Card Account Product

Card Account Product menu allows you to maintain the details of various credit card products that are offered by the bank to the customers. These products can be created under various types like Credit card account, Bonus account and Dispute account. Once the card account product is created, you can maintain the various parameters related to it such as interests, charges, value dates, balance class, etc.

The following are the tabs in a Card Account Product.

Adding Card Account Product

- From Card menu, click Settings, and then Card accountproduct. The Card Account Product Search page appears. All Card account products available in Aura appear on the page.

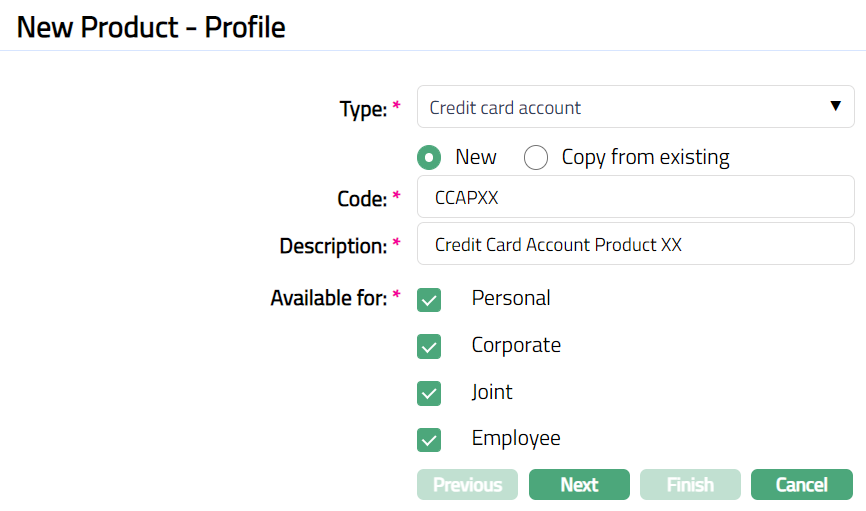

- Click Add. New Product -- Profile page appears.

Select Type of Credit card account from the available drop-down list of Product. Click "New" or "Copy from existing" radio button option for the Type selected.

Enter Code for the product. This has to be unique for the Entity.

Enter Description for the Product.

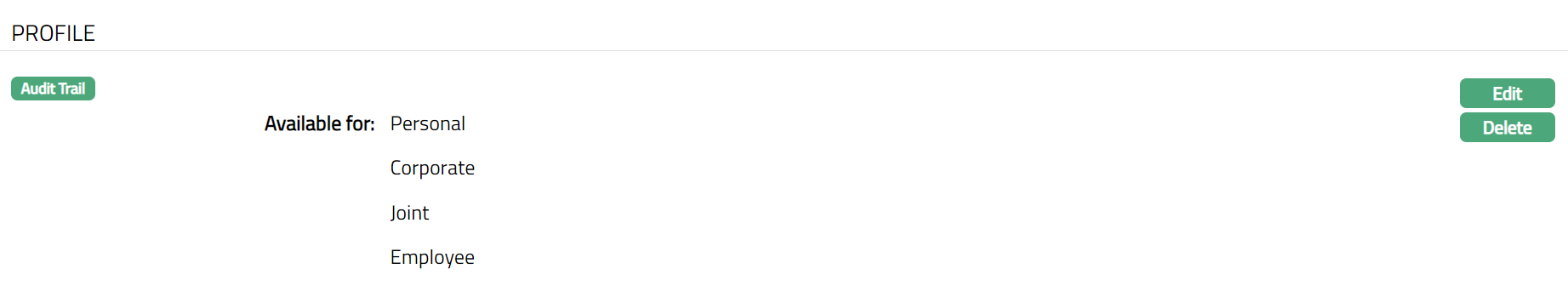

Select option for Available for field. This will determine the type of clients to which the product will be available. You can choose from:

Personal -- Single person

Corporate -- Organization

Joint -- Group of two or more persons

Employee -- Employee of the Bank.

Thus, if you want the Product to be available only for organizations, click only on the Corp orate checkbox.

Note: Employee and Joint ownership checkboxes will be enabled only when you select Personal.

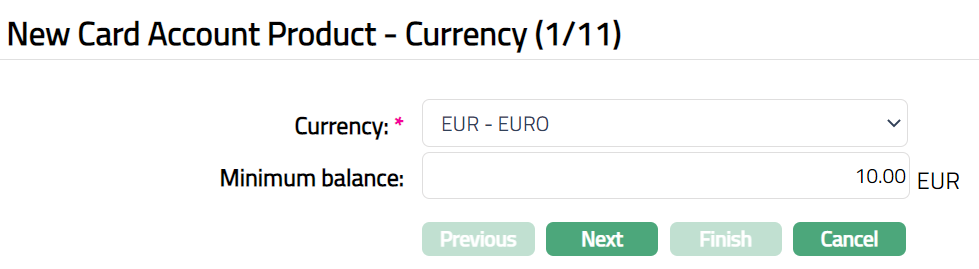

- Click Next. New Card Account Product -- Currency (1/11) page appears.

Select Currency for the Product from the dropdown list of GL Currencies. More currencies can be added during Edit using the Currency tab, once the Product record is created. Accounts for the product can be opened only in the selected currencies.

Enter Minimum balance that has to be maintained in accounts under the Product.

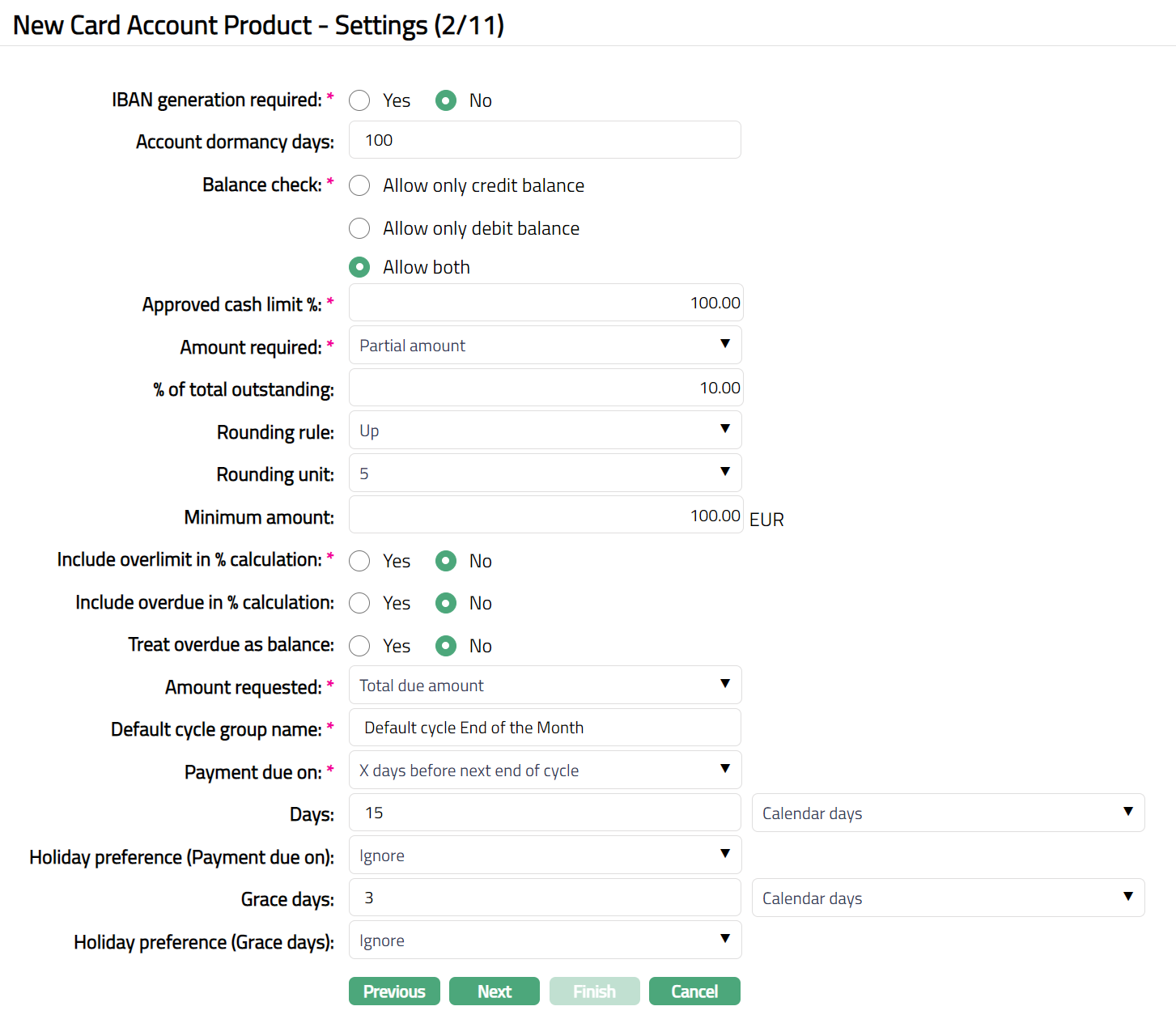

Click Next. New Card Account Product -- Settings (2/11) page appears.

Click Yes or No radio button for IBAN generation required for New Card Account Product. During account creation under the Product, if this has been selected as Yes, Aura will automatically create IBAN according to the IBAN format maintained at the Entity level.

Enter Account dormancy days for the Product. It is the number of days beyond which the account will be treated as dormant, if there are no activities in that account.

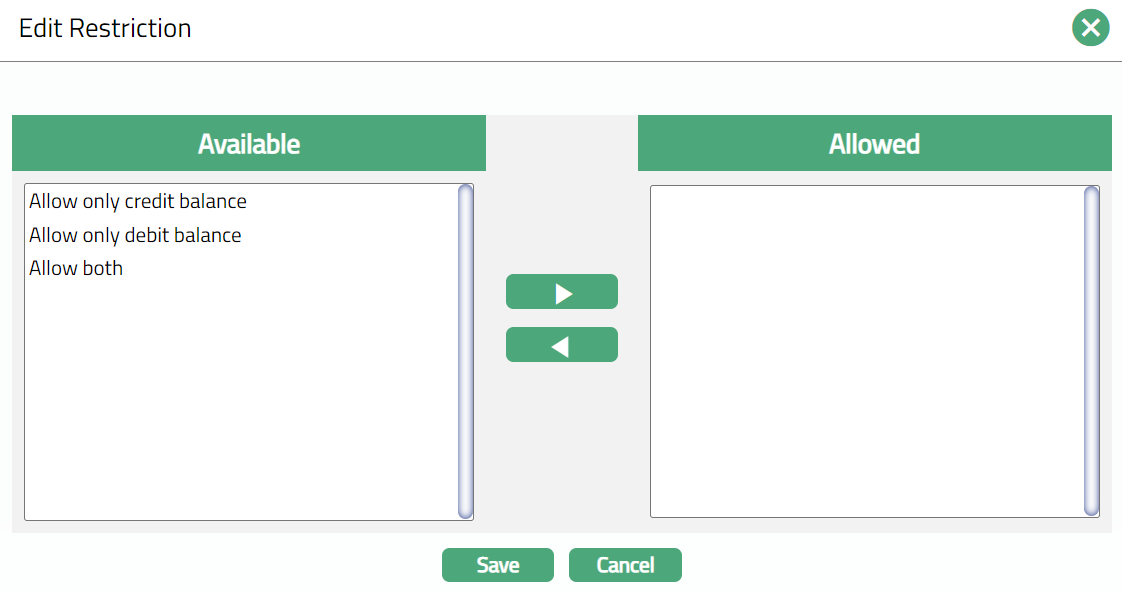

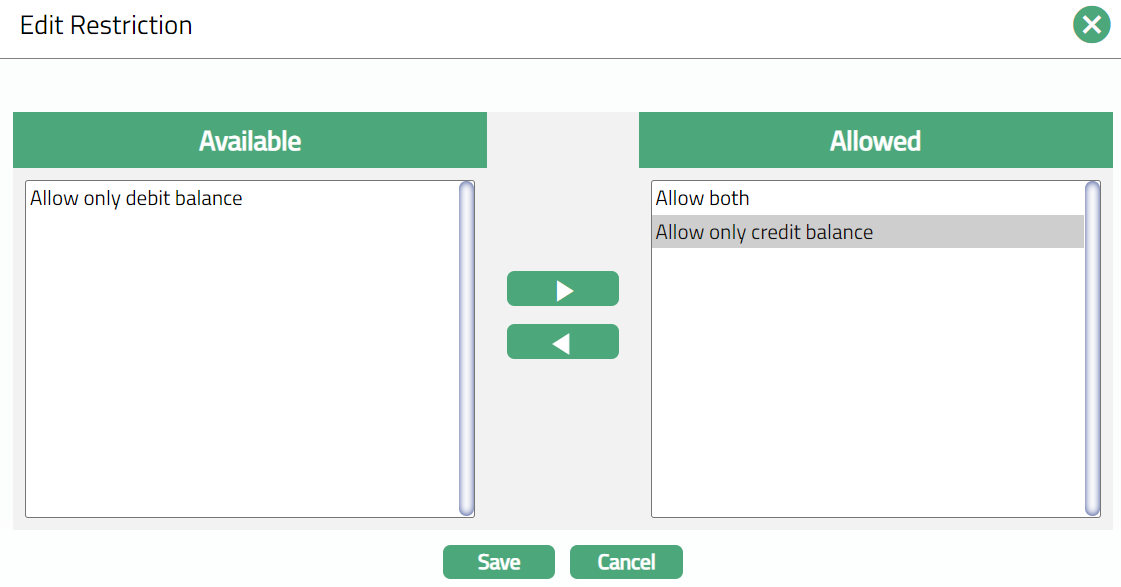

Select Balance check field as required from the available list.

- Allow only credit balance -- If you select Allow only credit balance, then Aura will allow only credit balance for that account. If a transaction would result in a debit balance, and if this account allows only credit balance, the transaction will fail.

Allow only debit balance -- If you select Allow only debit balance, then Aura will allow only debit balance for that account. If a transaction would result in a credit balance, and if this account allows only debit balance, the transaction will fail.

Allow both -- If you select Allow both, then Aura will allow both credit and debit balances for that account.

Enter Approved Cash Limit%. This is the percentage of the Credit Limit that will be available as the Cash Limit for the account. The Cash Limit% should be between 0 and 100. By default, 100% will get displayed and you can edit it as required.

Amount required is the minimum amount that the customer has to pay to avoid overdue interest or any overdue-related charges / status changes. The following options are available:

Partial Amount: If you want the customer to pay only a part amount of the total outstanding amount due for payment, choose this option. If you choose partial amount here, then Aura will ask to enter the percentage of the outstanding amount.

Total Due Amount: If you want the customer to pay the total outstanding amount due for payment, choose this option.

If Partial amount is selected in the Amount required field above, % of total outstanding will be enabled. Enter the % of total outstanding amount that needs to be paid on the payment due date.

If Partial amount is selected in the Amount required field above, Rounding rule will be enabled. This rule is used to round the Amount required. The following options are available:

Up: This option rounds the Amount required up to a higher amount.

Down: This option rounds the amount required down to a lower amount.

None: This option does not round the amount required and gives the exact calculated figure.

- If Partial amount is selected in the Amount required field above, Rounding unit is enabled. You can specify how much the rounding rule should be applied. The available options are:

1

5

10

50

100

Example:

If total balance is (-) 3427.60 and % of total outstanding is 5% and

Round up is marked as 1, and then amount required will be calculated as 172.

Round up is marked as 10, and then amount required will be calculated as 180.

Round up is marked as 100, and then amount required will be calculated as 200.

Note: The Amount required cannot be greater than the total balance outstanding in the account. If it is so during invoice generation, then the total balance outstanding becomes the Amount required.

- Enter Minimum amount for the partial payment. If the amount calculated using the % is less than the Minimum amount specified here, then, the Minimum amount specified here becomes the Amount required.

Examples:

a. Amount required is 5 % of balance, minimum 10. Total card usage and hence, outstanding = 150. Amount required = 5% of 150 = 7.5, subject to minimum of 10, and hence, 10

b. Amount required is 5% of balance, minimum 10. Total card usage and hence outstanding = 300. Amount required = 5% of 300 = 15, subject to minimum of 10 and hence, 15.

- Include Over limit in % calculation enables you to specify how the amount required is to be calculated when the account balance is over limit. By default, it will be No which means the over limit amount will be added in full; if checked, the over limit will be included in the % calculation and the amount required will be a % of the current due amount (including over limit).

Example 1

Amount required: 5% of total outstanding, minimum amount: 0, rounding up to 100. Account Limit: 10000

If total outstanding is 5000

Amount required = 5% of 5000 = 250, rounded up to [300.]

Example 2

Amount required: 5% of total outstanding, minimum amount: 100, rounding up to 0.

Account Limit: 10 000If total outstanding is 1000

Amount required = 5% of 1000 = 50, subject to minimum amount and hence, [100].

Example 3

Amount required: 5% of total outstanding, minimum amount: 100, rounding up to 0.

Account Limit: 10 000If total outstanding is 95

Amount required = 5% of 95 = 4.75, subject to minimum amount of 100. However, since the total outstanding is only 95, amount required will be 95.

Example 4

Amount required: 5% of total outstanding, minimum amount: 100, rounding up to 0. Include Overlimitin%calculationisNo

Account Limit: 10 000If total outstanding is 11000

Amount required = 5% of 10000 = 500 plus amount over limit 1000 = 1500.

Select the Amount requested from the preshipped values. If Total due amount is selected in the Amount required field, then Amount Requested will be defaulted to Total due amount and disabled. If the user chooses Partial amount in the Amount required field, then Amount Requested can be either Total due amount or Partial Amount.

Select option for when the Payment is due using the Payment due on.

The following table shows how the Payment due on is arrived at for each of the options. In this table, the Start date and End date for the cycle is taken as 26-Apr-13 and 25-May-13 respectively and X days is taken as 5 days.

| Sl | Option Chosen | Payment Due On |

|---|---|---|

| 1 | End of cycle | 25-May-13 |

| 2 | End of month | 31-May-13 |

| 3 | Last business day of month | 31-May-13 |

| 4 | Next end of cycle | 25-Jun-13 |

| 5 | Next end of month | 30-Jun-13 -- but, since this is |

| beyond Next End of Cycle (i.e., | ||

| 25-Jun-13), Payment due on will | ||

| be 25-Jun-13 | ||

| 6 | Last business day of next | 28-Jun-13 -- but, since this is |

| month | beyond Next End of Cycle (i.e., | |

| 25-Jun-13), Payment due on will | ||

| be 25-Jun-13 | ||

| 7 | X days after End of Cycle | 30-May-13 |

| 8 | X days after End of Month | 5-Jun-13 |

| 9 | X days before next End of | 20-Jun-13 |

| Cycle | ||

| 10 | X days before next End of | 25-Jun-13 |

| Month | ||

| 11 | X days after next End of | 5-Jul-13 -- but, since this is |

| Month | beyond Next End of Cycle (i.e., | |

| 25-Jun-13), Payment due on will | ||

| be 25-Jun-13 |

If option 11 is chosen above, Interest receivable Liquidation frequency options Daily and Monthly will be disabled.

Note: During every Invoice generation, if Payment due date is greater than next EOC, Payment due date will be taken as the next EOC. Similarly, if during invoice generation, if Payment due date falls within the same cycle, Payment due date will be taken as the current EOC date. This will be the case even if the Fix Payment Date at account level is marked Yes.

Also, the actual Payment Due Date will be in conjunction with the Invoice generation date (i.e., the Debit Interest liquidation date). For example, if the Frequency is quarterly and the Payment due on is Last business day of month, the payment due date for the invoice generated during March 2013 will be 29th Mar 2013, assuming 30th and 31st Mar are holidays.

If you have selected options 7 to 11 above, you need to specify the number of Days to be taken for the Payment due date calculation and also indicate if the number days should be taken as calendar days or business days.

Indicate Holiday Preference for the Payment due date calculated using the above values.

Following options are available:

Ignore: If the Payment due date falls on a holiday, and you still want to retain that date as the payment due date, choose Ignore. For Example, if the Payment due date is 25^th^ Dec which is a holiday and you have chosen Ignore, the payment due date will still remain 25^th^ Dec.

Next Business Day: If the Payment due date falls on a holiday, and you want to move it to the next business day, choose this option. In our above example, if this option is chosen, the Payment due date would be 26^th^ Dec.

Previous Business Day: If the Payment due date falls on a holiday, and you want to move it to the previous business day, choose this option. In our above example, if this option is chosen, the Payment due date would be 24^th^ Dec.

- Grace days enables you to provide a few additional days for the customer to make his payment; and if the customer makes the payment by the end of the Grace days period, the payment is considered as having been received by the Payment due date. Enter the required number of Grace days and indicate if these days should be calendar days / business days.

Note: If payment is made within the grace days, even if it is after the payment due date, the payment is not treated as overdue and associated charges / interest is not applied. If payment is not received within the payment date + grace days, then overdue interest accrual starts from the payment due date onwards.

Indicate Holiday preference for end of grace days calculated using the above values. If Grace days is business days, then this field will be disabled. In case of calendar days, indicate if the end of grace days arrived at is a holiday, whether it should not be moved / moved to next / previous working day.

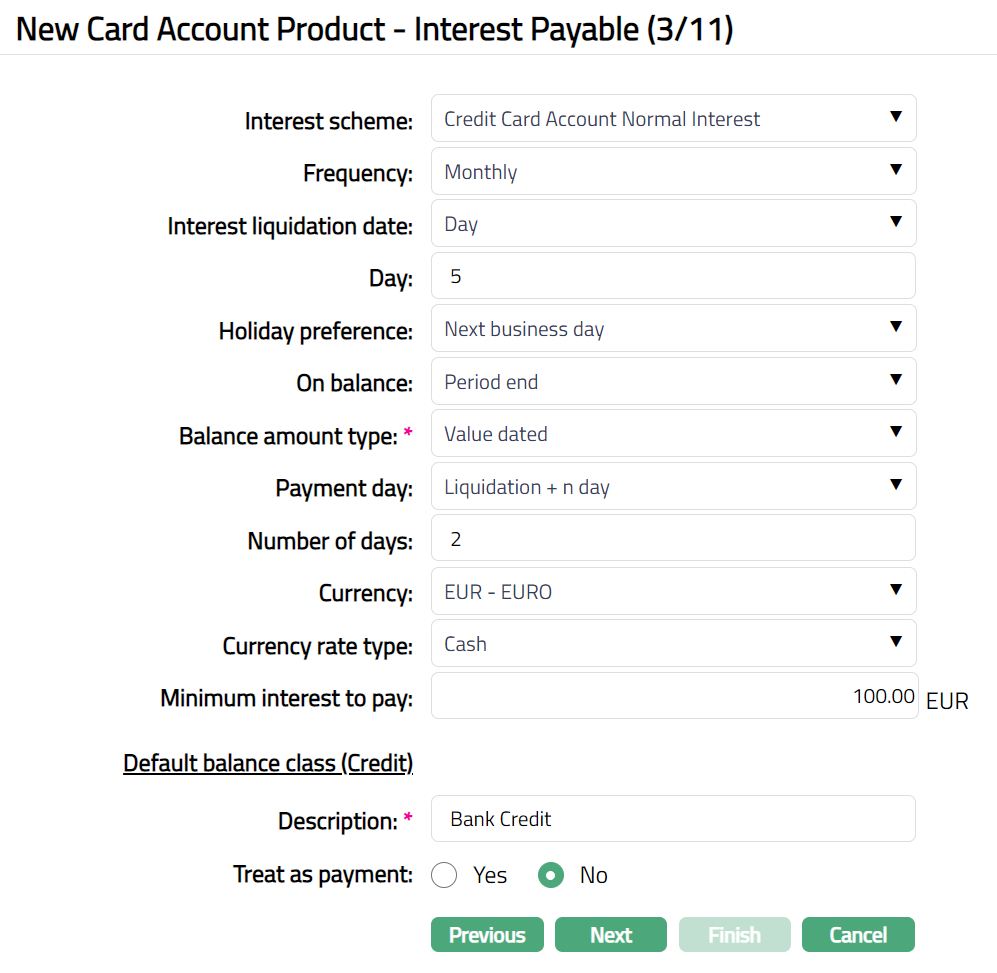

Click Next. New Card Account Product -- Interest Payable (3/11) page appears.

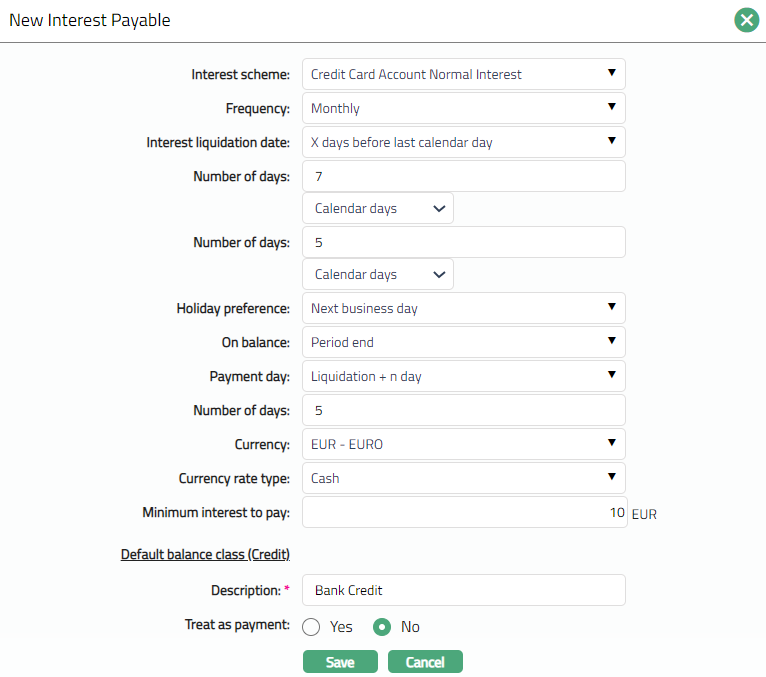

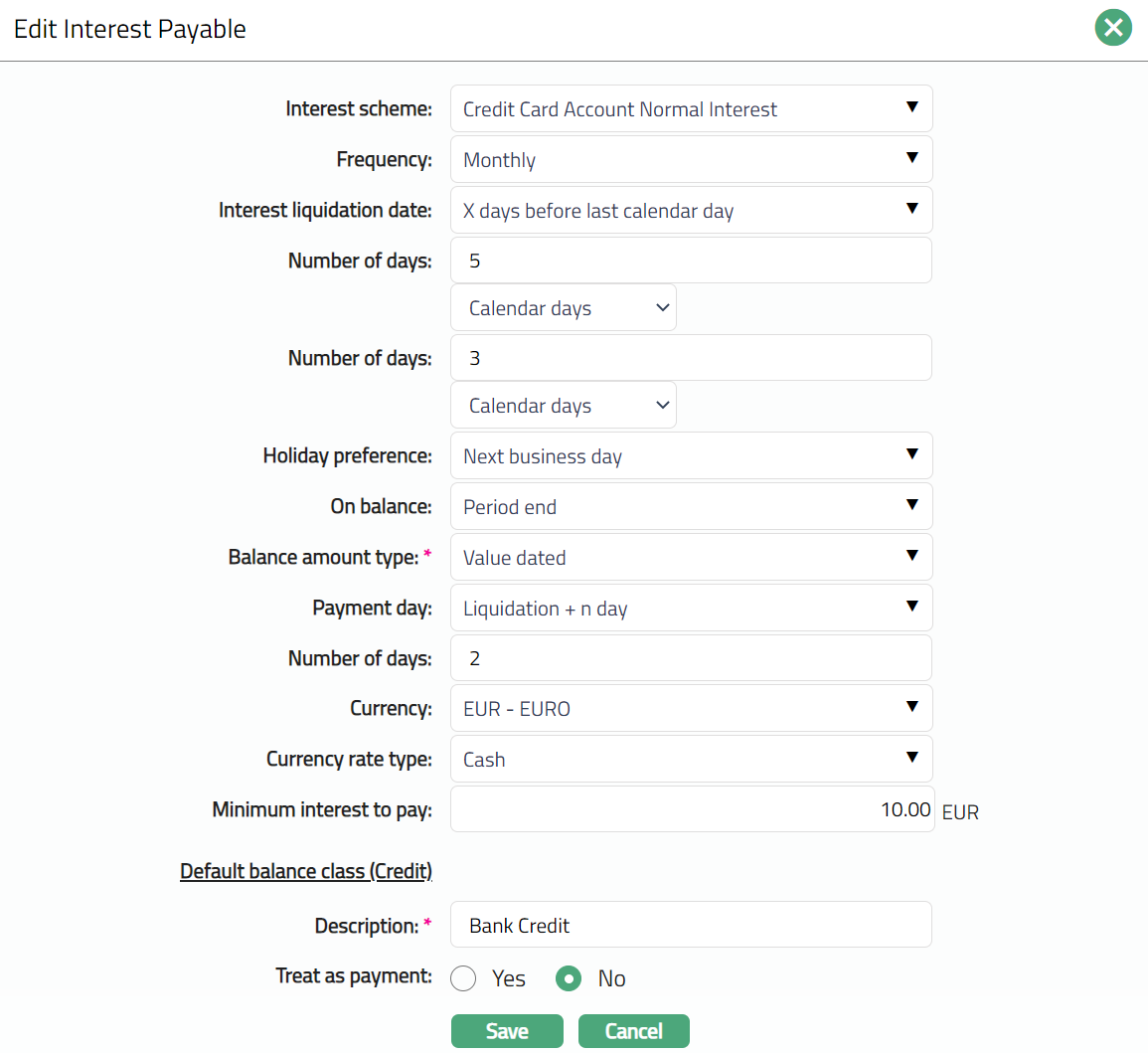

Select Interest scheme for Interest on the accounts under this product from the drop-down list. Interest schemes should have been created under Admin > System Codes > Interest > Interest Scheme.

Select Frequency for interest payable accrual from the drop-down list. Available options are: Monthly, Quarterly, Semi-annual and Annual.

If you select a frequency other than daily, you need to specify when the Interest has to be liquidated (capitalized) in the Interest Liquidation date. It is the date on which the interest will be posted to the accounts under this product. Available options are:

Day: If you want the interest to be liquidated on a specific date of the calendar month, choose this option. You need to then specify the day in the Day field.

Last Calendar day: If you want the interest to be liquidated on the last calendar day of the selected frequency instead of the specified date, choose this option.

Last Business day: If you want the interest to be liquidated on the last business day, then choose this option.

X days before last calendar day: If you want the interest to be liquidated x days before the last calendar day, then choose this option.

X days before last business day: If you want the interest to be liquidated x days before the last business day, then choose the option.

Note:

If Frequency is Monthly

If 31 is chosen and if the month has 30 days interest will be liquidated on 30th of the month

If 30 is chosen and if the month has 31 days interest will be liquidated on 30th of the month

If Frequency is quarterly, semi-annual or annual, the 'Day' parameter is interpreted in the same way as month; however, the month will be

March, June, September and December -- if it is quarterly,

June and December -- if it is semi-annual.

December -- if it is annual

If Interest liquidation date is selected as X days before last calendar day or x days before last business day, you need to then specify the value for the X in the Number of days field and also indicate if these days are calendar days or business days. The number of days field is available twice so that you can specify the interest liquidation date as: 5 business days before 2 calendar days before last calendar day.

If the interest liquidation date so arrived at is a holiday, specify how it should be treated using the Holiday preference. The options are:

Ignore: If this option is chosen, then the holiday will be ignored, and interest will be liquidated on same day. This is the default option selected.

Next business day: If this option is chosen, then interest will be liquidated on the next business day.

Previous business day: If this option is chosen, then interest will be liquidated on previous business day.

You can specify the balance amount on which the Interest payable is to be accrued using the On balance drop down list. Available options are: Daily and Period end. Based on the selected-On balance and Frequency, Aura accrues the interest. If you select the Frequency as Daily, then the On balance will be defaulted to Daily and you will not be allowed to select other options. Accrual and Liquidation will be either daily or period end.

Select Balance amount type from the drop-down list. It can be Book dated balance or Value dated balance. Based on the choice, the interest will be calculated on the chosen balance.

Select Payment day for the Interest payable from the drop-down list. Based on this, and the Number of days (next field), the date on which the interest will be paid to the accounts under this product is determined. Available options are On Liquidation day and Liquidation + n day. The latter will be allowed only on selecting the frequency as Monthly or Quarterly or Semi-annual or Annual.

Enter Number of days after which the liquidated interest is to be paid. This field will be enabled only on selecting Payment day as Liquidation plus n day.

If Frequency is Daily, Payment day can be only On Liquidation day and hence, this field is disabled.

If Frequency is Monthly, Payment day can be either of the options and hence this field is enabled. You need to enter the number of days between 1 and 30.

If Frequency is any other option, Payment day can be either of the options and hence this field is enabled. You need to enter the number of days between 1 and 90.

Select Currency for the minimum / maximum threshold for Interest from the drop-down list of GL currencies for the Entity.

Select Currency rate type for the minimum / maximum threshold for Interest. The interest will be accrued in terms of the Account Currency and will be converted into the equivalent amount in terms of the above Currency using this Currency Rate Type, as on the date of Liquidation.

Enter Minimum interest to pay. Aura will liquidate the interest to the account only if the accrued interest is greater than or equal to this amount.

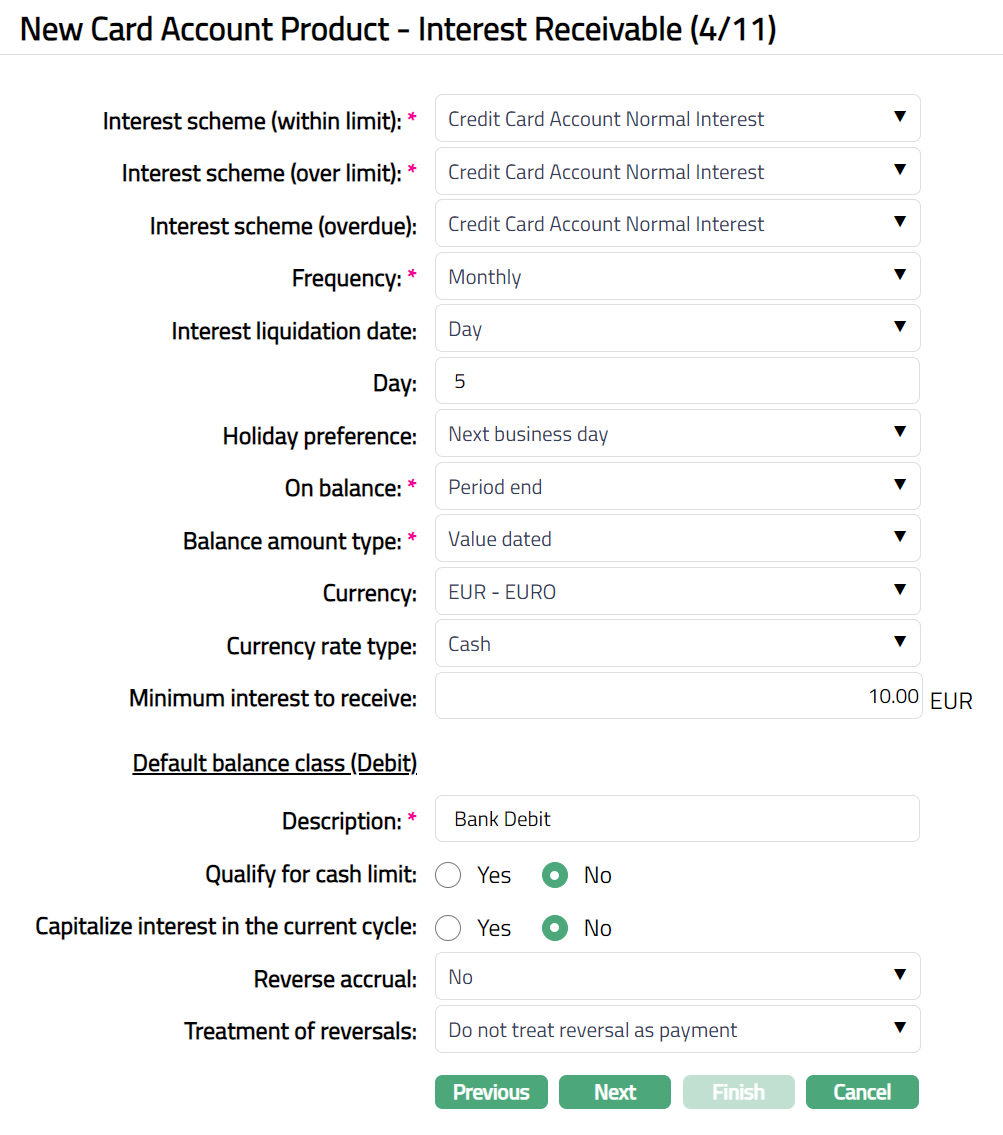

Click Next. New Card Account Product -- Interest Receivable (4/11) page appears.

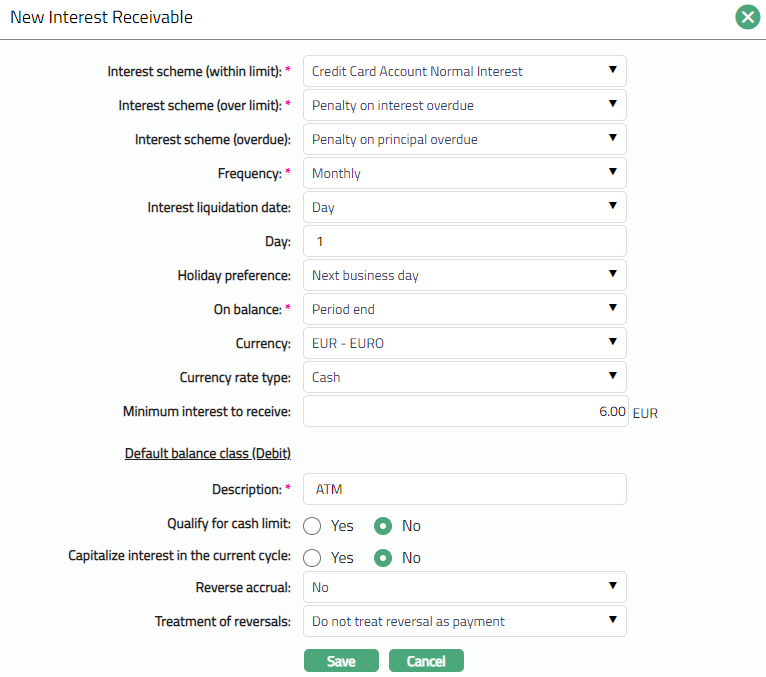

Select Interest scheme (within limit) from the drop-down list. This interest scheme will be used to calculate the interest receivable up to the approved limit for the default balance class for accounts under this product. Interest schemes should have been created under Admin > System Codes > Interest > Interest Scheme.

Select Interest scheme (over limit) from the drop-down list. In case the balance of any account under this product goes beyond the limit specified for the account, the interest receivable on such over limit amount will be calculated using this Interest scheme. Interest schemes should have been created under Admin > System Codes > Interest > Interest Scheme.

Select Interest Scheme (Overdue) from the drop-down list. This interest scheme will be used to calculate the interest receivable on the overdue amounts -- i.e., where the payment by due date + grace days does not cover the Amount required.

Select Frequency for the Interest Receivable accrual from the drop-down list. Available options are: Monthly, Quarterly, Semi-annual and Annual.

If you select a frequency other than daily, you need to specify when the Interest has to be liquidated (capitalized) in the Interest Liquidation date. It is the date on which the interest will be posted to the accounts under this product. Available options are as follows:

- Day: If you want the interest to be liquidated on a specific date of the calendar month, choose this option. You need to then specify the day in the Day field.

Last Calendar Day: If you want the interest to be liquidated on the last calendar day of the selected frequency instead of the specified date, choose this option.

Last Business day: If you want the interest to be liquidated on the last business day, then choose this option.

X days before last calendar day: If you want the interest to be liquidated x days before the last calendar day, then choose this option.

X days before last business day: If you want the interest to be liquidated x days before the last business day, then choose the option.

Note:

If frequency is Monthly

If 31 is chosen and if the month has 30 days interest will be liquidated on 30th of the month

If 30 is chosen and if the month has 31 days interest will be liquidated on 30th of the month

If frequency is quarterly, semi-annual or annual, the 'Day' parameter is interpreted in the same way as month; however, the month will be

March, June, September and December -- if it is quarterly,

June and December -- if it is semi-annual

December -- if it is annual

If Interest liquidation date is selected as X days before last calendar day or X days before last business day, you need to then specify the value for the X in the Number of days field and also indicate if these days are calendar days or business days. The number of days field is available twice so that you can specify the interest liquidation date as: 5 business days before 2 calendar days before last calendar day

If interest liquidation date so arrived at is a holiday, specify how it should be treated using the Holiday preference. The options are:

Ignore: If this option is chosen, then the holiday will be ignored, and interest will be liquidated on same day. This is the default option selected.

Next business day: If this option is chosen, then interest will be liquidated on the next business day.

Previous business day: If this option is chosen, then interest will be liquidated on previous business day

You can specify the balance amount on which the Interest receivable is to be accrued using the On balance drop down list. Available options are: Daily and Period end. Based on the selected-On balance and Frequency, Aura accrues the interest. If you select the Frequency as Daily, then the On balance will be defaulted to Daily and Aura will not allow you to select other options. Accrual and Liquidation will be either daily or period end.

Select Balance amount type from the drop-down list. It can be Book Dated balance or Value dated balance. Based on the choice, the interest will be calculated on the chosen balance.

Select the Treatment for reversals from the preshipped values. The options are as follows:

Do not consider reversals as payment: If you select this option the reversal that comes in will not be treated as payment.

Consider reversals in current cycle as payment: If you select this option the reversals in current cycle will be treated as payment.

Consider reversals in current and past cycle as payment: If you select this option reversal in current and past cycle will be treated as payment.

Select Currency name for the minimum / maximum threshold for Interest from the drop-down list of GL currencies for the Entity.

Select Currency rate type for the minimum / maximum threshold for Interest. The interest will be accrued in terms of the Account Currency and will be converted into the equivalent amount in terms of the above Currency using this Currency Rate Type, as on the date of Liquidation.

Enter Minimum interest to receive. This is the minimum interest amount that will be collected for an account under this product.

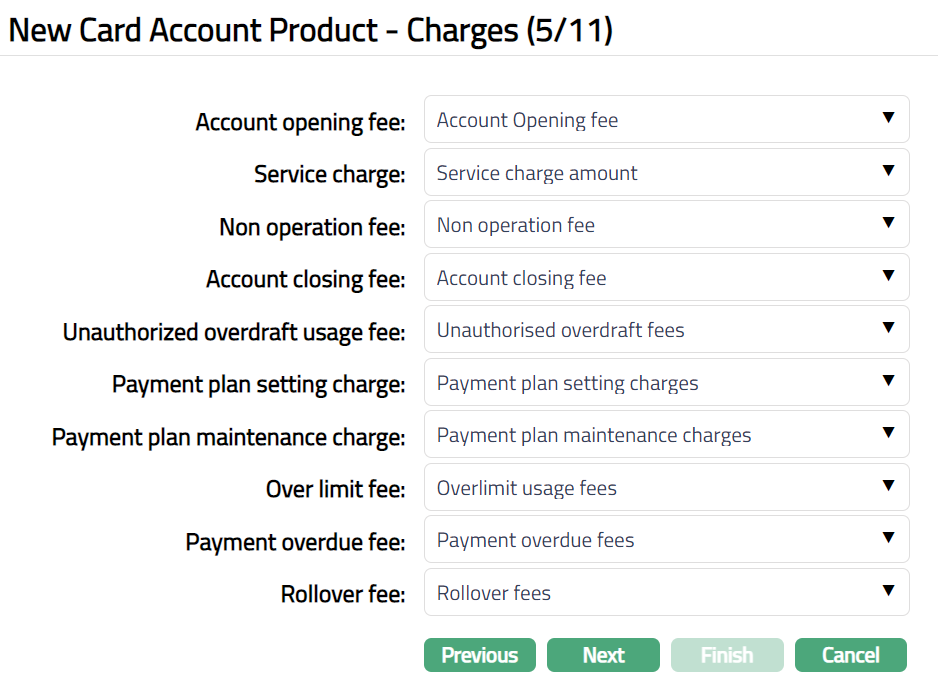

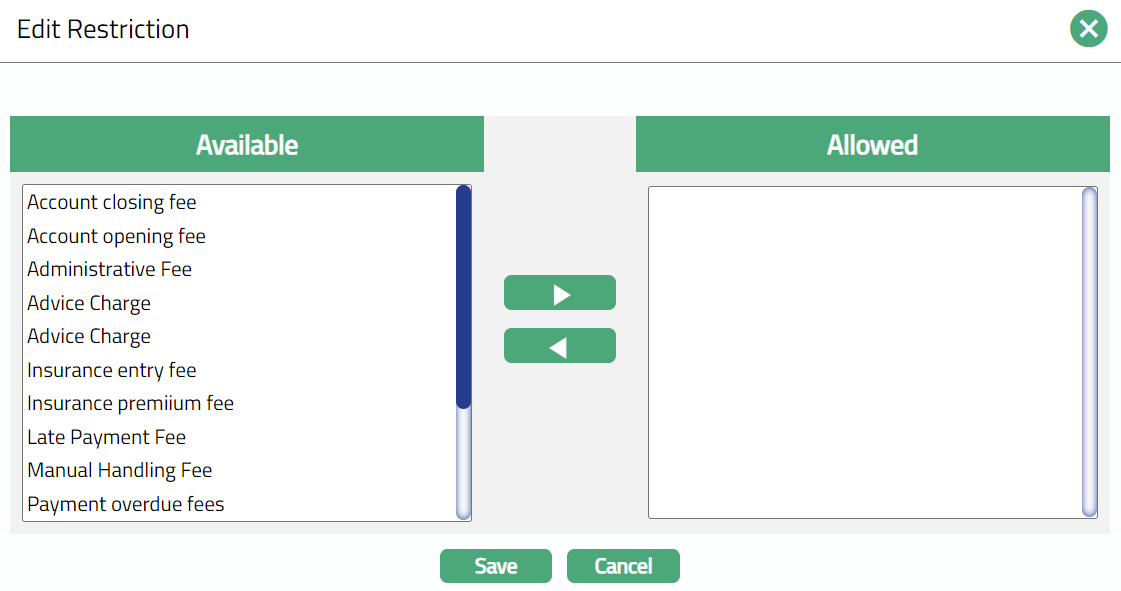

Click Next. New Card Account Product -- Charges (5/11) page appears.

If you want to collect charges for opening the account, select Account opening fee from the list of the Event based, Flat Charges.

If you want to collect service charges, select Service charge from the list of Periodic, Flat or Banded Charges. If banded, the card account outstanding balance will be the basis for the charge.

If you want to levy a charge for an account that remains unoperated, select the Nonoperation fee from the list of Periodic, Flat Charges. If there were no card transactions during the charge period, the charge will be applied at the end of the period. It will be only arrear charges.

If you want to collect charges for closure of the account, select Account closing fee from the list of Event based Flat charges.

If you want to levy a charge every time the account goes beyond its authorized limit, select Unauthorized overdraft usage fee from the list of Event based Flat charges.

Payment plan setting charge will be applied for every payment plan for an account when activated for the first time. Select the charge from the list of Event based Flat charges.

Payment plan maintenance charge will be applied whenever the Amount required is derived from an active Payment plan. Select the charge from the list of Periodic, Flat charges.

Over limit fee will be applied if the account goes beyond limit for even one day during the cycle. Select the charge from the list of Periodic, Flat charges.

Payment overdue fee will be levied if the customer miss's payment of minimum requested amount and if the payment status is Normal. Select the charge from the list of Event based Flat charges.

Note: Any additional charges, apart from those defined above, can be defined for the Product using Additional Charges tab in edit mode.

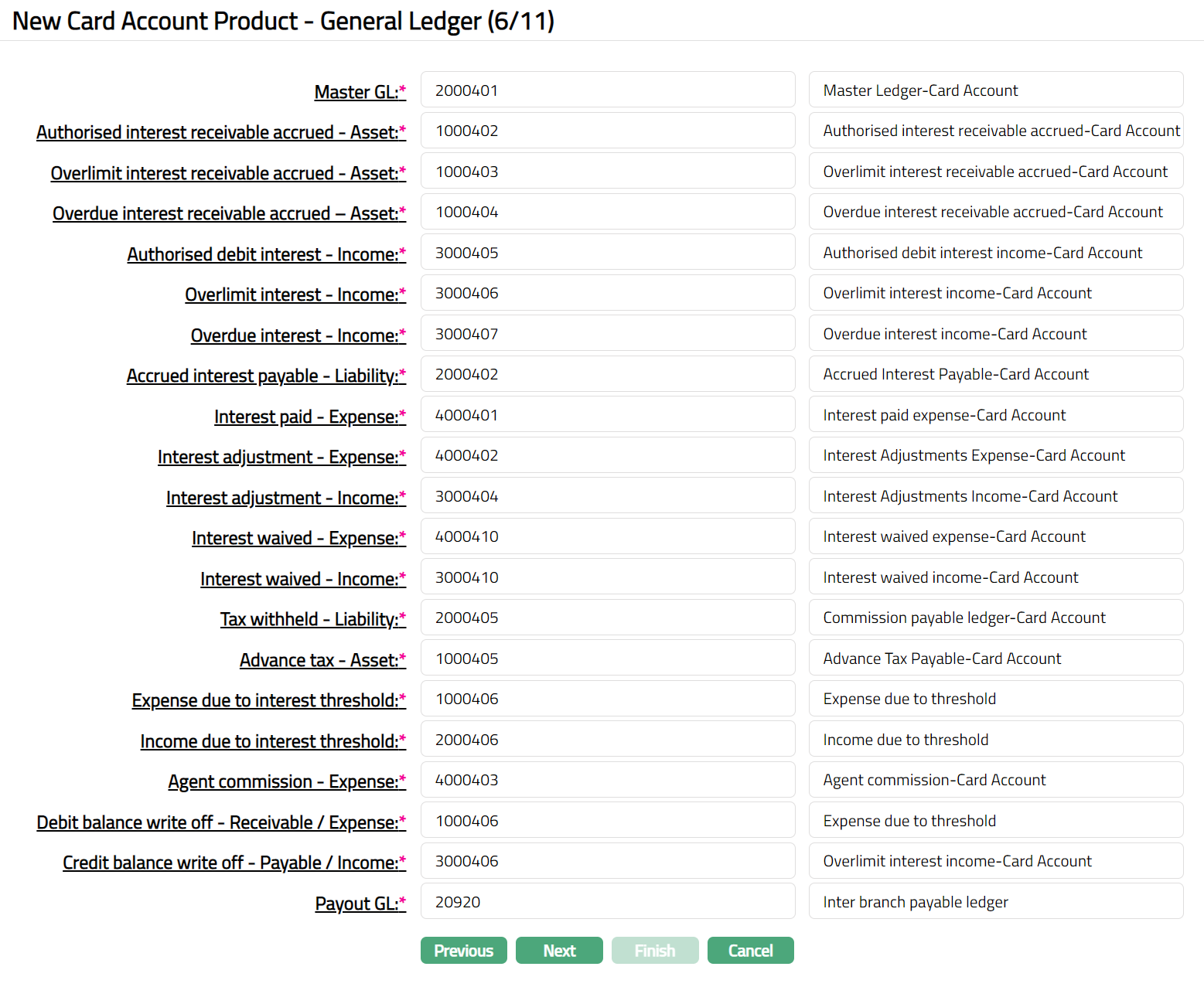

- Click Next. New Card Account Product --General Ledger (6/11) page appears.

- You will see the list of various GLs required to account for the events in the life cycle of the Product. The table below gives the fields, the use and the conditions for each of these GLs. You can either directly input the Ledger # or click on the hyperlink to see the list of GLs satisfying these conditions and select the required Ledger #.

| SL.No | Fields | Used | List of Accounts based on |

|---|---|---|---|

| 1 | Master GL | as the Master GL to record all transactions | ledger type Asset, Liability or Neutral where |

| under this product | the cash account is No, Manual posting is No | ||

| and the FX consolidation is blank | |||

| 2 | Interest paid -- Expense | for accounting the Interest paid on accounts | ledger type Expense |

| under this product | |||

| 3 | Interest earned -- Income | for accounting the Interest earned on accounts | ledger type Income |

| under this product | |||

| 4 | Accrued interest payable -- | for accounting the Accrued interest payable | ledger type Liability |

| Liability | on accounts under this product | ||

| 5 | Accrued interest receivable -- | for accounting the Accrued interest receivable | ledger type Asset |

| Asset | on accounts under this product | ||

| 6 | Interest adjustment -- Income | for accounting the Interest adjustment income | ledger type Income |

| on accounts under this product | |||

| 7 | Interest adjustment -- Expense | for accounting the Interest adjustment expense | ledger type Expense |

| on accounts under this product | |||

| 8 | Tax withheld -- Liability | for accounting the Tax withheld on accounts | ledger type Liability |

| under this product | |||

| 9 | Agent commission -- Expense | for accounting the Agent commission expense | ledger type Expense |

| on accounts under this product | |||

| 10 | Payout GL | for accounting the Payout GL on accounts | ledger type Income and Asset |

| under this product | |||

| 11 | Authorised Debit-Income | for accounting the Authorised Debit interest | ledger type Income |

| Income on accounts under this product | |||

| 12 | Overlimit Interest -- Income | for accounting the Overlimit Interest Income | ledger type Income |

| on accounts under this product | |||

| 13 | Authorised interest receivable accrued -- Asset | for accounting the accrual of Authorised | ledger type Asset |

| interest receivable on accounts under this | |||

| product | |||

| 14 | Overlimit interest receivable accrued -- Asset | for accounting the accrual of Overlimit | ledger type Asset |

| interest receivable on accounts under this | |||

| product | |||

| 15 | Overdue interest receivable -- Asset | for accounting the Overdue interest receivable | ledger type Asset |

| on accounts under this product | |||

| 16 | Overdue interest -- Income | for accounting the Overdue interest Income | ledger type Income |

| on accounts under this product | |||

| 17 | Debit Balance write off -- Receivable / Expense | for accounting the Debit Balance written off | ledger type Receivable or Expense |

| on accounts under this product | |||

| 18 | Credit Balance write off -- Payable / Income | for accounting the Credit Balance written off | ledger type Payable or Income |

| on accounts under this product | |||

| 19 | Overdue interest adjustment -- Receivable / Expense | for accounting the Overdue interest adjustment | ledger type Receivable or Expense |

| on accounts under this product | |||

| 20 | Over limit interest adjustment -- Receivable / Expense | for accounting the Over limit interest adjustment | ledger type Receivable or Expense |

| on accounts under this product | |||

| 21 | Expense due to interest threshold | for accounting the Expense due to interest | ledger type Asset or Expense |

| threshold on accounts under this product | |||

| 22 | Income due to interest threshold | for accounting the Income due to interest | ledger type Income or Liability |

| threshold on accounts under this product |

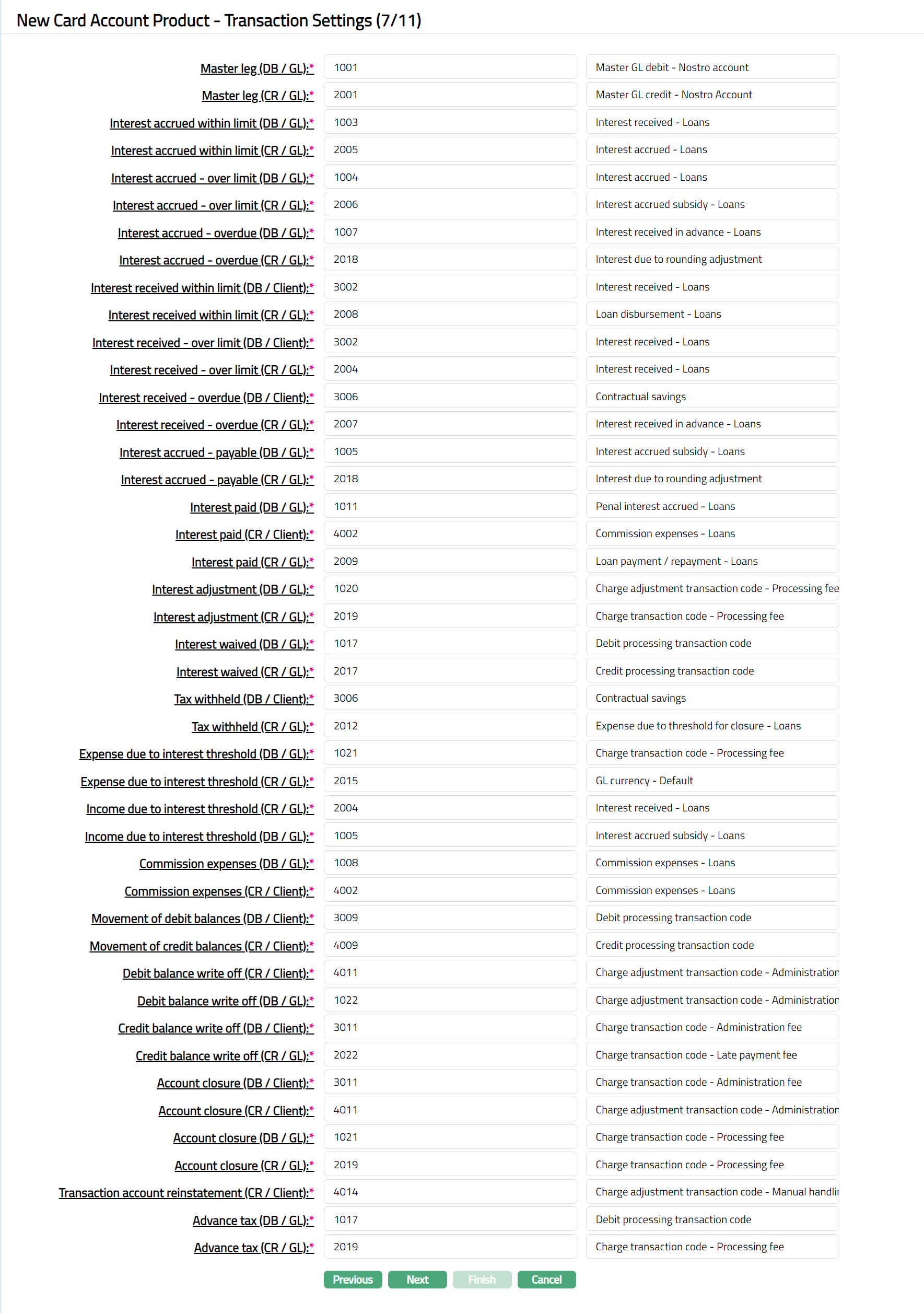

- Click Next. New Card Product -- Transaction Settings (7/10) page appears.

| Sl | Field Name of Transaction Settings | Used For | List of Transaction Codes Based On | Event When It Will Be Used |

|---|---|---|---|---|

| 1 | Master GL (DB/GL) | All the debit transactions affecting the | General Ledger Debit | All |

| accounts under this product. | ||||

| 2 | Master GL (CR/GL) | All the credit transactions affecting the | General Ledger Credit | All |

| accounts under this product. | ||||

| 3 | Interest Paid (DB/GL) | All the Interest paid transactions in the | General Ledger Debit | Liquidation |

| General Ledger Account | ||||

| 4 | Interest Paid (CR/Client) | All Interest paid transactions in the | Client Account Credit | Liquidation |

| Client Account | ||||

| 5 | Interest Paid (CR/GL) | All Interest paid transactions in the | General Ledger Credit | Liquidation |

| General Ledger Account | ||||

| 6 | Interest Received (DB/Client) | All Interest received transactions in the | Client Account Debit | Liquidation |

| Client Account | ||||

| 7 | Interest Received (CR/GL) | All Interest received transactions in the | General Ledger Credit | Liquidation |

| General Ledger Account | ||||

| 8 | Interest Accrued (DB/GL) | All Interest accrued transactions in the | General Ledger Debit | Accrual |

| General Ledger account | ||||

| 9 | Interest Accrued (CR/GL) | All Interest accrued transactions in the | General Ledger Credit | Accrual |

| General Ledger account | ||||

| 10 | Interest Adjustment (DB/GL) | All Interest adjustment transactions in the | General Ledger Debit | Reversal |

| General Ledger account | ||||

| 11 | Interest Adjustment (CR/GL) | All Interest adjustment transactions in the | General Ledger Credit | Reversal |

| General Ledger account | ||||

| 12 | Overdue Accrual (DB/GL) | All Overdue accrued transactions in the | General Ledger Debit | Accrual |

| General Ledger account | ||||

| 13 | Overdue Accrual (CR/GL) | All Overdue accrued transactions in the | General Ledger Credit | Accrual |

| General Ledger account | ||||

| 14 | Overdue Liquidation (DB/Client) | All Overdue Liquidation transactions in the | Client Account Credit | Liquidation |

| Client account | ||||

| 15 | Overdue Liquidation (CR/GL) | All Overdue Liquidation transactions in the | General Ledger Credit | Liquidation |

| General Ledger | ||||

| 16 | Account Closure (DB/Client) | All Account Closure transactions in the | Client Account Debit | Closure of Accounts |

| Client account | ||||

| 17 | Account Closure (CR/Client) | All Account Closure transactions in the | Client Account Credit | Closure of Accounts |

| Client account | ||||

| 18 | Account Closure (DB/GL) | All Account Closure transactions in the | General Ledger Debit | Closure of Accounts |

| General Ledger | ||||

| 19 | Account Closure (CR/GL) | All Account Closure transactions in the | General Ledger Credit | Closure of Accounts |

| General Ledger | ||||

| 20 | Tax Withheld (DB/Client) | All Tax withheld transactions in the Client | Client Account Debit | Liquidation |

| account | ||||

| 21 | Tax Withheld (CR/GL) | All Tax withheld transactions in the General | General Ledger Credit | Liquidation |

| Ledger | ||||

| 22 | Debit Balance Write Off (CR/Client) | All Debit balance write off transactions in | Client Account Credit | |

| the Client account | ||||

| 23 | Debit Balance Write Off (DB/GL) | All Debit balance write off transactions in | General Ledger Debit | |

| the General Ledger | ||||

| 24 | Credit Balance Write Off (DB/Client) | All Credit balance write off transactions in | Client Account Debit | |

| the Client account | ||||

| 25 | Credit Balance Write Off (CR/GL) | All Credit balance write off transactions in | General Ledger Credit | |

| the General Ledger | ||||

| 26 | Overdue Interest Adjustment (DB/GL) | All Overdue Interest adjustment transactions | General Ledger Debit | Reversal |

| in the General Ledger | ||||

| 27 | Overdue Interest Adjustment (CR/GL) | All Overdue Interest adjustment transactions | General Ledger Credit | Reversal |

| in the General Ledger | ||||

| 28 | Overlimit Interest Adjustment (DB/GL) | All Overlimit Interest adjustment transactions | General Ledger Debit | Reversal |

| in the General Ledger | ||||

| 29 | Overlimit Interest Adjustment (CR/GL) | All Overlimit Interest adjustment transactions | General Ledger Credit | Reversal |

| in the General Ledger | ||||

| 30 | Commission Expenses (DB/GL) | All commission expense transactions in the | General Ledger Debit | Expense |

| General Ledger account | ||||

| 31 | Commission Expenses (CR/Client) | All commission expense transactions in the | Client Account Credit | Expense |

| Client account | ||||

| 32 | Movement of Debit Balance (DB/Client) | All Movement of debit balance transactions in | Client Account Debit | |

| the Client account | ||||

| 33 | Movement of Credit Balance (CR/Client) | All Movement of credit balance transactions in | Client Account Credit | |

| the Client account | ||||

| 34 | Expense Due to Interest Threshold (DB/GL) | All Expense due to interest threshold | General Ledger Debit | Expense |

| transactions in the General Ledger | ||||

| 35 | Expense Due to Interest Threshold (CR/Client) | All Expense due to interest threshold | Client Account Credit | Expense |

| transactions in the Client account | ||||

| 36 | Income Due to Interest Threshold (CR/GL) | All Income due to interest threshold | General Ledger Credit | Income |

| transactions in the General Ledger | ||||

| 37 | Income Due to Interest Threshold (DB/Client) | All Income due to interest threshold | Client Account Debit | Income |

| transactions in the Client account |

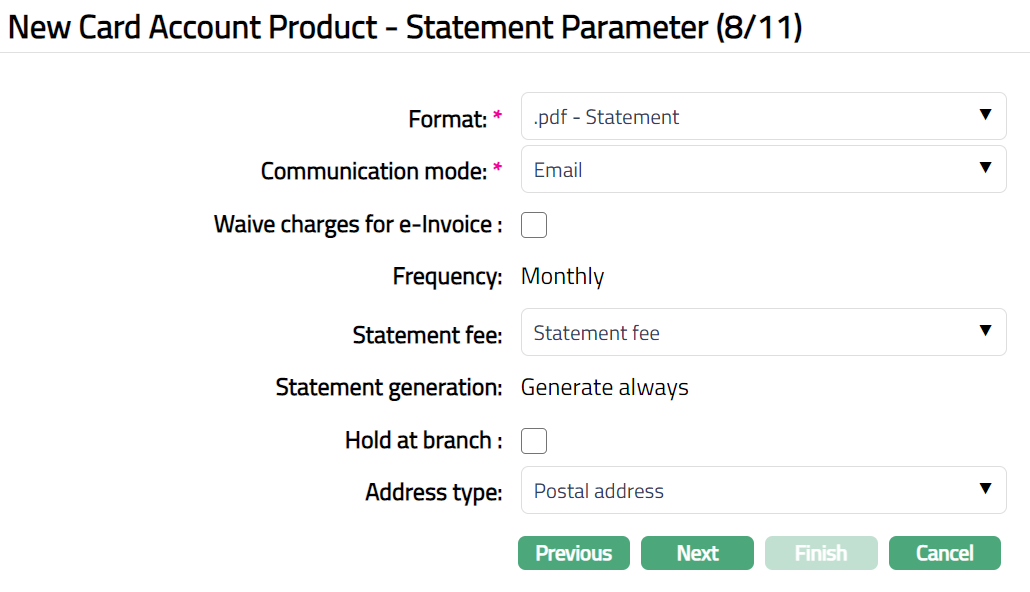

- Click Next. New Card Account Product -- Statement Parameter (8/10) page appears.

Select Format of the statement to be generated from the drop-down list of formats that have been maintained under Admin > System codes > Generic definition > Invoice formats. The statement chosen here will be considered as the Invoice for the accounts under this product.

Select Communication mode from the drop-down list -- i.e., the manner in which you want to send the statement. Available options are Email, Data handoff, e-invoice, Email, Paper, SMS, Web hotel.

The Waive charge for e-invoice flag is enabled only if communication mode is e-invoice. If checked charges for e-invoice will be waived off. If the flag is unchecked, then the charges will be levied for the e-invoice based on the statement fee chosen.

The Frequency of the statement is defaulted from the Interest Receivable frequency, as the interest liquidation and statement (invoice) generation go hand-in-hand. This cannot be edited.

If you want to levy a Statement fee for generation of this statement, select the charge from the list of Event based, Flat or Banded Charges. If banded, the card account balance will be taken as the basis for the charge.

Note: Any additional statements that may be required for the accounts under this product may be defined using Statement tab in edit mode for those accounts.

By default, Statement generation will be Generate always. This indicates that, the account statement will be generated only if there is any activity in the account or balance in the account.

If Hold at Branch flag is checked, then the statement is generated but instead of despatch to customer, it is held back at the branch.

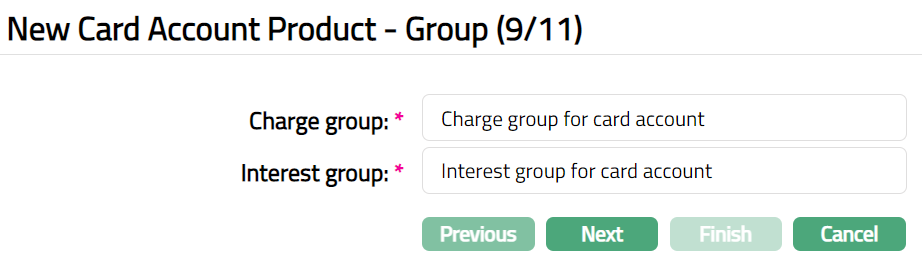

Click Next. New Card Account Product -- Group (9/10) page appears.

Enter name for the default Charge group. All the charges defined for the Product would be created under this Charge group as the Default Charge Group for the product.

Enter name for the default Interest group. All the interests defined for the Product would be created under this Interest group as the Default Interest Group for the product.

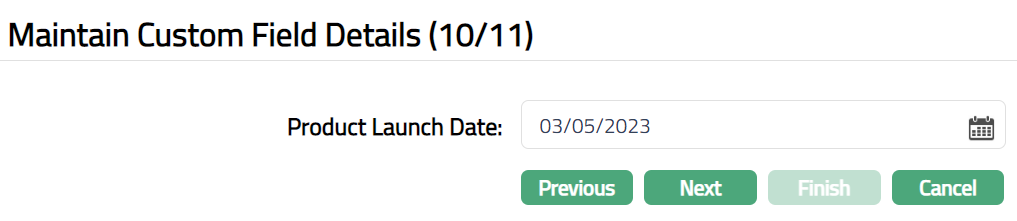

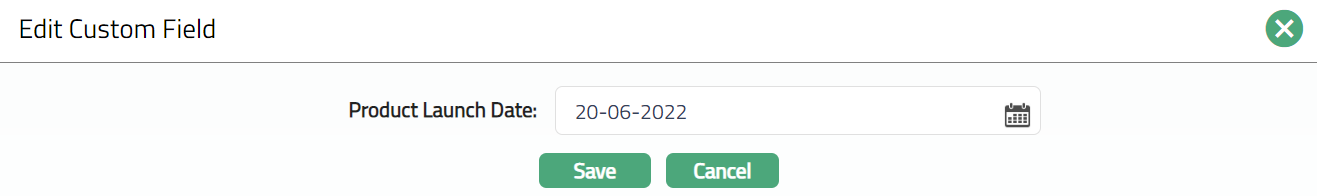

Click Next. Maintain Custom Field Details (10/11) page appears.

Select Product Launch Date from the available calendar.

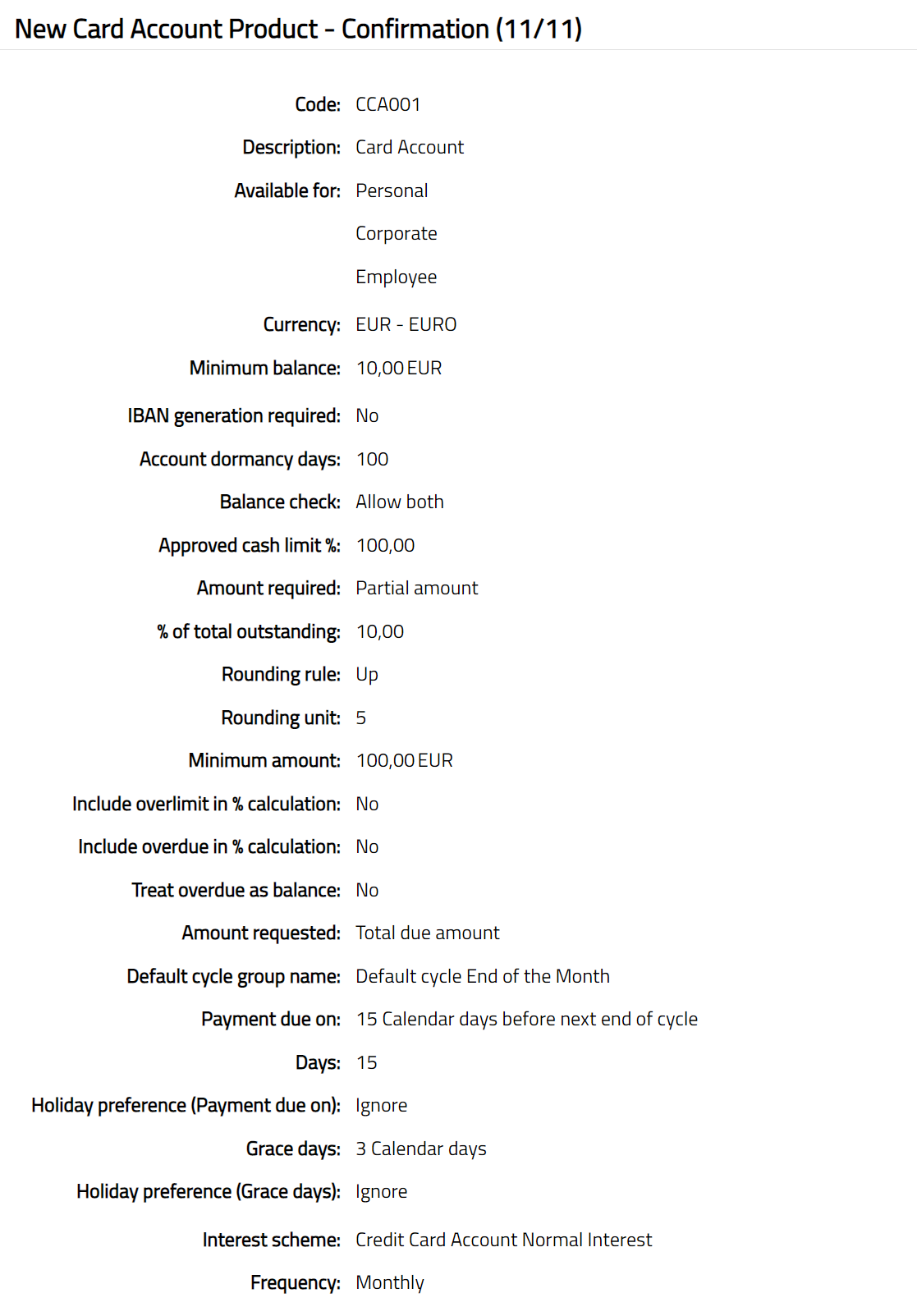

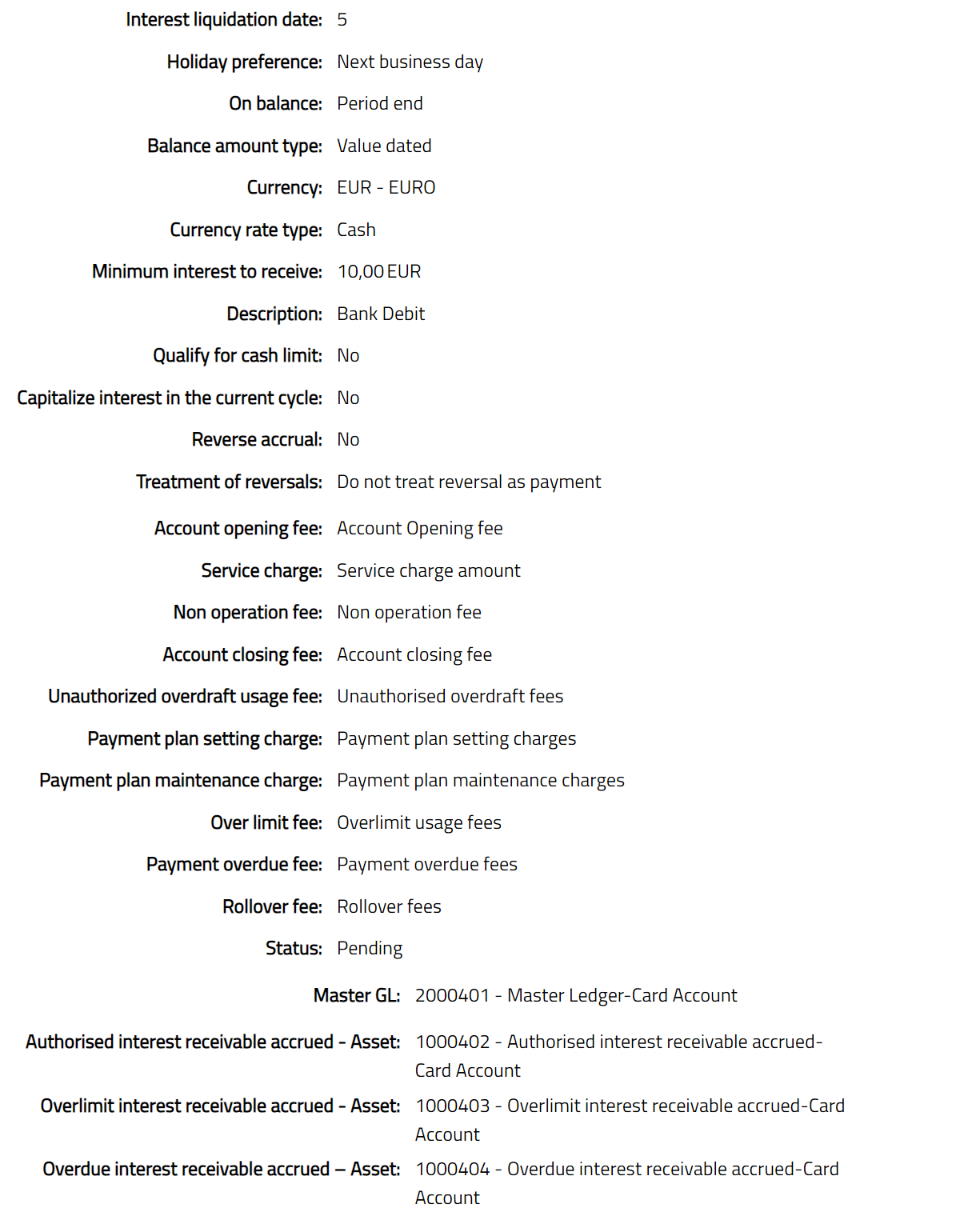

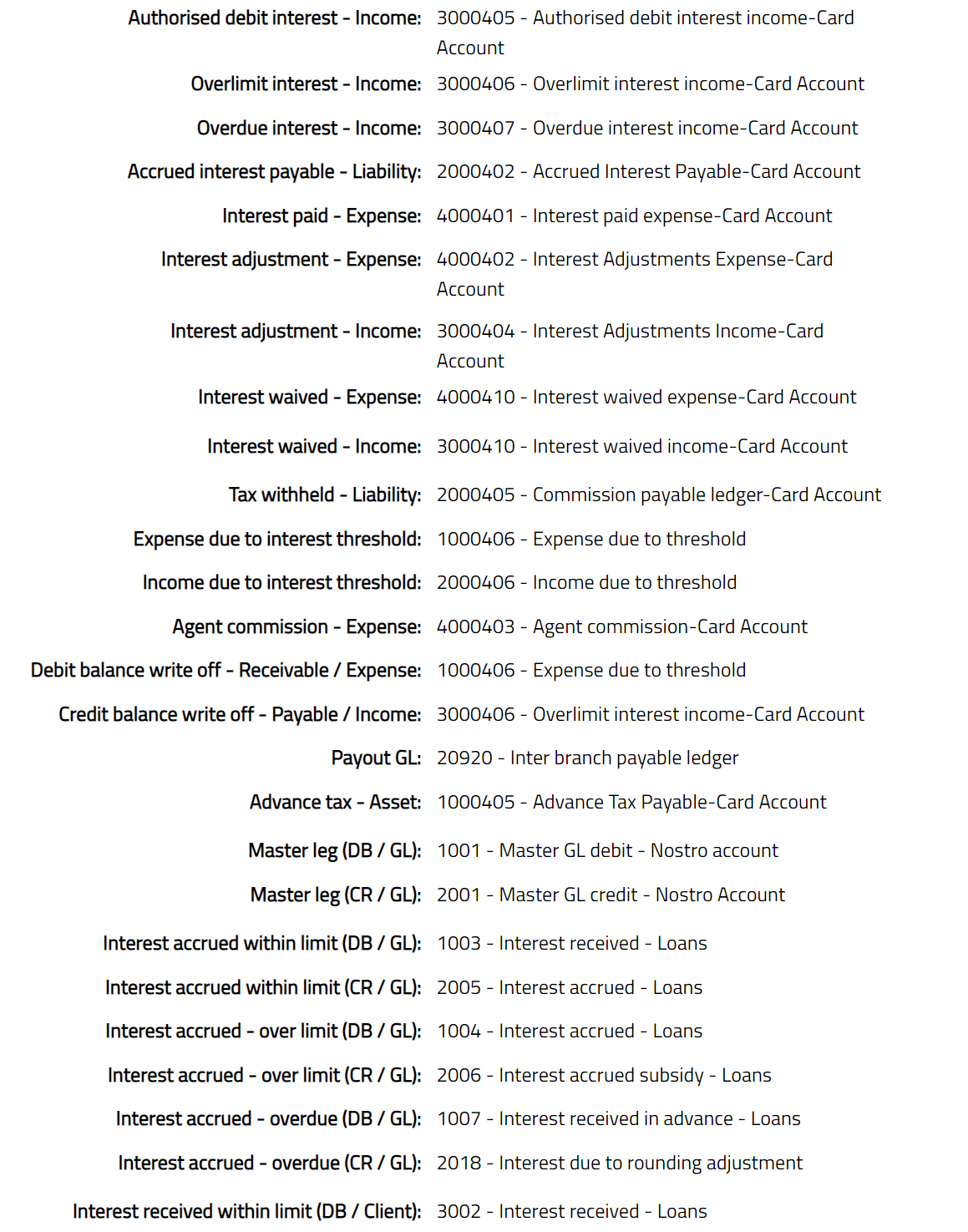

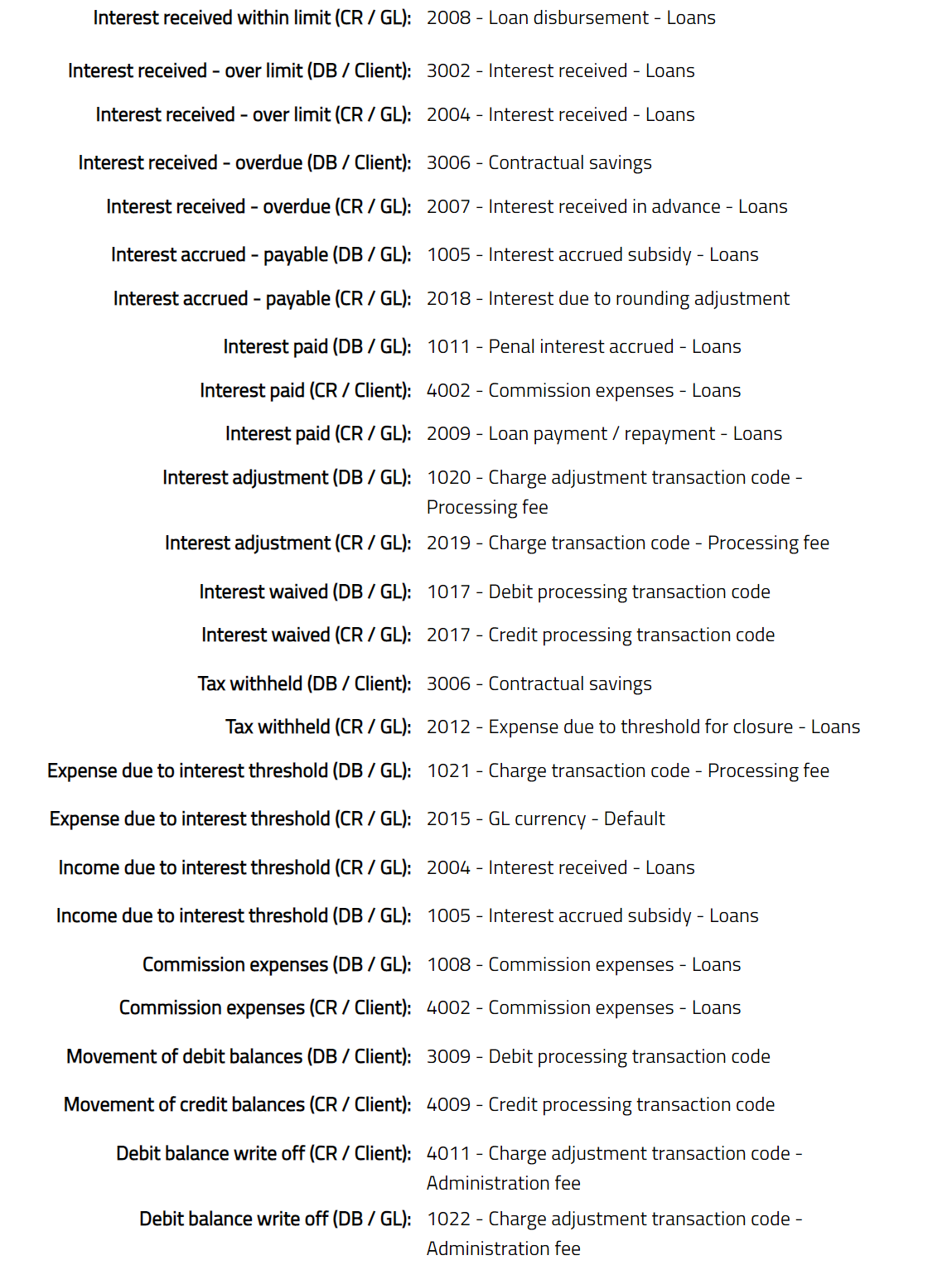

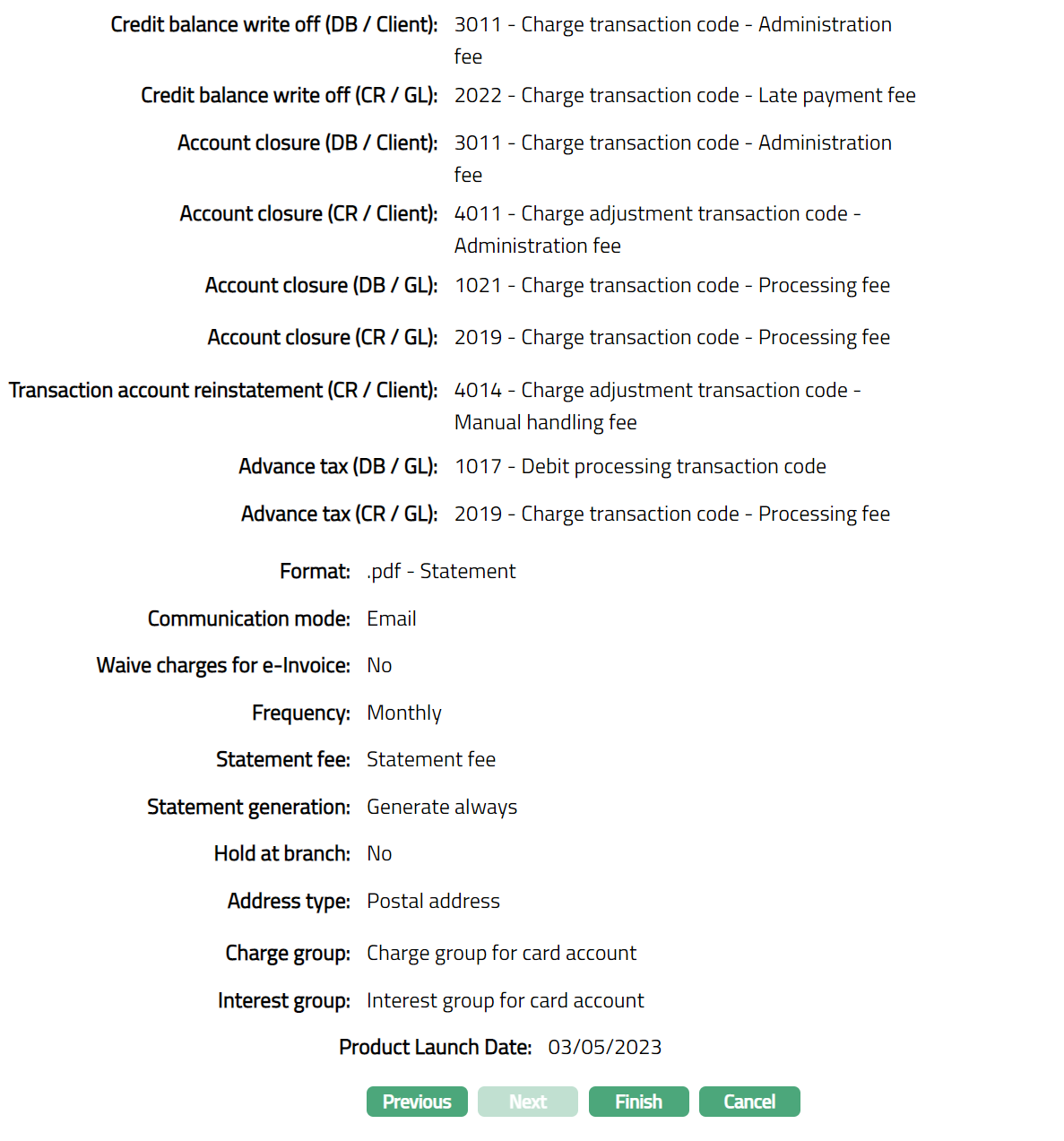

Click Next. New Card Account Product -- Confirmation (11/11) page appears showing all the details that you entered. An extract of the Confirmation screen is shown below:

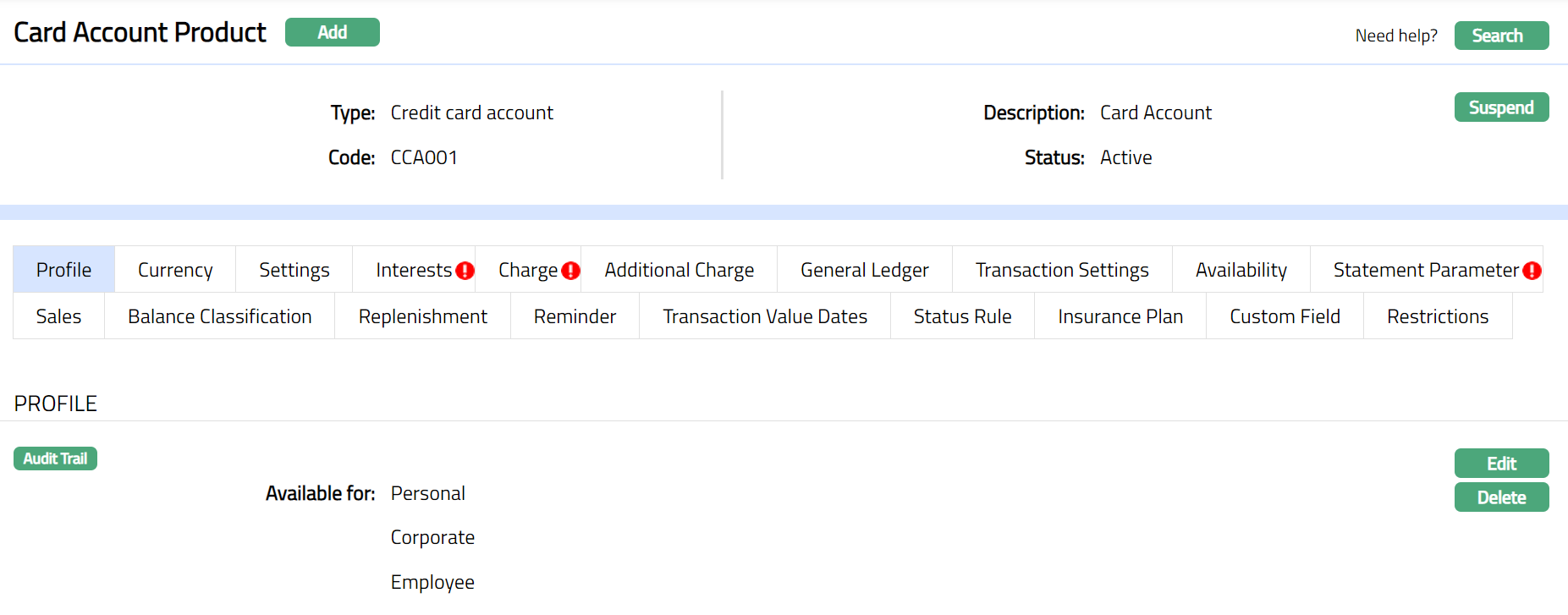

- Click Finish. Card Account Product record is created displaying the Profile tab by default.

Functions: Add, Search, Suspend, Activate,

Note: The status of the Card Account Product is Active as soon as the product is created. The status of the Interests, Charge and Statement Parameter tabs are Pending till they are approved by another user as indicated by the red bubbles on the tab. On approval, the tab status is set to Approved.

Edit: You can update the details of the Product by clicking on Edit button. The updated conditions will be applicable only for those accounts that are created after the changes have been done and will not affect the accounts that are already created.

Suspend: You can suspend the product by clicking on Suspend button. When you click on Suspend button, Aura will ask for confirmation, on approval of which of which the Product will be suspended. Suspending a product only makes it unavailable in future for any new account creation / any other dropdown list. Existing accounts under the product continue without any impact. Suspended products can be activated by using Activate button.

Delete: You can delete a product by clicking on Delete button. When you click on Delete button, Aura will ask for confirmation, on approval of which the Product will get deleted.

Profile

The Profile tab, which is the default tab in the Card Account Product screen, shows the basic details of the Card Account Product.

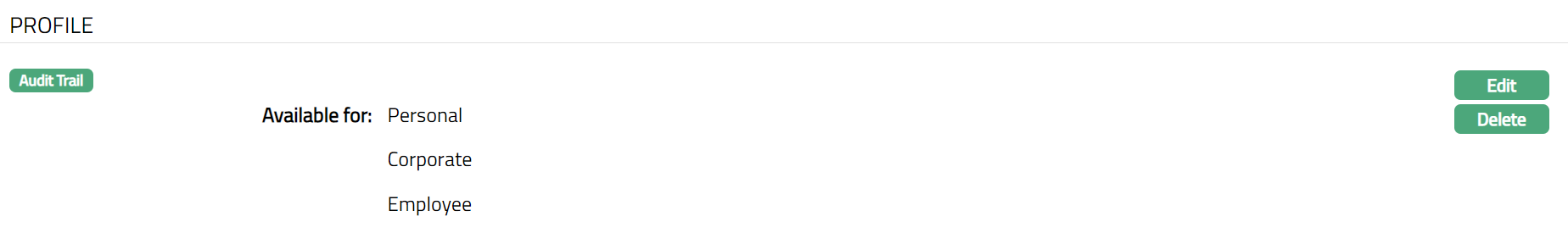

To view / edit Profile.

- Access Card Account Product page and click Profile tab to view the details as per sample below. The details are defaulted from the entries that are made during Card Account Product creation. For details refer to New Product -- Profile.

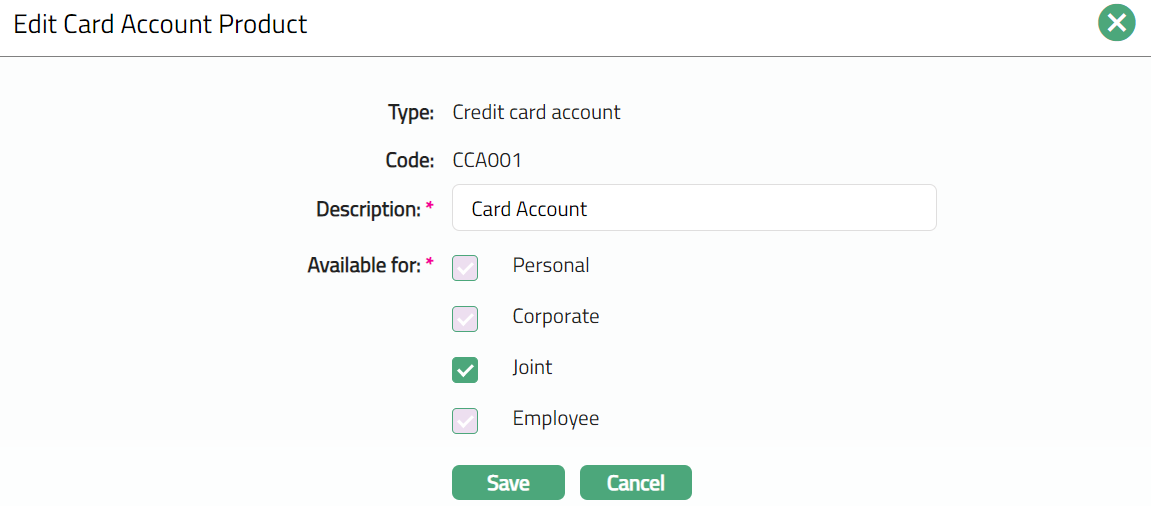

- Click Edit. Edit Card Account Product window appears.

- You can edit only the following fields:

Description

Available for: You can only add types to the ones that were already added for the Product. You cannot remove any type that was already selected.

- Click Save. Profile page appears with the edited details.

Functions: Edit, Delete

Functions: Edit, Delete

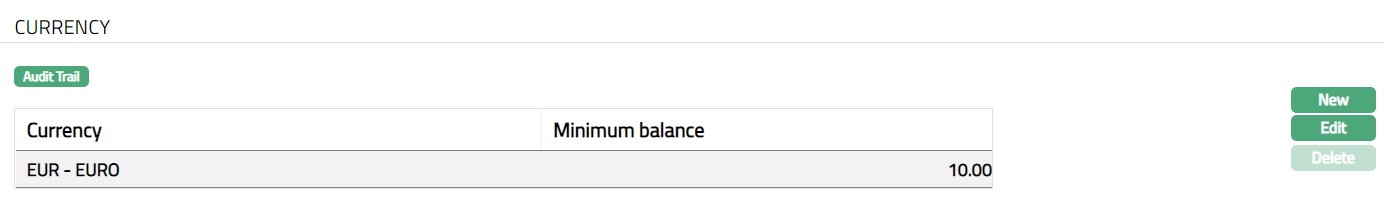

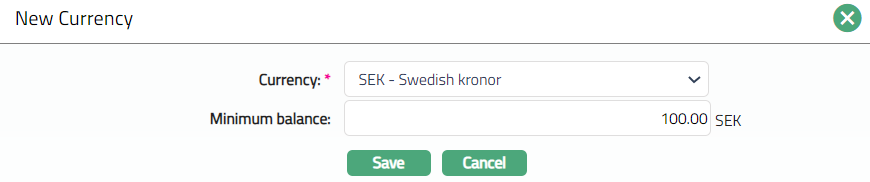

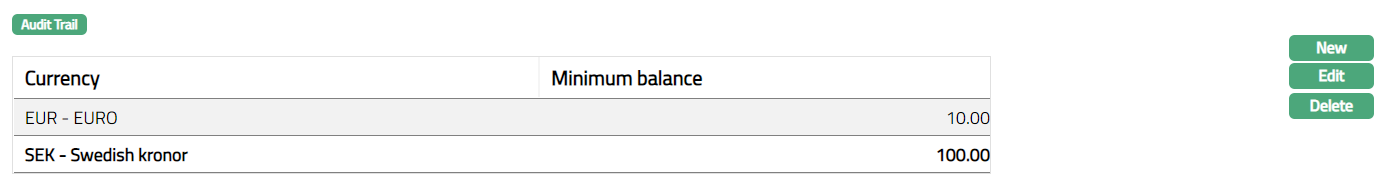

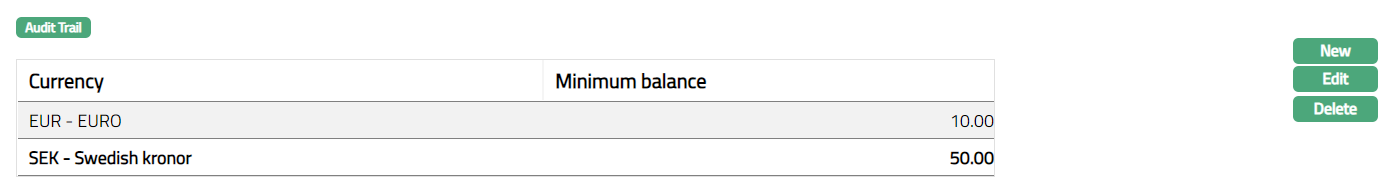

Currency

Currency tab allows you to maintain the currencies for the Card Account Product. One or more currencies can be added using the Currency tab, once the Product record is created. Accounts for the product can be opened only in the selected currencies.

To add a new currency or edit a new currency,

- Access Card Account Product page and click Currency tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to New Card Account Product -- Currency (1/11).

- Click New. New currency page appears.

Enter new Currency and Minimum balance.

Click Save. Currency page appears with the added details.

Functions: New, Edit, Delete

Functions: New, Edit, Delete

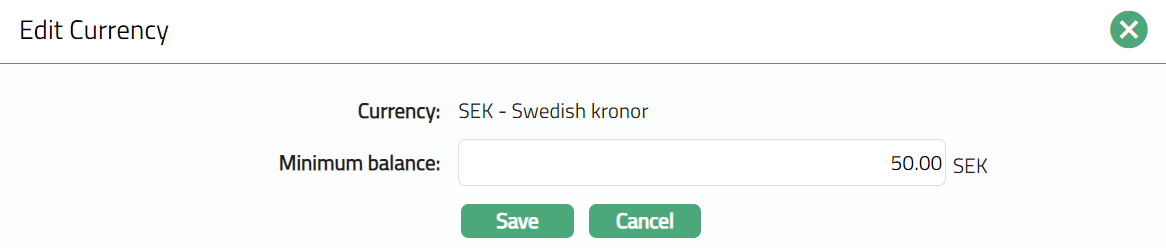

To Edit Currency

- Click Edit. Edit Currency page appears.

Note: Only Minimum balance field is editable.

- Click Save. Currency page appears with the edited details.

Functions: New, Edit, Delete

Functions: New, Edit, Delete

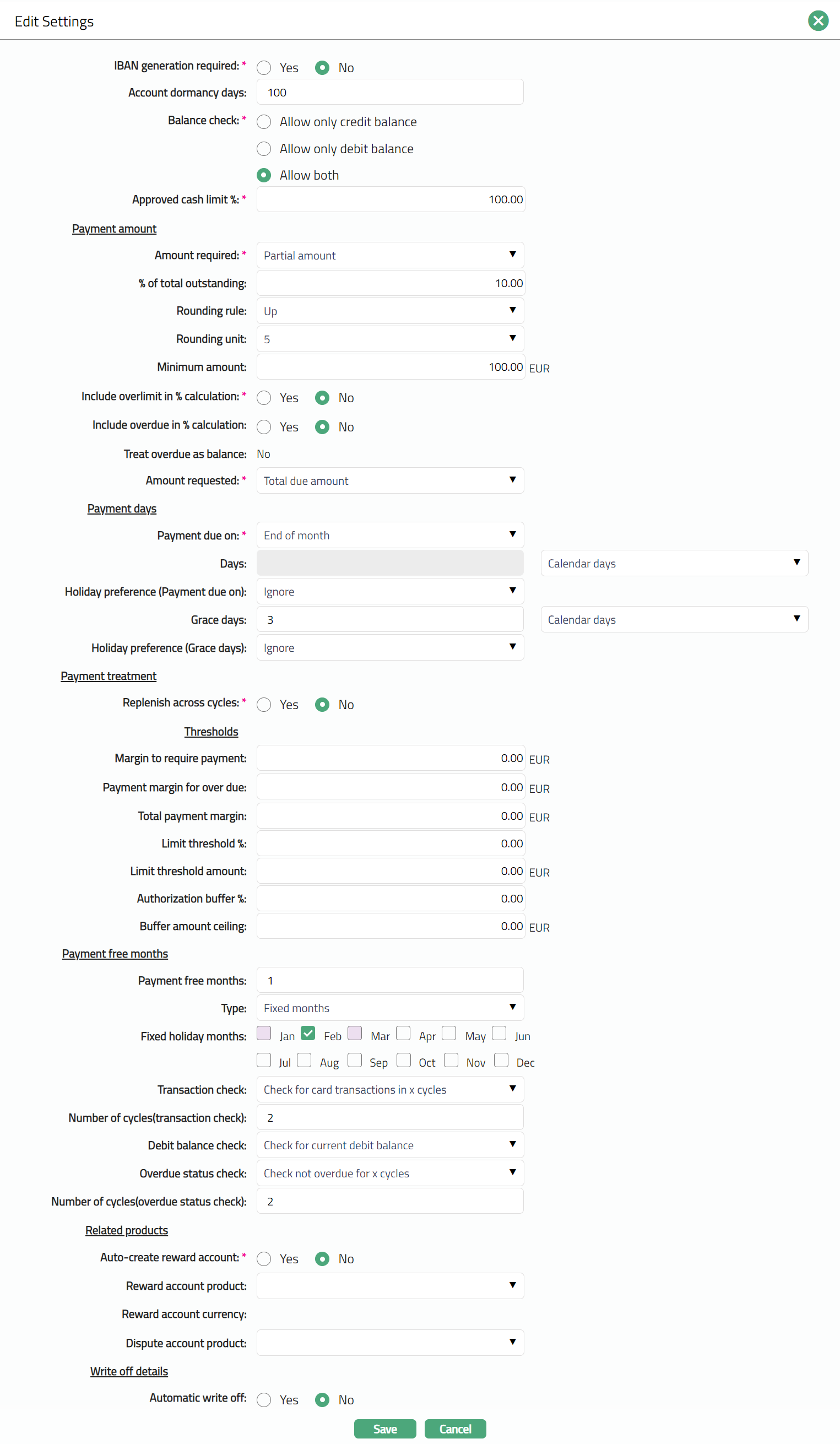

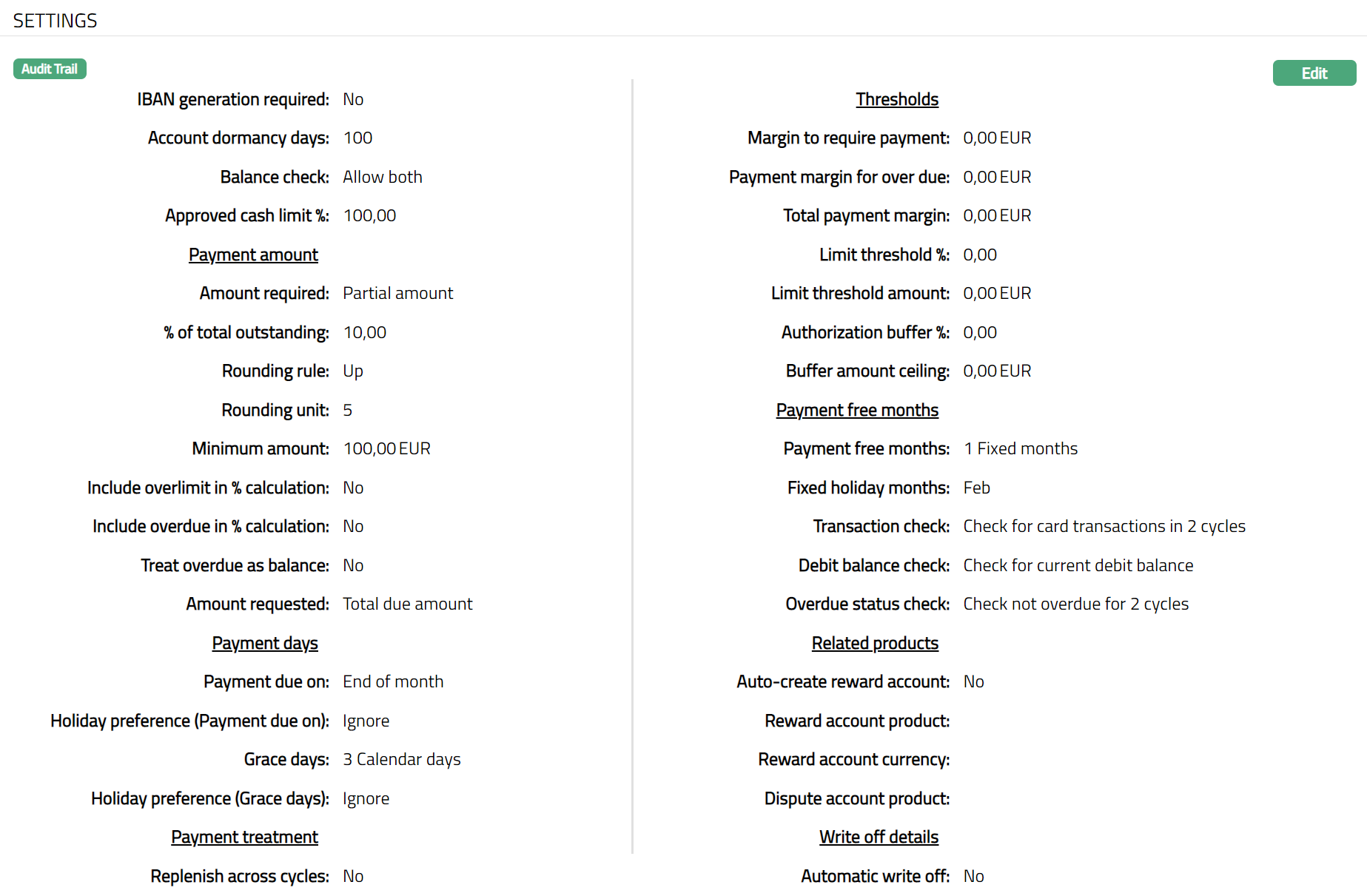

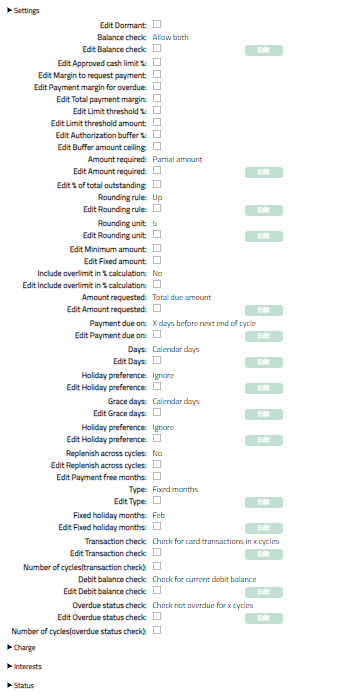

Settings

This Tab allows you to view and maintain certain product settings like Payment details, Payment days, Payment treatment, Thresholds, Payment Free months, Account dormancy, etc.

On creation of the Product, the following fields are updated with the following default values:

| Serial # | Fields | Values | Units |

|---|---|---|---|

| 1. | Replenish across cycles | No | |

| 2. | Margin to request payment | 0.00 | Base currency |

| 3. | Payment margin for overdue | 0.00 | Base currency |

| Interest | |||

| 4. | Total payment margin | 0.00 | Base currency |

| 5. | Limit threshold amount | 0.00 | Base currency |

| 6. | Limit threshold % | 0.00 | % |

| 7. | Authorization buffer % | 0.00 | % |

| 8. | Buffer amount ceiling | 0.00 | Base currency |

| 9. | Payment free months | None | |

| 10. | Auto-create bonus account | No | |

| 11. | Bonus account product | Null | |

| 12. | Bonus account currency | Null | |

| 13. | Dispute account product | Null | |

| 14. | Automatic write off | No |

To edit the settings

- Access Card Account Product page and click Settings tab to view the details as per sample below. The details are defaulted as per details above and from the entries made during Product creation. For details refer to New Card Account Product -- Settings (2/11).

- Click Edit. Edit Settings page appears.

The additional fields are as follows.

- By default, Replenish across cycles will be unchecked. If this field is checked, Aura will replenish Balance classes according to the Replenishment order but across cycles. If this is not checked Aura will replenish within a cycle and then move on to next cycle in the same order.

Example:

| Replenishment Order | Balance Class | Past Cycle (Balance) | Current Cycle (Balance) |

|---|---|---|---|

| 1 | ATM_Interest | 100 | 150 |

| 2 | ATM_Balance | 300 | 200 |

| 3 | POS_Interest | 200 | 150 |

| 4 | POS_Balance | 800 | 600 |

Case 1: Suppose Payment of 200 has been made and the Replenish across cycles is YES. The payment made will be replenished across the cycles.

| Replenishment Order | Balance Class | Past Cycle (Balance) | Current Cycle (Balance) |

|---|---|---|---|

| 1 | ATM_Interest | 100 - 100 = 0 | 150 - 100 = 50 |

| 2 | ATM_Balance | 300 | 200 |

| 3 | POS_Interest | 200 | 150 |

| 4 | POS_Balance | 800 | 600 |

Case 2: Suppose Payment of 200 has been made and the Replenish across cycles is NO. The payment made will be replenished within the cycles.

| Replenishment Order | Balance Class | Past Cycle (Balance) | Current Cycle (Balance) |

|---|---|---|---|

| 1 | ATM_Interest | 100 - 100 = 0 | 150 |

| 2 | ATM_Balance | 300 - 100 = 200 | 200 |

| 3 | POS_Interest | 200 | 150 |

| 4 | POS_Balance | 800 | 600 |

- Enter Margin to request payment. You can input any 3-digit amount in base currency. Aura will generate Amount required only if the balance in the account is more than this amount. If the balance is less than this amount, then no payment due is requested; but the statement will still be generated.

For Example: Suppose Margin to request payment is 100 SEK and Total outstanding is 90 SEK. In this case, no payment due is requested but a statement will be generated.

Enter Payment margin for overdue interest. You can input any 3-digit amount in base currency. If the Payment margin for overdue interest is 5 SEK, Amount required is 100 SEK and Payment amount is 95 SEK. Aura will check whether the payment amount is less than the amount required + 5 SEK (95 SEK + 5 SEK). If condition is satisfied, then no overdue interest or late payment fee will be applied. If condition is not satisfied, then overdue interest and late payment fee will be applied.

Enter Total payment margin. You can input any 3-digit amount in base currency. The amount entered here is taken into consideration if the payment falls short by this amount to qualify the payment for Total payment amount. The account will get all the benefits as though the Total payment amount is received.

Enter Limit threshold %. The limit threshold % ensures that over limit charges and interest are not marked if the limit is breached by an amount set within the threshold. Limit threshold % will be calculated on the limit amount.

Enter Limit threshold amount. This is similar to Limit threshold % but is entered as an amount. Aura will charge over limit charge and interest only if the account balance goes beyond the (limit + limit threshold amount).

Note: If both Limit threshold % and Limit threshold amount are entered, Aura will consider the lesser of the two as the actual threshold.

- Enter Authorization buffer %. Authorisation buffer ensures that the authorisation is not rejected for small amounts. The authorisation buffer is a % of the overall limit subject to a maximum amount. The authorization buffer applies only when the account is within the limit at the start of the transaction. If the account is already above the limit at the start of the transaction, then the buffer does not apply, and the authorization is declined with appropriate codes. Therefore, the buffer can only be applicable for one transaction at any given point of time.

For example, the limit is 10,000 SEK. The Authorization buffer is set to 1.5% of the limit. With a limit of 10,000 SEK this means that a maximum of 150 SEK is allowed as the authorization buffer. The available balance is 100 SEK. An authorization with the amount of 120 SEK is received. It will be approved since it is (120-100=20 SEK) within the authorization buffer. If the available balance had been 0 the authorization would have been rejected because the available balance was 0 even though the threshold was 150 SEK.

- Enter Buffer amount ceiling. It is the maximum authorization buffer amount.

For Example: If the account has a limit of 10,000 SEK and if the authorisation buffer is maintained as 3% subject to maximum threshold amount of 200 SEK, then the authorisation buffer is 200 SEK. If the limit is changed from 10,000 SEK to 5000 SEK, then the buffer becomes 150 SEK.

Enter number of months that are allowed as Payment free months. This cannot be greater than 6.

Select Type of Payment free month.

Fixed holiday months: You can choose specific months equal to the number input above.

Floating months: In this case, the months are not fixed but will be floating as per the choice of the client.

If you have chosen Fixed months, then, the Fixed holiday months check boxes are enabled. Check the required checkboxes to choose the Fixed holiday months.

If you have entered Payment free months, then, you also need to specify the conditions for the payment free months. The first check for payment free month applicability is whether the customer has had any card transactions in his account. This can be specified under Transaction check. The available options are:

No check: If you want to specify that the payment free month is applicable irrespective of any transactions in the account, choose No check. No transaction check will be done.

Check for card transaction in X cycles: If you want to specify that the payment free month is applicable only if the account has had card transaction in the past X cycles, choose this option. Aura will check for card transactions in x cycles.

Check for any transaction in X cycles: If you want to specify that the payment free month is applicable only if the account has had some transaction (not necessarily card transactions) in the past X cycles, then, choose this option. Aura will check for any kind of transactions in x cycles.

If you have chosen any option other than No check above, you need to specify the number of cycles for the transaction check in Number of cycles (transaction check).

One other eligibility condition for payment free month is whether the account has any debit balance. You can use Debit Balance check options for the same:

No check: If you want to specify that the payment free month is applicable irrespective of any balance in the account, use this option. No balance check for the account will be performed.

Check for current debit balance: If you want to specify that the payment free month is applicable only if the card account has a current debit balance, use this option. Aura will check for the current debit balance.

- Overdue Status check is the next eligibility condition for payment free month applicability. The following options are available:

No check: If you want to specify that the payment free month is applicable irrespective of whether the account is overdue or not, choose this option. No overdue status check for the account will be performed.

Check not overdue for X cycles: If you want to specify that the payment free month is applicable only if the account has not been overdue for the past X cycles, choose this option. Aura will check that the account has not gone overdue for the past X cycles.

If you have chosen any option other than No check above, you need to specify the number of cycles for the overdue status check in Number of cycles (overdue status check).

If you want a bonus account to be created automatically along with the card account creation, select Yes for Auto create Reward account. If you select No, Bonus account will get created only when a transaction eligible for bonus points is processed.

Select Reward account product which will be used for auto-creation of Reward Account.

The Reward account currency will be displayed by default. Aura will display the currency available for the Reward Account Product chosen above.

Select the Dispute account product from the drop-down list of all active Dispute account products. Whenever any dispute transaction has to be posted for an account under this Card Account Product, a dispute account will be created using this Dispute account product.

If you want an automatic write off trigger for an account status, choose Yes in Automatic write off field. If you click on Yes, you need to specify the status when the write off should be triggered.

Select the Write off triggering status from the drop-down list. The status needs to be maintained under Admin > System Codes > Generic definitions > Status as Account status.

Click Save. Settings page appears with the edited details.

Functions: Edit

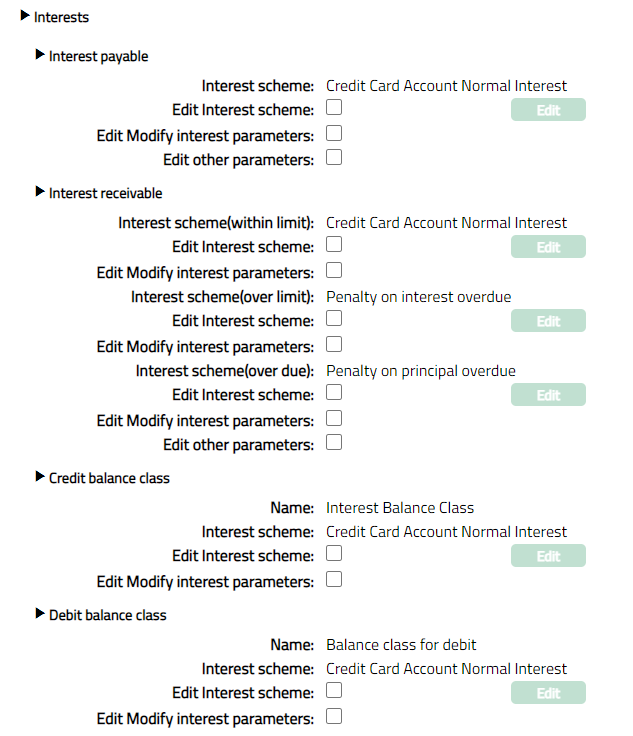

Interests

Using this tab you can add, edit, and delete the interest schemes for the Card Product. This tab has two sub-tabs:

Interest Payable

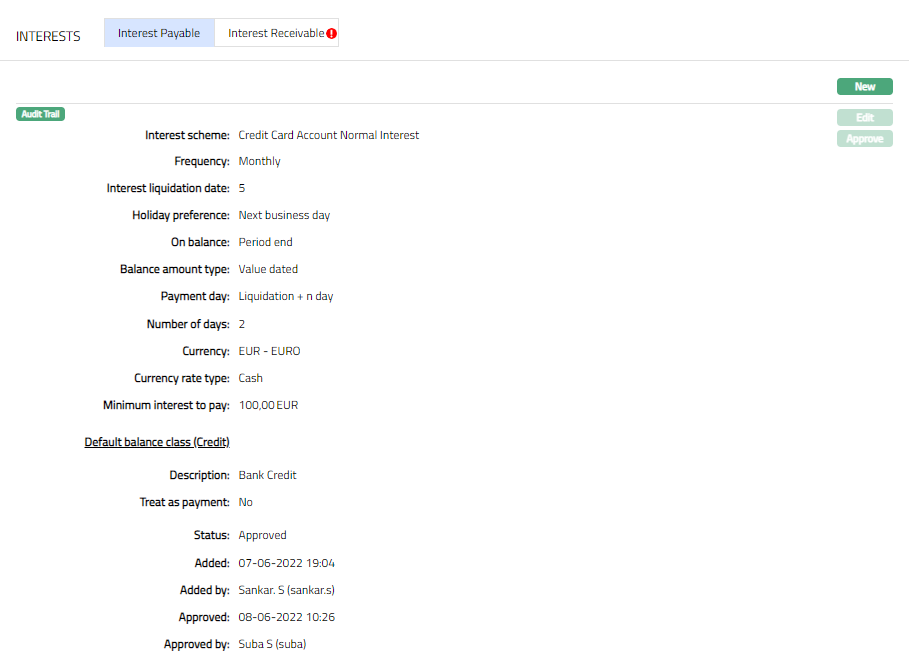

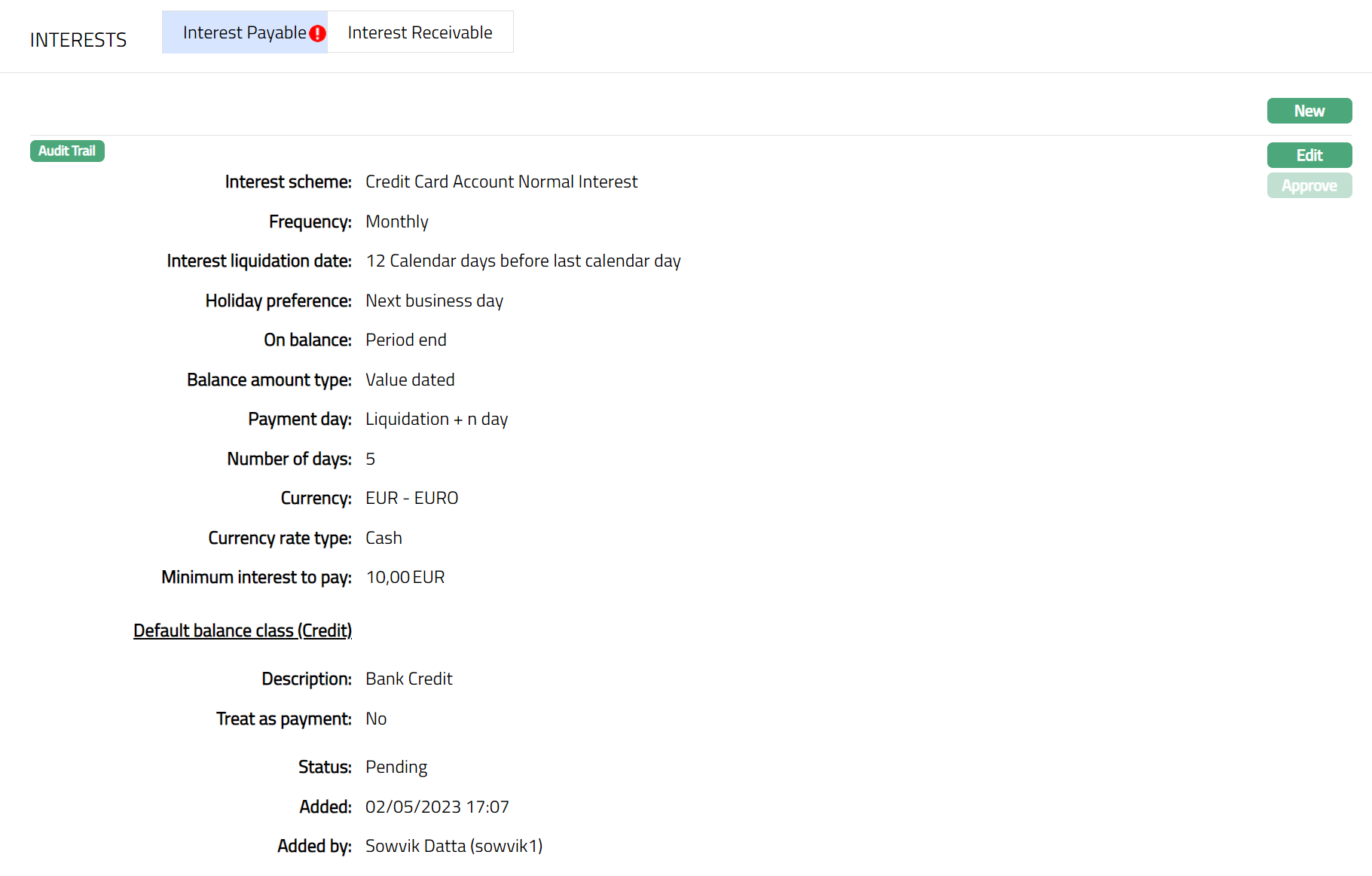

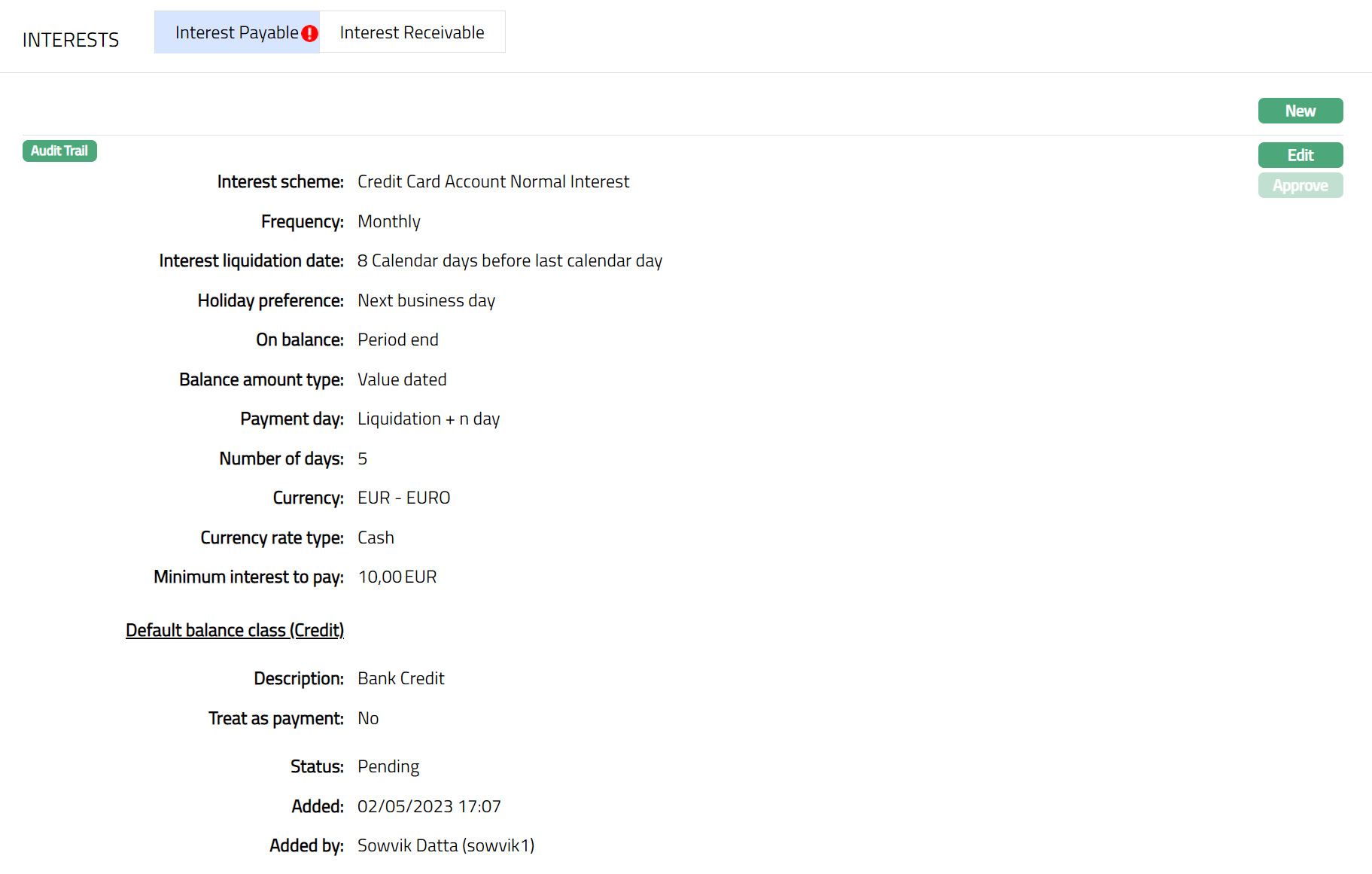

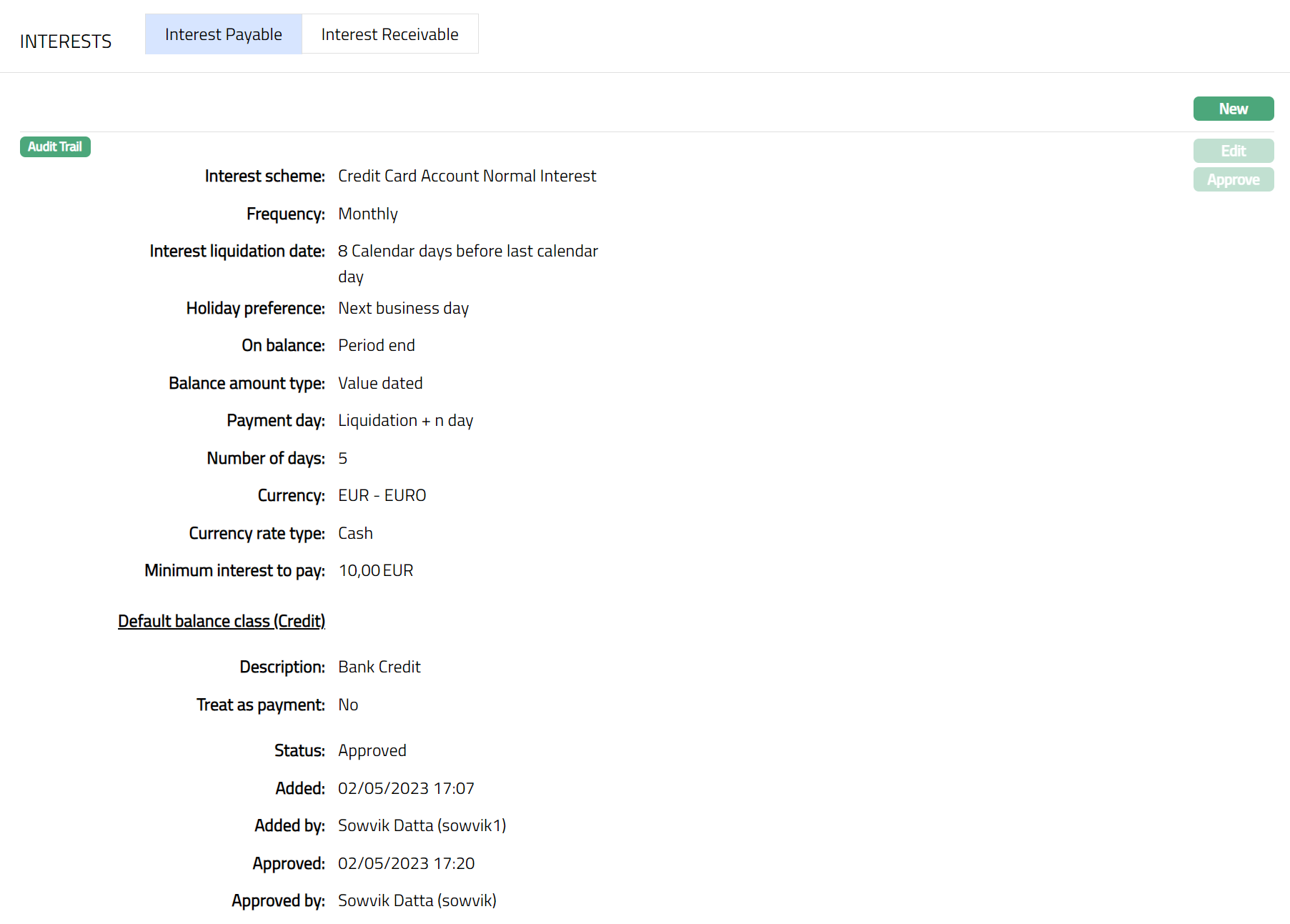

The Interest Payable tab allows you to create, view and maintain the interest rates payable on accounts under this product. As soon as a new product is created, the status of this tab is Pending -- as indicated by the bubbles on the tab heading. Once approved by a different user, the status of the tab becomes Approved, and the bubbles disappear. Only when the tab is in approved status, accounts under the product can be created.

Once the tab is approved, no further changes can be done on the Interest Payable tab. If you want to change any settings for the Product under the Interest payable tab, you have to use the New button.

- Access Card Account Product page and click Interests and then Interest Payable sub tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to New Card Account Product -- Interest Payable (3/11).

The additional fields that you can view in the Interest Payable tab are explained below.

Status field denotes the status of the interest payable tab.

Added field denotes the date on which the interest payable record was added.

Added by field denotes the name of the person who created the interest payable record.

Approved field denotes date on which the interest payable record was approved. This is displayed only if the record is approved.

Approved by field denotes name of the person who approved the interest payable record. This is displayed only if the record is approved.

- Click New. New Interest payable page appears.

Input new Interest Payable details. For further details regarding the fields, please refer to New Card Account Product -- Interest Payable (4/11) section in Add wizard.

Click Save. Interest Payable sub tab under Interest tab appears with the added details.

Functions: New, Edit, Approve

Note: On save, the tab status is Pending -- as indicated by the bubbles on the tab heading, till it is approved by another user. Once approved, the Interest payable cannot be edited / deleted. The New Interest payable record will replace the old record and will be applied to all accounts under the product.

- Click Edit. Edit Interest payable page appears.

Note: All fields are editable.

- Click Save. Interest Payable page appears with the edited details. Displaying status as pending.

Note: After creation / edit, the tab is in Pending status -- as indicated by the bubbles on the tab heading. To approve, retrieve the record and click on Approve.

Functions: New, Edit, Approve

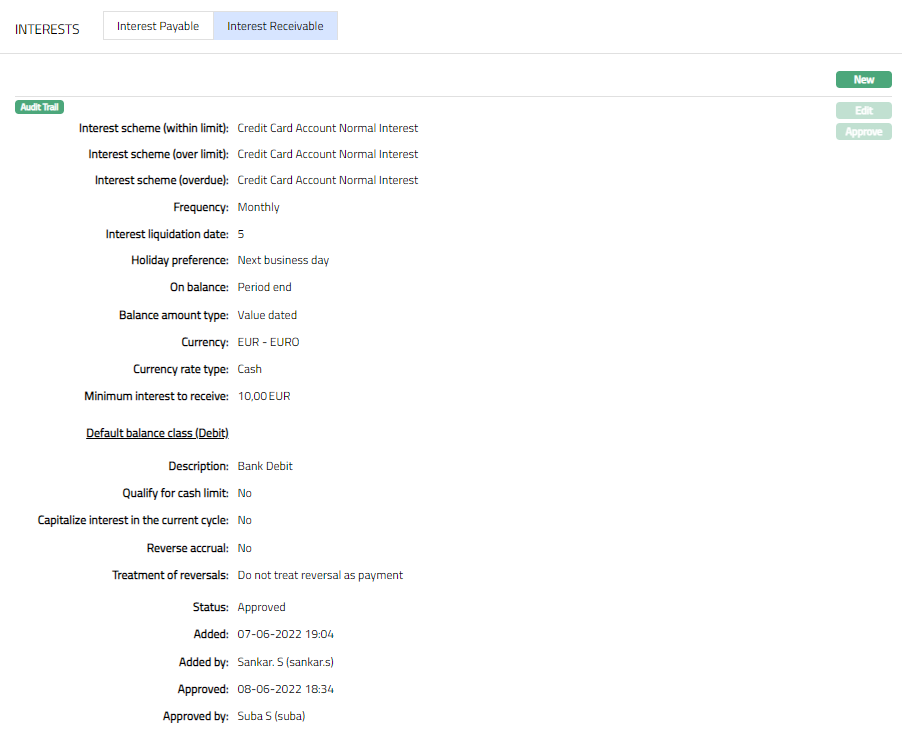

Interest Receivable

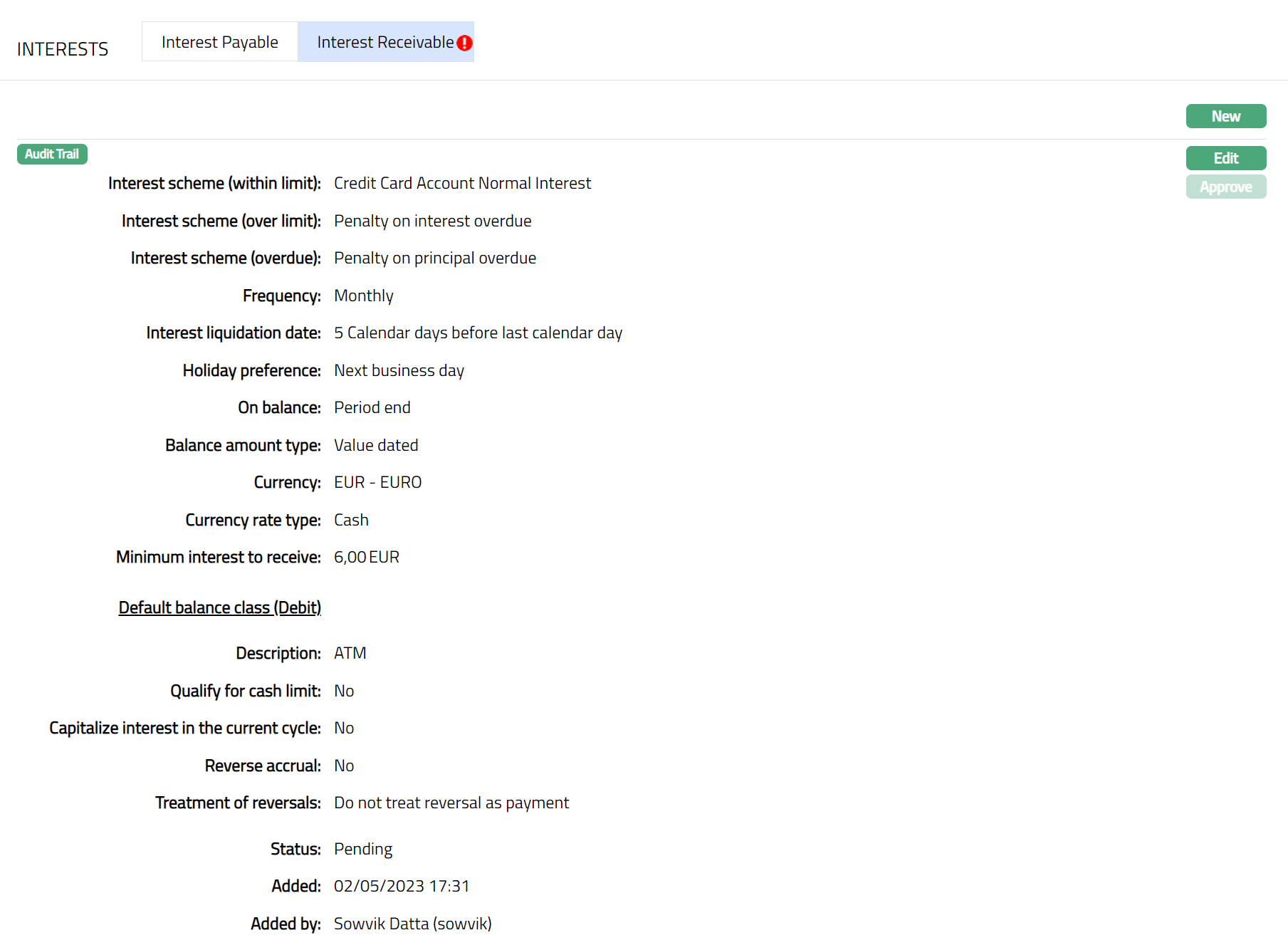

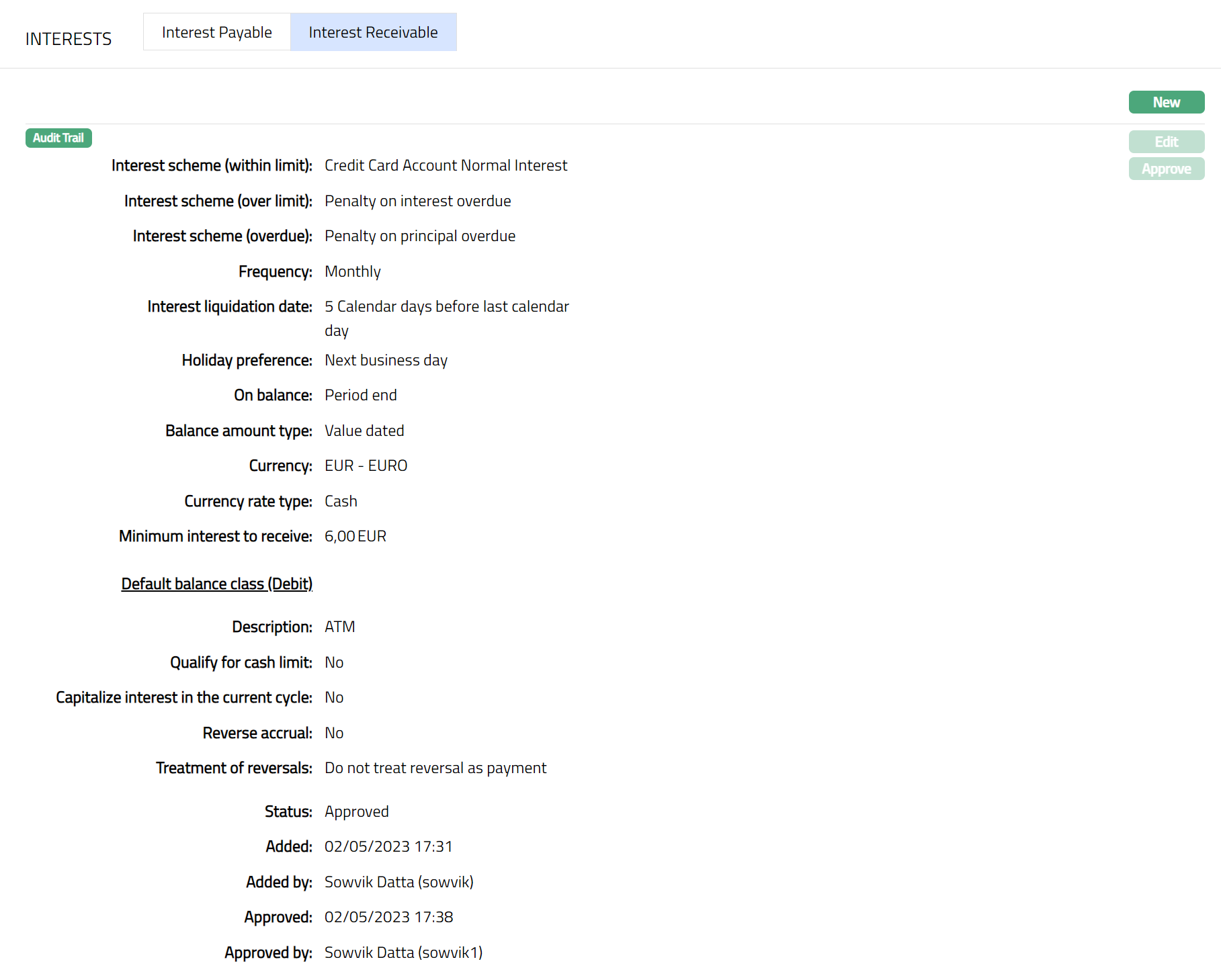

This [option](javascript:TextPopup(this)) allows you to create and maintain the interest which can be charged for the account balance under various components like within Approved limit, Overlimit or Overdue. As soon as a new product is created, the status of this tab is Pending -- as indicated by the bubbles on the tab heading. Once this is approved by a different user, the status of the tab becomes Approved, and the bubbles disappear. Only when the tab is in approved status, accounts under the product can be created.

Once the tab is approved, no further changes can be done on the Interest Receivable tab. If you want to change any settings for the Product under the Interest receivable tab, you have to use the New button.

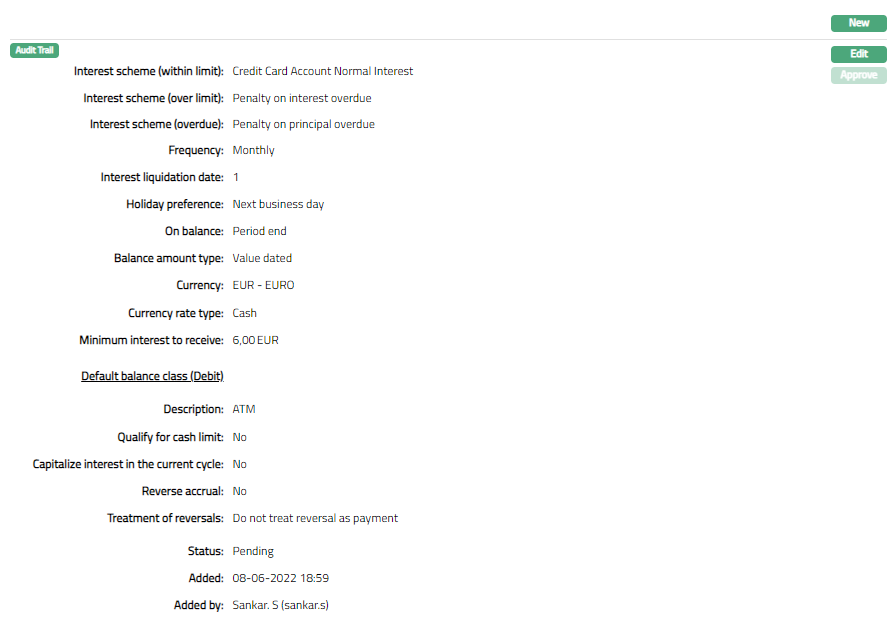

- Access Card Account Product page and click Interests and then Interest Receivable sub tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to New Card Account Product -- Interest Receivable (4/11).

The additional fields that you can view in the Interest Receivable tab are explained below.

Status field denotes the status of the interest receivable tab.

Added field denotes the date on which the interest receivable record was added.

Added by field denotes the name of the person who created the interest receivable record.

Approved field denotes date on which the interest receivable record was approved. This is displayed only if the record is approved.

Approved by field denotes name of the person who approved the interest receivable record. This is displayed only if the record is approved.

- Click New. New Interest Receivable page appears.

Input the new Interest Receivable details. For further details regarding the fields, please refer to the New Card Account Product -- Interest Receivable (4/10) section in Add wizard.

Click Save. Interest Receivable sub tab page under Interest tab appears with the added details.

Functions: New, Edit, Approve

Note: On save, the tab status is Pending -- as indicated by the bubbles on the tab heading, till it is approved by another user. Once approved, the Interest Receivable cannot be edited / deleted. The New Interest Receivable record will replace the old record and will be applied to all accounts under the product.

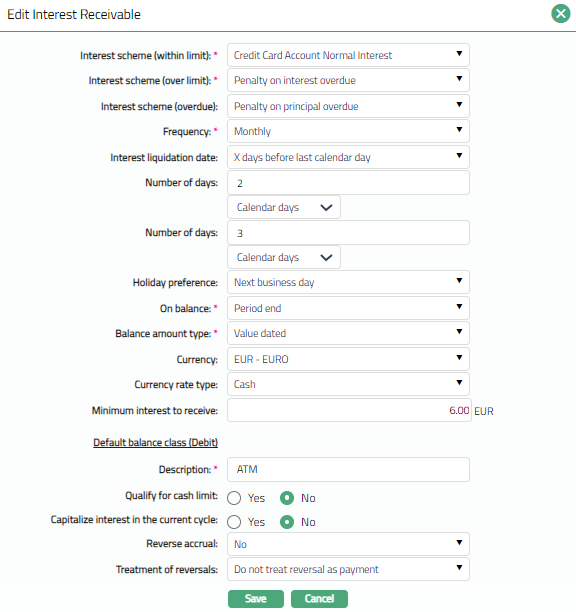

- Click Edit. Edit Interest receivable page appears.

Note: All fields are editable.

- Click Save. Interest Receivable page appears with the edited details. Displaying status as pending.

Note: After creation / edit, the tab is in Pending status -- as indicated by the bubbles on the tab heading. To approve, retrieve the record and click on Approve.

Functions: New, Edit, Approve

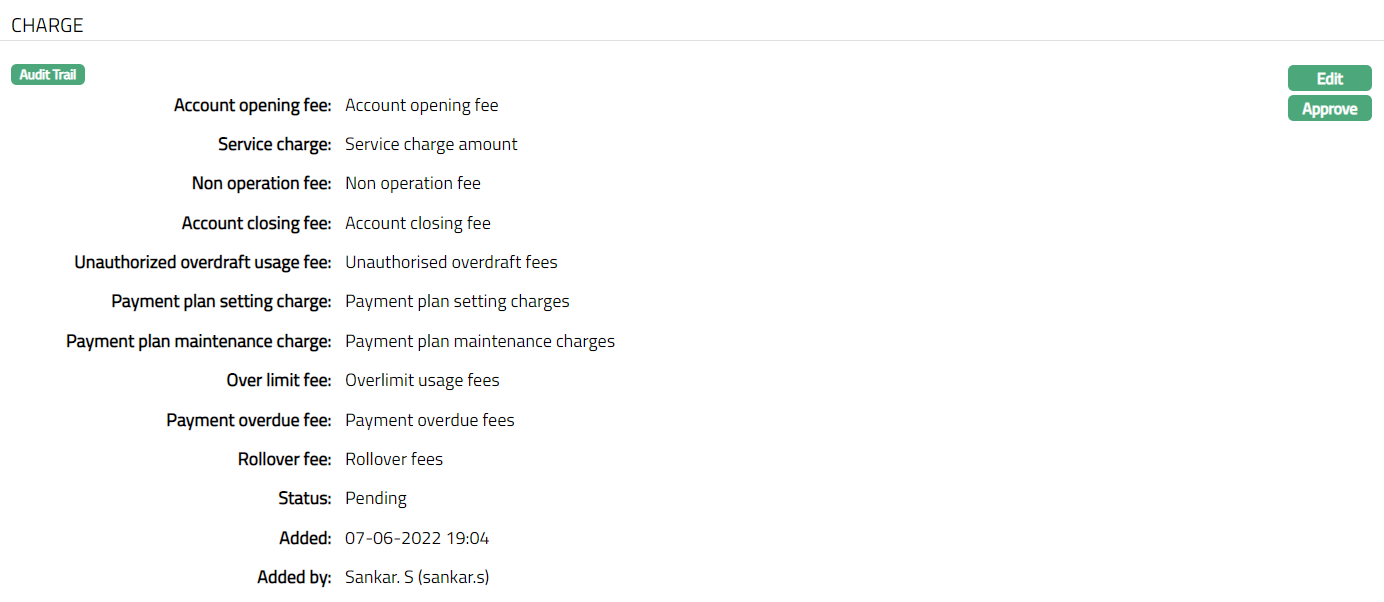

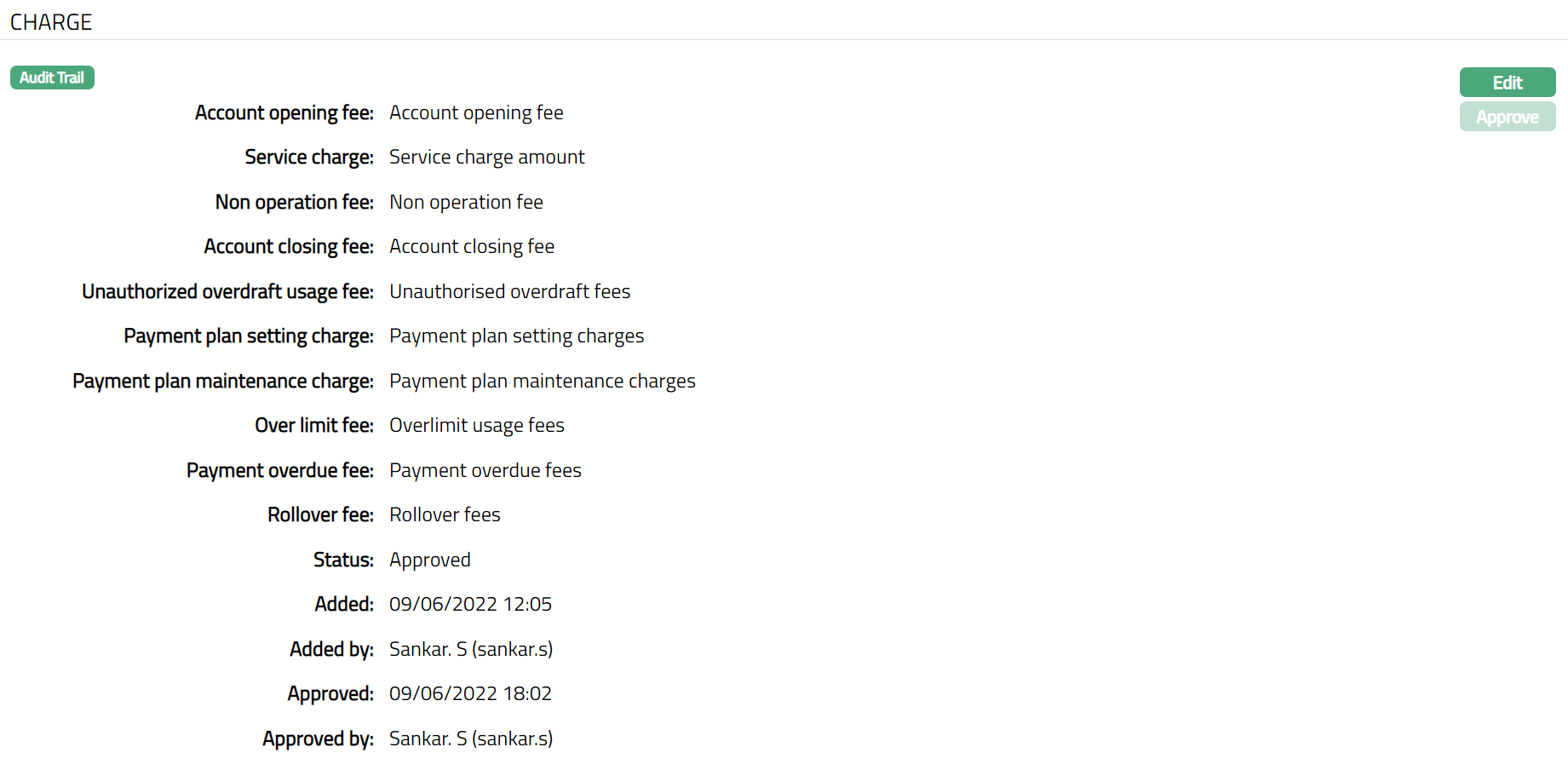

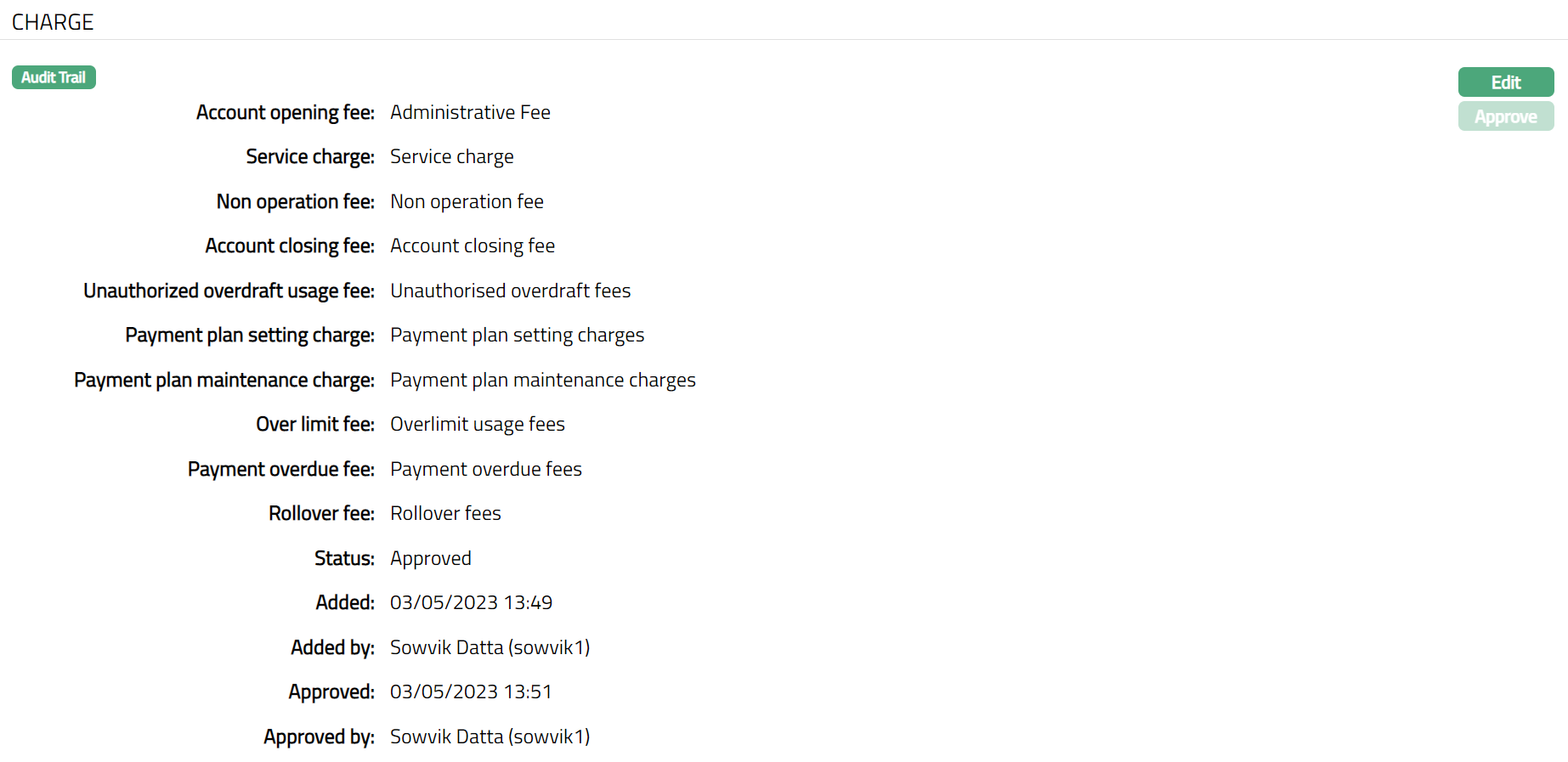

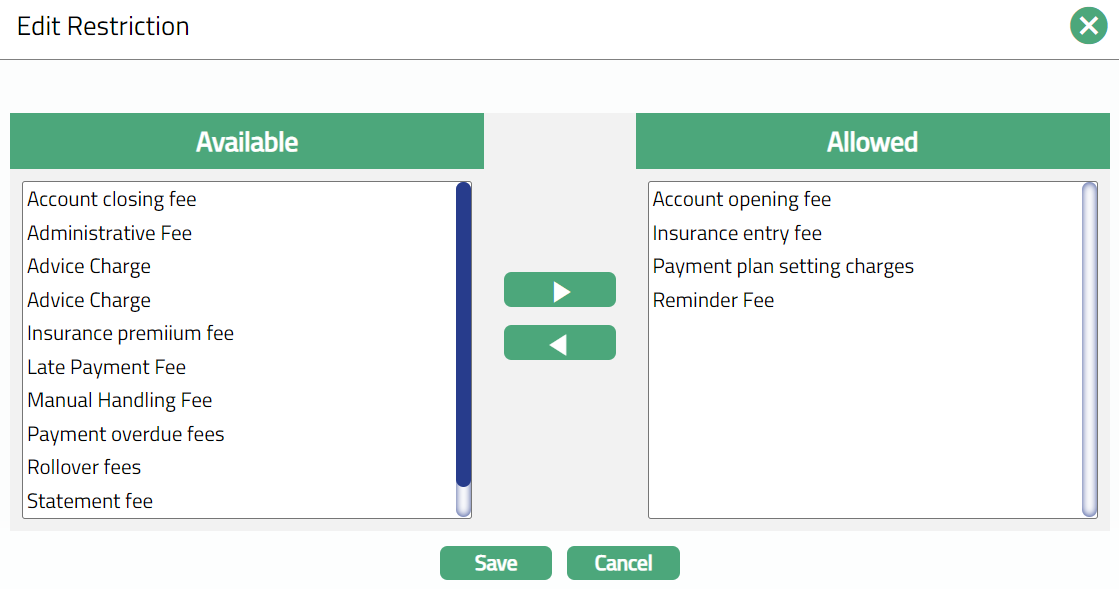

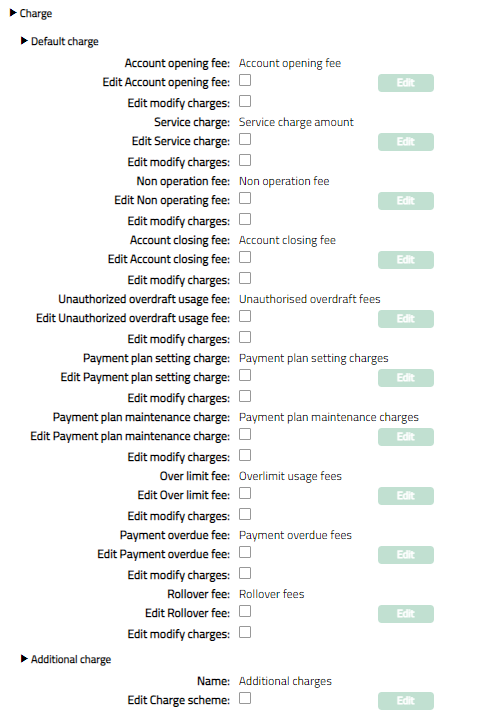

Charge

The Charge tab allows you to view and edit the details of different charges for accounts under the Card Account Product.

- Access Card Account Product page and click the Charge tab to view the details as per sample below. The details are defaulted from the entries that you made during Card Account Product creation. For details refer to New Card Account Product -- Charges (5/11).

Note: Status will display as pending still the same is approved. Once approved the status will be changed to Approved.

The additional fields available are:

Status field denotes the status of the tab.

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

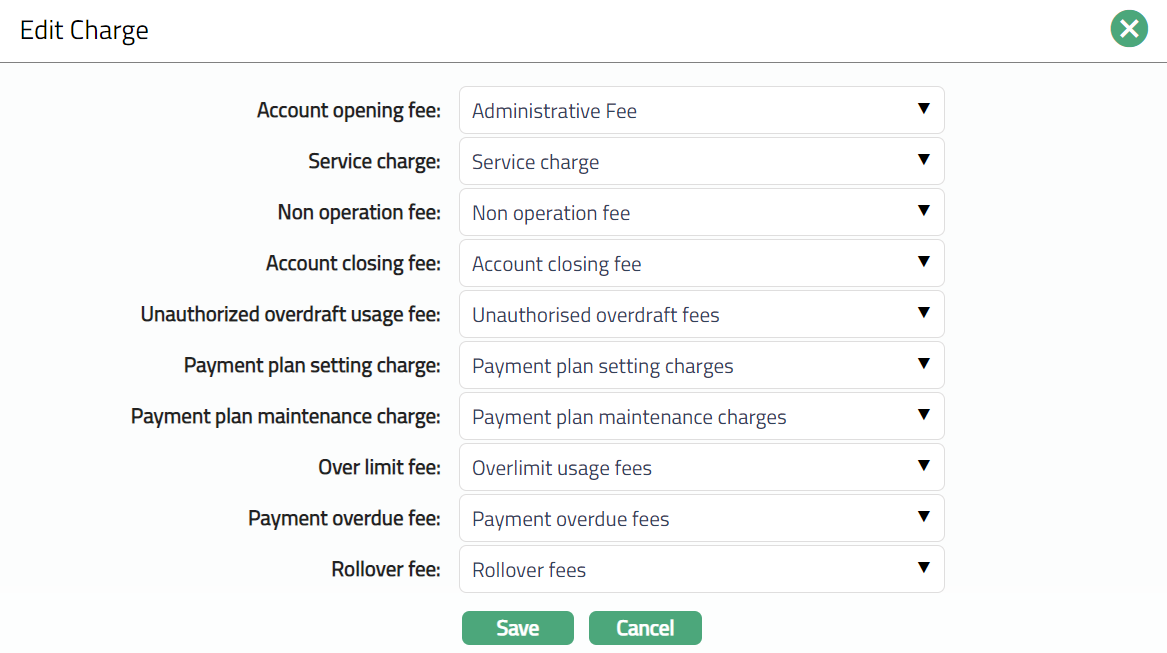

- Click Edit. Edit Charge page appears.

Note: All fields are editable.

- Click Save. Charge page appears with the edited details.

Note: Once charge is added or any changes made, the charge tab will be in the Pending status. On Approval, charges will be applicable on the new Accounts created based on this product.

Functions: Edit, Approve.

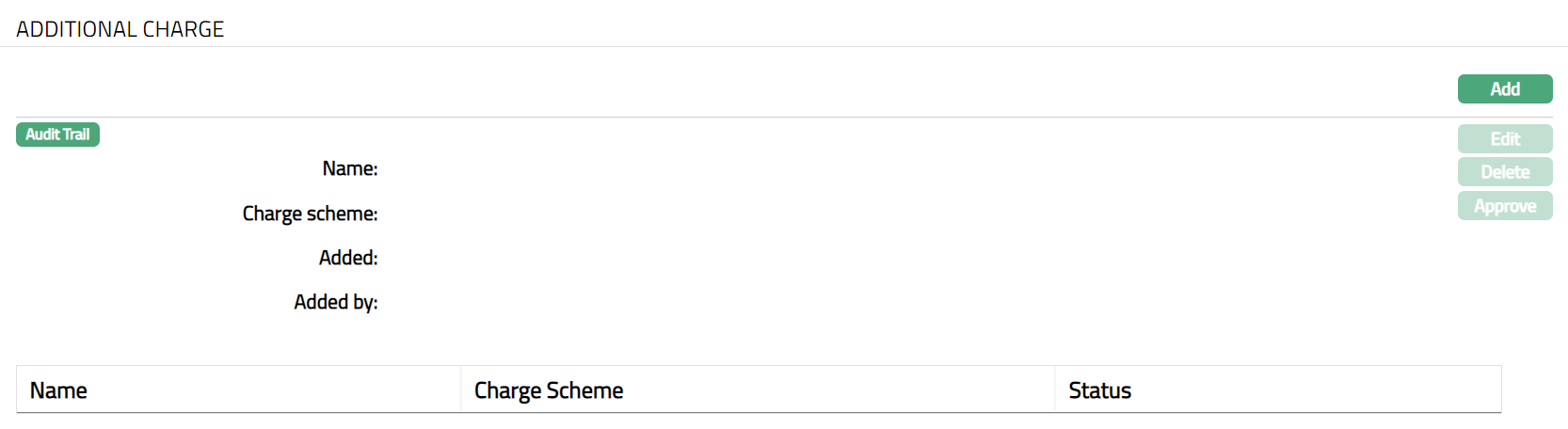

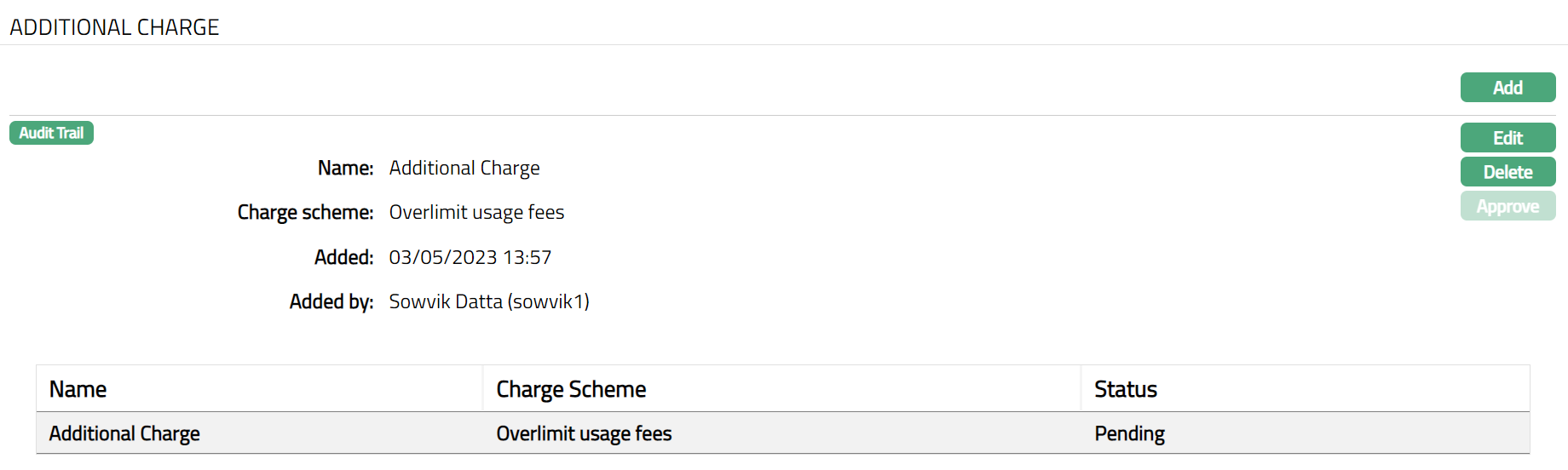

Additional Charge

The Additional Charge tab allows you to view and maintain additional charges for the Product -- apart from the ones that are specified under Charges tab.

- Access Card Account Product page. Click the Additional charge tab if any additional charges had already been added, these would be displayed; else, it will be blank.

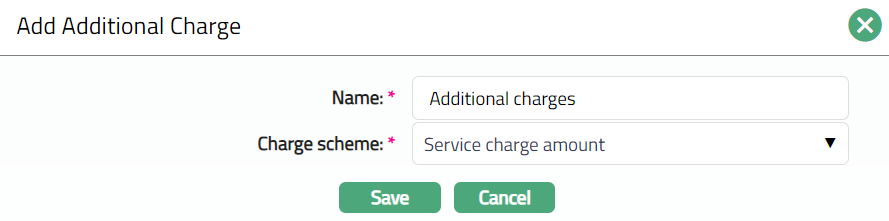

- Click Add. Add Additional Charge page appears.

Enter Name of the additional charge to be added.

Select Charge scheme for the Additional Charge from the drop-down list which must be maintained under Admin > Pricing > Charges > Charge Schemes. You can add any Periodic charge -- whether Flat or Banded. If Banded, the Current balance will be taken as the basis for the charge.

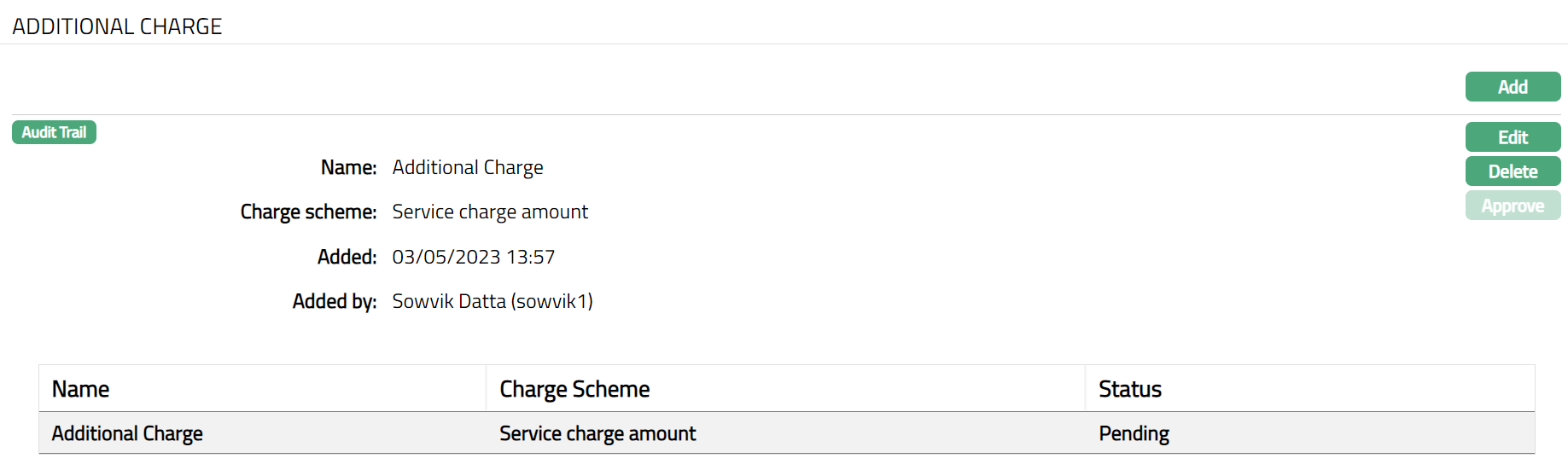

Click Save. Additional charge page appears with the added details.

Functions: Add, Edit, Delete, Approve.

Functions: Add, Edit, Delete, Approve.

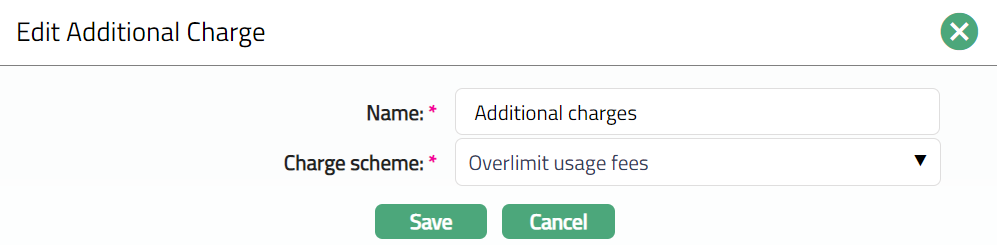

- Click Edit. Edit Additional Charge page appears.

Note: All fields are editable.

- Click Save. Additional Charge page appears with the edited details.

Note: Once the charge is added or any changes made, the charge tab will be in the Pending status. On Approval by another user who has not created the record, the status will change to Approve. Post approval, the charges will be applicable on the new Accounts created based on this product.

Functions: Add, Edit, Delete, Approve.

The additional fields available are:

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

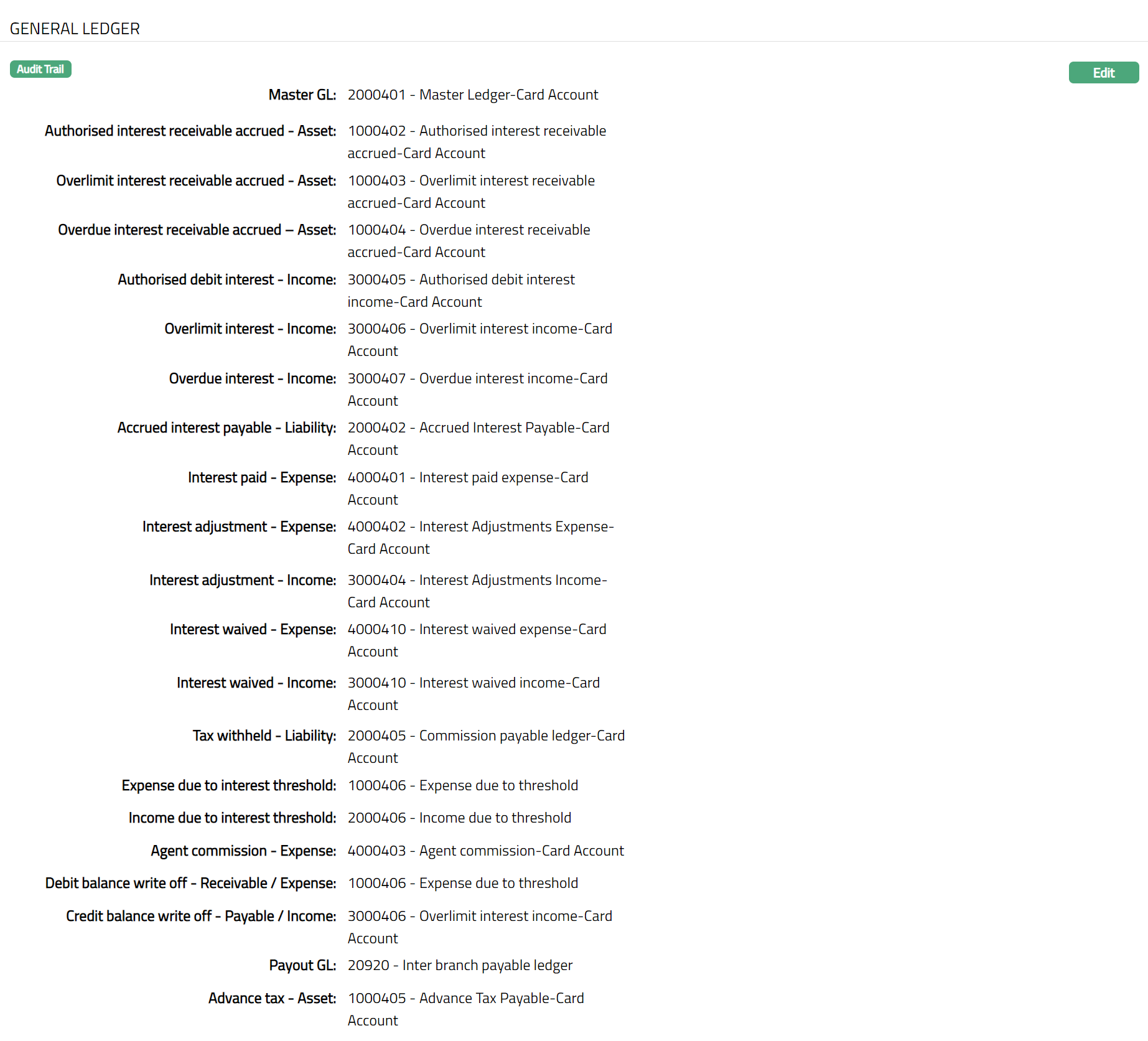

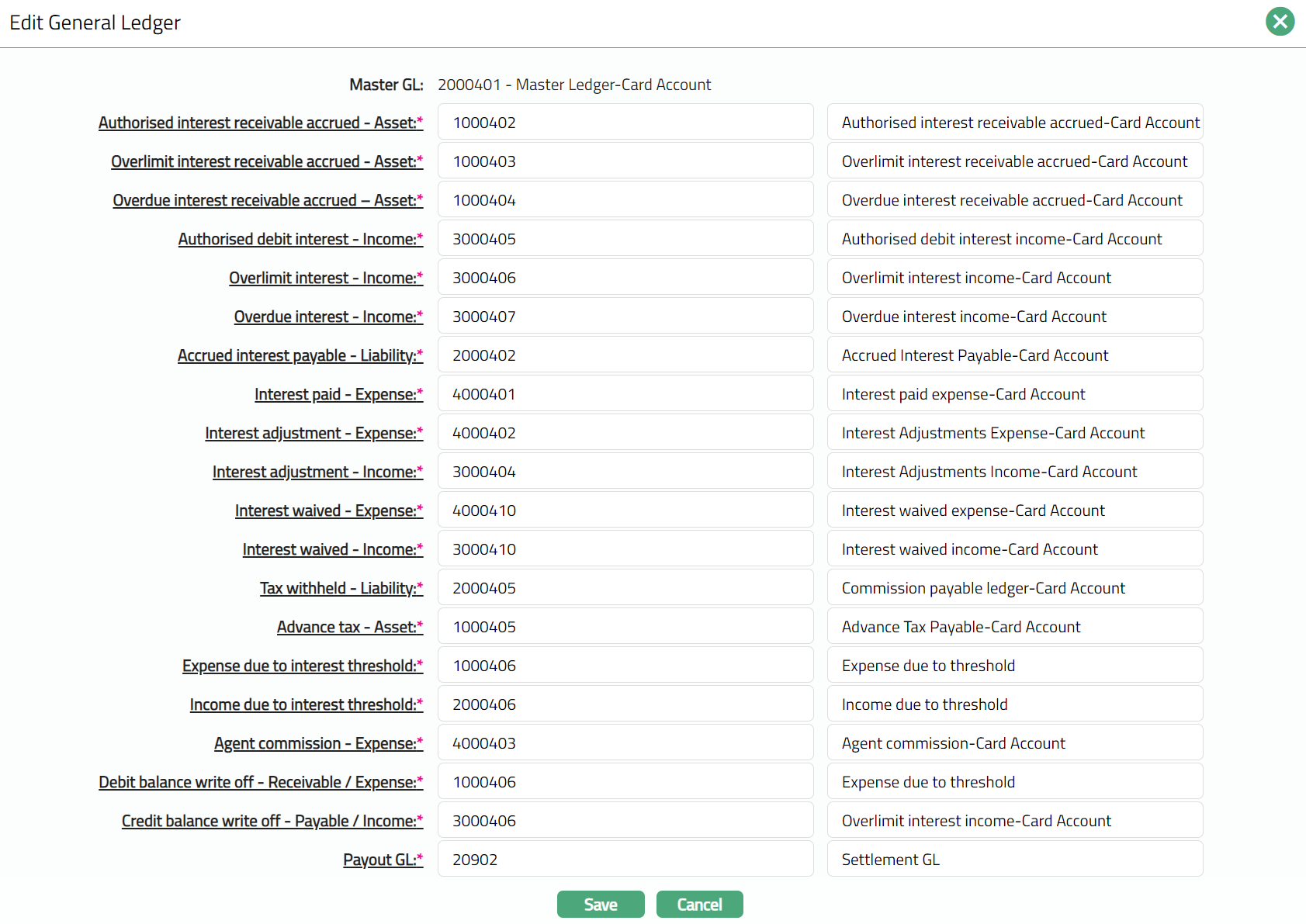

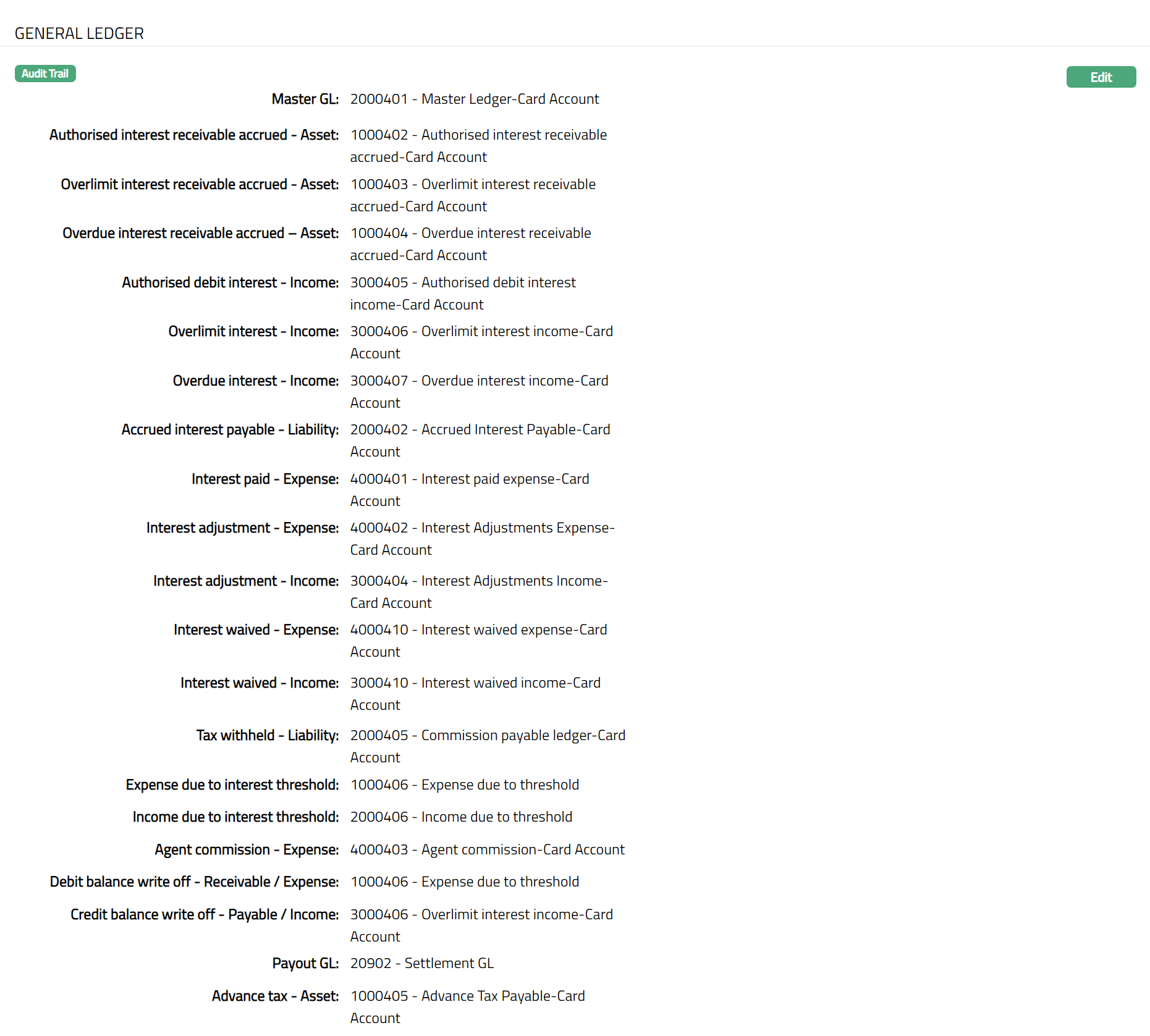

General Ledger

The General Ledger tab allows you to view and maintain the various GL accounts for the Card Product.

- Access Card Account Product page and click the General Ledger tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to New Card Account Product -- General Ledger (6/11).

- Click Edit. Edit General Ledger page appears.

Note: Except Master GL, all other fields are Editable.

- Click Save. General Ledger page appears with the edited details.

Functions: Edit

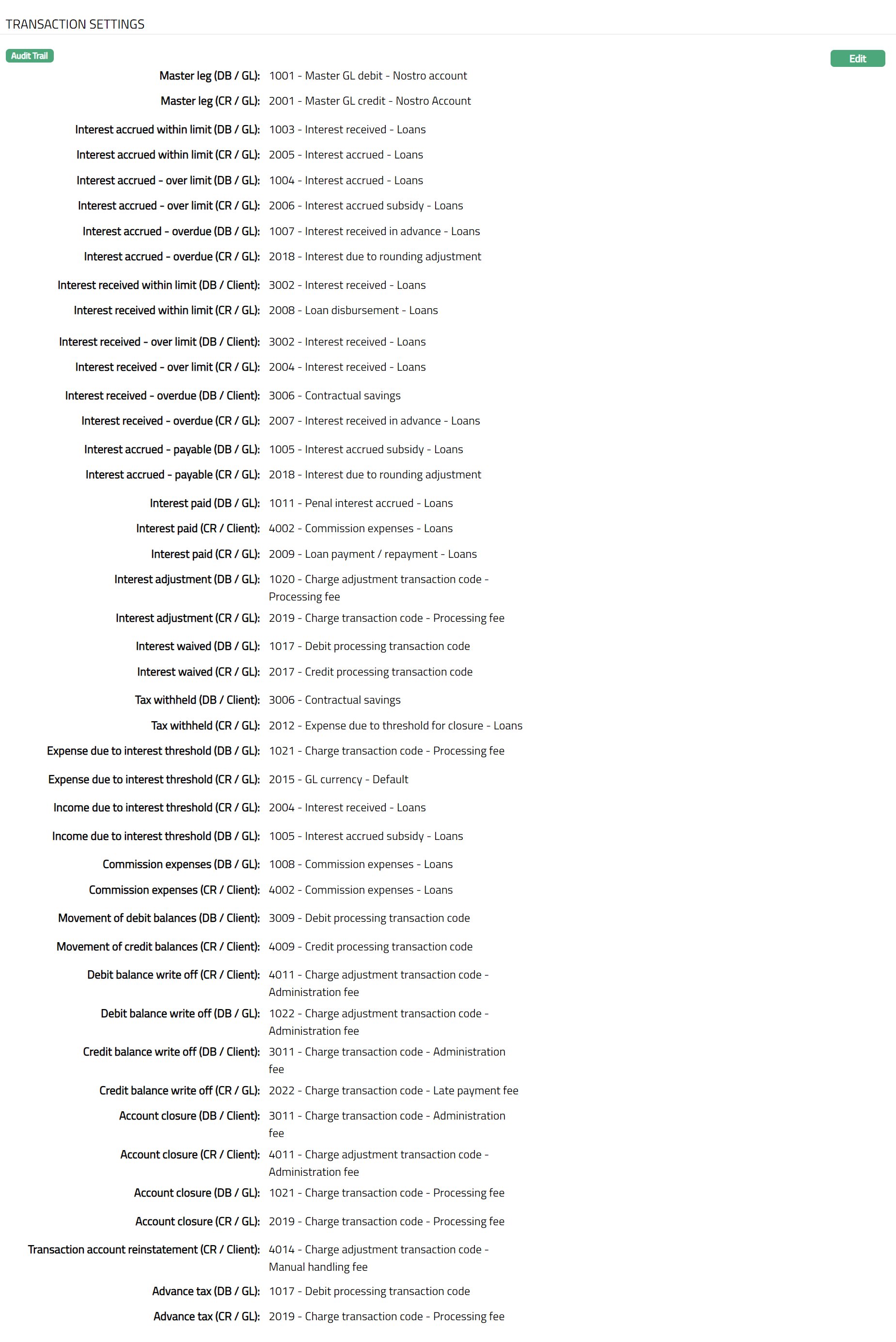

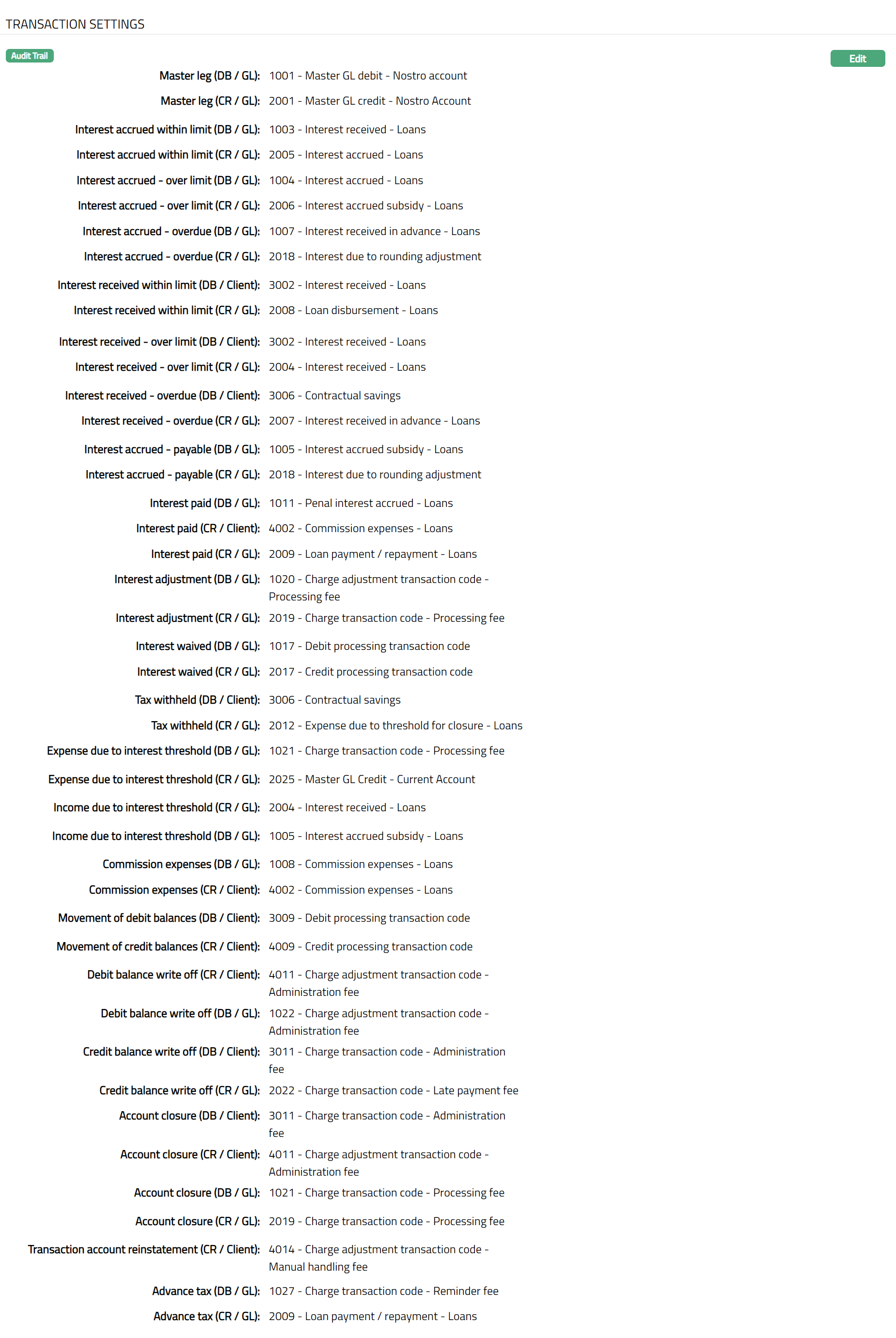

Transaction Settings

Transaction settings tab allows you to specify the transaction codes that are to be used for the various events in the life cycle of the Product. These transaction codes define what description / narration is used for the account postings / statements and may also be used to trigger other charges.

- Access Card Account Product page and click the Transaction settings tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to New Card Product -- Transaction Settings (7/11).

- Click Edit. Edit Transaction settings page appears.

Note: All fields are Editable.

- Click Save. Transaction Settings page appears with the edited details.

Functions: Edit

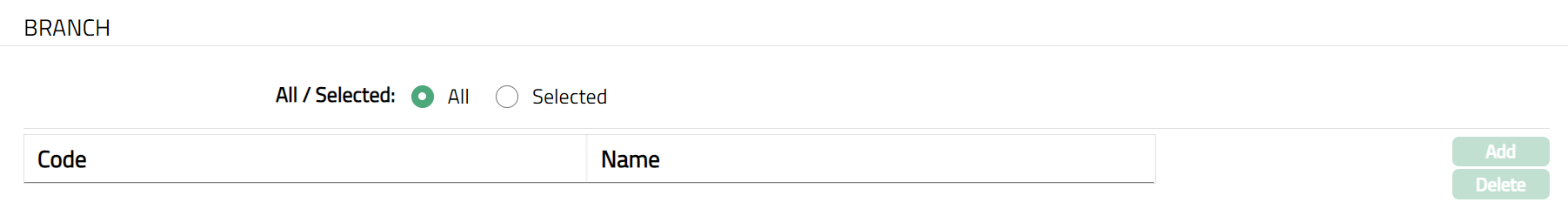

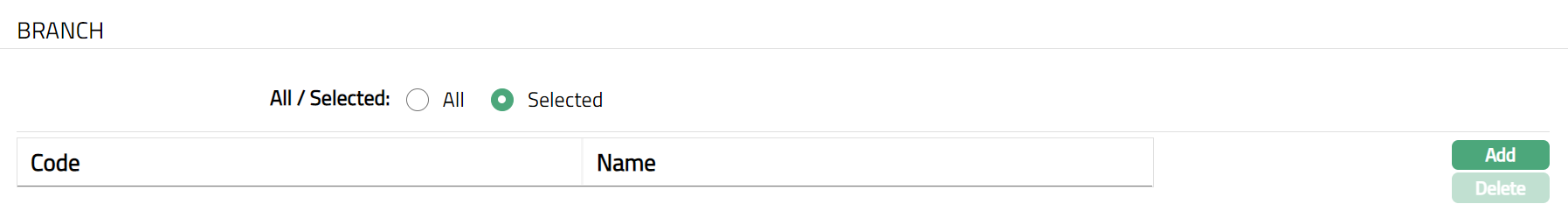

Availability

This tab can be used to control the availability of the product to specific Branch, Transaction Code, Offering or Client. It has four sub-tabs.

Availability -- Branch

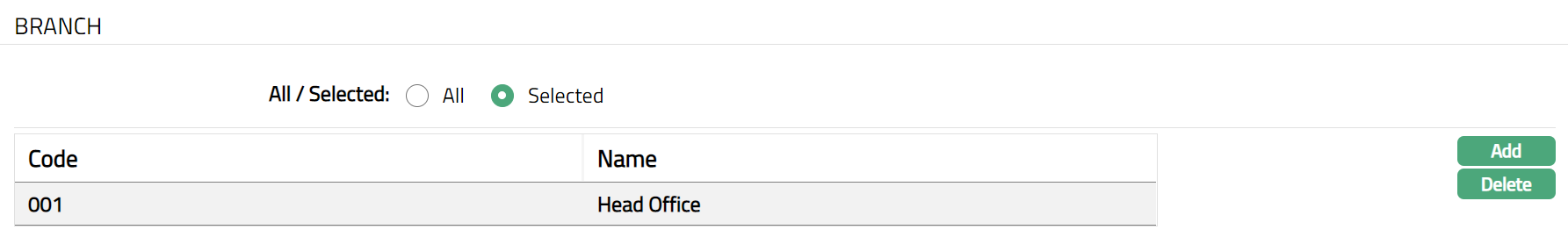

Using this tab, you can allow the Card Account Product to be available for all the Branches or only specific Branch (es).

To select the branch

- Access Card Account Product page, click Availability tab, and then click Branch sub tab.

The All radio button is selected by default, so that this Product is available for all Branches.

To restrict the branches for which this Product is available, click Selected radio button. Add button is now enabled.

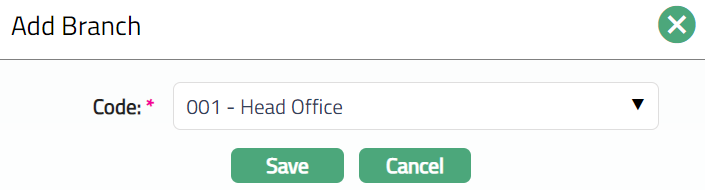

Click Add. Add Branch screen appears where you can select the required branch from the drop down of all active Branches of the Entity.

- Click Save. Branch Sub tab appears with the added details. The selected branch(es) will appear in Card Account Product screen.

Function: Add, Delete

Note: You may choose to allow All branches for the product at any time. However, Aura will prompt you to confirm if the selected branches may be deleted. If confirmed, then all the selected branches will be deleted, and the product will be available for ALL Branches.

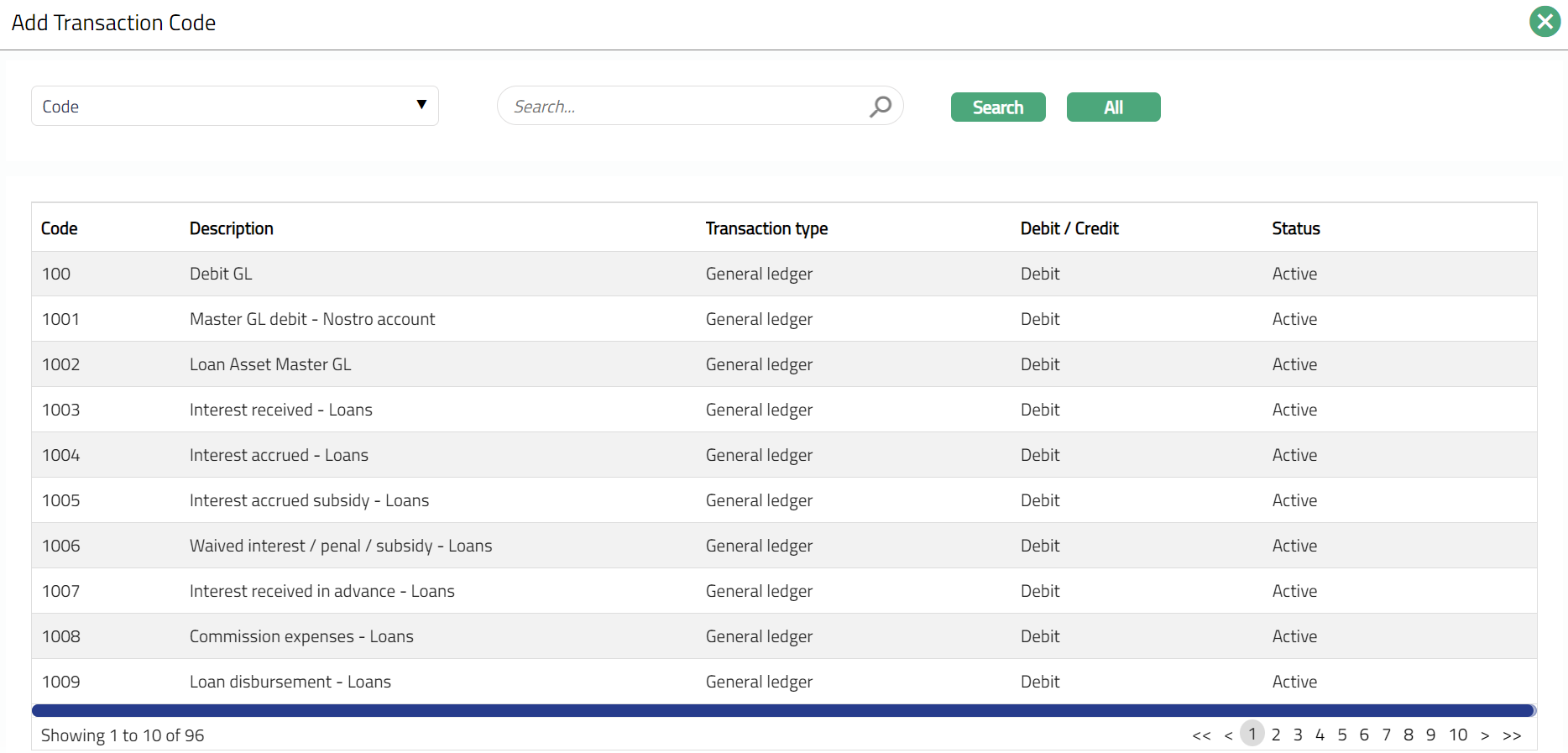

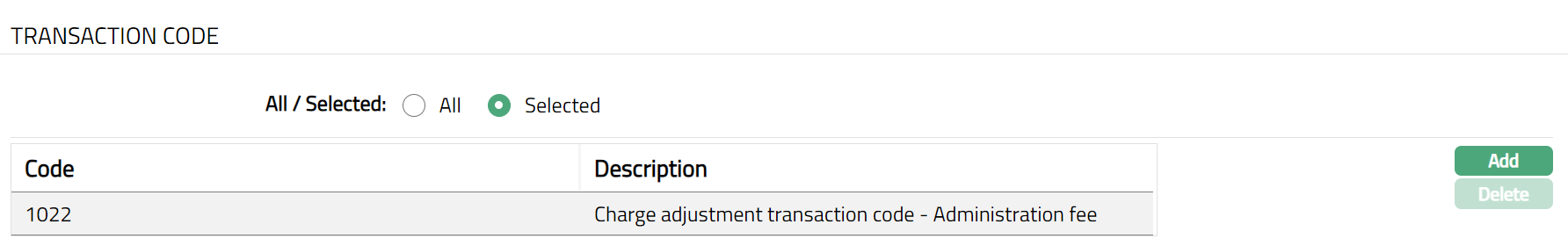

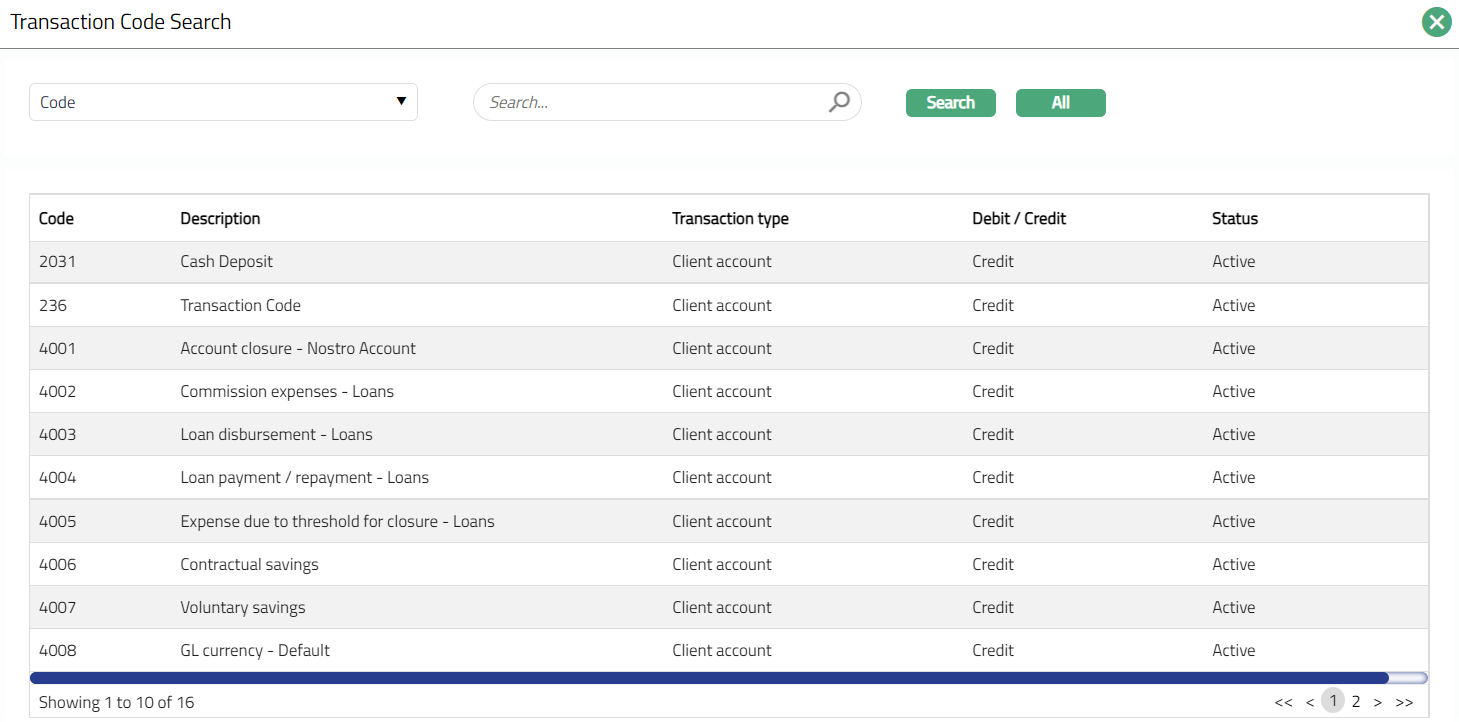

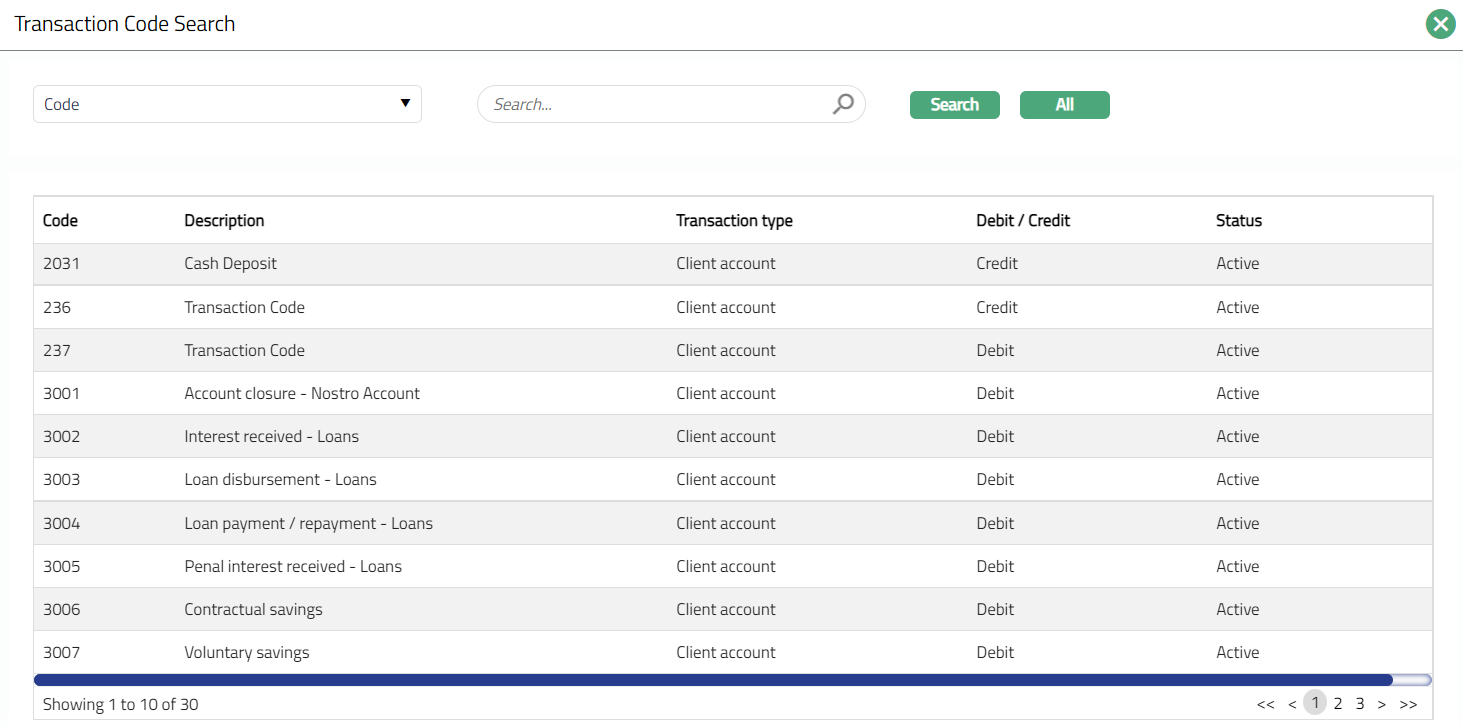

Availability -- Transaction Code

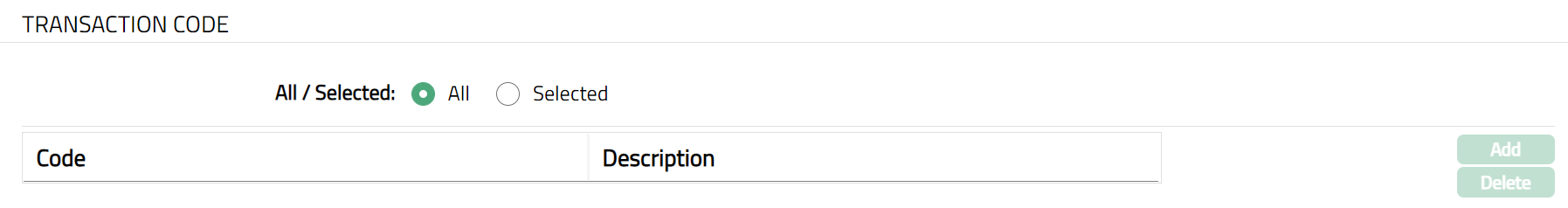

Using this tab, you can allow the Card Account Product to be available for all the Transaction Codes or only specific Transaction Code(s).

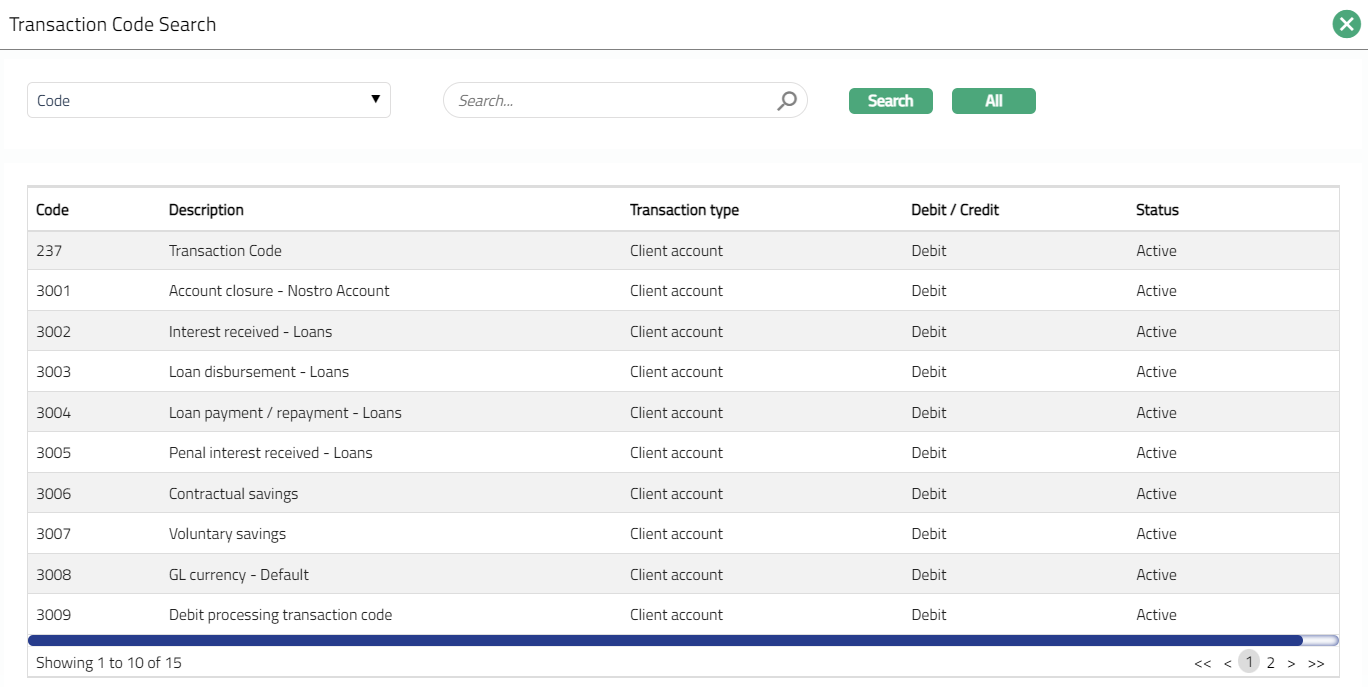

- Access Card Account Product page, click Availability tab, and then click Transaction code sub tab.

The All radio button is selected by default, so that this Product is available for all Transaction Codes.

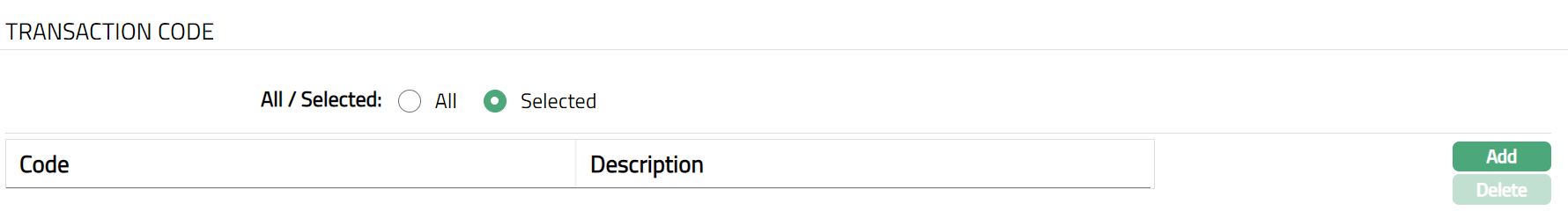

To restrict the Transaction Codes that are available under this product, click Selected radio button. Add button is now enabled.

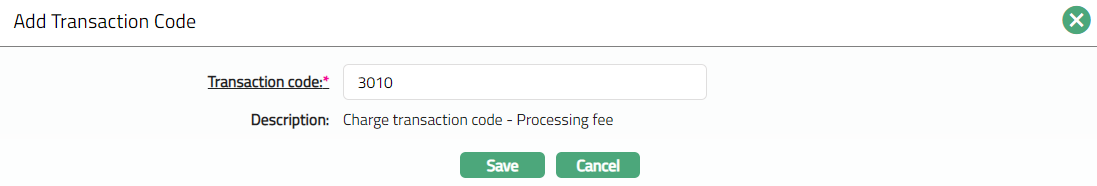

- Click Add. Add Transaction Code search page appears. Search for the required Transaction code with relevant criteria and select the required Transaction code.

- The selected Transaction Code will appear in Card Account Product screen as shown below.

Function: Add, Delete

Function: Add, Delete

Note: You may choose to allow All Transaction codes for the product at any time. However, Aura will prompt you to confirm if the selected Transaction code may be deleted. If confirmed, then all the selected Transaction codes will be deleted, and the product will be available for ALL Transaction Codes.

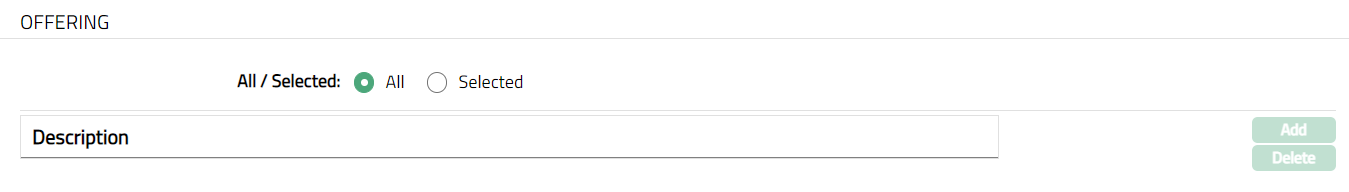

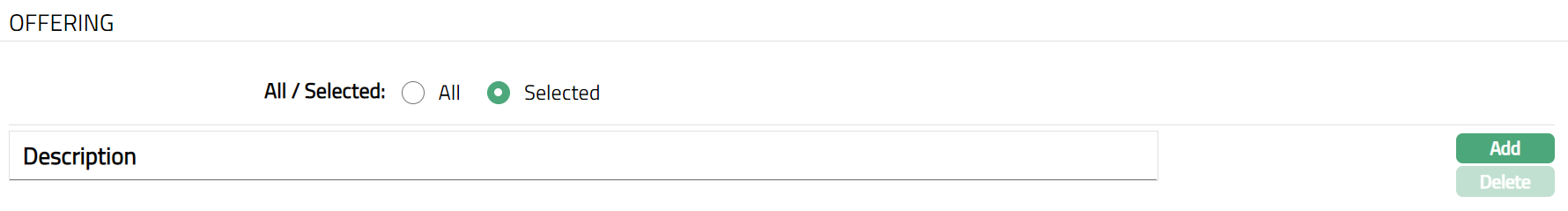

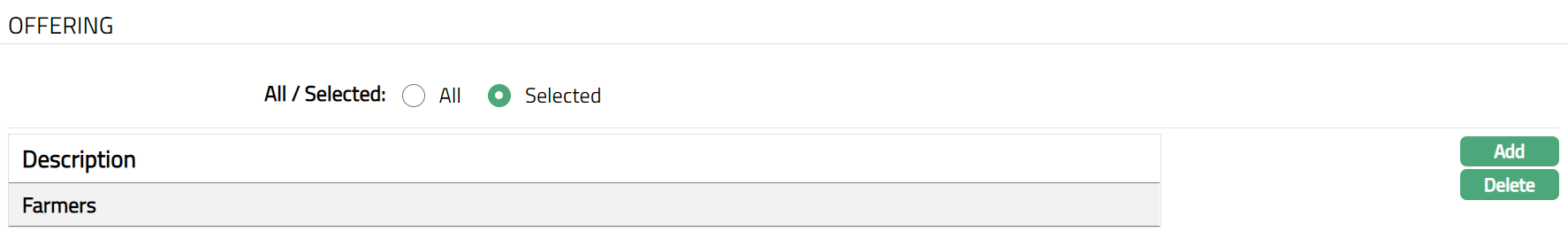

Availability -- Offering

Using this tab, you can allow the Card Account Product to be available for all the Offerings or only specific Offering(s).

Access Card Account Product page, click Availability tab, and then click Offering tab.

All radio button is selected by default, so that this Product is available for all Offerings.

To restrict the Offerings that are available under this product, click Selected radio button. Add button is now enabled.

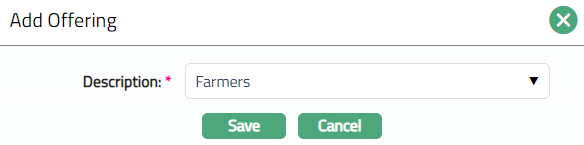

- Click Add. Add Offering screen appears where you can select the required Offering from the drop-down list of active Offerings.

- Click Save. Offering sub tab page appears with the added details. The selected Offering will appear in Card Account Product screen as shown below.

Function: Add, Delete

Function: Add, Delete

Note: You may choose to allow All Offerings for the product at any time. However, Aura will prompt you to confirm if the selected Offering may be deleted. If confirmed, then all the selected Offering will be deleted, and the product will be available for ALL Offerings.

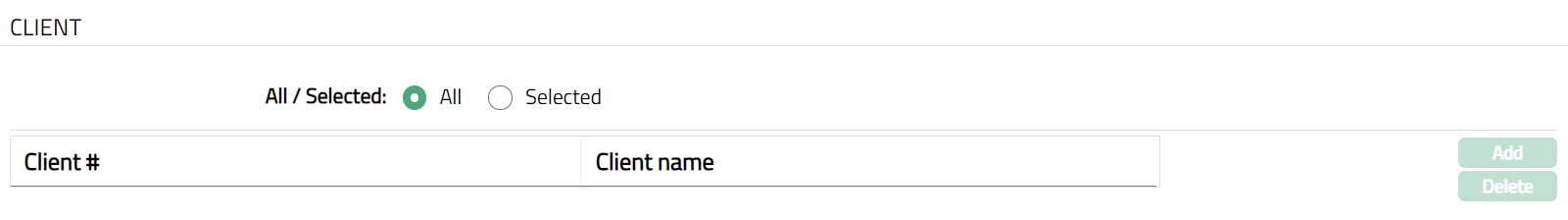

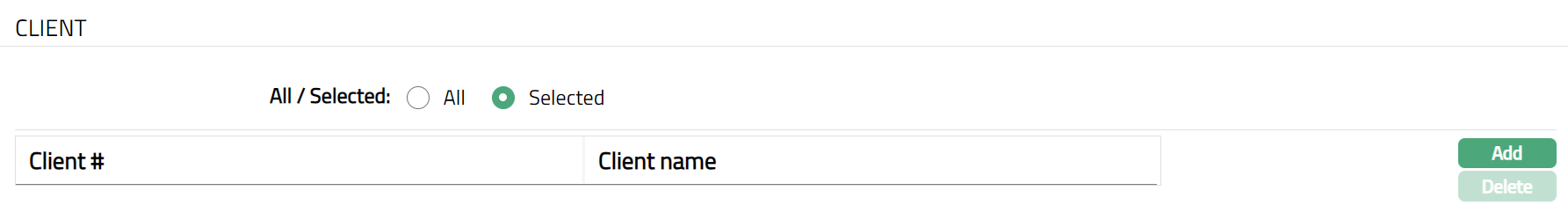

Availability -- Client

Using this tab, you can allow the Card Account Product to be available for all the Clients or only specific Client(s).

Access Card Account Product page, click Availability tab, and then click Client tab.

All radio button is selected by default, so that this Product is available for all Clients.

To restrict the Clients to whom this product is available, click Selected radio button. Add button is now enabled.

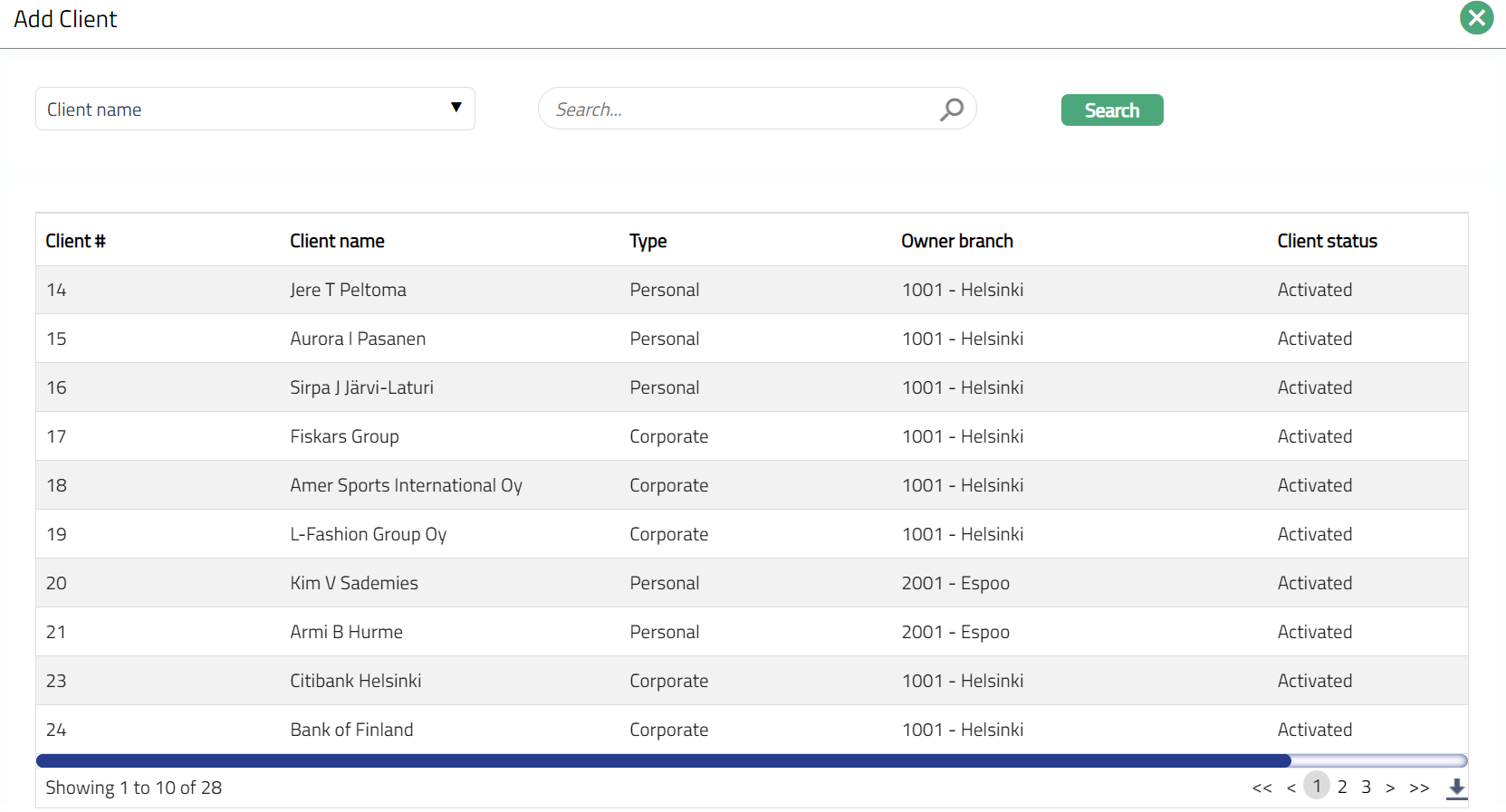

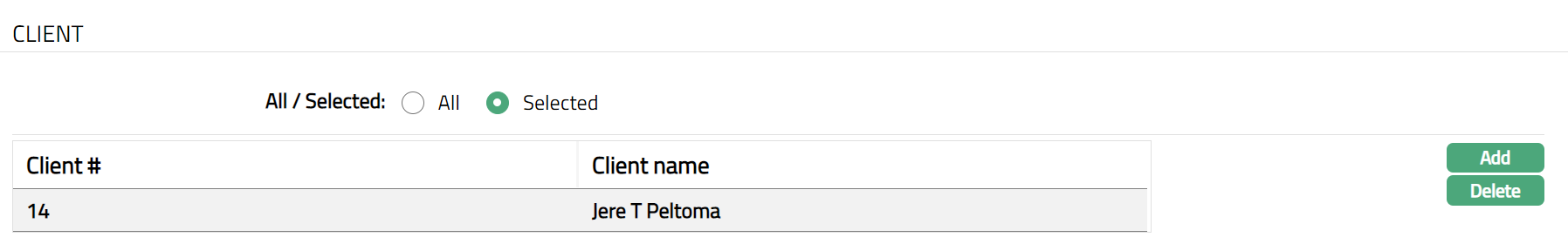

- Click Add. Add Client page appears where you can search for the required client with relevant criteria and select the required client.

- The selected Client will appear in Card Account Product screen as shown below.

Function: Add, Delete

Function: Add, Delete

Note: You may choose to allow All Clients for the product at any time. However, Aura will prompt you to confirm if the selected Clients may be deleted. If confirmed, then all the selected Clients will be deleted, and the product will be available for ALL Clients.

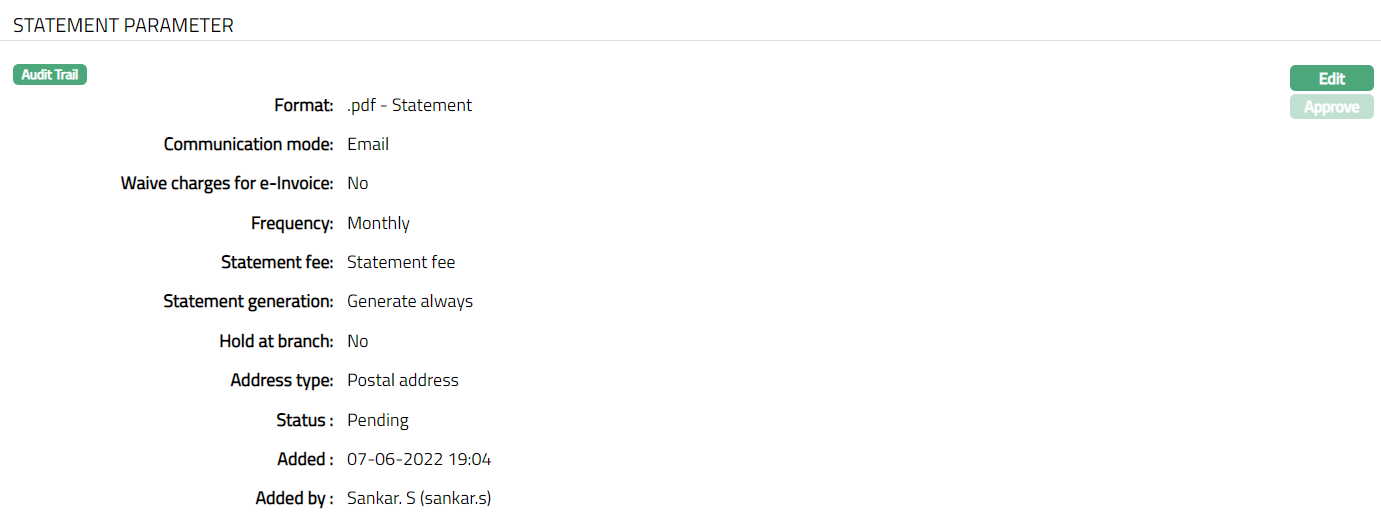

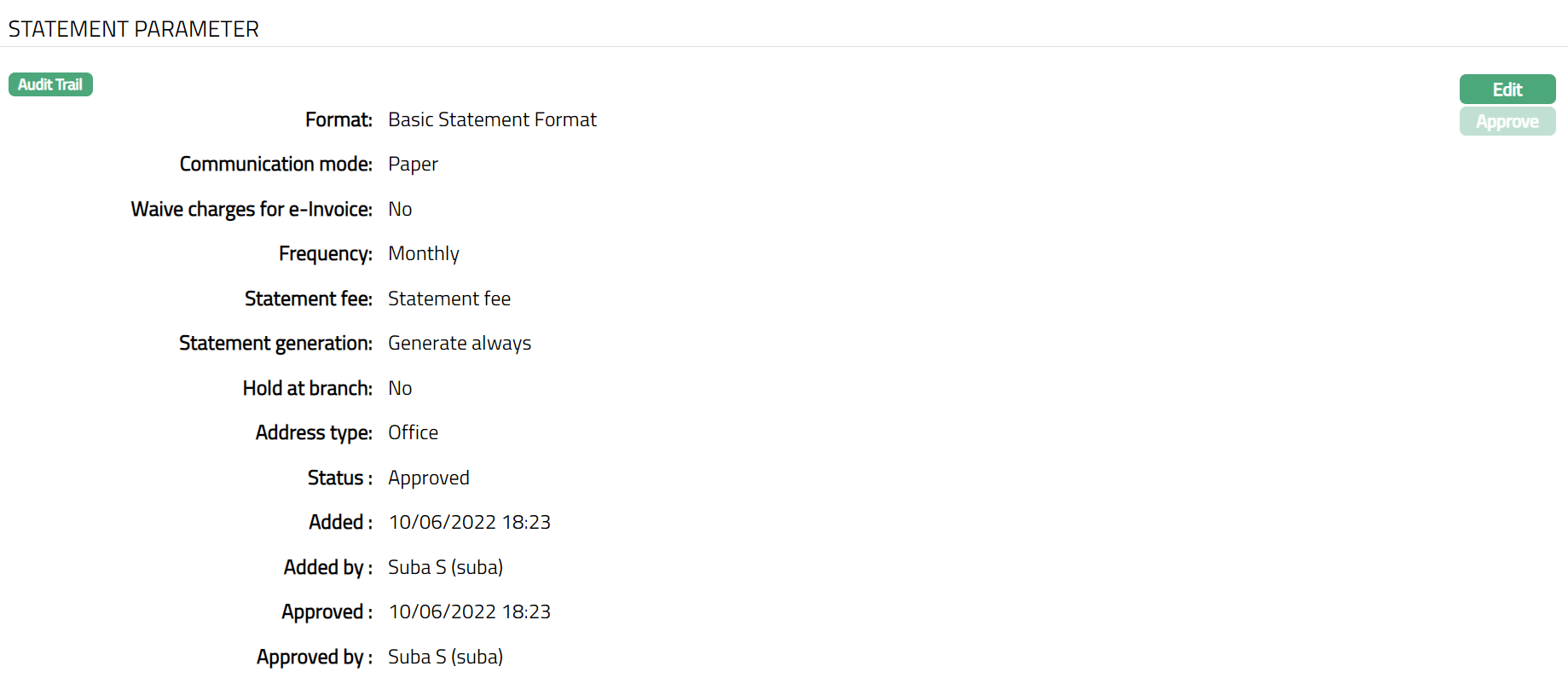

Statement Parameter

Using this tab, you can view and maintain the preferences for generating the statements. This is treated as the Invoice for the accounts created under this Product.

- Access Card Account Product page and click Statement Parameter tab to view the details as per sample below. The details are defaulted from the entries that you made during Product creation. For details refer to the New Card Account Product -- Statement Parameter (8/11)

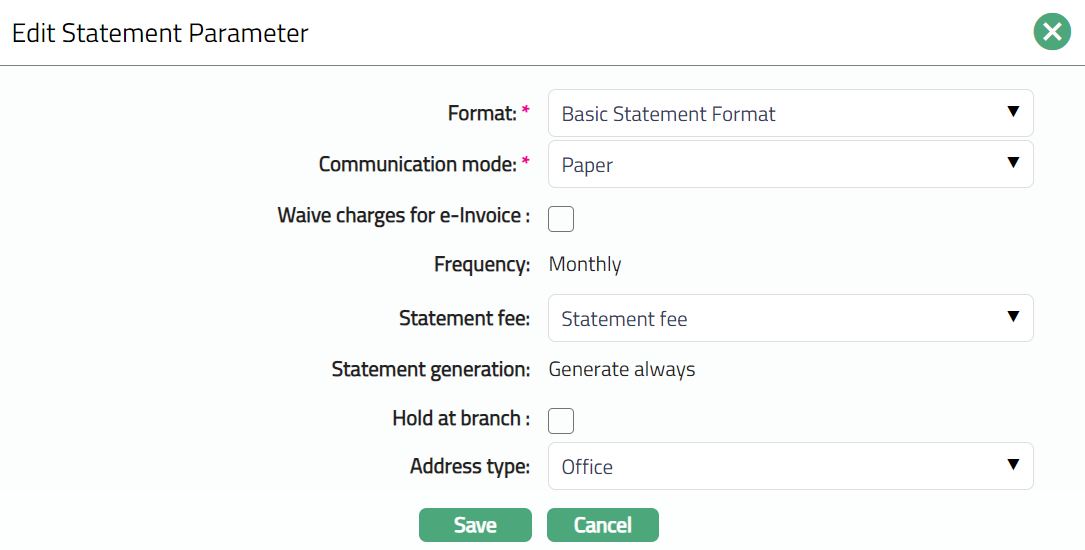

- Click Edit. Edit Statement parameter page appears.

Note: Except Frequency field, all other fields are Editable.

- Click Save. Statement Parameter page appears with the edited details. Note: The status will be displayed as pending, till the same is approved by another user who has not created the record. Once approved the status will change to Approve.

Function: Edit

The additional fields available are:

Added field denotes the date on which the record was added.

Added by field denotes the name of the user who created the record.

Approved field denotes date on which the record was approved and is displayed only for approved records.

Approved by field denotes name of the user who approved the record and is displayed only for approved records.

Sales

Using this tab, you can view and maintain the sales commission for the product.

Access Card Account Product page and click Sales tab.

Click Edit. Edit Sales page appears.

If you want to allow a specific commission for account opening, select the Account opening commission from the drop-down list. Aura will display the Charges where the Charge type is Event, Basis is Flat and Treat as Commission is Yes.

Click Save. Sales page appears with the edited details.

Function: Edit

Function: Edit

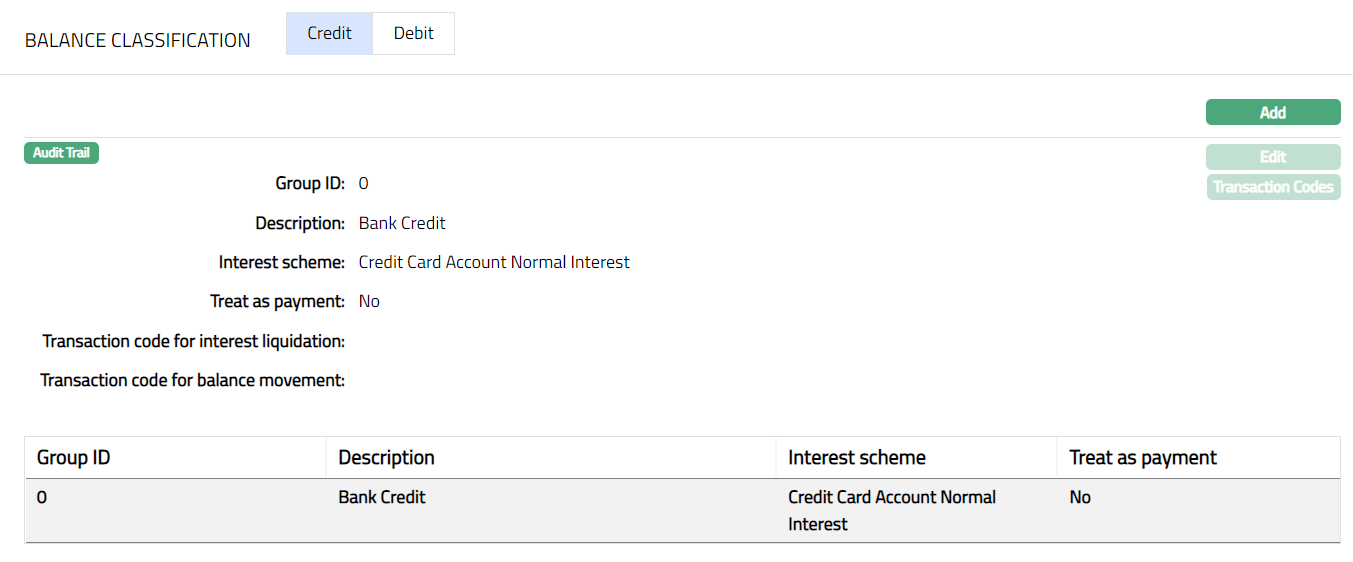

Balance Classification

Balance classification allows you to create groups of transaction codes which need differential treatment. This will provide the ability to

Treat balances differently, say, between POS withdrawals and ATM cash withdrawals -- so that cash limits can be tracked. Also, when payment is received, it gives the ability to prioritize, say, ATM withdrawals over POS withdrawals.

Provide differential interest attributes for different balances.

Group transactions for the purpose of display in statements view

There are two sub-tabs, one each for Debit Transaction Codes and Credit Transaction Codes. You can add one or more transaction codes under these sub-tabs, along with the specific interest scheme and other parameters like.

Qualify for Cash limit (Available only for Debits)

Capitalize interest in the current cycle (Available only for Debits)

Reverse accrual on full settlement (Available only for Debits)

Reverse accrual on full settlement only if not rolled over (Available only for Debits).

Liquidate interest for the current period transactions (Available only for debits)

Treat as Payment (Available only for Credits)

Interest on interest schemes (Available only for Debits)

During transaction processing, the transaction will be added to the respective balance class depending on the transaction code. If the specific transaction code is not maintained under a specific balance class, it will be added to a default balance class. The interest parameters of the default balance class will be those that are maintained at the Product -- Interest Receivable / Interest Payable tabs.

Note that the default balance classes do not have the other parameters listed above. Hence, if you want to apply any of the parameters to any transaction code, these have to be added to the required balance class.

Balance Classification sub-tabs are:

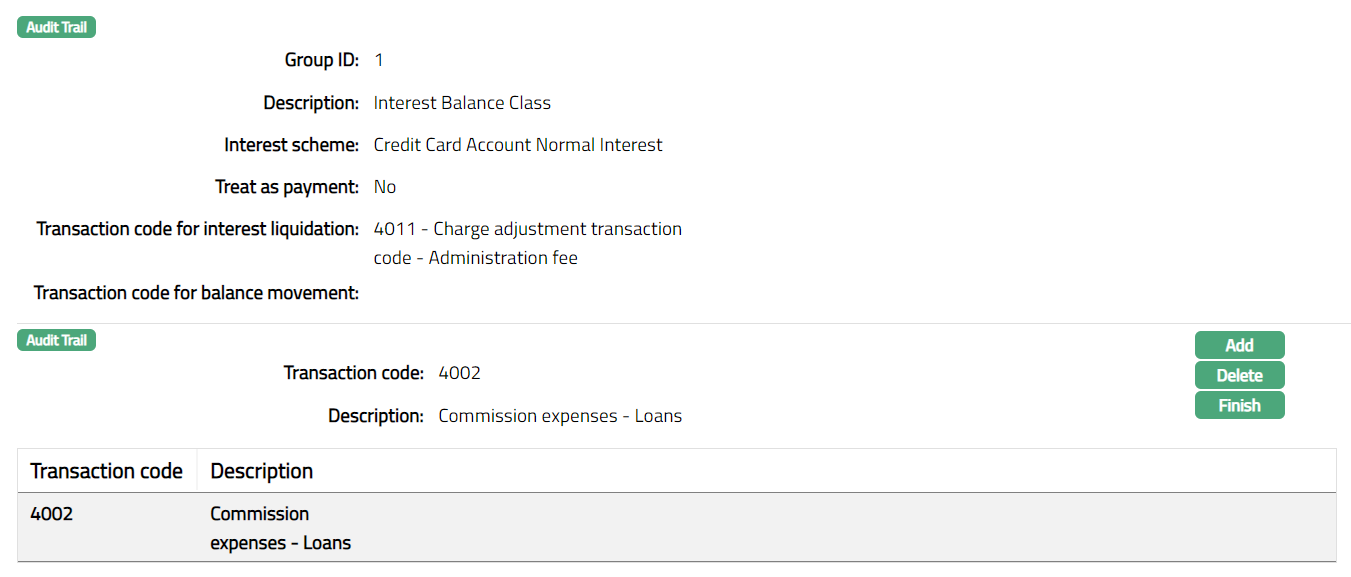

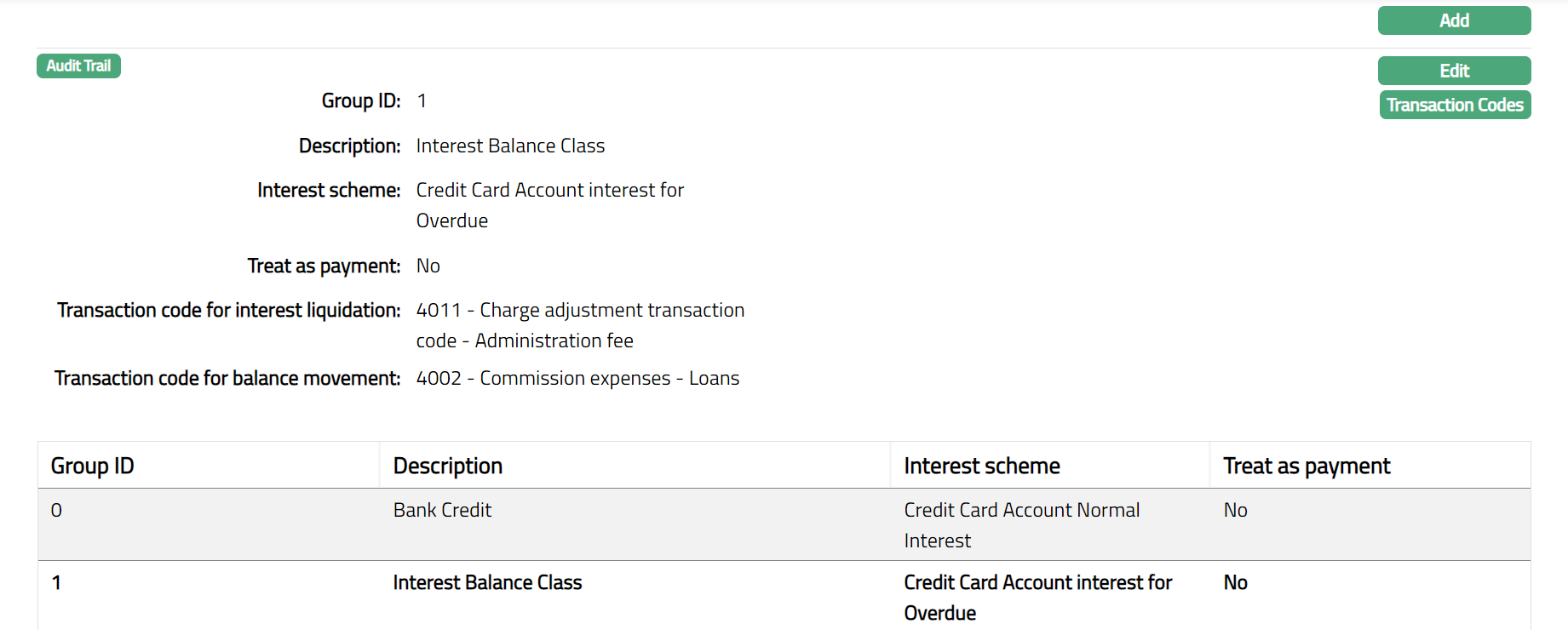

Balance Classification -- Credit

To add Credit Balance Class group

Access Card Account Product page and click the Balance Classification tab and then Credit sub tab.

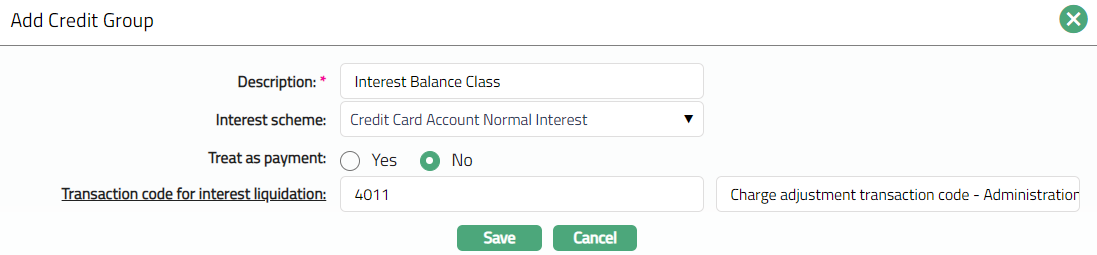

Click Add. Add Credit Group page appears.

Enter Description of the Credit Group.

Select Interest scheme for the credit group from the drop down of active Interest schemes maintained under Admin > System Codes > Interest > Interest Scheme.

If Treat as payment is selected as Yes, then the transaction code attached to the credit group will be considered as payment; else it won't be considered as Payment. By default, treat as payment is selected as No.

Click Transaction Code for interest liquidation hyperlink. Aura displays the list of all the active Client Credit transaction codes. This will be used for the liquidation of the interest on this balance class. In case of the Default balance class, the interest liquidation will be done using the transaction code selected at the Product level.

Select transaction code from the Transaction code search page.

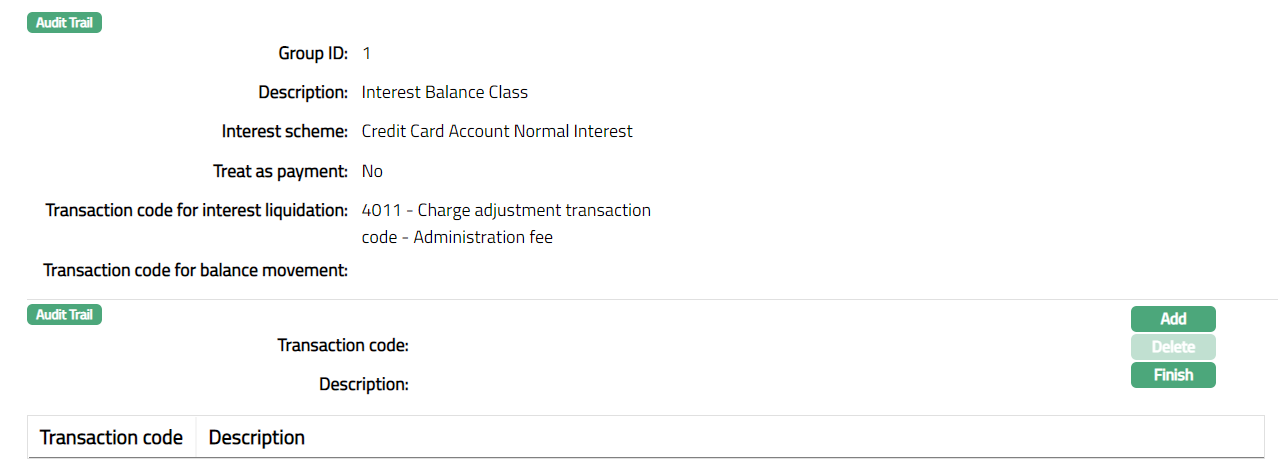

Click Save. Credit sub tab page appears with the added details along with a unique group id which identifies that group.

Functions: Add, Edit, Transaction Codes

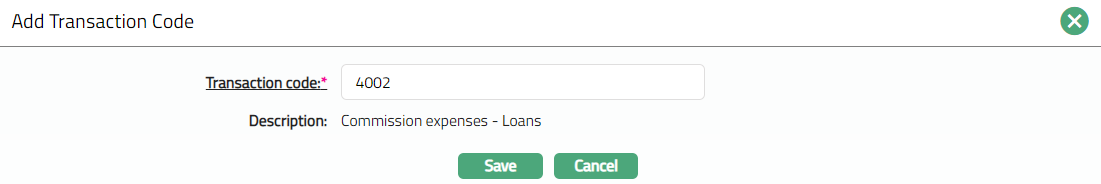

To add / view Transaction Codes that should belong to a Balance class group.

- Access required Balance class group and click Transaction Code.

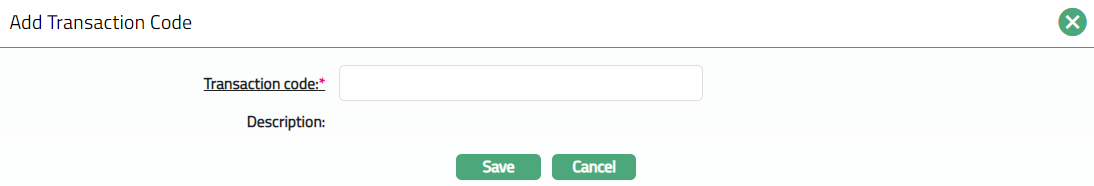

- Click Add. Add Transaction Code page appears.

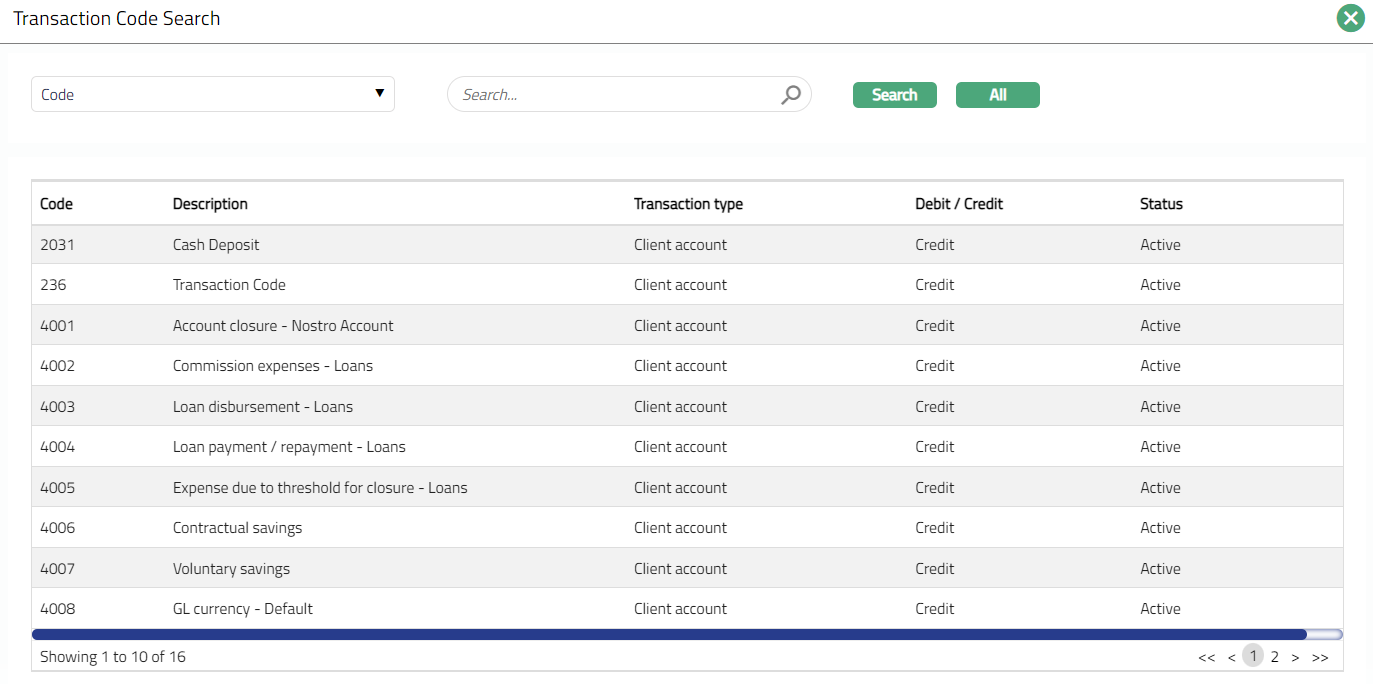

- Click the hyperlink for Transaction Code. The Transaction Code Search page appears with the list of Client Account Credit Transaction codes, apart from the ones that have already been mapped to the Product. Select the required transaction code from the list. You can also input the transaction code directly.

- Select Transaction code from the Transaction code search page. The selected code will be populated in the Add transaction code page.

- Click Save to see the added transaction code.

Functions: Add, Delete, Finish

- Click Finish. Credit sub tab page under Balance Classification tab appears with the added details.

Functions: Add, Edit, Transaction Code.

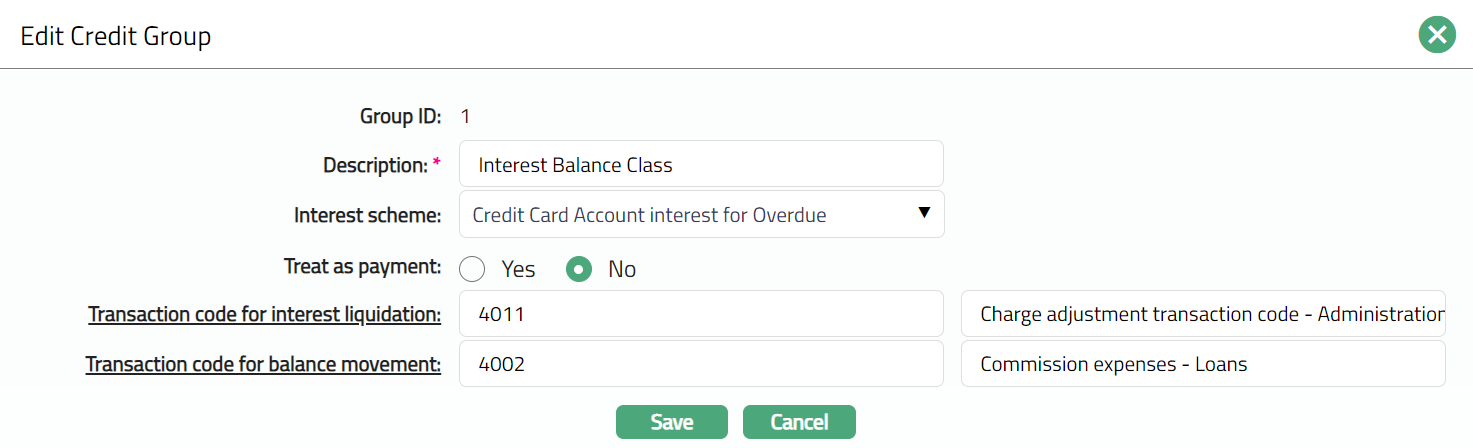

To Edit Credit

- Select the required record from the list of added record and click Edit. Edit Credit Group page appears.

Note: Except Group ID field, rest all other fields are editable.

- Click Save. Credit sub tab appears with the edited details.

Functions: Add, Edit, Transaction Code.

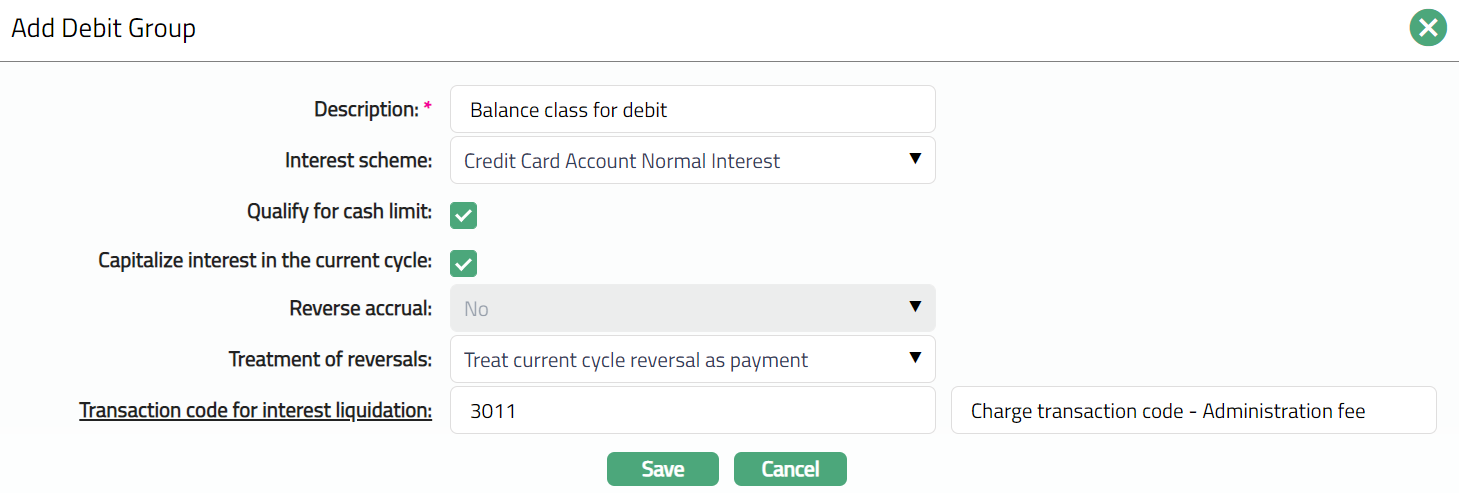

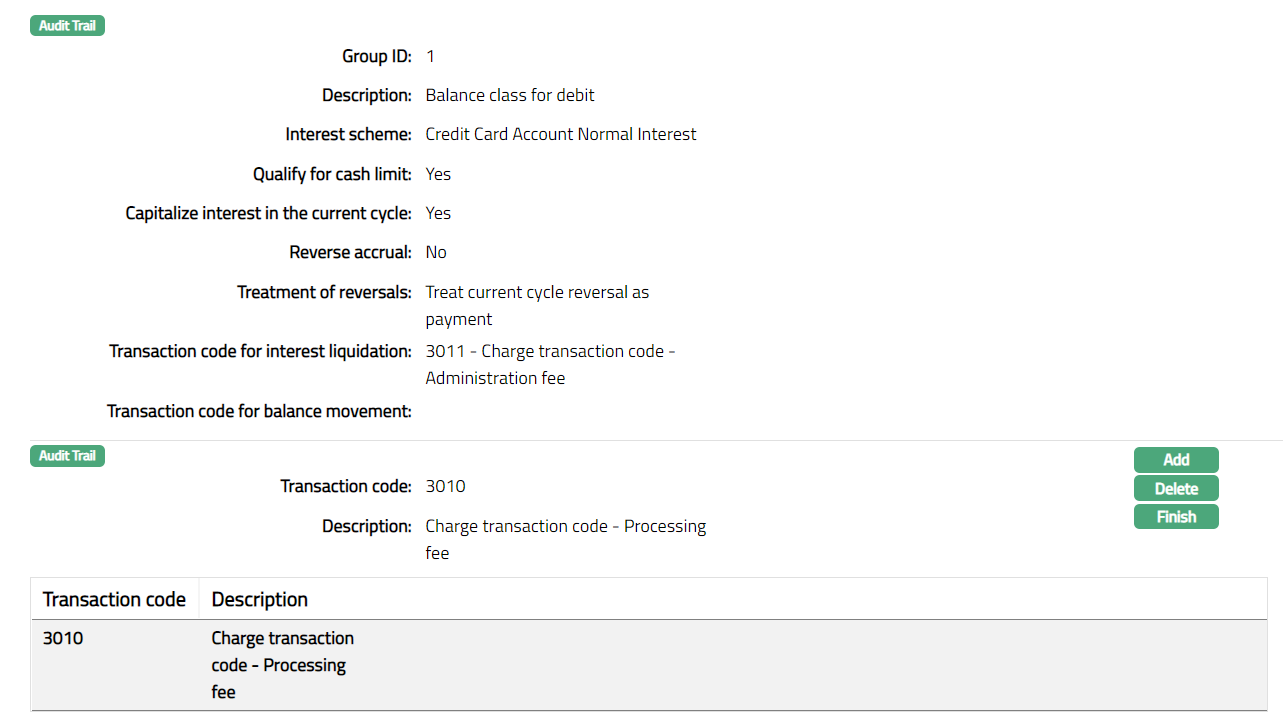

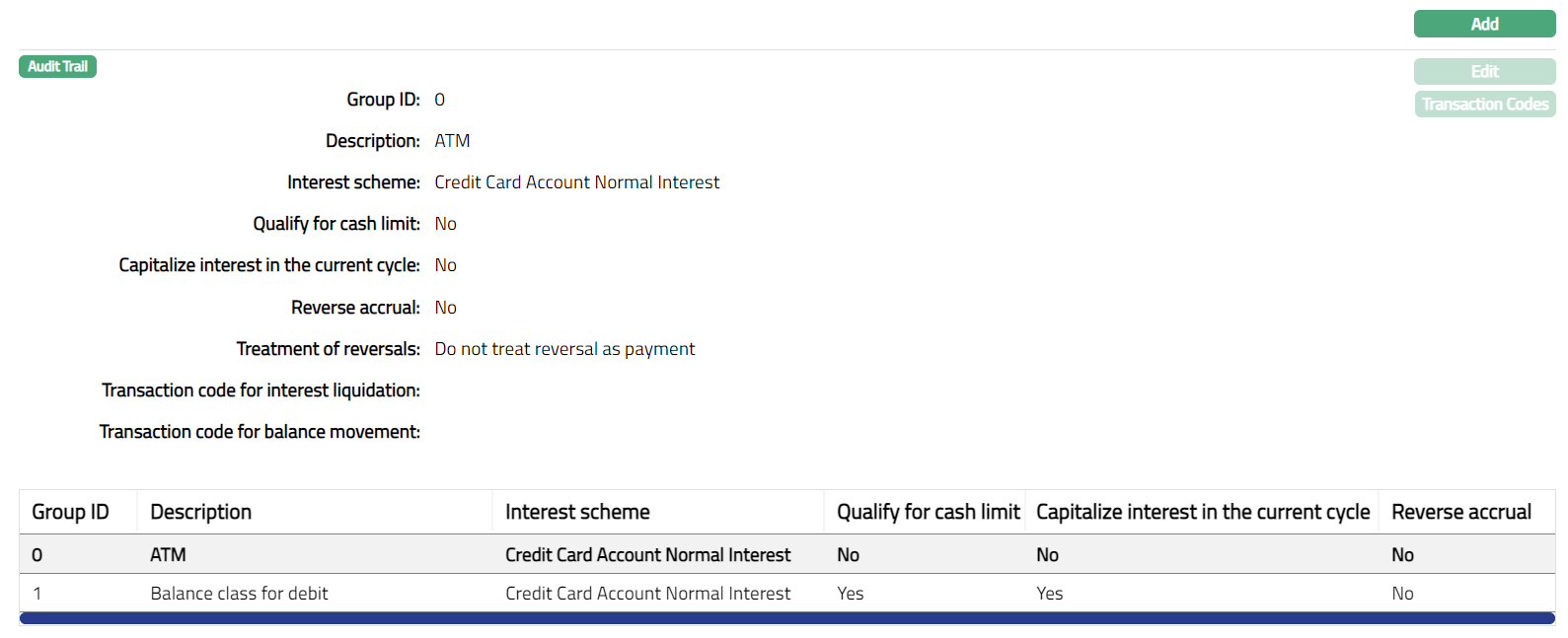

Balance Classification -- Debit

To add Debit Balance Class group

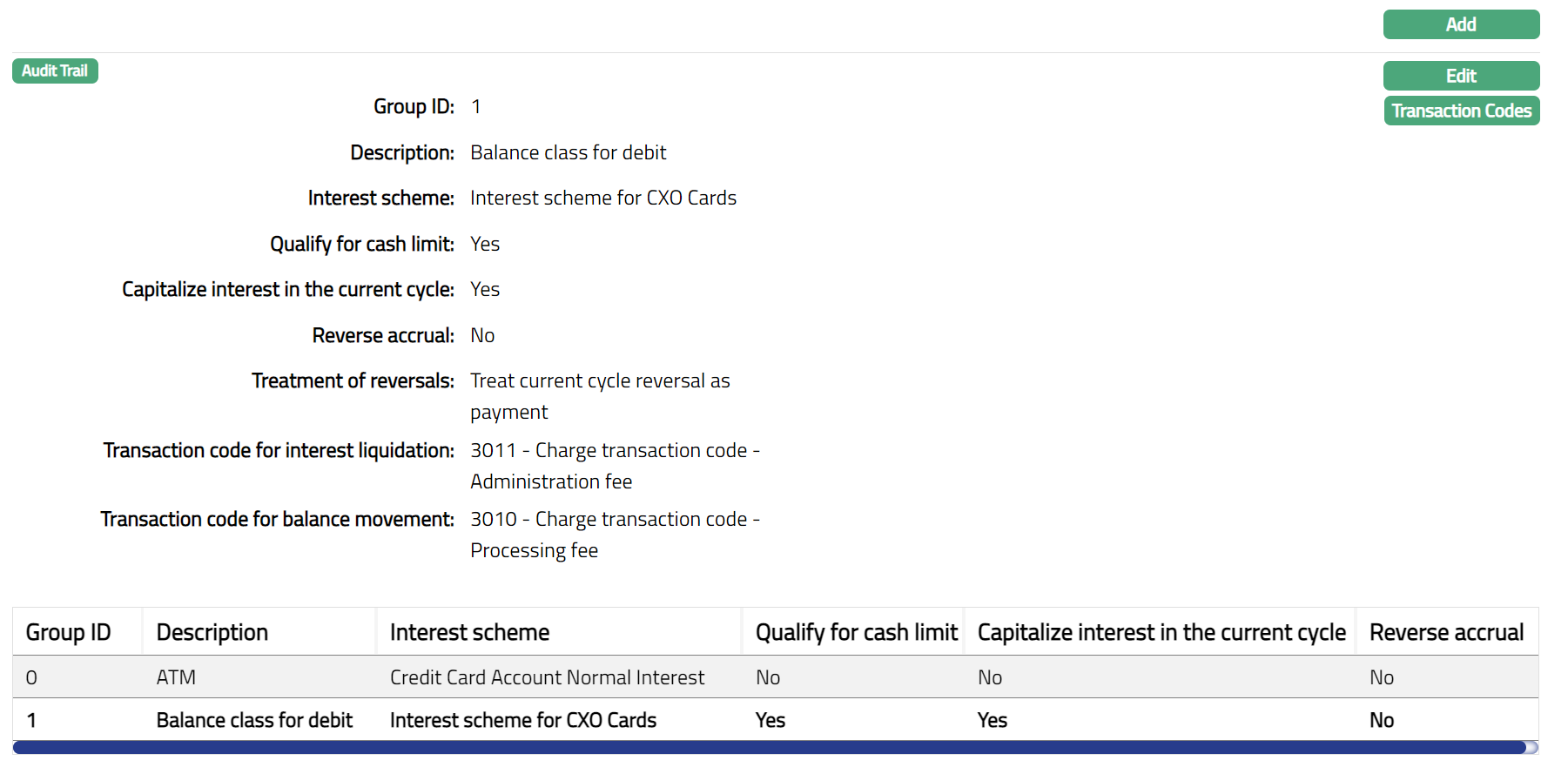

Access Card Account Product page and click Balance Classification tab and then Debit sub tab.

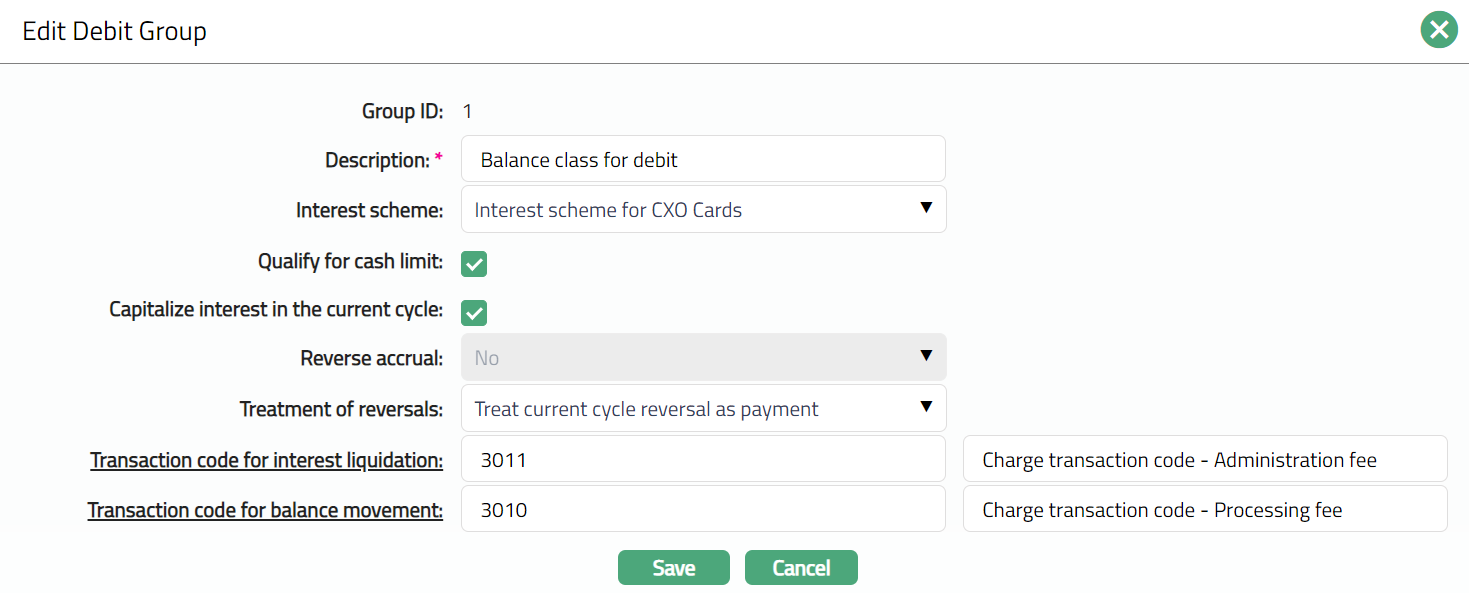

Click Add. Add Debit Group page appears.

Enter Description of the Debit Group.

Select Interest scheme from the drop-down list of active interest schemes maintained under Admin > System Codes > Interest > Interest Scheme.

The Qualify for Cash limit will be available only for debit transaction codes. If the flag is checked, the transactions using the transaction codes under this balance class group would be treated as using the Cash Limit for the account and thus, the available cash limit at account level will be arrived at.

If Capitalize interest in the current cycle flag is checked, then Aura will capitalize interest on transactions that have originated in the current cycle. By default, it does for the past period. If this flag is checked, the option to Reverse accrual on full payment field will be automatically marked as No and will be disabled, since the interest is already capitalized / liquidated before the payment.

Reverse accrual list gives you the following options to indicate when the accrued interest receivable can be reversed.

No: This is the default option. When selected, it means that the accrued interest will not be reversed irrespective of the payment.

On full settlement: When selected, it means that the accrued interest will be reversed only if the total outstanding on the account was paid in full.

On full settlement if not rolled over: When selected, it means that the accrued interest will be reversed only if the total outstanding on the account was paid in full and there was no previous roll over of the outstanding amount. If the balance has been rolled-over and in the next cycle if the customer pays the full balance the interest accrued in the current cycle is not reversed for the rolled-over amounts. However, the interest will be reversed for those amounts that were debited in immediate cycle and paid fully (without roll-over).

Select Treatment of reversals from the preshipped values. The options are:

Treat Current cycle reversal as payment: If this option is chosen, then all the current cycle reversals will be treated as payments.

Treat current and past cycle reversal as payment: If this option is chosen, then all the current and past cycle reversals will be treated as payments.

Click Transaction Code for interest liquidation hyper link. Aura displays the list of all the active Client Debit transaction codes. This will be used for the liquidation of the interest on this balance class. In case of the Default balance class, the interest liquidation will be done using the transaction code selected at the Product level.

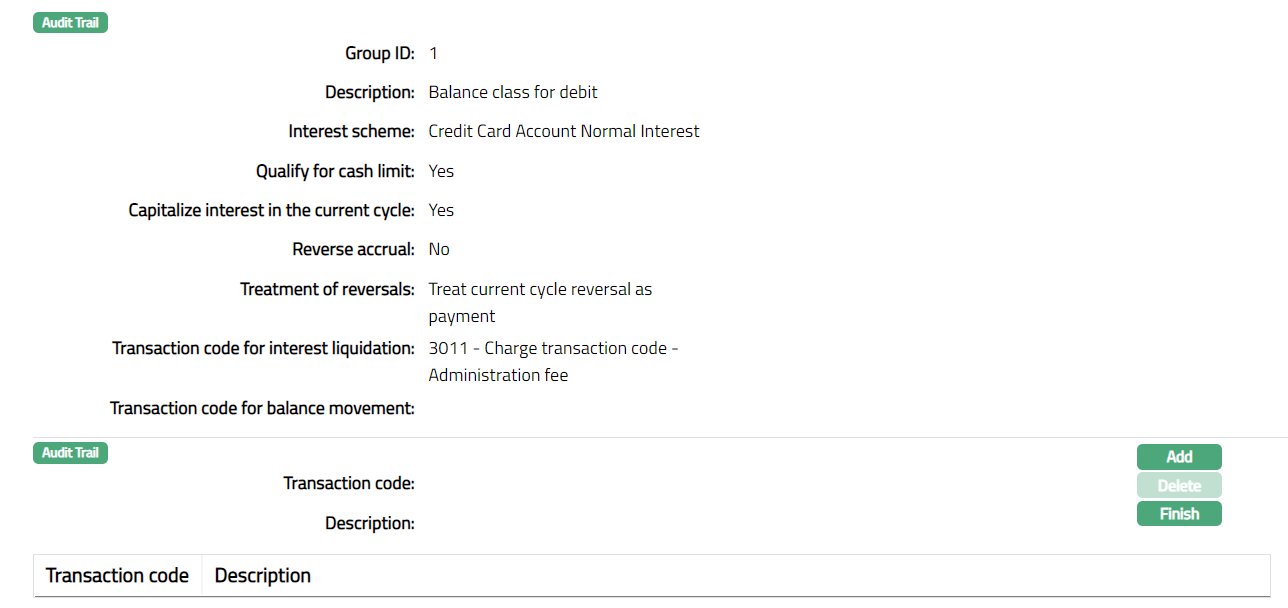

Click Save. Card Account Product page appears with the added details along with a unique group id which identifies that group.

Functions: Add, Edit, Transaction Code.

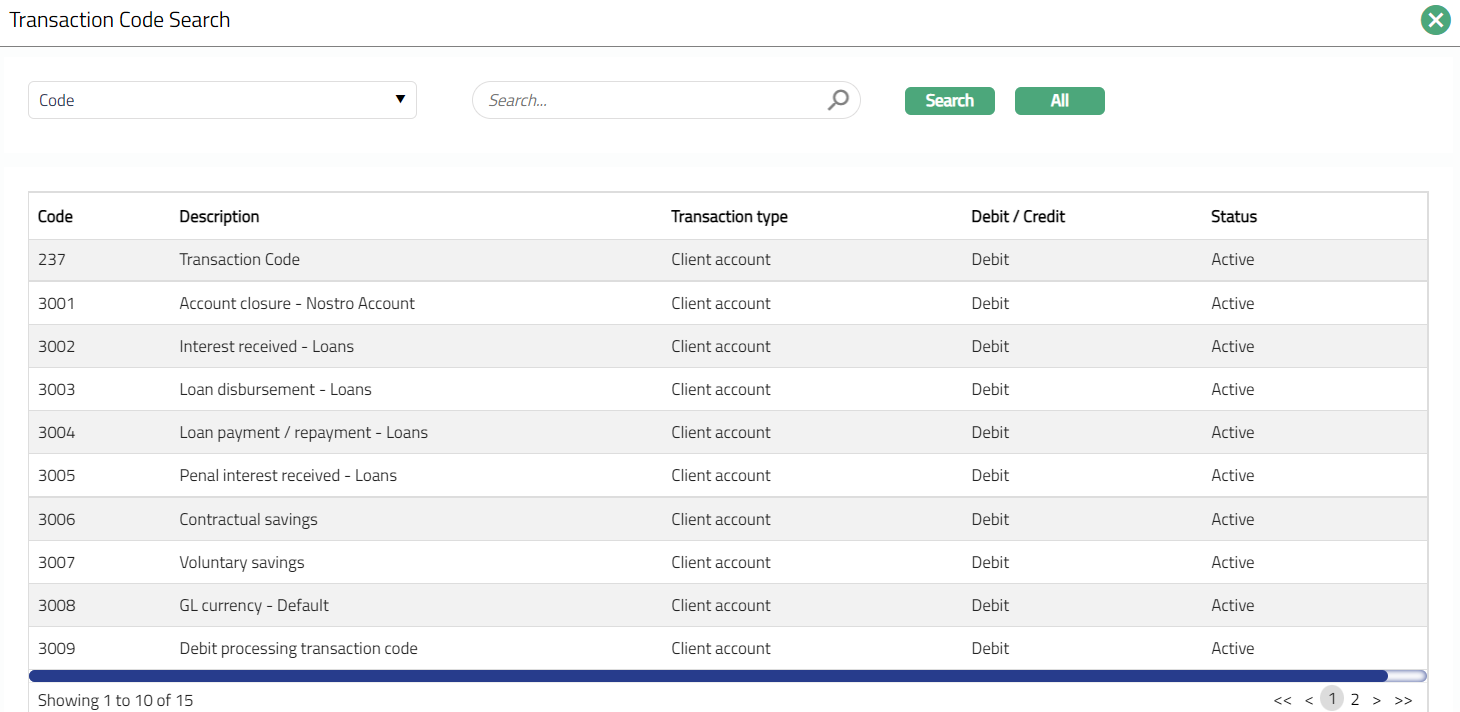

To add / view Transaction Codes that should belong to a Balance class group.

Access required Balance classification group and click Transaction Code.

Click Add. Add Transaction Code page appears.

Click hyperlinked Transaction code. Transaction Code Search page appears with the list of Client Account Debit Transaction codes, apart from the ones that have already been mapped to the Product. Select the required transaction code from the list. You can also input the transaction code directly.

Click Save to see the added transaction code.

Functions: Add, Delete, Finish.

Click Finish. Debit sub tab page under Balance Classification appears with the updated details.

Functions: Add, Edit, Transaction Code.

To Edit Debit

- Select required record from the list of added record and click Edit. Edit Debit Group page appears.

Note: Except Group ID field, rest all other fields are editable.

- Click Save. Debit sub tab appears with the edited details.

Functions: Add, Edit, Transaction Code.

Replenishment

Using Replenishment tab, you can provide the sequential preference for the groups maintained under balance classification (Debit / Credit) and Default Group. Based on the Replenishment preference, any payments coming in will allocate the paid amount in the order specified.

A replenishment function will allocate any credit balance towards debit balance classes. This function will be invoked for each transaction provided the nature of the transaction is against the nature of the current balance of the account. If the transaction is a debit while the current balance is credit, the replenishment function will be triggered. If the transaction is a credit while the current balance is debit, the replenishment function will be triggered.

Example:

Debit Classes -- ATM, POS, Default Debit (Indicates the To order)

Credit Classes -- Payments, Default Credit (Indicates the From order)

a. Account balance is 100 DB and a transaction of 25 CR comes in

I. Replenishment function will trigger and allocate 25 towards the

debit balance classes as per the order. Debit balance class will

total 75 after replenishment. Credit balance will have 0

balance.

b. Account balance is 100 DB, and a transaction of 125 CR comes in

I. Replenishment function will trigger and allocate 100 towards the

debit balance classes as per the order and retain 25 CR balance

in the credit class. Debit balance class will be 0 after

replenishment.

c. Account balance is 100 CR, and a transaction of 25 DB comes in

I. Replenishment function will trigger and allocate 25 towards the

debit balance classes as per the order. Debit balance class will

total 0 after replenishment and credit balance class will be

reduced to 75.

d. Account balance is 100 CR, and a transaction of 125 DB comes in

I. Replenishment function will trigger and allocate 100 towards the

debit balance classes as per the order. Debit balance class will

be 25 after replenishment and credit balance class will be 0.

The same logic will be applied for reversals where the amount of reversal exceeds the balance.

The following are the sub-tabs under Replenishment:

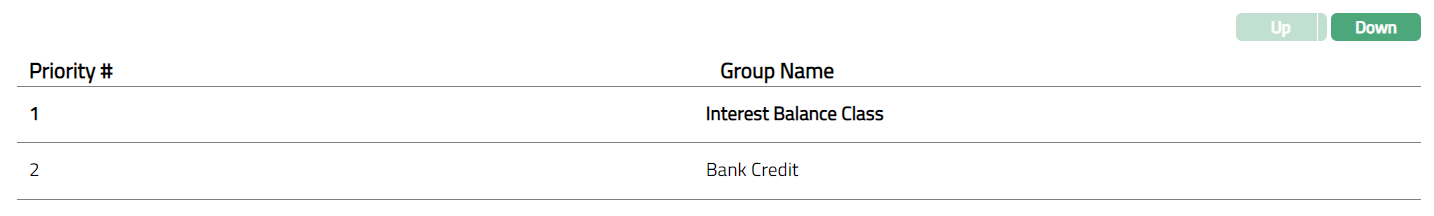

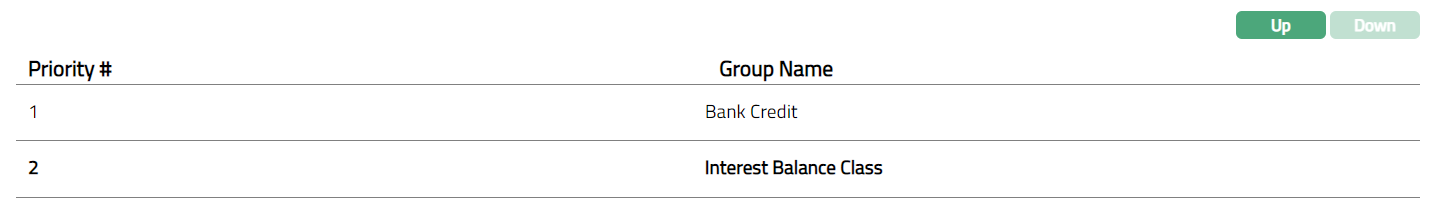

Replenishment Priority -- Credit

- Access Card Account Product page and click Replenishment tab, and then click Credit.

Default Group will be the first priority by default and all the Credit Balance Class Groups will be listed below. Up and Down button will be disabled.

If you want to change the order, select the required Group Name, which enables the Up and Down buttons.

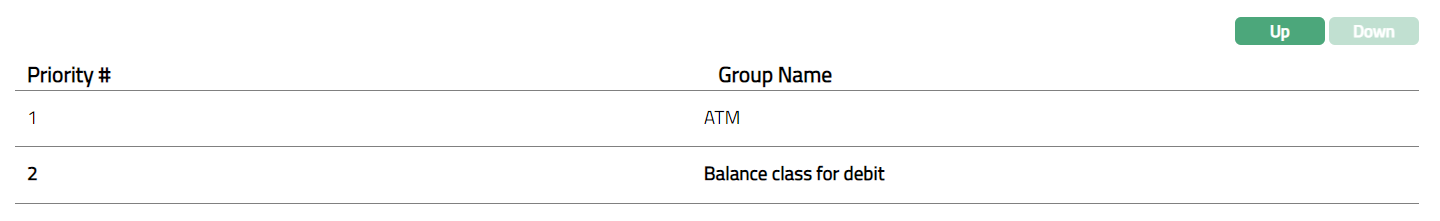

If you click on Up button, the selected Group Name will move to the next higher order of preference and interchange the position between the source and destination. For the topmost group the Up button will be disabled.

- If you click Down button, the selected Group Name will move to the next lower order of preference and interchange the position between the source and destination. For the bottom most group the Down button will be disabled.

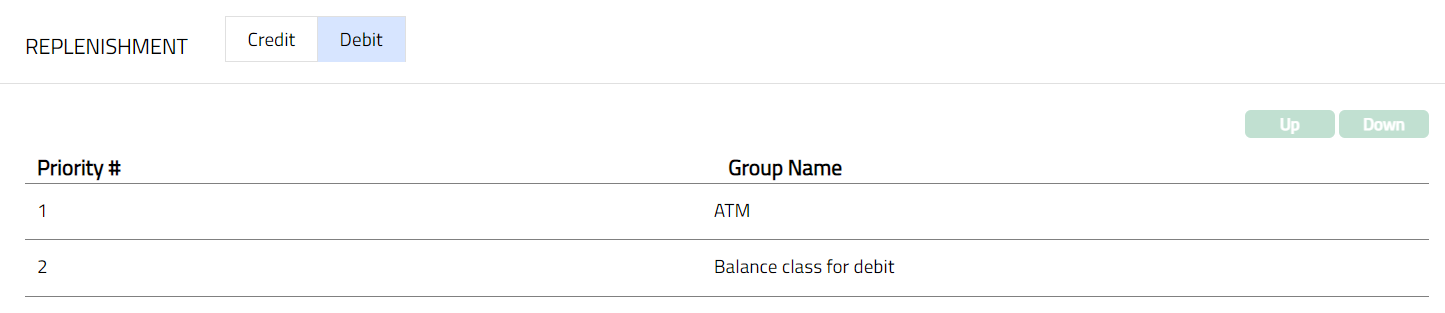

Replenishment Priority -- Debit

- Access Card Account Product page and click Replenishment tab, and then click Debit sub tab.

The Default Group will be the first priority by default and all the Debit Balance Class Groups will be listed below. Up and Down button will be disabled.

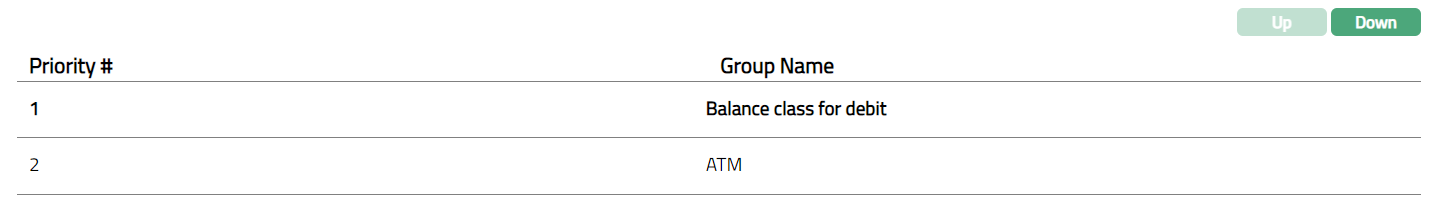

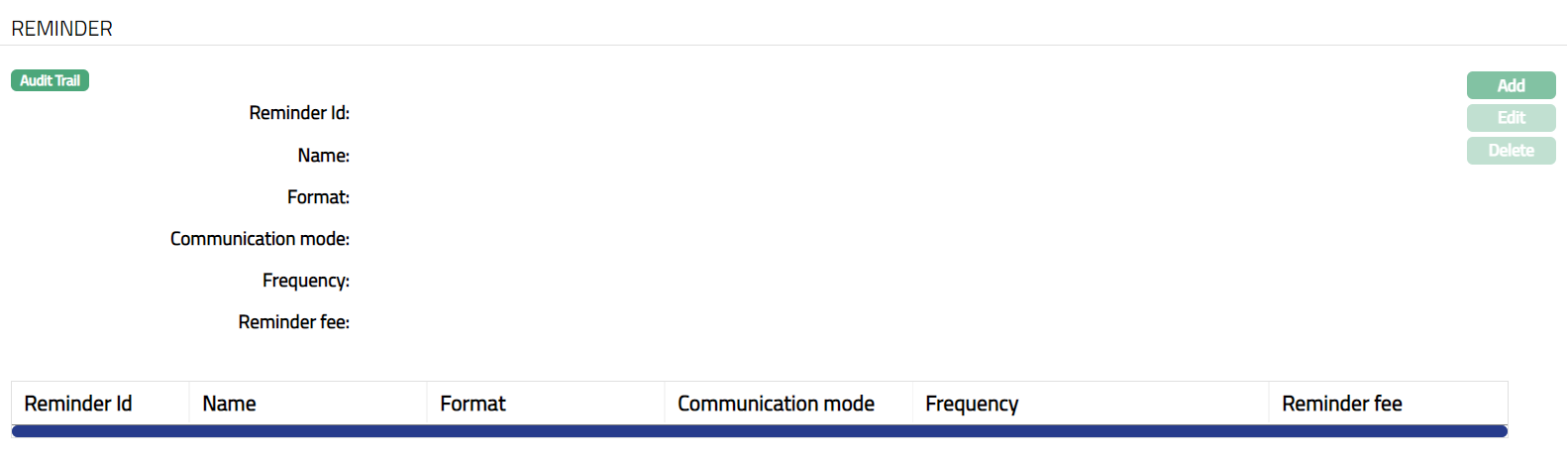

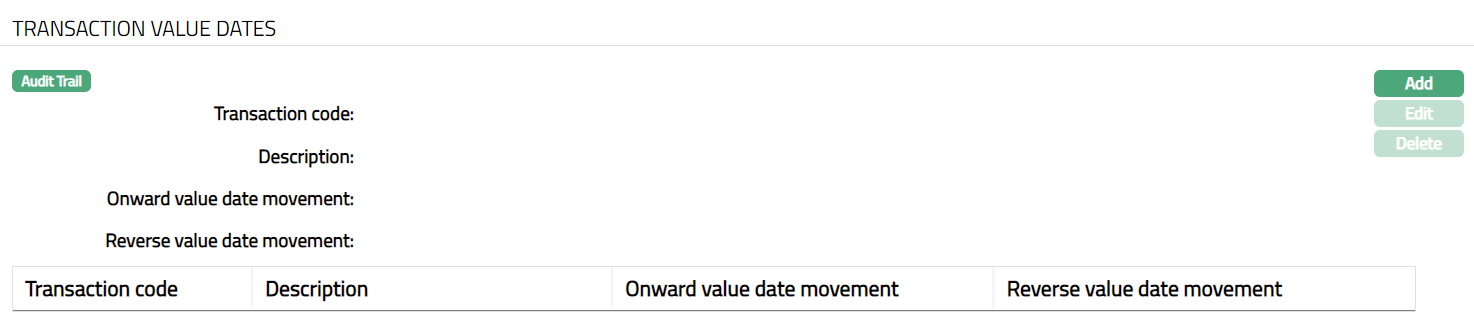

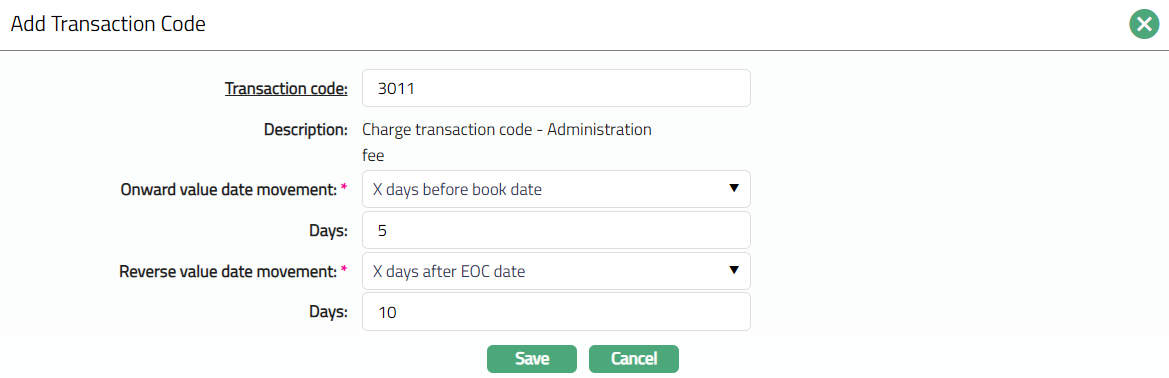

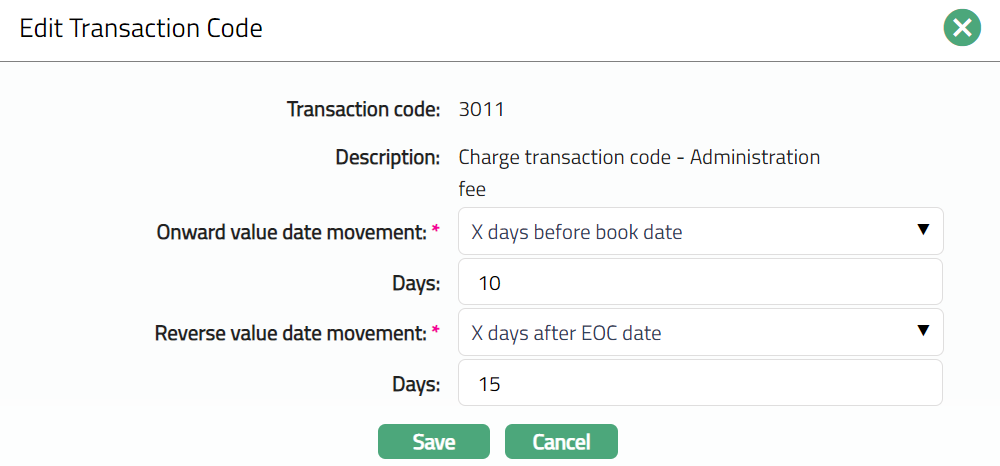

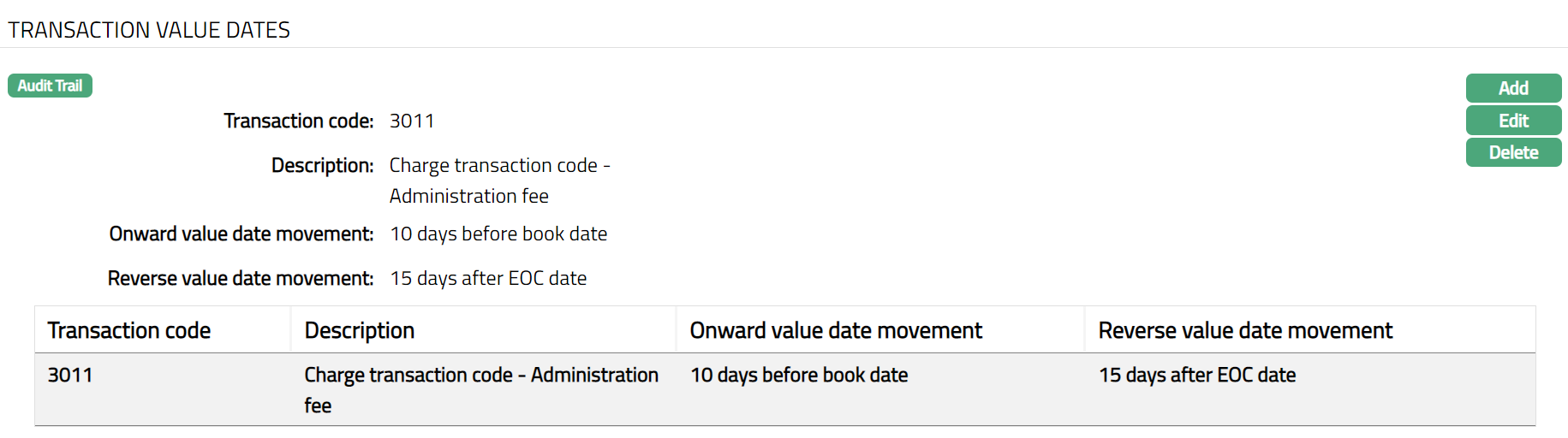

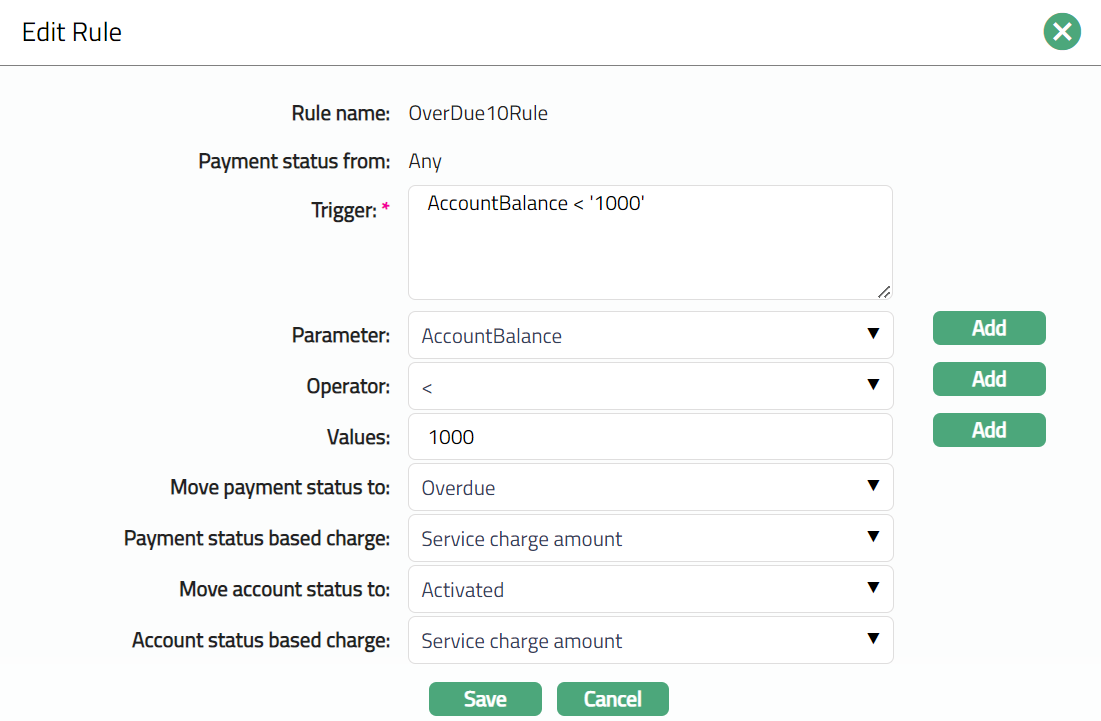

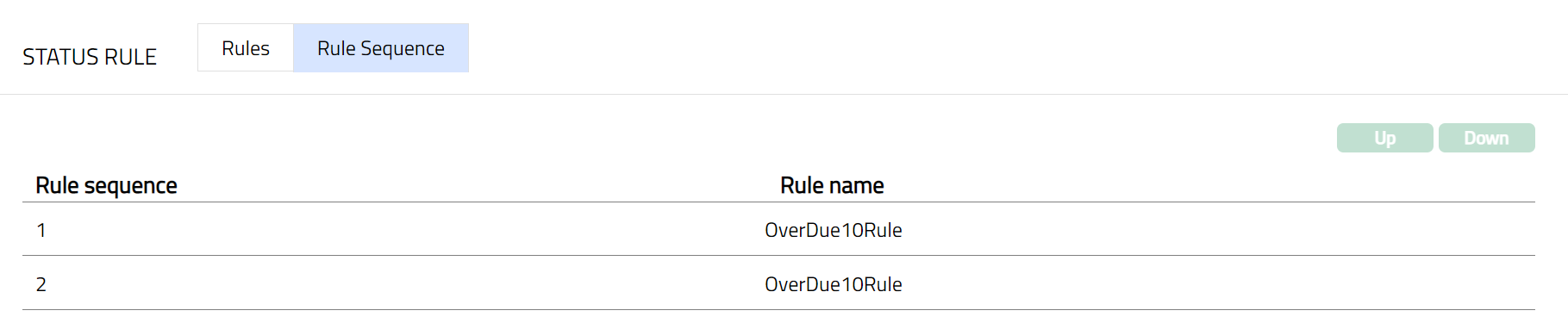

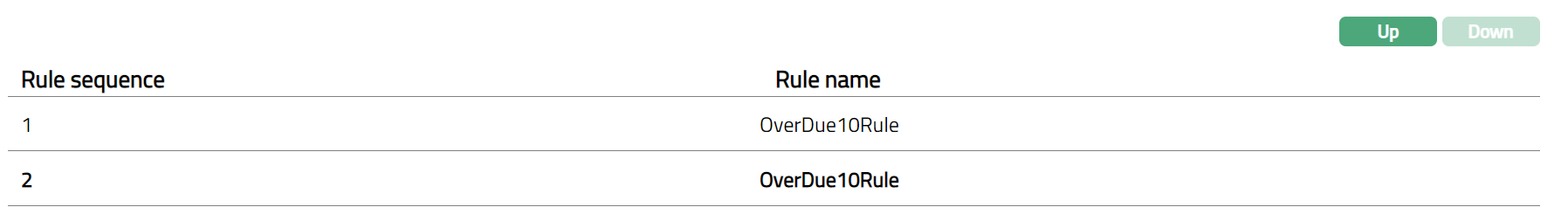

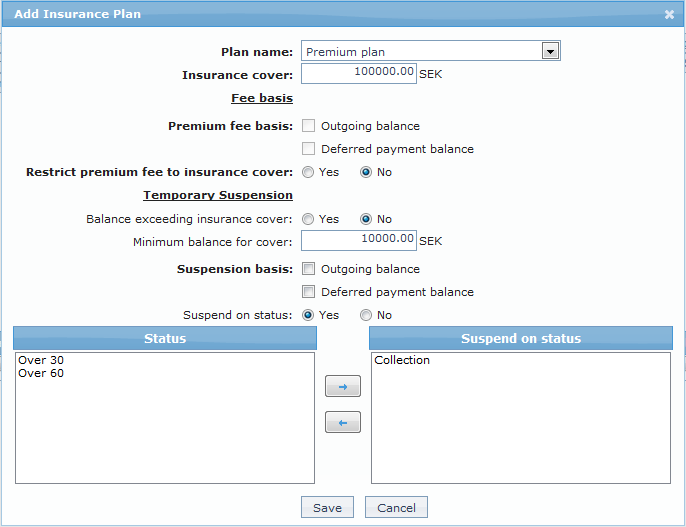

If you want to change the order, select the required Group Name, which enables the Up and Down buttons.