Adhoc Charges

Adhoc charges will allow you to charge the client for any Adhoc services rendered. Example:

Charge for verifying / attesting customer signature

Charge for a photocopy

Locker services

The Adhoc charges are applicable for Current Account, Consumer Loan Account, Mortgage Loan Account, Card Accounts and Card Loan Accounts. However, this will depend on the Modules that have been released to the Bank. If the Bank has taken only specific Modules, then the charges will be applicable only to accounts pertaining to those modules.

In case of Current Account and Card Account, the charged amount will be directly debited to the account. In case of Loan accounts, the charge will be treated as receivable in the loan account and will be part of the next invoice. The amount will be debited from the Service Account, in the normal course.

Following is the tab under Adhoc Charge:

To add an Adhoc charge,

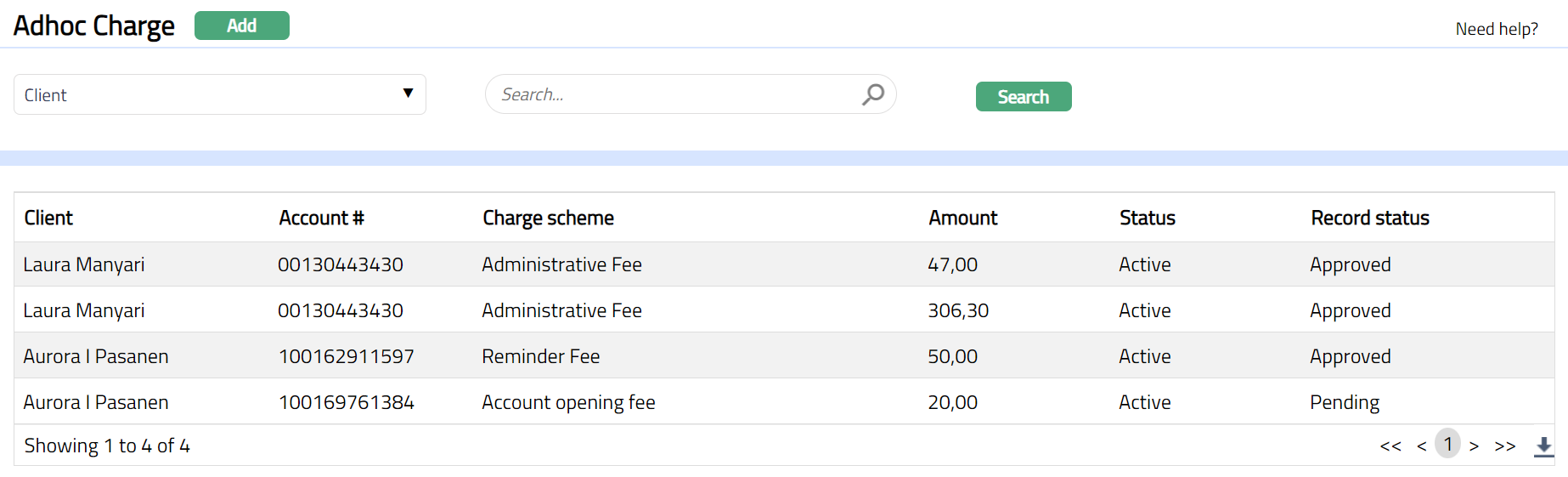

Access Retail menu, click Accounts, Operations and then Adhoc Charge. The system will display the Adhoc ChargeSearch screen. The list of all the adhoc charges issued in Aura will be displayed.

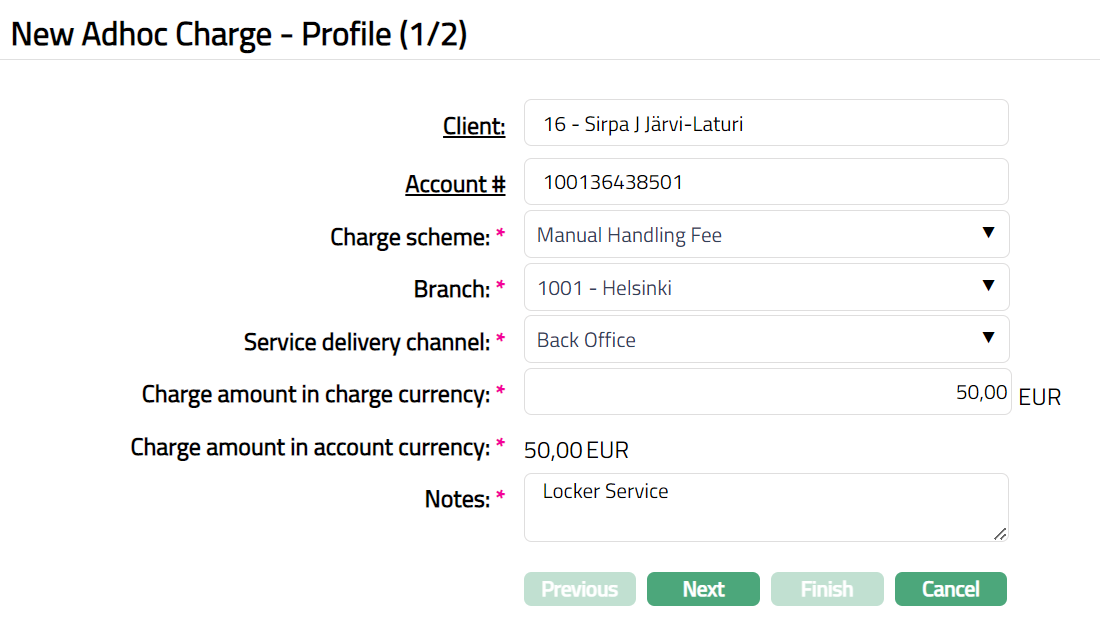

Click Add. The New Adhoc Charge -- Profile (1/2) page will be displayed.

Select Client by clicking on client hyperlink. The Client search page appears with the list of Clients maintained under CRM > Clients > Maintain. You can search for a client with relevant criteria and select the required client. You can also input the client's name or client number and select the required client from the list displayed by Aura.

Select account number by clicking on the Account# hyperlink. The Search Client Account page will appear with all the Current Account, Consumer Loan Account, Mortgage Loan Account, Card Accounts and Card Loan Accounts of the selected Client.

Select Charge scheme from the drop-down list of all the active Charges where the Charge Type is Event based Flat charge both deferred and non deferred for which Treat as Commission is marked as Yes. The Charge Scheme in the dropdown list will be populated based on the charge scheme combination maintained at Admin > System code > Charges > Charges.

Note:

If the charge is treated as commission, then Aura will not display these charges in the Charge Scheme dropdown list.

If the Account selected is Current account / Loan Account, then the deferred charges will not be displayed.

If the Account selected is Card Account, then Aura will display all the Event based flat irrespective of Defer Charges will be displayed.

Select Branch from the drop-down list of all the active branches maintained at Admin > Branches > Maintain.

Service delivery channel that will be used for transactions initiated by the Backoffice. You can select the required Service Delivery Channel from the list of service delivery channels maintained at Admin > System Codes > Categories > Service delivery.

Enter amount to be charged in Charge amount in charge currency field. The charge currency will be defaulted from the charge scheme based on the combination maintained at Admin > System code > Charges > Charges. The Charge Amount in Charge Currency has to be within the allowed variance range. Charge amount is derived according to the charge combinations maintained and else the default combination to get the charge amount based on the below parameters:

Client = Selected client

Branch = Selected branch

Charge currency = Selected Charge scheme,

Service delivery channel = Channel selected in the above fields

If the charge currency is different from the account currency, then Aura will convert the Charge Amount in Charge Currency to the Charge amount in account currency based on the currency conversion rate maintained at Admin > System code > Currencies > Currencies. The charge amount has to be greater than or equal to 0.

In Notes field, enter the reason for which the charges are applicable to the client.

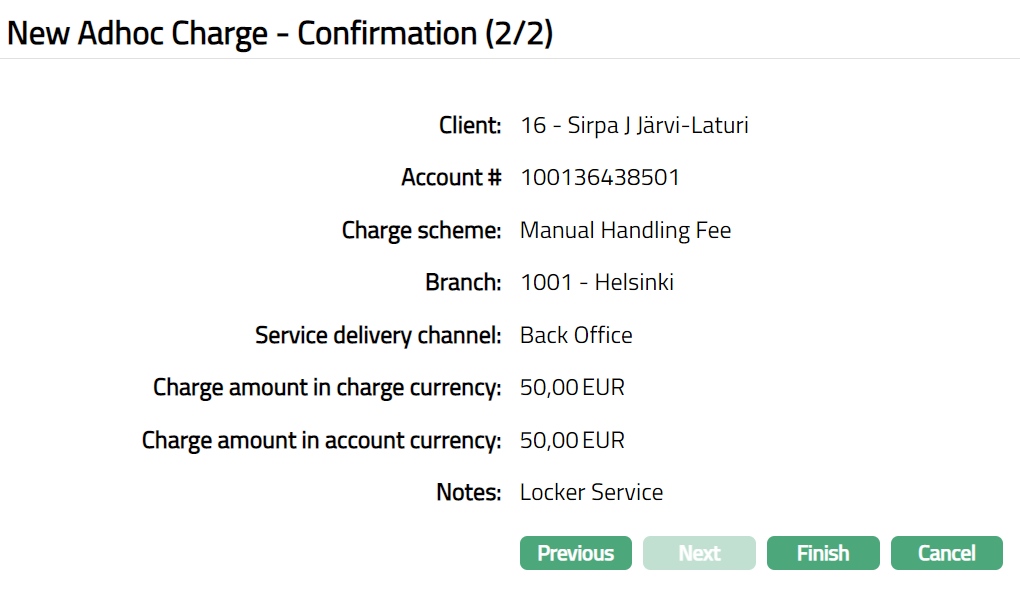

Click Next. The New Adhoc Charge -- Conformation (2/2) page will appear.

- Click Finish. The Adhoc Charge page will appear with all the added details.

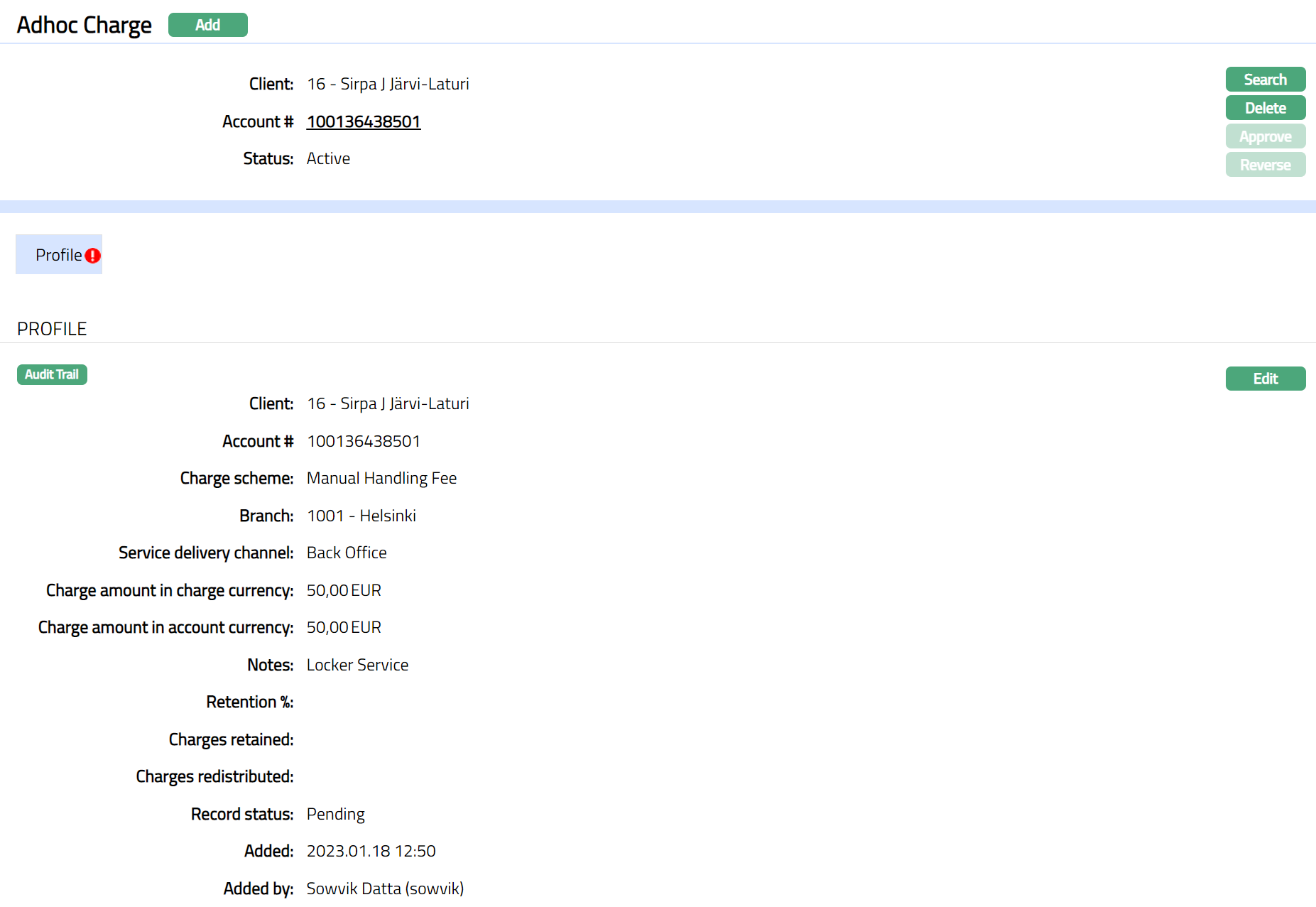

Functions: Add, Search, Delete, Approve, Reverse

On click of Finish, an Adhoc charge is created, and the status will be Active and record status will be Pending. If the Auto Approve Setting is marked as Yes then, the charge status will be Active and the record status will be Approved.

Delete: You can delete an Adhoc charges record by a click on Delete button until the record status is approved. Aura will ask for confirmation, on approving which selected record will be deleted. Once the record is approved, it cannot be deleted.

Note: Aura does not allow you to delete the Adhoc charge record when the charge record is Reversed, and the record status is Pending or Approved.

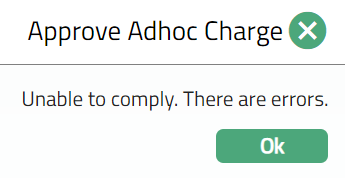

Approve: If you want to approve an Adhoc charges record, then retrieve the record and click on Approve. Aura will ask for confirmation. Once the record is approved, status gets changed from Pending to Approved. You can Approve the record only if you have initiated / reversed the record.

If the Status is Active:

The charge will be booked to the account, immediately on approval as per the following accounting entries.

Note:

In case of Loan accounts, the charge will be treated as a receivable and will be part of the next invoice. The amount will be debited from the Service Account, in the normal course. In case of Current Account and Card Account, the amount will be directly debited to the account.

Aura will display the Adhoc charge amount as due amount in the payment Schedule tab and will be collected according to the schedule for the loan account.

If Charge account is linked to the loan account Aura will debit the charge account immediately and display the ADHFEE event in the Charge account. You will be able to see the Adhoc charge details in the Loan account payment schedule tab and display the amount as Paid amount. Due date will be updated as booking date.

If loan account does not have a charge account attached, Adhoc fee will be considered as receivable and will be part of LNPAYS / LNPAYP event. You will be able to see the Adhoc charge details in the Loan account payment schedule tab and display the amount as due amount. Due will be updated as Schedule date for the next schedule.

| DB/CR | Account/GL | Currency | Charge Amount | Transaction Code |

|---|---|---|---|---|

| Debit | Account | Account | Adhoc charge amount | Charge Transaction code |

| currency | in account currency | (DB/Client) from Charge | ||

| (e.g., 8.00 EUR) | Scheme | |||

| Credit | Charge income GL | Account | Adhoc charge amount | Charge Transaction code |

| from Charge Scheme | Currency | in account currency | (CR/GL) from Charge Scheme | |

| (e.g., 8.00 EUR) |

Reverse: Reverse button will only be enabled if record status is Active/Approved.

On click of Reverse, Aura will ask for conformation. On confirming, Adhoc charges Status changes to reversed and record status is changed to pending.

If the status is Reversed:

The charge will be reversed to the account, immediately on approval as per the following accounting entries.

| DB/CR | Account/GL | Currency | Charge Amount | Transaction Code |

|---|---|---|---|---|

| Debit | Account | Account | Adhoc charge amount | Charge Transaction code |

| currency | in account currency | (DB/Client) from Charge Scheme | ||

| (e.g., 8.00 EUR) | ||||

| Credit | Charge income GL | Account | Adhoc charge amount | Charge Transaction code |

| from Charge Scheme | Currency | in account currency | (CR/GL) from Charge Scheme | |

| (e.g., 8.00 EUR) |

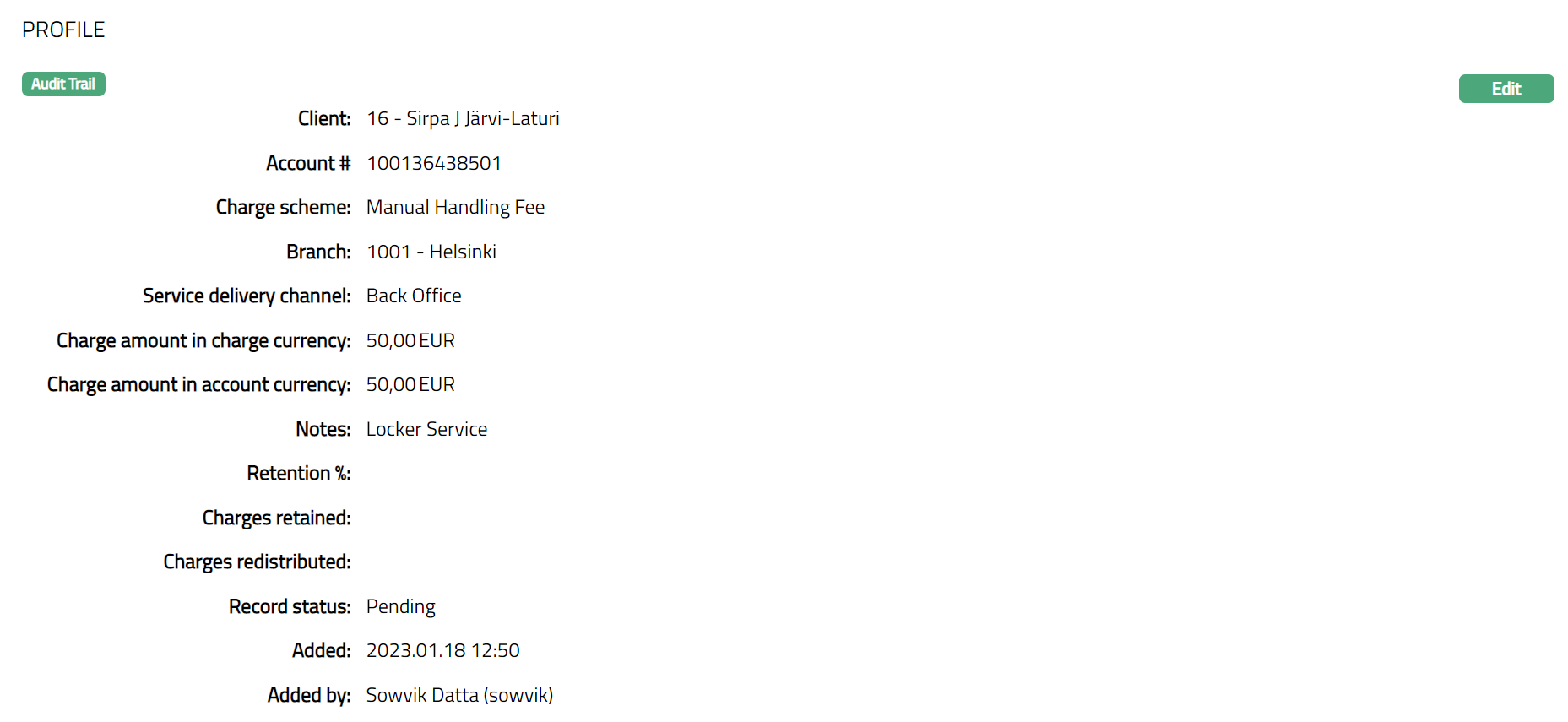

Profile

The Profile tab, which is the default tab in the Adhoc Charge screen, shows the basic details of the Adhoc charges.

A sample of the Profile tab is shown below:

To View Profile.

- Access Adhoc Charges page, by default the Profile tab will be displayed.

Functions: Edit

Additional fields are:

Status denotes the status of the Adhoc charges record.

Added denotes the date on which the Adhoc charges record was added.

Added by denotes the name of the user who created the Adhoc charges record.

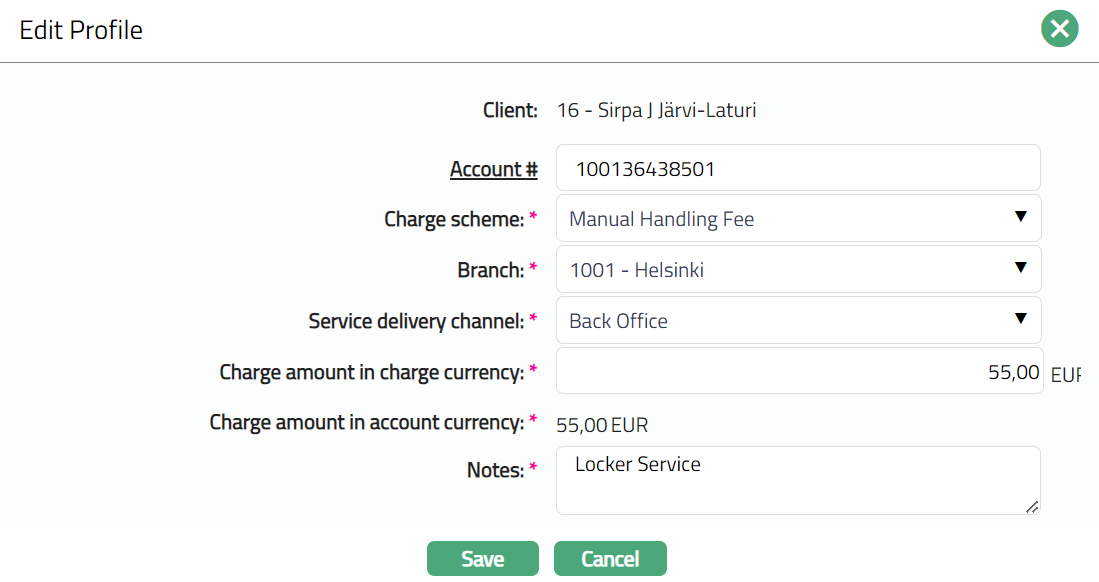

To edit profile,

Click Edit. The Edit Profile page is displayed.

Note: Except Client and Charge amount in account currency all other fields are editable.

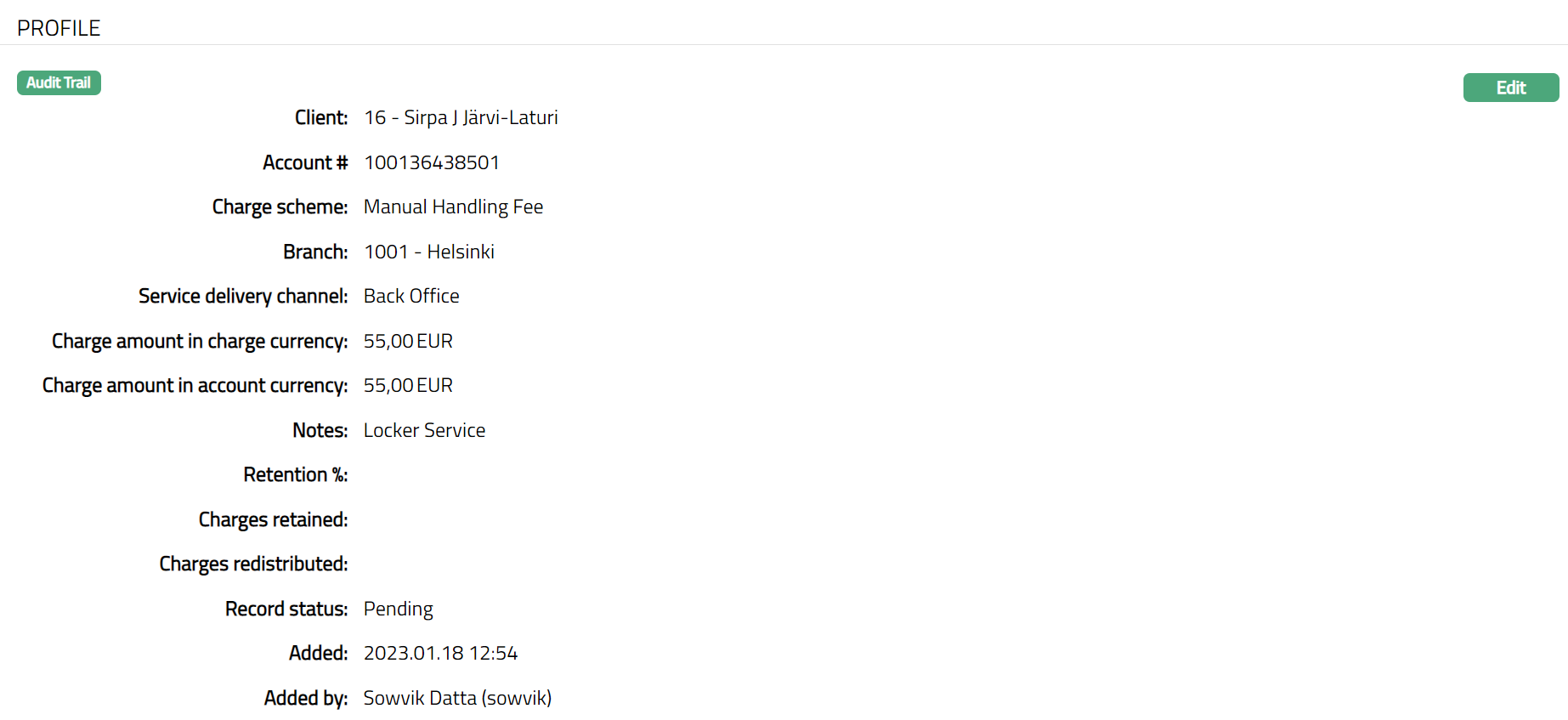

Click Save. The Profile tab appears with the edited details.

Function: Edit

Note: The Record Status will display as Pending unless it is approved by another user who has not created the Record. Once approved the Record Status will display as Approved.

Additional fields are:

Approved denotes date on which the Adhoc charges record was approved. This is displayed only if the record is approved.

Approved by denotes name of the user who approved the Adhoc charges record. This is displayed only if the record is approved.