Factoring Status

The Factoring Status screen allows you to define and manage custom statuses that can be applied to Factoring Contracts in Aura. These statuses help you track contract progress and enforce specific business rules through preferences such as fee restrictions, auto-movement behaviour, and penalty controls.

Just like Loan Statuses, you can configure both Account Statuses and Payment Statuses for factoring. These statuses, once defined, will be available for use in multiple factoring-related screens like Factoring Contracts, Status Rules, etc.

The following are the various tabs that appear on the Factoring Status page:

To add a new Factoring Status record,

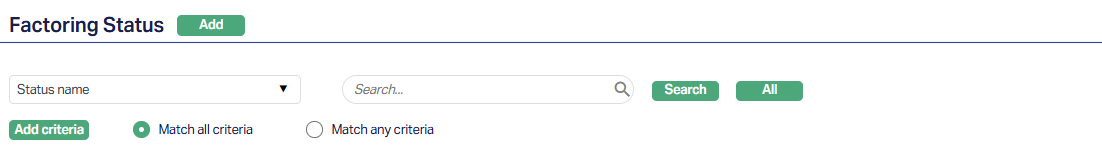

1. From the Admin menu, click Status, and then Factoring Status. The Factoring Status search page appears.

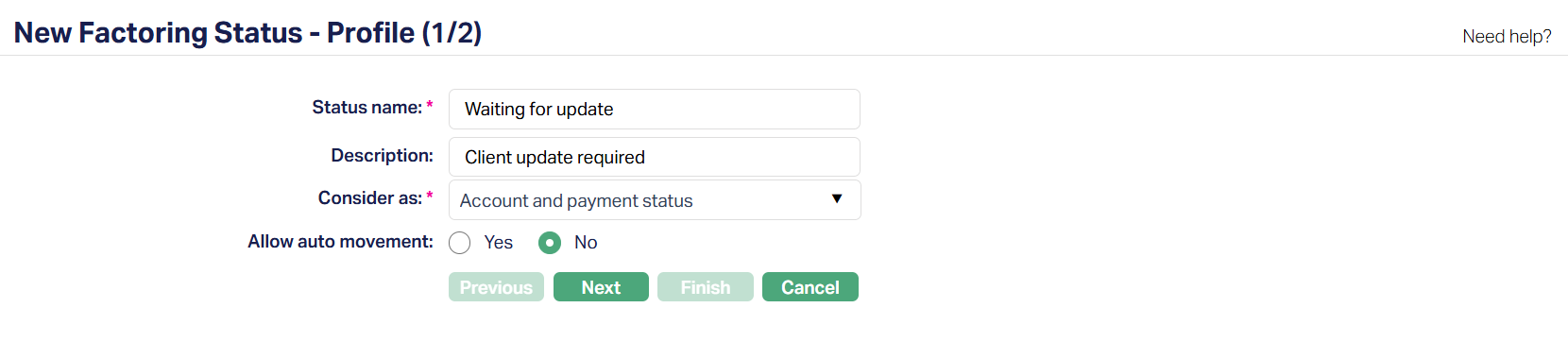

2. Click Add. New Factoring Status -- Profile (1/2) page appears.

3. Enter the name of the status in the Status Name field.

4. Enter Description for the status.

5. Select option from Consider as from the available drop-down list of Pre-shipped values. The values are -- Account Status, Payment Status, Account and Payment status.

If the Payment Status option is selected, then the Allow auto movement field will not appear.

6. Select option for Allow auto movement; this option will be available only when the Factoring status is considered as an Account status or when the Factoring status is considered as both Account status and Payment status.

When an account reaches this status, the Allow auto movement flag will be defaulted into the account from this maintenance. If Allow auto-movement is No, the account status will not automatically move even if the account satisfies the Rules maintained in the product's Rule Builder tab.

However, if Allow auto movement is selected as Yes, then the account status will change automatically, as per the Rules in the Rule Builder tab.

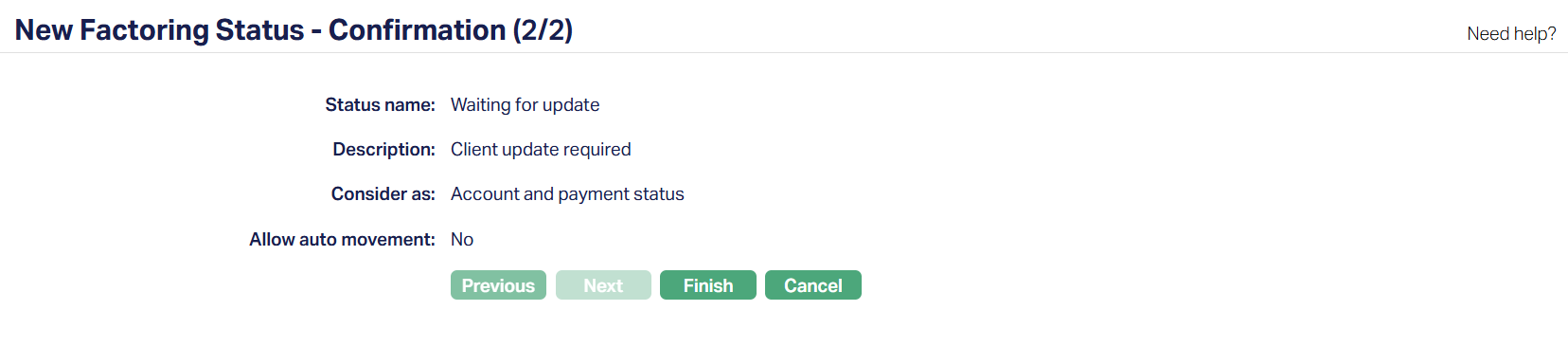

7. Click Next. New Factoring Status -- Confirmation (2/2) page appears.

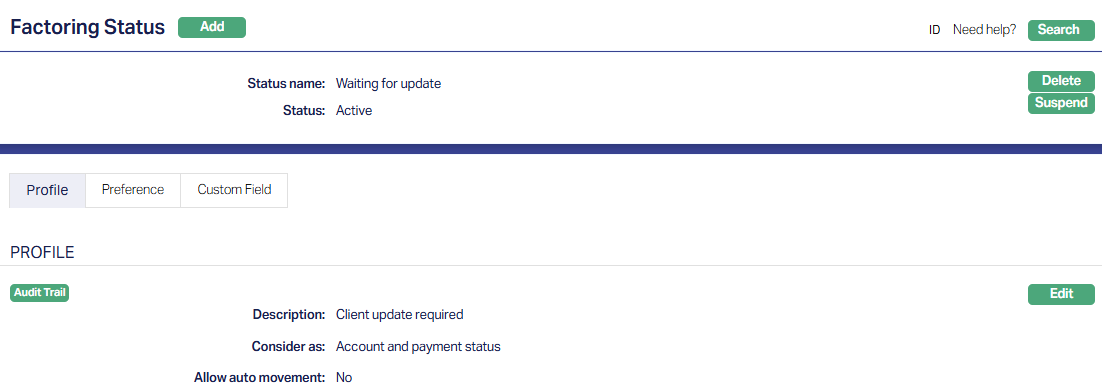

8. Click Finish. Factoring Status page appears displaying the details of the Status you added.

Status of the record will be Active.

Functions: Add, Search, Edit, Suspend, Activate, Delete

Delete: You can delete a Factoring Status record saved in Aura by a click on Delete button. Aura will ask for confirmation, on approving which the selected record will be deleted.

Suspend: You can suspend a Factoring status record by clicking on Suspend button. When you click on Suspend button, Aura will ask for confirmation. On confirmation Aura will suspend the Factoring Status and Activate button will appear in place of the Suspend button. The status of the Factoring Status is set to Suspended.

Activate: If you want to activate a suspended Factoring Status record then click on Activate button. Aura will ask for confirmation. On confirmation Aura will activate the Factoring Status and Suspend button will appear in place of Activate button. The status of the Factoring Status is set to Active.

Tabs Overview:

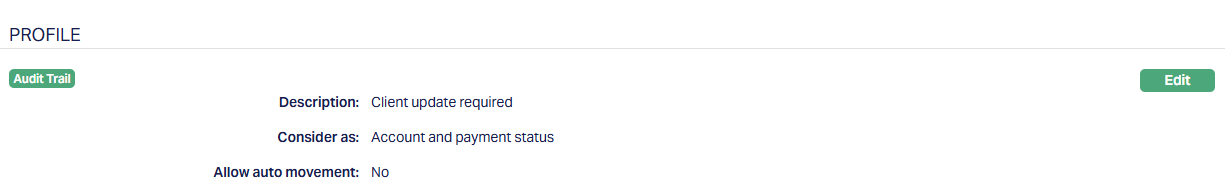

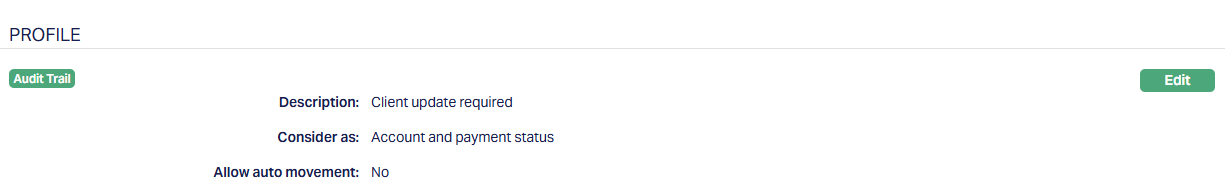

Profile

Profile tab, which is the default tab in Status screen, shows the basic status details which were added in New Factoring Status -- Profile (1/2)

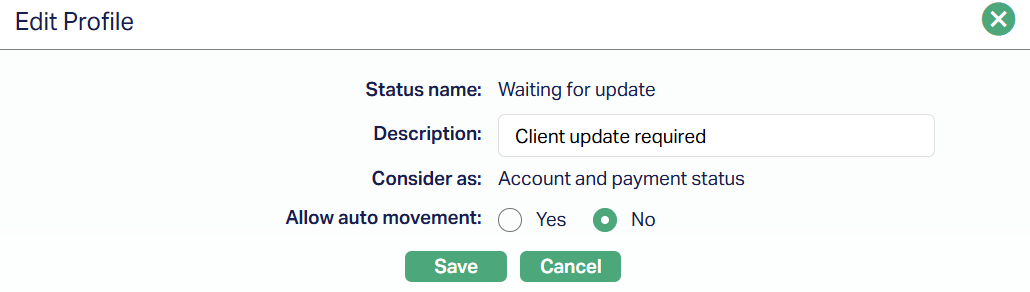

To Edit the Status

1. Access Factoring Status page. By default Profile tab will be displayed.

2. Click Edit. Edit Profile page appears.

Note: Only Description and Allow auto movement fields are editable.

3. Click Save. Factoring Status page appears with edited details.

Functions: Edit

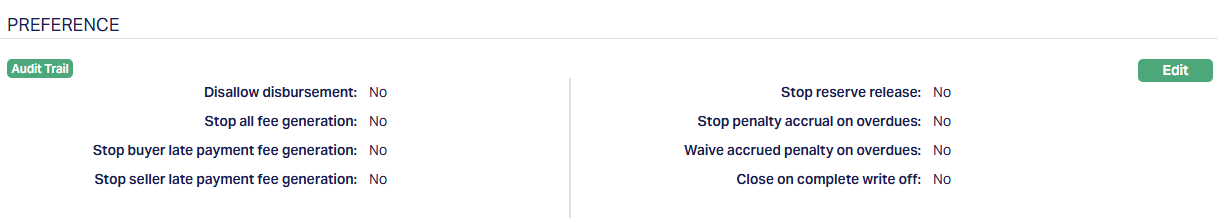

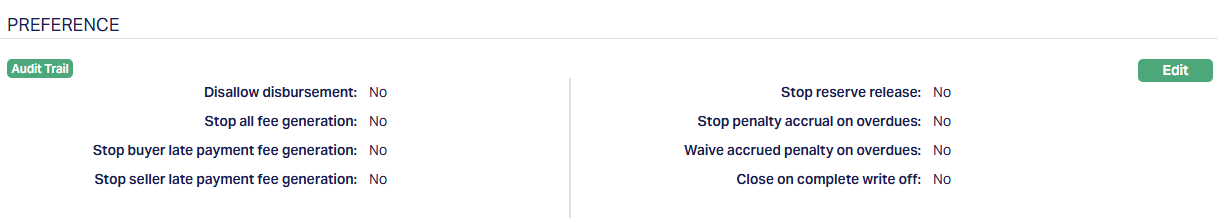

Preference

Preference tab allows you to maintain the corresponding preferences that will apply to accounts which fall into specific Factoring Status. Flexibility is provided in enabling or disabling specific preferences on accounts that reach a specific status.

Note: This tab is displayed only when the Factoring status is considered as an Account Status / Account and Payment Status.

To edit preferences

1. Access Factoring Status page and click Preference Tab.

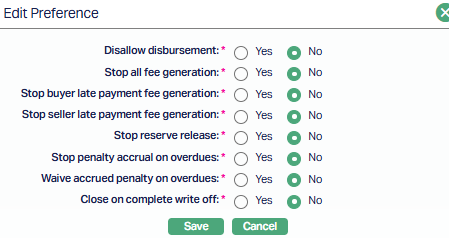

2. Click Edit. Edit Preference page appears.

3. The following are the Preferences available for an user-defined status. All these are by default marked as No such that normal activities are allowed in the account.

Disallow disbursement: When the flag is marked as Yes, aura will not allow you to disburse the factoring amount to that account. Amount disbursed will not be allowed to be debited from the factoring account. The factoring amount will not be allowed to be disbursed when the disbursement option is Auto or Manual.

Stop all fee generation: When the flag is marked as Yes, Aura will not process any periodic and event-based fee for the account. However events will be generated as usual but charge related entry is not displayed in the payment schedule under Events tab.

Stop buyer late payment fee generation: When the flag is marked as Yes, Aura halts the automatic calculation of new late payment fees for buyers with overdue payments, though existing fees remain. This is used for grace periods, fee waivers, or special agreements. Disabling it resumes normal late fee applications.

Stop seller late payment fee generation: When the flag is marked as Yes, the setting prevents Aura from generating new late payment fees for sellers with overdue payments while keeping existing fees unchanged. It is used for special payment terms or temporary financial relief. Disabling it restores normal late fee calculations.

Stop reserve release: When the flag is marked as Yes, Aura prevents the release of reserved funds associated with a factoring contract, ensuring they remain locked despite meeting usual release conditions. This is used in cases of disputes, pending approvals, or financial risk management. Disabling it allows normal reserve fund disbursement.

Stop penalty accrual on overdues: When the flag is marked as Yes, Aura will stop accruing penalty charges on any overdue amounts in the factoring contract. No further accrual entries will be passed until the contract moves into a status where this flag is marked as No. Accruals that were already generated before the status change will remain unaffected unless waived using the next flag.

Waive accrued penalty on overdues: When the flag is marked as Yes, Aura will automatically waive any penalty amounts that were accrued prior to the contract moving into this status. These penalties will not be considered for recovery, and the waived amount will be removed from the outstanding balance. When the flag is marked as No, previously accrued penalties will remain due and will continue to appear in the payment schedule.

Close on complete write off: When this flag is marked as Yes, Aura will automatically mark the factoring contract as Closed when a 100% write-off has been applied as part of the impairment treatment. If impairment treatment is not applied, the contract will remain in its current state. When the flag is marked as No, the contract will not be closed even after full write-off is completed.

4. Choose the required settings for the preferences and click Save. Factoring Status page appears with the edited details.

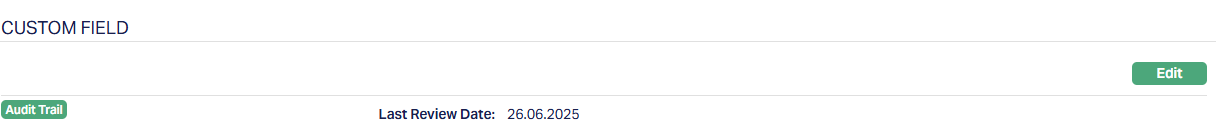

Custom Field

This option provides you the flexibility to define fields apart from those that are already available in the standard version of Aura. Thus, it enables you to customize additional data storage and use as required to suit your specific business needs.

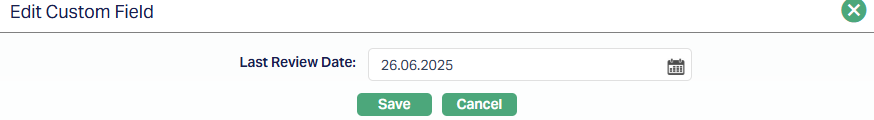

To Edit Custom Field,

1. Access Factoring Status page. Click Custom Field tab.

2. The field appears only when it is created in Admin > System codes > Custom fields > Custom fields and linked to specific Accounts option in Admin > System codes > Custom fields > Field mappings.

3. Click Edit. Edit Custom Field page appears. In the following illustration, a custom field, Last Review Date has been mapped to the Account as shown below.

4. Enter Last Review Date.

5. Click Save. Custom Field page appears with the edited details.

Functions: Edit