Nostro BIC Mapping

This functionality allows you to maintain the relationship between banks by mapping with the BIC of the bank, their Internal Nostro account number, external account number and currency. Nostro resolution is done through Nostro BIC Mapping for all Incoming messages (SWIFT and TARGET 2) and for outgoing interbank transactions like MT200 and MT202.

To add Nostro BIC Mapping

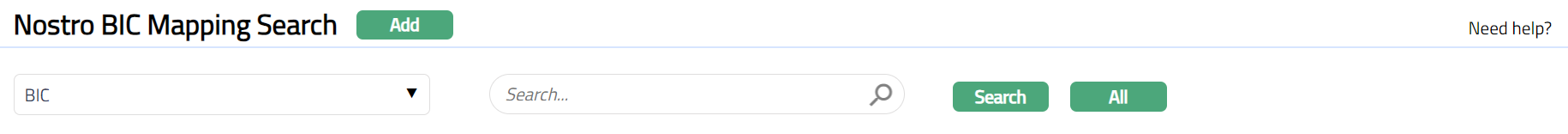

- From PaymentGrid menu, click Settings and then Nostro BIC mapping. Nostro BIC Mapping Search page appears.

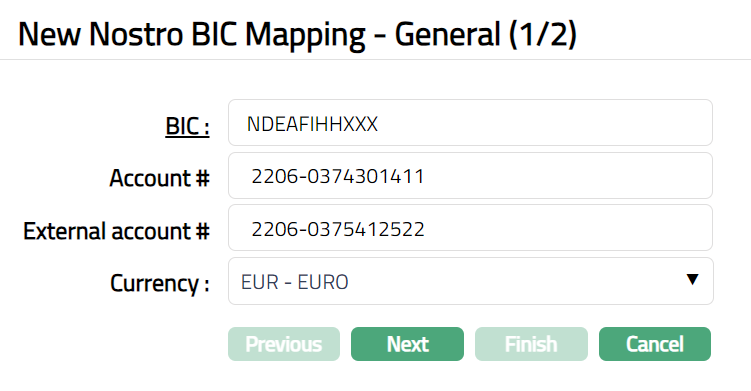

- Click Add. New Nostro BIC Mapping - General (1/2) page appears.

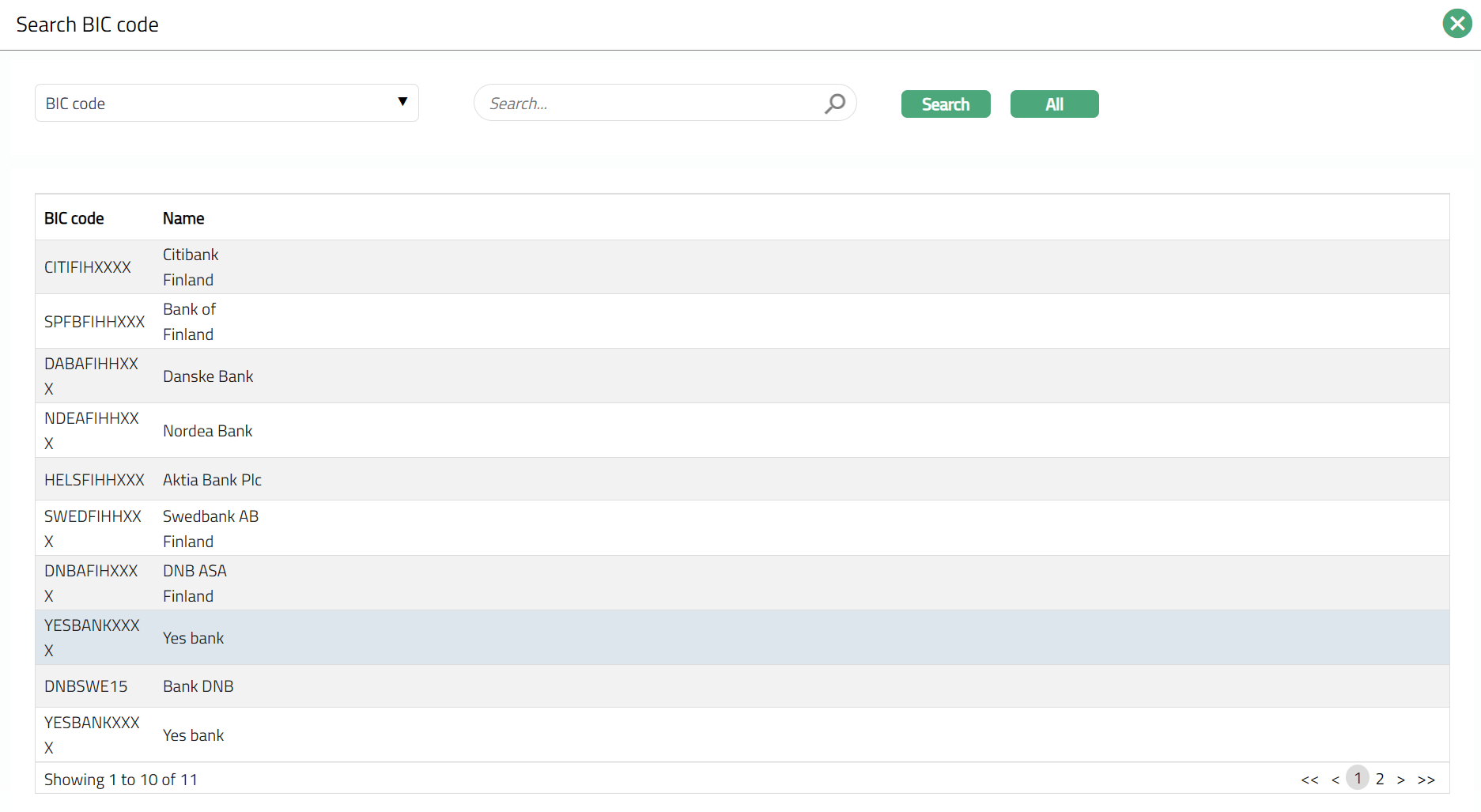

- Select BIC (Business Identifier Code) by clicking on BIC hyperlink. Search BIC code page appears with the list of active BIC's maintained under Admin > Management > Settlement Directory. You can search for a BIC code with relevant criteria and select the required BIC code. You can also input the BIC of the bank and select the required BIC code from the list displayed by CC-PG.

Enter Nostro Account # maintained in the Core Banking System.

Enter External account # i.e., the account number given by the bank where the above account is maintained.

Select **Currency **of the Nostro account from the drop-down list of active currencies maintained under Admin > System codes > Currencies > Currencies.

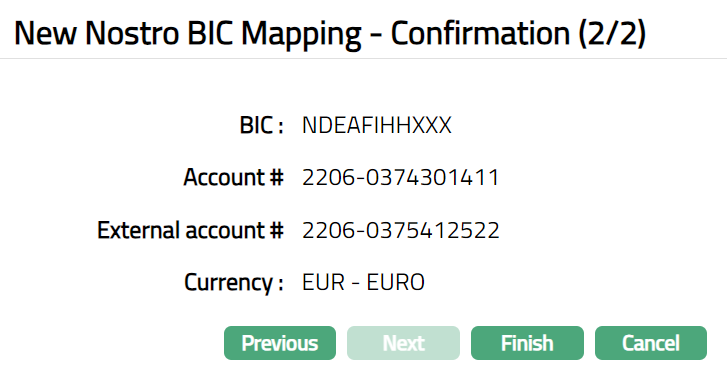

Click Next. New Nostro BIC mapping -- Confirmation (2/2) page appears.

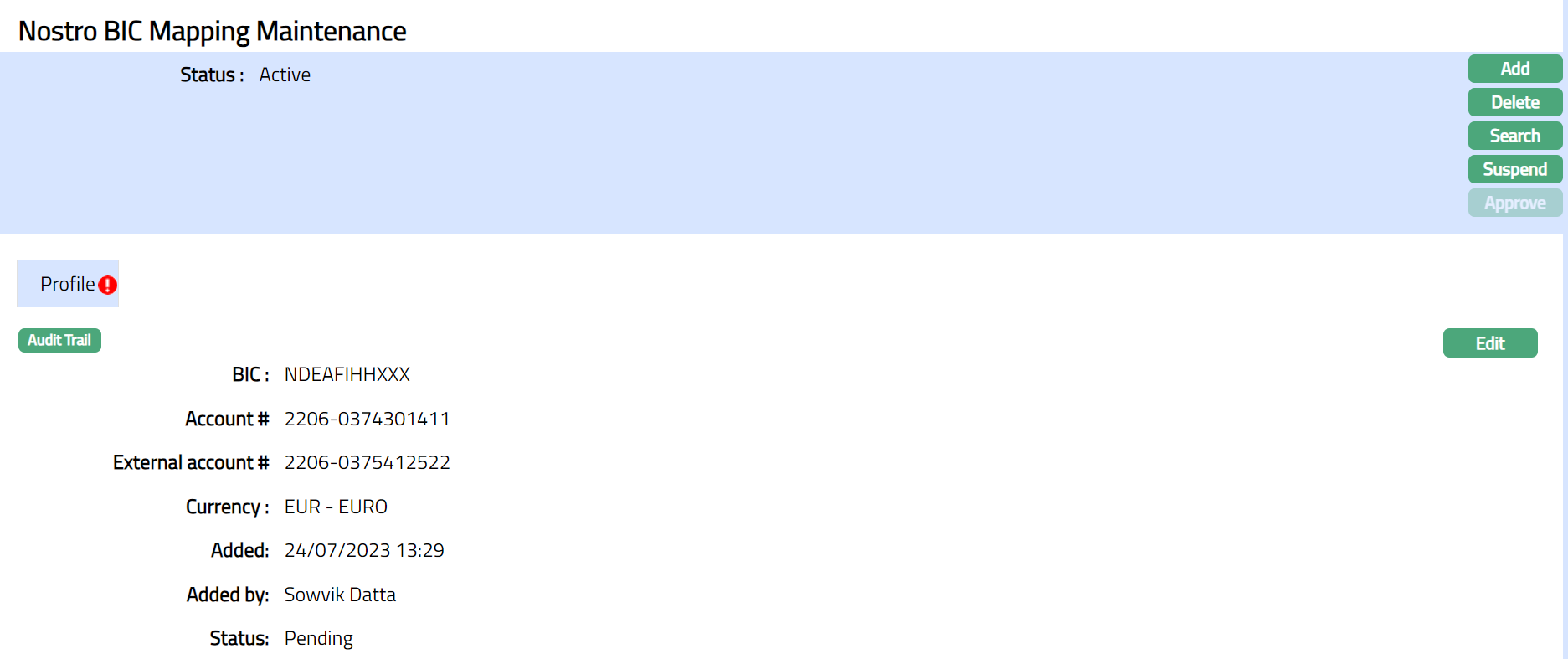

- Click Finish. Nostro BIC Mapping Maintenance page appears with the Nostro BIC Mapping details that you added, and you can see the Profile tab by default. The status of the record is Active.

Functions: Add, Delete, Search, Suspend, Activate, Approve, Edit

Note: On creation of a new Nostro BIC mapping record, the Status by default will be Active, record status will be Pending, and a blue bubble appears on the Profile tab. Only on Approval, the record Status gets changed to Approved and the blue bubble disappears.

Delete: You can delete Nostro BIC mapping record saved in CC-PG by a click on Delete button. CC-PG will ask for confirmation, on approving which the selected record will be deleted.

Approve: If you want to approve a Nostro BIC Mapping record, then retrieve the record and click on Approve. CC-PG will ask for confirmation. Once the tab is approved, status gets changed from Pending to Approved.

Suspend: You can suspend a Nostro BIC Mapping record by clicking on Suspend button. When you click on Suspend button, CC-PG will ask for confirmation. On confirmation CC-PG will suspend the Nostro BIC mapped record and Activate button will appear in place of the Suspend button.

Activate: If you want to activate a suspended Nostro BIC Mapping record then click on Activate button. CC-PG will ask for confirmation. On confirmation CC-PG will Activate the record and Suspend button will appear in place of Activate button.

Profile

The Profile tab, which is the default and only tab in the Nostro BIC Mapping Maintenance screen, shows the basic details of the Nostro BIC Mapping record.

- Access **Nostro BIC Mapping Maintenance **page and click Profile tab to view the details as per sample below. The details are defaulted from the entries that you made during New Nostro BIC Mapping record. For details refer to New nostro BIC mapping - General (1/2).

The additional fields that you can view in the Profile tab are as follows.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

**Approved **field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

Status field denotes the status of the tab.

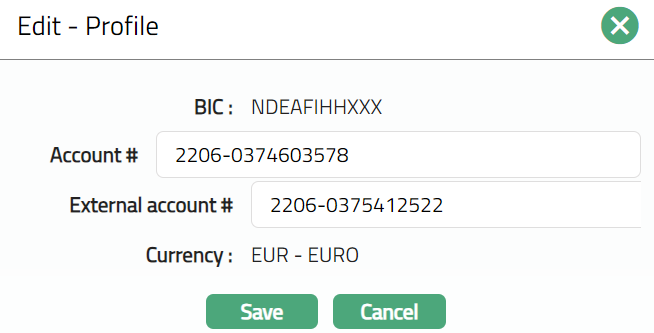

- Click Edit. Edit -- Profile page appears.

Note: The editable fields are Account# and External account#.

- Click Save. Profile tab appears with the edited details. Note: Status of the tab will be Pending, and a red bubble appears on Profile tab. Only on Approval Status gets changed to Approved and the red bubble disappears.

Functions: Edit