Loan Application

Loan Application menu allows you to maintain the details of a loan application that are used by your bank for its customers. Once the application is created, the values in these applications are defaulted to the customer accounts that are created under the application, with an option to change the details at the account level.

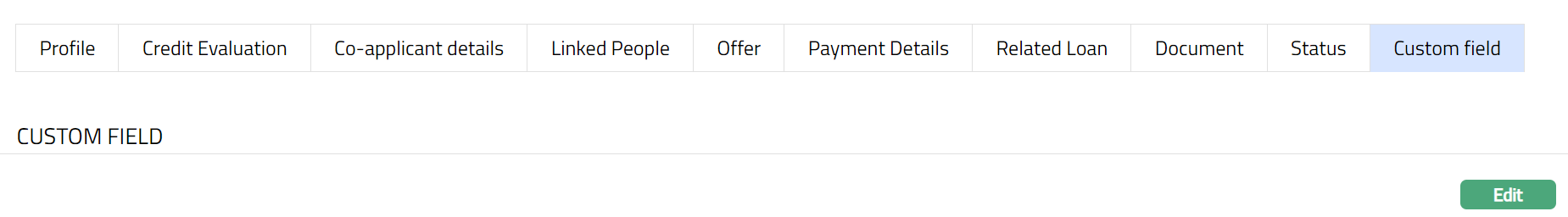

Following are the tabs in Loan Application:

Creating Loan Application.

To create new Loan Application

- From Retail menu, click Loans, then Loan Application and then Maintain. Loan Application page appears. All Applications available in Aura appear on the page

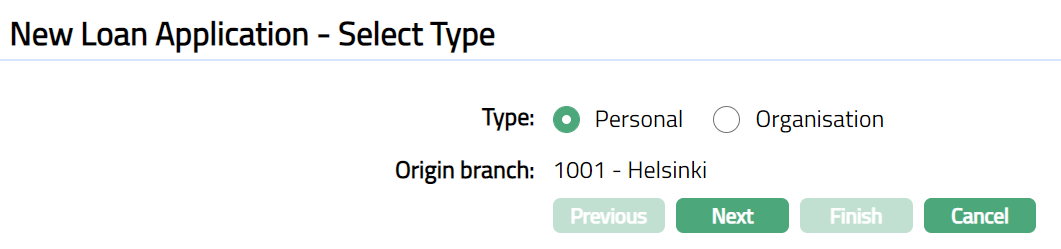

- Click Add. New Loan Application -- Select Type appears.

- Select Type:

Personal -- If the Application is for individual customer.

Organisation -- If the Application is for a Company/Organisation

Origin Branch will be defaulted based on the type selected.

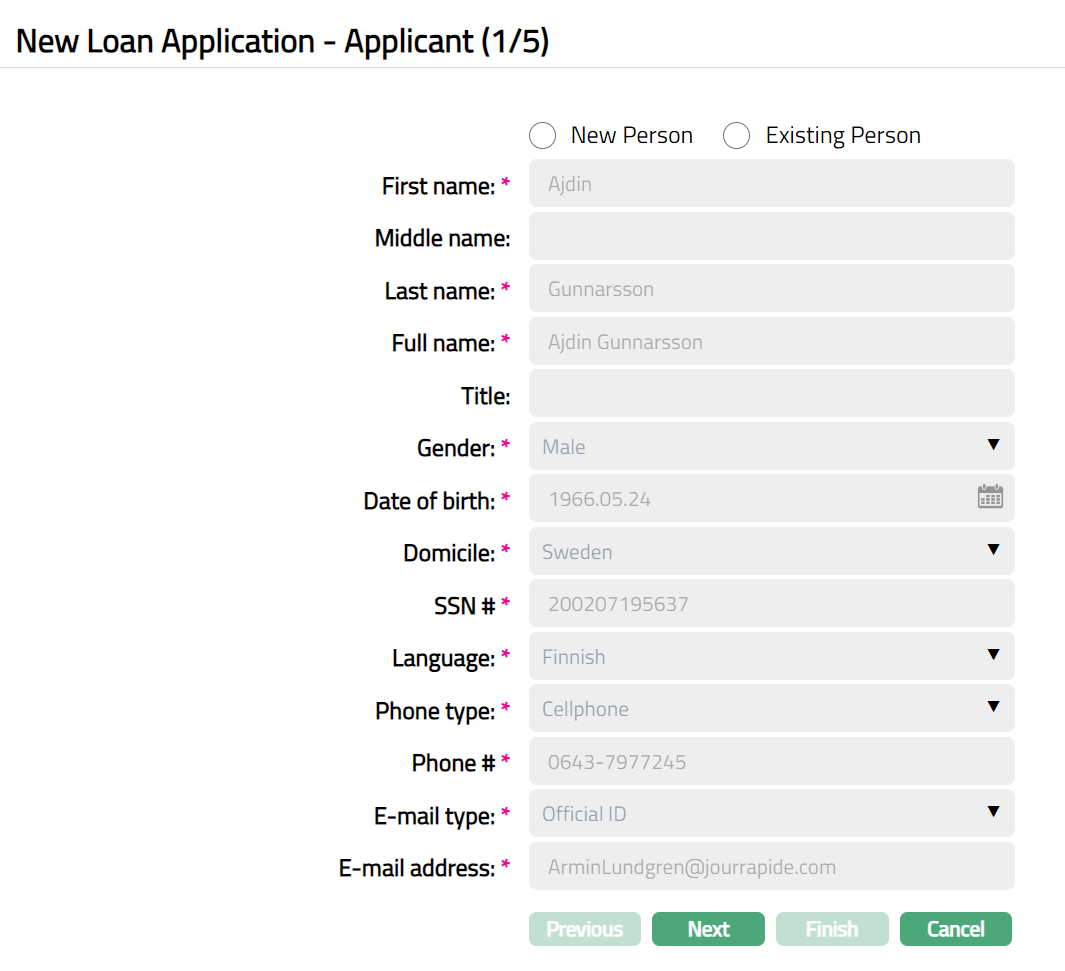

Click Next. New Loan Application- Applicant (1/5) page appears.

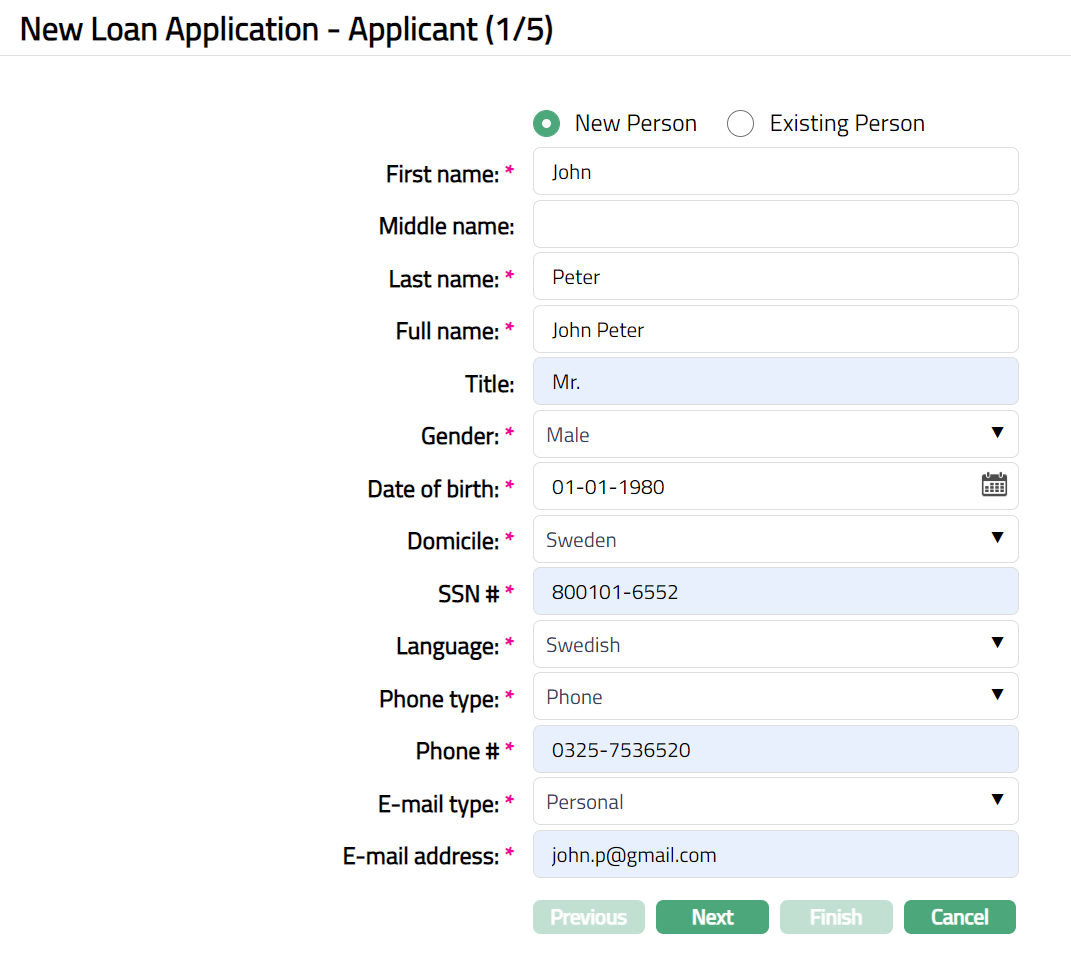

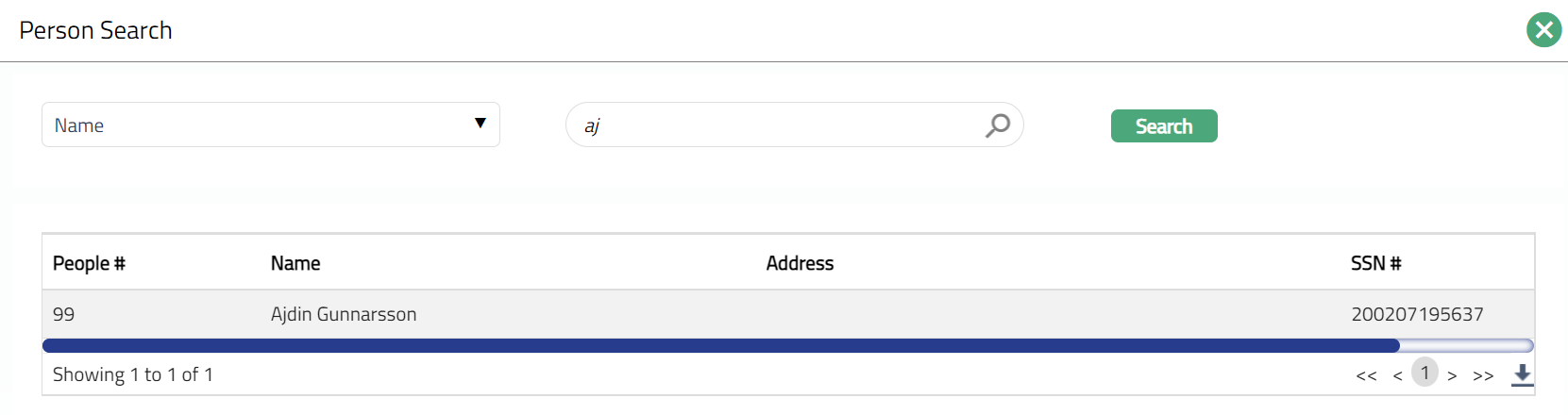

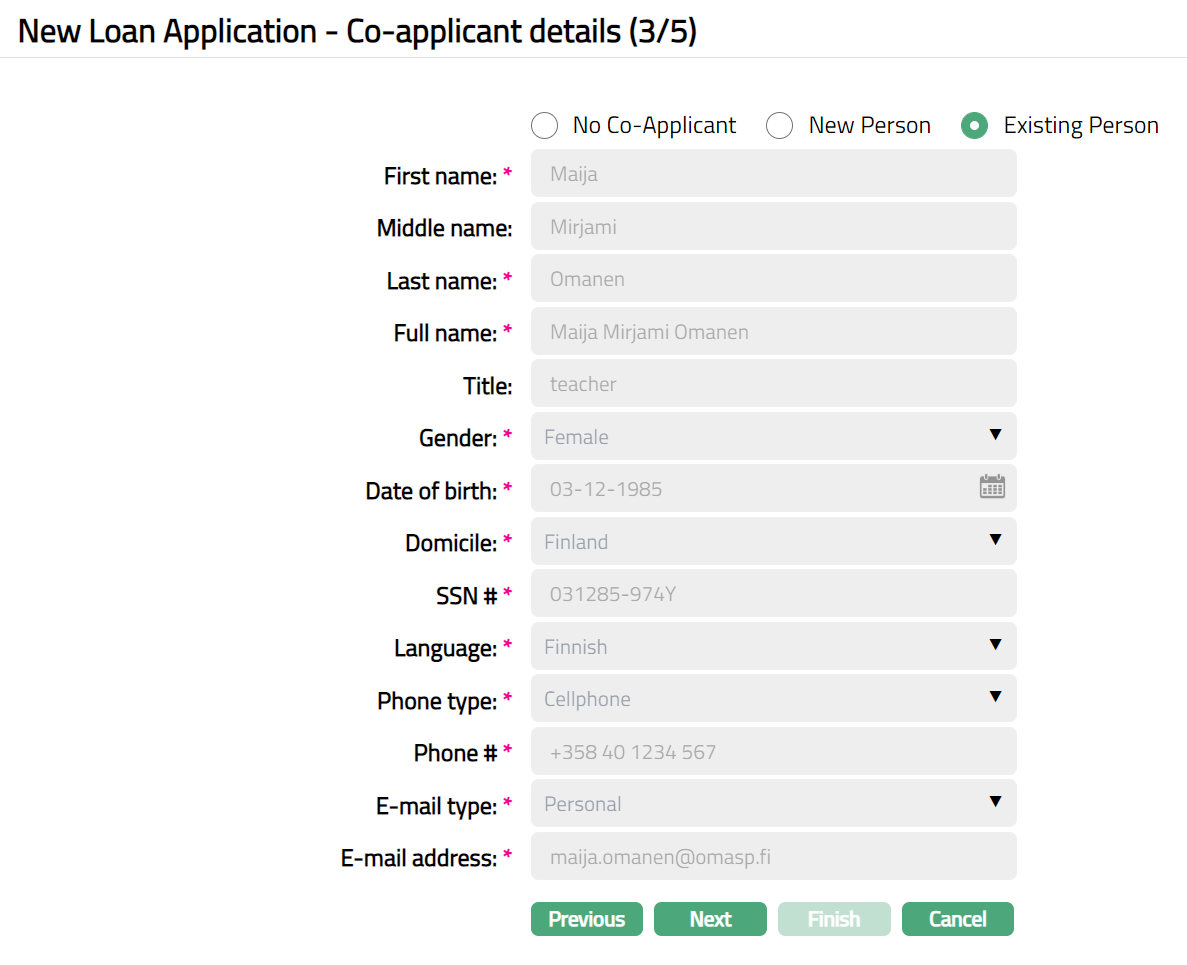

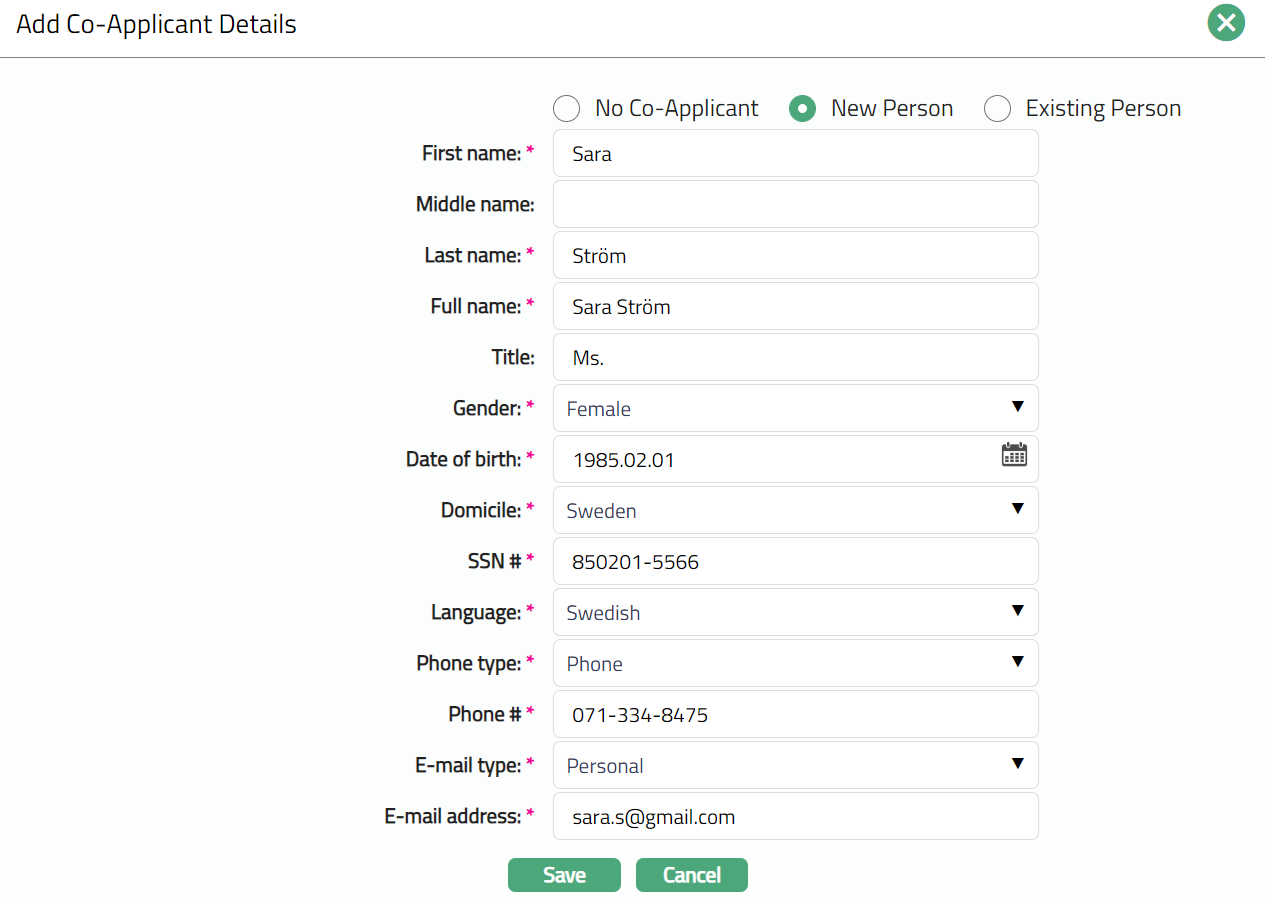

- By default, New Person is selected. If you want to add the details of a New Person, then select this option. Once you select Existing Person, Person Search screen appears. Select the person and the details will be defaulted. Sample screen shots shown below when you select Existing Person.

Enter First Name of the person.

Enter Middle Name of the person (If Applicable).

Enter Last Name of the person.

On entering the First Name and Last Name system derives Full Name of the person. You can however edit it as needed.

Enter Title of the person that is to be prefixed to the person's name.

Select Gender of the person from the drop-down list.

Input Date of birth of the person. You can either enter the date manually or select using the calendar. Aura will validate the date format using the format maintained under Entity maintenance > Regional > Date format.

Select Domicile of the person i.e., country of residence from the drop-down list.

Note: The list of countries for Citizen and Domicile should have been maintained under Admin > System codes > Generic definitions > Countries.

- Enter SSN#. It is the person's Social Security Number i.e., a unique number provided by the person's residence country.

Note: The validation for SSN, if required, may be customized during implementation.

Select Language i.e., Language of the person from the available drop-down list maintained under Admin > System codes > Generic definitions > Languages.

Select Phone Type from the available drop-down list maintained under Admin > System codes > Address Details > Phone Types.

Select E-mail Type from the available drop-down list maintained under Admin > System codes > Address Details > E-mail Types.

Enter E-mail Address for the person.

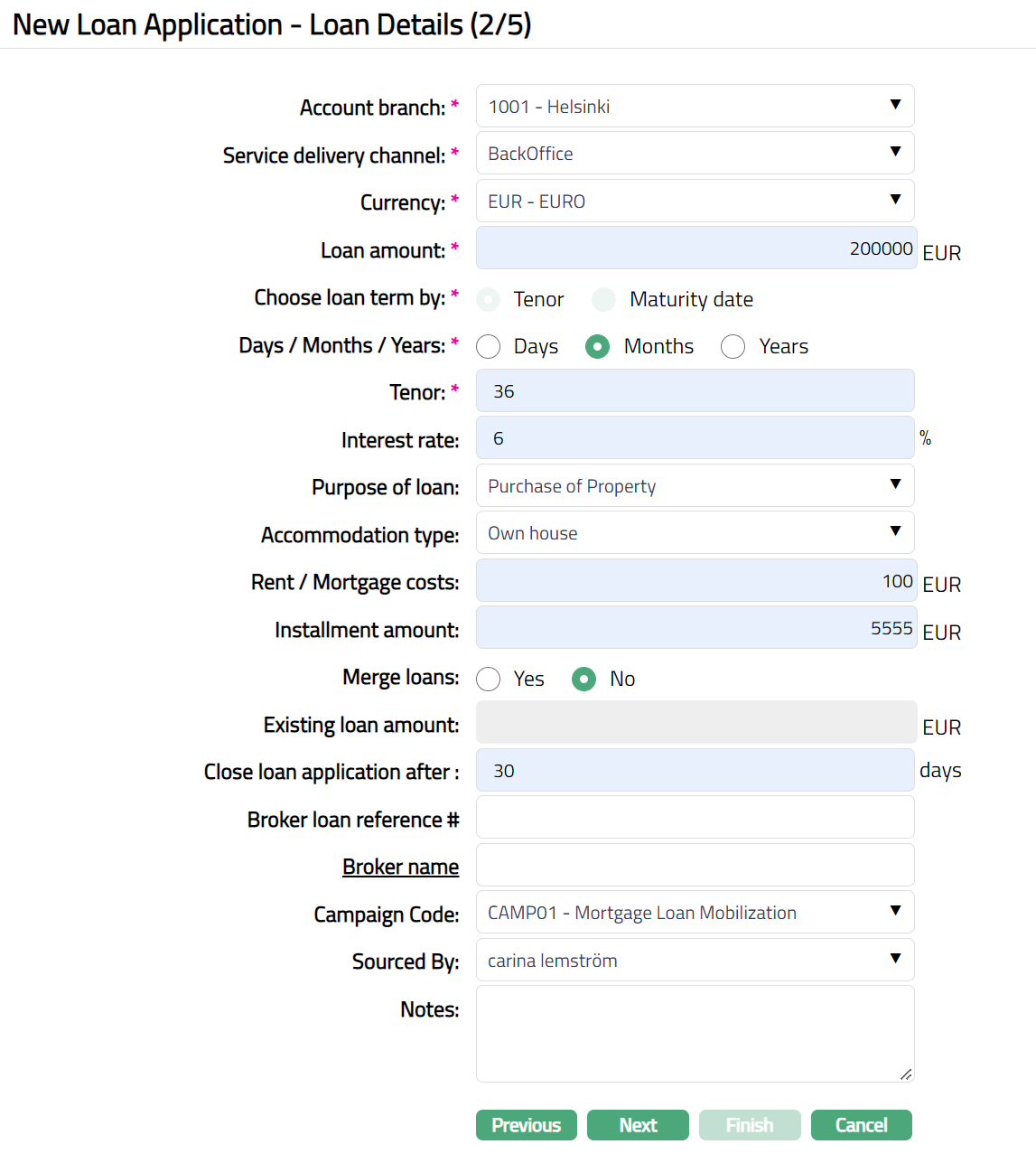

Click Next. New Loan Application- Loan Details (2/5) page appears.

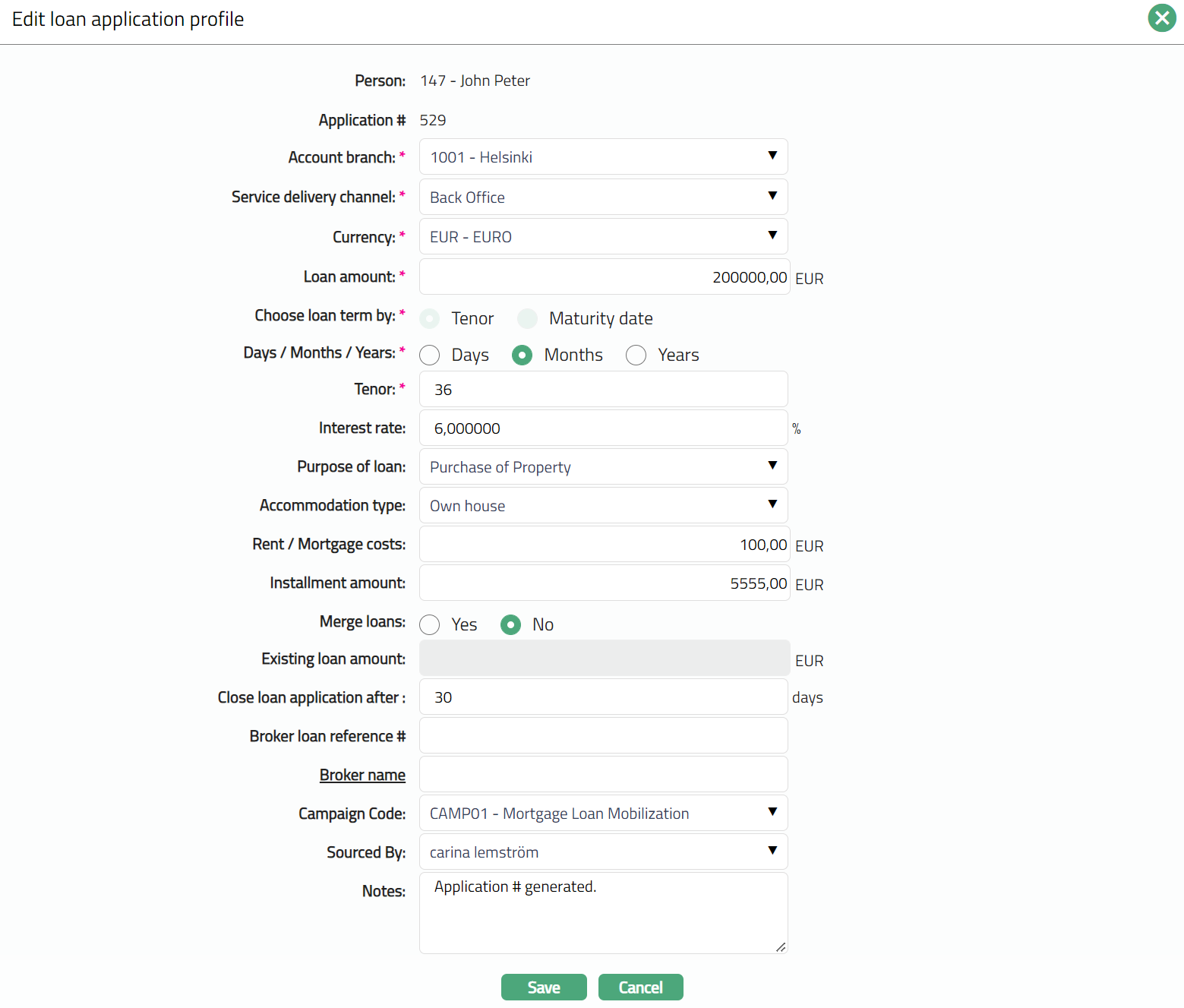

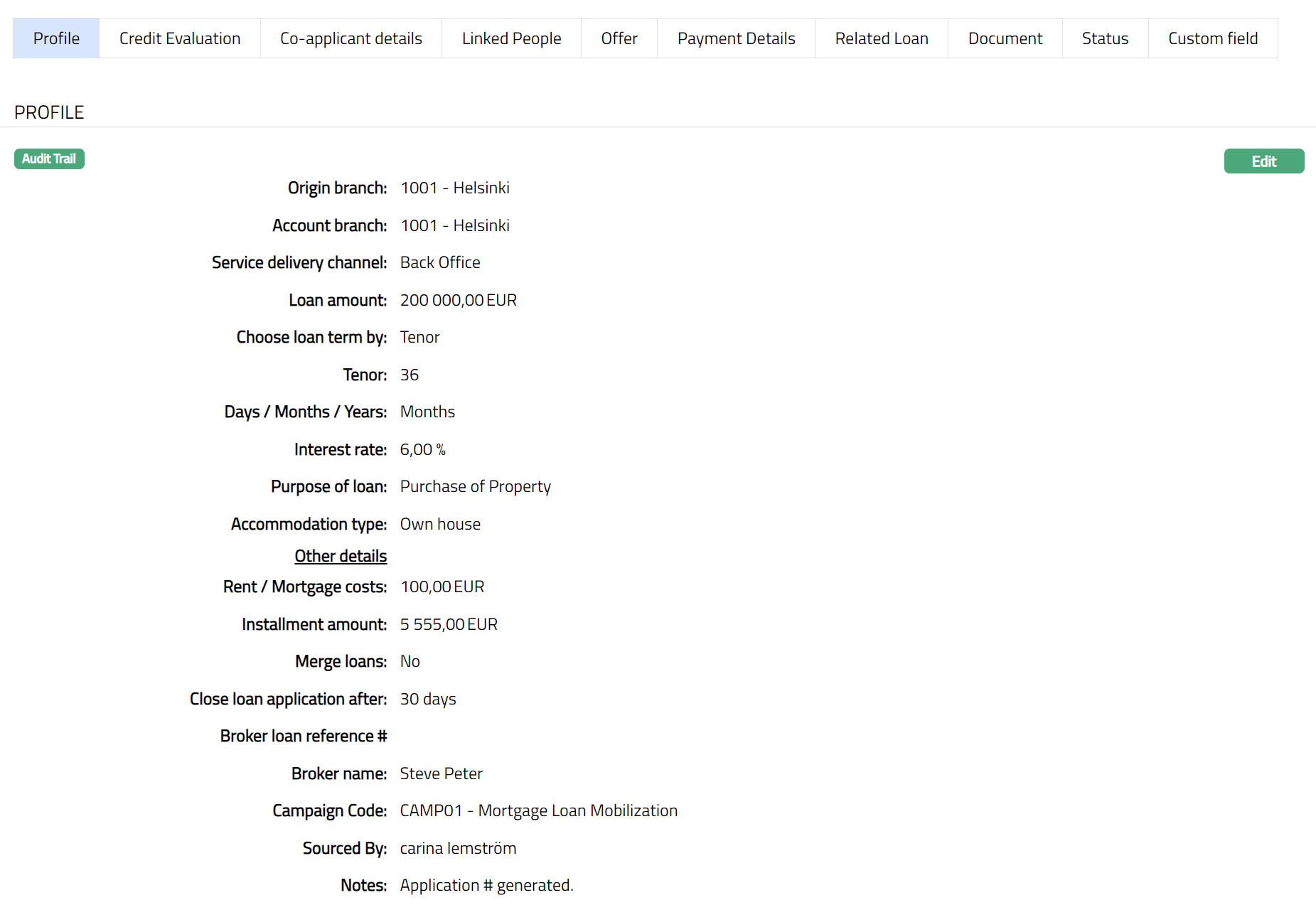

- Select Account branch from the drop-down list of all the branches which are allowed for the product. By default, the user's logged in branch is selected. You can change as required. This is the branch in which the account is maintained.

Select Service delivery channel from the drop-down list of Service Delivery Channels that are maintained under Admin > System codes > Categories > Service delivery channel.

Select Currency from the drop-down list maintained under Admin > System codes > Currency > Currency. The drop-down list displays all the currencies maintained for the selected product.

Enter Loan Amount for the account.

Select Tenor or Maturity date radio button to Choose loan term by If you want to indicate the loan's term by way of a specific duration / period, choose Tenor. If you want to indicate the loan's term by way of a specific maturity date, choose Maturity date.

Select Days / Months / Years depends on what was selected for Choose Loan Term By.

If you had selected Tenor, this field will be enabled, and you can select the appropriate radio button to specify the loan term in Days / Months / Years

If you had selected Maturity date, this field is disabled and is automatically defaulted to Days.

Enter Tenor.

Enter Interest Rate for the account.

Select Purpose of Loan from the drop-down list.

Select Accommodation Type from the drop-down list.

Enter Rent/Mortgage costs of the property.

Enter Instalment Amount for the loan.

Select Merge Loans. By default, No radio button will be selected. But if you want to merge any other existing loan then you can select Yes radio button.

Enter Existing loan amount for an existing loan. Note: Once you select Yes radio button under Merge Loans then this field will get activated for you to enter the existing loan amount. If selected, No under Merge Loans then this field will be deactivated.

Enter Close Loan application after in terms of days. Note: This field denotes the number of days after which this loan application will be closed.

Enter Broker loan reference # if applicable.

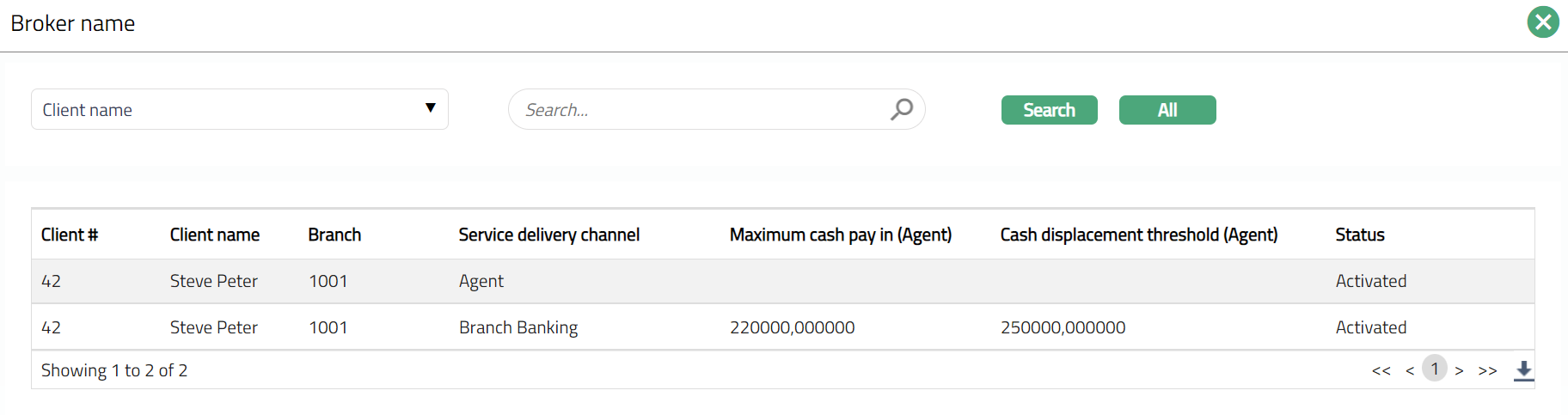

Click Broker Name hyperlink to select the name of the Broker if applicable maintained under the same bank.

Select Campaign Code if applicable for this account.

Select Sourced by. The name of the individual who has sourced this account.

Enter Notes for this account if applicable.

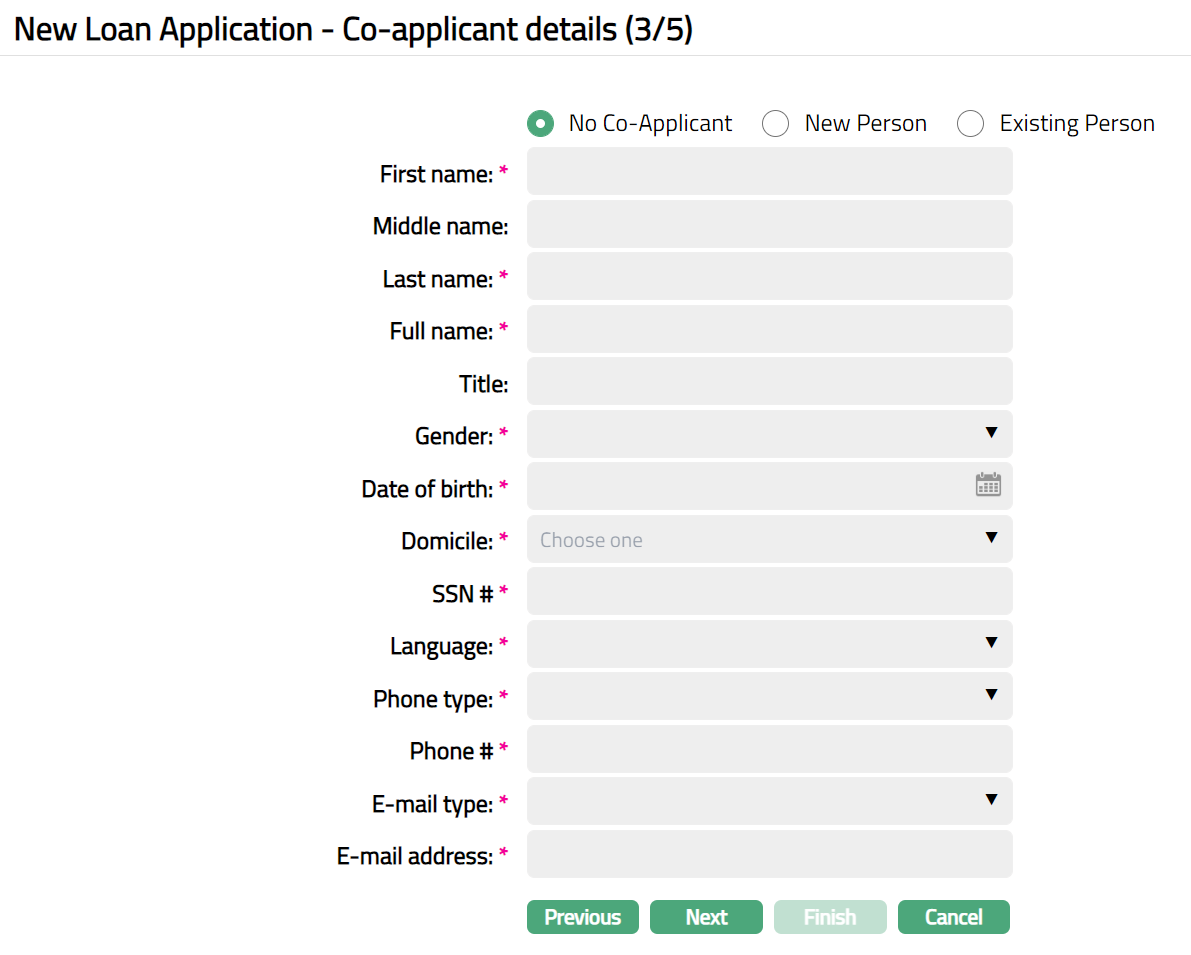

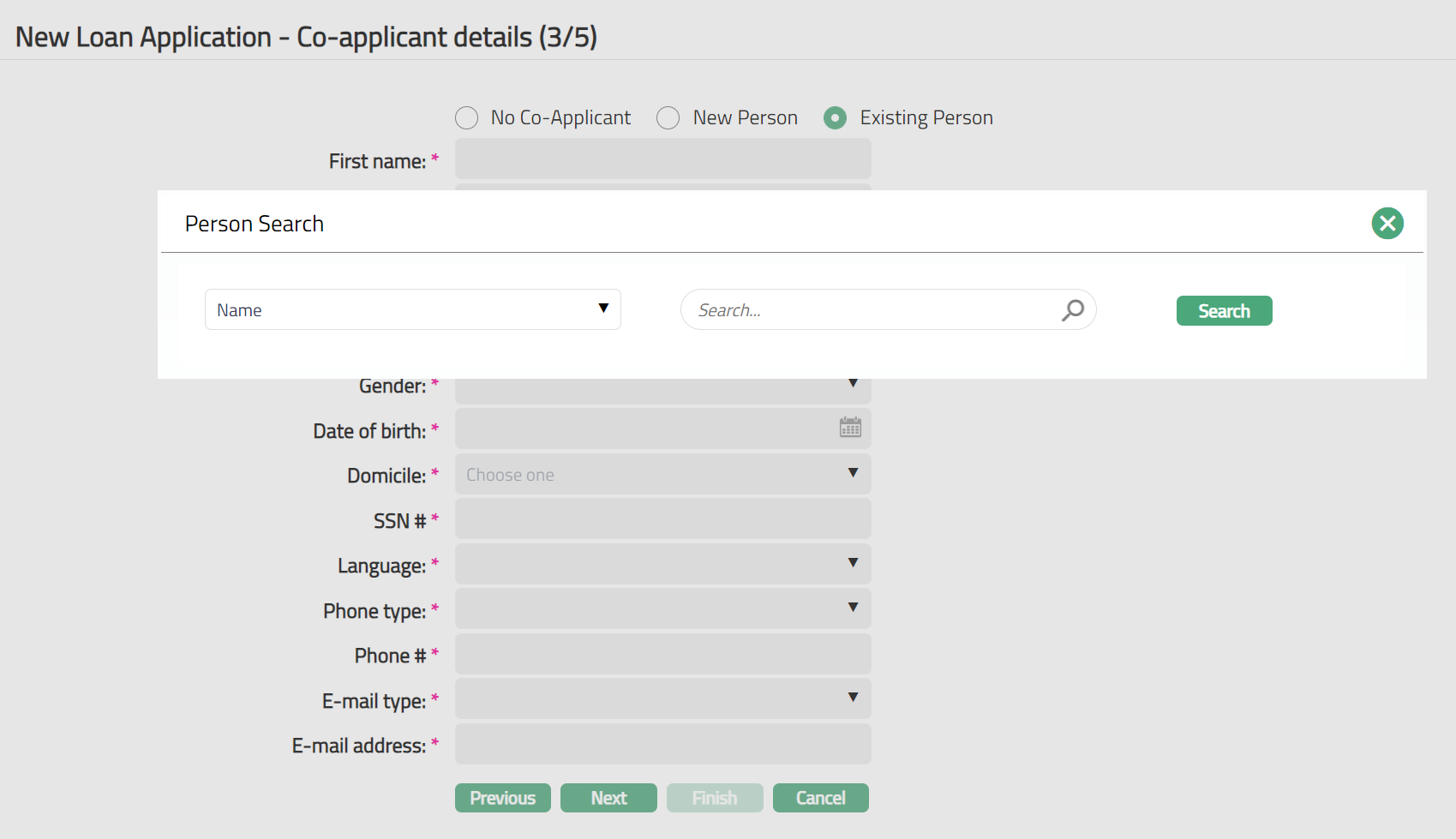

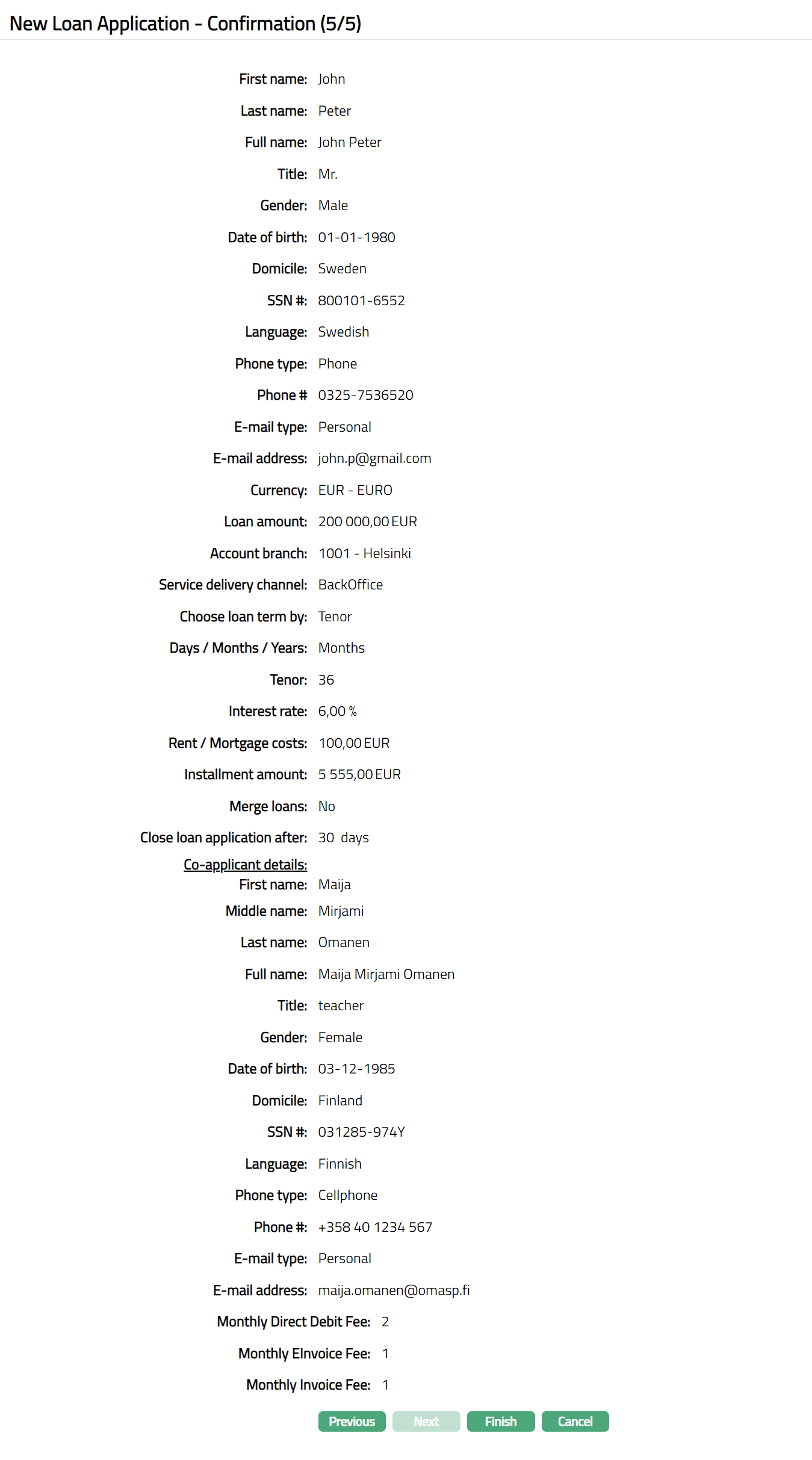

Click Next. New Loan Application- Co-applicant details (3/5) page appears.

By default, No Co-Applicant radio button will be selected. Sample screen shot as shown above.

If selected New Person radio button then you need to fill all the details as required.

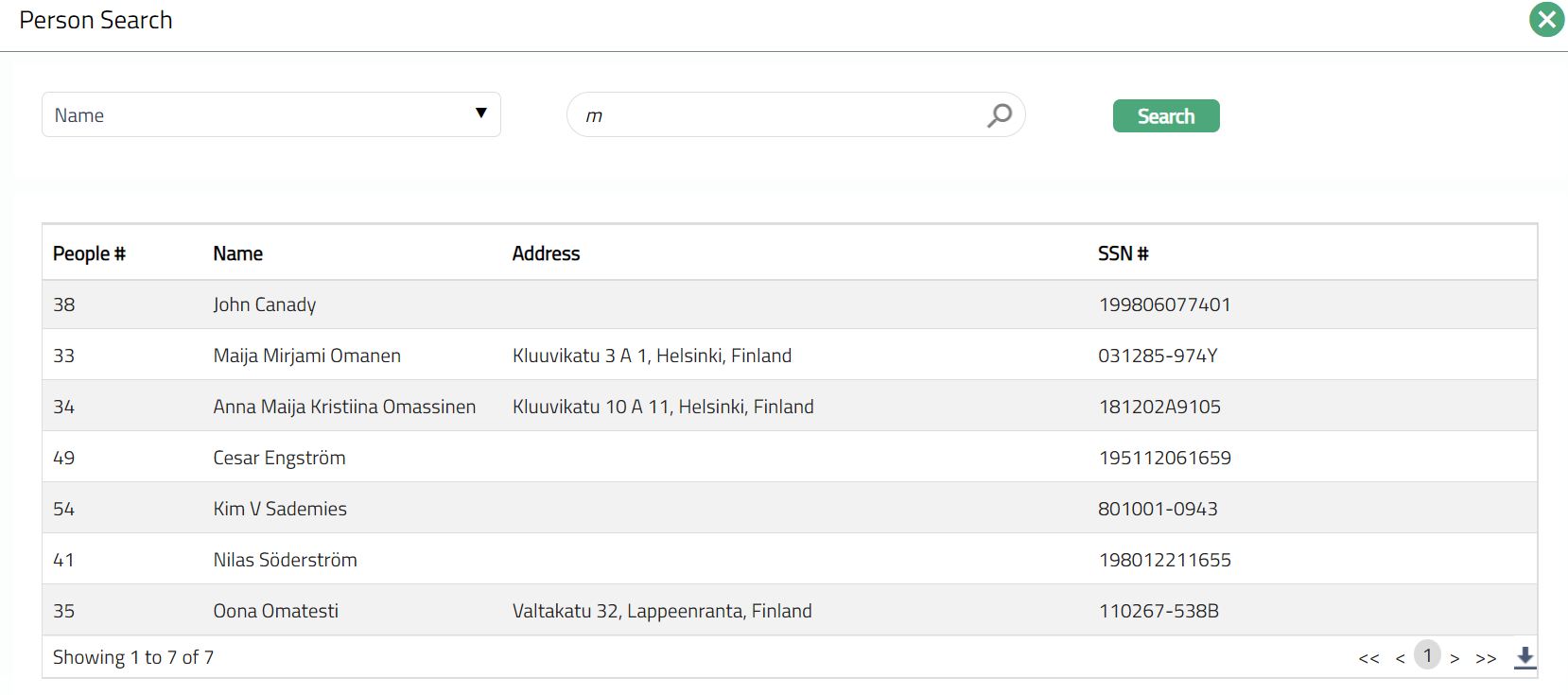

If selected Existing Person radio button, then search person page appears. Search the person and select the Co-Applicant. The details will get filled by default once you select the applicant. Sample screen shots shown below.

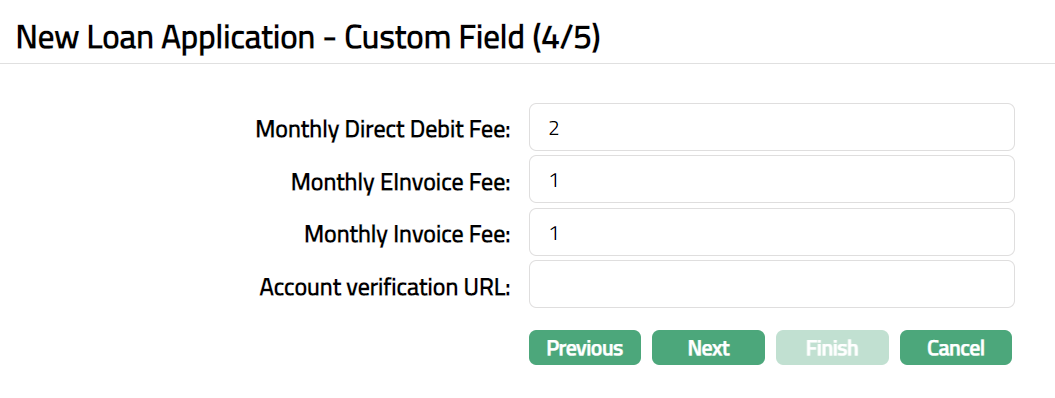

- Click Next. New Loan Application- Custom Field (4/5) page appears

Enter Monthly Direct Debit Fee if applicable.

Enter Monthly E Invoice Fee if applicable.

Enter Monthly Invoice Fee if applicable.

Enter Account verification URL if applicable.

Click Next. New Loan Application- Confirmation (5/5) page appears

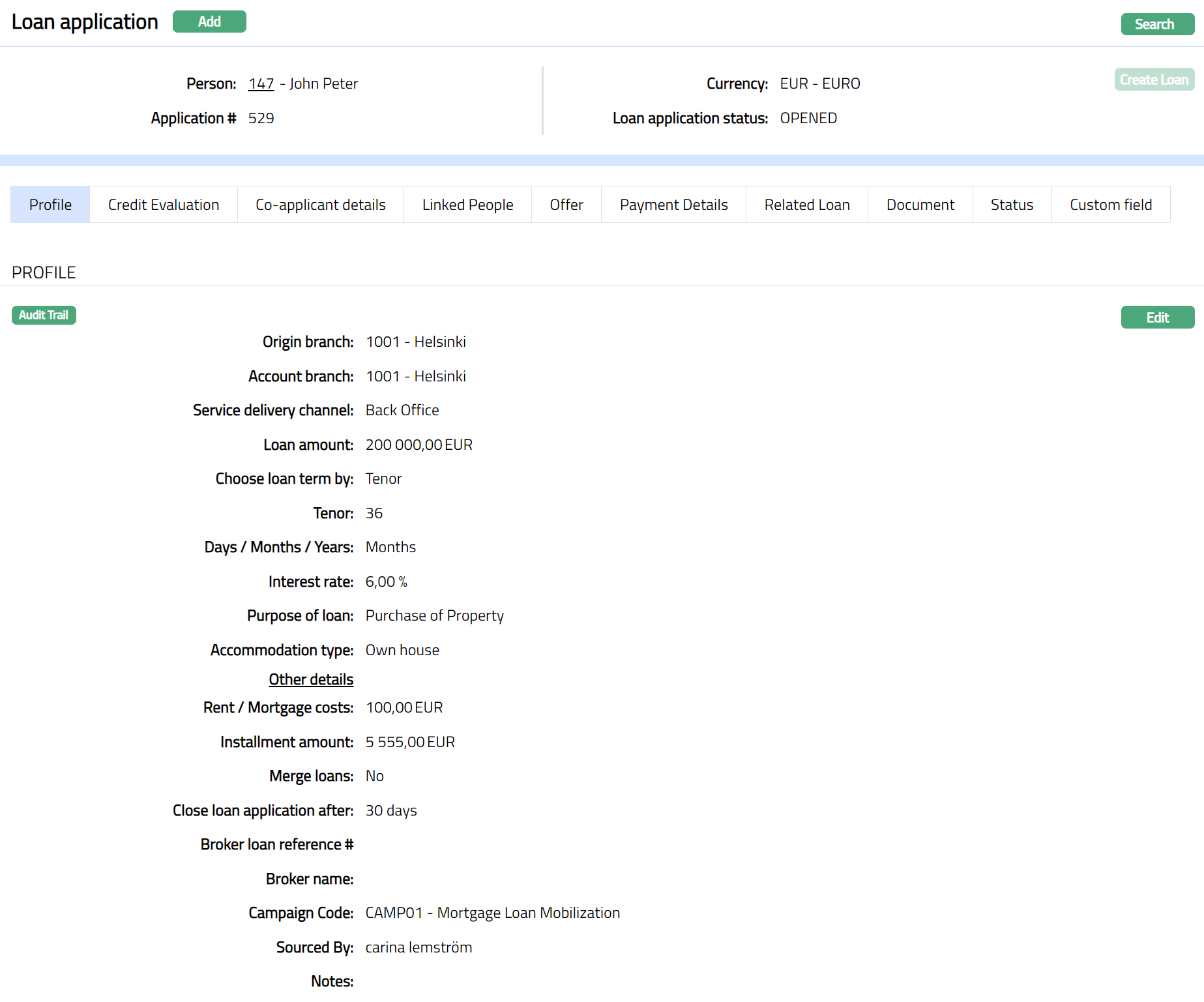

- Click Finish. Loan Application is created with a unique Application #. The Loan application page appears displaying the details of the application under Profile tab

Functions: Add, Search, Edit

Functions: Add, Search, Edit

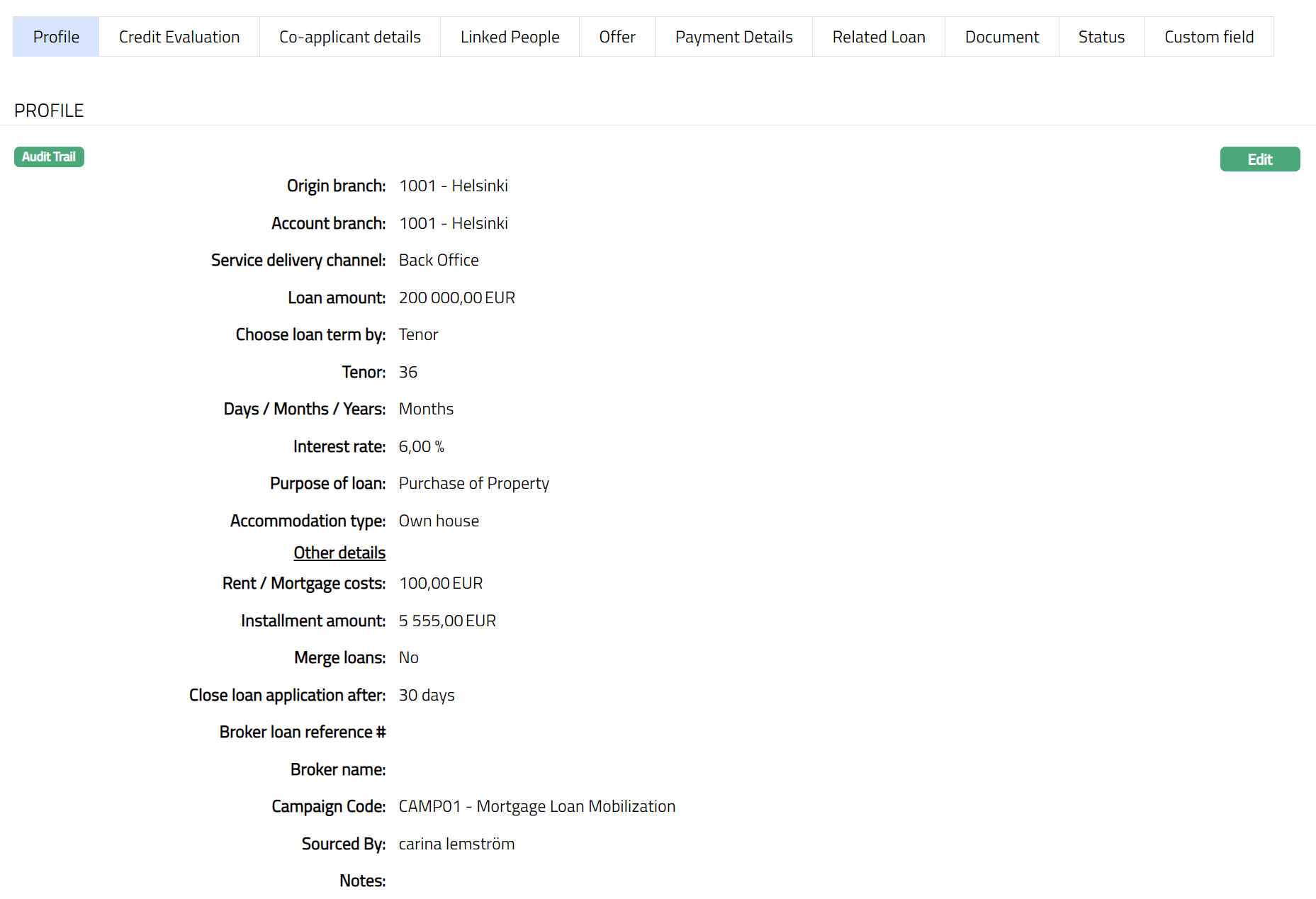

Profile

Profile tab, which is the default screen in the Loan Application screen, shows the basic details of the loan application. For details refer to New Loan Application- Loan Details (2/5).

To view/edit Profile

- Access Loan Application page. Then click Profile tab.

To edit Profile

- Click Edit. Edit Loan application profile page appears

Note: Except Person and Application # all other fields are editable.

- Click Save. Profile page appears with the edited details.

Functions: Edit

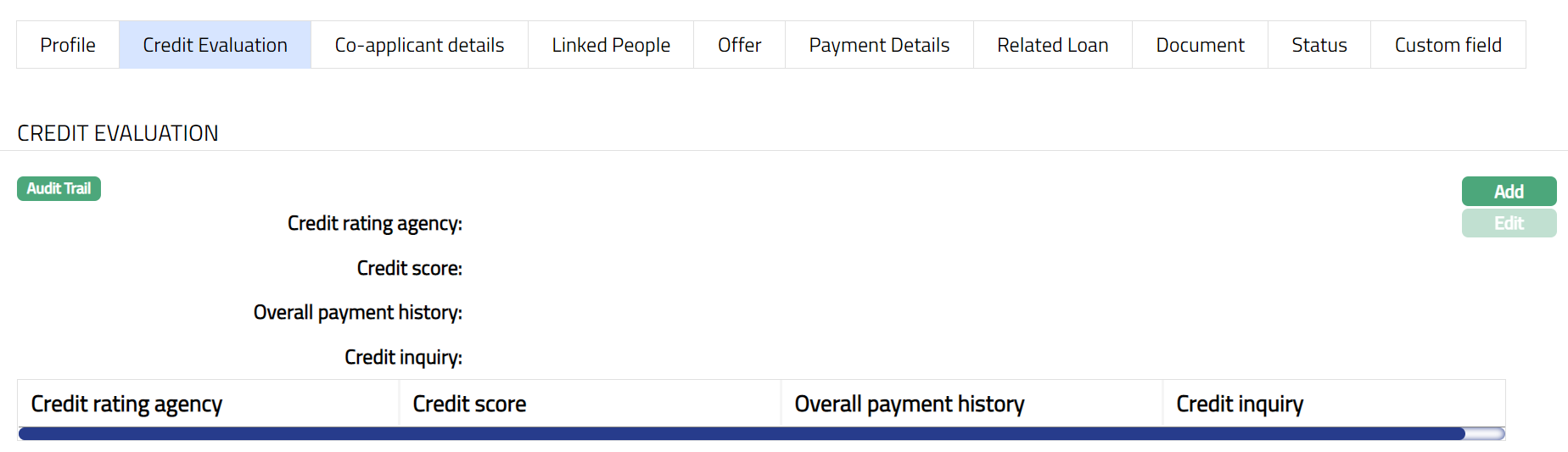

Credit Evaluation

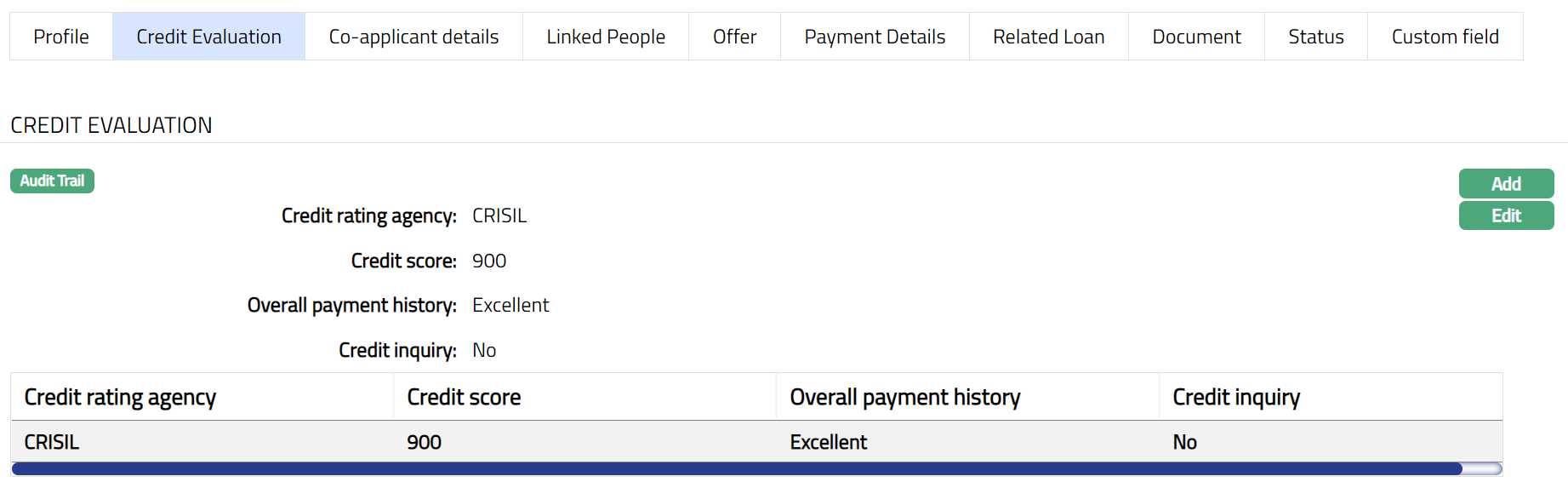

Credit Evaluation tab allows you to view and maintain credit score details for the account to become eligible for a loan.

To view/Add Credit Evaluation

- Access Loan Application page. Then click Credit Evaluation tab. If any credit evaluation details had already been added, these would be displayed; else, it will be blank.

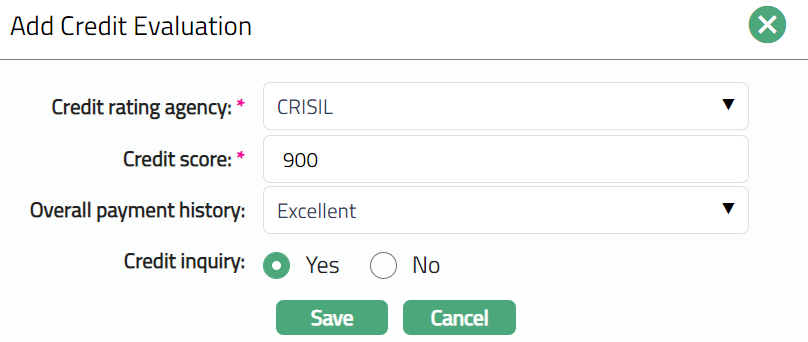

- Click Add. Add Credit Evaluation page appears.

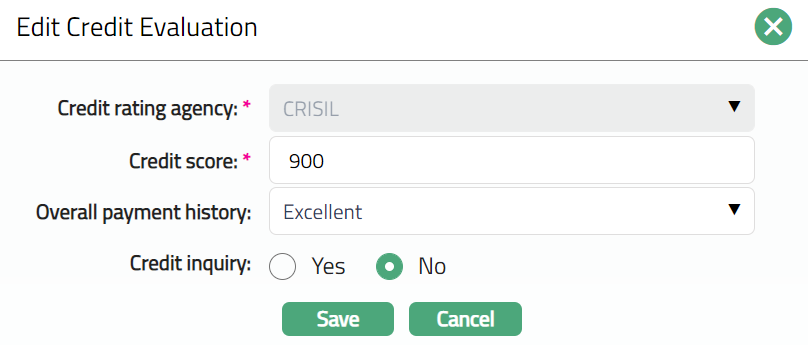

Select Credit rating agency for credit evaluation from the drop-down list which is maintained under Admin > System Codes > Generic definitions > Credit rating agency.

Enter Credit score as provided by the credit rating agency.

Select Overall payment history from the drop-down list of values. The List of values are Good, Bad and Excellent.

Select Yes or No radio button for further Credit inquiry.

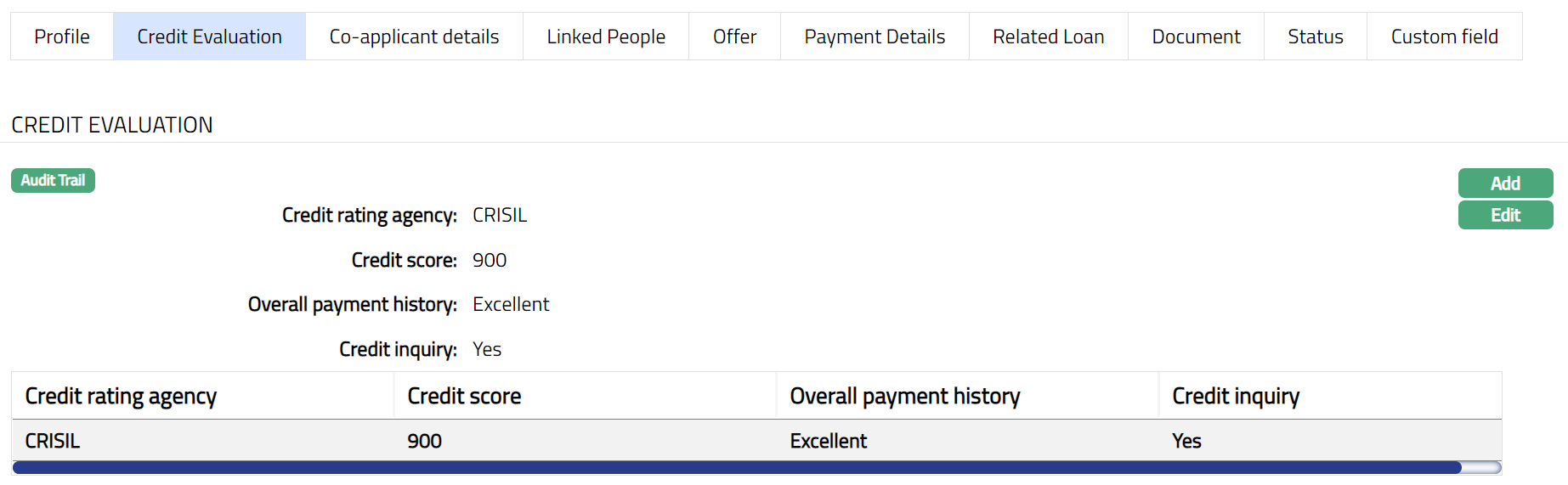

Click Save. Credit Evaluation page appears with the added details.

To edit Profile

- Click Edit. Edit Credit Evaluation page appears

Note: Except Credit rating agency all other fields are editable.

- Click Save. Credit Evaluation page appears with the edited details.

Functions: Add, Edit Co-applicant details

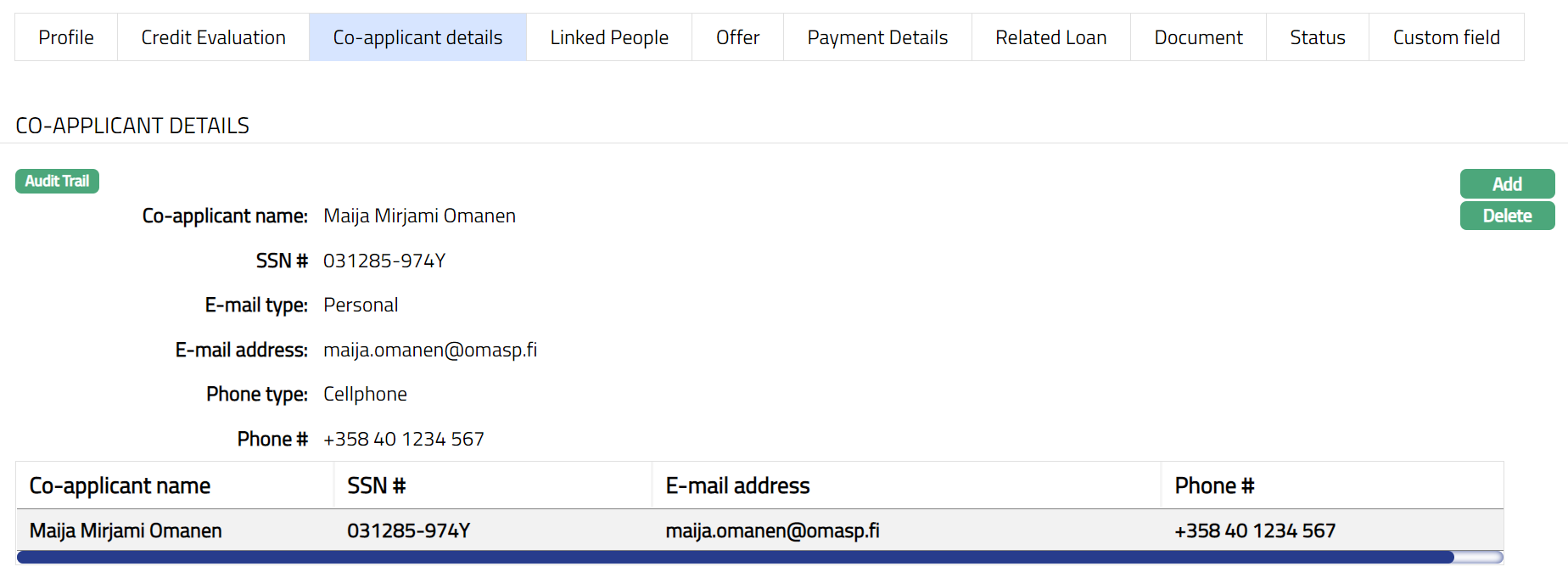

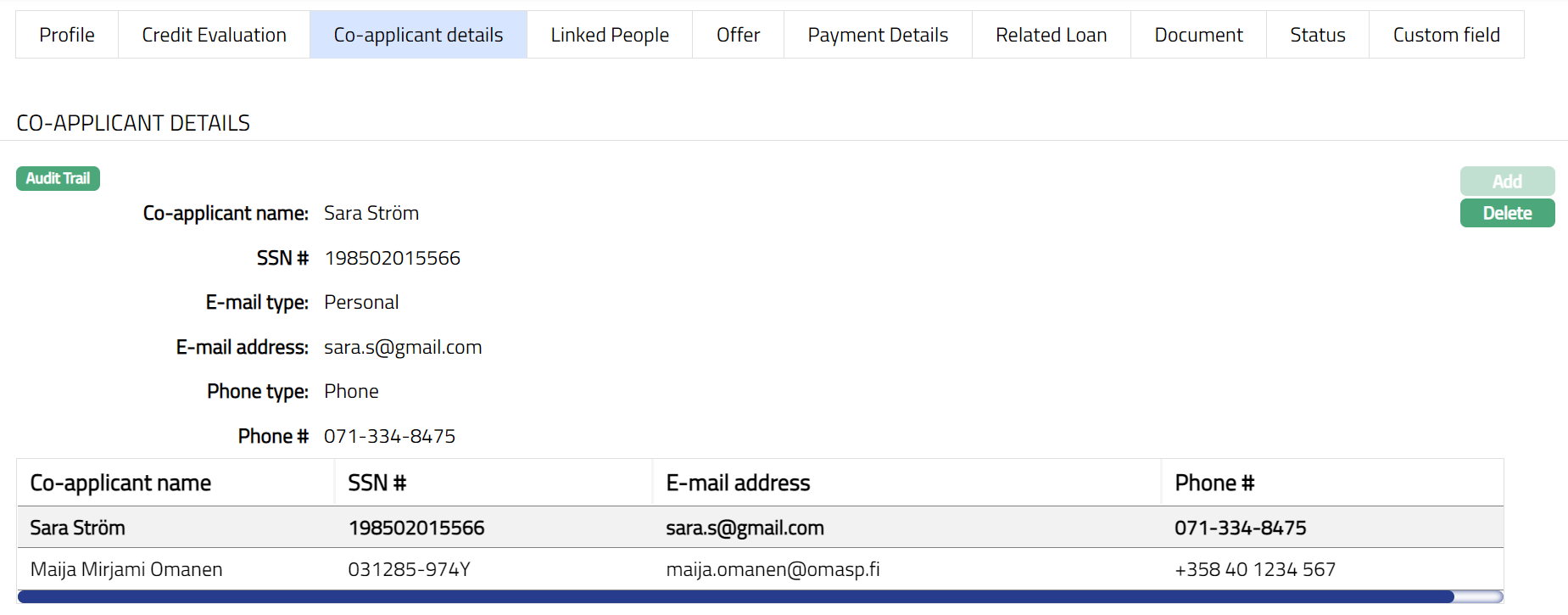

Co-applicant Details

Co-applicant details tab allows you to view and maintain multiple co-applicant details for the account.

To view/Add Co-applicant details

- Access Loan Application page. Then click Co-applicant details tab.

- Click Add. Add Co-Applicant Details page appears.

For details refer to New Loan Application- Co-applicant detail (3/5).

Click Save. Co-applicant details page appears with the new added co-applicant details.

Functions: Add, Delete

Delete: You can delete a co-applicant by a clicking on Delete button. When you click on Delete button, Aura displays an alert message. On confirmation, Aura will delete the co-applicant.

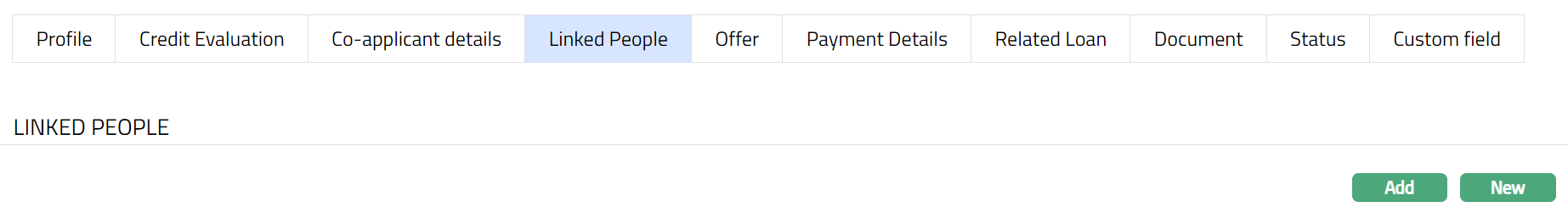

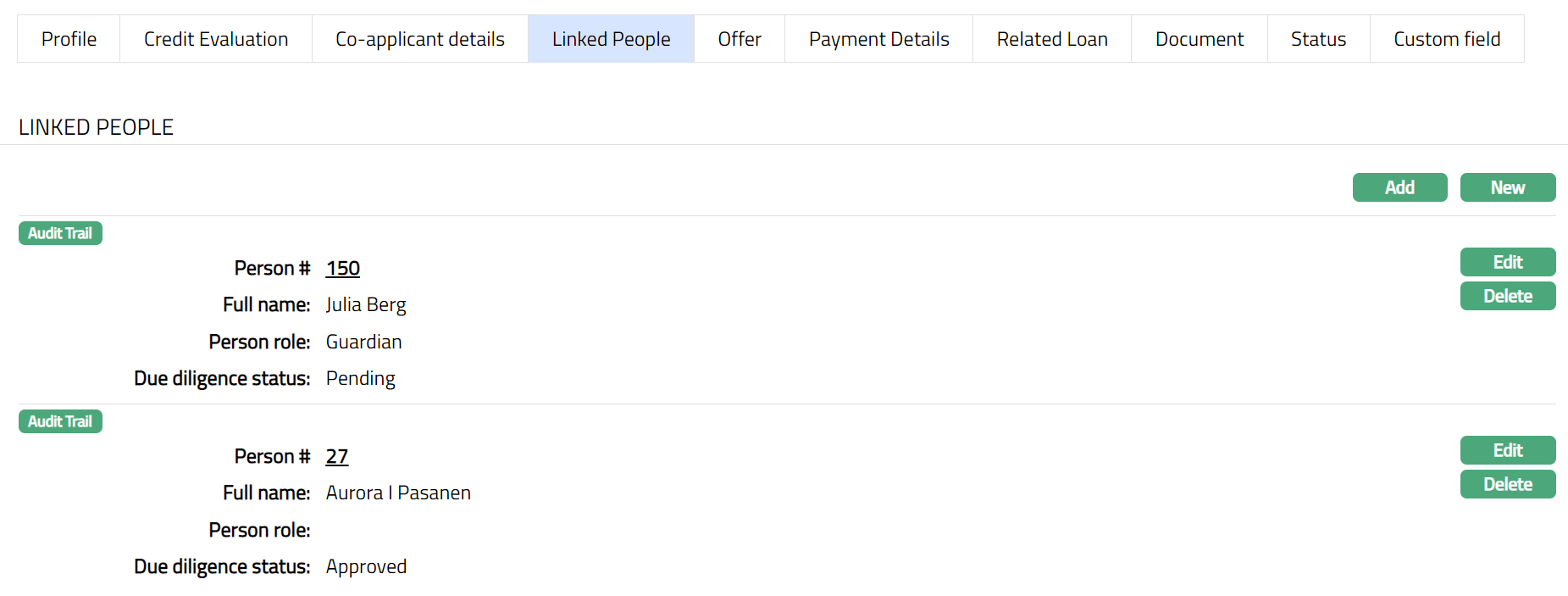

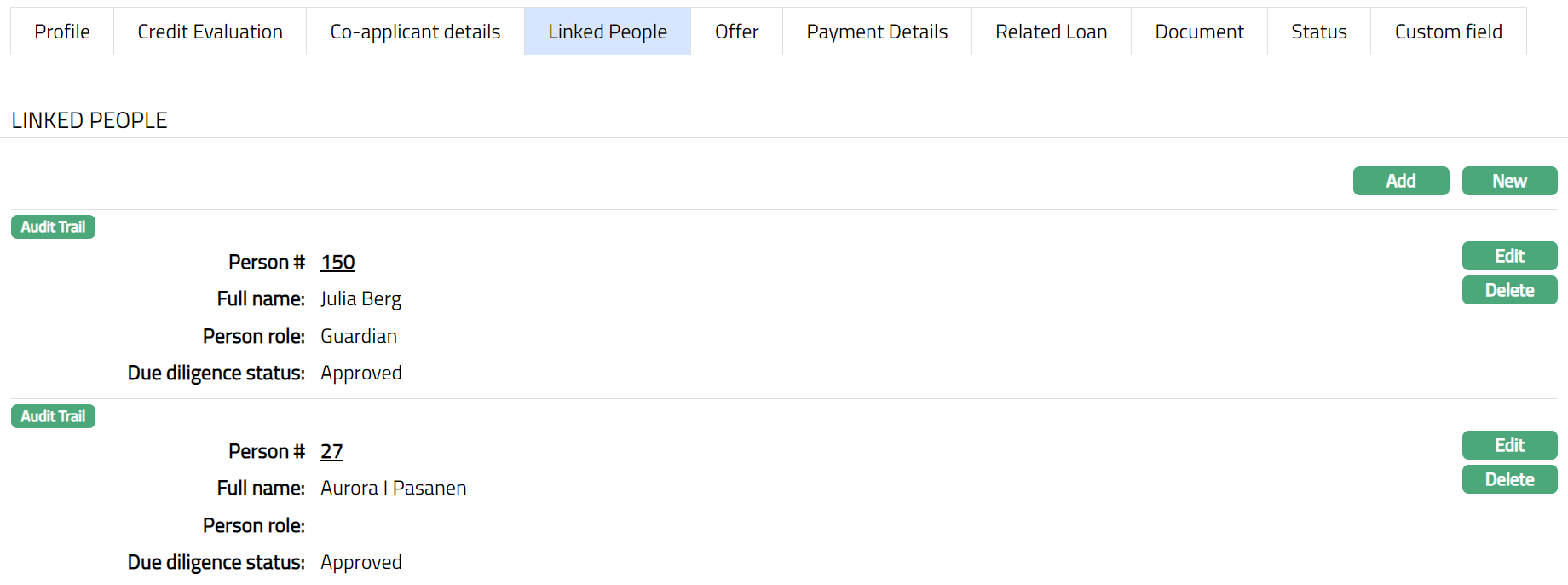

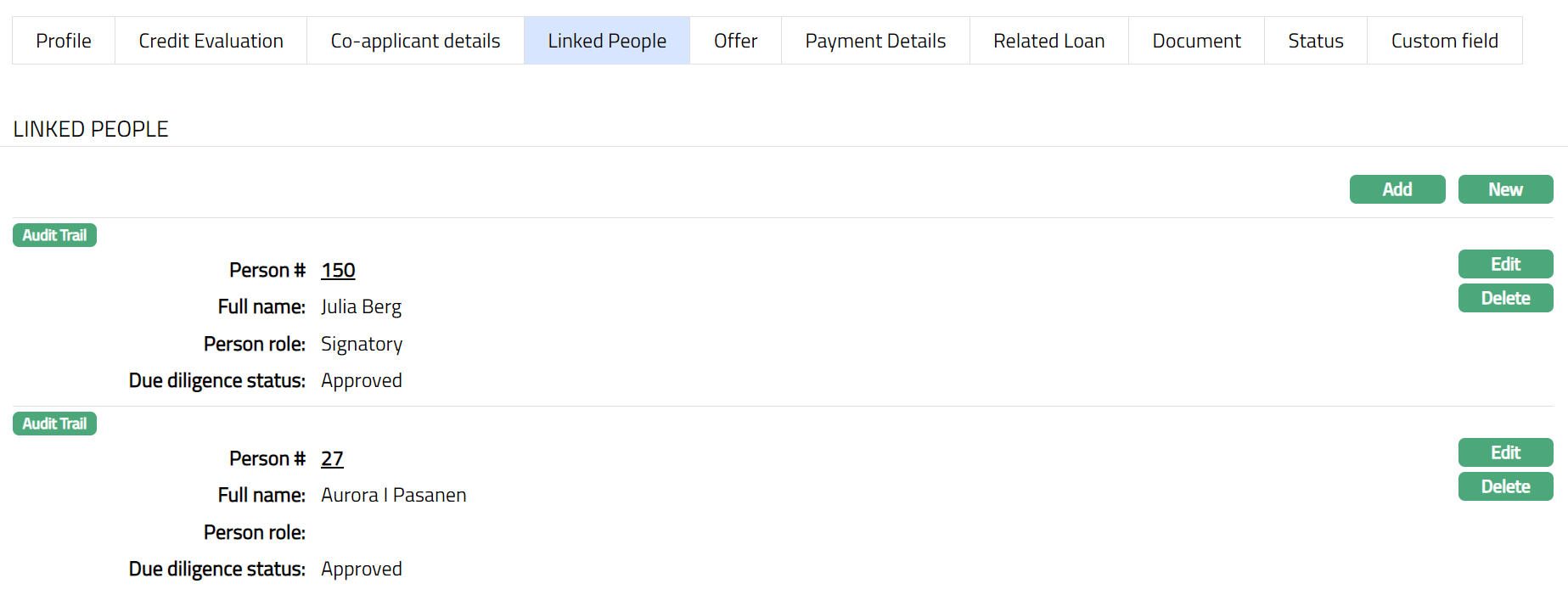

Linked People

This tab allows you to link people like Signatory or Guardian -to the loan Account.

To add linked people

Access Loan Application page and click Linked People tab.

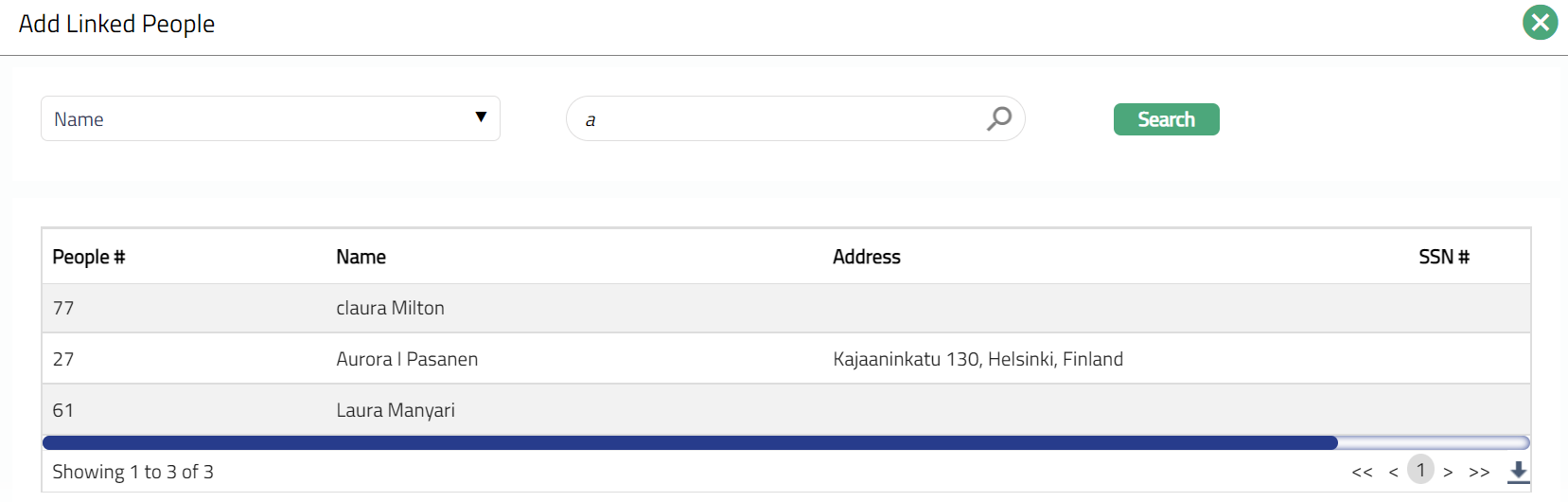

- If you want to link a person who has already been created as a Person under CRM > Person Maintenance, then click Add. Aura will display the Add Linked People window with the list of Persons maintained in Aura.

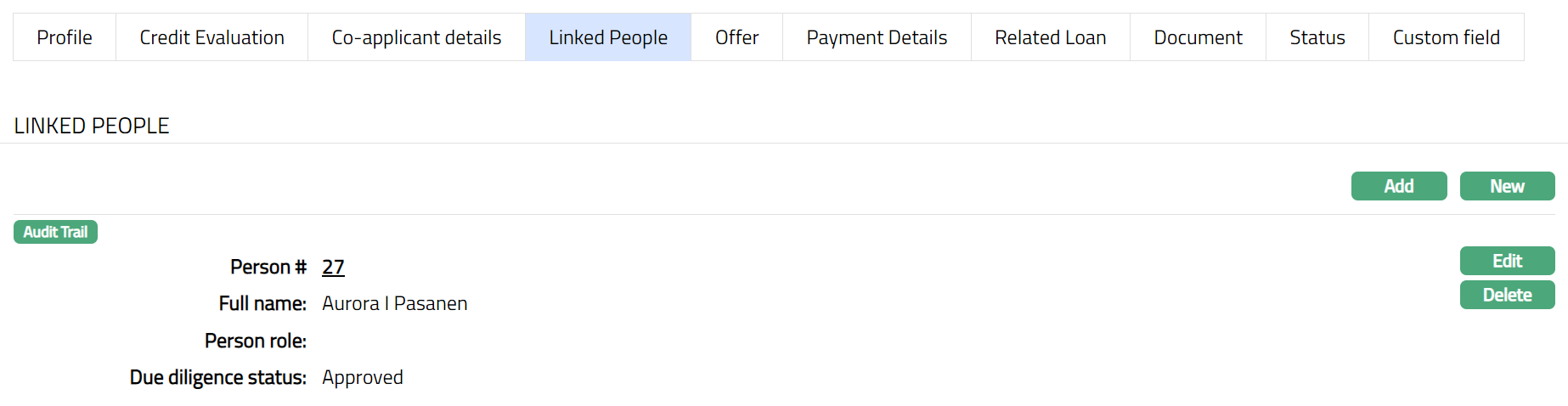

- Select the required Person. Linked People page appears with the selected person details.

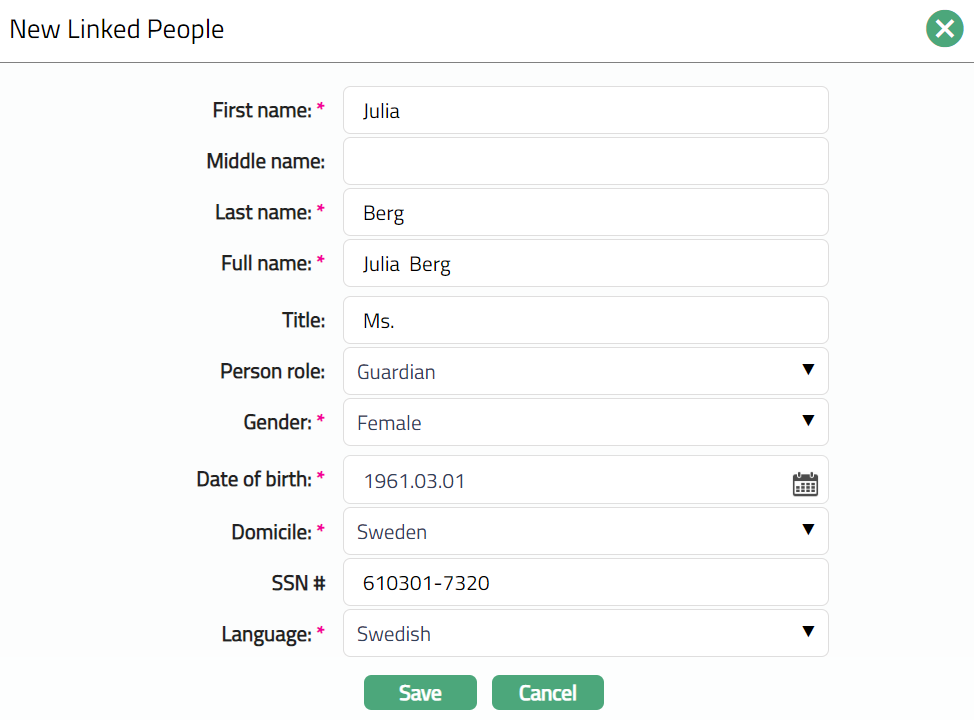

- If you want to enter the details of a Person / Client who has not yet been created as a Person under CRM > Person Maintenance, then click New. New Linked People page appears.

Enter First name of the person.

Enter Last name of the person.

On entering First Name and Last Name Aura derives Full name of the person.

Enter Title of the person that is to be prefixed to the person's First name.

Select the role of the Person in relation to this account using the Person role drop-down, which shows the list of Person Roles maintained under Admin > System codes > Generic definitions > Person role.

Select Gender of the person from the drop-down list.

Input Date of birth of the person. You can either enter the date manually or select using the calendar. Aura will validate the date format using the format maintained under Entity maintenance > Regional > Date format.

Select Domicile of the person i.e., country of residence from the drop-down list.

Note: The list of countries for Citizen and Domicile should have been maintained under Admin > System codes > Generic definitions > Countries.

- Enter SSN#. It is the person's Social Security Number i.e., a unique number provided by the person's residence country.

Note: The validation for SSN, if required, may be customized during implementation.

Select Language of the person from the drop-down list maintained under Admin > Generic definitions > Languages.

Click Save. Linked People page appears with the added New People details.

Note: Any change in the tab will set the Due diligence status to Pending till it is approved by another user. On approval, the Due diligence status is set to Approved.

Functions: Add, New, Edit, Delete.

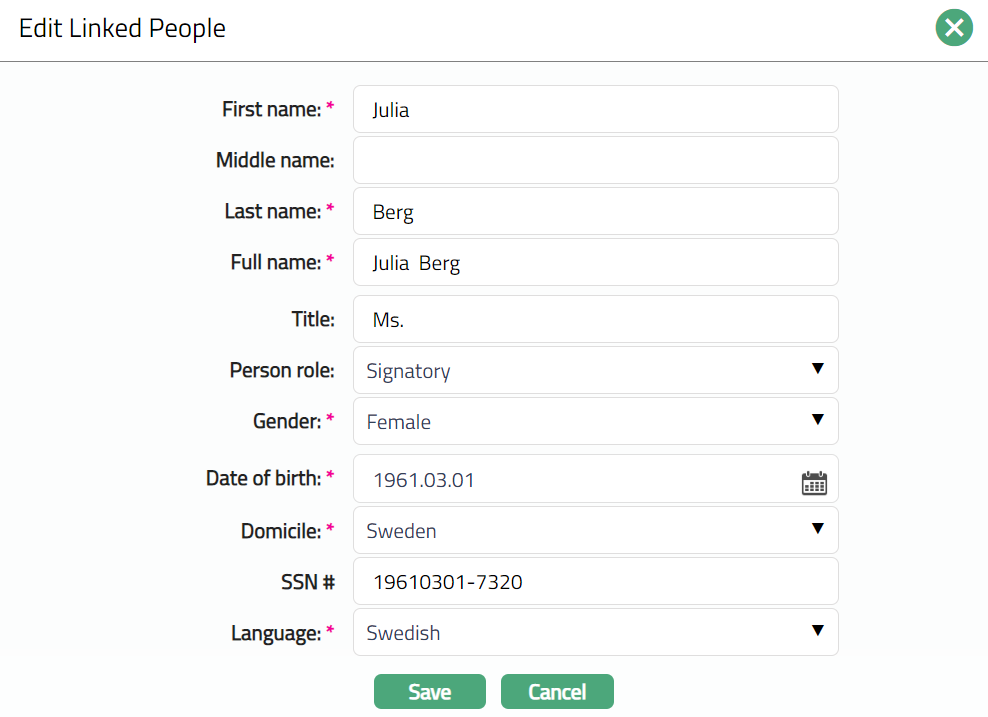

To edit linked people record

- Click Edit. Edit Linked People page appears.

Note: All fields are editable.

- Click Save. Linked People page appears with the edited details.

Functions: Edit, Delete.

Delete: You can delete a co-applicant by a clicking on Delete button. When you click on Delete button, Aura displays an alert message. On confirmation, Aura will delete the co-applicant.

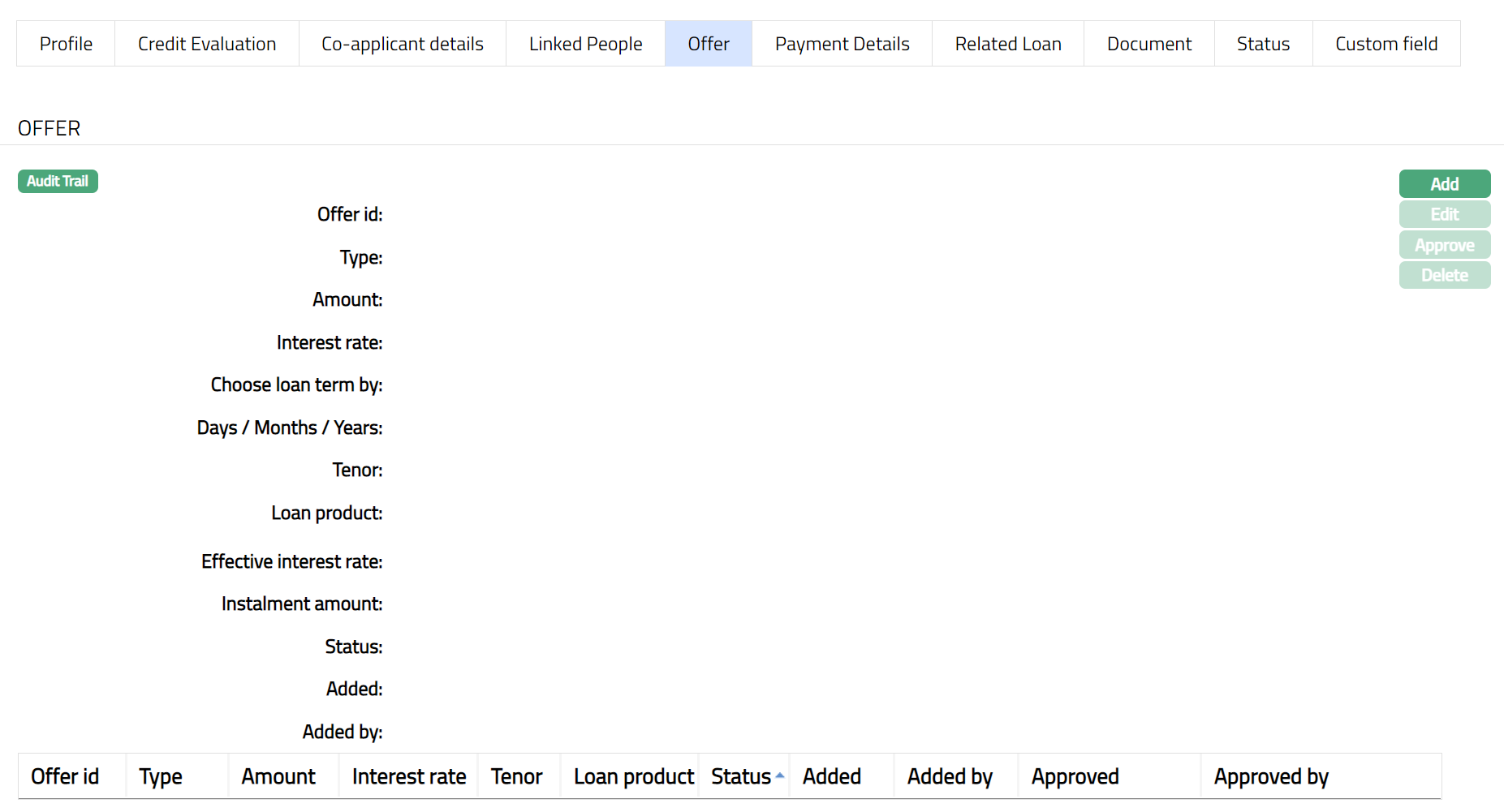

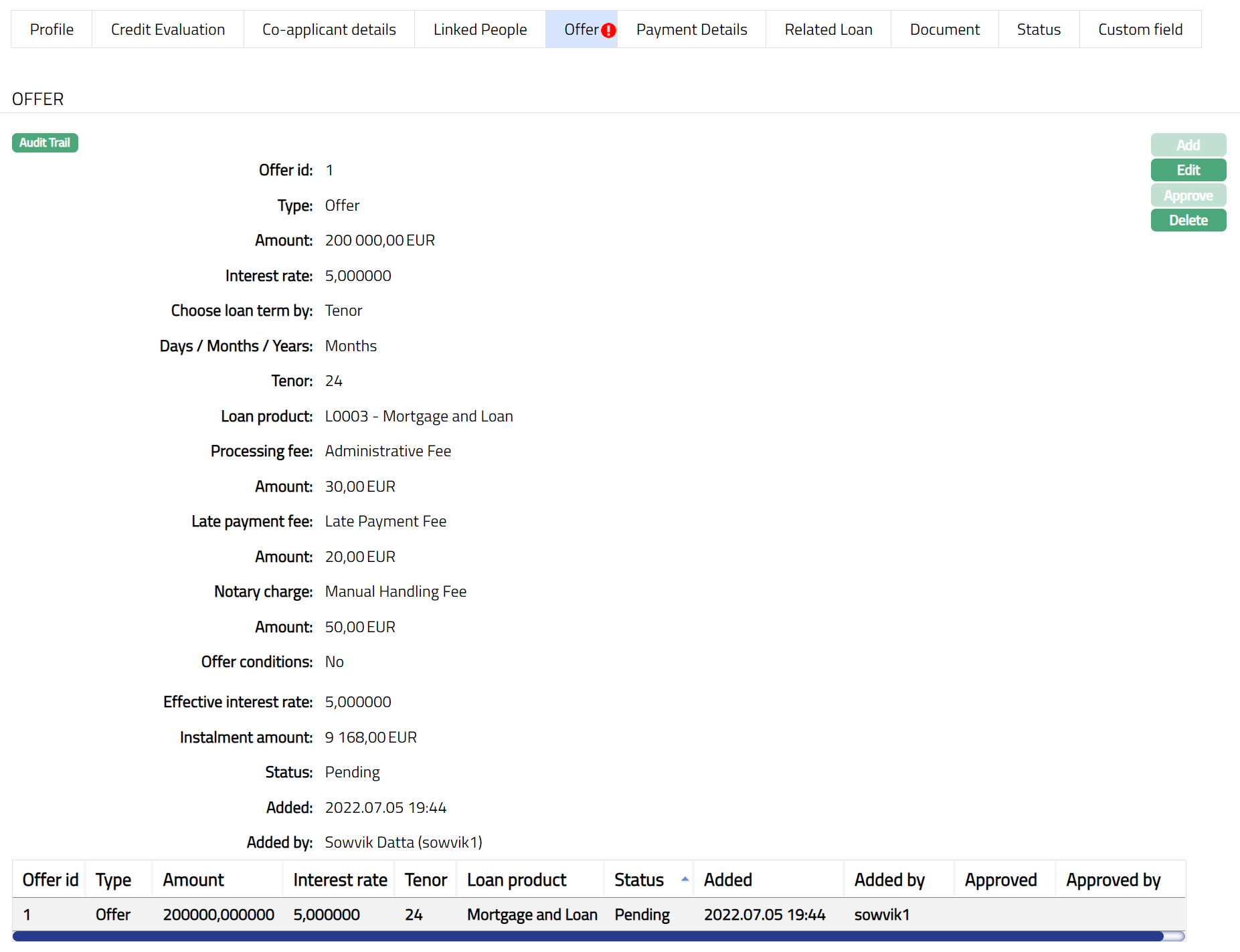

Offer

The Offer tab allows you to view and maintain various offer details applicable for the account.

To view/Add Offer

- Access Loan Application page. Then click Offer tab. If any offer details had already been added, these would be displayed; else, it will be blank.

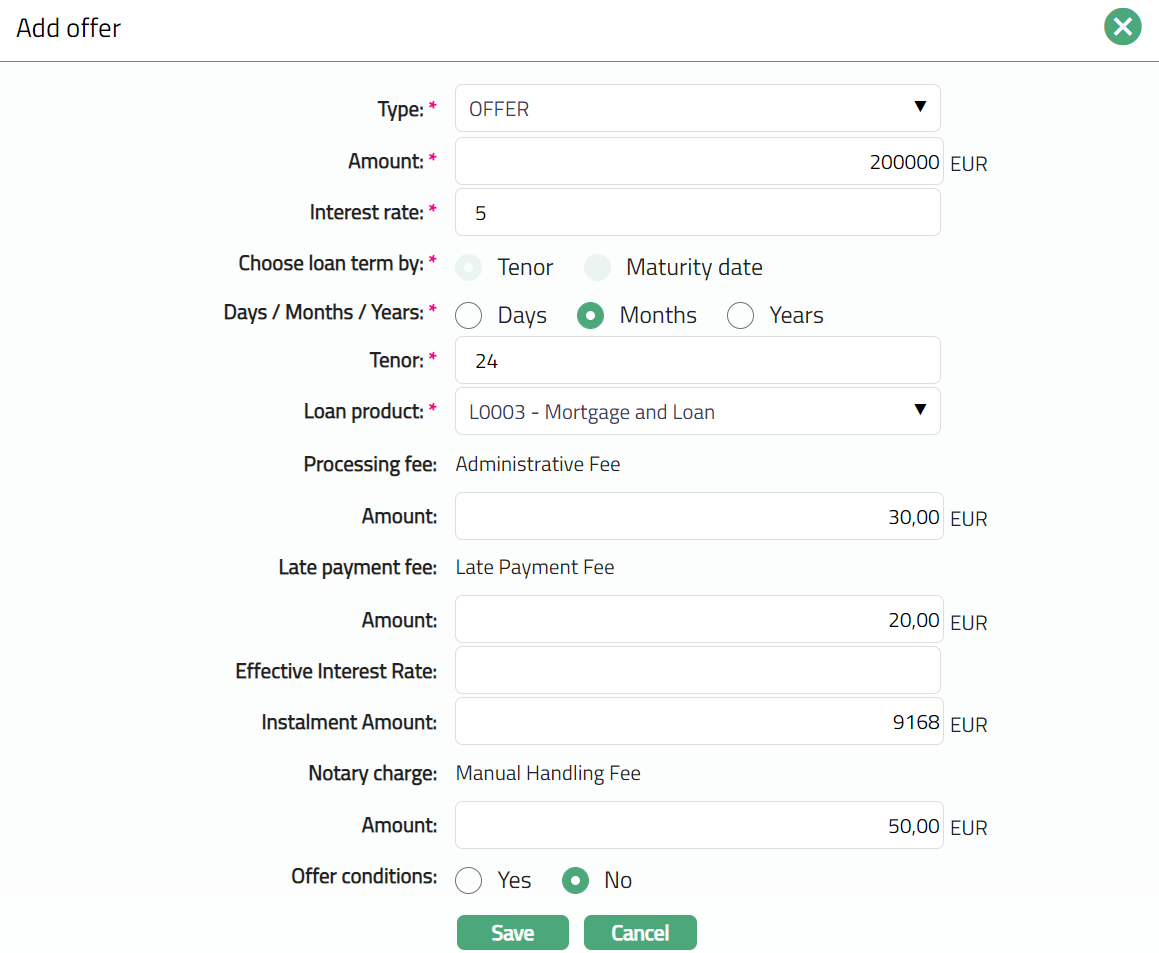

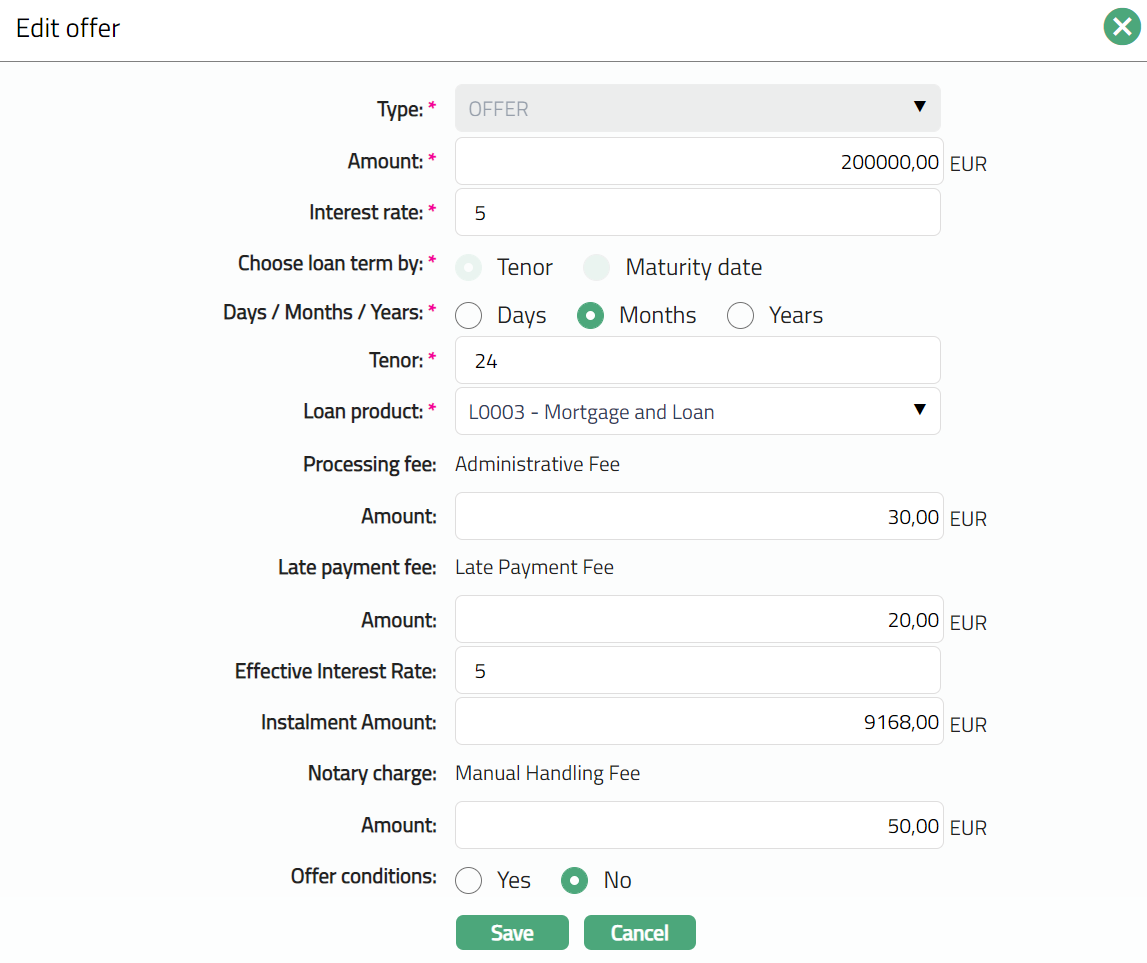

- Click Add. Add Offer page appears.

Select Type of offer from the drop-down list of values. The List of values are Offer and Counteroffer.

Enter Amount on which the offer is applicable.

Enter applicable Interest rate for the for the offer.

Select Tenor or Maturity date radio button to Choose loan term by. If you want to indicate the loan's term by way of a specific duration / period, choose Tenor. If you want to indicate the loan's term by way of a specific maturity date, choose Maturity date.

Select Days / Months / Years depends on what was selected for Choose Loan Term By.

If you had selected Tenor, this field will be enabled, and you can select the appropriate radio button to specify the loan term in Days / Months / Years

If you had selected Maturity date, this field is disabled and is automatically defaulted to Days.

Enter Tenor.

Select Loan Product from the drop-down list maintained under Retail > Settings > Product

Processing fee / Late payment fee / Notary charge: Names will be defaulted from Retail > Loans > Maintain > Mortgage Loan > Charge once you select Loan Product.

Enter Amount applicable for the Processing fee / Late payment fee / Notary charge respectively.

Enter Effective Interest Rate if applicable.

Enter Instalment Amount for the loan amount.

Select radio buttons Yes or No for the Offer Condition.

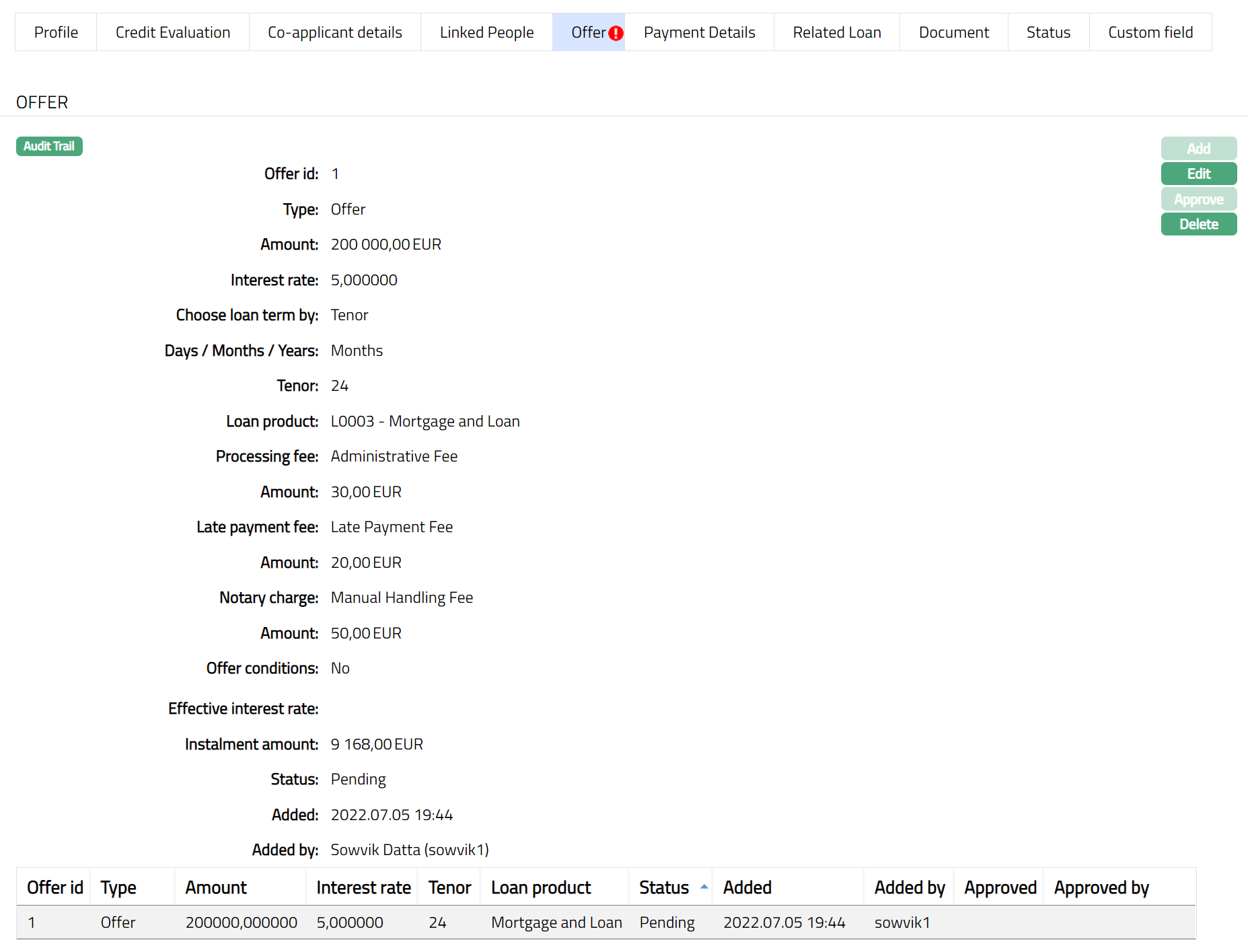

Click Save. Offer page appears with the added details.

Functions: Add, Edit, Approve, Delete.

Note: Any change in the tab will set the tab status to Pending till it is approved by another user. On approval, the tab status is set to Approved and the red bubble disappears.

To edit Offer record

- Click Edit. Edit Offer page appears. Note: You can edit the Offer record before approving. Once approved you cannot edit further.

Note: Except Type, Processing fee , Late payment fee, Notary charge rest all other fields are editable.

- Once edited click Save. Offer page appears with the edited details.

Note: Any change in the tab will set the tab status to Pending till it is approved by another user. On approval, the tab status is set to Approved and the red bubble disappears.

Delete: You can delete a co-applicant by a clicking on Delete button. When you click on Delete button, Aura displays an alert message. On confirmation, Aura will delete the co-applicant. Note: You can delete the offer record before approving. Once approved you cannot delete.

Functions: Add, Edit, Approve, Delete.

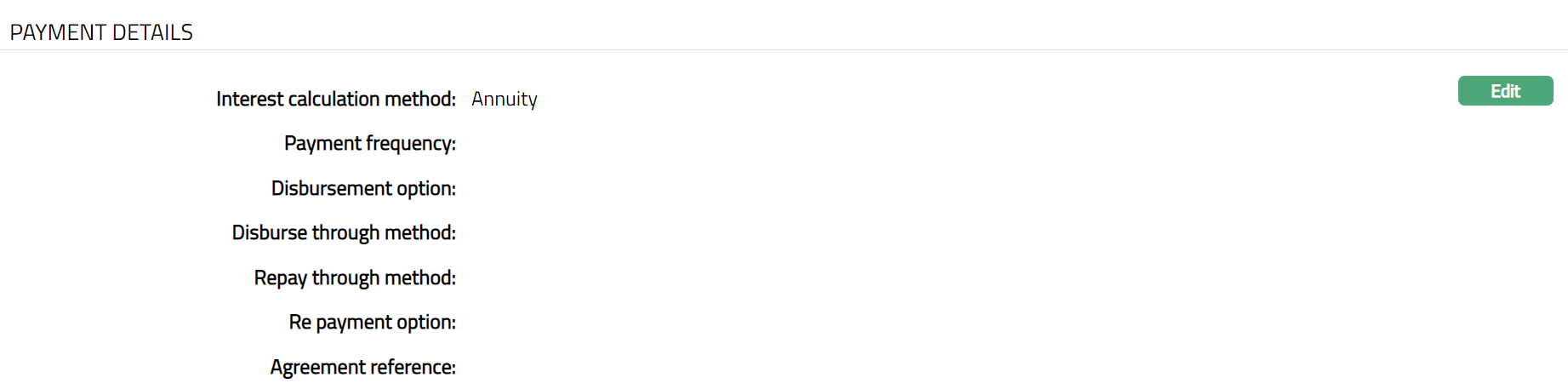

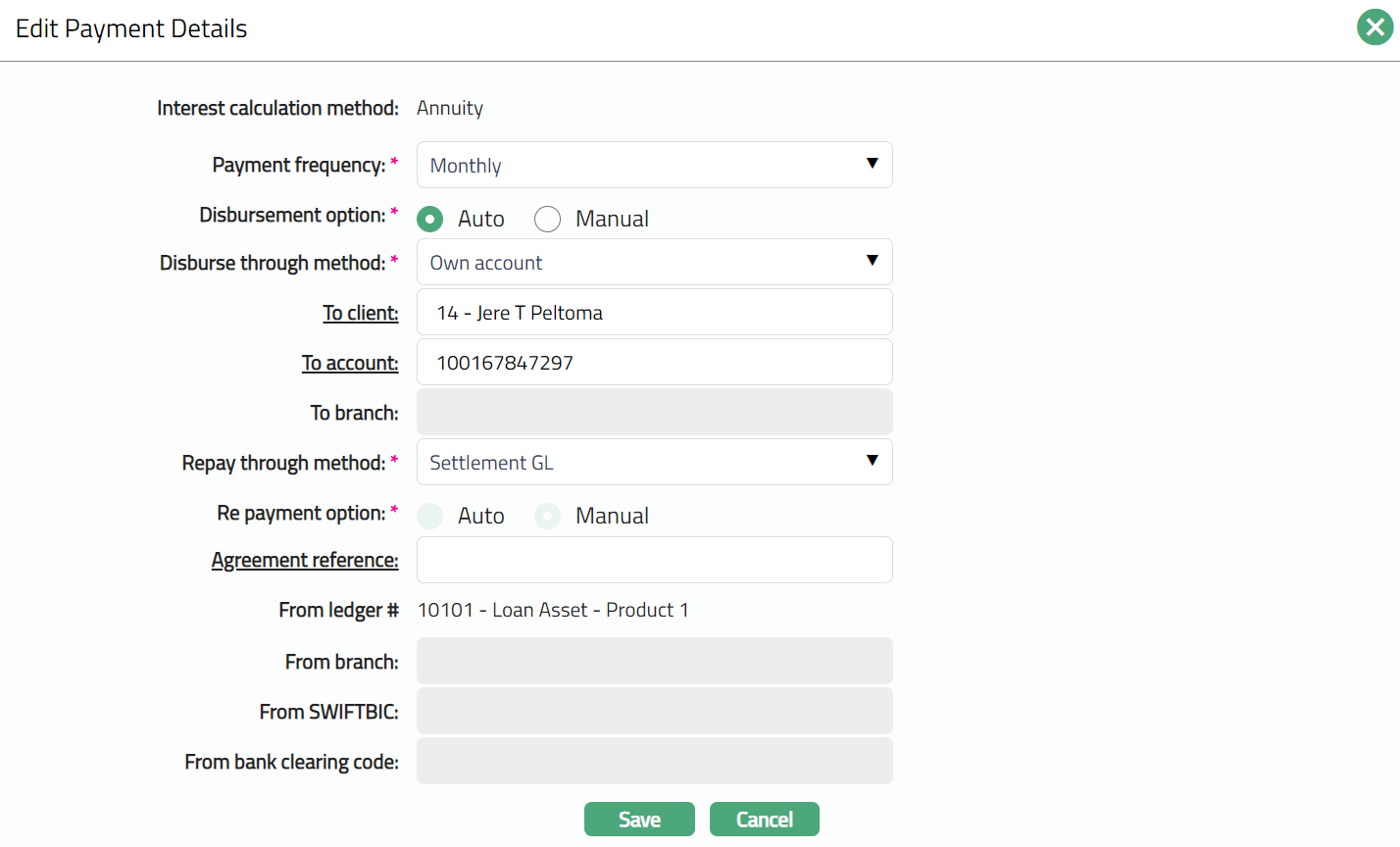

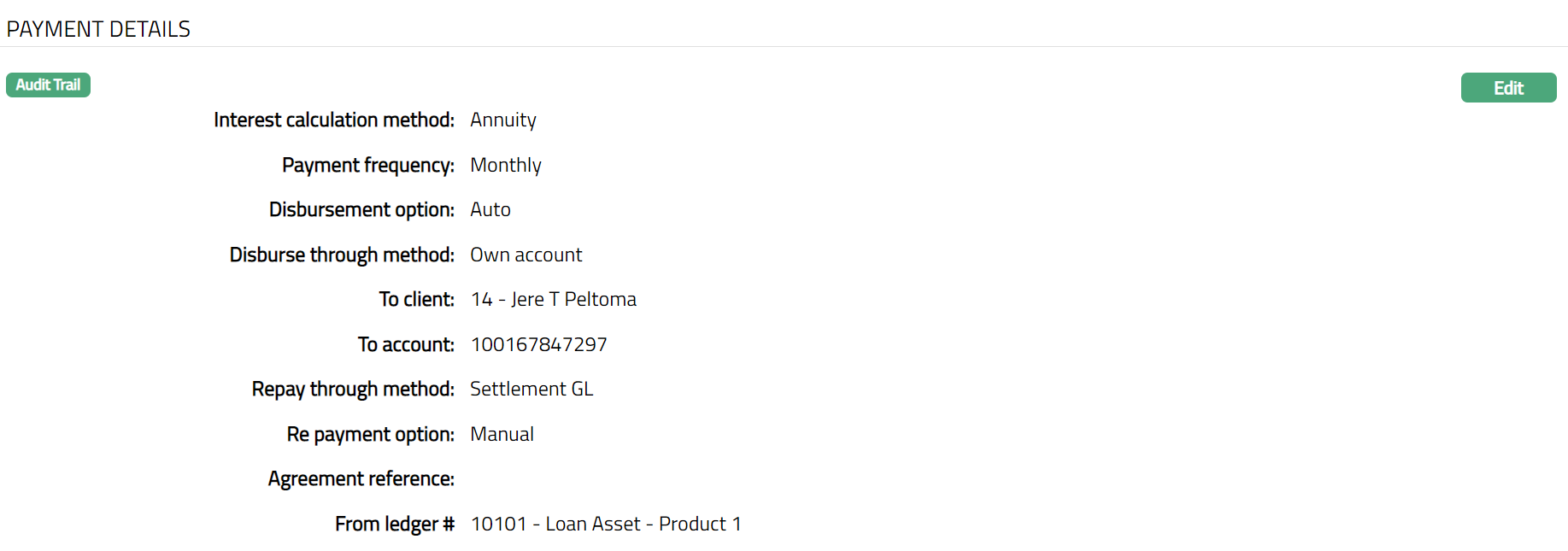

Payment Details

Using this tab, you can view or edit the payment related details of the account.

To edit Payment Details

- Access Loan application page. Click Payment details tab to view the details as per sample below. The details will be defaulted from the entries that you made during Account creation; else it will be blank.

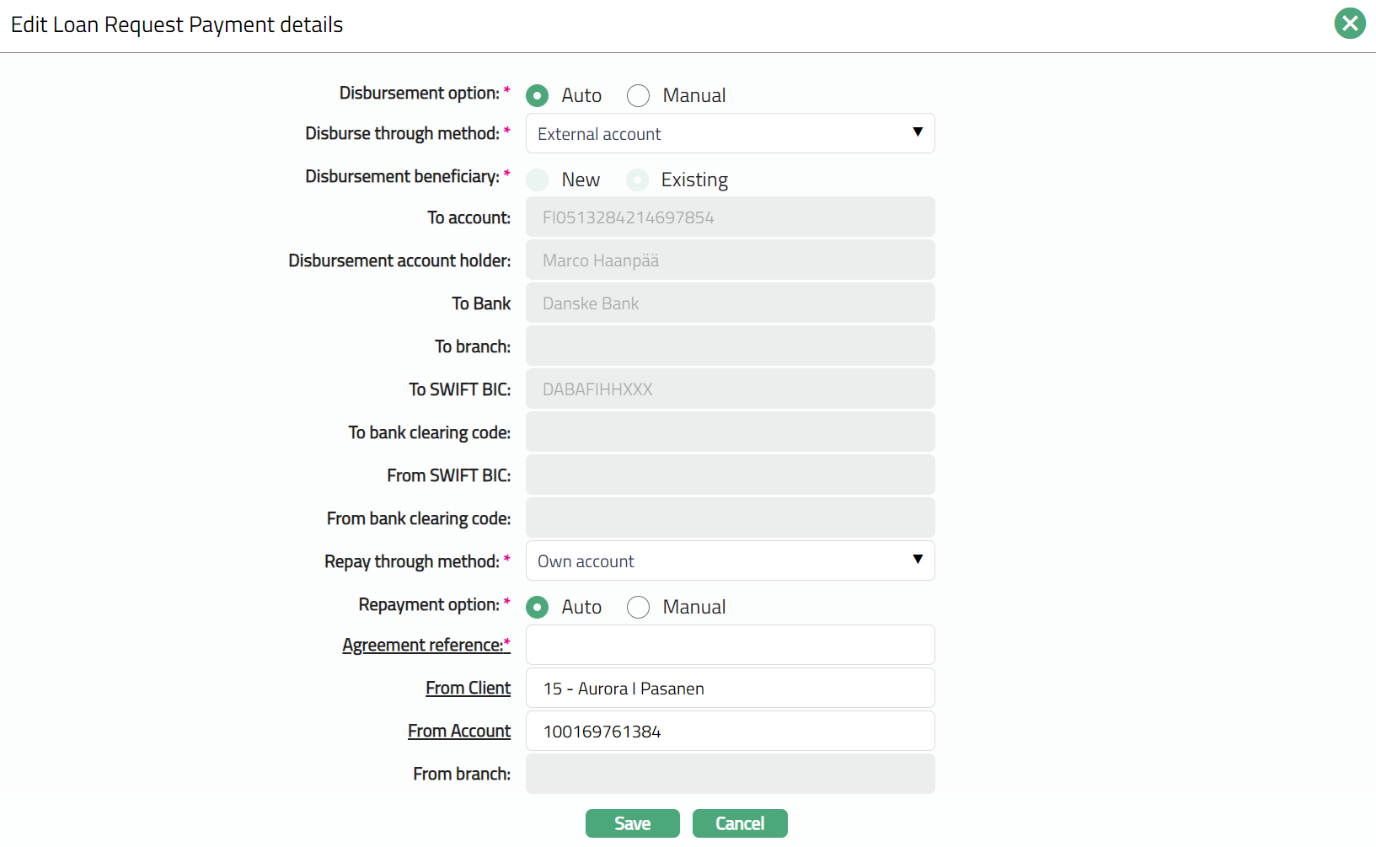

Click Edit. Edit Payment details page appears.

Note: Except Interest calculation method all other fields are editable.

Payment Frequency can be used to input how Principal and Interest amounts are to be paid by the borrower. Flexible payment frequency is available only for Principal during creation of the Loan; if Interest payment has to be flexible, it will have to be done using the Change of Terms option. The available options are: Weekly, Semi Monthly, Monthly, Quarterly, Semi Annual, Annual and on Maturity.

Select Disbursement Option by selecting the required radio button Auto or Manual.

Disburse through method can be either Automatic or Manual. Generally, the disbursement option should be Manual to ensure that the borrower completes all the documentation and other formalities before the money is actually disbursed. In case of Manual disbursement, you can disburse to the Borrower's account maintained with another Bank (External Account), or with your Bank (Own Account) or through the Settlement GL. Depending on the Disbursement Method chosen, input the associated other relevant details.

Note: Payment message initiation to the bank in case of External Account should be customized during implementation

To client will depend on Interest Payout Method that you have chosen:

If you have selected Credit to account in interest payout method, the To client field will be enabled. To client will be defaulted to client selected in the profile stage. However, you can change the client if required by clicking client hyperlink.

If you have selected Transfer to another bank, this field will be disabled.

To bank depends on the Interest Payout Method that you have chosen.

If you have selected Credit to account, this field is disabled.

If you have selected Transfer to other account, select the bank to which the interest is to be sent from the drop-down list. The list of banks should have been maintained under Banking > Management > Banks. You can choose Others, if the Bank has not been so maintained.

Select Repay through Method from the drop-down list. The available options are: Direct Debit, Own Account, Payment by Invoice, Settlement GL and Post-dated Cheques.

Select Repayment Option by selecting the required radio button Auto or Manual.

Enter Agreement Reference for the account by clicking on the hyperlink.

- From Ledger will be defaulted from the Settlement GL mapped to the client.

From branch is enabled only if the funding method is Transfer from another bank. Enter the branch of the Bank from where the funds are to be received. This field cannot be edited once it is created.

Aura will automatically display From SWIFT BIC code of the above bank from Admin > Management > Settlement directory if maintained. If the From Bank is 'Other' then you can input the SWIFT BIC code.

From bank clearing code are defaulted for the account selected. Note: Aura will automatically display the SWIFT BIC code of the above bank from Admin > Management > Settlement directory if maintained.

Click Save. Payment Details tab appears with the edited details.

Functions: Edit

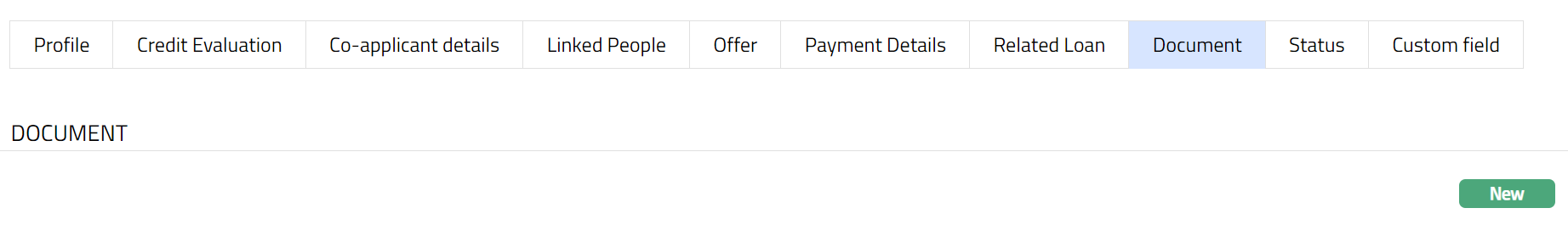

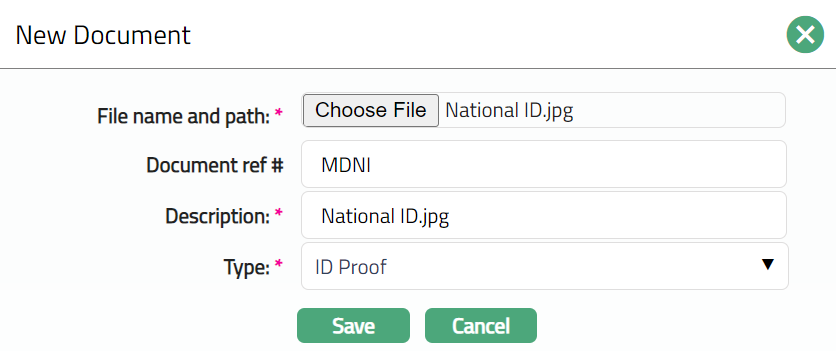

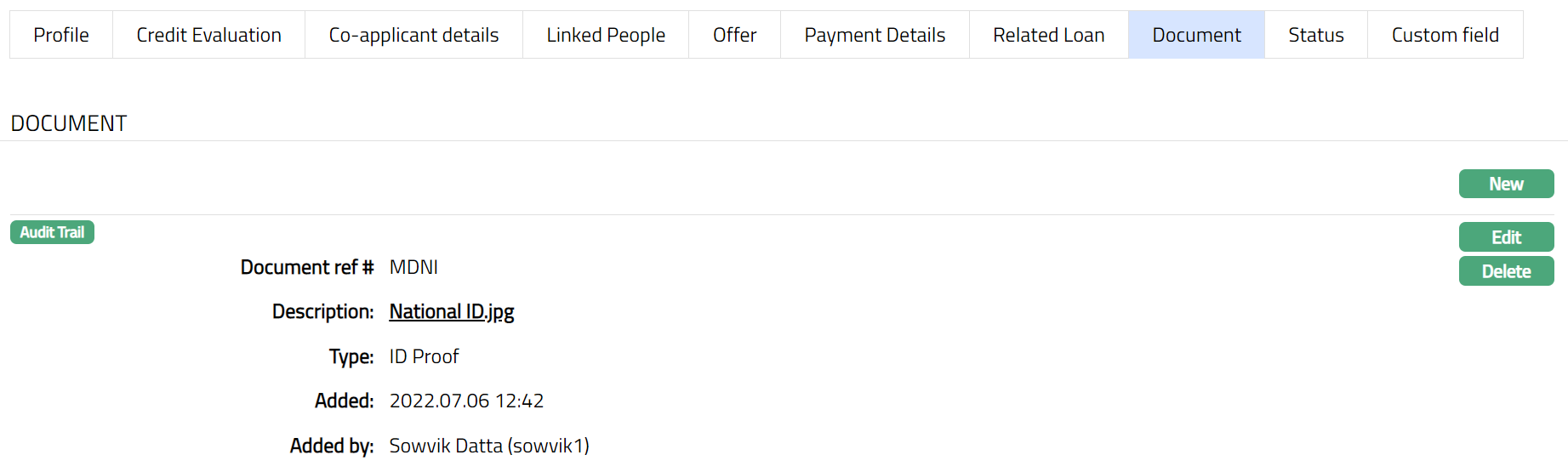

Document

Document tab allows you to upload / generate documents related to the Loan Account. Documents in the form of scanned images or files on your computer can be uploaded. You can categorise the documents as per Document Type and store with a document reference number. You can generate documents related to the Account based on Templates mapped to the Product.

To upload document

- Access Loan Application page. Click Document tab.

- Click New. New Document page appears.

Click Choose File button to select the File name and path of the document.

Enter Document ref no. for the document. This document reference number is used in Branch view > Documents.

Based on the file selected Description field will be derived. If required, you can change the description.

Select Type of the document uploaded. The document types should have been maintained using Admin > System codes > Documents > Document types. Once entered, this cannot be edited.

Click Save. Document page appears with the added details.

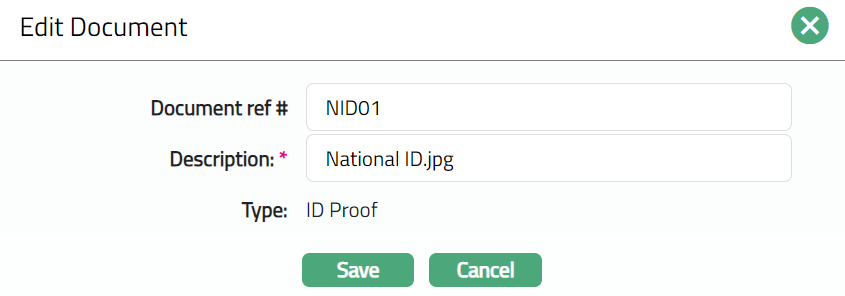

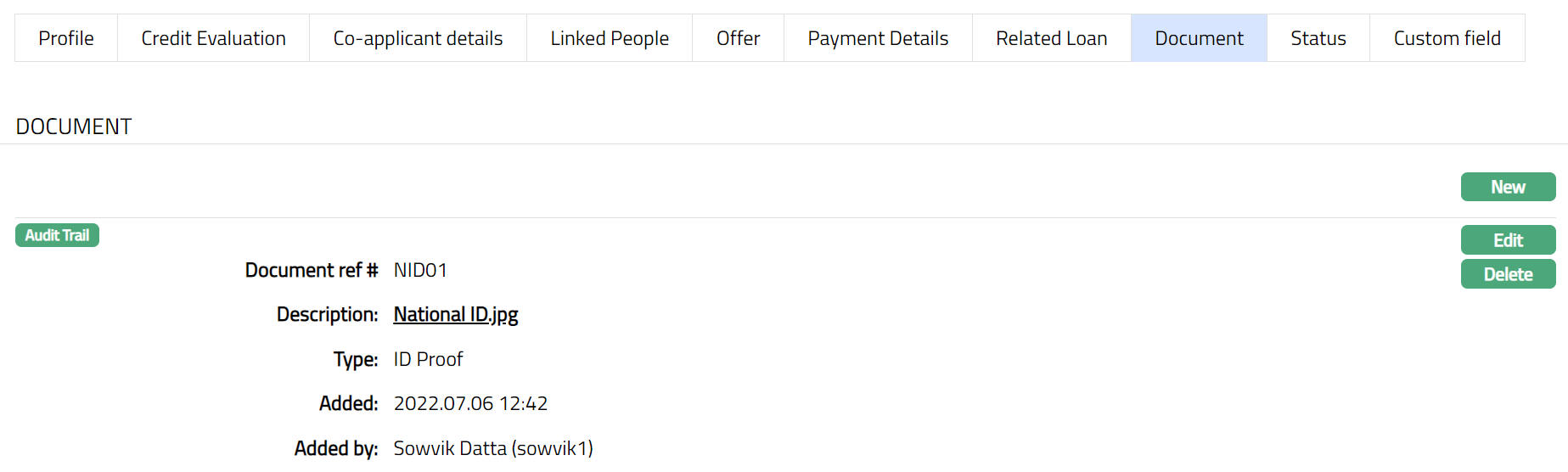

To Edit document

Access Loan Account page. Click Document tab.

Click Edit. Edit New Document page appears.

Note: Only Document ref # and Description fields are editable.

- Click Save. Document page appears with the edited details.

Functions: New, Edit, Delete

Delete: You can delete a co-applicant by a clicking on Delete button. When you click on Delete button, Aura displays an alert message. On confirmation, Aura will delete the co-applicant.

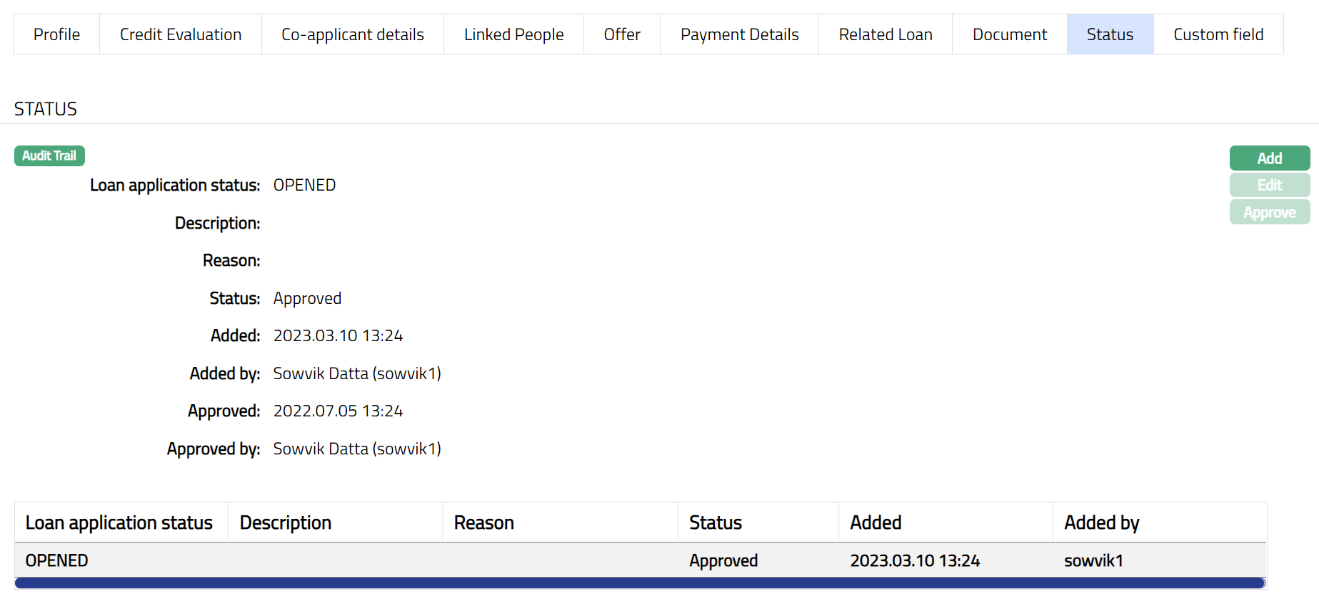

Status

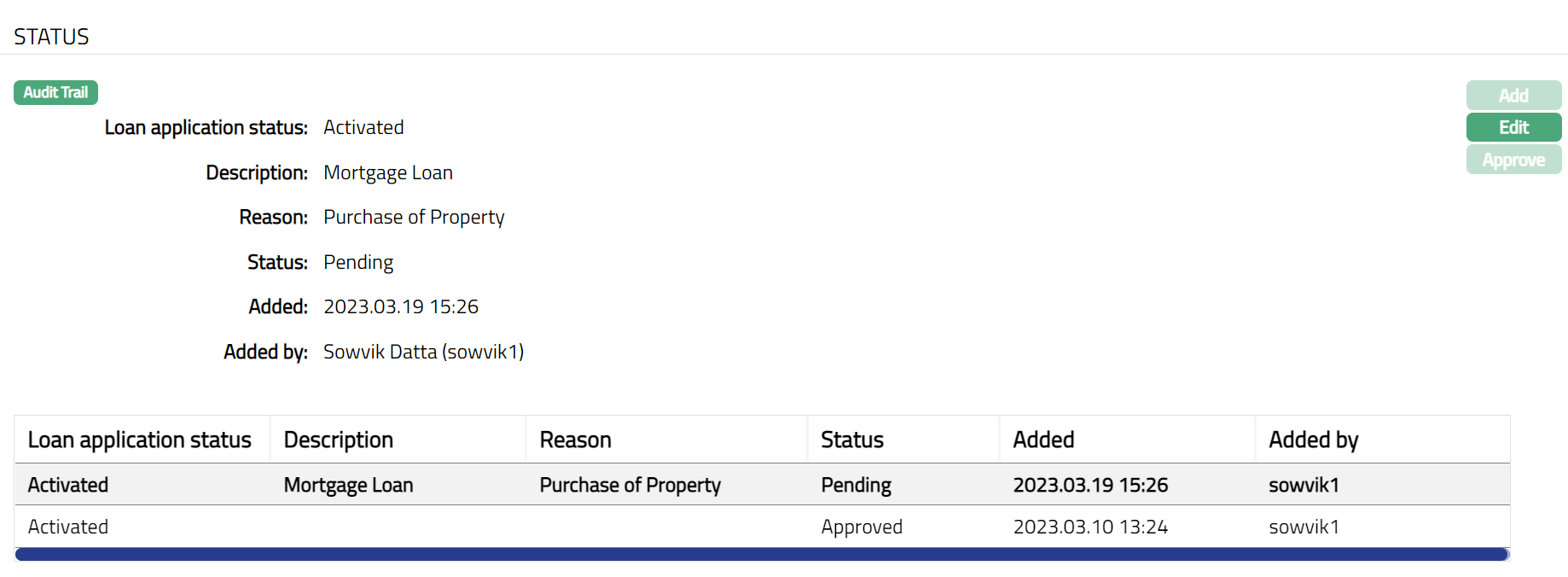

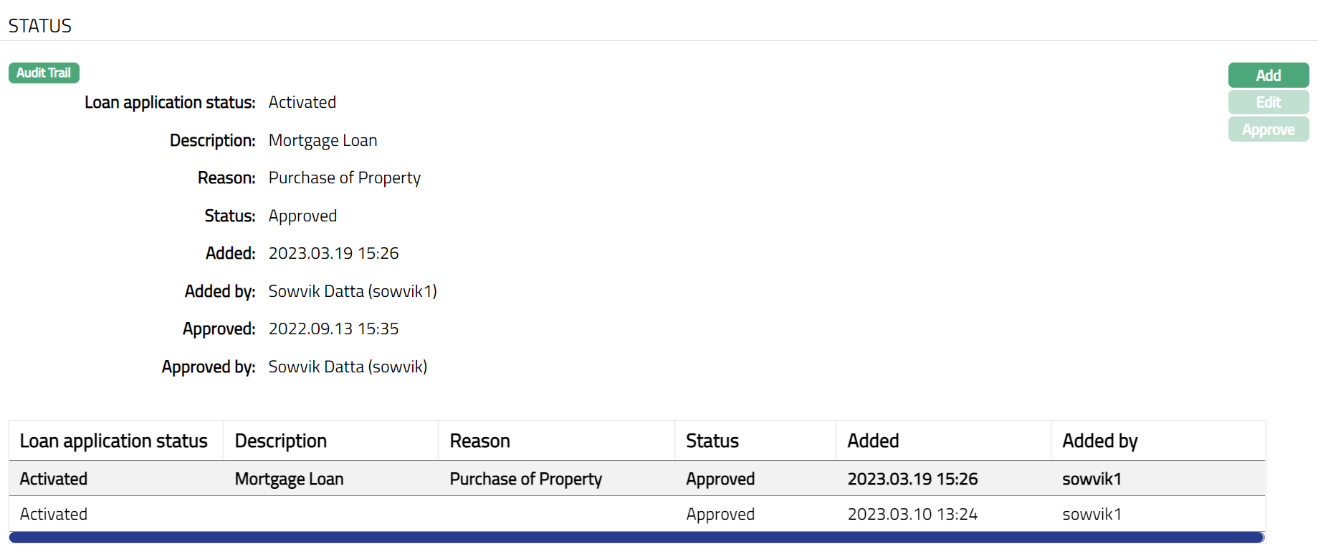

Using this tab, you can view the history of the account status. You can also approve the Status record created by another user.

To View Status tab

- Access Loan Application, then Maintain, then click Status tab.

Note: The Loan application Status will reflect as Opened and the Status will reflect as Approved. Also Note: Once approved by another user apart from the user who created the Account, you cannot Edit or Approve further.

The additional fields under Status tab are explained below.

Loan application Status denotes the current status of the loan application.

Description displays a brief description for the loan application.

Reason displays the reason for the status selected for the account. In case of automatic status movement, the reason is predefined; while in case of manual status updates, this will display the reason input during the manual status change.

Status displays the status of the loan application.

To Add Status.

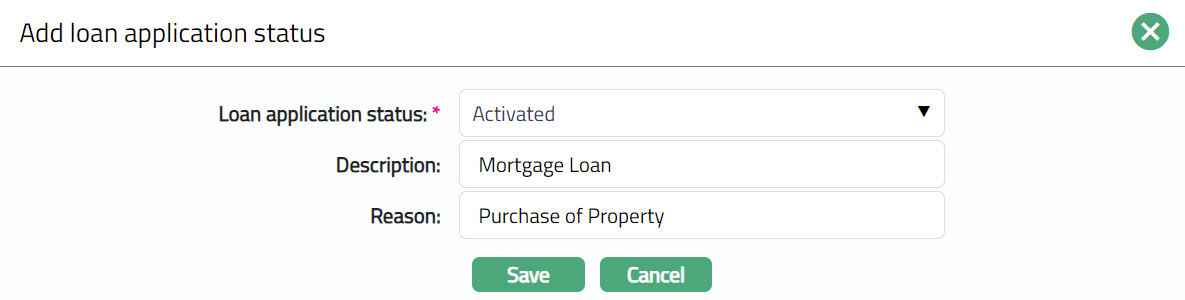

- Click Add. Add Loan application status page appears.

- Depending on the current status of the loan application, Status could be.

Opened: This is the initial status of the account as soon as it is created.

Activated: This status is automatically set when the value date is equal to current date and the funds for opening have been credited to the term deposit account. The record status should be approved by another user to make it effective.

Enter Description for Loan application.

Mention Reason for the Loan application Status.

Click Save. Status tab appears with the Added details.

Note: Once New application Status is added the Status will display as Pending.

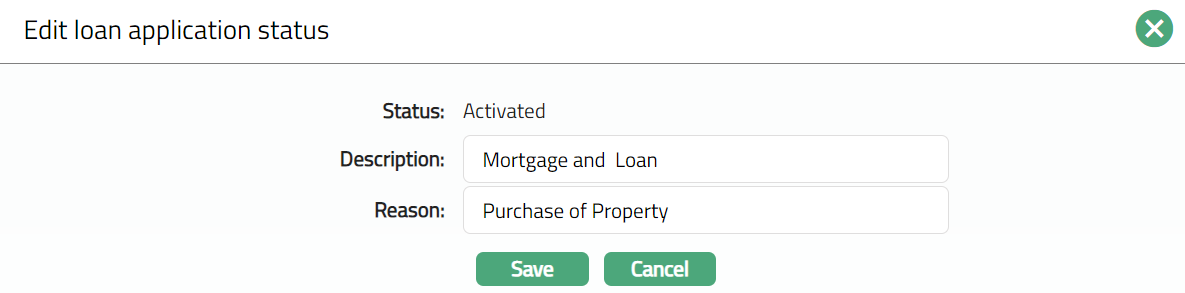

To Edit status

- Click Edit. Edit Status page appears. Note: If required you can Edit the Loan Application if Required by clicking on Edit button as per the screen shot shown below. Else you can Approve the Status.

Note: Except Status field all other fields are editable.

- After approval Status will display as approved. Note: Once Approved you cannot edit further. Please refer the screen shot shown below.

Functions: Add, Edit, Approve

Note: Approval can only be done by a user different from the one who created the record.

The additional fields available in view are:

Status denotes status of the record.

Added denotes the date and time on which the status record has been added.

Added by denotes the name of the user who has added the status record.

Approved denotes the date and time on which record is approved. This field is displayed for the approved record.

Approved by denotes the name of the user who has approved the record. This field is displayed for the approved record.

Custom Field

This option provides you the flexibility to define fields apart from those that are already available in the standard version of Aura. Thus, it enables you to customize additional data storage and use as required to suit your specific business needs.

To maintain Custom Field

- Access Loan Application page. Click Custom Field tab.

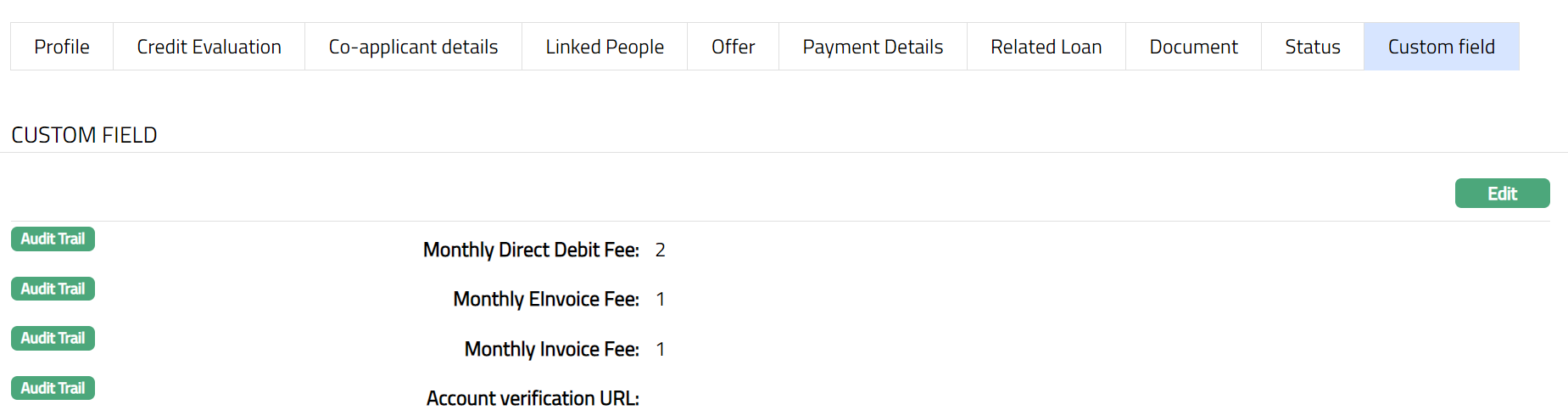

The field appears only when it is created in Admin > System codes > Custom fields > Custom fields and linked to Loan account option in Admin > System codes > Custom fields > Field mappings.

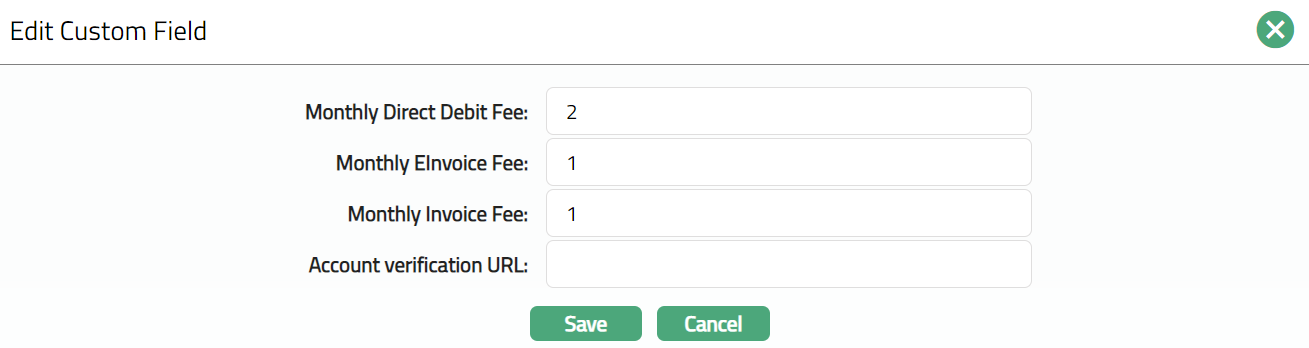

Click Edit. Edit Custom Field page appears. In the following illustration, four custom field Loan Categories has been mapped to the Loan application as per the sample screen shot shown below:

Enter Monthly Direct Debit Fee to which the loan application belongs.

Enter Monthly EInvoice Fee to which the loan application belongs.

Enter Monthly Invoice Fee to which the loan application belongs.

Enter Account verification URL if applicable.

Click Save. Custom Field page appears with the edited details.

Function: Edit

Function: Edit