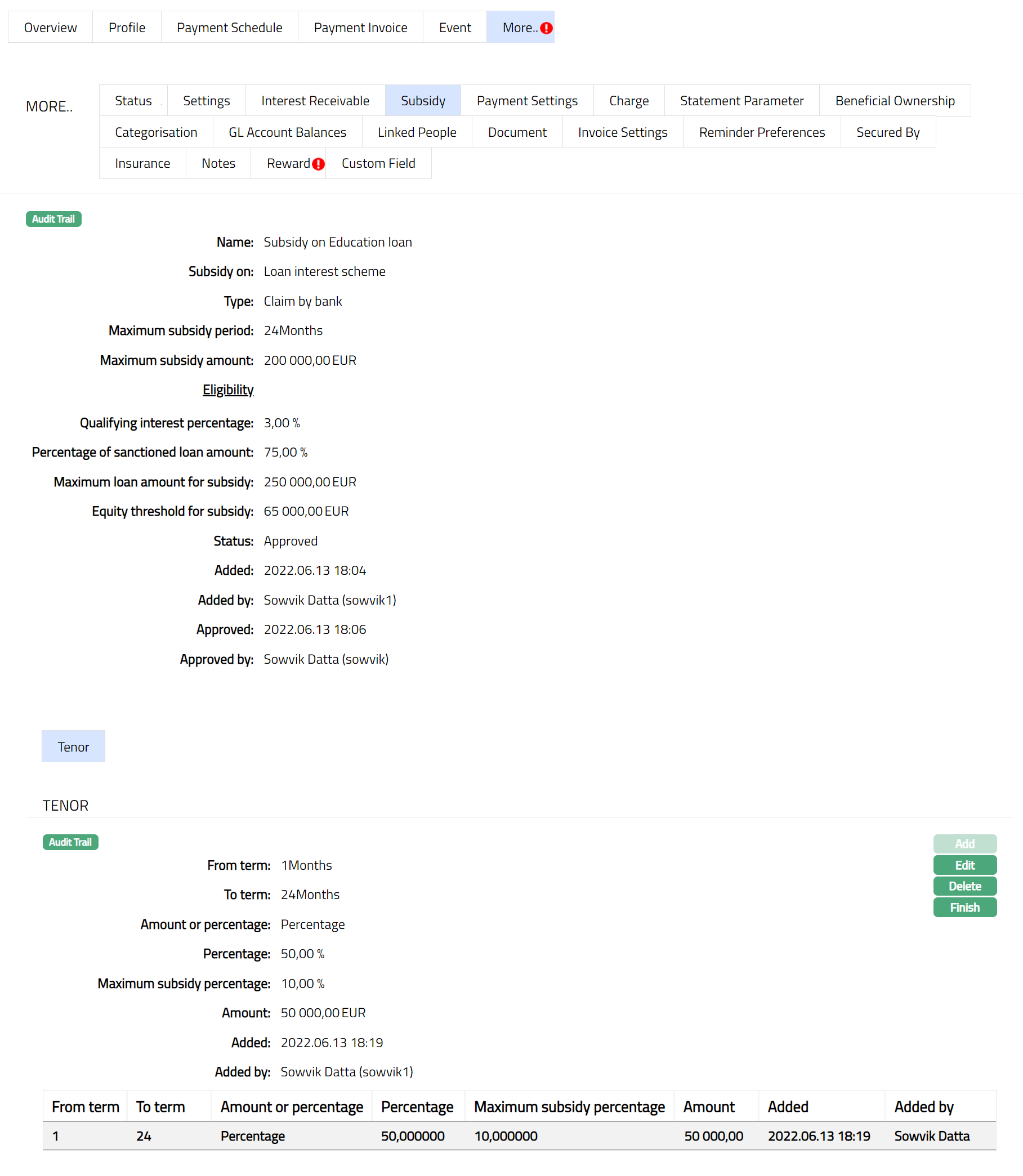

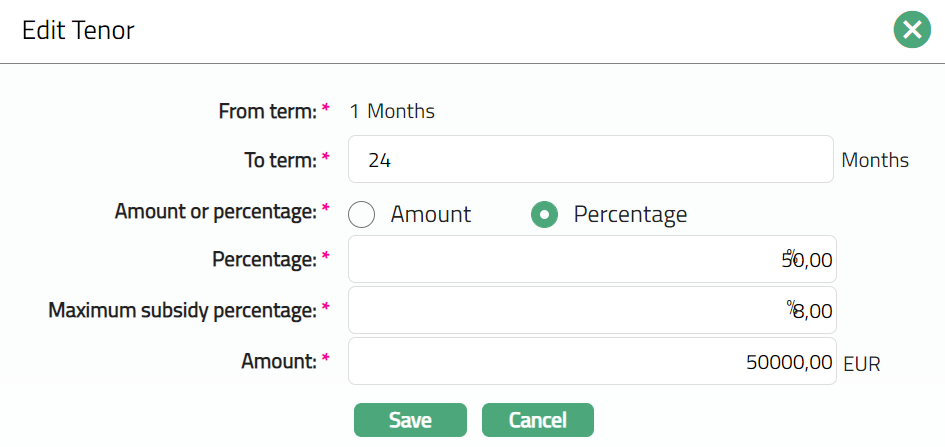

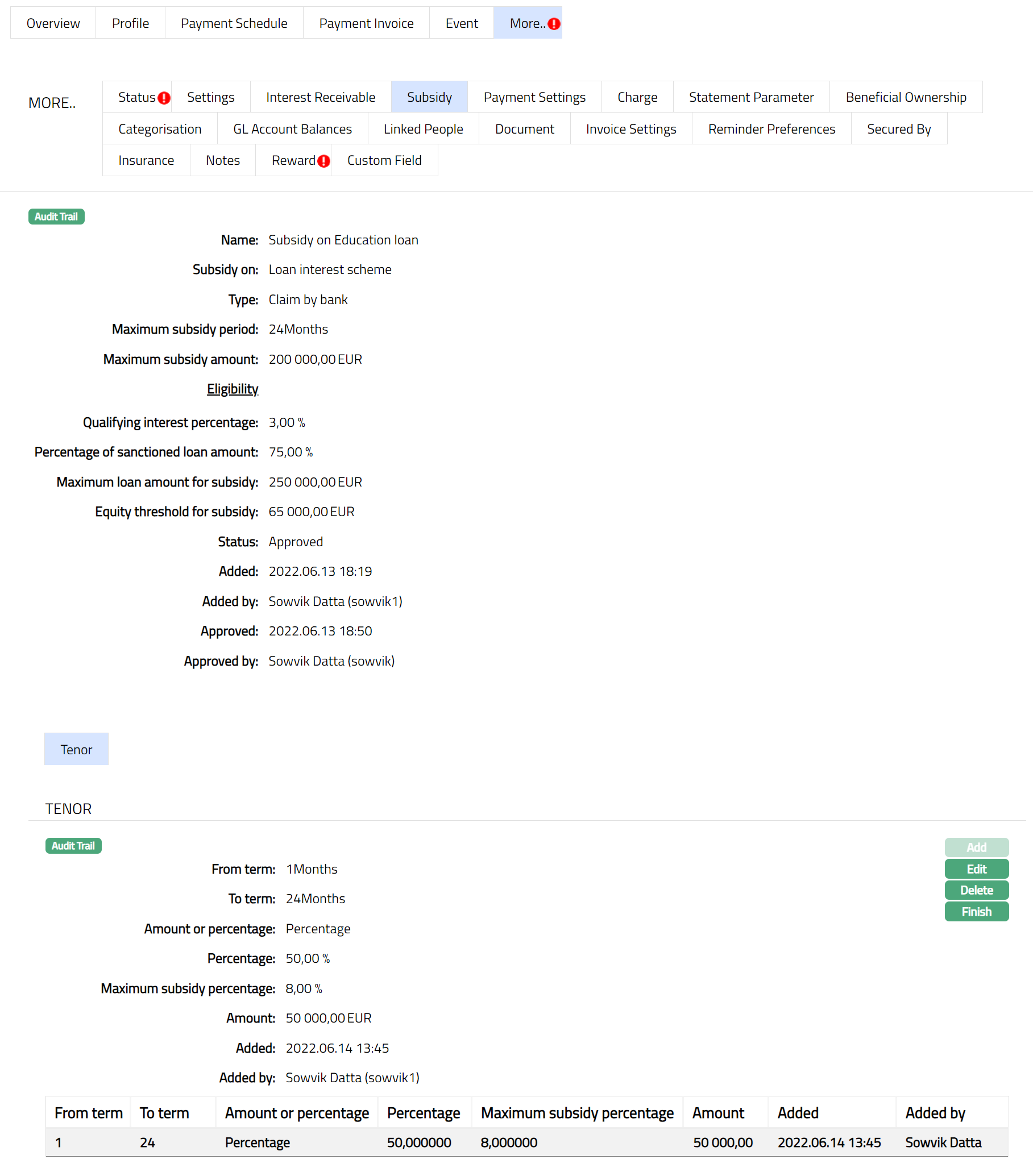

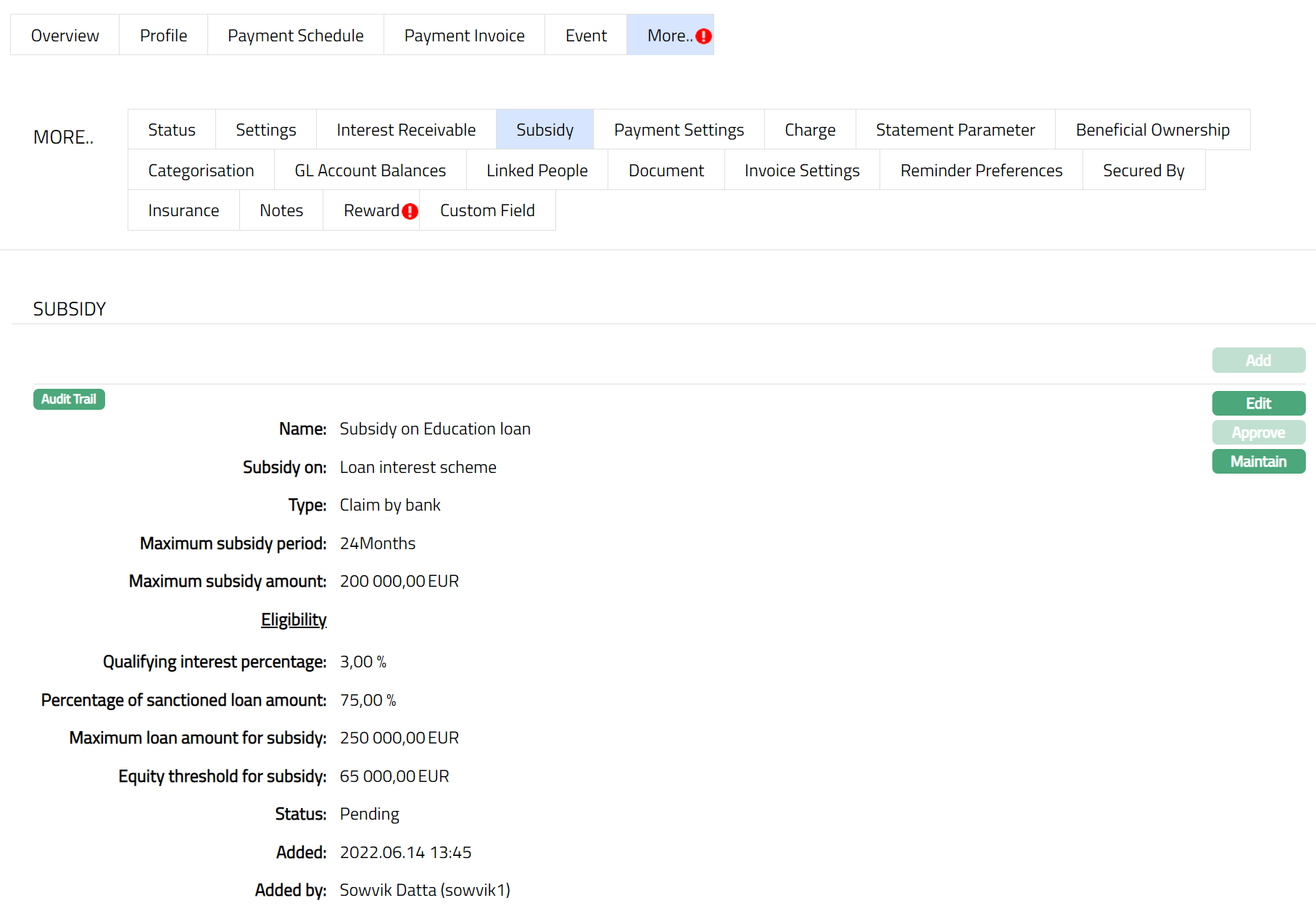

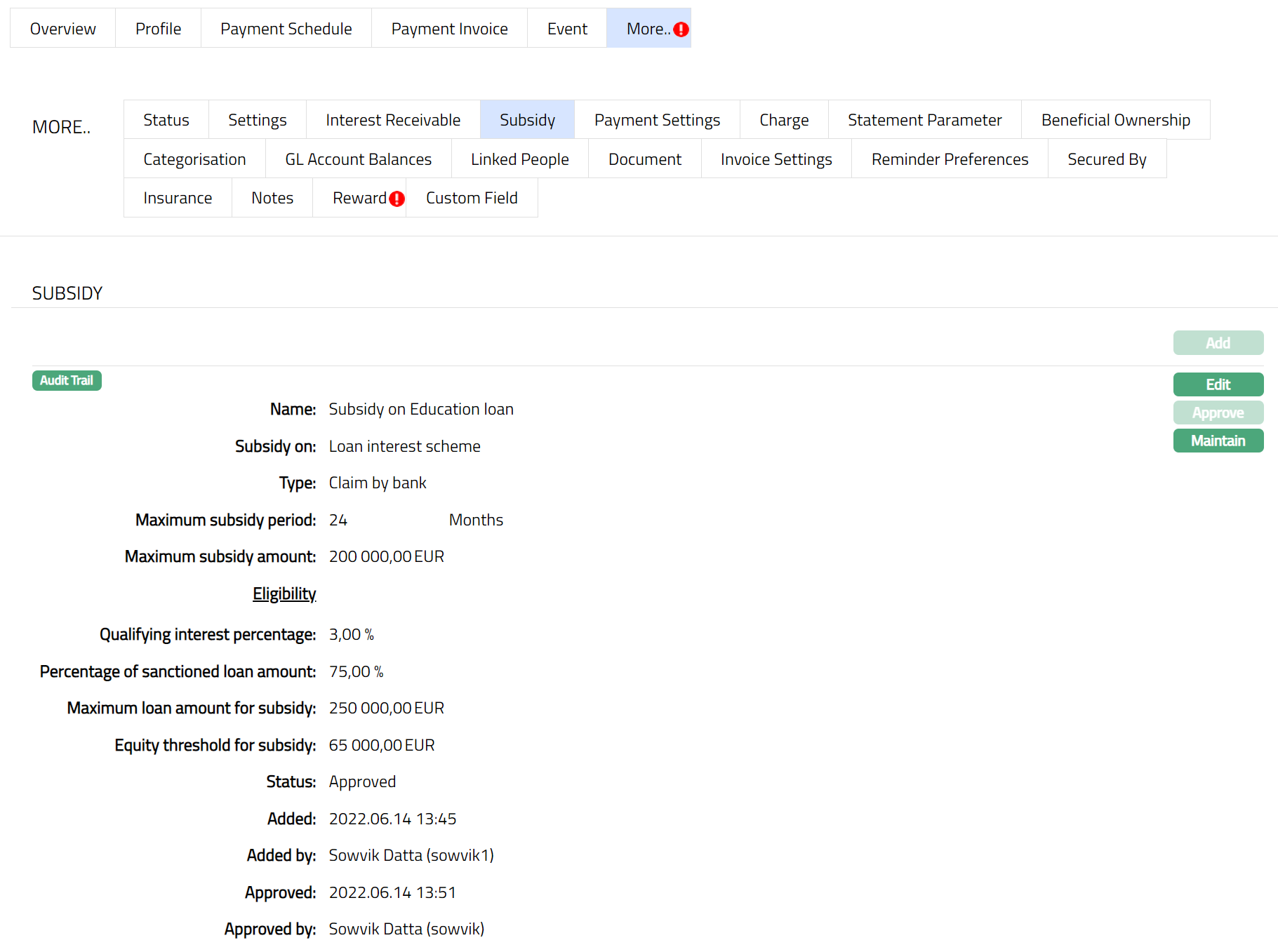

| 45 | LNINCN | Insurance cancellation | This event occurs when an insurance plan linked to the Loan Account is cancelled. |