Payment Processing in Aura

The aim of this document is to facilitate the configuration and validation of parameters that are set up in Aura to handle payments

Aura can be implemented in a financial institution (i.e., any organisation that does not act as a Bank on its own) or in a Bank. The set up would be a bit different in each case.

The set up generally is based on the country in which the Bank / FI (Entity, from now on) is implemented, the clearing network that will be used for the payments and the currencies that are to be handled. Also, the bank in which the FI has its account may have specific requirements which need to be taken into account.

Payments can be of the following types:

1. External Payment: Payment made to a customer's account with a Bank that is different from the Entity / Entity's Bank. It can be Outgoing or Incoming. When funds are transferred out of the Entity, it is Outgoing Payment; and when the funds are transferred into the Entity, it is Incoming Payment.

Example: Demo Bank is a Bank in which Aura is implemented. X is customer of Demo Bank and has an account also with Other Bank. When X transfers funds from her account in Demo Bank to her account in Other Bank, it is an Outgoing Payment. When X transfers funds from her account in Other Bank to her account in Demo Bank, it is an Incoming Payment.

Example: Pro AB is a Financial Institution in which Aura is implemented. Pro AB maintains its accounts with Bank1 and also with Bank2. X is a customer of Pro AB and has an account either with Bank1 or Bank2 or with Bank 3. When funds have to be transferred to X's account with Bank1 or Bank 2 or Bank3, it is an External Payment.

Examples of Outgoing Payments:

- Loan Account Disbursement

- Refunds of moneys received in excess

- Transfer of funds from customer's Client Account

Examples of Incoming Payments:

- Payments towards Loan Account

- Receipt of funds into a customer's Client Account

2. Direct Debit: Payments that are to be debited from the Debtor (Payer)’s account with a Bank on the basis of a request initiated by the Creditor (Payee) under a mandate provided by the Debtor to the Creditor. The mandate has to be registered with the Payer’s Bank.

3. Internal Payment: Payment made to a customer's account within Aura. It can be Own Account Transfer or Other Client Transfer.

a. Own Account Transfer: When the customer transfers funds among her own accounts, it is Own Account Transfer. Example: Demo Bank is a Bank in which Aura is implemented. X is customer of Demo Bank and has two accounts. When X transfers funds from one account to the other, it is an Own Account Transfer.

b. Other Client Transfer: When the customer transfers funds between her account and that of another customer, it is Other Client Transfer.

Example: Demo Bank is a Bank in which Aura is implemented. X and Y are two customers of Demo Bank and each has an account. When X transfers funds from her account to Y's account, it is Other Client Transfer.

In case of Internal Payments, funds do not move out of the Bank in which Aura is implemented; while in case of External Payments, funds move out of the Bank / FI in which Aura is implemented.

This document focusses on External Payments, using a pain.001 file format for the Outgoing Payments; and camt.053 for Incoming Payments.

In Aura, three modules are used to process payments:

- Aura Transaction Processing – where the accounts / contracts lifecycle is tracked

- Aura PaymentGrid – where the payments are processed and routing determined

- Aura Data Management – where the payment information is exchanged with external parties

We will see in the following sections how the configurations have to be done in each of the above modules so that there is a seamless processing of the payments.

ABBREVIATIONS USED

| Abbreviation | Expanded form | Notes |

|---|---|---|

| CC | ConnectCore | The Transaction Processing part of Aura |

| DM | DataManagement | The Data Management part of Aura |

| PG | PaymentGrid | The part of Aura that is the Payment Hub |

| FI | Financial Institution | Usually, an organization in which Aura is implemented, and it is not a Bank. |

COMMON MAINTENANCES

There are a few that are common for any type of External Payment.

1. Aura Transaction Processing

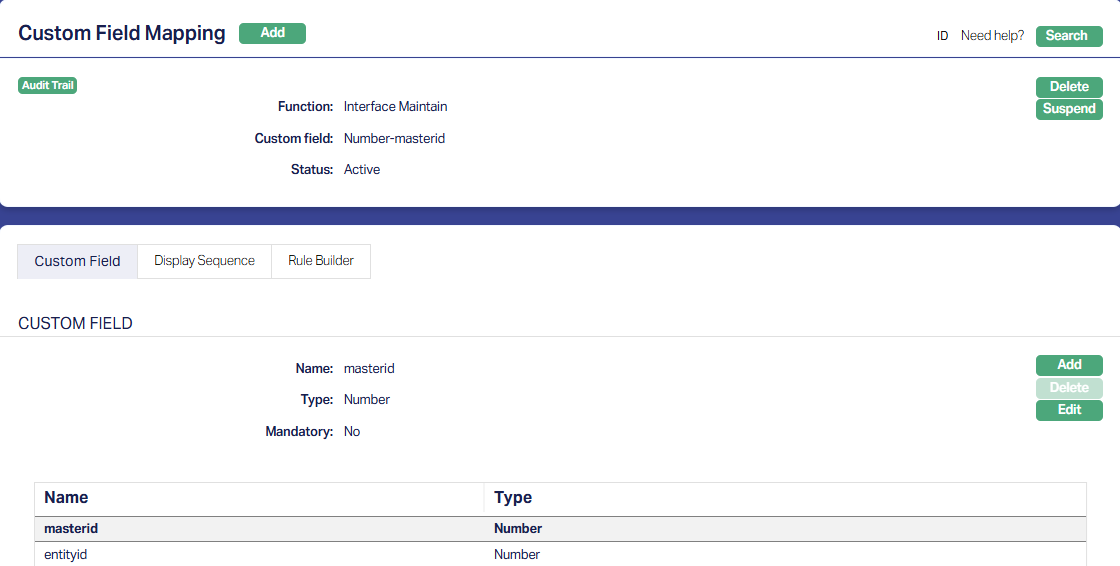

1.1 Admin > System Codes > Custom Fields

Two custom fields have to be maintained as follows:

1.1.1 Masterid

The Custom Field name MUST be maintained as given above.

1.1.2. Entityid

The Custom Field name MUST be maintained as given above.

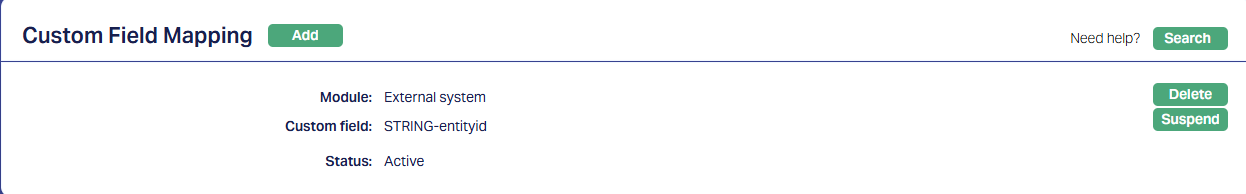

1.2. Admin > System Codes > Custom Fields > Field Mappings

Map the above custom fields to Interface Definition:

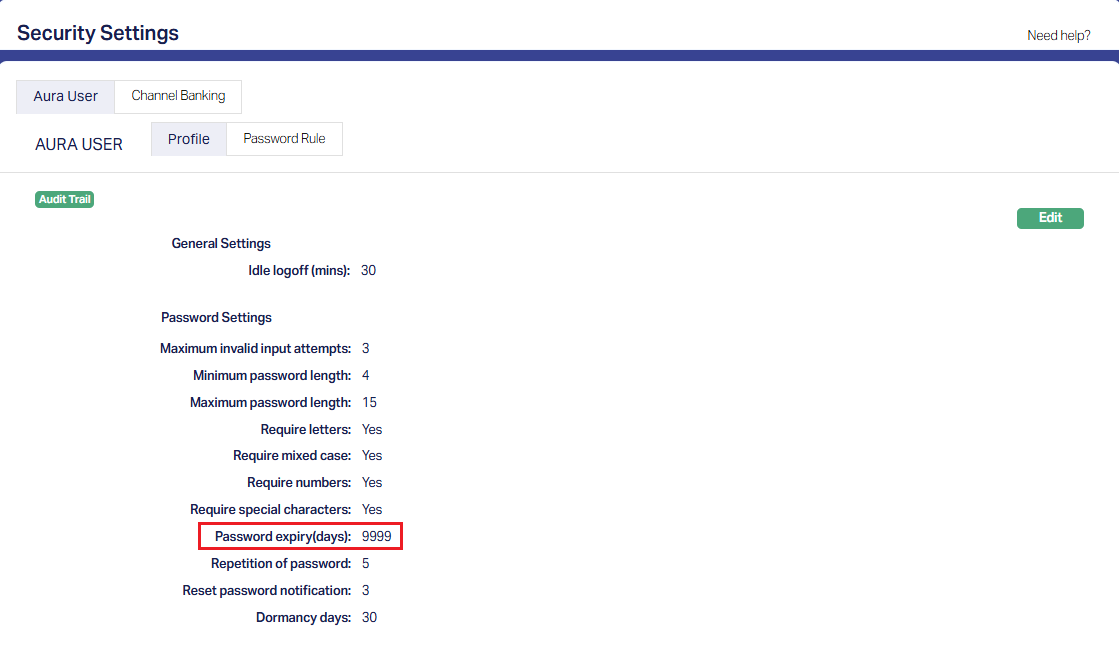

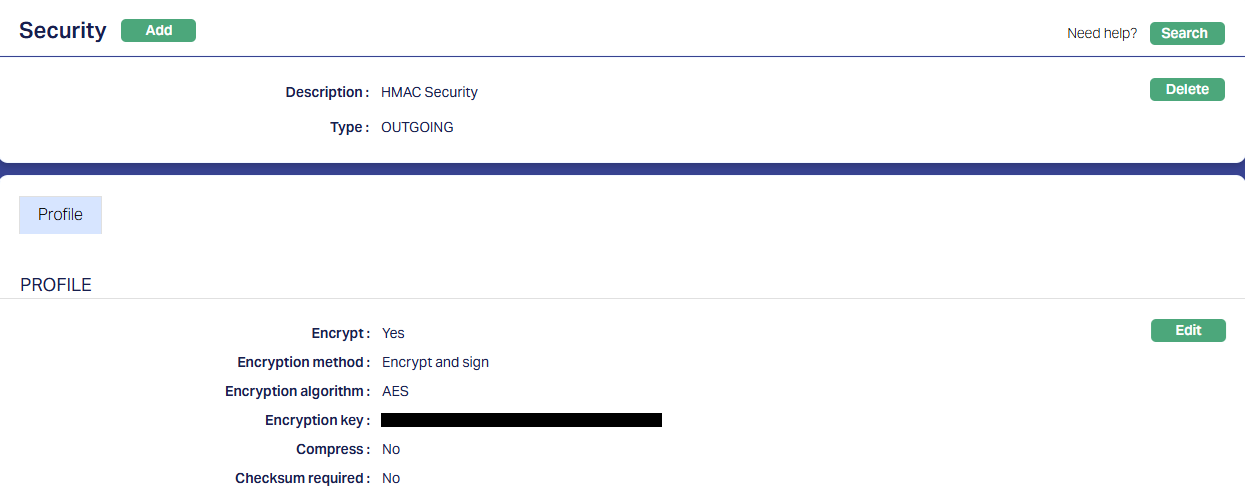

1.3. Admin > Settings > Security Settings

Ensure that the Password expiry is set to its maximum, as otherwise, the user records that are created for Aura's use for communication between the modules may expire and result in payments failing

1.4. Admin > Users > Maintain

Aura uses specific user names for its internal communication between modules and these are to be set up as follows:

| User id | Role Group | Use | Notes |

|---|---|---|---|

| pguser | Super Role | When CC accesses PG | |

| ccuser | Super Role | When PG responds to CC | |

| dmuser | Super Role | When PG accesses DM | Allow access to ADM=Yes |

| dmpguser | Super Role | When DM accesses PG | Allow access to ADM=Yes |

| dmccuser | Super Role | When DM accesses CC | Allow access to ADM=Yes |

Note:

- The user ids MUST be maintained as given above

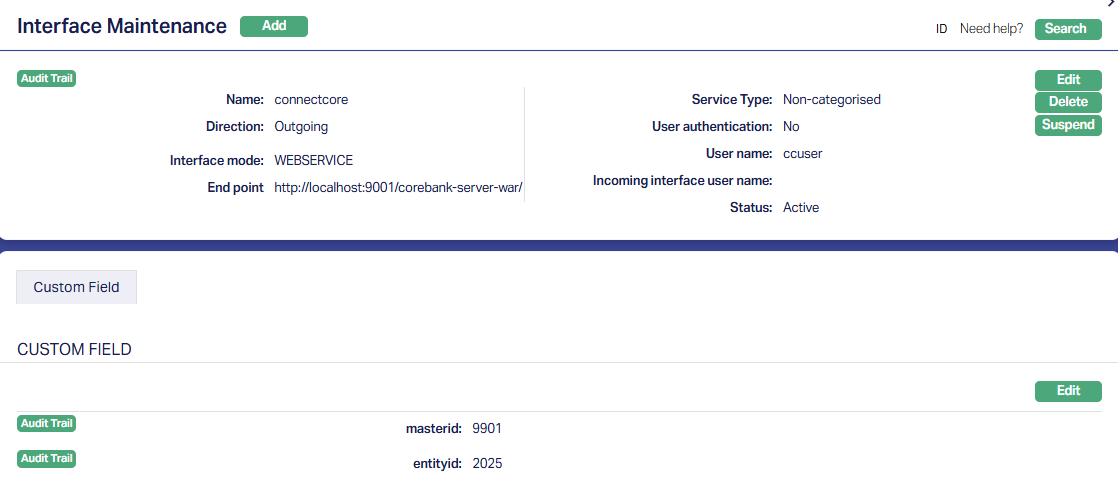

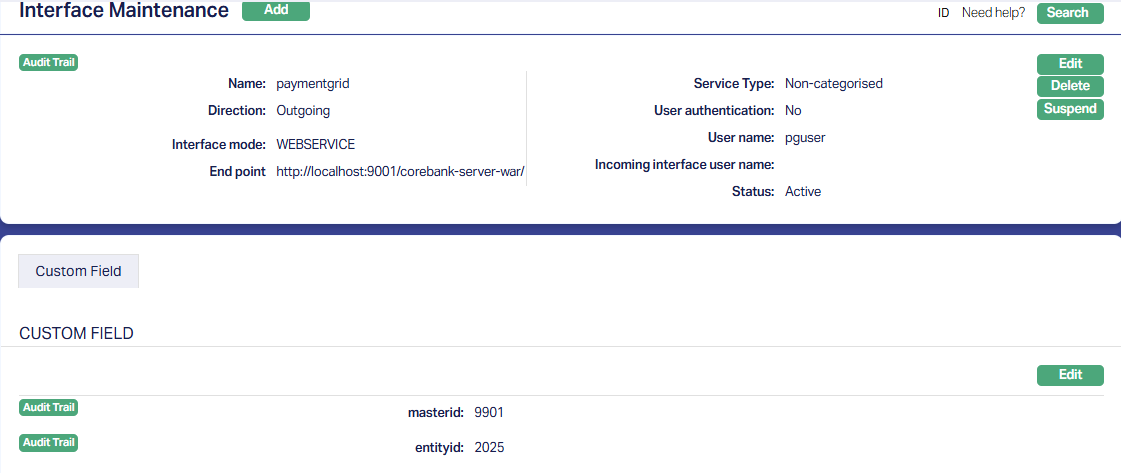

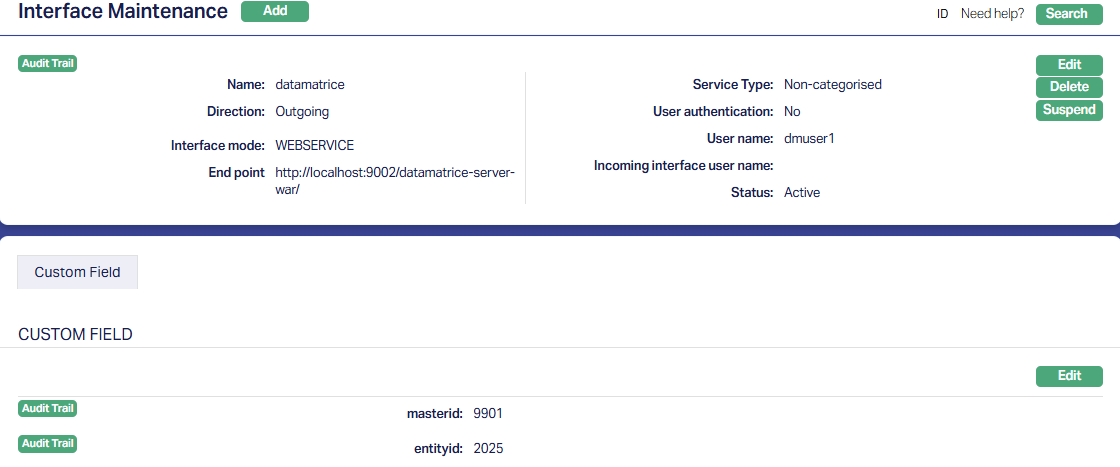

1.5. Admin > System Codes > Interface Definition > Maintain

1.5.1. Connectcore

1.5.2. Paymentgrid

1.5.3. Datamatrice

Note:

- All fields MUST be maintained as above, except values for End Point and the Custom fields viz., masterid and entityid. These will be decided at the time of installation and the values will be provided by IT. The masterid and entityid will be numeric. For an installation, there will be a single masterid, but there can be multiple entityids (if it is a multi-Entity installation).

2. Aura Data Management

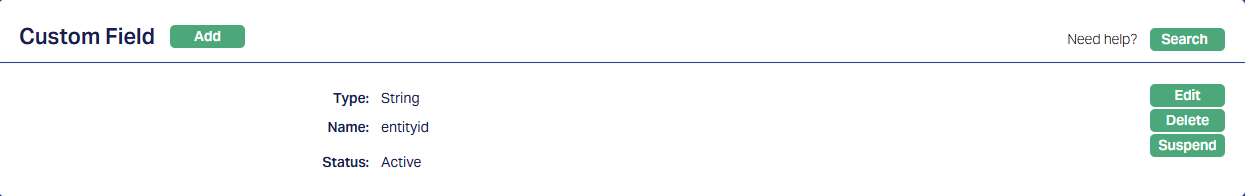

2.1. Admin > System Codes > Custom Fields > Custom Fields

Two custom fields have to be maintained as follows:

2.1.1. Masterid

2.1.2. Entityid

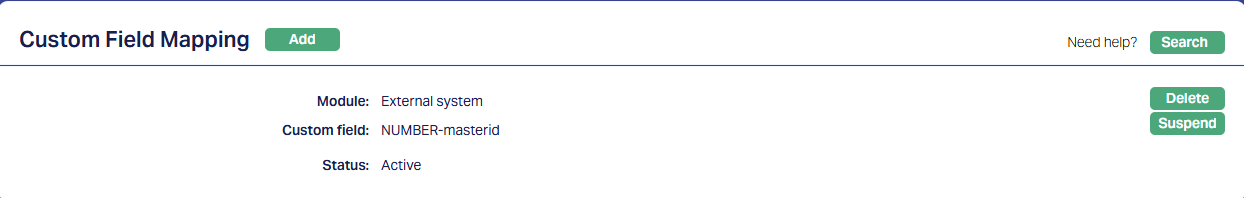

2.2. Admin > System Codes > Custom Fields > Field Mappings

Map the above custom fields to External System:

2.2.1. Masterid

2.2.2. Entityid

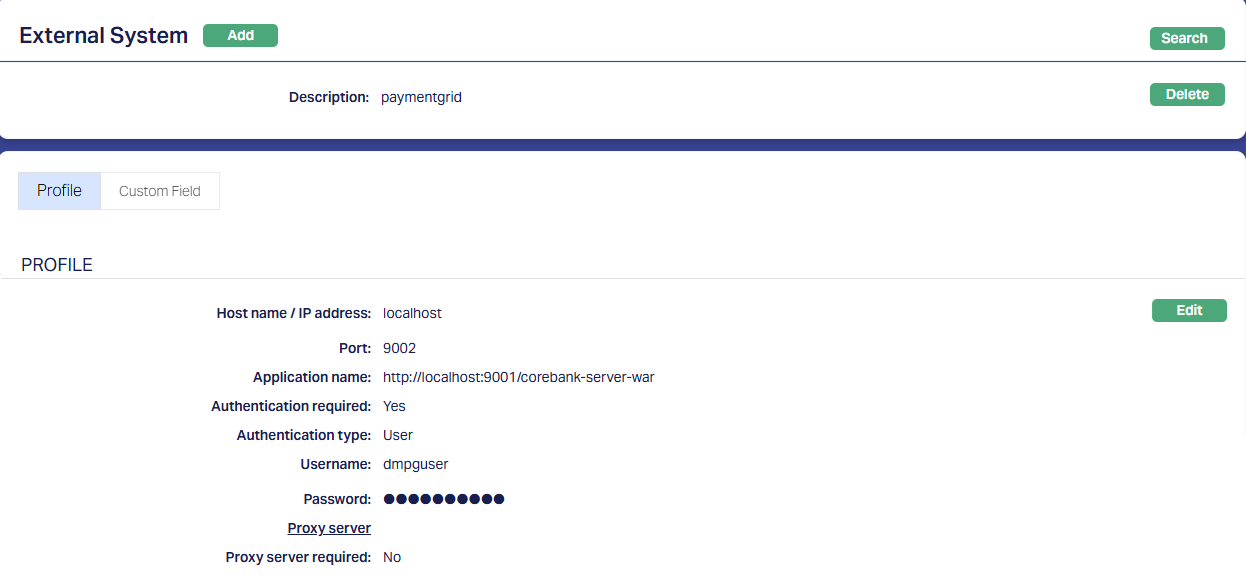

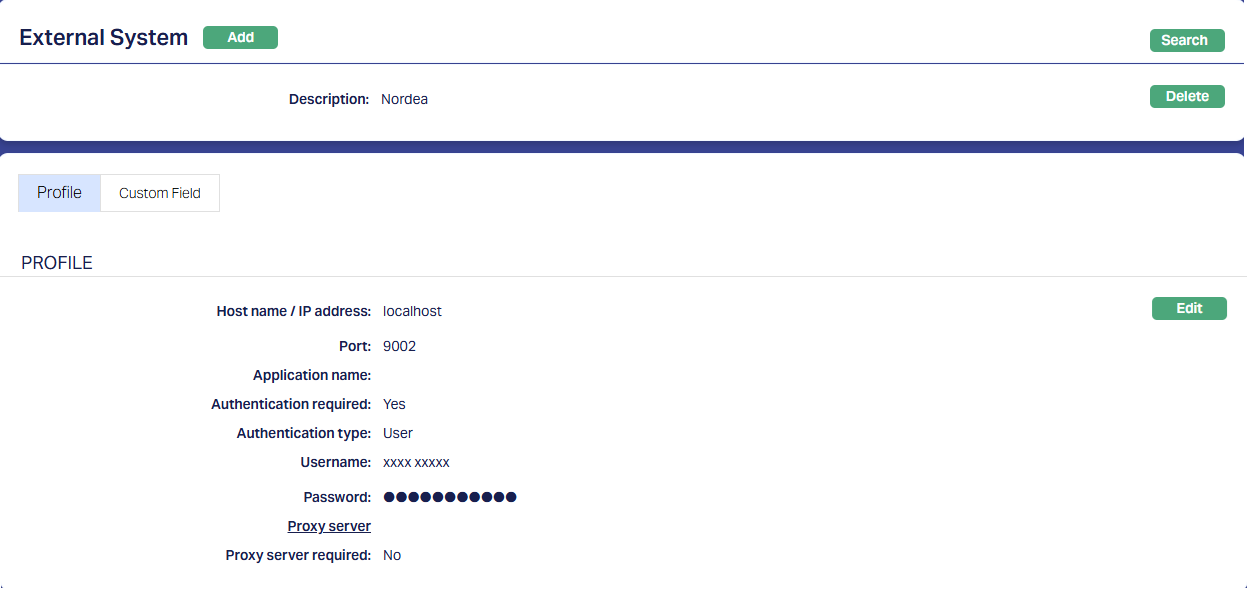

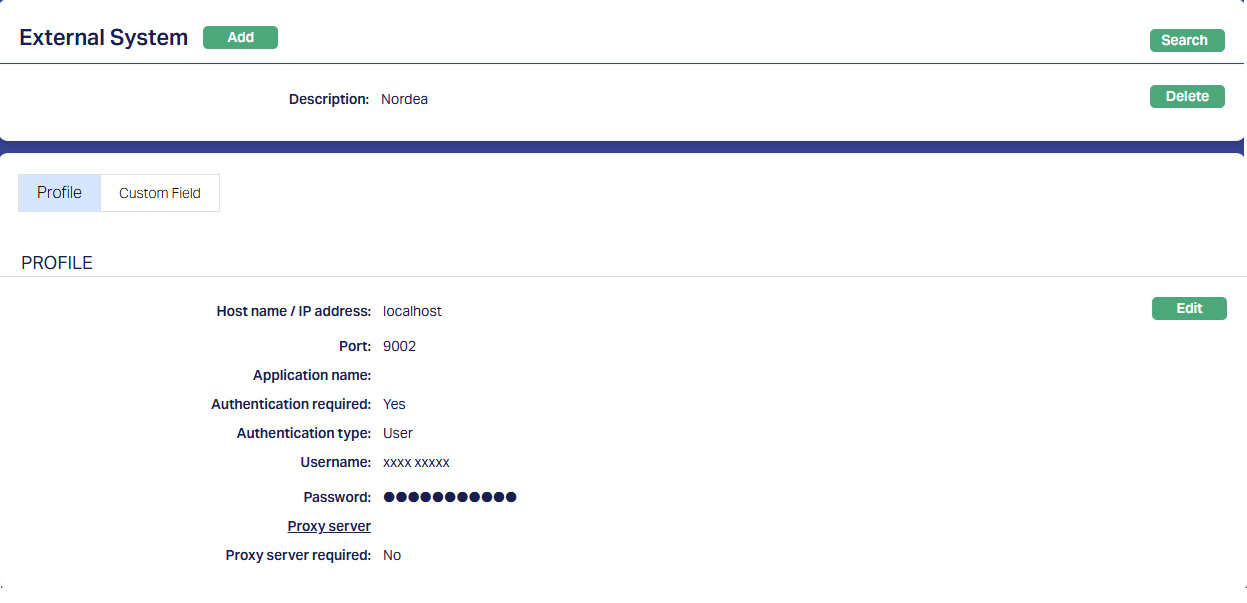

2.3. Data Management > Configurations > Settings > External System

2.3.1. paymentgrid

2.3.1.1. Profile

Note:

- The input in the Application Name field should be exactly the same as in Interface Definition where Interface Name = External System Description = paymentgrid

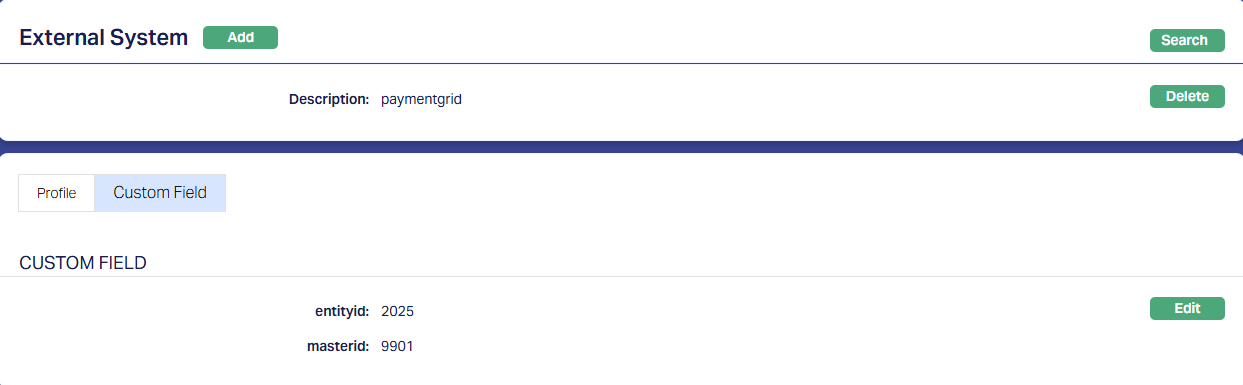

2.3.1.2. Custom Field

The value for the Custom Fields – entityid and masterid – should be exactly the same as in Interface Definition.

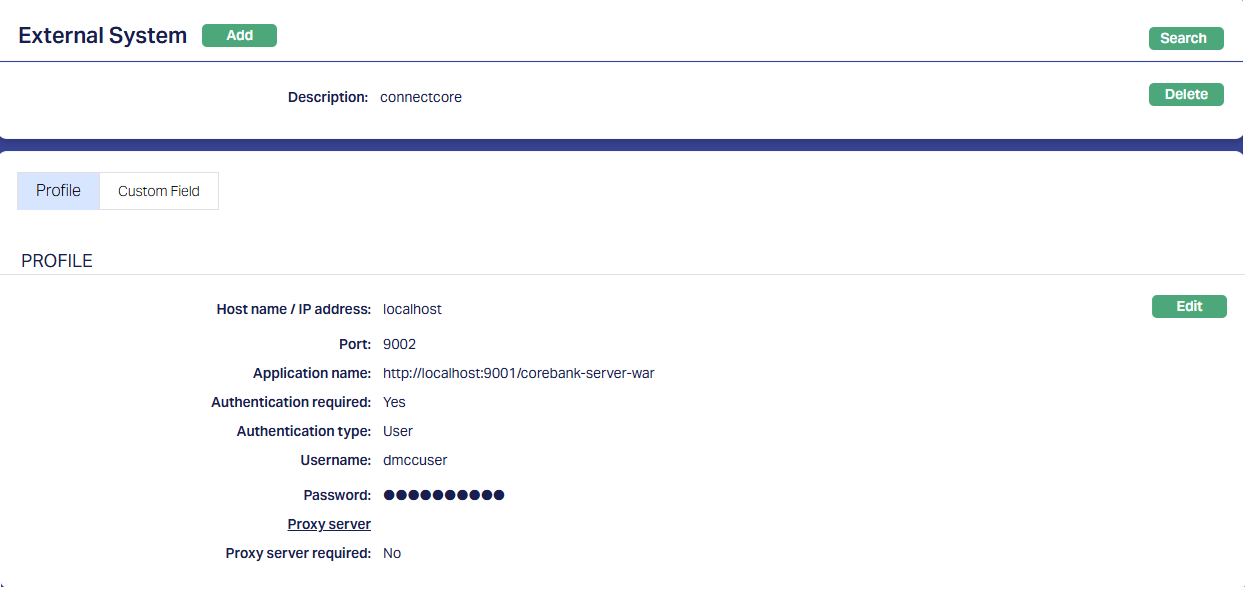

2.3.2. Connectcore

Note:

- The Application Name as input for both External Systems (paymentgrid and connectcore) is the same, as both CC & PG are hosted on the same server

OUTGOING PAYMENTS

The following are the specific maintenances for Outgoing Payments:

1. Aura Transaction Processing

1.1. Retail > Settings > Payment Settings

This is required to be set up to define the Ledger Accounts and Transaction Codes that are to be used for posting accounting entries related to the outgoing payments. Only one Payment Setting is to be maintained for Outgoing Payments

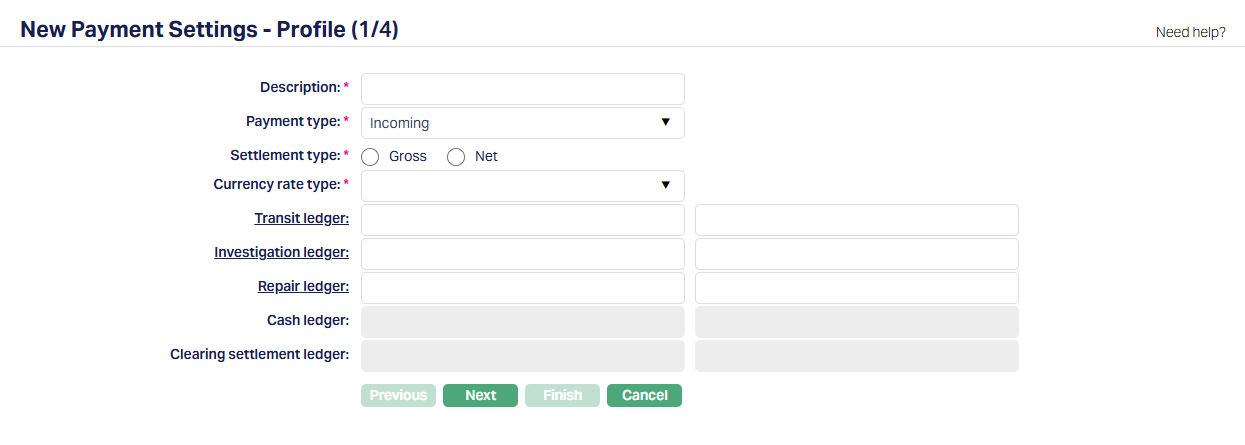

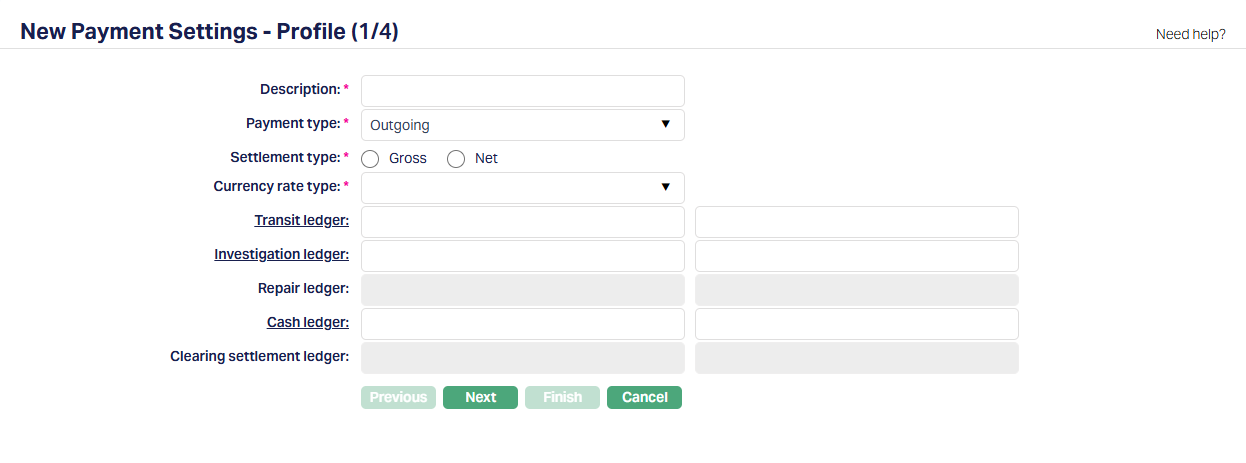

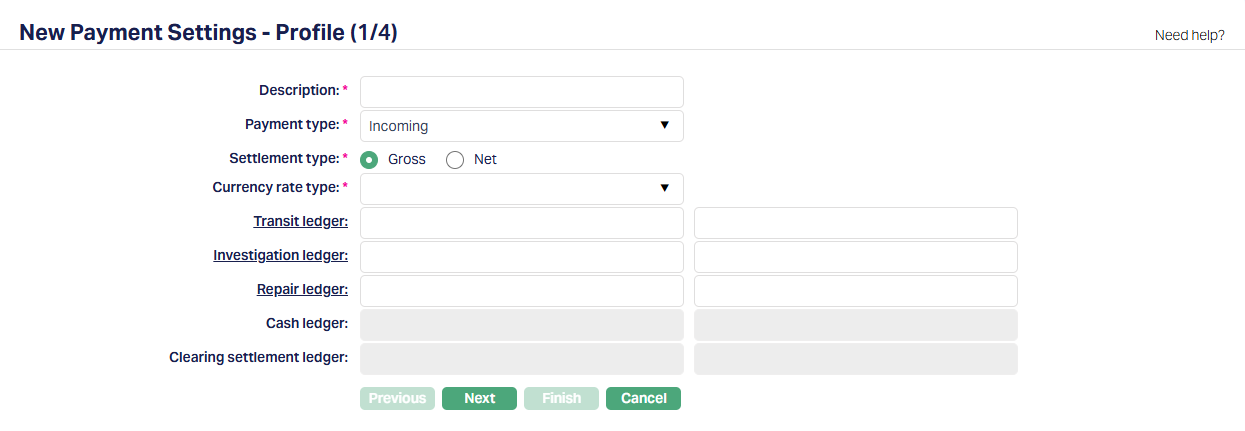

1.1.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | The description of the Payment Setting | Can be anything – Should be such that one can easily identify what this Payment Setting is for | This has to be copied to the PG > Settings > Product as this field is used to relate the Retail > Payment Settings to the PG > Product. Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so IMPORTANT: If you make any changes to this field value, please make sure that the same is copied to the PG > Settings > Product > External Product Code |

| Payment Type | Indicates the Type of Payment. | If Entity is an FI, this should be Outgoing | |

| Settlement Type | Can be Gross or Net | If Entity is an FI, this should be Gross | |

| Currency Rate Type | Indicates the exchange rate type to be used in case of cross-currency transactions | Can be anything. | If there are no cross-currency transactions, this will not be used. If there are cross-currency transactions, provide the correct Rate Type to be used to derive the exchange rates |

| Transit Ledger | The GL Account into which funds will be moved before hitting the nostro account | ||

| Investigation Ledger | The Ledger into which funds will be parked if there is any investigation to be carried out – for example, if AML check is positive | ||

| Cash Ledger | The ledger to be debited for Cash Transactions, if any. |

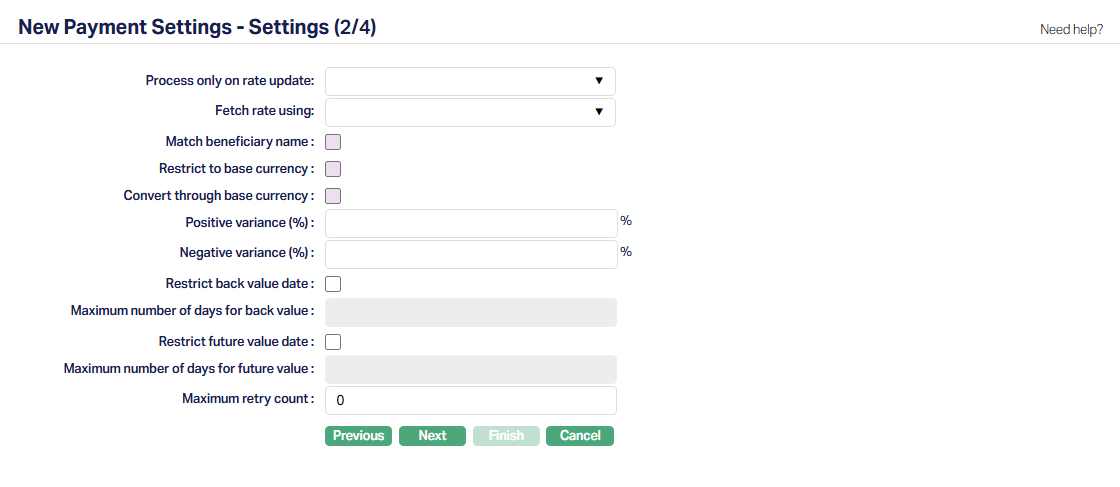

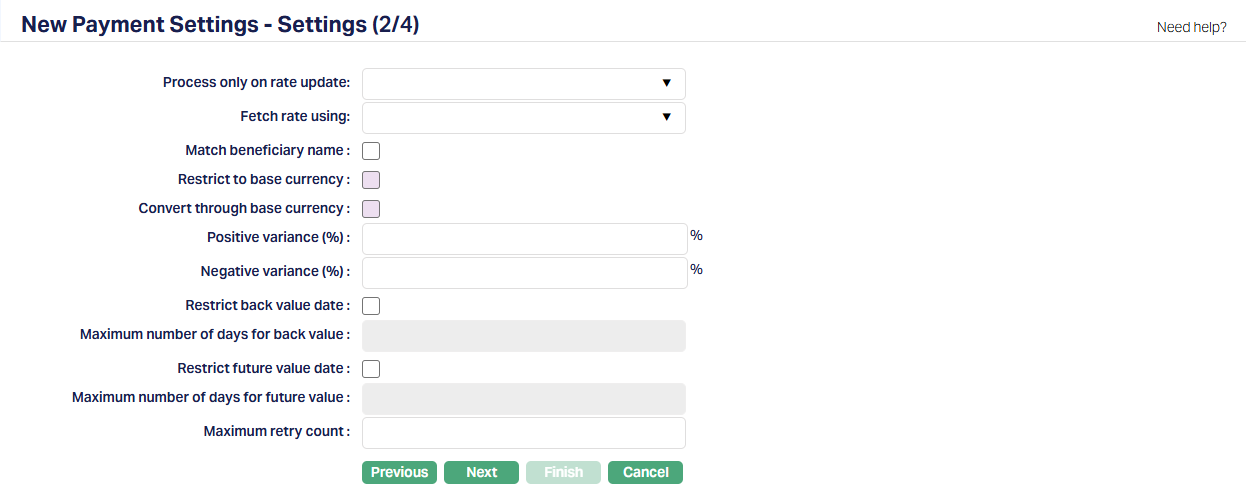

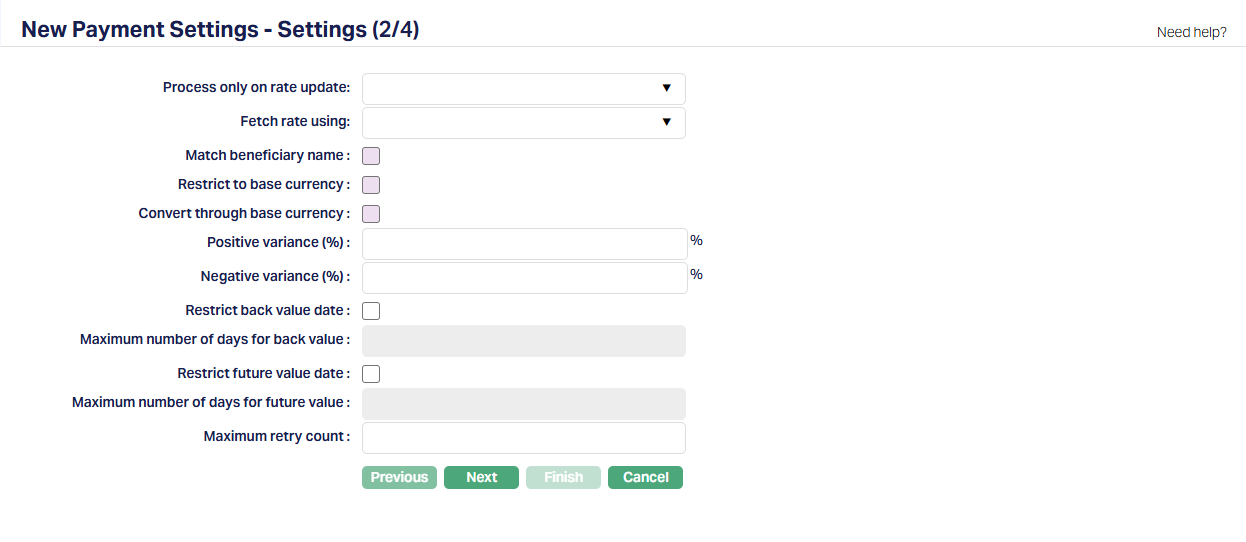

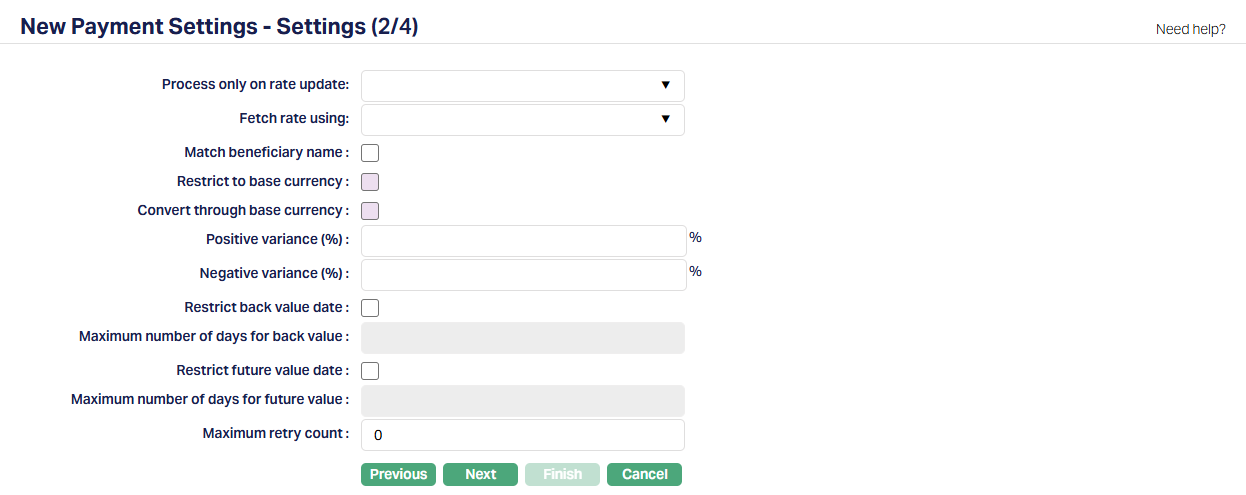

1.1.2. Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Process only on Rate Update | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Fetch Rate Using | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Positive Variance % | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Negative Variance % | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Restrict back value date | If Entity is a Financial Institution, this will depend on the Bank in which the account is maintained. | ||

| Restrict future value date | If Entity is a Financial Institution, this will depend on the Bank in which the account is maintained. |

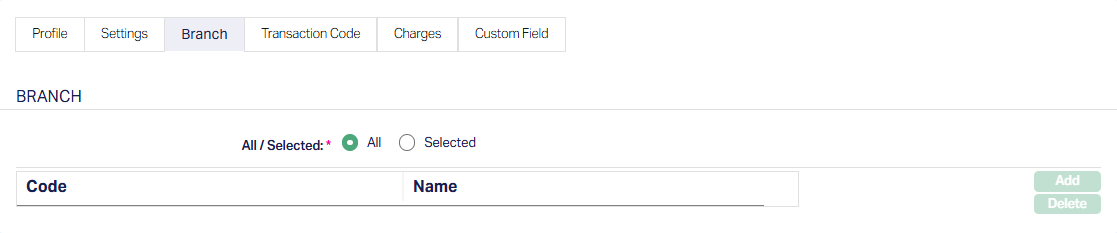

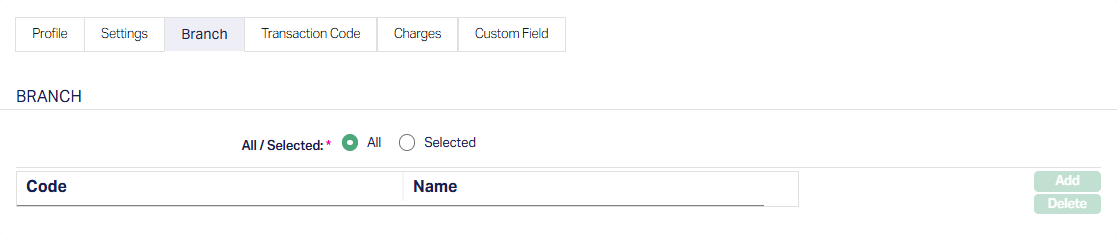

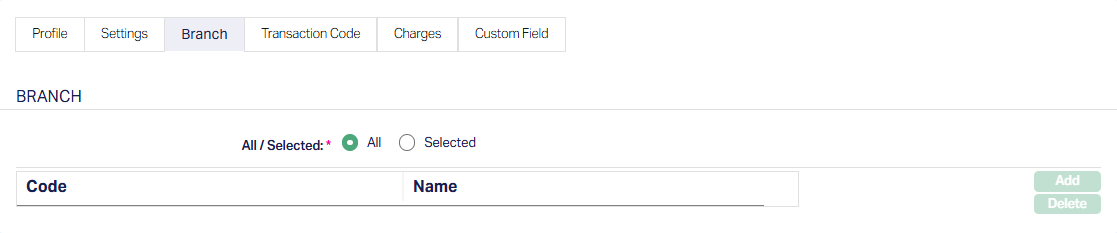

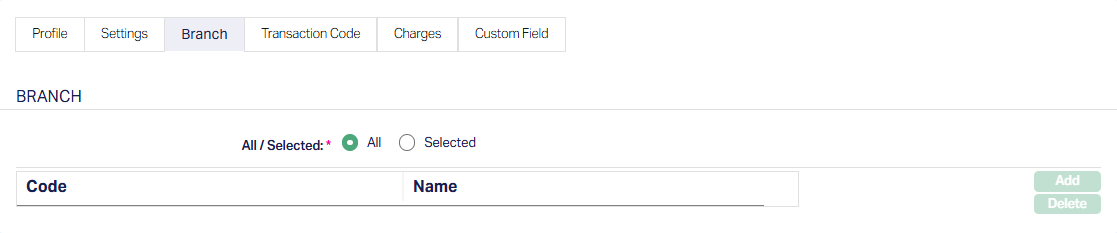

1.1.3. Branch

Applicable only in a multi-branch set up, if the Payment Setting is to be used for only selected branches.

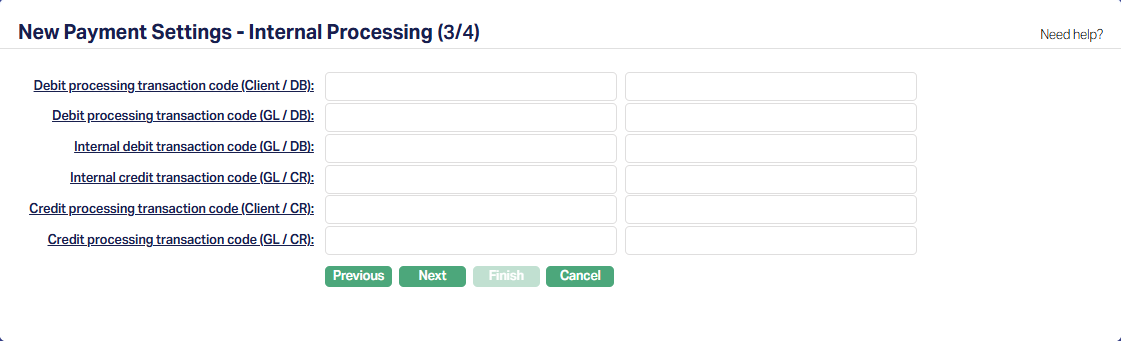

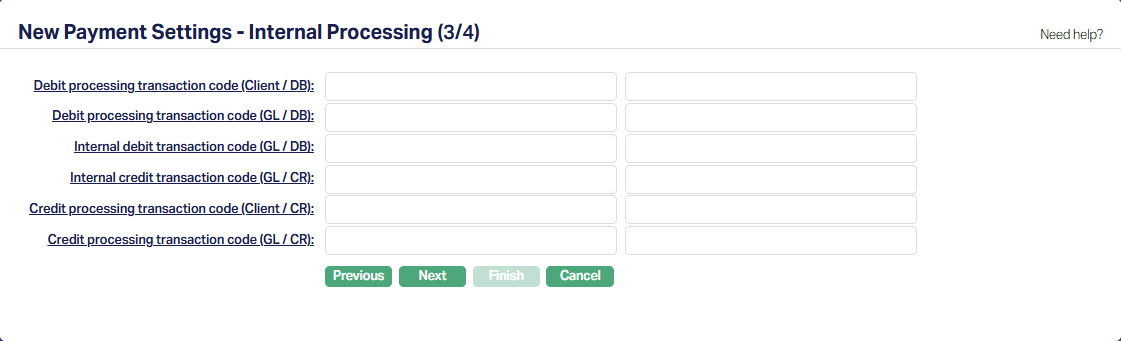

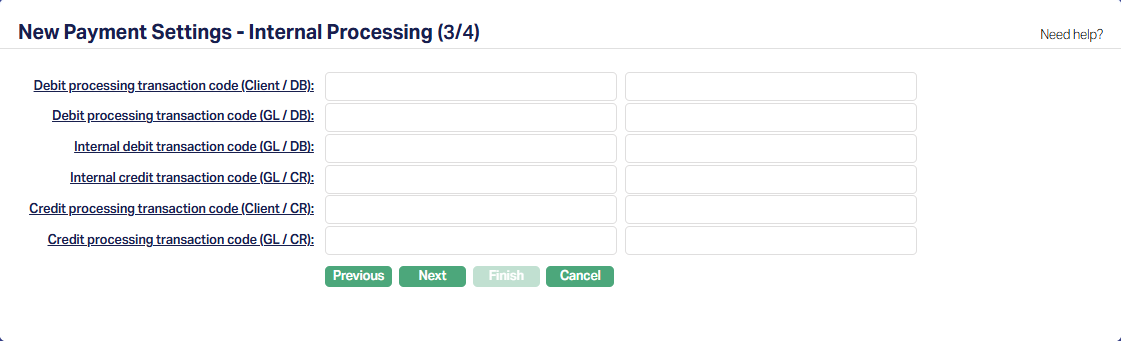

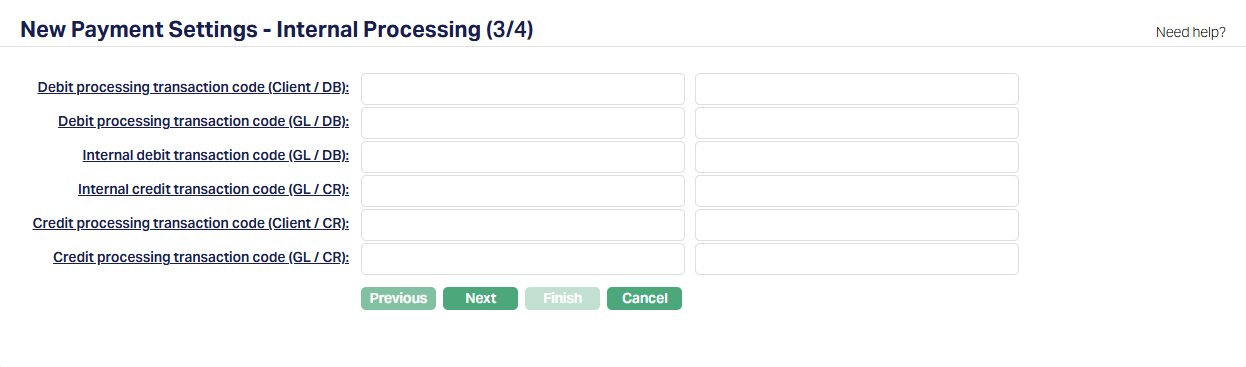

1.1.4. Transaction Codes for Internal Processing

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Debit Processing Transaction Code (Client / DB) | Used to debit a client’s account during Debit Processing (Event Code: PAYMDP) | Example: Debit a Client Account during Fund Transfer from Client Account (say, refund of excess receipts on a loan that was credited to an Internal Operations Account or a Client Account Transfer from an account in Aura to an external Account) | |

| Debit Processing Transaction Code (GL / DB) | Used to debit a GL during Debit Processing (Event Code: PAYMDP) | Example: Debit Loan Product > Suspense GL during Loan Disbursement to an External Bank Account and credit Transit GL | |

| Internal Debit Transaction Code (GL / DB) | Used to debit the Transit GL during Nostro accounting (Event Code: PAYMCP) | Example: Loan Account disbursement to an external bank account. The Transit GL will be debited and Nostro account (of the FI’s account with the Bank) will be credited | |

| Internal Credit Transaction Code (GL / CR) | Used to credit the Transit GL during Debit Processing (Event Code: PAYMDP) | Example: Debit Loan Product > Suspense GL during Loan Disbursement to an External Bank Account and credit Transit GL | |

| Credit Processing Transaction Code (Client / CR) | Used to credit a Nostro Account during Nostro Accounting (Event Code: PAYMCP) | Example: Loan Account disbursement to an external bank account. The Transit GL will be debited and Nostro account (of the FI’s account with the Bank) will be credited | |

| Credit Processing Transaction Code (GL / CR) | Used to credit a GL account during Nostro Accounting (Event Code: PAYMCP) | Example: This will be used if Nostro Resolution results in a GL to be credited |

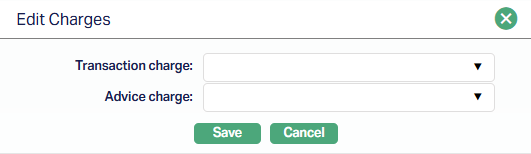

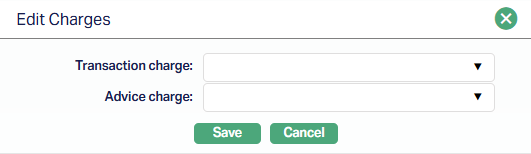

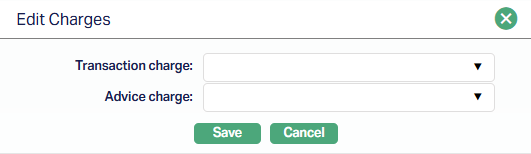

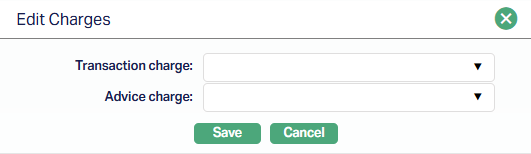

1.1.5. Charge

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Transaction Charge | Depends on solution / fitment. Can be blank | ||

| Advice Charge | Depends on solution / fitment. Can be blank |

1.1.6. Custom Field

Depends on solution / fitment. Can be blank

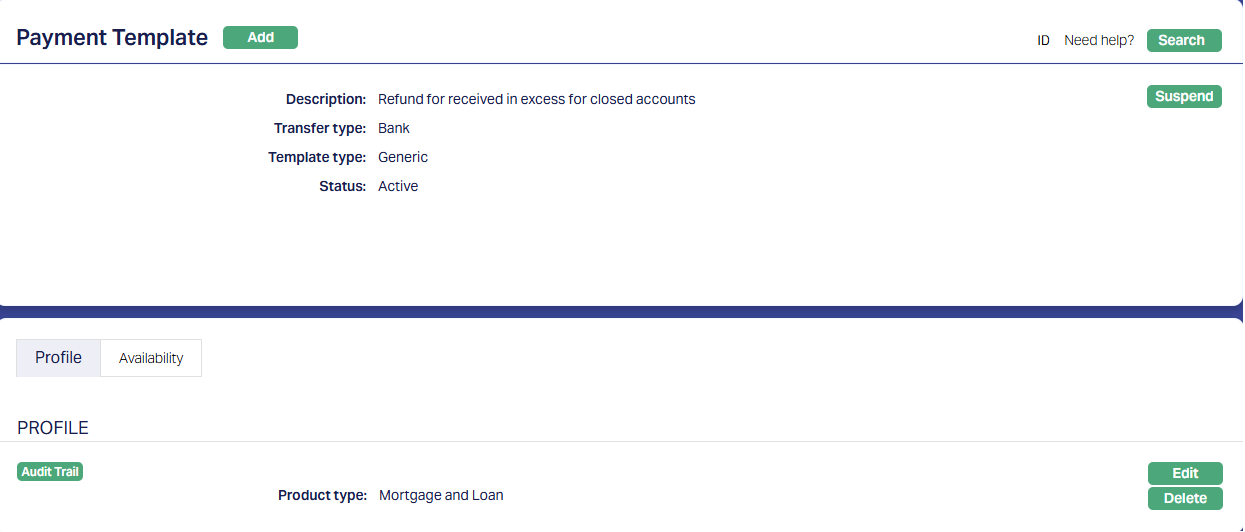

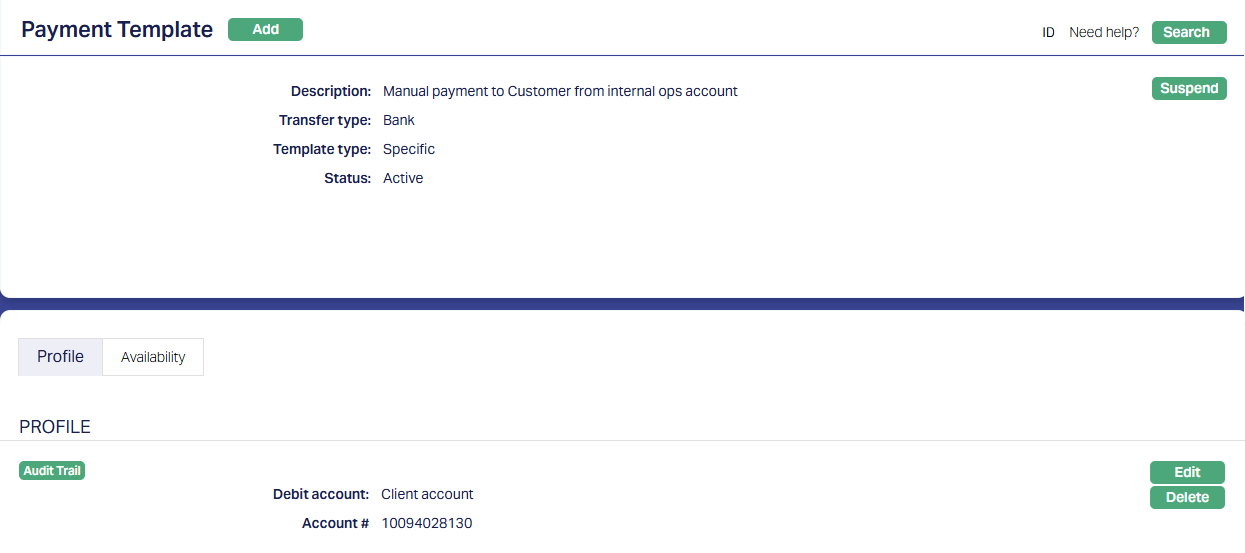

1.2. Retail > Settings > Payment Template

This is required to be set up when you have to manually initiate an Outgoing Payment from the Retail > Payments UI. For creating a record in Retail > Payments > Credit Transfer or RTGS/SWIFT/TARGET2, you need to have an appropriate Payment Template

1.2.1. Profile

If Template Type = Generic

If Template Type = Specific

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | Description for the Payment Template | Can be anything | |

| Transfer Type | Bank / Customer that initiates the Payment | Bank | If payments are to be initiated by the Entity, this should be Bank |

| Template Type | Generic / Specific | Depends on solution / fitment. | |

| If Generic: | |||

| Product Type | List of different Product Types | Depends on solution / fitment. If you want to be able to choose any Loan Account for which payment has to be initiated, choose Mortgage and Loan | |

| If Specific: | |||

| Debit Account | Account or General Ledger | Depends on solution / fitment. | |

| Account # / Ledger # | Depends on solution / fitment. If you want to be able to choose a specific Client Account (say, Internal Ops Account) or General Ledger, choose that specific Account # / GL # |

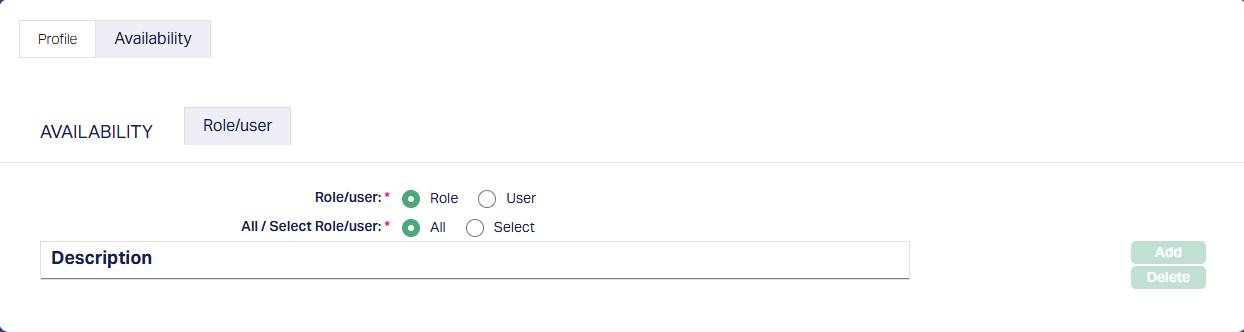

1.2.2. Availability

Depending on the need to restrict the availability of this Payment Template on the Retail > Payment screens, you can specify the Role > User

2. PaymentGrid

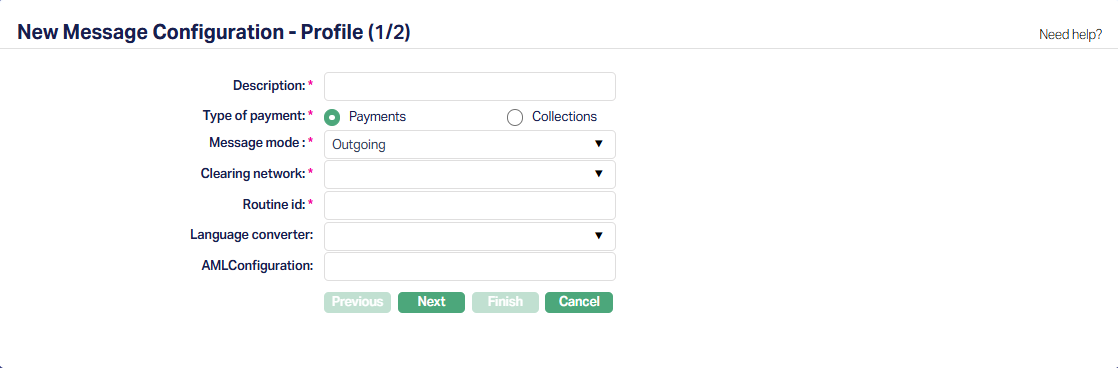

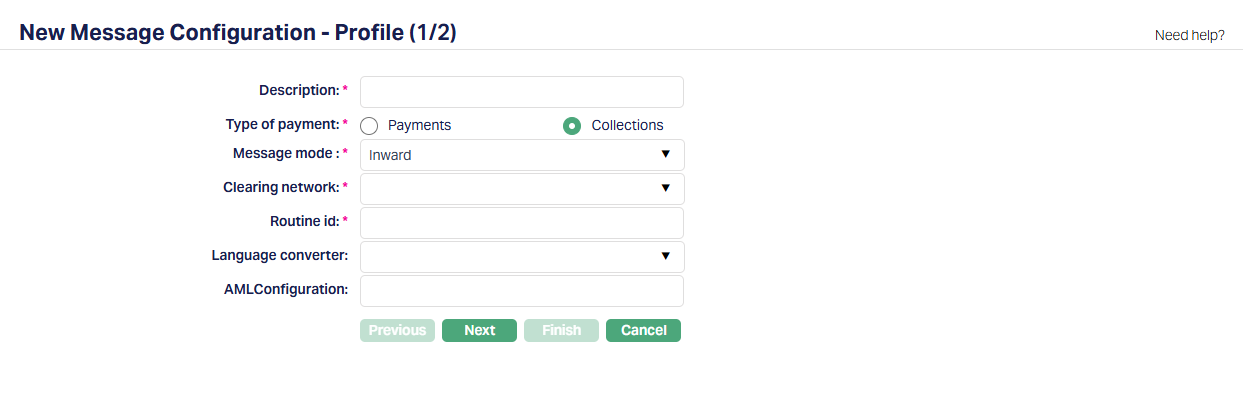

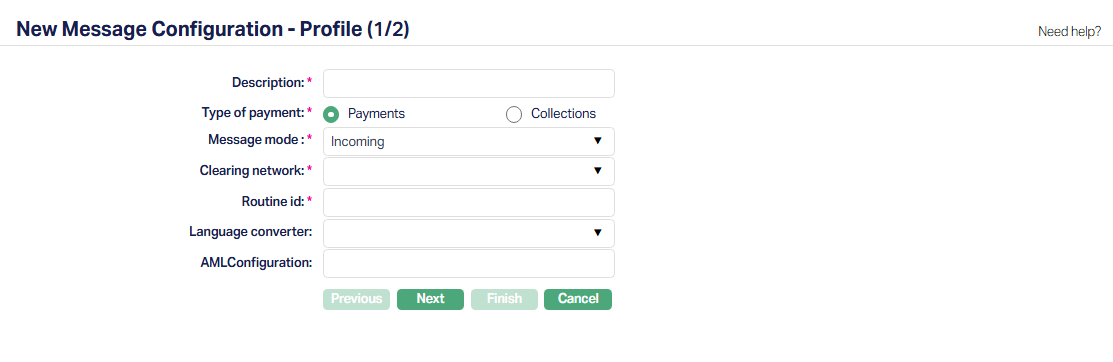

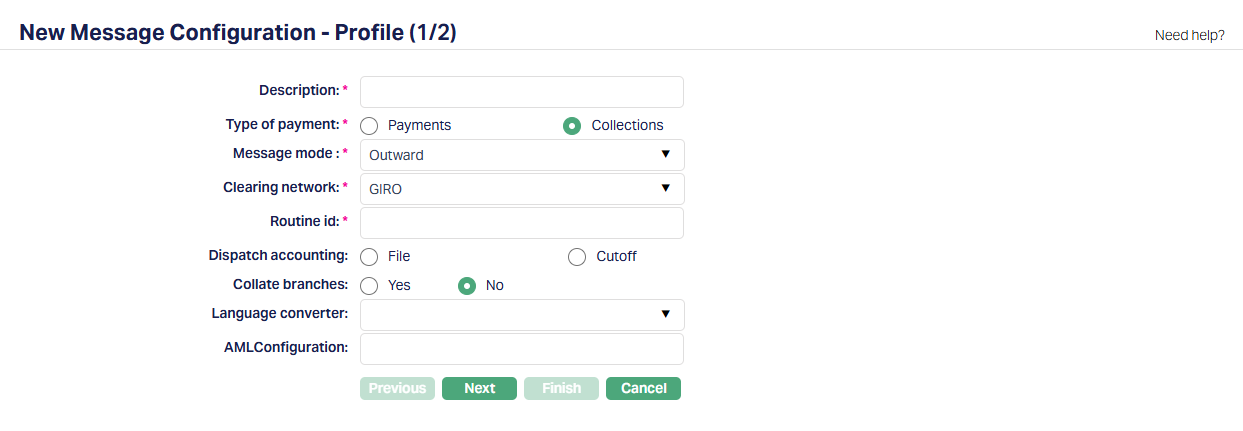

2.1. Settings > Message Configuration

There should be one Active Message Configuration per Clearing Network – Message Mode combination.

2.1.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | The description of the Message Configuration | Can be anything – Should be such that one can easily identify what this Message Configuration is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| Type of Payment | To indicate Payment / Collection | Should be Payment | |

| Message Mode | Should be Outgoing | ||

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Routine Id | This is the Routine Id in ADM that will be used to generate the outgoing payment message. | See Notes | If Entity = Bank it should be the valid actual Routine id in DM for the payment message generation. If Entity = FI, it can be any random number as Aura always generates a pain.001 message |

| Language Converter | Used to convert characters as required | Depends on solution / fitment. Can be blank | |

| AML Configuration | This is the Routine Id in ADM that will be used for AML Checks, if any. | Depends on solution / fitment. Can be blank. Note that it should be the valid actual Routine id in DM for the AML Check, if any. |

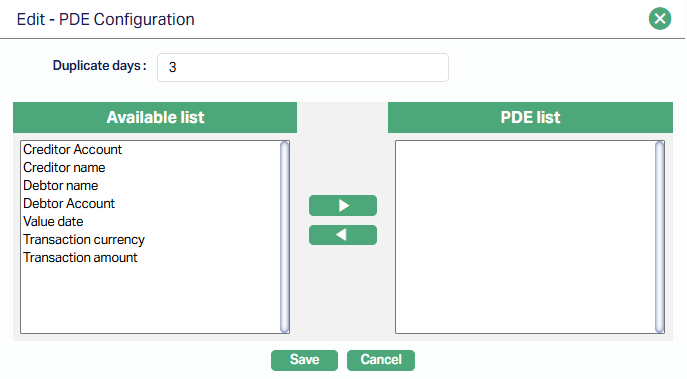

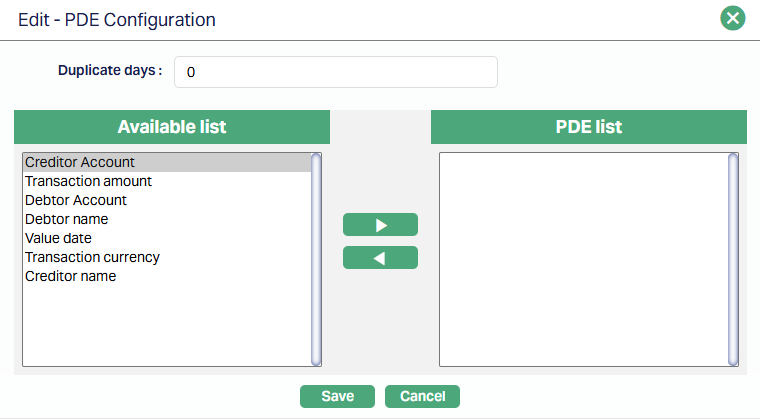

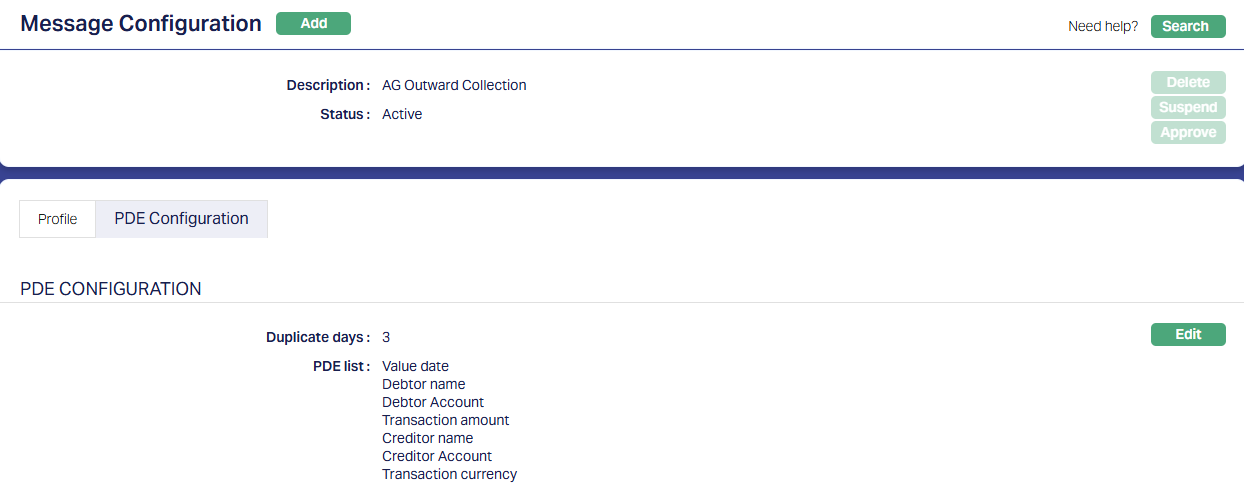

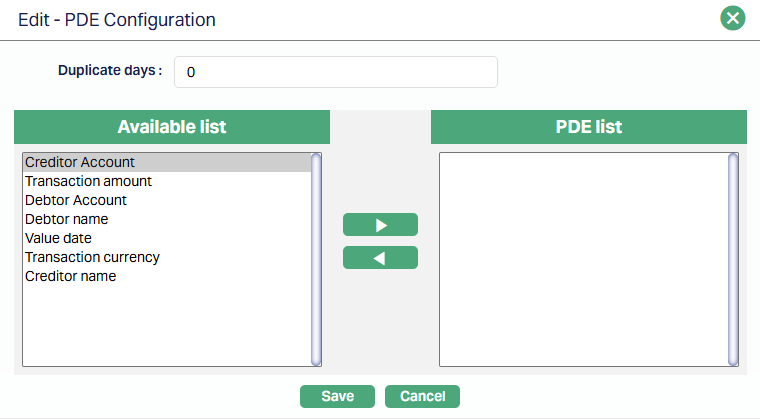

2.1.2. PDE Configuration

Based on the settings configured here, Aura will check for duplicate messages. If nothing is input, there will not be any check for duplicate messages. If this is configured and a possible duplicate is identified, the transaction will either be stopped during manual input / approval or it will appear in PaymentGrid > Operations > Net Settlement as a failed transaction with Exception = PDE. Unless this is sorted, the payment will not go through.

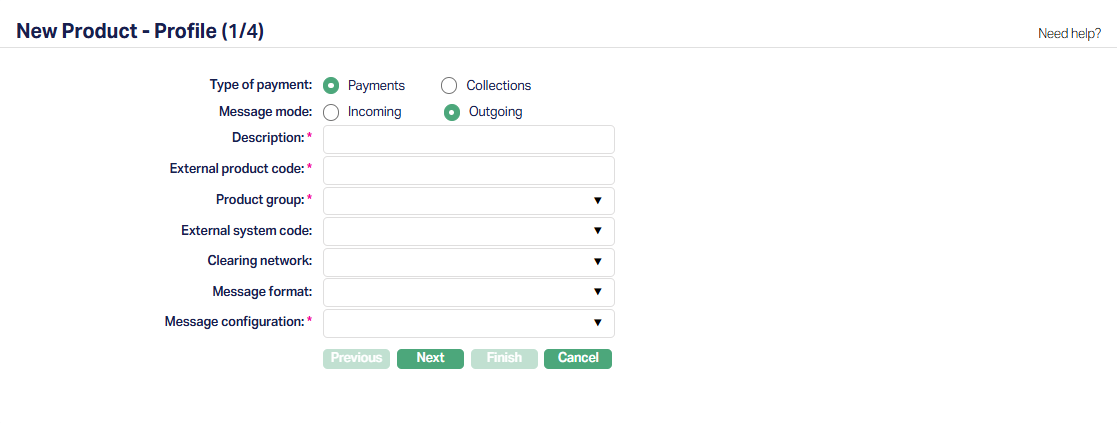

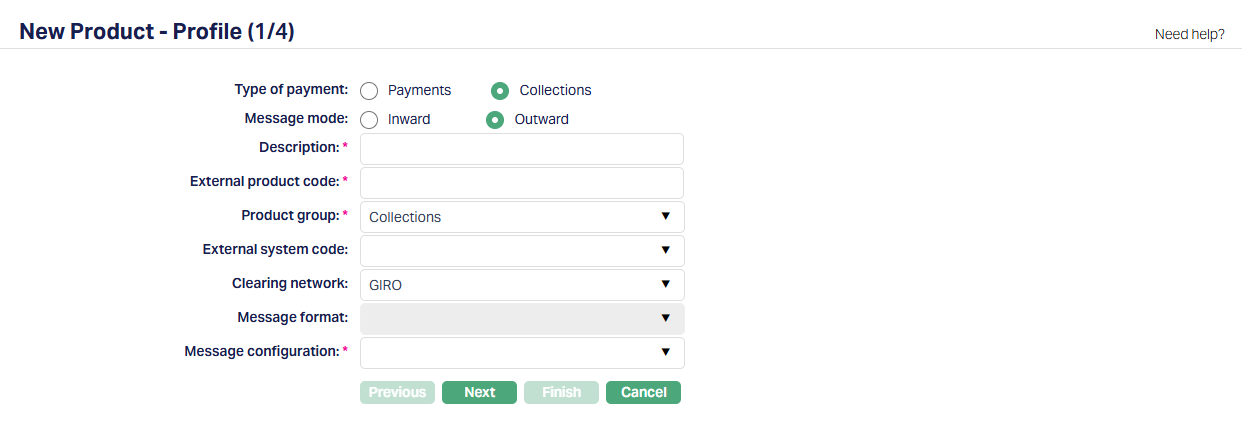

2.2. Settings > Product

The PG > Settings > Product is the linkage between the payment hub and the transaction processing system. Based on the transactions initiated in CC, the Payment Product is determined through the STP configuration to send the Payment Message as defined in the Message Configuration and accounting entries related to the Payment are initiated by PG and posted in CC. The Product defined here, thus, has reference to the Retail > Settings > Payment Settings (using the External Product Code) and the Message Configuration for a Clearing Network for a Product Group

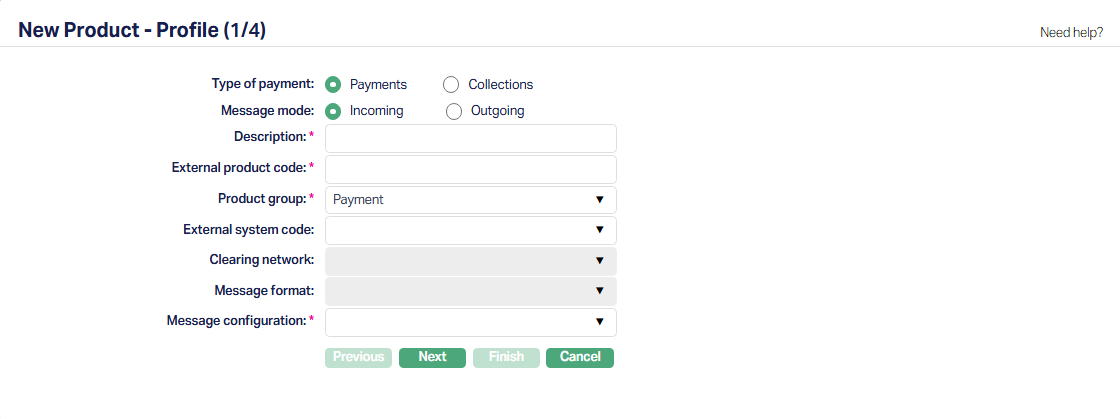

2.2.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Type of Payment | Should be Payments | ||

| Message Mode | Should be Outgoing | ||

| Description | The description of the Product | Can be anything – Should be such that one can easily identify what this Product is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| External Product Code | This will be the linkage between the Retail > Payment Settings and the PG > Settings > Product | Should be exactly the same as in Retail > Payment Settings > Description | Copy the Description from Retail > Payment Settings and paste it into this field so that it is exactly the same. |

| Product Group | Should always be Payments | The other option – Others – is for future use | |

| External System Code | List of active interfaces as defined in Admin > System Codes > Interface Definition > Maintain | Should be paymentgrid | |

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Message format | The format in which the payment message is to be sent out | Applies only for certain Clearing Networks. This has to be decided at the time of implementation based on whether Aura is being implemented at a Bank or FI; and also based on the arrangement between the FI and its Bank | |

| Message Configuration | List of active Message Configurations that match the Type of Payment, Message Mode and Clearing Network chosen above |

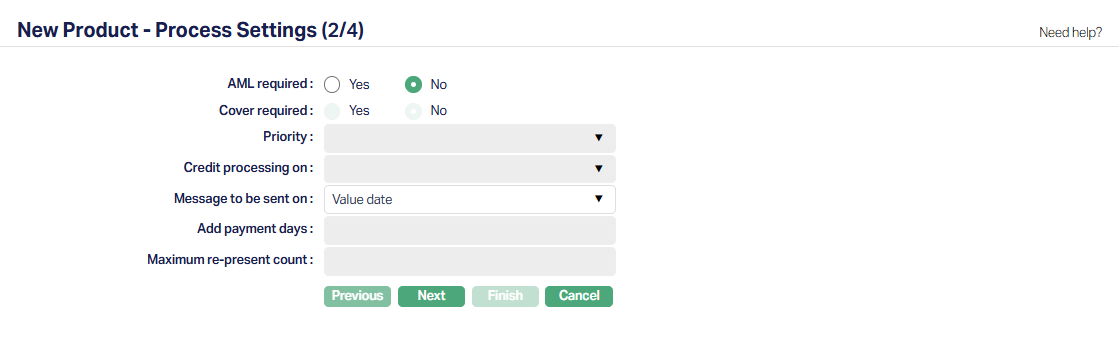

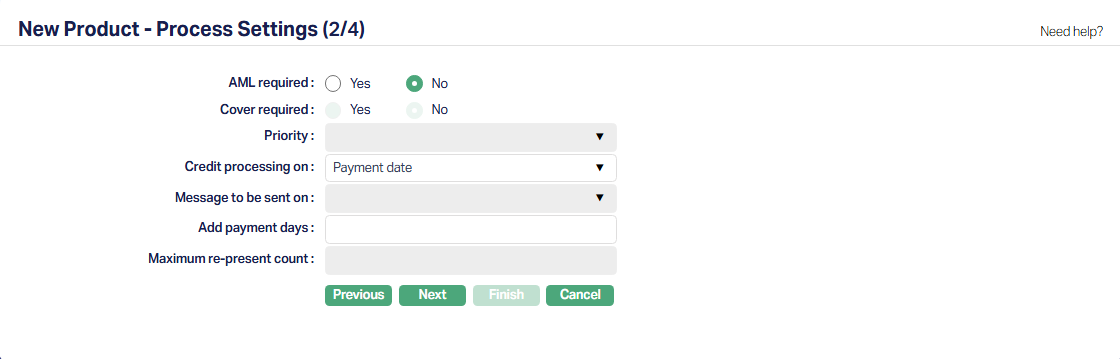

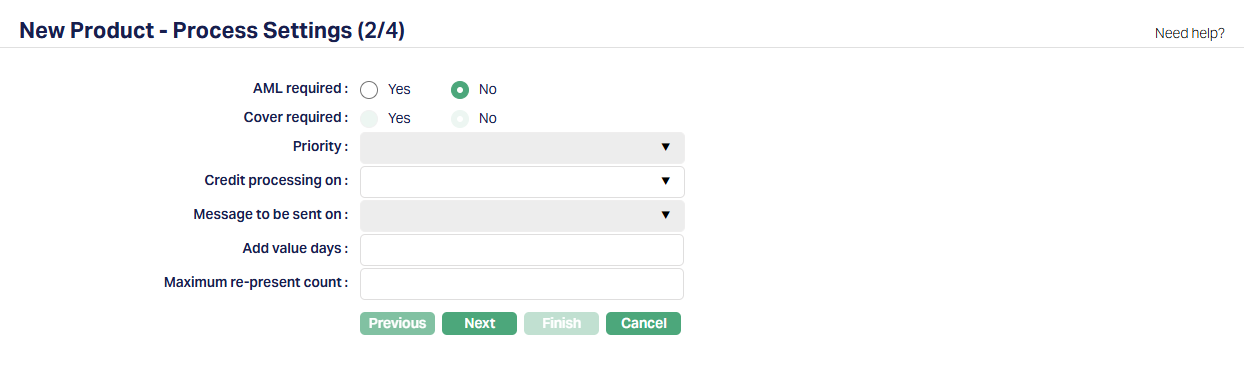

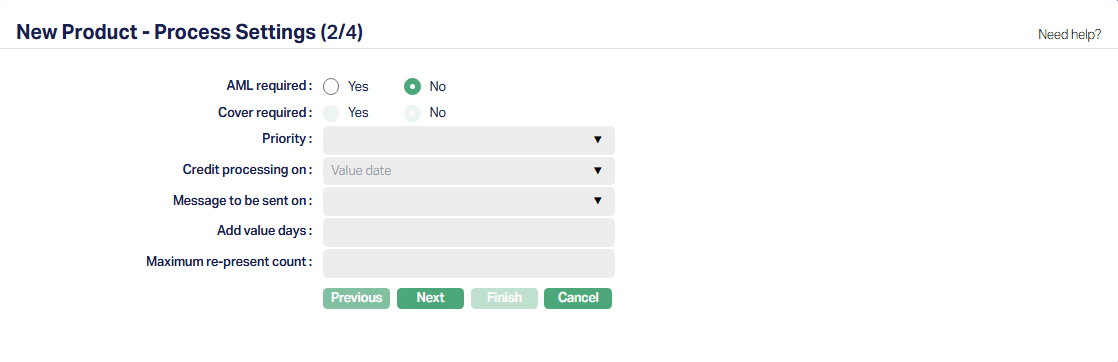

2.2.2. Process Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| AML Required | Depends on solution / fitment. | ||

| Cover Required | Enabled only for certain Clearing Networks | ||

| Priority | Enabled only for certain Clearing Networks | ||

| Credit Processing On | Enabled only if Message Mode is Incoming Not applicable for Outgoing | ||

| Message To Be Sent On | The date on which the Outgoing Payment Message should be sent. | Can be Payment Date or Value Date | |

| Add Payment Days | Enabled only if Message Mode is Incoming Not applicable for Outgoing | ||

| Maximum Re-present Count | Enabled only if Message Mode is Outward Not applicable for Outgoing |

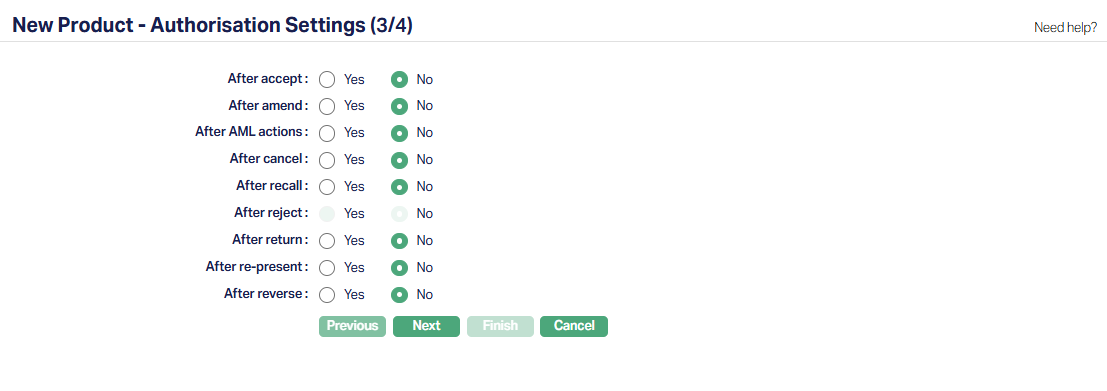

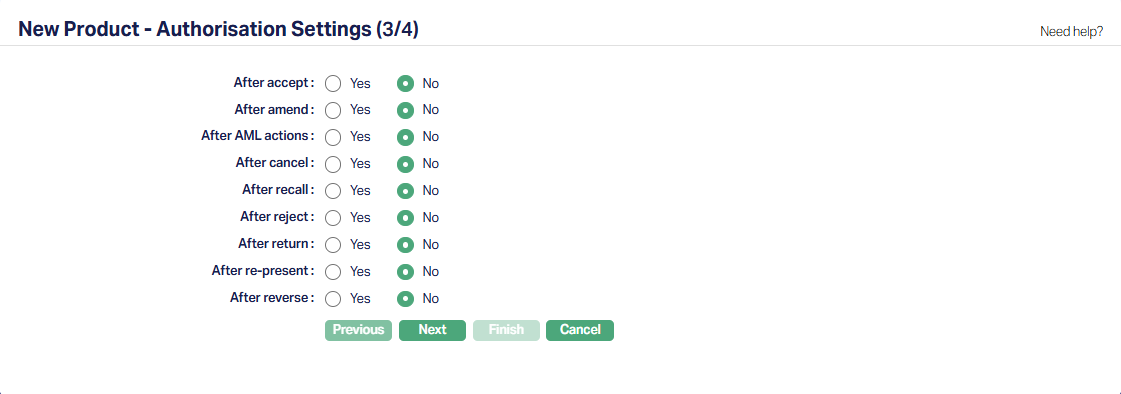

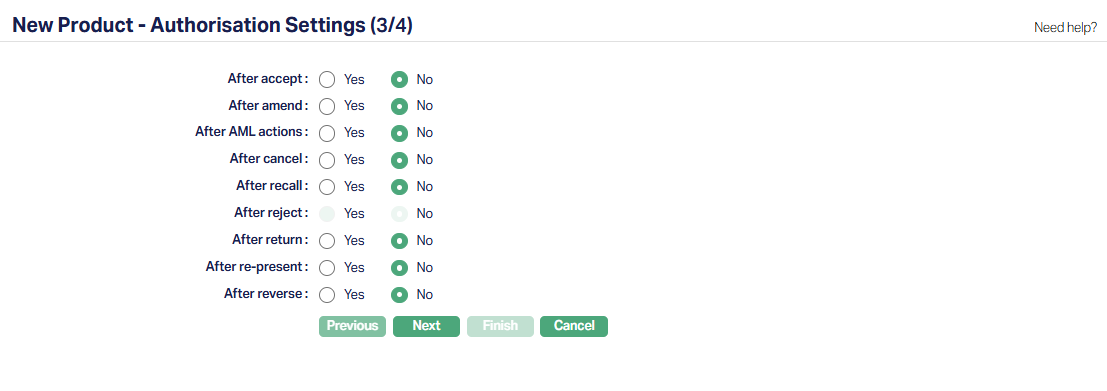

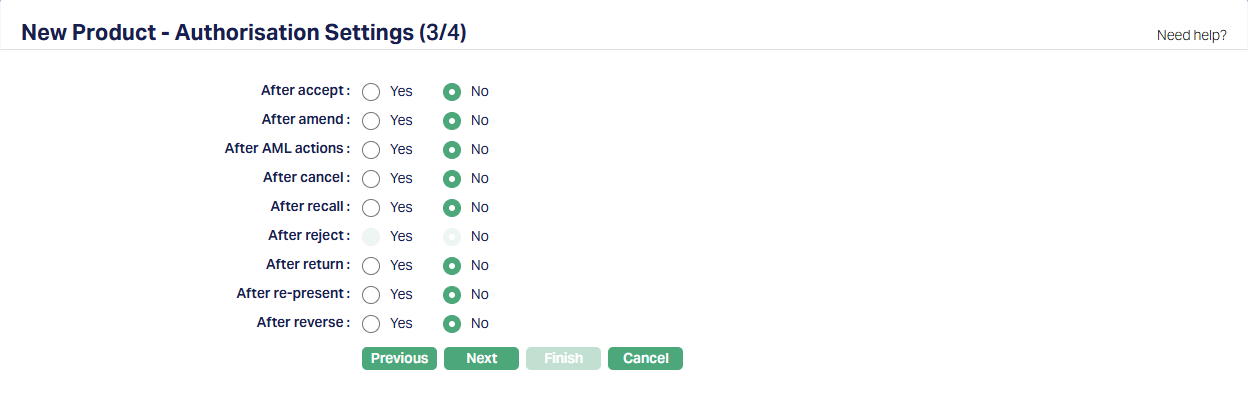

2.2.3. Authorisation Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| <All fields> | Depends on solution / fitment. |

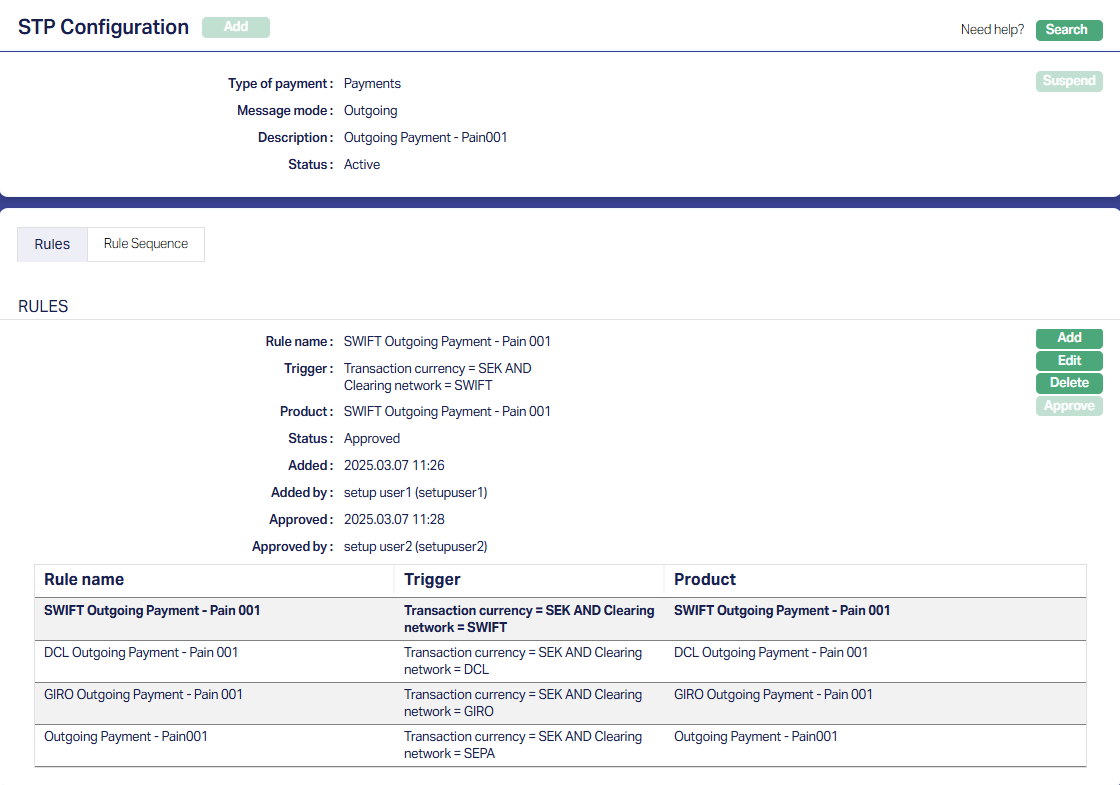

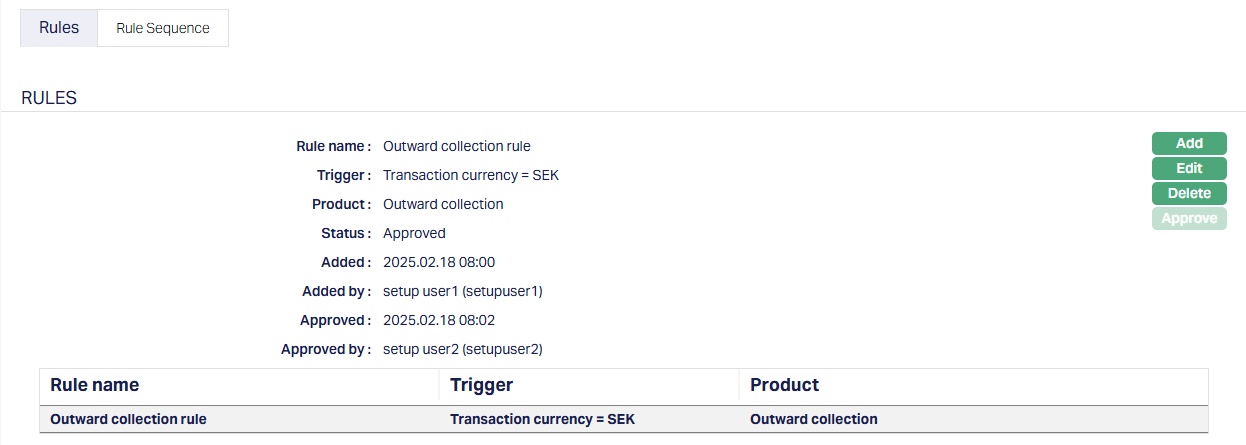

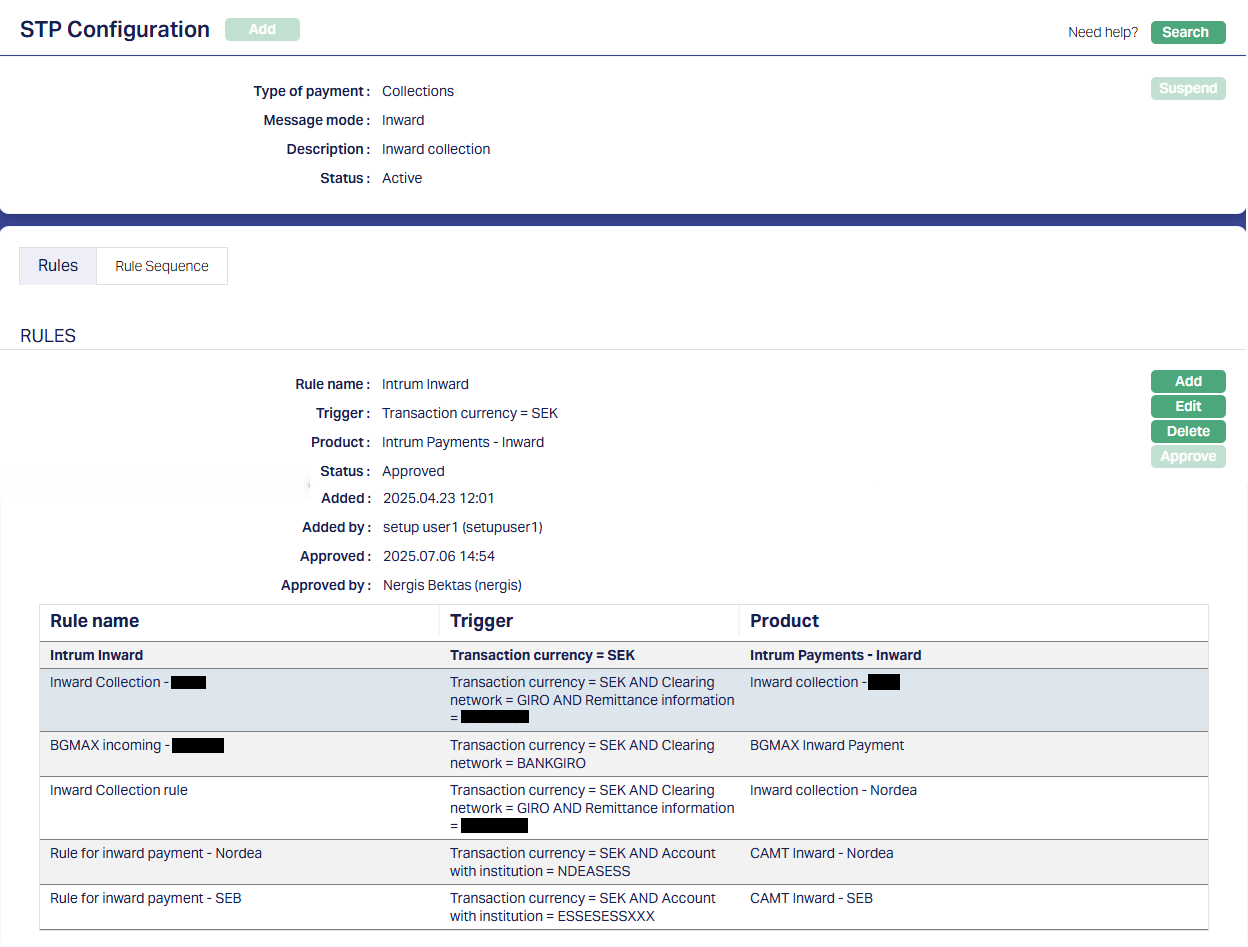

2.3. Settings > STP Configuration

A Straight-Through-Processing (STP) Configuration should be defined to resolve a PG > Product for each payment. Several handles are available to configure suitable rules such that for each payment, a unique Product can be resolved. Multiple rules can be defined.

Note:

- If a Product cannot be resolved using the STP Configuration, the transaction will either be stopped during manual input / approval or it will appear in PaymentGrid > Operations > STP Exception. Unless the Product is resolved, the payment will not go through.

A sample is shown below:

In the above sample, the Trigger uses only the Transaction Currency and the Clearing Network of the Payment Transaction to map to a unique Product. It is also important to set the Rule Sequence in such a way that the broadest filter is defined as the last.

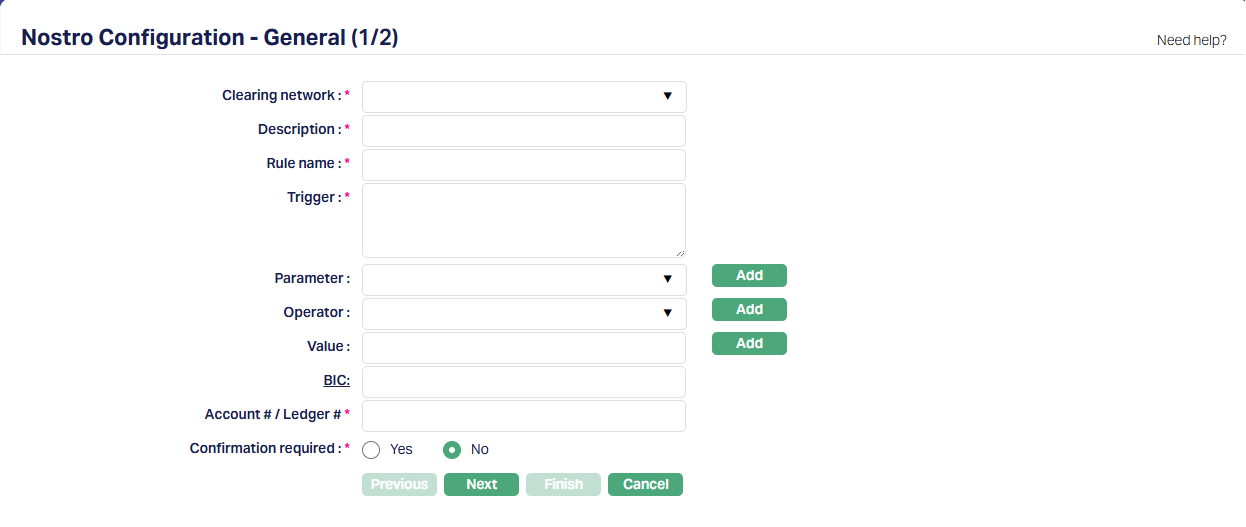

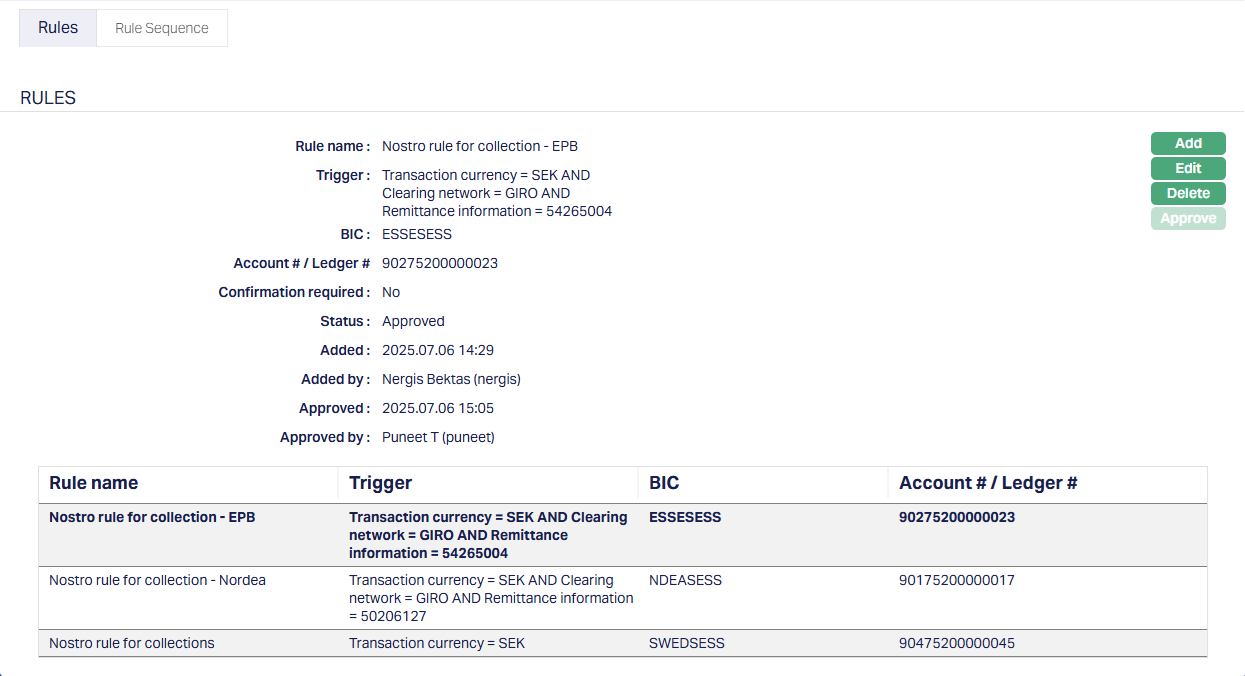

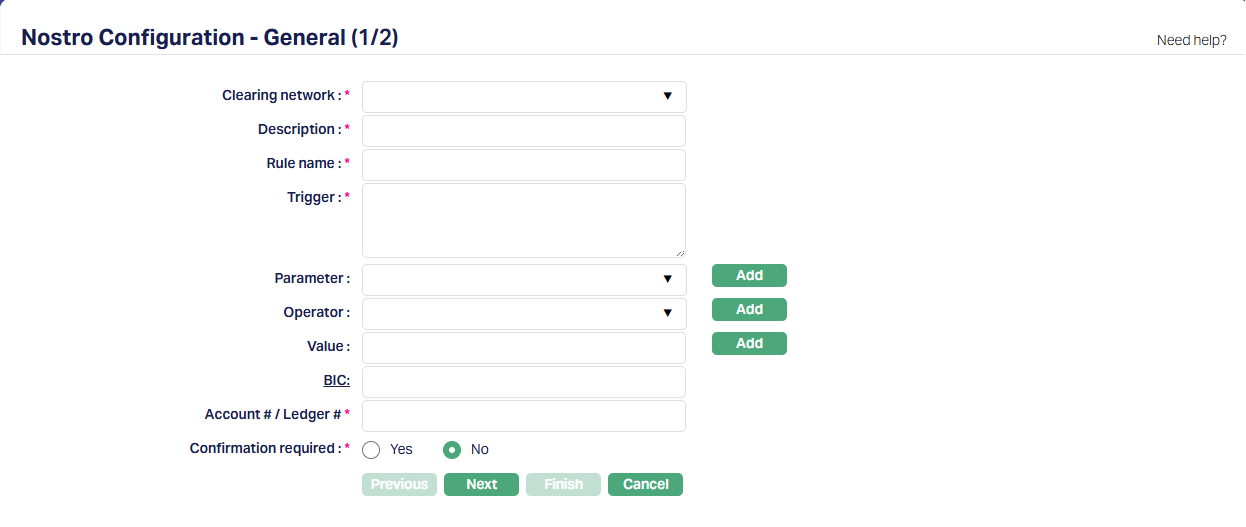

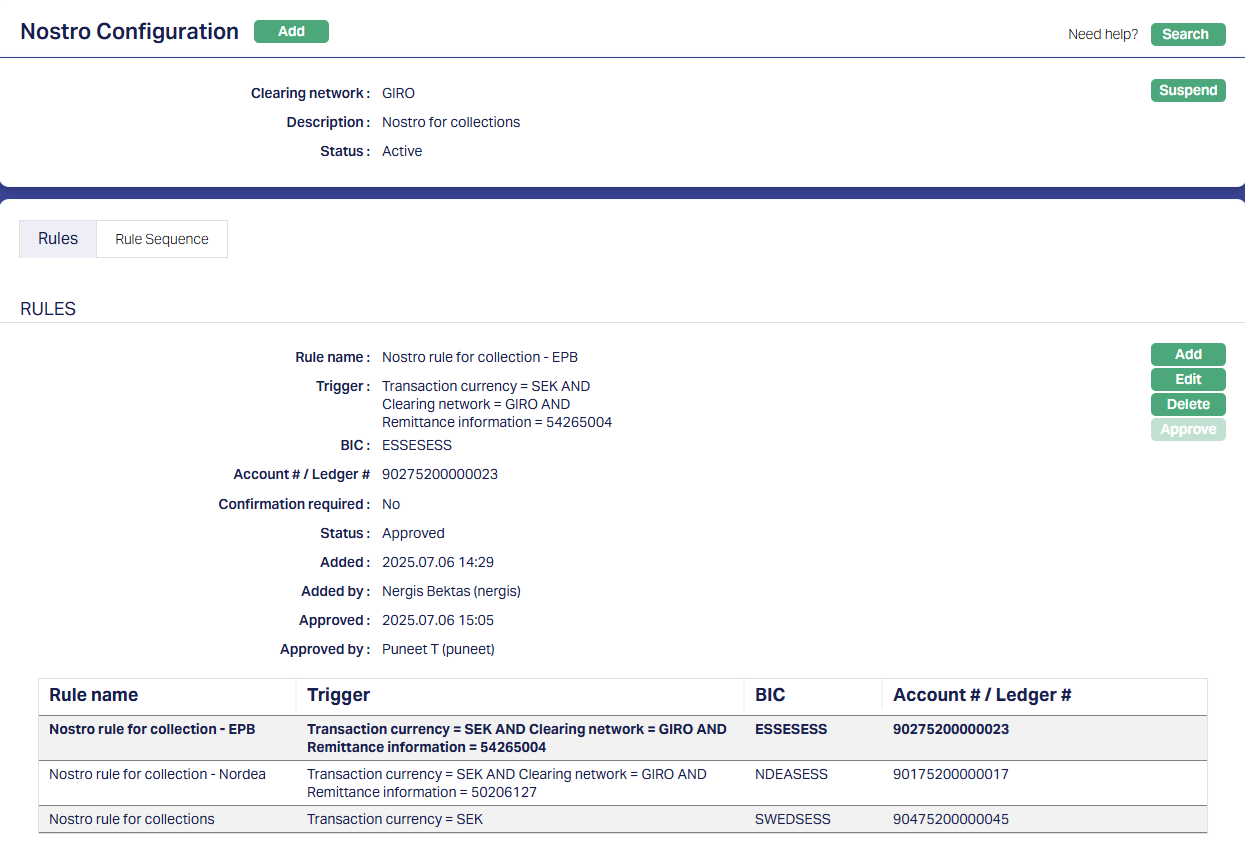

2.4. Settings > Nostro Configuration

This enables you to set up the Nostro that is to be used for the Outgoing Payment. The Nostro entries will mirror the entries in the Bank Account from which the Outgoing funds will be moved to the external accounts as input during Loan Disbursement / Credit Transfer / RTGS

One Nostro Configuration should be defined to resolve the Nostro Account for each Clearing network . Several handles are available to configure suitable rules such that for each payment, a unique Nostro Account can be resolved. Multiple rules can be defined.

Note:

- If a Nostro Account cannot be resolved using the Nostro Configuration, the transaction will be stopped during manual input / approval; and in case of automatic payment processing (for example, Loan Disbursement), the error will only be logged and the transaction will not be found in any exception queue. However, the payment will not go through. You need to check the Nostro entries every day to ensure that the Nostro posting has been completed for all such transactions.

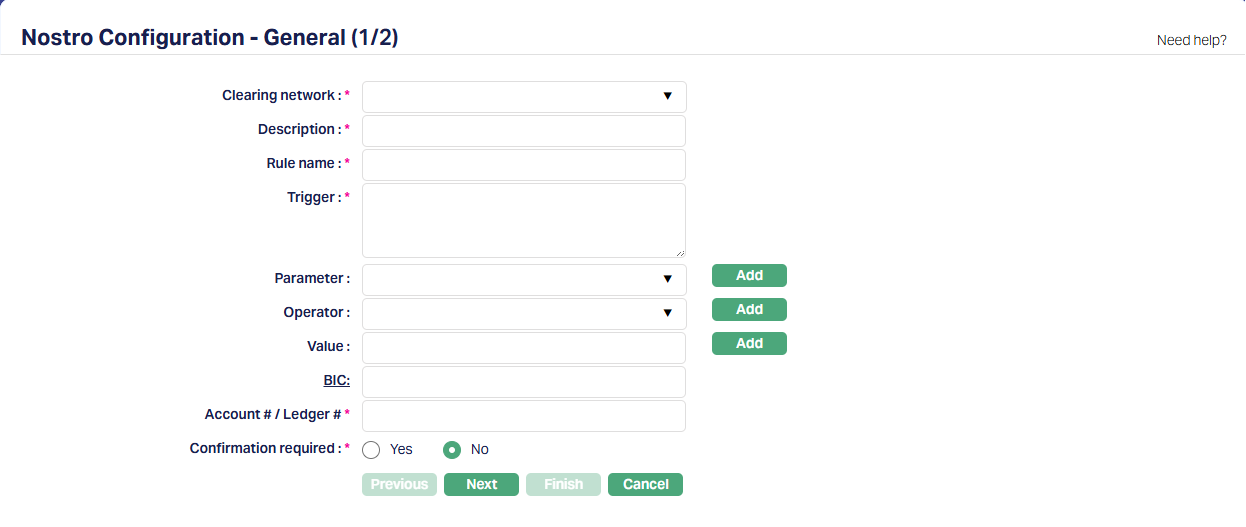

2.4.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Description | The description of the Nostro Configuration | Can be anything – Should be such that one can easily identify what this Nostro Configuration is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| Rule Name | Any free text that identifies what the Rule is for | ||

| Trigger, Parameter, Operator, Value | Use as required to build the Rule | ||

| BIC | The Bank Identifier Code of the Bank in which the Entity maintains the Bank Account | ||

| Account # / Ledger # | The Nostro Account # or the Ledger # into which the Nostro entries have to be posted. | This has to be exactly the same as maintained in CC for the Nostro Accounting entries to be successfully posted. Copy from CC and paste here | |

| Confirmation Required | Depends on solution / fitment. This is applicable only for SWIFT & TARGET2. For others, it can remain as No |

A sample is shown below:

In the above sample, the Trigger uses certain handles that facilitate mapping of the Payment Transaction to a unique Nostro Account. It is also important to set the Rule Sequence in such a way that the broadest filter is defined as the last.

3. Aura Data Management

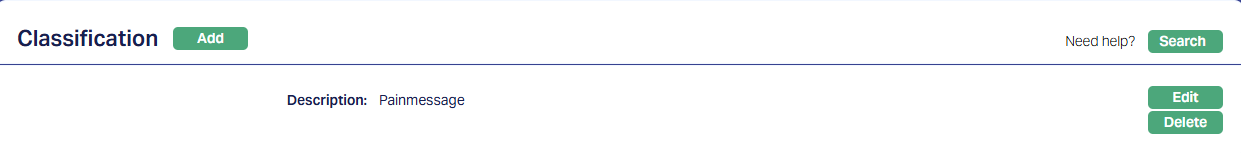

3.1. Admin > System Codes > Generic Definitions > Classifications

Classification enables you to categorize / label the various configurations in Data Management so that it is easier to know what the configuration is for. Create a Classification record where the Description identifies the purpose that is sought to be achieved.

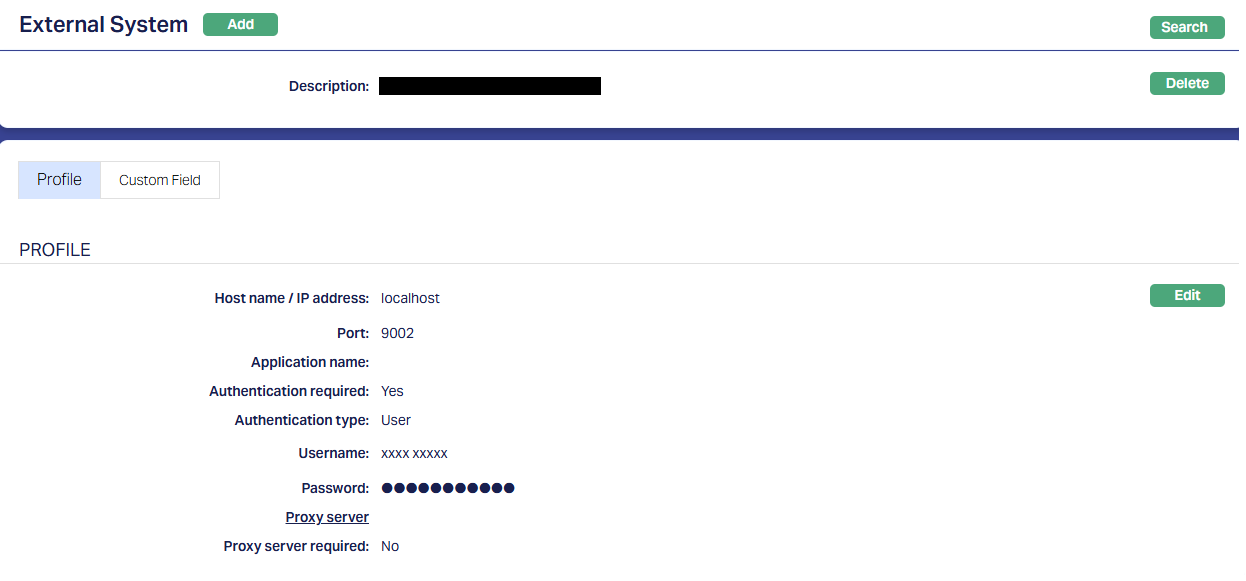

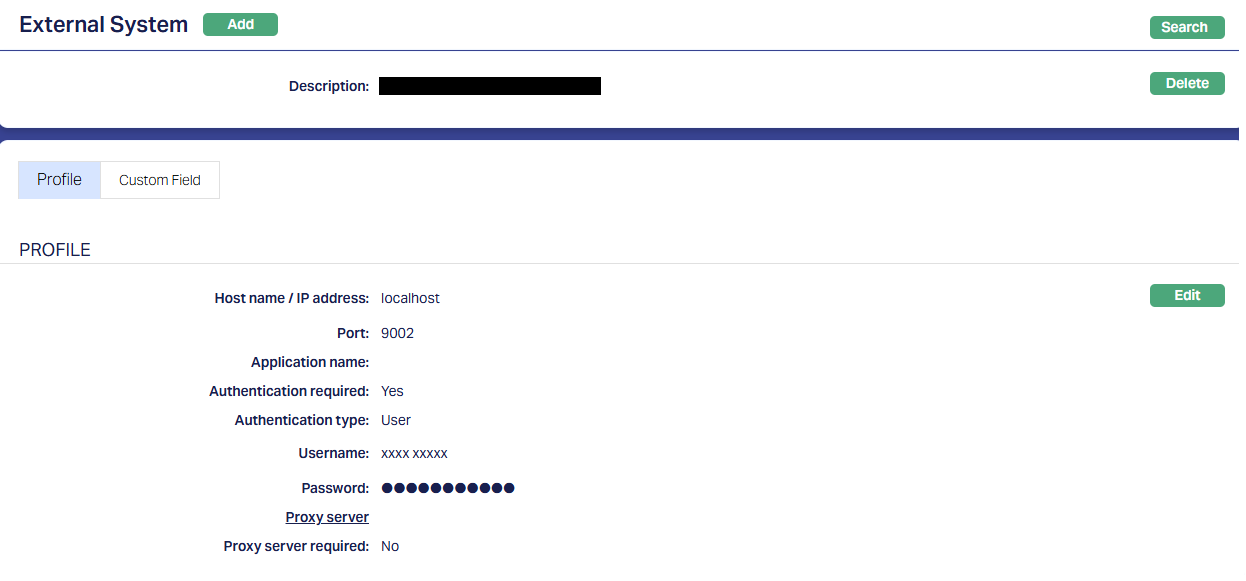

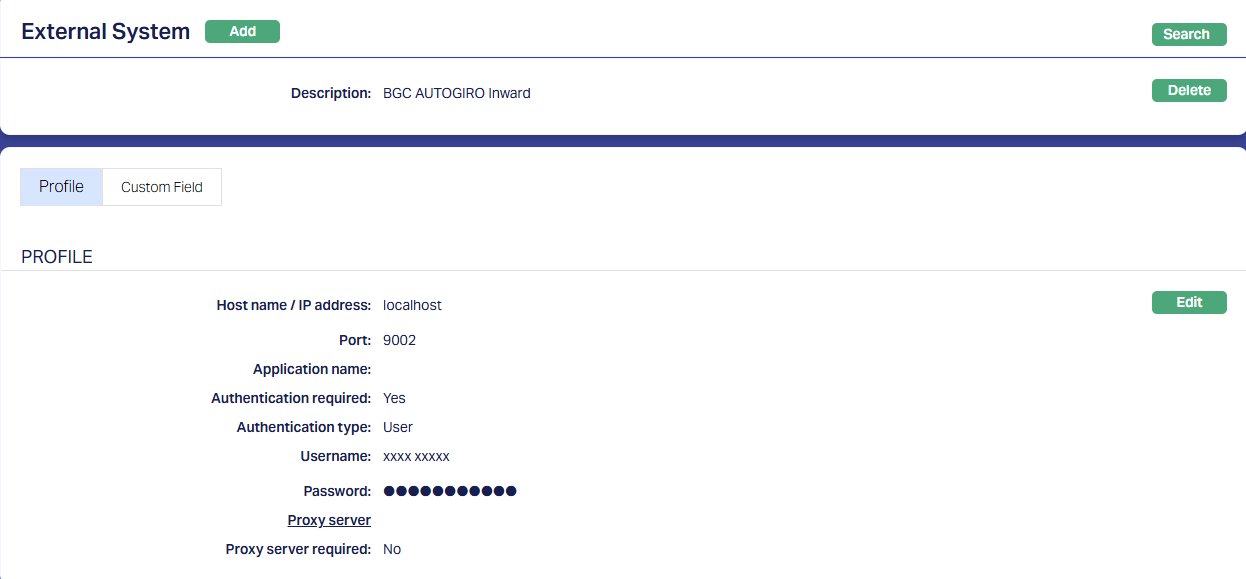

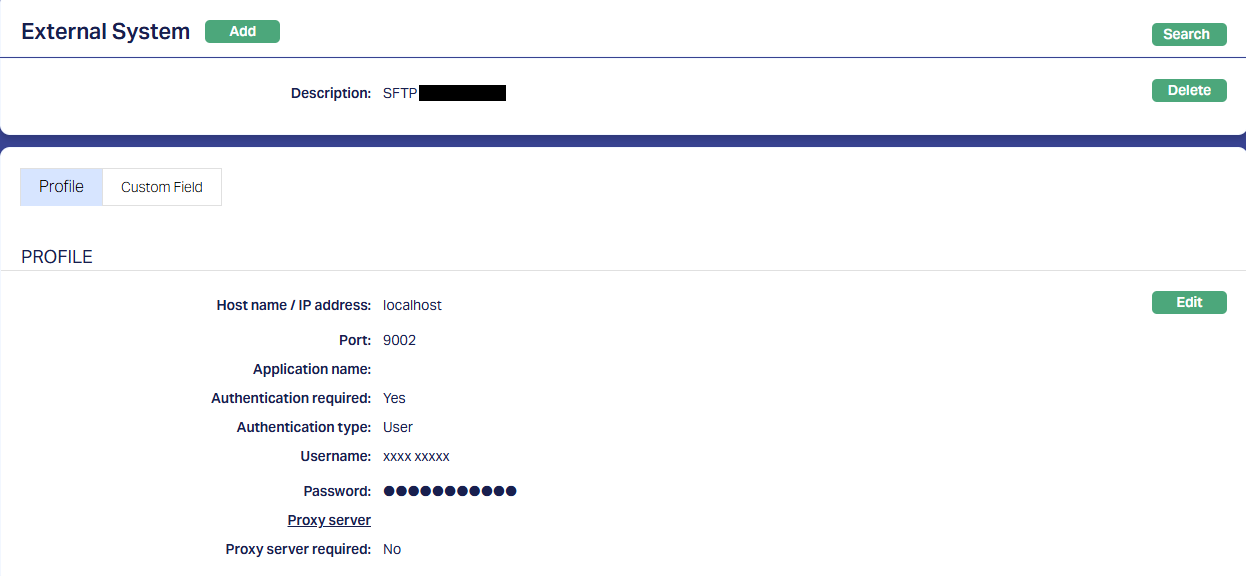

3.2. Data Management > Settings > External System

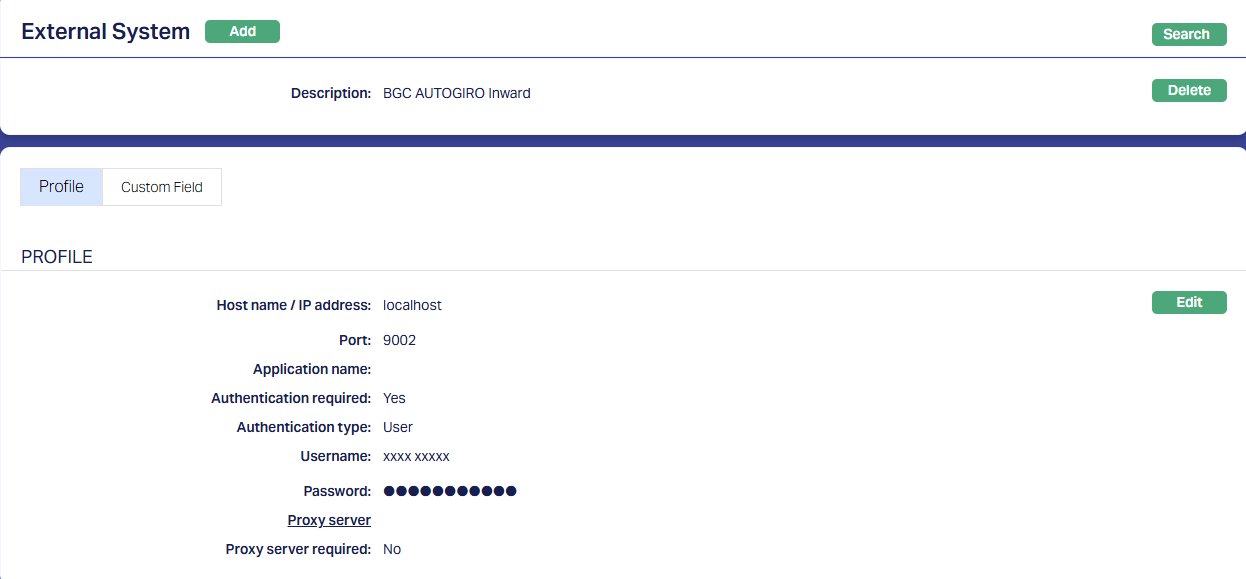

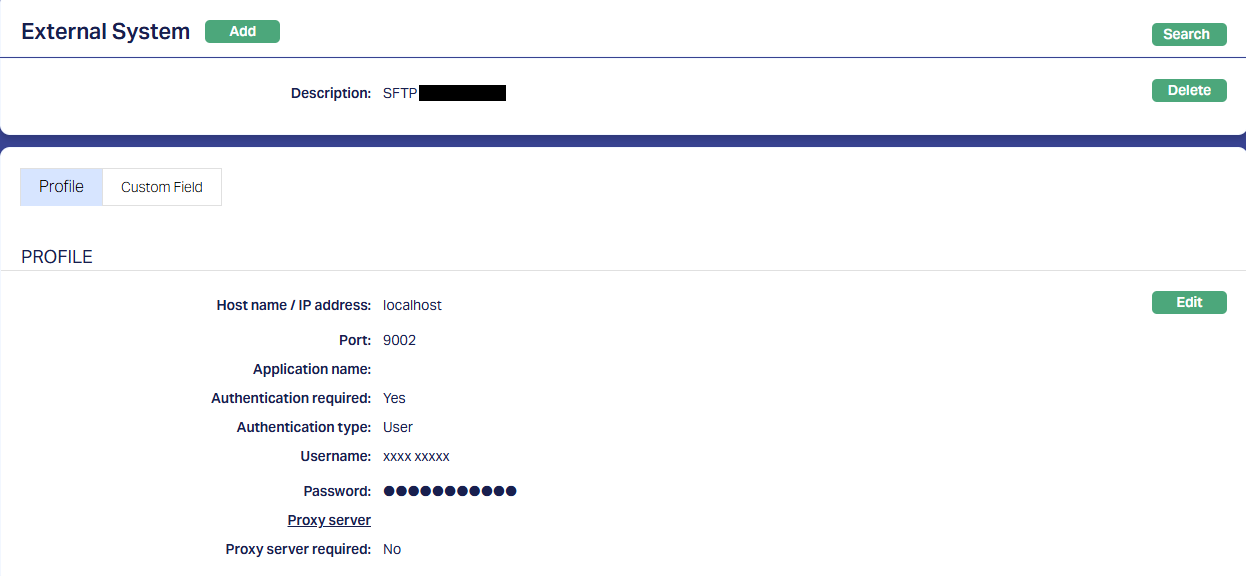

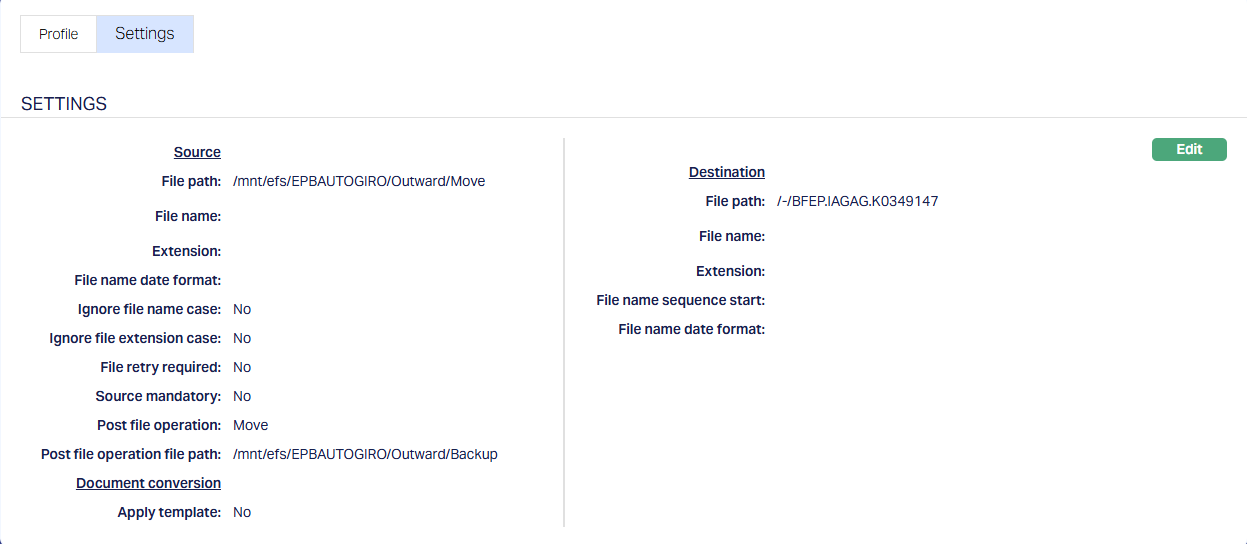

Depending on the Bank / external system to which the payment files have to be transferred and the mode of upload / transmission, you may have to create more records under External System. See sample below:

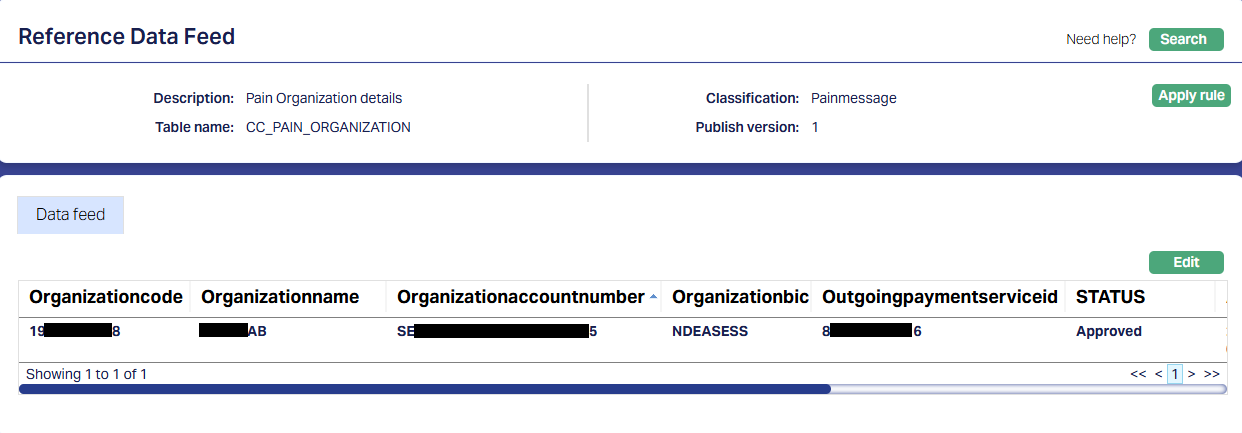

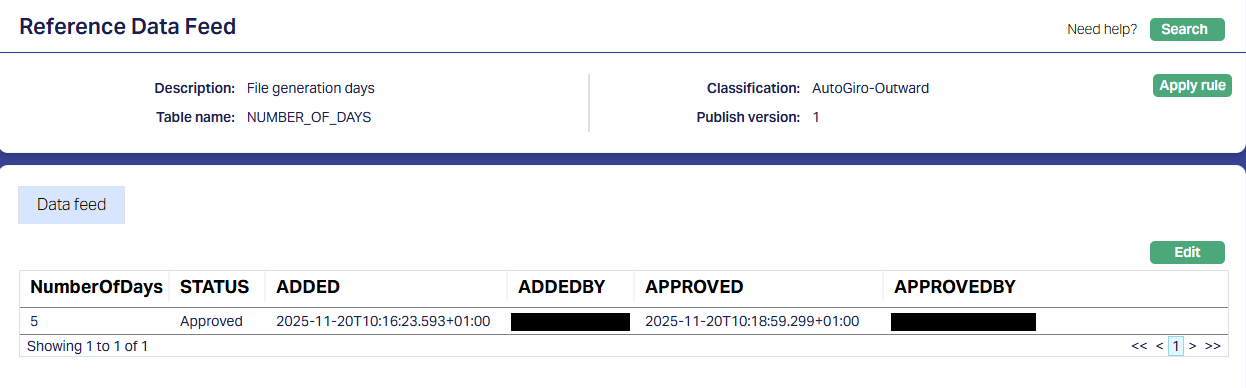

3.3. Data Management > Definitions > Reference Data > Data Feed

If Aura is being implemented in a FI and they have a Bank account to which a pain.001 file is to be sent, the following Reference Data > Data Feed details have to be input, based on the agreement between the FI and the Bank

| Field Name / Description | Field Value | Notes |

|---|---|---|

| Organization Code | xxxxxxx4248 | Parameter value changes based on implementation |

| Organization Name | xxxxxx AB | Parameter value changes based on implementation |

| Organization Account Number | xxxxxxxxxxxxxxxxxxxx5295 | Parameter value changes based on implementation |

| Organization BIC | NDExxxxx | Parameter value changes based on implementation |

| Outgoing Payment Service ID | xxxxxxxx0316 | Parameter value changes based on implementation |

Note:

- The Status of the Data Feed record should be Approved. The audit trail related fields appear when you scroll right and are not shown in the screenshot above.

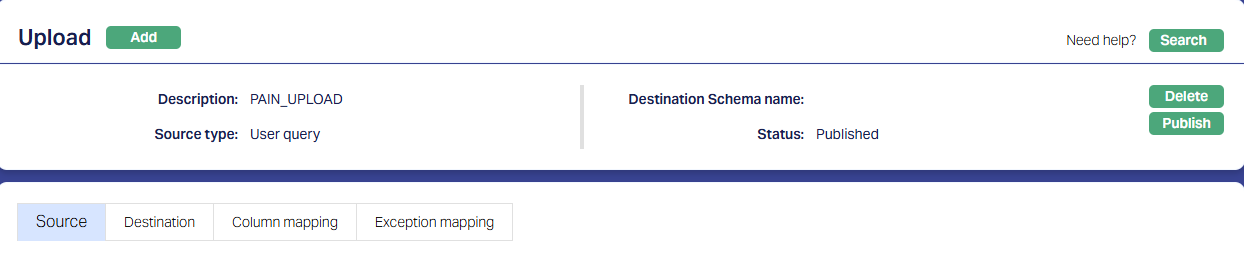

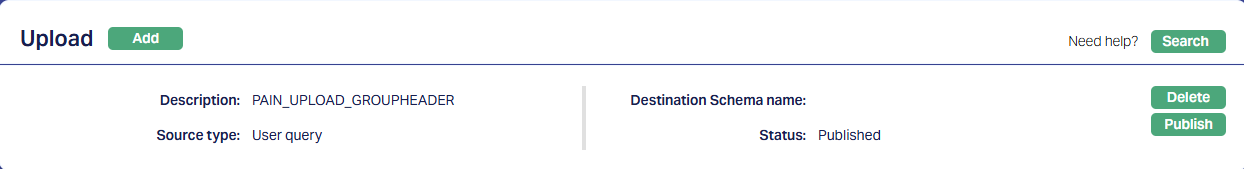

3.4. Data Management > Configurations > Uploads > Maintain

For pain.001, the following TWO Upload Functions should be available. Usually, these are part of the installation, but you need to verify that the Status of both is Published.

3.4.1. PAIN_UPLOAD

3.4.2. PAIN_UPLOAD_GROUPHEADER

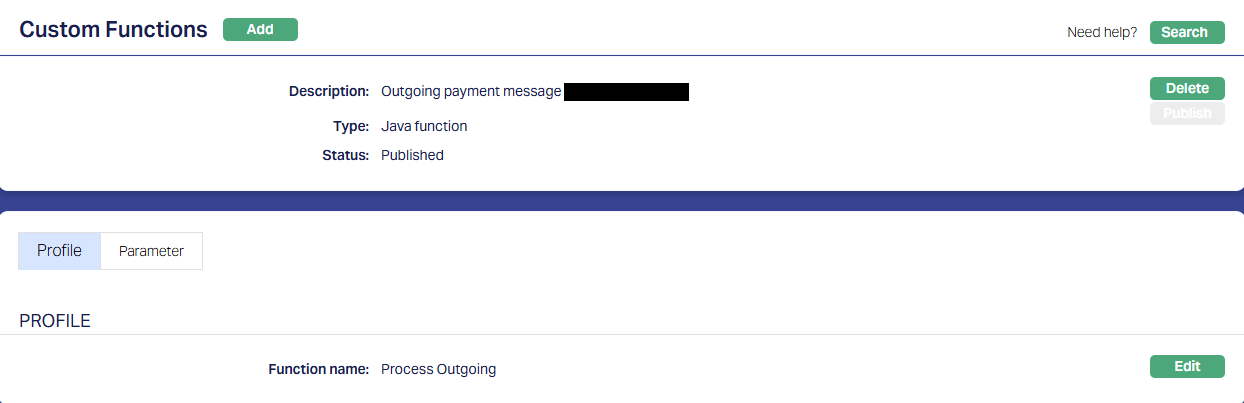

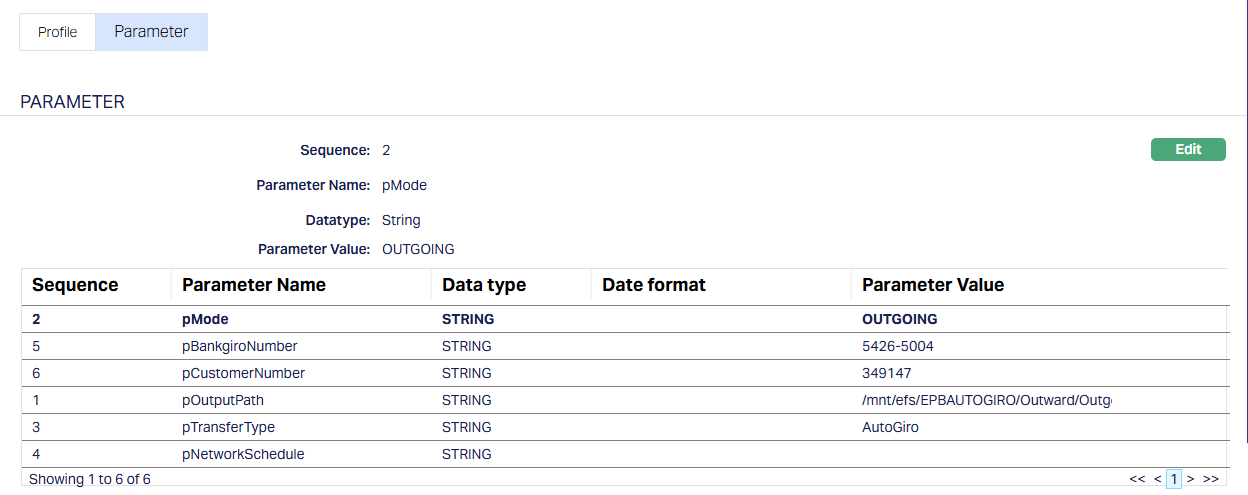

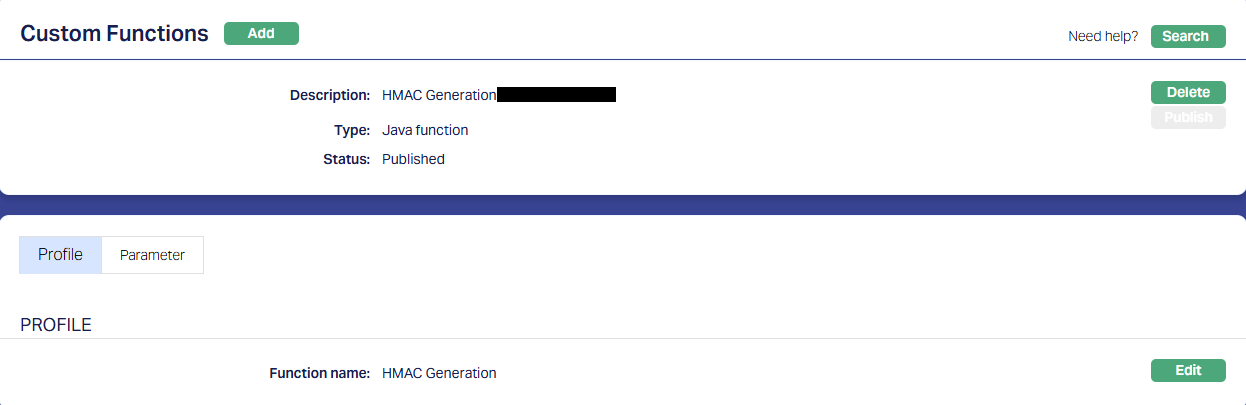

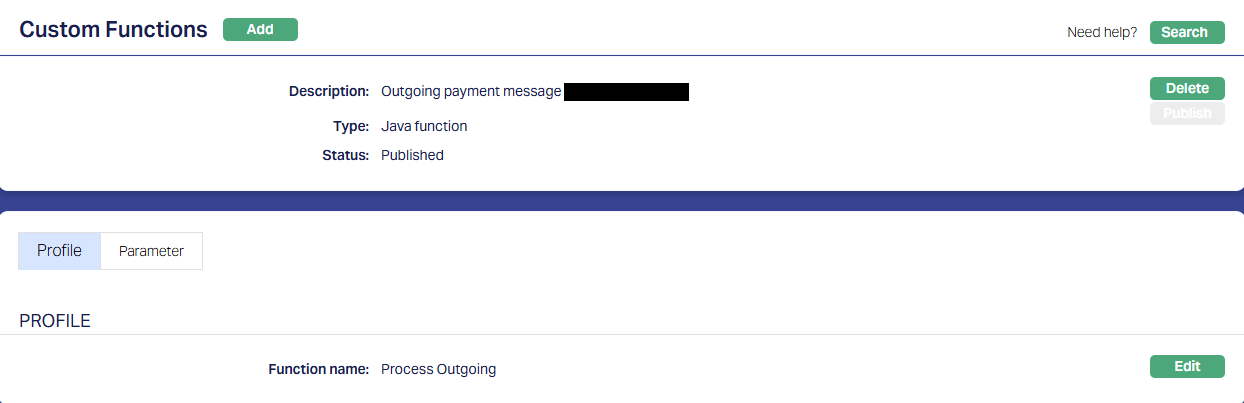

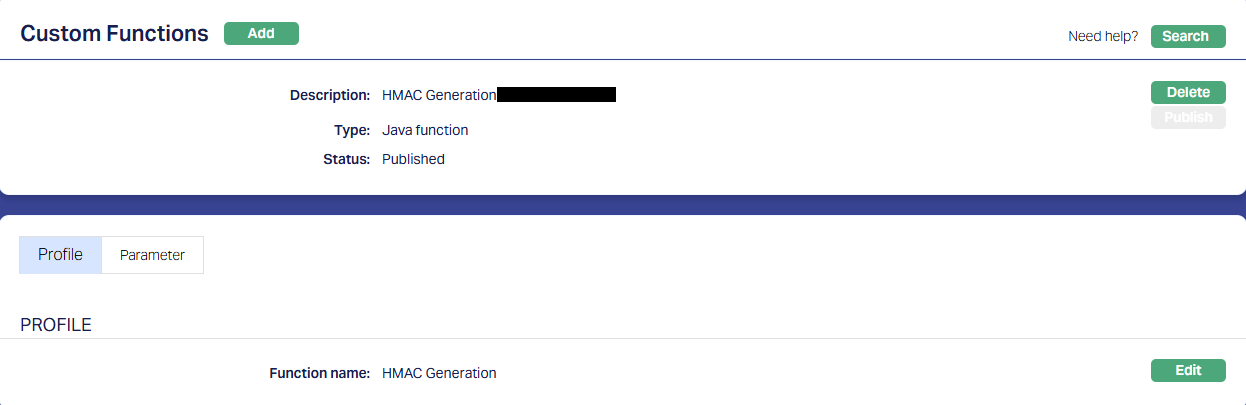

3.5. Data Management > Metadata > Custom Functions

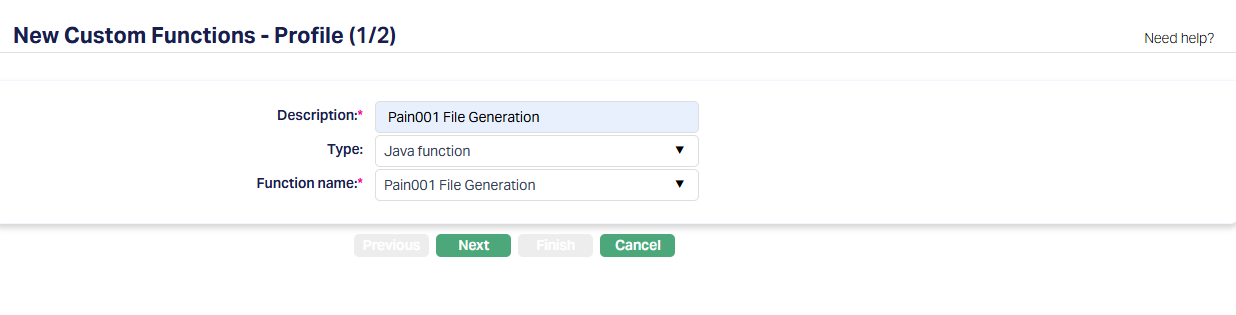

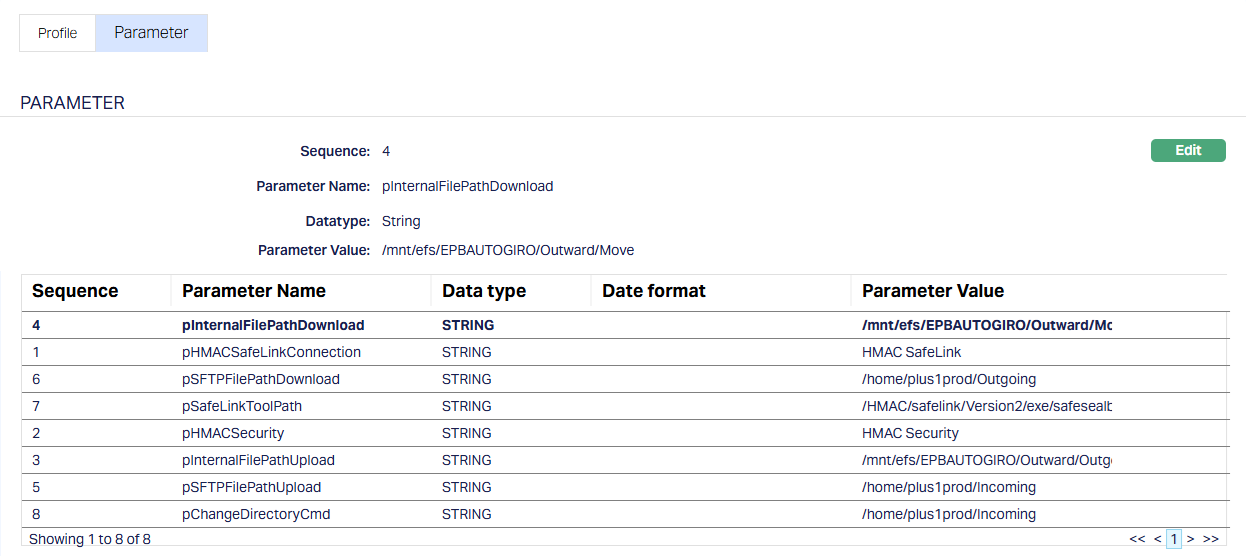

For pain.001, the following Custom Function should be configured. Usually, this is part of the installation. If not, you need to create a new Upload using the Java Function already available. And you need to ensure that the Status is Published and the Parameters are correct for that Implementation.

3.5.1. Pain001 File Generation

3.5.1.1. Profile

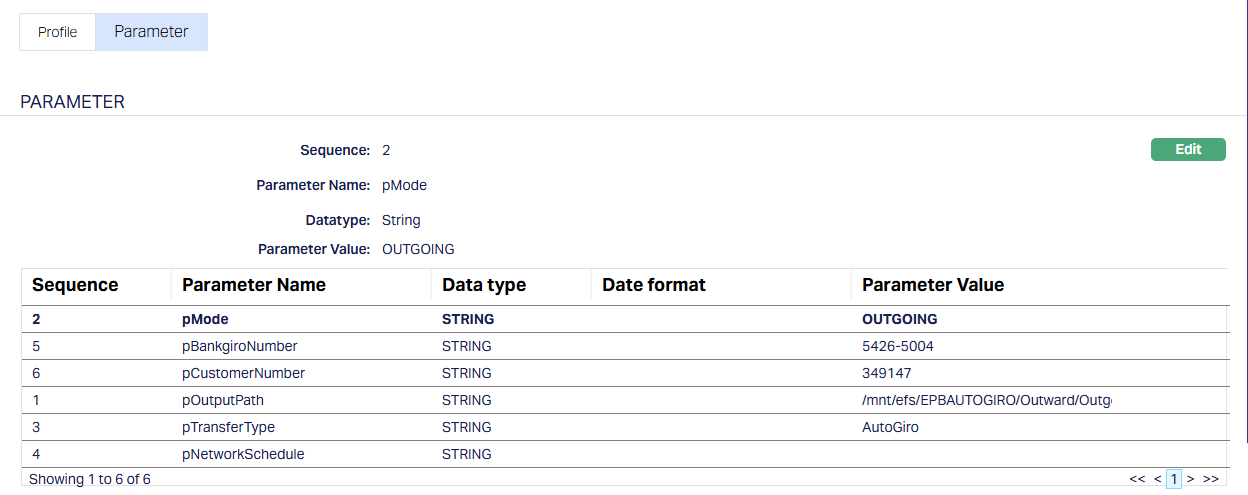

3.5.1.2. Parameter

| Parameter Name | Description | Parameter Value | Notes |

|---|---|---|---|

| pGenerationPath | Outgoing Pain File generation path | /xxx/efs/xxx/Pain001/Out | Parameter value changes based on implementation |

| pCommand | Command | UploadFile | Remains same for all implementation |

| pApplicationRequestFilePath | Application Certificate Path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pUploadEnvironment | Environment - Test or Production | PRODUCTION | Parameter value will change based on the Environment |

| pResponseFileGeneration | Purpose of File Generation | YES | Remains same for all implementation |

| pNordeaAliasName | Nordea Bank Alias name | nsc_xxxcontainer_xxxxxxxxxxxxxx7450 | Parameter value changes based on implementation |

| pSoapMessageFilePath | Soap Message file path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pCertificateFileName | Certificate file name | Plus1xxxxxx.p12 | Parameter value changes based on implementation |

| pNordeaServiceUrl | Nordea Service URL | https://xx.ebridge.xxxx.xxxxx.com/ws/Corporatexxxxxxxxxxx | Parameter value changes based on implementation |

| pFileType | File Type - pain.001 | xxxxPXMLI | Remains same for all implementation |

| pStatus | Status | NEW | Remains same for all implementation |

| pTargerId | Target ID | xxxxxxx4248 | Parameter value changes based on implementation |

| pNordeaAlgorithmType | Nordea Algorithm Type | xxxxx Pain upload | Parameter value changes based on implementation |

| pPainFilePath | Pain file Generation path | /xxx/efs/xxx/Pain001/Out/ | Parameter value changes based on implementation |

| pFileReference | File Reference | YES | Remains same for all implementation |

| pCustomerId | Customer ID | xxxxx8168 | Parameter value changes based on implementation |

| pSoftwareId | Software ID | xxxxxxxxxxClient | Parameter value changes based on implementation |

| pEnvironment | Environment - Test or Production | PRODUCTION | Parameter value will change based on the Environment |

| pCertificatepath | Certificate Path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

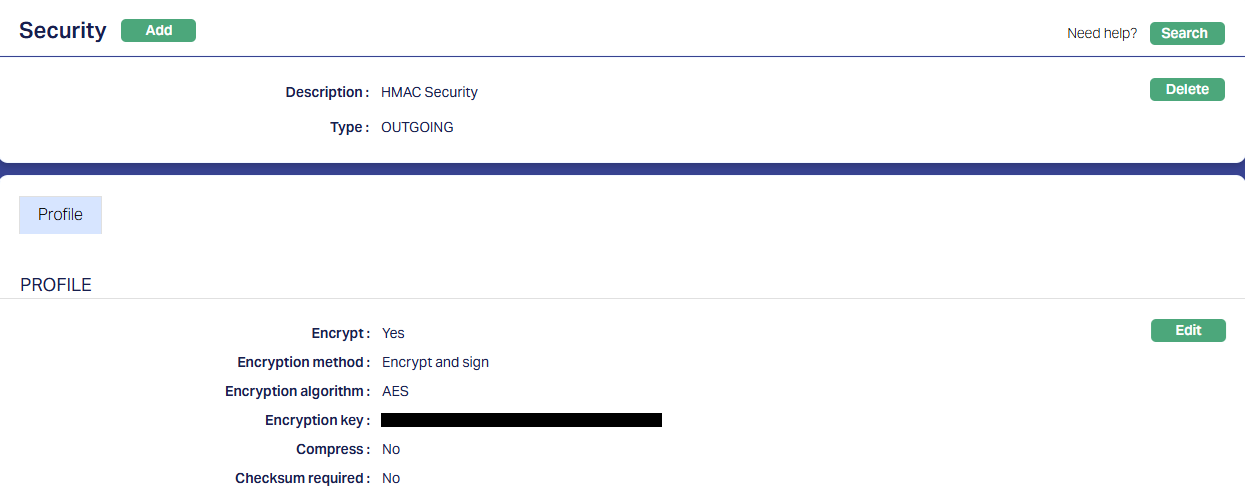

3.5.2. Other Custom Functions

Depending on the specific needs in an Implementation, you may have to create other Custom Function records and input the required Parameter values. In general, if the payment file has to be encrypted and / or handed off using a Webservice, etc., such additional Custom Function records have to be created and Published.

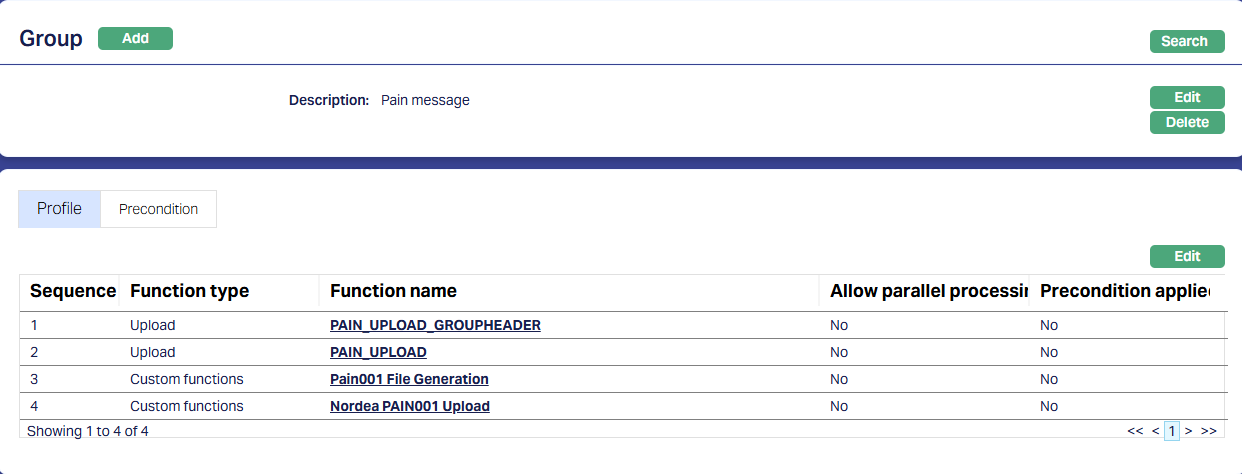

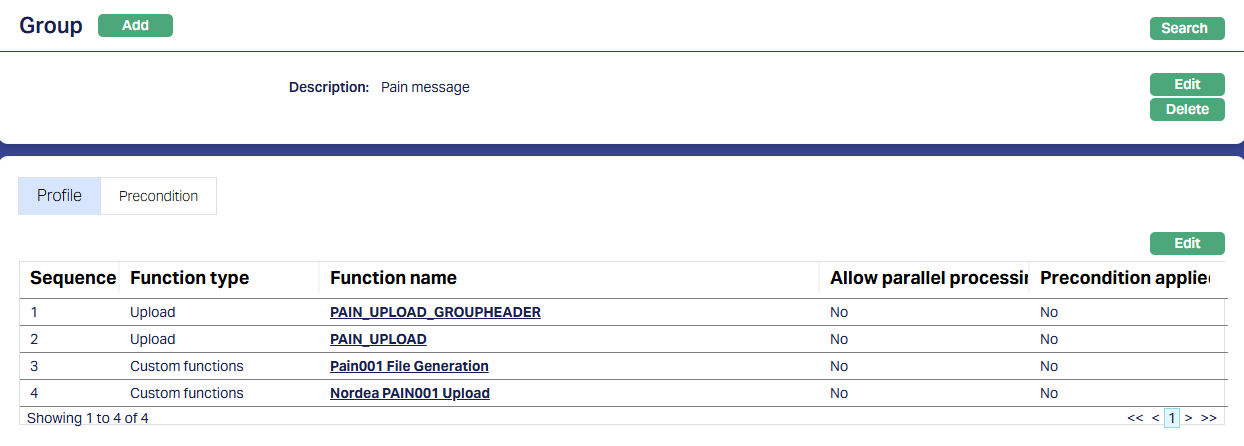

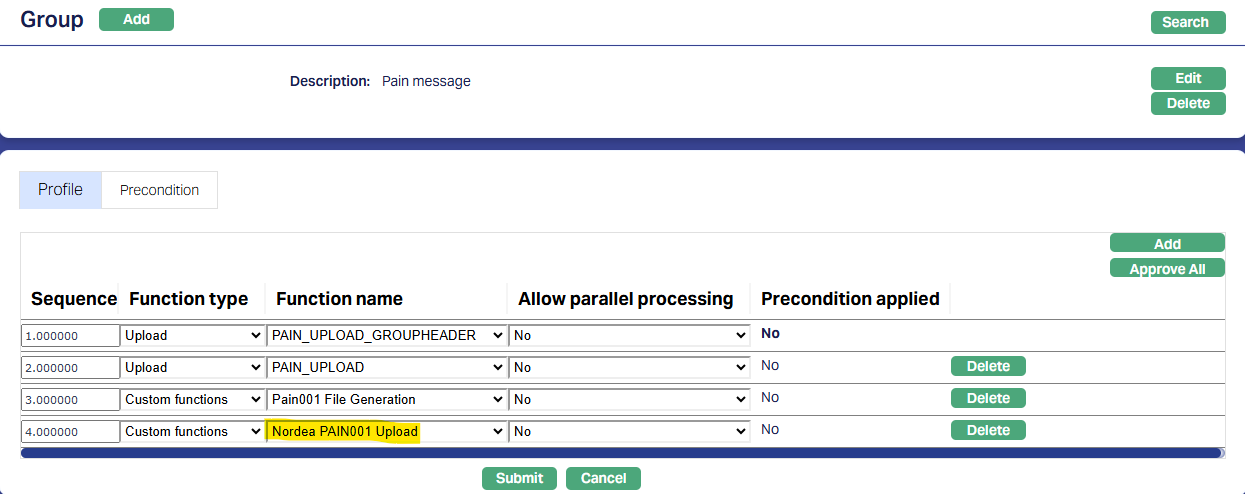

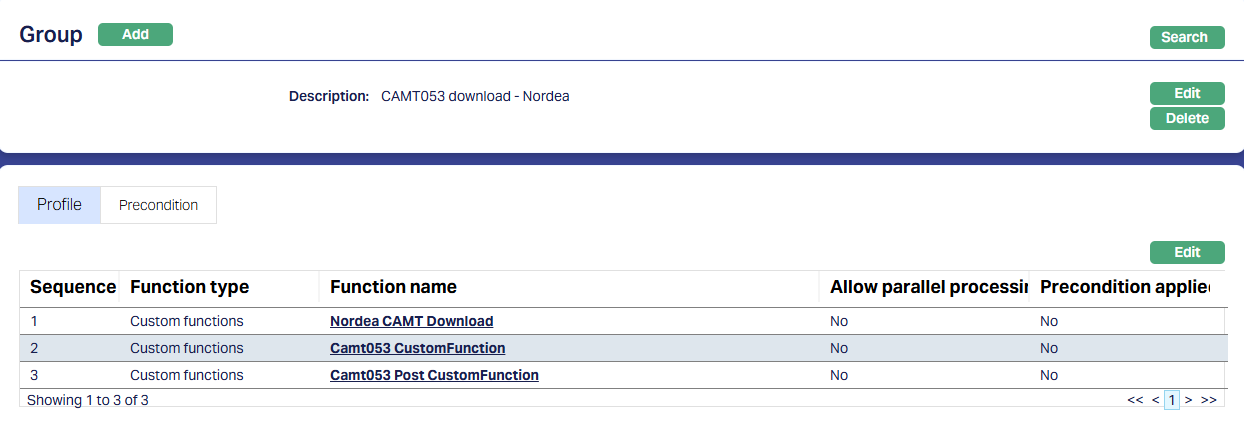

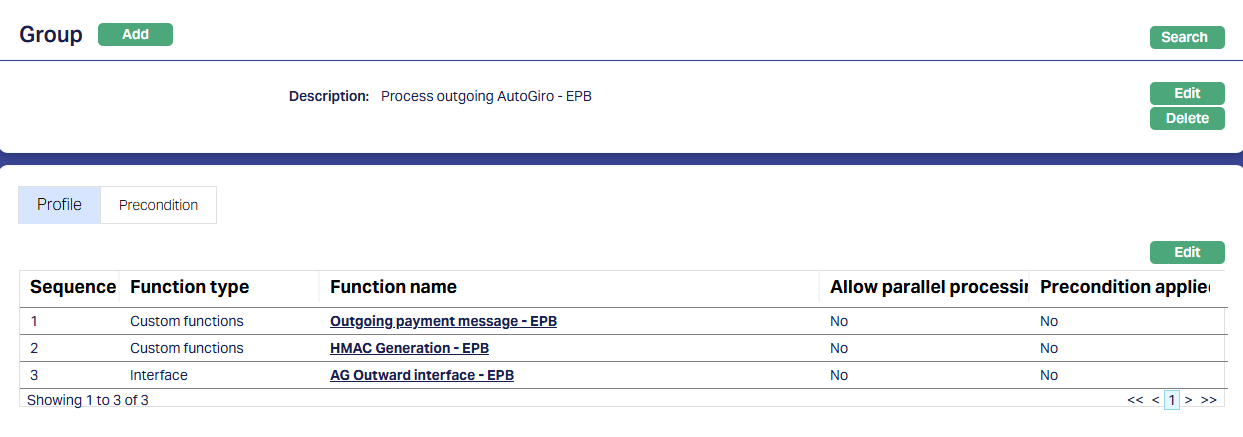

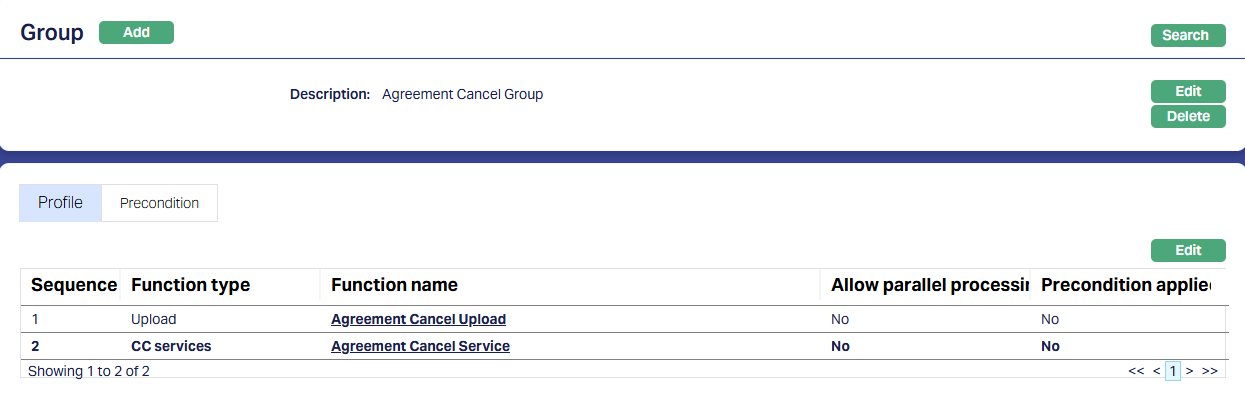

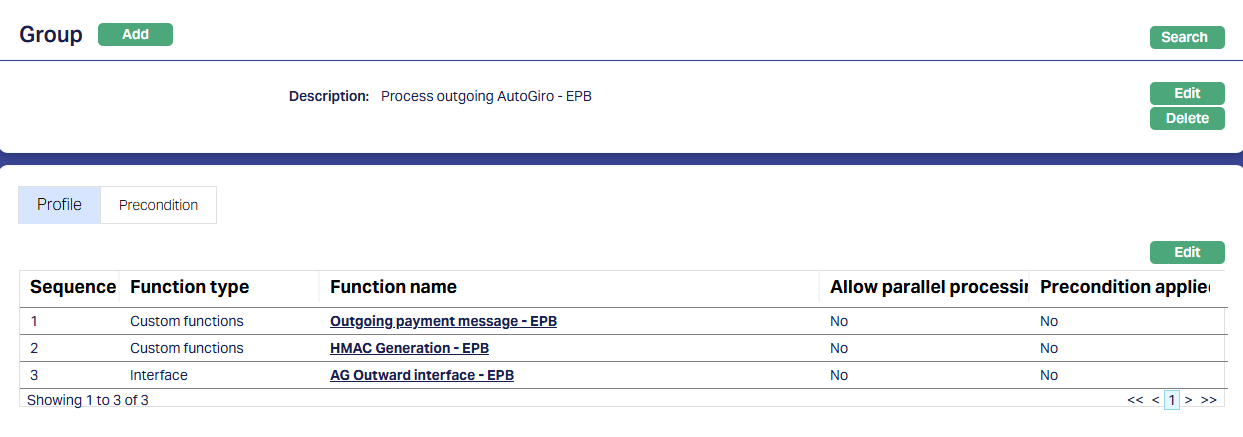

Data Management > Configurations > Groups > Maintain

Once the Upload and Custom Function records are Published, you have to create a Group and map all the required functions to that Group. This ensures that all the functions required for the pain.001 file generation are executed in the specific sequence. Usually, this is part of the installation. If not, you will have to do the same.

Note:

- The sequence of the functions is very critical and should be strictly set up as shown below.

The last in the sequence in the sample below is the additional Custom Function that is created to upload the file to the Bank as required for that Implementation.

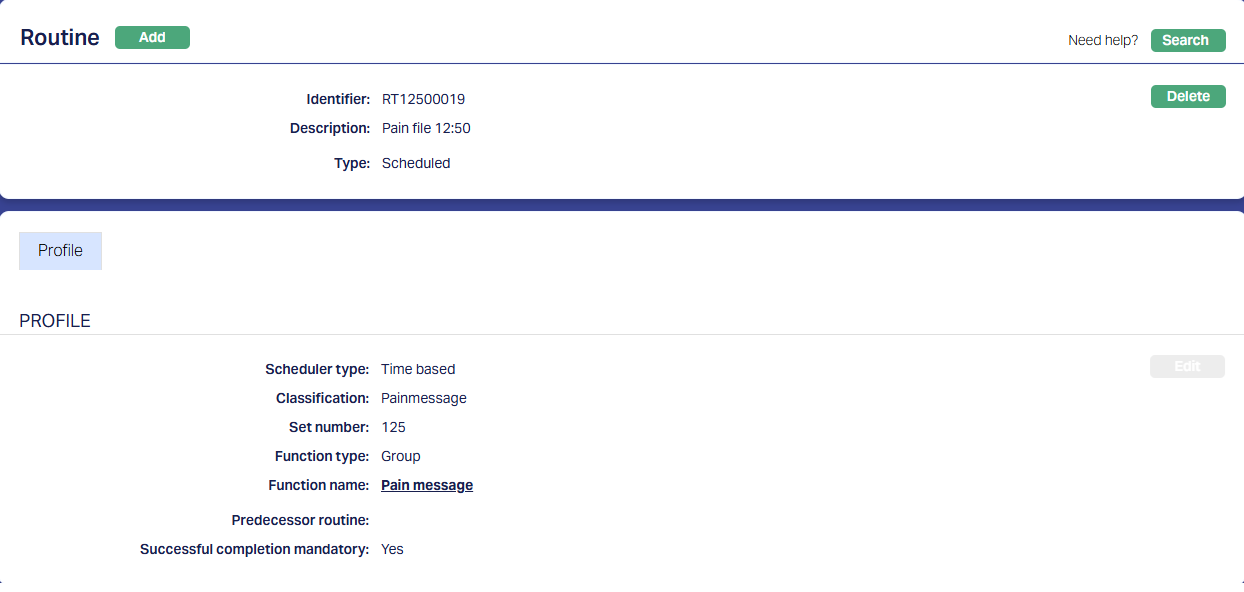

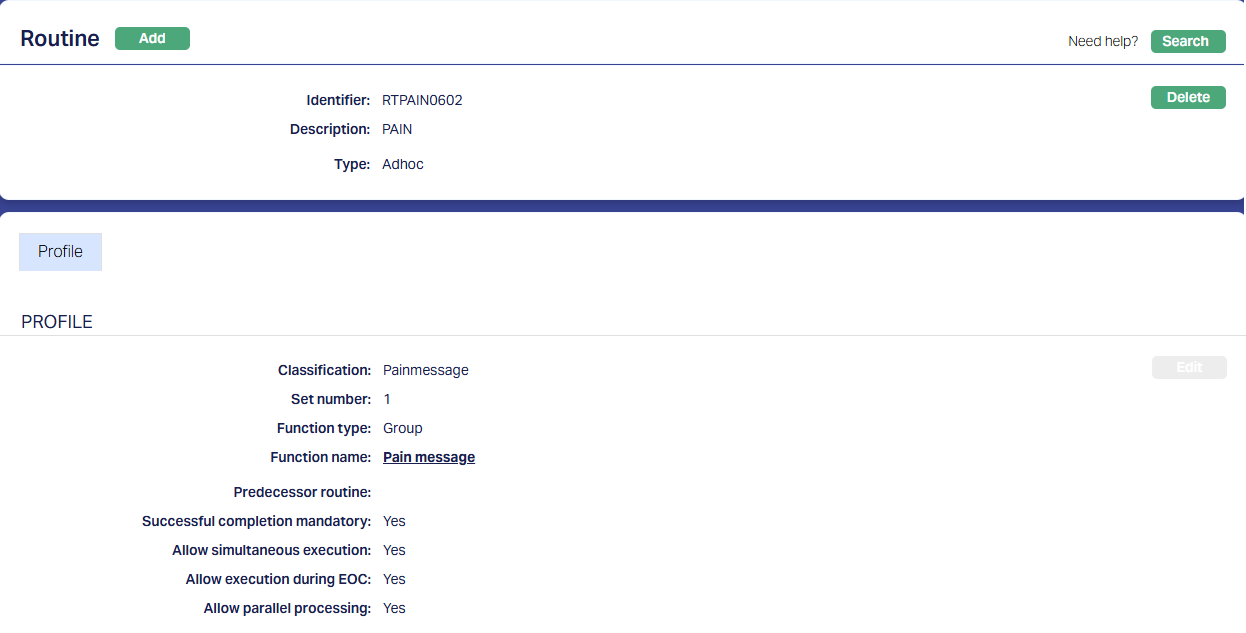

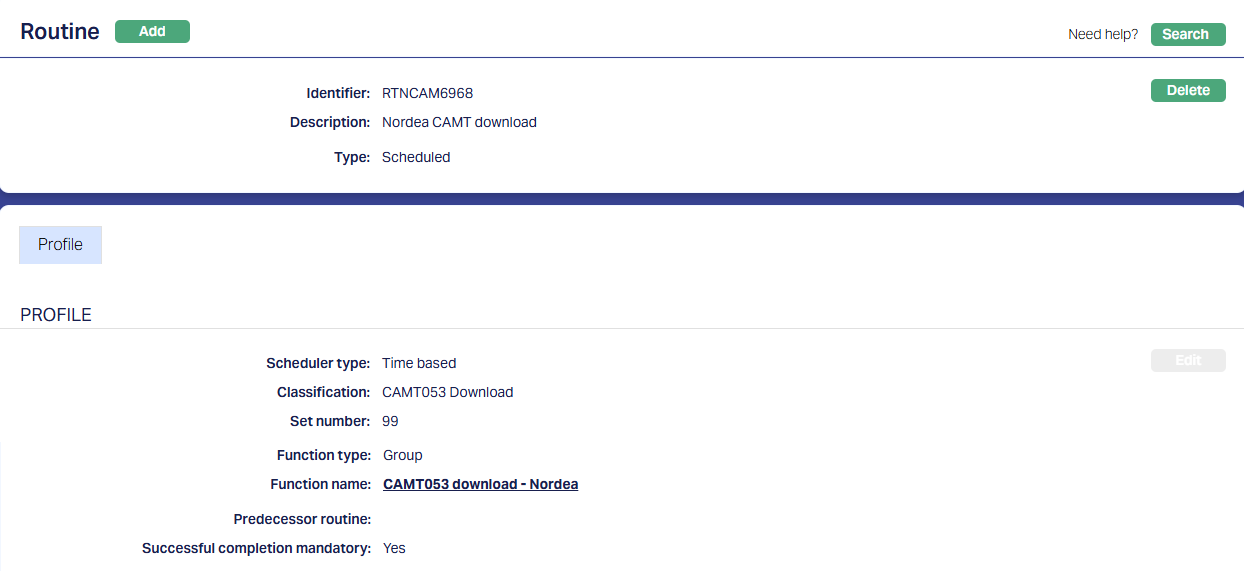

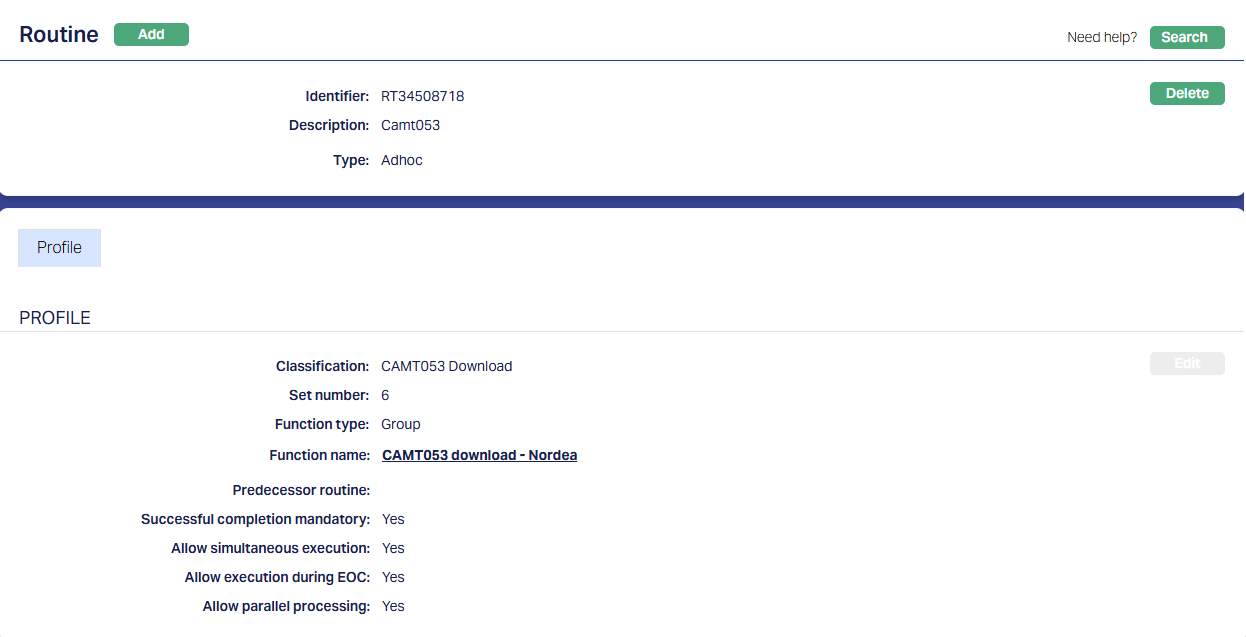

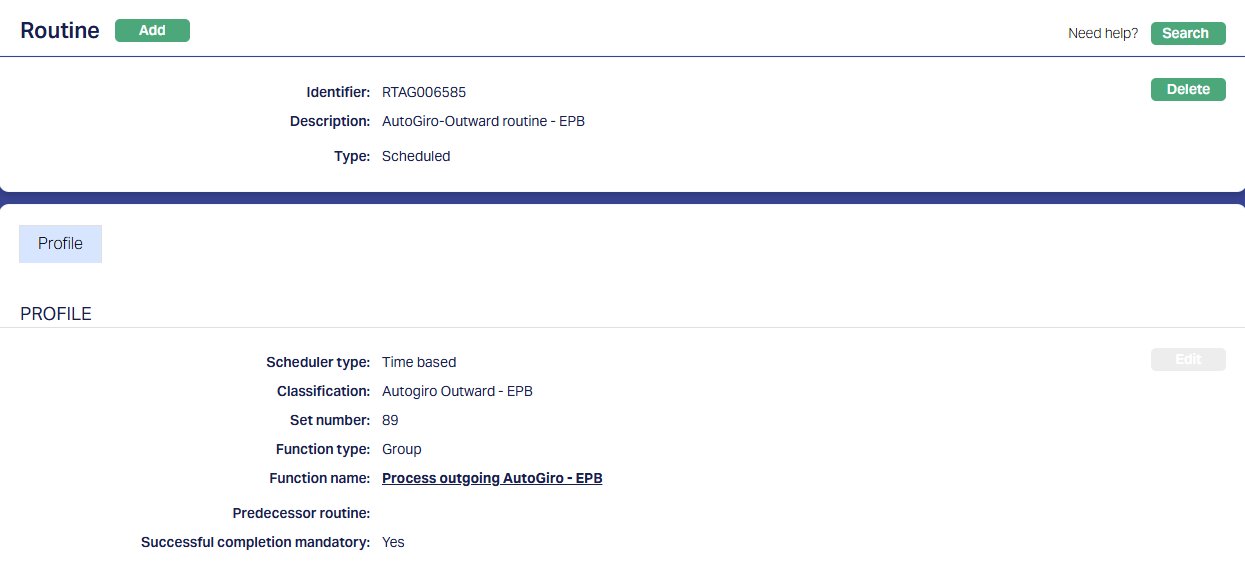

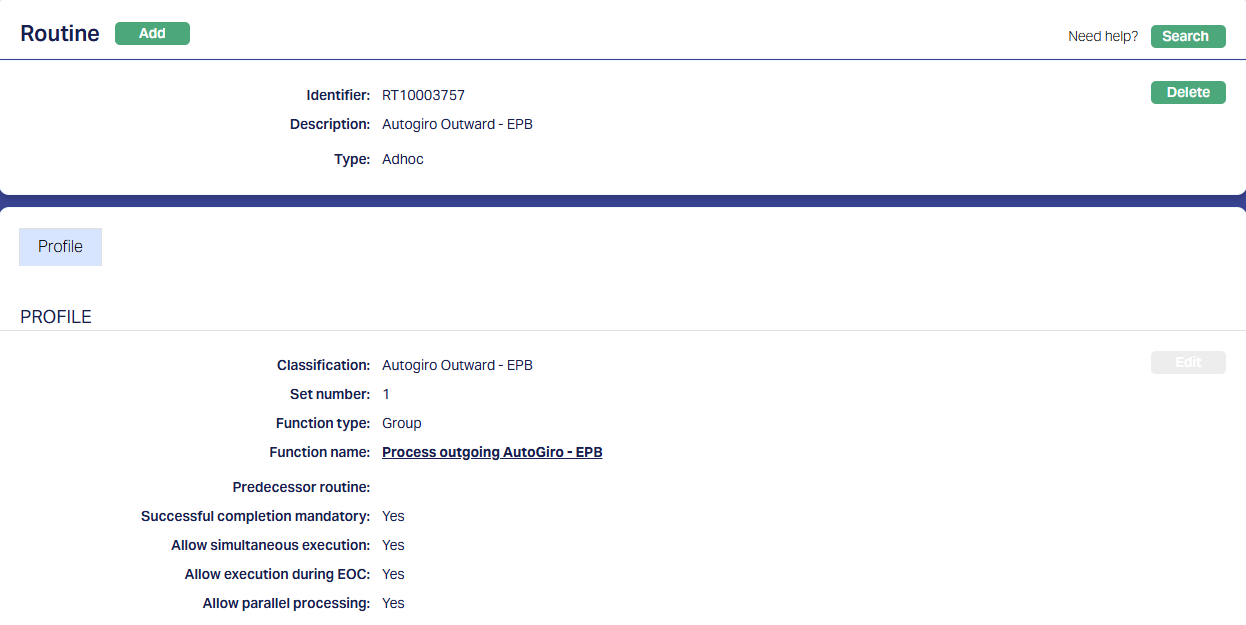

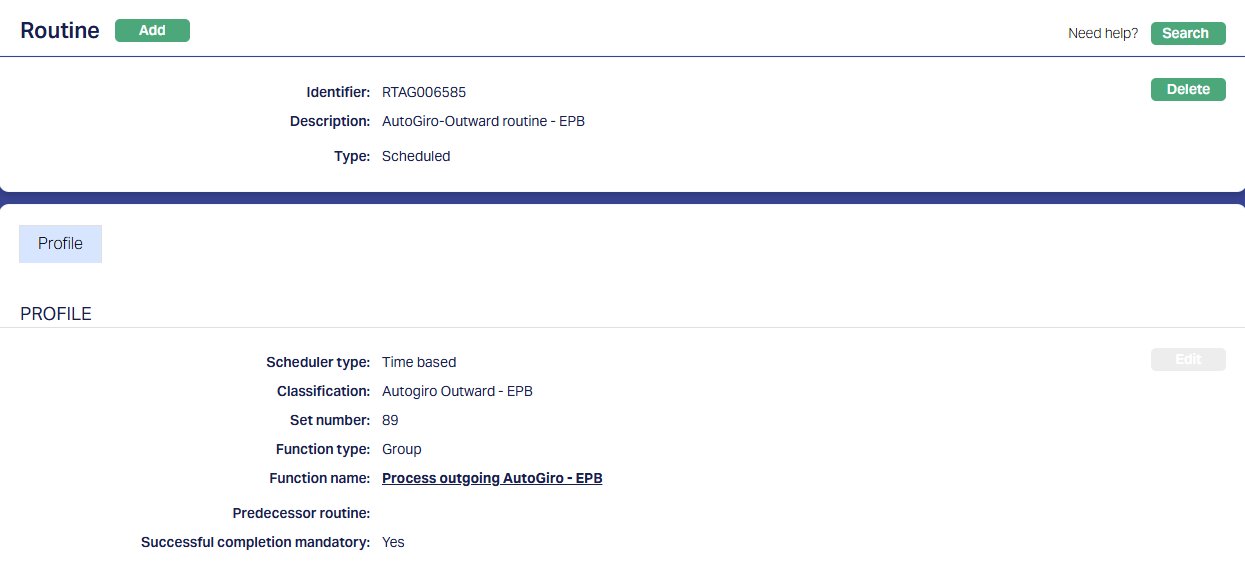

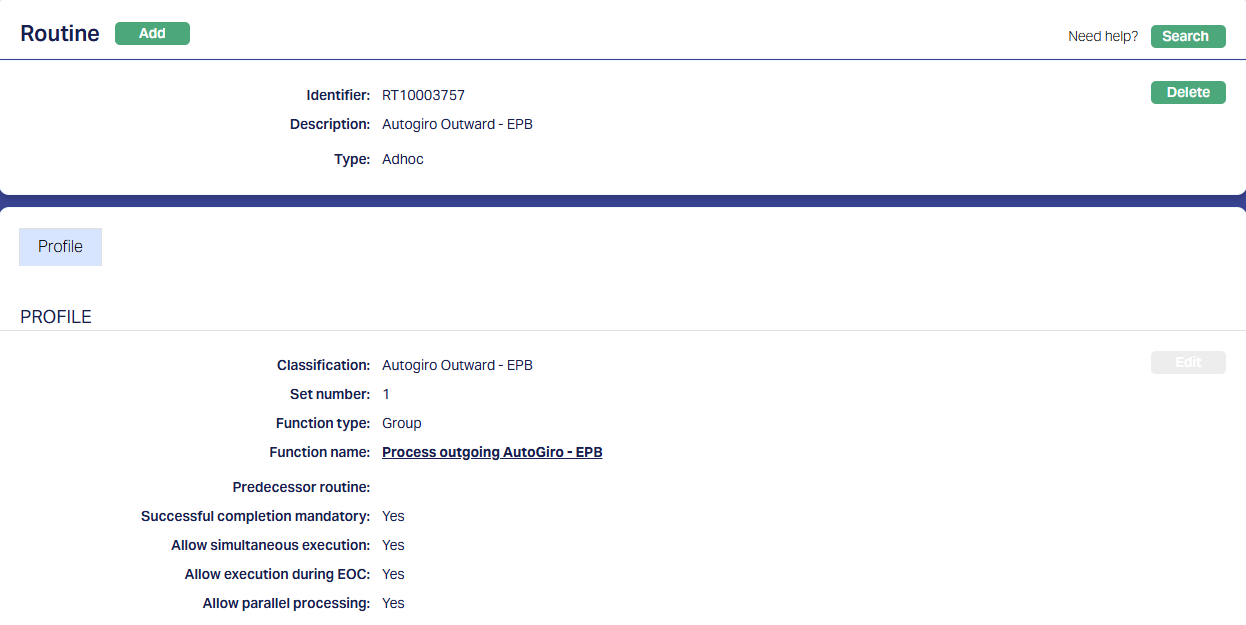

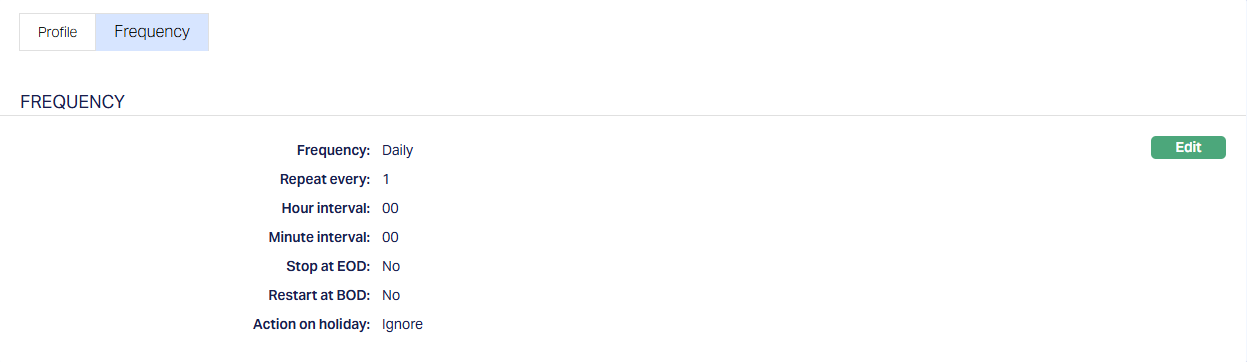

3.6. Data Management > Configurations > Routines > Maintain

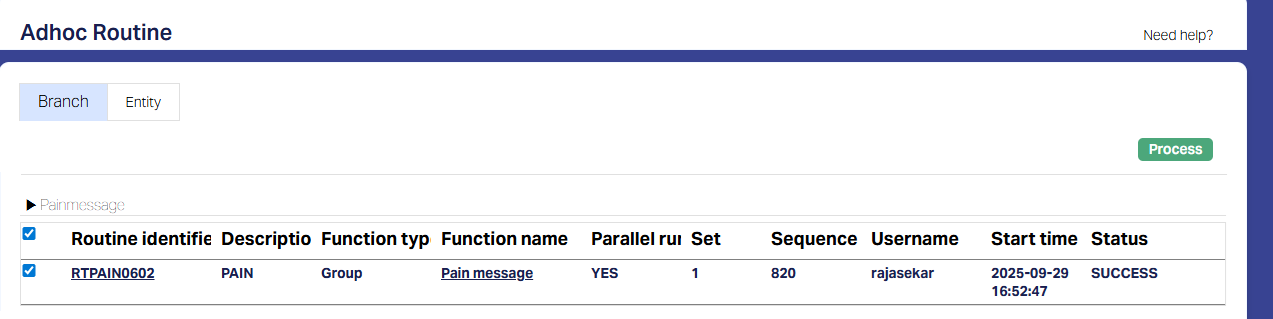

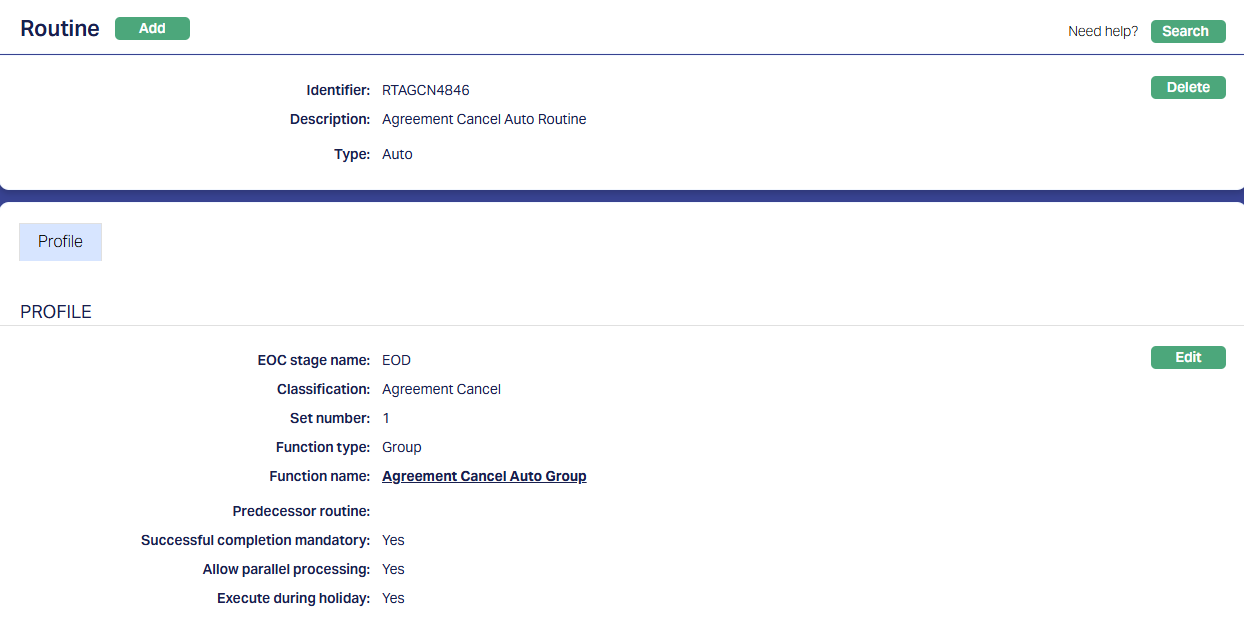

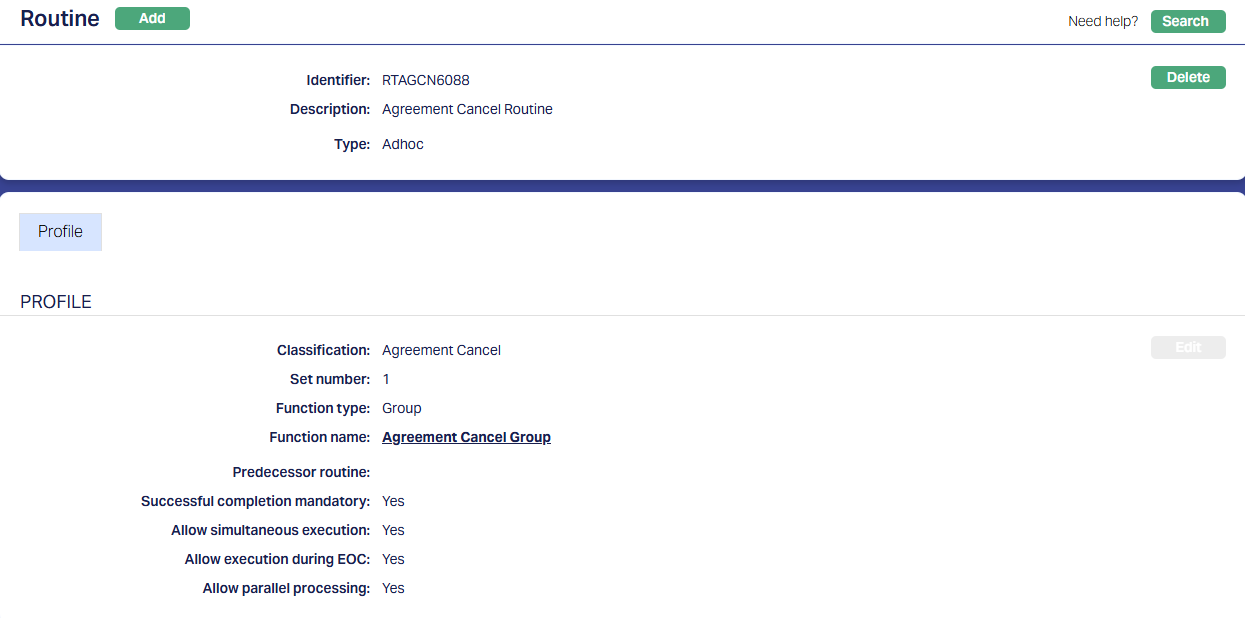

You have to create a Routine and map the Group as well as the Classification. You must always create two Routines for each Group: One of Type Scheduled / Auto as required; and one other of Type Adhoc. The Scheduled / Auto routine will be automatically executed at the Scheduled Time / during EOD/BOD as defined in the Routine; and in case there is any issue with such automatic execution, and a manual intervention is required, the Adhoc Routine can be used to run the routine after such manual intervention.

Usually, this is part of the installation. If not, you will have to do the same.

3.6.1. Scheduled Routine

3.6.2. Adhoc Routine

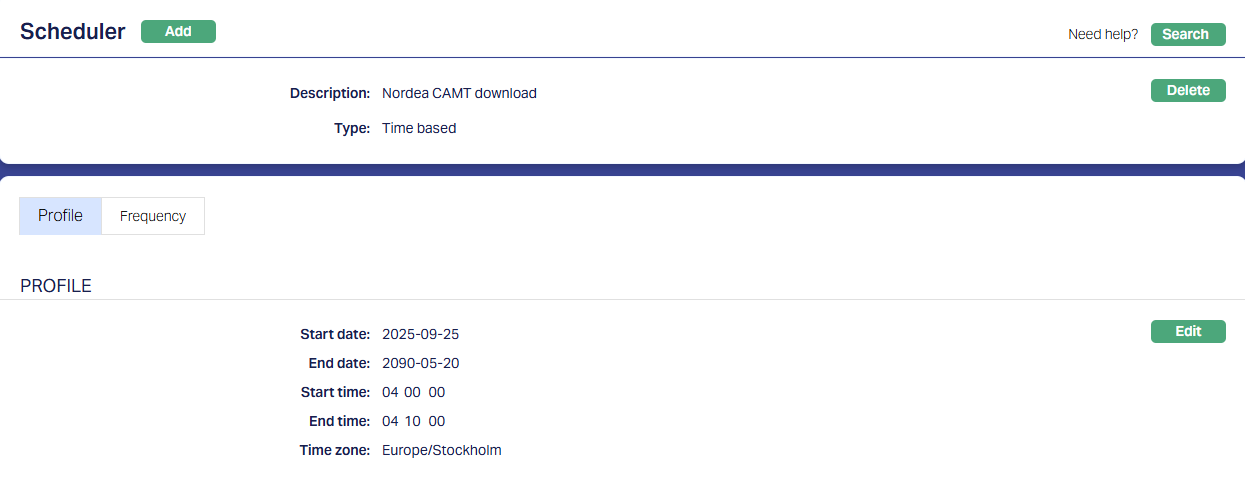

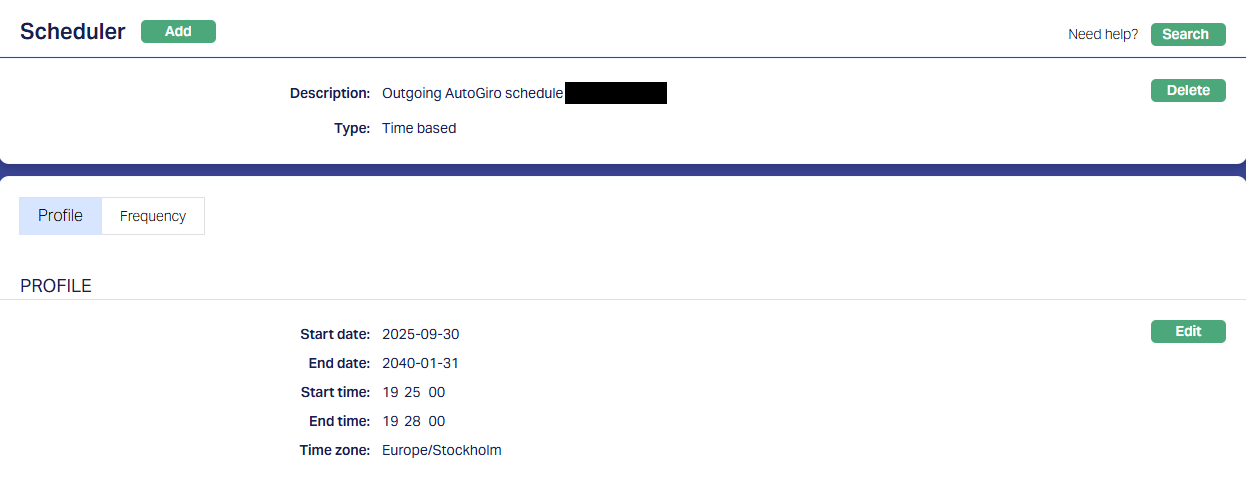

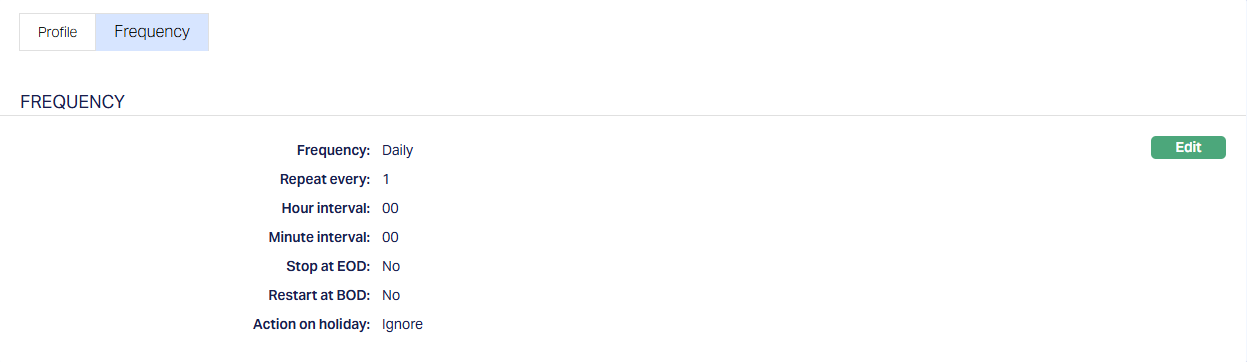

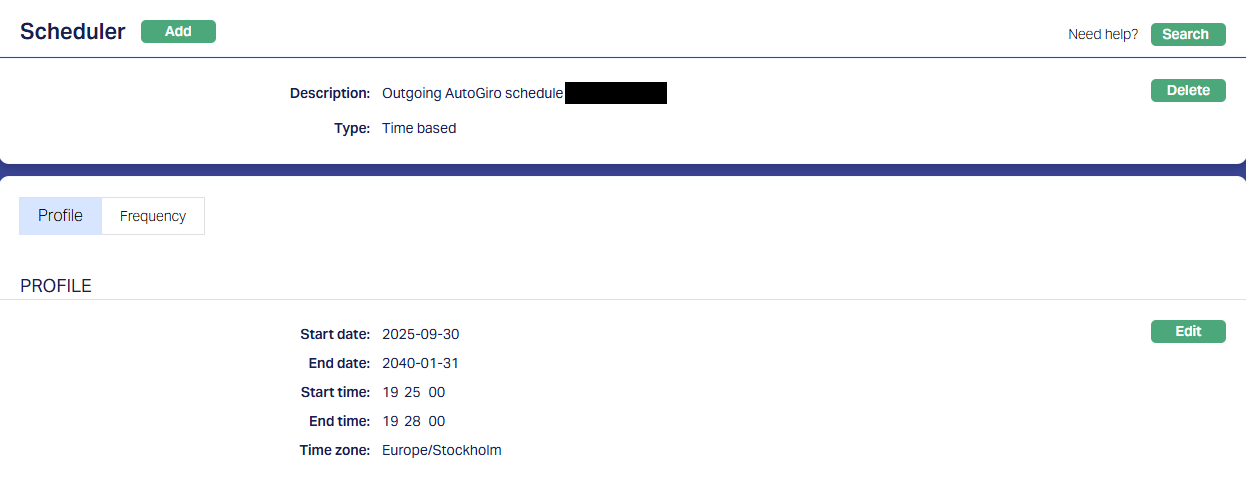

3.7. Data Management > Configurations > Scheduler > Maintain

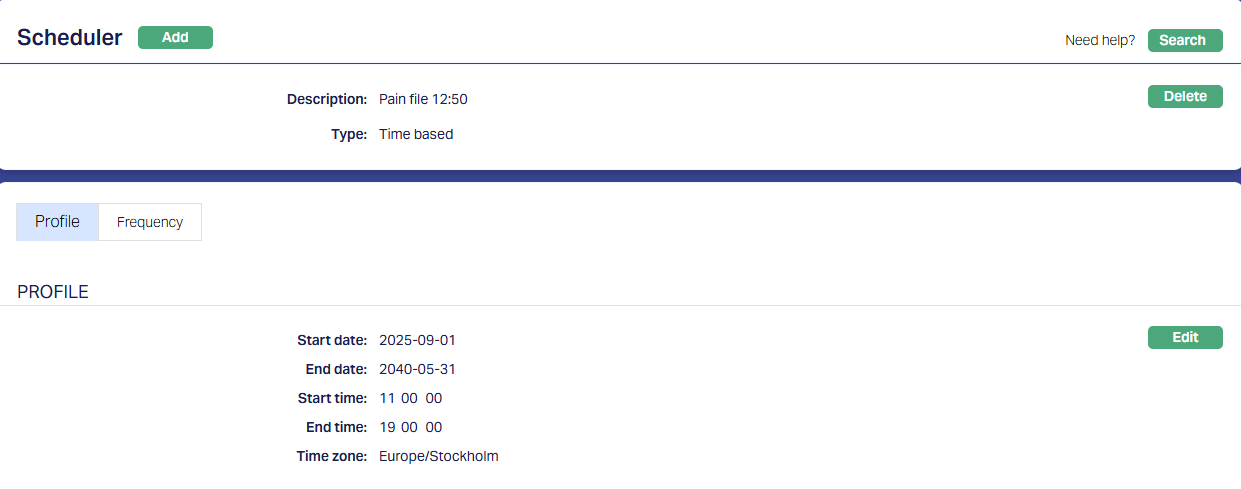

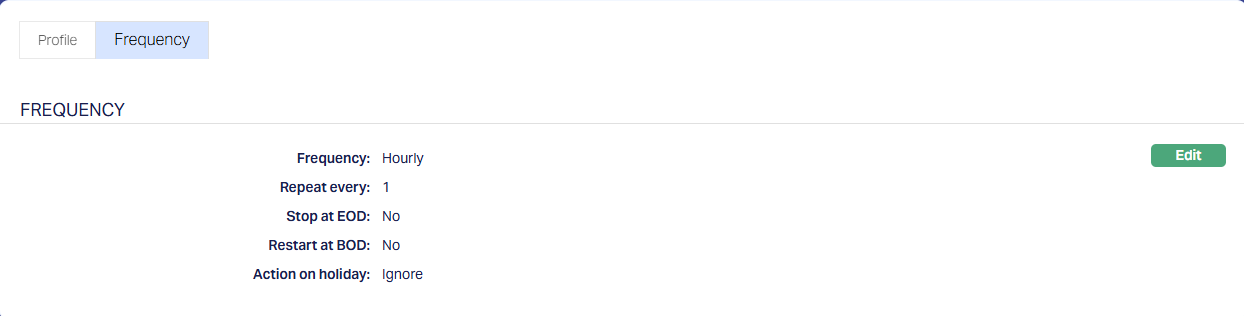

If the Routine has been created with Type = Scheduled, you need to create a Scheduler to define the frequency & time of execution.

3.7.1. Scheduler for pain file

A sample is shown below where the scheduler will run every hour between 11:00 and 19:00 for the period selected and as per the time zone selected.

Note:

- The scheduler has to be set up as per the needs of that specific implementation.

3.7.1.1. Profile

3.7.1.2. Frequency

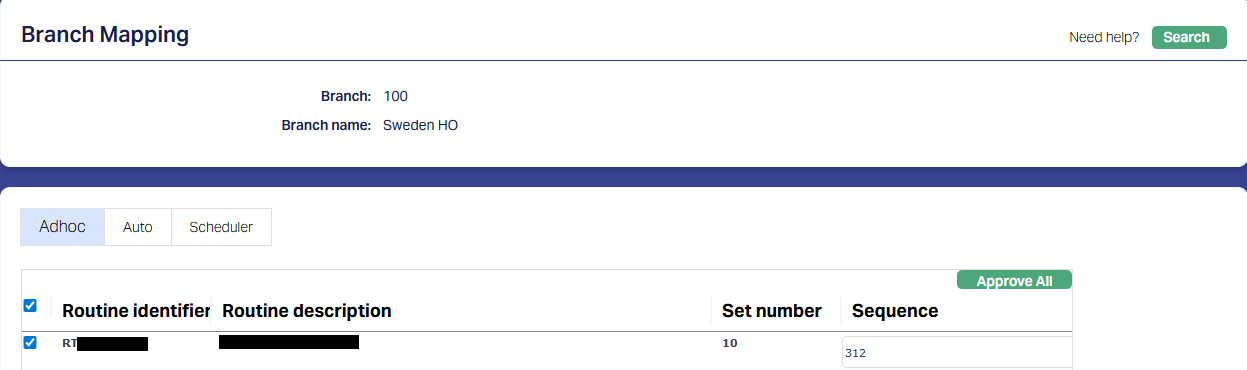

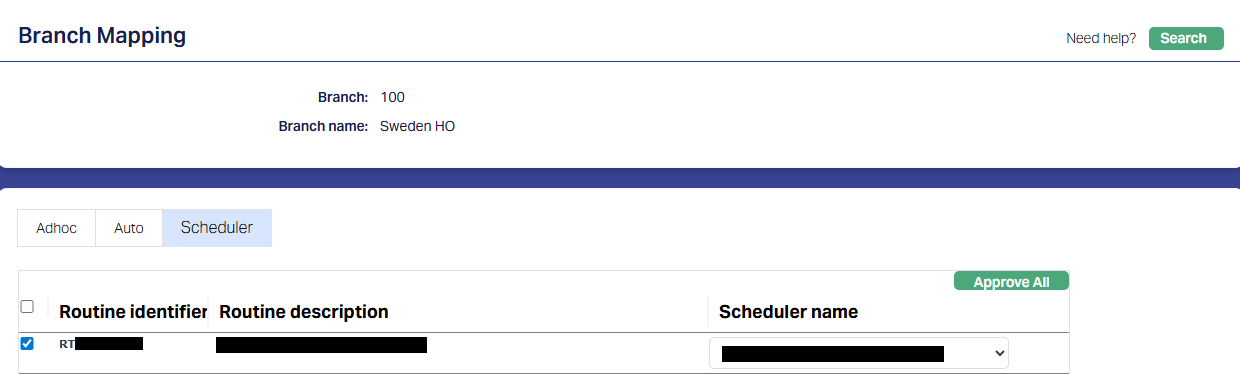

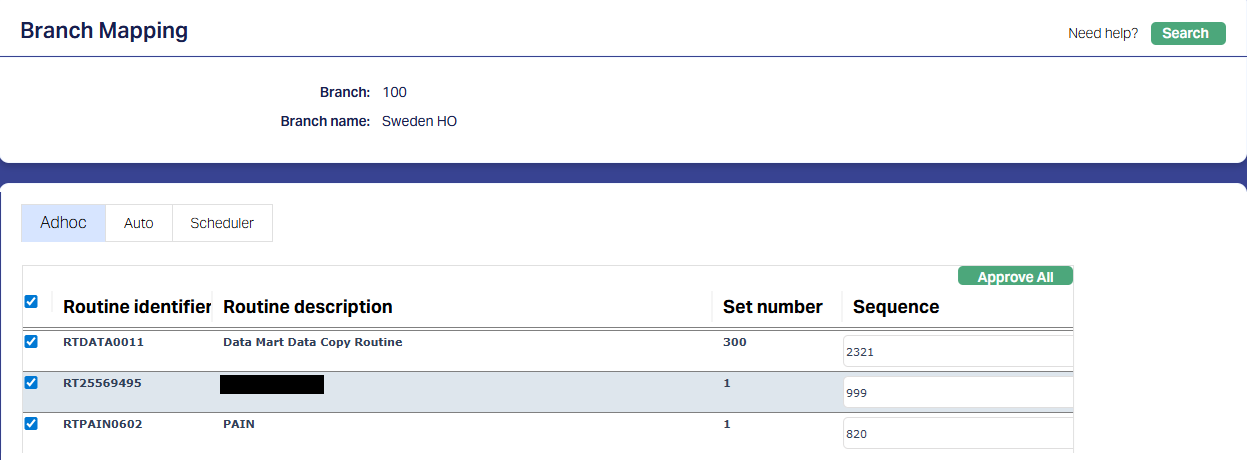

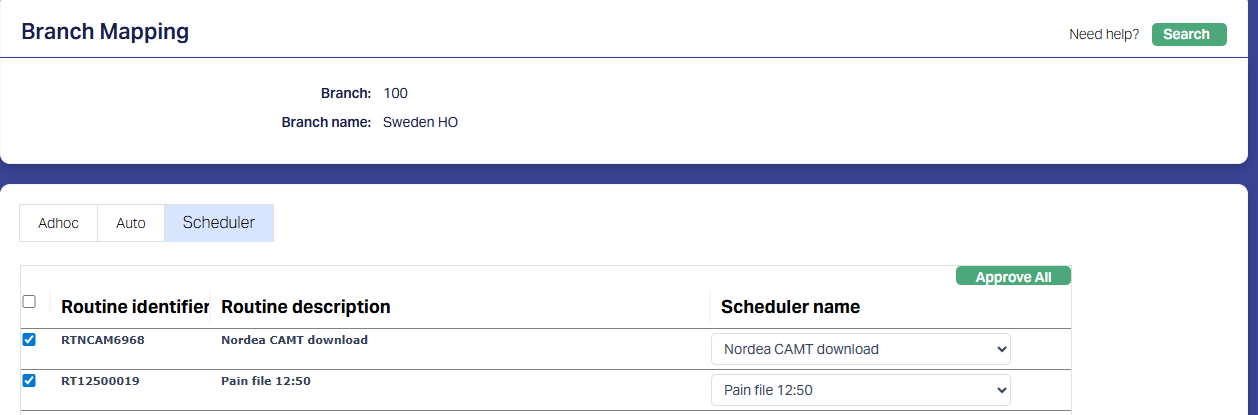

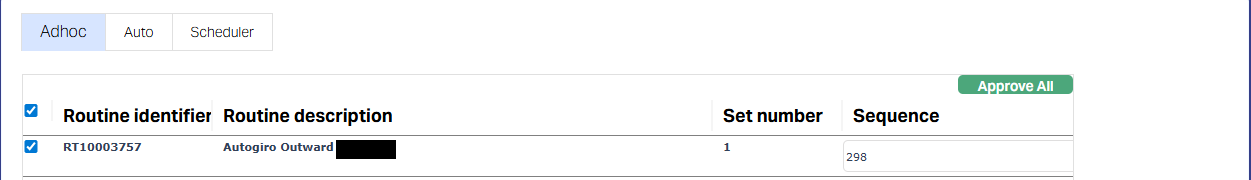

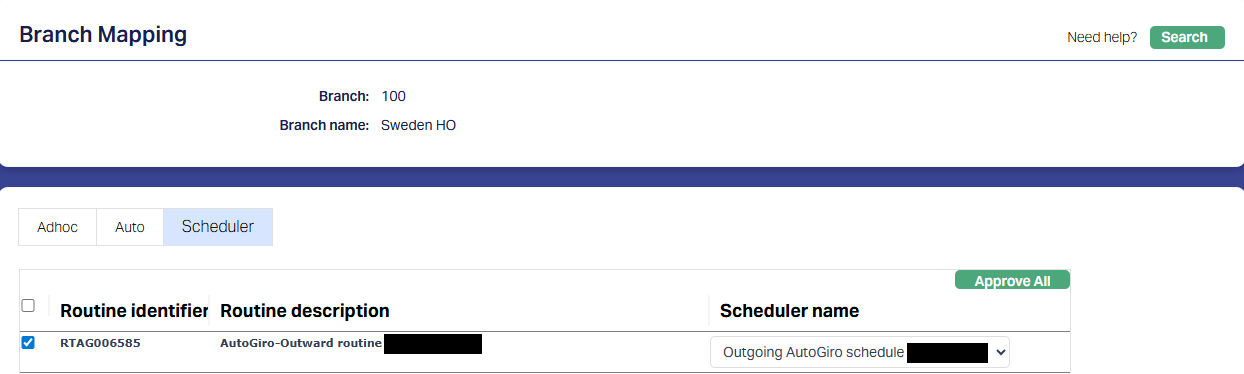

3.8. Data Management > Configurations > Routines > Branch Mapping

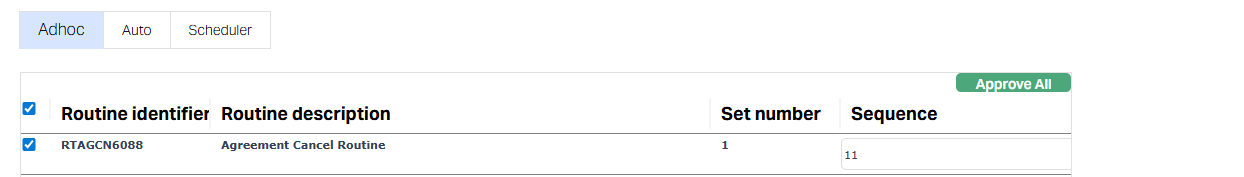

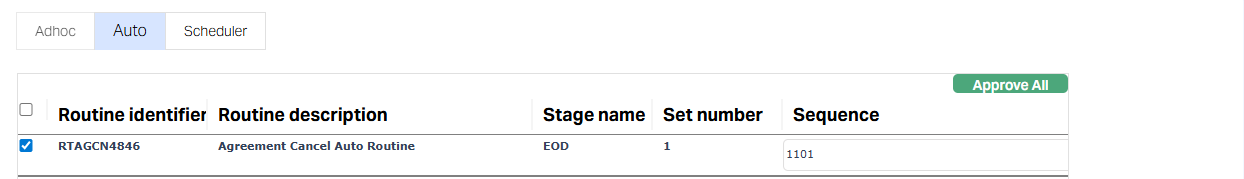

Once the Routines and Schedulers are configured, these should be mapped for the Branch(es) for which the Routines should be executed. You have to map both the Adhoc and Scheduled / Auto routines.

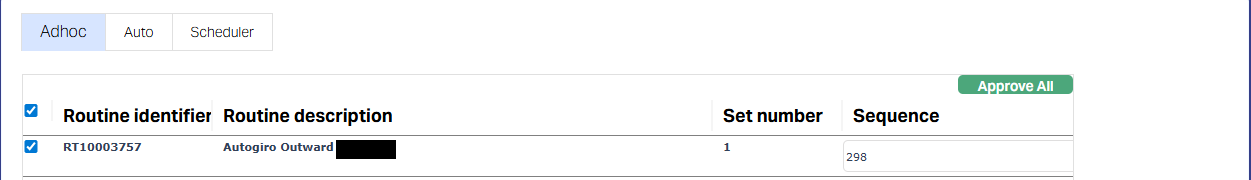

3.8.1. Adhoc > Edit

All Routines that are defined as Adhoc Type will display; check the relevant checkbox to map the Routine to the Branch; uncheck to unmap. Only mapped Routines can be manually executed for that Branch using Data Operations > Adhoc Routines

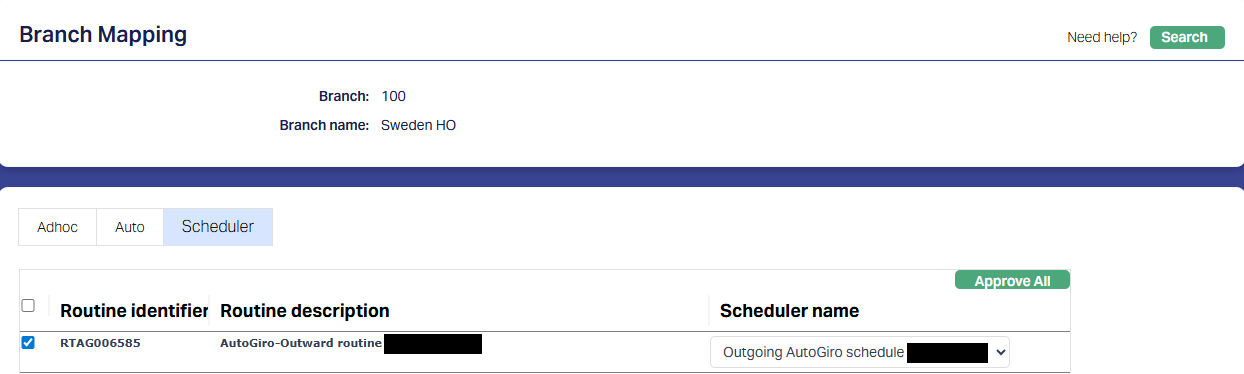

3.8.2. Scheduled > Edit

All Routines that are defined as Scheduled Type will display; check the relevant checkbox to map the Routine to the Branch; uncheck to unmap. Only mapped Routines will be automatically executed for that Branch as per the Scheduler mapped.

PROCESS OF LOAN DISBURSEMENTS

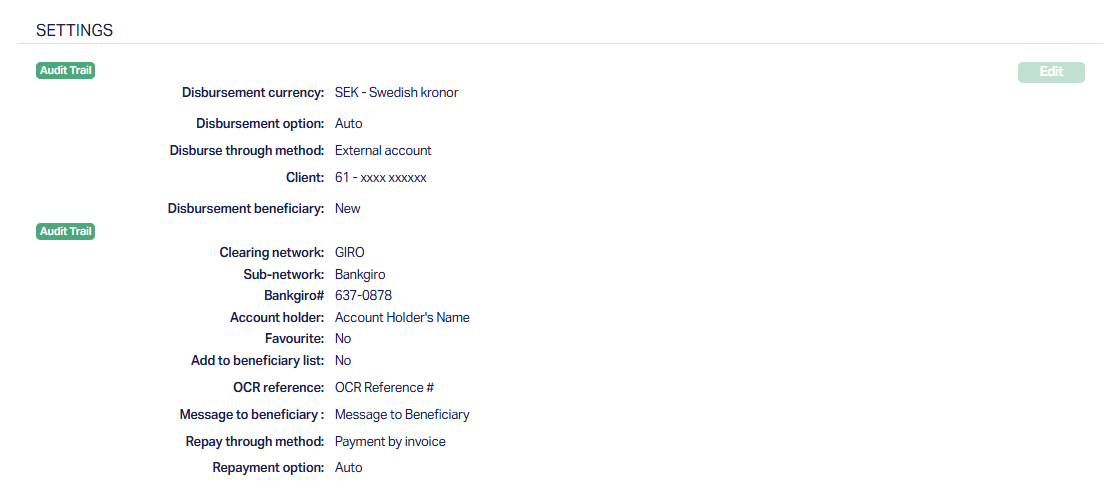

The Loan Disbursement could be initiated manually by users or automatically, as specified in the Loan Account > Settings > Disbursement Option. When the Disbursement Through Method for any such disbursement is External Account, the process flow is as below:

1. Disbursement is initiated in CC > Retail > Loans. It can be in the following ways:

a. In case of Auto, when the Loan Account is activated by approving the Account Status Tab for Account Status = Activated.

b. In case of Manual, when the Loan Disbursement record is approved.

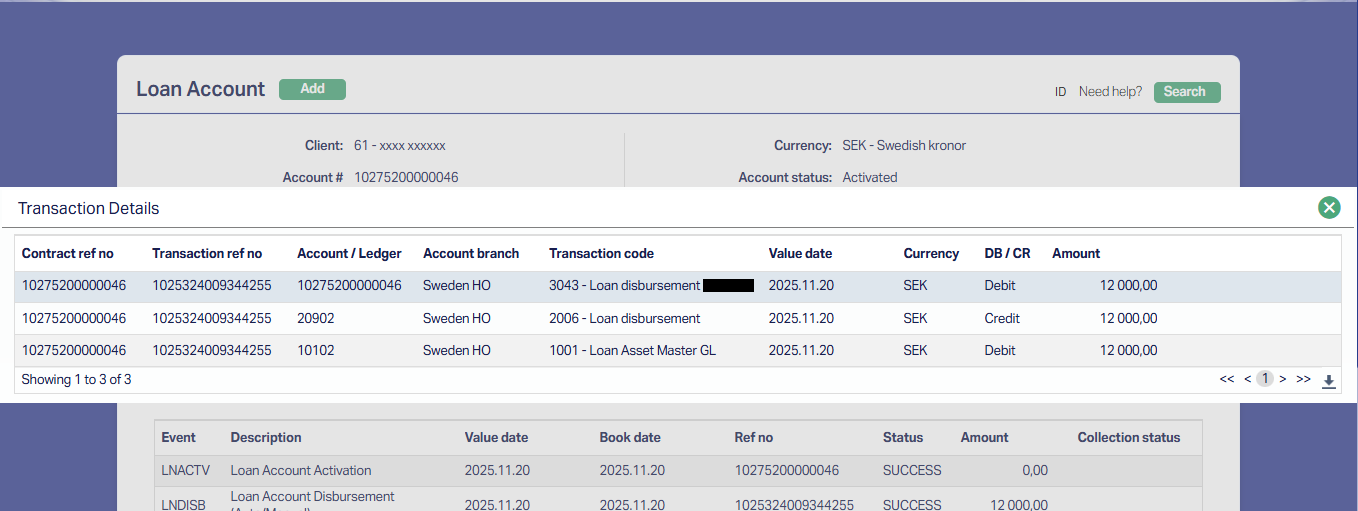

2. Accounting entries in CC on the above approval

a. The following accounting entry is passed with a unique Transaction Reference #. You can see details by clicking on the LNDISB event in the Loan Account > Events Tab

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code | Amount |

|---|---|---|---|---|---|---|

| LNDISB | Current Booking Date | Value Date in Loan / Disbursement record | Db | Loan Account | Loan disbursement (DB / Client) | Loan / Disbursement Amount |

| Value Date in Loan / Disbursement record | Db | Master GL of Loan Product | Master leg (DB/GL) from Loan Product | Loan / Disbursement Amount | ||

| Cr | Suspense GL - (Asset / Liability) | Loan disbursement (CR / GL) | Actual amount of transfer (net of receivables) | |||

| Cr | Charge Income GL | <> | Charge Amount |

Retail > Loans > Maintain

i. Settings Tab

ii. Events Tab – LNDISB Event

3. Process in PG & DM:

a. PG Product is resolved using the STP Configuration.

b. The Nostro Configuration is used to arrive at the Nostro Account to be used for the Payment.

c. Based on the Retail > Payment Settings that is mapped as External Product Code in the PG Product, Debit Processing accounting entries are posted in CC

d. Based on the Nostro Account arrived at, Credit Processing accounting entries are posted in CC

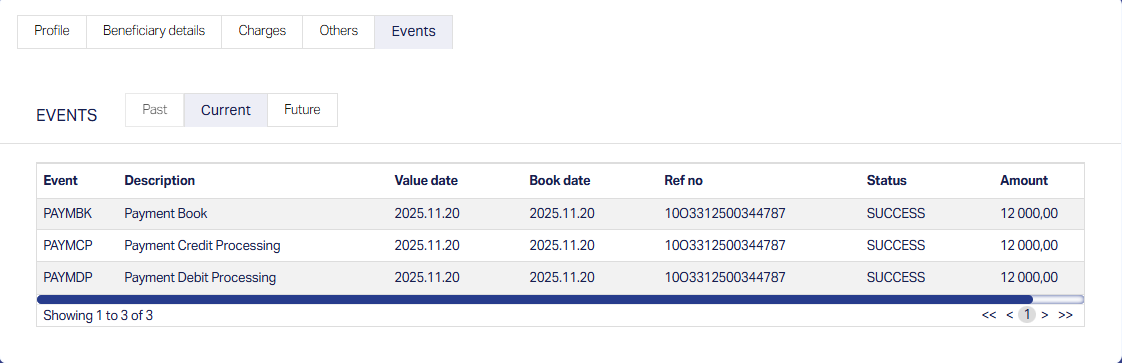

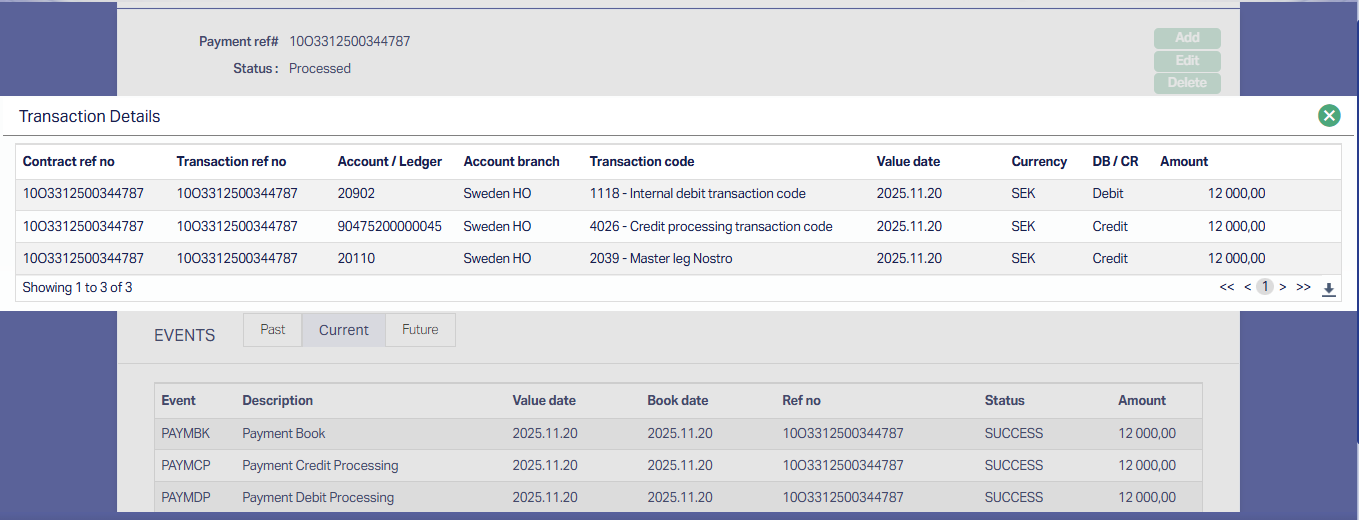

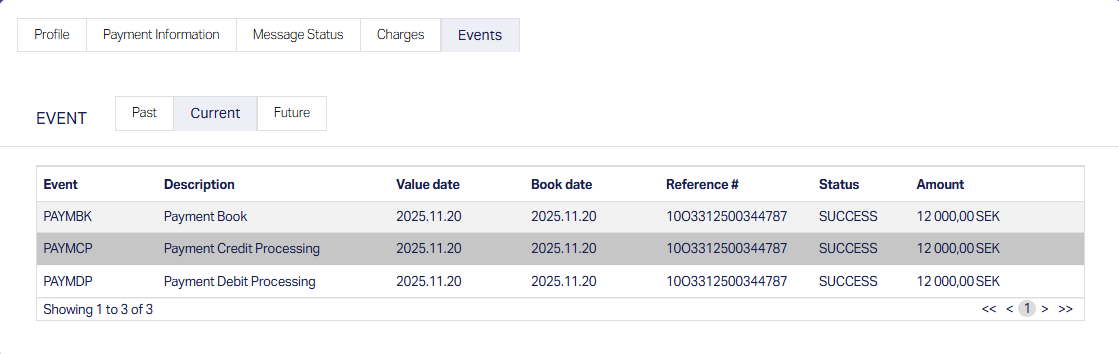

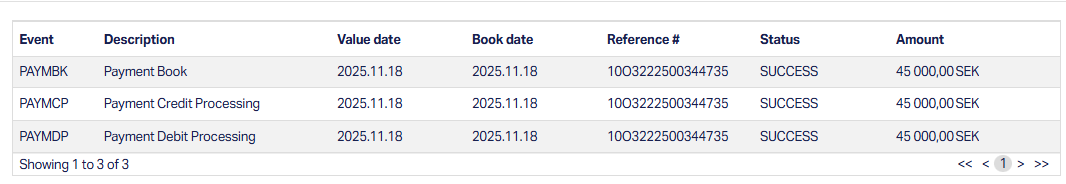

The following are the events in the Payment record:

1. PAYMBK – Payment book. There will be no accounting entry for this event.

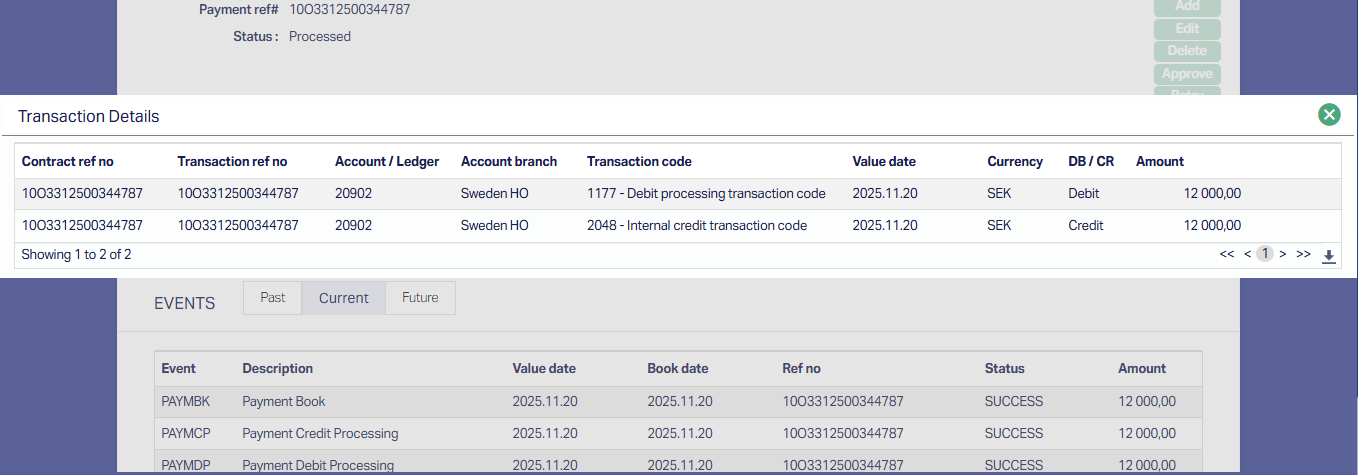

2. PAYMDP – Payment Debit Processing. The following accounting entry will be posted:

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code | Amount |

|---|---|---|---|---|---|---|

| PAYMDP | Current Booking Date | Value Date in Loan / Disbursement record | Db | Suspense GL from Product | Actual amount of transfer (net of receivables) | |

| Cr | Transit GL from Payment Settings | Actual amount of transfer (net of receivables) |

3. PAYMCP – Payment Debit Processing. The following accounting entry will be posted:

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code |

|---|---|---|---|---|---|

| PAYMCP | Current Booking Date | Value Date in Loan / Disbursement record | Db | Transit GL from Payment Settings | |

| Cr | Nostro account / GL resolved |

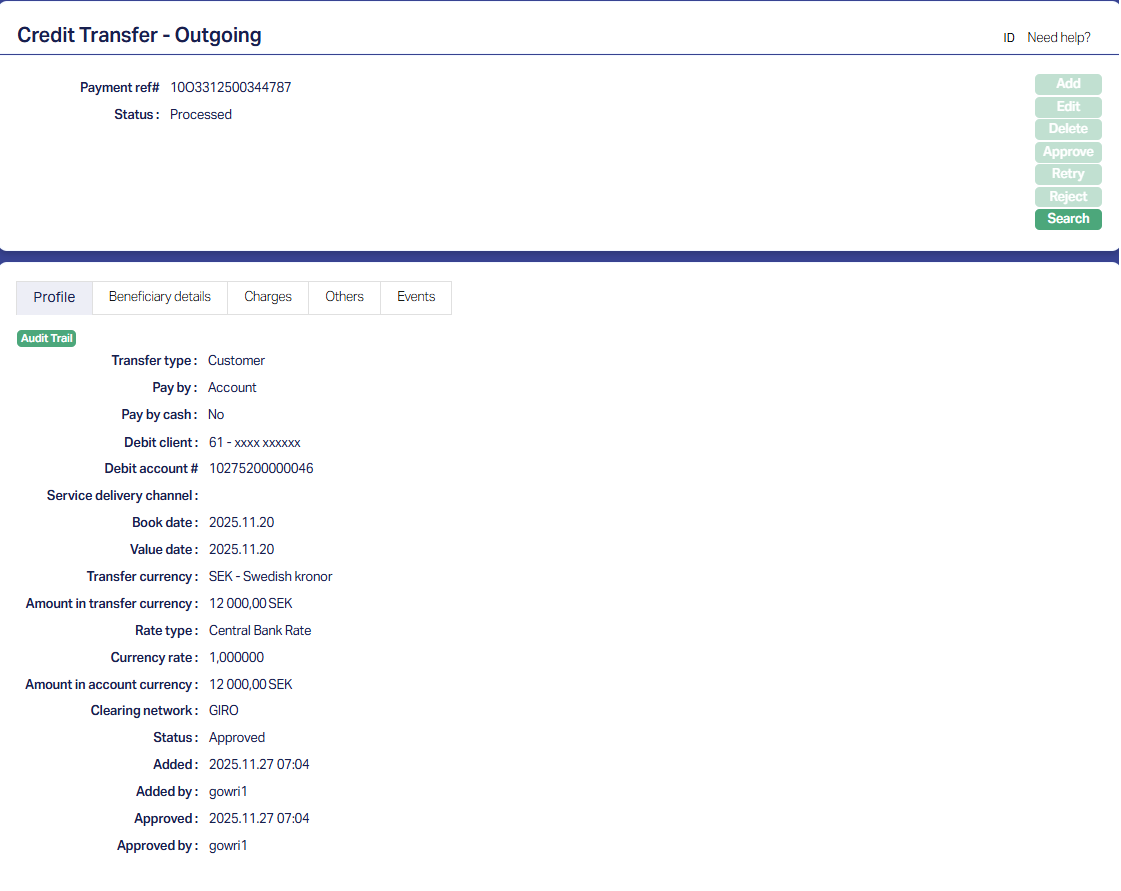

e. The payment record's Status is updated as Processed, Approved.

f. Data is also moved to the relevant payment tables in DM as preparation of the Payment File that is to be generated. However, you will not be able to view these details on the UI in DM. You can however query the database if needed.

Retail > Payments > Net Payment Settlement > Enquiry

You can see the outgoing payment record in Retail > Payments > Net Payment Settlement > Enquiry. You can use any search criterion. The Loan Account # is stored as the Debit Account #

Sample screenshots are shown below:

i. Profile Tab

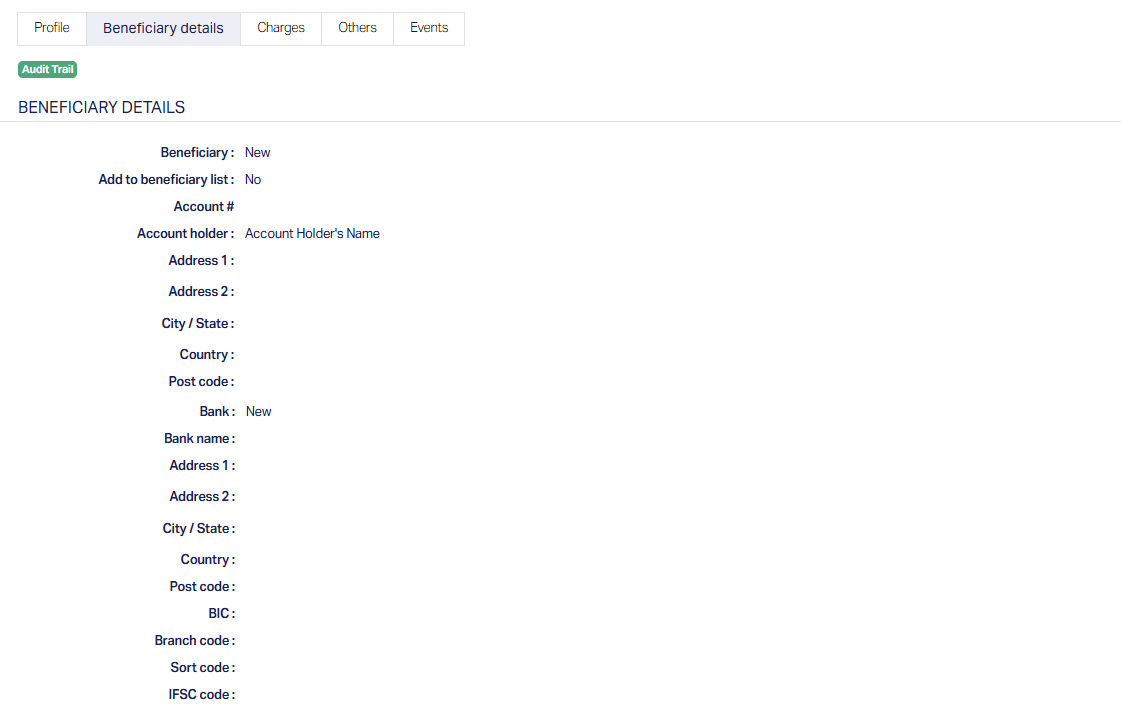

ii. Beneficiary Details Tab

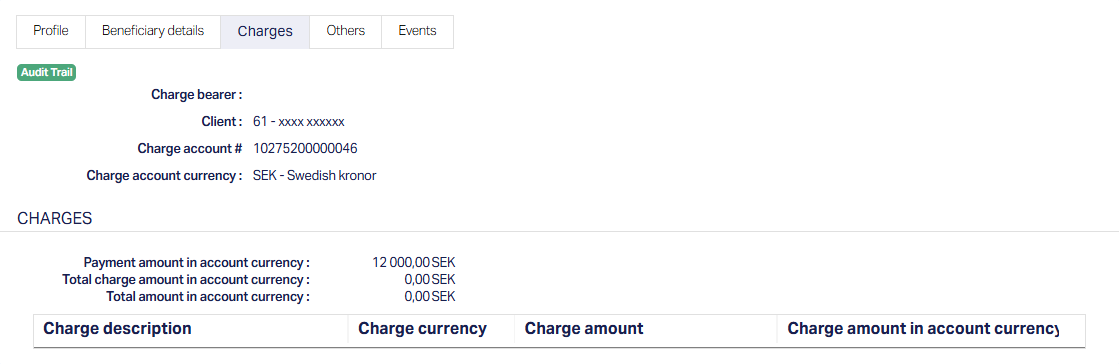

iii. Charges Tab

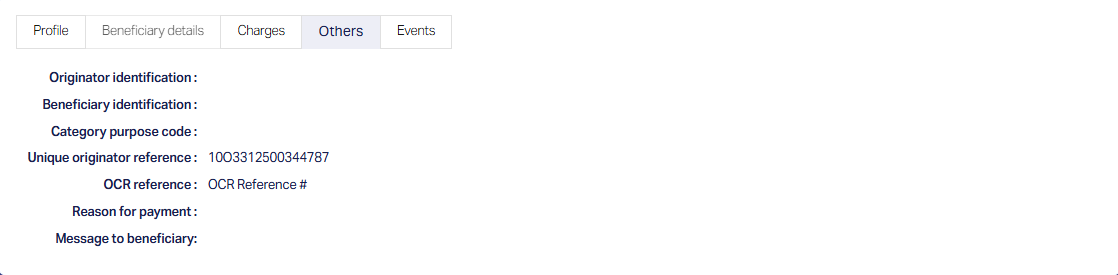

iv. Others Tab

v. Events Tab

PAYMDP Event – Details

PAYMCP Event – Details

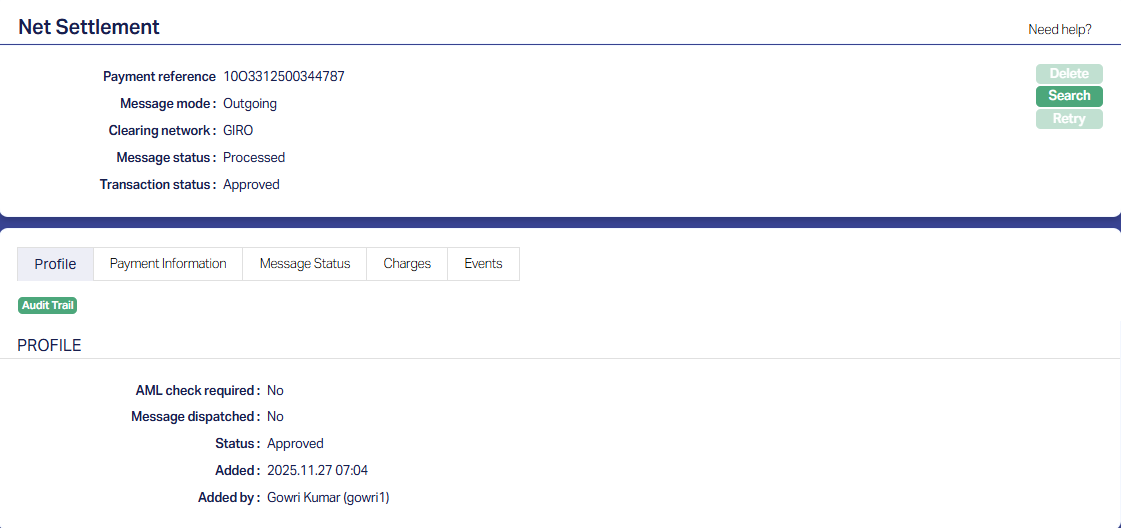

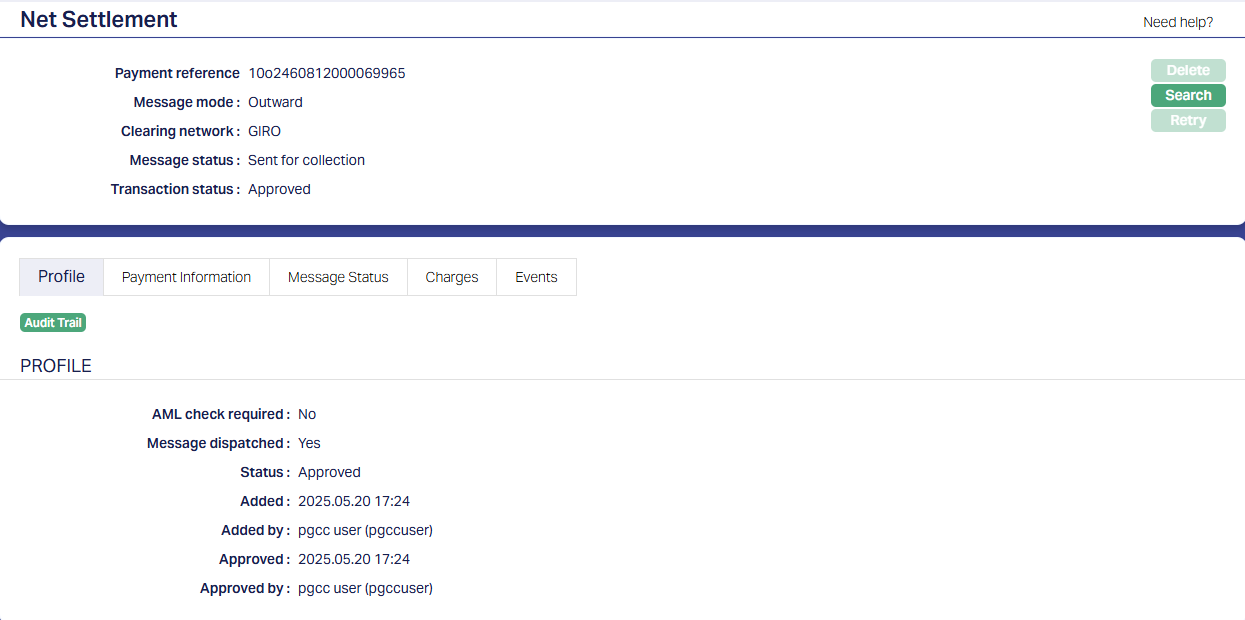

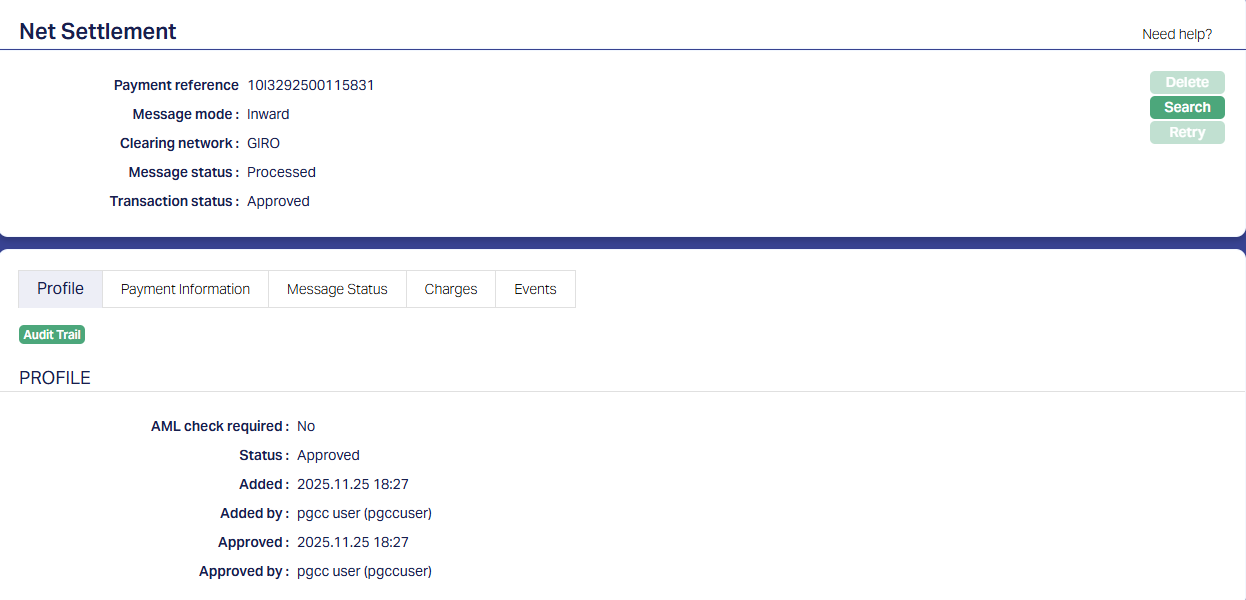

Payment Grid > Operations > Net Settlement

You can see the payment record in Payment Grid > Operations > Net > Settlement. Use any search criterion.

See sample screenshots below

i. Profile tab

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Header Pane | |||

| Payment Reference | Reference # for the Payment. | This will be the same as the Transaction Reference # in Loan Maintain > Event Tab for the LNDISB event | |

| Message Mode | Outgoing | ||

| Clearing Network | Clearing network through which the payment will be made | As selected in the Loan Disbursement | |

| Message Status | Registered / Processed | For Loan Disbursements, this will always be Processed | |

| Transaction Status | Pending / Approved | For Loan Disbursements, this will always be Approved | |

| Profile | |||

| AML Check required | Yes / No | Depends on solution / fitment. | |

| Message dispatched | Yes / No | Initially, this will be No; and once the outgoing payment message is sent to the Bank by the ADM, this field will be updated to Yes |

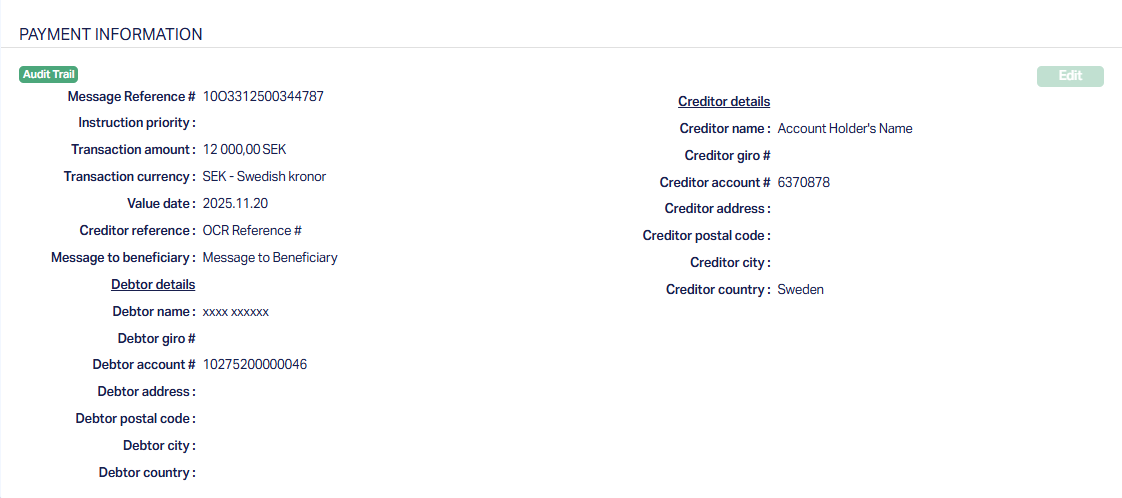

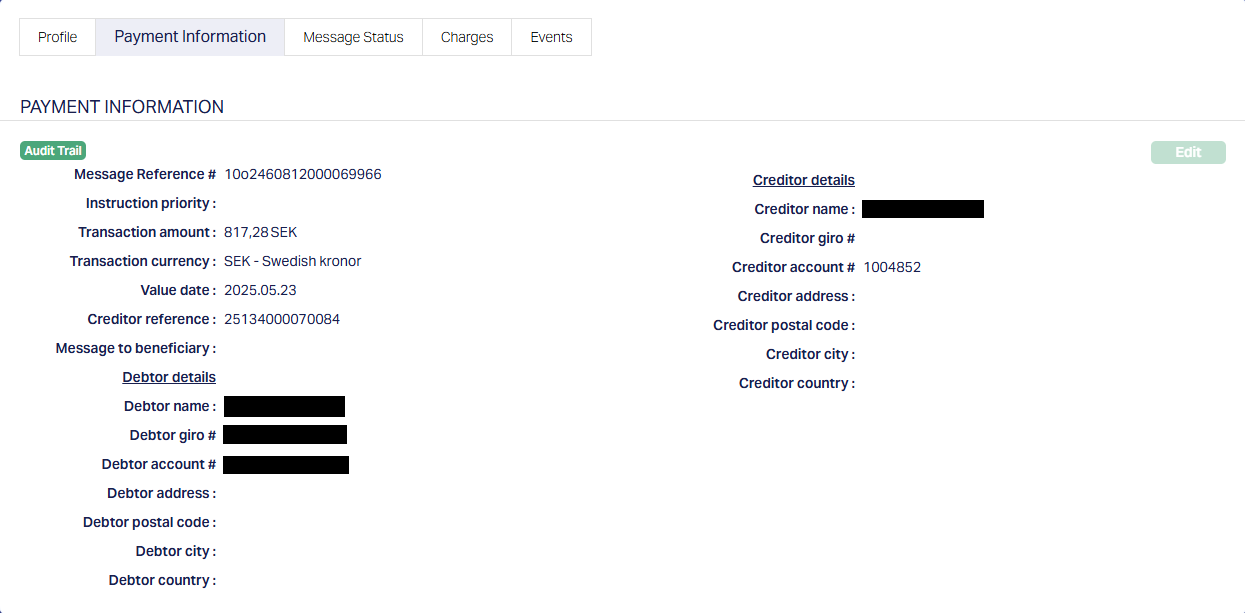

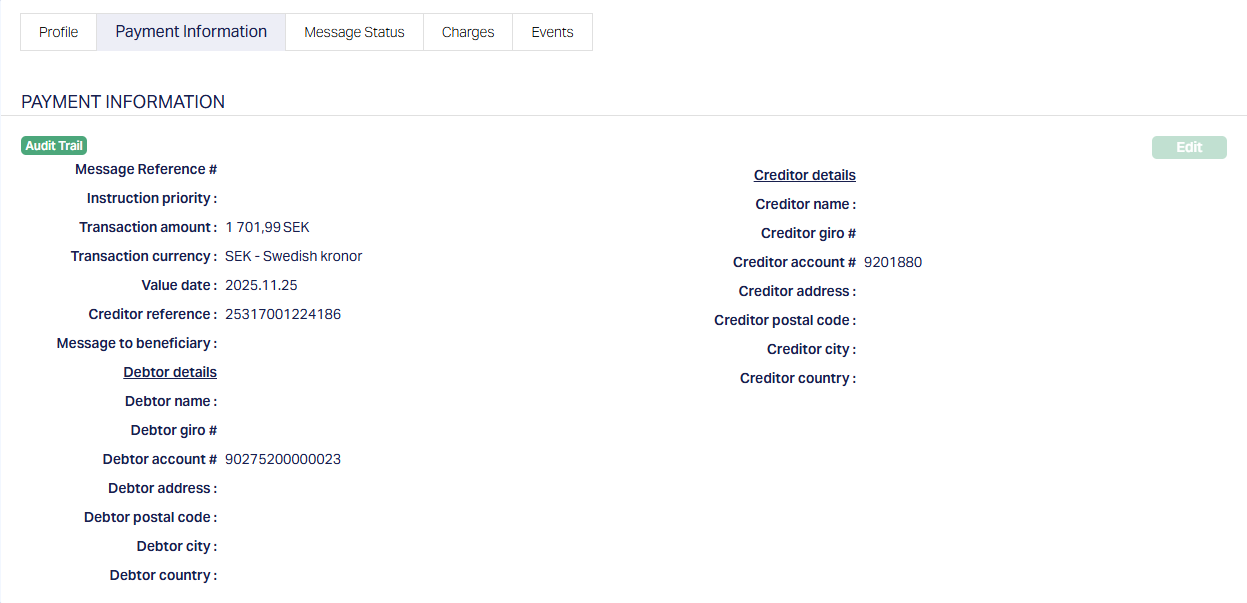

ii. Payment Information tab:

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Header Pane | |||

| Message Reference | Reference # for the Message. | This will be the same as the Payment Reference for the Outgoing Payment | |

| Transaction Amount | Disbursement Amount | ||

| Transaction Currency | Disbursement Currency | ||

| Value Date | Value date of the Disbursement | ||

| Debtor Name | Loan Client | ||

| Debtor Account # | Loan Account # | ||

| Creditor Name | Account Holder Name as input in the Disbursement | ||

| Creditor Account # | External Account # as input in the Disbursement | ||

| Creditor Country | Country as input in the Disbursement |

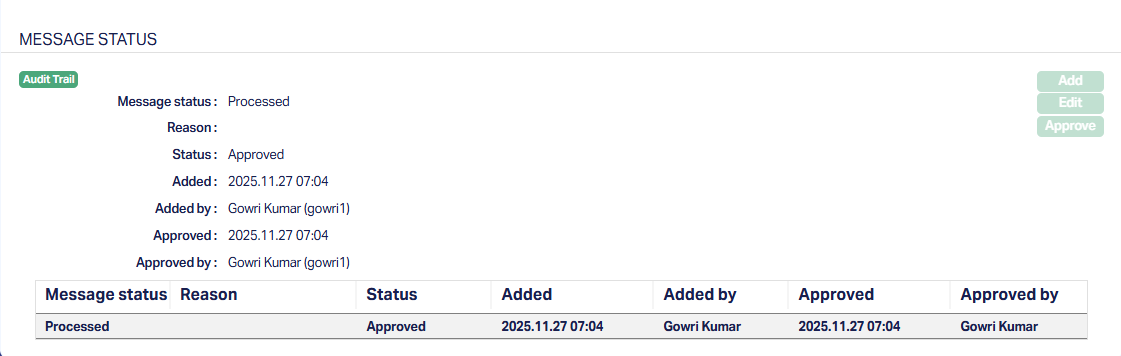

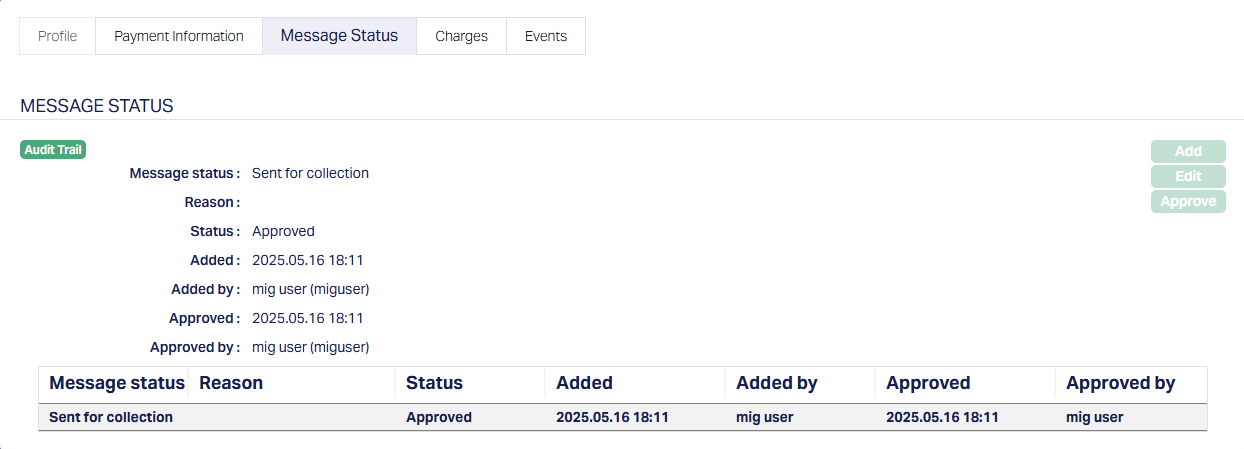

iii. Message Status tab

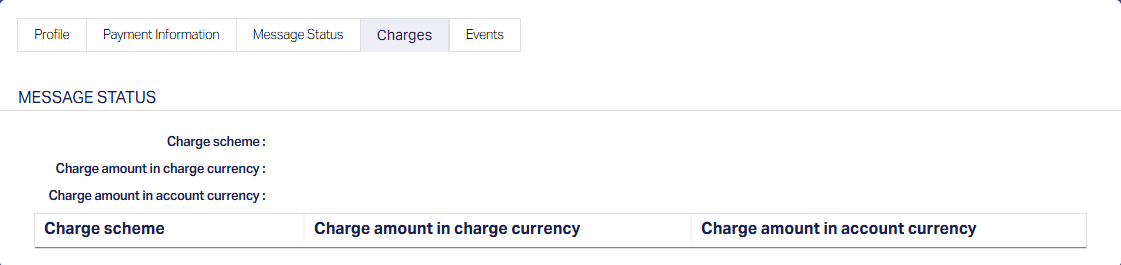

iv. Charges tab

v. Events Tab

There will not be any accounting entries in PG when you click on any of the above events.

4. Automatic Payment File Generation

Based on whether it is a Scheduled / Auto Routine for the Payment, the payment file will be generated at the scheduled time or at EOD / BOD.

5. Manual Payment File Generation

You may want to run the routine manually:

a. If there was an error during automatic execution which you have corrected and want to generate the file before its next automatic execution

b. There are some urgent payments that need to be sent to the Bank immediately / before the next automatic execution

In such a case, you need to do the following:

1. Access Data Operations > Adhoc Routine > Branch Tab and select the specific Adhoc Routine that pertains to the Outgoing Payment file generation

2. If you want to check the file before sending to the Bank, do the following:

a. INITIATE A REQUEST FOR APPROVAL OF THE REQUIRED CHANGES TO THE APPROPRIATE INTERNAL AUTHORITY. Once approved, follow the next steps.

b. Click on the Function name hyperlink.

c. The Group maintenance page will open in a new browser tab.

d. Click on Edit and remove the function pertaining to the Upload to Bank

e. Click on Approve

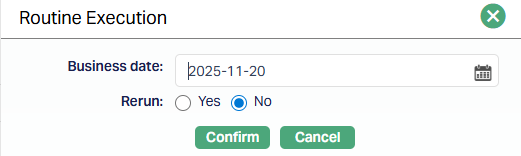

3. Click on Process to see this pop-up

4. Input the following details:

a. Business date = Current booking date

b. Rerun = No

5. Click on Confirm to execute the Routine

6. The Payment File will be available in the path specified.

7. You can do the required checks and once satisfied, you can edit the Group to retain only the function pertaining to the Upload to Bank and execute the Routine.

8. ENSURE TO PUT BACK ALL THE FUNCTIONS IN THE GROUP ONCE THE PAYMENT FILE IS UPLOADED TO THE BANK

PROCESS OF CREDIT TRANSFER

To initiate a manual Payment (as opposed to an automatic payment, say, automatic Loan Disbursement), a Payment Template should already have been defined. Depending on the Settlement Type, one of the following options should be used:

Retail > Payments > Net Settlement > Credit Transfer

Retail > Payments > Gross Settlement > RTGS/SWIFT/TARGET2

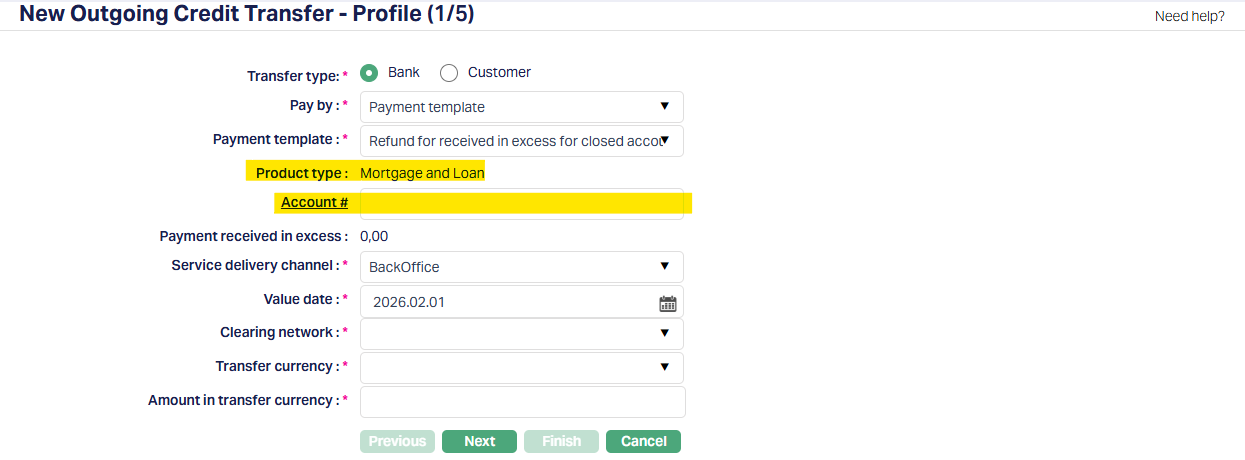

Here, we will see an example using Net Settlement > Credit Transfer

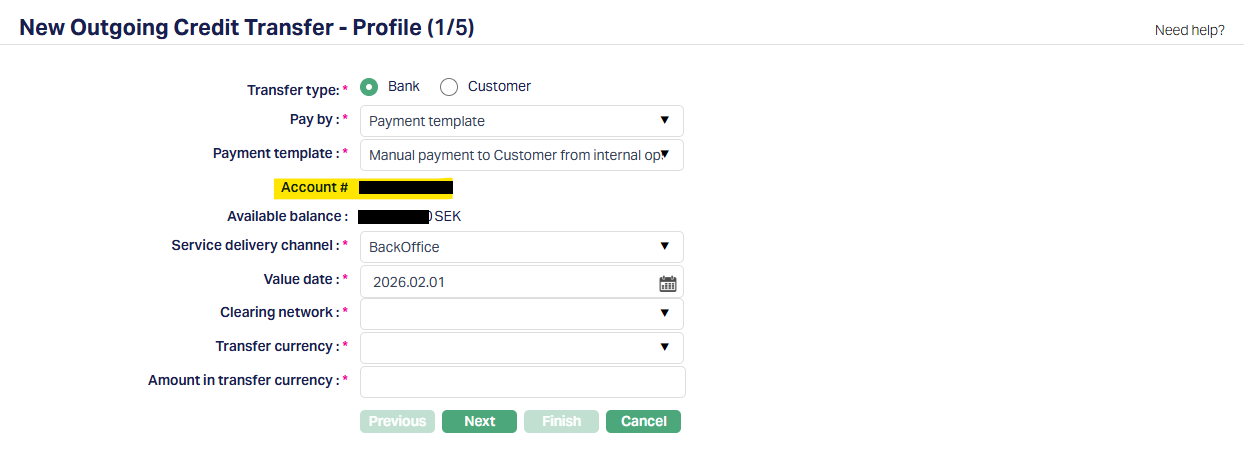

1. Step 1 fields change depending on the Transfer Type, Pay By and Payment Template Type. Here we will see a sample using Transfer Type = Bank and Pay By = Payment Template and Value Date = Current Booking Date.

2. Choose the required Template

3. Input the required details in Steps 1 to 5

If Template Type = Generic

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Transfer Type | Always Bank | ||

| Pay by | Always Payment Template | ||

| Payment Template | Choose the required value depending on the Payment | ||

| Product Type | Will be displayed based on the Payment Template chosen | ||

| Account # | Will be displayed based on the Payment Template chosen | Choose required Account # | |

| Payment received in excess | Will be displayed based on the Product Type above. For Mortgage & Loans, it will always display the amount received in excess, if any, in terms of the Account currency | ||

| Service Delivery Channel | |||

| Value Date | |||

| Clearing Network | The Network to be used for the payment | ||

| Transfer Currency | Currency in which the payment has to be made | ||

| Amount in Transfer Currency | Amount for the payment |

If Template Type = Specific

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Transfer Type | Always Bank | ||

| Pay by | Always Payment Template | ||

| Payment Template | Choose the required value depending on the Payment | ||

| Account # | Will be displayed based on the Payment Template chosen | ||

| Available balance | It will display the Available Balance in the above account, in terms of the Account currency | ||

| Service Delivery Channel | |||

| Value Date | |||

| Clearing Network | The Network to be used for the payment | ||

| Transfer Currency | Currency in which the payment has to be made | ||

| Amount in Transfer Currency | Amount for the payment |

Note:

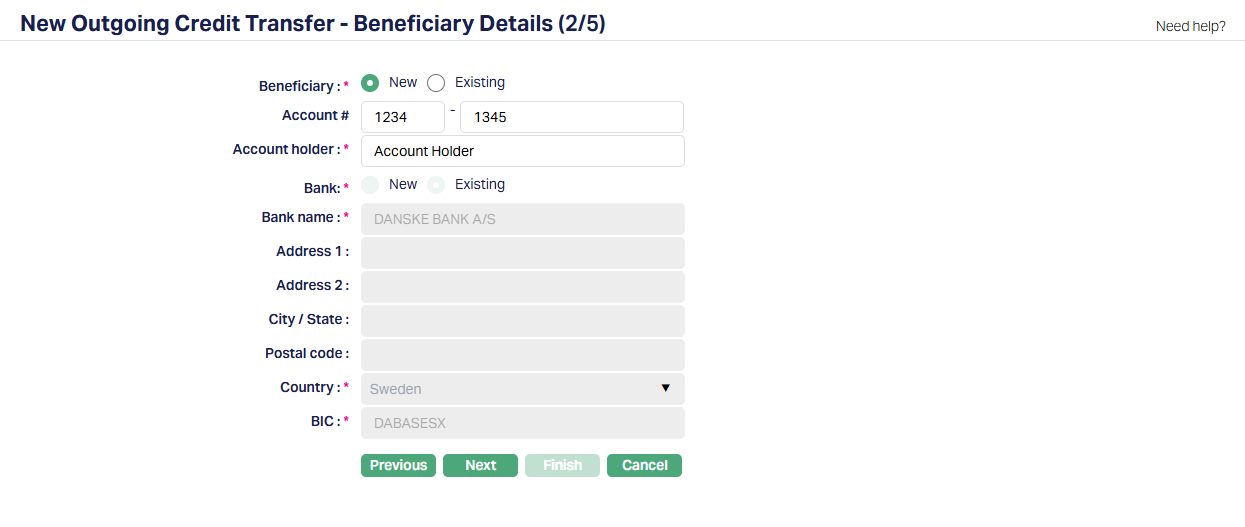

- Depending on the Clearing Network chosen in Step 1, the fields will change.

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Beneficiary | If you want to use a beneficiary record already linked to the Account, use Existing; else New | ||

| Subsequent fields | Will depend on the Network chosen in Step 1 and whether Beneficiary is New / Existing as above. | In case Beneficiary = New, the fields will be enabled for input; in case of Existing, values will be defaulted from the Beneficiary record chosen above |

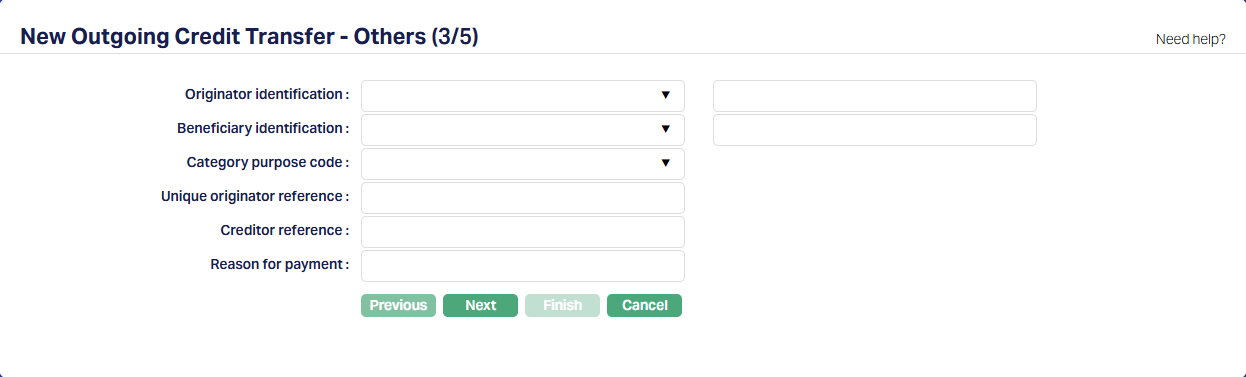

Note:

- Depending on the Clearing Network chosen in Step 1, the fields will change.

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Originator Identification | |||

| Beneficiary Identification | |||

| Category Purpose Code | Will be displayed depending on the Clearing Network chosen in Step 1 | ||

| Unique Originator Reference | |||

| Creditor Reference | Will be displayed depending on the Clearing Network chosen in Step 1 | ||

| Reason for Payment | |||

| OCR Reference | |||

| Message to beneficiary | Will be displayed depending on the Clearing Network chosen in Step 1 |

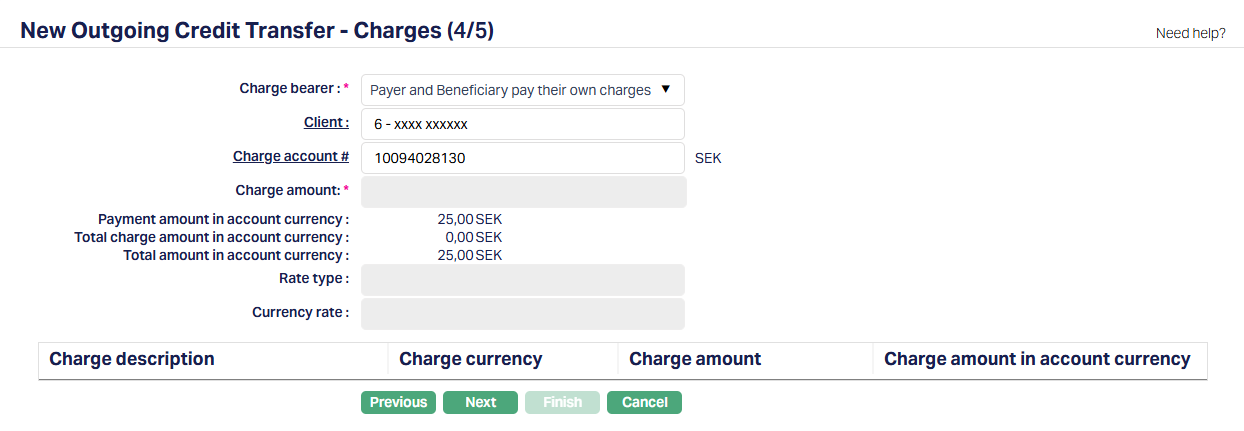

Note:

- Depending on the Debit Account, the fields will change.

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Charge bearer | |||

| Client | |||

| Charge Account # | |||

| Charge Amount |

On Finish,

The Status of the Payment record will be Registered, Pending.

You can see the PAYMBK Event with Status = Success in the Events Tab > Current sub-tab. There will not be any accounting entry at this point.

The Unique Originator Reference, if not input, will be automatically updated using the Payment Ref # generated by Aura on creation of the Payment record.

Editing a Payment record

Only the user who created the record would be able to make changes to a Payment record, and only when the Status = Registered, Pending. To make changes, go to Retail > Payments > Net Settlement > Enquiry; use the various search criteria available to retrieve the required record and click on the same to view details. Click Edit to make changes and Save.

Approving a Payment record

Only a user who did not create the record would be able to approve a Payment record, and only when the Status = Registered, Pending. To approve, go to Retail > Payments > Net Settlement > Enquiry; use the various search criteria available to retrieve the required record and click on the same to view details. Click Approve. If there is some reason for the payment to not get processed, the error will be shown on the screen; and you will have to take appropriate corrective action.

On approval, the internal processing is similar to what is described in the section on Process in PG & DM under Loan Disbursement above. Additionally, the Status of the Payment record will be updated as Registered, Approved.

INCOMING PAYMENTS

The following are the specific maintenances for Incoming Payments:

1. Aura Transaction Processing

1.1. Retail > Settings > Payment Settings

This is required to be set up to define the Ledger Accounts and Transaction Codes that are to be used for posting accounting entries related to the incoming payments.

Depending on the needs of the implementation, multiple Payment Settings have to be maintained for the Payments coming in through different modes (like instant transfers, credits through clearing, etc.,) towards different accounts (say, Loans under different Products, Client Accounts, etc.,). As a general guide, if different General Ledgers / Transaction Codes are required for different payments (say, for the purpose of reconciliation), multiple Payment Settings should be created.

1.1.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | The description of the Payment Setting | Can be anything – Should be such that one can easily identify what this Payment Setting is for | This has to be copied to the PG > Settings > Product as this field is used to relate the Retail > Payment Settings to the PG > Product. Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so IMPORTANT: If you make any changes to this field value, please make sure that the same is copied to the PG > Settings > Product > External Product Code |

| Payment Type | Indicates the Type of Payment. | If Entity is an FI, this should be Incoming | |

| Settlement Type | Can be Gross or Net | If Entity is an FI, this should be Gross | |

| Currency Rate Type | Indicates the exchange rate type to be used in case of cross-currency transactions | Can be anything. | If there are no cross-currency transactions, this will not be used. If there are cross-currency transactions, provide the correct Rate Type to be used to derive the exchange rates |

| Transit Ledger | The GL Account into which funds will be credited during Nostro Accounting | Usually, for Loan Payments, this will be the actual GL that has been mapped in the Loan Product as the Settlement GL | |

| Investigation Ledger | The Ledger into which funds will be parked if there is any investigation to be carried out – for example, if AML check is positive | ||

| Repair Ledger | The ledger to be used if the incoming payment goes to repair queue because of business validations exceptions. |

1.1.2. Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Process only on Rate Update | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Fetch Rate Using | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Match Beneficiary Name | If checked, the Incoming Payment will be processed only if Beneficiary Name in Aura matches with the name of the payment Initiator. Else, it will fail | ||

| Positive Variance % | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Negative Variance % | Applicable only if there are cross-currency transactions. Else, leave it blank | ||

| Restrict back value date | If Entity is a Financial Institution, this will depend on the Bank in which the account is maintained. | ||

| Restrict future value date | If Entity is a Financial Institution, this will depend on the Bank in which the account is maintained. | ||

| Maximum retry count |

1.1.3. Branch

Applicable only in a multi-branch set up, if the Payment Setting is to be used for only selected branches.

1.1.4. Transaction Codes for Internal Processing

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Debit Processing Transaction Code (Client / DB) | Used to debit a Nostro account during Debit Processing (Event Code: PAYMDP) | Example: Debit a Nostro Account during Incoming Payment Client Account (say, refund of excess receipts on a loan that was credited to an Internal Operations Account or a Client Account Transfer from an account in Aura to an external Account) | |

| Debit Processing Transaction Code (GL / DB) | Used to debit a Nostro GL during Debit Processing (Event Code: PAYMDP) | Example: Debit Loan Product > Suspense GL during Loan Disbursement to an External Bank Account and credit Transit GL | |

| Internal Debit Transaction Code (GL / DB) | Used to debit the Transit GL during Client account credit (Event Code: PAYMCP) | Example: Loan Account disbursement to an external bank account. The Transit GL will be debited and Nostro account (of the FI’s account with the Bank) will be credited | |

| Internal Credit Transaction Code (GL / CR) | Used to credit the Transit GL during Debit Processing (Event Code: PAYMDP) | Example: Debit Loan Product > Suspense GL during Loan Disbursement to an External Bank Account and credit Transit GL | |

| Credit Processing Transaction Code (Client / CR) | Used to credit a Client Account (Event Code: PAYMCP) | Example: Loan Account disbursement to an external bank account. The Transit GL will be debited and Nostro account (of the FI’s account with the Bank) will be credited | |

| Credit Processing Transaction Code (GL / CR) | Used to credit the Transit GL (Event Code: PAYMDP) | Example: This will be used if Nostro Resolution results in a GL to be credited |

1.1.5. Charge

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Transaction Charge | Depends on solution / fitment. Can be blank | ||

| Advice Charge | Depends on solution / fitment. Can be blank |

1.1.6. Custom Field

Depends on solution / fitment. Can be blank

1.2. Retail > Settings > Product

1.2.1. Create a Nostro Account Product – Refer to the User Manual

1.3. Retail > Accounts > Nostro Account > Maintain

1.3.1. Create a Nostro Account – Refer to the User Manual

Note:

- Depending on the needs of the implementation (say, different Nostro accounts to be used for multiple accounts that the FI has with the Bank; and different master GLs are to be used for each Nostro Account), multiple Nostro account may have to be set up under multiple Nostro Products.

2. PaymentGrid

2.1. Settings > Message Configuration

There should be one Active Message Configuration per Clearing Network – Message Mode combination.

Note:

If the Entity has loan repayments, there should be one configuration per Clearing Network for Message Mode = Inward

If the Entity has an Internal Operations Account to park incoming funds or if the Entity user Borrower Repayment Client Accounts into which all incoming payments will be credited, there should be one configuration per Clearing Network for Message Mode = Incoming

2.1.1. Profile

2.1.1.1. Message Mode = Inward

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | The description of the Message Configuration | Can be anything – Should be such that one can easily identify what this Message Configuration is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| Type of Payment | To indicate Payment / Collection | Should be Collections | |

| Message Mode | Should be Inward | ||

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Routine Id | This is the Routine Id in ADM that will be used to process the incoming payment message. | See Notes | If Entity = Bank it should be the valid actual Routine id in DM for the payment message processing. If Entity = FI, it can be any random number |

| Language Converter | Used to convert characters as required | Depends on solution / fitment. Can be blank | |

| AML Configuration | This is the Routine Id in ADM that will be used for AML checks, if any. | Depends on solution / fitment. Can be blank |

2.1.1.2. Message Mode = Incoming

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Description | The description of the Message Configuration | Can be anything – Should be such that one can easily identify what this Message Configuration is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| Type of Payment | To indicate Payment / Collection | Should be Payments | |

| Message Mode | Should be Incoming | ||

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Routine Id | This is the Routine Id in ADM that will be used to process the incoming payment message. | See Notes | If Entity = Bank it should be the valid actual Routine id in DM for the payment message processing. If Entity = FI, it can be any random number |

| Language Converter | Used to convert characters as required | Depends on solution / fitment. Can be blank | |

| AML Configuration | This is the Routine Id in ADM that will be used, if any. | Depends on solution / fitment. Can be blank |

2.1.2. PDE (Possible Duplicate Emission) Configuration

Based on the settings configured here, Aura will check for duplicate messages. If nothing is input, there will not be any check for duplicate messages. If any duplicates are identified, these will be marked as such so that users can investigate and take an appropriate decision.

This tab is the same for both Message Modes viz., Incoming and Inward.

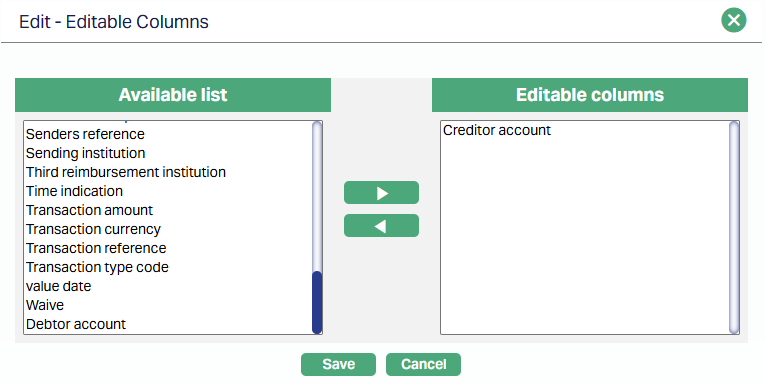

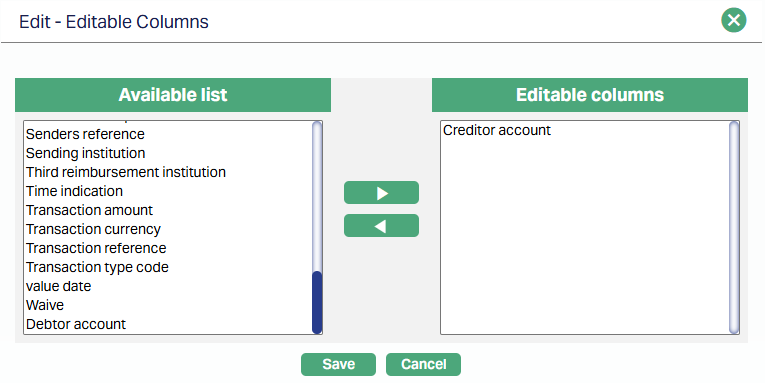

2.1.3. Editable Columns

This enables you to define the specific fields that can be edited for Failed Incoming Messages, so that these can be retried for processing. This tab is the same for both Message Modes viz., Incoming and Inward.

A sample is shown, where only the Creditor Account field is allowed to be edited to take care of incorrect / blank account numbers.

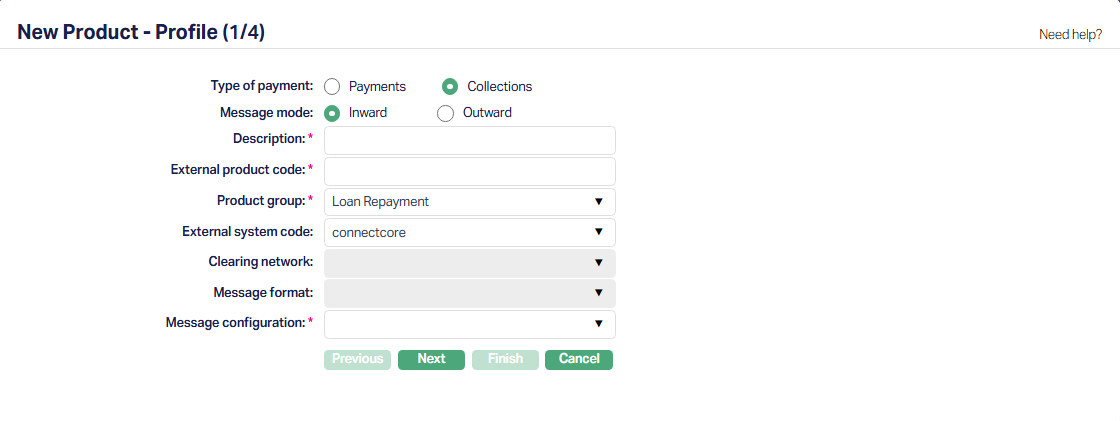

2.2. Settings > Product

The PG > Settings > Product is the linkage between the payment hub and the transaction processing system. Based on the payment records received from DM, the Payment Product is determined through the STP configuration and accounting entries related to the Payment are initiated by PG and posted in CC. The Product defined here, thus, has reference to the Retail > Settings > Payment Settings (using the External Product Code) and the Message Configuration for a Product Group.

Note:

If the Entity has loan repayments, there should be a Product for Message Mode = Inward

If the Entity has an Internal Operations Account to park incoming funds or if the Entity uses Borrower Repayment Client Accounts into which all incoming payments will be credited, there should be a Product for Message Mode = Incoming

Depending on the needs of the implementation, as many Products as required can be set up

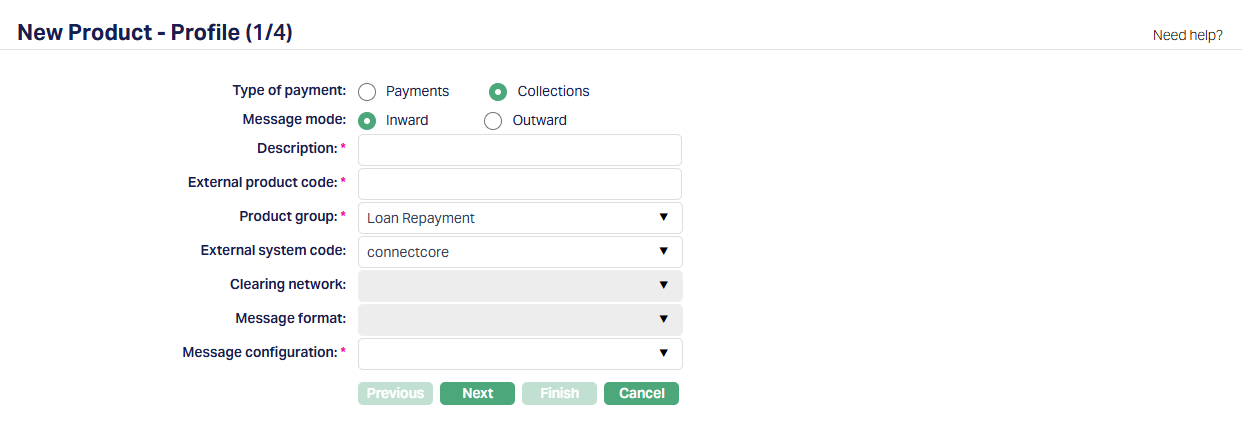

2.2.1. Message Mode = Inward

2.2.1.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Type of Payment | Should be Collections | ||

| Message Mode | Should be Inward | ||

| Description | The description of the Product | Can be anything – Should be such that one can easily identify what this Product is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| External Product Code | This will be the linkage between the Retail > Payment Settings and the PG > Settings > Product | Should be exactly the same as in Retail > Payment Settings > Description | Copy the Description from Retail > Payment Settings and paste it into this field so that it is exactly the same. |

| Product Group | Should be Loan Repayment | ||

| External System Code | List of active interfaces as defined in Admin > System Codes > Interface Definition > Maintain | Should be connectcore | |

| Message Configuration | List of active Message Configurations that match the Type of Payment and Message Mode chosen above |

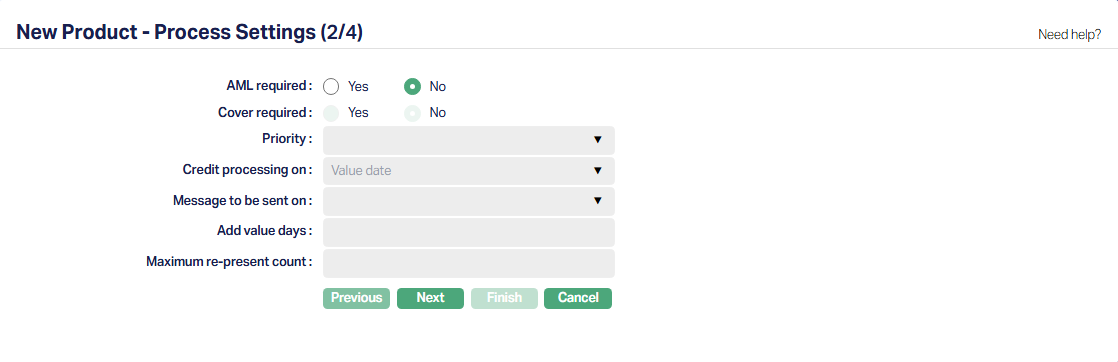

2.2.1.2. Process Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| AML Required | Depends on solution / fitment. | ||

| Other fields | All other fields are disabled |

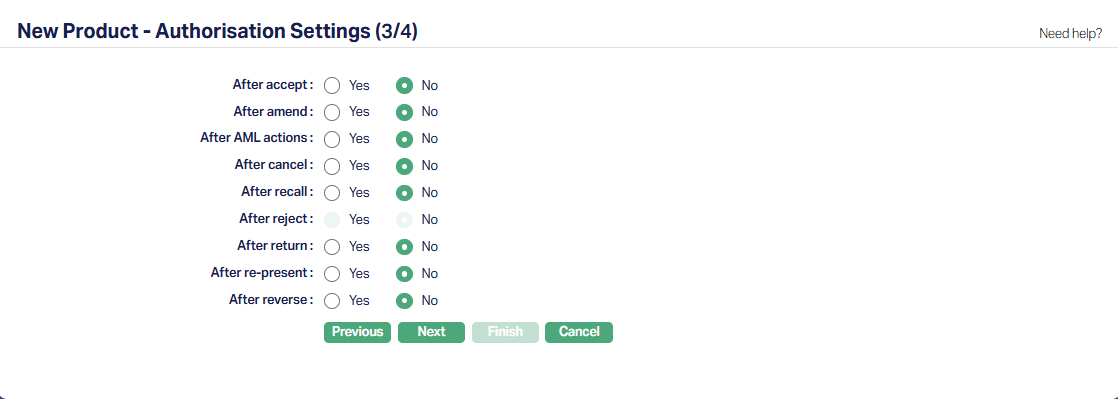

2.2.1.3. Authorisation Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| All fields | Whether an approval is required after the specific action | Depends on solution / fitment. |

2.2.2. Message Mode = Incoming

2.2.2.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Type of Payment | Should be Payments | ||

| Message Mode | Should be Incoming | ||

| Description | The description of the Product | Can be anything – Should be such that one can easily identify what this Product is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| External Product Code | This will be the linkage between the Retail > Payment Settings and the PG > Settings > Product | Should be exactly the same as in Retail > Payment Settings > Description | Copy the Description from Retail > Payment Settings and paste it into this field so that it is exactly the same. |

| Product Group | Should be Payment | ||

| External System Code | List of active interfaces as defined in Admin > System Codes > Interface Definition > Maintain | Should be paymentgrid | |

| Message Configuration | List of active Message Configurations that match the Type of Payment and Message Mode chosen above |

2.2.2.2. Process Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| AML Required | Depends on solution / fitment. | ||

| Credit Processing On | Payment Date | ||

| Add Payment Days | Leave it blank | ||

| Other fields | All other fields are disabled |

2.2.2.3. Authorisation Settings

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| All fields | Whether an approval is required after the specific action | Depends on solution / fitment. |

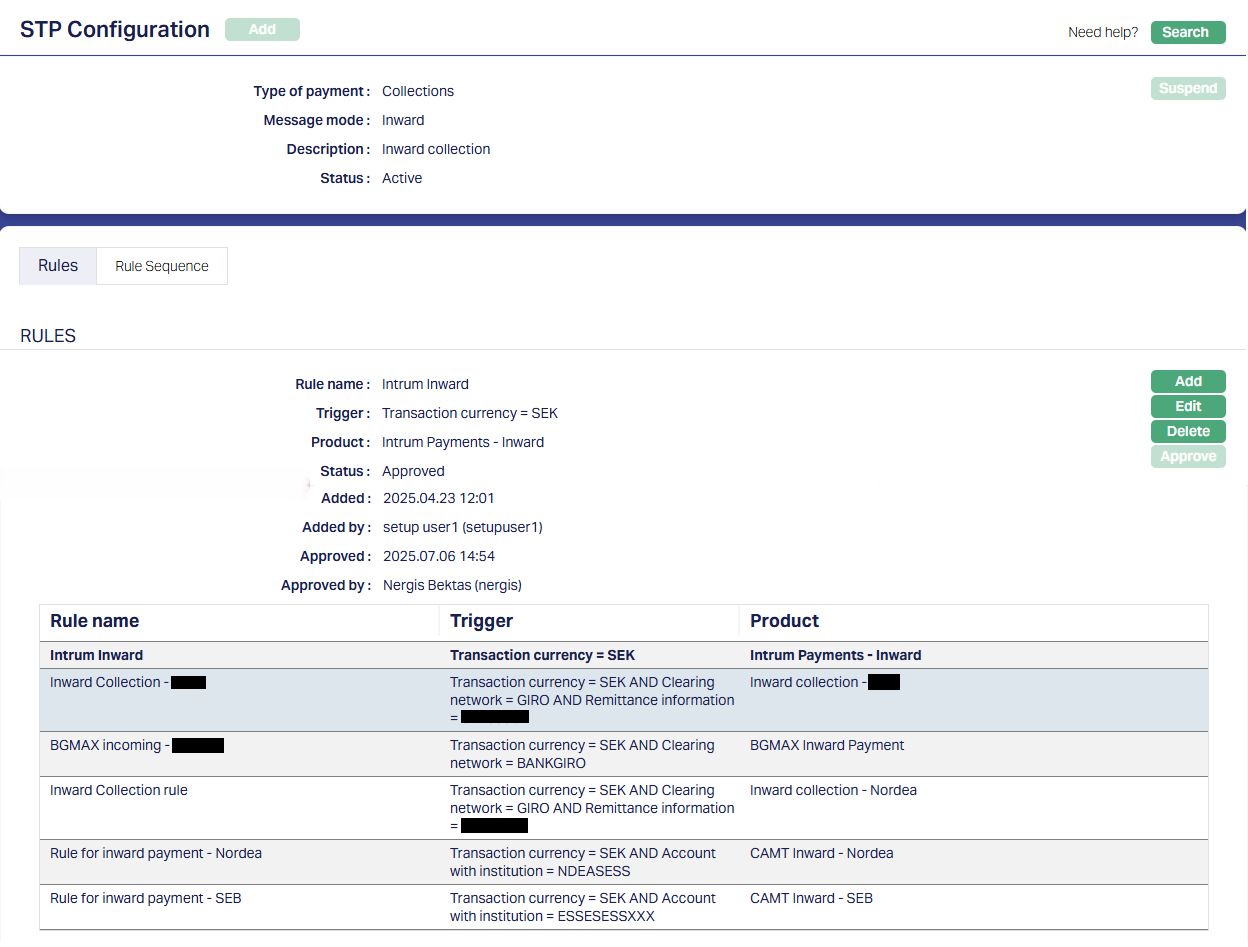

2.3. Settings > STP Configuration

A Straight-Through-Processing (STP) Configuration should be defined to resolve a PG > Product for each payment. Several handles are available to configure suitable rules such that for each payment, a unique Product can be resolved. Multiple rules can be defined.

Note:

If the Entity has loan repayments, there should be a configuration for Message Mode = Inward

If the Entity has an Internal Operations Account to park incoming funds or if the Entity user Borrower Repayment Client Accounts into which all incoming payments will be credited, there should be a configuration for Message Mode = Incoming.

A sample is shown below:

In the above sample, the Trigger uses multiple handles like Transaction Currency, Clearing Network, Remittance Information and Account With Institution to map the Payment Transaction to a unique Product. It is also important to set the Rule Sequence in such a way that there is no overlap / gap and all payment transactions can be uniquely resolved to a Product.

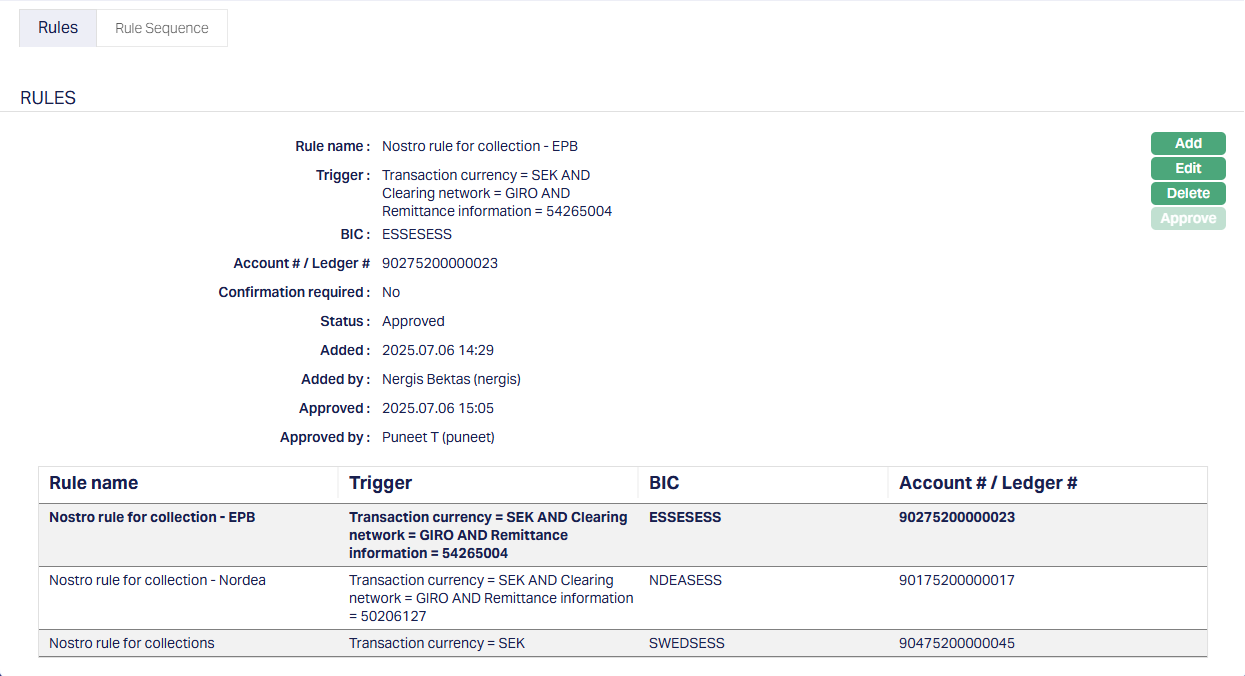

2.4. Settings > Nostro Configuration

This enables you to set up the Nostro that is to be used for the Incoming Payment. The Nostro entries will mirror the entries in the Bank Account from which the Incoming funds will be moved to the internal accounts as per the payment message.

One Nostro Configuration should be defined to resolve the Nostro Account for each Clearing Network for all Message Modes (like Incoming, Inward, Outgoing, Outward). Several handles are available to configure suitable rules such that for each payment, a unique Nostro Account can be resolved. Multiple rules can be defined. Usually, the STP Configuration and the Nostro Configuration have the same rules, but it need not necessarily be so. The former is used to identify the Product while the latter is used to identify the Nostro Account.

Note:

- The Originator Account # field in the pgpaymenttransaction table will store the Account # (IBAN) that the Entity has with the Bank. Thus, even if the Entity maintains multiple accounts with the same Bank (or with multiple Banks) for different purposes (like Loan Account repayments of a specific Loan Product to be paid into one Bank Account, and for other specific Loan Product, payments to be made into another Bank Account), the rules can be configured using this field to identify the transactions and resolve to different Nostro accounts if required.

2.4.1. Profile

| Field Name | Field Description | Field Value | Notes |

|---|---|---|---|

| Clearing Network | To define the Clearing Network | Choose as required | List of Clearing Networks as required for the implementation based on the country, currencies & payment services offered by the Entity. This is decided during Implementation |

| Description | The description of the Nostro Configuration | Can be anything – Should be such that one can easily identify what this Nostro Configuration is for | Usually, the Description for all maintenances is input as the same for ease of use, though, this need not strictly be so. |

| Rule Name | Any free text that identifies what the Rule is for | ||

| Trigger, Parameter, Operator, Value | Use as required to build the Rule | ||

| BIC | The Bank Identifier Code of the Bank in which the Entity maintains the Bank Account | ||

| Account # / Ledger # | The Nostro Account # or the Ledger # into which the Nostro entries have to be posted. | This has to be exactly the same as maintained in CC for the Nostro Accounting entries to be successfully posted. Copy from CC and paste here | |

| Confirmation Required | Depends on solution / fitment. This is applicable only for SWIFT & TARGET2. For others, it can remain as No |

A sample is shown below:

In the above sample, the Trigger uses certain handles that facilitate mapping of the Payment Transaction to a unique Nostro Account. It is also important to set the Rule Sequence in such a way that the broadest filter is defined as the last.

3. Aura Data Management

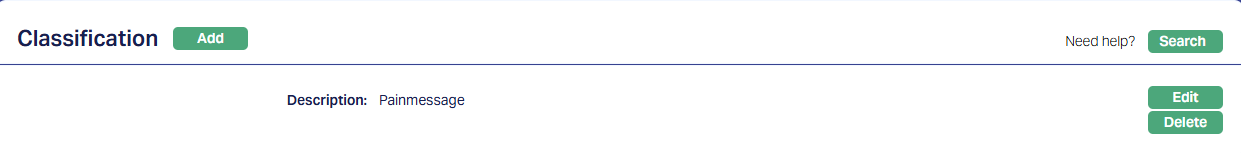

3.1. Admin > System Codes > Generic Definitions > Classifications

Classification enables you to categorize / label the various configurations in Data Management so that it is easier to know what the configuration is for. Create a Classification record where the Description identifies the purpose that is sought to be achieved.

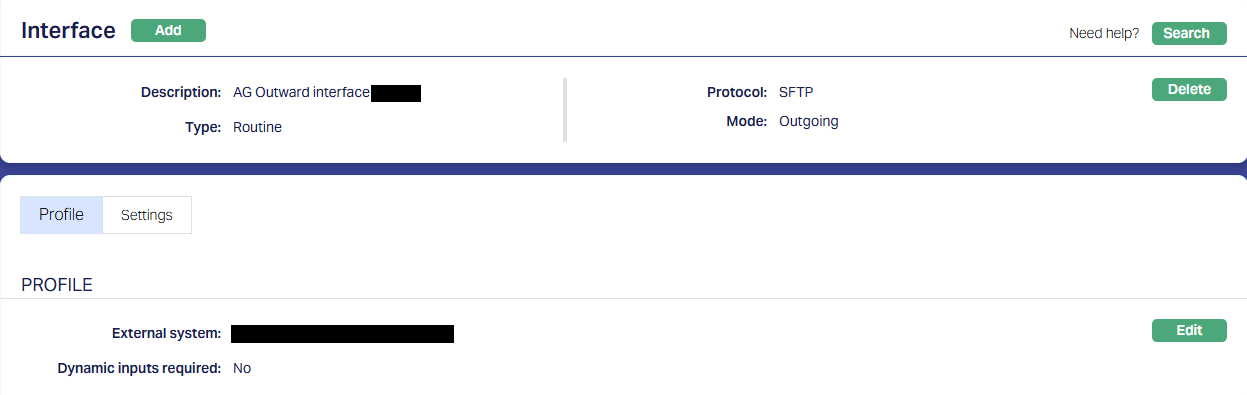

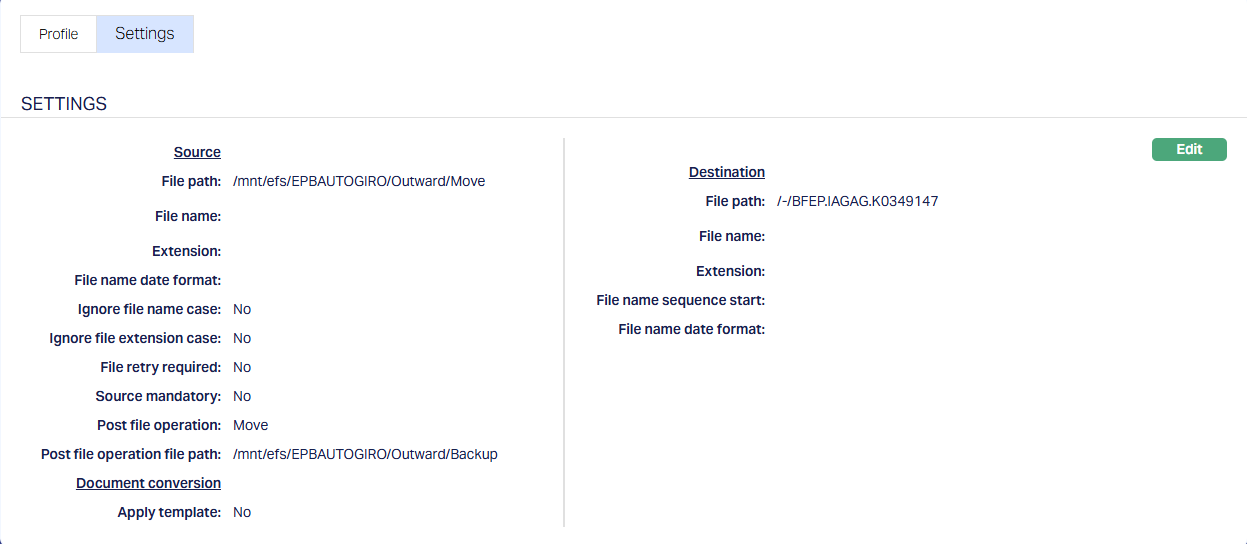

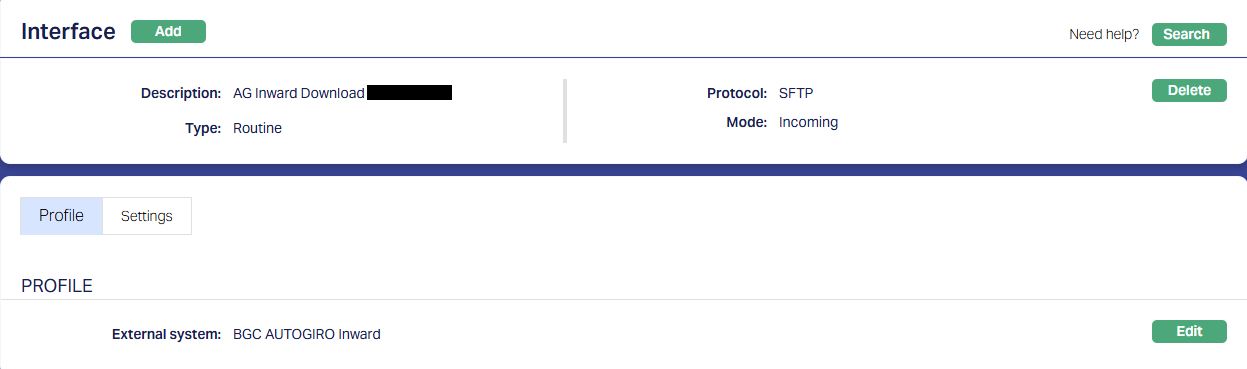

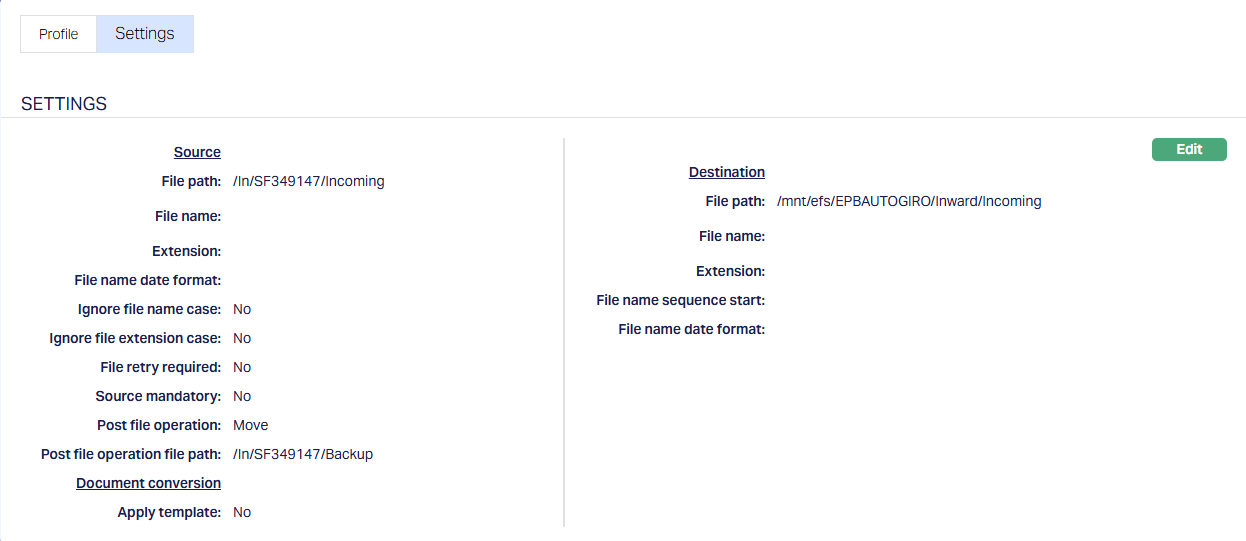

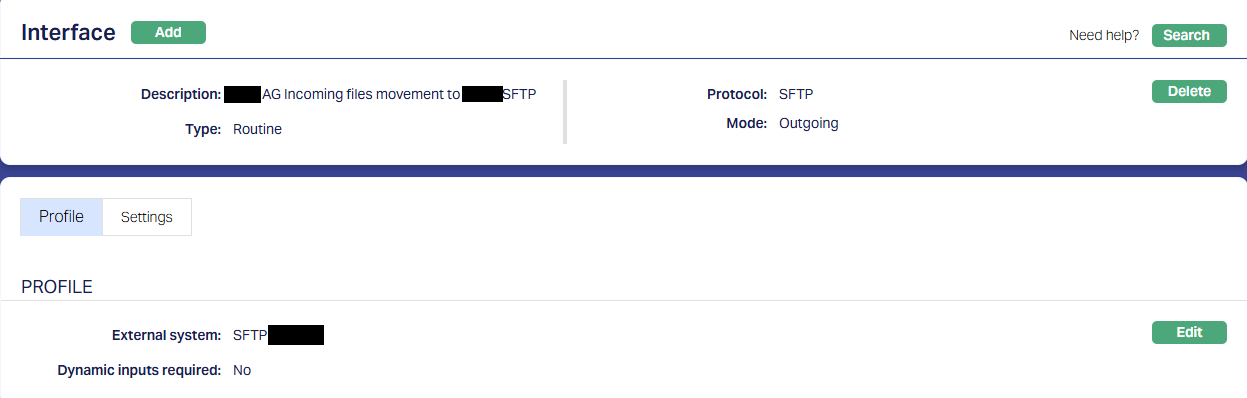

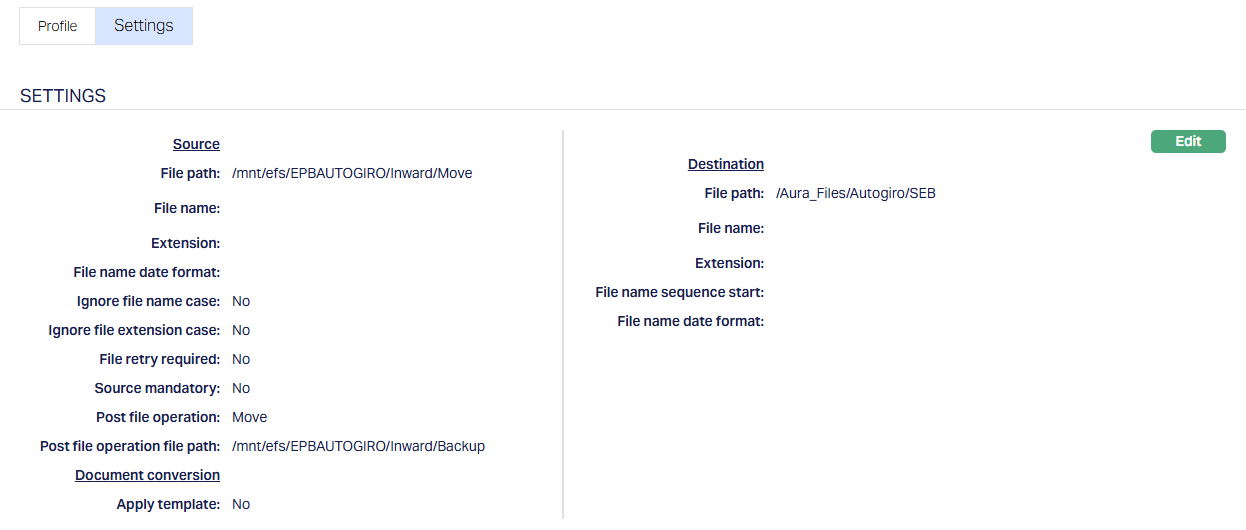

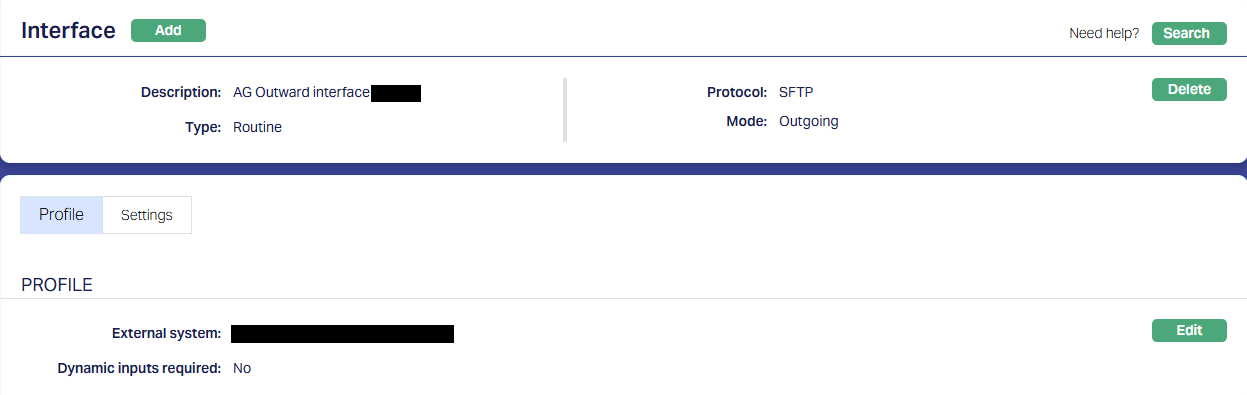

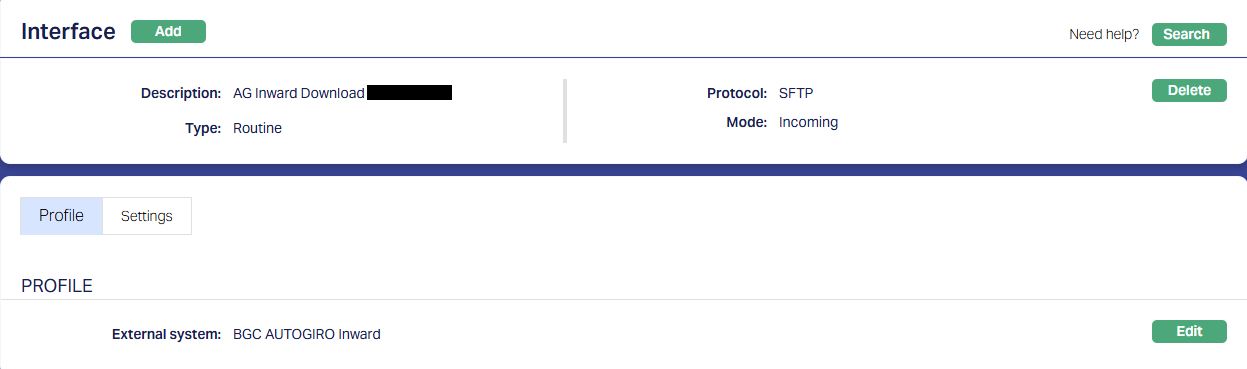

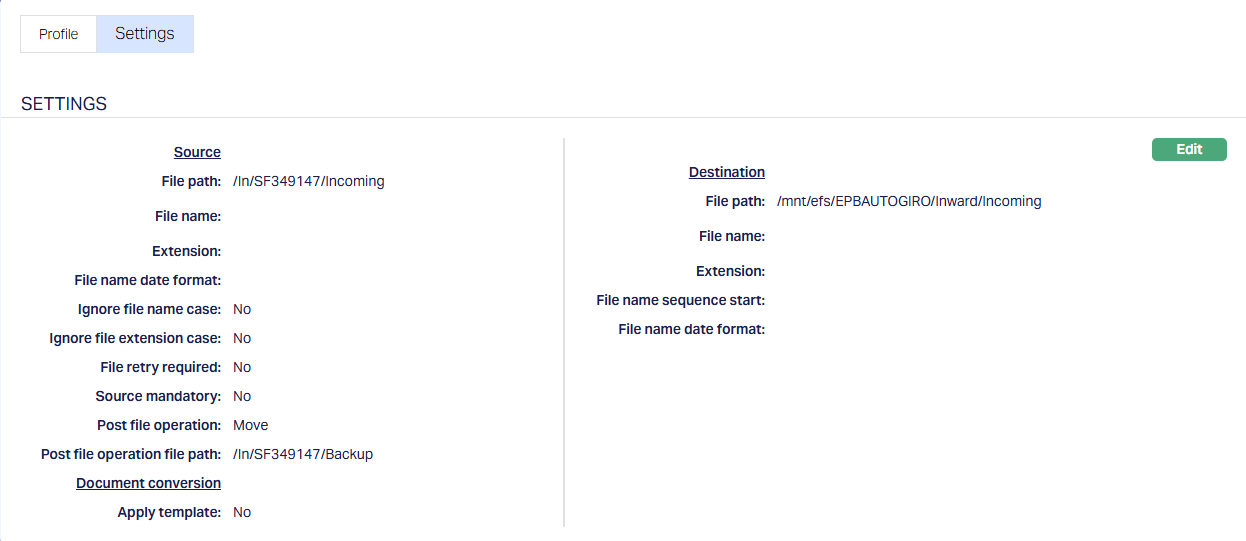

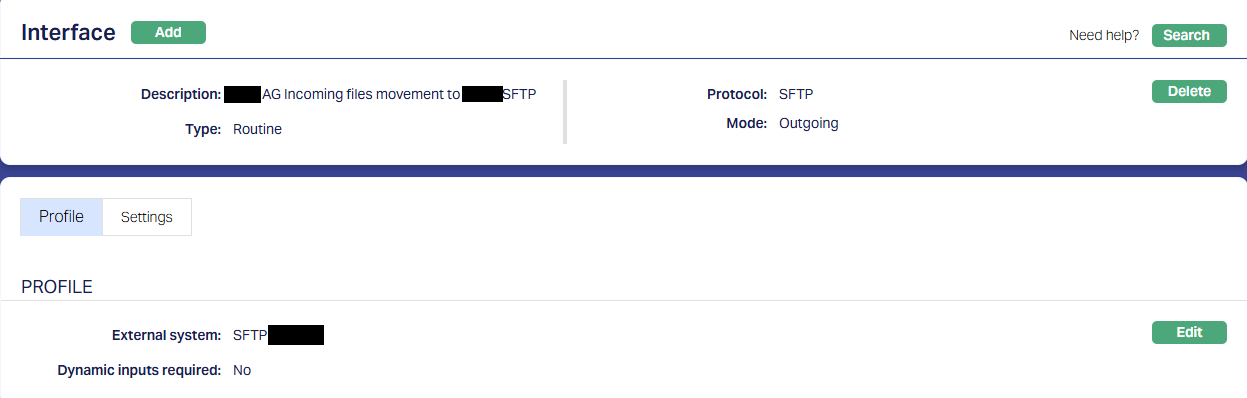

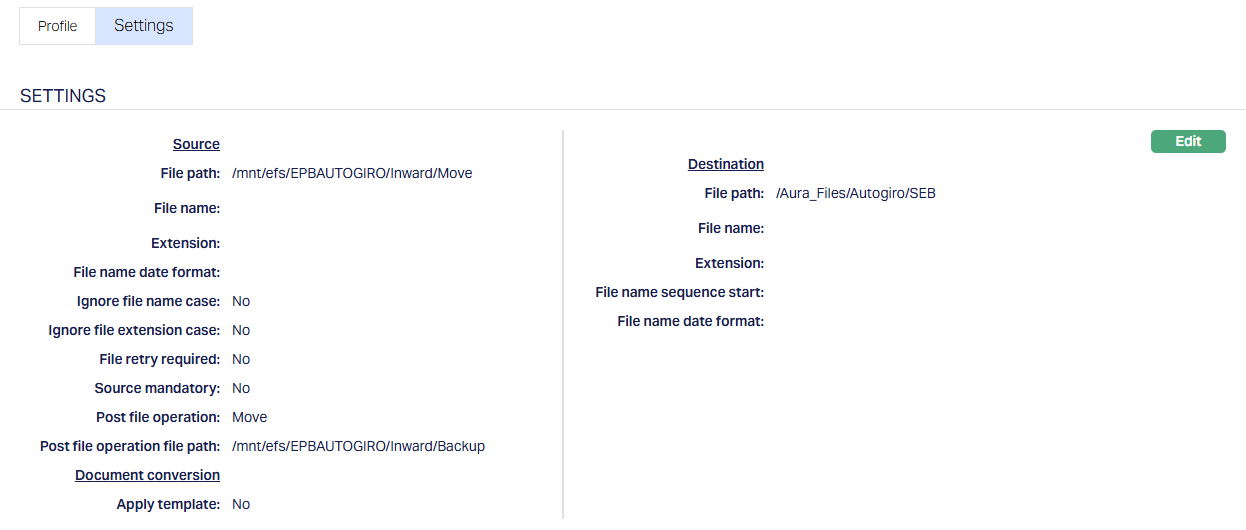

3.2. Data Management > Settings > External System

Depending on the Bank / external system from which the payment files have to be transferred and the mode of download / transmission, you may have to create more records under External System.

See sample below:

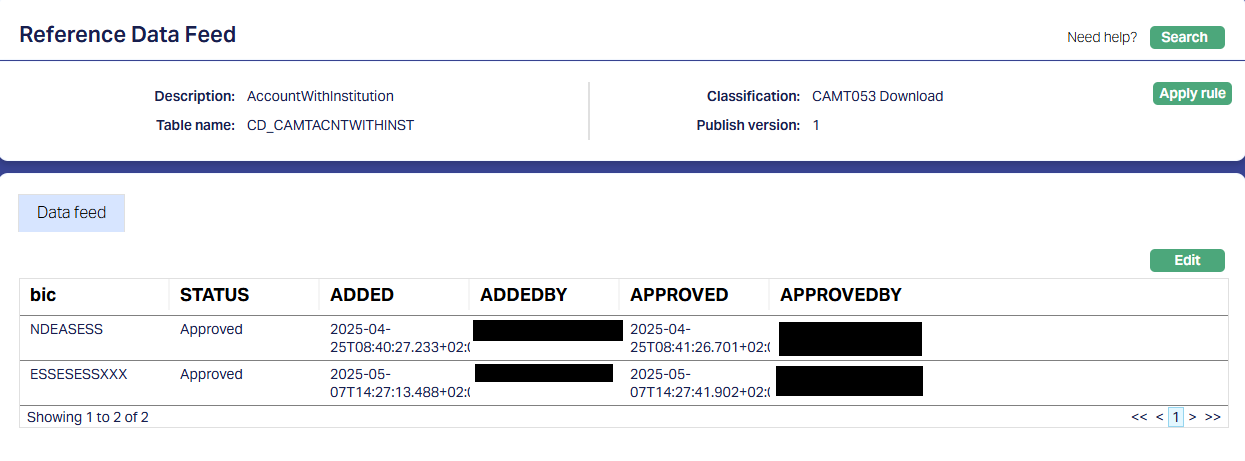

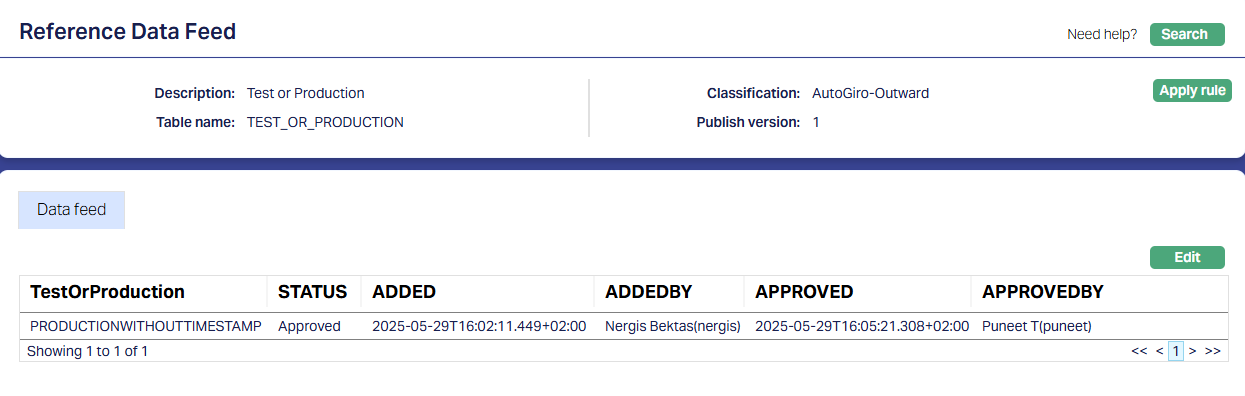

3.3. Data Management > Definitions > Reference Data > Data Feed

If Aura is being implemented in a FI and they have a Bank account from which a camt.053 file is to be received, the following Reference Data > Data Feed details have to be input, based on the agreement between the FI and the Bank.

| Field Name / Description | Field Value | Notes |

|---|---|---|

| BIC | NDExxxxx | Parameter value changes based on implementation |

| BIC | ESSExxxxxxx | Parameter value changes based on implementation |

| Account Number | xxxxxxxxxxxxxxxxxxxx4927 | Parameter value changes based on implementation |

| Account Number | xxxxxxxxxxxxxxxxxxxx4363 | Parameter value changes based on implementation |

3.3.1. Account with Institution

The BIC of the Bank in which the Entity is maintaining its accounts should be maintained in this. If the Entity has multiple Banks where its accounts are maintained, that many records should be available here.

3.3.2. camt External Account

The Account number as maintained by the FI with the Bank (say, IBAN) for each account should be maintained in this.

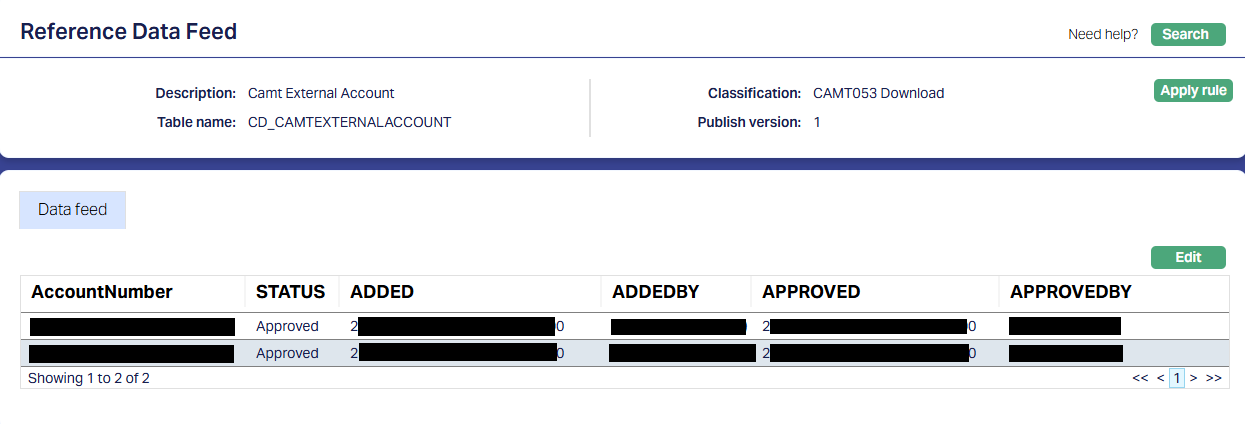

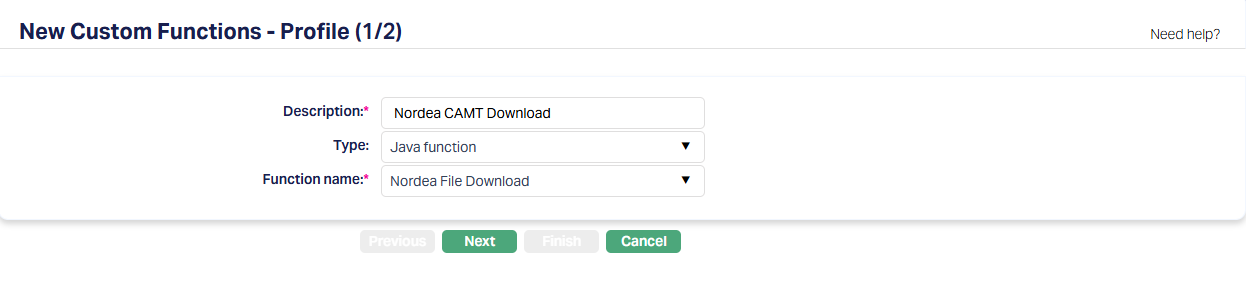

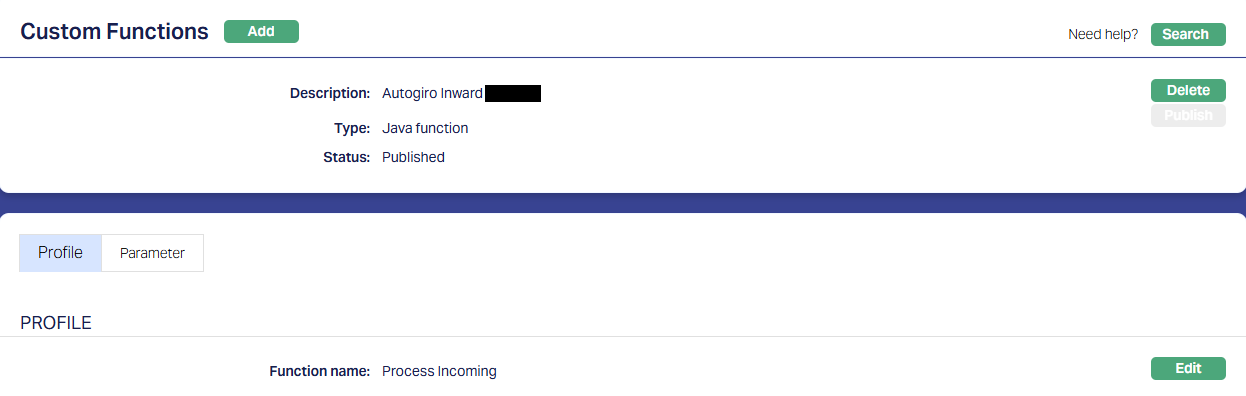

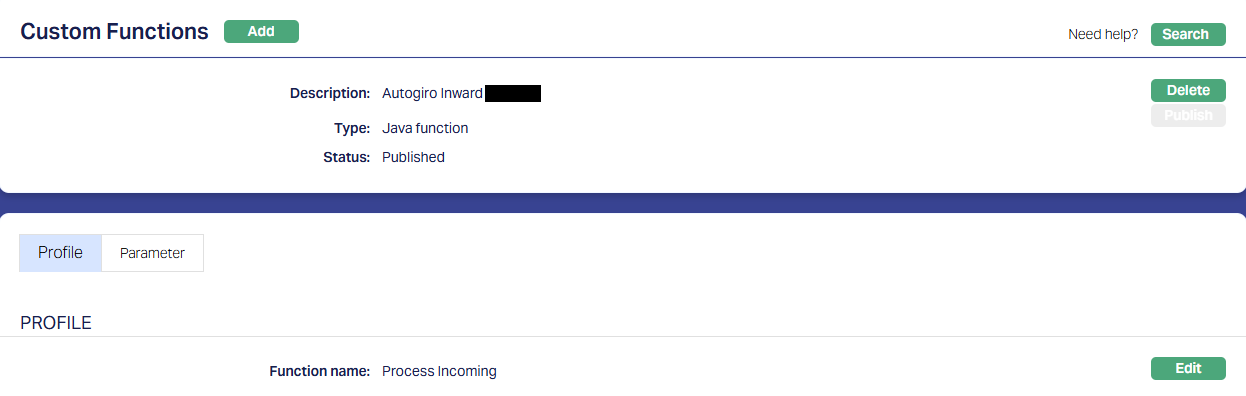

3.4. Data Management > Metadata > Custom Functions

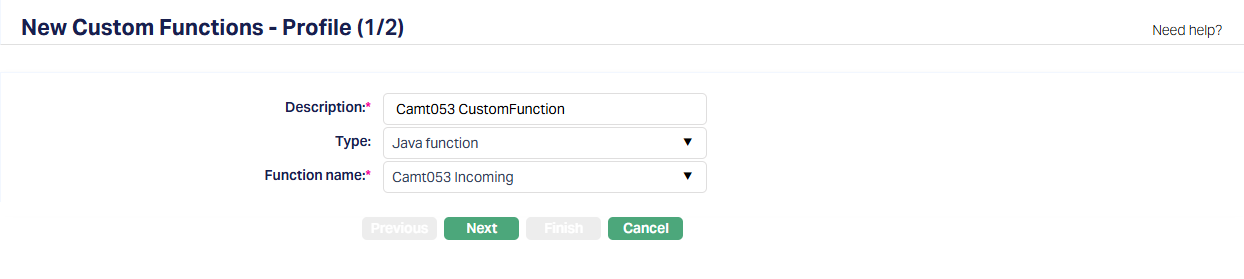

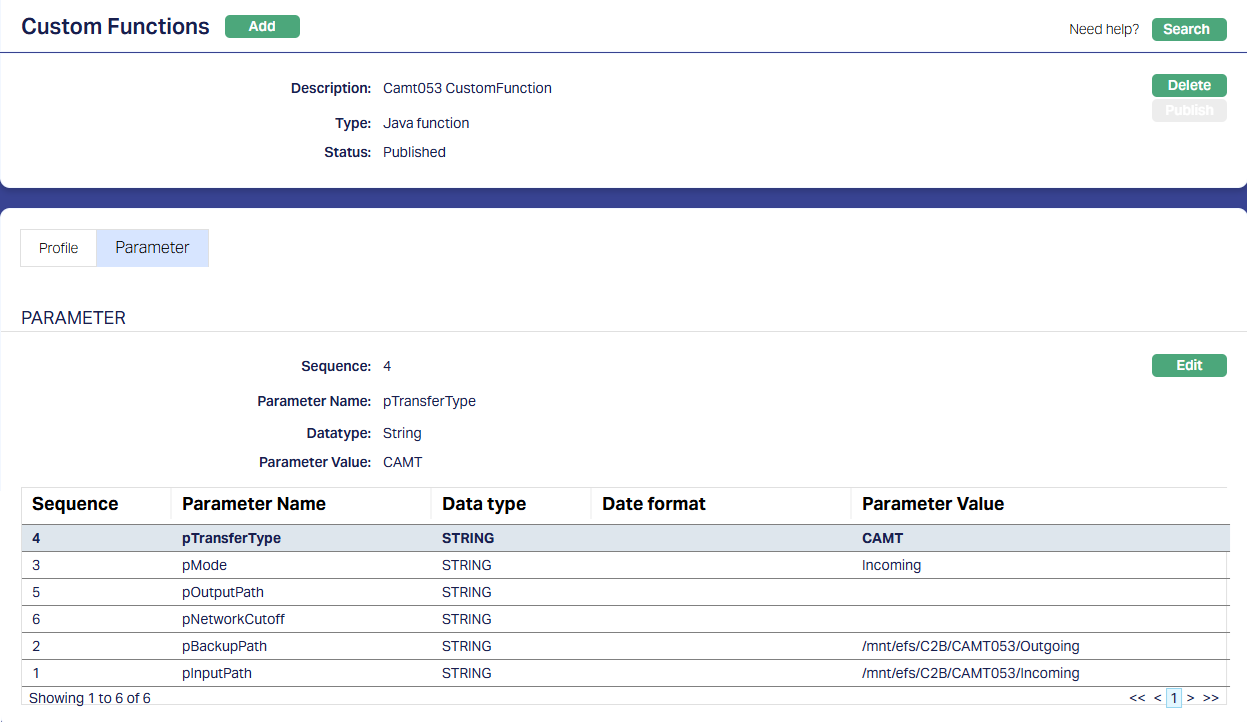

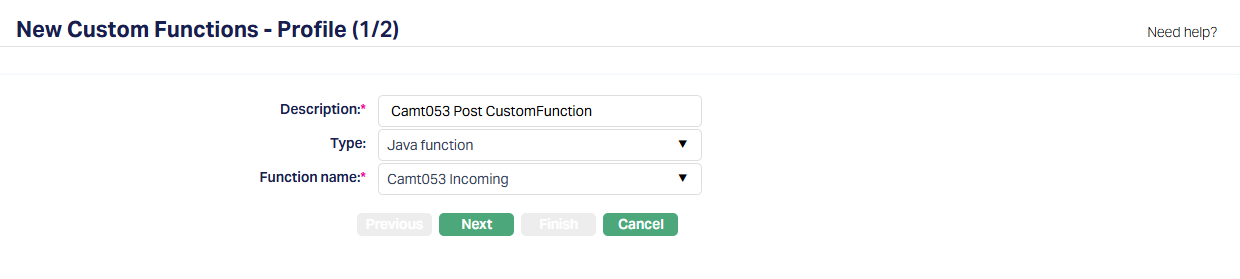

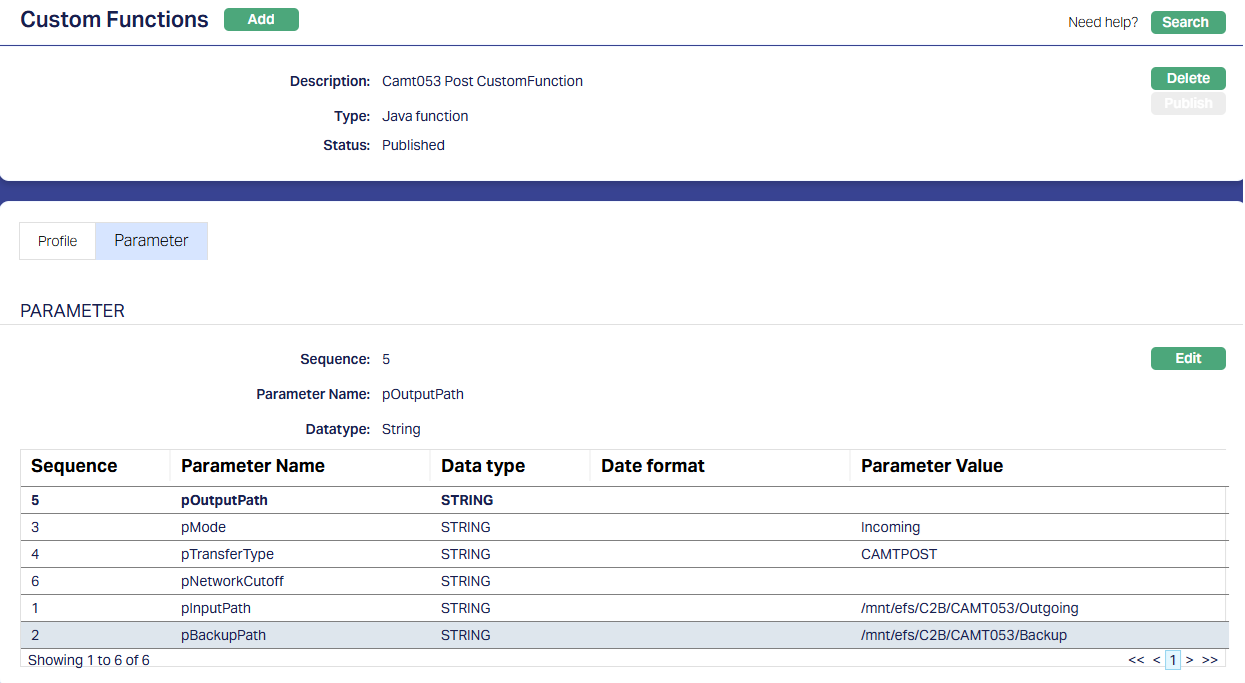

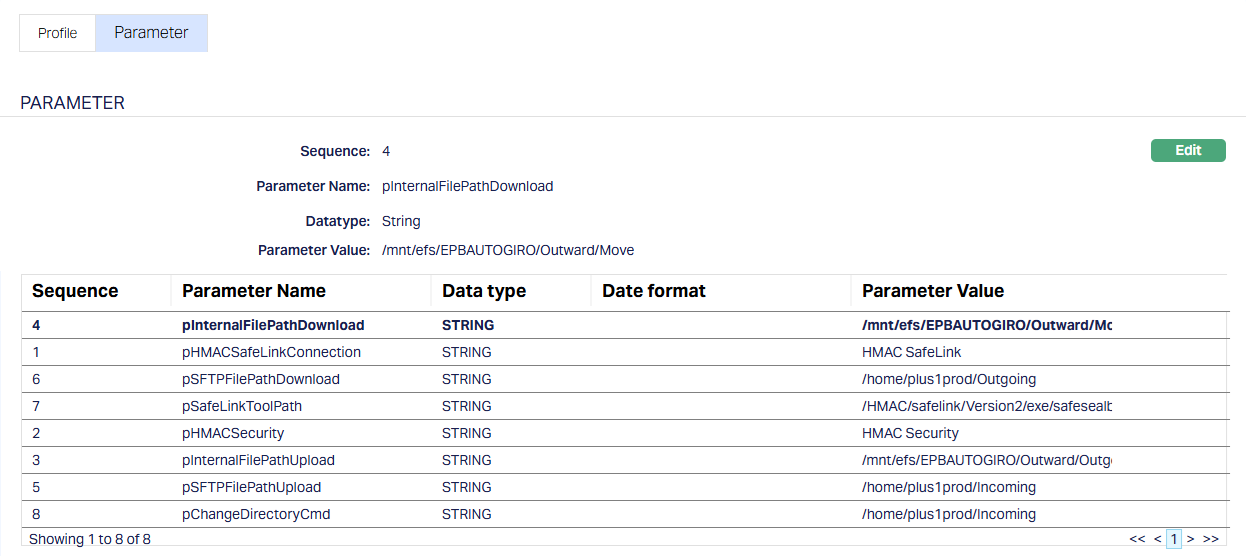

For camt.053 processing, the following Custom Functions should be configured. Usually, this is part of the installation. If not, you need to create new Custom Functions using the Java Function already available. And you need to ensure that the Status is Published and the Parameters are correct for that Implementation.

3.4.1. Download function

This is to download the camt.053 file from the Bank to Aura's servers. This will be based on the specific implementation and the agreement between the Entity and Bank in which the Entity holds its account. The parameters and values would depend on the type of file (xml, txt,etc.,) and the mode of transmission (SFTP, Webservice, etc.,)

3.4.1.1. Profile

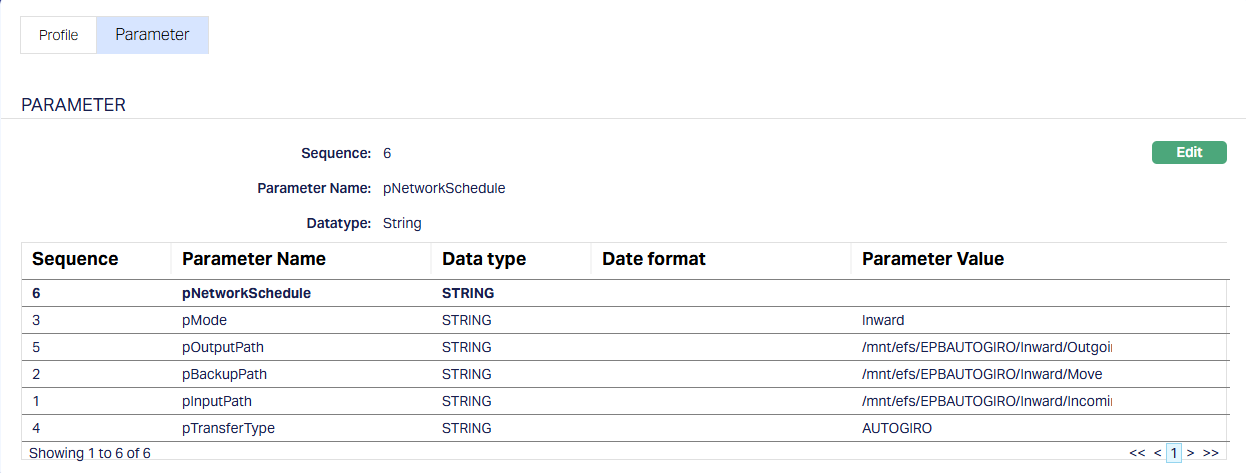

3.4.1.2. Parameter

| Parameter Name | Description | Parameter Value | Notes |

|---|---|---|---|

| pCommand | Command | DownloadFile | Remains same for all implementation |

| pApplicationRequestFilePath | Application Certificate Path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pResponseFileGeneration | Purpose of File Generation | YES | Remains same for all implementation |

| pNordeaAliasName | Nordea Bank Alias name | nsc_xxxcontainer_xxxxxxxxxxxxxxx7450 | Parameter value changes based on implementation |

| pSoapMessageFilePath | Soap Message file path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pCertificateFileName | Certificate file name | Plus1xxxxx.p12 | Parameter value changes based on implementation |

| pNordeaServiceUrl | Nordea Service URL | https://xx.ebridge.xxxx.xxxxx.com/ws/Corporatexxxxxxxxxxx | Parameter value changes based on implementation |

| pFileType | File Type - CAMT053 | xxxxxxXMLO | Remains same for all implementation |

| pStatus | Status | NEW | Remains same for all implementation |

| pTargerId | Target ID | xxxxxxx4248 | Parameter value changes based on implementation |

| pNordeaAlgorithmType | Nordea Algorithm Type | xxxxx Pain upload | Parameter value changes based on implementation |

| pPainFilePath | Pain file Generation path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pCustomerId | Customer ID | xxxxx8168 | Parameter value changes based on implementation |

| pSoftwareId | Software ID | xxxxxxxxxxClient | Parameter value changes based on implementation |

| pEnvironment | Environment - Test or Production | PRODUCTION | Parameter value will change based on the Environment |

| pCertificatepath | Certificate Path | /xxx/efs/xxxx/ | Parameter value changes based on implementation |

| pCamtFileGenerationPath | CAMT File Generation Path | /xxx/efs/xxx/CAMT053/Incoming/ | Parameter value changes based on implementation |

| pServiceId | Service ID | xxxxx1354 | Parameter value changes based on implementation |

| pTransferType | Transfer Type | CAMT | Remains same for all implementation |

| pMode | Payment Mode | Incoming | Remains same for all implementation |

| pOutputPath | Output Generation Path | no values | N/A |

| pNetworkCutoff | Clearing Network Cutoff | no values | N/A |

| pBackupPath | File Movement - Backup Path | /xxx/efs/xxx/CAMT053/Outgoing | Parameter value changes based on implementation |

| pInputPath | File Movement - Input Path | /xxx/efs/xxx/CAMT053/Incoming | Parameter value changes based on implementation |

| pOutputPath | Output Generation Path | no values | N/A |

| pMode | Payment Mode | Incoming | Remains same for all implementation |

| pTransferType | Transfer Type | CAMTPOST | Remains same for all implementation |

| pNetworkCutoff | Clearing Network Cutoff | no values | N/A |

| pInputPath | File Movement - Input Path | /xxx/efs/xxx/CAMT053/Outgoing | Parameter value changes based on implementation |

| pBackupPath | File Movement - Backup Path | /xxx/efs/xxx/CAMT053/Backup | Parameter value changes based on implementation |

3.4.2. Data population function

This function is used to parse the camt.053 file and populate the data in the DM tables.

3.4.2.1. Profile

3.4.2.2. Parameter

Note:

- The parameter values will be provided by IT during implementation

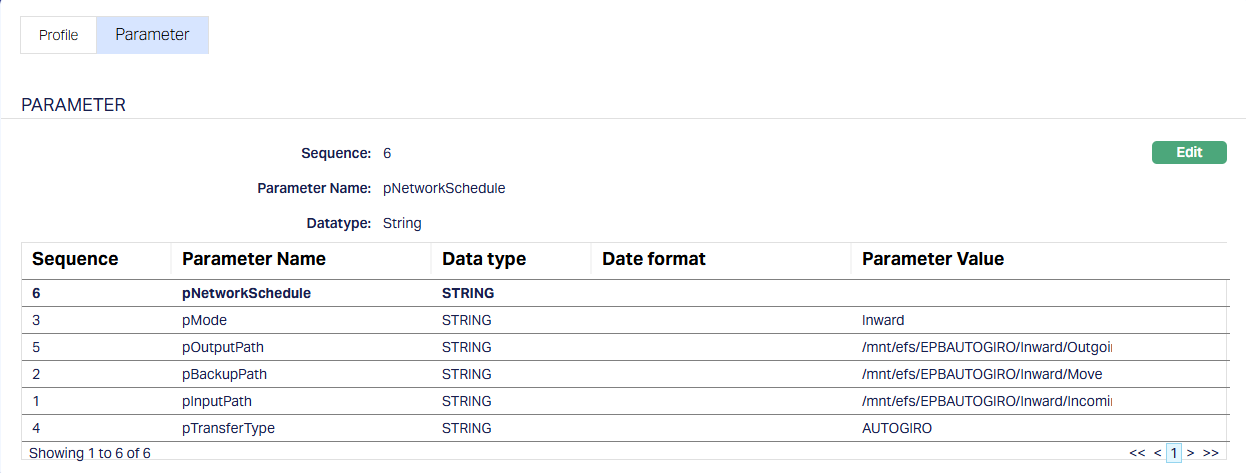

3.4.3. Post Function

This function is used to process the transactions and post them to the respective accounts / contracts in CC, through PG.

3.4.3.1. Profile

3.4.3.2. Parameter

3.4.4. Other Custom Functions

Depending on the specific needs in an Implementation, you may have to create other Custom Function records, input the required Parameter values and ensure that these are Published.

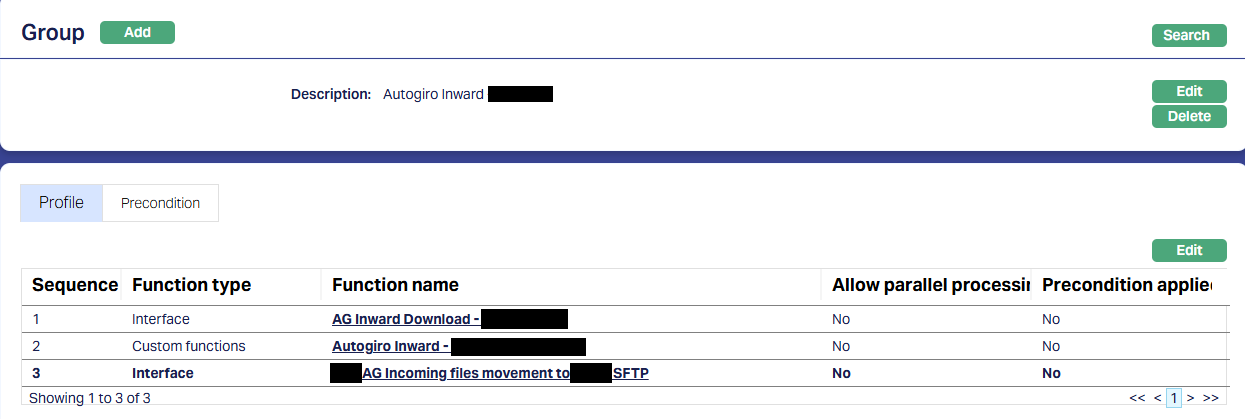

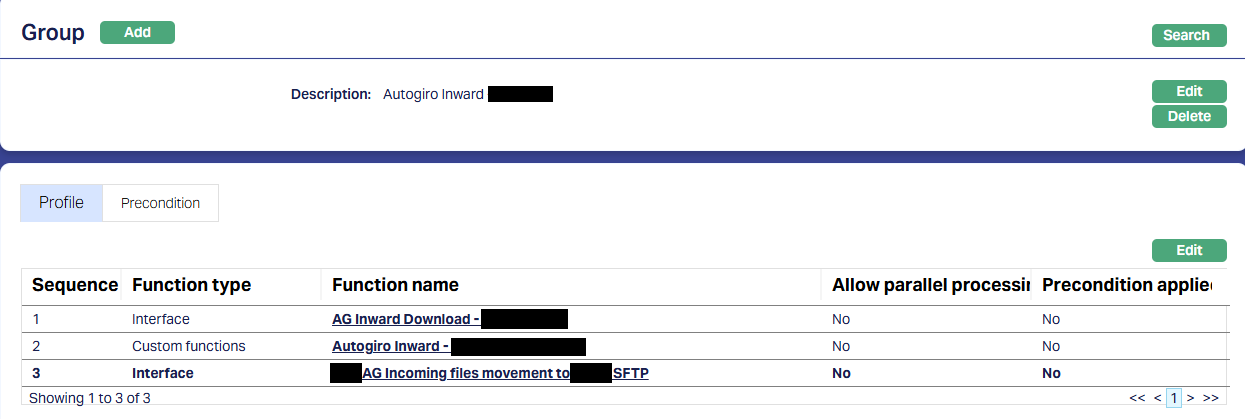

3.5. Data Management > Configurations > Groups > Maintain

Once the Custom Function records are Published, you have to create a Group and map all the required functions to that Group. This ensures that all the functions required for the camt.053 processing are executed in the specific sequence.

Usually, this is part of the installation. If not, you will have to do the same.

Note:

- The sequence of the functions is very critical and should be strictly set up as shown below.

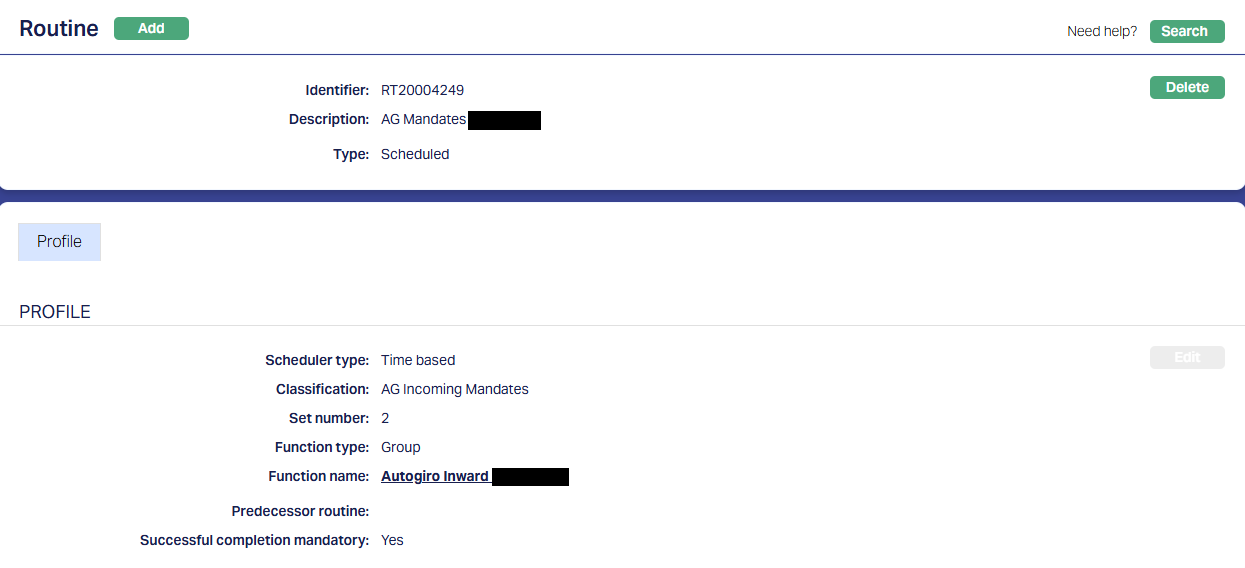

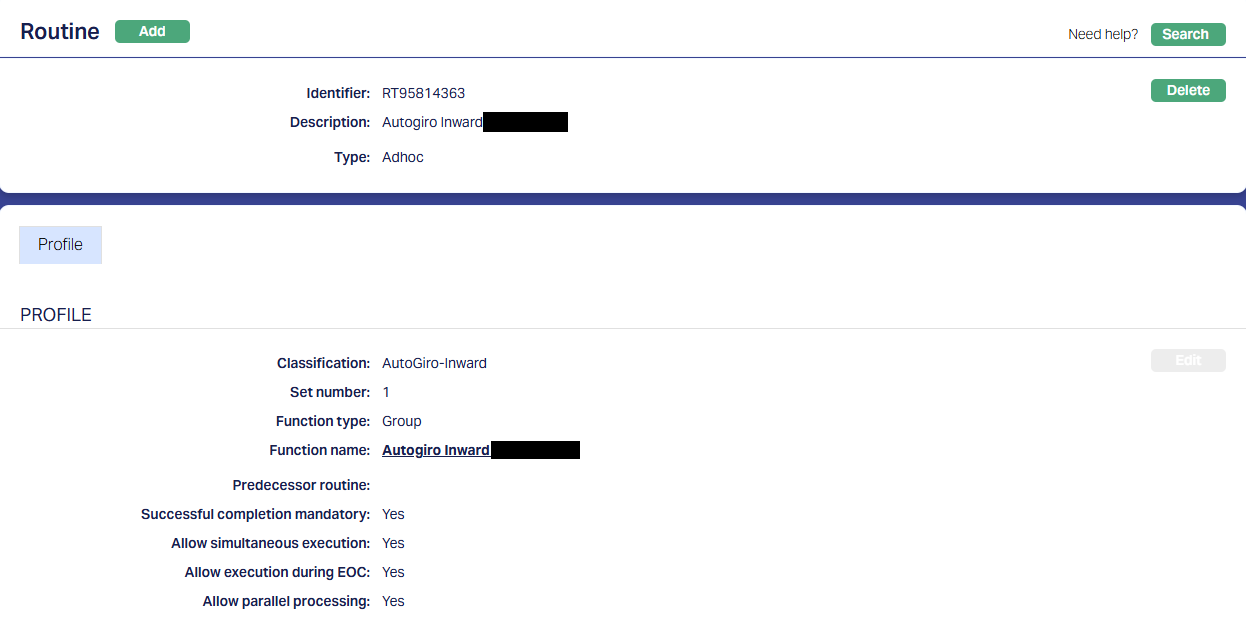

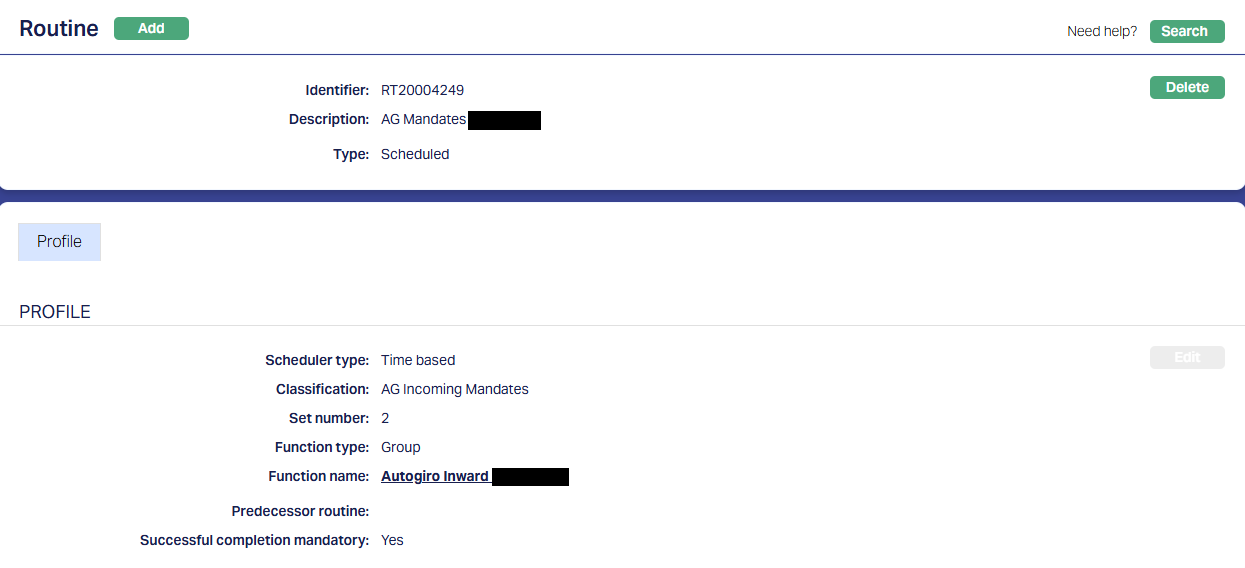

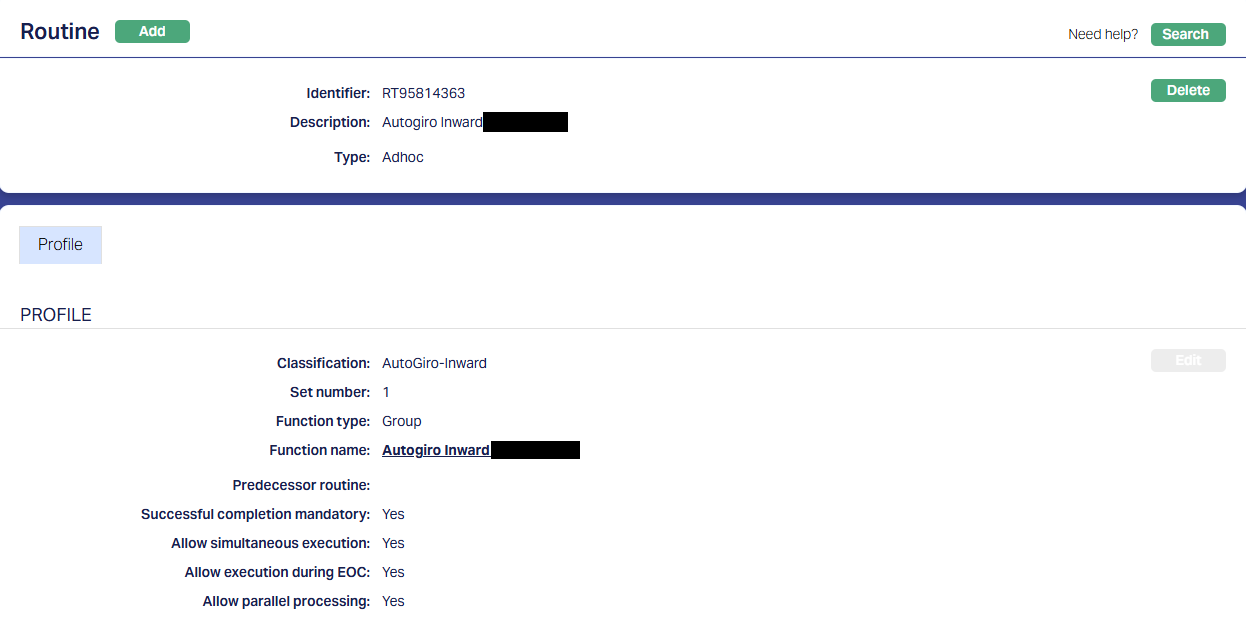

3.6. Data Management > Configurations > Routines > Maintain

You have to create a Routine and map the Group as well as the Classification. You must always create two Routines for each Group: One of Type Scheduled / Auto as required; and one other of Type Adhoc. The Scheduled / Auto routine will be automatically executed at the Scheduled Time / during EOD/BOD as defined in the Routine; and in case there is any issue with such automatic execution, and a manual intervention is required, the Adhoc Routine can be used to run the routine after such manual intervention.

Usually, this is part of the installation. If not, you will have to do the same.

3.6.1. Scheduled Routine

3.6.2. Adhoc Routine

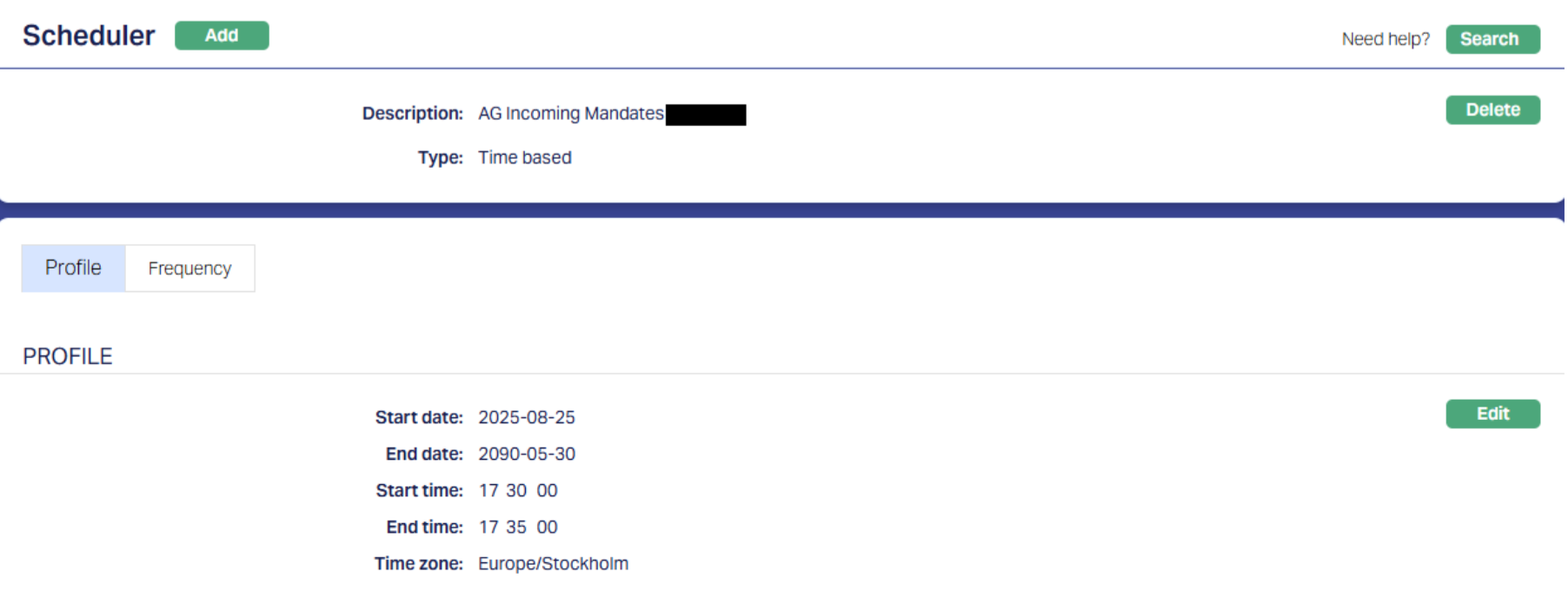

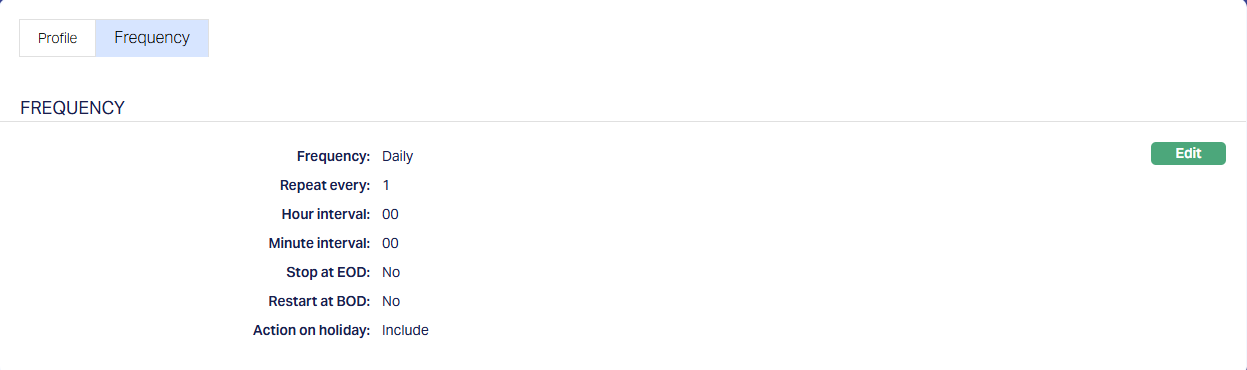

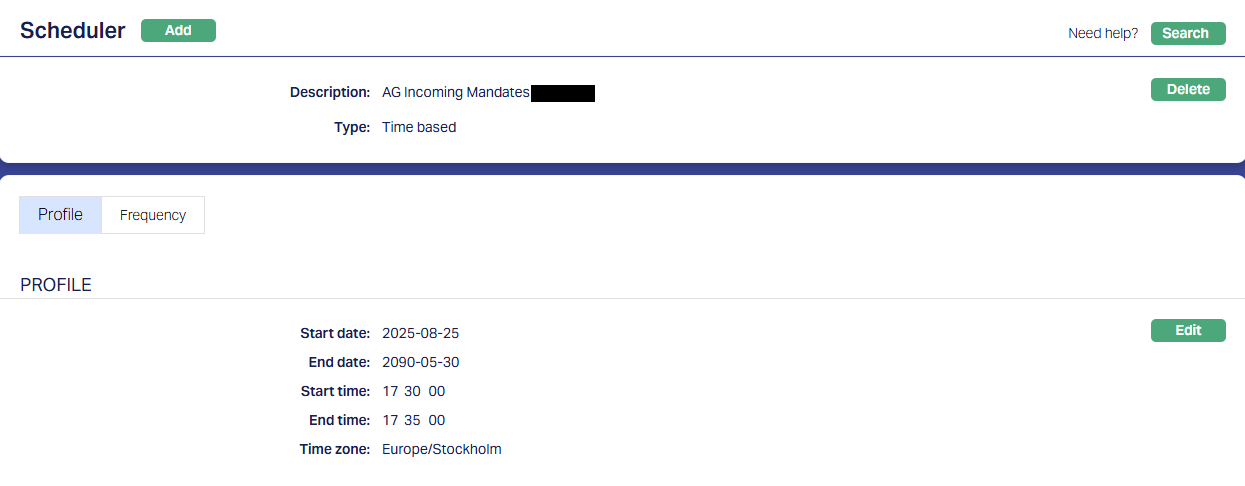

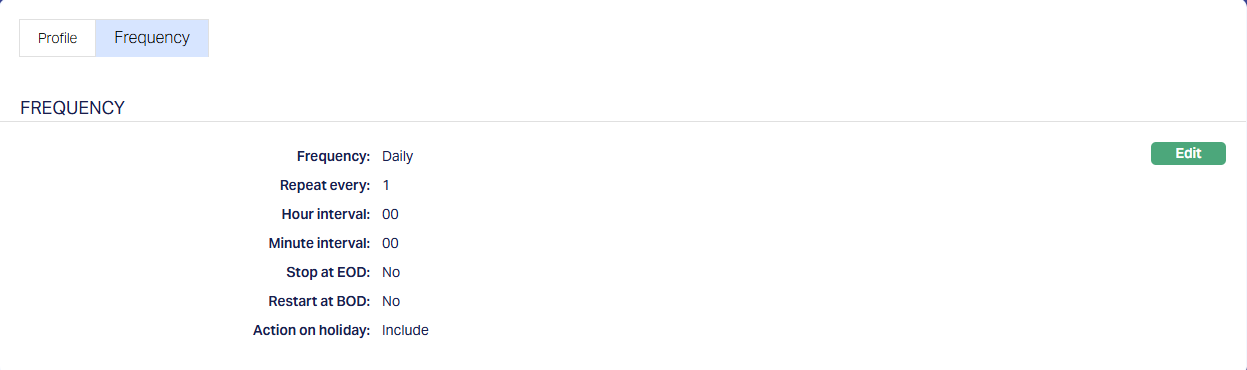

3.7. Data Management > Configurations > Scheduler > Maintain

If the Routine has been created with Type = Scheduled, you need to create a Scheduler to define the frequency & time of execution.

3.7.1. Scheduler for camt.053 file

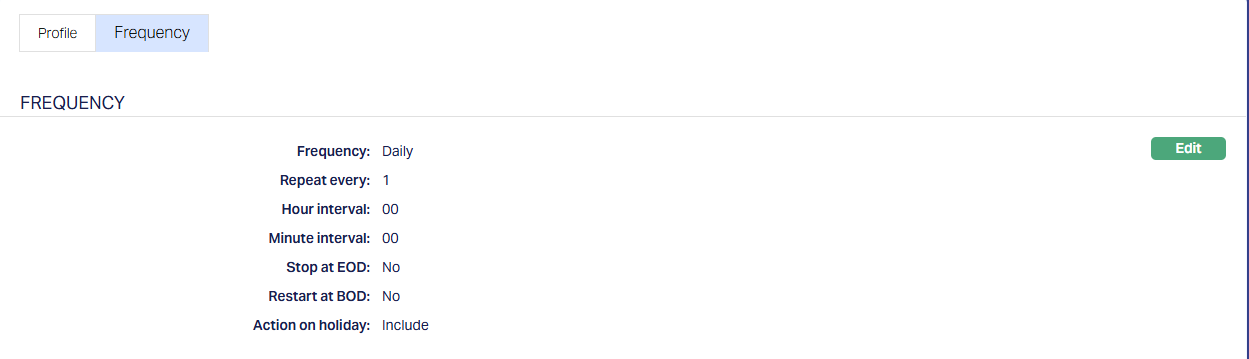

A sample is shown below where the scheduler will run every day between 04:00 and 04:10 for the period selected and as per the time zone selected.

Note:

- The scheduler has to be set up as per the needs of that specific Implementation

3.7.1.1. Profile

3.7.1.2. Frequency

3.8. Data Management > Configurations > Routines > Branch Mapping

Once the Routines and Schedulers are configured, these should be mapped for the Branch(es) for which the Routines should be executed. You have to map both the Adhoc and Scheduled / Auto routines.

3.8.1. Adhoc > Edit

3.8.1.1.

All Routines that are defined as Adhoc Type will display; check the relevant checkbox to map the Routine to the Branch; uncheck to unmap. Only mapped Routines can be manually executed for that Branch using Data Operations > Adhoc Routines

3.8.2. Scheduled > Edit

All Routines that are defined as Scheduled Type will display; check the relevant checkbox to map the Routine to the Branch; uncheck to unmap. Only mapped Routines will be automatically executed for that Branch as per the Scheduler mapped.

PROCESS OF INCOMING PAYMENT PROCESSING

The sequence of processing is as follows:

1. As per the scheduler that has been configured, the Payment File(s) will be downloaded and available in the path specified in the Download function

a. The function could fail if a connection could not be established with the Bank or if the required certificate has expired or such reasons. The Technical / IT Team will have to be involved for correcting and re-downloading the file.

2. The file(s) will then be parsed and data populated in the DM tables

a. The Reference Data Feeds will be used to identify the BIC / Account # for the payments.

i. If these do not match, the file data will not be populated into DM.

ii. Failure could also be due to incorrect file structure or some issue in reading the file. The Routine Status will be Failed. You can check the failure reason in the Routine History and take necessary corrective action.

b. Successfully loaded transactions will have a unique Message Reference for each transaction.

c. The Payment file(s) will be moved to the Backup Path as specified in the Custom function

3. Using the Post Function, data from the DM tables will then be posted to PG tables.

a. If there is any failure in connection between DM and PG, the entire Routine will fail. The Technical / IT team have to intervene to set this right and re-initiate the process.

4. PG resolves the PG Product using the STP Configuration and posts the accounting entries for the contracts / accounts in CC for each transaction.

a. Based on the value for the Reference #, i.e., the Creditor Account field in the pgpaymenttransaction table, the Product is resolved as follows:

i. If the value matches a Loan Account # or Invoice #, the Configuration for Type of Payment = Collection and Message Mode = Inward will be used

ii. If the value matches a Client Account # or Card Account #, the Configuration for Type of Payment = Payment and Message Mode = Incoming will be used

b. If the Creditor Account field value is null or if the value does not match the Loan Account #, Client Account #, Card Account # or Invoice #, that payment transaction will be marked as Failed and can be retried after required corrections

c. Successfully loaded transactions will have a unique Payment Reference for each transaction. This just indicates that the transaction is loaded, but the transaction posting could either be success or failure.

d. The table below summarizes the details at the end of the process:

| Type of account | Accounting entries | Message Mode | Status | Next Step |

|---|---|---|---|---|

| Loan | Successful | Inward | Processed, Approved | None |

| Loan | Failed | Incoming | Failed, Approved | User to initiate action & retry |

| Client Account | Successful | Incoming | Processed, Approved | None |

| Client Account | Failed | Incoming | Failed, Approved | User to initiate action and retry |

e. The accounting entries for successful transactions will be as follows:

i. In case of Loan Repayments:

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code | Amount |

|---|---|---|---|---|---|---|

| LNPAYS | Current Booking Date | Value Date in the Payment file | Db | Transit GL | ||

| Value Date in the Payment file | Cr | Loan Account | Amount allocated to Principal components | |||

| Cr | Master GL of Loan Product | Master leg (CR/GL) from Loan Product | Amount allocated to Principal components | |||

| Cr | <Respective GL based on allocation to components) | Amount allocated to various components |

ii. In case of Client Account credits:

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code | Amount |

|---|---|---|---|---|---|---|

| PAYMCP | Current Booking Date | Value Date in the Payment file | Db | Transit GL | ||

| Value Date in the Payment file | Cr | Client Account | Transaction Amount | |||

| Cr | Master GL of Client Account Product | Master leg (CR/GL) from Client Account Product | Transaction Amount |

f. Failure of individual payments could be due to:

i. STP Exception: If PG cannot resolve the Product through the existing rules in the STP configuration, the payment will fail and will be in STP Exception. Based on an analysis, the STP rules may have to be modified to ensure Product resolution; and the transaction has to be re-tried.

ii. Business failure: This could be due to several reasons like

Client Account: Account # incorrect, Account # is blank, Account has been disallowed for credits, Account has been blocked,

Loan Account: Loan has been marked for Manual repayment and not Auto repayment, Loan is Closed or Invoice has already been paid or some other fidelity issues.

In these cases, users can check details, correct and Retry, or, manually process for loan repayment after moving it to an Internal Ops Account / Suspense account.

iii. Technical failure: Could be due to Communication failure with Core – say, if CC user id has expired or is incorrect or somehow, a connection with Core is not established. In these cases, the technical team has to intervene to sort out the issue and re-initiate the process.

iv. PDE failure: This arises if Possible Duplicates are identified based on the Possible Duplicate Emission configuration. In such cases, these records have to be checked to determine if it is actually a duplicate or not. If it is determined that it is not a duplicate, process using Retry. If it is identified as an actual duplicate, the payment may have to be sent back to the bank manually.

g. For Failed Transactions, based on user action, the table below summarizes the details at the end of the Retry process

| User action | Type of account | Accounting entries | Message Mode | Status | Next Step |

|---|---|---|---|---|---|

| Option 1) Loan account # / Invoice # corrected | Loan | Successful | Inward | Processed, Approved | None |

| Option 2) Input a Client Account # (say, Internal Ops Account) | Client Account | Successful | Incoming | Processed, Approved | None |

- PG resolves the Nostro Account using the Nostro Configuration and posts the Nostro Accounting entries in CC for all the transactions received in that file, even if the CC posting for one or more transactions fail in the above step. This is because, the funds have been credited to the Entity's Bank Account; and the same should be correspondingly reflected in the Nostro Account.

The Nostro accounting entries will be as follows:

| Event Code | Book Date | Value Date | Db / Cr | GL / Account # | Transaction Code | Amount |

|---|---|---|---|---|---|---|

| CHQDBT | Current Booking Date | Value Date in the Payment file. If there are multiple value dates, what will this be taken as? | Db | Nostro Account / GL resolved | Total amount of credits received in the file | |

| Value Date in the Payment file | Db | Master GL of Nostro Account Product | Master leg (DB/GL) from Nostro Account Product | Total Amount posted to Nostro Account | ||

| Cr | Transit GL | Total amount of credits received in the file |

Note:

- If a Nostro Account cannot be resolved using the Nostro Configuration, the error will only be logged and the transaction will not be found in any exception queue. However, the payment will not go through. You need to check the Nostro entries every day to ensure that the Nostro posting has been completed for all the transactions.

- The incoming file is then moved to the Backup Path as specified in the Reference Data Feed.

Note:

- PG > Events Tab does not show any events.

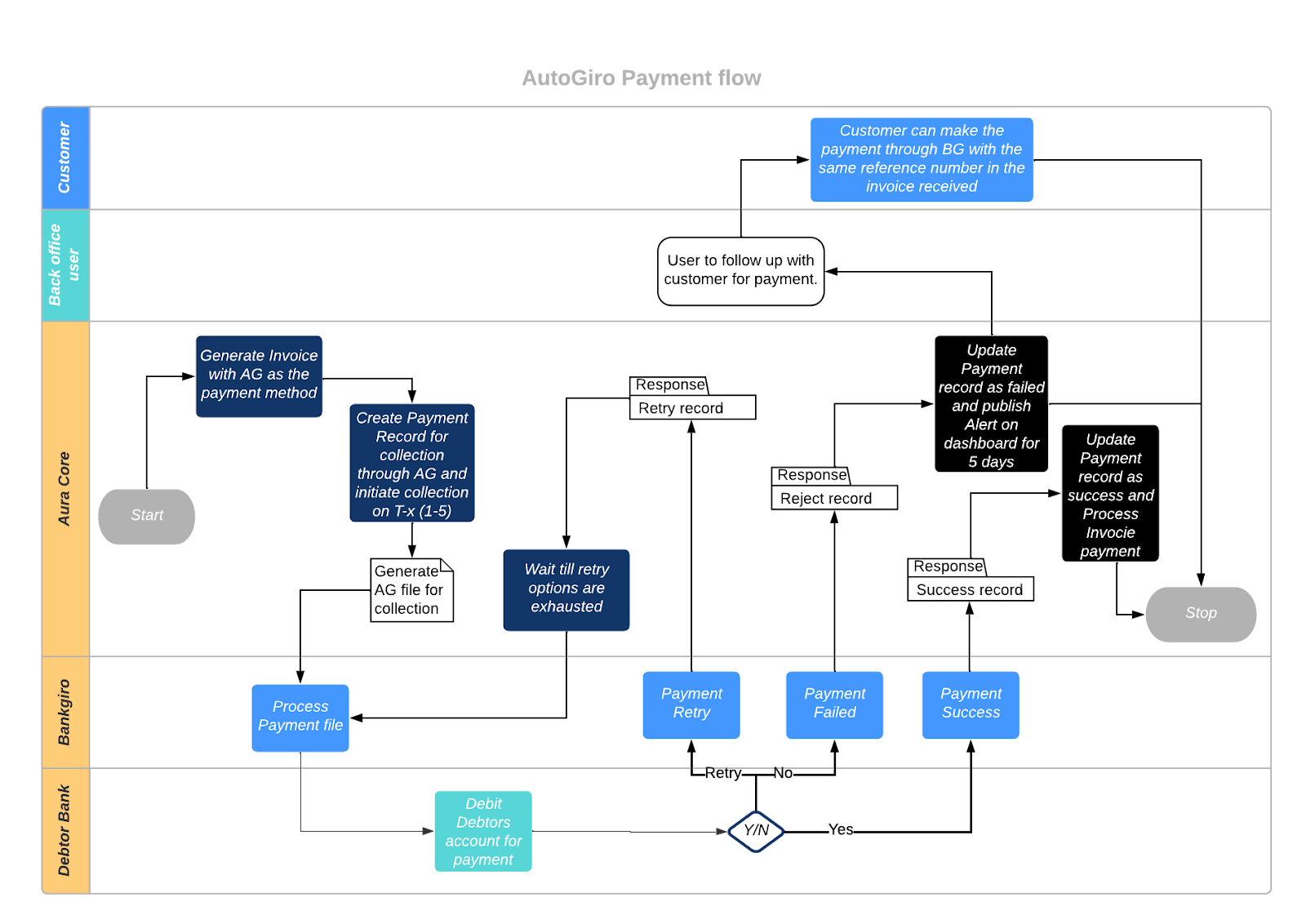

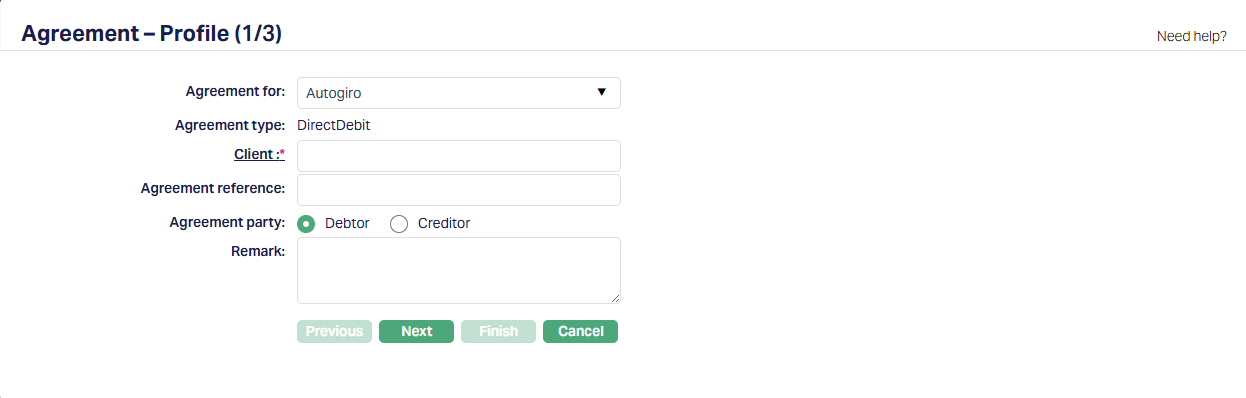

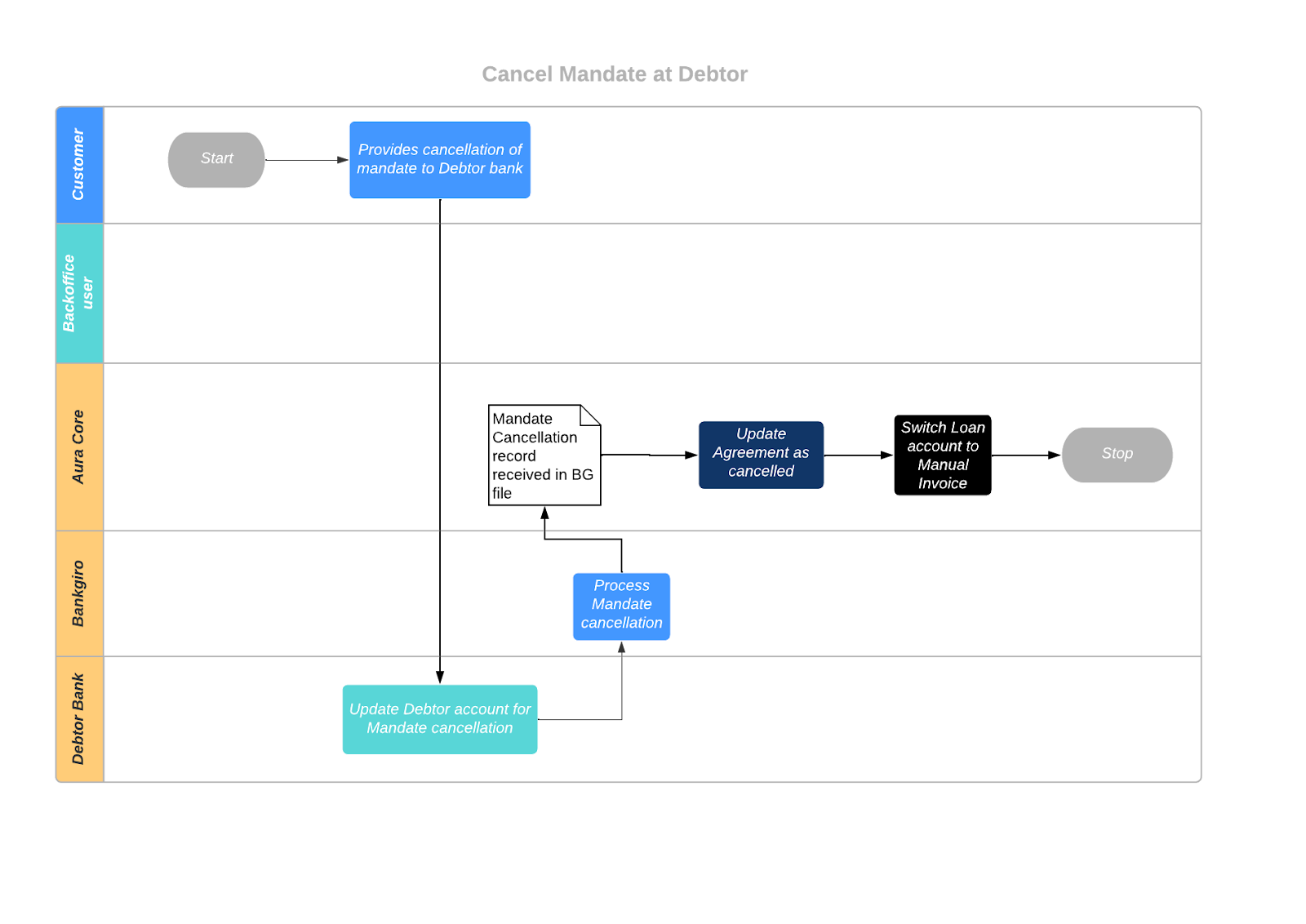

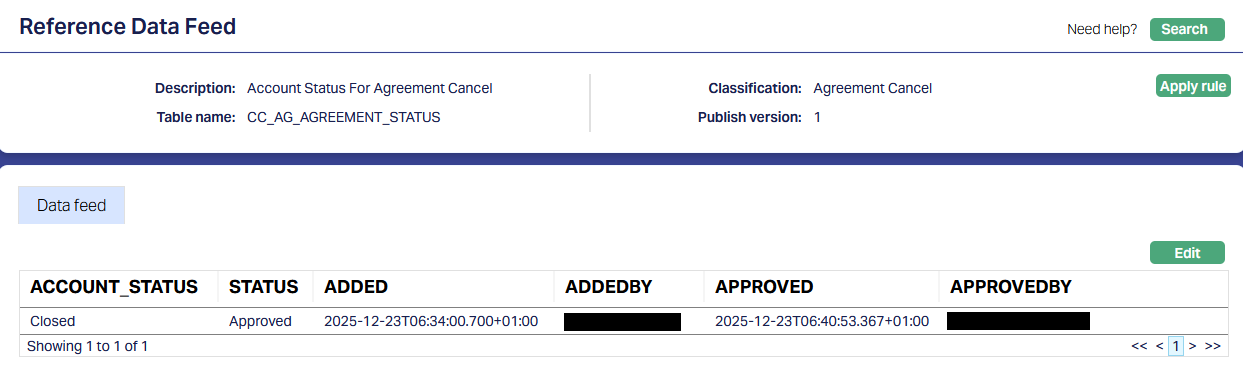

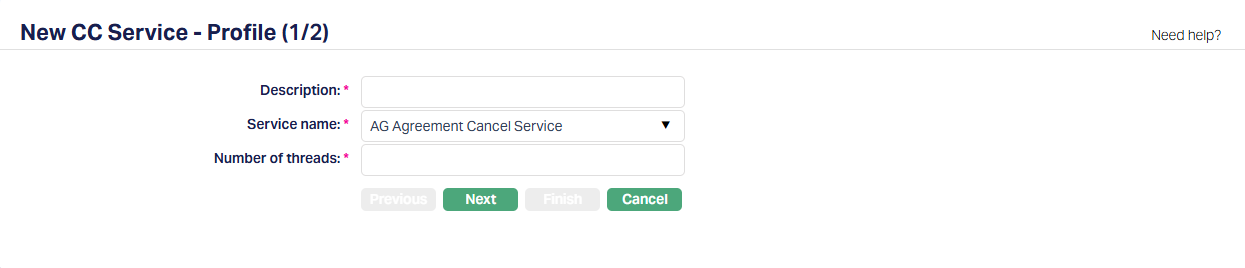

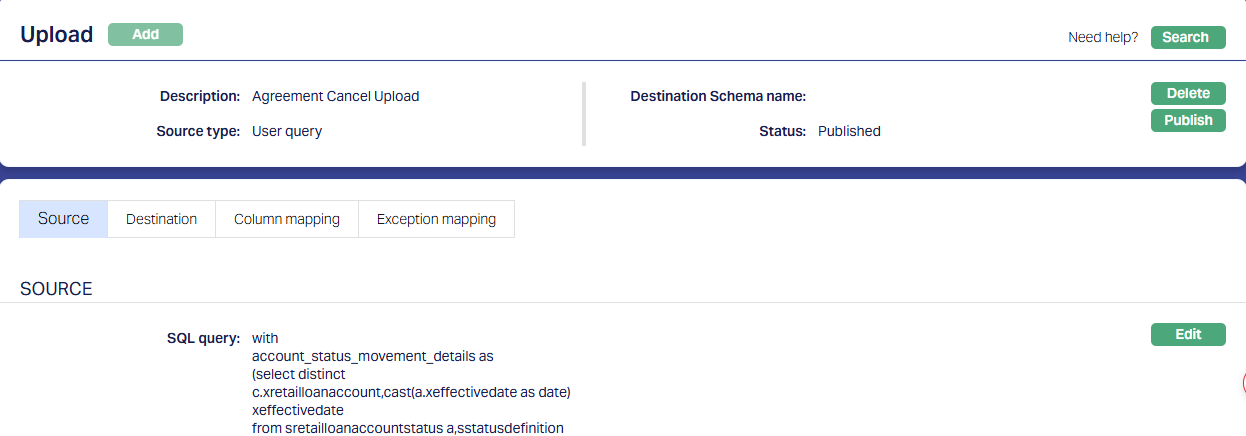

DIRECT DEBITS